Q4’21 Investor Presentation March 30, 2022

This presentation contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Statements that do not relate strictly to historical or current facts are forward-looking and can be identified by the use of words such as “anticipate,” “estimate,” “could,” “would,” “should,” “will,” “may,” “forecast,” “approximate,” “expect,” “project,” “seek,” “predict,” “potential,” “intend,” “plan,” “believe,” the negatives of such terms and other words of similar meaning. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation include statements regarding Appgate and its industry relating to matters such as anticipated future financial and operational performance and business prospects. The forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Appgate has based these forward-looking statements on current expectations and assumptions about future events, taking into account all information currently known by Appgate. While Appgate considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond Appgate’s control. These risks and uncertainties include, but are not limited to: Appgate’s future financial performance, including Appgate’s expectations regarding its total revenue, cost of revenue, gross profit or gross margin, operating expenses, including changes in operating expenses and our ability to achieve and maintain future profitability; the effects of increased competition in Appgate’s markets and Appgate’s ability to compete effectively; growth in the total addressable market for Appgate’s products and services, market acceptance of Appgate’s products and services and Appgate’s ability to increase adoption of its products; Appgate’s ability to maintain the security and availability of its products; Appgate’s ability to develop new products, or enhancements to existing products, and bring them to market in a timely manner; Appgate’s ability to maintain and expand its customer base, including by attracting new customers; the potential impact on Appgate’s business of the ongoing COVID-19 pandemic; Appgate’s ability to maintain, protect and enhance its intellectual property rights; Appgate’s ability to comply with laws and regulations that currently apply or become applicable to its business both in the United States and internationally; Appgate’s ability to maintain an effective system of disclosure controls and internal control over financial reporting; SIS Holdings’ significant influence over Appgate’s business and affairs; the future trading prices and liquidity of Appgate’s common stock; Appgate’s indebtedness, which may increase risk to Appgate’s business; and other risks and uncertainties, including those described under the section entitled “Risk Factors” in Appgate’s Form 10-K to be filed with the Securities and Exchange Commission (“SEC”) on March 31, 2022, as updated by any subsequent filings which Appgate makes with the SEC. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Appgate will not and does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. 2 Cautionary Statements

