MORGAN STANLEY TMT CONFERENCE

MANAGEMENT PRESENTATION

November 2006

1

SAFE HARBOUR

This presentation is provided for information purposes only and does not constitute, nor must it be interpreted as,

a solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction.

Any decision to buy or sell securities is the exclusive responsibility of the user. The presentation contains some

statements which constitute forward-looking statements which are based on the beliefs and assumptions of our

management and on information available to management at the time such statements were made.

These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to

predict. Further, certain forward-looking statements are based upon assumptions as to future events that may not

prove to be accurate. Therefore, actual developments and results may differ materially from the information,

opinions or intentions reflected in this presentation.

Forward-looking statements speak only as of the date they are made, and Sonaecom does not undertake any

obligation to publicly update them in light of new information or future developments or to provide reasons why

actual results may differ. Recipients are invited to consult the documentation and public information filed by

Sonaecom with the Portuguese Securities Exchange Commission (CMVM).

2

ÍNDICE

1

OVERVIEW OF SONAECOM’S 3Q06 RESULTS

3

HIGHLIGHTS OF 3Q06 RESULTS – FINANCIAL PERFORMANCE

Top-Line Growth:

Customer growth at Optimus and Sonaecom Fixed;

Customer Revenues up 6.5% vs 3Q05;

Service Revenues up 2.6% vs 3Q05.

Costs kept under control:

OPEX excluding COGS only 1% above 3Q05;

73.7% of Service Revenues compared to 74.9% in 3Q05;

Cost increases were growth led.

Improvement in Profitability:

EBITDA growth of 12.6%;

EBITDA – CAPEX growth of 47.6%;

FCF growth of 8.3%.

4

HIGHLIGHTS OF 3Q06 RESULTS – OTHER DEVELOPMENTS

EDP and Parpública Roll-up:

Share-for-share exchanges;

EDP received 58.3 million Sonaecom shares for 25.72% in Optimus;

Parpública received 11.4 million Sonaecom shares for 5.04% in

Optimus;

Enlarged share capital of 366.2 million shares;

New Market Cap. at €5.1/share of approximately €1.9bn.

Restructuring programme at Público:

Restructuring programme under implementation;

Actions to reduce fixed costs, improve productivity and redesign the

newspaper;

Restructuring costs with an impact of 2 million euros YTD;

Continued implementation during 4Q06 and 1Q07;

Benefits to be seen in 2007 results.

5

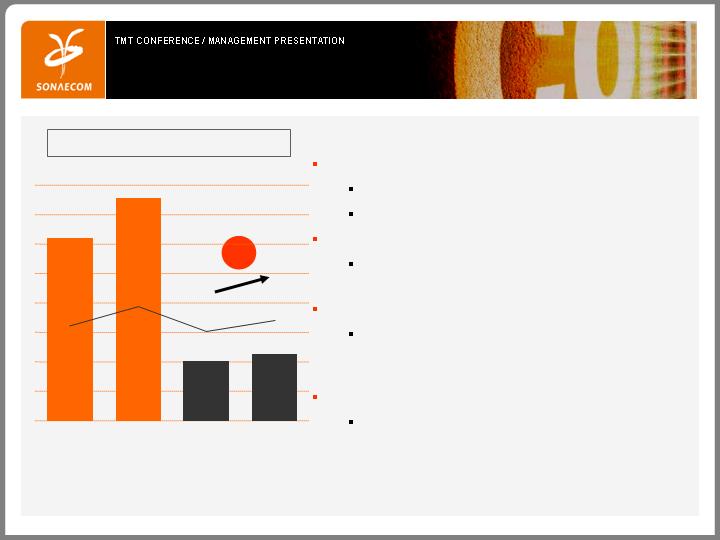

TOP LINE PERFORMANCE DRIVEN BY TELCO GROWTH

SERVICE REVENUES

CUSTOMER REVENUES

In € million

Growth in subscriber base at Optimus; strengthened position of Sonaecom

Fixed in the broadband market.

