UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended December 31, 2009 |

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from _____________to ______________ |

Commission file number 000-52007

CHINA PEDIATRIC PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 20-2718075 |

State or other jurisdiction of Incorporation or organization | (I.R.S. Employer Identification No.) |

9th Floor, No. 29 Nanxin Street

Xi'an, Shaanxi Province

People’s Republic of China 710004

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 86-29-8727-1818

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act:

Common Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes þ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note. – If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of June 30, 2009 was approximately $903,000 (4,300,000 shares of common stock held by non-affiliates) based upon a closing price of the common stock of $0.21 as quoted by Nasdaq OTC Bulletin Board on June 30, 2009.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. o Yes o No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of March 30, 2010, there are presently 8,680,288 shares of common stock, par value $0.001 issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

FORWARD LOOKING STATEMENTS

In this annual report, references to “China Pediatric Pharmaceuticals,” ”CPDU,” “the Company,” “we,” “our,” “us,” and the Company’s wholly owned subsidiaries and affiliated entities, “China Children,” “Xi’an Coova,” and “Shaanxi Jiali” refer to China Pediatric Pharmaceuticals, Inc.

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are urged not to place undue reliance on these forward-looking statements, which speak only as of th e date of this Annual Report on Form 10-K. We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Corporate History

China Pediatric Pharmaceuticals, Inc. was incorporated in the State of Nevada on April 20, 2005, under the name “Belford Enterprises B.C. Ltd.” and on August 15, 2005 changed its name to “Lid Hair Studios International, Inc.” On October 9, 2009, the company’s name was changed to “China Pediatric Pharmaceuticals, Inc.”

The Company was originally established to pursue opportunities in the hair salon industry through its operating subsidiary Belford Enterprises B.C. Ltd. (d/b/a Lid Hair Studio) in Vancouver, British Columbia, Canada. Prior to September 30, 2009, Belford Enterprises B.C. Ltd. acted as the operating company for all business activities relating to the company’s restaurant business(s) in Western Canada.

Through the steps described in the section entitled “the Merger Transaction” below, on September 30, 2009, the Company acquired control of Shaanxi Jiali Pharmaceutical Co., Ltd. (“Shaanxi Jiali”), a children’s pharmaceuticals manufacturer in China, by way of the Company’s acquisition of China Children Pharmaceutical, Inc., a company organized under the laws of Hong Kong (“China Children”).

In connection with the Merger Transaction and in order to more accurately describe our business, the Company undertook a number of steps to change its name from Lid Hair Studios International Inc. to China Pediatric Pharmaceuticals, Inc. (the “Name Change Transaction”). The name change was effected through a parent/subsidiary merger of our wholly-owned subsidiary, China Pediatric Pharmaceuticals, Inc., with and into the Company, with the Company as the surviving corporation. To effectuate the merger, the Company filed its Articles of Merger with the Nevada Secretary of State and the merger became effective on October 9, 2009. A copy of the filed Articles of Merger is being filed under Exhibit 3.3. The Company’s board of directors approved the merger which resulted in the name cha nge on October 9, 2009. In accordance with Section 92A.180 of the Nevada Revised Statutes, shareholder approval of the merger was not required. On the effective date of the merger, the Company’s name was changed to “China Pediatric Pharmaceuticals, Inc.” and the Company’s Articles of Incorporation were amended to reflect this name change.

Corporate History of Shaanxi Jiali

Shaanxi Jiali was incorporated in the PRC under the name Shaanxi Jiali Technologies Co, Ltd. on July 1, 1998. In October 2000, Shaanxi Jiali Technologies changed its name to Shaanxi Jiali Pharmaceutical Co. Ltd. Shaanxi Jiali is our operating company and is in the business of manufacturing, marketing and sales of pharmaceuticals in China with pediatric medicine as its focus.

Asia-Pharm Holding (“Asia-Pharm”) was incorporated in British Virgin Islands on June 20, 2008. As described below, on August 4, 2008, Asia-Pharm through its wholly owned subsidiary became the indirect holding company for Shaanxi Jiali.

China Children Pharmaceutical Co., Ltd. (“China Children”) was incorporated in Hong Kong on June 27, 2008. Prior to September 30, 2009, China Children was a wholly owned subsidiary of Asia-Pharm.

Xi-an Coova Children Pharmaceuticals Co., Ltd, (“Xi-an Coova”) is a “wholly owned foreign enterprise” incorporated in the PRC on July 25, 2008. Xi’an Coova is a wholly owned subsidiary of China Children.

As described below, on August 4, 2008, Xi-an Coova and Shaanxi Jiali entered into an Agreement on Entrustment for Operation and Management with Xi’an Coova and the shareholders of Shaanxi Jiali (the “Management Entrustment Agreement”), pursuant to which China Children, through its ownership of Xi’an Coova obtained control over the operations and business of Shaanxi Jiali through Xi’an Coova. Pursuant to the Entrustment Management Agreement, China Children shall receive all net profits and assume all operational losses of Shaanxi Jiali through Xi’an Coova.

On August 4, 2008, Xi’an Coova entered into a Management Entrustment Agreement with Shaanxi Jiali and the shareholders of Shaanxi Jiali, pursuant to which Shaanxi Jiali and its shareholders agreed to transfer control, or entrust, the operations and management of its business to Xi’an Coova. Under the agreement, Xi’an Coova manages the operations and assets of Shaanxi Jiali, controls all of the cash flows of Shaanxi Jiali through a bank account controlled by Xi’an Coova, is entitled to 100% of the pre-tax earnings of Shaanxi Jiali, a management fee, and is obligated to pay all payables and loan payments of Shaanxi Jiali. In addition, under the terms of the Management Entrustment Agreement, Xi’an Coova has been granted certain rights which include, in part, the right to appoint and terminate membe rs of Shaanxi Jiali’s Board of Directors, hire management and administrative personnel and control decisions relating to entering and performing customer contracts and other instruments. We anticipate that Shaanxi Jiali will continue to be the contracting party under its customer contracts, bank loans and certain other instruments unless Xi’an Coova exercises its option. The agreement does not terminate unless the business of Shaanxi Jiali is terminated or Xi’an Coova exercises its option to acquire all of the assets or equity of Shaanxi Jiali under the terms of the Exclusive Option Agreement as more fully described below and completes the acquisition of Shaanxi Jiali.

In order to induce Shaanxi Jiali and its shareholders to enter into the Management Entrustment Agreement, Xi’an Coova, through its indirect parent company Asia-Pharm, issued an aggregate of 12,000,000 shares of Asia-Pharm’s common stock to the shareholders of Shaanxi Jiali, which was allocated based on their respective pro rata ownership of Shaanxi Jiali.

