UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Verigy Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Verigy Ltd.

(Incorporated in the Republic of Singapore)

(Company Registration Number 200601091C)

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on April 14, 2009

To our shareholders:

You are cordially invited to attend, and NOTICE IS HEREBY GIVEN of, the Annual General Meeting of Shareholders of Verigy Ltd. (“Verigy” or the “Company”), which will be held at the offices of Verigy’s principal U.S. subsidiary, Verigy US, Inc., 10100 North Tantau Avenue, Cupertino, California 95014, U.S., at 9:00 a.m., Pacific Time, on April 14, 2009, for the following purposes:

As Ordinary Business

| | 1. | To re-elect Mr. Edward Grady as a Class II director of the Board of Directors. |

| | 2. | To re-elect Mr. Ernest Godshalk as a Class II director of the Board of Directors. |

| | 3. | To re-elect Mr. Bobby Cheng as a Class II director of the Board of Directors. |

| | 4. | To re-elect Mr. Keith Barnes as a Class III director of the Board of Directors. |

| | 5. | To approve the re-appointment of PricewaterhouseCoopers LLP to serve as the independent Singapore auditor for the fiscal year ending October 31, 2009, and to authorize the Board of Directors to fix PricewaterhouseCoopers LLP’s remuneration. |

As Special Business

| | 6. | To pass the following as an Ordinary Resolution: |

RESOLVED THAT, approval be and is hereby given for us to provide:

(a) cash compensation of $55,000 to each of our current non-employee directors for services rendered as directors for the period from the date of our 2009 Annual General Meeting of Shareholders through our 2010 Annual General Meeting of Shareholders;

(b) appropriate pro rata cash compensation, based on our cash compensation of $55,000 for 12 months of service, to any new non-employee director who is appointed by the Board of Directors after the date of our 2009 Annual General Meeting of Shareholders, for their services rendered as directors from the date of appointment through the date of our 2010 Annual General Meeting of Shareholders;

(c) additional cash compensation of $15,000 to the Lead Independent Director of the Board of Directors for services rendered in that capacity for the period from the day after of our 2009 Annual General Meeting of Shareholders through the date of 2010 Annual General Meeting of Shareholders;

(d) additional cash compensation of $20,000 to the chairperson of the Audit Committee for services rendered in that capacity for the period from the day after our 2009 Annual General Meeting of Shareholders through the date of our 2010 Annual General Meeting of Shareholders;

(e) additional cash compensation of $10,000 to the chairperson of the Compensation Committee for services rendered in that capacity for the period from the day after our 2009 Annual General Meeting of Shareholders through the date of our 2010 Annual General Meeting of Shareholders; and

(f) additional cash compensation of $5,000 to the chairperson of the Nominating and Governance Committee for services rendered in that capacity for the period from the day after of our 2009 Annual General Meeting of Shareholders through the date of our 2010 Annual General Meeting of Shareholders.

| | 7. | To pass the following as an Ordinary Resolution: |

RESOLVED THAT, pursuant to the provisions of Section 161 of the Singapore Companies Act, Cap. 50, and also subject to the provisions of that Act and our Articles of Association, authority be and is hereby given to our directors to:

(a) at any time to and/or with such persons and upon such terms and conditions and for such consideration as our directors may in their sole discretion deem fit, and with such rights or restrictions as our directors may think fit to impose, to:

| | (i) | allot and issue ordinary shares in our capital; and/or |

| | (ii) | make or grant offers, agreements, options or other instruments that might or would require ordinary shares to be allotted and issued, whether such allotment or issuance would occur during or after the expiration of this authority (including, but not limited to, the creation and issuance of warrants, debentures or other instruments convertible into ordinary shares); and |

(b) allot and issue ordinary shares in our capital pursuant to any offer, agreement, option or other agreement made, granted or authorized by our directors while this resolution was in effect, regardless of whether the authority conferred by this resolution may have ceased to be in effect at the time of the allotment and issuance and that such authority, if approved by our shareholders, shall continue in effect until the earlier of the conclusion of our next Annual General Meeting of Shareholders or the expiration of the period within which our next Annual General Meeting of Shareholders is required by law to be held.

| | 8. | To pass the following resolution as an Ordinary Resolution: |

RESOLVED THAT, pursuant to the provisions of Sections 76C and 76E of the Singapore Companies Act, Cap. 50, and also subject to the provisions of that Act and our Articles of Association:

(a) authority be and is hereby given to our directors to cause to be purchased or otherwise acquired issued ordinary shares in the capital of Verigy, not exceeding in aggregate the number of issued ordinary shares representing 10% (or such other higher percentage as the Minister may by notification prescribe pursuant to the Singapore Companies Act) of the total number of ordinary shares in the capital of Verigy outstanding as of (a) April 11, 2007 (the date of our last Annual General Meeting of Shareholders held before any resolution for the authority to repurchase shares was passed) or (b) April 14, 2009 (the date of the passing of this resolution), whichever is greater, at such price or prices as may be determined by our directors from time to time up to the maximum purchase price described in paragraph (c) below, whether by way of:

| | (i) | market purchases on the NASDAQ Global Select Market or any other stock exchange on which our ordinary shares may for the time being be listed and quoted; and/or |

| | (ii) | off-market purchases (if effected other than on the NASDAQ Global Select Market or, as the case may be, any other stock exchange on which our ordinary shares may for the time being be listed and quoted) in accordance with any equal access scheme(s) as may be determined or formulated by our directors as they consider fit, which scheme(s) shall satisfy all the conditions prescribed by the Singapore Companies Act, and otherwise in accordance with all other laws and regulations and rules of the NASDAQ Global Select Market or, as the case may be, any other stock exchange on which our ordinary shares may for the time being be listed and quoted as may for the time being be applicable, be and is hereby authorized and approved generally and unconditionally; |

(b) unless varied or revoked by our shareholders in a general meeting, the authority conferred on our directors pursuant to the mandate contained in paragraph (a) above may be exercised by our directors at any time and from time to time during the period commencing from the date of the passing of this resolution and expiring on the earlier of:

| | (i) | the date on which our next Annual General Meeting of Shareholders is held; or |

| | (ii) | the date by which our next Annual General Meeting of Shareholders is required by law to be held; |

(c) the maximum purchase price (excluding brokerage, commission, applicable goods and services tax and other related expenses) which may be paid for an ordinary share purchased or acquired by us pursuant to the mandate contained in paragraph (a) above, shall not exceed:

| | (i) | in the case of a market purchase of an ordinary share, the highest independent bid or the last independent transaction price, whichever is higher, of our ordinary shares quoted or reported on the NASDAQ Global Select Market at the time the purchase is effected; and |

| | (ii) | in the case of an off-market purchase pursuant to an equal access scheme, 150% of the Prior Day Close Price; |

and for the above purposes, the term Prior Day Close Price means the closing price of our ordinary shares as quoted on the NASDAQ Global Select Market or, as the case may be, any other stock exchange on which our ordinary shares may, for the time being, be listed and quoted on the day immediately preceding the date of the making of the offer pursuant to the off-market purchase. The date of the making of the offer refers to the date on which we announce our intention to make an offer for the purchase or acquisition of our ordinary shares from holders of our ordinary shares, stating therein the purchase price (which shall not be more than the maximum purchase price calculated on the foregoing basis) for each ordinary share and the relevant terms of the equal access scheme for effecting the off-market purchase; and

(d) our directors and/or any of them be and are hereby authorized to complete and do, or cause to be completed or done, all such acts and things (including executing such documents as may be required) as one or more may consider expedient or necessary to give effect to the transactions contemplated and/or authorized by this resolution.

As Ordinary Business

| | 9. | To transact any other business as may properly be transacted at the 2009 Annual General Meeting of Shareholders. |

Notes About the 2009 Annual General Meeting of Shareholders

Singapore Financial Statements. At the 2009 Annual General Meeting of Shareholders, our shareholders will have the opportunity to discuss and ask questions regarding our Singapore audited accounts for the fiscal year ended October 31, 2008, together with the reports of the directors and auditors thereon, in compliance with the laws of Singapore. Shareholder approval of our audited accounts is not being sought by this Proxy Statement and will not be sought at the 2009 Annual General Meeting of Shareholders.

