As filed with the Securities and Exchange Commission on February 10, 2006

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Windsor Energy Resources, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 1311 | | 56-2547532 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

14313 N. May Avenue

Suite 100

Oklahoma City, Oklahoma 73134

(405) 463-0510

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael P. Cross

Chief Executive Officer

Windsor Energy Resources, Inc.

14313 N. May Avenue

Suite 100

Oklahoma City, Oklahoma 73134

(405) 463-0510

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Seth R. Molay, P.C. Brett A. Schrader Akin Gump Strauss Hauer & Feld LLP 1700 Pacific Avenue, Suite 4100 Dallas, TX 75201 (214) 969-4780 | | Robert G. Reedy Porter & Hedges, L.L.P. 1000 Main Street, 36th Floor Houston, TX 77002 (713) 226-6674 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | |

Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate

Offering Price(2) | | Amount of

Registration Fee |

Common Stock, par value $0.01 per share (1) | | $ | 175,000,000 | | $ | 18,725 |

| (1) | Includes shares of common stock that may be sold to cover the exercise of an over-allotment option granted to the underwriter. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION. DATED FEBRUARY 10, 2006.

PROSPECTUS

Shares

Common Stock

We are offering shares of our common stock.

Prior to this offering, there has been no public market for our common stock. We expect the initial public offering price per share of our common stock to be between $ and $ . We intend to list our common stock on The Nasdaq National Market under the symbol “WERI.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 13.

| | | | | | |

| | | Public Offering Price

| | Underwriting Discount

| | Proceeds to Windsor Energy (Before Expenses)

|

Per Share | | $ | | $ | | $ |

Total | | $ | | $ | | $ |

We have granted the underwriter a 30-day option to purchase up to shares of our common stock to cover any over-allotments.

Delivery of the shares will be made on or about , 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Johnson Rice & Company L.L.C.

The date of this prospectus is , 2006.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not, and the underwriter has not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where an offer to sell is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise indicated or required by the context, references in this prospectus to “we,” “us,” “our” or the “Company” refer to the combined business of Windsor Energy Resources, Inc. and its predecessors. The term “you” refers to a prospective investor. Unless the context otherwise requires, the information in the prospectus (other than in the historical financial statements) assumes that the underwriter will not exercise its over-allotment option.

i

PROSPECTUS SUMMARY

This summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you should consider before investing in our common stock. You should read and carefully consider this entire prospectus before making an investment decision, especially the information presented under the heading “Risk Factors” and our combined financial statements and the accompanying notes included elsewhere in this prospectus, as well as the other documents to which we refer you. We have provided definitions for some of the oil and natural gas industry terms used in this prospectus in the “Glossary of Oil and Natural Gas Terms” in Appendix A. Natural gas equivalents and crude oil equivalents are determined using the ratio of six Mcf of natural gas to one Bbl of crude oil, condensate or natural gas liquids. The oil and natural gas assets and operations described in this prospectus are currently owned and/or operated by certain of our affiliates. Prior to the completion of this offering, these assets and operations will be transferred to us. The descriptions contained in this prospectus give effect to that transfer.

WINDSOR ENERGY RESOURCES, INC.

Overview

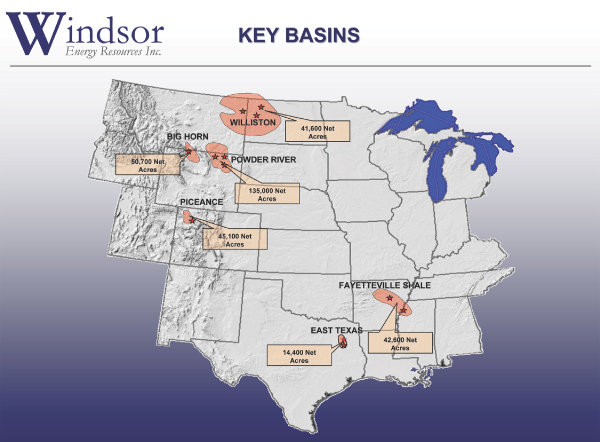

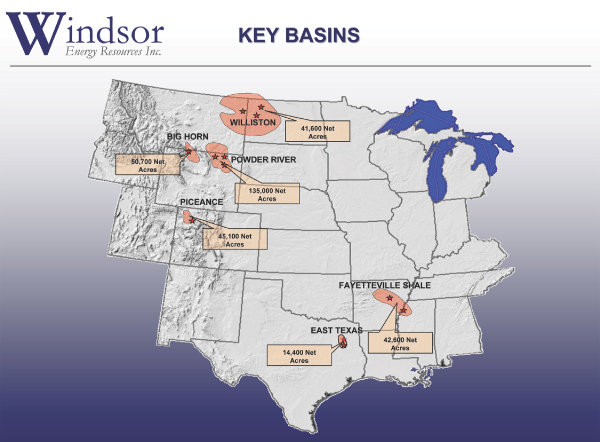

We are a rapidly growing independent energy company focused on the exploration, exploitation and development of both conventional and unconventional onshore oil and natural gas reserves. Our unconventional oil and natural gas projects include coalbed methane (CBM) gas development, basin-centered tight gas sand plays and shale plays. We have active unconventional resource development projects located in the Powder River and Piceance Basins in the Rocky Mountains and in the Cotton Valley and Travis Peak trends in East Texas and active conventional exploration and development projects located in the Big Horn Basin in the Rocky Mountains. We also have unconventional prospects in the Williston Basin in Montana and North Dakota and in the Fayetteville Shale trend in Arkansas and Mississippi that are in the exploration and development planning stage. Our management and technical teams have an extensive track record in the exploration and production business as well as significant operating experience in our core project areas. Our strategy is to maximize stockholder value by leveraging our significant undeveloped acreage position and the experience of our management and technical teams in finding and developing oil and natural gas reserves to profitably grow our reserves and production.

We commenced operations in 2003 when we acquired approximately 5,700 acres in the Powder River Basin. Since that time, we have continued to acquire leasehold interests, predominately undeveloped acreage, in several areas. As of December 31, 2005, we held leasehold interests in approximately 518,700 gross (365,900 net) acres. The following table sets forth our approximate acreage position as of December 31, 2005:

| | | | | | |

Basin / Trend

| | Location

| | Gross Acres

| | Net Acres

|

Powder River | | Wyoming | | 182,300 | | 135,000 |

Piceance | | Colorado | | 69,500 | | 45,100 |

Cotton Valley / Travis Peak | | East Texas | | 45,900 | | 14,400 |

Big Horn | | Wyoming | | 53,100 | | 50,700 |

Williston | | Montana / North Dakota | | 83,300 | | 41,600 |

Fayetteville Shale | | Arkansas / Mississippi | | 46,600 | | 42,600 |

Other | | Various | | 38,000 | | 36,500 |

| | | | |

| |

|

Total | | | | 518,700 | | 365,900 |

| | | | |

| |

|

At December 31, 2005, our acreage contained 573 gross producing wells and we had identified approximately 1,290 potential drilling locations. We operate approximately 96% of our current wells and expect to operate all future wells on our acreage. From our inception through December 31, 2005, we drilled 228 gross wells on our acreage, of which 224 were completed as producing wells or are in the process of being completed or are dewatering. During this same period, our capital expenditures aggregated approximately $159 million, of

1

which approximately $96 million was used for leasehold interest and property acquisitions and approximately $63 million was spent on drilling activities and infrastructure projects. Of the 228 gross wells we drilled, 222 were CBM wells in the Powder River Basin, three were in the Big Horn Basin, two were in the Piceance Basin and one was in the East Texas Basin. Approximately 34% of the CBM wells are currently producing natural gas in commercial quantities with the remainder in various stages of dewatering or awaiting additional infrastructure.