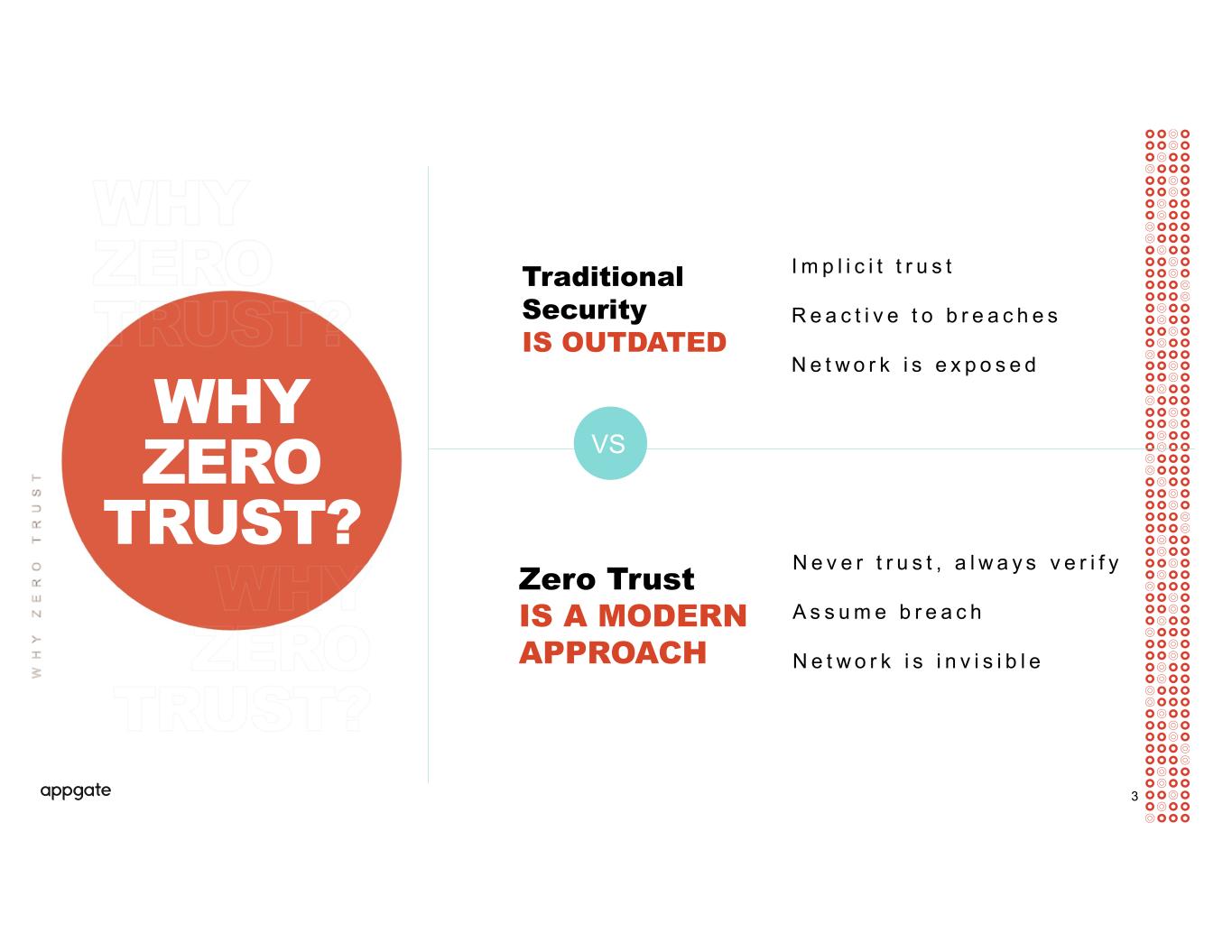

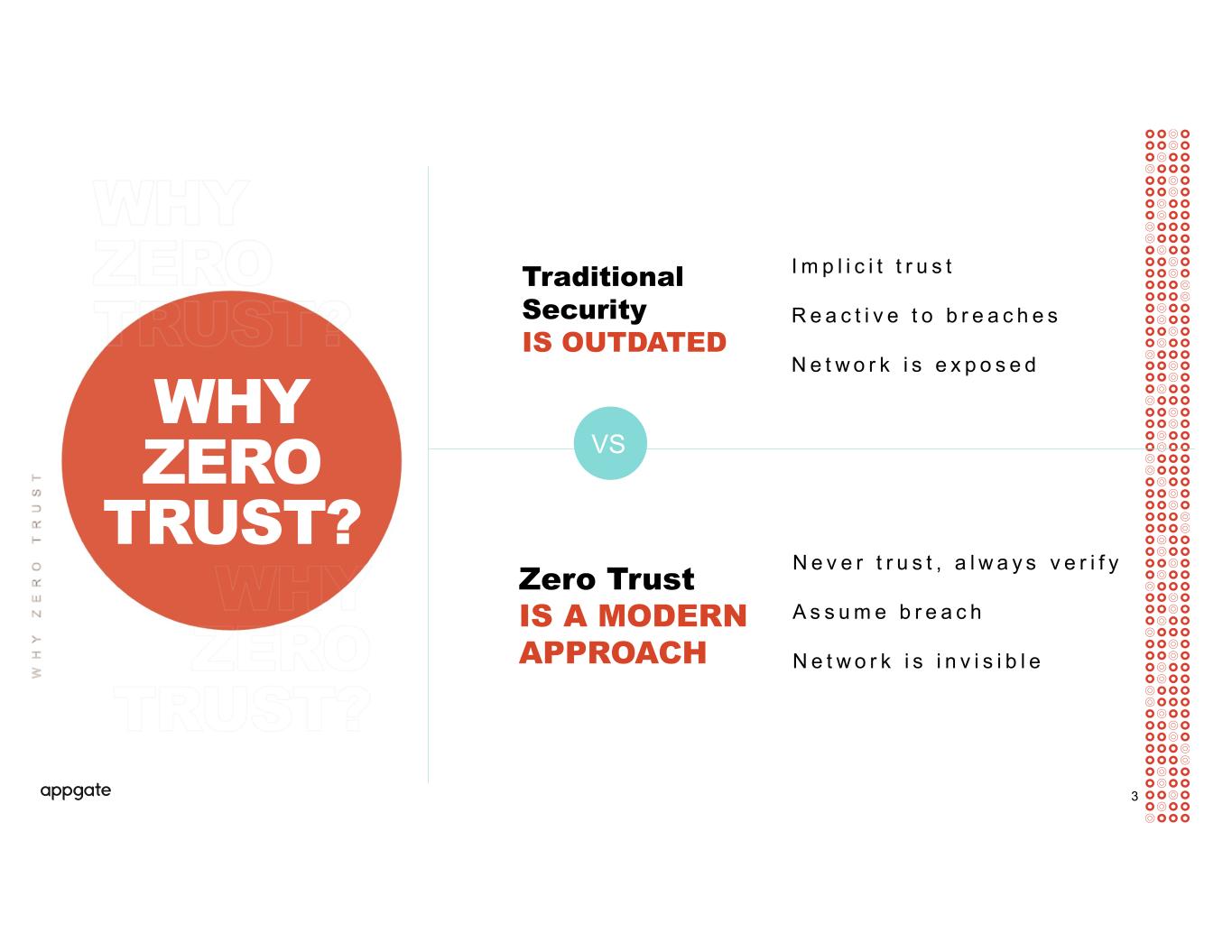

WHY ZERO TRUST? I m p l i c i t t r u s t R e a c t i v e t o b r e a c h e s N e t w o r k i s e x p o s e d N e v e r t r u s t , a l w a y s v e r i f y A s s u m e b r e a c h N e t w o r k i s i n v i s i b l e Traditional Security IS OUTDATED Zero Trust IS A MODERN APPROACH VS 3

4 To empower and protect how people work and connect We achieve our mission by providing a Pure-play Zero Trust Platform O U R M I S S I O N

Zero Trust Network Access Secure Consumer Access Threat Advisory Services • Easily integrates with current architecture • Makes day-to-day easier for IT • Enables secure, anywhere, anytime access on any device • Ensures better overall experience for users • Intelligently permits risk-based access • Enhanced protection without compromising experience • Digital threat monitoring, warning and protection • Know where you’re vulnerable • Real-world adversary simulations • Advanced penetration testing What we do 5