In order to give Xi’an Coova further control over Shaanxi Jiali, the Shaanxi Jiali shareholders and Xi’an Coova, entered into a Voting Proxy Agreement (the “Voting Proxy Agreement”) whereby the Shaanxi Jiali shareholders irrevocably and exclusively appointed the members of Xi’an Coova’s board of directors as their proxies to vote on all matters that require Shaanxi Jiali shareholder approval, including, without limitation, the right to appoint members of the board of directors of Shaanxi Jiali. The agreement further provides that Shaanxi Jiali will appoint all of the board of directors of Xi’an Coova as its board of directors and shall remove and appoint new members to its board to correspond to any changes to the Xi’an Coova board. The agreement terminates upon the exercise of the option by Xi’an Coova to purchase the shares of Shaanxi Jiali, as described below.

In order to permit Shaanxi Jiali to become an indirectly wholly owned subsidiary of China Children when permitted under PRC law, Xi’an Coova, Shaanxi Jiali and the Shaanxi Jiali shareholders entered into an exclusive option agreement (the “Exclusive Option Agreement”) whereby the Shaanxi Jiali shareholders granted Xi’an Coova an irrevocable and exclusive purchase option (the “Option”) to acquire Shaanxi Jiali’s equity and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. Current PRC law does not specifically provide for the equity of a non-PRC entity to be used as consideration for the purchase of a PRC entity’s assets or equity unless the value of the shares are equal to or greater than the value o f the enterprise acquired. In addition, there is a lengthy appraisal process which must be approved by the provincial PRC government entities. The consideration for the exercise of the Option is to be determined by the parties and memorialized in future definitive agreements setting forth the kind and value of such consideration. In considering whether or not Xi’an Coova will exercise the Option we may consider such factors as (1) if the exercise price can be lower than the appraised value under current PRC law (2) availability of funds, (3) any relevant tax considerations at the time, (4) any other relevant PRC laws that may exist at the time, (5) the value of the Asia-Pharm shares that were previously paid to shareholders of Shaanxi Jiali, and (6) whether or not the exercise of the Option will provide any other additional benefits to us or our shareholders. Upon exercise of the Option, the parties will prepare transfer documents to be submitted for governmental approval and work toget her to obtain all approvals and permits. The agreement may be terminated by agreement of all parties or by with 30 days notice and is governed by the laws of the PRC.

In order to further solidify China Children’s rights, benefits and control over Shaanxi Jiali through its ownership of Xi’an Coova, Xi’an Coova and the Shaanxi Jiali shareholders entered into a share pledge agreement (the “Share Pledge Agreement”) whereby the Shaanxi Jiali shareholders pledged all of their equity interests in Shaanxi Jiali, including the proceeds thereof, to guarantee the performance by the

shareholders of all of the agreements they entered into with Xi’an Coova. Upon breach by any of the shareholders of any of the Management Entrustment Agreement, Voting Proxy Agreement, the Exclusive Option Agreement or the Share Pledge Agreement, Xi’an Coova is entitled by operation of PRC law to become the beneficial owner of the shares of Shaanxi Jiali. Prior to termination of the Share Pledge Agreement, the pledged equity interests of Shaanxi Jiali cannot be transferred without Xi’an Coova’s prior written consent. The agreement will not terminate until agreed to by all of the parties in writing.

The Merger Transaction

On September 30, 2009, the Company entered into a Share Exchange Agreement with Eric Anderson and Asia-Pharm, pursuant to which the Company acquired all of the outstanding capital stock an ownership interest of China Children from Asia-Pharm. In exchange for the equity interest in China Children, the Company issued 2,000,000 (post-split) shares of common stock to the shareholders of Asia-Pharm.

Immediately after the closing of the Share Exchange Agreement, the Company had a total of 8,305,288 shares of common stock outstanding, with all of the Asia-Pharm shareholders owning approximately 84.28 % of the Company’s outstanding common stock. In addition, pursuant to an agreement dated September 30, 2009, Eric Anderson transferred 1,428571 shares of the Company’s common stock for cancellation and forgave his outstanding loan to the company in the amount of $86,173 in exchange for 100% of the issued and outstanding shares of Lid Hair Studios’ wholly-owned subsidiary, Belford Enterprises B.C. Ltd., d/b/a Lid Hair Studio.

As a result of the above-mentioned merger transactions, (i) China Children became a wholly-owned subsidiary of the Company, (ii) the Company acquired the business of Shaanxi Jiali as its sole business, and (iii) Belford Enterprises B.C. Ltd. was spun off from the Company.

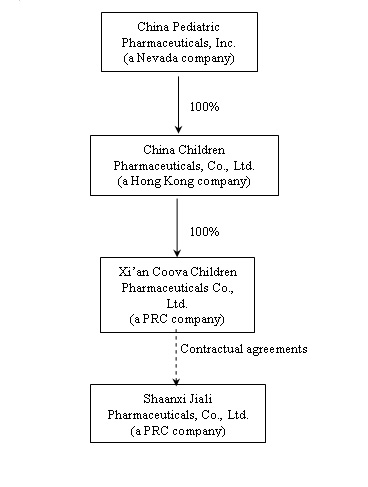

The following diagram sets forth the current corporate structure of China Pediatric Pharmaceuticals, Inc., giving effect to the Name Change Transaction consummated on October 9, 2009:

Subsidiaries

As a result of the Merger Transaction, China Children and Xi’an Coova are our wholly-owned subsidiaries. Shaanxi Jiali, the entity through which we operate our business, currently has no subsidiaries, either wholly-owned or partially-owned.

Our Business

Our operations are headquartered in Xi’an, Shaanxi Province, China. Through our operating entity, Shaanxi Jiali, we are a profitable, mid-sized Chinese pharmaceutical company that identifies, discovers, develops manufactures and distributes both prescription and over-the counter drugs (including conventional and Traditional Chinese Medicines (“TCMs”)) primarily for the treatment of some of the most common

children’s ailments and diseases. Approximately 72% of our products are intended for children’s use and approximately 28% of our products are intended for adult use.

Our operating company, Shaanxi Jiali, has its own manufacturing facility located in Baoji, Shaanxi Province. Our manufacturing facility was issued a Good Manufacturing Practices (“GMP”) certification by the State Food and Drug Administration (“SFDA”) in 2004. The Chinese government agency, SFDA, is analogous to the Food and Drug Administration (“FDA”) in the United States. Unlike the FDA, however, the SFDA provides intellectual property and competitive protection to certain classes of approved drugs.

Good Manufacturing Practices (“GMP”) is an internationally-recognized standard for pharmaceutical plant design and construction. GMP has been defined as “that part of quality assurance which ensures that products are consistently produced and controlled to the quality standards appropriate for their intended use and as required by the marketing authorization” (World Health Organization). GMP covers all aspects of the manufacturing process: defined manufacturing process; validated critical manufacturing steps; suitable premises, storage, transport; qualified and trained production and quality control personnel; adequate laboratory facilities; approved written procedures and instructions; records to show all steps of defined procedures taken; full traceability of a product through batch processing records an d distribution records; and systems for recall and investigation of complaints.