As of December 31, 2005, our estimated net proved reserves were approximately 48.5 Bcfe, of which 89% were natural gas. Our average net daily production in December 2005 was approximately 9.0 MMcfe/day.

Our Strategy

The principal elements of our strategy to maximize stockholder value are:

| | • | | Generate growth through drilling. We expect to generate long-term reserve and production growth predominantly through our drilling activities. We anticipate the majority of our future capital expenditures will be directed toward the drilling of wells, although we expect to continue to acquire additional leasehold interests. |

| | • | | Focus on lower risk development projects, with selective expenditures on higher risk exploration projects. We manage our inventory of properties as a portfolio, and seek to manage risk and return to maximize stockholder value. The majority of our acreage position is located in relatively low-risk, unconventional development areas that can provide what we believe are strong returns to our stockholders with limited risk. |

| | • | | Manage costs by maximizing operational control. We seek to exert control over our exploration, exploitation and development activities. As the operator of our projects, we have greater control over the amount and timing of the expenditures associated with those activities. |

| | • | | Pursue complementary leasehold interest and property acquisitions. We intend to use our experience and regional expertise to supplement our drilling strategy with complementary leasehold interest and property acquisitions. |

Our Strengths

We believe that our strengths will help us successfully execute our strategy. These strengths include:

| | • | | Inventory of growth opportunities. We have established an asset base of approximately 365,900 net leasehold acres, of which approximately 90% were undeveloped as of December 31, 2005. As of that date, we had identified approximately 1,290 potential drilling locations on our acreage. |

| | • | | Substantial acreage position in unconventional, development-based oil and natural gas plays. We have a significant acreage position in relatively low-risk, unconventional oil and natural gas development plays. This includes approximately 135,000 net acres of CBM leasehold interests in the Powder River Basin on which we have identified approximately 910 potential drilling locations, and approximately 177,700 net acres in other unconventional plays, including the Piceance Basin, Cotton Valley and Travis Peak trends, Williston Basin and Fayetteville Shale trend, on which we have identified approximately 370 potential drilling locations. |

| | • | | Experienced management and technical teams. Our four executive officers average 23 years of experience in the oil and natural gas industry. We have four full time geologists,five petroleum engineers andfive land professionals. |

2

| | • | | Operational control. We operate approximately 96% of the wells in which we have an interest and expect our leasehold ownership positions to allow us to be the operator of future wells drilled on our acreage. This will afford us a significant degree of control over costs and other operational matters. |

| | • | | Financial flexibility. As of December 31, 2005, as adjusted for this offering and our intended use of the net proceeds of this offering, we would have had $ million in cash and no outstanding debt. We seek to maintain a conservative financial position and believe that our operating cash flow and proceeds from this offering will provide us with the financial flexibility to pursue our planned exploration and development activities through 2006. |

Our Properties

Summary of Exploration, Exploitation and Development Areas

The following table summarizes information regarding our key exploration, exploitation and development areas:

| | | | | | | | | | | | | | | | | |

Basin/Trend

| | Project Area

| | Approximate

Net Acres

| | Anticipated

Average

Working

Interest(1)

| | | Identified Drilling Locations (2)

| | Estimated Capital

Expenditures (2)

|

| | | | | Total

| | 2006

| | 2005

| | 2006

|

| | | | | | | | | | | | | | (millions) | | (millions) |

Powder River | | Gas Draw/Harris | | 14,700 | | 80 | % | | 95 | | 95 | | $ | 4.8 | | $ | 6.4 |

| | | Jepson | | 17,100 | | 100 | % | | 248 | | 64 | | | 10.6 | | | 11.7 |

| | | Beaver Creek(3) | | 87,000 | | 75 | % | | 575 | | 1 | | | 13.7 | | | 3.5 |

| | | | | | | |

Piceance | | Castle Springs | | 8,600 | | 100 | % | | 100 | | 18 | | | 6.2 | | | 27.9 |

| | | | | | | |

East Texas | | Overton | | 6,800 | | 39 | % | | 85 | | 8 | | | — | | | 5.9 |

| | | Weeping Mary | | 7,600 | | 100 | % | | 75 | | 9 | | | 0.9 | | | 14.0 |

Big Horn | | Bennett Creek | | 9,000 | | 88 | % | | 4 | | 4 | | | 12.6 | | | 17.0 |

| | | | | | | |

| | | Clark 3-D | | 14,500 | | 95 | % | | — | | — | | | — | | | 3.0 |

| | | Bison Ranch | | 5,600 | | 95 | % | | 1 | | 1 | | | — | | | 3.9 |

| | | Heart Mountain | | 19,300 | | 95 | % | | — | | — | | | — | | | — |

| | | | | | | |

Williston | | Bakken Shale | | 41,600 | | 33 | % | | 60 | | 3 | | | — | | | 6.9 |

| | | | | | | |

Fayetteville Shale | | Fayetteville Shale | | 42,600 | | 100 | % | | 50 | | — | | | — | | | — |

| | | | |

| | | | |

| |

| |

|

| |

|

|

Total | | | | 274,400 | | | | | 1,293 | | 203 | | $ | 48.8 | | $ | 100.2 |

| | | | |

| | | | |

| |

| |

|

| |

|

|

| (1) | Anticipated average working interest is based on the terms of our leases and anticipated unit size. |

| (2) | For each project area, identified drilling locations represent total gross locations specifically identified by management as of December 31, 2005 to be included in our future multi-year drilling activities on existing acreage. Of the total identified drilling locations shown in the table, 66 are classified as proved undeveloped locations, or PUDs. Of the 203 identified drilling locations that are included in our 2006 drilling program, 64 are classified as PUDs. During the year ended December 31, 2005, we drilled a total of 153 gross wells, including 28 PUDs. Our estimated capital expenditure amounts are based on our current drilling and infrastructure plans for the properties indicated. These plans and our actual future drilling activities are subject to change based on a variety of factors, including, but not limited to, the success of our drilling activities, prevailing and anticipated prices for oil and natural gas, the availability of necessary equipment and infrastructure, the availability of capital, the receipt and timing of required regulatory permits and approvals, seasonal conditions and drilling and acquisition costs. Significant additional capital expenditures will be required to more fully develop these areas. For a more complete description of our proposed activities, see “Business.” |

| (3) | We have 90 gross (68 net) CBM wells in the Beaver Creek project area and we are in the process of installing the infrastructure in that area to commence the dewatering process for these wells. We have identified approximately 575 additional drilling locations in the Beaver Creek project area that may be pursued depending upon the success of our pilot programs. |

3

Active Project Areas

The following is a summary of our activities in each of the four basins in which we have development projects.