+6.5%

+2.6%

384.0

402.3

125.7

133.8

9M05(R)

9M06

3Q05(R)

3Q06

549.7

557.4

187.0

191.9

9M05(R)

9M06

3Q05(R)

3Q06

6

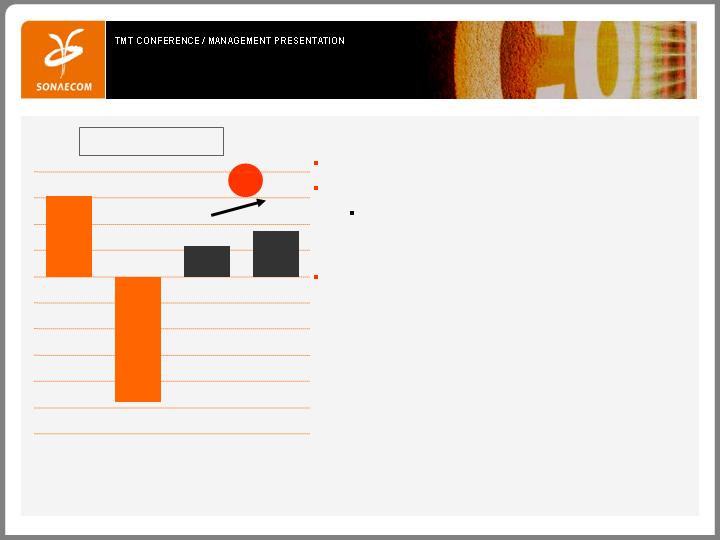

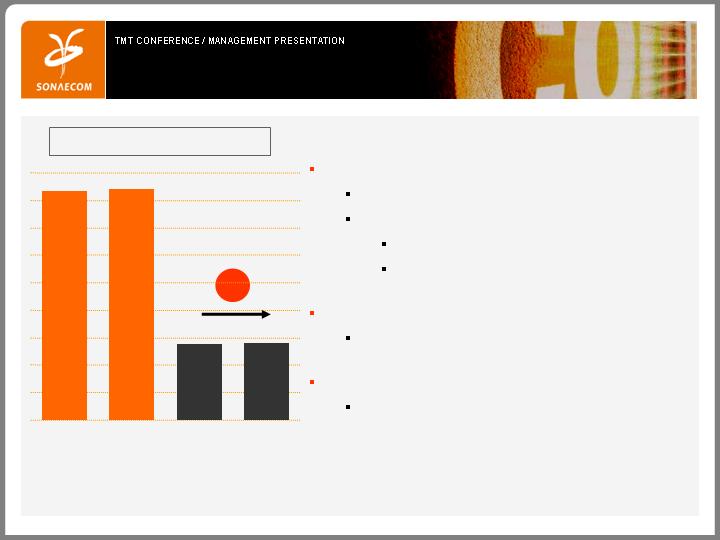

COSTS KEPT UNDER CONTROL

In € million

COSTS EXCLUDING COGS

Costs reflect investment in growing market share and achieving profitability.

Lower Network Costs (-4.1%):

lower maintenance and interconnection costs;

leased lines costs up 4.8%:

extension of direct access coverage;

higher monthly fees per local loop and

wholesale circuits;

Personnel Costs up 11.9%:

restructuring programme at Público and related

severance costs;

Marketing & Sales costs up 3.8%:

SCF promotion of double play offers.

+1%

416.7

421.7

140.2

141.5

9M05(R)

9M06

3Q05(R)

