- SPLK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Splunk (SPLK) DEF 14ADefinitive proxy

Filed: 4 May 21, 8:30am

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| Splunk Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

| 270 Brannan Street San Francisco, California 94107 |  |

Notice of Annual

Meeting of Stockholders

To Be Held at 3:30 p.m. Pacific Time on June 17, 2021

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Splunk Inc., a Delaware corporation (“Splunk,” “we,” or the “Company”), will be held virtually via live audio webcast on June 17, 2021, at 3:30 p.m. Pacific Time, for the following purposes, as more fully described in the accompanying proxy statement: |

| How to Cast Your Vote

www.proxyvote.com

1-800-690-6903

Mail your signed proxy card Note for Street Name Holders: Your vote is important. Please vote your shares as soon as possible. See “Other Matters—Questions and Answers About the Proxy Materials and Our 2021 Annual Meeting” for details on voting requirements and additional information about the Annual Meeting, including how to vote at the Annual Meeting. | |

| 1. | To elect four Class III directors to serve until the 2024 annual meeting of stockholders or until their successors are duly elected and qualified; | ||

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2022; | ||

| 3. | To conduct an advisory vote to approve the compensation of our named executive officers; and | ||

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | ||

The Board of Directors of Splunk (the “Board”) fixed the close of business on April 21, 2021 as the record date for the Annual Meeting. Only holders of our common stock as of the record date are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement. On or about May 4, 2021, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”). The Notice provides instructions on how to vote online, by telephone, or by mail and includes instructions on how to receive a paper or e-mail copy of proxy materials if you choose. Instructions on how to access our proxy statement and our fiscal 2021 Annual Report may be found in the Notice or on our website at investors.splunk.com. The Annual Meeting this year will be a virtual-only meeting, due to continuing public health and safety considerations posed by the COVID-19 pandemic and in order to allow all of our stockholders to join the meeting from any location. Stockholders will be able to attend and participate in the Annual Meeting, vote their shares electronically, submit questions, and examine a stockholder list during the live audio webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/SPLK2021 and entering their control number. Stockholders may submit questions for the meeting in advance at www.proxyvote.com. We anticipate returning to an in-person, or transitioning to a hybrid, meeting format in future years. YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting online, we urge you to submit your vote now via the Internet, telephone, or mail. We appreciate your continued support of Splunk. Very truly yours, | |||

Voting Matters, Vote Recommendations and Rationale

1 1 | Election of Class III Directors Vote Recommendation “FOR” each nominee. (page 10) The Board and the Nominating and Corporate Governance Committee believe that each of the nominees possesses the right skills, qualifications and experience to effectively oversee the Company’s long-term business strategy. |

2 2 | Ratification of Appointment of Independent Registered Public Accounting Firm Vote Recommendation “FOR”. (page 35) The Board and the Audit Committee believe that the retention of PricewaterhouseCoopers LLP for the fiscal year ending January 31, 2022 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm. |

3 3 | Advisory Vote to Approve Named Executive Officer Compensation Vote Recommendation “FOR”. (page 39) The Board and Compensation Committee believe our executive compensation program demonstrates the continuing evolution of our “pay for performance” philosophy, and reflects feedback received from stockholder engagement. We currently hold our Say-on-Pay advisory, non-binding vote annually. |

Your vote is important

This summary highlights information contained within this proxy statement. You should read the entire proxy statement carefully and consider all information before voting. Page references are supplied to help you find further information in this proxy statement.

| Splunk 2021 Proxy Statement 1 |

| Proxy Statement Summary |

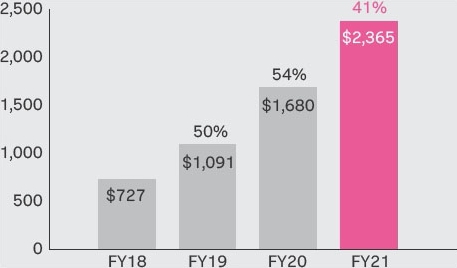

Fiscal 2021 Business Highlights

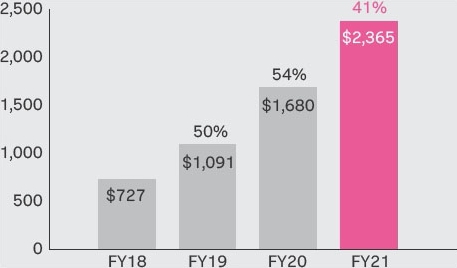

In fiscal 2021, we prioritized delivering growth with a focus on disciplined execution of our business objectives as we navigate our ongoing business transformation to a subscription model. Accordingly, in fiscal 2021, we and our investors focused on total annual recurring revenue (“ARR”) and operating cash flow metrics. Our ongoing efforts with respect to customer success and adoption led to continued top-line ARR growth. Our focus on capturing our large and growing market opportunity requires that we continue to invest in our business. Accordingly, in fiscal 2021, our executive compensation plans balanced growth and operational discipline in support of our long-term market opportunity. Our fiscal 2021 business highlights include achievement of the following ARR and operating cash flow results and other important metrics:

| ● | Total ARR of $2.365 billion, up 41% year-over-year(1); |

| ● | Operating cash flow of negative $191 million with free cash flow of negative $228 million(2); |

| ● | Non-GAAP operating margin of negative 3.8%(2); and |

| ● | 510 customers with ARR greater than $1 million, up 44% year-over-year. |

| (1) | Total ARR represents the annualized revenue run-rate of active subscription, term license, and maintenance contracts at the end of a reporting period as reported in our Annual Report on Form 10-K for the year ended January 31, 2021. Each contract is annualized by dividing the total contract value by the number of days in the contract term and then multiplying by 365. ARR should be viewed independently of revenue, and does not represent our revenue under GAAP on an annualized basis, as it is an operating metric that can be impacted by contract start and end dates and renewal rates. ARR is not intended to be a replacement or forecasts of revenue. |

| (2) | To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we provide investors with certain non-GAAP financial measures, including non-GAAP operating margin and free cash flow. For a full reconciliation between GAAP and non-GAAP operating margin and between net cash used in operating activities and free cash flow, please see our Annual Report on Form 10-K for the year ended January 31, 2021. |

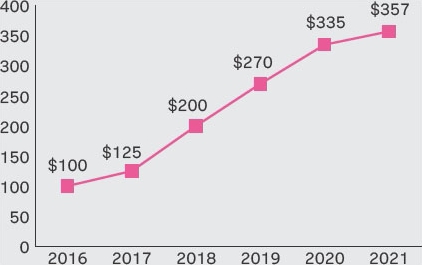

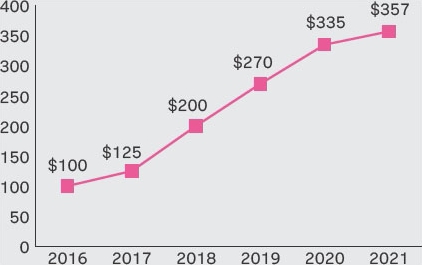

| Total ARR | Total Stockholder Return* | |||

| ($ in millions) • FYE January 31 | FYE January 31 | |||

|  | |||

|

| |||

| * | The chart shows the total return on our common stock through the end of fiscal 2021, assuming an initial investment of $100 at the end of fiscal 2016. | |||

| 2 |  |

| Proxy Statement Summary |

Focusing on Employees and Customers During Unprecedented Business and Market Uncertainty

| Ensuring Employee Health and Safety |  | Supporting Customers and Partners | |

●We offer employees 30 days of pay for pandemic-related absences plus 4 wellbeing paid rest days ●We reimburse certain expenses related to remote working ●We offer counseling, coaching and digital wellness | ●We granted payment concession requests ●We negotiated changes to contract durations | |||

| Helping Organizations |  | Helping Communities | |

●Our Global Restart program is designed to guide businesses through ways that data can most effectively support their return to work ●Our Remote Work Insights (RWI) is a solution designed to ease uncertainty and challenges of a distributed workforce | ●We built publicly available interactive COVID-19 tracking dashboards ●We developed a COVID-19 testing management platform with a coalition of private, public and non-profit partners | |||

Corporate Governance

We believe that good corporate governance promotes the long-term interests of our stockholders, strengthens our Board and management accountability and leads to better business performance. For these reasons, we are committed to maintaining strong corporate governance practices.

