SECOND AMENDED AND RESTATED CONSTRUCTION LOAN AGREEMENT dated as of January 31, 2024 among CARDINAL ETHANOL, LLC and CARDINAL COLWICH, LLC and FIRST NATIONAL BANK OF OMAHA

SECOND AMENDED AND RESTATED CONSTRUCTION LOAN AGREEMENT This Second Amended and Restated Construction Loan Agreement is made as of January 31, 2033 by and among CARDINAL ETHANOL, LLC, an Indiana limited liability company (“Cardinal Ethanol”), CARDINAL COLWICH, LLC, a Kansas limited liability company (“Cardinal Colwich” and along with Cardinal Ethanol, each a “Borrower” and collectively, the “Borrowers”), and FIRST NATIONAL BANK OF OMAHA, a national banking association ("Lender"). WHEREAS, Cardinal Ethanol and Lender are parties to a First Amended and Restated Construction Loan Agreement dated as of June 10, 2013, as amended (as so amended and as in effect prior to the date hereof, the "Current Credit Agreement"), pursuant to which Lender has made the loans and financial accommodations provided for therein available to Cardinal Ethanol; WHEREAS, the Current Credit Agreement amended and restated that certain Construction Loan Agreement dated December 19, 2006 (the “Original Credit Agreement”) among Cardinal Ethanol, Lender, and the other parties thereto; WHEREAS, Borrowers have requested that the Current Credit Agreement be amended and restated on the terms and conditions set forth herein; WHEREAS, it is intended that the indebtedness of Borrowers under this Agreement be a continuation of the indebtedness of Cardinal Ethanol under the Current Credit Agreement, and is not a novation thereof; and WHEREAS, under the terms and conditions of this Agreement, Lender has approved and is extending to Cardinal Ethanol a line of credit in the maximum principal amount of $20,000,000 (the “Revolving Credit Loan”), and a Declining Revolving Credit Loan in the principal amount of $39,000,000 (the "Declining Revolving Credit Loan"), as such Declining Revolving Credit Loan may convert to the APP Term Loan at the APP Loan Conversion as provided for in this Agreement in the then outstanding principal balance of the Declining Revolving Credit Loan at APP Loan Conversion (the “APP Term Loan”), and Lender has approved and is extending to Cardinal Colwich a term loan in the original principal amount of $22,000,000 (the “Term Loan”). NOW, THEREFORE, in consideration of the mutual agreements herein set forth and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows: ARTICLE I DEFINITIONS Section 1.01. Definitions. For all purposes of this Agreement unless the context otherwise requires, the terms defined below shall have the respective meanings hereinafter specified. “Adjusted EBITDA” means EBITDA less Capital Expenditures and less Permitted Distributions and other distributions permitted under this Agreement, in each case for the applicable reporting period. “Adjusted Prime Rate” means the Prime Rate determined in accordance with this Agreement minus the Applicable Margin at such time applicable to the Revolving Credit Loan,

Declining Revolving Credit Loan, and APP Term Loan, and plus the Applicable Margin at such time applicable to the Term Loan. "Advance" means any loan or other credit extension under the Revolving Credit Loan. "Agreement" means this Second Amended and Restated Construction Loan Agreement, as amended, renewed, restated, replaced or otherwise modified from time to time. “Anti-Corruption Laws” means all laws, rules, and regulations of any jurisdiction applicable to the Borrowers, Guarantor, or their Affiliates and Subsidiaries from time to time concerning or relating to bribery or corruption, including, without limitation, the United States Foreign Corrupt Practices Act of 1977 and the rules and regulations thereunder and the U.K. Bribery Act 2010 and the rules and regulations thereunder. “Anti-Money Laundering Laws” means any and all laws, statutes, regulations, or obligatory government orders, decrees, ordinances, or rules applicable to any Borrower, Guarantor, or their Subsidiaries or Affiliates related to terrorism financing or money laundering, including any applicable provision of the Patriot Act and The Currency and Foreign Transactions Reporting Act (also known as the “Bank Secrecy Act,” 31 U.S.C. §§ 5311-5330 and 12U.S.C. §§ 1818(s), 1820(b) and 1951-1959). “APP Budget" means the schedule of values and breakdown of hard costs, soft costs and other costs for construction of the APP Improvements in the APP Budget provided to and approved by Lender, as the same may be revised from time to time with the written approval of the Lender. "APP Completion Date" means May 1, 2024, or such other date as is approved in writing by the Lender. "APP Construction Advance" means an advance on the Declining Revolving Credit Loan used to pay for APP Improvements pursuant to the applicable terms of this Agreement and the APP Disbursing Agreement. “APP Construction Advance Maximum Amount” means the maximum amount of APP Construction Advances on the Declining Revolving Credit Loan which may be used by Cardinal Ethanol to finance the APP Improvements, which amount is $39,000,000. “APP Construction Period” means the period from April 1, 2022 to the APP Completion Date during which time the APP Improvements will be constructed and APP Construction Advances will be available to Cardinal Ethanol. "APP Construction Schedule" means the schedule for commencement and completion of the construction of the APP Improvements provided to and approved by the Lender as the same may be revised from time to time with the written approval of the Lender. “APP Disbursing Agreement” means the Disbursing Agreement dated February 28, 2022 among the Lender, Cardinal Ethanol, and Stewart Title Company, as amended, restated, supplemented or otherwise modified from time to time, relating to the disbursement of APP Construction Advances to Cardinal Ethanol. Loan Agreement — Page 2

“APP Improvements” means the construction and installation of advance processing package technological and efficiency improvements to the Project from ICM, Inc. “APP Loan Conversion” has the meaning given to such term in Section 2.04(b)(ii) of this Agreement. "APP Substantial Completion" means the occurrence of all of the following events with respect to the APP Improvements: (a) all APP Improvements are completed other than minor punch list items, are paid for in full free of all mechanic’s, labor, materialmen’s and other similar Lien claims, and the Lender has received a complete and total lien waiver from Contractor of the APP Improvements whose charges exceed $100,000.00 for all labor, materials and services on the APP Improvements or Project; (b) said completion has been certified by the applicable Contractor, Construction Inspector and Cardinal Ethanol, and no material punch-list items remain to be completed; (c) all applicable requirements, rules, orders and regulations of any Governmental Authority, including zoning, land use, building and environmental requirements, rules and regulations, and all private restrictions and covenants, have been complied with or satisfied and that unconditional certificates of occupancy (if required by a Governmental Authority) for all of such APP Improvements have been issued; (d) Cardinal Ethanol has obtained all Permits, and entered into all agreements necessary or appropriate to operate the Project at maximum capacity; and (e) all insurance required pursuant to the Loan Documents is in full force and effect. “APP Term Loan” means the amortizing term loan which permanently finances the outstanding principal balance of the Declining Revolving Credit Loan, including all APP Construction Advances, following the APP Loan Conversion. “APP Term Loan Maturity Date” means the earlier to occur of May 1, 2029 or the date the APP Term Loan is accelerated pursuant to Section 6.02 or any other applicable provision of this Agreement, on which date the principal balance, together with accrued and unpaid interest on the APP Term Loan, is due and payable in full. “APP Term Note” means the APP Term Note evidencing the APP Term Loan executed and delivered by Cardinal Ethanol in favor of Lender, and all amendments, restatements, replacements, and modifications thereof. "Applicable Margin" means, at any date, (a) in the case of the Revolving Credit Loan, 0.25%, (b) in the case of Declining Revolving Credit Loan, 0.05%, (c) in the case of the APP Term Loan, 0.05%, (d) in the case of the Term Loan, 0.25%, and (e) in the case of the Non-Use Fee, 0.25%. "Applicable Rate" means the Adjusted Prime Rate; provided, however, that in no event shall the Applicable Rate be less than the applicable Floor. “Appraisal” means a Member Appraisal Institute certified appraisal of each parcel of the Kansas Plant performed in accordance with FIRREA and Lender’s appraisal requirements by an appraiser selected and retained by Lender or otherwise consented to or approved by Lender. “Asset Purchase Agreement” means that certain Asset Purchase Agreement dated October 23, 2023 between Creative Planning Business Alliance, LLC (successor by merger of Alliance Management, LLC) as receiver of Element, LLC, and Cardinal Colwich, pursuant to which Cardinal Colwich is acquiring the Kansas Plant. Loan Agreement — Page 3

“Banking Services” means each and any of the following banking services provided to a Borrower, Guarantors, or their Affiliates by the Lender or any of its Affiliates: (a) credit cards for commercial customers (including, without limitation, “commercial credit cards” and purchasing cards), (b) stored value cards, (c) merchant processing services, and (d) treasury management services (including, without limitation, loan sweep arrangements, controlled disbursement, automated clearinghouse transactions, return items, any direct debit scheme or arrangement, overdrafts, and interstate depository network services). “Banking Services Obligations” means any and all fees, expenses, overdrafts, indemnity obligations, and obligations of any nature of the Borrowers, Guarantors or their respective Affiliates and Subsidiaries, whether absolute or contingent and howsoever and whenever created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor) in connection with Banking Services. “Bond Debt” means all Debt assumed by Cardinal Colwich arising under those certain City of Colwich, Kansas Taxable Industrial Revenue Bonds, Series 2019 (Element, LLC) issued pursuant to that certain Trust Indenture dated December 3, 2019 between the City of Colwich, Kansas, as Issuer, and United Missouri Bank, N.A. (successor of Commerce Bank), as Trustee, and the Site Lease and Project Lease, each dated December 3, 2019, and each between Element, LLC and the City of Colwich, Kansas relating to such bonds. "Borrowing" means a borrowing by the Borrowers pursuant to this Agreement or the other Loan Documents, whether evidenced by or arising under Loans or other advances. "Borrowing Base" means, at any time, an amount equal to the sum of (without duplication): (a) 75% of each Borrower’s corn inventory valued at the lower of cost or Market Price on the date reported, minus any accounts payable, deferred payments, grain drafts payable, delayed price contracts or other expenses due on such corn inventory that have priority payment or Lien over Lender; plus (b) 75% of each Borrower’s soybean inventory valued at the lower of cost or Market Price on the date reported, minus any accounts payable, deferred payments, grain drafts payable, delayed price contracts or other expenses due on such soybean inventory that have priority payment or Lien over Lender; plus (c) 75% of each Borrower’s Eligible Finished Goods-Ethanol, Corn Oil, Distiller’s Grains Inventory (both wet and dry), valued at the lower of cost or Market Price on the date reported; plus (d) 75% of the amount of each Borrower’s ethanol, corn oil, distillers grains (both wet and dry), high protein feed, and wet syrup Eligible Accounts aged thirty (30) days or less, excluding any of the foregoing accounts reasonably deemed ineligible by Lender; plus (e) 90% of each Borrower’s Eligible Margin Account Equity; minus (f) 100% of the negative value of such margin account equity; minus Loan Agreement — Page 4