Powder River Basin. Our Powder River Basin properties are located in northeastern Wyoming. Nearly all of our development operations in this basin are focused on CBM plays in three project areas. CBM development typically results in higher drilling success and lower drilling costs when compared to conventional exploration and development activity. CBM production is generally characterized by an initial dewatering phase followed by increasing and then stabilized production prior to a natural decline. We currently have 471 gross CBM wells in this basin, of which 243 are producing, 106 are in the dewatering phase and 122 are shut-in awaiting the installation of infrastructure. Our CBM wells target multiple coal seams in the Ft. Union formation at depths ranging from 300 to 3,500 feet. As of December 31, 2005, we operated all of the wells in each of our Powder River Basin project areas. Key statistics for our position in this basin include:

| | • | | 135,000 total net acres, including 104,000 net undeveloped acres, at December 31, 2005; |

| | • | | 5.3 MMcfe/day of estimated average net production for December 2005, compared to 3.5 MMcfe/day for December 2004; |

| | • | | 12.5 Bcfe of estimated net proved reserves at December 31, 2005; |

| | • | | $29.8 million of estimated capital expenditures for drilling and related well work and infrastructure during the year ended December 31, 2005, which included a 149 gross well drilling program and 50 recompletions, and $1.4 million for leasehold interest and property acquisitions during the year; and |

| | • | | estimated capital expenditures in this basin for 2006 of approximately $21.6 million, substantially all of which has been budgeted to drill 160 additional wells. |

Piceance Basin. Our Piceance Basin properties are located in northwestern Colorado. Our development, exploitation and exploration activities are primarily directed towards basin-centered tight gas sand plays. We have four project areas, one of which, Castle Springs, is currently active, while the other three areas are under evaluation. Basin-centered tight gas sand plays typically are characterized by high drilling success and high density drilling. Our Castle Springs wells primarily target the Mesaverde sands at depths ranging from 6,000 to 9,500 feet. All of our Castle Springs wells are fracture stimulated after drilling to improve production rates and recoverability. As of December 31, 2005, we operated all of the wells in our Castle Springs project area. Key statistics for our position in this basin include:

| | • | | 45,100 total net acres, including 44,200 net undeveloped acres, at December 31, 2005; |

| | • | | 1.2 MMcfe/day of estimated average net production for December 2005 following the commencement of production in this basin in November 2005; |

| | • | | 17.0 Bcfe of estimated net proved reserves at December 31, 2005; |

| | • | | $6.2 million of estimated capital expenditures for drilling and related well work and infrastructure during the year ended December 31, 2005, which included a two gross well drilling program and two recompletions, and $40,000 for leasehold interest and property acquisitions during the year; and |

| | • | | estimated capital expenditures in this basin for 2006 of approximately $27.9 million, substantially all of which has been budgeted to drill 18 additional wells. |

4

East Texas Basin. Our East Texas Basin properties are located adjacent to the Overton Fields in Smith and Cherokee counties in East Texas. Our two project areas focus on tight gas sand plays, targeting production from the Cotton Valley and Travis Peak intervals. The Cotton Valley and Travis Peak formations are found on our acreage at depths ranging from 9,000 to 14,000 feet. Like the Piceance Basin, this play is characterized by relatively high drilling success and high density drilling. At year end 2005, we were in the process of drilling one well and completing another well. All of our wells in this basin have been fracture stimulated after drilling to improve overall production rates, and we intend to fracture stimulate all future wells that we drill in this basin. As of December 31, 2005, we operated all of the wells in each of our East Texas project areas. Key statistics for our position in this basin include:

| | • | | 14,400 total net acres, including 14,200 net undeveloped acres, at December 31, 2005; |

| | • | | 0.6 MMcfe/day of estimated average net production for December 2005 following the acquisition of our interest in these project areas in June 2005; |

| | • | | 0.8 Bcfe of estimated net proved reserves at December 31, 2005; |

| | • | | $0.9 million of estimated capital expenditures for drilling and related well work and infrastructure, and $5.3 million for leasehold interest and property acquisitions, during the year ended December 31, 2005; and |

| | • | | estimated capital expenditures in this basin for 2006 of approximately $19.9 million, substantially all of which has been budgeted to complete two wells that we commenced drilling at the end of 2005 and drill 17 additional wells. |

Big Horn Basin. Our Big Horn Basin properties are located in northwest Wyoming. We are pursuing both conventional stratigraphic and structural gas plays, as well as unconventional basin-centered tight gas plays, in this basin. We have three shut-in wells in the Bennett Creek project area that tested at a combined rate of 8.6 MMcfe/day. We are in the process of constructing a 25-mile pipeline, with an estimated total cost upon completion of $5 million, that will provide the transportation required to begin initial production from those wells. We believe the pipeline will be completed in the second quarter of 2006. As of December 31, 2005, we operated all of the wells in each of our Big Horn Basin project areas. Key statistics for our position in this basin include:

| | • | | 50,700 total net acres, including 47,800 net undeveloped acres, at December 31, 2005; |

| | • | | 0.7 MMcfe/day of estimated average net production for December 2005, compared to 1.4 MMcfe/day for December 2004; |

| | • | | 15.5 Bcfe of estimated net proved reserves at December 31, 2005; |

| | • | | $13.2 million of estimated capital expenditures for drilling and related well work and infrastructure during the year ended December 31, 2005, which included a two gross well drilling program, four recompletions and construction of approximately five miles of pipeline; and |

| | • | | estimated capital expenditures in this basin for 2006 of approximately $23.9 million in 2006, of which approximately $18.4 million has been budgeted to drill five additional wells. |

Future Project Areas

The following is a summary of two new project areas that we are currently evaluating for future exploration and development potential.

Williston Basin. Our Williston Basin properties are located in western North Dakota and eastern Montana. The Williston Basin is predominantly an oil producing region and represents our only oil-focused project area.

5

Our planned activities in this basin include both development and exploration drilling programs situated in several areas, including the Bakken Shale. We anticipate using horizontal drilling technology in this basin to increase production and reserve recoveries while limiting the number of vertical wells we must drill. We may use 3-D seismic surveys to better define our exploration and development projects. Key statistics for our position in this basin include:

| | • | | 41,600 total net acres at December 31, 2005, all of which was undeveloped; |

| | • | | 0.7 Bcfe of estimated net proved reserves at December 31, 2005; |

| | • | | $10.3 million of capital expenditures for the year ended December 31, 2005 for leasehold interest and property acquisitions; and |

| | • | | estimated capital expenditures in this basin for 2006 of approximately $6.9 million, all of which has been budgeted to drill three wells. |

Fayetteville Shale Trend. Our properties in the Fayetteville Shale trend extend from eastern Arkansas to Mississippi. Our operations in the area involve exploration and development drilling activities. We currently own approximately 42,600 net acres, all of which are undeveloped. We spent approximately $6.0 million for leasehold interest and property acquisitions during 2005.