The “Corporate Governance at Splunk” section beginning on page 10 describes our governance practices, which include the following highlights:

●100% Independent Committee Members ●Independent Chair ●Majority Voting for Directors with Resignation Policy ●Annual Board and Committee Evaluation ●Board Continuing Education Program ●Proxy Access Bylaws ●Director Change in Circumstances with Resignation Policy ●Qualified Diverse Candidate Pool Policy ●Board Risk Oversight ●Periodic Review of Committee Charters and Governance Policies ●Regular Meetings of Independent Directors Without Management Present | ●Formal CEO Evaluation Process ●Clawback Policy ●Annual Say-on-Pay Vote ●Stockholder Engagement Program ●Stock Ownership Guidelines for Directors and Officers ●Anti-Hedging and Anti-Pledging Policy ●Code of Conduct for Directors, Officers and Employees ●Succession Planning Process ●Inaugural Environmental, Social and Governance (“ESG”) Update ●Inaugural Diversity & Inclusion Annual Report |

Stockholder Engagement

We believe that effective corporate governance includes regular, constructive conversations with our stockholders. We are committed to maintaining an active dialogue to understand the priorities and concerns of our stockholders and believe that ongoing engagement builds mutual trust and understanding with our stockholders. Stockholder engagement and feedback are critical components of our corporate governance practices and inform our decisions and programs.

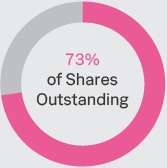

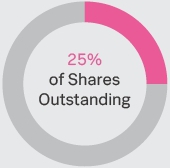

Over the past several years, in response to stockholder feedback, and as part of our ongoing evaluation of best practices, the Board has incorporated enhancements to our executive compensation program and corporate governance practices such as those depicted in the timeline. In fiscal 2021, we solicited the views of institutional stockholders representing approximately 73% of our shares and engaged in substantive discussions with stockholders representing approximately 25% of our shares. These discussions have helped ensure that our Board’s decisions are informed by stockholder objectives.

| Splunk 2021 Proxy Statement 3 |

| Proxy Statement Summary |

For additional information, see “Corporate Governance at Splunk—Stockholder Engagement” on page 31 of this proxy statement and “Executive Compensation—Compensation Discussion and Analysis—Executive Summary—Stockholder Engagement and Our 2020 Say-on-Pay Vote” on page 42 of this proxy statement.

| 2021 | APRIL | |||

●Enhanced proxy disclosure of Board oversight of COVID-19 response ●Added underrepresented community diversity of Board to proxy | ||||

| 2020 | NOVEMBER | |||

●Released first ESG update MARCH ●Replaced revenue metric with annual recurring revenue in both our executive bonus plan and our PSU program to align our incentives with key drivers of stockholder value and reflect our transition to a renewable business model ●Replaced non-GAAP operating margin metric with operating cash flow in our PSU program to reflect focus on disciplined execution of our business objectives during our transition to a renewable business model | ||||

| 2019 | APRIL | |||

●Enhanced proxy disclosures of Board succession planning, risk oversight and corporate sustainability | ||||

| 2018 | SEPTEMBER | |||

●Updated stock ownership guidelines APRIL ●Enhanced proxy disclosures of director qualifications and skills, the role of diversity in our director nominations process, Board refreshment and corporate sustainability MARCH ●Added stock price modifier to PSU program | ||||

| 2017 | DECEMBER | |||

●Adopted director change in circumstances with resignation policy ●Adopted qualified diverse candidate pool policy APRIL ●Added collective director qualifications table to proxy MARCH ●Replaced operating cash flow metric with non-GAAP operating margin in our PSU program to reflect increased strategic focus on a profitability measure | ||||

| 2016 | APRIL | |||

●Added proxy disclosure regarding Board and Committee self-evaluations and succession planning MARCH ●Implemented proxy access Bylaws ●Increased proportion of PSUs in long-term equity compensation program for all executive officers | ||||

| 2015 | APRIL | |||

●Significantly enhanced readability and presentation of proxy MARCH ●Introduced performance-based equity awards (“PSUs”) with revenue and operating cash flow metrics FEBRUARY ●Adopted clawback policy | ||||

| 2014 | SEPTEMBER | |||

●Launched formal stockholder engagement program ●Adopted majority voting for directors with resignation policy ●Adopted stock ownership guidelines | ||||

| 4 |  |

| Proxy Statement Summary |

Director Nominees and Other Directors

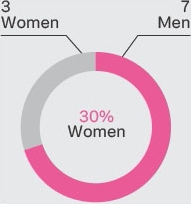

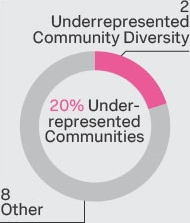

Ensuring the Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, experience, and backgrounds, and effectively represent the long-term interests of stockholders is a top priority of our Board and Nominating and Corporate Governance Committee. The Board believes periodic assessment of directors is integral to an effective governance structure and aims to strike a balance between ensuring that we retain directors with deep knowledge of the Company while adding directors who bring a fresh perspective. We have added three new directors since 2019, enhancing the Board’s breadth and depth of experience and diversity, while taking into account the Company’s evolving business model, the macro technology business environment and the changing governance landscape. See below for summary information about our Board and each director nominee and continuing director as of May 1, 2021. For purposes of the information below, a director is a member of an underrepresented community under California AB 979, defined as “an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual or transgender.” See pages 14 to 18 for more information.

Current Board Overview

| Director Independence | Tenure | Age | Gender Diversity | Underrepresented Community Diversity | ||||

|  |  |  |  |

| Committees | ||||||||||||||||||

| Class | Age | Director Since | Current Term Expires | Expiration of Term for Which Nominated |  |  |  | |||||||||||

| Sara Baack* | III | 49 | 2017 | 2021 | 2024 |  | |||||||||||

Sean Boyle* | III | 53 | 2020 | 2021 | 2024 |  | ||||||||||||

Douglas Merritt | III | 57 | 2015 | 2021 | 2024 | |||||||||||||

Graham Smith* | III | 61 | 2011 | 2021 | 2024 |  | ||||||||||||

| Mark Carges* | I | 59 | 2014 | 2022 | — |  | |||||||||||

Elisa Steele* | I | 54 | 2017 | 2022 | — |  | ||||||||||||

Sri Viswanath* | I | 45 | 2019 | 2022 | — |  | ||||||||||||

| Patricia Morrison* Former EVP, Customer Support Services, and CIO, Cardinal Health | II | 61 | 2013 | 2023 | — |  |  | |||||||||||

Stephen Newberry* | II | 67 | 2013 | 2023 | — |  | ||||||||||||

| General Dennis Via* EVP, Booz Allen Hamilton and Retired Four-Star U.S. Army General | II | 63 | 2020 | 2023 | — |  | ||||||||||||

| * Independent director |  | Audit Committee |  | Compensation Committee |  | Nominating and Corporate Governance Committee | |||