Proxy Materials on the Internet. We are pleased to take advantage of Securities and Exchange Commission rules that allow issuers to furnish proxy materials to some or all of their shareholders on the internet. In accordance with Singapore law our registered shareholders (shareholders who own our ordinary shares in their own name through our transfer agent, Computershare Investor Services, LLP) will not be able to vote their shares over the internet, but we will be providing this service to our beneficial holders (shareholders whose ordinary shares are held by a brokerage firm, a bank or a trustee). We believe these rules will allow us to provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual General Meeting of Shareholders.

Eligibility to Vote at Annual General Meeting of Shareholders; Receipt of Notice. The Board of Directors has fixed the close of business on February 19, 2009, as the record date for determining those shareholders who will be entitled to receive copies of this notice and accompanying Proxy Statement or the Notice of Internet Availability of Proxy Materials. Only shareholders of record on April 14, 2009, will be entitled to vote at the 2009 Annual General Meeting of Shareholders.

Quorum. The attendance, in person or by proxy, of at least a majority of our outstanding ordinary shares at the 2009 Annual General Meeting of Shareholders is required to constitute a quorum. Accordingly, it is important that your shares be represented at the 2009 Annual General Meeting of Shareholders, either in person or by proxy.

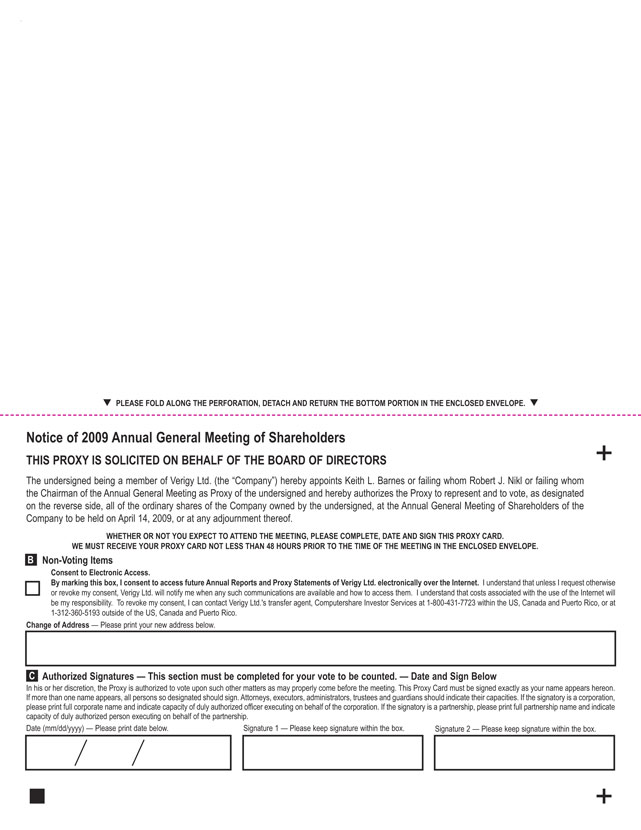

Proxies. A registered shareholder entitled to attend and vote at the 2009 Annual General Meeting of Shareholders is entitled to appoint a proxy to attend the meeting and vote on his or her behalf. A proxy need not also be a shareholder.Whether or not you plan to attend the meeting, please complete, date and sign the enclosed proxy card and return it in the enclosed envelope. If not delivered in person at the 2009 Annual General Meeting of Shareholders, a proxy card must be received by us c/o Proxy Services, c/o Computershare Investor Services LLC, P.O. Box 43102, Providence, RI 02940-5068 not less than 48 hours before the time appointed for holding the 2009 Annual General Meeting of Shareholders. If you are a beneficial holder you may vote by proxy over the internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials, or, if you request printed copies of the proxy materials by mail, you may vote by mail.

Mandatory Disclosure regarding Share Purchase Mandate Funds. Only funds legally available for purchasing or acquiring ordinary shares in accordance with our Articles of Association and applicable laws of Singapore will be used to repurchase our ordinary shares if Proposal 8 is approved. We intend to use our internal sources of funds to finance any purchase or acquisition of our ordinary shares. We do not intend to borrow money to finance any purchase or acquisition of our ordinary shares. The amount of funds required for us to purchase or acquire our issued ordinary shares, and the impact on our financial position will depend on the number of ordinary shares we purchase or acquire and the price at which we make such purchases. Our directors do not propose to exercise the Share Purchase Mandate in a manner and to such an extent that would materially affect our working capital requirements and those of our subsidiaries.

By Order of the Board of Directors,

Keith Barnes

Chairman, Chief Executive Officer and President

February [ ], 2009

You should read this entire Proxy Statement

carefully prior to voting.

TABLE OF CONTENTS

ELECTRONIC DELIVERY OF OUR SHAREHOLDER COMMUNICATIONS

We strongly encourage our shareholders to conserve natural resources, as well as significantly reduce our printing and mailing costs, bysigning up to receive your shareholder communications via e-mail.With electronic delivery, we will notify you when the Annual Report and the Proxy Statement are available on the Internet. Electronic delivery can also help reduce the number of bulky documents in your personal files and eliminate duplicate mailings. To sign up for electronic delivery:

| | 1. | If you are a registered holder (you hold your Verigy ordinary shares in your own name through our transfer agent, Computershare Investor Services, LLC), visit: www.computershare.com/us/ecomms to enroll. Under Option 2, select Verigy from the drop-down box of companies, then enter your account number and zip code (or family/last name if outside the United States). |

| | 2. | If you are a beneficial holder (your shares are held by a brokerage firm, a bank or a trustee), the voting instruction form provided by most banks or brokers will contain instructions for enrolling in electronic delivery. |

Your electronic delivery enrollment will be effective until you cancel it. If you have questions about electronic delivery, please call our Investor Relations department at (408) 864-7549.

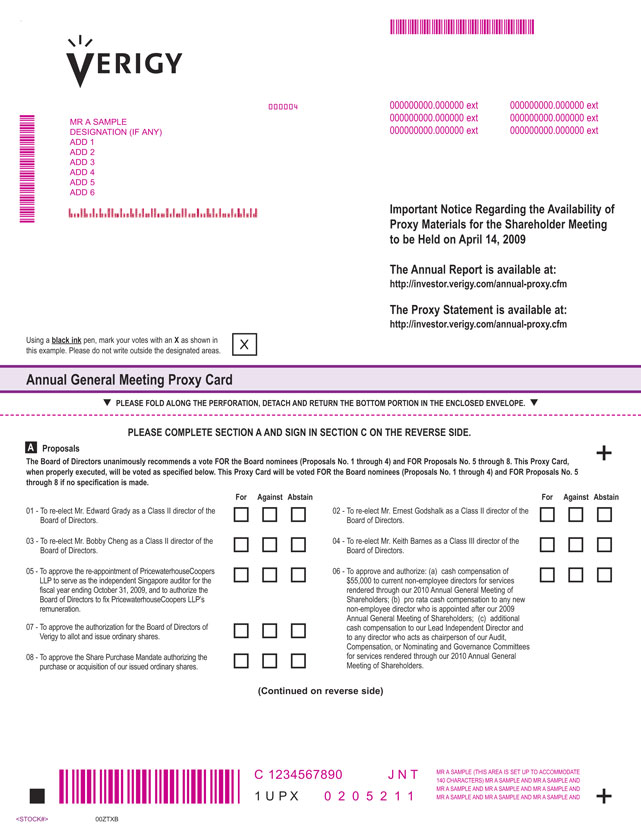

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2009 ANNUAL GENERAL MEETING OF SHAREHOLDERS

We have elected to provide access to our proxy materials (i) to our registered shareholders by mailing them a full set of proxy materials, including a proxy card, unless the shareholder previously consented to electronic delivery, and (ii) to our beneficial holders by notifying them of the availability of our proxy materials on the internet. For beneficial holders, instructions on how to request a printed copy of our proxy materials may be found in the Notice of Availability of Proxy Materials on the internet.

PROXY STATEMENT FOR

THE 2009 ANNUAL GENERAL MEETING OF

SHAREHOLDERS OF

VERIGY LTD.

