SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ___)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-12

LIBERTY BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

_______________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials: ___________________________________________________________ |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

[LIBERTY BANCORP, INC. LETTERHEAD]

December 26, 2006

Dear Fellow Stockholder:

We cordially invite you to attend the annual meeting of stockholders of Liberty Bancorp, Inc. We will hold the meeting at the branch office of our wholly owned subsidiary, BankLiberty, located at 9200 N.E. Barry Road, Kansas City, Missouri, on Monday, February 5, 2007, at 5:30 p.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on our operations for the recently completed fiscal year. Our directors and officers, as well as a representative of Michael Trokey & Company, P.C., our independent auditor, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

| | |

| | Sincerely, |

| | |

| | /s/ Brent M. Giles |

| Brent M. Giles |

| | President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

Your vote is important, regardless of the number of shares you own. On behalf of the Board of Directors, we urge you to sign, date and mail the enclosed proxy card as soon as possible, even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the Annual Meeting. Please act at your first convenience.

[LIBERTY BANCORP, INC. LOGO]

LIBERTY BANCORP, INC.

16 WEST FRANKLIN

LIBERTY, MISSOURI 64068

(816) 781-4822

NOTICE OF 2007 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE | | 5:30 p.m. on Monday, February 5, 2007 |

| | | |

PLACE | | 9200 NE Barry Road Kansas City, Missouri (Bank branch office) |

| | | |

ITEMS OF BUSINESS | | (1) To elect two directors, each to serve for a term of three years. (2) The approval of the Liberty Bancorp, Inc. 2007 Equity Incentive Plan. (3) To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| | | |

RECORD DATE | | In order to vote, you must have been a stockholder at the close of business on December 15, 2006. |

| | | |

PROXY VOTING | | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction form sent to you with this Proxy Statement. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement. |

| | | |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

PROXY STATEMENT

OF

LIBERTY BANCORP, INC.

16 WEST FRANKLIN

LIBERTY, MISSOURI 64068

(816) 781-4822

ANNUAL MEETING OF STOCKHOLDERS

February 5, 2007

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Liberty Bancorp, Inc. (the “Company” or “Liberty Bancorp”), to be used at the Annual Meeting of Stockholders of the Company. Liberty Bancorp is the holding company for BankLiberty (“Bank Liberty” or the “Bank”). The annual meeting will be held at the Bank’s branch office located at 9200 N.E. Barry Road, Kansas City, Missouri, on Monday, February 5, 2007 at 5:30 p.m. The accompanying Notice of Annual Meeting and this Proxy Statement are being first mailed to stockholders on or about December 26, 2006.

General Information About Voting

Who Can Vote at the Meeting

You are entitled to vote your shares of Liberty Bancorp common stock if the records of the Company show that you held your shares as of the close of business on December 15, 2006, the annual meeting record date. As of the close of business on December 15, 2006, a total of 4,760,137 shares of Liberty Bancorp common stock were issued and outstanding. Each share of common stock is entitled to one vote.

Attending the Meeting

If you are a beneficial owner of Liberty Bancorp common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Liberty Bancorp common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum and Vote Required

The annual meeting will be held only if there is a quorum present. A quorum exists if a majority of the outstanding shares of common stock entitled to vote are represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum but will not be counted as votes cast. A broker non-vote occurs when a broker, holding shares for a beneficial owner, returns a proxy to the Company but does not vote on a particular agenda item because the broker does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Under New York Stock Exchange rules, brokers will be permitted to vote on the election of directors but not on the 2007 Equity Incentive Plan.

In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of

directors. Directors must be elected by an affirmative vote of a majority of the shares present in person or by proxy at the annual meeting. Votes that are withheld will have the same effect as a negative vote, while broker non-votes will have no effect on the outcome of the election.

In voting to approve the Liberty Bancorp, Inc. 2007 Equity Incentive Plan (the “2007 Plan”), you may vote in favor of the proposal, vote against the proposal or abstain from voting. Approval of the 2007 Plan requires the affirmative vote of a majority of the votes eligible to be cast at the annual meeting. On this matter, abstentions and broker non-votes will have the effect of a vote against the proposal.

Voting by Proxy

The Board of Directors of Liberty Bancorp is sending you this proxy statement for the purpose of requesting that you allow your shares of Liberty Bancorp common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Liberty Bancorp common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends that you vote:

| · | for each of the nominees for director; and |

| | · | for the approval of the Liberty Bancorp, Inc. 2007 Plan. |

The proxy confers discretionary authority on the persons named therein to vote with respect to the election of any person as a director where the nominee is unable to serve or for good cause will not serve, and matters incident to the conduct of the annual meeting. If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their own best judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting in order to solicit additional proxies. If the annual meeting is postponed or adjourned, your Liberty Bancorp common stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in and of itself constitute revocation of your proxy.

If your Liberty Bancorp common stock is held in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instructions provided by your broker, bank or other nominee that accompanies this proxy statement.

Participants in the Amended and Restated Liberty Savings Bank Employee Stock Ownership Plan

If you participate in the Amended and Restated Liberty Savings Bank Employee Stock Ownership Plan (the “ESOP”), you will receive a voting instruction card that reflects all shares you are entitled to vote under the plan. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of Company common stock held by the ESOP and allocated shares for which no

voting instructions are received in the same proportion as shares for which it has received timely voting instructions. The deadline for submitting ESOP participant’s voting instructions to the ESOP trustee is January 24, 2007.

Stock Ownership

The following table sets forth information as of December 15, 2006 (i) with respect to any person or entity who was known to Liberty Bancorp to be the beneficial owner of more than 5% of our common stock, and (ii) as to our common stock beneficially owned by each director of Liberty Bancorp, the executive officers named in the “Summary Compensation Table” and all directors and executive officers as a group.

| | | Amount of Nature of Shares of Beneficial Ownership | | Number of Shares That Maybe Acquired Within 60 Days by Exercising Options | | Total | | Percent of Common Stock Outstanding (1) | |

Amended and Restated Liberty Savings Bank Employee Stock Ownership Plan Trust 16 West Franklin Liberty, Missouri 64068 | | | 300,071 | (2) | | - | | | 300,071 | | | 6.3 | % |

| | | | | | | | | | | | | | |

Directors: | | | | | | | | | | | | | |

| Ralph W. Brant, Jr. | | | 109,297 | (3) | | 22,753 | | | 132,050 | | | 2.8 | |

| Brent M. Giles | | | 65,478 | (4) | | 49,007 | | | 114,485 | | | 2.4 | |

| Steven K. Havens | | | 133,843 | | | 22,753 | | | 156,596 | | | 3.3 | |

| Daniel G. O’Dell | | | 234,566 | (5) | | 22,753 | | | 257,319 | | | 5.4 | |

| Robert T. Sevier | | | 192,335 | (6) | | 12,252 | | | 204,587 | | | 4.3 | |

| Marvin J. Weishaar | | | 60,131 | | | 22,753 | | | 82,884 | | | 1.7 | |

| | | | | | | | | | | | | | |

Named Executive Officers Who Are Not Also Directors: | | | | | | | | | | | | | |

| Mark E. Hecker | | | 41,438 | (7) | | 6,300 | | | 47,738 | | | * | |

| Marc J. Weishaar | | | 36,639 | (8) | | 6,300 | | | 42,939 | | | * | |

| | | | | | | | | | | | | | |

All directors and executive officers as a group (8 persons) | | | 1,173,798 | | | 164,853 | | | 1,338,651 | | | 27.2 | % |