| Chair |  | Member |  | Audit Committee Financial Expert |

| Splunk 2021 Proxy Statement 5 |

| Proxy Statement Summary |

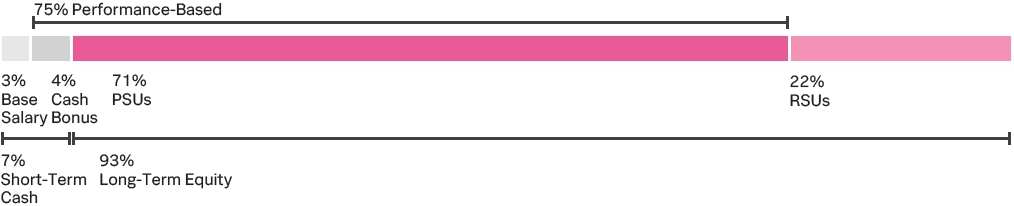

Executive Compensation Highlights

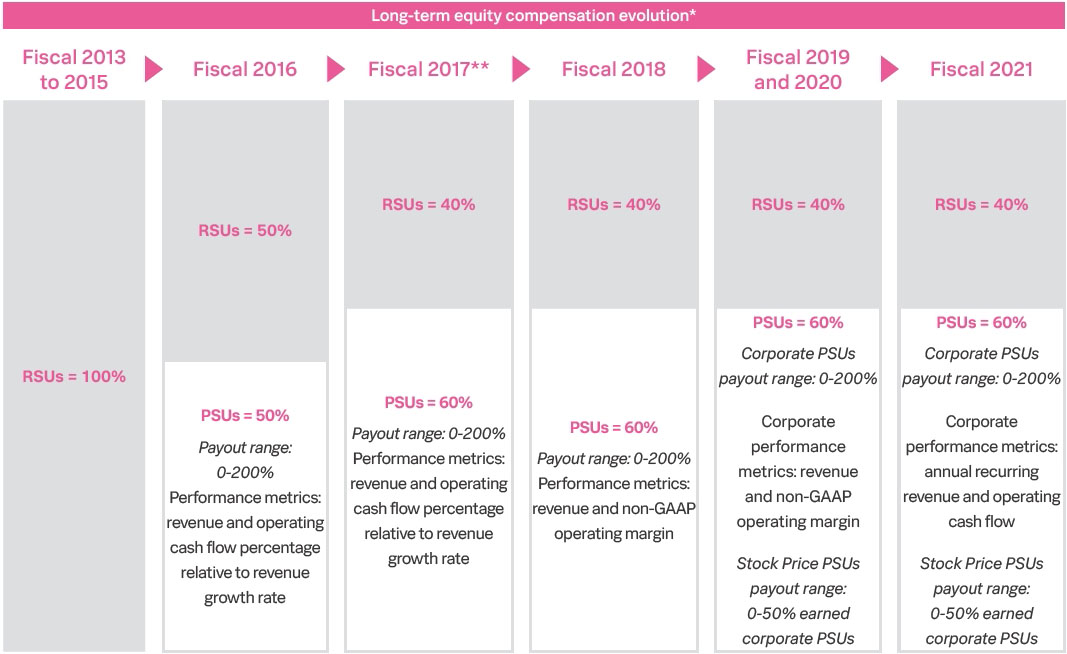

Our executive compensation program is designed to attract, motivate and retain the key executives who drive our success. Pay that reflects performance and aligns with the interests of long-term stockholders is key to our executive compensation program design and decisions. The Compensation Committee structures our executive compensation program to include significant performance attributes that are aligned with our business strategy and long-term stockholder value creation. The fiscal 2021 executive compensation program provided short-term cash bonuses designed to drive top-line growth and long-term equity awards designed to drive annual recurring revenue, operating cash flow and future stock price performance. The following chart summarizes the evolution of our long-term equity compensation design in response to stockholder feedback and other considerations.

| * | Equity weightings are at the target performance level; the actual mix of equity will vary with PSU results. |

| ** | In fiscal 2017 only, long-term equity compensation for our CEO consisted of 25% RSUs and 75% PSUs. |

| 6 |  |

| Proxy Statement Summary |

Our Executive Compensation Practices

Our executive compensation policies and practices are designed to reinforce our pay for performance philosophy and align with sound governance principles. Listed below are highlights of our fiscal 2021 executive compensation policies and practices:

|  | |||||

| WHAT WE DO | WHAT WE DON’T DO | |||||

●Performance-based cash and equity incentives ●Caps on performance-based cash and equity incentive compensation ●Annual review and approval of our executive compensation strategy ●Significant portion of executive compensation at risk based on corporate performance ●Clawback policy on cash and equity incentive compensation ●Stock ownership guidelines for executive officers and directors ●Multi-year vesting period for equity awards ●Independent compensation consultant engaged by the Compensation Committee ●100% independent directors on the Compensation Committee ●Limited and modest perquisites ●Formal CEO evaluation tied to compensation decisions ●Ongoing engagement with our institutional stockholders regarding our compensation policies and practices | ●No “single trigger” change in control payments and benefits ●No post-termination retirement or pension-type non-cash benefits or perquisites for our executive officers that are not generally available to our employees ●No tax gross-ups for change in control related payments ●No short sales, hedging, or pledging of stock ownership positions and transactions involving derivatives of our common stock ●No strict benchmarking of compensation to a specific percentile of our peer group | |||||

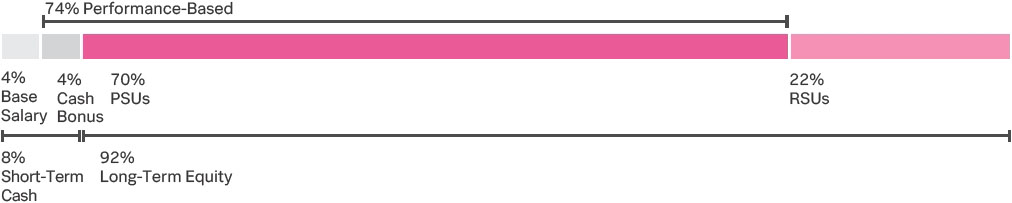

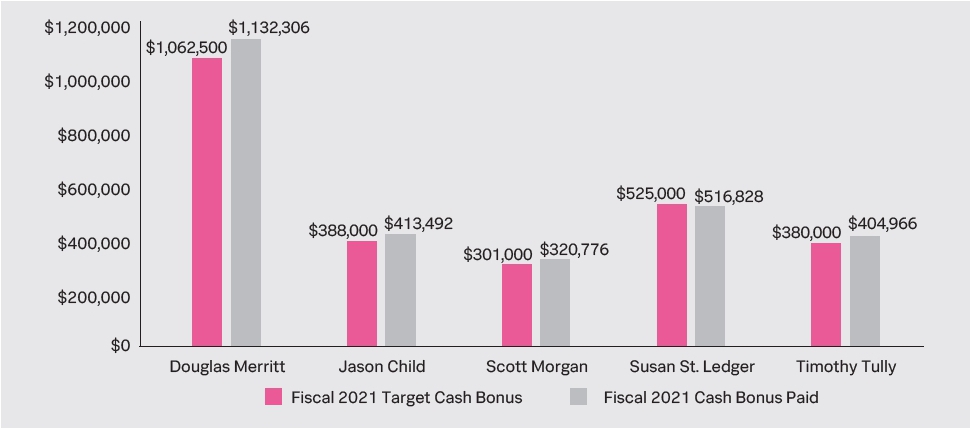

Our Fiscal 2021 Named Executive Officer Pay

The charts below show the pay mix of our CEO and other named executive officers (“NEOs”) and the components of their pay for fiscal 2021, specifically the base salary and cash bonus amounts earned and the grant date fair value of equity awards granted in fiscal 2021. These charts illustrate the predominance of at-risk and performance-based components in our regular executive compensation program. We believe these elements provide a compensation package that attracts and retains qualified individuals, links individual performance to Company performance, focuses the efforts of our NEOs and other executive officers on the achievement of both our short-term and long-term objectives and aligns the interests of our executive officers with those of our stockholders.

| Splunk 2021 Proxy Statement 7 |

| Proxy Statement Summary |

| CEO |

|

| All Other NEOs |

|

In addition, the chart below illustrates the short-term and long-term timeframe over which the various components of the NEOs’ fiscal 2021 compensation are earned and paid and serve to continue to retain and incentivize our NEOs.

| 8 |  |

| Corporate Governance at Splunk | 10 |

| Proposal 1: Election of Directors | 10 |

| Board Composition | 10 |

| Board’s Role and Responsibilities | 20 |

| Board Effectiveness | 23 |

| Board Meetings and Committees | 25 |

| Non-Employee Director Compensation | 27 |

| Stockholder Engagement | 31 |

| ESG Oversight and Highlights | 32 |

| Other Governance Policies and Practices | 34 |

| Audit Committee Matters | 35 |

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 35 |

| Report of the Audit Committee | 36 |

| Fees Paid to the Independent Registered Public Accounting Firm | 37 |

| Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | 37 |

| Other Matters | 74 |

| Questions and Answers About the Proxy Materials and Our 2021 Annual Meeting | 74 |

| Stockholder Proposals | 78 |

| Splunk 2021 Proxy Statement 9 |

Corporate Governance at Splunk

1 1 | Election of Directors The Board recommends a vote “FOR” each of the nominees named below. |

Our business affairs are managed under the direction of our Board, which is currently composed of ten members. Nine of our directors are independent within the meaning of the independent director rules of The Nasdaq Stock Market. Our Board is divided into three classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring. Each director’s term continues until the expiration of the term for which he or she is elected and until the election and qualification of his or her successor, or his or her earlier death, resignation, or removal.

Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. John Connors informed the Company on January 6, 2021 that he was resigning as a member of the Board, effective as of May 1, 2021. Promptly following his resignation, the size of our Board will be decreased from 11 to 10.

In an uncontested election, directors are elected by a majority vote. This means that in order for a nominee to be elected in an uncontested election, the number of votes cast “For” such nominee’s election must exceed the number of votes cast “Against” that nominee’s election. Broker non-votes and abstentions will have no effect on the outcome of such election. In addition to the majority vote standard for director elections, we have a director resignation policy described in “Other Matters-Questions and Answers About the Proxy Materials and Our 2021 Annual Meeting” on page 74.

In light of the individual qualifications and experiences of each of our director nominees, and the contributions that our nominees have made to our Board, our Board has recommended that each of our director nominees be elected by our stockholders. Biographies of all our directors are set forth below under “Nominees for Director” and “Continuing Directors.”

Considerations in Evaluating Director Nominees

Our Board follows an annual director nomination process that promotes thoughtful and in-depth review of overall Board composition and director nominees throughout the year. At the beginning of the process, the Nominating and Corporate Governance Committee reviews current Board composition and any specific characteristics desired for future director candidates. In its review of incumbent director candidates, the Nominating and Corporate Governance Committee evaluates any changes in circumstances that may impact their candidacy and considers information from the Board evaluation process. Upon a recommendation from the Nominating and Corporate Governance Committee, the Board considers and approves the nomination of director candidates for election at the annual meeting of the stockholders. See “Board Refreshment and Succession Planning” below for a discussion of the characteristics identified in the most recent director searches that culminated in the appointment of Mr. Boyle and General Via (ret) to our Board during fiscal 2021.

In evaluating director candidates and considering incumbent directors for nomination to the Board, the Nominating and Corporate Governance Committee expects certain minimum qualifications and takes into consideration key factors, experiences, qualifications and skills that are relevant to the Board’s work and the Company’s strategy and strengthen the current Board’s mix of skills.

| 10 |  |

| Corporate Governance at Splunk |

The Nominating and Corporate Governance Committee requires the following minimum qualifications to be satisfied by any nominee for a position on the Board:

| Highest personal and professional ethics & integrity |

Sound business judgment | Complementary skills to those of existing Board |  | Understanding of fiduciary duties |  | ||||||||

| Proven achievement in nominee’s field | Ability to assist management and significantly contribute to our success |  | Commitment of time and energy | |||||||||

Key factors the Nominating and Corporate Governance Committee considers when selecting directors and refreshing the Board (in addition to the current size and composition of the Board and the needs of the Board and its committees) include:

| Age and Tenure – While the Board does not have term limits, the Board seeks to establish appropriate levels of director turnover. New perspectives and new ideas are critical to an engaged forward-looking and strategic Board, as are the benefits of the valuable experience and familiarity that longer-serving directors bring. | ||

| Diversity – Our Corporate Governance Guidelines reflect our commitment to Board diversity, by explicitly stating the Board’s commitment to include qualified diverse candidates (including gender, race and ethnicity) in the pool from which nominees are considered. We believe that the judgment and perspective offered by a diverse board of directors improves the quality of decision making and enhances the Company’s business performance. We also believe such diversity can help the Board respond more effectively to the varying needs of our customers, stockholders, workforce and other stakeholders. | ||

| Experience – The Nominating and Corporate Governance Committee strives for a Board that spans a range of expertise and perspective in areas relevant to the Company’s business, strategic vision, governance and operating and innovation environment. | ||

| Full-time employment/Directorships – The Nominating and Corporate Governance Committee takes into consideration employment status and whether the director holds a current operating role or is retired, and the number of other public company boards on which the director serves to evaluate whether the nominee can commit the time and energy necessary to diligently carry out his or her fiduciary responsibilities and meaningfully contribute to the Company. | ||

| Independence – Having an independent Board is a core element of our governance philosophy. Our Corporate Governance Guidelines provide that a majority of our directors will be independent as defined under The Nasdaq Stock Market rules. |

The Nominating and Corporate Governance Committee also considers and evaluates other factors it deems to be in our and our stockholders’ best interests. The Nominating and Corporate Governance Committee does not pre-assign any weighting or priority to any of these factors.

The Nominating and Corporate Governance Committee reviews with the Board on an annual or more frequent basis the director skills and experience qualifications that it believes are desirable to be represented on the Board. The Board and the Nominating and Corporate Governance Committee believe that the collective experiences and qualifications of the directors allow the Board to best fulfill its responsibilities to the long-term interest of our stockholders.

| Splunk 2021 Proxy Statement 11 |

| Corporate Governance at Splunk |

Below is a summary of the primary experience, qualifications and skills that our director nominees and continuing directors bring to the Board:

Capability | Description | Number of directors with the capability | ||||

| Technology infrastructure | Deep insight in technology infrastructure, business prioritization, customer drivers and cybersecurity risk |  | |||

| Scaling a SaaS business | Experience growing successful SaaS companies, reaching scale and maturity |  | |||

| Investment | Experience creating long term value through investment, acquisitions, and growth strategies |  | |||

| CEO experience | Expertise shaping strategy, performance, prioritization, and scale leadership |  | |||

| Modern cloud technologist | Deep knowledge in technology architecture, including SaaS, cloud-based platforms, integrated solutions and customers’ data journey |  | |||

| Sales | Experience building global sales capability for cloud services and enterprise software |  | |||

| Marketing | Marketing and brand-building capability in rapidly changing industries, including new markets and opportunities for innovation and disruption |  | |||

| Key customer segment insight | Depth of insight into current and potential target markets and geographies |  | |||

| Finance | Financial expert with expertise in financial strategy, accounting, reporting |  | |||

| People and compensation | Expertise in aligning company culture, performance, reward and talent with strategy as well as remote and flexible work strategies |  | |||

| Governance, risk and compliance | Experience in public company corporate governance, privacy, compliance, policy, activism and creating long term sustainable value |  |

| Strong capability |  | Moderate capability |

| 12 |  |

| Corporate Governance at Splunk |

Board Refreshment and Succession Planning

The Nominating and Corporate Governance Committee, together with our Board, practices a long-term approach to Board refreshment. With the assistance of an independent search firm, the Nominating and Corporate Governance Committee focuses on identifying, considering and evaluating potential Board candidates with the goal of evolving the composition of our Board in line with the strategic needs of the Company. As the Company innovates, implements new technologies and enters new markets, its business model may require directors with new or different skill sets. Our succession planning process takes the Company’s evolution into account to ensure the Board remains a strategic asset capable of addressing the risks, trends, and opportunities that the Company will face in the future.

