CONSIDERATIONS ON SONAECOM’S OFFER ON PORTUGAL TELECOM—MARCH 2006

English_General

This presentation does not constitute an offer or invitation to purchase any securities or a solicitation of an offer to buy any securities, pursuant to the

proposed offer (the “Offer”) for the shares of Portugal Telecom, SGPS, S.A. (“PT”), or otherwise. The Offer will be made solely by an offer document

containing and setting out the terms and conditions of the Offer (the “Offer Document”) and the letter of transmittal and form of acceptance (the

“Acceptance Forms”), which will contain details of how the Offer may be accepted. In the United States, Sonae, SGPS, S.A. (“Sonae”), and Sonaecom,

SGPS, S.A. (“Sonaecom”), will be filing a Tender Offer Statement containing the Offer Document, the Acceptance Forms and other related documentation

with the US Securities and Exchange Commission (the “SEC”) on Schedule TO (the “Tender Offer Statement”) and PT is expected to file a Solicitation/

Recommendation Statement on Schedule 14D-9 (the “Solicitation/Recommendation Statement”) with the SEC after the Offer Document is made available

to PT shareholders. Free copies of the Tender Offer Statement, the Solicitation/ Recommendation Statement and the other related documents to be filed

by Sonae or Sonaecom and PT in connection with the Offer will be available from the date the Offer Document is made available to PT shareholders on the

SEC’s website at http://www.sec.gov. The Offer Document and the Acceptance Forms will be made available by Sonaecom or its duly designated agent to

all PT shareholders at no charge to them. PT shareholders are strongly advised to read the Offer Document and the Acceptance Forms, and any other

relevant documents filed with the SEC, as well as amendments and supplements to those documents because they will contain important information. PT

shareholders in the United States are also advised to read the Tender Offer Statement and the Solicitation/Recommendation Statement because they will

contain important information.

Unless otherwise determined by Sonae and/or Sonaecom and permitted by applicable law and regulation, the Offer will not be made, directly or indirectly,

in or into, or by use of the mails of, or by any other means or instrumentality (including, without limitation, telephonically or electronically) of interstate

or foreign commerce of, or of any facility of a national securities exchange of Canada, nor will it be made in or into Australia or Japan and the Offer will

not be capable of acceptance by any such use, means, instrumentality or facilities from or within Australia, Canada or Japan. Accordingly, unless otherwise

determined by Sonae and/or Sonaecom and permitted by applicable law and regulation, neither copies of this presentation nor any other documents

relating to the Offer are being, or may be, mailed or otherwise forwarded, distributed or sent in or into Australia, Canada or Japan and persons receiving

such documents (including custodians, nominees and trustees) must not distribute or send them in, into or from such jurisdictions.

Notwithstanding the foregoing, Sonae and/or Sonaecom retains the right to permit the Offer to be accepted and any sale of securities pursuant to the Offer

to be completed if, in its sole discretion, it is satisfied that the transaction in question can be undertaken in compliance with applicable law and

regulation. The availability of the Offer to persons not resident in Portugal or the United States may be affected by the laws of the relevant jurisdiction.

Persons who are not resident in Portugal or the United States should inform themselves about and observe any applicable requirements.

The Offer will be made by Sonae and/or Sonaecom and (outside the United States) by Banco Santander de Negócios Portugal, S.A., on its or their behalf.

This presentation may contain forward-looking information and statements about Sonae, Sonaecom, PT or their combined businesses after completion of

the proposed Offer, based on management’s current expectations or beliefs. Forward-looking statements are statements that are not historical facts.

These forward-looking statements may relate to, among other things: management strategies; synergies and cost savings; future operations, products and

services; integration of the businesses; market position; planned asset disposal and capital expenditures; net debt levels and EBITDA; and earnings per share

growth, dividend policy and timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of

factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including, but not

limited to, changes in regulation, the telecommunications industry and economic conditions; the ability to integrate the businesses; obtaining any

applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the

effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,”

“should,” “seeks,” “estimates,” “future” or similar expressions. Although these statements reflect our current expectations, which we believe are

reasonable, investors and PT shareholders are cautioned that forward-looking information and statements are subject to various risks and uncertainties,

many of which are difficult to predict and generally beyond our control, that could cause actual results and developments to differ materially from those

expressed in, or implied or projected by, the forward-looking information and statements. You are cautioned not to put undue reliance on any forward-

looking information or statements. We do not undertake any obligation to update any forward-looking information or statements.

