Exhibit (a)(5)(i)

* * * *

This communication does not constitute an offer or invitation to purchase any securities or a solicitation of an offer to buy any securities, pursuant to the proposed offer (the “Offer”) for the shares of Portugal Telecom, SGPS, S.A. (“PT”), or otherwise. The Offer will be made solely by an offer document containing and setting out the terms and conditions of the Offer (the “Offer Document”) and the letter of transmittal and form of acceptance (the “Acceptance Forms”), which will contain details of how the Offer may be accepted. In the United States, Sonae, SGPS, S.A. (“Sonae”), and Sonaecom, SGPS, S.A. (“Sonaecom”), will be filing a Tender Offer Statement containing the Offer Document, the Acceptance Forms and other related documentation with the US Securities and Exchange Commission (the “SEC���) on Schedule TO (the “Tender Offer Statement”) and PT is expected to file a Solicitation/ Recommendation Statement on Schedule 14D-9 (the “Solicitation/Recommendation Statement”) with the SEC after the Offer Document is made available to PT shareholders. Free copies of the Schedule TO, the Schedule 14D-9 and the other related documents to be filed by Sonae or Sonaecom and PT in connection with the Offer will be available from the date the Offer Document is made available to PT shareholders on the SEC’s website at http://www.sec.gov. The Offer Document and the Acceptance Forms will be made available by Sonaecom or its duly designated agent to all PT shareholders at no charge to them. PT shareholders are strongly advised to read the Offer Document and the Acceptance Forms, and any other relevant documents filed with the SEC, as well as amendments and supplements to those documents because they will contain important information. PT shareholders in the United States are also advised to read the Tender Offer Statement and the Solicitation/Recommendation Statement because they will contain important information.

Unless otherwise determined by Sonae and/or Sonaecom and permitted by applicable law and regulation, the Offer will not be made, directly or indirectly, in or into, or by use of the mails of, or by any other means or instrumentality (including, without limitation, telephonically or electronically) of interstate or foreign commerce of, or of any facility of a national securities exchange of Canada, nor will it be made in or into Australia or Japan and the Offer will not be capable of acceptance by any such use, means, instrumentality or facilities or from within Australia, Canada or Japan. Accordingly, unless otherwise determined by Sonae and/or Sonaecom and permitted by applicable law and regulation, neither copies of this announcement nor any other documents relating to the Offer are being, or may be, mailed or otherwise forwarded, distributed or sent in or into Australia, Canada or Japan and persons receiving such documents (including custodians, nominees and trustees) must not distribute or send them in, into or from such jurisdictions.

Notwithstanding the foregoing, Sonae and/or Sonaecom retains the right to permit the Offer to be accepted and any sale of securities pursuant to the Offer to be completed if, in its sole discretion, it is satisfied that the transaction in question can be undertaken in compliance with applicable law and regulation. The availability of the Offer to persons not resident in Portugal or the United States may be affected by the laws of the relevant jurisdiction. Persons who are not resident in Portugal or the United States should inform themselves about and observe any applicable requirements.

The Offer will be made by Sonae and/or Sonaecom and (outside the United States) by Banco Santander de Negócios Portugal, S.A., on its or their behalf.

* * * *

MAY 2006

1

Disclaimer

This presentation is provided for information purposes only and does not constitute, nor must it be interpreted as, a

solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction. Any

decision to buy or sell securities is the exclusive responsibility of the user. The presentation contains some

statements which constitute forward-looking statements which are based on the beliefs and assumptions of our

management and on information available to management at the time such statements were made.

These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to

predict. Further, certain forward-looking statements are based upon assumptions as to future events that may not

prove to be accurate. Therefore, actual developments and results may differ materially from the information,

opinions or intentions reflected in this presentation.

Forward-looking statements speak only as of the date they are made, and Sonaecom does not undertake any

obligation to publicly update them in light of new information or future developments or to provide reasons why

actual results may differ. Recipients are invited to consult the documentation and public information filed by

Sonaecom with the Portuguese Securities Exchange Commission (CMVM).

DISCLAIMER

2

INDEX

1. ABOUT SONAECOM

2. BUSINESS UNITS – 1Q06 HIGHLIGHTS

3. CONSOLIDATED 1Q06 RESULTS

4. CHALLENGES GOING FORWARD

5. CORPORATE DEVELOPMENT

6. MORE ON SONAECOM

3

ABOUT

SONAECOM

ABOUT SONAECOM

MISSION STATEMENT

Sonaecom is an entrepreneurial growth company whose ambition is to be the best Portuguese

communication services provider and the company of choice for exceptional people to work and

discover their full potential.

Sonaecom relentlessly pursues the creation of innovative products, services and solutions that