| * | Does not exceed 1.0% of the Company’s voting securities. |

| (1) | Based on 4,760,137 shares of Company common stock outstanding and entitled to vote as of the close of business on December 15, 2006. |

| (2) | The ESOP trustee, RS Group Trust Company, votes all allocated shares in accordance with the instructions of the participants. Unallocated shares and shares for which no instructions have been received are voted by the ESOP trustee in the same ratio as participants direct the voting of allocated shares or, in the absence of such direction, as directed by the Bank’s Board of Directors. At December 15, 2006, 178,084 shares had been allocated under the ESOP. |

| (3) | Includes 19,847 shares held by Mr. Brant’s IRA, 3,995 shares held by sons’ IRAs, 4,105 shares held by sons, 51,631 shares held in trust over which Mr. Brant has shared voting and dispositive power and 7,500 shares held by a corporation controlled by Mr. Brant. |

| (4) | Includes 4,776 shares allocated under the ESOP, 17,502 shares held in trust over which Mr. Giles has sole voting and dispositive power and 1,750 shares held by IRA. |

| (5) | Includes 30,000 shares held by spouse and 200,484 shares held by a trust over which Mr. O’Dell has sole voting and dispositive power. |

| (6) | Includes 15,432 shares held by spouse’s IRA, 10,000 shares held by spouse, 33,008 shares held by Mr. Sevier’s IRA and 113,895 shares held in trusts. Of the total 110,980 shares held in trusts, Mr. Sevier has shared voting and dispositive power for 40,002 shares and sole voting and dispositive power for 70,978 shares. |

| (7) | Includes 2,088 shares allocated under the ESOP, 14,500 shares held by Mr. Hecker’s IRA and 9,850 shares held by spouse’s IRA. |

| (8) | Includes 20,832 shares allocated under the ESOP and 970 shares held by IRA. |

Interest of Certain Persons in Matters To Be Acted Upon

The Liberty Bancorp, Inc. 2007 Plan is being presented to stockholders for approval. See “Proposal 2 - Approval of the Liberty Bancorp, Inc. 2007 Plan” for more information. Directors, officers and employees of the Company and the Bank may be granted restricted stock awards and stock options under the 2007 Plan.

Proposal I — Election Of Directors

General

The Company’s Board of Directors consists of six members. The Company’s Bylaws require that directors be divided into three classes as nearly equal in number as possible. The Board of Directors has nominated Robert T. Sevier and Ralph W. Brant, Jr. to serve as directors for three-year terms. It is intended that the persons named in the proxies solicited by the Board will vote for the election of the named nominees. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board knows of no reason why any nominee might be unavailable to serve. The nominees are currently directors of the Company and the Bank.

The Board of Directors intends that the proxies solicited by it will be voted for the election of the nominees named above. If any nominee is unable to serve, the persons named in the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends that stockholders vote “FOR” the election of the two nominees as directors of the Company.

The following table sets forth for each nominee, such person’s name, age at September 30, 2006, the year he first became a director of the Company and the year his term as a director of the Company will expire. The indicated period of service as a director includes service as a director of the Bank. No director is related to any other director or executive officer by blood, marriage or adoption, except that Director Marvin J. Weishaar is the father of Marc Weishaar, the Bank’s Senior Vice President and Chief Financial Officer. The Company’s Board of Directors has determined that all of the directors except Brent M. Giles, who is an employee of the Company and Bank, and Marvin J. Weishaar are “independent directors” as defined under Nasdaq Rule 4200(a)(15).

| Name | | Age | | Year First Elected Or Appointed Director | | Current Term As Director To Expire | |

Board Nominees For Term To Expire At 2010 Annual Meeting | |

| Robert T. Sevier | | | 66 | | | 1975 | | | 2007 | |

| Ralph W. Brant, Jr. | | | 59 | | | 1975 | | | 2007 | |

Directors Continuing In Office |

| Brent M. Giles | | | 39 | | | 2003 | | | 2008 | |

| Marvin J. Weishaar | | | 74 | | | 1970 | | | 2008 | |

| Daniel G. O’Dell | | | 52 | | | 1997 | | | 2009 | |

| Steven K. Havens | | | 56 | | | 2001 | | | 2009 | |

The principal occupation of each director of the Company during the last five years is set forth below.

Robert T. Sevier is the Recorder of Deeds of Clay County, Missouri, a position he assumed in January 1999. From 1971 to late 1995, he was self-employed as a title insurance agent in Liberty, Missouri. Mr. Sevier has served as a board member of Concerned Care, an advocacy group for developmentally disabled individuals and is a member of the Developmental Disabilities Resource Board of Clay County, Missouri.

Ralph W. Brant, Jr. is President of Brant’s Clothing, a retail-clothing establishment located in Liberty, Missouri. He has worked at Brant’s since 1975. Mr. Brant has served as a Director of the Liberty Chamber of Commerce and with the Liberty Downtown Merchants Group. He has also served as a Director and President of Martha Lafite Thompson Nature Sanctuary, and has worked with the Boy Scouts of America in various capacities.

Brent M. Giles has served as our President and Chief Executive Officer since September 2003. Prior to joining BankLiberty, from August 2001 to August 2003, Mr. Giles was President of Lawson Bank, Lawson, Missouri, a Missouri-based community bank. From May 2000 to July 2001, Mr. Giles served as a financial services consultant with Rightworks Corporation, San Jose, California, and from April 1998 to May 2000, Mr. Giles served as Vice President of UMB Bank, Kansas City, Missouri. From 1989 to April 1998, Mr. Giles was a financial institutions examiner with the Federal Deposit Insurance Corporation.

Marvin J. Weishaar retired in 2001 upon selling his public accounting practice located in Liberty, Missouri. From 1988 to 1998, he was employed as a partner and officer with Cochran Head and Company, PC, a local public accounting firm headquartered in Kansas City, Kansas. He was a self-employed certified public accountant from 1962 to 1988 in Liberty, Missouri. From 1957 to 1962, he was employed with KPMG in Kansas City, Missouri. Mr. Weishaar served as President of the Liberty Rotary Club and as a member and past President of the Liberty Area Chamber of Commerce. He was a founding member, board member and served as treasurer for 10 years for Habitat for Humanity, Northland.

Daniel G. O’Dell currently serves as Chairman of BankLiberty. Mr. O’Dell has been employed by O’Dell Publishing since 1984. Mr. O’Dell also serves on the Board of Directors of TheraDoc, Inc., Salt Lake City, Utah, and serves on the Board of Directors of CollegeHill Investments, a subsidiary of William Jewell College, Liberty, Missouri.

