UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| SBT Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | 4) | Date Filed: |

| | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 8, 2012

To the Shareholders of SBT Bancorp, Inc.:

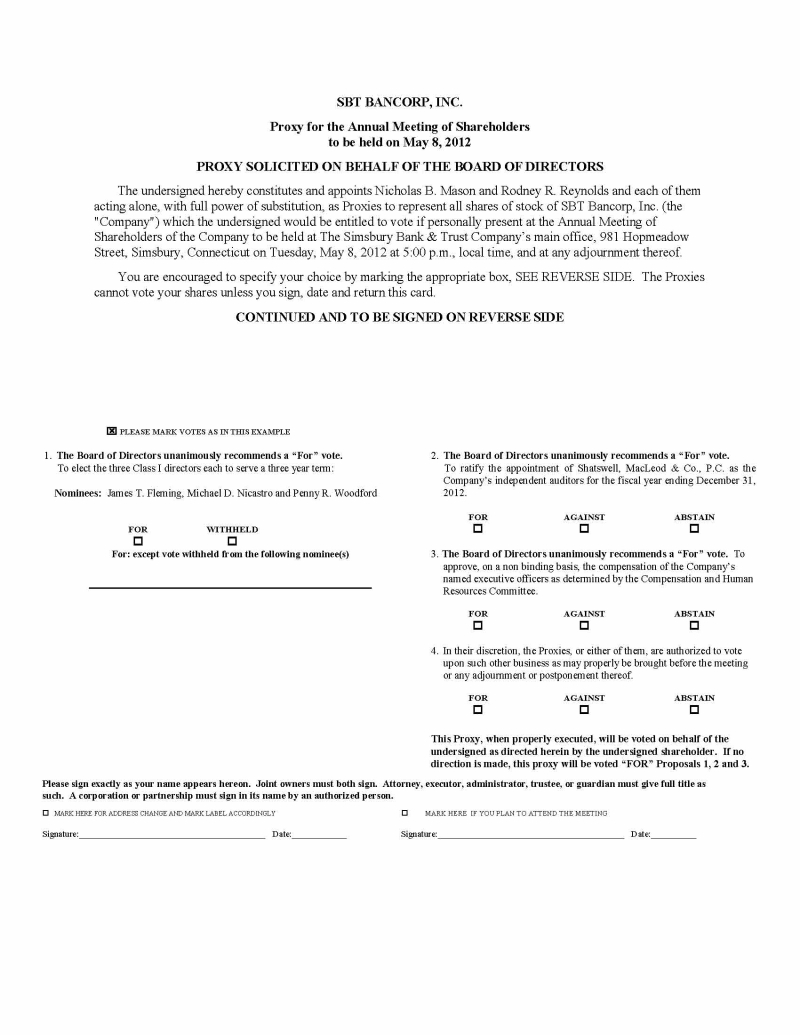

Notice is hereby given that the Annual Meeting of Shareholders of SBT Bancorp, Inc. will be held at the main office of the Company’s subsidiary, The Simsbury Bank & Trust Company, Inc., 981 Hopmeadow Street, Simsbury, Connecticut on Tuesday, May 8, 2012 at 5:00 p.m., local time. At the meeting, the shareholders will consider and vote upon the following matters:

| | 1. | The election of three Class I directors for a term expiring at the 2015 Annual Meeting; |

| | 2. | The ratification of the appointment of Shatswell, MacLeod & Co., P.C., certified public accountants, as independent auditors for SBT Bancorp, Inc. for the fiscal year ending December 31, 2012; |

| | 3. | The non-binding approval of the compensation of SBT Bancorp, Inc.’s named executive officers as determined by the Compensation and Human Resources Committee; and |

| | 4. | The transaction of such other business as may properly be brought before the meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on March 9, 2012 are entitled to notice of and to vote at the Annual Meeting and any and all adjournments or postponements thereof.

IT IS IMPORTANT THAT YOUR STOCK BE REPRESENTED AT THE MEETING. WE URGE YOU TO SIGN, DATE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON. SHAREHOLDERS OF RECORD WHO ATTEND THE MEETING MAY REVOKE THEIR PROXY AND VOTE IN PERSON.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | /s/ Gary R. Kevorkian |

| | |

| Simsbury, Connecticut | Gary R. Kevorkian, |

| April 11, 2012 | Secretary |

[THIS PAGE INTENTIONALLY LEFT BLANK]

SBT BANCORP, INC.

