UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

JOINT PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement. |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| |

| x | | Definitive Proxy Statement. |

| |

| ¨ | | Definitive Additional Materials. |

| |

| ¨ | | Soliciting Material under §240.14a-12. |

|

| Columbia Funds Series Trust II |

| (Name of Registrant as Specified in its Charter) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | |

Columbia Funds Series Trust I

Columbia Funds Series Trust II

Columbia Funds Variable Series Trust II

225 Franklin Street, Boston, Massachusetts 02110

Columbia Absolute Return Currency and Income Fund

Columbia Capital Allocation Aggressive Portfolio (formerly, Columbia Portfolio Builder Aggressive Fund)

Columbia Capital Allocation Conservative Portfolio (formerly, Columbia Portfolio Builder Conservative Fund)

Columbia Capital Allocation Moderate Portfolio (formerly, Columbia Portfolio Builder Moderate Fund)

Columbia Seligman Communications and Information Fund

Columbia Seligman Global Technology Fund

Columbia Technology Fund

Columbia Variable Portfolio – Seligman Global Technology Fund

Columbia Variable Portfolio – Short Duration U.S. Government Fund

(each, a “Fund” and collectively, the “Funds”)

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND

AND VOTE ON THE PROPOSALS

This is a brief overview of the matters on which you are being asked to vote. The accompanying Joint Proxy Statement contains more detailed information about each proposal, and we encourage you to read it in its entirety before voting. Your vote is important.

| Q. | Why are you sending me this information? |

| A. | On February 27, 2013, a Joint Special Meeting of Shareholders of each Fund (the “Meeting”) will be held at 225 Franklin Street (Room 3200 on the 32nd floor), Boston, MA 02110, at 10:00 a.m. (Eastern). You are receiving the Joint Proxy Statement and one or more proxy cards (the “Proxy Cards”) because you own shares of one or more of the Funds and have the right to vote on these important proposals concerning your investment. |

Columbia Variable Portfolio – Seligman Global Technology Fund and Columbia Variable Portfolio – Short Duration U.S. Government Fund are owned of record by sub-accounts of insurance companies (the “Participating Insurance Companies”) established to fund benefits under variable annuity contract and/or variable life insurance policies (each a “Contract”) issued by the Participating Insurance Companies, qualified pension or retirement plans, and other permissible investors under relevant U.S. federal income tax rules. Persons holding Contracts are referred to herein as “Contract Owners.” If you are a Contract Owner with Contract values allocated to Columbia Variable Portfolio – Seligman Global Technology Fund or Columbia Variable Portfolio – Short Duration U.S. Government Fund, you are being asked to provide voting instructions to the

Participating Insurance Company that issued your Contract regarding a proposal involving your fund. For simplicity, references to Fund shareholders include, as applicable, Contract Owners.

| Q. | What are the proposals? |

| A. | Shareholders of the Funds referenced below are being asked to vote or provide voting instructions on the following proposals: |

| | • | | For Columbia Capital Allocation Aggressive Portfolio, Columbia Capital Allocation Conservative Portfolio and Columbia Capital Allocation Moderate Portfolio, the approval of an amendment to the Investment Management Services Agreement to revise the fee structure, to add an investment advisory fee payable by those Funds for their investments in certain asset categories (Proposal 1); |

| | • | | For Columbia Absolute Return Currency and Income Fund, the approval of a change in the Fund’s fundamental policy regarding concentration (Proposal 2); |

| | • | | For Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund, the approval of a change in the Fund’s fundamental policy regarding concentration (Proposal 3); |

| | • | | For Columbia Variable Portfolio – Short Duration U.S. Government Fund, the approval of an amendment to the Fund’s investment objective changing it from fundamental to non-fundamental (Proposal 4); and |

| | • | | For Columbia Seligman Communications and Information Fund, Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund, the approval of a proposal to change the classification of such Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940 (the “1940 Act”) (Proposal 5). |

| Q. | For Columbia Capital Allocation Aggressive Portfolio, Columbia Capital Allocation Conservative Portfolio and Columbia Capital Allocation Moderate Portfolio, why am I being asked to vote on an amendment to the Investment Management Services Agreement? |

| A. | Proposal 1 requests your vote on an amendment to the Investment Management Services Agreement (the “IMS Agreement”) between Columbia Management and Columbia Funds Series Trust II, on behalf of the following Funds: |

Columbia Capital Allocation Aggressive Portfolio

Columbia Capital Allocation Conservative Portfolio

Columbia Capital Allocation Moderate Portfolio

(each, an “IMS Fee Fund” and collectively, the “IMS Fee Funds”)

The IMS Fee Funds were originally designed as “Funds-of-Funds” that invested exclusively in underlying funds advised by Columbia Management. As part of a

-2-

broader alignment of asset allocation products offered by Columbia Management, the IMS Fee Funds have recently expanded their mandate to invest in securities and instruments (securities) in addition to underlying funds advised by Columbia Management. The proposed amendment, if approved, is designed to adopt an investment management fee structure for assets of an IMS Fee Fund invested in securities other than underlying funds advised by Columbia Management. The proposed amendment to the IMS Agreement for each IMS Fee Fund would result in each IMS Fee Fund paying investment advisory fees to Columbia Management at a rate that varies based on the type of investments made by such IMS Fee Fund. Each IMS Fee Fund’s operations and the manner in which Columbia Management manages the IMS Fee Fund are not expected to change otherwise as a result of this amendment. More specifically, except for the proposed change to the investment advisory fee rates payable by an IMS Fee Fund, the IMS Agreement for such IMS Fee Funds would remain the same in all respects, including that no investment advisory fees would be payable directly by the IMS Fee Funds with respect to investments in other funds in the Columbia fund complex since these funds themselves pay an investment advisory fee to Columbia Management.

| Q. | Will the change to the investment advisory fee structure increase the expenses of my IMS Fee Fund? |

| A. | Investment advisory fees are expected to increase, but overall Fund expenses may be lower than if the IMS Fee Funds’ assets were invested exclusively in underlying funds advised by Columbia Management. That is, although the proposed amendment to the IMS Agreement would result in higher “direct” investment advisory fees for net assets invested in securities, direct investment by the IMS Fee Funds in securities, rather than in underlying funds advised by Columbia Management, decreases the “indirect” fees (often referred to as “acquired fund” fees and expenses) incurred by the IMS Fee Fund as a result of its investment in underlying funds. |

Comparisons of the investment advisory fee rates for each IMS Fee Fund, and gross and net expense ratios, are included in the accompanying Joint Proxy Statement.

| Q. | For the IMS Fee Funds, why should I approve an amendment that would or could increase the investment advisory fee rates payable by my Fund? |

| A. | The proposed amendment to the IMS Agreement is designed to enhance uniformity across the Columbia fund complex consistent with an expanded mandate of the IMS Fee Funds to invest directly in securities other than shares of underlying funds advised by Columbia Management. This proposal is intended to: |

| | • | | Standardize investment advisory fee rates and total management fee rates (i.e., the investment advisory fee rates and the administration/administrative fee rates), to the extent practicable, across target allocation funds in the Columbia fund complex (specifically, the amendment would align the investment advisory fee |

-3-

| | rates of the IMS Fee Funds with those of certain other target date funds advised by Columbia Management, as described in Proposal 1) to promote uniformity of pricing among similar funds; and |

| | • | | Compensate Columbia Management for the advisory services it provides to the IMS Fee Funds with respect to assets invested in securities other than underlying funds advised by Columbia Management. |