1 Note: PT has recently announced a dividend of €0.475 per share to be voted on the AGM. Offer price may be adjusted accordingly

1

Description of key offer terms and conditions

Offer

price

€9.50 for each

ordinary and class A share of

Portugal Telecom

(“PT”)

outstanding

(plus €5,000 for each

PT

convertible bond

outstanding

)

Acquisition

of

100% of the

PT

share capital

Valuing

PT

at €10.7bn

(equity value)

€9.03

for

each

shar

e

of

PT Multimedia (“PTM”)

Acquisition

of the stake not

-

owned by PT (~42%)

Price assumes a

dividend distribution of €0.385/share

for PT

and

€0.275/share

for PTM

1

Offer

conditions

The offer

for

PT is conditional on

the following

Sonaecom acquiring

a

t least 50.01%

Amendments to PT

articles of association

(

removing

limitations

on

voting rights

of shareholdings

higher than 10% and

on

competing company

acquisitions

of stakes higher than 10%

)

Non

-

opposition by the Portuguese State

The offer on PTM is

subject

to the

success of

the

offer

for PT

Offer structure highlights—assuming 100% acceptance

Back-up facility

provided by

Santander

PT

Comunicações

(fixed line)

TMN

(mobile)

Vivo

(Brazil)

PTM

Others

Capital increase

up to €1.5bn;

Sonae SGPS will

subscribe up to

€1.0bn

Cash offer at

€9.5/share valuing

PT at €10.7bn

Acquisition debt facility

provided by Santander

63%

100%

100%

50%

58%

Depending on acceptance level of the Offer, restructuring post-offer will include:

Combining Sonaecom/PT debt

The sale of one of PT’s two fixed telecommunications infrastructure networks (cable or fixed)

The possible sale or consolidation of certain assets

The merger of TMN/Optimus (synergies created will justify premium paid)

Sonaecom BV

100%

2

100%

Offer structure highlights—assuming 100% acceptance

(cont’d)

Bank

guarantee

Issuer: Sonae SGPS or Sonaecom

Amount: €11.1bn

3

Acquisition

finance

facility

Borrower: Sonaecom BV

Amount: €11.1bn

Maturity: 7 years (50% to be repaid within the first two years)

Capital

increase

Capital increase at Sonaecom level of up to €1.5bn

1 Facility used to refinance debt at PT level

Back-up

facility1

Borrower: Portugal Telecom SGPS

Amount: Up to €4.0bn

Maturity: Up to 4 years

Sonaecom’s five pillars for strategy of the new Sonaecom/PT

Group

Strengthen PT’s competitiveness within a much more competitive Portuguese

telecoms market

Integration of Sonaecom Group’s businesses with PT

Merger of Optimus and TMN

Sale of one of the Fixed networks (copper or cable)

Launch of Triple Play

Increase investment in technology and innovation

Reorient PT’s international strategy into a more cohesive portfolio of “controlled”

mobile investments

Readjust portfolio based on control

Negotiate with Telefonica

Reallocate resources towards controlled assets (existing/new)

Implement a clear commercial, technological and international partnership

strategy

European mobile partnerships

Preservation of independence

Protection of brands

Technological partnerships

4

Sonaecom’s five pillars for strategy of the new Sonaecom/PT

Group (cont’d)

Establish strong and stable shareholder leadership

Committed majority shareholding with vision and necessary skills for

implementation and execution

Sonae Group culture and corporate values

Able to live with “Golden Share” or other mechanism to safeguard strategic

interests of the Portuguese State

Intention to keep Sonaecom and PT (or merged entity) quoted on Euronext Lisbon

Adopt “best practice” in Corporate Governance

Board composition

Quality and transparency of financial information

Best practices (reporting, internal controls, managing conflicts, …)