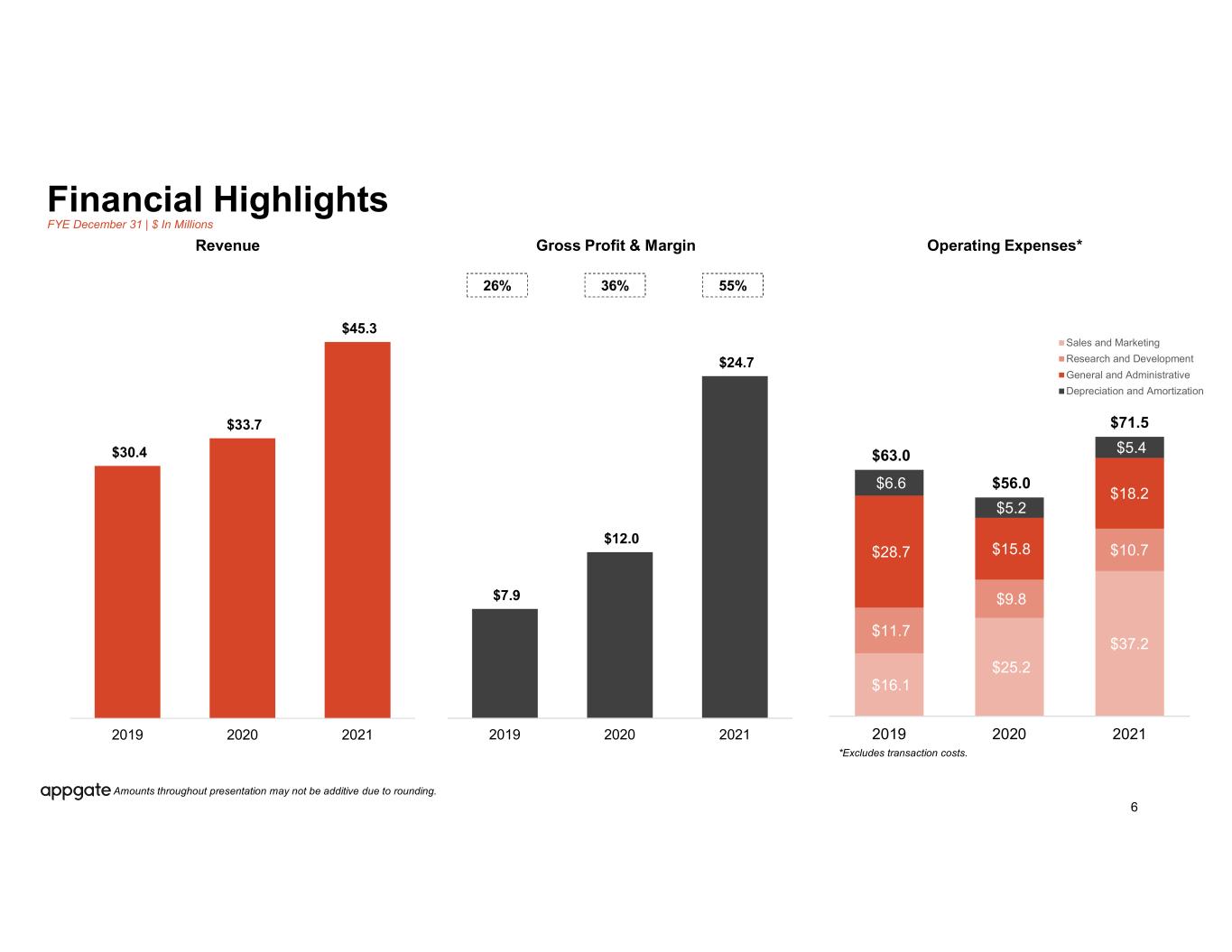

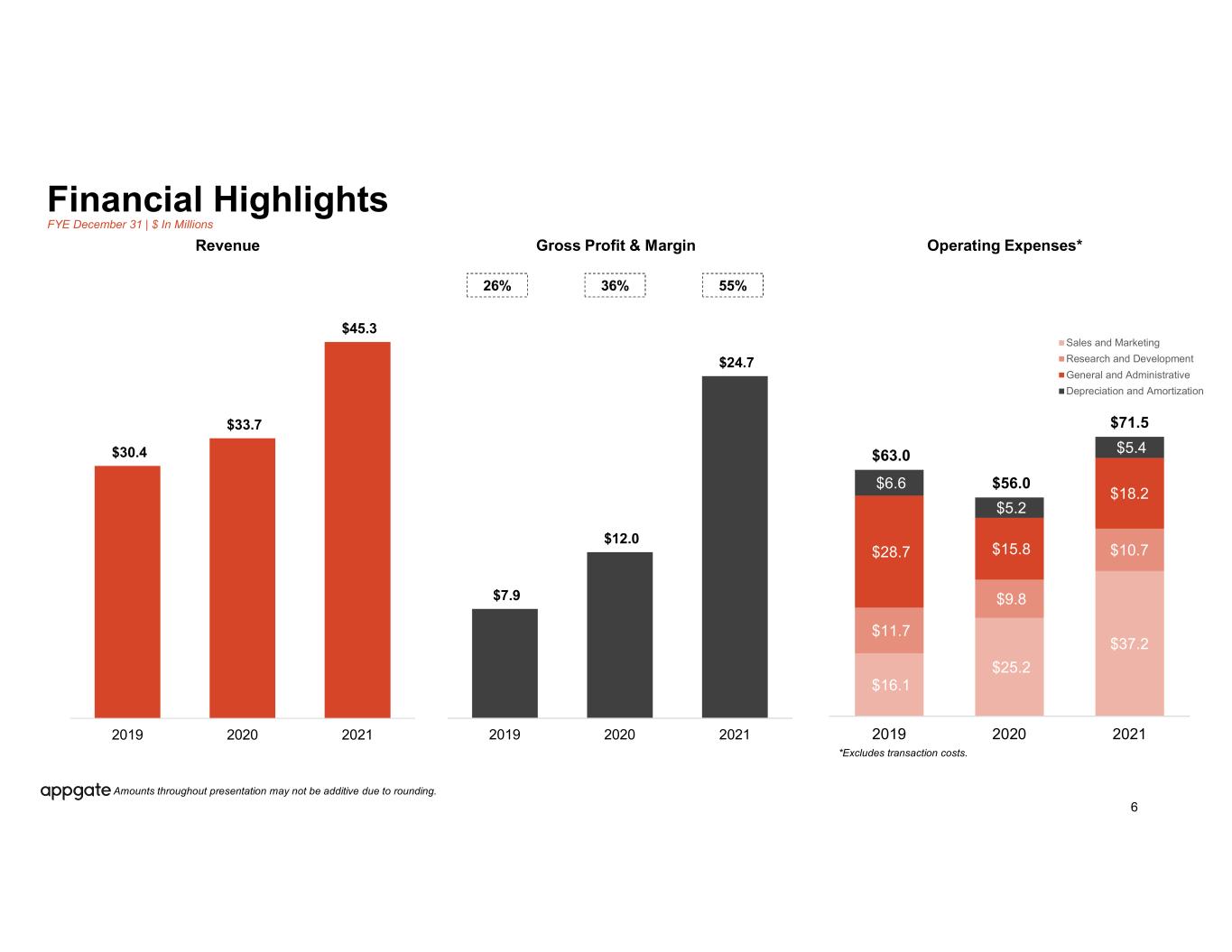

$16.1 $25.2 $37.2 $11.7 $9.8 $10.7$28.7 $15.8 $18.2 $6.6 $5.2 $5.4 $63.0 $56.0 $71.5 2019 2020 2021 Sales and Marketing Research and Development General and Administrative Depreciation and Amortization $7.9 $12.0 $24.7 2019 2020 2021 6 Revenue Gross Profit & Margin Operating Expenses* 26% 36% 55% $30.4 $33.7 $45.3 2019 2020 2021 *Excludes transaction costs. Financial Highlights FYE December 31 | $ In Millions Amounts throughout presentation may not be additive due to rounding.

Key Performance Indicators – Accelerating Growth 7 Annual Recurring Revenue Total Customers Net Retention RateCustomers with ARR Above $100k $18.6 $22.5 $31.1 2019 2020 2021 542 615 652 2019 2020 2021 40 44 66 2019 2020 2021 100% 105% 114% 2019 2020 2021 See slide 12 for definitions of Annual Recurring Revenue and Net Retention Rate. FYE December 31 | $ In Millions

29% 16% 71% 84% Q4'20 Q4'21 Perpetual Licenses & Services and Other Subscription 8 $30.4 $33.7 $13.9 $45.3 $10.2 38% 28% 19% 62% 72% 81% 2019 2020 2021 Perpetual Licenses & Services and Other Subscription Note: LTM Revenue from subscription at 81% of total revenue. Increase of 34% from 2020 and 49% from 2019. Note: YoY Q4’21 Revenue from subscription at 84% of total revenue. Increase of 36% from same period last year. Growth Driven by Subscription Revenue FYE December 31 | $ In Millions