To Be Held on April 14, 2009

9:00 a.m. (Pacific Time)

at the offices of Verigy’s principal US subsidiary, Verigy US, Inc., 10100 North Tantau Avenue,

Cupertino, California 95014, U.S.A.

We are making this Proxy Statement available in connection with the solicitation by the Board of Directors of Verigy of proxies to be voted at the 2009 Annual General Meeting of Shareholders, or at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders (the “Notice”).

Proxy Mailing. This Proxy Statement and the Notice were first made available on or about [ ] to shareholders of record as of February 19, 2009.

Costs of Solicitation. The entire cost of soliciting proxies will be borne by us. We and/or our agents may solicit proxies by mail, telephone, e-mail, fax or in person. After we first make the Notice, Proxy Statement and other soliciting materials available on the internet, we will request that brokers, custodians, nominees and other record holders of our ordinary shares forward copies of the proxy and other soliciting materials to persons for whom they hold ordinary shares and request authority for the exercise of proxies. In these cases, upon request, we will reimburse such holders for their reasonable expenses.

Our Registered Office. The mailing address of our registered office is One Marina Boulevard, #28-00, Singapore 018989. Please note, however, that any shareholder communications should be directed to the attention of our General Counsel at the offices of our principal U.S. subsidiary, Verigy US, Inc., 10100 North Tantau Avenue, Cupertino, California 95014-2540.

Financial Statements; Presentation. We have prepared, in accordance with the laws of Singapore, Singapore statutory financial statements, which are included with this Proxy Statement. Except as otherwise stated herein, all monetary amounts in this Proxy Statement have been presented in U.S. dollars.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The close of business on February 19, 2009, is the record date for shareholders entitled to notice of the 2009 Annual General Meeting of Shareholders. All of the ordinary shares issued and outstanding on April 14, 2009, are entitled to be voted at the 2009 Annual General Meeting of Shareholders, and shareholders of record on April 14, 2009, will have one vote for each ordinary share so held on the matters to be voted upon. As of February 19, 2009, we had [ ] ordinary shares issued and outstanding.

Proxies. Ordinary shares represented by proxies in the accompanying form, which are properly executed and received by us in accordance with the instructions set forth in the Notice, will be voted at the 2009 Annual General Meeting of Shareholders in accordance with the shareholders’ instructions set forth in the proxy.

Except as described above, in the absence of contrary instructions, shares represented by proxies will be voted FOR the Board of Directors nominees named in Proposals 1 through 4 and FOR Proposals 5 through 8. Management does not know of any matters to be presented at the 2009 Annual General Meeting of Shareholders other than those set forth in this Proxy Statement and in the Notice accompanying this Proxy Statement, nor have we received notice of any matter by the deadline prescribed by SEC Rule 14a-4(c). Without

1

limiting our ability to apply the advance notice provisions in our Articles of Association with respect to the procedures which must be followed for a matter to be properly presented at an annual general meeting, if other matters should properly come before the meeting, the proxy holders will vote on such matters in accordance with their best judgment.

Any shareholder of record as of April 14, 2009, has the right to revoke his or her proxy at any time prior to voting at the 2009 Annual General Meeting of Shareholders by (i) voting again at a later date on the internet, (ii) submitting a subsequently dated proxy, which, if not delivered in person at the meeting, must be received by us c/o Proxy Services, c/o Computershare Investor Services, P.O. Box 43102, Providence, RI 02940-5068, no later than 48 hours before the appointed time of the meeting, or (iii) by attending the meeting and voting in person. If your ordinary shares are held in street name through a broker, bank, or other nominee, you need to contact the holder of your ordinary shares regarding how to revoke your proxy.

Quorum. Representation at the 2009 Annual General Meeting of Shareholders, in person or by proxy, of at least a majority of all issued and outstanding ordinary shares is required to constitute a quorum.

Voting Rights. The affirmative vote of shareholders holding at least a majority of the ordinary shares held by the shareholders present in person or represented by proxy and entitled to vote at the 2009 Annual General Meeting of Shareholders is required to re-elect the directors nominated pursuant to Proposals 1 through 4, to approve the re-appointment of PricewaterhouseCoopers LLP as the independent Singapore auditor pursuant to Proposal 5, and to approve the ordinary resolutions contained in Proposals 6 through 8.

Abstentions and Broker Non-Votes. If a shareholder abstains from voting, including brokers holding their customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to be voted at the 2009 Annual General Meeting of Shareholders, and, therefore, are considered for purposes of determining whether or not a quorum is present. Under the laws of Singapore, however, abstentions will not be counted in the tabulation of votes cast on a proposal, and, thus, have no effect on whether a proposal has been approved. A broker “non-vote” is treated as not being entitled to vote on the relevant proposal and, therefore, is not counted for purposes of determination whether a proposal has been approved.

PROPOSALS 1 THROUGH 4:

RE-ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes serving staggered three-year terms. Pursuant to Article 42(c) of our Articles of Association, the term of office of at least one-third of the directors (or, if their number is not a multiple of three, then the number nearest to but not less than one-third of the directors), will expire. At the 2009 Annual General Meeting of Shareholders, you and the other shareholders will elect three individuals to the Board of Directors as Class II directors, to serve until the 2012 Annual General Meeting of Shareholders, and one Class III director, to serve until the 2010 Annual General Meeting of Shareholders.

Article 42(a) of our Articles of Association requires that any person appointed as a director by the Board of Directors shall hold office only until our next Annual General Meeting of the Shareholders, and will then be eligible for re-election. Bobby Cheng was appointed to the Board of Directors by resolution of the Board of Directors in June 2008 with an effective date of September 1, 2008. Mr. Cheng has been nominated to stand for re-election as a Class II director at the 2009 Annual General Meeting of Shareholders, to serve until the 2012 Annual General Meeting of Shareholders.

The proxy holders intend to vote all proxies received by them in the accompanying form FOR the re-appointment of the nominees for director listed below. In the event that any nominee is unable or declines to serve as a director at the time of the 2009 Annual General Meeting of Shareholders, the proxies will be voted for any nominee who shall be designated by a majority of the members of the Board of Directors present to fill the vacancy.

2

As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee for re-election who is unable or will decline to serve as a director.

OUR BOARD OF DIRECTORS

The following Class II Nominees are standing for Re-Election to Serve Until the 2012 Annual General Meeting of Shareholders.

Edward C. Grady (age 61)—Edward Grady has served as a member of our Board of Directors since July 2007, as a member of our Compensation Committee since December 2007 and as Compensation Committee chairman since September 2008. Mr. Grady was the President and CEO of Brooks Automation Inc. until October 1, 2007 when he retired. Prior to joining Brooks in 2003, he ran several divisions at KLA-Tencor, served as President and CEO of Hoya Micro Mask and was Vice President of Worldwide Sales for the EPI division of Monsanto/MEMC, where he started his career. Mr. Grady serves on the Board of Directors of Evergreen Solar Inc., Integrated Materials Inc., Finesse, LLC, Molecular Imprints Inc., Advanced Energy Industries, Inc. and Electro Scientific Industries, Inc. He holds a BS degree in engineering from Southern Illinois University and an MBA degree from the University of Houston, Clear Lake City.

Ernest L. Godshalk (age 63)—Ernest Godshalk has served as a member of our Board of Directors, as chairperson of our Audit Committee and as a member of the Nominating and Governance Committee since June 2006. Mr. Godshalk is Managing Director of ELGIN Management Group, a private investment company. From February 2001 until he retired in December 2004, Mr. Godshalk served as President, Chief Operating Officer and a director of Varian Semiconductor Equipment Associates, Inc., a supplier of semiconductor manufacturing equipment. From April 1999 until February 2001, Mr. Godshalk served as Varian Semiconductor’s Vice President and Chief Financial Officer. From November 1998 until April 1999, Mr. Godshalk was Vice President, Finance of the semiconductor equipment business of Varian Associates, Inc. Mr. Godshalk serves on the Board of Directors of GT Solar International Inc., Gloucester Adventure, Inc., and Hittite Microwave Corporation. He holds a BA degree from Yale University and an MBA degree from Harvard Business School.

