LIBERTY BANCORP, INC.

2007 ANNUAL REPORT

[LIBERTY BANCORP, INC. LETTERHEAD]

Dear Shareholder:

I am pleased to report consolidated net earnings of $1,944,000, or $.42 per share, for the year ended September 30, 2007 compared to $1,463,000, or $.31 per share, for the year ended September 30, 2006. The performance of the Company was aided by a significant loan loss recovery of $506,000 in the fourth quarter of the fiscal year. Total assets increased 15.86% from $287.6 million as of September 30, 2006, to $333.2 million as of September 30, 2007. For the same period, total deposits increased $53.8 million, from $198.5 million to $252.3 million, and total loans increased $32.1 million, from $200.2 million to $232.3 million.

The past year was challenging as numerous events and issues resulted in a difficult operating environment for financial institutions. Our trade area experienced a continued downturn in the housing market which has increased delinquencies and non-performing assets in our residential construction and development loan portfolio. Additionally, rising funding costs from increased competition, a flat yield curve, and volatile credit markets put pressure on our net interest margin. Throughout the year, our team of dedicated professionals worked very hard to minimize the effect of these arduous conditions and continue to build a premier community banking franchise.

We opened our seventh retail bank facility during September, 2007, in Gladstone, Missouri, our third new location in the last two years, and plan to open an additional banking center in North Kansas City, Missouri, in 2008. Although we expect our new banking centers to produce core deposit growth, revenue growth, and long-term shareholder value, these investments are likely to have a negative effect on earnings during the first two to three years of operation.

Our professional, friendly, and knowledgeable employees are focused on consistently delivering a superior experience to our customers. This customer focus, coupled with convenient locations and progressive products has produced a growing company and improving market share. The next year holds many uncertainties and may prove to be as challenging as the last, but we plan to make further strides building a solid banking franchise that will produce long-term shareholder value.

Thank you to our employees, customers, and stockholders for your continued support.

|

| |

| /s/ Brent M. Giles |

| Brent M. Giles |

| President and Chief Executive Officer |

|

Business of the Company

Liberty Bancorp, Inc. (the “Company” or “Liberty Bancorp”) was organized as a Missouri corporation at the direction of BankLiberty, formerly “Liberty Savings Bank, F.S.B.” (the “Bank” or “BankLiberty”), in February 2006 to become the holding company for the Bank upon the completion of the “second-step” mutual-to-stock conversion (the “Conversion”) of Liberty Savings Mutual Holding Company (the “MHC”). The Conversion was completed on July 21, 2006. As part of the Conversion, the MHC merged into the Bank, thereby ceasing to exist, and Liberty Savings Bank, F.S.B. changed its name to “BankLiberty.” A total of 2,807,383 shares of common stock were sold in the stock offering at a price of $10.00 per share. In addition, a total of approximately 1,952,754 shares of common stock were issued to the minority shareholders of the former Liberty Savings Bank, F.S.B. representing an exchange ratio of 3.5004 shares of Company common stock for each share of Liberty Savings Bank, F.S.B. common stock. Fractional shares in the aggregate, or 36 shares, were redeemed for cash. Total shares outstanding after the stock offering and the exchange totaled 4,760,137 shares. Net proceeds of $25.6 million were raised in the stock offering, excluding $1.2 million which was loaned by the Company to a trust for the Employee Stock Ownership Plan (the “ESOP”), enabling it to finance the purchase of 153,263 shares of common stock in the offering and exchange. Direct offering costs totaled approximately $1.3 million. In addition, as part of the Conversion, and dissolution of Liberty Savings Mutual Holding Company, the Bank received $694,000 of cash previously held by the MHC.

The Company has no significant assets, other than all of the outstanding shares of the Bank and the portion of the net proceeds it retained from the Conversion, and no significant liabilities. The Company neither owns nor leases any property, but instead uses the premises, equipment and furniture of the Bank.

Business of the Bank

The Bank is a community-oriented financial institution dedicated to serving the financial service needs of consumers and businesses within its market area which consists of Clay, Clinton, Platte and Jackson Counties in Missouri. We attract deposits from the general public and use these funds to originate loans secured by real estate located in our market area. Our real estate loans include construction loans, commercial real estate loans, and loans secured by single-family or multi-family properties. To a lesser extent, we originate consumer loans and commercial business loans. We currently operate out of our main office in Liberty, Missouri and six full-service branch offices – two in Kansas City, Missouri and one in Plattsburg, Platte City, Independence and Gladstone, Missouri.

The Bank is subject to extensive regulation, examination and supervision by the Office of Thrift Supervision, its primary federal regulator, and the Federal Deposit Insurance Corporation, its deposit insurer. The Bank has been a member of the Federal Home Loan Bank System since its inception and is a member of the Federal Home Loan Bank of Des Moines.

Common Stock

The common stock of Liberty Bancorp, Inc. is traded on the NASDAQ Capital Market under the symbol “LBCP.” The Company completed its initial public offering on July 21, 2006 and commenced trading on July 24, 2006. The following table sets forth the high and low sales prices for the common stock and dividends per share for the fourth quarter of 2006 and year ended September 30, 2007, as reported by NASDAQ. The prices do not necessarily reflect inter-dealer prices without retail markup, markdown or commissions and may not reflect actual transmissions.

| | | For the Year Ended | | For the Year Ended | |

| | | September 30, 2006 | | September 30, 2007 | |

| | | | | | | | | | | | |

| | | 4th Quarter | | 1st Quarter | | 2nd Quarter | | 3rd Quarter | | 4th Quarter | |

| | | | | | | | | | | | |

| High | | | 10.540 | | | 10.730 | | | 11.450 | | | 11.380 | | | 11.000 | |

| Low | | | 10.050 | | | 9.960 | | | 10.500 | | | 10.730 | | | 10.080 | |

| Dividend | | | .025 | | | .025 | | | .025 | | | .025 | | | .025 | |

As of September 30, 2007, the Company had approximately 407 stockholders of record; this does not reflect the number of persons whose shares are in nominee or “street” name accounts through brokers.

Liberty Bancorp is subject to Missouri law, which generally permits Liberty Bancorp to pay dividends on its common stock as long as no dividend is declared or paid at a time when the net assets of the corporation are less than its stated capital or when the payment of such dividends would reduce the net assets of the corporation below its stated capital.

Dividend payments by the Company depend primarily on dividends received by the Company from the Bank. See note 13 to Consolidated Financial Statements for information regarding the dividend restrictions applicable to the Company and the Bank.

On August 6, 2007 the Company announced a stock repurchase program to acquire up to 476,119 shares, or 10%, of the Company’s outstanding common stock. On December 20, 2007, the Company announced a second stock repurchase program to acquire up to 222,048 shares, or 5%, of the Company’s common stock. Subsequent to September 30, 2007, the Company has repurchased 320,230 shares at an average price of $10.57 per share. Repurchased shares will be held in treasury.

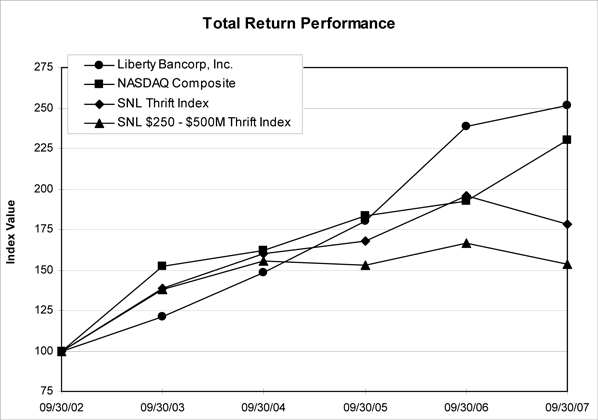

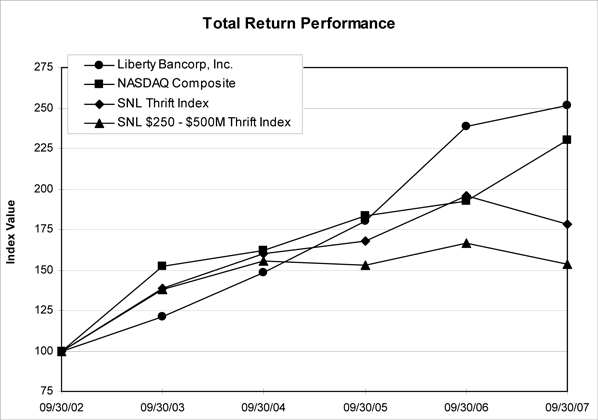

The graph and table which follow show the cumulative total return on the Company’s common stock during the period from September 30, 2002 through September 30, 2007 with (1) the total cumulative return of all companies whose equity securities are traded on the Nasdaq Stock Market, (2) the total cumulative return of thrifts and (3) the cumulative return of thrifts having asset sizes between $250 million and $500 million. The performance of the Company’s common stock also includes the performance of the common stock of the Bank, the predecessor to the Company, prior to its reorganization in 2006. The Bank’s common stock was traded on the OTC Bulletin Board and the Company’s common stock commenced trading on the Nasdaq Capital Market on July 24, 2006. Accordingly, the comparison assumes $100 was invested in the common stock of the Bank on June 30, 2002 in each of the foregoing indices and assumes reinvestment of dividends. The stockholder returns shown on the performance graph are not necessarily indicative of the future performance of the Company’s common stock or of any particular index.

| | | | |

Index | | 09/30/02 | | 09/30/03 | | 09/30/04 | | 09/30/05 | | 09/30/06 | | 09/30/07 | |

| Liberty Bancorp, Inc. | | | 100.00 | | | 121.21 | | | 148.43 | | | 180.12 | | | 238.37 | | | 251.87 | |

| NASDAQ Composite | | | 100.00 | | | 152.46 | | | 161.84 | | | 183.58 | | | 192.69 | | | 230.49 | |

| SNL Thrift Index | | | 100.00 | | | 138.64 | | | 160.15 | | | 168.09 | | | 195.66 | | | 178.57 | |

| SNL $250 - $500M Thrift Index | | | 100.00 | | | 138.10 | | | 155.47 | | | 152.86 | | | 166.34 | | | 153.70 | |

Selected Financial Highlights

The financial data presented below is qualified in its entirety by the more detailed financial data appearing elsewhere in this report. Financial data presented for 2003 through 2005 represents the financial position and results of operations for BankLiberty (formerly Liberty Savings Bank, F.S.B.). Financial data presented for 2006 and 2007 represents this same information for Liberty Bancorp, Inc. and its subsidiary, BankLiberty.