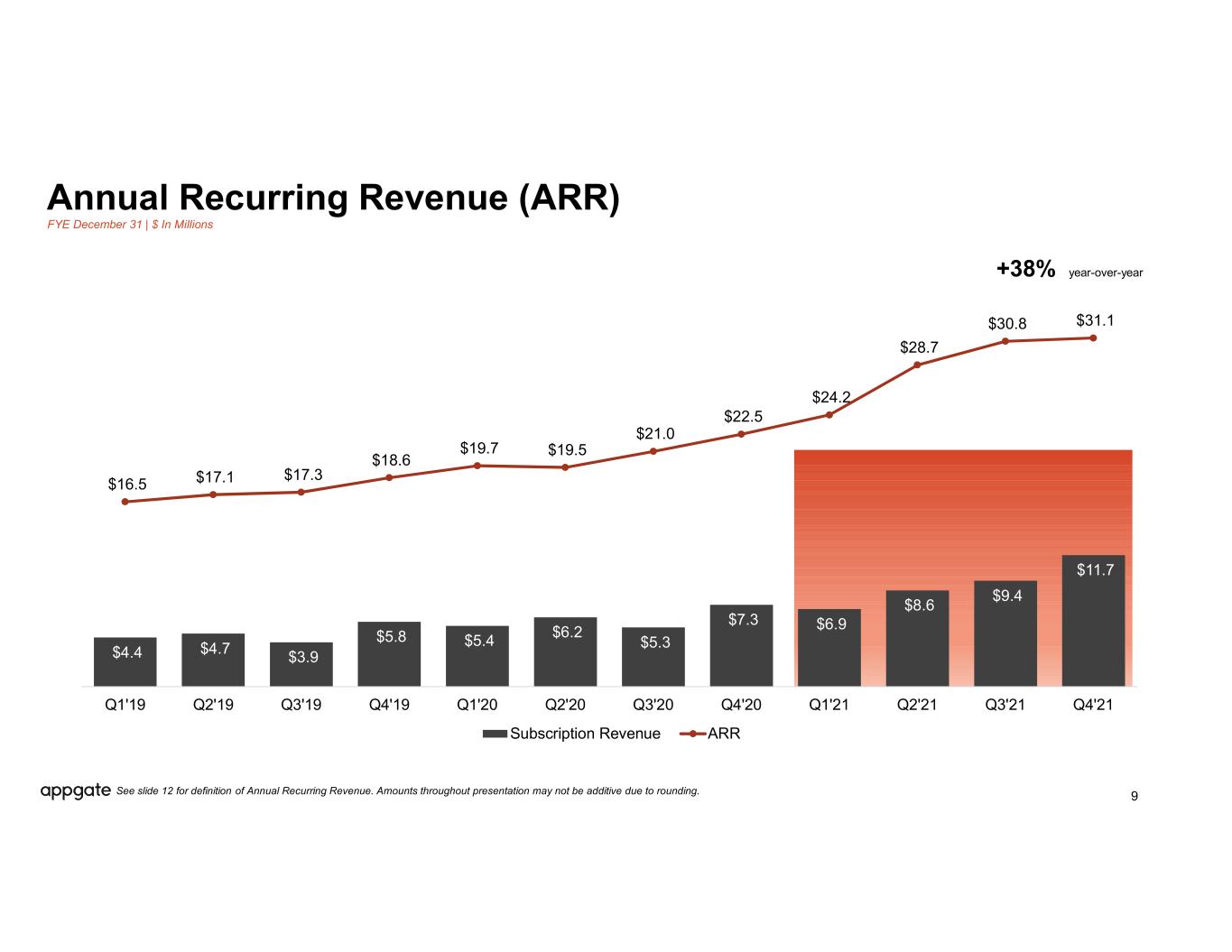

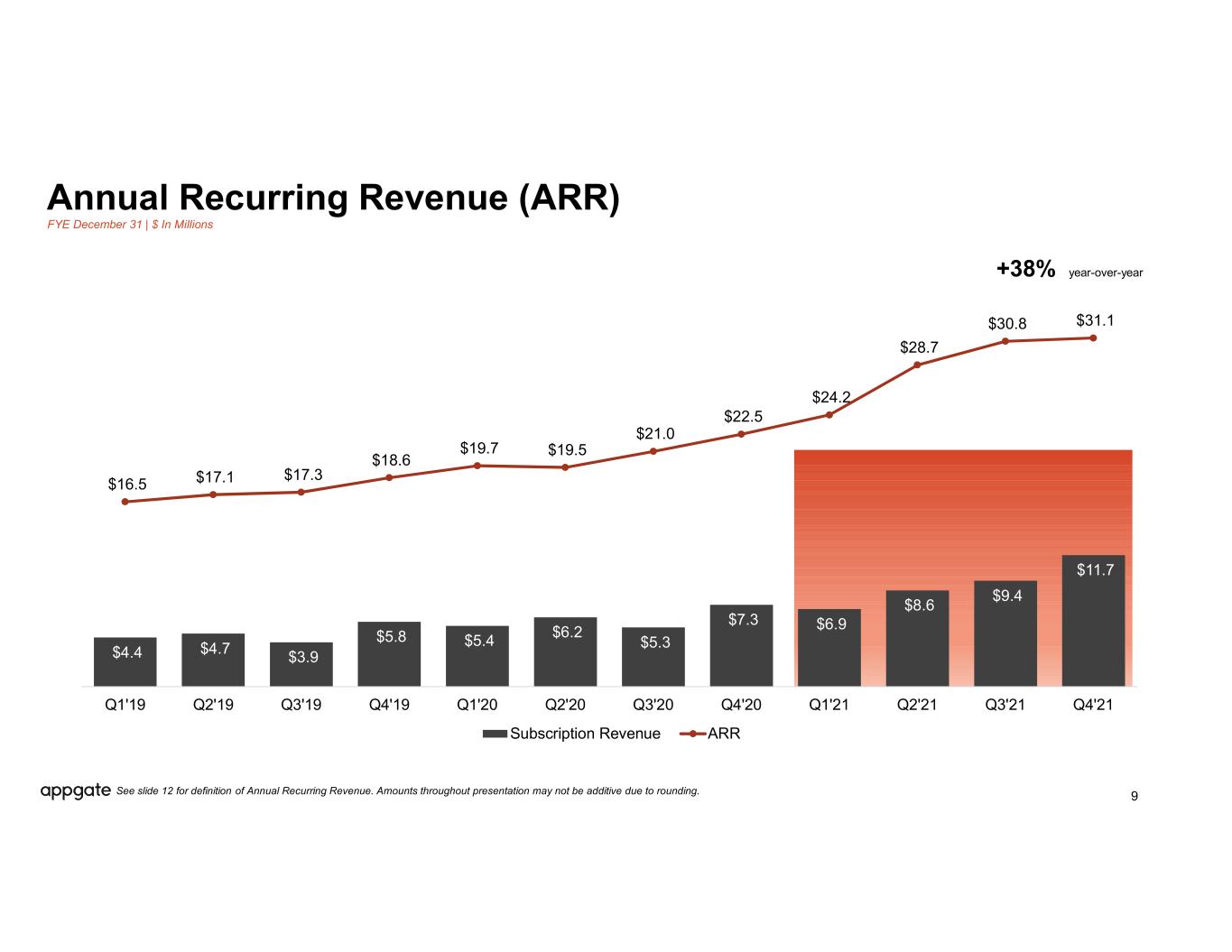

$4.4 $4.7 $3.9 $5.8 $5.4 $6.2 $5.3 $7.3 $6.9 $8.6 $9.4 $11.7 $16.5 $17.1 $17.3 $18.6 $19.7 $19.5 $21.0 $22.5 $24.2 $28.7 $30.8 $31.1 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Subscription Revenue ARR 9 Annual Recurring Revenue (ARR) +38% year-over-year See slide 12 for definition of Annual Recurring Revenue. Amounts throughout presentation may not be additive due to rounding. FYE December 31 | $ In Millions