Steven K. Havens is President of Havens Construction Co., Inc., serves as Chairman of the Clay County Airport Advisory Board, and is a past board member of the Liberty Chamber of Commerce. He also serves as the Secretary of BankLiberty.

Meetings of the Board of Directors

The Company and the Bank conduct business through meetings and activities of their Board of Directors and their committees. Regular meetings of the Board of Directors are held on a monthly basis and special meetings are held from time-to-time as needed. There were 12 regular meetings and eight special meetings of the Board of Directors of the Bank and two regular and six special meetings of the Board of Directors of the Company held during the fiscal year ended September 30, 2006. No director attended fewer than 75% of the total number of meetings of the Board of Directors and committees of the Board on which he served.

Committees of the Board of Directors

The following table identifies our standing committees and their members as of September 30, 2006. All members of each committee are independent in accordance with the listing standards of the Nasdaq Stock Market, Inc.

Director | | Audit Committee | | Compensation Committee | | Nominating Committee | |

| | | | | | | | |

| Ralph W. Brant, Jr. | | | X | | | X | | | X | |

| Brent M. Giles | | | | | | | | | | |

| Steven K. Havens | | | X | | | X | | | X | * |

| Daniel G. O’Dell | | | X | * | | X | * | | X | |

| Robert T. Sevier | | | X | | | X | | | X | |

| Marvin J. Weishaar | | | | | | | | | | |

| | | | | | | | | | | |

| Number of Meetings in Fiscal 2006(1) | | | 10 | | | 2 | | | 2 | |

| (1) | Includes meetings during the year ended September 30, 2006 of comparable committees of the Board of Directors of the Bank. The Company’s Audit, Compensation and Nominating Committees each met once during the year ended September 30, 2006. |

Audit Committee. The Company has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee meets periodically with the independent registered public accountants and management to review accounting, auditing, internal control structure and financial reporting matters. Each member of the Audit Committee is independent under the definition contained in the listing standards of the Nasdaq Stock Market. The Board of Directors has determined that the Audit Committee does not have a member who is an “audit committee financial expert” as such term is defined by the rules and regulations of the Securities and Exchange Commission. The current board members possess all of the criteria the Nominating Committee has determined are appropriate for Board membership if a holding company of a community-based financial institution. While the Board recognizes that no individual

Board member meets the qualifications required of an “audit committee financial expert,” the Board believes that appointment of a new director to the Board and to the Audit Committee at this time is not necessary as the level of financial knowledge and experience of the current members of the Audit Committee, including the ability to read and understand fundamental financial statements, is cumulatively sufficient to discharge adequately to the Audit Committee’s responsibilities. The Audit Committee acts under a written charter adopted by the Board of Directors, a copy of which is included as Appendix A to this proxy statement. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See “Audit Committee Report.”

Compensation Committee. The Compensation Committee is responsible for determining annual grade and salary levels for employees and establishing personnel policies. Each member of the Compensation Committee is independent under the definition contained in the listing standards of the Nasdaq Stock Market. The Compensation Committee operates under a written charter. The report of the compensation committee appears in this proxy statement under the heading “Compensation Committee Report.”

Nominating Committee. The Board of Directors’ Nominating Committee nominates directors to be voted on at the annual meeting and recommends nominees to fill any vacancies on the Board of Directors. The procedures of the Nominating Committee required to be disclosed by the rules of the Securities and Exchange Commission are included below under “Nominating Committee Procedures.” The members of the Nominating Committee are “independent directors” as defined in Nasdaq listing standards. The Board of Directors has adopted a Charter for the Nominating Committee, a copy of which is posted on our website at www.banklibertykc.com under the “Investor Relations” tab.

Nominating Committee Procedures

General

It is the policy of the Nominating Committee to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating Committee does not perceive a need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Nominating Committee’s resources, the Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders

Any stockholder wishing to recommend a candidate for consideration by the Nominating Committee as a possible director nominee for election at an upcoming annual meeting of stockholders must provide written notice to the Nominating Committee of such stockholder’s recommendation of a director nominee at least 120 calendar days prior to the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year. Notice should be provided to: Steven K. Havens, Corporate Secretary, Liberty Bancorp, Inc., 16 West Franklin, Liberty, Missouri 64068. Such notice must contain the following information:

| · | the name of the person recommended as a director candidate; |

| · | all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| · | the written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| · | as to the shareholder making the recommendation, the name and address, as he or she appears on the Company’s books, of such shareholder; provided, however, that if the shareholder is not a registered holder of the Company’s common stock, the shareholder should submit his or her name and address, along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| · | a statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

Minimum Qualifications

In its deliberations, the Nominating Committee considers a candidate’s personal and professional integrity, knowledge of the banking business and involvement in community, business and civic affairs, and also considers whether the candidate would provide for adequate representation of the Bank’s market area. Any nominee for director made by the Nominating Committee must be highly qualified with regard to some or all the attributes listed in the preceding sentence.

With respect to nominating an existing director for re-election to the Board of Directors, the Nominating Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Process for Identifying and Evaluating Nominees

Identification. In searching for qualified director candidates to fill vacancies in the Board, the Nominating Committee solicits the Company’s current directors for the names of potential qualified candidates. Moreover, the Nominating Committee may ask its directors to pursue their own business contacts for the names of potentially qualified candidates. In the event a stockholder has submitted a proposed nominee, the Nominating Committee would consider the proposed nominee in the same manner in which the Nominating Committee would evaluate nominees for director recommended by directors.

Evaluation. The Nominating Committee would then consider the potential pool of director candidates, select a candidate based on the candidate’s qualifications and the Board’s needs, and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history that would cause the candidate not to be qualified to serve as a director of the Company.

Board Policies Regarding Stockholder Communications and Attendance at Annual Meetings

The Board of Directors maintains a process for stockholders to communicate with the Board of Directors. Stockholders wishing to communicate with the Board of Directors should send any communication to Steven K. Havens, Corporate Secretary, Liberty Bancorp, Inc., 16 West Franklin Street, Liberty, Missouri 64068. All communications that relate to matters that are within the scope of the responsibilities of the Board and its committees are to be presented to the Board no later than its next regularly scheduled meeting. Communications that relate to matters that are within the responsibility of one of the Board committees are also to be forwarded to the Chair of the appropriate committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s

responsibilities, such as customer complaints, are to be sent to the appropriate officer. Solicitations, advertisements and obviously frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Directors are expected to prepare themselves for and to attend all Board meetings, the Annual Meeting of Stockholders and the meetings of the committees on which they serve, with the understanding that on occasion a director may be unable to attend a meeting. All of the Company’s directors except one attended the Company’s 2006 Annual Meeting of Stockholders.

