UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________

Amendment Number 3 to

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2008

o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-51886

| SO ACT NETWORK, INC. |

| (Exact name of issuer as specified in its charter) |

| | |

| Delaware | 26-3534190 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

5715 Will Clayton Parkway, #6572 Humble, TX | 77338 |

| (Address of principal executive offices) | (Zip Code) |

| | |

Registrant’s telephone number, including area code: 210-401-7667 |

| Securities registered under Section 12(b) of the Exchange Act: | None. |

| | |

| Securities registered under Section 12(g) of the Exchange Act: | Common stock, par value $0.001 per share. |

| | (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | | Accelerated filer | o |

| | | | | |

Non-accelerated filer (Do not check if a smaller reporting company) | o | | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No o

As of the last business day of the registrant’s most recently completed second fiscal quarter, there was no public trading market for our common stock.

As of March 30, 2009, the registrant had 182,284,000 shares issued and outstanding, respectively.

Documents Incorporated by Reference:

None.

TABLE OF CONTENTS

PART I

Description of Our Business

Overview

We were incorporated in the State of Delaware as of December 9, 2005 as 43010 , Inc to engage in any lawful corporate undertaking, including, but not limited to, locating and negotiating with a business entity for combination in the form of a merger, stock-for-stock exchange or stock-for-assets exchange. On October 7, 2008, pursuant to the terms of a stock purchase agreement, Mr. Greg Halpern purchased a total of 100,000 shares of our common stock from Michael Raleigh for an aggregate of $30,000 in cash. The total of 100,000 shares represents 100% of our issued and outstanding common stock at the time of the transfer. As a result, Mr. Halpern became our sole shareholder. As part of the acquisition, and pursuant to the Stock Purchase Agreement, Michael Raleigh, our then President, CEO, CFO, and Chairman resigned from all the positions he held in the company, and Mr. Halpern was appointed as our President, CEO CFO and Chairman. The current business model was developed by Mr. Halpern in September of 2008 and began when he joined the company on October 7, 2008.On October 2008, we became a development stage company focused on creating an Internet search engine and networking web site. Our website domain name is www.soact.net.

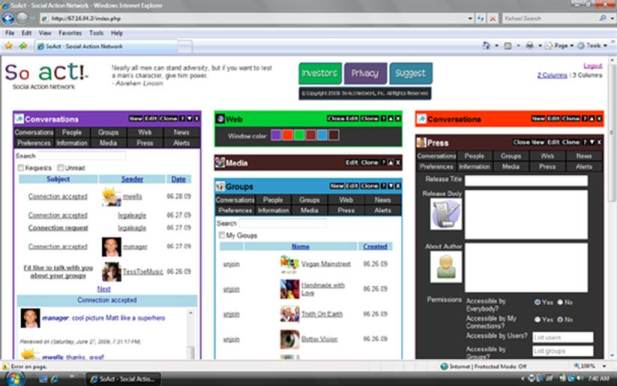

Our website is up and running. We currently have 204 members registered on our website. Our web site has the following operational features: Conversations, Connect with People, List People, Review People, Start New Groups, View Groups, Join Groups, Interact with Groups, Web (Search Engine), Preferences, Maintain Profile, View Profiles, Send Press Releases, Review Press Releases, 2 column, 3 column, Invite People, iPhone Safari version. We are working on and expect the following portions of the web site to be operational by mid-October 2009: News, Media and Alerts. We are continuing to update and maintain certain areas of the website, including, but not limited to, search engine, message board, chat room, media warehouse, advertisement, and web & news, but as of June 30, 2009 the website was fully functional and users could register. The following is a visual of our website search feature and what users will interface with when they visit our site .

Our website domain name is www.soact.net. We have a preliminary website up and running which is fully functional. As of June 30, 2009, our website and search engine, message board and ability for users to post blogs was fully functional and offered to users. The following is a visual of our website search feature and what users will interface with when they visit our site.

We do not currently have any subscribers nor do we have any revenue from advertising. We will also be notifying some organizations that are in line with our goals to let them know of our site and how we can help them expand and get their message to as many people as possible. Once we begin getting subscribers, we will then look to enter into advertising contracts and produce advertising revenue.

We have no current clients for advertising but believe that we will be able to secure advertisers who pay for clicks on ads that represent their products or services being advertised to So Act Members who opt-in to see those ads.

We plan to generate revenue from low membership fees of between $2 to $10 per-member-per-month. We believe there is a large number of people in the world who are actively working to solve problems and our website will bring them together. We also believe we can sell pay-per-click advertising to green, eco-friendly companies who could find potential value in reaching the type of socially conscious consumers and problem solvers that we feel will use our search engine and network.

We only began our operations on October 8, 2008 when we purchased the Form 10 company from the previous owners. Since that date, we have completed a financing to raise initial start-up money for the building of our website and to start our operations. Additionally, we have been working to build our So Act website, user interface and search engine so we can begin attracting subscribers and building support for our site. We launched the live site of So Act Search Engine and So Act Network on June 30, 2009. Gigablast, Inc. (the “Gigabalst”), our engine and network developer, and we have entered into an Amendment to Gigablast Professional Services Agreement, pursuant to which, Gigablast agrees to reduce our outstanding balance from $34,325.00 to $17,162.50, which represents a 50% discount to the fees arising from the professional services provided by Gigablast in connection with developing the So Act Search Engine and So Act Network and reduce their hourly rate of labor for further development of the So Act Network from $150 per hour to $75 per hour. For the aforementioned considerations received, we grant Gigablast the right to use, for any purpose other than in the field of social action network, all work or intellectual property that Gigablast has developed for the Company under the Gigablast Professional Services Agreement. In addition to this Amendment with Gigablast, we issued 80,000 shares of our common stock to Matt Wells, the CEO of Gigablast, as compensation for the website platform design services rendered to us in the first quarter of 2009. We issued the shares to Matt Wells pursuant to a separate independent contractors agreement that we entered into for his personal services to the Company. Pursuant to this independent contractor agreement, Matt Wells agreed to provide his consulting services in designing and implementing the website in exchange for 80,000 shares of Company common stock. A copy of the independent contractor agreement is attached as Exhibit 10.11 to this Amendment Number 4 to the Registration Statement on Form S-1. We have also received three loans from Mr. Greg Halpern, in the amount of $9,500, $15,000 or $16,700 on May 11, May 22, and May 26, 2009, respectively. Each of the loans bears an interest at the primate rate. Additional expenses may arise from the maintenance of our regulatory filings and responsibilities which include legal, accounting and electronic filing services. It is anticipated that the cost to maintain these activities will be no less than $76,000 and no more than $108,000. We have entered into a Credit Line Agreement and Line of Credit Note with Greg Halpern who has agreed to establish a revolving line of credit for us with a maximum amount of $100,000 that will mature and expire on May 29, 2011. The Credit Line Agreement shall accrue interest at the prime rate. The prime rate of interest is the rate of interest that major banks charge their most creditworthy customers. For the purposes of this agreement, we shall determine the prime rate by using the prime rate reported by the Wall Street Journal on the date funds are extended to the Company. Based on the current prime rate, it is estimated that the prime rate shall be 3.25% but that may be subject to adjustment based on market factors and the fluctuation of the prime rate. Although we believe that the $100,000 will be sufficient to cover the additional expense arising from maintenance of our regulatory filings with the SEC, we may need additional financing if the additional expenses exceed our budget and/or Mr. Halpern cannot fulfill his obligations under the Credit Line Agreement.