Financial Condition Data:

| | | At September, 30 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | (Dollars in Thousands) | |

| Total assets | | $ | 333,186 | | $ | 287,561 | | $ | 237,576 | | $ | 213,482 | | $ | 189,264 | |

| Cash and cash equivalents, federal funds sold, securities and stock in the Federal Home Loan Bank of Des Moines | | | 58,556 | | | 51,239 | | | 34,465 | | | 22,477 | | | 16,877 | |

| Mortgage-backed securities | | | 19,277 | | | 24,217 | | | 27,189 | | | 23,107 | | | 23,961 | |

| Loans receivable, net | | | 232,308 | | | 200,222 | | | 163,843 | | | 159,840 | | | 141,993 | |

| Deposits | | | 252,305 | | | 198,471 | | | 181,617 | | | 152,929 | | | 136,339 | |

| Advances from the Federal Home Loan Bank of Des Moines | | | 26,430 | | | 34,064 | | | 30,497 | | | 37,130 | | | 30,314 | |

| Stockholders’ equity | | | 50,195 | | | 48,982 | | | 21,131 | | | 20,184 | | | 19,465 | |

| Full service offices open | | | 7 | | | 6 | | | 5 | | | 4 | | | 4 | |

Operating Data:

| | | For the Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | (Dollars in Thousands) | |

| Interest income | | $ | 20,563 | | $ | 16,664 | | $ | 12,816 | | $ | 10,595 | | $ | 10,659 | |

| Interest expense | | | (10,494 | ) | | (7,600 | ) | | (5,175 | ) | | (4,031 | ) | | (5,168 | ) |

| Net interest income | | | 10,069 | | | 9,064 | | | 7,641 | | | 6,564 | | | 5,491 | |

| Provision for loan losses | | | (602 | ) | | (852 | ) | | (430 | ) | | (885 | ) | | (206 | ) |

| Net interest income after provision for loan losses | | | 9,467 | | | 8,212 | | | 7,211 | | | 5,679 | | | 5,285 | |

| Noninterest income | | | 1,477 | | | 1,237 | | | 1,200 | | | 1,118 | | | 1,783 | |

| Noninterest expense | | | (8,046 | ) | | (7,203 | ) | | (6,065 | ) | | (5,267 | ) | | (5,972 | ) |

| Earnings before income taxes | | | 2,898 | | | 2,246 | | | 2,346 | | | 1,530 | | | 1,096 | |

| Income taxes | | | (954 | ) | | (783 | ) | | (841 | ) | | (567 | ) | | (395 | ) |

| Net earnings | | $ | 1,944 | | $ | 1,463 | | $ | 1,505 | | $ | 963 | | $ | 701 | |

Per Share Data: | | | | | | | | | | | | | | | | |

| Basic earnings per share (1) | | $ | 0.42 | | $ | 0.32 | | $ | 0.32 | | $ | 0.21 | | $ | 0.15 | |

| Diluted earnings per share (1) | | | 0.42 | | | 0.31 | | | 0.32 | | | 0.21 | | | 0.15 | |

| Dividends per share (2) | | | 0.10 | | | 0.20 | | | 0.23 | | | 0.23 | | | 0.23 | |

| (1) | Earnings per share are based upon the weighted-average shares outstanding. Weighted-average shares outstanding for periods prior to the July 21, 2006 conversion date have been adjusted by the exchange ratio of 3.5004 to calculate earnings per share. |

| (2) | Dividends per share prior to the July 21, 2006 conversion date have been adjusted by the exchange ratio of 3.5004. Dividends on 800,000 shares owned by Liberty Savings Mutual Holding Company were waived. See note 13 of the notes to consolidated financial statements |

| | | At or For the Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Performance Ratios: | | | | | | | | | | | |

| Return on average assets | | | 0.63 | % | | 0.56 | % | | 0.67 | % | | 0.47 | % | | 0.37 | % |

| Return on average equity | | | 3.94 | | | 5.47 | | | 7.28 | | | 4.81 | | | 3.57 | |

| Interest rate spread (1) | | | 2.97 | | | 3.43 | | | 3.41 | | | 3.22 | | | 2.76 | |

| Net interest margin (2) | | | 3.47 | | | 3.66 | | | 3.54 | | | 3.37 | | | 3.03 | |

| Noninterest expense to average assets | | | 2.61 | | | 2.74 | | | 2.69 | | | 2.62 | | | 3.21 | |

| Efficiency ratio (3) | | | 69.68 | | | 69.93 | | | 68.60 | | | 68.56 | | | 82.10 | |

| Average interest-earning assets to average interest-bearing liabilities | | | 113.88 | | | 107.40 | | | 105.48 | | | 106.54 | | | 109.31 | |

| Average equity to average assets | | | 16.00 | | | 10.16 | | | 9.16 | | | 9.74 | | | 10.56 | |

| Dividend payout ratio (4) | | | 23.86 | | | 29.86 | | | 28.26 | | | 43.37 | | | 59.90 | |

Capital Ratios: (5) | | | | | | | | | | | | | | | | |

| Tangible capital | | | 10.84 | | | 12.73 | | | 8.99 | | | 9.42 | | | 10.32 | |

| Core capital | | | 10.84 | | | 12.73 | | | 8.99 | | | 9.42 | | | 10.32 | |

| Tier 1 risk-based capital | | | 13.91 | | | 17.12 | | | 12.31 | | | 12.64 | | | 14.62 | |

| Total risk-based capital | | | 15.08 | | | 18.14 | | | 13.32 | | | 13.89 | | | 15.59 | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | |

| Allowance for loan losses as a percent of gross loans | | | 1.13 | | | 0.93 | | | 0.93 | | | 1.09 | | | 0.80 | |

| Allowance for loan losses as a percent of non-performing loans | | | 87.98 | | | 50.80 | | | 134.50 | | | 55.38 | | | 472.43 | |

| Net charge-offs (recoveries) to average outstanding loans during the year | | | (0.12 | ) | | 0.25 | | | 0.40 | | | 0.09 | | | (0.02 | ) |

| Non-accrual and 90 days or more past due loans as a percent of total loans, net | | | 1.47 | | | 2.11 | | | 0.55 | | | 0.45 | | | ― | |

| Non-performing assets as a percent of total assets | | | 1.53 | | | 2.02 | | | 1.20 | | | 1.97 | | | 0.15 | |

| | (1) | Represents the difference between the weighted average yield on average interest-earning assets and the weighted average cost of interest-bearing liabilities. No tax equivalent adjustments were made. |

| | (2) | Represents net interest income as a percent of average interest-earning assets. No tax equivalent adjustments were made. |

| | (3) | Represents noninterest expense divided by the sum of net interest income and noninterest income. |

| | (4) | Represents dividends paid to shareholders as a percent of net earnings. Does not include dividends waived by Liberty Savings Mutual Holding Company. |

| (5) | Represents capital ratios only for the Company’s subsidiary, BankLiberty. |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Forward-Looking Statements

This Annual Report contains “forward-looking statements” within the meaning of the federal securities laws. These statements are not historical fact; rather, they are statements based on Liberty Bancorp, Inc.’s current expectations regarding its business strategies, intended results and future performance. Forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project” or similar expressions.

Management’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of Liberty Bancorp, Inc. and its subsidiary include, but are not limited to, changes in interest rates, national and regional economic conditions, legislative and regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board, the quality and composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in BankLiberty’s market area, changes in real estate market values in BankLiberty’s market area, changes in relevant accounting principles and guidelines and inability or third party service providers to perform.

These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Except as required by applicable law or regulations, Liberty Bancorp, Inc. does not undertake, and specifically disclaims any obligation, to release publicly the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of the statements or to reflect the occurrence of anticipated or unanticipated events.

Overview

Income. Our primary source of pre-tax income is net interest income. Net interest income is the difference between interest income, which is the income that we earn on our loans and securities, and interest expense, which is the interest that we pay on our deposits and borrowings. Other significant sources of pre-tax income are service charges on deposit accounts, gains on sales of loans and other loan service charges. In addition, we recognize income or losses from the sale of investments in years that we have such sales.