(g) 100% of Debt outstanding under the Revolving Credit Loan and 100% of the exposure under letters of credit issued for the account of a Borrower. If an item of Collateral could be included in the Borrowing Base under more than one subparagraph above, such item shall only be included in the Borrowing Base under the subparagraph that produces the lowest value for such item for purposes of the Borrowing Base. "Borrowing Base Certificate" means a certificate to be delivered pursuant to Section 4.12(c) of this Agreement and substantially in the form of Exhibit E to this Agreement. "Budget Variance Report" means a report submitted by Cardinal Ethanol to the Lender requesting a reallocation of funds from one budget category in the APP Budget to another or a modification, amendment or supplement the APP Budget, as applicable, in either case in excess of $100,000.00 individually or $500,000 in the aggregate. Each Budget Variance Report shall include the details of such reallocation, modification, amendment or supplement. "Business Day" means any day other than a Saturday, Sunday or other day on which commercial banks in Omaha, Nebraska and New York, New York are authorized or required to close. “Cardinal DISC” means Cardinal Ethanol Export Sales, Inc., a Delaware corporation organized as an IC-DISC under the Internal Revenue Code, its successors and assign. "Capital Expenditures" means an investment made in or purchase of a depreciable fixed or capital asset of $5,000 or more. "Closing Date" means the date of this Agreement, as reflected in the introductory paragraph hereof. "Collateral" means all property (real and personal, tangible and intangible) of the Borrowers and Guarantors with respect to which a security interest, assignment, mortgage or other Lien has been or is hereafter granted to or for the benefit of the Lender. The term includes, but is not limited to, all property encumbered at any time pursuant to the Mortgage (subject to any limitation in any Mortgage which expressly limits the principal amount of the obligations secured thereby), all property encumbered at any time pursuant to the Security Agreements, the Guarantor Security Agreement, the Control Agreements, the assignment, and consents thereto, of the Material Contracts, and the property pledged under any other Loan Documents. The term includes, but is not limited to, all "Collateral" referred to in the Current Credit Agreement and Original Credit Agreement, including, but not limited to, the assignments of the Material Contracts listed in Schedule 3.01(u). “Commitment Increase” has the meaning given to such term in Section 2.06 of this Agreement. “Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. § 1 et seq.), and any successor statute. "Compliance Certificate" means a certificate required to be delivered pursuant to Section 4.12(f) of this Agreement. Loan Agreement — Page 5

"Construction Inspector" means a Person appointed or designated by the Lender from time to time to inspect the progress of the construction of the APP Improvements and the conformity of the construction of the APP Improvements with the APP Budget and APP Construction Schedule, as applicable, and to perform such other acts and duties for such purposes or other reasonable purposes as the Lender may from time to time deem appropriate or as may be required by the terms of this Agreement. “Contractor” means ICM, Inc. and each other Person who has provided labor and/or materials to the construction of the APP Improvements, including all Persons who have the right to file any Lien against the Project arising out of the APP Improvements. "Control Agreements" means, collectively, the Security Agreement and Assignment of Hedging Accounts relating to Cardinal Ethanol’s Hedge Accounts with Cunningham Commodities, LLC, INTL FCStone Markets, LLC, INTL FCStone Financial, Inc., RJ O'Brien & Associates, LLC and ADM Investor Services, Inc. and the respective control agreement relating thereto among Cardinal Ethanol, Lender and Cunningham Commodities LLC, INTL FCStone Markets, LLC, INTL FCStone Financial, Inc., RJ O'Brien & Associates, LLC and ADM Investor Services, Inc. respectively relating thereto; together with all amendments, renewals, restatements, replacements and other modifications of each of the foregoing agreements. "Daily Credit Balance" means, on any day, the aggregate principal amount of all Revolving Credit Loans and all Declining Revolving Credit Loans outstanding at the end of such day. "Debt" with respect to any Person means (a) all obligations of such Person for borrowed money or with respect to deposits or advances of any kind, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person upon which interest charges are customarily paid, (d) all obligations of such Person under conditional sale or other title retention agreements relating to property acquired by such Person, (e) all obligations of such Person in respect of the deferred purchase price of property or services (excluding current accounts payable incurred in the ordinary course of business), (f) all Debt of others secured by (or for which the holder of such Debt has an existing right, contingent or otherwise, to be secured by) any Lien on property owned or acquired by such Person, whether or not the Debt secured thereby has been assumed, (g) all guarantees by such Person of Debt of others, (h) all capital lease obligations (as determined in accordance with generally accepted accounting principles) of such Person, (i) all obligations, contingent or otherwise, of such Person as an account party in respect of letters of credit and letters of guaranty, (j) all liabilities in respect of unfunded vested benefits under plans covered by Title IV of the Employee Retirement Income Security Act of 1974, as amended, (k) all obligations, contingent or otherwise, of such Person in respect of bankers’ acceptances, (1) obligations under Financial Instrument Agreements and (m) obligations and exposure under letters of credit issued for the account of such Person. The Debt of any Person shall include the Debt of any other entity (including any partnership in which such Person is a general partner) to the extent such Person is liable therefor as a result of such Person’s ownership interest in or other relationship with such entity, except to the extent the terms of such Debt provide that such Person is not liable therefor. "Debt for Borrowed Money" means Debt of the types set forth in clauses (a), (b), (c), (1), (i) and (m) of the definition of "Debt" in this Section. Loan Agreement — Page 6