The following describes the Company’s selection process for new directors:

Source Candidate Pool from ●Independent Search Firm ●Stockholders ●Independent Directors ●Our Management Team |  | In-Depth Review and Oversight by the Nominating and Corporate Governance Committee ●Consider skills mix and needs ●Consider diversity screen qualifications ●Review independence and potential conflicts |  | Meeting with Candidate ●Chair ●CEO ●CFO ●CLO ●Chair of each committee ●Opportunity for all other directors to meet |  | Recommend Selected Candidate for Appointment to our Board |  | Review and Appointment by full Board | |||

| Select Director 3 new directors since 2019 | |||||||||||

This past year, as part of the Board succession planning and refreshment process, and in line with its multi-year view of potential director departures and leadership changes, the Nominating and Corporate Governance Committee, together with the Board, discussed the Board’s future composition needs. This discussion included the desired skills and attributes of successors for long-tenured directors, including Mr. Connors, who resigned from the Board this year, as well as successors for our Chair and committee chairs. It also took into account the current and long-term needs of our business and the skills composition of our Board and our committees. Through this process we identified finance and accounting expertise in the technology industry and public sector, leadership and policy experience as important priorities for overall Board composition. The Nominating and Corporate Governance Committee worked with a third-party search firm to identify candidates with these skills and attributes. A year-long, robust and deliberate search process culminated in August 2020 with the appointment of Sean Boyle, former Vice President and Chief Financial Officer of Amazon Web Services, Inc. and current Chief Operating Officer and Chief Financial Officer of Wildlife Studios Limited, and in November 2020 with the appointment of Dennis Via, retired four-star U.S. Army general and current Executive Vice President of Booz Allen Hamilton, to our Board.

Mr. Connors resigned from the Board effective May 1, 2021. In addition, the Board appointed Mr. Boyle as a member and chair of the Audit Committee, replacing Mr. Connors, and General Via (ret) as a member of the Nominating and Corporate Governance Committee.

| Splunk 2021 Proxy Statement 13 |

| Corporate Governance at Splunk |

Nominees for Director

Sara Baack | Ms. Baack possesses specific attributes that qualify her to serve as a director, including her knowledge and experience in the information technology services industry and professional experience serving in leadership positions at other public companies. Sara Baack has served as a member of our Board since 2017. Since April 2019, Ms. Baack has served as Chief Product Officer of Equinix, Inc., a global interconnection and data center company. Previously, she was Equinix’s Chief Marketing Officer from 2012 to April 2019. Prior to joining Equinix, she served in various executive positions at Level 3 Communications Inc., a provider of integrated communications services, most recently as Senior Vice President, Voice Services from 2007 to 2012 and in other leadership positions in the company from 2000 to 2007. Prior to Level 3, she worked in financial services investing private equity for PaineWebber Capital (since acquired by UBS Group AG). Ms. Baack has served as a member of the board of directors of Crucible Acquisitions Corporation, a special purchase acquisition company, since 2021. Ms. Baack holds a B.A. from Rice University and an M.B.A. from Harvard Business School. | Ms. Baack brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Chief Product Officer of Age 49 Director Since 2017 Splunk Committee(s): |

|

|

| |||

Technology | Scaling a SaaS | Investment | ||||

|  |  | ||||

Modern cloud | Sales | Marketing | ||||

|  |  | ||||

Key customer | Finance | People and | ||||

| ||||||

Governance, | ||||||

Sean Boyle | Mr. Boyle possesses specific attributes that qualify him to serve as a director, including his financial expertise and professional experience serving in leadership positions at other public companies. Sean Boyle has served as a member of our Board since 2020. Since December 2020, Mr. Boyle has served as Chief Operating Officer and Chief Financial Officer of Wildlife Studios Limited, a mobile gaming company. Previously, he served in various roles at Amazon and Amazon Web Services, Inc., a cloud computing and infrastructure company, from 2006 to 2020, including most recently as Vice President in 2020, Vice President and Chief Financial Officer from 2015 to 2020 and before that in various finance leadership roles. Mr. Boyle holds a B.Com. (Hons) and an M.B.A. from the University of Windsor. | Mr. Boyle brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Chief Operating Officer Age 53 Director Since 2020 Splunk Committee(s): |

|

|

| |||

Technology | Scaling a SaaS | Investment | ||||

|  |  | ||||

Modern cloud | Key customer | Finance | ||||

| ||||||

People and | ||||||

| | ||||||

| | ||||||

| 14 |  |

| Corporate Governance at Splunk |

Douglas Merritt | Mr. Merritt possesses specific attributes that qualify him to serve as a director, including the knowledge and perspective he brings through his experience as our CEO and our former Senior Vice President of Field Operations, and his experience as a public company executive and as a member of the board of directors of private companies in the enterprise software industry. Douglas Merritt has served as our President, CEO and a member of our Board since 2015. Mr. Merritt served as our Senior Vice President of Field Operations from 2014 to 2015. Prior to joining us, he served as Senior Vice President of Products and Solutions Marketing at Cisco Systems, Inc., a networking company, from 2012 to 2014. From 2011 to 2012, he served as Chief Executive Officer of Baynote, Inc., a behavioral personalization and marketing technology company. Previously, Mr. Merritt served in a number of executive roles and as a member of the extended Executive Board at SAP A.G., an enterprise software company, from 2005 to 2011. From 2001 to 2004, Mr. Merritt served as Group Vice President and General Manager of the Human Capital Management Product Division at PeopleSoft Inc., a software company (acquired by Oracle Corporation). He also co-founded and served as Chief Executive Officer of Icarian, Inc., a cloud-based company (since acquired by Workstream Corp.), from 1996 to 2001. Mr. Merritt has served as a member of the board of directors of Dragoneer Growth Opportunities Corp., a special purchase acquisition company, since 2020. Mr. Merritt holds a B.S. from The University of the Pacific in Stockton, California. | Mr. Merritt brings the following primary experiences, qualifications and skills to the Board: | ||||

President and CEO of Age 57 Director Since 2015 Splunk Committee(s): |

|

|

| |||

Technology | Scaling a SaaS | Investment | ||||

|  |  | ||||

CEO | Modern cloud | Sales | ||||

|  |  | ||||

Marketing | Key customer | Finance | ||||

|  | |||||

People and | Governance, | |||||

Graham Smith | Mr. Smith possesses specific attributes that qualify him to serve as a director, including his financial expertise and professional experience as an executive and as a member of the board of directors of other public software companies. Graham Smith has served as a member of our Board since 2011 and Chair since 2019. Mr. Smith served in various leadership positions at salesforce.com, inc., a provider of enterprise cloud computing software, from 2007 to 2015, including as Chief Financial Officer and most recently as Executive Vice President. Prior to joining salesforce, Mr. Smith served as Chief Financial Officer at Advent Software Inc., a portfolio accounting software company, from 2003 to 2007. Mr. Smith has served as a member of the board of directors of BlackLine, Inc., a provider of cloud-based solutions for finance and accounting since 2015, and Slack Technologies, Inc., a provider of cloud-based professional collaboration tools, since 2018. Mr. Smith previously served on the board of directors of Citrix Systems, Inc., an enterprise software company, from 2015 to 2018, MINDBODY, Inc., a cloud-based wellness services marketplace (acquired by Vista Equity Partners), from 2015 to 2019, and Xero Limited, an online accounting software company, from 2015 to 2020. Mr. Smith holds a B.Sc. from Bristol University in England and qualified as a chartered accountant in England and Wales. | Mr. Smith brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Chair of Splunk Age 61 Director Since 2011 Splunk Committee(s): |

|

|

| |||

Scaling a SaaS | Investment | Modern cloud | ||||

|  |  | ||||

Key customer | Finance | People and | ||||

| ||||||

Governance, | ||||||

| ||||||

| Splunk 2021 Proxy Statement 15 |

| Corporate Governance at Splunk |

Continuing Directors

Mark Carges | Mr. Carges possesses specific attributes that qualify him to serve as a director, including his knowledge and experience in the software industry and professional experience serving in leadership positions at various technology companies. Mark Carges has served as a member of our Board since 2014. Mr. Carges previously served as the Chief Technology Officer of eBay Inc., an e-commerce company, from September 2009 to September 2014. From September 2009 to November 2013, he also served as eBay’s Senior Vice President, Global Products, Marketplaces. From September 2008 to September 2009, he served as eBay’s Senior Vice President, Technology. From November 2005 to May 2008, Mr. Carges served as Executive Vice President, Products and General Manager of the Business Interaction Division of BEA Systems, Inc., a software company (acquired by Oracle Corporation). Mr. Carges has served as a member of the board of directors of Veeva Systems Inc., a provider of industry cloud solutions for the global life sciences industry, since 2017. Mr. Carges holds a B.A. from the University of California, Berkeley and an M.S. from New York University. | Mr. Carges brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Former CTO of Age 59 Director Since 2014 Splunk Committee(s): |