Allowance for Loan Losses. The allowance for loan losses is a valuation allowance for probable losses inherent in the loan portfolio. Provisions for loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance. We estimate the allowance balance required using past loan loss experience, the nature and value of the portfolio, information about specific borrower situations, and estimated collateral values, economic conditions and other factors. Allocation of the allowance may be made for specific loans, but the entire allowance is available for any loan that, in our judgment, should be charged off.

Expenses. The noninterest expenses we incur in operating our business consist of compensation and employee benefit expenses, occupancy expense, equipment and data processing expenses, advertising expenses, federal deposit insurance premiums and various other miscellaneous expenses.

Compensation and employee benefits consist primarily of salaries and wages paid to our employees, director and committee fees, payroll taxes, expenses for health insurance and other employee benefits.

Occupancy and equipment expenses, which are the fixed and variable costs of buildings and equipment, consist primarily of depreciation charges, furniture and equipment expenses, rent expense, maintenance, real estate taxes and costs of utilities. Depreciation of premises and equipment is computed using the straight-line method based on the useful lives of the related assets, which range from three to 40 years.

Data processing expenses include fees paid to our third party data processing service and ATM expense.

Advertising expenses include expenses for print, radio and television advertisements, promotions, third-party marketing services and premium items.

Federal deposit insurance premiums are primarily payments we make to the Federal Deposit Insurance Corporation for insurance of our deposit accounts.

Other expenses include correspondent banking charges, operations from foreclosed real estate, professional and regulatory services, expenses for supplies, telephone and postage, contributions and donations, insurance and surety bond premiums and other fees and expenses.

We expect that noninterest expenses will increase as a result of our strategy to expand our branch network. These additional expenses will consist primarily of salaries and employee benefits and occupancy and equipment expenses. Initially, we expect that these expenses will be greater than the additional income that we generate through our new facilities. Over time, we anticipate that we will generate sufficient income to offset the expenses related to our new facilities and new employees, but we cannot provide assurances as to when or if our branch expansion strategy will be accretive to our earnings.

Critical Accounting Policies

Our accounting and reporting policies were prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) and to general practices within the financial services industry. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates. Management has identified the accounting policies described below as those that, due to the judgments, estimates and assumptions inherent in those policies, are critical to an understanding of our financial statements and management’s discussion and analysis.

Income Recognition. We recognize interest income by methods conforming to US GAAP that include general accounting practices within the financial services industry. Interest income on loans and investment securities is recognized by methods that result in level rates of return on principal amounts outstanding, including yield adjustments resulting from the amortization of loan costs and premiums on investment securities and accretion of loan fees and discounts on investment securities.

In the event management believes collection of all or a portion of contractual interest on a loan has become doubtful, which generally occurs after the loan is 90 days past due, the accrual of interest is discontinued. In addition, previously accrued interest deemed uncollectible that was recognized in income is reversed. Interest received on nonaccrual loans is included in income only if principal recovery is reasonably assured. A non-accrual loan is restored to accrual status when it is brought current or has performed in accordance with contractual terms for a reasonable period of time, and the collectibility of the total contractual principal and interest is no longer doubtful.

Allowance for Loan Losses. Valuation allowances are established for impaired loans for the difference between the loan amount and the fair value of collateral less estimated selling costs. We consider a loan to be impaired when, based on current information and events, it is probable that we will be unable to collect all amounts due according to the contractual terms of the loan agreement on a timely basis. The types of loans for which impairment is measured include nonaccrual income property loans (excluding those loans included in the homogenous portfolio which are collectively reviewed for impairment), large, non-accrual single-family loans and troubled debt restructurings. Such loans are generally placed on non-accrual status at the point deemed uncollectible. Impairment losses are recognized through an increase in the allowance for loan losses. See note 5 of the notes to consolidated financial statements for information regarding impaired loans at September 30, 2007, 2006 and 2005.

Allowances for loan losses are available to absorb losses incurred on loans and represent additions charged to expense, less net charge-offs. The allowances are evaluated on a regular basis by management and are based on management’s periodic review of the collectibility of loans, in light of historical experience, fair value of the underlying collateral, changes in the types and mix of loans originated and prevailing economic conditions.

Operating Strategy

Our mission is to operate and further expand a profitable and diversified community banking franchise. We plan to achieve this by executing our strategy of:

| · | expanding through de novo branching in the Kansas City metropolitan area; and |

| | · | continuing to transform our balance sheet to emphasize assets and liabilities that allow us to increase our net interest margin while reducing our exposure to risk from interest rate fluctuations. |

Expansion Through De Novo Branching. In 2004, the Board of Directors, with the assistance of our Chief Executive Officer hired in September 2003, determined to pursue a strategic plan to enhance long-term shareholder value through franchise growth. The strategic plan calls for expansion through de novo branching in the Kansas City metropolitan area to enable us to take advantage of the opportunities afforded by recent and forecasted economic growth in that market. We believe that the increased asset size to be achieved through the planned expansion will enable us to leverage better efficiencies and technology but still attract customers based on personal service and relationships. Our first new branch was opened in Independence, Missouri in May 2005, a second new branch was opened in Kansas City, Missouri in January 2006, and a third new branch was opened in Gladstone, Missouri in September 2007. We anticipate that over the next three to five years, based on and subject to local market conditions, we will open additional branch offices in suburban Kansas City growth areas that complement our existing branch network.

While we anticipate that this expansion strategy will enhance long-term shareholder value, we cannot assure you when or if our branch expansion strategy will be accretive to our earnings. New branches generally require a significant initial capital investment and take approximately three years or longer to become profitable. New branches require an upfront investment of between $2.0 million and $3.0 million each for land and building expenses. Accordingly, we anticipate that, in the short term, net income will be negatively affected as we incur significant capital expenditures and noninterest expense in opening and operating new branches before the new branches can produce sufficient net interest income to offset the increased expense. In addition, the need to use capital to fund de novo branching may limit our ability to pay or increase dividends on our common stock. There also is implementation risk associated with new branches. Numerous factors will determine whether our branch expansion strategy will be successful, such as our ability to select suitable branch locations, real estate acquisition costs, competition, interest rates, managerial resources, our ability to hire and retain qualified personnel, the effectiveness of our marketing strategy and our ability to attract deposits.

Continued Transformation of Our Balance Sheet. Our strategic plan also calls for us to transform our balance sheet to emphasize assets and liabilities that allow us to increase our net interest margin while reducing our exposure to risk from interest rate fluctuations.

With respect to our assets, our strategy has been, and continues to be, to increase the percentage of assets invested in commercial business, commercial real estate and multi-family loans, which tend to have higher yields than traditional single-family residential mortgage loans and which have shorter terms to maturity or adjustable interest rates. In addition, in recent years we have sought to increase our originations of real estate construction loans, which also have short terms and adjustable interest rates, although in the future we will seek to maintain construction loans approximately at current levels so as not to unduly concentrate credit risk in the real estate construction market. At the same time, we have sought to decrease our reliance on single-family residential mortgage loans. Currently, we sell substantially all new, fixed-rate conforming single-family loans in the secondary market.

Commercial real estate, commercial business and multi-family real estate loans provide us with the opportunity to earn more income because they tend to have higher interest rates than residential mortgage loans. In addition, these loans are beneficial for interest rate risk management because they typically have shorter terms and adjustable interest rates. There are many multi-family and commercial properties and businesses located in our market area, and with the additional capital raised in the offering we intend to pursue the larger lending relationships associated with these opportunities. To facilitate our growth, we have added expertise in our commercial loan department in recent years through the hiring of experienced personnel, including a new chief lending officer.

As a result of these efforts, our commercial real estate loans have increased from $16.2 million, or 12.18% of total loans, at September 30, 2001 to $57.2 million, or 21.44% of total loans, at September 30, 2007. In addition, commercial business loans have increased from $2.7 million, or 2.04% of total loans, at September 30, 2001 to $18.0 million, or 6.72% of total loans, at September 30, 2007, and multi-family real estate loans have increased from $3.4 million, or 2.56% of total loans, at September 30, 2001 to $12.2 million, or 4.57% of total loans, at September 30, 2007. The percentage of our total loan portfolio comprised of residential mortgage loans has decreased in recent years, amounting to 36.28%, 28.71%, 20.71%, 18.48% and 15.64% at September 30, 2003, 2004, 2005, 2006 and 2007, respectively.

With respect to liabilities, our strategy is to emphasize transaction and money market accounts, as well as shorter-term certificates of deposit. We value these types of deposits because they represent longer-term customer relationships and a lower cost of funding compared to longer-term certificates of deposit. We aggressively seek transaction and money market deposits through competitive products and pricing and targeted advertising. In addition, we offer business checking accounts for our commercial customers. We also hope to increase core deposits through our de novo branching strategy.

Balance Sheet Analysis

Loans. Our primary lending activity is the origination of loans secured by real estate. We originate construction loans, single-family residential loans and multi-family and commercial real estate loans. To a lesser extent, we also originate commercial business and consumer loans.