We were awarded the National High-tech Enterprise Award by the Shaanxi Technology Administration in 2006. As a result of receiving the National High-tech Award Shaanxi Jiali is entitled to the “Two exemption Three half” tax holiday based on the local government’s policy to encourage outside investment into the locality. According to PRC tax laws, “Two exemption Three half” policy means foreign investment enterprises including Shaanxi Jiali may enjoy an exemption from corporate income tax for 2 years starting from its first profitable year, followed by 3 years at a rate that is one half of the regular rate for corporate income tax. The Company expects to enjoy for this benefit through fiscal year 2010.

We distribute our high value, branded medicines, both prescription and OTC, through exclusive territory agents who sell our products directly to local pharmacies who in turn sell them to their retail customers.

Principal Products

In the fiscal year ended December 31, 2009, our revenues were principally derived from sales of 26 products listed below, of which 7 products are Western medicines and 19 are ready-made Chinese traditional medicines. We have SFDA approval for all medicines that we market. Detailed information is provided in the table of products below.

We currently have 26 products that are manufactured by both our in-house production facility and through OEM companies. Of these products, 13 are produced in-house at our production plant:

Table of Products Manufactured by Shaanxi Jiali

| Manufacturer | | Brand Name &Product | | Type: Prescription/ OTC Conventional OTC TCM | | Primary Function |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Radix lsatidis Granule (5g) | | OTC TCM | | Treatment for inflammation and pain. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Radix lsatidis Granule (10g) | | OTC TCM | | Treatment for inflammation and pain. |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Da shanzha Granule | | OTC TCM | | Treatment for indigestion. |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Paracetamol, Artificial Cow-bezoar and Chlorphenamine Maleale Granule | | OTC Conventional | | Treatment for inflammation, pain and fever. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Erythromycin Estolate Granule | | OTC Conventional | | Treatment for indigestion. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Compound Danshen Tablet | | OTC TCM | | Treatment for heart and blood conditions. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Ganmao Tuire Granule | | OTC TCM | | Treatment for inflammatory and pain. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Qingrejiedu Tablet | | OTC TCM | | Treatment for respiratory tract inflammation. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Erythromycin Ethylsuccinate Tablets (0.125 g) | | OTC Conventional | | Treatment for indigestion. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Yuanhu Pain killer | | OTC TCM | | Treatment for pain. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Vitamin C Tablets (50mg) | | OTC Conventional | | Vitamin |

| Shaanxi Jiali Pharmaceuticals | | Xianzhi Series Kechuanqing Tablet | | Prescription | | Treatment for bronchitis and asthma. |

| Shaanxi Jiali Pharmaceuticals | | Qingsongling Series Paracetamol,Caffein,Atificial Cow-bezoar and chlorphenamine Maleate Capsules | | OTC Conventional | | Treatment for common colds. |

The table below represents our 13 of our medicines that are produced by OEM companies.

Table of Products Manufactured by OEM Companies

| Manufacturer | | Brand Name &Product | | Type: Prescription/ OTC Conventional OTC TCM | | Primary Function |

| OEM: Hubei Kanger Jian Bioengineering Co. Ltd. | | Cooer Jin 21 Multivitamin Chewing Tablets | | OTC Conventional | | Vitamin. |

| OEM: Hubei Kanger Jian Bioengineering Co. Ltd. | | Cooer Lacidophilin Granules | | OTC Conventional | | Treatment for indigestion and diarrhea. |

| OEM Partner: Taiji Group Sichuan Nanchong Pharmaceutical Factory | | Cooer Xiaochaihu Granules | | OTC TCM | | Treatment for indigestion. |

| OEM Partner: Taiji Group Sichuan Nanchong Pharmaceutical Factory | | Cooer Xiaoer Expectorant Granules | | OTC TCM | | Treatment for coughs. |

| OEM: Taiji Group Sichuan Nanchong Pharmaceutical Factory | | Cooer Xiaoer Throat-cleaning Granules | | OTC TCM | | Treatment for throat pain. |

| OEM : Taiji Group Sichuan Nanchong Pharmaceutical Factory | | Cooer Xiaoer Cough-curing Syrup | | OTC TCM | | Treatment for coughs. |

| OEM: Xi’an KeLi Pharmaceuticals Co. Ltd. | | Cooer Xiaoer Xishi Granule | | OTC TCM | | Treatment for indigestion and diarrhea. |

| OEM: Xi’an KeLi Pharmaceuticals Co. Ltd. | | Cooer Xiaoer Kechuanling Granule | | OTC TCM | | Treatment for respiratory tract infection and coughs. |

| OEM: Xi’an KeLi Pharmaceuticals Co. Ltd. | | Cooer I+1 Suit | | OTC Conventional | | Treatment for fever. |

| OEM : Fosham City Yichuang Biochemistry Science and Technology Co. Ltd. | | Cooer Fever Release Paste | | OTC TCM | | Treatment for fever. |

| OEM: Jiyuan City, Taiji Medical Supplies Co. Ltd. | | Cooer Paste for Pediatric Diarrhea | | OTC TCM | | Treatment for diarrhea. |

| OEM Partner: Jiyuan City, Taiji Medical Supplies Co. Ltd. | | Cooer Paste for Pediatric Cough & Asthma | | OTC TCM | | Treatment for asthma and coughs. |

| OEM: Jiyuan City, Taiji Medical Supplies Co. Ltd. | | Cooer Paste for Pediatric Cold | | OTC TCM | | Treatment for the common cold. |

We currently market our products under three brands:

Cooers Brand Products

The Cooers Brand product line is focused on the pediatric medicine market. The product line includes both prescription and over–the-counter pharmaceutical products, including both conventional and traditional Chinese medicines. The Cooers product line has 15 products that address numerous ailments including, but not limited, to pain relief, anti-inflammatory, anti-bacteria, infection, digestion, respiratory tract infections, gangrene, diarrhea and fever, cold and cough remedies and vitamins.

Qingsongling Brand Products

The Qingsongling product line is focused on the adult market. This product line includes both prescription and over –the-counter pharmaceutical products including both conventional and traditional Chinese medicines. The Qingsongling product line has 8 products for treatment of numerous ailments, including but not limited to, treatments for heart disease and angina, respiratory tract infection, influenza, gangrene, anti-inflammatory pain relief, cold and fever remedies and vitamins.

Zianzhi Brand Product

The Zianzhi product line is focused on the adult medicine market. Xianzhi series includes one product which is prescription medicine (TCM). The Zianzhi product line has one product for treatment for chronic bronchitis and asthma.

Marketing and Sales

Shaanxi Jiali’s high value branded prescription and OTC medicines are distributed through the following distribution channels: Pharmaceutical Manufacturer (the company) - Exclusive Agents - Pharmacies – Patients.

Shaanxi Jiali currently sells its products thru 15 exclusive territory agents in 7 provinces throughout China. The exclusive territory agents sell the company’s products directly to local pharmacies in their assigned territory. This method of distribution minimizes the company’s need to maintain a large direct sales force.