|

|

| |||

Technology | Scaling a SaaS | Modern cloud | ||||

|  |  | ||||

Key customer | People and | Governance, | ||||

| ||||||

| ||||||

Elisa Steele | Ms. Steele possesses specific attributes that qualify her to serve as a director, including her knowledge and experience in the software industry and professional experience as a former executive of various technology companies. Elisa Steele has served as a member of our Board since 2017. Ms. Steele previously served as Chief Executive Officer of Namely, Inc., a financial and human capital management software company, from 2018 to 2019. Prior to joining Namely, Ms. Steele served as Chief Executive Officer and President of Jive Software, Inc., a collaboration software company (acquired by Aurea Software, Inc.), from 2015 to 2017, and was a member of the executive leadership team since 2014. Prior to joining Jive Software, Ms. Steele served as Chief Marketing Officer and Corporate Vice President, Consumer Apps & Services at Microsoft Corporation, a worldwide provider of software, services and solutions, and Chief Marketing Officer of Skype, an Internet communications company, from 2012 to 2014. Ms. Steele also has held executive leadership positions at Yahoo! Inc. and NetApp, Inc. Ms. Steele has served as a member of the board of directors of Cornerstone OnDemand, Inc., a learning and human capital management software company, since 2018, JFrog Ltd., an enterprise software company, since 2020, and Bumble Inc., an online dating and social networking platform, since 2020. Ms. Steele holds a B.S. from the University of New Hampshire and an M.B.A. from San Francisco State University. | Ms. Steele brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Independent Board Age 54 Director Since 2017 Splunk Committee(s): |

|

|

| |||

Scaling a SaaS | CEO | Modern cloud | ||||

|  |  | ||||

Sales | Marketing | Key customer | ||||

|  | |||||

People and | Governance, |

| ||||

|

| |||||

| 16 |  |

| Corporate Governance at Splunk |

Sri Viswanath | Mr. Viswanath possesses specific attributes that qualify him to serve as a director, including his product and engineering expertise, his knowledge and experience in the software industry and professional experience serving in leadership positions at other public companies. Sri Viswanath has served as a member of our Board since 2019. Since 2016, Mr. Viswanath has served as Chief Technology Officer at Atlassian Corporation Plc, a provider of team collaboration and productivity software. Prior to joining Atlassian, Mr. Viswanath served as Senior Vice President of Engineering and Operations from April 2013 to October 2014 and Chief Technology Officer from October 2014 to January 2016 at Groupon, Inc., an e-commerce company. From 2012 to 2013, he served as Vice President of Research and Development for mobile computing at VMware, Inc., a provider of cloud and virtualization software and services. His previous experience also includes senior-level product positions at Glam Media, Inc. and Ning Inc. (acquired by Glam Media). He began his career in engineering roles at Sun Microsystems, Inc. Mr. Viswanath previously served on the board of directors of SendGrid, Inc., a provider of a cloud-based customer communication platform (acquired by Twilio Inc.), from 2017 to 2019. Mr. Viswanath holds a B.E. from Bangalore University, and a M.S. from each of Clemson University and Stanford University. | Mr. Viswanath brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent CTO of Atlassian Age 45 Director Since 2019 Splunk Committee(s): |

|

|

| |||

Technology | Scaling a SaaS | Modern cloud | ||||

|  |  | ||||

Marketing | Key customer | People and | ||||

|

|

| ||||

|

| |||||

Patricia Morrison | Ms. Morrison possesses specific attributes that qualify her to serve as a director, including her information technology expertise and professional experience as an executive and as a member of the board of directors of other public companies. Patricia Morrison has served as a member of our Board since 2013. Ms. Morrison was Executive Vice President, Customer Support Services and Chief Information Officer at Cardinal Health, Inc., a provider of healthcare services, from 2009 to 2018. Prior to joining Cardinal Health, Ms. Morrison was Chief Executive Officer of Mainstay Partners, a technology advisory firm, from 2008 to 2009, and Executive Vice President and Chief Information Officer at Motorola, Inc., a designer, manufacturer, marketer and seller of mobility products, from 2005 to 2008. Her previous experience also includes Chief Information Officer of Office Depot, Inc. and senior-level information technology positions at PepsiCo, Inc., The Quaker Oats Company, General Electric Company and The Procter & Gamble Company. Ms. Morrison has served as a member of the board of directors of Baxter International Inc., a global medical products company, since 2019. Ms. Morrison previously served as a member of the board of directors of Aramark, a global provider of food, facilities and uniform services, from 2017 to 2019, and Virtusa Corporation, a global provider of digital strategy, digital engineering, and IT services and solutions, from 2020 to 2021. Ms. Morrison holds a B.A. and B.S. from Miami University in Oxford, Ohio. | Ms. Morrison brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Former EVP, Customer Age 61 Director Since 2013 Splunk Committee(s): |

|

|

| |||

Technology | Modern cloud | Key customer | ||||

|  | |||||

People and | Governance, |

| ||||

|

|

| ||||

|

| |||||

| Splunk 2021 Proxy Statement 17 |

| Corporate Governance at Splunk |

Stephen Newberry | Mr. Newberry possesses specific attributes that qualify him to serve as a director, including the perspective and experience he brings as a former executive of global technology companies. Stephen Newberry has served as a member of our Board since 2013. Mr. Newberry served as a director of Lam Research Corporation, a supplier of wafer fabrication equipment and services, from 2005 to 2019, and served as the Chairman of the board of Lam Research from 2012 to 2019. He served as Lam Research’s Chief Executive Officer from 2005 to 2011, President from 1998 to 2010, and Chief Operating Officer from 1997 to 2005. Prior to joining Lam Research, Mr. Newberry held various executive positions at Applied Materials, Inc., a provider of manufacturing solutions for the semiconductor, flat panel display and solar industries. Mr. Newberry holds a B.S. from the United States Naval Academy and is a graduate of the Program for Management Development at Harvard Business School. | Mr. Newberry brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Former Chairman of Lam Age 67 Director Since 2013 Splunk Committee(s): |

|

|

| |||

Scaling a SaaS | CEO | Sales | ||||

|  |  | ||||

Marketing | Key customer | People and | ||||

| ||||||

Governance, | ||||||

General Dennis Via | General Via (ret) possesses specific attributes that qualify him to serve as a director, including his information technology expertise and extensive government and leadership experience. General Dennis L. Via, US Army, Retired, has served on our Board since 2020. General Via (ret) has served as an Executive Vice President in the Global Defense Group’s Joint Combatant Command since 2018 and a fellow for Defense Futures since 2017 at Booz Allen Hamilton Inc., a management and information technology consulting firm, and prior to this role, he served as Senior Executive Advisor from 2017 to 2018. Prior to joining Booz Allen, he served in the United States Army from 1980 to 2016, holding multiple command and senior leadership positions, including as the Commander of the U.S. Army Materiel Command from 2012 to 2016 and retiring as a four-star General. He holds a B.S. from Virginia State University and a Master of Education from Boston University. | General Via (ret) brings the following primary experiences, qualifications and skills to the Board: | ||||

Independent Executive Vice President, Age 63 Director Since 2020 Splunk Committee(s): |

|

|

| |||

Technology | CEO | Modern cloud | ||||

|  |  | ||||

Key customer | People and compensation | Governance, risk and compliance | ||||

| 18 |  |

| Corporate Governance at Splunk |

Director Independence

Our common stock is listed on The Nasdaq Global Select Market. Under the rules of The Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s board of directors, and subject to specified limited exceptions, all members of its audit, compensation, and nominating and corporate governance committees must be independent. Under those rules, a director is independent only if a company’s board of directors makes an affirmative determination that the director has no material relationship with the company that would impair his or her independence.