The largest segment of our loan portfolio is real estate construction loans. At September 30, 2007, these loans totaled $125.8 million and represented 47.12% of total loans, compared to $99.8 million, or 43.25% of total loans, at September 30, 2006. Through the implementation of our strategic plan, the size of our real estate construction loan portfolio rose $26.0 million over this period due primarily to increased emphasis on development and commercial construction lending which have higher yields as compared to single-family construction loans. During the year ended September 30, 2007, the largest growth in our construction loan portfolio resulted from increases in commercial real estate construction loans. This was the result of our successful efforts to increase this type of lending. Commercial real estate construction loans increased by $25.8 million, or 102.67%, from $25.2 million at September 30, 2006 to $51.0 million at September 30, 2007. Development loans increased by $12.4 million, or 51.95%, from $24.0 million at September 30, 2006 to $36.4 million at September 30, 2007. Single-family – spec loans decreased by $8.5 million, or 22.33%, from $37.8 million at September 30, 2006 to $29.3 million at September 30, 2007. Single-family – custom construction loans decreased by $5.2 million, or 42.07%, from $12.3 million at September 30, 2006 to $7.1 million at September 30, 2007. Decreases in single-family spec and custom construction loans reflect loan portfolio adjustments to current market conditions.

Single-family residential loans totaled $41.7 million and represented 15.64% of total loans at September 30, 2007, compared to $42.6 million, or 18.48% of total loans, at September 30, 2006. The Bank has pursued the strategy of selling substantially all new, fixed-rate residential loans we originate because of the relatively low yields that have been attainable on residential loans over the last several years and to decrease the interest rate risk resulting from the retention of longer-term fixed-rate loans.

Commercial real estate loans increased by $3.9 million, or 7.27%, to $57.2 million and represented 21.44% of total loans at September 30, 2007, compared to $53.3 million, or 23.13% of total loans, at September 30, 2006. These increases were due to our strategic decision to emphasize lending on income producing property projects. Currently, the Bank offers a variety of commercial real estate products to owner occupants and investors. Our primary commercial real estate lending focus areas are retail, office and industrial uses.

Multi-family loans totaled $12.2 million and represented 4.57% of total loans at September 30, 2007, compared to $10.4 million, or 4.52% of total loans, at September 30, 2006.

We also originate a variety of consumer loans and home equity loans, as well as loans secured by deposit accounts, automobile loans and other miscellaneous loans. Consumer loans totaled $12.0 million and represented 4.51% of total loans at September 30, 2007, compared to $13.2 million, or 5.73% of total loans, at September 30, 2006. The decrease in consumer loans was due primarily to a decrease in home equity loans.

Commercial business loans increased from $11.3 million or 4.89% of total loans at September 30, 2006 to $18.0 million, or 6.72% of total loans at September 30, 2007. The increase was due primarily to the addition of two loans totaling $6.5 million.

Set forth below is selected data relating to the composition of our loan portfolio at the dates indicated.

| | | At September 30, | |

| | | 2007 | | 2006 | |

| | Amount | | % | | Amount | | % | |

| | | (Dollars in thousands) | |

Type of Loan: | | | | | | | | | |

| Real estate loans: | | | | | | | | | |

| Single-family 1-4 units | | $ | 41,749 | | | 15.64 | % | $ | 42,623 | | | 18.48 | % |

| Multi-family 5 or more units | | | 12,198 | | | 4.57 | | | 10,416 | | | 4.52 | |

| Real estate construction loans | | | 125,797 | | | 47.12 | | | 99,759 | | | 43.25 | |

| Commercial real estate loans | | | 57,241 | | | 21.44 | | | 53,360 | | | 23.13 | |

| Total real estate loans | | | 236,985 | | | 88.77 | | | 206,158 | | | 89.38 | |

| Consumer loans: | | | | | | | | | | | | | |

| Loans secured by deposit accounts | | | 228 | | | 0.09 | | | 211 | | | 0.09 | |

| Automobile loans | | | 477 | | | 0.18 | | | 608 | | | 0.26 | |

| Home equity loans | | | 10,713 | | | 4.01 | | | 11,662 | | | 5.06 | |

| Other | | | 620 | | | 0.23 | | | 738 | | | 0.32 | |

| Total consumer loans | | | 12,038 | | | 4.51 | | | 13,219 | | | 5.73 | |

| Commercial business loans | | | 17,951 | | | 6.72 | | | 11,270 | | | 4.89 | |

| Total gross loans | | | 266,974 | | | 100.00 | % | | 230,647 | | | 100.00 | % |

| Loans in process | | | (31,316 | ) | | | | | (27,962 | ) | | | |

| Deferred loan fees, net | | | (339 | ) | | | | | (314 | ) | | | |

| Unearned discounts, net | | | ¾ | | | | | | (5 | ) | | | |

| Allowance for loan losses | | | (3,011 | ) | | | | | (2,144 | ) | | | |

| Total | | $ | 232,308 | | | | | $ | 200,222 | | | | |

| | | At September 30, | |

| | | 2005 | | 2004 | | 2003 | |

| | | Amount | | % | | Amount | | % | | Amount | | % | |

| | | (Dollars in thousands) | |

Type of Loan: | | | | | | | | | | | | | |

| Real estate loans: | | | | | | | | | | | | | |

| Single-family 1-4 units | | $ | 39,435 | | | 20.71 | % | $ | 53,098 | | | 28.71 | % | $ | 59,123 | | | 36.28 | % |

| Multi-family 5 or more units | | | 15,603 | | | 8.20 | | | 12,877 | | | 6.96 | | | 11,027 | | | 6.77 | |

| Real estate construction loans | | | 79,979 | | | 42.01 | | | 71,875 | | | 38.86 | | | 54,423 | | | 33.40 | |

| Commercial real estate loans | | | 37,568 | | | 19.74 | | | 30,294 | | | 16.38 | | | 23,671 | | | 14.53 | |

| Total real estate loans | | | 172,585 | | | 90.66 | | | 168,144 | | | 90.91 | | | 148,244 | | | 90.98 | |

| | | | | | | | | | | | | | | | | | | | |

| Consumer loans: | | | | | | | | | | | | | | | | | | | |

| Loans secured by deposit accounts | | | 128 | | | 0.07 | | | 167 | | | 0.09 | | | 166 | | | 0.10 | |

| Automobile loans | | | 867 | | | 0.46 | | | 1,097 | | | 0.59 | | | 1,316 | | | 0.81 | |

| Home equity loans | | | 10,266 | | | 5.39 | | | 9,764 | | | 5.28 | | | 8,126 | | | 4.99 | |

| Other | | | 1,129 | | | 0.59 | | | 1,037 | | | 0.56 | | | 638 | | | 0.39 | |

| Total consumer loans | | | 12,390 | | | 6.51 | | | 12,065 | | | 6.52 | | | 10,246 | | | 6.29 | |

| Commercial business loans | | | 5,397 | | | 2.83 | | | 4,754 | | | 2.57 | | | 4,457 | | | 2.73 | |

| | | | | | | | | | | | | | | | | | | | |

| Total gross loans | | | 190,372 | | | 100.00 | % | | 184,963 | | | 100.00 | % | | 162,947 | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | |

| Loans in process | | | (24,444 | ) | | | | | (22,549 | ) | | | | | (19,066 | ) | | | |

| Deferred loan fees, net | | | (316 | ) | | | | | (368 | ) | | | | | (389 | ) | | | |

| Unearned discounts, net | | | (7 | ) | | | | | (182 | ) | | | | | (202 | ) | | | |

| Allowance for loan losses | | | (1,762 | ) | | | | | (2,024 | ) | | | | | (1,297 | ) | | | |

| Total | | $ | 163,843 | | | | | $ | 159,840 | | | | | $ | 141,993 | | | | |

The following table sets forth certain information at September 30, 2007, regarding the dollar amount of loan principal repayments coming due during the years indicated. The table below does not include any estimate of prepayments, which significantly shorten the average life of all loans and may cause our actual repayment experience to differ from that shown below. Demand loans having no stated schedule of repayments and no stated maturity are reported as due in one year or less.

| | | Due during the Year Ended September 30, | | Due after 3 through 5 years after | | Due after 5 through 10 years after | | Due after 10 through 15 years after | | Due after 15 years after | | | |

| | | 2008 | | 2009 | | 2010 | | 9/30/07 | | 9/30/07 | | 9/30/07 | | 9/30/07 | | Total | |

| | | (Dollars in thousands) | |

| Single-family mortgage loans | | $ | 1,156 | | $ | 1,244 | | $ | 1,339 | | $ | 2,992 | | $ | 9,721 | | $ | 14,037 | | $ | 11,260 | | $ | 41,749 | |

| Multi-family mortgage loans | | | 338 | | | 364 | | | 391 | | | 874 | | | 2,840 | | | 4,101 | | | 3,290 | | | 12,198 | |

| Real estate construction loans | | | 99,610 | | | 26,187 | | | | | | — | | | | | | | | | | | | 125,797 | |

| Commercial real estate loans | | | 1,517 | | | 1,639 | | | 1,772 | | | 3,984 | | | 13,143 | | | 19,382 | | | 15,804 | | | 57,241 | |

| Loans secured by deposit accounts | | | 228 | | | | | | | | | | | | | | | | | | | | | 228 | |

| Other consumer loans | | | 2,609 | | | 2,826 | | | 3,060 | | | 3,315 | | | | | | | | | | | | 11,810 | |

| Commercial business loans | | | 2,430 | | | 2,631 | | | 2,849 | | | 6,425 | | | 3,616 | | | | | | | | | 17,951 | |

| Total gross loans | | $ | 107,888 | | $ | 34,891 | | $ | 9,411 | | $ | 17,590 | | $ | 29,320 | | $ | 37,520 | | $ | 30,354 | | $ | 266,974 | |