760 Hopmeadow Street

P.O. Box 248

Simsbury, CT 06070-0248

(860) 408-5493

| | | |

| | PROXY STATEMENT OF SBT BANCORP, INC. FOR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 8, 2012 | |

This Proxy Statement is furnished to shareholders of common stock of SBT Bancorp, Inc. (the “Company” or “we”) in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the Annual Meeting of Shareholders of the Company to be held at the main office of the Company’s subsidiary, The Simsbury Bank & Trust Company, Inc. (the “Bank”), 981 Hopmeadow Street, Simsbury, Connecticut, at 5:00 p.m. on May 8, 2012, and any and all adjournments or postponements thereof (the “2012 Annual Meeting”).

This Proxy Statement, the Notice of the 2012 Annual Meeting, the enclosed form of proxy and the Annual Report to Shareholders for the year ended December 31, 2011 for SBT Bancorp, Inc. (the “Annual Report”) are first being mailed to shareholders of our common stock on or about April 11, 2012. We will, upon written request and without charge, furnish you with additional copies of the Annual Report. Please address all such requests to us by mail to SBT Bancorp, Inc., Attention: Gary R. Kevorkian, at the principal executive offices of the Company, which are located at 760 Hopmeadow Street, P.O. Box 248, Simsbury, Connecticut 06070-0248 (telephone number (860) 408-5493).

INFORMATION ABOUT SOLICITATION AND VOTING

A shareholder of record of the common stock who executes the enclosed form of proxy may revoke it at any time before it is voted by written notice of such revocation or a duly executed proxy bearing a later date delivered to the Secretary of the Company at the address set forth above or by attending the 2012 Annual Meeting and revoking the proxy at such time. Attendance at the 2012 Annual Meeting will not itself revoke a proxy. Shares represented by properly executed proxies will be voted at the 2012 Annual Meeting in accordance with the specifications thereon. Shareholders of record of the common stock who are present at the 2012 Annual Meeting may vote by ballot.

This proxy solicitation is being made by the Board. The expense of soliciting proxies in favor of the Company’s proposals will be borne by the Company. In addition to solicitation of proxies by mail, proxies may also be solicited by telephone or personal contact by employees and/or directors of the Company who will not receive additional compensation for soliciting proxies.

Only shareholders of record of the Company’s common stock at the close of business on March 9, 2012 (the “Record Date”) are entitled to notice and to vote at the 2012 Annual Meeting. On the Record Date, there were 876,394 outstanding shares of the Company’s common stock, no par value. Each share of common stock is entitled to one vote. The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock on the Record Date, or 438,198 shares, is necessary to constitute a quorum at the 2012 Annual Meeting. Abstentions and broker non-votes are counted as present for establishing a quorum. When a record holder (e.g., a bank or brokerage firm) holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because the beneficial owner has not provided voting instructions, this is referred to as a “broker non-vote.”

If the shares you own are held in “street name” by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the instructions your bank or brokerage firm provides you.

If your shares are held in “street name,” you must bring an account statement or letter from your brokerage firm or bank showing that you are the beneficial owner of the shares as of the record date in order to be admitted to the 2012 Annual Meeting. To be able to vote your shares held in street name at the 2012 Annual Meeting, you will need to obtain a proxy card from the holder of record.

With respect to the proposals at the 2012 Annual Meeting concerning the approval of the appointment of the Company’s independent auditors, your broker is entitled to use its discretion in voting your shares, even if you do not give your broker instructions as to how to vote.

Directors will be elected by a plurality of the votes cast at the 2012 Annual Meeting. Thus, an abstention or a broker “non-vote” will have no effect on the outcome of the vote on election of directors at the meeting. The ratification of the appointment of Shatswell, MacLeod & Co., P.C. will be approved if a majority of the votes cast are FOR the proposal. Abstentions and broker “non-votes” will have no impact on the ratification of Shatswell, MacLeod & Co., P.C. The non-binding proposal regarding the compensation of our named executive officers will be approved if a majority of the votes cast are FOR the proposal. Abstentions and broker “non-votes” will have no impact on the approval of this advisory proposal.

The votes will be counted, tabulated and certified by Nicholas B. Mason and Rodney R. Reynolds. Each proxy received will be voted as directed. However, if no direction is indicated, the proxy will be voted: in Item 1, FOR the election to the Board of Directors of three Class I director nominees; in Item 2, FOR the ratification of Shatswell, MacLeod & Co., P.C. as independent auditors; in Item 3, FOR the non-binding approval of the compensation of the Company’s named executive officers as determined by the Compensation and Human Resources Committee; and on such other matters as may properly come before the 2012 Annual Meeting, in such manner as the persons so named in the proxy shall decide.