Bobby Cheng (age 60)—Bobby Cheng has served as a member of our Board of Directors since September 2008. He began his career as Asia Regional Marketing Director with Texas Instruments, Inc., and over subsequent years held regional leadership roles in Asia-Pacific with computer systems and related companies, including Digital Equipment Corp., Computervision, Inc., International Computer Limited (ICL) and Autodesk, Inc. In 1993, he founded his own IC tooling and supply chain company. Since selling his company in 1998, he has consulted on business strategies in Asia for clients such as Jabil Circuit, Inc., and World Bank-IFC. He has served on the board of governors for the Singapore Institute of Management and a committee for the Singapore Stock Exchange. He served on the Board of Courts from March through December 2008 and is the non-executive chairman of IVCG Corporation, an investment holding company he founded with other partners in 2006.

Mr. Barnes, a Class III Nominee, Is Standing for Re-Election to Serve Until the 2010 Annual General Meeting of Shareholders.

Keith L. Barnes (age 57)— Keith Barnes has served as our President and Chief Executive Officer since May 2006, as a member of our Board of Directors since June 2006, and as Chairman of our Board of Directors since July 2007. From October 2003 through April 2006, Mr. Barnes was Chairman and Chief Executive Officer of Electroglas, Inc., an integrated circuit probe manufacturer located in San Jose, California. From August 2002 to October 2003, Mr. Barnes was Vice Chairman of the Board of Directors of Oregon Growth Account and a management consultant. He served as Chief Executive Officer of Integrated Measurement Systems, Inc. (“IMS”), a manufacturer of engineering test stations and test software, from 1995 until 2001, and also as Chairman of the

3

Board of Directors of IMS from 1998 through 2001 when it was acquired by Credence Systems Corporation. Prior to becoming CEO of IMS, Mr. Barnes was a Division President at Valid Logic Systems and later Cadence Design Systems. Mr. Barnes is on the Board of Directors of Cascade Microtech, Inc. and is a Regent at The University of Portland. Mr. Barnes holds a BSES degree from California State University, San Jose.

The following Class I Directors Are Not Standing for Re-election, and are Currently Serving a Term of Office Expiring at the 2011 Annual General Meeting of Shareholders.

C. Scott Gibson (age 56)—C. Scott Gibson has served as a member of our Board of Directors, Audit Committee and as the chairman of our Nominating and Governance Committee since June 2006. Mr. Gibson also served as chairman of our Compensation Committee from June 2006 to September 2008. Mr. Gibson has served as our Lead Independent Director since July 2007. Mr. Gibson has served on the Board of Directors of Radisys Corporation, a global supplier of embedded computing solutions for automation, telecommunications and other industries, since June 1993 and as chairperson of its Board of Directors since October 2002. From January 1983 through March 1992, Mr. Gibson co-founded Sequent Computer Systems, Inc., a computer systems company, and served as President from January 1988 to March 1992. Before co-founding Sequent, Mr. Gibson served as General Manager, Memory Components Operation, at Intel Corporation. Mr. Gibson serves on the Board of Directors of several other companies, including TriQuint Semiconductors, Inc., Pixelworks, Inc., Northwest Natural Gas Company and Electroglas, Inc. He also serves on the Board of Trustees of Franklin W. Olin College of Engineering, is the Vice Chairman of the Oregon Health and Sciences University Governing Board of Trustees, and serves as a director of the Oregon Community Foundation. Mr. Gibson holds a BSEE degree and an MBA degree from the University of Illinois.

Eric Meurice (age 52)—Eric Meurice has served as a member of our Board of Directors since November 2006. Mr. Meurice has served as the President, Chief Executive Officer and Chairman of the Board of Management of ASML Holding, a manufacturer of lithography equipment and supplier to the semiconductor industry, since October 2004. From March 2001 until he joined ASML, Mr. Meurice was Executive Vice President of Thomson Television Worldwide. Between 1995 and 2001, Mr. Meurice served as Vice President of Dell Computer, where he ran the Western and Eastern Europe regions and Dell’s emerging markets business within Europe, the Middle East and Africa. Mr. Meurice holds a Master’s degree in applied economics from the Sorbonne University in Paris, France, a Master’s degree in mechanics and energy generation from the École Centrale de Paris, and an MBA from Stanford University.

ClaudineSimson(age 55)—Claudine Simson has served as a member of our Board of Directors and Compensation Committee since November 2006. Dr. Simson served as a member of our Audit Committee from November 2006 to January 2009. Dr. Simson is Executive Vice President and Chief Technology Officer of LSI Corporation. Dr. Simson served as Corporate Vice President and Chief Technology Officer of Motorola Inc. and its semiconductor product sector spin-off, Freescale Semiconductor, from April 2003 to April 2006. Prior to joining Motorola, from September 2002 to March 2003, Dr. Simson served as Chief Technology Officer at IPVALUE Management Inc., an emerging company specializing in the commercialization of corporate intellectual property. Prior to joining IPVALUE, Dr. Simson was with Nortel Networks for 23 years, holding senior executive positions including General Manager of Nortel’s Semiconductor Business and Vice President of Global Technology Research and Intellectual Property. Dr. Simson received a Bachelor’s degree in electrical engineering and a Ph.D. in semiconductor physics from l’Institut National des Sciences Appliquées in Toulouse, France.

The following Class III Director Is Not Standing for Re-election, and is Currently Serving a Term of Office Expiring at the 2010 Annual General Meeting of Shareholders.

Steven W. Berglund (age 57)—Steven Berglund has served as a member of our Board of Directors and as a member of our Audit Committee since January 2008. Mr. Berglund joined Trimble Navigation Limited as President and CEO in March 1999, and has diverse industry experience, including engineering, manufacturing,

4

finance, and global operations. Prior to joining Trimble Navigation Limited, he was President of Spectra Precision, a unit of Spectra-Physics AB, and a pioneer in the development of laser systems. In the early 1980s, Mr. Berglund spent a number of years at Varian Associates in Palo Alto, California, where he held roles in planning and manufacturing. He began his career as a process engineer at Eastman Kodak in Rochester, New York. Mr. Berglund serves on the Board of Directors of Trimble Navigation Limited and World Education Services. He attended the University of Oslo and the University of Minnesota, where he received a BS in chemical engineering. Mr. Berglund also received an MBA from the University of Rochester.

The Board of Directors recommends a vote FOR

the re-election of Mr. Grady, Mr. Godshalk, Mr. Cheng and Mr. Barnes

to the Board of Directors.

5

CORPORATE GOVERNANCE

Standards of Business Conduct

We have adopted Standards of Business Conduct that apply to all of our employees and our directors. The Standards of Business Conduct is available on our website at http://investor.verigy.com/documents.cfm. Any amendment (other than technical, administrative or other non-substantive amendments) to, or material waiver (as defined by the SEC) of, a provision of the Standards of Business Conduct that applies to our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions and relates to elements of the Standards of Business Conduct specified in the rules of the SEC, will be posted on our website.

Director Retirement Age

Under Section 153(2) of the Singapore Companies Act, Cap. 50, the office of a director of a public company becomes vacant at the conclusion of the Annual General Meeting of Shareholders first held after such director attains the age of 70 years, and any re-appointment of such director must be approved by our shareholders by ordinary resolution.

Shareholder Communications With Our Board of Directors

Shareholders may communicate with our Board of Directors at the following address:

The Board of Directors

c/o General Counsel

Verigy US, Inc.

10100 North Tantau Avenue

Cupertino, CA 95014-2540

Communications are distributed to the Board of Directors or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is filtered out will be made available to any non-management director upon request.

You may also communicate with our Board of Directors as a group online at http://investor.verigy.com/contactboard.cfm.

Corporate Governance Guidelines

The Board of Directors has adopted a set of Corporate Governance Guidelines. The Nominating and Governance Committee is responsible for overseeing the guidelines and periodically reviews them and makes recommendations to the Board of Directors concerning corporate governance matters. The Board of Directors may periodically amend the guidelines and may waive, suspend or repeal any of the guidelines at any time, with or without public notice, as it determines necessary or appropriate in the exercise of the Board of Directors’ judgment or fiduciary duties.