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile oil and natural gas prices and other material factors. You should read carefully the section of this prospectus entitled “Risk Factors” beginning on page 13 for an explanation of these risks before investing in our common stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy as well as activities on our properties, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

| | • | | Limited operating history. We are a relatively new company. As such, we have made significant expenditures to acquire and develop our property base and increase production. This has resulted in significant losses in certain periods since our inception. We can give you no assurance that we will not incur further losses in the future. |

| | • | | Risks relating to the development of oil and natural gas reserves. Approximately 90% of our net leasehold acreage is undeveloped, or acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves. Our oil and natural gas reserves and future production and, therefore, our future cash flow and income are highly dependent on our ability to successfully develop our undeveloped leasehold acreage, which will require substantial amounts of capital. If we are unsuccessful in our drilling efforts or unable to secure other financing, we will not be able to develop our acreage. |

| | • | | Risks relating to oil and natural gas reserve estimates. Reserve estimates are based on many assumptions and our properties may not produce the reserves we originally forecast. Our reserves will decline unless we are successful in finding or acquiring new reserves. |

| | • | | Access to equipment and personnel. Shortages of drilling rigs, equipment, supplies or personnel could delay, restrict or increase the cost of our exploration, exploitation and development operations, which in turn could impair our financial condition and results of operations. |

6

| | • | | Concentration and competition. Our presence in the Rocky Mountain and East Texas regions may make us disproportionately exposed to impacts of weather, government regulation and transportation constraints unique to those geographic locations. In addition, competition with other companies in the Rocky Mountain and East Texas regions is significant and may hinder our ability to pursue leasehold interest and property acquisitions as well as our ability to operate in certain of our core areas. |

| | • | | Risks related to rapid growth. We have grown rapidly through acquisitions and may make additional acquisitions in the future. Acquired leasehold interests and other properties may not produce as projected and we may be unable to determine reserve potential, identify liabilities associated with the leasehold interests and other properties or obtain indemnification or similar protections from sellers against them. |

For a discussion of other considerations that could negatively affect us, see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Our Equity Sponsor

We were formed by affiliates of Wexford Capital LLC, or Wexford, in July 2003. Wexford is a Greenwich, Connecticut based SEC registered investment advisor with approximately $4.0 billion under management as of September 30, 2005. Wexford has made private equity investments in many different sectors with particular expertise in the energy and natural resources sector. Immediately prior to this offering, Wexford beneficially owned all of our outstanding common stock through Windsor Energy Holdings, L.L.C., or Windsor Holdings. Upon completion of the offering, Wexford will beneficially own approximately % of our common stock (approximately % if the over-allotment option is exercised in full).

Our Offices

Our principal executive offices are located at 14313 N. May Avenue, Suite 100, Oklahoma City, Oklahoma, and our telephone number at that address is (405) 463-0510. Our website address iswww.windsorenergy.com. Information contained on our website does not constitute part of this prospectus.

7

The Offering

Common stock offered by us | | shares |

Common stock to be outstanding immediately after completion of this offering | shares |

Use of proceeds | We intend to use the proceeds of this offering to fund exploration and development activities and for other general corporate purposes, including acquisitions and the repayment of approximately $4.5 million of outstanding indebtedness. See “Use of Proceeds.” |

Dividend policy | We currently anticipate that we will retain all future earnings, if any, to finance the growth and development of our business. We do not intend to pay cash dividends in the foreseeable future. |

Nasdaq National Market symbol | WERI |

Except as otherwise indicated, all information contained in this prospectus:

| | • | | assumes the underwriter does not exercise its over-allotment option; |

| | • | | excludes shares of our common stock issuable upon the exercise of options to be outstanding upon completion of this offering, at an exercise price per share equal to the offering price set forth on the cover of this prospectus; and |

| | • | | excludes an additional shares of common stock reserved for issuance under our equity incentive plan. |

8

Summary Financial Data

The following table sets forth our summary historical financial data as of and for each of the periods indicated. The data as of and for the periods ended December 31, 2004 and 2003 is derived from our historical audited combined financial statements for the periods indicated. The data as of and for the periods ended September 30, 2005 and 2004 is derived from our historical unaudited combined financial statements for the interim periods indicated. The interim unaudited information was prepared on a basis consistent with that used in preparing our audited combined financial statements and includes all adjustments, consisting of normal and recurring items, that we consider necessary for a fair presentation of the financial position and results of operations for the unaudited periods. Operating results for the nine months ended September 30, 2005 are not necessarily indicative of results that may be expected for the entire year 2005. You should review this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and combined historical financial statements and related notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | |

| | | Period from

Inception (July 8, 2003)

to December 31, 2003

| | | Year Ended

December 31, 2004

| | | Nine Months Ended

September 30,

| |

| | | | | 2004

| | | 2005

| |

| | | | | | | | | (unaudited) | |

| | | (in thousands, except per share amounts) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 2,158 | | | $ | 9,046 | | | $ | 6,239 | | | $ | 11,629 | |

Other income | | | — | | | | 84 | | | | 100 | | | | 6 | |

Expenses: | | | | | | | | | | | | | | | | |

Lease operating expense | | | 350 | | | | 2,868 | | | | 1,704 | | | | 6,218 | |

Production taxes | | | 114 | | | | 540 | | | | 326 | | | | 1,138 | |

Gathering and transportation | | | 144 | | | | 414 | | | | 354 | | | | 405 | |

Depreciation, depletion and amortization | | | 586 | | | | 4,025 | | | | 2,881 | | | | 5,007 | |

General and administrative | | | 34 | | | | 530 | | | | 235 | | | | 1,786 | |

Accretion expense | | | 13 | | | | 37 | | | | 28 | | | | 145 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total expenses | | | 1,241 | | | | 8,414 | | | | 5,528 | | | | 14,699 | |

Income (loss) from operations | | | 917 | | | | 716 | | | | 811 | | | | (3,064 | ) |

Other income (expense): | | | | | | | | | | | | | | | | |

Interest expense | | | (100 | ) | | | (402 | ) | | | (286 | ) | | | (333 | ) |

Interest income | | | — | | | | 9 | | | | 7 | | | | 13 | |

Total other income (expense) | | | (100 | ) | | | (393 | ) | | | (279 | ) | | | (320 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 817 | | | $ | 323 | | | $ | 532 | | | $ | (3,384 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Pro Forma C Corporation Data (unaudited):(1)(2) | | | | | | | | | | | | | | | | |

Historical net income (loss) before income taxes | | $ | 817 | | | $ | 323 | | | $ | 532 | | | $ | (3,384 | ) |

Pro forma provision (benefit) for income taxes | | | 328 | | | | 122 | | | | 201 | | | | (1,277 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma net income (loss) | | $ | 489 | | | $ | 201 | | | $ | 331 | | | $ | (2,107 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma income (loss) per common share—basic and diluted | | $ | | | | $ | | | | $ | | | | $ | | |

Weighted average pro forma shares outstanding—basic and diluted | | | | | | | | | | | | | | | | |

| | | | |

Selected Cash Flow and Other Financial Data: | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 817 | | | $ | 323 | | | $ | 532 | | | $ | (3,384 | ) |

Depreciation, depletion and amortization | | | 586 | | | | 4,025 | | | | 2,881 | | | | 5,007 | |

Other non-cash items | | | 14 | | | | 40 | | | | 30 | | | | 148 | |

Change in current assets and liabilities | | | (1,193 | ) | | | (251 | ) | | | 224 | | | | 900 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash provided by operating activities | | $ | 224 | | | $ | 4,137 | | | $ | 3,667 | | | $ | 2,671 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Capital expenditures | | $ | 35,053 | | | $ | 54,382 | | | $ | 37,914 | | | $ | 43,392 | |