Exclusive Territory Agents

Shaanxi Jiali has entered into contracts with Exclusive Territory Agents for the sale and distribution of our products to local pharmacies in the agent’s respective exclusive territory. In 2008, we signed six Exclusive Territory Agent contracts and as of September 30, 2009 we have increased our number of contracts to a total of fifteen. As the company expands into new markets and gains more access to additional capital, we expect to increase the number of contracts with Exclusive Territory Agents. Please see Exhibit 10.2.

Special Marketing Initiatives

Coors Brand Initiative. Shaanxi Jiali intends to further develop the series of products based on the Coors Brand and designed to target the pediatric medicine market. These products will continue be sold through exclusive territory agents who in turn distribute to local pharmacies in their assigned territories.

Regional Expansion Initiative. Shaanxi Jiali intends to further expand its distribution channels by increasing the number of exclusive territory agents. These additional exclusive territory agents will be contracted to distribute Shaanxi Jiali products to local pharmacies in several additional provinces or regions throughout China.

Status of Publicly Announced New Products

We expect that the following products in our development pipeline will generate growth in our revenue in the next few years. We expect to launch commercial production for products for which we recently received SFDA approval as soon as possible.

Development Status of Key Products in our Pipeline as of December 31, 2009:

| Proposed Manufacturer | | Name of Brand and Product name | | Type: Prescription/ OTC Conventional/ OTC TCM | | Primary Function | | SFDA Status |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Fuxiening Granules | | OTC TCM | | Treatment for common cold symptoms | | Application Submitted to SFDA waiting for approval |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Kechuanling Granule | | OTC TCM | | Treatment for common cold symptoms | | Application Submitted to SFDA waiting for approval |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Kangganjiedu Granules | | OTC TCM | | Treatment for common cold symptoms | | Application Submitted to SFDA waiting for approval |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Digesting Tablet | | OTC TCM | | Treatment for common cold symptoms | | Application Submitted to SFDA waiting for approval |

| Shaanxi Jiali Pharmaceuticals | | Cooer Xiaoer Jianpibuxue Granules | | OTC TCM | | Treatment for common cold symptoms | | Application Submitted to SFDA waiting for approval |

During the year ended December 31, 2009, we spent approximately $4.96 million on marketing. During the fiscal year ended December 31, 2008, we spent approximately $5.62 million on marketing.

Quality Control

Our production facilities are designed and maintained with a view towards conforming with good practice standards. To comply with GMP operational requirements, we have implemented a quality assurance plan setting forth our quality assurance procedures. Our Quality Control department is responsible for maintaining quality standards throughout the production process. Quality Control executes the following functions:

| | ● | setting internal controls and regulations for semi-finished and finished products; |

| | ● | implementing sampling systems and sample files; |

| | ● | maintaining quality of equipment, instruments, reagents, test solutions, volumetric solutions, culture media and laboratory animals; |

| | ● | auditing production records to ensure delivery of quality products; |

| | ● | monitoring the number of dust particles and microbes in the clean areas; |

| | ● | evaluating stability of raw materials, semi-finished products and finished products in order to generate accurate statistics on storage duration and shelf life; |

| | ● | articulating the responsibilities of Quality Control staff; and |

| | ● | on-site evaluation of supplier quality control systems. |

Competition

There are certain opportunities for growth through the following growth strategies:

Rapidly growing Chinese pharmaceutical market. With approximately one-fifth of the world’s population and a fast-growing gross domestic product, China represents a significant potential market for the pharmaceutical industry. We believe the significant expected growth of the pharmaceutical market in China is due to factors such as robust economic growth and increased pharmaceutical expenditure, aging population and increased lifestyle-related diseases, government support of the pharmaceutical industry, the relatively low research and development and clinical trial costs in China as compared to developed countries, as well as the increased availability of funding for medical insurance and industry consolidation in China.

Currently China has about 3,500 drug companies, falling from more than 5,000 in 2004, according to government figures. The number is expected to drop further. The domestic companies compete in the $10 billion market without a dominant leader. Most often cited adverse factors include a lack of protection of intellectual property rights, a lack of visibility for drug approval procedures, a lack of effective governmental incentives, poor corporate support for drug research and differences in the treatment in China accorded to local and foreign firms. The profile of the pharmaceutical industry in China remains very low. China accounts for approximately 20% of the world’s population but only 1.5% of the global drug market. As of 2008, China was the world's eighth largest drug market.

New Product Development. We will continue to evaluate and develop additional product candidates, both through our in-house research and development department and working with our research and development partners, to expand our pipeline where we perceive an unmet need and commercial potential. We will face the risk that in developing new products we may spend substantial sums of money and the new products developed may not effectively meet the perceived need or may not be successfully commercialized.

Focus on brand development. With intense price competition among many similar or identical products in the industry, we believe that building brand equity is the primary means to generate and sustain profitable growth in the future. The company intends to focus its brand development efforts on building the Cooers brand name with the intent on it becoming a leading pediatric medicine brand in China.

Marketing and Sales Function. We intend to grow our internal marketing and sales function and increase our relationships with other exclusive territory distributors to expand the distribution and presence of our pharmaceutical products. In expanding market share of our products, we intend to take advantage of our large manufacturing scale and reasonable cost control mechanisms, and our strong sales network. In addition, our goal is to establish our products as a preferred choice for children’s medicines in local pharmacies. We hope to add other pharmaceutical products into this channel over the next few years. We may face risks in obtaining adequate quantities of raw materials at reasonable prices in order to meet increased demand for our products that result from any growth. In seeking additional employees, sales representatives, and exclusive territory agents, we will compete with many other established pharmaceutical manufacturers that may have greater resources than we do.

Low cost producer. Our continuing success in optimizing our manufacturing processes and minimizing our production costs provides us with a competitive advantage.

Government sponsored industry consolidation presents opportunities for acquisitions. China’s thousands of domestic companies account for 70 percent of the pharmaceutical market. Anticipating the effects of WTO entry and in an effort to compete with foreign firms, the Chinese government has decided to nurture its own large pharmaceutical companies, by encouraging the consolidation of its government-owned companies. To this end, the Chinese State Economic and Trade Commission (SETC) announced plans to consolidate the industry and support the development of 10 to 15 largest pharmaceutical firms. According to government statistics, China currently has about 3,500 drug companies, down from over 5,00 0 in 2004. The number is expected to drop further. As the industry undergoes further consolidation, China Pediatric will have the opportunity to grow by acquisition.