Among other matters, the guidelines include the following items concerning the Board of Directors:

| | • | | There should be a majority of independent directors on the Board of Directors. |

| | • | | The Board of Directors may, but is not required to, elect an independent director to serve as Lead Independent Director. The responsibilities of the Lead Independent Director include presiding at all meetings at which the Chairman is not present including executive sessions of the independent directors, calling meetings of the non-employee directors when necessary and appropriate, and performing such other duties as the Board of Directors may from time to time delegate. |

6

| | • | | Independent directors meet on a regular basis apart from other Board of Directors members and management representatives. |

| | • | | Directors are required to notify the Nominating and Governance Committee upon a change of employer, a significant change of position or retirement. After consultation with our Chief Executive Officer, the Nominating and Governance Committee will recommend to the Board of Directors whether such director shall be asked to continue his or her service or to offer his or her resignation from the Board of Directors. |

| | • | | Absent approval from the Nominating and Governance Committee, no director should serve on more than six public company boards, including our Board of Directors, nor should any member of our Audit Committee serve on more than four public company audit committees, including our Audit Committee. |

| | • | | The Audit, Compensation, and Nominating and Governance Committees shall consist entirely of independent directors. |

| | • | | The Board of Directors has access to, and may contact and meet with, any of our employees. Directors are authorized to conduct independent investigations and to hire outside consultants or experts at our expense. Directors also have access to company records and files and may contact other directors without informing our management of the purpose or even the fact of such contact. |

| | • | | The Board of Directors, together with the Compensation Committee, is responsible for overseeing succession planning and management development. |

| | • | | At least annually, the Board of Directors evaluates the performance of the Chief Executive Officer. |

| | • | | The Nominating and Governance Committee manages a process whereby the Board of Directors and its members are subject to annual evaluation of the effectiveness of the Board of Directors, and each committee of the Board of Directors is responsible for performing an annual evaluation of its effectiveness. |

Shareholder Nominations to Our Board of Directors

Shareholders can recommend qualified candidates for our Board of Directors to the Nominating and Governance Committee by submitting recommendations to our General Counsel at 10100 North Tantau Ave., Cupertino, CA 95014-2540. Submissions which include the following requirements will be forwarded to the Nominating and Governance Committee for review and consideration:

| | • | | the candidate’s name and business address; |

| | • | | a resume or curriculum vitae describing the candidate’s qualifications, which clearly indicates that he or she has the necessary experiences, skills, and qualifications to serve as a director; |

| | • | | a statement as to whether or not, during the past ten years, the candidate has been convicted in a criminal proceeding (excluding minor traffic violations) and, if so, the dates, the nature of the conviction, the name or other disposition of the case, and whether the individual has been involved in any other legal proceeding during the past five years; |

| | • | | a statement from the candidate that he or she consents to serve on the Board of Directors if elected; and |

| | • | | a statement from the person submitting the candidate that he or she is the registered holder of ordinary shares, or if the shareholder is not the registered holder, a written statement from the record holder of the ordinary shares (usually a broker or bank) verifying that at the time the shareholder submitted the candidate that he or she was a beneficial owner of ordinary shares. |

7

Board of Directors

Our Articles of Association give our Board of Directors general powers to manage our business. The Board of Directors oversees and provides policy guidance on our strategic and business planning processes, oversees the conduct of our business by senior management and is principally responsible for the succession planning for our key executives, including our President and Chief Executive Officer.

The Board of Directors has determined that each of our directors is an independent director as defined by the applicable rules of the NASDAQ Stock Market LLC (“NASDAQ”), other than Mr. Barnes, who currently serves as our Chairman, Chief Executive Officer and President.

Our Board of Directors held a total of 10 meetings, and acted by written consent 4 times, during fiscal year 2008. All directors attended at least 75% of the aggregate of the total number of meetings of our Board of Directors together with the total number of meetings held by all committees of our Board of Directors on which he or she served, counting only those meetings during which such person was a member of our Board of Directors and of the respective committee. Our non-employee directors met at regularly scheduled executive sessions without management participation.

Our Board of Directors has adopted a policy that encourages each director to attend the Annual General Meeting of Shareholders, but attendance is not required. Mr. Barnes, Mr. Berglund, Mr. Gibson, Mr. Godshalk, Mr. Grady, and Mr. Meurice each attended the 2008 Annual General Meeting of Shareholders in person or via tele-conference.

Board of Directors Committees

The standing committees of our Board of Directors are the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The table below provides current membership for each of these committees.

| | | | | | |

Name | | Audit

Committee | | Compensation

Committee | | Nominating and

Governance

Committee |

Keith Barnes | | — | | — | | — |

Bobby Cheng | | — | | — | | — |

C. Scott Gibson(1) | | X | | X | | X(2) |

Ernest Godshalk | | X(2) | | — | | X |

Edward Grady | | — | | X(2) | | — |

Eric Meurice | | — | | — | | — |

Claudine Simson | | — | | X | | — |

Steven Berglund | | X | | — | | — |

| (1) | Lead Independent Director |

Audit Committee

The Audit Committee is currently composed of Ernest Godshalk, the chairperson of the committee, C. Scott Gibson and Steven Berglund, each of whom the Board of Directors has determined to be an independent director and to meet the financial experience requirements under both the rules of the SEC and NASDAQ. The Board of Directors has also determined that Mr. Godshalk is an “audit committee financial expert” within the meaning of the rules of the SEC and is “financially sophisticated” within the meaning of the rules of NASDAQ. The Audit Committee held 9 meetings during fiscal year 2008.

8

Our Board of Directors has adopted an Audit Committee charter that is available on our website at http://investor.verigy.com/documents.cfm. The Audit Committee is responsible for, among other things, assisting the Board of Director’s oversight of:

| | • | | the quality and integrity of our financial statements and internal controls; |

| | • | | our compliance with legal and regulatory requirements; |

| | • | | our independent registered public accounting firm’s appointment, compensation, retention, qualifications and independence; |

| | • | | the performance of our internal audit function and independent registered public accounting firms; and |

| | • | | related party transactions. |

The Audit Committee’s principal functions are to:

| | • | | monitor and evaluate periodic reviews of the adequacy of the accounting and financial reporting processes and systems of internal control that are conducted by our financial and senior management, and our independent registered public accounting firm; |

| | • | | be directly responsible for the appointment, compensation, retention, oversight of the work and, if necessary, termination and replacement, of our independent registered public accounting firm (including resolution of any disagreements between our management and the auditors regarding financial reporting); and |

| | • | | facilitate communication among our independent registered public accounting firm, our financial and senior management and our Board of Directors. |

Compensation Committee

The Compensation Committee is currently composed of Edward Grady, the chairperson of the committee, Claudine Simson and C. Scott Gibson. The Board of Directors has determined that each member of the Compensation Committee is an independent director under applicable NASDAQ rules. Furthermore, pursuant to our Compensation Committee charter, our Board of Directors has determined that each member of the Compensation Committee is an outside director, as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, (the “Code”) and is a non-employee director within the meaning of Rule 16b-3 of the rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee held 6 meetings, and acted by written consent twice, in fiscal year 2008. The Compensation Committee is responsible for, among other things:

| | • | | reviewing and making recommendations to our Board of Directors relating to the compensation policy for our officers and directors; |

| | • | | administering our equity-based incentive plans exclusively as they relate to our executive officers and directors and non-exclusively as they relate to other eligible participants; |

| | • | | approving all employment, severance, or change in control agreements or special or supplemental benefits applicable to our executive officers; and |

| | • | | producing an Annual Report on executive compensation for inclusion in our annual Proxy Statement. |

Our Board of Directors has adopted a Compensation Committee charter that is available on our website at http://investor.verigy.com/documents.cfm.

Compensation Committee Interlocks and Insider Participation. None of our executive officers serves on the Compensation Committee. None of our directors has interlocking or other relationships with other boards, compensation committees or our executive officers that require disclosure under Item 407(e)(4) of Regulation S-K of the rules and regulations of the SEC.