9

| | | | | | | | | |

| | | As of December 31,

| | As of

September 30, 2005

|

| | | 2003

| | 2004

| |

| | | | | | | (unaudited) |

| | | (in thousands) |

Balance sheet data: | | | | | | | | | |

Cash and cash equivalents | | $ | 664 | | $ | 2,010 | | $ | 5,834 |

Other current assets | | | 1,542 | | | 2,283 | | | 3,580 |

Oil and gas properties, net—using full cost method of accounting | | | 35,063 | | | 90,019 | | | 130,807 |

Other assets | | | 79 | | | 496 | | | 1,909 |

| | |

|

| |

|

| |

|

|

Total assets | | $ | 37,348 | | $ | 94,808 | | $ | 142,130 |

| | |

|

| |

|

| |

|

|

Current liabilities | | $ | 2,147 | | $ | 5,832 | | $ | 11,579 |

Long-term debt, net of current maturities | | | 6,450 | | | 5,906 | | | 3,517 |

Asset retirement obligations, net of current obligation | | | 601 | | | 3,109 | | | 3,523 |

Members’ equity | | | 28,150 | | | 79,961 | | | 123,511 |

| | |

|

| |

|

| |

|

|

Total liabilities and members’ equity | | $ | 37,348 | | $ | 94,808 | | $ | 142,130 |

| | |

|

| |

|

| |

|

|

| (1) | Windsor Energy Resources, Inc. was formed as a Delaware corporation in December 2005. The combined financial statements and other financial information included in this prospectus pertain to the assets, liabilities, revenues and expenses of certain limited liability companies and limited partnerships and certain oil and natural gas properties owned by companies which, in each case, are affiliated with Windsor Energy Resources, Inc. through our equity sponsor, Wexford. These affiliates were treated as partnerships for federal income tax purposes. As a result, essentially all of our taxable earnings and losses were passed through to Wexford, and we did not pay federal income taxes at the entity level. Prior to the completion of this offering, the oil and natural gas assets and operations currently owned and/or operated by these affiliates will be transferred to Windsor Energy Resources, Inc., which will be taxed as a C corporation. For comparative purposes, we have included a pro forma provision (benefit) for income taxes assuming we had been taxed as a C corporation in all periods prior to the transfer. |

| (2) | Unaudited pro forma basic and diluted income (loss) per share will be presented for all periods on the basis of shares to be issued to Windsor Holdings in connection with the transfer of the oil and natural gas assets and operations to us upon determination of the number of those shares. |

10

Summary Operating and Reserve Data

The following estimates of net proved oil and natural gas reserves are based on the reserve report prepared by DeGolyer and MacNaughton, our independent petroleum engineers, and have been made in accordance with the rules and regulations of the SEC. A copy of the reserve report is attached to this prospectus as Appendix B. You should refer to “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business—Oil and Gas Data—Proved Reserves,” “Business—Oil and Gas Data—Production and Price History” and the reserve report included in this prospectus in evaluating the material presented below.

| | | | | | | | | |

| | | Period from

Inception

through

(July 8, 2003)

December 31,

2003(2)

| | Year Ended

December 31,

2004

| | Nine Months

Ended September 30,

2005

|

Production Data: | | | | | | | | | |

Natural gas (MMcf)(1) | | | 466.1 | | | 1,590.5 | | | 1,986.3 |

Oil (MBbls) | | | 9.3 | | | 28.3 | | | 18.2 |

Combined volumes (MMcfe) | | | 522.0 | | | 1,760.5 | | | 2,095.3 |

Daily combined volumes (MMcfe/day) | | | 3.0 | | | 4.8 | | | 7.7 |

| | | |

Average Prices: | | | | | | | | | |

Natural gas (per Mcf) | | $ | 4.06 | | $ | 5.01 | | $ | 5.41 |

Oil (per Bbl) | | | 28.49 | | | 37.80 | | | 48.71 |

Combined (per Mcfe) | | | 4.13 | | | 5.14 | | | 5.55 |

| | |

| | | As of December 31,

| | |

| | | 2004

| | 2005

| | |

| Estimated Net Proved Reserves: | | | | | | | | | |

Natural gas (Bcf) | | | 40.8 | | | 43.0 | | | |

Oil (MMBbls) | | | 1.0 | | | 0.9 | | | |

Total (Bcfe) | | | 46.6 | | | 48.5 | | | |

PV-10 (in millions)(3) | | $ | 96.4 | | $ | 135.2 | | | |

Standardized measure (in millions)(4) | | $ | 77.3 | | $ | | | | |

| (1) | Production of natural gas liquids is included in natural gas revenues and production. |

| (2) | Production data for 2003 covers only a partial year as we acquired our initial properties in the Powder River Basin on July 8, 2003. |

| (3) | The present values of future net revenues before income taxes (PV-10) were determined using the prices for natural gas and oil at December 31, 2004 and 2005, which were $5.85 per MMcf of natural gas and $40.60 per barrel of oil in 2004 and $8.54 per MMcf of natural gas and $57.31 per barrel of oil in 2005. |

The present value of future net cash flows (PV-10 value) is a non-GAAP measure because it excludes income tax effects. Management believes that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating oil and gas companies. Because many factors that are unique to each individual company impact the amount of future income taxes estimated to be paid, the use of a pre-tax measure is valuable when evaluating acquisition candidates. PV-10 is not a measure of financial or operating performance under GAAP. PV-10 should not be considered as an alternative to the standardized measure as defined under GAAP. We have included a reconciliation to the most directly comparable GAAP

11

measure—standardized measure of discounted future net cash flows. The following table reconciles the standardized measure of future net cash flows to the PV-10 value:

| | | | | | |

| | | December 31,

|

| | | 2004

| | 2005

|

Standardized measure of discounted future net cash flows | | $ | 77.3 | | $ | |

Add: Present value of future income tax discounted at 10% | | | 19.1 | | | |

| | |

|

| |

|

|

PV-10 value | | $ | 96.4 | | $ | |

| | |

|

| |

|

|

| (4) | The standardized measure represents the present value of estimated future cash inflows from proved oil and natural gas reserves, less future development, production, and income tax expenses, discounted at 10% per annum to reflect timing of future cash flows and using the same pricing assumptions as were used to calculate PV-10. Standardized measure differs from PV-10 because standardized measure includes the effect of future income taxes. |

12

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks and all of the other information contained in this prospectus before deciding to invest in our common stock. The risks described below are not the only ones facing our company. Additional risks not presently known to us or which we currently consider immaterial also may adversely affect our company.

Risks Related to the Oil and Natural Gas Industry and Our Business

Our business is difficult to evaluate because we have a limited operating history.

In considering whether to invest in our common stock, you should consider that there is only limited historical financial and operating information available on which to base your evaluation of our performance. We acquired our first oil and natural gas properties in 2003 and, as a result, we have a limited operating history.

Our oil and natural gas reserves and future production, and, therefore, our future cash flow and income, are highly dependent on our successfully developing our undeveloped leasehold acreage.

Approximately 90% of our net leasehold acreage is undeveloped, or acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves. In addition, many of our oil and gas leases require us to drill wells that are commercially productive, and if we are unsuccessful in drilling such wells, we could lose our rights under such leases. We intend to use cash flow from operations and the proceeds of this offering to develop our leasehold acreage by funding our exploration, exploitation and development activities. Our future oil and natural gas reserves and production, and, therefore, our future cash flow and income are highly dependent on successfully developing our undeveloped leasehold acreage.