Executive Compensation

Summary Compensation Table. The following information is provided for Brent M. Giles, our President and Chief Executive Officer, Marc J. Weishaar, our Senior Vice President and Chief Financial Officer, and Mark E. Hecker, our Senior Vice President and Chief Lending Officer. No other executive officer of the Company received a salary and bonus of $100,000 or more during the year ended September 30, 2006.

| | | | | | | | Long-Term Compensation Awards | | |

| Name and Principal Positions | | Fiscal Year | | Annual Compensation | | Other Annual Compensation ($) | | Restricted Stock] Awards ($) | | Securities SARS (#) | | All Other Compensation (2) | |

| | | Salary | | Bonus | | | | |

| | | | | | | | | | | | | | | | |

Brent M. Giles President and Chief Executive Officer | | | 2006 2005 2004 | | $ | 186,765 175,764 141,847 | | $ | 35,000 30,000 15,000 | | | - - - | | | - - - | | | 7,001 17,502 52,506 | | $ | 39,879 18,391 4,204 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Marc J. Weishaar Senior Vice President and Chief Financial Officer | | | 2006 2005 2004 | | $ | 98,095 88,178 82,359 | | $ | 12,000 15,000 8,000 | | | - - - | | | - - - | | | - 5,251 10,501 | | $ | 20,481 12,205 9,927 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Mark E. Hecker (1) Senior Vice President and Chief Lending Officer | | | 2006 2005 2004 | | $ | 109,924 100,198 25,000 | | $ | 25,000 20,000 5,000 | | | - - - | | | - - - | | | - 8,751 7,001 | | $ | 23,203 2,218 | |

| (1) | Mr. Hecker joined the Bank on June 21, 2004. |

| (2) | Details about the amounts reported in the “All Other Compensation” column for 2006 are provided in the table below. |

Item | | Mr. Giles | | Mr. Weishaar | | Mr. Hecker | |

| Employer contribution to 401(k) plan | | $ | 5,419 | | $ | 2,827 | | $ | 3,248 | |

| ESOP Allocation Market Value | | | 32,780 | | | 17,654 | | | 19,955 | |

| Automobile Allowance | | | 1,680 | | | ─ | | | ─ | |

Total | | $ | 39,879 | | $ | 20,481 | | $ | 23,203 | |

Option Grants in Last Fiscal Year. The following table contains information concerning the grant of stock options during the year ended September 30, 2006 to the executive officers named in the Summary Compensation Table set forth above and contains certain information about the potential value of those options based upon certain assumptions as to the appreciation of the Company’s common stock over the life of the option.

Name | | Number of Securities Underlying Options Granted (1) | | Percent of Total Options Granted to Employees in Fiscal Year | | Exercise Price (1) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) | |

| | | | | | | | | | | 5% | | 10% | |

| | | | | | | | | | | | | | |

| Brent M. Giles | | | 7,001 | | | 94.2 | % | $ | 8.07 | | | 11/23/2015 | | | 35,565 | | | 90,033 | |

| | | | | | | | | | | | | | | | | | | | |

| Marc J. Weishaar | | | - | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Mark E. Hecker | | | - | | | - | | | - | | | - | | | - | | | - | |

| (1) | Adjusted for the 3.5004 exchange ratio in the Bank’s reorganization from the mutual holding company form of organization to the fully stock form of organization, completed on July 21, 2006 (the “Reorganization”). All options granted have a 10-year term. 50% of the options granted to Mr. Giles vested on November 23, 2005, and the remaining options granted to Mr. Giles vested on September 30, 2006. |

| (2) | The dollar gains under these columns result from calculations required by the Securities and Exchange Commission’s rules and are not intended to forecast future price appreciation of the Company’s common stock. Options have value only if the stock price increases above the exercise price shown in the table during the effective option period. In order for the executive to realize the potential values set forth in the 5% and 10% columns in the table, the price per share of the Company’s common stock would have to be approximately $13.15 and $20.93, respectively, as of the expiration date of the options. |

Fiscal Year End Option Value. The following table sets forth information regarding the unexercised options held by the executive officers named in the Summary Compensation Table above. No options were exercised by the named executive officers during the 2006 fiscal year.

Name | | Number of Securities Underlying Unexercised Options at Fiscal Year End Exercisable/Unexercisable (1) | | Value of Unexercised In-the-Money Options at Fiscal Year End Exercisable/Unexercisable (2) |

| | | | | |

| Brent M. Giles | | 49,007/28,002 | | 157,102/69,619 |

| | | | | |

| Marc J. Weishaar | | 5,250/10,502 | | 16,244/29,489 |

| | | | | |

| Mark E. Hecker | | 4,900/10,852 | | 14,560/28,667 |

| (1) | Adjusted for the 3.5004 exchange ratio in the Reorganization. |

| (2) | Calculated based on the product of: (a) the number of shares subject to options, and (b) the difference between the fair market value of the underlying common stock at September 30, 2006 determined based on $10.23, the most recent sale price on September 30, 2006 of the common stock as quoted on the Nasdaq Capital Market and the exercise price of the options. |

Employment Agreements. The Company and the Bank have a three-year employment agreement with Brent M. Giles, President and Chief Executive Officer. The term of the employment agreement may be renewed on an annual basis. Mr. Giles’ employment agreement establishes a base salary which currently is $198,000. The Boards of Directors of Liberty Bancorp and BankLiberty review Mr. Giles’ base salary each year in order to consider any appropriate changes. In addition to his base salary, Mr. Giles’ employment agreement provides for, among other things, participation in stock benefit plans and other fringe benefits applicable to executive personnel.

The employment agreement provides that BankLiberty and Liberty Bancorp may terminate the executive’s employment for cause, as defined in the employment agreement, at any time. If BankLiberty or Liberty Bancorp chooses to terminate Mr. Giles’ employment for reasons other than for cause, or if Mr. Giles resigns from BankLiberty or Liberty Bancorp after specified circumstances that would constitute constructive termination, Mr. Giles or, if he dies, his beneficiary, would be entitled to receive an amount equal to the remaining base salary payments due to him for the remaining term of the employment agreement and the contributions that would have been made on his behalf to any employee benefit plans of Liberty Bancorp and BankLiberty during the remaining term of the employment agreement. BankLiberty would also continue and/or pay for Mr. Giles’ life, health and dental coverage for the remaining term of the employment agreement. If Mr. Giles’ termination of employment is for reasons other than a change in control, he must adhere to a one-year non-competition agreement. In the event Mr. Giles is terminated for disability, as defined in the agreements, he will be paid an amount equal to 100% of his bi-weekly rate of base salary in effect as of the date of his termination of employment due to disability.

Under the employment agreement, if voluntary (upon circumstances discussed in the agreement) or involuntary termination follows a change in control of Liberty Bancorp, Mr. Giles or, if he dies, his beneficiary, would be entitled to a severance payment equal to three times Mr. Giles’ average annual compensation over the five taxable calendar years immediately preceding the effective date of the change in control. In addition, Mr. Giles shall, for a 36-month period following his termination of employment, receive the benefits he would have received over such period under any of the BankLiberty or Liberty Bancorp retirement programs (tax-qualified or non-qualified) in which he participated prior to his termination of employment. BankLiberty will also continue and/or pay for Mr. Giles’ life, health and dental coverage for 36 months. Section 280G of the Internal Revenue Code provides that severance payments that equal or exceed three times the individual’s base amount are deemed to be “excess parachute payments” if they are contingent upon a change in control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of the payment in excess of the base amount, and the employer may not deduct such amount for federal tax purposes. The agreement limits payments made to Mr. Giles in connection with a change in control to amounts that will not exceed the limits imposed by Section 280G. If a change in control of Liberty Bancorp or BankLiberty were to occur, the total payments that would be due under the employment agreement, based solely on the current annual compensation paid to Mr. Giles and excluding any benefits under any employee benefit plan which may be payable, would equal approximately $486,000.