Human resources

5

We reiterate our stated position and strategy regarding our Public Tender

Offer for Portugal Telecom

June

July

April

May

February

March

August

September

Indicative timetable for the Offer

Note: indicative timetable for the Offer; does not take into account Sonaecom’s share capital increase process. Excludes the impact of a competing bid (which imposes material delays for

the process). Indicative timetable also excludes PTM Offer, which may vary depending on CMVM deciding that if it will be subsequent or simultaneous to PT Offer

¹ Indicative timeframe-assuming ruling from Portuguese Competition Authority on June 21, 2006

² Delivery of the banking guarantee

06/Feb/2006¹

27/Feb/2006

27/Feb/2006

06/Mar/2006

21/Apr/2006

21/Jun/2006

30/Jun/2006

09/Jul/2006

09/Jul/2006

24/Jul/2006

19/Aug/2006

23/Aug/2006

18/Sep/2006

21/Sep/2006

20/Feb/2006

PT's annual shareholders meeting

Decision of Competition Authority¹

Registration of Offer with CMVM²

Filing schedule to with the SEC

Offer period: maximum 10 weeks

Announcement of offer launch and

distributing prospectus

Request for shareholders meeting

(amendments to PT's articles of

association)

PT shareholders meeting

Formalization of the decisions

taken in PT's shareholders meeting

Offer expiration

(limit date for a competing offer)