We will report the voting results in a current report on Form 8-K, which we expect to file with the Securities and Exchange Commission, within four business days of the date of the Annual Meeting (i.e., on or before May 14, 2012).

If you have any questions about the 2012 Annual Meeting or your ownership of our common stock, please contact Gary R. Kevorkian, our corporate secretary, by mail at SBT Bancorp, Inc., Attention: Gary R. Kevorkian, Secretary, 760 Hopmeadow Street, P.O. Box 248, Simsbury, Connecticut 06070-0248, or by email to Mr. Kevorkian’s attention at sbtinfo@simsburybank.com.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 8, 2012

Under rules adopted by the Securities and Exchange Commission, we are furnishing proxy materials on the Internet in addition to mailing paper copies of the materials to our shareholders. The following proxy materials are available at http://investors.simsburybank.com/financialdocs.aspx?iid=4100578:

| | · | Notice of Annual Meeting of Shareholders to be held May 8, 2012; and |

| | · | Proxy Statement for the Annual Meeting of Shareholders to be held May 8, 2012; and |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the common stock of the Company as of March 16, 2012 by (i) each director and nominee for director of the Company, (ii) named executive officers, (iii) all directors and executive officers as a group and (iv) shareholders of record who beneficially own five percent or more of the Company’s common stock. Except as indicated by footnote, the persons named in the table have sole voting and investment powers with respect to all shares shown as beneficially owned by them. All persons listed are directors of both the Company and the Bank unless noted otherwise. All directors and executive officers can receive mail in care of SBT Bancorp, Inc., 760 Hopmeadow Street, P.O. Box 248, Simsbury, CT 06070. The addresses of the shareholders of record who beneficially own five percent or more of the Company’s common stock are listed below their respective names in the following table.

Name of Beneficial Owner | | Amount and Nature Of Beneficial Ownership | | Percent Of Class |

| | | | | | | |

| Directors and Executive Officers | | | | | | |

Robert J. Bogino, Chairman | | | 27,986 | (1) | | | 3.2 | % |

James T. Fleming, Director | | | 934 | (2) | | | * | |

Martin J. Geitz, President, Chief Executive Officer and Director | | | 35,644 | (3) | | | 4.0 | % |

Gary R. Kevorkian, Director | | | 31,144 | (4) | | | 3.6 | % |

Jerry W. Long, Director | | | 2,714 | (5) | | | * | |

Nicholas B. Mason, Director | | | 2,755 | (6) | | | * | |

Michael D. Nicastro, Director Nominee of the Company and a Director of the Bank | | | 914 | (7) | | | * | |

George B. Odlum, Jr., DMD, Director | | | 13,995 | (8) | | | 1.6 | % |

Rodney R. Reynolds, Director | | | 5,236 | (9) | | | * | |

David W. Sessions, Vice Chairman | | | 16,265 | (10) | | | 1.9 | % |

Penny R. Woodford, Director | | | 2,676 | (11) | | | * | |

Anthony F. Bisceglio, Executive Vice President, Chief Financial Officer and Treasurer | | | 4,301 | (12) | | | * | |

Michael T. Sheahan, Senior Vice President and Chief Mortgage & Consumer Lending Officer | | | 965 | (13) | | | * | |

| | | | | | | | | |

| All directors and executive officers as a group (15 persons) | | | 147,449 | (14) | | | 16.4 | % |

| | | | | | | | | |

| Principal Shareholders | | | | | | | | |

| | | | | | | | | |

Friedlander & Co., Inc. Theodore Friedlander III 322 East Michigan Street, Suite 250 Milwaukee, WI 53202 | | | 72,100 | (15) | | | 8.2 | % |

| | | | | | | | | |

Banc Fund VI L.P. Banc Fund VII L.P. Banc Fund VIII L.P. 20 North Wacker Drive Suite 3300 Chicago, IL 60606 | | | 58,969 | (16) | | | 6.7 | % |