fulfil the needs of its markets and generate superior economic value

5

ABOUT SONAECOM

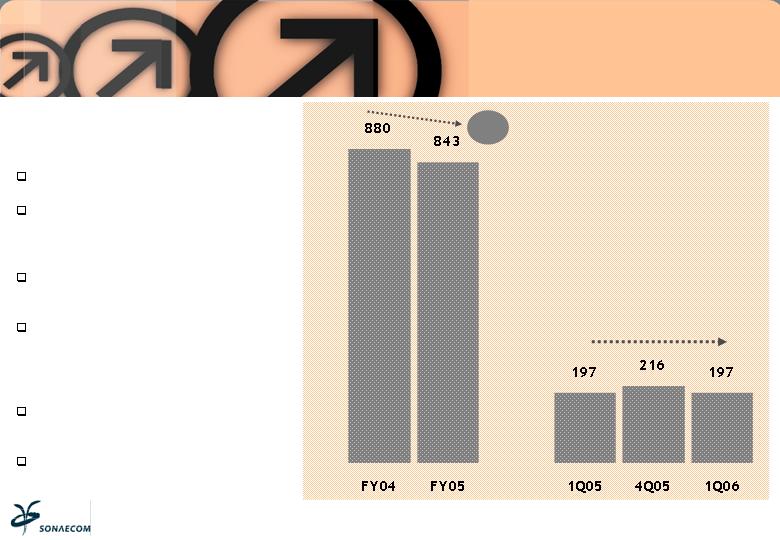

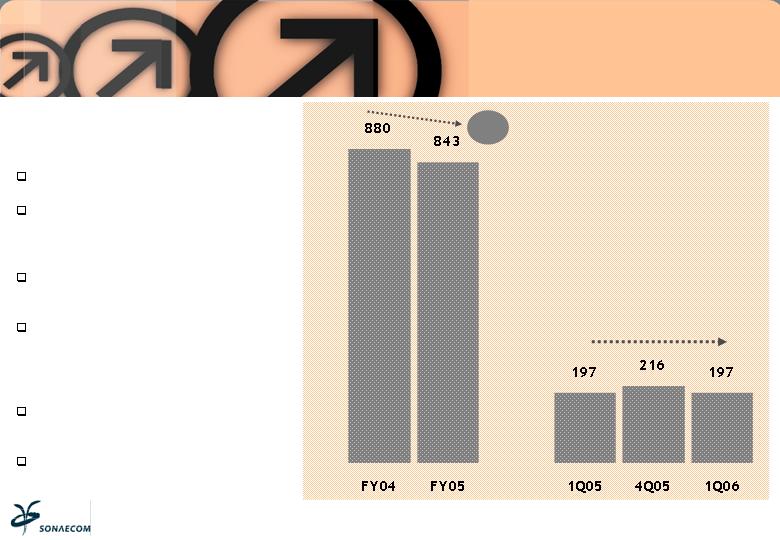

FINANCIAL HIGHLIGHTS

2005

1Q05

€ Millions

Turnover

EBITDA

Margin

Net Profit (1)

CAPEX

EBITDA-CAPEX

(1) Net Profit after Minority Interest

843

157

19%

2

197

44

22%

4.6

35

2.6

1Q06 RESULTS BETTER THAN EXPECTED, DUE TO BENEFITS OF OUR GROWTH ORIENTED INVESTMENT STRATEGY

1Q06

197

39

20%

0.1

3.0

y.o.y.

0.0%

-11.3%

-2.5pp

-96.8%

14.2%

Free Cash Flow

12

-17.8

-19.5

-9.6%

122

41.4

36.1

-12.9%

6

ABOUT SONAECOM

OPERATIONAL HIGHLIGHTS

POSITIVE OPERATIONAL DEVELOPMENTS AT THE TELECOMS BUSINESSES IN CUSTOMER BASE, CUSTOMER

REVENUES AND LEADING INDICATORS IN 1Q06

1Q05

€ Millions

Customers (EOP) (000)

Data as % Service Rev.

Minutes of Use

ARPU (euros)

Total Services (EOP)

Direct Services (EOP)

2,135

9.9%

108.7

22.2

Direct access as % Customer Rev.

Optimus

Sonaecom Fixed

268,840

11,343

27.3%

1Q06

2,383

13.4%

113.7

19.3

309,735

154,262

56.9%

2005

2,353

11.2%

114.4

21.9

93,861

271,463

48.5%

y.o.y.

11.6%

3.5pp

4.6%

-12.9%

29.6pp

15.2%

1,260%

7

ABOUT SONAECOM

OPERATING MILESTONES

Beginning 2005: implementation of growth investment strategy, through innovation and

redefinition of markets and business models;

Success of strategy delivering growth: visible in main operational indicators and

quarterly results.

INVESTMENT

STRATEGY

TRANSFORMATION

OF SONAECOM

FIXED

UMTS/HSDPA

DEPLOYMENT

3G NETWORK

RENEGOTIATION

INTEGRATING

NETWORK

Sonaecom Fixed Strategy: refocus to a direct access business, through expansion of

ADSL broadband services over ULL;

1Q06 results reflect implemented strategy: direct access business with 75% of the ULL

market growth; 50% of total Broadband customer net additions in coverage areas.

UMTS network: 50% of the population coverage by end 1Q06; expected 80% of

population coverage by the end of 2006;

HSDPA network: Optimus - first Operator with commercially available HSDPA network;

increase of UMTS bandwidth up to 1.8 Mbps;; more than 40% of population coverage by

end 1Q06.

Optimus 1Q06: completion of RFP process to improve prices and conditions of supply of

UMTS/HSDPA network elements;

Huawei, Ericsson and Motorola as the main backbone and access network providers;

CAPEX savings of up to 100 million euros in the next 2 years.

Sonaecom 1Q06: extension of strategy of telecom integration in the pursuit of

operating efficiencies and cost synergies;

Full integration of both Optimus and Sonaecom Fixed technical teams, being managed

under an unified organizational team structure.

8

BUSINESS UNITS

1Q06 HIGHLIGHTS

BUSINESS UNITS

OPTIMUS-STRATEGY

STRATEGY AIMED AT INCREASE REVENUE PER CLIENT, MARKET SHARE GROWTH AND EXTENSION OF

ADDRESSABLE MARKET, BASED ON FOUR KEY CORNERSTONES`

MIGRATION TO 3G

SEGMENTATION

INNOVATION AND

LAUNCH OF NEW

DATA SERVICES

FIXED-MOBILE

CONVERGENCE

Decision Leadership in

3G handsets and

multimedia services

Considerable

extension of the UMTS

network, reaching

more than 50%

population coverage

and deployment of

HSDPA technology

(First operator in

Portugal)

Reformulation of all

tariff plans

Launch of

revolutionary tariffs,

such as Chat

Launch of Rede4, the

discount mobile

service with an

“internet” cost

structure

Launch of innovative

data services:

Push E-mail

Push-to-talk

Instant Messaging

Launch of Kanguru, a

portable broadband

internet offer over

UMTS technology

Launch of Kanguru

Xpress, a broadband

internet offer over

HSDPA technology

Launch of Optimus

Home, pioneer world

hybrid product, with

fixed dial numbers,

fixed network costs

and GSM access.