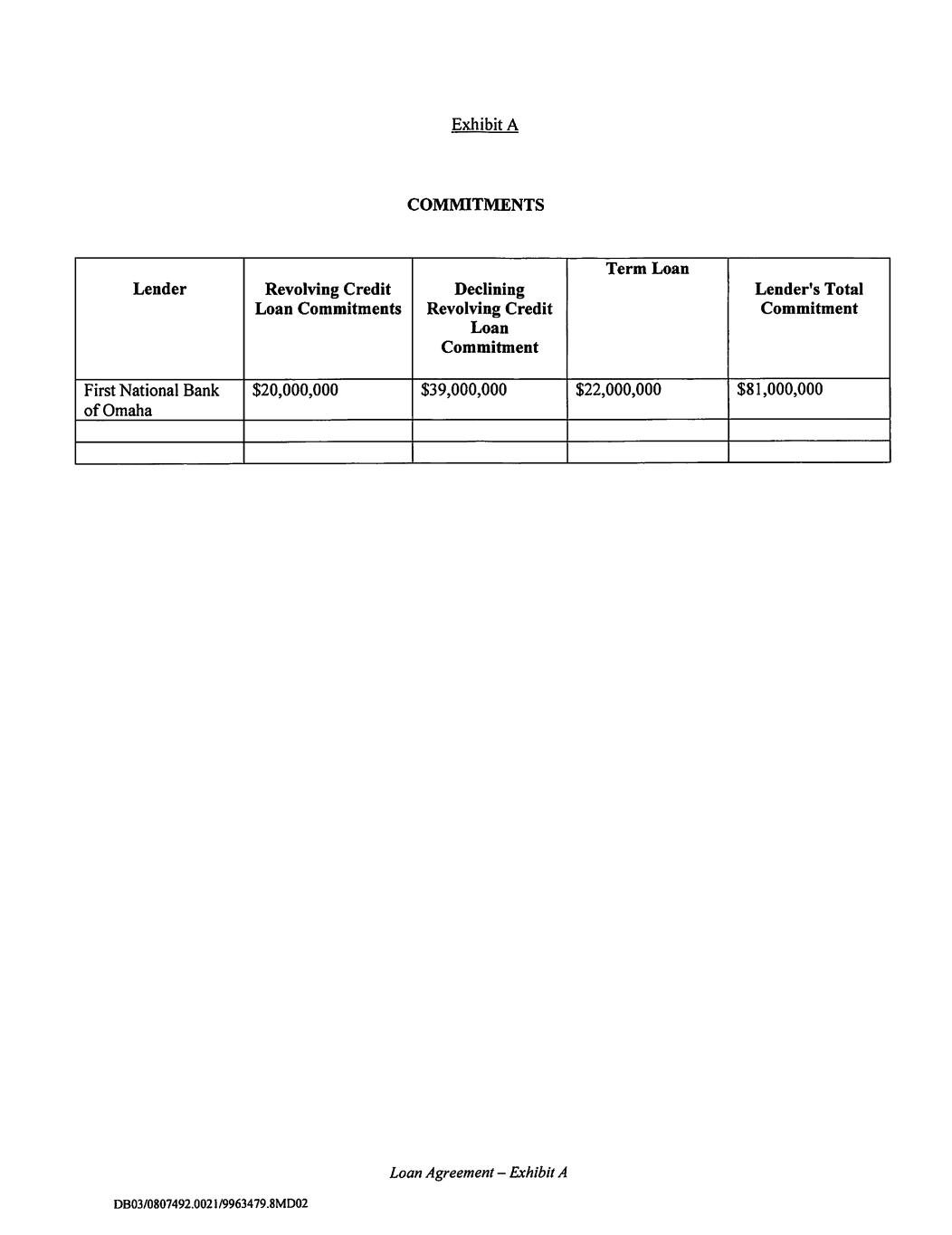

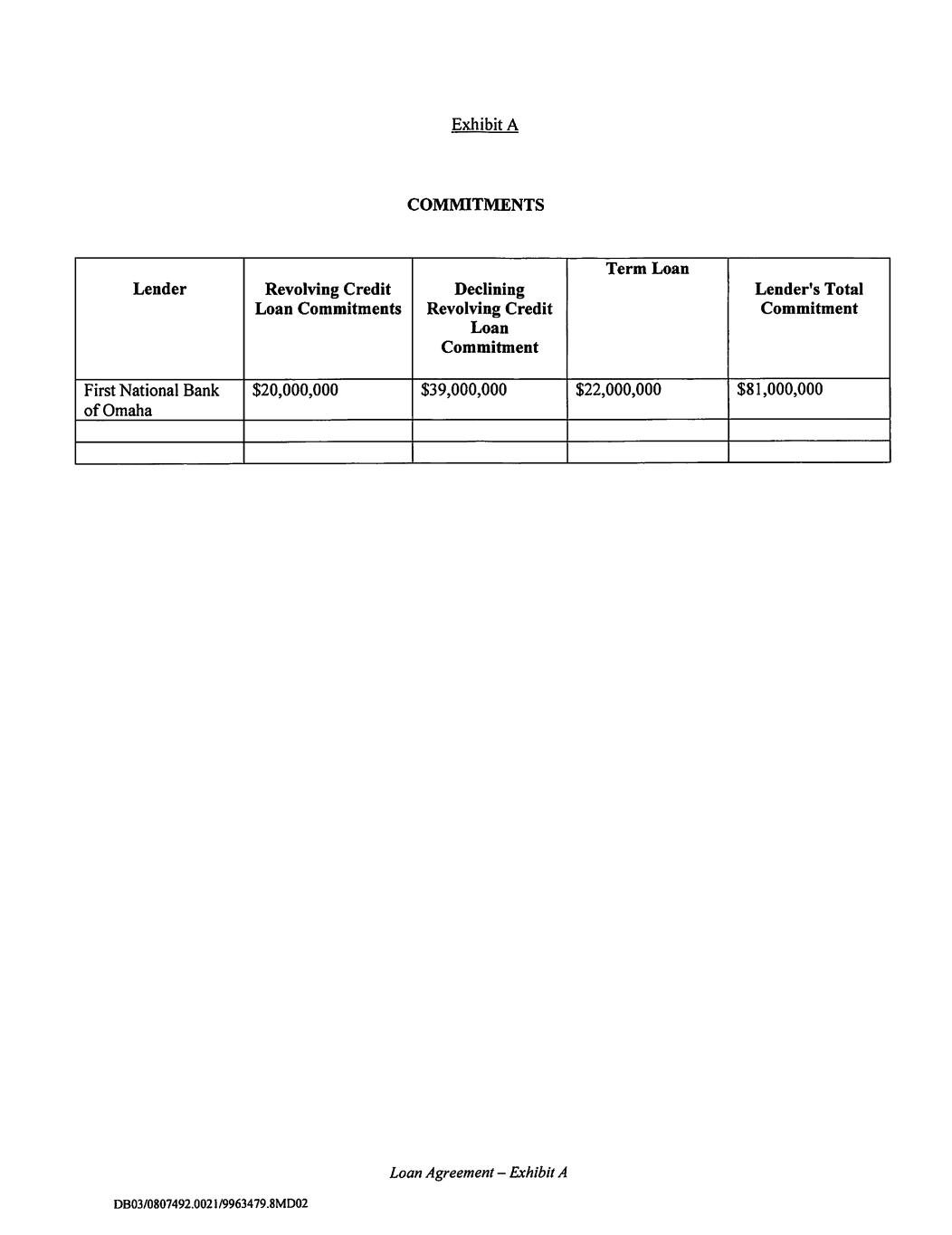

“Debt Service Coverage Ratio” means, for any period, the ratio derived when comparing (a) EBITDA to (b) Borrowers’ scheduled payments of principal and interest on the Loans during the applicable reporting period. "Declining Revolving Credit Commitment" means the amount set opposite Lender's name under the column entitled "Declining Revolving Credit Loan Commitment" on Exhibit A hereto. "Declining Revolving Credit Loans" has the meaning provided in Section 2.01(a)(ii) of this Agreement. "Declining Revolving Credit Note" has the meaning provided in Section 2.03(b) of this Agreement. "Default" means any condition or event which constitutes an Event of Default or which with the giving of notice or the lapse of time or both would, unless cured or waived, become an Event of Default. "EBITDA" means, for any period and determined in accordance with GAAP, Net Income before interest, taxes, depreciation and amortization. "Eligible Account" means an account owing to a Borrower arising in the ordinary course of such Borrower’s business from the sale of ethanol, distiller's grains (both wet and dry), high protein feed, wet syrup, or corn oil in which the Lender has a perfected first priority security interest and which meets all of the following specifications at the time it came into existence and continues to meet the same until it is collected in full: (a) The account is due and payable no later than thirty (30) days after the date of the applicable invoice or other writing evidencing such account, and the account has been due and payable not more than thirty (30) days after the due date stated in the applicable invoice or other writing evidencing such account; (b) The account is not owing by an account debtor who has failed to pay twenty-five percent (25%) or more of the aggregate outstanding amount of its accounts owing to the applicable Borrower within thirty (30) days after the due date stated in the applicable invoices or other writings evidencing such accounts; (c) The account is due and payable from an account debtor located in the continental United States which is not a subsidiary or affiliate (under common ownership and/or control) of the applicable Borrower; (d) The account arose from a bona fide, outright sale of goods by a Borrower or from the performance of services by a Borrower and such Borrower has possession of and will deliver to the Lender, if requested, shipping and delivery receipts evidencing shipment of the goods or inventory and, if representing services, receipts and/or invoices evidencing that the services have been fully performed for the respective account debtor; (e) The account is not subject to any Lien created by a Borrower, or claimed under or through a Borrower, except the security interest of the Lender, and Borrowers will not make any other assignment thereof or create any further security interest Loan Agreement — Page 7

therein nor permit their rights therein to be reached by attachment, levy, garnishment or other judicial process; (f) The account is the valid and legally enforceable obligation of the account debtor thereunder and is not subject to any claim for credit, set-off, allowance or adjustment by the account debtor or any counterclaim, and the account debtor has not returned any of the goods from the sale of which the account arose, nor has any partial payment been made thereon; (g) The account arose in the ordinary course of a Borrower’s business, and the account debtor has not filed bankruptcy, is not insolvent or no material adverse change in the financial condition of the account debtor has occurred; (h) The account is not owing by an account debtor who has died or dissolved or terminated its existence, the account debtor’s business has not failed, the account debtor has not disappeared, a receiver has not been appointed for any part of the property of the account debtor, the account debtor has not made an assignment for the benefit of creditors or filed, or has had filed against it, a petition under or the commencement of any proceeding under any bankruptcy code or process; (i) The account is not evidenced by a judgment, an instrument or chattel paper; Gj) The account debtor is not an employee of a Borrower or Guarantor; (k) The account is not owing by any account debtor whose aggregate outstanding accounts with a Borrower exceed thirty percent (30%) of the aggregate of all accounts by all account debtors owing to such Borrower, provided, however, that thirty percent (30%) of the aggregate amount outstanding on such accounts will be deemed Eligible Accounts, and provided further that such threshold shall not apply to accounts owed to a Borrower by any marketer under a Sales and Marketing Contract; and (I) The account or any portion thereof is acceptable to the Lender or is not otherwise deemed ineligible by the Lender in its reasonable discretion. An account which is at any time an Eligible Account but which subsequently fails to meet any of the foregoing requirements shall forthwith cease to be an Eligible Account. The Lender shall determine whether accounts qualify as Eligible Accounts from time to time in its sole and absolute discretion and any such determination shall be conclusive and binding for all purposes, absent manifest error. “Eligible Finished Goods — Ethanol, Corn Oil and Distiller’s Grains Inventory” means all ethanol, corn oil, high protein feed, wet syrup, and distiller’s grains (wet and dry) inventory of a Borrower (i) that is owned by (and in the possession or under the control of) such Borrower as of such date and is not consigned or covered by or subject to a seller’s right to repurchase or any consensual or nonconsensual Lien (including, without limitation, purchase money Liens) in favor of any party other than the Lender, (ii) that is located at a facility owned by a Borrower and listed in Schedule A of such Borrower’s respective Security Agreement and is in such Borrower’s exclusive possession, (iii) that is in good and marketable condition, (iv) that meets all standards imposed by any governmental agency or department or division thereof having regulatory authority over such inventory, its use or sale, (v) that is either currently usable or currently Loan Agreement — Page 8

saleable in the normal course of such Borrower’s business without any notice to, or consent of, any governmental agency or department or division thereof (excluding however, any such inventory that has been shipped to a customer of such Borrower, even if on a consignment or “sale or return” basis), (vi) is not work-in-process, in transit, obsolete or slow-moving and (vii) no prepayment has been received for such inventory; provided that the Lender may at any time exclude from Eligible Finished Goods — Ethanol, Corn Oil and Distiller’s Grains Inventory any type of ethanol, corn oil, high protein feed, wet syrup, or distiller’s grains inventory that the Lender reasonably determines to be unmarketable or ineligible in its sole discretion. The Lender shall have the right, in the exercise of reasonable discretion, to determine whether finished goods ethanol, corn oil and distiller's grains inventory is eligible for inclusion in the Borrowing Base at any particular time. "Eligible Margin Account Equity" means the positive equity value of open positions in the money in margin accounts maintained by a Borrower with a broker for hedging and not speculative purposes and which have been collaterally assigned by such Borrower to the Lender, in which the Lender has a first priority security interest, as determined by the Lender in its good faith business judgment, and in which the broker has acknowledged in writing pursuant to an executed control agreement the security interest of the Lender therein and has agreed, to the Lender's satisfaction, that the Lender has "control" of such account for purposes of perfecting the Lender's security interest therein. Such equity value shall be determined by the Lender from the brokers' statements and shall be net of all losses or out of the money positions. “Encroachment Easement” means that certain Encroachment Easement Agreement dated as of January 23, 2020 between ICM, Inc. and Element, LLC and recorded January 23, 2020 as Document No. 29929203 with the Sedgwick County, Kansas Register of Deeds, as assigned to Cardinal Colwich pursuant to the Asset Purchase Agreement, pursuant to which ICM, Inc. grants Cardinal Colwich a non-exclusive easement for the Encroachment on the ICM Property (as such terms are defined in such Encroachment Easement). "Excess Cash Flow" means the Adjusted EBITDA of Cardinal Ethanol plus the Adjusted EBITDA of Cardinal Colwich, less Fixed Charges for Cardinal Ethanol and Fixed Charges for Cardinal Colwich during the applicable reporting period. “Excluded Swap Obligations” means, with respect to any Guarantor, any Swap Obligation if, and to the extent that, all or a portion of the Guaranty of such Guarantor of, or the grant by such Guarantor of a security interest to secure, such Swap Obligation (or any Guaranty thereof) is or becomes illegal under the Commodity Exchange Act or any rule, regulation or order of the Commodity Futures Trading Commission (or the application or official interpretation of any thereof) by virtue of such Guarantor’s failure for any reason not to constitute an “eligible contract participant” as defined in the Commodity Exchange Act (determined after giving effect to Section 4.29 and any other “keepwell, support or other agreements” for the benefit of such Guarantor) at the time the Guaranty of, or the grant of such security interest by, such Guarantor becomes effective with respect to such related Swap Obligation. If a Swap Obligation arises under a master agreement governing more than one swap, such exclusion shall apply only to the portion of such Swap Obligation that is attributable to swaps for which such Guaranty or grant of security interest is or becomes illegal. "Event of Default" has the meaning set forth in Section 6.01 of this Agreement. “FATCA” means Sections 1471 through 1474 of the Internal Revenue Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and Loan Agreement — Page 9