____________________________

* Less than 1%

| (1) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. Also includes 6,600 shares owned jointly with Mr. Bogino’s spouse, 822 shares held in a trust of which Mr. Bogino serves as trustee, 2,084 shares in trusts for two of his children for which Mr. Bogino serves as the trustee and 11,500 shares owned by his spouse. Mr. Bogino disclaims beneficial ownership of the shares beneficially owned by his spouse. |

| (2) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. |

| (3) | Includes a grant of 3,080 shares of restricted stock which shall vest over three years as follows: 1,026 shares on August 17, 2012, 1,026 shares on August 17, 2013 and 1,028 shares on August 17, 2014. Also includes 21,000 shares which may be acquired within 60 days through the exercise of stock options. |

| (4) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. Also includes 22,592 shares held in trusts for which Mr. Kevorkian is trustee, including 965 shares in a trust for Mr. Kevorkian’s spouse. |

| (5) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. |

| (6) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. |

| (7) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. |

| (8) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. Also includes 3,550 shares owned by Dr. Odlum’s spouse. Dr. Odlum disclaims beneficial ownership of the shares beneficially owned by his spouse. |

| (9) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. Also includes 2,500 shares owned by the Reynolds Family, LLC, of which Mr. Reynolds and his spouse own approximately 39% of the membership interest with the balance of the membership interest owned by their children. Mr. Reynolds and his spouse are co-managers of the Reynolds Family, LLC. |

| (10) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. Also includes 1,564 shares owned jointly with Mr. Sessions’s spouse, 1,357 shares owned by a private corporation owned by Mr. Sessions and his siblings and 2,252 shares owned by his children. Mr. Sessions disclaims beneficial ownership of the shares beneficially owned by his children. |

| (11) | Includes a grant of 414 shares of restricted stock which shall vest over three years as follows: 138 shares on August 17, 2012, 138 shares on August 17, 2013 and 138 shares on August 17, 2014. |

| (12) | Includes a grant of 1,101 shares of restricted stock which shall vest over three years as follows: 367 shares on August 17, 2012, 367 shares on August 17, 2013 and 367 shares on August 17, 2014. |

| (13) | Includes a grant of 965 shares of restricted stock which shall vest over three years as follows: 321 shares on August 17, 2012, 321 shares on August 17, 2013 and 323 shares on August 17, 2014. |

| (14) | Includes 21,000 in shares which directors and executive officers may acquire beneficial ownership within 60 days through the exercise of stock options and 11,206 in restricted stock awards that vest over three years as follows: 3,734 shares on August 17, 2012, 3,734 shares on August 17, 2013 and 3,738 shares on August 17, 2014. |

| (15) | Consists of 72,100 shares in which Friedlander & Co., Inc. (“Friedlander & Co.”) reports beneficial ownership as a result of having sole dispositive power over such shares and is based on information set forth in a Schedule 13G/A filed jointly on February 13, 2012 by Friedlander & Co. and Theodore Friedlander III. The 72,100 shares include 10,000 shares in which Theodore Friedlander III reports beneficial ownership as a result of having sole voting power. Mr. Friedlander is a controlling person of Friedlander & Co. and as such may be deemed to beneficially own the shares of common stock of the Company beneficially owned by Friedlander & Co. Mr. Friedlander beneficially owns less than 1% of the shares held by Friedlander & Co. and disclaims beneficial ownership of all other shares held by Friedlander & Co. |

| (16) | Consists of 10,750 shares owned by Banc Fund VI L.P. (“BF VI”), 39,456 shares owned by Banc Fund VII L.P. (“BF VII”) and 8,763 shares owned by Banc Fund VIII L.P. (“BF VIII”) and is based on information set forth in a Schedule 13G/A filed jointly on February 8, 2012 by BF VI, BF VII and BF VIII. The general partner of BF VI is MidBanc VI L.P. (“MidBanc VI”), whose principal business is to be a general partner of BF VI. The general partner of BF VII is MidBanc VII L.P. (“MidBanc VII”), whose principal business is to be a general partner of BF VII. The general partner of BF VIII is MidBanc VIII L.P. (“MidBanc VIII”), whose principal business is to be a general partner of BF VIII. The general partner of MidBanc VI, MidBanc VII, and MidBanc VIII is The Banc Funds Company, L.L.C. (“TBFC”), whose principal business is to be a general partner of MidBanc VI, MidBanc VII, and MidBanc VIII. TBFC is an Illinois corporation whose principal shareholder is Charles J. Moore. Mr. Moore has been the manager of BF VI, BF VII, and BF VIII, since their respective inceptions. As manager, Mr. Moore has voting and dispositive power over the securities of the Company held by each of those entities. As the controlling member of TBFC, Mr. Moore will control TBFC, and therefore each of the partnership entities directly and indirectly controlled by TBFC. |

DISCUSSION OF PROPOSALS

ITEM 1

ELECTION OF DIRECTORS

As of the date of this Proxy Statement, the Company’s Certificate of Incorporation provides that the Board of Directors shall be divided into three classes, as nearly equal in number as possible, with each class having a three-year term. The size of the Board is currently set at 11 directors that is comprised as follows: three Class I directors, four Class II directors and four Class III directors. There are presently 10 persons serving as directors of the Company and one vacancy for a Class I director. Proxies solicited from shareholders cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The terms of the classes are staggered so that the term of a class expires at each annual meeting of the Company. The terms of the two incumbent Class I directors, James T. Fleming and Penny R. Woodford, expire at the 2012 Annual Meeting.