10

BUSINESS UNITS

OPTIMUS-PERFORMANCE

INVESTMENT STRATEGY AND NEW PRODUCTS AND SERVICES LAUNCHED HAVE DELIVERED GROWTH IN 1Q06

COMPARED TO 1Q05

Customer base increased significantly:

Customers grew 11.6%;

Net Additions of 30.2 thousand;

ARPU decrease explained by MTR’s impact and price cuts in Roaming in;

New products (Home, Kanguru, Rede4) the main drivers of Customer growth.

Data usage growth reflected investment in GPRS ad 3G data:

Data revenues represented 13.4% of service Revenues;

Approximately 9% of customer base was 3G enabled.

Traffic growth:

Mobile traffic 15.8% higher and MOU increasing 4.6%;

Continued reduction of incoming fixed traffic.

Growth initiatives continued to be implemented:

Optimus being first operator in Europe offering Push email in PDA windows mobile handsets.

11

BUSINESS UNITS

OPTIMUS-FINANCIALS

SUCCESS OF GROWTH STRATEGY VISIBLE IN 1Q06 RESULTS

2005

1Q05

€ Millions

Turnover

EBITDA

Margin

Net Profit

EBITDA -CAPEX

627.4

167.1

26.6%

45.1

146.8

43.5

29.6%

11.5

79.9

26.8

1Q06

141.2

44.4

31.4%

15.8

18.1

Free Cash Flow

75.5

9.5

2.2

CAPEX

87.2

16.7

26.3

2004

659.6

190.2

28.8%

50.5

54.5

103.6

86.6

12

BUSINESS UNITS

SONAECOM FIXED-STRATEGY

STRATEGY AIMED AT BOTH TRANSFORMING THE BUSINESS TO A DIRECT ACCESS MODEL AND AT GROWING THE

WHOLESALE BUSINESS, BASED ON FOUR KEY CORNERSTONES

DIRECT ACCESS

FOCUS ON SME AND

CORPORATE

SEGMENTS

WHOLESALE

GROWTH

INNOVATION ON

BROADBAND

Increase of the local

access capillarity

through local loop

unbundling;

Continuous

investment in superior

technology (VOIP,

GiGabit Ethernet,

ADSL 2+, IP);

Increase of direct

access customers

based on direct voice

and ADSL services

Focus on acquiring

national and

international clients.

Launch of the 16MG

ADSL offer for bundle

voice and internet

Commercial pilot test

of Triple Play bundled

offer of voice, internet

and TV over IP, at the

end of November

2005. Commercial

launch planned for

2H06.

Development of new

services and

functionalities for SME

and corporate

segments:

Web conference

File sharing

13

BUSINESS UNITS

SONAECOM FIXED-PERFORMANCE

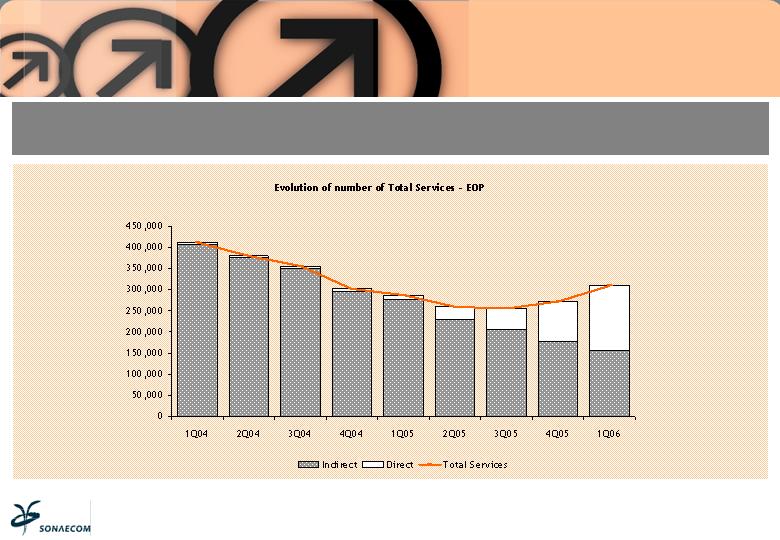

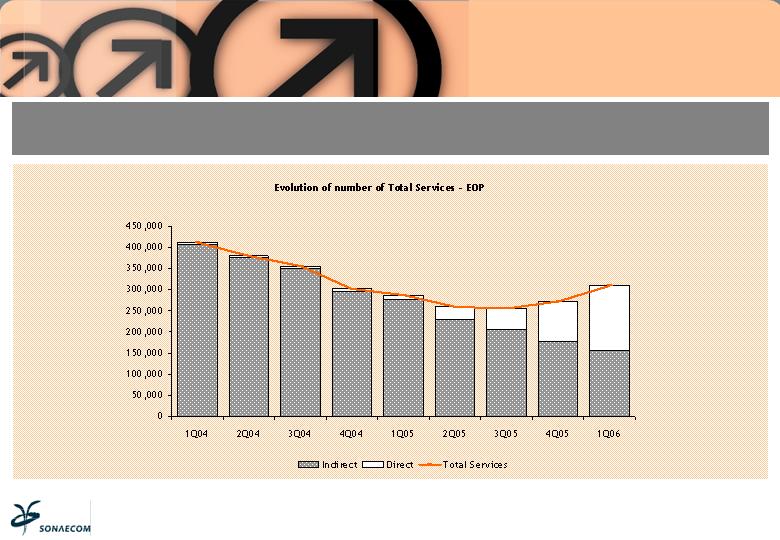

REAL PROGRESS WAS MADE DURING 1Q06 IN THE TRANSFORMATION OF SONAECOM FIXED TO A DIRECT ACCESS BUSINESS

Customer Base increased:

Total services reached 309 thousand, increasing 15%;

Acquisition of direct access services more than compensated decline of indirect access customers;

Total Direct Services representing almost 50% of Customer base;

… and accounted for 57% of Customer Revenues.

Traffic growth:

Traffic increased 35%;

wholesale traffic growth by 62.1%;

increase of Direct voice traffic by 168%, partially compensating decrease of indirect voice traffic.