The IMS Fee Funds do not currently pay Columbia Management a management fee, because at the time the IMS Fee Funds were created, it was contemplated that they would invest exclusively in underlying funds advised by, and that paid an advisory fee to, Columbia Management. Under the proposed amendment and based on the allocation of the IMS Fee Funds’ assets as of August 31, 2012, it is expected that the investment advisory fee rate will increase 0.0145% for Columbia Capital Allocation Conservative Portfolio, 0.003% for Columbia Capital Allocation Moderate Portfolio and 0.006% for Columbia Capital Allocation Aggressive Portfolio, as described in the accompanying Joint Proxy Statement (assuming the current portfolio positions of the funds).

| Q. | For Columbia Absolute Return Currency and Income Fund, why am I being asked to approve a change to my Fund’s fundamental policy regarding concentration? |

| A. | Proposal 2 asks the shareholders of Columbia Absolute Return Currency and Income Fund to approve a change in the fundamental policy regarding concentration of their Fund. Currently, Columbia Absolute Return Currency and Income Fund has a fundamental investment policy that it will not concentrate in any one industry, provided, however, that this restriction shall not apply to securities or obligations issued or guaranteed by the U.S. Government, banks or bank holding companies or finance companies. For all other industries, this means that no more than 25% of the Fund’s total assets, based on current market value at the time of purchase, can be invested in any one industry. |

Following an internal review that included portfolio management and product management, Columbia Management determined there was no present intention for Columbia Absolute Return Currency and Income Fund to concentrate in banks, bank holding companies or finance companies. As a result, Proposal 2 asks shareholders to approve the following as a new fundamental investment policy for the Fund, replacing the Fund’s current concentration policy described above:

The Fund will not purchase any securities which would cause 25% or more of the value of its total assets at the time of purchase to be invested in the securities of one or more issuers conducting their principal business activities in the same industry, provided that: (i) there is no limitation with respect to obligations issued or guaranteed by the U.S. Government, any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions; and (ii) notwithstanding this limitation or any other fundamental investment

-4-

limitation, assets may be invested in the securities of one or more management investment companies to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief.

| Q. | For Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund, why am I being asked to approve a change to my Fund’s fundamental policy regarding concentration? |

| A. | Proposal 3 asks the shareholders of Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund (each, a “Technology Fund” and collectively, the “Technology Funds”) to approve a change in the fundamental policy regarding concentration to provide that each Fund will, under normal market conditions, invest at least 25% of its total assets in securities of companies in the technology and related group of industries. Currently, each Technology Fund has a fundamental investment policy that it will not concentrate in any one industry, provided, however, that this restriction shall not apply to securities or obligations issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities or, in the case of Columbia Technology Fund, by any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions. For Columbia Technology Fund, the limitation on industry concentration does not apply to assets invested in the securities of one or more management investment companies or subsidiaries to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. This means that for all other industries, no more than 25% of the Fund’s total assets, based on current market value at the time of purchase, can be invested in any one industry. |

Following an internal review, Columbia Management determined that each Technology Fund would be better able to pursue its investment objectives if it were to concentrate its investments in the technology and related group of industries. Historically, each Technology Fund has treated each of the internet software and services, IT consulting and other services, data processing and outsourced services, application software, systems software, home entertainment software, communications equipment, computer hardware, computer storage and peripherals, electronic equipment and instruments, electronic components, electronic manufacturing services, technology distributors, office electronics, semiconductor equipment, and semiconductors sub-industries as a separate industry for purposes of its policy generally prohibiting the Fund from investing more than 25% of its total assets in the securities of issuers in any industry. Issuers in each of these sub-industries will be treated as belonging to the technology and related group of industries under the proposed policy. Columbia Management believes that the process of monitoring compliance with each Technology Fund’s concentration policy will be simplified, and each Fund will be better able to pursue its investment objectives, if the Fund’s fundamental policy relating to concentration is changed as proposed. Increasing the percentage of a

-5-

Technology Fund’s total assets that can be invested in the securities of issuers in a single industry or group of related industries increases the risk that the Fund will be adversely affected by events impacting such industries or group of related industries. Such a Fund would be more significantly affected by events impacting such industries than would a Fund that was not so concentrated.

For these reasons, Proposal 3 asks shareholders to approve the following as a new fundamental investment policy for each Technology Fund, replacing the Fund’s current concentration policy described above:

The Fund will, under normal market conditions, invest at least 25% of the value of its total assets at the time of purchase in the securities of issuers conducting their principal business activities in the technology and related group of industries, provided that: (i) there is no limitation with respect to obligations issued or guaranteed by the U.S. Government, any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions; and (ii) notwithstanding this limitation or any other fundamental investment limitation, assets may be invested in the securities of one or more management investment companies or subsidiaries to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief.

| Q. | For Columbia Variable Portfolio – Short Duration U.S. Government Fund, why am I being asked to approve the conversion of my Fund’s investment objective? |

| A. | Proposal 4 asks Contract Owners of Columbia Variable Portfolio – Short Duration U.S. Government Fund (the “Short Duration Fund”) to provide voting instructions to approve the conversion of its investment objective from “fundamental” (i.e., one that cannot be changed without shareholder approval) to “non-fundamental” (i.e., can be changed by the Board without shareholder approval). Currently, the Short Duration Fund’s investment objective is to seek a “high level of current income and safety of principal consistent with an investment in U.S. government and government agency securities.” The Board has approved, subject to approval of the proposal to make the Short Duration Fund’s investment objective non-fundamental, making the Short Duration Fund’s objective (the “New Objective”) to seek “current income as its primary objective and, as its secondary objective, preservation of capital.” Columbia Management believes the proposed investment objective is generally similar to the current investment objective, but will give the Fund greater investment flexibility. In connection with this proposal, the Board has approved (i) changing the Fund’s principal investment strategies to require the Fund to invest, under normal circumstances, at least 80% of its net assets in mortgage related securities that either are issued or guaranteed as to principal and interest by the U.S. Government, its agencies, authorities or instrumentalities, and (ii) changing the Fund’s benchmark from the Barclays U.S. 1-3 year Government Index to the Barclays U.S. Mortgage Backed Securities Index. |

-6-

If this proposal is approved, the New Objective, as stated, would be implemented following the Meeting.

Changing the investment objective from “fundamental” to “non-fundamental” will give the Board additional flexibility to make changes to the Short Duration Fund’s investment objective that it deems appropriate in the future to address changing market conditions or performance issues, while saving the Short Duration Fund’s shareholders the cost of a proxy solicitation.

| Q. | For Columbia Seligman Communications and Information Fund, Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund, why am I being asked to approve a change to my Fund’s diversification status? |

| A. | Proposal 5 asks the shareholders of Columbia Seligman Communications and Information Fund, Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund (each a “Policy Change Fund” and collectively, the “Policy Change Funds”) to approve a change in the classification of their Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the 1940 Act (each, a “Reclassification” and collectively, the “Reclassifications”). Currently, each Policy Change Fund is classified as a “diversified” fund. This means that a Policy Change Fund may not, with respect to 75% of its total assets, invest more than 5% of its total assets in securities of any one issuer or purchase more than 10% of the outstanding voting securities of any one issuer, except obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities and except securities of other investment companies. With respect to the remaining 25% of the Fund’s total assets, there is no limitation on the amount of assets a Policy Change Fund may invest in any one issuer. |

By changing its classification to a “non-diversified” fund, a Policy Change Fund would no longer be subject to these restrictions, but would continue to be subject to certain other diversification restrictions under the Internal Revenue Code of 1986 (the “Code”). As a result of this change, Columbia Management, on behalf of each Policy Change Fund, would be able to invest the Fund’s assets in a smaller number of issuers and/or invest with higher levels of concentration in certain issuers. Thus, the Reclassification enhances Columbia Management’s flexibility to invest a Policy Change Fund’s assets by easing a restriction on Columbia Management’s ability to manage the Fund’s portfolio. Columbia Management believes this increased investment flexibility may provide the Policy Change Funds with more opportunities to enhance their performance. However, because the appreciation or depreciation of a single security may have a greater impact on the net asset value of a Policy Change Fund, its share price may fluctuate more than a comparable fund which is classified as diversified.