not materially more onerous to comply with), any current or future regulations or official interpretations thereof and any agreement entered into pursuant to Section 1471(b)(1) of the Internal Revenue Code. "Financial Instrument Agreements" means any agreements with respect to any transaction now existing or hereafter entered into among a Borrower and the Lender or any of its subsidiaries or affiliates or their successors, or any other third party, which is a rate swap, basis swap, forward rate transaction, equity or equity index swap, equity or equity index option, bond option, interest rate option, foreign exchange transaction, cap transaction, floor transaction, collar transaction, forward transaction, currency swap transaction, cross-currency rate swap transaction, currency option or any other similar transaction (including any option with respect to any of these transactions) or any combination thereof, whether linked to one or more interest rates, foreign currencies, commodity prices, equity prices or other financial measures; provided that such transaction is entered into by the such Borrower for hedging purposes and not speculation. “Financial Instruments Obligations” means any and all obligations of the Borrowers, whether absolute or contingent and however and wherever created, arising, evidenced, or acquired (including all renewals, extensions, and modifications thereof and substitutions therefor), under any and all Financial Instruments Agreements permitted under this Agreement with the Lender or an Affiliate of the Lender. “FIRREA” means The Financial Institutions Reform, Recovery and Enforcement Act of 1989, as amended from time to time. "Fixed Charge Coverage Ratio" means, for any period, the ratio derived when comparing (a) Adjusted EBITDA to (b) Borrowers’ scheduled payments on the principal and interest of the Loans due during the applicable reporting period. "Fixed Charges" means, for any period, the sum of scheduled principal on the Loans that is payable during such period, and including, without limitation, scheduled interest and other finance charges paid or payable with respect to the Loans unless such interest and other finance charges are paid in full prior to the measurement date. “Flood Certificate” means a “Standard Flood Hazard Determination Form” of the Federal Emergency Management Agency and any successor Governmental Authority performing a similar function. “Flood Hazard Property” means any Real Estate located in a Flood Zone or otherwise in an area designated by the Federal Emergency Management Agency as having special flood and mudslide hazards. “Flood Program” means the National Flood Insurance Program created pursuant to the National Flood Insurance Act of 1968, the Flood Disaster Protection Act of 1973, the National Flood Insurance Reform Act of 1994, and the Flood Insurance Reform Act of 2004. “Flood Zone” means areas having special flood hazards as described in the Flood Program. “Floor” means two and three quarters percent (2.75%) per annum with respect to the Revolving Credit Loan, two and eighty-five hundredths percent (2.85%) per annum with respect Loan Agreement — Page 10

to the Declining Revolving Credit Loan and APP Term Loan, and three and one quarter percent (3.25%) per annum with respect to the Term Loan. “GAAP” means generally accepted accounting principles in the United States applied on a consistent basis and subject to the terms of Section 1.02. “Governmental Authority” means the government of the United States of America, any other nation or any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government. “Guarantors” means Cardinal DISC, Cardinal Ethanol, and Cardinal Colwich. “Guarantor Security Agreement” means the Security Agreement encumbering the Collateral defined therein executed and delivered by Cardinal DISC in favor of Lender, as it may be amended, restated, replaced, supplemented, or otherwise modified. “Guaranty” means that certain Guaranty executed and delivered by each Guarantor in favor of Lender, as it may be amended, restated, replaced, supplemented, or otherwise modified. “Interest_Expense” means, for any period determined on a consolidated basis in accordance with GAAP, the sum of (i) total interest expense, including without limitation the interest component of any payments in respect of capital lease obligations capitalized or expensed during such period (whether or not actually paid during such period), plus (ii) the net amount payable (or minus the net amount receivable) under Financial Instrument Agreements related to interest rates during such period (whether or not actually paid or received during such period). “Kansas Plant” means the ethanol plant constructed on the Real Estate located in Sedgwick County, Kansas described in the Mortgage encumbering the Kansas Plant, capable of producing fuel grade ethanol and related byproducts of dried, high protein feed and wet syrup, together with all necessary and appropriate fixtures, equipment, attachments, and accessories. “Kansas Tithe Company” means Kansas Title Company Kansas Secured Title, Inc., as agent for Chicago Title Insurance Company, its successors and assigns. "Lender" means First National Bank of Omaha and its successors and assigns. "Lien" means, with respect to any asset, any mortgage, lien, pledge, charge, assignment, security interest or other encumbrance of any kind in respect of such asset. "Loan Documents" means this Agreement, the Notes, the Security Agreement, the Control Agreements, the Mortgage, the assignments of the Material Contracts, the Guaranties, the Guarantor Security Agreement, the APP Disbursing Agreement, the Subordination Agreement, and any documents relating to any Financial Instrument Agreements, letters of credit, and all other documents, instruments and agreements executed and/or delivered in connection therewith at any time, all as the same may be amended, renewed, replaced, restated, consolidated or otherwise modified from time to time in accordance with the terms thereof and hereof. Loan Agreement — Page 11

"Loans" means, collectively, the Revolving Credit Loan and Advances thereunder, the Declining Revolving Credit Loans, the APP Term Loan, Term Loan, and any letters of credit issued for the account of a Borrower. “Management Contracts” means all agreements and contracts related to the management and risk management of the Project and Kansas Plant and the operation of Borrowers’ business in effect presently involving monetary liability of or to any such person in an amount in excess of Two Hundred Fifty Thousand and No/100 Dollars ($250,00.00) per year, and entered into from time to time hereafter, including those listed in Schedule 3.01(u)(i), as the same such agreements and contracts are amended, restated, supplemental or otherwise modified from time to time. "Market Price" of any inventory means, at any time, the then-current market price of such inventory as reasonably determined by the Lender. "Material Adverse Effect" means, with respect to any event, act, condition or occurrence of whatever nature (including any adverse determination in any litigation, arbitration, or governmental investigation or proceeding), whether singularly or in conjunction with any other event or events, act or acts, condition or conditions, occurrence or occurrences whether or not related, a material adverse change in, or a material adverse effect on, (i) the business, operations, results of operations, financial condition, assets, Collateral or liabilities, of either Borrower or any Guarantor taken as a whole, (ii) the ability of Borrowers or Guarantors to perform any of their respective obligations under the Loan Documents, (iii) the rights and remedies of Lender under any of the Loan Documents or (iv) the legality, validity or enforceability of any of the Loan Documents. “Material Contracts” means (a) the Management Contracts, Supply Contracts, Sales and Marketing Contracts, Transportation Contracts, and Utility Contracts, (b) that certain License Agreement dated on or about December 14, 2006 between Cardinal Ethanol and ICM, Inc., (c) that certain Owner’s License Agreement dated on or about March 2, 2018 between Cardinal Colwich, via assignment from Element, LLC, and ICM, Inc., (d) the Water Sharing Agreement, (e) any other contract or any other agreement, written or oral, of either Borrower involving monetary liability of or to any such person in an amount in excess of Two Hundred Fifty Thousand and No/100 Dollars ($250,000.00) per year, and (f) any other contract or agreement, written or oral, of either Borrower, the failure to comply with would have a Material Adverse Effect on such Borrower. “Material Indebtedness” means Debt (other than the Loans) or obligations in respect of one or more Financial Instrument Agreements of a Borrower in an aggregate principal amount exceeding $250,000 at any one time outstanding during the term of the Loans. "Mortgage" means, collectively, the Second Amended and Restated Construction Loan Mortgage, Security Agreement, Assignment of Leases and Rents and Fixture Financing Statement, dated of even date herewith given by Cardinal Ethanol in favor of the Lender, which creates a Lien against the Project and the other property described therein, and the Mortgage, Security Agreement, Assignment of Leases and Rents and Fixture Financing Statement dated of even date herewith given by Cardinal Colwich in favor of the Lender, which creates a Lien against the Kansas Plant and the other property described therein and all amendments, restatements, renewals, replacements and other modifications of the foregoing. "Mortgaged Property" has the meaning given to such term in each Mortgage. Loan Agreement — Page 12

“Negative Termination Value” means, with respect to any Financial Instrument Agreement of a Borrower, the amount (if any) that such Borrower would be required to pay if such Financial Instrument Agreement were terminated by reason of a default by or other termination event relating to such Borrower, such amount to be determined on the basis of a good faith estimate made by the Lender, in consultation with such Borrower. The Negative Termination Value of any such Financial Instrument Agreement at any date shall be determined (i) as of the end of the most recent fiscal quarter ended on or prior to such date if such Financial Instrument Agreement was then outstanding or (ii) as of the date such Financial Instrument Agreement is terminated. However, if an applicable agreement between a Borrower and the relevant counterparty provides that, upon any such termination by such counterparty, one or more other Financial Instrument Agreements (if any exist) between such Borrower and such counterparty would also terminate and the amount (if any) payable by such Borrower would be a net amount reflecting the termination of all the Financial Instrument Agreements so terminated, then the Negative Termination Value of all the Financial Instrument Agreements subject to such netting shall be, at any date, a single amount equal to such net amount (if any) payable by such Borrower, determined as of the later of (i) the end of the most recently ended fiscal quarter or (ii) the date on which the most recent Financial Instrument Agreement subject to such netting was terminated. “Net Income” means, for any period, the net income (or loss) of Borrowers for such period determined in accordance with GAAP. "Net Worth" means , as to Borrowers as of any date, total assets less total liabilities and less the following types of assets: (i) leasehold improvements; (ii) receivables (other than those created by sale of goods) to a member and other investments in or amounts due from any member, employee or other person or entity related to or affiliated with Borrowers); (iii) goodwill, patents, copyrights, mailing lists, trade names, trademarks, servicing rights, organizational and franchise costs, bond underwriting costs and other like assets properly classified as intangible, and (iv) treasury stock or equity interests, all as determined in accordance with GAAP; provided, however, Net Worth shall not include any Debt due to Borrowers not acceptable to Lender in the exercise of its reasonable discretion. “Non-Use Fee” has the meaning given to such term in Section 2.11 of this Agreement. "Notes" means, collectively, the Revolving Credit Note, the Declining Revolving Credit Note, the APP Term Note, and the Term Note and all amendments, restatements, renewals, replacements and other modifications of the foregoing. "Obligations" means, collectively, all indebtedness, liabilities and obligations whatsoever of Borrowers or Guarantors to the Lender whether now existing or hereafter arising, regardless of the form the liability takes or its purpose, including, without limitation, the Banking Services Obligations and Financial Instruments Obligations, and all indebtedness, liabilities and obligations under or in connection with this Agreement, the Notes, the Guaranties, and/or any of the other Loan Documents, including without limitation, the principal of, and interest on, the Loans, all future advances thereunder, and all other amounts now or hereafter owing to the Lender under this Agreement, the Notes, Guaranties, letters of credit, or any of the other Loan Documents, but not including Excluded Swap Obligations. “OFAC” means the U.S. Department of the Treasury’s Office of Foreign Asset Control. Loan Agreement — Page 13