Settlement of the Offer

Opinion of PT’s and PTM’s

Board of Directors on Offers

Request registration from CMVM

Delivery of Offer documents to PT/PTM

Notification to Competition Authority

Preliminary announcement

6

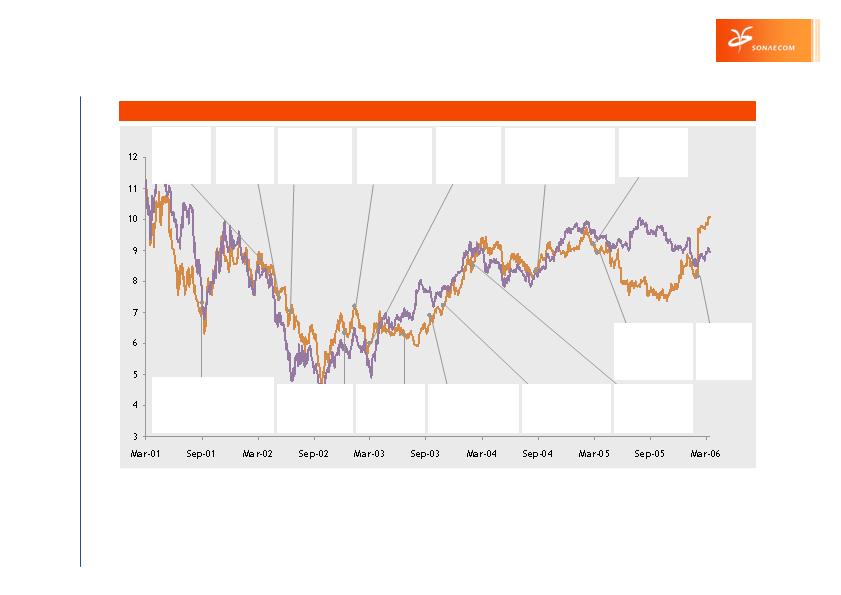

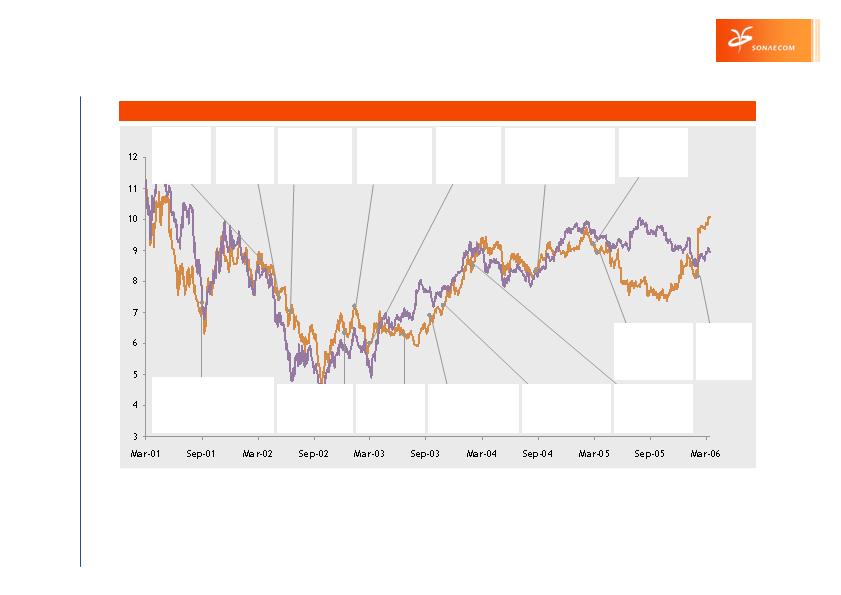

Historical share price performance of PT

17-Mar-05: Issue of

€750mm worth of 7 year

bonds and €500mm of 5

year bonds; a 20 year

tranche is withdrawn due

to difficult market

conditions

02-Mar-05: PT divests

newspaper and radio

group Lusomundo for

€300mm to Portuguese

sports entrepreneur Mr

Oliveira

26-Aug-04: Portugal Telecom and

Telefonica Moviles announce their

intention to enforce their

commitment in Latin American

markets, starting with a public tender

offer for the outstanding stakes in

Vivo’s subsidiaries

05-Feb-04: Sonaecom

suspends offering

broadband services as a

response to Portugal

Telecom’s alleged abuse of

dominant market position

31-Oct-03: Portugal Telecom

is one of the first European

operators to announce a fully

integrated telecommunication

package comprising fixed,

mobile and cable services

17-Sep-03: Share price rises

4.6% in one day after Portugal

Telecom publishes better-than-

expected half year results and

announces a substantial

increase in dividends

24-Jun-03: Dividend

target raised by 10% to

€0.22 giving Portugal

Telecom the highest

dividend yield among

European incumbents

07-Mar-03: Year

2002 results beat

market expectations

with strongly

improved profits

despite declining

revenues

17-Jan-03: Brasilcel, the

Brazilian joint venture of

Portugal Telecom and

Telefonica Moviles,

acquires TCO and

increases its market

share to above 50%

21-Jun-02: Portugal

Telecom announces a

60% increase in dividends

and high profit growth

rates leading to a sharp

increase of the share

price

May-02: Miguel

Horta e Costa

becomes new CEO

after the company

separated the

posts of CEO and

chairman

17-Mar-02: Low

profits due to

acquisition costs

and exchange rate

losses are in line

with market

expectations

05-Sep-01: Portugal Telecom withdraws

its offer to acquire the remaining 58% of

shares in its Brazilian subsidiary Telesp

Celular through a share swap after its own

share price drops below the minimum

level initially established in the public

offer

12-Dec-02: Portugal

Telecom acquires the

fixed-line telephone

network from the

Portuguese government

for €325mm

06-Feb-06:

Sonaecom makes

an unsolicited

public offer to

acquire all shares

of Portugal

Telecom

Source: Company information and Datastream as of March 17, 2006

1 Peers index is un-weighted and include the following companies Swisscom, Deutsche Telekom, France Telecom, Telecom Italia, OTE, Telefonica and Telenor

Peers un-weighted index1

Portugal Telecom

7

Share price performance – last five years (rebased to PT)

Source: Company information and Datastream as of March 17, 2006

1 Announcement occurred on February 6, 2006 (after closing of market)

2 Share price as of March 17, 2006

3 Last closing price prior to the takeover announcement

Share price analysis

8

Share price performance (rebased to 100)—since announcement

Summary of market data—as of March 17, 2006

PT defence announcement

(March 7, 2006)

PSI-20

PTMulti-

media

Portugal

Telecom

Sonaecom

Sonae

SGPS

Portugal

Telecom

PT

Multimedia

Sonae SGPS

Sonaecom

Closing share price one day

before announcement (€)