Growth initiatives in place:

Continued with pilot test of triple play offer, developing commercial and communication strategy;

All essential content negotiations, including PT’s controlled content, successfully completed

14

BUSINESS UNITS

SONAECOM FIXED-FINANCIALS

INVESTMENT IN ADSL2+ BROADBAND SERVICES OVER ULL, BEGAN TO SHOW TANGIBLE RESULTS, STIMULATED

BY A GOOD PRODUCT MIX, IMPROVED PRICING AND IMPROVED PROCESSES AND SYSTEMS

2005

1Q05

€ Millions

Turnover

EBITDA

Margin

Net Profit

EBITDA-CAPEX

158.4

-14.7

-9.2%

-34.5

36.6

-1.3

-3.5%

-4.3

-41.6

-5.8

1Q06

44.5

-4.5

-10.1%

-8.8

-13.2

Free Cash Flow

-34.7

-8.8

-18.7

CAPEX

26.9

4.5

8.7

2004

150.1

3.7

2.5%

-14.5

-6

26.2

-22.5

15

BUSINESS UNITS

SONAECOM FIXED-SERVICES

SONAECOM FIXED SAW A SIGNIFICANT INCREASE IN ITS DIRECT ACCESS BUSINESS, WHICH NOW ACCOUNTS FOR

APPROXIMATELY 50% OF TOTAL SERVICES

16

BUSINESS UNITS

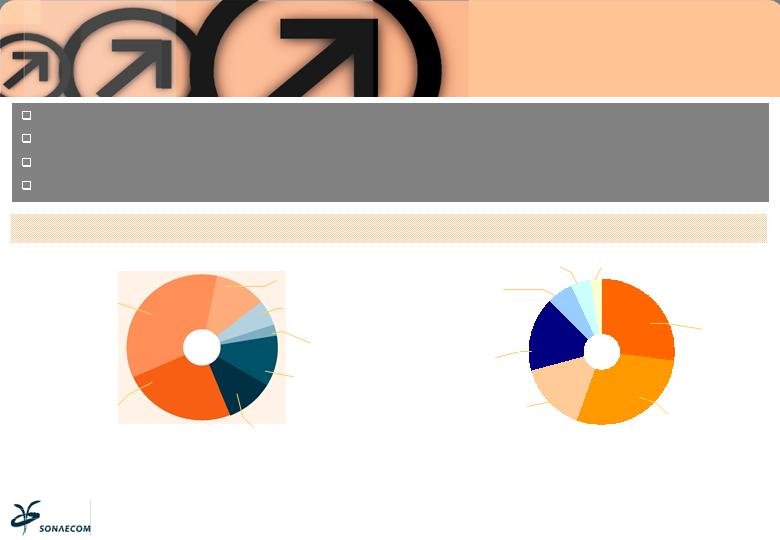

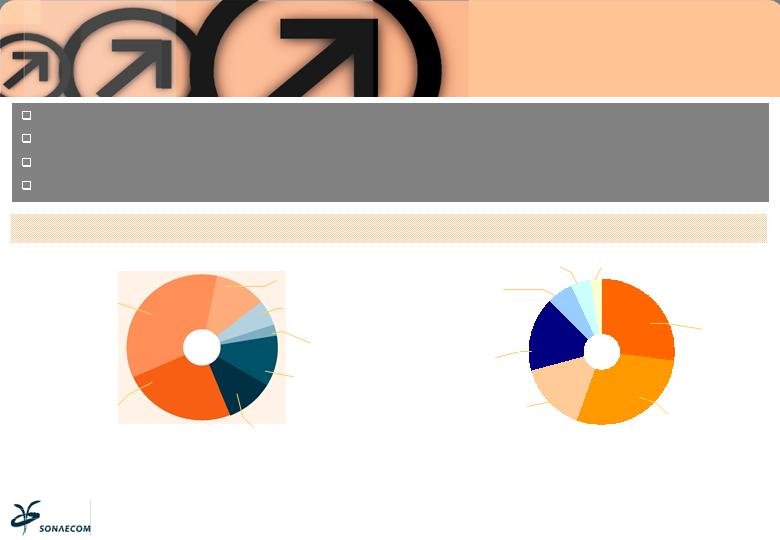

PÚBLICO-HIGHLIGHTS

Third daily newspaper in paid circulation;

Pioneer in the development of Associated Products;

Strategic content provider;

Protection against increased sector concentration.

MARKET SHARE OF PAID CIRCULATION JAN/DEC 05

MARKET SHARE OF ADVERTISING 1Q06

SOURCE: APCT latest available data

Jornal de Notícias

26.5%

Correio da Manhã

31.7%

Público

13.6%

Jornal de Negócios

2%

Diário Económico

3.3%

24 Horas

13.6%

Diário de Notícias

9.3%

Jornal de Notícias

26%

Correio da Manhã

26.9%

Público

15.6%

Jornal de Negócios

3.4%

Diário Económico

6.4%

24 Horas

4.5%

Diário de Notícias

16.3%

SOURCE: Marktest/MediaMonitor

17

BUSINESS UNITS

PÚBLICO-PERFORMANCE

PÚBLICO HAD ANOTHER CHALLENGING 1Q06 AND FACED PRESSURE ON ALL 3 OF ITS REVENUE LINES

Average Paid circulation decreased by 8.1% (average of 44,256 units);

Advertising sales were down 11.6%;

Market share was not impacted by circulation performance, reaching 15.7%;

Associated Products sales were down 22%;

Strategy has been established to address difficulties:

Redesign the newspaper introducing more colour;

Seeking new sales and distribution channels;

Improving POS quality and control;

Step-up Advertising commercial activity by strengthening relationship with top brands and establishing

partnerships.