3Q06

7

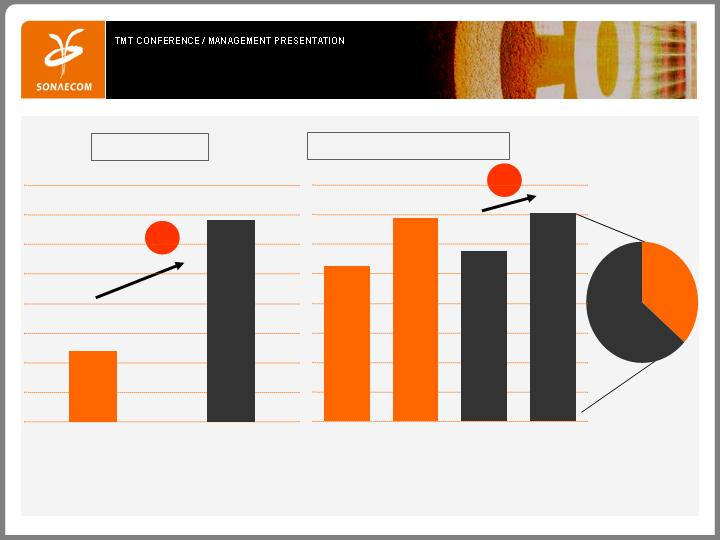

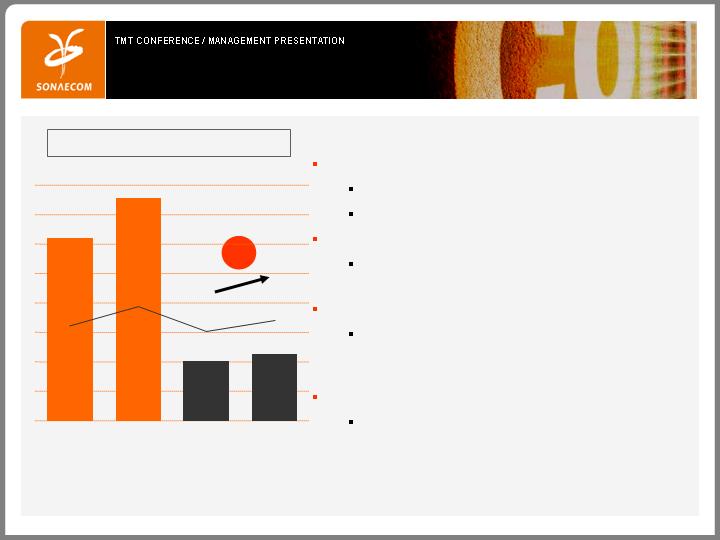

EBITDA UP 12.6% YOY DESPITE IMPACT OF MTRs

In € million

EBITDA & EBITDA MARGIN

Optimus EBITDA up 6.5%:

higher Customer Revenues (+2.2%);

lower total OPEX;

Sonaecom Fixed EBITDA break-even:

ULL direct business began to generate positive

contribution to profitability;

Público negative EBITDA:

lower Advertising Sales, lower Associated

Product margins and Severance Costs (1.7

million euros);

SSI EBITDA down 0.6 million:

driven by lower EBITDA at WeDo.

EBITDA growth was driven by the performance of our telco companies.

+12.6%

124.3

151.3

40.7

45.8

18.9%

20.0%

24.2%

21.3%

9M05(R)

9M06

3Q05(R)

3Q06

8

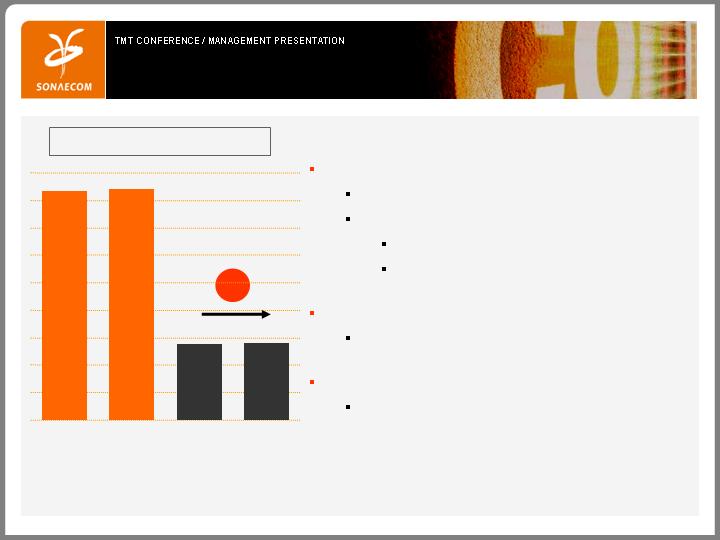

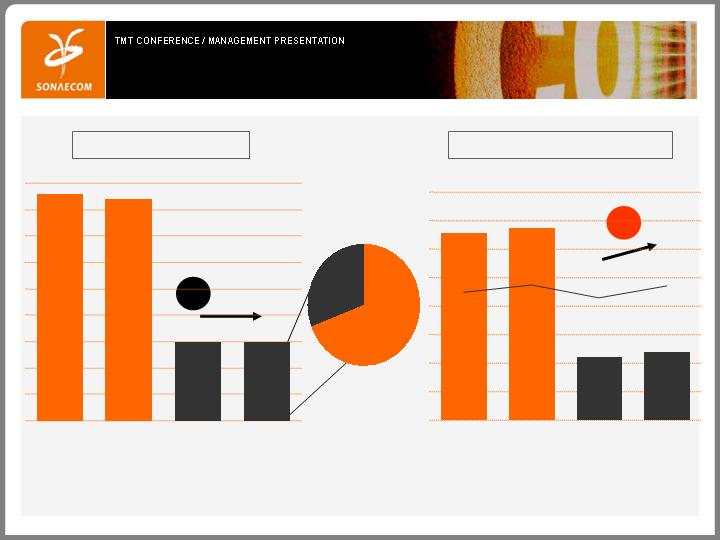

POSITIVE EBITDA - CAPEX

In € million

EBITDA - CAPEX

EBITDA up 12.6%;