Customers

The five largest customers of Shaanxi Jiali in the fiscal year ended December 31, 2009 are as follows:

| | Customer Name | % of Sales |

| 1 | Xi’an Zaolutang Kushidai | 11.61% |

| 2 | Jiangsu Yabang Pharmaceuticals Distribution Center Co., Ltd. | 10.90% |

| 3 | Hunan Jiuwang Pharmaceuticals Co., Ltd. | 8.86% |

| 4 | Hangzhou Zhencheng Pharmaceuticals Co.,Ltd. | 8.77% |

| 5 | Shandong Yaoshan Pharmaceuticals Co., Ltd | 8.59% |

The five largest customers of Shaanxi Jiali in the fiscal year ended December 31, 2008 are as follows:

| | Customer Name | % of Sales |

| 1 | Zhengzhou Tianhe Pharmaceuticals Inc. | 23.38% |

| 2 | Xi’an Zaolutang Kushidai Medicine Sales Department | 21.22% |

| 3 | Hangzhou Zhencheng Pharmaceuticals Co., Ltd. | 14.41% |

| 4 | Jiangsu Yabang Pharmaceuticals Distribution Center Co., Ltd. | 14.37% |

| 5 | Hunan Jiuwang Pharmaceuticals Co., Ltd. | 13.64% |

Raw Materials and Principal Suppliers

The raw materials used to manufacture our products include various medicinal herbs, which we obtain from numerous qualified suppliers with national qualifications. We also enter into trading agreements for the supply of many of the materials used to manufacture and package our products. Shaanxi Jiali has written agreements with substantially all of its suppliers.

The five largest suppliers of Shaanxi Jiali in the fiscal year ended December 31, 2009 are as follows:

| | Supplier | Type of Raw Material Purchased | % |

| 1 | Shaanxi Dayang Mark Co.,Ltd. | Packaging materials | 13.14% |

| 2 | Xianyang Wenhui Printing Co., Ltd. | Packaging materials | 12.17% |

| 3 | Baoji Meixian lvyuan Chinese Herbal Medicine Planting and R&D Co., Ltd | Materials of TCM | 11.12% |

| 4 | Baoji Weixin Tangye Wholesale Shop | Sugar | 10.20% |

| 5 | Shaanxi Aokesen Laboratory Co., Ltd | Supporting material | 7.75% |

The five largest suppliers of Shaanxi Jiali in the fiscal year ended December 31, 2008 are as follows:

| | Supplier | Type of Raw Material Purchased | % |

| 1 | Shaanxi Aokesen Laboratory Co., Ltd | Supporting material | 21 |

| 2 | Baoji Weixin Tangye Wholesale Shop | Sugar | 16 |

| 3 | Baoji Meixian lvyuan Chinese Herbal Medicine Planting and R&D Co., Ltd | Materials of TCM | 13 |

| 4 | Baoji Chencang Qu JieLi Carton Factory | Packaging materials | 11 |

| 5 | Shaanxi Daxin Suye Co.Ltd | Packaging materials | 10 |

Intellectual Property

We regard our service marks, trademarks, trade secrets, patents and similar intellectual property as critical factors to our success. We rely on patent, trademark and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights.

Pursuant to certain PRC laws protecting TCMs, certain ready- made TCM products which have received SFDA approval are automatically afforded intellectual property rights. The administrative protection period covered by SFDA approval is 8 years, after which protection is automatically shifted in form from administrative protection to legal protection to TCM and will cover all dosage types of each product approved for a period of 20 years. The patents listed below have a protection period of 20 years (from 2005 to 2025). Once the SFDA protection period has expired, a company may apply for patent protection.

To a large extent, we rely on such protection regulation to protect our intellectual property rights with respect to such products.

Patents

Two types of medicine-related patents exist in PRC: the medicine production technique patent and medicine invention formula patent. In PRC, illegal infringements of production technique patents are widespread. A tiny modification to a filed medicine production technique might be construed as a new one and argued as not violating the patent laws. Invention formula patents are as easily imitated as production technique patents. However, since only one SFDA production certificate can be issued on new branded medicine based on the major pharmaceutical ingredients used, a minor modification to the formula would not warrant a new SFDA production certificate. This means that, even if another manufacturer gets to know a patented formula, it won’t be able to produce it, in PRC, without the proper SFDA production certifica te.

Shaanxi Jiali currently holds two patents: ZL03 1 08011.1 for the treatment of chronic bronchitis and ZL 03 1 08012.X and for the treatment of dermatosis.

| Product Description | | Patent No. | | Published date | | Expiration Date |

| A Chinese Traditional Medicine for the treatment of chronic bronchitis disease and the pharmacy | | ZL03 1 08011.1 | | Sept. 14, 2005 | | Sept. 13, 2025 |

| A Chinese Traditional Medicine for the treatment of dermatosis and gynecology disease and the pharmacy | | ZL 03 1 08012.X | | Sept. 14, 2005 | | Sept. 13, 2025 |

Trademarks

Shaanxi Jiali currently holds nine registered trade names for the following medicine names: Image, Sanseqi, Cooer, Tailaishi, Qingsongling, Beishiting, Zhiben, Xianzhi, Chugan, Yunlaitongjingbao and has filed trademark applications, the approvals of which are pending, for 3 other medicine names or general trademarks.

| Brand Name | | Certificate No. | | Type of Products | | Validity Period |

| Sanseqi | | 1795539 | | 5 | | 2002/6/28 to 2012/06/27 |

| Cooer | | 3180187 | | 5 | | 2003/11/21to 2013/ 11/ 20 |

| Tailaishi | | 3180186 | | 5 | | 2003/11/21 to 2013/11/20 |

| Qingsongling | | 3180188 | | 5 | | 2003/11/21 to 2013/11/20 |

| Beishiting | | 3241933 | | 5 | | 2004/01/07 to 2014/ 01/06 |

| Zhiben | | 3389585 | | 5 | | 2004/07/21 to 2014/07/20 |

| Xianzhi | | 3898392 | | 5 | | 2006/06/28 to 2016/06/27 |

| Chugan | | 4203833 | | 5 | | 2009/02/28 to 2019/02/27 |

| Yunlaitongjingbao | | 4506025 | | 5 | | 2008/07/07 to 2018/07/06 |

Research and Development

We develop new products in-house as well as through an arrangement with the Shaanxi Research Institution of Chinese Traditional Medicines, in Xi’an. We expect to continue to develop additional new drugs under this method.

Shaanxi Jiali’s in-house Research & Development department coordinates and supervises the contract based outsourced R&D processes. Shaanxi Jiali’s Research & Development had a staff of five during the years ended December 31, 2008 and 2009.

Shaanxi Jiali entered into a Medicine Research and Development Agreement with the Shaanxi Research Institute of Chinese Traditional Medicines on December 10, 2007. Under the terms of the Medicine Research and Development Agreement the Shaanxi Research Institute of Chinese Traditional Medicines was contracted for the research and development and for the application of productional approval of five new “pediatric cold treatment

medicines”: Cooer Xiaoer Fuxiening Granules; Cooer Xiaoer Kechuanling Granule; Cooer Xiaoer Kangganjiedu Granules; Cooer Xiaoer Digesting Table , and Cooer Xiaoer Jianpibuxue Granules. Under the terms of the research and development agreement Shaanxi Jiali is committed to paying the Shaanxi Research Institute of Chinese Traditional Medicines $293,000 for each of the five new products contracted for development. Under the terms of the research and development agreement Shaanxi Jiali owns the Intellectual Property rights for the five new pharmaceutical products developed by the Shaanxi Research Institute of Chinese Traditional Medicines.