18

BUSINESS UNITS

PÚBLICO-FINANCIALS

EFFORTS WILL CONTINUE TO TURN-AROUND THE CURRENT PERFORMANCE AND ACHIEVE AN ACCEPTABLE LEVEL OF

PROFITABILITY

2005

1Q05

€ Millions

Turnover

EBITDA

Margin

Net Profit

EBITDA-CAPEX

44.1

-1.7

-3.9%

-3.2

10

-0.4

-4.3%

-0.5

-2.6

-0.5

1Q06

8.7

-1.9

-22%

-2.2

-2.0

Free Cash Flow

-3.9

-2.5

-2.2

CAPEX

0.9

0.1

0.1

2004

55.5

2.1

3.7%

0.0

1.1

0.8

1.3

19

BUSINESS UNITS

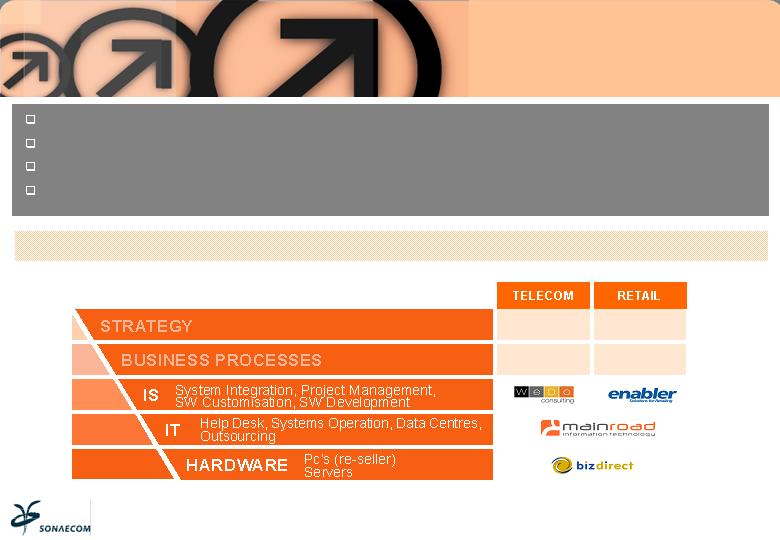

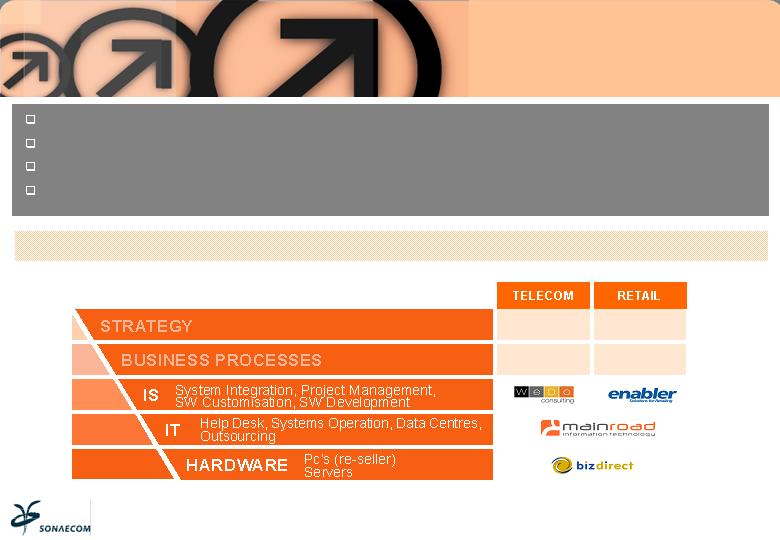

SSI-HIGHLIGHTS

Sixth largest IT/IS group in Portugal;

International presence through Enabler (Retail IS) and Wedo (Telco IS);

Major accounts in UK, Germany, Spain, Brazil, Italy and France;

Strong organic growth.

SOFTWARE AND SYSTEMS INTEGRATION UNITS AND TARGET MARKETS

20

BUSINESS UNITS

SSI-PERFORMANCE

SSI CONTINUED TO PROMOTE AND EXPLORE INTERNATIONAL GROWTH OPPORTUNITIES

Turnover increased by 10.4%;

Lower margins due to higher volume of Equipment sales (30% of Turnover) that generate lower margins;

EBITDA decreased by 35.6%, mainly explained by lower margins of Equipment sales and weaker contribution from

Enabler.

Despite Enabler’s weaker project base in 1Q06, it has acquired new customers during the quarter:

Tesco UK, Tesco Ireland;

Tesco Check Republic;

Gallery Lafayette;

Dubai duty Free;

…impacting 2Q06 results performance.

WeDo had a good quarter, with a Turnover increasing by 10% and EBITDA growing by 18%

21

BUSINESS UNITS

SSI-FINANCIALS

SSI HAD A POSITIVE 1Q06, ALTHOUGH EBITDA WAS LOWER THAN IN 1Q05 DUE TO WEAKER PERFORMANCE AT ENABLER

2004

2005

1Q05

€ Millions

Turnover

EBITDA

Margin

Net Profit

EBITDA-CAPEX

82.0

8.4

10.2%

4.0

86.0

9.5

11.1%

5.2

20.0

3.0

14.8%

1.9

6.2

8.8

2.8

1Q06

22.1

1.9

8.6%

1.1

1.7

Free Cash Flow

7.3

7.1

-1.8

-1.1

CAPEX

2.2

0.7

0.2

0.2

22

CONSOLIDATED

1Q06 RESULTS

CONSOLIDATED 1Q06 RESULTS

OVERVIEW

EXCELLENT OPERATIONAL PERFORMANCE, COMPARED TO LAST YEAR, DESPITE REGULATORY CONDITIONS

POSITIVE

EFFECTS

(compared to 1Q05)

NEGATIVE

EFFECTS

(compared to 1Q05)

Optimus Customer base growing;

Optimus Data Revenues with higher weight;

Continued growth of Optimus new services, in particular Optimus Home and Kanguru;

Customer Revenues growth at Optimus;

Sonaecom Fixed significant increase of direct access services;

Customer and Wholesale Revenues increase at Sonaecom Fixed;

Lower Mobile Termination Rates;

Lower Fixed incoming traffic;

Accelerated reduction of indirect access voice and narrowband internet;

Higher Network Costs, due to the 3G/HSDPA deployment;

Higher Servicing Costs associated with ULL double play activation process (customer

services; IT/IS);

Higher Marketing & Sales Costs (advertising; commissions).