CAPEX down 1.8% (13.2% Turnover):

lower investment at SCF (-20.8%), due to less

aggressive expansion of capacity given

investment effort in 3Q05;

EBITDA – CAPEX up 47.6%.

Operational cash flow performance driven by EBITDA growth and lower

CAPEX.

+47.6%

30.9

-47.9

11.9

17.5

9M05(R)

9M06

3Q05(R)

3Q06

9

ÍNDICE

2

OPTIMUS’ PERFORMANCE

10

OPTIMUS - STEADY GROWTH OF CUSTOMERS AND DATA USAGE

CUSTOMERS

DATA % SERVICE REV.

In thousands

Non-SMS data

36.5%

Extracting more value from data and broadening market boundaries through

wireless internet products and fixed-mobile convergent products.

SMS data

63.5%

+9.7%

+2.7pp

2,270.5

2,491.5

3Q05

3Q06

10.5%

13.8%

11.5%

14.1%

9M05

9M06

3Q05

3Q06

11

OPTIMUS - SERVICE REVENUES AND EBITDA POSITIVE

EVOLUTION

SERVICE REVENUES

Customer Revenues

69.2%

Operator Revenues

30.8%

EBITDA & EBITDA MARGIN

Growth achieved in Customer Revenues and EBITDA.

In € million

In € million

+6.5%

-0.7%

428.4

420.0

150.6

149.6

9M05

9M06

3Q05

3Q06

130.7