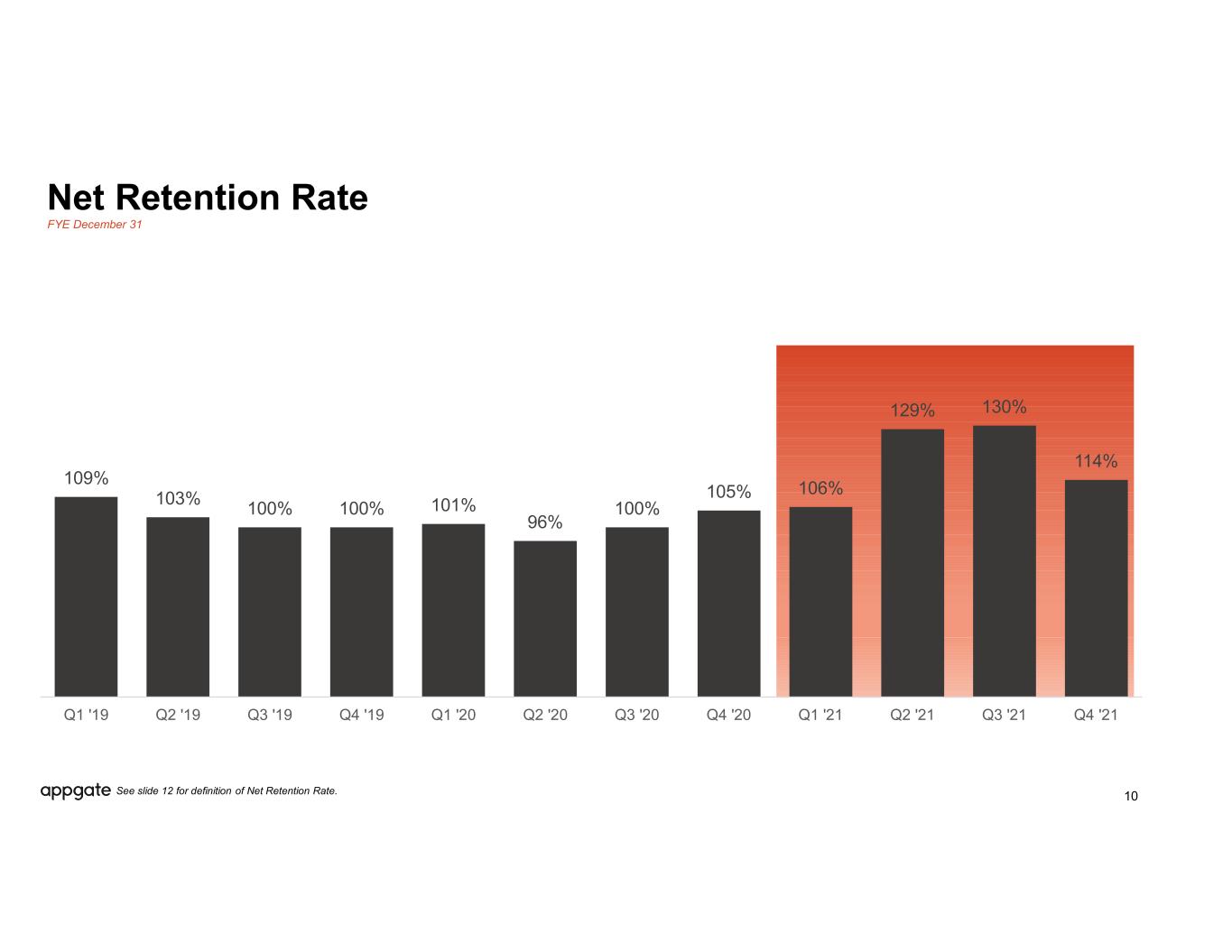

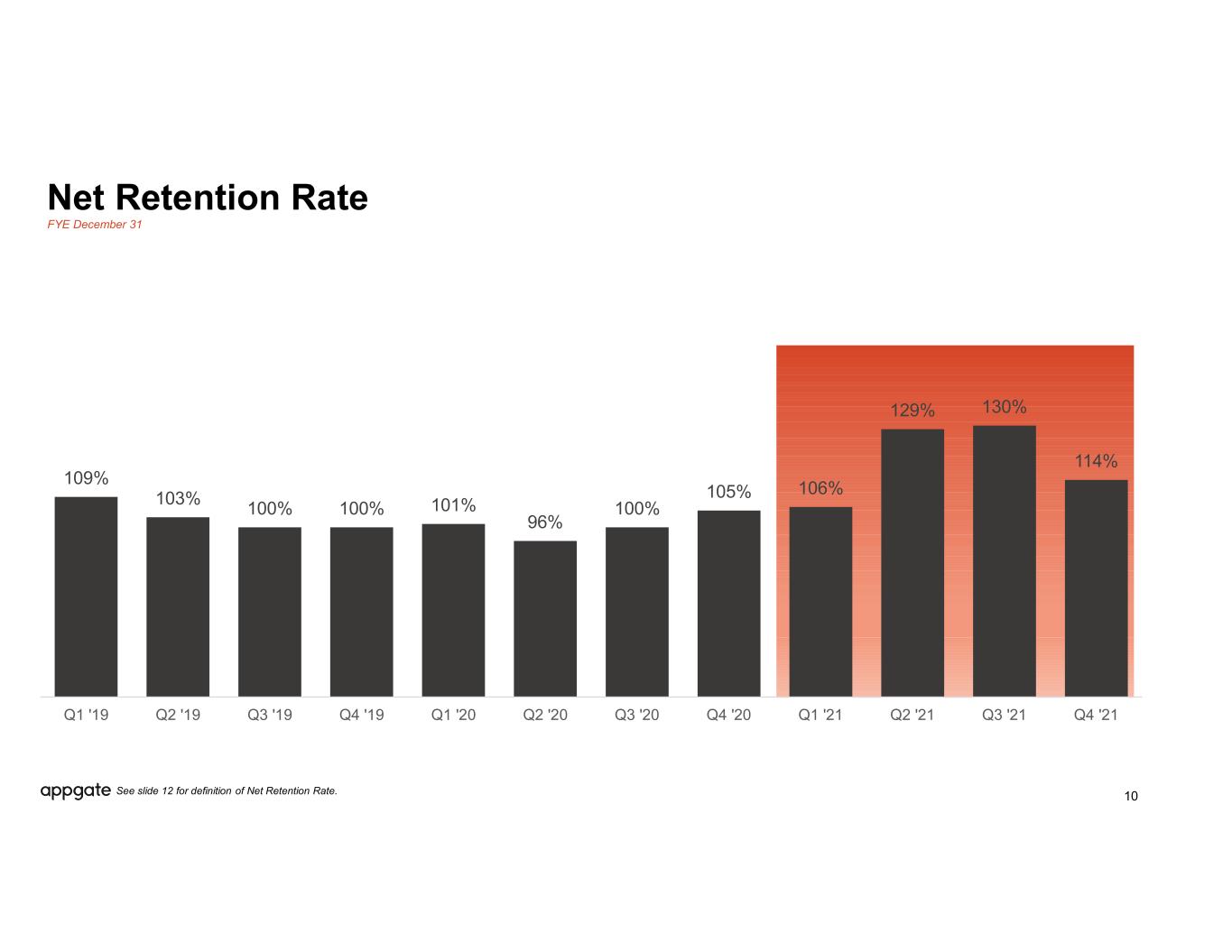

10 Net Retention Rate 109% 103% 100% 100% 101% 96% 100% 105% 106% 129% 130% 114% Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 See slide 12 for definition of Net Retention Rate. FYE December 31