1

8.2

9.6

1.2

3.5

Reaction on offer

day

18.5%

2.9%

3.4%

3.4%

Current c

losing share price (€)

2

10.1

10.4

1.4

3.9

% of 52 weeks high

99

.8 %

98.3 %

99.3 %

89.5 %

Performance since 06/02/2006

3

23.0 %

8.3 %

14.4 %

11.6 %

Maximum

on day

(€)

10.1

10.5

1.4

4.0

Minimum

on day

(€)

10.1

10.4

1.3

3.9

Number of shares traded (

000)

3,650

127

7,921

476

% of 3 mont

hs average

46.6 %

43.8 %

52.4 %

52.6 %

Market cap (€mm)

11,735

3,221

2,700

891

Source: Datastream (trading prices for the 6 months prior to announcement date)

1 Adjusted average (excluding maximums and minimums)

Premium

of 20.9%

Premium

of 25.8%

Weighted average price

last 6 months

Offer price (including dividend)

Offer price (excluding dividend)

1 Including announced dividend of €0.385/share, announced prior to the announcement of the offer

2 As of February 6, 2006

9.6%

Premium to offer price

8.67

1

(€)

Adjusted average

YE 06

9.9

Buy

05

-

Oct

-

07

BCP

YE 06

8.2

Hold

05

-

Oct

-

11

Bernstein

YE 06

8.6

Buy

05

-

Oct

-

13

Santander

YE 06

7.6

Hold

05

-

Oct

-

28

Credit Suisse

/A

N

8.7

Hold

05

-

Nov

-

02

Morgan Stanley

N/A

9.8

Buy

05

-

Nov

-

22

Dresdner

YE 05

7.4

Hold

05

-

Nov

-

24

Societé Générale

YE 06

8.9

Buy

05

-

Dec

-

05

JPMorgan

N/A

8.2

Hold

05

-

Dec

-

05

UBS

YE 06

8.4

Hold

05

-

Dec

-

05

Deutsche Bank

N/A

8.2

Hold

05

-

Dec

-

12

WestLB

N/A

9.2

old

H

05

-

Dec

-

12

BNP Paribas

YE 06

8.2

Hold

05

-

Dec

-

15

BPI

YE 05

7.9

Hold

05

-

Dec

-

19

ABN Amro

N/A

8.8

Buy

05

-

Dec

-

27

Espírito Santo

YE 06

10.5

Buy

06

-

Jan

-

12

Citigroup

YE 06

9.5

Buy

06

-

Jan

-

20

ING

date

Target

(€)

Target price

Recommendation

Date

Broker report

33.9%

28.7%

7.38

announcement

Minimum price of 6 months prior to

11.4%

7.1%

8.87

announcement

Maximum price of 6 months prior to

20.3%

15.6%

8.22

announcement

Weighted average of 3 months prior to

25.8%

20.9%

7.86

announcement

Weighted average of 6 months prior to

20.8%

16.1%

8.18

²

Closing price on day prior to announcement

¹

premium

Adjusted implied

premium

Implied

share (€)

Price per

Source: Broker’s reports and JCF as of February 2006

1 Adjusted average (excluding maximums and minimums) of the trading multiples of the following

comparables: Telefónica, Deutsche Telekom, France Telecom, Telecom Itália, Swisscom,

Telenor, Belgacom and OTE (February 2006). PT multiples were calculated based on brokers

consensus

2 Implied multiples based on offer price (consolidated values for PT and including the proposed

gross dividend of €0.385/share, announced prior to the announcement of the offer)

Premium analysis to brokers price targets

Portugal

Telecom

Premium analysis to trading multiples

Premium analysis to trading prices (€/share)

9

Offer premium analysis

2005E

2006E

2007E

FV/EBITDA

Average of comparables¹

5.7x

5.2x

4.8x

Portugal Telecom

²

6.5x

6.4x

6.1x

Premium

14.0%

23.1%

26.3%

P/E

Average of comparables¹

13.4x

12.6x

11.0x

Portugal Telecom²

19.1x

15.9x

13.7

x

Premium

42.5%

26.2%

17.1%

Brokers’ reaction to the Offer

Brokers’ comments

“There is a possibility of a counter bid, although a Portuguese takeover

would be preferred by the authorities... We believe that Sonae is

financially, not politically, motivated.”