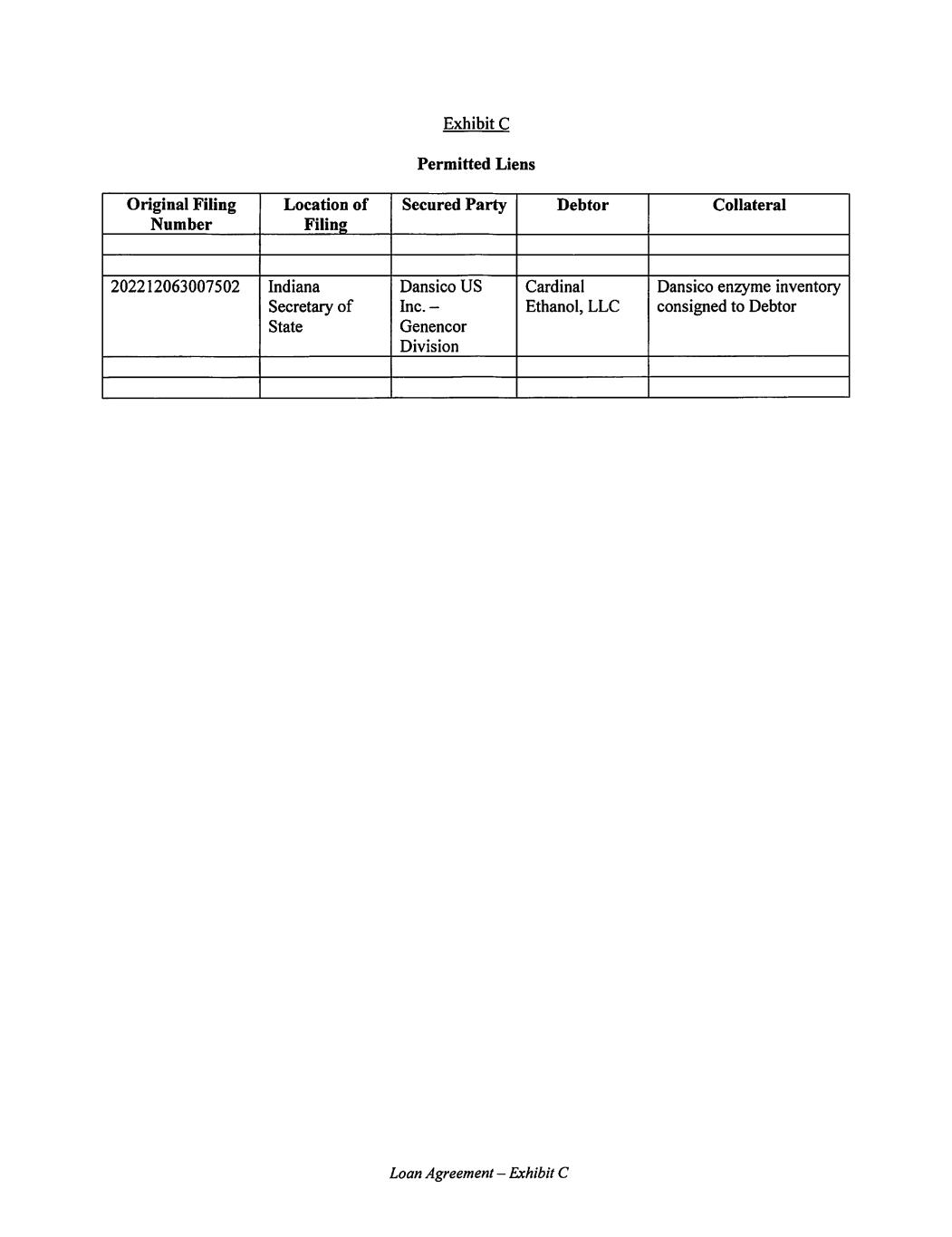

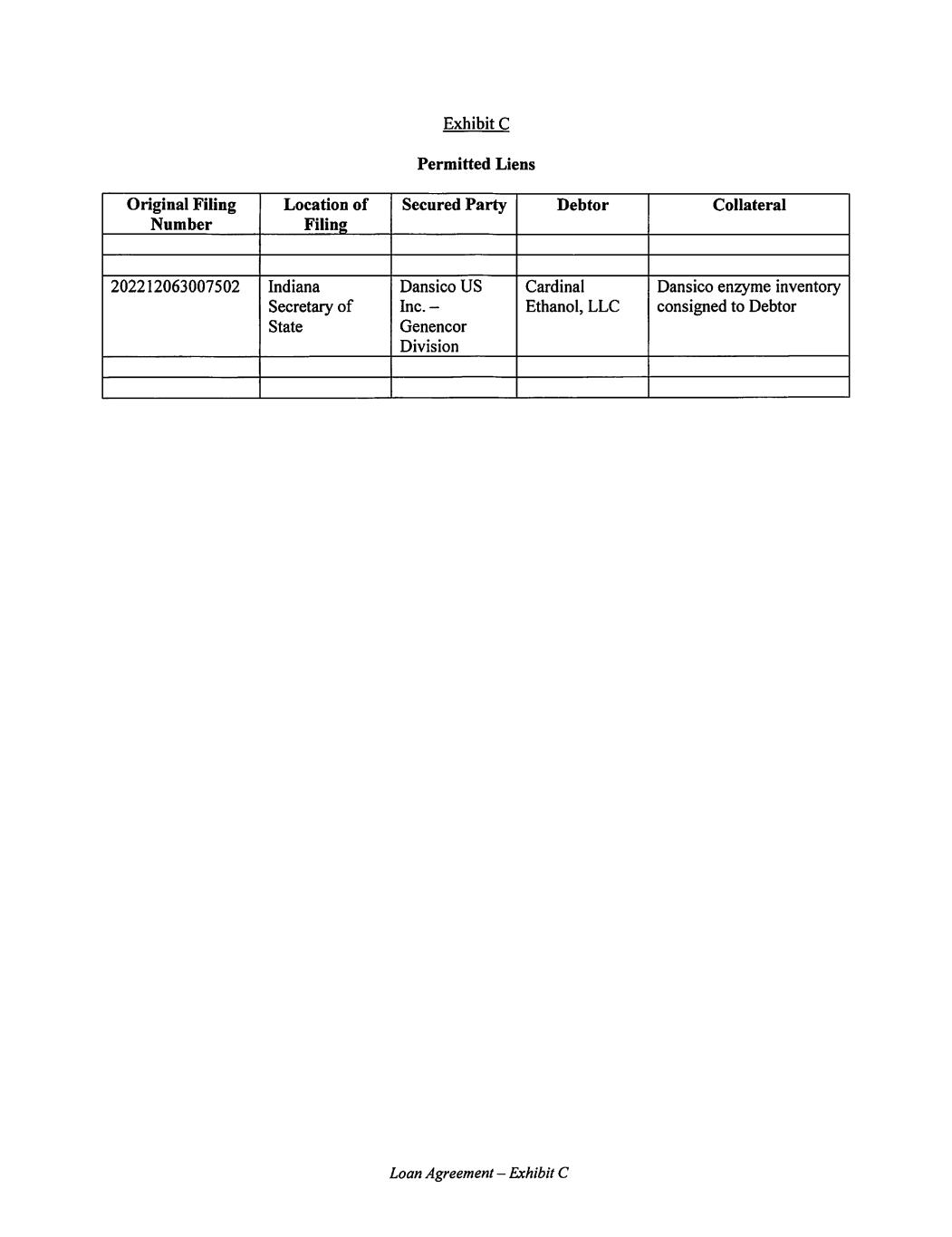

“Permits” means all licenses, consents, approvals, authorizations and permits of Governmental Authorities which a Borrower is required to obtain in connection with the Project and the Kansas Plant, and operation of Borrowers’ respective business as now conducted and as contemplated following completion of the APP Improvements and the acquisition of the Kansas Plant, including but not limited to any of the foregoing related to environmental laws (including an air emissions permit and a national pollution discharge elimination system construction permit, each of which will allow a Borrower to operate its facilities at maximum capacity), zoning and land-use laws (including any requirement to obtain a special exception, if applicable), water use laws, waste disposal laws, laws requiring construction permits and occupancy certificates, and laws relating to construction and operation of above or underground ground storage tanks. "Permitted Debt" means: (a) Debt under this Agreement and the other Loan Documents; (b) the Bond Debt so long as such Bond Debt does not exceed $1,000,000; and (c) Debt incurred on or after the Closing Date in an aggregate principal amount not to exceed $250,000 at any time outstanding, without the prior written consent of the Lender. "Permitted Liens" has the meaning given to such term in Section 4.16 of this Agreement. "Person" means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, governmental department or authority or other entity. “Prime Rate” means the U.S. Prime Rate as published by The Wall Street Journal as the U.S. Prime Rate and is currently determined by the base rate on corporate loans posted by at least seventy percent (70%) of the nation’s ten (10) largest banks (the “Index”). The Index is not necessarily the lowest rate charged by Lender on its loans. Lender will tell Borrowers the current Index rate upon a Borrower’s request. The interest rate will change with and be adjusted and determined on each day the Index changes (each, an “Interest Rate Change Date”). The interest rate change will not occur more often than daily. If at any time the Index is less than zero, then it shall be deemed to be zero for the purpose of calculating the Adjusted Prime Rate. Borrowers understand that Lender may make loans based on other rates as well. If Lender determines, in its sole discretion, that the Index has become unavailable or unreliable, either temporarily, indefinitely, or permanently, during the term of the Loans, Lender may amend this Agreement by designating a substantially similar substitute index. Lender may also adjust the Applicable Margin to accompany the substitute index. The change to the Applicable Margin may be a positive or negative value, or zero. In making these amendments, Lender will act in a commercially reasonable manner and may take into consideration any then prevailing market convention for selecting a substitute index and margin for the specific Index that is unavailable or unreliable. Such an amendment to the terms of this Agreement will become effective and bind Borrowers ten (10) business days after Lender gives written notice to Borrowers without any action or consent of Borrowers. “Project” means the dry milling ethanol plant constructed on the Real Estate located in Randolph County, Indiana described in the applicable Mortgage, capable of producing approximately 100 million gallons of fuel grade ethanol per year, and related byproducts of dried, distillers grains with solubles, together with all necessary and appropriate fixtures, equipment, attachments, and accessories. "Projections" has the meaning provided in Section 4.12(g) of this Agreement. “Real Estate” means, collectively, the real property on which the Project is constructed, the Kansas Plant is located, and all other real property owned or leased by a Borrower. Loan Agreement — Page 14