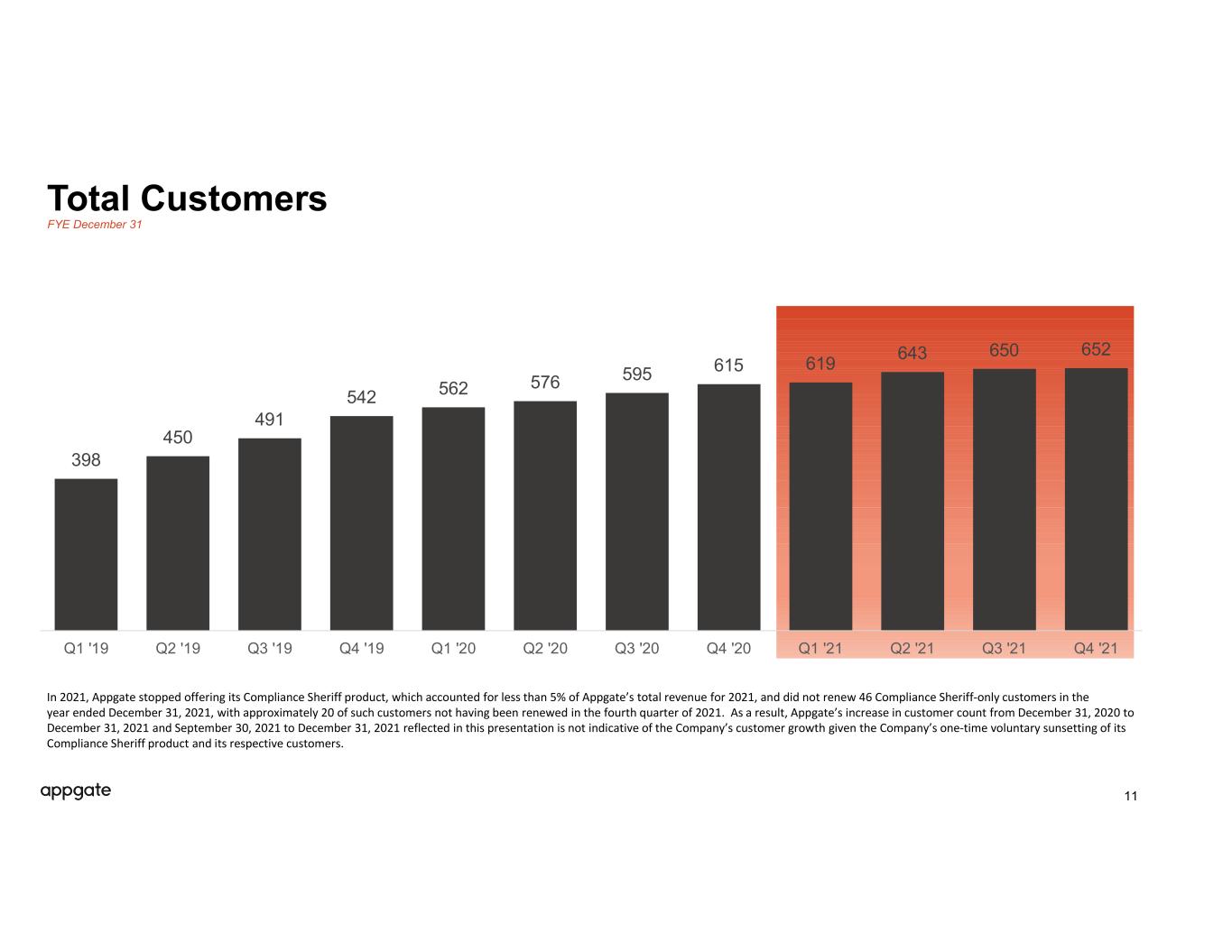

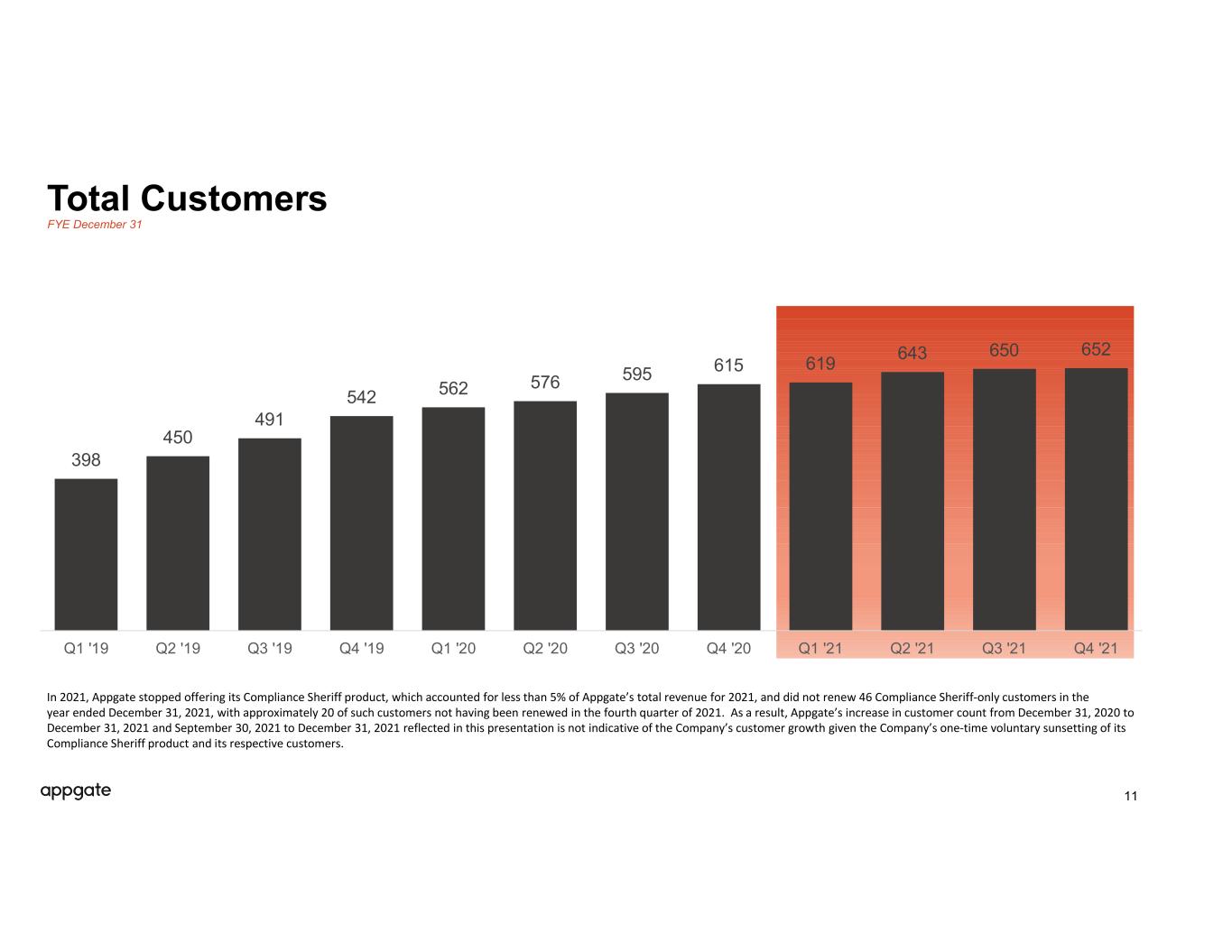

11 Total Customers 398 450 491 542 562 576 595 615 619 643 650 652 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 FYE December 31 In 2021, Appgate stopped offering its Compliance Sheriff product, which accounted for less than 5% of Appgate’s total revenue for 2021, and did not renew 46 Compliance Sheriff-only customers in the year ended December 31, 2021, with approximately 20 of such customers not having been renewed in the fourth quarter of 2021. As a result, Appgate’s increase in customer count from December 31, 2020 to December 31, 2021 and September 30, 2021 to December 31, 2021 reflected in this presentation is not indicative of the Company’s customer growth given the Company’s one-time voluntary sunsetting of its Compliance Sheriff product and its respective customers.

Appgate’s management reviews a number of key performance indicators, each as described below, to evaluate the business of Appgate, measure its performance, identify trends affecting its business, formulate business plans and make strategic decisions. • Annual recurring revenue (ARR) is defined as the annualized value of software-as-a-service (“SaaS”), subscription, and term- based license and maintenance contracts from Appgate’s recurring software products in effect at the end of a given period. • Dollar-based net retention rate (or net retention) reflects customer renewals, expansion, contraction, and customer attrition within Appgate’s ARR base. Appgate calculates dollar-based net retention rate by dividing the numerator by the denominator as set forth below: • Denominator: As of the end of a reporting period, ARR as of the last day of the same reporting period in the prior year. • Numerator: ARR for that same cohort of customers as of the end of the reporting period in the current year, including any expansion and net of contraction and customer attrition over the trailing 12 months, excluding ARR from new subscription customers in the current period. Key Business Metric Definitions 12