At a meeting held on February 14, 2012 the Board of Directors voted unanimously to recommend the following three persons for election to the Board of Directors with terms expiring on the dates set forth below:

| Nominee | | Class | | Term Expiration |

| James T. Fleming | | Class I | | 2015 Annual Meeting of Shareholders |

| Michael D. Nicastro | | Class I | | 2015 Annual Meeting of Shareholders |

| Penny R. Woodford | | Class I | | 2015 Annual Meeting of Shareholders |

Nominees Fleming and Woodford each currently serve as a director of the Company and are nominated to serve for his or her term and until his or her successor is elected and qualified. Nominees Fleming and Woodford were last elected as Class I directors in 2009. Nominee Nicastro was nominated to be a Class I director by the Company’s Board of Directors on February 14, 2012. At the time of his nomination, Nicastro was serving as a director of the Bank, a position that he has held since June 2, 2011. In the event that any of the nominees become unable to serve, an event which the Board does not expect, the shares represented by proxy may be voted for a substitute nominee to be designated by the Board or a committee thereof, unless the proxy withholds authority to vote for all nominees.

If a quorum is present at the 2012 Annual Meeting, the election of directors will require the affirmative vote of a plurality of the votes cast. Abstentions by shareholders and broker non-votes with respect to the election of directors will not be included in determining whether nominees have received the vote of such plurality. Certain information about the business experience of the director nominees, including their service as directors of other corporations, is listed below. References to terms of service as a director or officer of the Company include service as a director or officer of the Bank prior to the date of the holding company reorganization on March 2, 2006.

Director Nominees, Class I

James T. Fleming (56) - Mr. Fleming has been a director of the Company since 1992. He is currently the President of the Connecticut Automotive Retailers Association, Inc. (CARA, Inc.), which position he has held since March 2008. He also serves as the Secretary and Treasurer of the Greater Hartford Automobile Dealer’s Association Foundation, a not-for-profit organization, and is the former Executive Secretary of the GHADA Association, which was merged with CARA, Inc. in 2010. Mr. Fleming is a former member of the Governors’ Cabinet of the State of Connecticut, serving from 2007 to 2008 as a Commissioner of the Department of Public Utility Control, serving from 2003 to 2007 as Commissioner of the Department of Public Works, and serving from 1999 to 2003 as Commissioner of Consumer Protection. He is the former Majority Leader of the Connecticut State Senate. He is a member of the Simsbury Charter Revision Commission and is also a director of the Simsbury Cemetery Association, Vice President of the Simsbury Volunteer Fire District and was a corporator of Saint Francis Hospital. Mr. Fleming holds a B.A. from The Eisenhower College of Rochester Institute of Technology and an MA from Trinity College. Mr. Fleming brings important managerial, operational and organizational skills and expertise to the Board from his many years of public sector service.

Penny R. Woodford (67) - Ms. Woodford has been a director of the Company since 1992. She is a real estate agent with the Coldwell Banker Residential Brokerage, which position she has held since 2003. Prior to that, she was a real estate agent with DeWolf Companies from 1996 to 2003 and with Westledge Real Estate from 1983 to 1996. She is Chairperson of the Nominating Committee of the Avon Republican Town Committee. In her role as a top real estate salesperson in the Company’s market, Ms. Woodford brings valuable current real estate market insight and a large business network to the Board.