134.6

44.8

47.7

26.8%

29.4%

29.7%

28.0%

9M05

9M06

3Q05

3Q06

12

ÍNDICE

3

SONAECOM FIXED PERFORMANCE

13

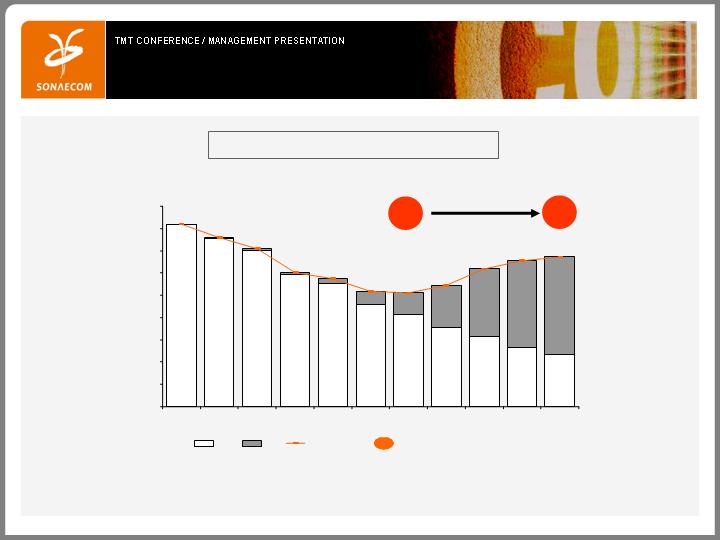

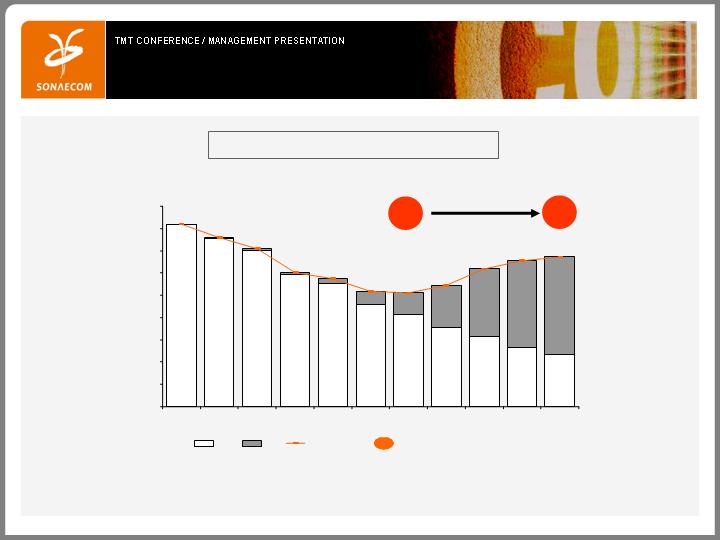

SCF - CONTINUOUS EXPANSION OF DIRECT ADSL SERVICES

TOTAL SERVICES EVOLUTION EOP

Significant increase in direct business, representing 68% of Customer

Revenues.

38%

68%

408,160

376,786

350,571

295,837

275,478

230,538

206,068

177,602

155,473

133,107

117,311

2,038

3,383

4,186

5,492

11,919

27,895

49,024

93,861

153,790

194,240

219,160

410,198

380,169

354,757

301,329

287,397

258,433

255,092

271,463

309,263

327,347

336,471

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

Indirect

Direct

Total Services

Direct Access % Customer Revenues

14

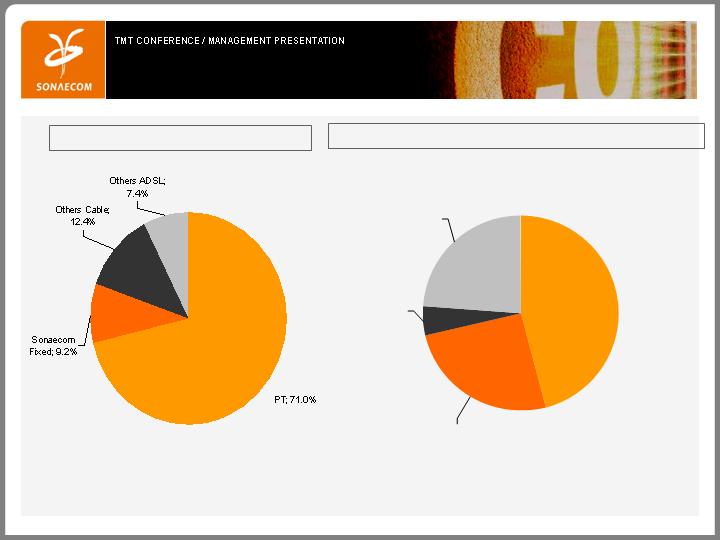

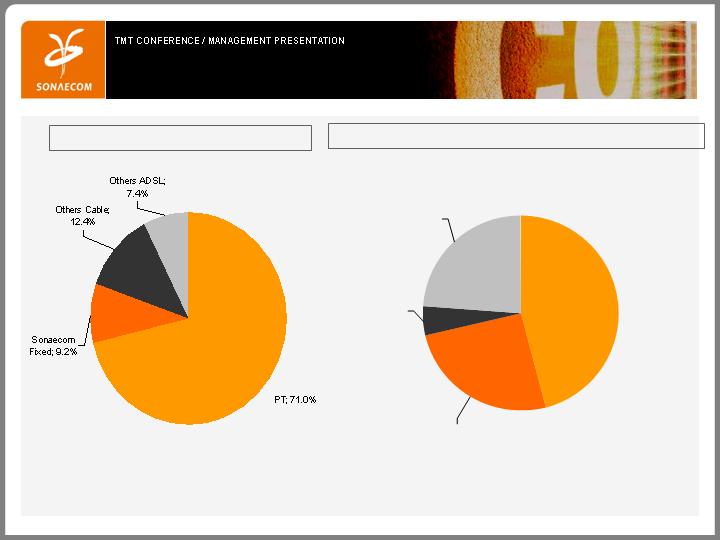

SCF – LEADING THE ALTNETS BROADBAND MARKET

BROADBAND MARKET SHARE 3Q06

BROADBAND MARKET SHARE NET ADDS 3Q06

Sonaecom Fixed is reinforcing its Broadband market share.