We believe this would be sufficient cash because, on June 25, we pre-paid Gigablast $6,000 for one year of hosting of So Act Network. The hosting needs of the company are therefore paid in full until June 24, 2010. The other potential fees will apply if we had one million or more users accessing our network on a daily basis. So we do not anticipate other hosting fees for at least the next 12 months. As for the hourly fees, the initial development of the network has been completed and is paid for. On June 25 we completed our Beta test and on June 30, 2009 So Act Network went live with all of the initial features planned; i.e our no spam-no ads communication tool called Conversations, our People tool allowing for people to join worldwide and contact and connect with each other, our Groups tool allowing people to start Groups and work on anything that is important to them while networking globally with others who seek to pursue those same interests, our information tool allowing peoples interests to be searched and found or made publicly available or only upon request, our preferences tool allowing people to provide publicly updated profiles on their backgrounds or upon request only, our Web tool which allows ads to be opted in or out and provides only the top 5 results on the Internet without millions of unusable pages and last our Press tool which will allow people to create press releases for major and minor media and a members followers.

We anticipate approximately $15,000 more between July and August for completion of all the design work. Other than that, we do not foresee any other expenses with Gigablast.

This leaves only the cost of operations (which is primarily salary and the expense of being public). This equals all salary abated until the company can afford to pay Greg Halpern, its one employee, after all other expenses of the company are paid and there is a surplus.

Service Agreement

On January 19, 2009, we engaged Gigablast, Inc, a Delaware corporation, as the So Act Engine and Network developer. Pursuant to the Gigablast Professional Service Agreement, Gigablast will provide us professional services according to our specifications, including, but not limited to:

| • | Establish a user accounting system. |

| • | Create the ability for one user to connect to another as a "friend'' |

| • | Create the ability for a user to create and moderate groups which other users can join, with permission from the creator |

| • | Create the ability for one user to connect to another as a "friend'' |

| • | Create the ability to message all members of a group. |

| • | Establish a private email module |

| • | Create a commerce module to charge users $40/Year to become members and thus belong to the "member" group. Commerce module should connect to a billing service to conduct the actual transaction. PayPal should be supported. Module should record all transactions and make them easy to view |

| • | Create a permission system so a user can control permissions for his/her pages and files based on groups or individual users |

| • | Create an Inspirational module to display one of 365 personal and life wisdom success items (quotations, uplifting thoughts, etc.). Only available to members. There might already be a module for this in elgg.com, etc. |

| • | Create Page Builder Module. Make it easy to create a page describing an Initiate. Initiative (kind of like a business plan) includes information on the following topics: Objective, Management, Resources, and Requirements. Select a stock clip art icon for each topic and then fill in the blanks. Consider using a "drag & drop" of the clip art so it seems slick |

| • | Establish an alert module to email and message a user when new results match his/her query. Used to aid in connecting users. One user may have certain resources that another user requires. |

| • | Allow creation of other pages and files that go into more detail about the initiative but are meant only for non-public groups. |

| • | Show search results from within the network on top of web search results, but only for members. Non-members do not get to search the network. Allow user to keep searching on either the network or the web exclusively by providing separate "Next 10" links. |

| • | Host the social network service on a single machine using raid level 1. Backup the server on a nightly basis to another server located 100 ft. or more away in a different. room. The social network service servers are separate from the search engine servers. |

After Gigablast completes developing the So Act Network and Engine, they will be responsible for maintaining our server and platform in accordance with the following fee table

Up to This Many 25KB Documents in Index (In Millions) | Max 25KB Pages Downloaded Per Day (In Millions) | Max Typical Queries Per Day | Flat Monthly Fee |

| 25 | 1 | 4,000,000 | $3,000 |

| 50 | 2 | 4,000,000 | $4,500 |

| 100 | 4 | 4,000,000 | $6,750 |

| 200 | 8 | 4,000,000 | $10,125 |

| 500 | 16 | 4,000,000 | $15,187 |

| 1000 | 30 | 4,000,000 | $22,781 |

| 2000 | 50 | 4,000,000 | $34,171 |

| 5000 | 100 | 4,000,000 | $49,257 |

Our Product

We are developing a Search Engine and networking website for individuals and organizations. We believe our networking website will help people find others who have the similar interest.

The So Act Network has a zero-spam communication tool called “Conversations” that combines email and real-time chat with security and archiving. By cloning the “Conversation” tool, a user can have as many simultaneous conversations going as he or she wants. For example, when such user is having a conference meeting with several likeminded people, such user use the “Clone” tool to create additional conversation boxes to chat with other friends or family members. The “People” tool archives all the people a user knows, meets and interacts with on the So Act Network. The “Group” tool allows likeminded people to form unique groups focused on specific problems. The first ten (10) groups that a user can create are free of charge. The “Press Club” tool allows a user to release news to AP, Yahoo, Top 100 Radio, TV and Print Media, Top 50 information sites, Top 50 Blogs, Top 50 Social Networks, and people such user has interacted with on the So Act Network.

There will not be a charge for a general user to create a membership and that member will be permitted to access certain areas of the site, including review posts and search the general sections of the site. However, members will be charged $1 per month if they have a network of people between 100 and 500 people. If the members network grows to a number between 500 and 5,000 people then the member will be required to pay $2 per month for their membership. Anything above 5,000 people in a members network will be a fee of $5 per month. Also, if the member wants to join groups with no spam and no ads, the member will be charged a fee of $1 per group per month. Lastly, we will charge members a fee for storage space. If a member wants to keep files on their profile or under their member name, there will be a charge of $1 per month for 500 megabytes of memory and $5 per month for any amount of space greater than 500 megabytes. We will also offer a Press Club membership for a membership fee of $2 per month for the membership and then an additional $5 for each press release issued.