9

Nominating and Governance Committee

The Nominating and Governance Committee is currently composed of C. Scott Gibson, the chairperson of the committee, and Ernest Godshalk, each of whom our Board of Directors has determined to be an independent director under applicable NASDAQ rules. The Nominating and Governance Committee held 4 meetings in fiscal year 2008. The Nominating and Governance Committee recruits, evaluates and recommends candidates for appointment or election as members of our Board of Directors and recommends corporate governance guidelines to the Board of Directors. Our Board of Directors has adopted a Nominating and Governance Committee charter that is available on our website at http://investor.verigy.com/documents.cfm.

One goal of the Nominating and Governance Committee is to ensure that our Board of Directors possesses a variety of perspectives and skills derived from high-quality business and professional experience. The Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capabilities on our Board of Directors, while maintaining a sense of collegiality and cooperation that is conducive to a productive working relationship within the Board of Directors and between the Board of Directors and management. To this end, the Nominating and Governance Committee seeks nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education, broad-based business acumen, and the ability to think strategically. Although the Nominating and Governance Committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees.

Consideration of new board nominee candidates typically involves a series of internal discussions, review of information concerning candidates and interviews with selected candidates. Members of the Board of Directors, management or a third party search firm typically suggests candidates for nomination to the Board of Directors. The Nominating and Governance Committee will also consider recommendations submitted by our shareholders that meet the specific requirements set forth above under “Shareholder Nominations to Our Board of Directors.” To date, we have not received any such recommendations from our shareholders.

In 2008, we retained a third-party search firm to assist the Nominating and Governance Committee in identifying and evaluating potential nominees. Once the Board of Directors determined to add one or more directors, the Nominating and Governance Committee considered the specific qualifications and skills a candidate should possess. Guided by those considerations, the search firm conducted research to identify viable candidates. It prepared a list for the Nominating and Governance Committee that included a brief biography of each candidate. The list was provided to, and discussed by, the Nominating and Governance Committee. The search firm then conducted further research on the candidates in whom the Nominating and Governance Committee had the most interest. The search firm then reported their results to the Nominating and Governance Committee.

10

DIRECTOR COMPENSATION

Under the laws of Singapore, our shareholders must approve all cash compensation paid to our non-employee directors. In addition to the compensation provided to our non-employee directors detailed below, each non-employee director receives reimbursement of reasonable out-of-pocket expenses incurred in connection with attending in-person meetings of the Board of Directors and of committees of the Board of Directors, as well as reimbursement of expenses incurred for attendance at continuing education courses for directors. No director who is employeed by any Verigy group companies receives compensation for services rendered as a director. Accordingly, Mr. Barnes, our Chairman, Chief Executive Officer and President, does not receive compensation for his role as a director.

Equity Compensation

Initial Option Grants. Under the automatic equity grant provisions of our 2006 Equity Incentive Plan, which we refer to as the 2006 Plan, each individual who first becomes a non-employee director receives:

| | • | | a one-time grant of a non-statutory stock option to purchase that number of ordinary shares with an aggregate accounting value of $120,000; and |

| | • | | a one-time grant of restricted ordinary share units with an aggregate accounting value of $120,000. |

The initial one-time option grants are granted on the date when the outside director first joins the Board of Directors. For purposes of determining the accounting value of the initial stock option grant, the accounting value is the value calculated using the same methodology that we applied for purposes of determining the accounting charge associated with similar equity-based awards. We measure the fair value of option awards using the Black-Scholes option pricing model which requires a number of complex and subjective assumptions including our stock price volatility and option exercise patterns (expected life of the options and the risk-free interest rate). The fair value of restricted share units is determined based on the fair market value of Verigy’s ordinary shares on the date of grant. The restricted share units and stock options initially issued to non-employee directors vest in full on the first anniversary of the grant date. Settlement of the restricted share units occurs in a lump sum on the third anniversary of the grant date. During 2008, Mr. Berglund and Mr. Cheng received initial grants of stock options to purchase 10,681 ordinary shares and 16,027 ordinary shares at exercise prices of $27.17 and $18.47 per share, respectively, and initial grants of 4,049 restricted ordinary share units and 6,498 restricted ordinary share units, respectively. Employee directors and outside directors who were previously employees of Verigy are not eligible for the initial equity-based awards.

Yearly Option Grants. Under the terms of the automatic option grant provisions of the 2006 Plan, on the date of each Annual General Meeting of Shareholders, each non-employee director, who did not receive an initial award in the same calendar year, automatically receives a non-statutory stock option, covering ordinary shares, with an aggregate accounting value of $60,000 on the date of grant.These options vest and are exercisable quarterly over a period of four quarters from the date of grant. Employee directors and outside directors who were previously employees of Verigy are not eligible for the annual equity-based awards.

Yearly Restricted Share Unit Awards. Under the terms of the automatic restricted share unit grant provisions of the 2006 Plan, on the date of each Annual General Meeting of Shareholders, each non-employee director, who did not receive an initial award in the same calendar year, automatically receives a restricted share unit award consisting of such number of ordinary shares having an aggregate accounting value of $60,000 on the date of grant. The restricted share unit awards vest quarterly over a period of four quarters from the date of grant. Employee directors and outside directors who were previously employees of Verigy are not eligible for the annual equity-based awards.

Discretionary Grants. Under the terms of the discretionary option grant provisions of the 2006 Plan, non-employee directors are eligible to receive non-statutory stock options, restricted shares, share units, or SARs granted at the discretion of the Compensation Committee. To date, our Compensation Committee has not made any discretionary grants to our non-employee directors.

11

Cash Compensation. Verigy provides annual cash compensation to its non-employee directors as follows:

| | • | | An annual cash retainer of $55,000 for service on our Board of Directors and for service as a member of any committees on which a director serves; |

| | • | | A supplemental annual retainer of $20,000 per year payable to the chairperson of the Audit Committee for the additional services rendered in connection with chairing such committee; |

| | • | | A supplemental annual retainer of $10,000 per year payable to the chairperson of the Compensation Committee for the additional services rendered in connection with chairing such committee; |

| | • | | A supplemental annual retainer of $5,000 per year payable to the chairperson of the Nominating and Governance Committee for the additional services rendered in connection with chairing such committee; and |

| | • | | A supplemental annual retainer of $15,000 per year payable to our Lead Independent Director for the additional services rendered in connection with this position. |

Annual Cash Compensation. Verigy’s cash-based compensation for non-employee directors is paid following each Annual General Meeting of Shareholders, making cash compensation, like the annual equity compensation, coincide with the directors’ terms of office.

The Compensation Committee reviewed the cash compensation levels payable to non-employee directors and elected to retain the annual rates approved at our 2008 Annual General Meeting of Shareholders, with the exception of the annual retainer to the chairperson of the Audit Committee, which was increased from $10,000 to $20,000.

Director Compensation Table

The following table summarizes the compensation earned by our non-employee directors for the 2008 fiscal year. Verigy’s cash-based compensation for non-employee directors is paid following each Annual General Meeting of Shareholders.

| | | | | | | | | |

Name | | Fees Earned or Paid in

Cash

($) | | | Stock Awards

($)(1) | | Option Awards

($)(2) | | Total

($) |

Steven Berglund | | 55,000 | (3) | | 91,376 | | 99,794 | | 246,170 |

Eric Meurice | | 55,000 | (3) | | 57,520 | | 54,486 | | 167,006 |

Claudine Simson | | 55,000 | (3) | | 57,520 | | 54,486 | | 167,006 |

Edward Grady | | 56,389 | (4) | | 108,769 | | 111,827 | | 276,985 |

C. Scott Gibson | | 84,167 | (5) | | 57,219 | | 54,177 | | 195,563 |

Ernest Godshalk | | 65,000 | (6) | | 57,219 | | 54,177 | | 176,396 |

Bobby Cheng | | 9,167 | (7) | | 19,894 | | 20,249 | | 49,310 |

Paul Chan Kwai Wah | | 55,000 | (8) | | 39,500 | | 36,832 | | 131,332 |

| (1) | Represents amounts reported as fiscal year 2008 compensation in accordance with FAS 123R for stock awards issued to non-employee directors. In accordance with FAS 123R, the grant date value of share unit awards, which is equal to the number of restricted share units (“RSUs”) awarded multiplied by the fair market value per share on the date of award is expensed over the vesting period. Additional information on these stock awards, including grant date fair value computed in accordance with FAS 123R is set forth in the Director Equity Awards Table below. |

| (2) | Represents amounts reported as fiscal year 2008 compensation in accordance with FAS 123R for option awards issued to non-employee directors. In accordance with FAS 123R, the award date fair value of options, which is calculated using the Black-Scholes formula, is expensed over the vesting period. Additional information on these option awards, including grant date fair value computed in accordance with FAS 123R, is set forth in the Director Equity Awards Table below. |