Latest available market data (Cable and ADSL)

Latest available market data (Cable and ADSL)

Source: Anacom, Company reports; Sonaecom analysis

Others ADSL;

23,8%

Others Cable;

4,8%

Sonaecom

Fixed; 25,6%

PT; 45,8%

15

SCF - DIRECT SERVICES GENERATING TANGIBLE FINANCIAL

RESULTS

TURNOVER

EBITDA & EBITDA MARGIN

Direct Revenues

30.7%

Operator Revenues

54.4%

Indirect

Revenues

13.3%

Investment in direct access business began to show returns, with the

company achieving positive EBITDA in the quarter.

In € million

In € million

+25.3%

Other

1.6%

117.0

146.2

41.8

52.4

9M05

9M06

3Q05

3Q06

-8.3

-6.4

-4.3

0.6

-10.2%

-7.1%

-4.4%

1.2%

9M05

9M06

3Q05

3Q06

16

ÍNDICE

4

PT TENDER OFFER - CONSIDERATIONS

17

BRIEF OVERVIEW OF SONAECOM’S OFFER FOR PT AND PTM

OFFER PRICE

€9.50 for each ordinary shares (including ADSs) and class A shares

of Portugal Telecom (“PT”):

100% of PT share capital;

Valuing PT at €10.7bn (equity value);

€9.03 for each share of PT Multimedia (“PTM”):

Acquisition of the stake not-owned by PT (~42%);

On announcement, prices assumed a dividend distribution of

€0.385/share for PT and €0.275/share for PTM.

Principal Tender Offer conditions include:

Sonaecom acquiring at least 50.01%;

Amendments to PT articles of association;

Approval from the Portuguese Competition Authority;

Non-opposition by the Portuguese Government;

Offer for PTM subject to the success of the Offer for PT.

PRINCIPAL TENDER

OFFER CONDITIONS

18

INDICATIVE TENDER OFFER TIMETABLE

Timing dependent on ADC’s final decision

Sonaecom to file draft

revised prospectus,

Offer announcement

and draft bank

guarantee / cash

confirmation with CMVM

Comments permitted

prior to AdC sign

-

off

PT Deadline to file

Schedule 14d

-

9 with

SEC with

recommendation to

PT shareholders

1

3

4

8

D Day

15 Dec

27 Sept

6

5

D

-

5

7 Dec

2

D

-

10

[30 Nov]

D+10

26 Dec

7

D+?

D+65/74

9 Feb (8 wks)

23 Feb (10 wks)

D+?

Offer

Period

OFFER

COMMENCES

Announcement

of preliminary

ADC approval

Final ADC

Approval

CMVM

Register final prospectus with CMVM

SEC

File Schedule TO with SEC

Notice sent to PT

shareholders on

EGM to be held re.

conditions of Offer

EGM

Expiration

of the Offer

9

D+69/78

15 Feb (8 wks)

1 Mar (10 wks)

Settlement

of the Offer

EGM

called

1

–

19

PRELIMINARY ADC DECISION MORE AGGRESSIVE THAN

EXPECTED

REMEDIES MORE

AGGRESSIVE

THAN EXPECTED

Combination of remedies will stimulate market competition;

Fixed Networks:

Vertical separation if Sonaecom keeps copper network;

Not enough to separate horizontally.

Content:

Divest all content assets inside PTM;

Cannot bundle content assets with sale of one of fixed

networks.

Mobile:

Rapid creation of a new MNO;

Divestment of more spectrum than expected;

Network effects: MNO protection regarding M-M

interconnection; and on-net/ off-net pricing.

Substantial negative impact on the NPV of combined business plan.