The So Act Search Engine has a function to filter out irrelevant search results and provide a user with ten most relevant results. Advertisements in the search engine are optional, and related to the exact words searched. So with respect to advertisements, a user can choose to opt in or out anytime.

Marketing

Our plan is to draw our customer bases from two groups of audiences. The first group is categorized as socially conscious innovators, inventors, scientists, explorers, investors and creative thinkers developing legitimate world-improving solutions. The second group is categorized as socially conscious, social investing, social business, green and eco-friendly companies who can advertise their existing solutions to targeted consumers within our network.

The only marketing we are doing right now is word of mouth. We are notifying everyone we know about this website and asking for their comments and feedback. We are also hoping that they help by telling their friends and family about the website and what it offers.

In the future and as we grow, we will target our two groups of audiences by targeting not-for-profits that have missions similar to our goals and missions. We will contact these organizations by email, regular mail and phone calls. We will also set-up meetings with each organization and give a presentation to their members to garner support for our website. We hope that they will partner with us to help market our website and business goals.

Competition

We are not aware of any other specific web-based companies that closely resemble the business model and features we are developing. Therefore, we see ourselves in a niche market that has very few competitors.

There are other internet search engines and networking sites but they are all much larger and cater to the broader market. We are strictly focused on the person who wants to address the world’s problems. Therefore, we do not expect to compete with the other search engines or networking sites because users who want to address the world’s problems will come to our website and users who want to surf the web or meet people in general will not be interested in visiting our site.

Intellectual Property

We received a Registered Trademark No. 3,626,525 on May 26, 2009 from the U.S. Patent and Trademark Office, for the name So Act which is now reflected at our website SoAct.net in the form of a circled R and throughout any of our web based marketing materials whereever our logo appears. Our Search Engine and Network platform contain certain trade secrets, however, the Company has no specific state or federal protections for its trade secrets. To the best of our ability we intend to keep certain proprietary aspects of our technology as trade secrets that we feel are unique and may provide future market advantages. At this time we do not plan to seek any other specific Intellectual Property protections. Our intellectual property is not being relied on as a protection against competition.

At this time, we do seek to obtain copyright protection on our name and certain other parts of our website. However, we do not expect to seek patents for our platform or technologies.

Research and Development

Over the last two fiscal years, we have spent approximately 416 hours on the development of our website and our business plan and have contributed over 1110 hours to the development of the network platform. We have not spent any time on any research, except for the time we spend showing individuals our website and asking for feedback which consists of approximately 2 hours per week.

Employees

Greg Halpern is our sole employee. We do not have any other full- or part-time employees. Until such time as we begin generating revenues, we do not anticipate a need to hire additional employees.

We are a publicly reporting company under the Exchange Act and are required to file periodic reports with the Securities and Exchange Commission. The public may read and copy any materials you file with the Commission at the SEC's Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and state the address of that site (http://www.sec.gov). In addition, you can obtain all of the current filings at our internet website at www.soact.net.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable for smaller reporting companies.

ITEM 2. DESCRIPTION OF PROPERTY.

Office Arrangements and Operational Activities

We do not have a principal business office. We are renting our Texas location, located at 5715 Will Clayton Parkway, #6572, Humble, TX 77338 from a business service corporation on a month-to-month basis The office provides us with general office services such as mail, phone, fax, shipping and receiving capabilities. There is no shareholder that contributes the space. We do not have a lease with the business service corporation. Within one year, we plan to move our operation to a permanent office in Texas or New Mexico, However, as of the date of this registration statement, we have not actively searched for an office location. The day-to-day operations are conducted in Illinois where Mr. Halpern resides part-time. The Illinois office is a mobile RV office which Mr, Halpern utilizes at his own expense to travel the continental United States following the activities of various solution makers. When Mr. Halpern is traveling in his RV, there is no one who is occupying or working out of the principal business office in Humble, Texas.

Our search engine and network platform was launched on June 30, 2009 and was built at and located in Albuquerque, New Mexico. Gigablast, our third party web hosting vendor located in Albuquerque, New Mexico, is responsible for developing and maintaining our search engine and network pursuant to the Professional Service Agreement. The platform is supported by minimal hardware for 100,000 servers with databases scalable to 200 billion web pages which represents Gigablast total capacity. We currently have no obligation to the New Mexico location to lease servers or space. Upon completion of the development of our platform, we will pay hosting for service to all users of our search engine and network on a bandwidth cost basis commensurate with market rates.

ITEM 3. LEGAL PROCEEDINGS.

To the best of our knowledge, there are no known or pending litigation proceedings against us.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

On October 7, 2008, in accordance with the majority vote of our shareholders in lieu of a special meeting, we appointed Greg Halpern as the chairman of our Board of Directors.

On October 15, 2008, in accordance with the majority vote of our shareholders in lieu of a special meeting, we changed our company name from 43010, Inc. to So Act Network, Inc. by filing an amendment to the Articles of Incorporation with the Delaware Secretary of State. The amendment was attached as Exhibit 3.1 to the current report on Form 8-K filed on October 17, 2008 and is incorporated herewith by reference.

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

Market Information

There is presently no public market for our shares of common stock. We anticipate applying for trading of our common stock on the OTC Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms apart. However, we can provide no assurance that our shares of common stock will be traded on the OTC Bulletin Board or, if traded, that a public market will materialize.

Holders

As of March 30, 2009, in accordance with our transfer agent records, we had 42 record holders of our Common Stock.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Stock Option Grants

To date, we have not granted any stock options.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

The following plan of operation provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Overview

We were incorporated in the State of Delaware as of December 9, 2005. The current business model was developed by Mr. Halpern in September of 2008 and began when he joined the company on October 7, 2008.On October 2008, we became a development stage company focused on creating an Internet search engine and networking website. The live So Act Search Engine and So Act Network was launched on June 30, 2009.