Our Board has undertaken a review of the independence of each director. In making this determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock of each non-employee director, as well as relationships that our directors may have with our customers and vendors. Based on this review, our Board has determined that Ms. Baack, Mr. Boyle, Mr. Carges, Ms. Morrison, Mr. Newberry, Mr. Smith, Ms. Steele, General Via (ret) and Mr. Viswanath, representing nine of our ten directors, are “independent” as that term is defined under the rules of The Nasdaq Stock Market for purposes of serving on our Board and committees of our Board. In addition, our Board determined that Mr. Connors, who served as a director until his resignation on May 1, 2021, was independent during the time he served as a director.

Stockholder Recommendations

The Nominating and Corporate Governance Committee will consider candidates for director recommended by stockholders holding at least one percent of our fully diluted capitalization continuously for at least 12 months. The Nominating and Corporate Governance Committee will evaluate such recommendations in accordance with its charter, our Bylaws, our policies and procedures for director candidates, as well as the nominee criteria described above. This process is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Stockholders meeting the applicable requirements that wish to recommend a candidate for nomination should contact our Corporate Secretary in writing. Such recommendations must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our stock and a signed letter from the candidate confirming willingness to serve on our Board. The Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors. We did not receive any stockholder recommendations in 2020.

Stockholder Nominations

Our Bylaws permit stockholders to nominate director candidates through proxy access for inclusion in our proxy statement.

PROXY ACCESS PROCESS

| 1 |  | 2 |  | 3 |  | ||

a single stockholder, or group | the individual or group may submit | stockholders and nominees who | |||||

| Splunk 2021 Proxy Statement 19 |

| Corporate Governance at Splunk |

To be timely for our 2022 annual meeting of stockholders, our Corporate Secretary must receive a stockholder’s notice of a proxy access nomination at our principal executive offices:

| ● | not earlier than December 5, 2021; and |

| ● | not later than the close of business on January 4, 2022. |

Advance Notice Procedures

Our Bylaws also permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time period described under “Other Matters—Stockholder Proposals” for stockholder proposals that are not intended to be included in our proxy statement.

Board’s Role and Responsibilities

Stockholders elect the Board to oversee our management team and to serve stockholders’ long-term interests. In exercising their fiduciary duties, the Board represents and acts in the interests of our stockholders and is committed to strong corporate governance. The Board is deeply involved in the Company’s strategic planning process, risk oversight, human capital management, succession planning and selecting and evaluating the performance of our CEO.

Long-Term Strategic Planning

Our Board recognizes the importance of assuring that our overall business strategy is designed to create long-term, sustainable value for our stockholders. As a result, our Board maintains an active oversight role in helping our management team formulate, plan and implement the Company’s strategy. The Board and our management team routinely discuss the execution of our long-term strategic plans, the status of key initiatives and the key opportunities and risks facing the Company. At least annually, the Board participates in an in-depth review of the Company’s overall strategy with our management team. The Board and our management team discuss the industry and competitive landscapes, and short- and long-term plans and priorities. In addition to our business strategy, the Board reviews the Company’s financial plan for the upcoming year, which is aligned to the Company’s long-term strategic plans and priorities.

Risk Oversight

Our Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to the Company and its stockholders. Our Board is responsible for assuring that an appropriate culture of risk management exists within the Company and for setting the right “tone at the top,” overseeing our risk management programs and practices, which includes areas such as strategic risks, including risks related to product, go-to-market and sales strategies, competitive risks, financial risks, brand and reputation risks, legal, compliance, governance and geo-political risks, operational risks and cybersecurity and technology risks.

Our Board exercises its risk oversight responsibility both directly and through its three standing committees, each of which is delegated specific risks and keeps our Board informed of its oversight responsibilities through regular reports by the committee chairs. Our management team is responsible for the day-to-day management of risks we face and members of our management team engage with the Board and its three standing committees regularly regarding such risks. Throughout the year, our Board and each committee spend a portion of their time reviewing and discussing specific risk topics.

| 20 |  |

| Corporate Governance at Splunk |

The following are the key oversight responsibilities of our Board and its committees:

| BOARD OF DIRECTORS | |||||||||

| Oversees Major Risks | |||||||||

●Strategic and competitive ●Operational | ●Financial ●Data protection and cybersecurity | ●Brand and reputational ●Succession planning | ●Legal, compliance and geo-political ●Culture | ||||||

| AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING & CORPORATE GOVERNANCE COMMITTEE | |||||||

Primary Risk Oversight ●Risk management framework ●Financial statements, financial reporting and internal controls ●Data protection and cybersecurity ●Legal and compliance | Primary Risk Oversight ●Employee compensation policies and practices ●Non-executive director compensation policies and practices ●Human capital management ●CEO and management succession planning | Primary Risk Oversight ●Governance framework ●Board effectiveness ●Board succession planning ●Conflicts of interest and compliance ●ESG activities, programs and public disclosure | |||||||

|

| ||||||||

| MANAGEMENT | |||||||||

| Identification, assessment, and mitigation of risks | |||||||||

| Splunk 2021 Proxy Statement 21 |

| Corporate Governance at Splunk |

Human Capital Management Oversight

The tone and culture of the Company is set at the Board level and the standing committees have responsibility for specific areas of human capital management oversight. The Nominating and Corporate Governance Committee is responsible for director appointments and ensuring a diverse pool of director candidates are considered. The Compensation Committee periodically reviews and discusses with our management team the Company’s human capital management activities including, among other things, matters related to talent management and development, talent acquisition, employee engagement and diversity and inclusion. The Audit Committee oversees compliance with the Code of Business Conduct and Ethics (the “Code”). Our management team is responsible for ensuring that our policies and processes reflect and reinforce our desired corporate culture. We publish a Diversity & Inclusion Report annually in which we use our own data to identify and assess what we have achieved and understand what we need to do to increase our diversity in the workplace.

Other Core Business Functions Oversight

In addition, those employees representing certain core business functions also regularly engage with the Board and its committees. For example, some of these functions include:

| ● | Our Chief Information Security Officer (“CISO”) provides periodic updates to the Audit Committee and the Board on cybersecurity and other risks relevant to our information technology environment. The Audit Committee and the Board also receive updates about the results of periodic exercises and response readiness assessments led by our CISO and outside advisors who provide a third-party independent assessment of our cyber risk management program and our internal response preparedness. |

| ● | Reporting to the Audit Committee, our internal audit function provides objective audit, investigative, and advisory services aimed at providing assurance to our management team and the Board that the Company is anticipating, identifying, assessing, and appropriately prioritizing and mitigating risks. |

| ● | Representatives from our Legal Department update our Board regularly on material legal, ethics, compliance, governance and geo-political matters. Our Chief Ethics and Compliance Officer oversees risks related to ethics and compliance, labor and employment and disputes and litigation, and provides regular reports to the Audit Committee on these areas. |

| ● | Our Strategy and Corporate Development team, along with others, assists the Board in its governance of strategic acquisitions and investments and assessments of the competitive landscape. |

Our Board believes that its current leadership structure, described in detail under “Board Effectiveness” on page 23, supports the risk oversight function of our Board by providing for open communication between our management team and our Board. In addition, independent directors chair the various committees involved in assisting with risk oversight, and all directors are involved in the risk oversight function.

Leadership Development and Management Succession Planning

The Board and management team recognize the importance of continuously developing our executive talent. The Compensation Committee periodically reviews the performance of, and succession planning for, our management team and reports its findings and recommendations to the Board, works with the Board in evaluating potential successors to management positions and confers with the CEO to encourage our management team’s employee development programs. The Compensation Committee also periodically reviews a succession plan for the CEO position, using formal criteria to evaluate potential successors, and reporting such information to the Board. In conducting its evaluation, the Compensation Committee considers current and future organizational needs, competitive challenges, leadership/ management potential and development, and emergency situations.

The Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of the Board to ensure a mix of skills, experience, tenure and diversity, as described under “Board Composition—Board Refreshment and Succession Planning” beginning on page 13.

| 22 |  |

| Corporate Governance at Splunk |

CEO Evaluation Process

Our Board conducts an annual CEO evaluation process, consisting of both a performance review and, with the Compensation Committee, a compensation analysis. For fiscal 2021, the performance evaluation component was led by our Chair of the Board and the chair of the Compensation Committee and included an assessment of the CEO’s performance in light of set objectives and a detailed CEO self-assessment. Separately, Compensia conducted a market analysis to assess alignment of CEO compensation with competitive market practices and provided its findings to the Compensation Committee. Once all the relevant performance data had been collected, our Chair and the chair of the Compensation Committee met with the CEO to discuss his performance and then prepared and presented their evaluation on CEO performance to the Board. The Compensation Committee then met in executive session to discuss the CEO performance evaluation results and CEO compensation. After reviewing all the collected data regarding performance, the Compensation Committee made its decision regarding CEO compensation for fiscal 2022. Our CEO abstained from participating in all discussions of the Compensation Committee and Board related to the final determination of his compensation.

Leadership Structure

Mr. Smith, one of the Company’s independent directors, currently serves as Chair of our Board. The Chair presides over meetings of the Board, presides over meetings of stockholders, works with our management team to prepare agendas for meetings of the Board, serves as a liaison between our management team and the directors, and performs additional duties as the Board determines. Our Board believes that its leadership structure appropriately and effectively allocates authority, responsibility, and oversight between our management team and the members of our Board. It gives primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while the Chair facilitates our Board’s independent oversight of our management team, promotes communication between our management team and our Board, engages with stockholders, when appropriate, and leads our Board’s consideration of key governance matters.

Our Corporate Governance Guidelines require an independent director to serve as Lead Independent Director if the Chair is not an independent director. As the current Chair is an independent director, we do not currently have a Lead Independent Director.

The Nominating and Corporate Governance Committee periodically reviews the Board’s leadership structure and when appropriate, recommends changes to the Board’s leadership structure, taking into consideration the needs of the Board and the Company at such time.

Executive Sessions

The independent members of our Board and all committees of the Board generally meet in executive session without our management team present during their regularly scheduled board and committee meetings. For as long as we have independent Board and committee chairs, the Chairs will preside over these meetings.

Board Evaluations

Each year, the Nominating and Corporate Governance Committee reviews the format and framework of the Board and committee evaluation process and oversees the process itself.

The evaluation process has historically taken one of two forms: an internal assessment led by the independent Chair or Lead Independent Director (when we do not have an independent Chair) or an assessment using the services of an independent consultant. In either instance, the purpose of the evaluation is to focus on areas in which the Board or the committees believe contributions can be made going forward to increase the effectiveness of the Board or the committees. While this formal evaluation is conducted on an annual basis, directors share perspectives, feedback and suggestions year-round.

| Splunk 2021 Proxy Statement 23 |

| Corporate Governance at Splunk |

For fiscal 2021, as with the last several years, the Nominating and Corporate Governance Committee used an independent consultant, experienced in corporate governance matters, to assist with the Board and committee evaluation process. Using a combination of online surveys and interviews by the consultant, directors provided feedback on individual directors, committees and the Board in general. The topics covered included, among other things, Board and committee processes, Board composition and expertise, Board refreshment and succession planning processes, and other matters designed to elicit information to be used in improving Board and committee operation, performance and capability. In addition, certain members of our management team completed an online survey regarding Board performance and Board engagement with our management team.

The consultant synthesized the results and comments received during the interviews. The consultant presented the findings to the Nominating and Corporate Governance Committee and the Board, followed by review and discussion by the full Board.

Over the past few years, the evaluation process has led to a broader scope of topics covered in Board meetings and improvements in Board process.

| ●These improvements include changes relating to the preparation and distribution of Board materials, adjustments to the timing and location of Board and committee meetings, a directors’ education day, an annual in-depth review of the Company’s overall strategy with our management team and a more fluid discussion of anticipated future director skills. ●The Board and management team also developed a shared understanding on Board dynamics, progress made and agreed on areas of focus for improved performance. ●The process has also informed Board and committee composition and leadership roles, which includes evolution of the director skills and experience qualifications criteria to meet the current and anticipated needs of the business and improved structure and transparency around Board refreshment and succession planning. | |

| Results of the process, including review of contributions and performance of each director, are used by the Nominating and Corporate Governance Committee when considering whether to nominate the director for reelection to the Board. |

Director Onboarding and Continuing Education

As part of our onboarding process, all new directors participate in an orientation program which familiarizes them with the Company’s business, operations, strategies and corporate governance practices, and assists them in developing Company and industry knowledge to optimize their service on the Board. Our onboarding process also includes meetings with members of our management team to accelerate their effectiveness to engage fully in deliberations of our Board.

The Company encourages directors to participate in continuing education programs focused on the Company’s business and industry, committee roles and responsibilities and legal and ethical responsibilities of directors. The Company reimburses directors for their expenses associated with this participation. We provide membership in the National Association of Corporate Directors to all Board members. We also encourage our directors to attend Splunk events such as our annual users’ conference and take virtual Splunk education classes. Continuing director education is also provided during Board meetings and other Board discussions as part of the formal meetings and may include internally developed materials and presentations as well as programs presented by third parties.

| 24 |  |

| Corporate Governance at Splunk |

During our fiscal year ended January 31, 2021, the Board held ten meetings, and no director attended fewer than 75% of the total number of meetings of the Board during the period for which he or she has been a director and the committees of which such director was a member during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our Board at annual meetings of stockholders, we encourage directors to attend. All then-serving directors attended our 2020 annual meeting of stockholders. Our Board has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our Board.

Sean Boyle Our Audit Committee operates under a written charter that was adopted by our Board and satisfies the applicable standards of the SEC and The Nasdaq Stock Market. A copy of the Audit Committee Charter is available on our investor website at http://investors. splunk.com/corporate-governance. | AUDIT COMMITTEE The current members of our Audit Committee are Mr. Boyle, Ms. Morrison and Mr. Smith. Our Board has determined that each of the members of our Audit Committee satisfies the requirements for independence and financial literacy under the rules and regulations of The Nasdaq Stock Market and the Securities and Exchange Commission (“SEC”) applicable to Audit Committee members. Mr. Connors, who served on the Audit Committee until May 2021, was independent during his service. Our Board also determined that Mr. Boyle, Mr. Connors and Mr. Smith are audit committee financial experts as contemplated by the rules of the SEC implementing Section 407 of the Sarbanes Oxley Act of 2002. The Audit Committee held 14 meetings during the fiscal year ended January 31, 2021. Our Audit Committee oversees our accounting and financial reporting processes and the audit of our financial statements and assists our Board in monitoring our financial systems and our legal and regulatory compliance. Our Audit Committee is responsible for, among other things: ●appointing, compensating and overseeing the work of our independent auditors, including resolving disagreements between our management team and the independent registered public accounting firm regarding financial reporting and any other required communications described in applicable accounting standards, including critical audit matters; ●approving engagements of the independent registered public accounting firm to render any audit or permissible non-audit services; ●reviewing the qualifications and independence of the independent registered public accounting firm; ●reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices; ●reviewing the adequacy and effectiveness of our internal control over financial reporting; ●establishing procedures for the receipt, retention and treatment of accounting, internal accounting controls or auditing matters, the prompt internal reporting of violations of the Code that could have a significant impact on our financial statements, and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; ●preparing the audit committee report required by SEC rules to be included in our annual proxy statement; ●reviewing and discussing with our management team and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements and our publicly filed reports; ●reviewing and maintaining the related person transaction policy to ensure compliance with applicable law and that any proposed related person transactions are disclosed as required; ●overseeing the internal audit function; ●overseeing compliance with the Code and reviewing material legal and ethical matters; ●overseeing the adequacy and effectiveness of the Company’s enterprise risk management framework; and ●reviewing our cybersecurity and other information technology risks, controls and procedures. |

| Splunk 2021 Proxy Statement 25 |

| Corporate Governance at Splunk |