-7-

| Q. | How does the Board recommend that I vote? |

| A. | The applicable Board unanimously recommends that you vote (or instruct your Participating Insurance Company to vote) FOR each proposal related to your Fund or Funds. |

| Q. | Will my Fund pay for this proxy solicitation? |

| A. | No. Columbia Management or an affiliated company will bear all of these costs. |

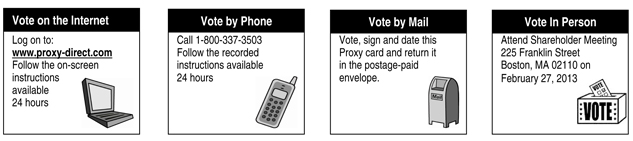

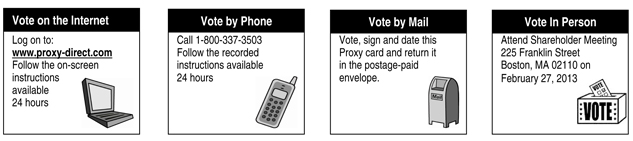

| A. | You can vote or provide voting instructions in one of four ways: |

| | • | | By telephone: Call the toll-free number printed on the enclosed Proxy Card(s) and follow the directions. |

| | • | | By internet: Access the website address printed on the enclosed Proxy Card(s) and follow the directions on the website. |

| | • | | By mail: Complete, sign and return the enclosed Proxy Card(s) in the enclosed self-addressed, postage-paid envelope. |

| | • | | In person at the Meeting scheduled to occur at 225 Franklin Street, Boston, MA 02110 (32nd Floor, Room 3200) on February 27, 2013 at 10:00 a.m. (Eastern). If you decide to vote in person, you must attend the Meeting at the time and place described in the accompanying Joint Proxy Statement. To attend the Meeting in person, you will need proof of ownership of the shares of the relevant Fund, such as your Proxy Card (or a copy thereof) or, if your shares are held of record by a financial intermediary, such as a broker, or nominee, a Proxy Card from the record holder or other proof of beneficial ownership, such as a brokerage statement showing your holdings of the shares of the relevant Fund. |

| Q. | Why might I receive more than one Proxy Card? |

| A. | If you own shares of more than one Fund or own shares of a Fund in more than one account, you may receive a separate Proxy Card for each such Fund or account, and should vote each Proxy Card received. |

| Q. | Will I be notified of the results of the vote? |

| A. | The final voting results will be included in each Fund’s next report to shareholders following the Meeting. |

| Q. | Whom should I call if I have questions? |

| A. | If you have questions about any of the proposals described in the Joint Proxy Statement or about voting procedures, please call the Funds’ proxy solicitor, Computershare Fund Services, toll free at 800-708-7953. |

-8-

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

Columbia Absolute Return Currency and Income Fund

Columbia Capital Allocation Aggressive Portfolio (formerly, Columbia Portfolio Builder Aggressive Fund)

Columbia Capital Allocation Conservative Portfolio (formerly, Columbia Portfolio Builder Conservative Fund)

Columbia Capital Allocation Moderate Portfolio (formerly, Columbia Portfolio Builder Moderate Fund)

Columbia Seligman Communications and Information Fund

Columbia Seligman Global Technology Fund

Columbia Technology Fund

Columbia Variable Portfolio – Seligman Global Technology Fund

Columbia Variable Portfolio – Short Duration U.S. Government Fund

To be held on February 27, 2013

A Joint Special Meeting of Shareholders (the “Meeting”) of each Fund and of Columbia Funds Series Trust I, Columbia Funds Series Trust II and Columbia Funds Variable Series Trust II (the “Trusts”), as a whole, will be held at 225 Franklin Street, Boston, MA 02110 (32nd Floor, Room 3200), at 10:00 a.m. (Eastern) on February 27, 2013. At the Meeting, shareholders will be asked to:

| | | | | | |

| | | Proposal | | Funds Covered By Proposal |

| | 1. | | | Approve a proposed amendment to the Investment Management Services Agreement between Columbia Funds Series Trust II, on behalf of the Fund, and Columbia Management Investment Advisers, LLC to provide for the payment of investment advisory fees to Columbia Management at a rate that varies based on the type of investments made by such Fund. | | Columbia Capital Allocation Aggressive Portfolio Columbia Capital Allocation Conservative Portfolio Columbia Capital Allocation Moderate Portfolio |

| | 2. | | | Approve a change to the Fund’s fundamental policy regarding concentration. | | Columbia Absolute Return Currency Income Fund |

| | 3. | | | Approve a change to the Fund’s fundamental policy regarding concentration. | | Columbia Seligman Global Technology Fund Columbia Technology Fund Columbia Variable Portfolio – Seligman Global Technology Fund |

| | 4. | | | Approve a proposal to make the Fund’s investment objective non-fundamental. | | Columbia Variable Portfolio – Short Duration U.S. Government Fund |

| | | | | | |

| | | | Proposal | | Funds Covered By Proposal |

| | 5. | | | Approve a reclassification of the Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940. | | Columbia Seligman Communications and Information Fund Columbia Seligman Global Technology Fund Columbia Technology Fund Columbia Variable Portfolio – Seligman Global Technology Fund |

Please take some time to read the enclosed Joint Proxy Statement. It discusses these proposals in more detail. If you were a shareholder of a Fund or held a Contract as of the close of business on February 27, 2013, you may vote at the Meeting or at any adjournment of the Meeting on the proposal(s) applicable to your Fund(s). You are welcome to attend the Meeting in person. If you cannot attend in person to cast your vote, please vote (or instruct your Participating Insurance Company how to vote) by mail, telephone or internet. Just follow the instructions on the enclosed Proxy Card. If you have questions, please call the Funds’ proxy solicitor toll free at (800) 708-7953. It is important that you vote. Your Board unanimously recommends that you vote (or instruct your Participating Insurance Company to vote) FOR each applicable proposal in the Joint Proxy Statement.

By order of the Boards of Trustees,

Christopher O. Petersen, Secretary

-2-

Columbia Funds Series Trust I

Columbia Funds Series Trust II

Columbia Funds Variable Series Trust II

225 Franklin Street, Boston, Massachusetts 02110

Columbia Absolute Return Currency and Income Fund

Columbia Capital Allocation Aggressive Portfolio (formerly, Columbia Portfolio Builder Aggressive Fund)

Columbia Capital Allocation Conservative Portfolio (formerly, Columbia Portfolio Builder Conservative Fund)

Columbia Capital Allocation Moderate Portfolio (formerly, Columbia Portfolio Builder Moderate Fund)

Columbia Seligman Communications and Information Fund

Columbia Seligman Global Technology Fund

Columbia Technology Fund

Columbia Variable Portfolio – Seligman Global Technology Fund

Columbia Variable Portfolio – Short Duration U.S. Government Fund

(each, a “Fund” and collectively, the “Funds”)

JOINT PROXY STATEMENT

Joint Special Meeting of Shareholders to be held on February 27, 2013

This Joint Proxy Statement is furnished to you in connection with the solicitation of proxies by the boards of trustees (each a “Board”) of Columbia Funds Series Trust I, Columbia Funds Series Trust II and Columbia Funds Variable Series Trust II (the “Trusts”), as a whole, will be held at 225 Franklin Street, Boston, MA 02110 (32nd Floor, Room 3200), at 10:00 a.m. (Eastern) on February 27, 2013. It is expected that this Joint Proxy Statement will be mailed to shareholders on or about December 17, 2012.