We did not obtain any certificates or approvals of drug production for any new drug batches during the fiscal year ended December 31, 2009. However, we expect to develop additional new drugs in 2010. During the last two fiscal years ended December 31, 2009 and 2008, we spent $808,800 and $955,900, respectively, to purchase the exclusive rights to certain new products from several research institutes and for ongoing in-house research and development activitiesy.

Compliance with Government Regulations

The testing, approval, manufacturing, labeling, advertising and marketing, post-approval safety reporting, of our products or product candidates are extensively regulated by governmental authorities in the PRC. Our sole sales market is presently in China. We are subject to the Drug Administration Law of China, which governs the licensing, manufacturing, marketing and distribution of pharmaceutical products in China and sets penalties for violations of the law. Additionally, we are subject to various regulations and permit systems by the Chinese government. These regulations and their impact on the business of Shaanxi Jiali Pharmaceutical are set forth in more detail below.

| | ● | Drug Administration Law of the PRC was promulgated by the Standing Committee of National People’s Congress on February 28, 2001 and effective as of December 1, 2001, and its implemental rules were promulgated by the State Council on August 4, 2004 and effective as of September 15, 2002. According to Drug Administration Law of the PRC and its implemental rules, a pharmaceutical manufacturer is to obtain a Pharmaceutical Manufacturing Permit and the Drug Approval Number for each manufactured medicine from relevant SFDA’s provincial branch, which are valid for five years and are renewable upon application before expiration. Shaanxi Jiali Pharmaceuticals is required to file for these approvals for each of its medicines and renew them prior to expiration. |

| | ● | Administration Regulations for Drug Registration was promulgated by the SFDA on July 10, 2007, and was effective as of October 1, 2007. Administration Regulations for Drug Registration specifies the requirements and procedures of obtaining a Drug Approval Number for new drugs, including the requirements for clinical trial of new drugs, procedures of registering imported medicines and report and approval procedures of generic medicines. The Drug Approval Number is valid for five years and can be re-registered upon expiration. Shaanxi Jiali Pharmaceuticals is required to obtain a Drug Approval Number for each of its new drugs and reapply prior to the expiration date. |

| | ● | Good Manufacturing Practices (GMP) for Pharmaceutical Products, as revised in 1998 was promulgated by the SFDA on June 18, 1999 and became effective as of August 1, 1999, and the Authentication Regulations for Drug GMP was promulgated by the SFDA on September 7, 2005 and became effective on of October1, 2005. A pharmaceutical manufacturer must meet the GMP standards and obtain the GMP Certificate with a five-year validity period from SFDA. Before the GMP Certification expires, the pharmaceutical manufacturer must apply again and complete the relevant procedures, which may take about 120 working days, to obtain a new GMP Certificate. On October 24, 2007, the SFDA issued the new guideline for authentication standards of GMP, effective as of January 1, 2008. The new guideline may result in a rise of cost for a pharmaceutical manufacturer to meet the new standards so as to maintain the GMP qualification. If a pharmaceutical manufacturer fails to obtain or maintain GMP Certification and still carry on its production, it will be fined and the Pharmaceutical Manufacturing Permit may be revoked under serious circumstances. Shaanxi Jiali Pharmaceuticals holds one GMP certificate that expire August 3, 2011, July 1, 2012 and July 1, 2012 and is required to reapply prior to the expiration date and maintain its Pharmaceutical Manufacturing Permit. |

| | ● | Administration Regulations for Drug Call-back was promulgated by the SFDA on December 10, 2007 and effective on the same day. According to the Administration Regulations for Drug Call-back, the pharmaceutical manufacturer should establish a drug call-back system and collect information regarding the drug safety. If a manufacturer discovers any unreasonable danger of drug that threatens people’s safety and health, it should immediately stop the manufacturing and sale of such drug, notify the distributors and report to the branch of the SFDA. This regulation also stipulates the procedures of drug call-back and danger valuation standards established and maintain a drug call back system in conformance the regulations. |

| | ● | Administration Regulations for Drug Instructions and Labels was promulgated by the SFDA on March 15, 2006 and was effective as of June 1, 2006. According to Administration Regulations for Drug Instructions and Labels, the contents of instructions and labels of each drug must be approved by the SFDA, and the smallest packing unit of drug shall be attached with instructions. Shaanxi Jiali Pharmaceuticals received approval and maintains drug labeling in conformance with the regulations for its existing products and must do so for new products. |

| ● | Supervision Administration Regulations for Drug Distribution was promulgated by the SFDA on January 31, 2007 and effective as of May 1, 2007. According to Supervision Administration Regulations for Drug Distribution, a pharmaceutical manufacturer can only sell drugs produced by itself, and it shall not sell drugs produced by other manufacturers or produced by itself but for commissioning manufacturing purpose. Shaanxi Jiali Pharmaceuticals does not resell any other pharmaceutical manufacturers drugs. |

| ● | Regulations for Drug Advertisement Censoring was promulgated by the SFDA and State Administration for Industry and Commerce (the “SAIC”) on March 13, 2007 and effective as of May 1, 2007. Standards for Drug Advertisement Censoring and Publication promulgated by the SFDA and the SAIC on March 3, 2007 and effective as of May 1, 2007. According to Regulations for Drug Advertisement Censoring, a pharmaceutical manufacturer must obtain a Drug Advertisement Approval Number from the provincial branch of the SFDA which is valid period of one year if the drug advertisement describe s the functions or benefits of a drug. However, if an over the counter drug advertisement in any media, or a prescription drug advertisement in professional medical magazine, only refers to the name of the drug, including the general name and commercial name, without any other addition promotional information, the advertisement does not need to be censored or approved. Shaanxi Jiali Pharmaceuticals obtained a Drug Advertisement Approval Number and reviews all of its over the counter and prescription drug advertisements so that it is in conformance with the regulations relating to advertising its products. The application and approval procedure in China for a newly developed drug product has numerous steps. New drug applicants prepare the documentation of pharmacological study, toxicity study and pharmacokinetics and drug metabolism (PKDM) study and new drug samples. Documentation and samples are then submitted to provincial food and drug administration (“provincial FDA”). The provincial FDA sends its officials to the applicant to check the applicant’s research and development facilities and to arrange new drug examination committee meeting for approval deliberations. This process usually takes three months. After the documentation and samples are approved by the provincial FDA, the provincial FDA will submit the approved documentation and samples to SFDA. SFDA examines the documentation and tests the samples and a rranges new drug examination committee meeting for approval deliberations. If the application is approved by SFDA, SFDA will issue a clinical trial license to the applicant for clinical trials. The clinical trial license approval typically takes one year. The applicant completes the clinical trial process and prepares documentation and files that are submitted to SFDA for new drug approval. The clinical trial process usually takes one year or two depending on the category and class of the new drug. SFDA examines the documentation and gives final approval for the new drug and issues the new drug license to the applicant. This process usually takes eight months. The whole process for new drug approval usually takes three to four years. The SFDA and China Traditional Medicine Administration Bureau regulate the process for new drug approval and licensing in China, which can involve many layers of authority, lacks transparency, and presents one of the greatest obstacles for companies in introducing new drugs into the market. One of the preliminary aspects of the application process involves a review of the Chinese market’s need for a particular drug. If the SFDA determines that the market niche for a particular drug is saturated, the drug will not receive further consideration and the licensing application will be denied. According to industry analysts, eighty-five percent of the applications for new drugs licensing are determined by SFDA to be in saturated markets and thus are not considered for approval. Only fifteen percent of new-to-market drug applications are considered for approval by the SFDA. Shaanxi Jiali’s receipt of the GMP certificate and approval by the SFDA of its prescription and OTC drugs represents a significant competitive advantage as these approvals present a significant barrier to entry by new companies. Any new products may not pass the clinical review and testing process which can negatively affect cash flow and income. |