24

Turnover similar to 1Q05, for the first

time since 2004

Optimus

Higher Customer Revenues (+4.8%):

performance of new products;

Lower Service Revenues (-3.5%): MTR

cuts, lower Roaming In.

Sonaecom Fixed

Higher Turnover (+21.5%): strong growth

in Operator Revenues (+30.6%) and in

Customer Revenues (+13.5%);

Positive performance of ULL direct access

business: direct access revenues

increased (+136.5%).

SSI

Turnover up 10.4%.

Público

Lower Turnover by 12.5%.

-4.2%

TURNOVER

(MILLION EUROS)

CONSOLIDATED 1Q06 RESULTS

TURNOVER

25

Total Operating Costs increased 3.2% on

1Q05, due to growth related costs

Outsourcing costs up 24.7%: growth of

Sonaecom Fixed ULL direct access

services requiring more customer

activation support services;

Marketing & Sales up 7.2%: aggressive

sales of Sonaecom Fixed direct broadband

double play offers;

Network costs up 1.6%: extension of 3G

network and number of central offices

unbundled (energy and rental).

Non-related growth costs decreased

compared to last year

COGS decreased 9.6%: expected one-off

discount from equipment suppliers;

Interconnection costs fell 9.6%: MTR’s

reduction;

Leased Lines decreased 2%: Optimization

of fixed network.

+2.1%

+3.2%

TOTAL OPEX

(MILLION EUROS)

CONSOLIDATED 1Q06 RESULTS

OPEX

26

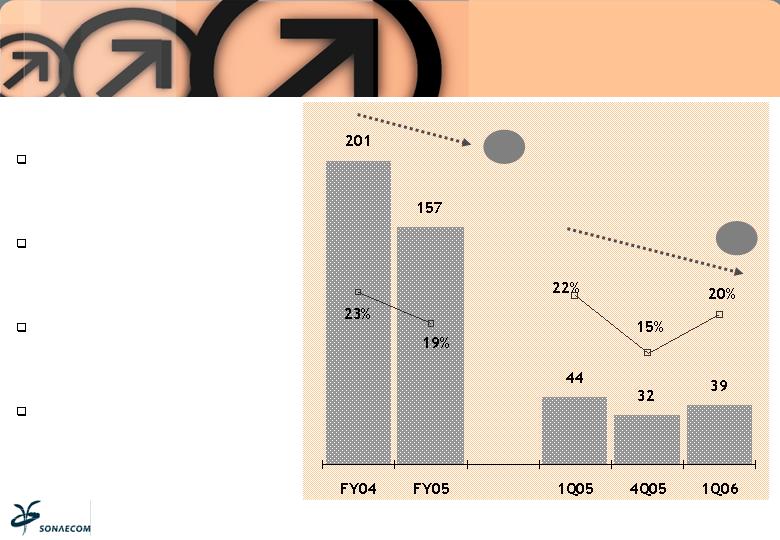

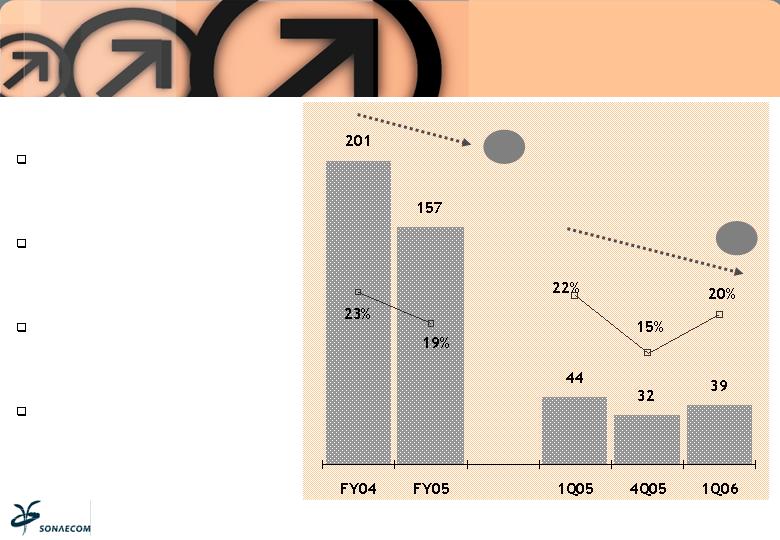

Consolidated EBITDA better than expected

Optimus

EBITDA up 2%: higher Customer Revenues

and lower Total OPEX and despite MTR

reductions;

Sonaecom Fixed

Negative EBITDA: higher investment in

customer acquisition and other ULL

related costs-

Público

Negative EBITDA: lower sales of three

revenue lines; lower margins of

Associated Products.

SSI

Lower EBITDA by 35.6%: lower Service

Revenues at Enabler.

-11.3%

-21.8%

EBITDA & EBITDA MARGIN

(MILLION EUROS)