Our development and exploration operations require substantial capital and we may be unable to obtain needed capital or financing on satisfactory terms, which could lead to a loss of properties and a decline in our oil and natural gas reserves.

The oil and natural gas industry is capital intensive. We make and expect to continue to make substantial capital expenditures in our business and operations for the exploration for and development, production and acquisition of oil and natural gas reserves. To date, we have financed capital expenditures primarily with funding from our equity sponsor, bank debt and cash generated by operations. In the near term, we intend to finance our capital expenditures with cash flow from operations and the proceeds from this offering. Our cash flow from operations and access to capital are subject to a number of variables, including:

| | • | | the level of oil and natural gas we are able to produce from existing wells; |

| | • | | the prices at which oil and natural gas are sold; and |

| | • | | our ability to acquire, locate and produce new reserves. |

We may, from time to time, need to seek additional financing, including a revolving credit facility. If our revenues decrease or our ability to obtain future financing is impaired as a result of lower oil and natural gas prices, operating difficulties, declines in reserves or for any other reason, we may have limited ability to obtain the capital necessary to sustain our operations at current levels. There can be no assurance as to the availability or terms of any additional financing.

Even if additional capital is needed, we may not be able to obtain debt or equity financing on terms favorable to us, or at all. If cash generated by operations is not sufficient to meet our capital requirements, the

13

failure to obtain additional financing could result in a curtailment of our operations relating to exploration and development of our prospects, which in turn could lead to a possible loss of properties and a decline in our oil and natural gas reserves.

Our project areas, which are in various stages of development, may not yield oil or natural gas in commercially viable quantities.

Our project areas are in various stages of development, ranging from project areas with current drilling or production activity to project areas that consist of recently acquired leasehold acreage or that have limited drilling or production history. From inception through December 31, 2005, we participated in drilling a total of 228 gross wells, of which 79 gross wells were completed as producing wells, two gross wells were in the process of being drilled or completed, 57 gross wells were dewatering, 86 wells were shut in awaiting infrastructure to begin dewatering and four gross wells were identified as dry holes. If the wells in the process of being completed or dewatering do not produce sufficient revenues to return a profit or if we drill additional dry holes, our business may be materially affected. The cost of drilling, completing and operating any wells is often uncertain and new wells may not be productive.

Our identified drilling locations comprise an estimation of part of our future drilling plans over several years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling.

We have specifically identified drilling locations to be included in our future multi-year drilling activities on our existing acreage. As of December 31, 2005, we had identified approximately 1,290 gross drilling locations. These identified drilling locations represent a significant part of our growth strategy. Our ability to drill and develop these locations depends on a number of uncertainties, including the availability of capital, construction of infrastructure, seasonal conditions, regulatory approvals, oil and natural gas prices, costs and drilling results. For example, 575 of these potential drilling locations are located in our Beaver Creek project area in the Power River Basin. All of our existing wells in this project area are currently shut in awaiting power and infrastructure, which will account for most of our 2006 capital expenditures in this project area with only one of the 575 potential drilling locations projected to be drilled in 2006. Because of these uncertainties, we do not know if the numerous potential drilling locations we have identified will ever be drilled or if we will be able to produce oil or natural gas from these or any other potential drilling locations. As such, our actual drilling activities may materially differ from those presently identified, which could adversely affect our business.

Oil and natural gas prices are volatile and a decline in oil and natural gas prices can significantly affect our financial results and impede our growth.

Our revenue, profitability and cash flow depend upon the prices and demand for oil and natural gas. The markets for these commodities are very volatile and even relatively modest drops in prices can significantly affect our financial results and impede our growth. Changes in oil and natural gas prices have a significant impact on the value of our reserves and on our cash flow. Prices for oil and natural gas may fluctuate widely in response to relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty and a variety of additional factors that are beyond our control, such as:

| | • | | the domestic and foreign supply of oil and natural gas; |

| | • | | the price of foreign imports; |

| | • | | overall domestic and global economic conditions; |

| | • | | political and economic conditions in oil producing countries, including the Middle East and South America; |

| | • | | the ability of members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls; |

14

| | • | | the level of consumer product demand; |

| | • | | technological advances affecting energy consumption; |

| | • | | domestic and foreign governmental regulations; |

| | • | | proximity and capacity of oil and gas pipelines and other transportation facilities; and |

| | • | | the price and availability of alternative fuels. |

Lower oil and natural gas prices may not only decrease our revenues on a per unit basis, but also may reduce the amount of oil and natural gas that we can produce economically. This may result in our having to make substantial downward adjustments to our estimated proved reserves. If this occurs or if our production estimates change or our exploration or development results deteriorate, full cost accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our oil and natural gas properties. Additionally, we currently do not hedge our oil and natural gas production. By not hedging our production, we may be more adversely affected by declines in oil and natural gas prices than our competitors who engage in hedging arrangements. Further, should we elect to hedge in the future, such hedges may result in us receiving lower than current prevailing market prices and place additional financial strains on us due to having to post margin calls on our hedges.

Our method of accounting for investments in oil and natural gas properties may result in impairment of asset value.

We follow the full cost method of accounting for oil and natural gas properties. Accordingly, all costs associated with the acquisition, exploration and development of oil and natural gas properties, including costs of undeveloped leasehold, geological and geophysical expenses, dry holes, leasehold equipment and legal due diligence costs directly related to acquisition, exploration and development activities, are capitalized. Capitalized costs of oil and natural gas properties also include estimated asset retirement costs recorded based on the fair value of the asset retirement obligation when incurred. The capitalized costs plus future development and dismantlement costs are depleted and charged to operations using the equivalent unit-of-production method based on proved oil and natural gas reserves as determined by our independent petroleum engineers. To the extent that such capitalized costs, net of depletion and amortization, exceed the present value of estimated future net revenues, discounted at 10%, from proved oil and natural gas reserves, after income tax effects, such excess costs are charged to operations. Once incurred, a write down of oil and natural gas properties is not reversible at a later date, even if oil or natural gas prices increase. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Oil and Gas Properties” and “—Ceiling Test” for a more detailed description of our method of accounting.

Our estimated reserves are based on many assumptions that may turn out to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present value of our reserves.

No one can measure underground accumulations of oil and natural gas in an exact way. Oil and natural gas reserve engineering requires subjective estimates of underground accumulations of oil and natural gas and assumptions concerning future oil and natural gas prices, production levels, and operating and development costs. As a result, estimated quantities of proved reserves and projections of future production rates and the timing of development expenditures may be incorrect. Our estimates of proved reserves and related valuations are based on reports prepared by independent petroleum engineers. The independent petroleum engineers conducted a well-by-well review of all our properties using information provided by us. Over time, we may make

15

material changes to reserve estimates taking into account the results of actual drilling, testing, and production. Also, certain assumptions regarding future oil and natural gas prices, production levels, and operating and development costs may prove incorrect. Any significant variance from these assumptions to actual figures could greatly affect our estimates of reserves, the economically recoverable quantities of oil and natural gas attributable to any particular group of properties, the classifications of reserves based on risk of recovery, and estimates of the future net cash flows.A substantial portion of our reserve estimates are made without the benefit of a lengthy production history, which are less reliable than estimates based on a lengthy production history. Numerous changes over time to the assumptions on which our reserve estimates are based, as described above, often result in the actual quantities of oil and natural gas we ultimately recover being different from our reserve estimates.