The following table sets forth the dollar amount of all loans at September 30, 2007, that are due after September 30, 2008 which have either fixed interest rates or adjustable interest rates.

| | | Fixed Rates | | Adjustable Rates | | Total | |

| | | (Dollars in thousands) | |

| | | | | | | | |

| Single-family mortgage loans | | $ | 25,072 | | $ | 15,521 | | $ | 40,593 | |

| Multi-family mortgage loans | | | 6,353 | | | 5,507 | | | 11,860 | |

| Real estate construction loans | | | 7,556 | | | 18,631 | | | 26,187 | |

| Commercial real estate loans | | | 50,850 | | | 4,874 | | | 55,724 | |

| Loans secured by deposit accounts | | | ¾ | | | ¾ | | | ¾ | |

| Other consumer loans | | | 1,096 | | | 8,105 | | | 9,201 | |

| Commercial business loans | | | 11,892 | | | 3,629 | | | 15,521 | |

| Total gross loans | | $ | 102,819 | | $ | 56,267 | | $ | 159,086 | |

The following table shows our loan origination, sale and other activity during the years indicated.

| | | For the Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | (Dollars in thousands) | |

| Total net loans at the beginning of year | | $ | 200,222 | | $ | 163,843 | | $ | 159,840 | |

| Loans originated for portfolio: | | | | | | | | | | |

| Single and multi-family mortgage loans | | | 25,703 | | | 17,437 | | | 12,378 | |

| Real estate construction loans | | | 64,541 | | | 74,792 | | | 68,648 | |

| Commercial real estate loans | | | 27,002 | | | 33,167 | | | 19,172 | |

| Commercial business loans | | | 16,657 | | | 9,179 | | | 2,919 | |

| Loans secured by deposit accounts | | | 212 | | | 295 | | | 197 | |

| Home equity loans | | | 3,460 | | | 4,277 | | | 2,602 | |

| Automobile and other consumer loans | | | 1,036 | | | 1,028 | | | 1,984 | |

| Total loans originated | | $ | 138,611 | | $ | 140,175 | | $ | 107,900 | |

| | | | | | | | | | | |

| Deduct: | | | | | | | | | | |

| Principal loan repayment and other, net | | | 106,790 | | | 103,326 | | | 103,205 | |

| Loan charge-offs, net of (recoveries) | | | (265 | ) | | 470 | | | 692 | |

| Total net loans at end of year | | $ | 232,308 | | $ | 200,222 | | $ | 163,843 | |

| Loans originated for sale | | $ | 20,354 | | $ | 17,656 | | $ | 21,140 | |

| Loans sold in secondary market | | $ | 20,094 | | $ | 19,281 | | $ | 20,132 | |

Loans Held for Sale. Loans held for sale increased $260,000 to $719,000 at September 30, 2007.

Securities. Our securities portfolio consists primarily of government agency securities, municipal securities and mortgage-backed securities. Although municipal securities generally have greater credit risk than government agency securities, they generally have higher yields than government securities of similar duration. Securities available for sale increased from $35.9 million at September 30, 2006 to $48.0 million at September 30, 2007 due to purchases of intermediate-term agencies and intermediate and long-term municipal securities, partially offset by maturities and calls. Mortgage-backed securities available for sale decreased from $24.2 million at September 30, 2006 to $19.3 million at September 30, 2007 due to principal repayments.

The following table sets forth the Bank’s mortgage-backed securities purchases and sales for the years indicated.

| | | Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | (In thousands) | |

| Mortgage-backed securities: | | | | | | | |

| Purchased | | | ¾ | | $ | 3,452 | | $ | 13,755 | |

| Sold | | | ¾ | | | ¾ | | | 1,874 | |

The following table sets forth the carrying values and fair values of our securities and mortgage-backed securities portfolio at the dates indicated.

| | | At September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | Amortized Cost | | Fair Value | | Amortized Cost | | Fair Value | | Amortized Cost | | Fair Value | |

| | | (Dollars in thousands) | |

| Securities available for sale: | | | | | | | | | | | | | |

| Federal agency obligations | | $ | 34,555 | | $ | 34,848 | | $ | 29,711 | | $ | 29,543 | | $ | 16,577 | | $ | 16,450 | |

| State and municipal obligations | | | 12,839 | | | 12,741 | | | 6,435 | | | 6,340 | | | 5,882 | | | 5,864 | |

| Mortgage-backed securities | | | 19,621 | | | 19,277 | | | 24,863 | | | 24,217 | | | 27,583 | | | 27,189 | |

| Equity securities | | | 395 | | | 394 | | | ¾ | | | ¾ | | | ¾ | | | ¾ | |

| Total securities available for sale | | $ | 67,410 | | $ | 67,260 | | $ | 61,009 | | $ | 60,100 | | $ | 50,042 | | $ | 49,503 | |

| | | | | | | | | | | | | | | | | | | | |

| Weighted-average rate on securities (1) | | | 4.72 | % | | | | | 4.44 | % | | | | | 3.94 | % | | | |

| Weighted-average rate on mortgage - backed securities | | | 4.31 | % | | | | | 4.29 | % | | | | | 4.16 | % | | | |

(1) Weighted-average yields are not presented on a tax-equivalent basis.

At September 30, 2007, we had no investments in a single company or entity (other than U.S. Government- sponsored entity securities) that had an aggregate book value in excess of 10% of our equity.

The following table sets forth the maturities and weighted-average yields of debt securities at September 30, 2007. Weighted-average yields are not presented on a tax-equivalent basis.

| | | One Year or Less | | More than One Year to Five Years | | More than Five Years to Ten Years | | More than Ten Years | | Total | |

| | | Carrying Value | | Weighted -Average Yield | | Carrying Value | | Weighted -Average Yield | | Carrying Value | | Weighted -Average Yield | | Carrying Value | | Weighted -Average Yield | | Carrying Value | | Weighted -Average Yield | |

| | | (Dollars in thousands) | |

| Securities available-for sale: | | | | | | | | | | | | | | | | | | | | | |

| State and municipal obligations | | $ | | | | | % | $ | 2,512 | | | 4.29 | % | $ | 4,119 | | | 4.22 | % | $ | 6,110 | | | 5.26 | % | $ | 12,741 | | | 4.73 | % |

| Federal agency obligations | | | 4,287 | | | 4.23 | | | 27,048 | | | 4.77 | | | 3,513 | | | 5.41 | | | | | | | | | 34,848 | | | 4.77 | |

| Mortgage-backed securities | | | 1,244 | | | 4.44 | | | 9,723 | | | 4.23 | | | 829 | | | 5.00 | | | 6,907 | | | 4.39 | | | 18,703 | | | 4.34 | |

| Collateralized mortgage obligations | | | | | | | | | | | | | | | | | | | | | 574 | | | 3.36 | | | 574 | | | 3.36 | |

| Total securities available for sale | | $ | 5,531 | | | 3.99 | | $ | 39,283 | | | 4.60 | | $ | 8,461 | | | 4.78 | | $ | 13,591 | | | 4.74 | | $ | 66,866 | | | 4.60 | |

Premises and Equipment. Premises and equipment, net, increased from $6.7 million at September 30, 2006 to $8.7 million at September 30, 2007 due to the opening of a new branch in Gladstone, Missouri in September 2007.

Other Assets. Bank-owned life insurance represents the purchase of two policies of $3.0 million in June 2007 and $5.0 million in July 2007, respectively, and change in cash surrender value of $101,000. Accrued interest receivable increased due to higher securities and loan balances and timing of interest receipts.

Deposits. Our primary source of funds is our deposit accounts, which are comprised of noninterest-bearing NOW accounts, interest-bearing NOW accounts, money market accounts, statement accounts and certificates of deposit. These deposits are provided primarily by individuals within our market areas. Deposits increased $53.8 million, or 27.1%, to $252.3 million at September 30, 2007 from $198.5 million at September 30, 2006. The increase in deposits for the year ended September 30, 2007 consisted of an increase in money market accounts and certificate of deposit accounts less than twelve months, which were attracted primarily through special promotions, brokered deposits and to a lesser extent, an increase in noninterest-bearing checking accounts, partially offset by a decrease in interest bearing checking accounts and certificate of deposit accounts greater than twelve months. The amount of brokered deposits in the future will be contingent upon current market rates as compared to retail deposits and FHLB advances.