The purpose of the Meeting is to ask Fund shareholders to:

| | | | | | |

| | | | Proposal | | Funds Covered By Proposal |

| | 1. | | | Approve a proposed amendment to the Investment Management Services Agreement between Columbia Funds Series Trust II, on behalf of the Fund, and Columbia Management Investment Advisers, LLC to provide for the payment of investment advisory fees to Columbia Management at a rate that varies based on the type of investments made by such Fund. | | Columbia Capital Allocation Aggressive Portfolio Columbia Capital Allocation Conservative Portfolio Columbia Capital Allocation Moderate Portfolio |

| | 2. | | | Approve a change to the Fund’s fundamental policy regarding concentration. | | Columbia Absolute Return Currency Income Fund |

| | | | | | |

| | | Proposal | | Funds Covered By Proposal |

| | 3. | | | Approve a change to the Fund’s fundamental policy regarding concentration. | | Columbia Seligman Global Technology Fund Columbia Technology Fund Columbia Variable Portfolio – Seligman Global Technology Fund |

| | 3. | | | Approve a proposal to make the Fund’s investment objective non-fundamental. | | Columbia Variable Portfolio – Short Duration U.S. Government Fund |

| | 4. | | | Approve a reclassification of the Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940. | | Columbia Seligman Communications and Information Fund Columbia Seligman Global Technology Fund Columbia Technology Fund Columbia Variable Portfolio – Seligman Global Technology Fund |

Additional information about the Funds is available in their respective prospectuses, statements of additional information and annual and semi-annual reports to shareholders. The Funds’ most recent annual and semi-annual reports previously have been mailed to shareholders. Additional copies of any of these documents are available without charge upon request by writing Columbia Management Investment Services Corp., P.O. Box 8081, Boston, MA 02266-8081 or by calling (800) 345-6611. All of these documents also are filed with the U.S. Securities and Exchange Commission (the “SEC”) and are available on the SEC’s website at www.sec.gov.

-2-

TABLE OF CONTENTS

-3-

GENERAL OVERVIEW

Proposal 1: Approve an Amendment to the Investment Management Services Agreement

The shareholders of certain Funds are being asked to approve a proposed amendment to the Investment Management Services Agreement between Columbia Funds Series Trust II, on behalf of the Funds, and Columbia Management Investment Advisers, LLC (“Columbia Management”). Columbia Capital Allocation Aggressive Portfolio, Columbia Capital Allocation Conservative Portfolio and Columbia Capital Allocation Moderate Portfolio (each, an “IMS Fee Fund” and collectively, the “IMS Fee Funds”) were originally designed as “Funds-of-Funds” that invested exclusively in underlying funds advised by Columbia Management. As part of a broader alignment of asset allocation products offered by Columbia Management, the IMS Fee Funds have recently expanded their investment mandate to include securities and instruments (securities) in addition to underlying funds advised by Columbia Management. This mandate is substantially similar to that of certain other Columbia funds, each a series of Columbia Funds Series Trust and formerly branded as Columbia LifeGoal® Funds (the “Legacy LifeGoal® Portfolios”). The proposed amendment, if approved, is therefore designed to achieve a consistent pricing approach across the target allocation portfolios advised by Columbia Management: the IMS Fee Funds and the Legacy LifeGoal® Portfolios. Except for the investment advisory fee rates payable by those Funds, the Investment Management Services Agreement for such Funds would remain the same in all respects, including that no investment advisory fees would be payable directly by the IMS Fee Funds with respect to investments in other funds in the Columbia Family of Funds for which an investment advisory fee is separately paid. Investment advisory fees are expected to increase, but overall Fund expenses may be lower than if the IMS Fee Funds’ assets were invested exclusively in underlying funds advised by Columbia Management. That is, although the proposed amendment to the IMS Agreement would result in higher “direct” investment advisory fees for net assets invested in securities, direct investment by the IMS Fee Funds in securities, rather than in underlying funds advised by Columbia Management, decreases the “indirect” fees (often referred to as “acquired fund” fees and expenses) incurred by the IMS Fee Fund. Additional information (including fee and expense comparisons) about the proposed amendment to the Investment Management Services Agreement is set forth under Proposal 1.

Proposal 2: Approve a Change to the Fund’s Fundamental Policy Regarding Concentration

The shareholders of Columbia Absolute Return Currency and Income Fund are being asked to approve a change to the fundamental policy regarding concentration. Currently, Columbia Absolute Return Currency and Income Fund has a fundamental investment policy that it will not concentrate in any one industry, provided, however, that this restriction does not apply to securities or obligations issued or guaranteed by the U.S. Government, banks or bank holding companies or finance companies. For all

-4-

other industries, this means that no more than 25% of the fund’s total assets, based on current market value at the time of purchase, can be invested in any one industry.

Following an internal review that included portfolio management and product management, Columbia Management determined there was no present intention for Columbia Absolute Return Currency and Income Fund to reserve the right to concentrate in banks, bank holding companies or finance companies. As a result, Proposal 2 asks shareholders to approve the following as a new fundamental investment policy for the Fund, replacing the Fund’s current concentration policy described above:

The Fund will not purchase any securities which would cause 25% or more of the value of its total assets at the time of purchase to be invested in the securities of one or more issuers conducting their principal business activities in the same industry, provided that: (i) there is no limitation with respect to obligations issued or guaranteed by the U.S. Government, any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions; and (ii) notwithstanding this limitation or any other fundamental investment limitation, assets may be invested in the securities of one or more management investment companies to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief.

Additional information is set forth under Proposal 2.

Proposal 3: Approve a Change to the Fund’s Fundamental Policy Regarding Concentration

The shareholders of Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund (each, a “Technology Fund” and collectively, the “Technology Funds”) are being asked to approve a change in the fundamental policy regarding concentration to provide that each Fund will, under normal market conditions, invest at least 25% of its total assets in securities of companies in the technology and related group of industries. Currently, each Technology Fund has a fundamental investment policy that it will not concentrate in any one industry, provided, however, that this restriction shall not apply to securities or obligations issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities or, in the case of Columbia Technology Fund, by any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions. For Columbia Technology Fund, the limitation on industry concentration does not apply to assets invested in the securities of one or more management investment companies or subsidiaries to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. This means that for all other industries, no more than 25% of the Fund’s total assets, based on current market value at the time of purchase, can be invested in any one industry.

Following an internal review, Columbia Management determined that each Technology Fund would be better able to pursue its investment objectives if it were to

-5-

concentrate its investments in the technology and related group of industries. Historically, each Technology Fund has treated each of the internet software and services, IT consulting and other services, data processing and outsourced services, application software, systems software, home entertainment software, communications equipment, computer hardware, computer storage and peripherals, electronic equipment and instruments, electronic components, electronic manufacturing services, technology distributors, office electronics, semiconductor equipment, and semiconductors sub-industries as a separate industry for purposes of its policy generally prohibiting the Fund from investing more than 25% of its total assets in the securities of issuers in any industry. Issuers in each of these sub-industries will be treated as belonging to the technology and related group of industries under the proposed policy. Columbia Management believes that the process of monitoring compliance with each Technology Fund’s concentration policy will be simplified, and each Fund will be better able to pursue its investment objectives, if the Fund’s fundamental policy relating to concentration is changed as proposed. Increasing the percentage of a Technology Fund’s total assets that can be invested in the securities of issuers in a single industry or group of related industries increases the risk that the Fund will be adversely affected by events impacting such industries or group of related industries. Such a Fund would be more significantly affected by events impacting such industries than would a Fund that was not so concentrated.