The present value of future net cash flows from our proved reserves is not necessarily the same as the current market value of our estimated oil and natural gas reserves. We base the estimated discounted future net cash flows from our proved reserves on prices and costs in effect on the day of estimate. However, actual future net cash flows from our oil and natural gas properties also will be affected by factors such as:

| | • | | actual prices we receive for oil and natural gas; |

| | • | | the amount and timing of actual production; |

| | • | | supply of and demand for oil and natural gas; and |

| | • | | changes in governmental regulations or taxation. |

The timing of both our production and our incurrence of costs in connection with the development and production of oil and natural gas properties will affect the timing of actual future net cash flows from proved reserves, and thus their actual present value. In addition, the 10% discount factor we use when calculating discounted future net cash flows may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and natural gas industry in general. For example, if natural gas prices decline by $0.10 per Mcf and oil prices remain constant, then the PV-10 of our proved reserves as of December 31, 2005 would decrease from $135.2 million to $133.3 million. PV-10 is a non-GAAP measure because it excludes income tax effects. We have provided a reconciliation of PV-10 to the standardized measure of discounted future net cash flows “Prospectus Summary—Summary Operating and Reserve Data.”

Many of our producing properties are located in the Rocky Mountain and East Texas regions, making us vulnerable to risks associated with operating in these areas.

Our operations are focused on the Rocky Mountain and East Texas regions, which means our producing properties are geographically concentrated in those areas. As a result, we may be disproportionately exposed to the impact of delays or interruptions of production from these regions caused by significant governmental regulation, lack of infrastructure, transportation capacity constraints, curtailment of production or interruption of transportation of natural gas produced from the wells in this basin. For example, we are currently constructing a 25-mile pipeline that will provide the transportation required to begin initial production from our wells in our Bennett Creek project area in the Big Horn Basin. We estimate the total cost of the pipeline upon its completion will be $5 million.

Shortage of rigs, equipment, supplies or personnel may restrict our operations.

The oil and natural gas industry is cyclical, and at the present time, there is a shortage of drilling rigs, equipment, supplies and personnel. The costs and delivery times of rigs, equipment and supplies has increased as drilling activities have increased. In addition, demand for, and wage rates of, qualified drilling rig crews have risen with increases in the number of active rigs in service. Shortages of drilling rigs, equipment, supplies or personnel could delay or restrict our exploration and development operations, which in turn could impair our financial condition and results of operations.

16

Seasonal weather conditions and lease stipulations adversely affect our ability to conduct drilling activities in some of the areas where we operate.

Oil and natural gas operations in the Rocky Mountains are adversely affected by seasonal weather conditions and lease stipulations designed to protect various wildlife. In certain areas, drilling and other oil and natural gas activities can only be conducted during the spring, summer and fall months. Many of our leases with the Department of the Interior’s Bureau of Land Management restrict our operations in those areas from December to April due to wildlife migration. This limits our ability to operate in those areas and can intensify competition during those months for drilling rigs, oilfield equipment, services, supplies and qualified personnel, which may lead to periodic shortages. These constraints and the resulting shortages or high costs could delay our operations and materially increase our operating and capital costs.

Market conditions or operational impediments may hinder our access to oil and natural gas markets or delay our production.

Market conditions or the unavailability of satisfactory oil and natural gas transportation arrangements may hinder our access to oil and natural gas markets or delay our production. The availability of a ready market for our oil and natural gas production depends on a number of factors, including the demand for and supply of oil and natural gas and the proximity of reserves to pipelines and terminal facilities. Our ability to market our production depends in substantial part on the availability and capacity of gathering systems, pipelines and processing facilities owned and operated by third parties. Our failure to obtain such services on acceptable terms could materially harm our business. We may be required to shut in wells for a lack of a market or because of inadequacy or unavailability of natural gas pipeline, gathering system capacity or processing facilities. If that were to occur, then we would be unable to realize revenue from those wells until production arrangements were made to deliver the production to market.

We are subject to complex federal, state, local and other laws and regulations that could adversely affect the cost, manner or feasibility of doing business.

Our exploration, development, production and marketing operations are regulated extensively at the federal, state and local levels. Under these laws and regulations, we could be held liable for personal injuries, property damage, site clean-up and restoration obligations or costs and other damages and liabilities. Failure to comply with these laws and regulations may also result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties, including the assessment of natural resource damages. Environmental and other governmental laws and regulations also increase the costs to plan, design, drill, install, operate and abandon oil and natural gas wells and remediate impacted areas. These laws and regulations commonly impose strict liability and could impose liability upon us, regardless of fault. Moreover, public interest in environmental protection is intense, and environmental organizations have opposed, with some success, certain drilling projects. For example, the Clark Resource Council is opposing the approval by the Department of the Interior’s Bureau of Land Management, or BLM, of our operations in our Bennett Creek and Clark project areas.

Our coalbed methane exploration and production activities result in the discharge of large volumes of produced water into adjacent ponds, creekbeds and below ground disposal systems. The ratio of methane gas to produced water varies over the life of the well. The environmental soundness of discharging produced water pursuant to water discharge permits has come under increased scrutiny. Moratoriums on the issuance of additional water discharge permits, issuance of stricter permits, modifications to existing permits or requirements for more costly methods of handling these produced waters, may adversely affect future well operation and development. Compliance with more stringent laws or regulations, changed interpretations of these laws and regulations, or more vigorous enforcement policies of the regulatory agencies, or difficulties in negotiating required surface use agreements with land owners, or receiving other governmental approvals, could delay or otherwise adversely affect our CBM exploration and production activities and/or require us to make material expenditures for the installation and operation of systems and equipment for pollution control and/or remediation, all of which could have a material adverse effect on our financial condition or results of operations.

17

For example, approximately 15% of our acreage in the Castle Springs project area is subject to a drilling moratorium put in place by the Colorado Oil and Gas Conservation Commission upon the discovery in March 2004 of a gas seep caused by a faulty well drilled by another operator.

In August 2004, the Tenth Circuit Court of Appeals inPennaco Energy, Inc. v. United States Department of the Interior, upheld a decision by the Interior Board of Land Appeals that the BLM failed to fully comply with the National Environmental Policy Act, or NEPA, in granting certain federal leases in the Powder River Basin to Pennaco Energy, Inc. for CBM development. Other recent decisions in the federal district court in Montana have also held that BLM failed to comply with NEPA when considering CBM development in the Powder River Basin. While these recent decisions have not had a material impact on our current operations or planned exploration and development activities, future litigation and/or agency responses to such litigation could materially impact our ability to obtain or maintain required regulatory approvals to conduct operations in the Powder River Basin or elsewhere.