"Revolving Credit Commitment" means the amount set opposite Lender's name under the column entitled "Revolving Credit Loan -Commitment" on Exhibit A hereto. "Revolving Credit Loans" has the meaning provided in Section 2.01(a)(i) of this Agreement. "Revolving Credit Note" has the meaning provided in Section 2.03(a) of this Agreement. “Sales and Marketing Contracts” means all agreements and contracts in effect presently and entered into from time to time hereafter which are material to the sale or disposal of products and by-products produced by Borrowers including the marketing and sale of ethanol, carbon dioxide and distillers grains (“DDGS”), including that certain Carbon Dioxide Purchase and Sale Agreement March 8, 2010 between Cardinal Ethanol and EPCO Carbon Dioxide Products, Inc., that certain Ethanol Purchase and Sale Agreement dated December 20, 2006 between Cardinal Ethanol and Murex, LLC (f/k/a Murex, N.A., Ltd.), the Distiller’s Grain Marketing Agreement dated December 13, 2006 between Cardinal Ethanol and CHS, Inc., any other agreements specified in Schedule 3.01(u)(iii), and any sales and marketing contracts assumed by Cardinal Colwich under the Asset Purchase Agreement, as such agreements and contracts are extended, amended, restated, supplemented or otherwise modified from time to time. “Sales Order” means that certain Order and Decree Authorizing Sale of Receivership Property issued by the District Court of Sedgwick, County, Kansas (the “Court”) on December 1, 2023 in the case styled Compeer Financial, FLCA, Plaintiff, v. Element, LLC, et al., as Case No. 2023-CV-000694-CM, pursuant to which the Court ordered the sale of the Purchased Assets (as defined in the motion underlying the Sales Order), and Cardinal Colwich’s assumption of the Assumed Liabilities under the Assumed Contracts (as such terms are defined in the motion underlying the Sales Order), in accordance with and under the terms of the Asset Purchase Agreement. “Sanctions” means any and all economic or financial sanctions, sectoral sanctions, secondary sanctions, trade embargoes, and anti-terrorism laws, including but not limited to those imposed, administered, or enforced from time to time by the U.S. government (including those administered by OFAC or the U.S. Department of State), the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority with jurisdiction over any Lender, the Borrowers, Guarantors, or any of Borrowers’ or Guarantors’ Subsidiaries or Affiliates. “Sanctioned Country” means at any time, a country or territory which is itself the subject or target of any Sanctions (including, as of the Closing Date, Cuba, Iran, North Korea, Sudan, Syria, Crimea, Venezuela, and Luhansk People’s Republic (also known as Donetsk People’s Republic). “Sanctioned Person” means, at any time, (a) any Person listed in any Sanctions-related list of designated Persons maintained by OFAC (including, without limitation, OFAC’s Specially Designated Nationals and Blocked Persons List and OFAC’s Consolidated Non-SDN List), the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority, (b) any Person operating, organized, or resident in a Sanctioned Country, or (c) any Person owned or controlled by any such Person or Persons described in clauses (a) and (b), including a Person that is deemed by OFAC to be a Sanctions target based on the ownership of such legal entity by Sanctioned Peron(s). Loan Agreement — Page 15

"Security Agreement" means collectively the Second Amended and Restated Security Agreement to be executed by the Cardinal Ethanol and the Security Agreement to be executed by Cardinal Colwich on or about the Closing Date in favor of the Lender and by which the Borrowers shall grant to the Lender, as security for the Obligations, a security interest in all of the Borrowers’ presently owned or hereafter acquired personal property, including without limitation, all of the Borrowers’ inventory, equipment, other goods, accounts receivable, general intangibles, hedging accounts, deposit accounts and investment property, as the same may be amended, renewed, replaced, restated, consolidated or otherwise modified from time to time. “Subordination Agreement” means that certain Subordination Agreement of even date with this Agreement between Lender and Cardinal Ethanol pursuant to which Cardinal! Ethanol subordinates any Debt extended by Cardinal Ethanol to Cardinal Colwich to the Obligations and subordinates any Liens held by Cardinal Ethanol to secure such Debt to Lender’s Liens securing the Obligations, as the same may be amended, renewed, replaced, restated, consolidated or otherwise modified from time to time. “Supply Contracts” means all other agreements and contracts related to the supply of inputs material to operation of Borrowers’ business in effect presently involving monetary liability of or to any such person in an amount in excess of Two Hundred Fifty Thousand and No/100 Dollars ($250,00.00) per year, and entered into from time to time hereafter, including those listed in Schedule 3.01(u)(ii), as the same such agreements and contracts are amended, restated, supplemental or otherwise modified from time to time. “Survey” means a survey satisfactory to the Lender prepared in accordance with the standards adopted by the American Land Title Association and American Congress on Survey and Mapping known as the “Minimum Standard Detail Requirements of Land Title Surveys” and in sufficient form to satisfy any requirements of the Title Company on the Kansas Plant to provide extended coverage over any survey exceptions and, at a minimum, shall also show the location of improvements, utilities, easements, and any encroachments, and include the flood zone classification of the applicable Real Estate. “Swap Obligation” means, with respect to any Guarantor, any obligation to pay or perform under any Financial Instrument Agreement or other agreement, contract, or transaction that constitutes a “swap” within the meaning of section 1a(47) of the Commodity Exchange Act. “Term Loan” means the amortizing term loan which partially finances the acquisition of the Kansas Plant in the original principal amount of the Term Loan Commitment. “Term Loan Commitment” means the amount set opposite Lender's name under the column entitled "Term Loan Commitment" on Exhibit A hereto. “Term Loan Maturity Date” means the earlier to occur of March 1, 2029 or the date the Term Loan is accelerated pursuant to Section 6.02 or any other applicable provision of this Agreement, on which date the principal balance, together with accrued and unpaid interest on the Term Loan is due and payable in full. “Term Note” means the Term Note evidencing the Term Loan executed and delivered by Cardinal Colwich in favor of Lender, and all amendments, restatements, replacements, and modifications thereof. Loan Agreement — Page 16

"Termination Date" with respect to the Revolving Credit Loan means February 28, 2025, with respect to the Declining Revolving Credit means the APP Loan Conversion date, or, in each case, the earlier date of termination in whole of the commitments pursuant to Section 6.02 or any other applicable provision of this Agreement, on which date the outstanding principal balance of the Revolving Credit Loan, Declining Revolving Credit Loan and APP Term Loan, as applicable, together with all accrued and unpaid interest is due and payable in full. "Title Companv" means Stewart Title Company with respect to Lender's title insurance policy on the Project and the Kansas Title Company with respect to Lender's title insurance policy on the Kansas Plant, and their respective successors and assigns. "Transportation Contracts" means all agreements and contracts in effect presently and entered into from time to time hereafter related to the provision of transportation or shipping services which are material to the operation of Borrowers' business involving monetary liability of or to any such person in an amount in excess of Two Hundred Fifty Thousand and No/100 Dollars ($250,000) per year, including those listed in Schedule 3.01(u)(iv), as the same such agreements and contracts are extended, amended, restated, supplemented or otherwise modified from time to time. "Utilitv Contracts" means the Water Sharing Agreement and the other agreements referenced in Schedule 3.01(u)(v) (including all exhibits thereto) and all other contracts and agreements in effect presently and entered into from time to time hereafter which are material to the provision to Borrowers of necessary electricity, natural gas, water, fuel oil, coal and other energy resources in connection with the operation of each Borrower's respective plant, equipment and offices involving, except with respect to the Water Sharing Agreement, monetaiy liability of or to any such person in an amount in excess of Two Hundred Fifty Thousand and No/100 Dollars ($250,000) per year, as the same such agreements and contracts are extended, amended, restated, supplemented or otherwise modified from time to time. "Water Plan" has the meaning given to such term in Section 4.32 of this Agreement. "Water Sharing Agreement" means that certain Water Sharing Agreement dated on or about February 28, 2018 between Element, LLC and Evergy Kansas South, Inc., successor of Kansas Gas and Electric Company, as assigned to Cardinal Colwich pursuant to and in connection with the Asset Purchase Agreement, and as the same such agreement is extended, amended, restated, supplemented or otherwise modified from time to time. "Working Capital" means current assets at the time of determination (including, without limitation, (i) the amount available to Cardinal Ethanol for drawing under the Declining Revolving Credit Loan, and (ii) prepayments for natural gas supplies), less the sum of (x) investments in or other amounts due from any member, manager, employee or any person or entity related to or affiliated with a Borrower, other than amounts due to a Borrower under a Sales and Marketing Agreement, and (y) current liabilities (all at the time of determination and without duplication). "Working Capital Advance" means an advance on the Declining Revolving Credit Loan other than an APP Construction Advance used for any purposes permissible under this Agreement. Loan Agreement - Page 17