The So Act Network has a zero-spam communication tool called “Conversations” that combines email and real-time chat with security and archiving. By cloning the “Conversation” tool, a user can have as many simultaneous conversations going as he or she wants. For example, when such user is having a conference meeting with several likeminded people, such user use the “Clone” tool to create additional conversation boxes to chat with other friends or family members. The “People” tool archives all the people a user knows, meets and interacts with on the So Act Network. The “Group” tool allows likeminded people to form unique groups focused on specific problems. The first ten (10) groups that a user can create are free of charge. The “Press Club” tool allows a user to release news to AP, Yahoo, Top 100 Radio, TV and Print Media, Top 50 information sites, Top 50 Blogs, Top 50 Social Networks, and people such user has interacted with on the So Act Network.

There will not be a charge for a general user to create a membership and that member will be permitted to access certain areas of the site, including review posts and search the general sections of the site. However, members will be charged $1 per month if they have a network of people between 100 and 500 people. If the members network grows to a number between 500 and 5,000 people then the member will be required to pay $2 per month for their membership. Anything above 5,000 people in a members network will be a fee of $5 per month. Also, if the member wants to join groups with no spam and no ads, the member will be charged a fee of $1 per group per month. Lastly, we will charge members a fee for storage space. If a member wants to keep files on their profile or under their member name, there will be a charge of $1 per month for 500 megabytes of memory and $5 per month for any amount of space greater than 500 megabytes. We will also offer a Press Club membership for a membership fee of $2 per month for the membership and then an additional $5 for each press release issued.

The So Act Search Engine has a function to filter out irrelevant search results and provide a user with ten most relevant results. Advertisements in the search engine are optional, and related to the exact words searched. So with respect to advertisements, a user can choose to opt in or out anytime.

Plan of Operation

Our initial membership to join So Act Network is free but we will be charging a fee to users for upgraded services. Such as, members will be charged $1 per month if they have a network of people between 100 and 500 people. If the member’s network grows to a number between 500 and 5,000 people then the member will be required to pay $2 per month for their membership. Anything above 5,000 people in a member’s network will be a fee of $5 per month. Also, if a member wants to join groups with no spam and no ads, the member will be charged a fee of $1 per group per month. Lastly, we will charge members a fee for storage space. If a member wants to keep files on their profile or under their member name, there will be a charge of $1 per month for 500 megabytes of memory and $5 per month for any amount of space greater than 500 megabytes. We will also offer a Press Club membership for a fee of $2 per month for the membership and then an additional $5 for each press release issued. We believe we will be able to generate revenue in the future from low membership fees of between $2 and $10 per member per month from problem solvers as well as pay-per-click targeted advertising from green, eco-friendly companies who could find value in the type of socially conscious consumer who frequents our search engine and wants to solve problems in our network.

We believe there is a social and professional demand for our network. Our plan is to draw our customer bases from two groups of audiences. The first group is categorized as socially conscious innovators, inventors, scientists, explorers, investors and creative thinkers developing legitimate world-improving solutions. The second group is categorized as socially conscious, social investing, social business, green and eco-friendly companies who can advertise their existing solutions to targeted consumers within our network.

The live So Act Search Engine and So Act Network was launched on June 30, 2009. Gigablast, Inc. (the “Gigabalst”), our engine and network developer, and we have entered into an Amendment to Gigablast Professional Services Agreement, pursuant to which, Gigablast agrees to reduce our outstanding balance from $34,325.00 to $17,162.50, which represents a 50% discount to the fees arising from the professional services provided by Gigablast in connection with developing the So Act Search Engine and So Act Network and reduce their hourly rate of labor for further development of the So Act Network from $150 per hour to $75 per hour. For the aforementioned considerations received, we grant Gigablast the right to use, for any purpose other than in the field of social action network, all work or intellectual property that Gigablast has developed for the Company under the Gigablast Professional Services Agreement. In addition, we have received three loans from Mr. Greg Halpern, in the amount of $9,500, $15,000 or $16,700 on May 11, May 22, and May 26, 2009, respectively. Each of the loans bears an interest at the primate rate. Additional expenses may arise from the maintenance of our regulatory filings and responsibilities which include legal, accounting and electronic filing services. It is anticipated that the cost to maintain these activities will be no less than $76,000 and no more than $108,000. We have entered into a Credit Line Agreement and Line of Credit Note with Greg Halpern who has agreed to establish a revolving line of credit for us with a maximum amount of $100,000 that will mature and expire on May 29, 2011. The Credit Line Agreement shall accrue interest at the prime rate. The prime rate of interest is the rate of interest that major banks charge their most creditworthy customers. For the purposes of this agreement, we shall determine the prime rate by using the prime rate reported by the Wall Street Journal on the date funds are extended to the Company. Based on the current prime rate, it is estimated that the prime rate shall be 3.25% but that may be subject to adjustment based on market factors and the fluctuation of the prime rate. We believe that the $100,000 will be sufficient to cover the additional expense arising from maintenance of our regulatory filings with the SEC. In the event that we are not able to obtain additional funding or Mr. Halpern either fails to extend us sufficient financing, declines to loan additional cash, declines to fund the line of credit, declines to defer his salary payments, or seeks repayment of his existing loans, we will no longer be able to continue to operate and will have to cease operations unless we begin to generate sufficient revenue to cover all our costs.

We believe this is sufficient to cover fund our operations for the next year because, on June 25, we pre-paid Gigablast $6,000 for one year of hosting of So Act Network. The hosting needs of the company are therefore paid in full until June 24, 2010. The other potential fees will apply when we have at least one million users accessing our network on a daily basis. We do not anticipate other hosting fees for at least the next 12 months. As for the hourly fees, the initial development of the network has been completed and is paid for. On June 25 we completed our Beta test and on June 30, 2009 So Act Network went live with all of the initial features planned; i.e our no spam- no ads communication tool called Conversations, our People tool allowing for people to join worldwide and contact and connect with each other, our Groups tool allowing people to start Groups and work on anything that is important to them while networking globally with others who seek to pursue those same interests, our information tool allowing peoples interests to be searched and found or made publicly available or only upon request, our preferences tool allowing people to provide publicly updated profiles on their backgrounds or upon request only, our Web tool which allows ads to be opted in or out and provides only the top 5 results on the Internet without millions of unusable pages and last our Press tool which will allow people to create press releases for major and minor media and a members followers.

We anticipate approximately $15,000 more between July and August for completion of all the design work. Other than that, we do not foresee any other expenses with Gigablast.

This leaves only the cost of operations (which is primarily salary and the expense of being public). This includes all salary abated until the company can afford to pay Greg Halpern, its one employee, after all other expenses of the company are paid and there is a surplus .

As of the date of this filing, we do not expect to purchase or sell any plant or significant equipment or increase our number of employees in the next 12 months.