Michael D. Nicastro (53) – Mr. Nicastro has been a director of the Bank since 2011. He is the President and Chief Executive Officer of the Central Connecticut and Greater Bristol Chambers of Commerce, positions he has held since 2008. He serves as President of the Chambers Benefits Centers Leadership Cabinet. Prior to joining the Chamber, Mr. Nicastro was Senior Vice President & Chief Marketing Officer of Open Solutions, Inc., a position he held starting in 1994. He also serves on the board of two start-up venture capital backed companies – Continuity Control and Weston Software. He serves on the board of the Angel Investor Forum of Connecticut and the Central Connecticut Revolving Loan Fund. Mr. Nicastro is a member of the Governing Board of Directors and Executive Committee of the Hartford Stage Company and is President of the Board of the Connecticut Rivers Council, Boy Scouts of America. He also serves on the Board of the State Academic Awards, the oversight board of Charter Oak State College and the Connecticut Distance Learning Center. Mr. Nicastro holds a Bachelor’s Degree from Central Connecticut State University and a Juris Doctorate from Western New England College, School of Law. Mr. Nicastro’s extensive business background, with an emphasis in banking technology, provides important managerial, marketing and operational skills and expertise to the Board. Mr. Nicastro is a member of the Bank’s Loan Committee and the Bank’s Audit & Compliance Committee.

INFORMATION ABOUT OUR DIRECTORS

Certain information about the business experience of the remaining incumbent directors and the non-director officers of the Company, including their service as directors of other companies, is listed below. References to terms of service as a director or officer of the Company include service as a director or officer of the Bank prior to the date of the holding company reorganization on March 2, 2006.

Class II Directors, Terms Expiring at the 2013 Annual Meeting of Shareholders

Martin J. Geitz (55) - Mr. Geitz is the President and Chief Executive Officer of the Company and the Bank and has held these positions since 2004. He has been a member of the Board since 2005. He brings 30 years of senior management experience, including a lengthy career with Fleet Bank, to the Company. He is Chairman of the Boards of the Connecticut Bankers Association, the main trade association for banks operating in Connecticut, and Hedco, Inc., a not-for-profit community development organization, a Trustee of each of McLean Fund and the Simsbury Free Library, and a board member of the Bloomfield Chamber of Commerce and the Charter Oak State College Foundation. Mr. Geitz holds a B.A. from Johns Hopkins University and an MBA from Cornell University. Mr. Geitz’s extensive experience in banking and his leadership ability make him a valuable member of the Board.

Gary R. Kevorkian (58) - Mr. Kevorkian has been Secretary of the Company since 2007 and a director of the Company since 1994. Mr. Kevorkian serves as Chairman of the Compensation and Human Resources Committee. He is an attorney-at-law and has maintained his own practice in Granby, Connecticut since 1981. In his practice, he specializes in real estate, trusts and estates. As an attorney and business owner, he brings his legal and financial insight to the Board. Mr. Kevorkian is not an employee of the Company and is not compensated for his service as the Company’s Secretary.

Jerry W. Long (60) – Mr. Long has been a director of the Bank since January 2010 and a director of both the Bank and the Company since May 2010. He has been the President and CEO of PCC Technology, LLC, an information technology consulting firm, since 1994. Mr. Long is a director for Hartford Youth Scholars Foundation and Chairman of the Bloomfield Economic Development Commission. He is also a former board member of the Connecticut Business & Industry Association and a former Vice Chairman of Charter Oak State College Board of Trustees. He is a member of the Rotary Club of Bloomfield and past president of the Bloomfield, Connecticut Chamber of Commerce. Mr. Long’s many years of business ownership and managerial and technology experience are valuable to the Board.

George B. Odlum, Jr., DMD (72) - Dr. Odlum has been a director of the Company since 1992 and formerly served as the Company’s Secretary. He serves as Chairman of the Audit & Compliance Committee. Dr. Odlum was a family practice dentist in Simsbury, Connecticut, where he practiced dentistry from 1968 until his retirement in 2007. He served on the Board of Trustees of The Society for Savings, a mutual savings bank, from 1980 to 1982 and on the Board of Directors of The Village Water Company of Simsbury, a public utility, from 1972 to 1995. At the end of his tenure, The Village Water Company of Simsbury was acquired by Aquarion Water Company of Connecticut. Dr. Odlum also serves as a director of the Farmington Valley Visiting Nurse Association. Dr. Odlum’s experience on other company boards, including as President of the Simsbury Chamber of Commerce from 1972 to 1974 and various Town of Simsbury commissions, brings valuable managerial experience and local knowledge of our primary market area to the Board. Dr. Odlum obtained his B.S. from Trinity College and his DMD from Tufts University School of Dentistry.

