Results of Operations

As of October 31, 2016, the number of Japanese Yen owned by the Trust was 11,588,845,853, resulting in a redeemable capital Share value of $110,230,193. During the year ended October 31, 2017, an additional 3,300,000 Shares were created in exchange for 31,802,013,465 Japanese Yen and 3,200,000 Shares were redeemed in exchange for 30,833,153,795 Japanese Yen. In addition, 66,298,233 Japanese Yen were withdrawn to pay the portion of the Sponsor’s fee that exceeded interest earned. As of October 31, 2017, the number of Japanese Yen owned by the Trust was 12,491,407,290, resulting in a redeemable capital Share value of $109,883,188. During the year ended October 31, 2018, an additional 1,300,000 Shares were created in exchange for 12,462,736,515 Japanese Yen and 1,100,000 Shares were redeemed in exchange for 10,536,230,459 Japanese Yen. In addition, 76,898,821 Japanese Yen were withdrawn to pay the portion of the Sponsor’s fee that exceeded interest earned. As of October 31, 2018, the number of Japanese Yen owned by the Trust was 14,341,014,525, resulting in a redeemable capital Share value of $127,020,589.

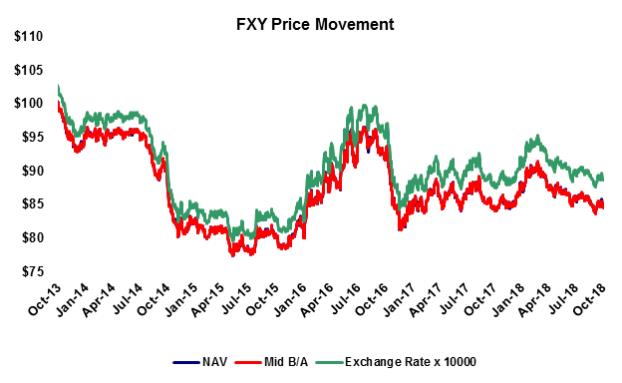

An increase in the Trust’s redeemable capital share value from $109,883,188 at October 31, 2017 to $127,020,589 at October 31, 2018 was primarily the result of an increase in the number of Shares outstanding from 1,300,000 at October 31, 2017 to 1,500,000 at October 31, 2018 coupled with an increase in the Closing Spot Rate from 0.00880 at October 31, 2017 to 0.00886 at October 31, 2018. A decrease in the Trust’s redeemable capital Share value from $110,230,193 at October 31, 2016 to $109,883,188 at October 31, 2017, was primarily the result of a decrease in the Closing Spot Rate from 0.00952 at October 31, 2016 to 0.00880 at October 31, 2017, but partially offset by an increase in the number of Shares outstanding from 1,200,000 at October 31, 2016 to 1,300,000 at October 31, 2017.

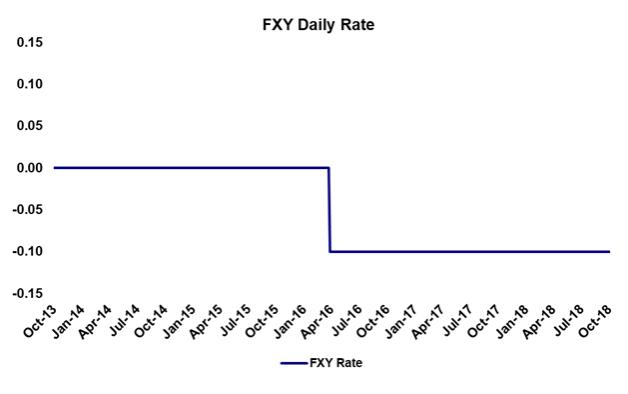

No interest income was earned during the years ended October 31, 2018, October 31, 2017 and October 31, 2016, due to an annual nominal interest rate at or below 0.00% through those periods as set forth in the chart above.

The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the Japanese Yen in the Trust. Due primarily to an increase in the weighted-average Japanese Yen in the Trust, the Sponsor’s fee increased from $472,348 for the year ended October 31, 2017 to $562,074 for the year ended October 31, 2018. Due primarily to an increase in the weighted-average Japanese Yen in the Trust and a steady interest rate below 0%, interest expense on currency deposits increased from $119,844 for the year ended October 31, 2017 to $142,359 for the year ended October 31, 2018. The only expenses of the Trust during the year ended October 31, 2018 were the Sponsor’s fee and interest expense on currency deposits. Due primarily to a decrease in the weighted-average Japanese Yen in the Trust, the Sponsor’s fee decreased from $749,584 for the year ended October 31, 2016 to $472,348 for the year ended October 31, 2017. Interest expense on currency deposits increased from $76,904 for the year ended October 31, 2016 to $119,844 for the year ended October 31, 2017 due primarily to an interest rate declining further below 0%, but partially offset by a decrease in the weighted-average Japanese Yen in the Trust. The only expenses of the Trust during the year ended October 31, 2017 were the Sponsor’s fee and interest expense on currency deposits.

The Trust’s net comprehensive loss for the year ended October 31, 2018 was $704,433, due to the Sponsor’s fee of $562,074 and interest expense on currency deposits of $142,359 exceeding interest income of $0. The Trust’s net comprehensive loss for the year ended October 31, 2017 was $592,192 due to the Sponsor’s fee of $472,348 and interest expense on currency deposits of $119,844 exceeding interest income of $0. The Trust’s net comprehensive loss during October 31, 2016 was $826,488, due to the Sponsor’s fee of $749,584 and interest expense on currency deposits of $76,904 exceeding the interest income of $0.

Cash dividends were not paid by the Trust in the years ended October 31, 2018, October 31, 2017 and October 31, 2016, as the Trust’s interest income did not exceed the Trust’s expenses during those periods.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Except as described above with respect to the Japanese Yen/USD exchange rate and the nominal annual interest rate paid by the Depository on Japanese Yen held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

14