Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Sponsor’s management to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosures of contingent liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period covered by this report.

In addition to the description below, please refer to Note 3 to the financial statements for further discussion of our accounting policies.

The functional currency of the Trust is the Canadian Dollar in accordance with ASC 830, Foreign Currency Translation.

Results of Operations

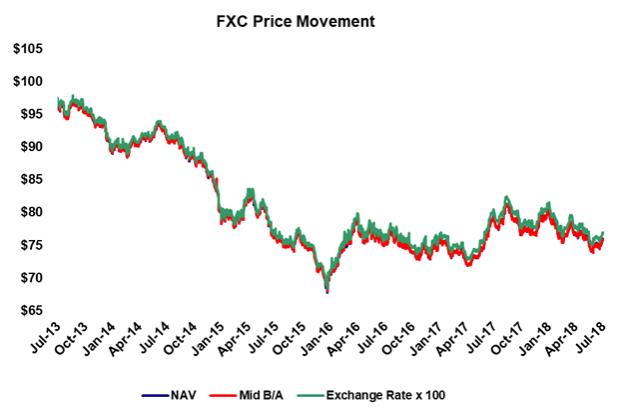

As of October 31, 2017, the number of Canadian Dollars owned by the Trust was 226,889,725, resulting in a redeemable capital share value of $176,007,716. During the nine months ended July 31, 2018, 400,000 Shares were created in exchange for 39,458,191 Canadian Dollars and 550,000 Shares were redeemed in exchange for 54,255,284 Canadian Dollars. In addition, 4,300 Canadian Dollars were withdrawn to pay the portion of the Sponsor’s fee that exceeded interest earned. As of July 31, 2018, the number of Canadian Dollars owned by the Trust was 212,088,332, resulting in a redeemable capital Share value of $162,959,705.

A decrease in the Trust’s redeemable capital Share value from $176,007,716 at October 31, 2017 to $162,959,705 at July 31, 2018 was primarily the result of a decrease in the number of Shares outstanding from 2,300,000 at October 31, 2017 to 2,150,000 at July 31, 2018, and a decrease in the Closing Spot Rate from 0.7757 at October 31, 2017 to 0.7680 at July 31, 2018.

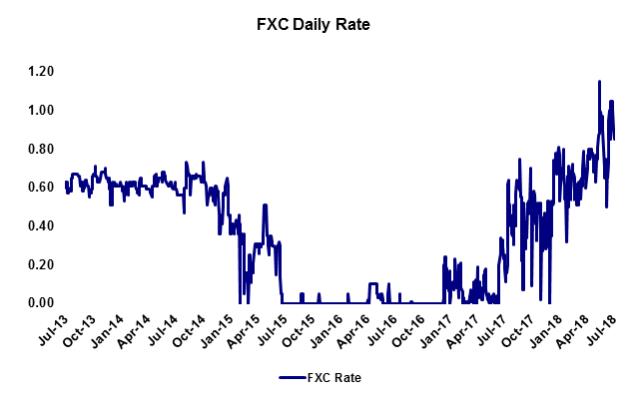

Interest income increased from $45,511 for the three months ended July 31, 2017 to $339,643 for the three months ended July 31, 2018, and increased from $92,307 for the nine months ended July 31, 2017 to $817,229 for the nine months ended July 31, 2018, attributable primarily to an increase in the annual nominal interest rate paid by the Depository, as set forth in the chart above.

The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the Canadian Dollars in the Trust. Due primarily to a decrease in the weighted-average Canadian Dollars in the Trust and a decrease in the Closing Spot Rate, the Sponsor’s fee decreased from $187,853 for the three months ended July 31, 2017 to $162,663 for the three months ended July 31, 2018, and decreased from $567,541 for the nine months ended July 31, 2017 to $503,696 for the nine months ended July 31, 2018. The only expense of the Trust during the three months and nine months ended July 31, 2018 was the Sponsor’s fee.

The Trust’s net income for the three months ended July 31, 2018 was $176,980 due to interest income of $339,643 exceeding the Sponsor’s fee of $162,663. The Trust’s net income for the nine months ended July 31, 2018 was $313,533 due to interest income of $817,229 exceeding the Sponsor’s fee of $503,696.

Cash dividends per Share increased from $0.00 per Share for the three months ended July 31, 2017 to $0.07 per Share for the three months ended July 31, 2018, and cash dividends per Share increased from $0.00 per Share for the nine months ended July 31, 2017 to $0.12 per Share for the nine months ended July 31, 2018. This increase in cash dividends per Share was primarily the result of an increase in the annual nominal interest rate paid by the Depository.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Except as described above with respect to fluctuations in the Canadian Dollar/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on Canadian Dollars held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative products.

Item 4. Controls and Procedures

The Trust maintains disclosure controls and procedures (as defined in Rules13a-15(e) and15d-15(e) under the Securities Exchange Act of 1934) designed to ensure that material information relating to the Trust is recorded, processed and disclosed on a timely basis. The Trust’s disclosure controls and procedures are designed by or under the supervision of the Sponsor’s principal executive officer and principal financial officer, who exercise oversight over the Trust as the Trust has no officers. The principal executive officer and principal financial officer of the Sponsor have evaluated the effectiveness of the Trust’s disclosure controls and procedures as of July 31, 2018. Based on that evaluation, the principal executive officer and principal financial officer of the Sponsor have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this report.

14