Class III Directors, Terms Expiring at the 2014 Annual Meeting of Shareholders

Robert J. Bogino (69) - Mr. Bogino is the Chairman of the Company and the Bank and has been a director of the Company since 1994. Mr. Bogino served as the Company’s Vice Chairman from 2005 to 2010 and Secretary from 2002 to 2005. He currently serves as Chairman of the Corporate Governance Committee. He was the President, Treasurer and co-owner of Bogino & DeMaria, Inc. in Avon, Connecticut, an insurance agency of which he was a founder in 1972. As Treasurer of Bogino & DeMaria, Inc., he was responsible for all financial and accounting matters including monthly financial statement preparation and analysis, coordination with outside accounting firm for the preparation and filing of local, State and Federal tax returns and annual corporate financial statements. In 2003, he became a Vice President of the Watson Group, an insurance agency in Wethersfield until his retirement in 2004. Mr. Bogino received an MBA in Finance from Columbia University Graduate School of Business. Mr. Bogino brings his many years of business ownership, management and insurance expertise to the Board.

Rodney R. Reynolds (72) - Mr. Reynolds has served as a director of the Company since 2007. He was a co-founder of Equistrides Therapeutic Riding Center, Inc., a not-for-profit organization that provided services to people with disabilities, and served as co-manager and trustee of that organization from 2000 to 2006. Mr. Reynolds served as a director of the Trust Company of Connecticut, an investment management and trust services company, from 1990 to 2005. Mr. Reynolds was self-employed as a commercial real estate developer and owner/manager of real estate from 1984 to 2006. Mr. Reynolds’s experience in trust services, investment experience and the real estate market is valuable to the Board.

Nicholas B. Mason (67) - Mr. Mason has been a director of the Company since March 2011 and a director of the Bank since 2010. He is a retired financial consultant. Mr. Mason had a long career as CFO of the Savings Bank of Manchester from 1988 to 2000, where he directed and managed the financial, treasury, accounting and audit functions of the Bank. Prior to that, he worked for eight years at the Hartford Insurance Group in property casualty accounting, and information management. He spent four years at the Travelers Insurance Company in the Life Insurance Department and seven years at Hartford National Bank in strategic planning. Mr. Mason is active in many Farmington Valley organizations. He is President of the Farmington Valley Visiting Nurse Association and Treasurer of Simsbury Community Television and the Old Drake Hill Flower Bridge. He serves as an elected member of the Town of Simsbury Board of Finance and as an appointed member of the Town Pension Committee and Insurance Committee. In the past, he has served as Treasurer of the Simsbury Light Opera Company and the Manchester Symphony Orchestra and Chorale among other community groups. He was a founding director of Bankers’ Bank Northeast in Glastonbury, CT. Mr. Mason’s experience as a former senior bank executive officer and his experience as a financial professional provide insight into analysis of bank financial statements, regulatory reporting, budgeting, business and strategic planning, investment management and audit administration. Mr. Mason obtained a B.A. in Economics from Dartmouth College, an MBA in Finance from Columbia University Graduate School of Business, and an M.A. in Economics from the University of Hartford Graduate School of Business.

David W. Sessions (61) - Mr. Sessions is the Vice Chairman of the Company and the Bank and has been a director of the Company since 1992. He serves as chairman of the Executive Committee and Loan Committee. He is President and Treasurer of The CASLE Corporation, headquartered in Avon, Connecticut, a commercial design-build development and construction company which he co-founded in 1981. Over the past 15 years, CASLE’s main focus has been on the development and management of a portfolio of medical office buildings throughout Connecticut. He is Chairman of the Architectural Review Committee of the Town of New Hartford, a member of the New Hartford Democratic Town Committee and a former Chairman and member of the Board of Finance of the Town of New Hartford. Mr. Sessions also operates a concert series for the benefit of the Beekley Memorial Library in New Hartford, Connecticut. He received a B.A. from Middlebury College in 1972 and a J.D. from George Washington University in 1975. Mr. Sessions has many years of experience as a business owner and real estate developer and brings important managerial, operational and current real estate knowledge to the Board.

Non-Director Executive Officers

Anthony F. Bisceglio (64) – Mr. Bisceglio is Executive Vice President of the Company and the Bank, positions he has held since January 2005, as well as Chief Financial Officer and Treasurer of the Company and the Bank, which positions he has held since 1995. Prior to joining the Bank in 1995, Mr. Bisceglio was Vice President and Group Financial Officer of Shawmut National Corporation and Chief Financial Officer of Shawmut Bank of Rhode Island. He is also on the Connecticut Bankers Association’s Management Development Committee, serves on the Economic Policy Survey Panel of the National Association for Business Economics and is a member of the American Finance Association. He is a past board member of the Financial Managers Society and past Chairman of its Strategic Issues Council.