12

| (3) | Represents the annual retainer of $55,000. |

| (4) | Represents the annual retainer of $55,000, and the pro rata retainer of $1,389 earned as chairperson of the Compensation Committee for service from September 10, 2008 through October 31, 2008. |

| (5) | Represents the $55,000 annual retainer, the $5,000 annual retainer as chairperson of the Nominating and Governance Committee, and the $15,000 annual retainer as our Lead Independent Director. In addition, Mr. Gibson was paid a pro rata retainer of $9,167 for eleven months of service as chairperson of the Compensation Committee, a position he held until September 10, 2008. |

| (6) | Represents the annual retainer of $55,000 and a retainer of $10,000 for services as chairperson of the Audit Committee. |

| (7) | Represents the pro rata annual retainer earned by Mr. Cheng for the period from his appointment as a director by the Board of Directors on September 1, 2008 through the fiscal year end of October 31, 2008. |

| (8) | Represents the annual retainer of $55,000. Our cash compensation for non-employee directors is paid in advance in full following each Annual General Meeting of Shareholders. Therefore, even though Mr. Chan Kwai Wah retired from our Board of Directors on September 1, 2008, he was paid the full amount of the annual retainer. |

13

Director Equity Awards Table

The following table reports additional information related to the non-employee directors’ equity awards listed in the Director Compensation Table.

| | | | | | | | | | | | |

Name | | Grant

Date | | Number

of RSUs

Granted

(#) | | Number of

Shares

Underlying

Option

Awards

(#) | | Option

Exercise

Price

($) | | Grant

Date

Fair

Value

($) | | Vesting Term |

Steven Berglund | | 1/1/2008 | | — | | 10,681 | | 27.17 | | 120,146 | | 100% on 1st anniversary |

| | 1/1/2008 | | 4,049 | | — | | — | | 110,011 | | 100% on 1st anniversary(1) |

| | | | | | |

C. Scott Gibson | | 4/11/2007 | | — | | 5,341 | | 25.77 | | 49,721 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 58,755 | | 4 quarterly installments, beginning 7/15/2008 |

| | 4/11/2007 | | 2,135 | | — | | — | | 55,019 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 60,007 | | 4 quarterly installments(1) |

| | | | | | |

Ernest Godshalk | | 4/11/2007 | | — | | 5,341 | | 25.77 | | 49,721 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 58,755 | | 4 quarterly installments, beginning 7/15/2008 |

| | 4/11/2007 | | 2,135 | | — | | — | | 55,019 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 60,007 | | 4 quarterly installments(1) |

| | | | | | |

Claudine Simson | | 4/11/2007 | | — | | 5,341 | | 25.77 | | 49,721 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 58,755 | | 4 quarterly installments, beginning 7/15/2008 |

| | 4/11/2007 | | 2,135 | | — | | — | | 55,019 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 60,007 | | 4 quarterly installments(1) |

| | | | | | |

Eric Meurice | | 4/11/2007 | | — | | 5,341 | | 25.77 | | 49,721 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 58,755 | | 4 quarterly installments, beginning 7/15/2008 |

| | 4/11/2007 | | 2,135 | | — | | — | | 55,019 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 60,007 | | 4 quarterly installments(1) |

| | | | | | |

Edward Grady | | 7/10/2007 | | — | | 10,443 | | 29.16 | | 115,432 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 58,755 | | 4 quarterly installments, beginning 7/15/2008 |

| | 7/10/2007 | | 3,773 | | — | | — | | 110,021 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 60,007 | | 4 quarterly installments(1) |

| | | | | | |

Bobby Cheng | | 9/1/2008 | | — | | 16,027 | | 18.47 | | 126,320 | | 4 quarterly installments, beginning 12/15/2008 |

| | 9/1/2008 | | 6,498 | | — | | — | | 120,018 | | 4 quarterly installments(1) |

| | | | | | |

Paul Chan Kwai Wah | | 4/11/2007 | | — | | 5,341 | | 25.77 | | 49,721 | | 100% on 1st anniversary |

| | 4/15/2008 | | — | | 7,596 | | 19.08 | | 14,689 | | 4 quarterly installments, beginning 7/15/2008 |

| | 4/11/2007 | | 2,135 | | — | | — | | 55,019 | | 100% on 1st anniversary(1) |

| | 4/15/2008 | | 3,145 | | — | | — | | 14,997 | | 4 quarterly installments(1) |

| (1) | All restricted share units pay out on the third anniversary of the award date. |

14

PROPOSAL 5:

APPROVAL OF THE RE-APPOINTMENT OF INDEPENDENT

SINGAPORE AUDITOR FOR FISCAL YEAR 2009

AND AUTHORIZATION OF OUR DIRECTORS TO FIX ITS REMUNERATION

PricewaterhouseCoopers LLP is our independent registered public accounting firm in the U.S. and audits our consolidated financial statements. During fiscal year 2008, PricewaterhouseCoopers LLP in Singapore was our independent Singapore auditor of our Singapore statutory financial statements. Pursuant to section 205(2) and 205(4) of the Singapore Companies Act, any appointment after the Board of Directors’ initial appointment of our independent Singapore auditor, or its subsequent removal, requires the approval of our shareholders. The Audit Committee has approved, subject to shareholder approval, the re-appointment of PricewaterhouseCoopers LLP as the independent Singapore auditor for the fiscal year ending October 31, 2009. Pursuant to Section 205(16) of the Singapore Companies Act, the remuneration of a company’s auditors shall be fixed by the shareholders in a general meeting or the shareholders may authorize directors to fix the remuneration. The Board of Directors is thus requesting that the shareholders authorize the directors to fix the auditors’ remuneration for service rendered through the next Annual General Meeting of Shareholders. We expect a representative from PricewaterhouseCoopers LLP to be present at the 2009 Annual General Meeting of Shareholders. This representative will have the opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR the approval of the re-appointment of

PricewaterhouseCoopers LLP as independent Singapore auditor for fiscal year 2009 and authorization of

the directors to fix its remuneration.

Principal Accountant Fees and Services

Set forth below are the aggregate fees paid for the services performed by our principal accounting firm, PricewaterhouseCoopers LLP, during fiscal years 2007 and 2008. All audit and non-audit services reflected in the fees below were pre-approved by the Audit Committee in accordance with established procedures.

| | | | | | |

| | | Fiscal Year

2008 | | Fiscal Year

2007 |

| | | (in thousands) | | (in thousands) |

Audit Fees | | $ | 2,138 | | $ | 2,251 |

Audit-Related Fees | | | 28 | | | — |

Tax Fees | | | 231 | | | — |

All Other Fees | | | — | | | — |

| | | | | | |

Total | | $ | 2,397 | | $ | 2,251 |

| | | | | | |

Audit Fees consist of fees for professional services rendered by our independent registered public accounting firm for the audit of our annual financial statements included in our Annual Report on Form 10-K and the review of our quarterly financial statements included in our Quarterly Reports on Form 10-Q during fiscal years 2007 and 2008. These fees include fees for services that are normally incurred in connection with statutory and regulatory filings or engagements, such as comfort letters, statutory audits, consents and review of documents filed with the SEC.

Audit-Related Fees consist of fees related to our acquisition of Invoys Corporation, completed in January 2008.

Tax Fees consist of fees incurred for the review of the net operating loss limitation study (Section 382 Study) relating to the Invoys acquisition, services relating to the adoption of Financial Accounting Standards Board Interpretation No. 48 and the review of state and federal tax returns.