Environmental Laws

Shaanxi Jiali’s operations and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in China. Relevant laws and regulations include provisions governing air emissions, water discharges and the management and disposal of hazardous substances and wastes. The PRC regulatory authorities require pharmaceutical companies to carry out environmental impact studies before engaging in new construction projects to ensure that their production processes meet the required environmental standards.

Shaanxi Jiali maintains controls at its production facilities to facilitate compliance with environmental rules and regulations. Shaanxi Jiali is not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor has it been subject to any action made by any environmental administration authorities of the PRC. To management’s knowledge, Shaanxi Jiali’s operations meet or exceed the existing requirements of the PRC as well as applicable local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failur e has not occurred in the past, and we generally do not anticipate that it will occur in the future, but no assurance can be given in this regard.

During the last two years, Shaanxi Jiali spent $5,500 on environmental compliance.

Advertising Laws

The Advertisement Law of the People’s Republic of China and Rules of Medicine Advertisements Management from State Admission for Industry and Commerce, Regulations on Control of Advertisements (tentative) from State Council provide guidelines for advertising prescription and OTC drugs and nutrients made by Shaanxi Jiali. The rules limit where advertisements may be place and govern the claims that may be made by the manufacturer.

Insurance Catalogue

Pursuant to the Decision of the State Council on the Establishment of the State Basic Medical Insurance System for Urban Employees and the Implementation Measures for the Administration of the Scope of Medical Insurance Coverage for Pharmaceuticals for Urban Employees, the Ministry of Labor and Social Security in China established the Insurance Catalogue. The Insurance Catalogue is divided into Parts A and B. The medicines included in Part A are designated by the Chinese governmental authorities for general application. Local governmental authorities may not adjust the content of medicines in Part A. Although the medicines included in Part B are designated by Chinese governmental authorities in the first instance, provincial level authorities may make limited changes to the medicines included in Part B, resulting in some regional variations in the medicines included in Part B from region to region.

Patients purchasing medicines included in Part A are entitled to reimbursement of the costs of such medicines from the social medical fund in accordance with relevant regulations in China. Patients purchasing medicines included in Part B are required to pay a predetermined proportion of the costs of such medicines.

The medicines included in the Insurance Catalogue are selected by the Chinese government authorities based on various factors including treatment requirements, frequency of use, effectiveness and price. Medicines included in the Insurance Catalogue are subject to price control by the Chinese government. The Insurance Catalogue is revised every two years. In connection with each revision, the relevant provincial drug authority collects proposals from relevant enterprises before organizing a comprehensive appraisal. The SFDA then makes the final decision on any revisions based on the preliminary opinion suggested by the provincial drug administration. Approximately 40% of our revenues are derived from pharmaceutical products listed in the Insurance Catalogue so that purchasers can receive reimbursement on these products. Removal of a significant portion of these products from the Insurance Catalogue would adversely affect our total revenue.

Price Controls

The prices of approximately 1,500 pharmaceuticals are presently set by the PRC government. These constitute approximately 10% of all distributed drugs. The prices for the other 90%, or approximately 12,000 pharmaceuticals, are established by the market (by the companies themselves). Corporations typically establish these prices based on operating costs, and market supply and demand. The Supervision Department of the PRC government will intervene only if there is a significant fluctuation in prices or a monopoly develops in a particular drug. We have not had any products subject to specific pricing control and production and trading of none of our pharmaceutical products constitutes a monopoly.

Employees

We have approximately 192 full-time, salaried employees who receive labor insurance. Our employee breakdown includes twenty-one in management and administration, seventy-nine in sales, marketing and distribution, ninety-six in production and quality control, and five in research and development. Our employees are not unionized nor represented by a labor group for purposes of collective bargaining. We have good employee relations with little turnover in staff.

Executive Offices

Our principal executive offices are located at 9th Floor, No. 29 Nanxin Street, Xi’an, Shaanxi Province, PRC 710004. Our telephone number is 86-29-8727-1818.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this report before deciding to invest in our common stock.

Risks Related To Our Business

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Shaanxi Jiali commenced its current line of business operations on July 1, 1998 and received its Good Manufacturing Practices (“GMP”) certifications in November, 2004. These certifications must be renewed every five years for Shaanxi Jiali to stay in business. We have applied for renewal of all of our necessary GMP certifications and expect to receive approval for these renewals in April 2010. Notwithstanding the above, Shaanxi Jiali’s

operating history may not provide a meaningful basis on which to evaluate its business. We cannot assure you that Shaanxi Jiali will maintain GMP approval for its products, maintain its profitability, or assure you that we will not incur net losses in the future. We expect that Shaanxi Jiali’s operating expenses will increase as it expands. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| ● | raise adequate capital for expansion and operations; |

| ● | implement our business model and strategy and adapt and modify them as needed; |

| ● | increase awareness of our brand name, protect our reputation and develop customer loyalty; |

| ● | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| ● | maintain adequate control of our expenses; |

| ● | anticipate and adapt to changing conditions in the medical over the counter, pharmaceutical and nutritional supplement markets in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

The loss of Shaanxi Jiali as our operating business would have a material adverse effect on our business and the price of our common stock.