“Working Capital Advance Maximum Amount” means the maximum amount of Working Capital Advances on the Declining Revolving Credit Loan which may outstanding at any one time, which amount is $5,000,000. Section 1.02. General; Fiscal Year. All accounting terms not specifically defined herein shall be construed in accordance with generally accepted accounting principles, as in effect in the United States. Unless the context clearly requires otherwise, all references to "dollars" or "$" are to United States dollars. "Including” (and with correlative meaning “include”) means including without limiting the generality of any description preceding such term. This Agreement and the other Loan Documents shall be construed without regard to any presumption or rule requiring construction against the party causing any such document or any portion thereof to be drafted. The Section and other headings in this Agreement and any index in this Agreement are for convenience of reference only and shall not limit or otherwise affect any of the terms of this Agreement. Similarly, any page footers or headers or similar word processing, document or page identification numbers in this Agreement or any index or exhibit are for convenience of reference only and shall not limit or otherwise affect any of the terms of this Agreement, nor shall there be any requirement that any such footers or other numbers be consistent from page to page. Unless the context clearly requires otherwise, any reference to a Section of this Agreement refers to all Sections and Subsections thereunder. Any pronoun used herein shall be deemed to cover all genders. Defined terms used in this Agreement may be set forth in Section 1.01 or other Sections of this Agreement, and all such definitions defined in the singular shall have a corresponding meaning when used in the plural and vice versa. Unless the context requires otherwise, references herein to "fiscal year" or "fiscal quarter" shall mean the fiscal year or fiscal quarter, as the case may be, of the Borrowers. ARTICLE II AMOUNT AND TERMS OF LOANS Section 2.01. Commitments to Lend. (a) The Revolving Credit Loan and the Declining Revolving Credit Loan Facilities. (i) Revolving Credit Loans. Lender agrees, subject to the terms and conditions of this Agreement, to make revolving credit loans (collectively, the "Revolving Credit Loan") to Cardinal Ethanol from time to time from the Closing Date to the Business Day immediately preceding the Termination Date applicable to the Revolving Credit Loan up to a maximum principal amount at any time outstanding equal to Lender's Revolving Credit Commitment at such time. However, Lender shall not be obligated to make an Advance on the Revolving Credit Loan if the aggregate amount of all Advances under the Revolving Credit Loan then outstanding exceeds, or would exceed if the requested Advance were to be made, (1) the Revolving Credit Commitment, (2) the Borrowing Base at such time, or (3) any Default or Event of Default exists or would result from the making of such Advance. Subject to the terms and conditions of this Agreement, Cardinal Ethanol may borrow, repay and re-borrow under the Revolving Credit Loan. (ii) Declining Revolving Credit Loans. During the APP Construction Period, Lender agrees, subject to the terms and conditions of this Agreement, to make APP Construction Advances under the Declining Revolving Credit Loan to Cardinal Ethanol to be used to pay or reimburse Cardinal Ethanol for APP Improvements from time to time in accordance with the APP Construction Advance procedures provided for in this Agreement and the APP Disbursing Agreement up to a maximum principal amount at any time outstanding equal to the APP Construction Advance Maximum Amount; provided, however, that Lender shall not be obligated to make such an APP Construction Advance if: (1) the aggregate amount of all APP Construction Advances then outstanding exceeds, or would exceed if the requested APP Construction Advance Loan Agreement — Page 18

were to be made, the APP Construction Advance Maximum Amount; (2) the aggregate amount of all APP Construction Advances and Working Capital Advances then outstanding exceeds, or would exceed if the requested APP Construction Advance were to be made, the Declining Revolving Credit Commitment; (3) the then applicable conditions to the making of such APP Construction Advance have not been satisfied or waived; or (4) any Default or Event of Default exists or would result from the making of such APP Construction Advance. APP Construction Advances are non-revolving and Cardinal Ethanol may not repay and re-borrower APP Construction Advances. Subject to the terms and conditions of this Agreement, Lender agrees to make Working Capital Advances to Cardinal Ethanol under the Declining Revolving Credit Loan to be used by Cardinal Ethanol for working capital purposes from time to time in accordance with the Working Capital Advance procedures provided for in this Agreement to but not including the date of APP Loan Conversion up to a maximum principal amount at any time outstanding equal to the Working Capital Advance Maximum Amount in effect at the time of the request; provided, however, that Lender shall not be obligated to make such a Working Capital Advance if: (1) the aggregate amount of all Working Capital Advances then outstanding exceeds, or would exceed if the requested Working Capital Advance were to be made, the Working Capital Advance Maximum Amount; (2) the aggregate amount of all APP Construction Advances and Working Capital Advances then outstanding exceeds, or would exceed if the requested Working Capital Advance were to be made, the Declining Revolving Credit Commitment; (3) the then applicable conditions to the making of such Working Capital Advance have not been satisfied or waived; or (4) any Default or Event of Default exists or would result from the making of such Working Capital Advance. Working Capital Advances under the Declining Revolving Credit Loan are revolving and Cardinal Ethanol may borrow, repay and re-borrow Working Capital Advances under the Declining Revolving Credit Loan, up to the Working Capital Advance Maximum Amount. (iii) | Financial Instrument Agreements. Lender or its subsidiaries or affiliates may, but shall not be obligated, to enter into from time to time with a Borrower, one or more Financial Instrument Agreements. Each such Financial Instrument Agreement will be subject to separate documentation, including without limitation an ISDA Master Swap Agreement, a schedule and confirmation with respect to such Financial Instrument Agreement. The obligations of the applicable Borrower related to any Financial Instrument Agreement will be as set forth in such separate documentation, provided such obligations will be cross defaulted to the obligations of such Borrower hereunder, and shall be additional Obligations secured by the Collateral. (iv) Use of Proceeds. The Revolving Credit Loan shall be used by Cardinal Ethanol solely for purposes of re-financing the loans and financial accommodations extended under the Current Credit Agreement, finance Cardinal Ethanol’s general working capital needs and other general corporate purposes, to support the issuance of letters of credit for the account of a Borrower, to support Cardinal Colwich’s working capital needs, and to finance capital expenditures by Cardinal Ethanol and Cardinal Colwich, to the extent not inconsistent with the terms of this Agreement. The Declining Revolving Credit Loan shall be used by Cardinal Ethanol solely for purposes of financing the APP Improvements and Cardinal Ethanol’s general working capital needs and other general corporate purposes, to the extent not inconsistent with the terms of this Agreement. Cardinal Colwich shall use the proceeds of the Term Loan to partially finance the acquisition of the Kansas Plant. Notwithstanding anything herein to the contrary, the Borrowers shall not, directly or indirectly, use any part of the proceeds of any Loan for the purpose of purchasing or carrying any margin stock within the meaning of Regulation U of the Board of Governors of the Federal Reserve System, or to extend credit to any Person for Loan Agreement — Page 19

the purpose of purchasing or carrying any such margin stock, or for any purpose which violates, or is inconsistent with, Regulation X or Regulation T of such Board of Governors. The Borrowers will not request any Borrowing, and the Borrowers shall not use, and shall procure that its Affiliates and Subsidiaries and its or their respective directors, officers, employees and agents shall not use, the proceeds of any Borrowing (1) in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any Anti-Corruption Laws or Anti-Money Laundering Laws, (2) for the purpose of funding, financing or facilitating any activities, business or transaction of or with any Sanctioned Person, or in any Sanctioned Country, to the extent that such activities, business or transaction would be prohibited by Sanctions if conducted by a corporation incorporated in the United States or the European Union, or (3) in any manner that would result in the violation of any Sanctions applicable to any party hereto. (b) Term Loan Facility. Subject to the terms of this Agreement, Lender agrees to lend to Cardinal Colwich Lender’s Term Loan Commitment. The Term Loan will be evidenced by that certain Term Note (as defined in Section 2.03 below) of even date with this Agreement in the amount of Lender's Term Loan Commitment. (c) Banking Services. The Lender or its Affiliates may from time to time provide Banking Services for Borrowers and Guarantors. The Banking Service Obligations shall be deemed Obligations secured by the Collateral. Section 2.02. Manner of Borrowing. (a) Revolving Credit Loan. Cardinal Ethanol shall give the Lender notice of Cardinal Ethanol’s intention to borrow under the Revolving Credit Loan no later than 2 p.m. Omaha, Nebraska time on the requested funding date, in each case specifying: (1) the proposed funding date of such Advance; (2) the amount of such Advance; and (3) whether the principal amount of any such Advance, together with the principal amount of all Advances then outstanding, is within the Borrowing Base at such time and is within the Revolving Credit Commitment at such time. Lender will make such Advance available to Cardinal Ethanol on the funding date of such Advance. For purposes of this Section, Cardinal Ethanol agrees that the Lender may rely and act upon any request for an Advance from any individual who the Lender, absent gross negligence or willful misconduct, believes to be a representative of Cardinal Ethanol. (b) Declining Revolving Credit Loan. (i) APP Construction Advances. Cardinal Ethanol has submitted to the Lender and the Lender has approved, the APP Budget and the APP Construction Schedule. If Cardinal Ethanol desires to reallocate funds from one budget category to another or modify, amend or supplement the APP Budget, in either case in excess of $100,000.00 individually or in excess of $500,000.00 when aggregated with all other reallocations or modifications, then Cardinal Ethanol shall notify the Lender of such reallocation or modification of the APP Budget by submitting to the Lender for the Lender’s approval a Budget Variance Report showing the details of such reallocation, modification, amendment or supplement. The Lender may approve or disapprove of such Budget Variance Report in the Lender’s discretion, but the Lender’s approval shall not be unreasonably withheld. Notwithstanding the foregoing, Cardinal Ethanol agrees that all cost over runs on the APP Improvements shall be paid solely by Cardinal Ethanol. Cardinal Ethanol will be entitled to apply any previously achieved savings in any Loan Agreement — Page 20