February 7, 2006

UBS

“We are happy that like us, [Sonae] can see value in the current PT share

price. We believe that Sonae’s bid is likely to be supportive to the share

price in the near-term”

February 7, 2006

Citigroup

“Sonae’s unexpected [bid] ... appears politically acceptable. We expect

that it is already financed. Existing PT shareholders may force the price up

a little, but we see a good chance of Sonae achieving majority control ...

The bid appears to have been carefully considered and assembled, and the

timing appears clever ... By remaining independent of other telcos, the co-

operation between Telefonica and Sonae-Owned PT could continue”

February 7, 2006

DKW

“Goldman Sachs refers that the offer price seems high, since PT was trading

at lower prices before the tender offer. Goldman indicates three potential

outcomes for the transaction (1) Telefonica launches a competing bid at

€10 per share, with the main motivation of consolidating 100% of Vivo and

MediTelecom (2) Sonae acquires PT, with Sonae being forced to divest some

assets, keeping the fixed line and the mobile businesses and selling Novis,

Optimus and PTM (3) LBO of PT”

February 8, 2006

Goldman Sachs – (translation from Portuguese Jornal de Negocios news

article)

“In case Sonaecom wins ... there’s the possibility that TMN and Optimus

may be merged ... we see this [as] acceptable given that there would be

other ways to foster even further competition in the market: Setting price-

caps, cutting interconnection rates and introducing MVNOs.”

February 13, 2006

BPI

“From a valuation standpoint this offer, slightly below our valuation, makes

sense for Sonae and points to a long-term interest in the telecoms sector ...

We [think] that this move makes sense for Sonae.”

February 7, 2006

Bear Stearns

Market analysts have reacted positively to the announcement of the transaction, highlighting

the offer price and the strong industrial rationale/proposition

10

Brokers’ reaction to PT’s defence statement

11

Brokers’ reaction

“Key takeout: PT is now a faith investment in whether investors support PT

management or take Soneacom's cash. PT management are very good at

hitting “revised guidance", but for example, the company only just

squeezed into its TMN guidance range of -5% to -10% EBITDA in 2005

(delivered -9.8%) when this was only set on June 1!”

March 7, 2006

Deutsche Bank

“PT's reaction was expected, but management team commits towards a

strong shareholder remuneration policy and an increase in financial

leverage, possibly fending-off any attempt for a hostile offer; we wonder

from where the claimed savings of opex and capex gains worth some

Eur250mn/year come from, as they had not seen any previous reference to

it; as for PT's new 2006-08 targets, we are generally more conservative,

assuming a cumulative EBITDA-Capex of some Eur4bn and EBITDA roughly

flat in the same period; the difference to PT's estimates relates to the

company's expected opex and capex/wc savings of Eur250mn/year”

March 7, 2006

BPI

Market analysts have focussed their reaction on PT’s defence proposition, referring to the

difficulties of delivering PT’s proposed growth and value targets

“ BNP Paribas considers that the offer launched by Sonaecom could be

approved by the government in order to keep the Portuguese

telecommunications company owned by a Portuguese shareholder. The

results presented by PT led to a cut in the price target from the previous

€10.6 to €10.3, maintained the neutral recommendation. The main reason

for the cut in the price target was the disclosed value of the unfunded

pension liabilities higher that what was expected”

March 7, 2006

BNP Paribas – (translation from Portuguese Jornal de Negocios news

article)

“ Lehman Brothers cut PT’s price target to €7.5 from €7.9. The research

house assumes that there is a regulatory risk in the merger between

Optimus and TMN that could be the strongest barrier to the takeover

launched by Sonaecom.

Neverthless, the cut in the price target was due to the weak results

presented by PT and the not so positive expected trend for PT’s future.”

March 7, 2006

Lehman Brothers – (translation from Portuguese Jornal de Negocios news

article)