All reasonable costs and legal fees paid or incurred by Mr. Giles in any dispute or question of interpretation relating to the employment agreement will be paid by BankLiberty or Liberty Bancorp, if Mr. Giles is successful on the merits in a legal judgment, arbitration or settlement. The employment agreement also provides that BankLiberty and Liberty Bancorp will indemnify Mr. Giles to the fullest extent legally allowable.

Change in Control Agreements. BankLiberty has two-year change in control agreements with Marc J. Weishaar and Mark E. Hecker. The Board of Directors of BankLiberty may renew these agreements annually. The agreements provide that if involuntary termination or, under certain circumstances, voluntary termination, follows a change in control of Liberty Bancorp or BankLiberty, Messrs. Weishaar and Hecker would each be entitled to receive a severance payment equal to two times the executive’s “base amount,” as defined under the Internal Revenue Code. BankLiberty would also continue and/or pay for life, health and dental coverage for 24 months following termination of the executive’s employment. Payments to Messrs. Weishaar and Hecker under the agreements will be paid by Liberty Bancorp if payments (or other benefits) are not paid by BankLiberty. Section 280G of the Internal Revenue Code provides that severance payments that equal or exceed three times the individual’s base amount are deemed to be “excess parachute payments” if they are contingent upon a change in

control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of the payment in excess of the base amount, and the employer may not deduct such amount for federal tax purposes. The agreements limit payments made to Messrs. Weishaar and Hecker in connection with a change in control to amounts that will not exceed the limits imposed by Section 280G. If a change in control of Liberty Bancorp or BankLiberty were to occur, the total payments that would be due under the change in control agreements, based solely on the current annual compensation paid to Messrs. Weishaar and Hecker and excluding any benefits under any employee benefit plan which may be payable, would equal approximately $160,500 and $200,000, respectively.

Directors’ Compensation

Cash Retainer and Fees for Non-Employee Directors. The following table sets forth the applicable retainers and fees that will be paid to our non-employee directors for their service on our Boards of Directors during fiscal 2007.

| Annual Retainer for Bank Board Service | | $ | 12,000 | |

| Quarterly Retainer for Company Board Service (1) | | | 1,000 | |

| Quarterly Fee for Loan/Executive Committee Service | | | 2,000 | |

| (1) | As the Reorganization was completed on July 21, 2006, the members of the Board of Directors were paid only one quarterly retainer for service on the Company’s Board of Directors during the year ended September 30, 2006. |

Non-Employee Director Compensation. The following table sets forth the total cash compensation paid and option awards made to our non-employee directors for their service on our Board of Directors during fiscal 2006. During fiscal 2006, no restricted stock awards were granted to our non-employee directors.

Director | | Cash | | Stock Option Awards (1) | |

| | | | | | |

| Ralph W. Brant, Jr. | | $ | 21,000 | | | 7,001 | |

| Steven K. Havens | | | 21,000 | | | 7,001 | |

| Daniel G. O’Dell | | | 21,000 | | | 7,001 | |

| Robert T. Sevier | | | 21,000 | | | 7,001 | |

| Marvin J. Weishaar | | | 21,000 | | | 7,001 | |

| (1) | Adjusted for the 3.5004 exchange ratio in the Reorganization. All options have an exercise price equal to the fair market value of our common stock, which was $8.07, with half of the options vesting on the date of grant, which was November 23, 2005, and the other half vesting on September 30, 2006. |

Benefits. Non-employee directors of BankLiberty also receive health and major medical insurance for themselves, their spouses and minor dependents. Additionally, non-employee directors are eligible to participate in the Amended and Restated Liberty Bancorp, Inc. 2003 Incentive Equity and Deferred Compensation Plan. No awards were made to non-employee directors under this plan during the year ended September 30, 2006. Non-employee directors are eligible to participate in the incentive equity plan to be implemented pending approval at the upcoming annual meeting.

Directors’ Retirement Plan. BankLiberty maintains a retirement plan for Messrs. Brant, Weishaar and Sevier. Under the plan, each of Messrs. Brant, Weishaar and Sevier receive an annual retirement benefit in an amount equal to the product of his Vested Percentage (as defined in the plan), with a maximum annual benefit of $15,000. Each director’s Vested Percentage is based on his cumulative years of service on the board, and increases in increments of 25%, from 0% for less than 10

years of service, to 25% for 10 years of service, to 50% for 15 years of service, to 75% for 20 years of service and to 100% for 25 or more years of service. Benefits are payable over a ten-year period following the participating director’s termination of service on the board of directors.

In the event that Messrs. Brant, Weishaar or Sevier terminates his position as a director due to his disability, the Bank will pay the director an annual payment for 10 years in an amount equal to $15,000. In the event that Messrs. Brant, Weishaar or Sevier dies before collecting any retirement or disability benefits, the Bank will pay to the director’s surviving spouse, if any, the monthly amounts otherwise payable, with the payment being made as though the director had both terminated service on the Board on the date of his death or disability, and had a Vesting Percentage equal to 100%, and survived to collect all retirement benefits payable. If the director dies after commencing to receive retirement or disability benefits, BankLiberty pays to the director’s surviving spouse, if any, the monthly payment then being made to the director with the period for such payments being determined as though the director had survived to collect all retirement or disability benefits payable. A director’s Vested Percentage becomes 100% upon a Change in Control, as defined in the plan, and the director becomes entitled to receive the present value of his retirement benefits in one lump sum payment within 10 days following the Change in Control. In the event of a Change in Control after a director terminates service on the Board of Directors, the present value of any retirement benefits not yet paid to the director will be due and payable in one lump-sum payment within 10 days following the Change in Control. In addition to an annual retirement benefit, Messrs. Brant, Weishaar or Sevier will receive post-retirement medical coverage not to exceed $500 per month for a period of 20 years.

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company or the Bank serves or has served as a member of the compensation committee of any other entity, one of whose executive officers serves on the Compensation Committee of the Company. No executive officer of the Company or the Bank serves or has served as a director of another entity, one of whose executive officers serves on the Compensation Committee of the Company.

Transactions with Management

The Sarbanes-Oxley Act generally prohibits loans by the Company to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by the Bank to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors of insured institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and must not involve more than the normal risk of repayment or present other unfavorable features. The Bank is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public, except for loans made pursuant to programs generally available to all employees. Notwithstanding this rule, federal regulations permit the Bank to make loans to executive officers and directors at reduced interest rates if the loan is made under a benefit program generally available to all other employees and does not give preference to any executive officer or director over any other employee. No loans are outstanding to directors or executive officers at reduced rates or other preferential terms under such a company-wide program. Furthermore, all loans to such persons must be approved in advance by a disinterested majority of the Board of Directors. At September 30, 2006, the Bank had $815,163 in loans outstanding to directors and executive officers. All such loans were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and do not involve more than the normal risk of collectibility or present other unfavorable features.