Results of Operations

The following tables set forth key components of our results of operations for the periods indicated, in dollars, and key components of our revenue for the period indicated, in dollars.

| | | For the Years Ended December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Operating Expenses | | | | | | |

General and Administrative | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

Provision for Income Taxes | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

Net Loss Per Share - Basic and Diluted | | | | | | | | |

| | | | | | | | | |

Weighted average number of shares outstanding | | | | | | | | |

during the year Basic and Diluted | | | | | | | | |

For the Fiscal Year Ended December 31, 2008 and for the Fiscal Year Ended December 31, 2007

General and Administrative Expenses: Our general and administrative expenses were $62,210 for the fiscal year of 2008 and $1,400 for the fiscal year of 2007, representing an increase of $60,810 or approximately 4343.57%, as a result of our expenses on advertising which include the cost of public relations activities, stock issued for services, and other expenses associated with the private placement memorandum.

Net Loss: Our net loss for the fiscal year of 2008 was $117,115, compared to $1,400 for fiscal year of 2007. The increase in net loss was the result of the substantial increase in our operating expenses.

Liquidity and Capital Resources

We are in the development state with no revenue and have an accumulated deficit of $256,820 for the period from December 9, 2005 (inception) to December 31, 2008, and have negative cash flow from operations of $21,914 from inception.

Our financial statements have been presented on the basis that it is a going concern, which contemplates the realization of revenues from our subscriber base and the satisfaction of liabilities in the normal course of business. We have incurred losses from inception. These factors raise substantial doubt about our ability to continue as a going concern.

From our inception through December 31, 2008, our primary source of funds has been the proceeds of private offerings of our common stock and loans from stockholders. Our need to obtain capital from outside investors is expected to continue until we are able to achieve profitable operations, if ever. There is no assurance that management will be successful in fulfilling all or any elements of its plans.

For the fiscal year ended December 31, 2008, we received $18,803 from Mr. Greg Halpern, our principal shareholder. Pursuant to the terms of the loan, the loan is bearing an annual interest rate of 3.25% and due on demand. As of December 31, 2008, we owed $3,803 in principal and $31 in accrued interest. During the three months ended March 31, 2009 the shareholder loan balance has been repaid and the balance is $0.

We have received three loans from Mr. Greg Halpern, in the amount of $9,500, $15,000 or $16,700 on May 11, May 22, and May 26, 2009, respectively. Each of these loans are due upon demand and accrue interest at the prime rate. The prime rate of interest is the rate of interest that major banks charge their most creditworthy customers. For the purposes of this agreement, we shall determine the prime rate by using the prime rate reported by the Wall Street Journal on the date funds are extended to the Company. Based on the current prime rate, it is estimated that the prime rate shall be 3.25% but that may be subject to adjustment based on market factors and the fluctuation of the prime rate.

We have entered into an Amendment to Gigablast Professional Services Agreement, pursuant to which, Gigablast agrees to reduce our outstanding balance from $34,325.00 to $17,162.50, which represents a 50% discount to the fees arising from the professional services provided by Gigablast in connection with developing the So Act Search Engine and So Act Network and reduce their hourly rate of labor for further development of the So Act Network from $150 per hour to $75 per hour. For the aforementioned considerations received, we grant Gigablast the right to use, for any purpose other than in the field of social action network, all work or intellectual property that Gigablast has developed for the Company under the Gigablast Professional Services Agreement. With Gigablast’s service fees reduction and the loans from Mr. Greg Halpern, we believe until we are able to achieve profitable operations, we do not need additional capital to fund our business operations and development.

However, additional expenses may arise from the maintenance of our regulatory filings and responsibilities which include legal, accounting and electronic filing services. It is anticipated that the cost to maintain these activities will be no less than $76,000 and no more than $108,000. We have entered into a Credit Line Agreement and Line of Credit Note with Greg Halpern who has agreed to establish a revolving line of credit for us with a maximum amount of $100,000 that will mature and expire on May 29, 2011. The Credit Line Agreement shall accrue interest at the prime rate. The prime rate of interest is the rate of interest that major banks charge their most creditworthy customers. For the purposes of this agreement, we shall determine the prime rate by using the prime rate reported by the Wall Street Journal on the date funds are extended to the Company. Based on the current prime rate, it is estimated that the prime rate shall be 3.25% but that may be subject to adjustment based on market factors and the fluctuation of the prime rate. We believe that the $100,000 will be sufficient to cover the additional expense arising from maintenance of our regulatory filings with the SEC.

We believe this credit line will be sufficient because, on June 25, we pre-paid Gigablast $6,000 for one year of hosting of So Act Network. The hosting needs of the company are therefore paid in full until June 24, 2010. The other potential fees will apply when we have at least one million users accessing our network on a daily basis. We do not anticipate other hosting fees for the next 12 months. As for the hourly fees, the initial development of the network has been completed and is paid for. On June 25 we completed our Beta test and on June 30, 2009 So Act Network went live with all of the initial features planned; i.e our no spam- no ads communication tool called Conversations, our People tool allowing for people to join worldwide and contact and connect with each other, our Groups tool allowing people to start Groups and work on anything that is important to them while networking globally with others who seek to pursue those same interests, our information tool allowing peoples interests to be searched and found or made publicly available or only upon request, our preferences tool allowing people to provide publicly updated profiles on their backgrounds or upon request only, our Web tool which allows ads to be opted in or out and provides only the top 5 results on the Internet without millions of unusable pages and last our Press tool which will allow people to create press releases for major and minor media and a members followers.

We anticipate approximately $15,000 more between July and August for completion of all the design work. Other than that, we do not foresee any other expenses with Gigablast.

This leaves only the cost of operations (which is primarily salary and the expense of being public). This includes all salary abated until the company can afford to pay Greg Halpern, its one employee, after all other expenses of the company are paid and there is a surplus.

As stated above, we do not expect significant cash needs other than our regulatory filing needs (including, legal, accounting and filing fees). As of July 1, 2009, our cash balance is $15,435. We do not expect to pay any salary because the only salary that we have is Mr. Halpern’s salary of $18,000 per month and that is being deferred. Additionally, we do not expect to have any additional general & administrative expenses other than rent in the amount of $100 per month for the next twelve months.