We have no equity ownership interest in Shaanxi Jiali. Our ability to control Shaanxi Jiali and consolidate its financial results is through a series of contractual agreements between Shaanxi Jiali and our wholly-owned subsidiary Xi’an Coova. The management of Shaanxi Jiali is an affiliate of us and of Xi’an Coova and the stockholders of Shaanxi Jiali are also our shareholders. Thus the Management Entrustment Agreement was not entered into as a result of arms’ length negotiations because the parties to the agreement are under common control. Mr. Xia, our CEO and Chairman, holds approximately 35% of the shares of Shaanxi Jiali and approximately 31.45% of our common stock. The Management Entrustment Agreement may be terminated upon the termination of the business of Shaanxi Jiali or upon the date upon which Xi’an Coova completes the acquisition of Shaanxi Jiali. Any other termination would be a breach of the agreement. While the Company has been advised by its PRC counsel that the Management Entrustment Agreement is legal and enforceable under PRC law, these affiliates control the parties to the Management Entrustment Agreement and it could be possible for them to cause Shaanxi Jiali to breach the Management Entrustment Agreement and our unaffiliated investors would have little or no recourse because of the inherent difficulties in enforcing their rights since all our assets are located in the PRC. (See, Risk Factor “The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.”) In the event that management of Shaanxi Jiali decides to breach the Management Entrustment Agreement, the risk of loss of the affiliated shareholders of Shaanxi Jiali could be lower than unaffiliated investors and the interests of the management and shareholders of Shaanxi Jiali would be in conflict with the interest of our other stockholders.

Shaanxi Jiali’s failure to compete effectively may adversely affect our ability to generate revenue.

Shaanxi Jiali competes with other companies, many of whom are developing or can be expected to develop products similar to Shaanxi Jiali. Shaanxi Jiali’s market is a large market with many competitors. Many of its competitors are more established than Shaanxi Jiali is, and have significantly greater financial, technical, marketing and other resources than it presently possess. Some of Shaanxi Jiali’s competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that Shaanxi Jiali will be able to compete effectively with cu rrent or future competitors or that the competitive pressures it faces will not harm it business.

We may not be able to effectively control and manage the growth of Shaanxi Jiali.

If Shaanxi Jiali’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect its operations and cause delay in production and delivery of its pharmaceutical prescription, over the counter and medical nutrient products as well as administrative inefficiencies.

We may require additional financing in the future and a failure to obtain such required financing will inhibit Shaanxi Jiali’s ability to grow.

The continued growth of Shaanxi Jiali’s business may require additional funding from time to time, which we expect to raise in private placements of our equity or debt securities with accredited investors or by offering our securities for sale pursuant to an effective registration statement on a market where our common stock is traded. The proceeds of these funding would be forwarded to Shaanxi Jiali and accounted for as a loan to Shaanxi Jiali and eliminated during consolidation. The proceeds would be used for general corporate purposes of Shaanxi Jiali, which could include acquisitions, investments, repayment of debt and capital expenditures among other things. We may

also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Obtaining additional funding would be subject to a number of factors including market conditions, operating performance and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, terms and conditions of additional funding unattractive or unavailable to us. Our management believes that we currently have sufficient funds from working capital to meet our current operating costs over the next 12 months.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Shaanxi Jiali’s business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

We, through our subsidiaries/affiliated companies China Pediatric, Xi’an Coova or Shaanxi Jiali, may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiaries/affiliated companies China Children, Xi’an Coova or Shaanxi Jiali, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Shaanxi Jiali, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time Shaanxi Jiali reviews investments in new businesses and we, through our subsidiaries/affiliated companies China Children, Xi’an Coova or Shaanxi Jiali, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Shaanxi Jiali and accounted for as a loan to Shaanxi Jiali and eliminated during consolidation. In the event of any future acquisitions, we could:

| ● | issue equity securities which would dilute current stockholders’ percentage ownership; |

| ● | incur substantial debt; |

| ● | assume contingent liabilities; or |

| ● | expend significant cash. |

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if through our subsidiaries/affiliated companies, China Children, Xi’an Coova, or Shaanxi Jiali, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

| ● | difficulties in the assimilation of acquired operations, technologies and/or products; |

| ● | unanticipated costs associated with the acquisition or investment transaction; |

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and attestation of this assessment by our company's independent registered public accountants. The SEC extended the compliance dates for "non-accelerated filers," as defined by the SEC. Accordingly, we believe that the annual assessment of our internal controls requirement first applied to our annual report for the 2007 fiscal year and the attestation requirement of management's assessment by our independent registered public accountants will first apply to our annual report for the 2010 fiscal year. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testin g and possible remediation to meet the detailed standards. We have not yet evaluated our internal controls over financial reporting in order to allow management to report on, and our independent auditors to attest to, our internal controls over financial reporting, as will be required by Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC. We have never performed the system and process evaluation and testing required in an effort to comply with the management assessment and auditor certification requirements of Section 404, which will initially apply to us as of December 31, 2007 and December 31, 2010 respectively. Our lack of familiarity with Section 404 may unduly divert management's

time and resources in executing the business plan. If, in the future, management identifies one or more material weaknesses, or our external auditors are unable to attest that our management's report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price and/or subject us to sanctions or investigation by regulatory authorities. So far, our external auditors have not reported to our board of directors any significant weakness on our internal control and provided recommendations accordingly.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and pharmaceutical factory operational expertise of key personnel. Jun Xia, our Chief Executive Officer and Chairman of the Board, and Minggang Xiao, our Chief Financial Officer, perform key functions in the operation of our and Shaanxi Jiali’s business. There can be no assurance that Shaanxi Jiali will be able to retain these officers after the term of their employment contracts expire. The loss of these officers could have a material adverse effect upon our business, financial condition, and results of operations. Shaanxi Jiali must attract, recruit and retain a sizeable workforce of technically competent employees. We do not carry key man life insurance for any of our key personnel or personnel nor do we foresee purch asing such insurance to protect against a loss of key personnel and the key personnel.

We are dependent upon the services of Mr. Xia for the continued growth and operation of our company because of his experience in the industry and his personal and business contacts in the PRC. Although we have entered into two-year employment agreements with Mr. Xia and we have no reason to believe that he will discontinue their services with the Company or Shaanxi Jiali, the interruption or loss of his services would adversely affect our ability to effectively run our business and pursue our business strategy as well as our results of operations.

We may not be able to hire and retain qualified personnel to support its growth and if it is unable to retain or hire these personnel in the future, its ability to improve its products and implement its business objectives could be adversely affected.

Competition for senior management and senior personnel in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition. We expect to hire additional sales and plant personnel throughout fiscal year 2010 in order to accommodate its growth.

If we fail to increase our brand recognition, we may face difficulty in obtaining new customers and business partners.

We believe that establishing, maintaining and enhancing our brand in a cost-effective manner is critical to achieving widespread acceptance of our current and future products and services and is an important element in our effort to increase our customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in our market develops. Some of our potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and ability to provide reliable and useful products and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any incr eased revenue may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition, would be materially adversely affected.

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

| ● | the costs of pharmaceutical products and development; |

| ● | the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our products; |

| ● | capital expenditure for equipment; |

| ● | marketing and promotional activities and other costs; |

| ● | changes in our pricing policies, suppliers and competitors; |