Audit Committee Report

The Company’s management is responsible for the Company’s internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those consolidated financial statements with U.S. generally accepted accounting principles. The Audit Committee oversees the Company’s internal control over financial reporting on behalf of the Board of Directors.

In this context, the Audit Committee has reviewed and discussed the audited financial statements of the Company with management and has discussed with Michael Trokey & Company, P.C. (“MTPC”), the Company’s independent registered public accountants, the matters required to be discussed under Statements on Auditing Standards No. 61 (“SAS 61”). In addition, the Audit Committee has received from MTPC the written disclosures and the letter required to be delivered by MTPC under Independence Standards Board Standard No. 1 (“ISB Standard No. 1”) and has met with representatives of MTPC to discuss the independence of the auditing firm.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal control over financial reporting, and the overall quality of the Company’s financial reporting process.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors who, in their report, express an opinion on the conformity of the Company’s financial statements to U.S. generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with U.S. generally accepted accounting principles, that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that the Company’s independent auditors are in fact “independent.”

Based on the Audit Committee’s review of the financial statements, its discussion with MTPC regarding SAS 61 and the written materials provided by MTPC under ISB Standard No. 1 and the related discussion with MTPC of their independence, the Audit Committee has recommended to the Board of Directors that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the year ended September 30, 2006 for filing with the Securities and Exchange Commission.

| | | The Audit Committee |

| | |

| | Daniel G. O’Dell (Chairperson) Ralph W. Brant, Jr. Robert T. Sevier Steven K. Havens |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing and reviewing the work of the independent registered public accounting firm and setting the independent registered public accounting firm’s compensation. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. This approval process ensures that the independent registered public accounting firm does not provide any non-audit services to the Company that are prohibited by law or regulation. During the year ended September 30, 2006, all services were approved in advance by the Audit Committee in compliance with these procedures.

Independent Registered Public Accountant

Michael Trokey & Company, P.C. (“MTPC”) served as the Company’s independent registered public accountants for the 2006 fiscal year. A representative of MTPC will be present at the meeting to respond to stockholders’ questions and will have an opportunity to make a statement if he so desires. The Audit Committee of the Board of Directors has not yet selected a firm to serve as independent auditors for the Company for the year ending September 30, 2007.

Fees Paid To Independent Registered Public Accountant

For the years ended September 30, 2006 and 2005, the Company was billed by MTPC for fees aggregating $195,460 and $78,990, respectively. Such fees comprised of the following:

Audit Fees. During the fiscal years ended September 30, 2006 and 2005, the aggregate fees billed by the Company’s independent registered public accountant for professional services rendered for the audit of the annual financial statements and the review of the financial statements included in Quarterly Reports on Form 10-Q filed during the fiscal years ended September 30, 2006 and 2005 were $75,500 and $75,490, respectively.

Audit-Related Fees. No fees were billed by the Company’s independent registered public accountant for audit-related services for the fiscal years ended September 30, 2006 and 2005.

Tax Fees. The aggregate fees billed by the Company’s independent registered public accountant for tax services for both fiscal years ended September 30, 2006 and 2005 were $3,500. For both years, such fees were for tax return preparation.

All Other Fees. During the fiscal year ended September 30, 2006, the Company was billed $116,460 by MTPC for Reorganization expenses. There were no fees billed by MTPC for all other fees for the fiscal year ended September 30, 2005.

Proposal II — Approval of the Liberty Bancorp, Inc. 2007 Equity Incentive Plan

General

On November 22, 2006, the Board of Directors unanimously adopted, subject to stockholder approval at the annual meeting, the Liberty Bancorp, Inc. 2007 Equity Incentive Plan (the “2007 Plan”). The 2007 Plan will become effective as of the date it is approved by the stockholders. The 2007 Plan complies with applicable OTS regulations, but the OTS does not endorse or approve the 2007 Plan

in any way.

The Board of Directors has reserved a total of 226,340 shares of common stock for issuance upon the grant or exercise of awards pursuant to the 2007 Plan. Subject to the limitations set forth in the 2007 Plan (and described below under “Regulatory Restrictions”), all of the Company’s employees, officers and directors are eligible to participate in the 2007 Plan. A summary of the 2007 Plan is set forth below. This summary is qualified in its entirety by the full text of the 2007 Plan, which is attached to this proxy statement as Appendix B.

In voting to approve the 2007 Plan, you may vote in favor of the proposal, against the proposal or abstain from voting. To be approved, this matter requires the affirmative vote of a majority of the votes eligible to be cast at the annual meeting. Abstentions and broker non-votes will have the effect of a vote against this proposal.

Summary of the 2007 Plan

Purpose. The purpose of the 2007 Plan is to promote the Company’s success by linking the personal, financial and economic interests of its employees, officers and directors to those of the Company’s stockholders, and by providing participants with an incentive for outstanding performance. The 2007 Plan is further intended to provide flexibility to the Company in its ability to motivate, attract and retain the services of employees, officers and directors upon whose judgment, interest and special efforts the successful conduct of the Company’s operation largely depends.

Eligibility. Any officer, director or employee of the Company or any other entity that controls or is controlled by the Company may receive awards under the 2007 Plan, but only employees of the Company or any parent or subsidiary of the Company may receive incentive stock options under the 2007 Plan. There are approximately 86 persons eligible to receive awards under the 2007 Plan.

Permissible Awards. The 2007 Plan authorizes the granting of awards in any of the following forms:

| · | options to purchase shares of Company common stock, which may be non-statutory stock options or incentive stock options under the U.S. Internal Revenue Code (the “Code”); and |

| · | restricted stock, which is subject to restrictions on transferability and subject to forfeiture. |

Shares Available for Awards. Subject to adjustment as provided in the 2007 Plan, the aggregate number of shares of common stock reserved and available for issuance pursuant to awards granted under the 2007 Plan is 226,340. Except for shares retained or surrendered to satisfy tax withholding obligations, only shares actually issued under the 2007 Plan count against the total number of shares available under the 2007 Plan. Of the total shares available under the 2007 Plan, 100,691 shares may be issued in connection with the exercise of stock options and 125,649 shares may be issued as restricted stock.

Limitations on Awards. The maximum number of shares of Company common stock that may be covered by options granted under the 2007 Plan to any one person during any one calendar year is 25,172.

Administration. The 2007 Plan will be administered by a committee appointed by the Board of Directors which shall consist of at least two disinterested directors (the “Committee”) or, at the discretion

of the Board of Directors from time to time, the 2007 Plan may be administered by the Board of Directors. The Committee will have the authority to grant awards; designate participants; determine the type or types of awards to be granted to each participant and the number, terms and conditions of awards; accelerate the vesting, exercisability or lapse of restrictions of any outstanding award; prescribe the form of each award agreement; decide all other matters that must be determined in connection with an award; establish, adopt or revise any rules, regulations, guidelines or procedures as it may deem necessary or advisable to administer the 2007 Plan; make all other decisions and determinations that may be required under the 2007 Plan; and amend the 2007 Plan or any award agreement as provided in the 2007 Plan.