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements – an amendment of ARB No. 51”. This statement improves the relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards that require; the ownership interests in subsidiaries held by parties other than the parent and the amount of consolidated net income attributable to the parent and to the non-controlling interest be clearly identified and presented on the face of the consolidated statement of income, changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently, when a subsidiary is deconsolidated, any retained non-controlling equity investment in the former subsidiary be initially measured at fair value, entities provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS No. 160 affects those entities that have an outstanding non-controlling interest in one or more subsidiaries or that deconsolidate a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Early adoption is prohibited. The adoption of this statement is not expected to have a material effect on the Company's financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133” (SFAS 161). This statement is intended to improve transparency in financial reporting by requiring enhanced disclosures of an entity’s derivative instruments and hedging activities and their effects on the entity’s financial position, financial performance, and cash flows. SFAS 161 applies to all derivative instruments within the scope of SFAS 133, “Accounting for Derivative Instruments and Hedging Activities” (SFAS 133) as well as related hedged items, bifurcated derivatives, and non-derivative instruments that are designated and qualify as hedging instruments. Entities with instruments subject to SFAS 161 must provide more robust qualitative disclosures and expanded quantitative disclosures. SFAS 161 is effective prospectively for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application permitted. We are currently evaluating the disclosure implications of this statement.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for selecting principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles in the United States. This statement shall be effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board’s amendments to AU section 411, The Meaning of Present Fairly in Conformity with Generally Accepted Accounting Principles. The Company is currently evaluating the impact of SFAS 162, but does not expect the adoption of this pronouncement will have a material impact on its financial position, results of operations or cash flows.

In May 2008, the FASB issued SFAS No. 163, “Accounting for Financial Guarantee Insurance Contracts-an interpretation of FASB Statement No. 60.” Diversity exists in practice in accounting for financial guarantee insurance contracts by insurance enterprises under FASB Statement No. 60, Accounting and Reporting by Insurance Enterprises. This results in inconsistencies in the recognition and measurement of claim liabilities. This Statement requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. This Statement requires expanded disclosures about financial guarantee insurance contracts. The accounting and disclosure requirements of the Statement will improve the quality of information provided to users of financial statements. The adoption of FASB 163 is not expected to have a material impact on the Company’s financial position.

Critical Accounting Policies and Estimates

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Use of Estimates: In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates.

Revenue Recognition: Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable and collectability is assured. We had no revenue for the twelve months ended December 31, 2008 and 2007, respectively.

Stock-Based Compensation:

The Company accounts for its stock-based compensation under the provisions of SFAS No.123(R) Accounting for Stock Based Compensation. Under SFAS No. 123(R), the Company is permitted to record expenses for stock options and other employee compensation plans based on their fair value at the date of grant. Any such compensation cost is charged to expense on a straight-line basis over the periods the options vest. If the options had cashless exercise provisions, the Company utilizes variable accounting.

Common stock, stock options and common stock warrants issued to other than employees or directors are recorded on the basis of their fair value, as required by SFAS No. 123(R), which is measured as of the date required by EITF Issue 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services. In accordance with EITF 96-18, the stock options or common stock warrants are valued using the Black-Scholes model on the basis of the market price of the underlying common stock on the valuation date, which for options and warrants related to contracts that have substantial disincentives to nonperformance is the date of the contract, and for all other contracts is the vesting date. Expense related to the options and warrants is recognized on a straight-line basis over the shorter of the period over which services are to be received or the vesting period. Where expense must be recognized prior to a valuation date, the expense is computed under the Black-Scholes model on the basis of the market price of the underlying common stock at the end of the period, and any subsequent changes in the market price of the underlying common stock up through the valuation date is reflected in the expense recorded in the subsequent period in which that change occurs.

In December 2002, the Financial Accounting Standards Board (FASB) issued SFAS No. 148, Accounting for Stock-Based Compensation-Transition and Disclosure. SFAS No. 148 also amends the disclosure requirements of SFAS No. 123(R), requiring prominent disclosure in annual and interim financial statements regarding a company's method for accounting for stock-based employee compensation and the effect of the method on reported results.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are subject to certain market risks, including changes in interest rates and currency exchange rates. We have not undertaken any specific actions to limit those exposures.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

(A DEVELOPMENT STAGE COMPANY)

CONTENTS

| PAGE | F-1 - F-2 | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS |

| | | |

| PAGE | F-3 | BALANCE SHEETS AS OF DECEMBER 31, 2008 AND AS OF DECEMBER 31, 2007 |

| | | |

| PAGE | F-4 | STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2008 AND DECEMBER 31, 2007 AND FOR THE PERIOD DECEMBER 9, 2005 (INCEPTION) TO DECEMBER 31, 2008 |

| | | |

| PAGE | F-5 | STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIENCY FOR THE PERIOD FROM DECEMBER 9, 2005 (INCEPTION) TO DECEMBER 31, 2008 |

| | | |

| PAGE | F-6 | STATEMENTS OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2008 AND DECEMBER 31, 2007 AND FOR THE PERIOD DECEMBER 9, 2005 (INCEPTION) TO DECEMBER 31, 2008 |

| | | |

| PAGES | F-7 - F-14 | NOTES TO FINANCIAL STATEMENTS |

| | | |

| Webb & Company, P.A. |

| Certified Public Accountants |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of:

So Act Network, Inc. (F/K/A 43010, Inc.) (A Development Stage Company)

We have audited the accompanying balance sheet of So Act Network, Inc. (F/K/A 43010, Inc.) (A Development Stage Company) as of December 31, 2008 and the related statements of operations, changes in stockholders' deficiency and cash flows for the year then ended and for the period from December 9, 2005(inception) to December 31, 2008. The financial statements for the year ended December 31, 2007 were audited by other auditors who issued a report dated February 25, 2008. The financial statements for the period from December 9, 2005 (inception) to December 31, 2008 in so far as they relate to amounts for the period through December 31, 2007, are based solely on the report of the other auditors. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly in all material respects, the financial position of So Act Network, Inc. (F/K/A 43010, Inc.) (A Development Stage Company) as of December 31, 2008 and the results of its operations and its cash flows for the year then ended and for the period December 9, 2005 (inception) through to December 31, 2008 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company is in the development stage with no operations, has an accumulated deficit of $256,820 for the period from December 9, 2005 (Inception) to December 31, 2008, and has a negative cash flow from operations of $21,914 from inception. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans concerning these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/WEBB & COMPANY, P.A.

WEBB & COMPANY, P.A.