The following table sets forth average balances and average rates of our deposit products for the years indicated. For purposes of this table, average balances have been calculated using month-end balances. Management does not believe that the use of month-end balances instead of daily average balances has caused any material differences in the information presented.

| | | Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | Average Balance | | Average Rate | | Average Balance | | Average Rate | | Average Balance | | Average Rate | |

| | | (Dollars in thousands) | |

| | | | | | | | | | | | | | |

| Noninterest-bearing NOW accounts | | $ | 12,458 | | | — | | $ | 11,633 | | | — | | $ | 9,933 | | | — | |

| Interest-bearing NOW accounts | | | 24,331 | | | 1.88 | % | | 25,224 | | | 1.83 | % | | 18,146 | | | 1.15 | % |

| Money market accounts | | | 38,052 | | | 4.47 | | | 21,290 | | | 2.38 | | | 25,315 | | | 1.77 | |

| Statement accounts | | | 7,336 | | | 0.31 | | | 9,059 | | | 0.34 | | | 9,024 | | | 0.31 | |

| Certificates of deposit | | | 143,665 | | | 4.80 | | | 126,275 | | | 3.97 | | | 106,218 | | | 3.10 | |

| Total | | $ | 225,842 | | | 4.02 | | $ | 193,481 | | | 3.10 | | $ | 168,636 | | | 2.36 | |

The following table sets forth the balances of our deposit products at the dates indicated.

| | | At September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent | |

| Noninterest-bearing NOW accounts | | $ | 13,617 | | | 5.4 | % | $ | 11,896 | | | 6.0 | % | $ | 11,590 | | | 6.4 | % |

| Interest-bearing NOW accounts | | | 21,368 | | | 8.5 | | | 25,234 | | | 12.7 | | | 22,020 | | | 12.1 | |

| Money market accounts | | | 68,482 | | | 27.1 | | | 13,617 | | | 6.9 | | | 26,237 | | | 14.4 | |

| Statement accounts | | | 7,200 | | | 2.9 | | | 7,702 | | | 3.9 | | | 8,880 | | | 4.9 | |

| Certificates of deposit | | | 141,638 | | | 56.1 | | | 140,022 | | | 70.5 | | | 112,890 | | | 62.2 | |

| Total | | $ | 252,305 | | | 100.0 | % | $ | 198,471 | | | 100.0 | % | $ | 181,617 | | | 100.0 | % |

The following table indicates the amount of jumbo certificates of deposit by time remaining until maturity as of September 30, 2007. Jumbo certificates of deposit require minimum deposits of $100,000.

Maturity Period | | Certificates of

Deposit | |

| | | (In thousands) | |

| Three months or less | | $ | 29,144 | |

| Over three through six months | | | 10,304 | |

| Over six through 12 months | | | 5,337 | |

| Over 12 months | | | 2,948 | |

| Total | | $ | 47,733 | |

The following table sets forth time deposits classified by rates at the dates indicated.

| | | At September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | | | | | | |

| 0.00 - 0.99% | | $ | — | | $ | — | | $ | 47 | |

| 1.00 - 1.99 | | | — | | | 5 | | | 653 | |

| 2.00 - 2.99 | | | 300 | | | 2,254 | | | 27,956 | |

| 3.00 - 3.99 | | | 9,249 | | | 33,373 | | | 61,079 | |

| 4.00 - 4.99 | | | 60,152 | | | 44,344 | | | 20,224 | |

| 5.00 - 5.99 | | | 71,937 | | | 60,046 | | | 2,542 | |

| 6.00 - 6.99 | | | — | | | — | | | 389 | |

| | | $ | 141,638 | | $ | 140,022 | | $ | 112,890 | |

The following table sets forth the amount and maturities of time deposits at September 30, 2007.

| | | Amount Due | | | |

| | | One Year or Less | | 1-2 Years | | 2-3 Years | | 3-4 Years | | 4-5 Years | | Total | | Percent of

Total Certificate Accounts | |

| | | (In thousands) | |

| 2.00 - 2.99 | | $ | 300 | | $ | ¾ | | $ | ¾ | | $ | ¾ | | $ | ¾ | | $ | 300 | | | .2 | % |

| 3.00 - 3.99 | | | 5,770 | | | 2,305 | | | 1,051 | | | 41 | | | 82 | | | 9,249 | | | 6.5 | |

| 4.00 - 4.99 | | | 51,415 | | | 3,580 | | | 2,693 | | | 870 | | | 1,594 | | | 60,152 | | | 42.5 | |

| 5.00 - 5.99 | | | 69,149 | | | 1,610 | | | 170 | | | 992 | | | 16 | | | 71,937 | | | 50.8 | |

| | | $ | 126,634 | | $ | 7,495 | | $ | 3,914 | | $ | 1,903 | | $ | 1,692 | | $ | 141,638 | | | 100.0 | % |

The following table sets forth deposit activity for the years indicated.

| | | Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | (In thousands) | |

| | | | | | | | |

| Net deposits (withdrawals) before interest credited | | $ | 45,803 | | $ | 11,629 | | $ | 25,459 | |

| Interest credited | | | 8,032 | | | 5,225 | | | 3,229 | |

| Net increase (decrease) in deposits | | $ | 53,835 | | $ | 16,854 | | $ | 28,688 | |

Borrowings. We utilize borrowings from the Federal Home Loan Bank of Des Moines and securities sold under agreement to repurchase to supplement our supply of funds for loans and investments and to meet deposit withdrawal requirements.

The following table sets forth certain information regarding short-term borrowings by the Bank at the end of and during the years indicated:

| | | At September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | (Dollars in thousands) | |

| Outstanding advances from Federal Home Loan Bank | | $ | 22,056 | | $ | 23,833 | | $ | 9,633 | |

| Weighted-average rate paid on advances from Federal Home Loan Bank | | | 4.90 | % | | 4.19 | % | | 3.17 | % |

| Outstanding securities sold under agreement to repurchase | | $ | 681 | | $ | 3,384 | | $ | 1,157 | |

| Weighted-average rate paid on securities sold under agreement to repurchase | | | 3.41 | % | | 3.44 | % | | 2.05 | % |

| | | Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | (Dollars in thousands) | |

| Maximum outstanding advances from Federal Home Loan Bank at any month end | | $ | 26,083 | | $ | 35,633 | | $ | 17,133 | |

| Weighted-average rate paid on advances from Federal Home Loan Bank (1) | | | 4.84 | % | | 3.97 | % | | 2.44 | % |

| Average advances from Federal Home Loan Bank outstanding | | $ | 19,904 | | $ | 22,167 | | $ | 10,967 | |

| Maximum outstanding securities sold under agreement to repurchase at any month end | | $ | 5,164 | | $ | 4,400 | | $ | 1,798 | |

| Weighted-average rate paid on securities sold under agreement to repurchase (2) | | | 3.39 | % | | 3.18 | % | | 1.76 | % |

| Average securities sold under agreement to repurchase | | $ | 1,573 | | $ | 2,224 | | $ | 1,073 | |

| (1) | The weighted-average rate paid is based on the weighted-average balances determined on a monthly basis. |

| (2) | The weighted-average rate paid is based on the weighted-average balances determined on a daily basis. |

Federal Home Loan Bank of Des Moines borrowings decreased $7.7 million, or 22.4%, to $26.4 million at September 30, 2007 from $34.1 million at September 30, 2006. The advances outstanding as of September 30, 2007 mature in 2007 through 2012.

Securities sold under agreement to repurchase decreased by $2.2 million for the year ended September 30, 2007 due to lower balances from existing customers. Accrued interest on deposits increased due to higher money market and certificate balances, and rate and timing of payments. Other liabilities increased as a result of the timing of payroll payments and higher accrued bonuses and other accrual items.

Results of Operations for the Years Ended September 30, 2007, 2006 and 2005

Overview.

| | | Years Ended September 30, | | % Change | | % Change | |

| | | 2007 | | 2006 | | 2005 | | 2007/2006 | | 2006/2005 | |

| | | (Dollars in thousands) | | | | | |

| | | | | | | | | | | | |

| Net earnings | | $ | 1,944 | | $ | 1,463 | | $ | 1,505 | | | 32.9 | % | | (2.8 | )% |

| Return on assets (1) | | | 0.63 | % | | 0.56 | % | | 0.67 | % | | 12.5 | | | (16.4 | ) |

| Return on stockholders’ equity (2) | | | 3.94 | | | 5.47 | | | 7.28 | | | (28.0 | ) | | (24.9 | ) |

| Stockholders’ equity-to-assets ratio (3) | | | 16.00 | | | 10.16 | | | 9.16 | | | 57.5 | | | 10.9 | |

| Dividend payout ratio (4) | | | 23.86 | | | 29.86 | | | 28.26 | | | (20.1 | ) | | 5.7 | |

| (1) | Net earnings divided by average assets. |

| (2) | Net earnings divided by average stockholders’ equity. |

| (3) | Average stockholders’ equity divided by average total assets. |

| (4) | Represents dividends paid to shareholders as a percent of net earnings. Does not include dividends waived by Liberty Savings Mutual Holding Company. |

2007 vs. 2006. Net earnings increased $481,000, or 32.9%, for the year ended September 30, 2007 compared to the year ended September 30, 2006. The increase in net earnings was due primarily to a $3.9 million or 23.4% increase in interest income, partially offset by a $2.9 million or 38.1% increase in interest expense and a $843,000 or 11.7% increase in noninterest expense. Net interest income increased primarily as a result of an increase in loans receivable, partially offset by a smaller interest rate spread. Noninterest income in 2007 increased primarily due to an increase in the cash surrender value of bank-owned life insurance, deposit account service charges and gains on sale of loans. Noninterest expense increased primarily due to an increase in compensation, occupancy, net expenses from operations from foreclosed real estate and other noninterest expenses, partially offset by a decrease in advertising expenses.

2006 vs. 2005. Net earnings decreased $42,000, or 2.8%, for the year ended September 30, 2006 compared to the year ended September 30, 2005. The decrease in net earnings was due primarily to a $3.8 million or 30.0% increase in interest income, being more than offset by a $2.4 million or 46.8% increase in interest expense, $422,000 or 98.1% increase in provisions for loan losses and a $1.1 million or 18.8% increase in noninterest expense. Net interest income increased primarily as a result of an increase in loans receivable. Noninterest income in 2006 was positively affected by a higher amount of deposit account service charges, loan service charges and gains on sale of loans, partially offset by a decrease in gains on sale of mortgage-backed securities. Noninterest expense increased as a result of increased expenses attributable to new branches.