Limitations on Transfer; Beneficiaries. Generally, participants may not assign or transfer awards other than by will or the laws of descent and distribution or (except in the case of an incentive stock option) pursuant to a qualified domestic relations order. The Committee may permit other transfers; however, where it concludes that a transfer will not result in accelerated taxation, will not cause any option intended to be an incentive stock option to fail to qualify as such, and that a transfer is otherwise appropriate and desirable, taking into account any factors deemed relevant, including, without limitation, any state or federal tax or securities laws or regulations applicable to transferable awards. A participant may, in the manner determined by the Committee, designate a beneficiary to exercise the rights of the participant and to receive any distribution with respect to any award upon the participant’s death.

Acceleration Upon Certain Events. If a participant’s service terminates by reason of death or disability, or if there is a change in control of the Company, all of the participant’s outstanding options and restricted stock awards will become fully vested and exercisable and all time-based vesting restrictions on the outstanding awards will lapse.

Adjustments. In the event of a stock split, a dividend payable in shares of Company common stock, or a combination or consolidation of the Company’s common stock into a lesser number of shares, the share authorization limits under the 2007 Plan will automatically be adjusted proportionately, and the shares then subject to each award will automatically be adjusted proportionately, without any change in the aggregate purchase price for each award. If the Company is involved in another corporate transaction or event that affects its common stock, such as an extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination or exchange of shares, the share authorization limits under the 2007 Plan will be adjusted proportionately, and the Committee may adjust the 2007 Plan and outstanding awards to preserve the benefits or potential benefits of the awards.

Termination and Amendment. The Board of Directors may, at any time and from time to time, amend, modify or terminate the 2007 Plan. An amendment will be subject to stockholder approval if the amendment to the 2007 Plan would materially increase the number of shares of stock issuable under the 2007 Plan, expand the types of awards provided under the 2007 Plan, materially expand the class of participants eligible to participate in the 2007 Plan, materially extend the term of the 2007 Plan, or otherwise constitute a material amendment requiring stockholder approval under applicable stock market or stock exchange listing requirements, laws, policies or regulations. In addition, the Board of Directors may condition any other amendment or modification on the approval of stockholders for any other reason. No termination or amendment of the 2007 Plan may adversely affect any award previously granted under the 2007 Plan without the written consent of the participant.

The Committee may amend, modify or terminate outstanding awards; however, such amendments may require the consent of the participant and, unless approved by the stockholders or otherwise permitted by the anti-dilution provisions of the 2007 Plan, the exercise price of an outstanding option may not be reduced, directly or indirectly, and the original term of an option may not be extended.

Prohibition on Repricing. As indicated above under “Termination and Amendment,” outstanding stock options cannot be repriced, directly or indirectly, without the prior consent of the Company’s stockholders. The exchange of an “underwater” option (i.e., an option having an exercise price in excess of the current market value of the underlying stock) for another award would be considered an indirect repricing and would, therefore, require the prior consent of the Company’s stockholders.

Regulatory Restrictions. Under the 2007 Plan, the Committee may not grant options and restricted stock to any one individual for shares that would exceed 25% of the shares reserved for each type of award. The Committee may not grant options and restricted stock to any non-employee individual director for shares that would exceed 5% of the shares received for each type of award. The Committee may not grant, in the aggregate, to non-employee directors options and restricted stock that would exceed 30% of the shares reserved for each type of award. All awards must vest over a period of time no more rapidly than 20% per year commencing on the first anniversary of the date of grant; however, awards may fully vest upon death or disability of an award recipient or upon a change in control. Further, the 2007 Plan provides that all executive officers or directors who have received awards under the 2007 Plan must exercise or forfeit their options in the event BankLiberty becomes critically undercapitalized (as defined in the OTS regulations), is subject to OTS enforcement action or receives a capital directive for prompt corrective action. These provisions comply with the rules and regulations issued by the OTS.

Certain Federal Income Tax Effects

Nonstatutory Stock Options. There will be no federal income tax consequences to the optionee or to the Company upon the grant of a nonstatutory stock option under the 2007 Plan. When the optionee exercises a nonstatutory option, however, he or she will recognize ordinary income equal to the excess of the fair market value of the common stock received upon exercise of the option at the time of exercise over the exercise price, and the Company will be allowed a corresponding deduction, subject to any applicable limitations under Code Section 162(m). Any gain that the optionee realizes when he or she later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

Incentive Stock Options. There typically will be no federal income tax consequences to the optionee or to the Company upon the grant or exercise of an incentive stock option. If the optionee holds the option shares for at least two years after the date the option was granted or for one year after exercise, the difference between the exercise price and the amount realized upon sale or disposition of the option shares will be long-term capital gain or loss, and the Company will not be entitled to a federal income tax deduction. If the optionee disposes of the option shares in a sale, exchange or other disqualifying disposition before the required holding period ends, he or she will recognize taxable ordinary income in an amount equal to the excess of the fair market value of the option shares at the time of exercise over the exercise price, and the Company will be allowed a federal income tax deduction equal to such amount. While the exercise of an incentive stock option does not result in current taxable income, the excess of the fair market value of the option shares at the time of exercise over the exercise price will be an item of adjustment for purposes of determining the optionee’s alternative minimum taxable income.

Restricted Stock. Unless a participant makes an election to accelerate recognition of the income to the date of grant as described below, a participant will not recognize income, and the Company will not be allowed a tax deduction, at the time a restricted stock award is granted, provided that the award is subject to restrictions on transfer and is subject to a substantial risk of forfeiture. When the restrictions lapse, the participant will recognize ordinary income equal to the fair market value of the common stock as of that date (less any amount he or she paid for the stock), and the Company will be allowed a corresponding federal income tax deduction at that time, subject to any applicable limitations under Code Section 162(m). If the participant files an election under Code Section 83(b) within 30 days

after the date of grant of the restricted stock, he or she will recognize ordinary income as of the date of grant equal to the fair market value of the stock as of that date (less any amount paid for the stock), and the Company will be allowed a corresponding federal income tax deduction at that time, subject to any applicable limitations under Code Section 162(m). Any future appreciation in the stock will be taxable to the participant at capital gains rates. However, if the stock is later forfeited, the participant will not be able to recover the tax previously paid pursuant to the Code Section 83(b) election.

Benefits to Named Executive Officers and Others

Awards, if any, will be granted under the 2007 Plan only after the 2007 Plan is approved by stockholders. All awards under the 2007 Plan will be made at the discretion of the Committee or under delegated authority. Therefore, it is not possible to determine the benefits or amounts that will be received by any individuals or groups pursuant to the 2007 Plan in the future, or the benefits or amounts that would have been received by any individuals or groups for the last completed fiscal year if the 2007 Plan had been in effect.

Equity Compensation Plan Information

The following table sets forth information about Company common stock that may be issued upon exercise of options, warrants and rights under all of the Company’s equity compensation plans as of September 30, 2006. The Company does not maintain any equity compensation plans that have not been approved by shareholders.