For these reasons, Proposal 3 asks shareholders to approve the following as a new fundamental investment policy for each Technology Fund, replacing the Fund’s current concentration policy described above:

The Fund will, under normal market conditions, invest at least 25% of the value of its total assets at the time of purchase in the securities of issuers conducting their principal business activities in the technology and related group of industries, provided that: (i) there is no limitation with respect to obligations issued or guaranteed by the U.S. Government, any state or territory of the United States or any of their agencies, instrumentalities or political subdivisions; and (ii) notwithstanding this limitation or any other fundamental investment limitation, assets may be invested in the securities of one or more management investment companies or subsidiaries to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief.

Additional information is set forth under Proposal 3.

Proposal 4: Approve an Amendment to the Fund’s Investment Objective

The Contract Owners of Columbia Variable Portfolio – Short Duration U.S. Government Fund (the “Short Duration Fund”) are being asked to provide voting instructions to approve the conversion of its investment objective from “fundamental” (i.e., can’t be changed without shareholder approval) to “non-fundamental” (i.e., can be changed by the Board without shareholder approval). If this proposal is approved, the Board will have the authority to modify the Short Duration Fund’s investment

-6-

objective in the future without shareholder approval. Currently, the Short Duration Fund’s investment objective is to seek a “high level of current income and safety of principal consistent with an investment in U.S. government and government agency securities.” The Short Duration Fund’s Board has approved, subject to approval of the proposal to make the Short Duration Fund’s investment objective non-fundamental, making the Short Duration Fund’s objective (the “New Objective”) to seek “current income as its primary objective and, as its secondary objective, preservation of capital.” Columbia Management believes the proposed investment objective is generally similar to the current investment objective, but will give the Fund greater investment flexibility. In connection with this proposal, the Board has approved (i) changing the Fund’s principal investment strategies to require the Fund to invest, under normal circumstances, at least 80% of its net assets in mortgage related securities that either are issued or guaranteed as to principal and interest by the U.S. Government, its agencies, authorities or instrumentalities, and (ii) changing the Fund’s benchmark from the Barclays U.S. 1-3 year Government Index to the Barclays U.S. Mortgage Backed Securities Index.

If this proposal is approved, the New Objective, as stated, would be implemented following the Meeting.

Additional information is set forth under Proposal 4.

Proposal 5: Approve a Reclassification of the Fund from a “Diversified” Fund to a “Non-Diversified” Fund

The shareholders of Columbia Seligman Communications and Information Fund, Columbia Seligman Global Technology Fund, Columbia Technology Fund and Columbia Variable Portfolio – Seligman Global Technology Fund (each, a “Policy Change Fund” and collectively, the “Policy Change Funds”) are being asked to approve a change in the classification of their Fund (each, a “Reclassification” and collectively, the “Reclassifications”) from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the 1940 Act. The Reclassifications would enhance Columbia Management’s flexibility to invest a Policy Change Fund’s assets by easing a restriction on Columbia Management’s ability to manage the portfolio. Additional information (including the associated risks) about the Reclassifications is set forth under Proposal 5.

Effectiveness of the Proposals

None of the proposals is contingent on the outcome of any other proposal. In addition, approval of a proposal by one Fund is not contingent on the approval of the same proposal by any other Fund.

-7-

PROPOSAL 1 – Approve an Amendment to the Investment Management Services Agreement

Columbia Capital Allocation Aggressive Portfolio

Columbia Capital Allocation Conservative Portfolio

Columbia Capital Allocation Moderate Portfolio

(each, an “IMS Fee Fund” and collectively, the “IMS Fee Funds”)

Background

The Board has unanimously approved an amendment to the Investment Management Services Agreement (the “IMS Agreement”) between Columbia Management and Columbia Funds Series Trust II, on behalf of each of the IMS Fee Funds. Under the 1940 Act, shareholder approval is required before any Fund can implement the proposed amendment. If shareholders of an IMS Fee Fund do not approve the proposed amendment, such Fund will continue operating pursuant to the IMS Agreement currently in effect.

Prior to November 2011, the IMS Fee Funds invested exclusively in underlying funds advised by Columbia Management. In November 2011, the Board approved a modification to the principal investment strategies of the IMS Fee Funds to allow for direct investment in individual securities and other instruments, including derivatives. These modifications have enhanced the IMS Fee Funds’ ability to make tactical changes and manage cash flows, and such investments generally result in a corresponding reduction in investment in underlying funds advised by Columbia Management. Columbia Management is not currently compensated for its investment advisory services in connection with the purchase and sale of these securities for the IMS Fee Funds. The proposed amendment to the IMS Agreement will bring the fee structure of the IMS Fee Funds into conformity with that of Columbia LifeGoal® Income Portfolio, Columbia Capital Allocation Moderate Conservative Portfolio (formerly, Columbia LifeGoal® Income and Growth Portfolio), Columbia Capital Allocation Moderate Aggressive Portfolio (formerly, Columbia LifeGoal® Balanced Growth Portfolio) and Columbia Strategic Equity Portfolio (formerly, Columbia LifeGoal® Growth Portfolios) (each, a “Legacy LifeGoal® Portfolio” and collectively, the “Legacy LifeGoal® Portfolios”).

The proposed amendment, together with a set of proposed mergers of the Legacy LifeGoal® Portfolios and Capital Allocation branded funds, including the IMS Fee Funds (collectively, the “Capital Allocation Funds”), would result in a single suite of target allocation portfolios, with a consistent investment mandate and pricing structure.

The proposed amendment to the IMS Agreement for each IMS Fee Fund would include a three-part management fee schedule comprised of (i) 0.00% on assets invested in underlying funds advised by Columbia Management (excluding any underlying fund that does not pay an investment advisory fee to Columbia

-8-

Management), (ii) 0.55% on assets that are invested in securities (including exchange-traded funds, derivatives and individual securities) and underlying funds advised by Columbia Management that do not pay an advisory fee to Columbia Management, and (iii) 0.10% on assets invested in non-exchange traded third-party advised mutual funds. The proposed amendment to the IMS Agreement would result in slightly higher investment advisory fees payable by the IMS Fee Funds based on the allocation of the IMS Fee Funds’ assets as of August 31, 2012. However, because the proposed advisory fee rate with respect to assets invested directly in such securities is lower than the total indirect underlying fund fees and expenses of most funds advised by Columbia Management, direct investment in such securities (even after taking into account the proposed fees imposed on such investments) would generally result in overall expenses (i.e., direct plus indirect expenses) borne by the IMS Fee Funds that are the same or lower. Each IMS Fee Fund’s operations and the manner in which Columbia Management generally manages the IMS Fee Fund are not expected to change as a result of this amendment. Except for the direct investment advisory fee rates payable by an IMS Fee Fund, the IMS Agreement for such IMS Fee Funds would remain the same in all respects.

A description of key terms and provisions of the IMS Agreement follows. Additional details about the effects of the proposed amendment on the IMS Fee Funds’ fee rates are set forth under “Changes to Investment Advisory Fee Rates” and “Board Considerations” below. Additional information about Columbia Management is provided inAppendix A.