completed category of the APP Budget to pay for any such cost over runs. In addition, Cardinal Ethanol may from time to time request that the contingency fund line item in the APP Budget be reallocated to pay needed costs of the APP Improvements. Such requests shall be subject to the Lender’s written approval in its reasonable discretion, which shall not be unreasonably withheld; however, Cardinal Ethanol will be entitled to advances from the contingency fund line item in the APP Budget so long as at all times there are sufficient funds remaining from all sources identified in the sources and uses of funds in the APP Budget to complete the construction of the APP Improvements in the discretion of the Lender. During the APP Construction Period, Cardinal Ethanol may request an APP Construction Advance to be used to pay or reimburse Cardinal Ethanol for the cost of APP Improvements by submitting to the Lender and Title Company a draw request set forth on AIA forms G702 and G703 or in another form approved by the Lender and the Title Company (each, a "Draw Request"). Each Draw Request shall be signed by a duly authorized officer of Cardinal Ethanol, shall show the percentage of completion of construction of the APP Improvements and shall set forth by APP Budget category and in such detail as may be required by the Lender the amounts expended and/or costs incurred for work done and materials incorporated into the APP Improvements in accordance with the APP Budget and APP Construction Schedule. Each Draw Request will be reviewed by the Construction Inspector and must be submitted to the Lender and Title Company at least five (5) Business Days prior to the requested funding date of the APP Construction Advance, which must be a Business Day. Each Draw Request will constitute a certification, representation and warranty that the conditions precedent for APP Construction Advances set forth in this Agreement and the APP Disbursing Agreement have been satisfied. APP Construction Advances shall not be made more frequently than twice per month and are subject to the conditions precedent set forth in this Agreement. Each Draw Request shall be limited to amounts equal to (i) the total of costs actually incurred and paid or owing by Cardinal Ethanol to the date of such Draw Request for work performed, services provided or materials and equipment incorporated in the APP Improvements as described in the approved APP Budget, plus (ii) the cost of materials and equipment not incorporated in the APP Improvements, but delivered to and suitably stored at the Project site, plus (iii) prepayments for materials and equipment when prepayment is required by the manufacturer or supplier or, with the Lender’s prior written approval, when such prepayment results in a material financial benefit to Cardinal Ethanol; plus (iv) any other hard or soft costs which are consistent with the APP Budget approved by the Lender, as modified or supplemented by any Budget Variance Report approved by the Lender, for which an APP Construction Advance is available under this Agreement and as demonstrated in the approved APP Budget; less, (v) prior disbursements for such costs and from the Declining Revolving Credit Loan or Cardinal Ethanol’s own funds for such costs. APP Construction Advances will be delivered to Cardinal Ethanol under the terms of the APP Disbursing Agreement, the terms and conditions of which are hereby incorporated by reference. Unless otherwise authorized by the Lender, each APP Construction Advance shall be disbursed by wire transfer from the Lender to the applicable Title Company in an account established by such Title Company for the sole purpose of funding the cost of APP Improvements. All APP Construction Advances will be considered and deemed received by Cardinal! Ethanol upon receipt by the applicable Title Company. Cardinal Ethanol irrevocably assigns to the Lender and grants to the Loan Agreement — Page 21

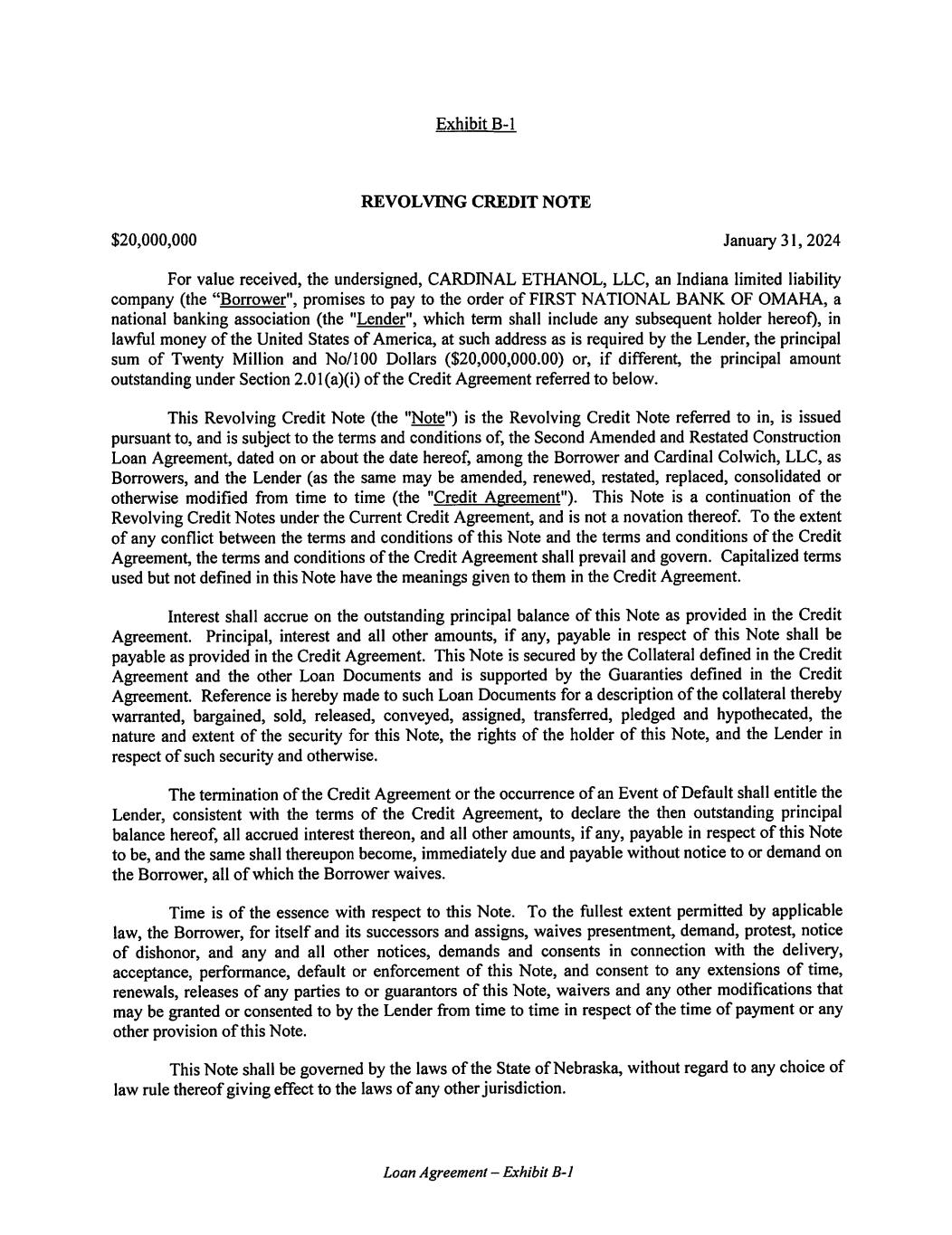

Lender a security interest in, as additional security for the performance of the Obligations, its interest in all funds held by the applicable Title Company pursuant to this Agreement and the APP Disbursing Agreement, whether or not disbursed, all funds deposited by Cardinal Ethanol with the Lender under this Agreement, all reserves, including deferred payments, deposits, refunds, cost savings, and payments of any kind relating to the construction of the APP Improvements and, to the extent assignable, all Permits obtained for the lawful construction of the APP Improvements. (ii) Working Capital Advances. Cardinal] Ethanol shall give the Lender notice of Cardinal Ethanol's intention to borrow a Working Capital Advance no later than 2 p.m. Omaha, Nebraska time on the requested funding date, in each case specifying: (1) the proposed funding date of such Working Capital Advance; (2) the amount of such Working Capital Advance; and (3) whether the principal amount of any such Working Capital Advance is within the Working Capital Advance Maximum Amount at such time and will remain so after the Working Capital Advance is made; and (4) whether such Working Capital Advance, together with the principal amount of all APP Construction Advances and Working Capital Advances then outstanding, is within the Declining Revolving Credit Commitment at such time, and will remain so after the making of such Working Capital Advance. Lender will make such Working Capital Advance available to Cardinal Ethanol on the funding date of such Working Capital Advance. For purposes of this Section, Cardinal Ethanol agrees that the Lender may rely and act upon any request for a Working Capital Advance from any individual who the Lender, absent gross negligence or willful misconduct, believes to be a representative of Cardinal Ethanol. Section 2.03. Notes. (a) The Revolving Credit Loan shall be evidenced by a promissory note payable to Lender, substantially in the form of Exhibit B-1 hereto ( as amended, renewed, restated, replaced, consolidated or otherwise modified from time to time, the "Revolving Credit Note"). (b) The Declining Revolving Credit Loans shall be evidenced by a promissory note payable to Lender, substantially in the form of Exhibit B-2 hereto (as amended, renewed, restated, replaced, consolidated or otherwise modified from time to time, the "Declining Revolving Credit Note"). (c) The Term Note shall be evidenced by a promissory note payable to Lender, substantially in the form of Exhibit B-3 hereto ( as amended, renewed, restated, replaced, consolidated or otherwise modified from time to time, the "Term Note"). Section 2.04. Payment. (a) Revolving Credit Loans. (i) Accrued interest on the outstanding principal balance of each Advance under the Revolving Credit Loan is due and payable on the first (1) calendar day of each month until the Termination Date applicable to the Revolving Credit Loan when all accrued but unpaid interest on each Revolving Credit Loan is due and payable in full. Loan Agreement — Page 22

(ii) The outstanding principal balance of the Revolving Credit Loan is payable in full on the Termination Date applicable to the Revolving Credit Loan. (b) Declining Revolving Credit Loan. (i) Accrued and unpaid interest on the Declining Revolving Credit Loan will be paid monthly, in arrears, on the first (1st) calendar day of each month until the APP Completion Date, when all accrued but unpaid interest on the APP Declining Revolving Credit Loan is due and payable in full; (ii) Subject to APP Loan Conversion, the outstanding principal balance of the Declining Revolving Credit Loan is due and payable in full on the APP Completion Date. On or before the APP Completion Date and as conditions precedent to APP Loan Conversion, Cardinal Ethanol shall provide the following to the Lender: (1) a certificate from a duly authorized officer of Cardinal Ethanol certifying Substantial Completion of the APP Improvements, along with such supporting evidence as the Lender may require; (2) copies of all Permits applicable to the APP Improvements; (3) Borrowers have paid the Lender all of the Obligations which have accrued to such date, and any other fees and expenses provided for in this Agreement which have not been previously paid and are due under the terms of this Agreement; (4) Cardinal Ethanol has paid all accrued and outstanding interest on the outstanding balance of the Declining Revolving Credit Loan as of the APP Loan Conversion; (5) Cardinal Ethanol has submitted to the Lender and the applicable Title Company final lien waivers from each Contractor with invoices which exceed $100,000.00; and (6) such other documents, instruments, and certificates as the Lender may reasonably request. Upon the Lender’s determination that each of the foregoing is in form and substance satisfactory to the Lender in its sole discretion or is waived by Lender in writing, and provided no Default or Event of Default has occurred and is continuing, the aggregate principal balance of the Declining Revolving Credit Loan then outstanding will be converted into the APP Term Loan and repaid in sixty (60) equal monthly installments, with such installment amount based on a ten (10) year amortization period, (with such principal amount and installment amount to be established by amendment to this Agreement acceptable to Lender and evidenced by an APP Term Note in form and substance acceptable to Lender), commencing on the first day of the month following the APP Loan Conversion to the APP Term Loan Maturity Date when such principal balance Loan Agreement — Page 23