Net Earnings.

2007 vs. 2006. Net earnings increased by $481,000 from $1.5 million for 2006 to $1.9 million for 2007. The increase was due to higher net interest income and noninterest income, and lower provisions for loan losses, partially offset by higher noninterest expense and income taxes.

2006 vs. 2005. Net earnings remained substantially the same at $1.5 million for both 2005 and 2006, with only a slight decrease of $42,000. The slight decrease in net earnings was due to higher net interest income, being more than offset by higher provisions for loan losses and noninterest expense.

Net Interest Income.

2007 vs. 2006. Net interest income increased by $1.0 million, or 11.1%, from $9.1 million for 2006 to $10.1 million for 2007 as a result of an increase in net earning assets, partially offset by a lower interest rate spread. The increase in net earning assets is due to an increase of $42.6 million, or 17.2%, in interest-earning assets, partially offset by an increase of $24.3 million, or 10.5%, in average interest-bearing liabilities. The interest rate spread decreased from 3.43% for 2006 to 2.97% for 2007.

Interest on loans receivable increased as a result of a higher weighted-average balance and, to a lesser extent a higher average yield. The weighted-average yield on loans increased from 7.59% for 2006 to 7.91% for 2007.

Interest on mortgage-backed securities decreased due to a lower average balance, partially offset by a higher average yield.

Interest on securities increased as a result of a higher average balance and yield, reflecting higher market interest rates. Interest on other interest-earning assets also increased as a result of a higher average balance and yield.

Interest on deposits increased as a result of a higher weighted-average rate and, to a lesser extent a higher weighted-average balance. During 2007, the Bank’s promotion of attractive money market and short-term certificate of deposit rates resulted in increased balances. Higher weighted-average rates resulted from higher market interest rates.

Interest on advances from the Federal Home Loan Bank of Des Moines decreased primarily due to a lower average balance, partially offset by a higher average rate.

2006 vs. 2005. Net interest income increased by $1.4 million, or 18.6%, from $7.7 million for 2005 to $9.1 million for 2006 as a result of higher interest rates on loans, deposits and advances and to a lesser extent, higher loan, investment, deposit and advance balances.

Interest on loans receivable increased as a result of a higher average balance and yield. The weighted-average yield on loans increased from 6.57% for 2005 to 7.59% for 2006.

Interest on mortgage-backed securities increased due to a higher yield, reflecting higher market interest rates and a higher weighted-average balance.

Interest on securities increased as a result of a higher weighted-average balance and yield, reflecting higher market interest rates. Interest on other interest-earning assets increased as a result of a higher weighted-average yield.

Interest on deposits increased as a result of a higher weighted-average balance and, to a greater extent, a higher weighted-average rate. During 2006, the Bank’s promotion of attractive certificates of deposit rates resulted in increased balances, particularly in short-term certificates.

Interest on advances from the Federal Home Loan Bank of Des Moines increased primarily due to a higher average rate.

Average Balances and Yields. The following table presents information regarding average balances of assets and liabilities, the total dollar amounts of interest income and dividends from average interest-earnings assets, the total dollar amounts of interest expense on average interest-bearing liabilities, and the resulting average yields and costs. The yields and costs for the years indicated are derived by dividing income or expense by the average balances of assets or liabilities, respectively, for the years presented. For purposes of this table, average balances have been calculated using month-end balances and, to a lesser extent, daily balances, and nonaccrual loans are included in average balances only. Management does not believe that the use of month-end balances instead of daily average balances has caused any material differences in the information presented. No tax equivalent adjustments were made. Nonaccruing loans have been included in the table as loans carrying a zero yield.

| | | Years Ended September 30, | |

| | | 2007 | | 2006 | | 2005 | |

| | | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost | |

| | | (Dollars in thousands) | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans receivable | | $ | 217,841 | | $ | 17,233 | | | 7.91 | % | $ | 187,818 | | $ | 14,253 | | | 7.59 | % | $ | 172,869 | | $ | 11,354 | | | 6.57 | % |

| Mortgage-backed securities | | | 22,229 | | | 933 | | | 4.20 | | | 25,216 | | | 995 | | | 3.95 | | | 21,656 | | | 808 | | | 3.73 | |

| Securities | | | 43,988 | | | 2,076 | | | 4.72 | | | 29,117 | | | 1,170 | | | 4.02 | | | 14,371 | | | 463 | | | 3.22 | |

| Other interest-earning assets | | | 6,484 | | | 321 | | | 4.95 | | | 5,768 | | | 246 | | | 4.27 | | | 6,942 | | | 191 | | | 2.75 | |

| Total interest-earning assets | | | 290,542 | | | 20,563 | | | 7.08 | | | 247,919 | | | 16,664 | | | 6.72 | | | 215,838 | | | 12,816 | | | 5.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | 225,842 | | | 9,084 | | | 4.02 | | | 193,481 | | | 6,007 | | | 3.10 | | | 168,636 | | | 3,979 | | | 2.36 | |

| Federal Home Loan Bank advances | | | 27,189 | | | 1,333 | | | 4.90 | | | 34,807 | | | 1,497 | | | 4.30 | | | 34,525 | | | 1,142 | | | 3.31 | |

| Securities sold under agreement to repurchase | | | 2,097 | | | 77 | | | 3.69 | | | 2,224 | | | 71 | | | 3.18 | | | 1,058 | | | 30 | | | 2.81 | |

| ESOP note payable | | | — | | | — | | | — | | | 327 | | | 25 | | | 7.66 | | | 415 | | | 25 | | | 5.93 | |

| Total interest-bearing liabilities | | $ | 255,128 | | | 10,494 | | | 4.11 | | $ | 230,839 | | | 7,600 | | | 3.29 | | $ | 204,634 | | | 5,176 | | | 2.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income before provision for loan losses | | | | | $ | 10,069 | | | | | | | | $ | 9,064 | | | | | | | | $ | 7,640 | | | | |

| Net interest-earning assets | | $ | 35,414 | | | | | | | | $ | 17,080 | | | | | | | | $ | 11,204 | | | | | | | |

| Interest rate spread | | | | | | | | | 2.97 | % | | | | | | | | 3.43 | % | | | | | | | | 3.41 | % |

| Net yield on average interest-earning assets | | | | | | | | | 3.47 | % | | | | | | | | 3.66 | % | | | | | | | | 3.54 | % |

| Ratio of average interest-earning assets to average interest-bearing liabilities | | | 113.88 | % | | | | | | | | 107.40 | % | | | | | | | | 105.48 | % | | | | | | |

Rate/Volume Analysis. The following table sets forth the effects of changing rates and volumes on our net interest income. The rate column shows the effects attributable to changes in rate (changes in rate multiplied by prior volume). The volume column shows the effects attributable to changes in volume (changes in volume multiplied by prior rate). The rate/volume column shows the effects attributable to changes in both rate and volume (changes in rate multiplied by changes in volume). The total column represents the sum of the prior columns.

| | | Year Ended September 30, 2007 vs. 2006 | | Year Ended September 30, 2006 vs. 2005 | |

| | | Increase (Decrease) due to: | | Increase (Decrease) due to: | |

| | | Volume | | Rate | | Rate/ Volume | | Total | | Volume | | Rate | | Rate/ Volume | | Total | |

| | | (Dollars in thousands) | |

| Interest income: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans receivable | | $ | 2,279 | | $ | 605 | | $ | 96 | | $ | 2,980 | | $ | 982 | | $ | 1,764 | | $ | 153 | | $ | 2,899 | |

| Mortgage-backed securities | | | (118 | ) | | 63 | | | (7 | ) | | (62 | ) | | 132 | | | 47 | | | 8 | | | 187 | |

| Securities | | | 598 | | | 204 | | | 104 | | | 906 | | | 474 | | | 115 | | | 118 | | | 707 | |

| Other interest-earning assets | | | 31 | | | 39 | | | 5 | | | 75 | | | (32 | ) | | 105 | | | (18 | ) | | 55 | |

| Total interest-earning assets | | $ | 2,790 | | $ | 911 | | $ | 198 | | $ | 3,899 | | $ | 1,556 | | $ | 2,031 | | $ | 261 | | $ | 3,848 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | 1,003 | | | 1,777 | | | 297 | | | 3,077 | | | 586 | | | 1,258 | | | 184 | | | 2,028 | |

| Federal Home Loan Bank advances | | | (328 | ) | | 209 | | | (45 | ) | | (164 | ) | | 9 | | | 342 | | | 4 | | | 355 | |

| Securities sold under agreement to repurchase | | | (4 | ) | | 11 | | | (1 | ) | | 6 | | | 33 | | | 4 | | | 4 | | | 41 | |

| ESOP note payable | | | (25 | ) | | (25 | ) | | 25 | | | (25 | ) | | (5 | ) | | 7 | | | (2 | ) | | — | |

| Total interest-bearing liabilities | | | 646 | | | 1,972 | | | 276 | | | 2,894 | | | 623 | | | 1,611 | | | 190 | | | 2,424 | |

| Change in net interest income | | $ | 2,144 | | $ | (1,061 | ) | $ | (78 | ) | $ | 1,005 | | $ | 933 | | $ | 420 | | $ | 71 | | $ | 1,424 | |

Provision for Loan Losses.