20

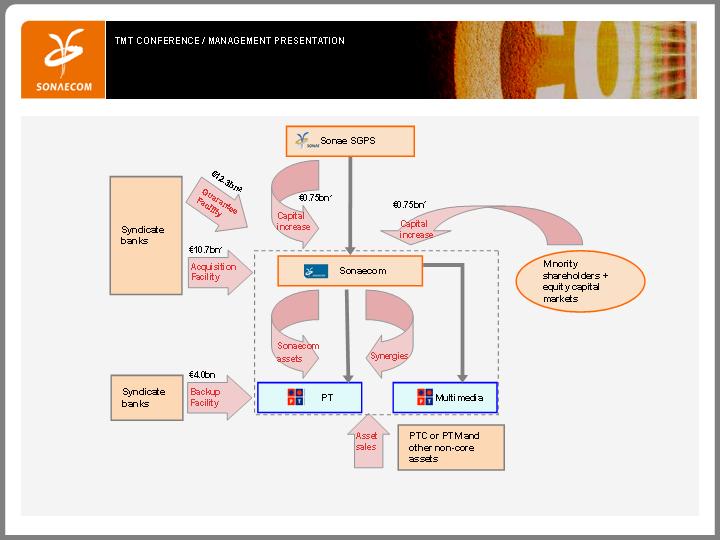

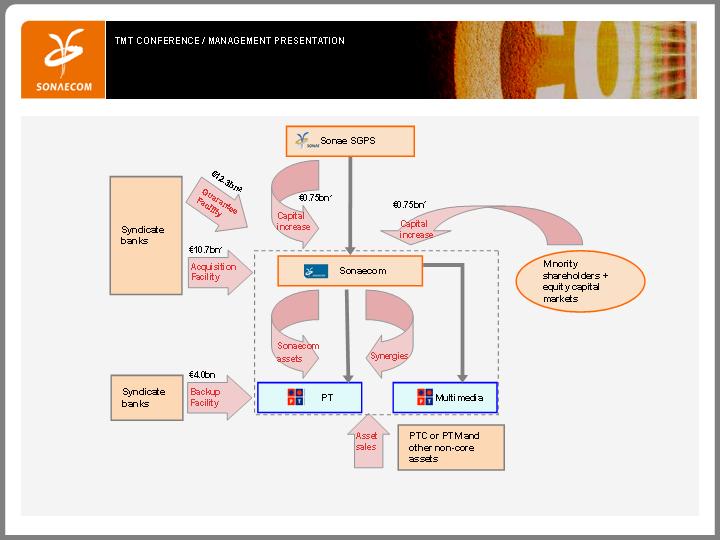

THE OFFER IS FULLY FINANCED THROUGH A SOUND STRUCTURE

Full flexible financing structure; Sonae Group is committing its telecom assets,

related synergies and share of equity recapitalization.

1 Capital increased will be used to amortize part of the acquisition facility

2 Guarantee facility include the full acquisition of PT shares, the acquisition of PTM minorities and the acquisition of outstanding convertible bonds

21

A CAPITAL INCREASE WAS APPROVED BY SONAECOM’S BOARD

CONDITIONED TO THE SUCCESS OF THE OFFER

BOARD APPROVAL

On 26 October 2006, Sonaecom’s Board unanimously approved a

share capital increase of €1.5bn;

The share capital increase is conditional upon the registration,

launch and success of the Tender Offer over PT.

Format: rights issue;

Issue size: €1.5bn (1,500,000,000 new ordinary shares);

Price: nominal value of €1.00 each;

Underwriting: the rights issue will be fully underwritten by Sonae

SGPS and/or the banks leading the offering.

Capital increase to be launched after settlement of the Tender Offer;

Operation could be completed within 10 to 14 weeks.

SUMMARY OF

MAIN TERMS

TIMING

22

PT – UNDERLYING VALUE CONSIDERATIONS

PTC:

Line loss and traffic deterioration – total main lines decreased by 1.2%

yoy in 3Q06 and total traffic fell by 9.6% yoy

Poor broadband growth – only +22K ADSL retail lines net adds in 3Q06

(vs.+47K in 3Q05)

3Q06 retail wireline revenues (excluding ADSL) down 16.0% yoy.

PTM:

Net loss of 28K Pay TV customers (9M06) vs. 36K net additions in 9M05;

Net adds in cable broadband customers of only 1K in 9M06, a decrease of

98.4% in relation to 9M05.

Vivo:

Continue market share loss to GSM operators: now less than 30% vs.

36% a year ago;

GSM migration: estimated CAPEX of €400m; probable customer loss

during migration;

9M06 EBITDA fell 24.7% in relation to 9M05 (in Brazilian Real).

TMN:

Market share under pressure;

Customer Revenues down 0.6% in 9M06 vs 9M05.

23

PT – UNDERLYING VALUE CONSIDERATIONS (CONT’D)

At €9.5 per share Sonaecom is paying a full and fair price for PT.

Dividend per PT ordinary share paid in 2006 higher than what was

previously expected (€0.475 vs. €0.385);

Uncertainty surrounding the fair value of the unfunded pension & healthcare

liability.

24

MORGAN STANLEY TMT CONFERENCE

MANAGEMENT PRESENTATION

November 2006

25