Part of the regulatory environment in which we operate includes, in some cases, federal requirements for performing or preparing environmental assessments, environmental impact studies and/or plans of development before commencing exploration and production activities. In addition, our activities are subject to the regulation by oil and natural gas-producing states of conservation practices and protection of correlative rights. These regulations affect our operations and limit the quantity of oil and natural gas we may produce and sell. A major risk inherent in our drilling plans is the need to obtain drilling permits from state and local authorities. Delays in obtaining regulatory approvals, drilling permits, the failure to obtain a drilling permit for a well or the receipt of a permit with unreasonable conditions or costs could have a material adverse effect on our ability to explore on or develop our properties. The permitting and approval process has been more difficult in recent years than in the past due to increased activism from environmental and other groups and has extended the time it takes us to receive permits. Because of our relatively small size and concentrated property base, we can be disproportionately disadvantaged by delays in obtaining or failing to obtain drilling approvals compared to companies with larger or more dispersed property bases. As a result, we are less able to shift drilling activities to areas where permitting may be easier and we have fewer properties over which to spread the costs related to complying with these regulations and the costs or foregone opportunities resulting from delays. Additionally, the oil and natural gas regulatory environment could change in ways that might substantially increase the financial and managerial costs to comply with the requirements of these laws and regulations and, consequently, adversely affect our profitability. See “Business—Operations—Environmental Matters and Regulation” and “Business—Operations—Other Regulation of the Oil and Gas Industry” for a description of the laws and regulations that affect us.

We rely on a few key employees whose absence or loss could adversely affect our business.

Many key responsibilities within our business have been assigned to a small number of employees. The loss of their services could adversely affect our business. In particular, the loss of the services of our Chief Executive Officer, Michael P. Cross, could disrupt our operations. We do not have an employment contract with any of our executives and they are not restricted from competing with us if they cease to be employed by us. Additionally, as a practical matter, any employment agreement we may enter into will not assure the retention of our employees. In addition, we do not maintain “key person” life insurance policies on any of our employees. As a result, we are not insured against any losses resulting from the death of our key employees.

Our use of 2-D and 3-D seismic data is subject to interpretation and may not accurately identify the presence of oil and natural gas, which could adversely affect the results of our drilling operations.

Even when properly used and interpreted, 2-D and 3-D seismic data and visualization techniques are only tools used to assist geoscientists in identifying subsurface structures and hydrocarbon indicators and do not enable the interpreter to know whether hydrocarbons are, in fact, present in those structures. In addition, the use of 3-D seismic and other advanced technologies requires greater predrilling expenditures than traditional drilling strategies, and we could incur losses as a result of such expenditures. As a result, our drilling activities may not be successful or economical.

18

Our interpretation of seismic data delineates for us those portions of an area that we believe are desirable for drilling. Therefore, we may chose not to acquire option or lease rights prior to acquiring seismic data and, in many cases, we may identify hydrocarbon indicators before seeking option or lease rights in the location. If we are not able to lease those locations on acceptable terms, it would result in our having made substantial expenditures to acquire and analyze 3-D data without having an opportunity to attempt to benefit from those expenditures.

Drilling for and producing oil and natural gas are high-risk activities with many uncertainties that could adversely affect our business, financial condition or results of operations.

Our drilling activities are subject to many risks, including the risk that we will not discover commercially productive reservoirs. In addition, our drilling and producing operations may be curtailed, delayed or canceled as a result of other factors, including:

| | • | | unusual or unexpected geological formations; |

| | • | | loss of drilling fluid circulation; |

| | • | | facility or equipment malfunctions; |

| | • | | unexpected operational events; |

| | • | | shortages or delivery delays of equipment and services; |

| | • | | compliance with environmental and other governmental requirements; and |

| | • | | adverse weather conditions. |

Any of these risks can cause substantial losses, including personal injury or loss of life, damage to or destruction of property, natural resources and equipment, pollution, environmental contamination or loss of wells and other regulatory penalties.

Additionally, the coal beds in the Powder River Basin from which we produce methane gas frequently contain water, which may hamper our ability to produce gas in commercial quantities. The amount of CBM that can be commercially produced depends upon the coal quality, the original gas content of the coal seam, the thickness of the seam, the reservoir pressure, the rate at which gas is released from the coal, and the existence of any natural fractures through which the gas can flow to the well bore. However, coal beds frequently contain water that must be removed in order for the gas to flow to the well bore. The average life of a CBM well in this basin is only five to 15 years. Our ability to remove and dispose of sufficient quantities of water from the coal seam will determine whether or not we can produce coal bed methane in commercial quantities.

Losses and liabilities from uninsured or underinsured drilling and operating activities could have a material adverse effect on our financial condition and operations.

We ordinarily maintain insurance against various losses and liabilities arising from our operations; however, insurance against all operational risks is not available to us. Additionally, we may elect not to obtain insurance if we believe that the cost of available insurance is excessive relative to the perceived risks presented. Thus, losses could occur for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. The occurrence of an event that is not fully covered by insurance could have a material adverse impact on our business activities, financial condition and results of operations.

19

We may be unable to successfully acquire additional leasehold interests or other oil and natural gas properties.

Acquisitions of leasehold interests or other oil and natural gas properties have been an important element of our business, and we will continue to pursue acquisitions in the future. In the last several years, we have pursued and consummated leasehold or other property acquisitions that have provided us opportunities to expand our acreage position, and, to a lesser extent, grow our production and reserves. Although we regularly engage in discussions and submit proposals regarding leasehold interests or other properties, suitable acquisitions may not be available in the future on reasonable terms.

If we do identify appropriate leasehold interests or other properties, we may be unable to successfully negotiate the terms of an acquisition, finance the acquisition or, if the acquisition occurs, successfully develop the acquired leasehold interests or other properties. Negotiations of potential acquisitions may require a disproportionate amount of management’s attention and our resources. Even if we complete additional acquisitions, continued acquisition financing may not be available or available on reasonable terms and any new leasehold interests or other properties may not provide production or reserves comparable to our existing leasehold interests and other properties.

The success of any acquisition will depend on a number of factors, including the ability to identify drilling locations, estimate accurately the recoverable volumes of reserves, rates of future production and future net revenues attainable from the reserves and to assess possible environmental or other liabilities. However, even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it permit a buyer to become sufficiently familiar with the properties to assess fully their deficiencies and potential. Inspections may not always be performed on every well, and environmental problems, such as ground water contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, we often assume certain environmental and other risks and liabilities in connection with acquired properties.

Unless we replace our oil and natural gas reserves, our reserves and production will decline, which would adversely affect our business, financial condition and results of operations.

We face the challenge of natural production declines. As initial reservoir pressures are depleted, oil and gas production from a given well naturally decreases. Thus, an oil and gas exploration and production company depletes part of its asset base with each unit of oil or natural gas it produces. Because total estimated proved reserves include our proved undeveloped reserves at December 31, 2005, production will decline even if those proved undeveloped reserves are developed and the wells produce as expected. The rate of decline will change if production from our existing wells declines in a different manner than we have estimated and can change under other circumstances. Thus, our future oil and natural gas reserves and production and, therefore, our cash flow and income are highly dependent on our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves. Our future growth will depend on our ability to continue to add reserves in excess of production. Our ability to add reserves through drilling is dependent on our capital resources and can be limited by many factors, including our ability to timely obtain drilling permits and regulatory approvals. Thus, we may not be able to develop, find or acquire additional reserves to replace our current and future production at acceptable costs.

Competition in the oil and natural gas industry is intense, which may adversely affect our ability to succeed.

The oil and natural gas industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also carry on refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive oil and natural gas properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human

20