Boynton Beach, Florida

March 2, 2009

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have audited the accompanying balance sheets of So Act Network, Inc. (F/K/A 43010, Inc.) as of December 31, 2007 and the related statements of operations, stockholders’ equity, and cash flows for the the year ended December 31, 2007 and the period from December 9, 2005 (inception) through December 31, 2007. These financial statements are the responsibility of company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of The Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of So Act Network at December 31, 2007 and the results of its operations and its cash flows for the twelve months then ended December 31, 2007 and the period from December 9, 2005 (inception) through December 31, 2007,in conformity with U.S. Generally Accepted Accounting Principles.

Gately & Associates, L.L.C.

Altamonte Springs, FL

February 25, 2008

| So Act Network, Inc. | |

| (f/k/a 43010, Inc.) | |

| (A Development Stage Company) | |

| Balance Sheets | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| ASSETS | |

| | | | | | | |

| | | | | | | |

| | | December 31, 2008 | | | December 31, 2007 | |

| | | | | | | |

| Current Assets | | | | | | |

| Cash | | $ | 33,950 | | | $ | - | |

| Prepaid Expenses | | | 359 | | | | - | |

| Total Current Assets | | | 34,309 | | | | - | |

| | | | | | | | | |

| Property and Equipment, net | | | 2,437 | | | | | |

| | | | | | | | | |

| Intangible assets | | | 275 | | | | - | |

| | | | | | | | | |

| Total Assets | | $ | 37,021 | | | $ | - | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIENCY | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 860 | | | $ | - | |

| Accrued Expenses | | | 46,910 | | | | 3,150 | |

| Loan payable - related party | | | 3,803 | | | | - | |

| Total Current Liabilities | | | 51,573 | | | | 3,150 | |

| | | | | | | | | |

| Commitments and Contingencies | | | - | | | | - | |

| | | | | | | | | |

| Stockholders' Deficiency | | | | | | | | |

| Preferred stock, $0.001 par value; 10,000,000 shares authorized, | | | | | | | | |

| No shares issued and outstanding | | | - | | | | - | |

| Common stock, $0.001 par value; 250,000,000 shares authorized, | | | | | | | | |

| 181,940,000 and 100,000 shares issued and outstanding, respectively | | | 181,940 | | | | 100 | |

| Additional paid-in capital | | | 128,078 | | | | - | |

| Subscription receivable | | | (67,750 | ) | | | - | |

| Deficit accumulated during the development stage | | | (256,820 | ) | | | (3,250 | ) |

| Total Stockholders' Deficiency | | | (14,552 | ) | | | (3,150 | ) |

| | | | | | | | | |

| Total Liabilities and Stockholders' Deficiency | | $ | 37,021 | | | $ | - | |

See accompanying notes to financial statements.

| So Act Network, Inc. | |

| (f/k/a 43010, Inc.) | |

| (A Development Stage Company) | |

| Statements of Operations | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | For the Years Ended December 31, | | | | For the Period From December 9, 2005 | |

| | | | | 2008 | | | | | 2007 | | | | (Inception) to December 31, 2008 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | |

| General and Administrative | | | | $ | 62,210 | | | | | $ | 1,400 | | | | $ | 65,460 | |

| Professional Fees | | | | | 11,325 | | | | | | - | | | | | 11,325 | |

| Compensation | | | | | 43,549 | | | | | | - | | | | | 43,549 | |

| Total Operating Expenses | | | | | 117,084 | | | | | | 1,400 | | | | | 120,334 | |

| | | | | | | | | | | | | | | | | | |

| Loss from Operations | | | | | (117,084 | ) | | | | | (1,400 | ) | | | | (120,334 | ) |

| | | | | | | | | | | | | | | | | | |

| Other Expense | | | | | | | | | | | | | | | | | |

| Interest Expense | | | | | (31 | ) | | | | | - | | | | | (31 | ) |

| Total Other Expense | | | | | (31 | ) | | | | | - | | | | | (31 | ) |

| | | | | | | | | | | | | | | | | | |

| Provision for Income Taxes | | | | | - | | | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | |

| Net Loss | | | | $ | (117,115 | ) | | | | $ | (1,400 | ) | | | $ | (120,365 | ) |

| | | | | | | | | | | | | | | | | | |

| Net Loss Per Share - Basic and Diluted | | | | $ | (0.00 | ) | | | | $ | (0.00 | ) | | | | | |

| | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding | | | | | | | | | | | | | | | | | |

| during the year Basic and Diluted | | | | | 38,818,104 | | | | | | 400,000 | | | | | | |

See accompanying notes to financial statements.

| So Act Network, Inc. | |

| (f/k/a 43010, Inc.) | |

| (A Development Stage Company) | |

| Statement of Changes in Stockholders' Deficiency | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Deficit | | | | | | | |

| | | | | | | | | | | | | | | | | | Accumulated | | | | | | | |

| | | Preferred stock | | | Common stock | | | Additional | | | During the | | | | | | Total | |

| | | | | | | | | | | | | | | paid-in | | | Development | | | Subscription | | | Stockholder's | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | capital | | | Stage | | | Receivable | | | (Deficiency) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 9, 2005 (Inception) | | | - | | | $ | - | | | | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock issued on acceptance of incorporation expenses | | | - | | | | - | | | | 100,000 | | | | 100 | | | | - | | | | - | | | | - | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the peiord December 9, 2005 (Inception) to December 31, 2005 | | | - | | | | - | | | | - | | | | - | | | | - | | | | (400 | ) | | | | | | | (400 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2005 | | | - | | | | - | | | | 100,000 | | | | 100 | | | | - | | | | (400 | ) | | | - | | | | (300 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,450 | ) | | | - | | | | (1,450 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2006 | | | - | | | | - | | | | 100,000 | | | | 100 | | | | - | | | | (1,850 | ) | | | - | | | | (1,750 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,400 | ) | | | - | | | | (1,400 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2007 | | | - | | | | - | | | | 100,000 | | | | 100 | | | | - | | | | (3,250 | ) | | | - | | | | (3,150 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued for services to founder ($0.001/sh) | | | - | | | | - | | | | 44,900,000 | | | | 44,900 | | | | - | | | | - | | | | - | | | | 44,900 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued for cash ($0.25/sh) | | | - | | | | - | | | | 473,000 | | | | 473 | | | | 117,777 | | | | - | | | | (67,750 | ) | | | 50,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued for services ($0.25/sh) | | | - | | | | - | | | | 12,000 | | | | 12 | | | | 2,988 | | | | - | | | | - | | | | 3,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued in connection with stock dividend | | | - | | | | - | | | | 136,455,000 | | | | 136,455 | | | | - | | | | (136,455 | ) | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In kind contribution of rent | | | - | | | | - | | | | - | | | | - | | | | 2,913 | | | | - | | | | - | | | | 2,913 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Accrued expenses payment made by a former shareholder | | | - | | | | - | | | | - | | | | - | | | | 4,400 | | | | - | | | | - | | | | 4,400 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (117,115 | ) | | | - | | | | (117,115 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2008 | | | - | | | $ | - | | | | 181,940,000 | | | $ | 181,940 | | | $ | 128,078 | | | $ | (256,820 | ) | | $ | (67,750 | ) | | $ | (14,552 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| |