Description of IMS Agreement

The current IMS Agreement is dated as of September 22, 2010 and was last approved by shareholders of the Funds at a joint special meeting of such shareholders that was held on February 15, 2011.

The IMS Agreement generally provides that, subject to oversight by the Board and the authorized officers of Columbia Funds Series Trust II, Columbia Management agrees to: continuously furnish the IMS Fee Funds with investment advice; decide what securities are to be purchased, held or sold, consistent with the IMS Fee Funds’ respective investment objectives, strategies and policies; perform investment research; prepare and make available to the Board all research and statistical data in connection therewith; and execute or cause the execution of purchase and sell orders for the IMS Fee Funds. The IMS Agreement adds that Columbia Management will determine which investments to make consistent with the IMS Fee Fund’s investment strategies, recommend changes to investment objectives, strategies and policies to the Board and furnish to the Board such reports, statistical data and other information relating to the investment management of the relevant IMS Fee Fund in the form and at such intervals that the Board may reasonably request.

Under the IMS Agreement, Columbia Management, in executing portfolio transactions and selecting brokers or dealers for an IMS Fee Fund, agrees to seek best

-9-

execution. Columbia Management may consider not only the price of the security being traded (including commission or mark-up), but also other relevant facts such as, without limitation, the size and difficulty of the transaction, the characteristics of the security being traded, the broker-dealer’s financial condition and execution capabilities, or research or other information furnished to Columbia Management. The IMS Agreement explicitly contemplates that Columbia Management may, except where otherwise directed by the Board, execute transactions or pay to a broker or dealer who provides brokerage and research services a commission for executing a portfolio transaction for an IMS Fee Fund that is in excess of the amount of commission another broker or dealer would have charged for effecting the transaction, to the extent consistent with applicable law.

The IMS Agreement contemplates the engagement by Columbia Management of subadvisers for the IMS Fee Funds, and provides that Columbia Management may subcontract and pay for certain of the services described under the IMS Agreement, with the further understanding that the quality and level of services required to be provided under the agreement will not be diminished thereby and with the understanding that Columbia Management will obtain the approval of the Board and/or an IMS Fee Fund’s shareholders as required by applicable law, rules, regulations promulgated thereunder, the terms of the IMS Agreement, resolutions of the Board and Columbia Management’s commitments.

The IMS Agreement contemplates that Columbia Management will provide support as required or requested by the Board with respect to voting proxies solicited by or with respect to the issuers of securities owned by an IMS Fee Fund. The IMS Agreement also contemplates that Columbia Management may vote proxies and provide or withhold consents as directed by the Board from time to time.

The IMS Agreement generally requires that all information provided by an IMS Fee Fund to Columbia Management and vice versa be treated as confidential and non-disclosable to unaffiliated third parties except under limited circumstances. The IMS Agreement generally requires books and records to be maintained by Columbia Management on behalf of an IMS Fee Fund.

Fees

The IMS Fee Funds do not pay Columbia Management a direct management fee under the current IMS Agreement. The amounts that would have been paid by each IMS Fee Fund if the proposed fee rates had been in effect during the last fiscal year are set forth inAppendix B to this Joint Proxy Statement. The amounts paid by the IMS Fee Funds to Columbia Management and its affiliated persons during each such Fund’s last fiscal year are also set forth inAppendix B. Information about the current and proposed fee rates for each IMS Fee Fund is set forth below under “Changes to Investment Advisory Fee Rates –Current and Proposed Management Fee Rates”. In addition, current and proposed fee tables for each IMS Fee Fund are set forth inAppendix C to this Joint Proxy Statement.

-10-

Columbia Management is solely responsible for compensating any subadviser(s) for performing any of the duties delegated to them.

Payment of Expenses

The IMS Agreement requires Columbia Management to furnish at its expense the office space, supplies, equipment, clerical help and other personnel and services required to render its investment management services and to pay the compensation of the trustees or officers of Columbia Funds Series Trust II who are directors, officers, or employees of Columbia Management (except to the extent that the Board specifically approves the payment by the Fund of all or a portion of such compensation). The IMS Agreement specifically notes that, except to the extent expressly assumed by Columbia Management, and except to the extent required by law to be paid or reimbursed by Columbia Management, Columbia Management will have no duty to pay any IMS Fee Fund operating expenses incurred in the organization and operation of the Fund.

Limits of Liability

Under the IMS Agreement, and subject to U.S. federal securities laws, neither Columbia Management nor any of its directors, officers, partners, principals, employees or agents will be liable for any acts or omissions or for any loss suffered by an IMS Fee Fund or the Fund’s shareholders or creditors, except for a loss resulting from willful misfeasance, bad faith or negligence on its part in the performance of its duties under the IMS Agreement or reckless disregard of its obligations or duties under the IMS Agreement.

Changes to Investment Advisory Fee Rates

The Board has approved, and recommends that shareholders of each IMS Fee Fund approve, an amendment to the IMS Agreement between Columbia Management and Columbia Funds Series Trust II, on behalf of the IMS Fee Funds, that would, at current investment levels, increase the direct investment advisory fee rates payable by each IMS Fee Fund to Columbia Management with respect to assets of the IMS Fee Funds invested in securities other than underlying funds advised by Columbia Management that pay a management fee. Except for the investment advisory fee rates, an IMS Agreement for such IMS Fee Fund would remain the same in all respects.

Prior to November 2011, the IMS Fee Funds invested exclusively in underlying funds advised by Columbia Management. In November 2011, the Board approved a change to the principal investment strategies of the IMS Fee Funds to allow for direct investment in individual securities and derivatives. The proposed amendment is intended to provide shareholders of the IMS Fee Funds and the Legacy LifeGoal® Portfolios with a consistent pricing structure, and to compensate Columbia Management for the services it provides to the IMS Fee Funds with respect to investments in securities other than underlying funds advised by Columbia Management that pay a management fee. The proposed management fee is typically lower than current total underlying fund expenses, and, as a result, overall (i.e., direct

-11-

plus indirect) expenses borne by shareholders would potentially fall as a result of an IMS Fee Fund’s investment in direct securities that are subject to the proposed IMS fee.

The proposed amendment to the IMS Agreement for each IMS Fee Fund would include a three-part management fee schedule comprised of (1) 0.00% on assets invested in Columbia proprietary funds (excluding any proprietary fund that does not pay an investment advisory fee to Columbia Management), (ii) 0.55% on assets that are invested in securities other than third-party advised mutual funds and in Columbia Funds that do not pay an advisory fee (including exchange-traded funds, derivatives and individual securities) and (iii) 0.10% on assets invested in non-exchange traded third-party funds. Based on the allocation of the IMS Fee Funds’ assets as of August 31, 2012, the net increase in fees for the IMS Fee Funds will range from 0.003% to 0.0145%.

The following chart provides additional information on a Fund-by-Fund basis about current and proposed investment advisory fee rates for the IMS Fee Funds and illustrates the impact of the changes to investment advisory fee rates on a consolidated basis, assuming each IMS Fee Fund’s assets are allocated as they were on August 31, 2012.