CONSOLIDATED 1Q06 RESULTS

EBITDA

27

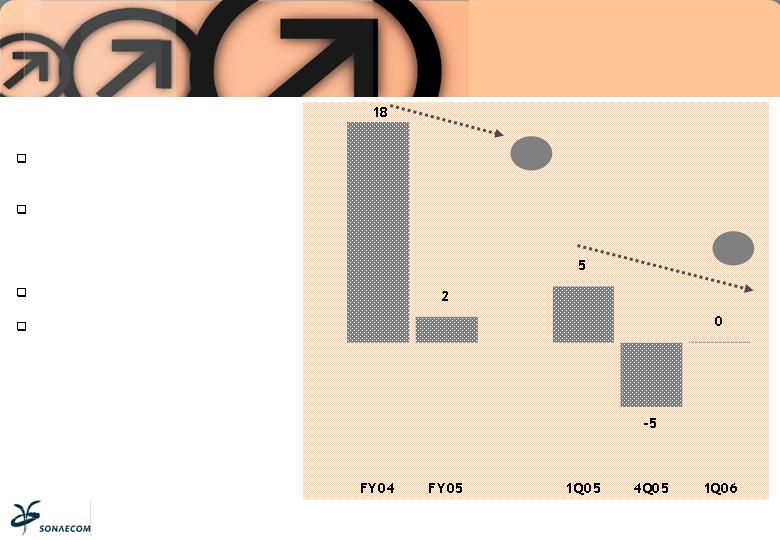

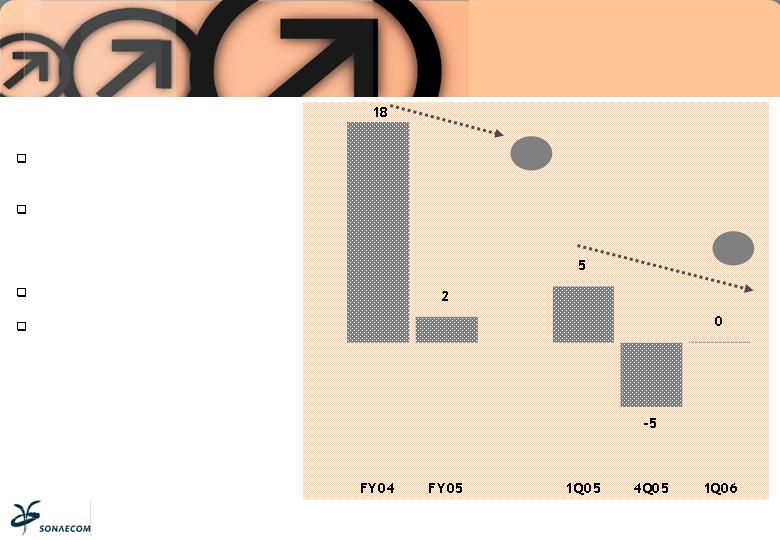

NET PROFIT AFTER MINORITIES

(MILLION EUROS)

Net Results Group share positive 0.1

million euros

Depreciation & Amortization up 2.6%:

extension of 3G network;

Net Financial charges increased 0.7

million euros: higher Gross debt due to

150 million euros bond issue; increase of

Euribor rates by 25 basis points;

Tax line with benefit of 2.2 million euros

Minority Interest impact: since

December05, Consolidated Results

include 100% of Sonaecom Fixed and

69.2% of Optimus (versus 56.7% and 49%)

with Roll-up of FT.

-96.8%

-88.8%

CONSOLIDATED 1Q06 RESULTS

NET PROFIT

28

FREE CASH FLOW

(MILLION EUROS)

CAPEX lower by 12.9% vs 1Q05 and

representing 18.3% Turnover

Consistent with strategy of investment in

UMTS/HSDPA (41% of CAPEX) and in ULL

broadband business (16% of CAPEX);

1Q05 CAPEX includes financial investment

of acquisition of minority position by 18.8

million euros.

FCF down 9.6% vs 1Q05

Higher investment in working capital

(+6.6 million euros): increased stock

levels at Optimus; higher payments to

trade creditors at telecom businesses.

EBITDA – CAPEX 14% up on 1Q05

-80.6%

-9.6%

CONSOLIDATED 1Q06 RESULTS

CAPEX & FCF

29

NET DEBT & DEBT:EQUITY

(MILLION EUROS)

INTEREST

COVER

NET DEBT:

EBITDA

12.9X

12.4X

1.3X

1.6X

16.6X

8.9X

10.0X

1.8X

1.6X

1.4X

Stable Capital Structure

Consolidated Gross Debt stood at 457

million euros (+149 million euros): 150

million euros bond issue in June 2005;

Liquidity increased by 156 million euros

(+156 million euros): bond issue proceeds

invested as treasury application and FCF

performance at Optimus and SSI;

Leverage increased: Net Debt to

annualized EBITDA at 1.8x;

Gearing remained at 40%

Interest cover improved vs 4Q05

-3.9%

-2.8%

256

246

275

247

267

39.8%

39.9%

41.2%

39.9%

41.2%

FY04

FY05

1Q05

4Q05

1Q06

CONSOLIDATED 1Q06 RESULTS

CAPITAL STRUCTURE

30

CHALLENGES

GOING FORWARD

GOING FORWARD

GUIDANCE 2006

Build on new services launched;

Promote enhanced 3G services (HSDPA).

OPTIMUS

Turnover: marginal decrease

EBITDA: marginal decrease

EBT:30% decrease

EBITDA – CAPEX: approximately 30% decrease

Continue to grow Direct Access broadband

business: double play and future triple play

offers

SONAECOM

FIXED

Assuming 215 thousand BB direct access services

Turnover: approximately 20% growth

EBITDA: marginal improvement in margin

EBT/CAPEX: Flat

Efforts to achieve acceptable level of

profitability

PÚBLICO

EBITDA: marginal improvement

Promote and explore international growth

opportunities

SSI

Turnover/EBITDA: 5%-10% growth

CONTINUE TO BUILD ON ESTABLISHED GROWTH STRATEGY FOR TELECOMS BUSINESSES

Benefit from Customer Revenues growth

both at Optimus and Sonaecom Fixed

SONAECOM

Turnover: Flat to marginal growth, despite MTR

reductions

EBITDA/CAPEX: Flat

EBT/FCF: Positive

32

CORPORATE

DEVELOPMENT

CORPORATE DEVELOPMENT

PUBLIC TENDER OFFER

WE REITERATE OUR STATED POSITION REGARDING OUR PUBLIC TENDER OFFER FOR PORTUGAL TELECOM

Offer of 9.5 euros per share plus dividend of 0.385 euros per share reflects a full and fair value.

Offer driven by estimated 2 billion euros of mobile synergies from the combination of TMN and Optimus’

operations, expected to generate OPEX and CAPEX savings.