2007 vs. 2006. Provision for loan losses decreased from $852,000 for 2006 to $602,000 for 2007. At September 30, 2007, the allowance for loan losses was $3.0 million, or 1.1% of the gross loan portfolio, compared to $2.1 million or 0.9% of the loan portfolio at September 30, 2006. At September 30, 2007, loans secured by non-construction single-family properties totaled 15.6% of total loans and 7.0% of the allowance for loan losses was allocated to these loans. All other loans totaled 84.4% of the portfolio and 93.0% of the allowance for loan losses.

During the year ended September 30, 2007, we recorded a provision for loan losses of $602,000, a decrease of 29.3% from the provision for loan losses of $852,000 recorded for the year ended September 30, 2006. The decreased provision is the result of an increase in recoveries of previously charged off loans.

Non-accrual loans amounted to $3.4 million and $1.5 million at September 30, 2007 and 2006, respectively. Other impaired loans, single family specs decreased by $2.7 million due to the foreclosure of such properties, primarily in November 2006. There were net recoveries of $265,000 during 2007 compared to net charge-offs of $470,000 during 2006. Recoveries in 2007 included $506,000 which were related to previously charged-off loans secured by 1-4 family investment properties.

2006 vs. 2005. Provision for loan losses increased from $430,000 for 2005 to $852,000 for 2006. At September 30, 2006, the allowance for loan losses was $2.1 million, or 0.9% of the gross loan portfolio, compared to $1.8 million or 0.9% of the loan portfolio at September 30, 2005. At September 30, 2006, loans secured by non-construction single-family properties totaled 18.5% of total loans and 9.3% of the allowance for loan losses was allocated to these loans. All other loans totaled 81.5% of the portfolio and 90.7% of the allowance for loan losses.

During the year ended September 30, 2006, we recorded a provision for loan losses of $852,000, an increase of 98.1% from the provision for loan losses of $430,000 recorded for the year ended September 30, 2005. The increased provision is the result of the growth of the loan portfolio and the increase in classified assets.

Non-accrual loans amounted to $1.5 million and $907,000 at September 30, 2006 and 2005, respectively. Net loan charge-offs amounted to $470,000 during 2006 compared to $692,000 during 2005. The majority of the net loan charge-offs in 2006 were due to loans that were identified as classified assets as of September 30, 2005.

Noninterest Income. The following table shows the components of noninterest income and the percentage changes for the years ended September 30, 2007 and 2006.

| | | Years Ended September 30, | | % Change | | % Change | |

| | | 2007 | | 2006 | | 2005 | | 2007/2006 | | 2006/2005 | |

| | | (Dollars in thousands) | | | | | |

| | | | | | | | | | | | |

| Loan service charges | | $ | 90 | | $ | 69 | | $ | 53 | | | 30.3 | % | | 29.0 | % |

| Gain on sale of mortgage-backed securities available for sale | | | — | | | — | | | 10 | | | — | | | (100.0 | ) |

| Gain on sale of loans | | | 247 | | | 203 | | | 194 | | | 21.8 | | | 4.7 | |

| Change in cash surrender value of BOLI | | | 101 | | | — | | | — | | | 100.0 | | | — | |

| Deposit account service charges | | | 1,039 | | | 965 | | | 943 | | | 7.7 | | | 2.4 | |

| Total | | $ | 1,477 | | $ | 1,237 | | $ | 1,200 | | | 19.4 | | | 3.1 | |

2007 vs. 2006. Noninterest income increased from $1.2 million for 2006 to $1.5 million for 2007 due to an increase in the cash surrender value of bank-owned life insurance, deposit account service charges, gains on sale of loans and loan service charges.

The Bank recognized gains on sale of loans of $247,000 and $203,000 for the years ended September 30, 2007 and 2006, respectively. During 2007 and 2006, we sold loans to secondary market investors totaling $20.1 million and $19.3 million, respectively.

2006 vs. 2005. Noninterest income remained substantially the same at $1.2 million for both 2005 and 2006, with only a slight $37,000 increase due to a higher amount of deposit account service charges, loan service charges and gains on sale of loans, partially offset by a decrease in gains on sale of mortgage-backed securities.

The Bank recognized gains on sale of loans of $203,000 and $194,000 for the years ended September 30, 2006 and 2005, respectively. During 2006 and 2005, we sold loans to secondary market investors totaling $19.3 million and $20.1 million, respectively.

Noninterest Expense. The following table shows the components of noninterest expense and the percentage changes for the years ended September 30, 2007 and 2006.

| | | Years Ended September 30, | | % Change | | % Change | |

| | | 2007 | | 2006 | | 2005 | | 2007/2006 | | 2006/2005 | |

| | | (Dollars in thousands) | | | | | |

| Compensation and benefits | | $ | 4,445 | | $ | 3,975 | | $ | 3,302 | | | 11.8 | % | | 20.4 | % |

| Occupancy expense | | | 625 | | | 508 | | | 433 | | | 22.8 | | | 17.4 | |

| Equipment and data processing expense | | | 798 | | | 740 | | | 770 | | | 7.9 | | | (4.0 | ) |

| Operations from foreclosed real estate, net | | | 356 | | | 139 | | | (22 | ) | | 156.4 | | | 736.4 | |

| Federal deposit insurance premiums | | | 41 | | | 24 | | | 23 | | | 72.5 | | | 5.6 | |

| Professional and regulatory services | | | 408 | | | 347 | | | 305 | | | 17.6 | | | 13.6 | |

| Advertising | | | 255 | | | 414 | | | 315 | | | (38.4 | ) | | 31.6 | |

| Correspondent banking charges | | | 260 | | | 260 | | | 216 | | | 0.2 | | | 20.7 | |

| Supplies | | | 138 | | | 182 | | | 141 | | | (24.6 | ) | | 29.7 | |

| Other | | | 720 | | | 614 | | | 582 | | | 17.3 | | | 5.4 | |

| Total noninterest expense | | $ | 8,046 | | $ | 7,203 | | $ | 6,065 | | | 11.7 | % | | 18.8 | % |

| | | | | | | | | | | | | | | | | |

| Efficiency ratio (1) | | | 69.7 | % | | 69.9 | % | | 68.6 | % | | | | | | |

(1) Computed as noninterest expense divided by the sum of net interest income and noninterest income.

2007 vs. 2006. Noninterest expense increased from $7.2 million for 2006 to $8.0 million for 2007. Compensation and benefit expense increased due to the costs associated with the additional staff for the new branches and higher ESOP and stock-based compensation plan expenses.

On October 1, 2006, the Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised 2004) (SFAS No. 123(R)), “Share-Based Payment”, using the modified prospective method. Under this method compensation expense is recognized based on the fair value of unvested stock awards at the implementation of SFAS No. 123(R) and new awards granted thereafter, which includes restricted stock and stock awards at the grant date and is recognized on a straight-line basis over the requisite service period. The fair value of stock options is estimated at the date of grant using the Black-Scholes pricing model and related assumptions. Prior to October 1, 2006, the Company applied the intrinsic value method of accounting for stock-based compensation expense under APB No. 25 and adopted the disclosure requirements. Under the intrinsic value method, no compensation expense was recognized in the financial statements since the exercise price of the Company’s stock was equal to the market price of the stock at the grant date.

During 2007, the Company recognized stock option expense and restricted stock award expense of $68,000 and $163,000, respectively. During both 2006 and 2005, the Company recognized stock option expense and restricted stock award expense of $0 and $28,000, respectively. At September 30, 2007, total unrecognized stock option expense was approximately $219,000 and is expected to be recognized over the weighted-average period of 3.40 years. At September 30, 2007, total unrecognized restricted stock award expense was $1.1 million and is expected to be recognized over the next 4.4 years.

Operations for foreclosed real estate, net increased from a loss of $139,000 to $356,000 for the years ended September 30, 2006 and 2007, respectively. The Bank recognized net losses for 2006 and 2007 on sale of foreclosed real estate of $89,000, and $288,000, respectively. Occupancy expense increased due to the opening of the new branches. There were also modest increases in professional and regulatory services, equipment and data processing expense and a small decrease in supplies expense. Advertising expense decreased due to lower direct mail costs. Other noninterest expense increased from $614,000 for 2006 to $720,000 for 2007 due primarily to higher stock administration and data line expense.

2006 vs. 2005. Noninterest expense increased from $6.1 million for 2005 to $7.2 million for 2006. Compensation and benefit expense increased due to the costs associated with the additional staff for the new branches and higher ESOP expenses. Occupancy, advertising and supplies expense also increased because of the new branches. Operations for foreclosed real estate, net increased from a gain of $22,000 to a loss of $139,000 for the years ended September 30, 2005 and 2006, respectively. In 2005, the Bank recognized net gains on sale of foreclosed real estate of $77,000, in contrast to net losses on sale of foreclosed real estate of $89,000 recognized in 2006. There were also modest increases in professional and regulatory services, correspondent banking charges and a decrease in equipment and data processing expense. Other noninterest expense increased from $582,000 for 2005 to $614,000 for 2006 due primarily to costs involving new data lines.

Income Taxes.