Current and Proposed Management Fee Rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class A | | | 475,766,458.22 | | | | 0.00 | % | | | 0.49 | % | | | 0.49 | % | | | 475,766,458.22 | | | | 0.01 | % | | | 0.49 | % | | | 0.50 | % |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class B | | | 38,182,737.53 | | | | 0.00 | % | | | 1.24 | % | | | 1.24 | % | | | 38,182,737.53 | | | | 0.01 | % | | | 1.24 | % | | | 1.25 | % |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class C | | | 35,485,551.04 | | | | 0.00 | % | | | 1.24 | % | | | 1.24 | % | | | 35,485,551.04 | | | | 0.01 | % | | | 1.24 | % | | | 1.25 | % |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class R | | | 61,977.17 | | | | 0.00 | % | | | 0.70 | % | | | 0.70 | % | | | 61,977.17 | | | | 0.01 | % | | | 0.70 | % | | | 0.71 | % |

-12-

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class K | | | 390,612.76 | | | | 0.00 | % | | | 0.35 | % | | | 0.35 | % | | | 390,612.76 | | | | 0.01 | % | | | 0.35 | % | | | 0.36 | % |

Columbia

Capital

Allocation

Aggressive

Portfolio-

Class Z | | | 196,177.26 | | | | 0.00 | % | | | 0.24 | % | | | 0.24 | % | | | 196,177.26 | | | | 0.01 | % | | | 0.24 | % | | | 0.25 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class A | | | 263,140,219.29 | | | | 0.00 | % | | | 0.49 | % | | | 0.49 | % | | | 263,140,219.29 | | | | 0.01 | % | | | 0.49 | % | | | 0.50 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class B | | | 19,657,586.82 | | | | 0.00 | % | | | 1.24 | % | | | 1.24 | % | | | 19,657,586.82 | | | | 0.01 | % | | | 1.24 | % | | | 1.25 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class C | | | 40,631,520.06 | | | | 0.00 | % | | | 1.24 | % | | | 1.24 | % | | | 40,631,520.06 | | | | 0.01 | % | | | 1.24 | % | | | 1.25 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class R | | | 31,706.08 | | | | 0.00 | % | | | 0.75 | % | | | 0.75 | % | | | 31,706.08 | | | | 0.01 | % | | | 0.75 | % | | | 0.76 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class K | | | 57,485.70 | | | | 0.00 | % | | | 0.41 | % | | | 0.41 | % | | | 57,485.70 | | | | 0.01 | % | | | 0.41 | % | | | 0.42 | % |

Columbia

Capital

Allocation

Conservative

Portfolio-

Class Z | | | 571,476.48 | | | | 0.00 | % | | | 0.24 | % | | | 0.24 | % | | | 571,476.48 | | | | 0.01 | % | | | 0.24 | % | | | 0.25 | % |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class A | | | 1,279,621,848.16 | | | | 0.00 | % | | | 0.43 | % | | | 0.43 | % | | | 1,279,621,848.16 | | | | 0.00 | % | | | 0.43 | % | | | 0.43 | % |

-13-

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Other

Expenses | | | Total

Direct

Annual

Fund

Operating

Expenses | |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class B | | | 93,091,126.74 | | | | 0.00 | % | | | 1.18 | % | | | 1.18 | % | | | 93,091,126.74 | | | | 0.00 | % | | | 1.18 | % | | | 1.18 | % |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class C | | | 119,448,312.51 | | | | 0.00 | % | | | 1.18 | % | | | 1.18 | % | | | 119,448,312.51 | | | | 0.00 | % | | | 1.18 | % | | | 1.18 | % |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class R | | | 164,610.52 | | | | 0.00 | % | | | 0.71 | % | | | 0.71 | % | | | 164,610.52 | | | | 0.00 | % | | | 0.71 | % | | | 0.71 | % |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class K | | | 333,519.31 | | | | 0.00 | % | | | 0.34 | % | | | 0.34 | % | | | 333,519.31 | | | | 0.00 | % | | | 0.34 | % | | | 0.34 | % |

Columbia

Capital

Allocation

Moderate

Portfolio-

Class Z | | | 1,217,350.66 | | | | 0.00 | % | | | 0.19 | % | | | 0.19 | % | | | 1,217,350.66 | | | | 0.00 | % | | | 0.19 | % | | | 0.19 | % |

Appendix C shows current and proposed fee tables for each IMS Fee Fund.

Columbia Management has contractually agreed to cap certain expenses of the IMS Fee Funds through May 31, 2013 to the extent they would exceed an annual rate of 0.51% for Class A, 1.26% for Class B, 1.26% for Class C, 0.76% for Class R, 0.44% for class K and 0.26% for Class Z.

Board Considerations

In September 2012, the Board unanimously approved the proposed amendment to the IMS Agreement on behalf of the IMS Fee Funds. As detailed below, the Board held numerous meetings and discussions with the management team of Columbia Management and reviewed and considered materials in connection with the approval of the proposed investment advisory fee rates before determining to approve the amendment. The schedule of proposed investment advisory fee rates for each IMS Fee Fund under its IMS Agreement is set forth above in “Changes to Investment Advisory Fee Rates –Current and Proposed Management Fee Rates.” The amounts that would have been paid to Columbia Management by the IMS Fee Funds during the most recently completed fiscal year under the amended IMS Agreement are set forth inAppendix B.

-14-

In April 2012, Columbia Management presented the Board and its Contracts Committee with various data comparing current and proposed fee schedules to the fee schedules of peer funds, as selected by an independent third-party data provider. The Committee and the trustees who are not “interested persons” (as defined in the 1940 Act) of Columbia Funds Series Trust II (the “Independent Trustees”) requested and evaluated materials from, and were provided materials and information regarding the IMS Agreement by, Columbia Management. The Committee, at meetings held in September 2012, reviewed the materials provided in connection with their consideration of the amendment to the IMS Agreement and other matters relating to the proposals and discussed them with representatives of Columbia Management. The Committee and the Independent Trustees also reviewed and considered information that they had previously received in connection with their most recent consideration and renewal of the current IMS Agreement with Columbia Management. They also consulted with Fund counsel and with the Independent Trustees’ independent legal counsel, who advised on the legal standards for consideration by the trustees and otherwise assisted the trustees in their deliberations. On September 12, 2012 the Committee recommended that the trustees approve the amendment to the IMS Agreement. On September 13, 2012, the trustees, including a majority of the Independent Trustees, approved the amendment to the IMS Agreement for each IMS Fee Fund, subject to shareholder approval.

The trustees considered all materials that they, their legal counsel or Columbia Management believed reasonably necessary to evaluate and to determine whether to approve the amendment to the IMS Agreement. In addition to factors that led to the Trustee’s renewal of the IMS Amendment for each Fund in April 2012, the Trustees considered the following specific factors relating to the proposed amendment in recommending approval and approving the amendment to the IMS Agreement for each IMS Fee Fund:

| | • | | The expected benefits of continuing to retain Columbia Management as the IMS Fee Funds’ investment manager; |

| | • | | The terms and conditions of the IMS Agreement, including the proposed increase in the advisory fee schedule for each IMS Fee Fund; |

| | • | | The impact of the proposed changes in investment advisory fee rates on each IMS Fee Fund’s total expense ratio; |

| | • | | That Columbia Management, and not any IMS Fee Fund, would bear the costs of obtaining any necessary shareholder approvals of the amendment to the IMS Agreement; and |

| | • | | The expected benefits of further integrating the target allocation portfolios by adopting a consistent pricing structure. |

Nature, Extent and Quality of Services

The trustees considered the nature, extent and quality of services provided to the IMS Fee Funds by Columbia Management under the IMS Agreement, and the

-15-

resources dedicated to the IMS Fee Funds by Columbia Management and its affiliates. In this regard, the trustees recalled and considered their analyses and conclusions in April 2012 that led to their renewal of each IMS Agreement. They recalled, in particular, their analysis of various reports and presentations they had received detailing the services performed by Columbia Management, as well as its expertise, resources and capabilities. The Independent Trustees had considered many developments during 2011 concerning the services provided by Columbia Management, including, in particular, the continued investment in, and resources dedicated to, the IMS Fee Funds’ operations and the successful completion of various integration initiatives and the consolidation of dozens of Funds. The Independent Trustees noted the information they received concerning Columbia Management’s ability to retain key portfolio management personnel. The Independent Trustees also observed Columbia Management’s significant investment in upgrading technology (such as an equity trading system) and considered management’s commitments to enhance existing resources in this area.