Offer implies an EV/EBITDA (2005) of 7.5x, significant premium to comparable incumbent transactions (adjusted

for information released by PT in its FY05 accounts);

A WELL AND

BALANCED OFFER

THAT ADDRESSES THE

OBJECTIVES OF ALL

CONSTITUENTS

PT INVESTORS

COMPETITION

AUTHORITY AND

CONSUMERS

PORTUGUESE

STATE

EMPLOYEES

Proposes a full and fair all cash offer

Transforms overnight the competitive landscape of the wireline and

content markets, where PT currently has market shares of between

80% to 90%;

Offers to act as a strong Portuguese controlling shareholder in a

strategic national asset, providing a solution for the existing ‘golden

share

Offers long term employment opportunities and career development

through clear leadership and a focused growth strategy

34

SONAECOM’S STRATEGY FOR NEW SONAECOM/PT GROUP IS CLEAR AND BASED ON FIVE MAIN STRATEGIC PILLARS

Integration of Sonaecom Group’s businesses with PT;

Merger of Optimus and TMN;

Sale of one of the Fixed networks (copper or cable);

Launch of Triple Play;

Increase investment in technology and innovation.

Readjust portfolio based on control;

Negotiate with Telefonica;

Reallocate resources towards controlled assets (existing/new).

European mobile partnerships;

Preservation of independence;

Protection of brands;

Technological partnerships.

Committed majority shareholding with vision and necessary skills for

implementation and execution;

Sonae Group culture and corporate values;

Able to live with “Golden Share” or other mechanism to safeguard

strategic interests of the Portuguese State;

Intention to keep Sonaecom and PT (or merged entity) quoted on

Euronext Lisbon.

Board composition;

Quality and transparency of financial information;

Best practices (reporting, internal controls, managing conflicts, etc.);

Human resources.

Strengthen PT’s competitiveness within a

much more competitive Portuguese telecoms

market

Reorient PT’s international strategy into a

more cohesive portfolio of “controlled”

mobile investments

Implement a clear commercial, technological

and international partnership strategy

Establish strong and stable shareholder

leadership

Adopt “best practice” in Corporate

Governance

CORPORATE DEVELOPMENT

PUBLIC TENDER OFFER

35

MORE ON

SONAECOM

MORE ON SONAECOM

GROUP STRUCTURE

L

E

A

D

I

N

G

I

T

&

S

Y

S

T

E

M

S

I

N

T

E

G

R

A

T

O

R

S

T

E

L

C

O

M

O

B

I

L

E

#

3

M

O

B

I

L

E

O

P

E

R

A

T

O

R

T

E

L

C

O

F

I

X

E

D

#2 FIXED OPERATOR

INTERNET AND VOICE

M

E

D

I

A

LEADING REFERENCE

DAILY PAPER

S

O

N

A

E

S

G

P

S

F

R

E

E

F

L

O

A

T

F

R

A

N

C

E

T

E

L

E

C

O

M

2

3

.

7

%

S

O

N

A

E

C

O

M

6

9

.

2

4

%

(

1

)

1

0

0

%

1

0

0

%

1

0

0

%

(2)

S

S

I

(2) Minority Shareholders: EDP – 25.7%; Parpública-5.04%

(1) 65.2% of voting rights

(3) Software and Systems Integration

(3)

61.79%

14.51%

37

MORE ON SONAECOM

ORGANIZATION

T

O

T

A

L

S

O

N

A

E

C

O

M

G

R

O

U

P

S

O

N

A

E

C

O

M

C

O

R

P

O

R

A

T

E

C

E

N

T

R

E

2

6

S

H

A

R

E

D

S

E

R

V

I

C

E

S

B

a

c

k

O

f

f

i

c

e

C

o

r

p

o

r

a

t

e

S

e

r

v

i

c

e

s

M

i

d

d

l

e

w

a

r

e

T

E

L

E

C

O

M

S

M

O

B

I

L

E

F

I

X

E

D

P

Ú

B

L

I

C

O

3

5

4

S

S

I

1

7

0

2,165 (1)

(1) As at 30 March 2006

Senior Management

PCG

IR

PR

Legal

IA

532

263

790

38

MORE ON SONAECOM

EXECUTIVE COMMITTEE

SONAECOM EXECUTIVE TEAM

CEO

Mobile &

Fixed

CFO

Mobile

Group CEO

SSI

Media

CFO

M&A

Planning and

Control

Internal Audit

Accounting

Finance

Treasury

Investor

Relations

COO

CEO

Fixed/Mobile

Human

Resources

IT/IS

Technical

Internal

Communication

Mobile

Customer

Service

Paulo Azevedo

Luis Reis

Miguel Almeida

Chris Lawrie

Legal &

Regulation

Legal

Regulation

Public

Relations

Fiscal Planning

António Lobo

Xavier

COO Fixed

Pedro Carlos

COO SSI

COO Media

COO Miau

Cláudia Azevedo

Fixed

Media/SSI

39

MORE ON SONAECOM

BOARD & COMMITTEES

BOARD OF DIRECTORS

EXECUTIVE

NON-EXECUTIVE

AUDIT AND FINANCE

COMMITTEE

NOMINATION AND

REMUNERATION

COMMITTEE

NON-INDEPENDENT

INDEPENDENT

Belmiro de Azevedo

David Charles Hobley

Jean-François Pontal

Michel Marie Combes

Paulo Azevedo

Luis Filipe Reis

Christopher Lawrie

Miguel Almeida

Cláudia Azevedo

CHAIRMAN

DIRECTORS

x

x

x

x

x

x

x

x

x

x

David Bain

x

x

x

x

x

40

MORE ON SONAECOM

MOBILE SECTOR OVERVIEW

Source: Companies’ Report & Accounts

MARKET SHARE EVOLUTION - SUBSCRIBERS EOP

20.3%

20.3%

20.1%

19.7%

19.8%

19.9%

19.9%

20.0%

31.7%

32.3%

33.1%

33.6%

33.2%

33.5%

34.3%

35.0%

48.0%

47.4%

46.9%

46.7%

47.1%

46.6%

45.7%

45.1%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

41