| |

(A Development Stage Company) | |

| |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | For the Years Ended December 31, | | | For the Period FromDecember 9, 2005 (Inception) to | |

| | | 2008 | | | 2007 | | | December 31, 2008 | |

| | | | | | | | | | |

| Cash Flows From Operating Activities: | | | | | | | | | |

| Net Loss | | $ | (117,115 | ) | | $ | (1,400 | ) | | $ | (120,365 | ) |

| Adjustments to reconcile net loss to net cash used in operations | | | | | | | | | | | | |

| Depreciation | | | 127 | | | | - | | | | 127 | |

| In kind contribution of rent | | | 2,913 | | | | - | | | | 2,913 | |

| Stock issued for services | | | 47,900 | | | | - | | | | 48,000 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Increase in prepaid expenses | | | (359 | ) | | | - | | | | (359 | ) |

| Increase accounts payable | | | 860 | | | | - | | | | 860 | |

| Increase in accrued expenses | | | 43,760 | | | | 1,400 | | | | 46,910 | |

| Net Cash Used In Operating Activities | | | (21,914 | ) | | | - | | | | (21,914 | ) |

| | | | | | | | | | | | | |

| Cash Flows From Investing Activities: | | | | | | | | | | | | |

| Register of trademark | | | (275 | ) | | | - | | | | (275 | ) |

| Purchase of equipment | | | (2,564 | ) | | | - | | | | (2,564 | ) |

| Net Cash Used In Investing Activities | | | (2,839 | ) | | | - | | | | (2,839 | ) |

| | | | | | | | | | | | | |

| Cash Flows From Financing Activities: | | | | | | | | | | | | |

| Proceeds from stockholder loans | | | 18,803 | | | | - | | | | 18,803 | |

| Repayment of stockholder loans | | | (15,000 | ) | | | - | | | | (15,000 | ) |

| Accrued Expenses payment made by a former shareholder | | | 4,400 | | | | | | | | 4,400 | |

| Proceeds from issuance of stock, net of subscriptions receivable | | | 50,500 | | | | - | | | | 50,500 | |

| Net Cash Provided by Financing Activities | | | 58,703 | | | | - | | | | 58,703 | |

| | | | | | | | | | | | | |

| Net Decrease in Cash | | | 33,950 | | | | - | | | | 33,950 | |

| | | | | | | | | | | | | |

| Cash at Beginning of Year | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Cash at End of Year | | $ | 33,950 | | | $ | - | | | $ | 33,950 | |

| | | | | | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash paid for interest | | $ | - | | | $ | - | | | $ | - | |

| Cash paid for taxes | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Shares issued in connection with stock dividend | | $ | 136,455 | | | | | | | $ | 136,455 | |

| Stock sold for subscription | | $ | 67,750 | | | $ | - | | | $ | 67,750 | |

| | | | | | | | | | | | | |

See accompanying notes to financial statements.

SO ACT NETWORK, INC.

(F/K/A 43010, Inc.)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2008 AND 2007

| NOTE 1 | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND ORGANIZATION |

(A) Organization

So Act Network, Inc. Inc. (f/k/a 43010, Inc.) (the “Company”) was incorporated in Delaware on December 9, 2005. The Company is currently in the development stage and plans to create search technologies within an online networking platform.

On October 15, 2008 the Company changed its name to So Act Network, Inc.

(B) Use of Estimates

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates.

(C) Cash and Cash Equivalents

For purposes of the cash flow statements, the Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.

(D) Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and repairs are charged to expense as incurred. Depreciation is provided using the straight-line method over the estimated useful life of three to five years.

(E) Revenue Recognition

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable and collectability is assured. The Company had no revenue for the twelve months ended December 31, 2008 and 2007, respectively.

(F) Advertising Costs

Advertising costs are expensed as incurred and include the costs of public relations activities. These costs are included in general and administrative expenses and totaled $867 and $0 in the years ended December 31, 2008 and 2007, respectively.

SO ACT NETWORK, INC.

(F/K/A 43010, Inc.)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2008 AND 2007

(G) Identifiable Intangible Assets

As of December 31, 2008 and 2007, $275 and $0, respectively of costs related to registering a trademark has been capitalized. It has been determined that the trademark has an indefinite useful life and not subject to amortization. However, the trademark will be reviewed for impairment annually, or more frequently if impairment indicators arise.

(H) Loss Per Share

Basic and diluted net loss per common share is computed based upon the weighted average common shares outstanding as defined by Financial Accounting Standards No. 128, “Earnings per Share.” As of December 31, 2008 and 2007, respectively, there were no common share equivalents outstanding.

(I) Income Taxes

The Company accounts for income taxes under the Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (“Statement 109”). Under Statement 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under Statement 109, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

As of December 31, 2008 and 2007, the Company has a net operating loss carry forward of approximately $67,942 and $3,250, available to offset future taxable income through 2028 and 2007, respectively. The valuation allowance at December 31, 2008 and 2007 was $23,100 and $650, respectively. The net change in the valuation allowance for the period ended December 31, 2008 and 2007 was an increase of $22,820 and $280, respectively.

(J) Business Segments

The Company operates in one segment and therefore segment information is not presented.

SO ACT NETWORK, INC.

(F/K/A 43010, Inc.)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2008 AND 2007

(K) Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51”. This statement improves the relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards that require; the ownership interests in subsidiaries held by parties other than the parent and the amount of consolidated net income attributable to the parent and to the noncontrolling interest be clearly identified and presented on the face of the consolidated statement of income, changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently, when a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary be initially measured at fair value, entities provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS No. 160 affects those entities that have an outstanding noncontrolling interest in one or more subsidiaries or that deconsolidate a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Early adoption is prohibited. The adoption of this statement is not expected to have a material effect on the Company's financial statements.