15

Audit Committee Pre-Approval Policy

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services, and other services. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

PROPOSAL 6:

ORDINARY RESOLUTION TO APPROVE

NON-EMPLOYEE DIRECTOR CASH COMPENSATION,

CASH COMPENSATION FOR THE CHAIRPERSON OF THE AUDIT, COMPENSATION, AND

NOMINATING AND GOVERNANCE COMMITTEES, AND CASH COMPENSATION FOR

THE LEAD INDEPENDENT DIRECTOR

Under the laws of Singapore, we may provide cash compensation to our directors for services rendered in their capacity as directors only with the approval of our shareholders at a general meeting. As approved by the shareholders at the 2008 Annual General Meeting of Shareholders, cash compensation to our non-employee directors is paid following each Annual General Meeting of Shareholders, aligning directors’ cash compensation with their term of office. Accordingly, we are seeking shareholder approval to provide payment of the following cash compensation to our non-employee directors for the period of approximately 12 months from April 15, 2009, the day after our 2009 Annual General Meeting of Shareholders, through our 2010 Annual General Meeting of Shareholders (the “2009 cash payment cycle”) as follows:

| | • | | cash compensation of $55,000 to each of our non-employee directors for services rendered as a director for the 2009 cash payment cycle; |

| | • | | appropriate pro rata cash compensation, based on our cash compensation of $55,000 for 12 months of service, to any new non-employee director who is appointed by the Board of Directors following the date of our 2009 Annual General Meeting of Shareholders, for services rendered as directors through our 2010 Annual General Meeting of Shareholders; |

| | • | | additional cash compensation of $15,000 to the Lead Independent Director of the Board of Directors for the 2009 cash payment cycle; |

| | • | | additional cash compensation of $20,000 to the chairperson of the Audit Committee for services rendered for the 2009 cash payment cycle; |

| | • | | additional cash compensation of $10,000 to the chairperson of the Compensation Committee for services rendered as chairperson for the 2009 cash payment cycle; and |

| | • | | additional cash compensation of $5,000 to the chairperson of the Nominating and Governance Committee for services rendered as chairperson of that committee for the 2009 cash payment cycle. |

We believe that this authorization will benefit our shareholders by enabling us to attract and retain qualified individuals to serve as members of our Board of Directors and to continue to provide leadership for our company.

The Board of Directors recommends a vote FOR the resolution to approve the

directors’, committee chairpersons’ and

Lead Independent Director’s cash compensation to be paid

for the 2009 cash payment cycle.

16

PROPOSAL 7:

ORDINARY RESOLUTION TO AUTHORIZE

ORDINARY SHARE ISSUANCES

We are incorporated in the Republic of Singapore. Under the laws of Singapore, our directors may issue ordinary shares and make offers or agreements or grant options that might or would require the issuance of ordinary shares only with the prior approval of our shareholders. We are submitting this proposal because we are required to do so under the laws of Singapore before we can issue any ordinary shares in connection with our equity compensation plans, possible future strategic transactions, or public and private offerings.

If this proposal is approved, the authorization would be effective from the date of the 2009 Annual General Meeting of Shareholders and continue until the earlier of (i) the conclusion of the 2010 Annual General Meeting of Shareholders or (ii) the expiration of the period within which the 2010 Annual General Meeting of Shareholders is required by the laws of Singapore to be held. The 2010 Annual General Meeting of Shareholders is required to be held no later than 15 months after the date of the 2009 Annual General Meeting of Shareholders and no later than six months after the date of our 2009 fiscal year end. The laws of Singapore allow for a one-time application to be made with the Singapore Accounting and Corporate Regulatory Authority for an extension of the time in which to hold an Annual General Meeting of Shareholders of up to a maximum of three months.

The Board of Directors believes that it is advisable and in the best interests of our shareholders for our shareholders to authorize the directors to issue ordinary shares and to make or grant offers, agreements or options that might or would require the issuance of ordinary shares. In the future, the directors may need to issue shares or make agreements that would require the issuance of new ordinary shares. For example:

| | • | | in connection with strategic transactions and acquisitions; |

| | • | | pursuant to public and private offerings of our ordinary shares, as well as instruments convertible into our ordinary shares; or |

| | • | | in connection with our equity compensation plans and arrangements. |

Notwithstanding this general authorization to issue our ordinary shares, we will be required to seek shareholder approval with respect to future issuances of ordinary shares, where required, under NASDAQ rules, such as where we propose to issue ordinary shares that will result in a change in control of Verigy or in connection with a transaction involving the issuance of ordinary shares representing 20% or more of our outstanding ordinary shares.

The Board of Directors expects that we will continue to issue ordinary shares and grant options and other equity-based awards in the future under circumstances similar to those in the past. As of the date of this Proxy Statement, other than issuances of ordinary shares or agreements that would require the issuance of new ordinary shares in connection with our equity compensation plans and arrangements, we have no specific plans, agreements or commitments to issue any ordinary shares for which approval of this proposal is required. Nevertheless, the Board of Directors believes that it is advisable and in the best interests of our shareholders for our shareholders to provide this general authorization in order to avoid the delay and expense of obtaining shareholder approval at a later date, and to provide us with greater flexibility to pursue strategic transactions and acquisitions and raise additional capital through public and private offerings of our ordinary shares, as well as instruments convertible into our ordinary shares.

If this proposal is approved, our directors would be authorized to issue, during the period described above, ordinary shares subject to applicable Singapore laws and NASDAQ rules. The issuance of a large number of ordinary shares could be dilutive to existing shareholders or reduce the trading price of our ordinary shares on the NASDAQ Global Select Market. If this proposal is not approved, we would not be permitted to issue ordinary shares (other than shares issuable on exercise or settlement of outstanding options, restricted share units and

17

other instruments convertible into or exercisable for ordinary shares or the like, which were previously granted when the previous shareholder approved share issue mandates were in force). If we are unable to rely upon equity as a component of compensation, we would have to review our compensation practices, and would likely have to substantially increase cash compensation to retain key personnel.

The Board of Directors recommends a vote FOR the resolution

to authorize ordinary share issuances.

PROPOSAL 8:

ORDINARY RESOLUTION TO RENEW

THE SHARE PURCHASE MANDATE

Our purchases or acquisitions of our ordinary shares must be made in accordance with, and in the manner prescribed by, the Singapore Companies Act, NASDAQ rules and such other laws and regulations as may from time to time be applicable.

Singapore law requires us to obtain shareholder approval of a “general and unconditional share purchase mandate” given to our directors if we wish to purchase or otherwise acquire our ordinary shares. We refer to this general and unconditional mandate as the “Share Purchase Mandate,” and it allows our directors to exercise their authority to purchase or otherwise acquire our issued ordinary shares. At the 2008 Annual General Meeting of Shareholders, our shareholders approved the share repurchase mandate which provided our directors authority to acquire up to 10 percent, or approximately 6 million shares, of Verigy’s outstanding ordinary shares. Pursuant to this authority, as of February 19, 2009, Verigy had repurchased [ ] ordinary shares. The Share Purchase Mandate approved at the 2008 Annual General Meeting of Shareholders will expire at the conclusion of our 2009 Annual General Meeting of Shareholders. Accordingly, we are submitting this proposal to seek approval for the renewal of the Share Purchase Mandate from our shareholders at the 2009 Annual General Meeting of Shareholders. This resolution is proposed as an Ordinary Resolution pursuant to which the Share Purchase Mandate will be given to our directors to exercise all powers to purchase or otherwise acquire our issued ordinary shares on the terms of the Share Purchase Mandate.

If renewed by our shareholders at the 2009 Annual General Meeting of Shareholders, the authority conferred by the Share Purchase Mandate will, unless varied or revoked by our shareholders at a general meeting, continue in force until the earlier of the date of the 2010 Annual General Meeting of Shareholders or the date by which the 2010 Annual General Meeting of Shareholders is required by law to be held.

The authority and limitations placed on our share purchases or acquisitions under the proposed Share Purchase Mandate, if renewed at the 2009 Annual General Meeting, are summarized below:

Limit on Number of Ordinary Shares Allowed to be Purchased

We may purchase or acquire that aggregate number of our ordinary shares that is equal to 10% of the total number of issued ordinary shares outstanding as of (a) April 11, 2007 (the date of our last Annual General Meeting of Shareholders held before any resolution for the authority to repurchase shares was passed) or (b) April 14, 2009 (the date of the passing of this resolution), which ever is greater.