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

Plan category | | (a) | | (b) | | (c) | |

| | | | | | | | |

Equity compensation plans provided by security holders | | | 234,961 | | $ | 7.31 | | | ─ | |

| | | | | | | | | | | |

Equity compensation plans not approved by security holders | | | None | | | None | | | None | |

| | | | | | | | | | | |

Total | | | 234,961 | | | 7.31 | | | ─ | |

The Board of Directors unanimously recommends that you vote “FOR” approval of the Liberty Bancorp, Inc. 2007 Plan.

Compensation Committee Report on Executive Compensation

The following is a report of the Compensation Committee of the Board of Directors regarding executive compensation. The Compensation Committee’s membership and duties are described in this proxy statement under the heading “Proposal 1 - Election of Directors - Board Meetings and Committees of the Board of Directors.”

Compensation Policies

The Committee’s objectives in designing and administering the specific elements of the Company’s executive compensation program are as follows:

The Compensation Committee bases its executive compensation policy on the same principles that guide the Company in establishing all of its compensation programs. The Company designs programs to attract, retain and motivate highly talented individuals at all levels of the organization while balancing the interests of stockholders. The compensation program for executives consists of three key elements:

| · | Performance-based annual bonus; and |

| · | Long-term stock incentive compensation. |

The Committe’s objectives in designing and administering the specific elements of the Company’s executive compensation program are as follows:

| · | To link executive compensation rewards to increases in shareholder value, as measured by favorable long-term operating results and continued strengthening of the Company’s financial condition. |

| · | To provide incentives for executive officers to work towards achieving successful annual results as a step in achieving the Company’s long-term operating results and strategic objectives. |

| · | To correlate, as closely as possible, executive officers’ receipt of compensation with the attainment of specified performance objectives. |

| · | To maintain a competitive mix of total executive compensation, with particular emphasis on awards related to increases in long-term shareholder value. |

| · | To attract and retain top performing executive officers for the long-term success of the Company. |

| · | To facilitate stock ownership through the granting of stock options and other equity awards. |

Components of Executive Compensation

In furtherance of the above objectives, the Committee has determined that there should be three specific components of executive compensation: base salary, a cash bonus and long-term incentive compensation designed to provide long-term incentives through the facilitation of stock ownership in the Company.

Base Salary. Salary levels for all employees, including executive officers, are set so as to reflect the duties and levels of responsibilities inherent in the position and to reflect competitive conditions in the banking business in the Company’s market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for a given position. The Compensation Committee utilizes information from the SNL Executive Compensation Book for financial institutions in the midwest region of the United States with an asset size of less than $500 million, as well as other surveys prepared by trade groups and independent benefits consultants. Base salaries for executive

officers are reviewed annually by the Compensation Committee, which takes into account the competitive level of pay as reflected in the surveys consulted. In setting base salaries, the Compensation Committee also considers a number of factors relating to the particular executive, including individual performance, job responsibilities, level of experience, ability and knowledge of the position. These factors are considered subjectively in the aggregate and none of the factors is accorded a specific weight.

Bonus. The Company maintains a bonus plan, which provides for annual cash incentive compensation based on the achievement of a combination of individual and Company performance measures. The Compensation Committee assesses Company performance relative to the budget established at the beginning of the fiscal year, including net income, return on assets, return on equity and loan and deposit growth. The Compensation Committee also considers competitive levels of compensation at similar companies as set forth in the SNL Executive Compensation Book. Bonuses are discretionary by the Compensation Committee. For performance in fiscal 2006, bonuses were awarded to executive officers based on the Compensation Committee’s recognition of the individual contributions made by executive officers that enabled the Company to perform well both financially and operationally, despite the very difficult economic environment, and based on competitive levels of compensation at similar companies.

Long-Term Incentive Compensation. The Committee believes that stock options and restricted stock are important elements of compensation because they provide executives with incentives linked to the performance of the common stock. The Company awards stock options and restricted stock as a means of providing employees the opportunity to acquire a proprietary interest in the Company and to link their interests with those of the Company’s stockholders. Options are granted with an exercise price equal to the market value of the common stock on the date of grant, and thus acquire value only if the Company’s stock price increases. Although there is no specific formula, in determining the level of option or restricted stock awards, the Committee takes into consideration the same Company, Bank and stock price performance criteria considered in awarding cash bonuses, as well as individual performance.

Brent M. Giles - Chief Executive Officer Compensation

In determining Mr. Giles’ cash compensation for fiscal 2006, the board focused on the Company’s financial performance during the year, the number of initiatives begun, expanded or completed by the Company since Mr. Giles’ employment began, competitive levels of compensation for chief executive officers managing operations of similar size, complexity and performance level and the importance of retaining a President and Chief Executive Officer with the strategic, financial and leadership skills to ensure the Company’s continued growth into the foreseeable future. In analyzing Mr. Giles’ performance for fiscal year 2006, the board specifically considered the success of the Company’s stock offering and the Bank’s Reorganization, the Company’s overall growth and continued achievement of its goals as set forth in its strategic plan, financial metrics such as net income, loan and deposit growth, the Bank’s successful opening of an additional branch location and Mr. Giles’ success in enhancing the Bank’s regulatory compliance controls and procedures. The Committee believes that Mr. Giles’ total compensation package for 2006 will be approximately at the median of total compensation for chief executive officers in its peer group, based on data obtained via the SNL Executive Compensation Book.

| | The Compensation Committee |

| | |

| | Daniel G. O’Dell (Chairperson) Steven K. Havens Robert T. Sevier Ralph W. Brant, Jr. |

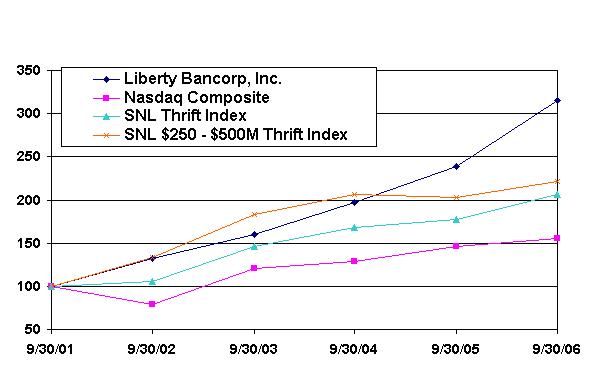

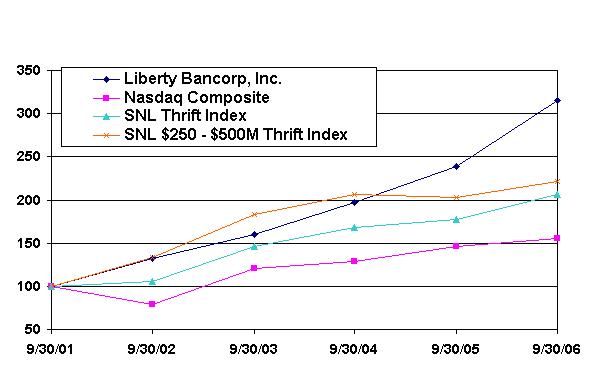

Performance Graph