In connection with the trustees’ evaluation of the overall package of services provided by Columbia Management, the trustees also recalled their consideration of the quality of administrative services provided to the IMS Fee Funds by Columbia Management. In addition, the trustees had reviewed the financial condition of Columbia Management (and its affiliates) and each entity’s ability to carry out its responsibilities under the IMS Agreement and the Fund’s other services agreements with affiliates of Ameriprise Financial. The trustees also discussed the acceptability of the terms of the IMS Agreement (including the relatively broad scope of services required to be performed by Columbia Management). The trustees recalled their conclusion in April that the services being performed under the IMS Agreement were of a reasonably high quality and noted that in the short time since April, no new information had been provided to warrant a different conclusion.

Based on the foregoing, and based on other information received (both oral and written, including the information on investment performance referenced below) and other considerations, the trustees concluded, within the context of their overall conclusions, that the nature, extent and quality of the services being provided to each IMS Fee Fund under the amended IMS Agreement supported the approval of the amended IMS Agreement.

Investment Performance

The trustees recalled their recent review of information about the performance of each IMS Fee Fund over various time periods, including information prepared by an independent third-party data provider that compared the performance of each IMS Fee Fund to the performance of peer groups of mutual funds and performance benchmarks. In the case of each IMS Fee Fund whose performance lagged that of a relevant peer group for certain (although not necessarily all) periods, the Board observed that the Fund’s performance reflected the interrelationship of market conditions with the particular investment Strategies employed by the past management team.

-16-

Comparative Fees, Costs of Services Provided and the Profits Realized by Columbia Management and its Affiliates from their Relationships with the Fund:

The trustees recalled their review of comparative fees and the costs of services being provided under the amended IMS Agreement. The trustees had considered detailed comparative information set forth in an annual report on fees and expenses, including, among other things, data (based on analyses conducted by an independent organization) showing a comparison of the IMS Fee Fund’s expenses with median expenses paid by funds in its comparative peer universe, as well as data showing the IMS Fee Fund’s contribution to Columbia Management’s profitability. The trustees had reviewed the fees charged to comparable institutional or other accounts/vehicles managed by Columbia Management and discussed differences in how the products are managed and operated, noting no unreasonable differences in the levels of contractual fees.

The trustees accorded particular weight to the notion that the level of fees should reflect a rational pricing model applied consistently across the various product lines in the Fund family, while assuring that the overall fees for each IMS Fee Fund (with few defined exceptions) are generally in line with the “pricing philosophy” (i.e., that the total expense ratio of each IMS Fee Fund is at, or below, the median expense ratio of funds in the same comparison universe of such IMS Fee Fund). The trustees took into account that each IMS Fee Fund’s total expense ratio (after considering the proposed amendment to the IMS Fees as well as existing expense caps/waivers) was below the peer universe’s median expense ratio shown in the reports.

Further, with respect to the proposed imposition of an IMS fee on each IMS Fee Fund’s direct securities investments, the Independent Trustees specifically considered that while investment advisory fees are expected to increase very slightly, the overall Fund expenses may be lower than if there was no direct management fee at all and the IMS Fee Funds’ assets were invested exclusively in underlying funds advised by Columbia Management because the proposed advisory fee rate with respect to assets invested directly in securities is lower than the total indirect underlying fund fees and expenses of most funds advised by Columbia Management.

Based on its review, the trustees concluded that the IMS Fee Funds’ proposed management fee was fair and reasonable in light of the extent and quality of services that the IMS Fee Funds receive.

The trustees also considered the expected profitability of Columbia Management and its affiliates in connection with Columbia Management providing investment management services to the IMS Fee Funds. In this regard, the Trustees considered their evaluation of profitability in April 2012 and their conclusion that profitability levels from the IMS Fee Funds were reasonable. They also observed that since the proposed fee should not have any direct material impact on the level of advisory fees paid to Columbia Management and that, in fact, total fund expenses may be reduced, their conclusion in April regarding the reasonableness of profitability remains applicable after considering the proposed fee change.

-17-

Economies of Scale

The trustees considered the existence of any economies of scale in the provision by Columbia Management of services to each IMS Fee Fund, to groups of related funds and to Columbia Management’s investment advisory clients as a whole, and the extent to which those economies of scale would be shared with the IMS Fee Funds through breakpoints in the proposed investment advisory fee rates or other means, such as expense limitation arrangements and additional investments by Columbia Management in investment, trading and compliance resources. The Trustees observed that, currently, the proposed fees would result in only an immaterial increase in direct advisory fees and, thus, economies of scale are not yet materially relevant. However, the Trustees agreed to monitor direct IMS fees of the IMS Fee Funds, going forward, to assess the potential for these Funds to realize economies of scale to the extent higher levels of assets may be invested in direct securities investments (and, thus, are subject to higher IMS fees) and/or their overall expense ratios increase in the future in any material respect.

In their deliberations, the trustees did not identify any single item that was paramount or controlling and individual trustees may have attributed different weights to various factors. The trustees also evaluated all information available to them on a fund-by-fund basis, and their determinations were made separately in respect of each IMS Fee Fund.

Based on the foregoing, the trustees concluded that the proposed investment advisory fee rates for each IMS Fee Fund are acceptable. Accordingly, the Board unanimously approved the amendment to the IMS Agreement with respect to each IMS Fee Fund and unanimously recommends that shareholders of each such Fund vote “FOR” the approval of Proposal 1.

If shareholders of an IMS Fund approve the amendment to the IMS Agreement, the amendment will take effect for the IMS Fund shortly after the Meeting. If shareholders of an IMS Fund do not approve the amendment to the IMS Agreement, the IMS Fund will continue to operate under the current framework of the IMS Agreement.

Required Vote and Recommendation

For each IMS Fee Fund, approval of the amendment to the IMS Agreement requires the affirmative vote of a “majority of the outstanding voting securities” of the Fund, which for this purpose means the affirmative vote of the lesser of (i) more than 50% of the outstanding voting securities of such Fund or (ii) 67% or more of the outstanding voting securities of the Fund present at the Meeting if more than 50% of the outstanding voting securities of the Fund are present at the Meeting in person or represented by proxy. All shares of an IMS Fee Fund vote together as a single class on Proposal 1. Each IMS Fee Fund’s shareholders vote separately from each other Fund’s shareholders on Proposal 1.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTEFOR THE APPROVAL OF THE PROPOSED AMENDMENT TO THE IMS AGREEMENT.

-18-

PROPOSAL 2 – Approve a Change to the Fund’s Fundamental Policy Regarding Concentration

Columbia Absolute Return Currency and Income Fund

The Board has approved, on behalf of Columbia Absolute Return Currency and Income Fund, and recommends that shareholders of Columbia Absolute Return Currency and Income Fund approve, a proposal to change the Columbia Absolute Return Currency and Income Fund’s fundamental policy regarding concentration.

Columbia Absolute Currency and Income Fund currently has a fundamental investment policy that it will not concentrate in any one industry, provided, however, that this restriction does not apply to securities or obligations issued or guaranteed by the U.S. Government, banks or bank holding companies or finance companies. For all other industries, this means that not more than 25% of the fund’s total assets, based on current market value at the time of purchase, can be invested in any one industry.