Michael T. Sheahan (52) – Mr. Sheahan is a Senior Vice President and Chief Mortgage and Consumer Lending Officer, which positions he has held since 2009. Prior to joining the Bank, he served as the Mortgage Lending Division Head at Webster Financial where he was employed from 2000 to 2009 and prior to that, he had a lengthy career in mortgage and consumer financial services and online services with Shawmut Bank, Meca Software, and Centerbank Mortgage. Mr. Sheahan holds a CPA designation. Mr. Sheahan currently serves on the Board of Directors of the Connecticut Mortgage Bankers Association.

Howard R. Zern (65) – Mr. Zern is Executive Vice President and Chief Retail Banking, Technology and Operations Officer of the Bank, which positions he has held since 2011 and 2008, respectively. Prior to joining the Bank, he was an Executive Vice President of Bank of America, from which he retired in 2005. Mr. Zern is a former director of Stony Brook University Alumni Association, former Vice Chairman of TheaterWorks, past Treasurer of the Artists Collective in Hartford and former Chairman of the Urban League of Greater Hartford. Mr. Zern holds a BA from the State University of New York at Stony Brook.

Michael L. Alberts (53) – Mr. Alberts is Senior Vice President and Chief Commercial Banking Officer of the Bank, which positions he has held since 2011. Prior to these positions, Mr. Alberts was a Vice President and Commercial Relationship Manager at the Bank since 2009. Prior to joining the Bank, Mr. Alberts was Senior Vice President and Senior Commercial Loan Officer with Putnam Bank from 2007 to 2009. Prior to that, he was a Vice President with Savings Institute Bank & Trust Company from 2004 to 2007. Since 2005, he has been the State Representative for Connecticut’s 50th Assembly District and currently serves as the Ranking Member of the Banks Committee. Mr. Alberts holds undergraduate and graduate degrees from the University of Connecticut, including a Master’s Degree in Business Administration.

Audit and Compliance Committee Financial Expert

The Board has determined that the Company currently has at least one audit committee financial expert serving on its Audit and Compliance Committee. That person was Robert J. Bogino from January 1, 2011 to March 16, 2011, at which time Nicholas B. Mason was determined to be the audit committee financial expert upon his election to the Board and the Audit and Compliance Committee. Each of Mr. Bogino and Mr. Mason is “independent,” as that term is defined in Rule 5605 of the NASDAQ listing standards.

Independence of Directors and Director Nominees

The following directors and director nominees are independent in accordance with Rule 5605 of the NASDAQ listing standards: Robert J. Bogino, James T. Fleming, Gary R. Kevorkian, Jerry W. Long, Nicholas B. Mason, Michael D. Nicastro, George B. Odlum, Jr., DMD, David W. Sessions, Rodney R. Reynolds and Penny R. Woodford.

Board Leadership Structure and the Board’s Role in Risk Oversight

The Company has an independent Chairman separate from the Chief Executive Officer. The Board believes it is important to have an independent director in a board leadership position at all times. The Company’s Chairman provides independent leadership of the Board. Having an independent Chairman enables non-management directors to raise issues and concerns for Board consideration without immediately involving management. The Chairman also serves as a liaison between the Board and senior management. The Board has determined that having an independent Chairman separate from the Chief Executive Officer is the most appropriate structure for risk oversight of the Company.

Risk management at the Company is the process of identifying, measuring, controlling and monitoring risk across the enterprise. Risk management crosses all functions and employees and is embedded in all aspects of planning and performance measurement. Systems, information and timely reporting enable the Company to identify, measure, control and monitor risk throughout the enterprise.

The Board is responsible for oversight of the Company’s enterprise risk framework. The Board has delegated primary responsibility to the Executive Committee for overseeing financial, investment and operational risk exposures, to the Audit and Compliance Committee for overseeing regulatory and legal risk, to the Loan Committee of the Bank for overseeing credit risk, and to the Compensation and Human Resources Committee for oversight of risk related to management and staff. These Committees report to the full Board to ensure the Company’s overall risk exposures are understood, including risk interrelationships. Risk reports are provided at Committee and Board meetings and the Board regularly engages in discussions of these risk reports and risk management. The Board also oversees reputational risk.

The Board of Directors presently has four standing committees – the Audit and Compliance Committee, the Corporate Governance Committee, the Executive Committee and the Compensation and Human Resources Committee.

Audit and Compliance Committee of the Company. The Audit and Compliance Committee has oversight responsibility for and reviews all financial and other reports provided by the Company’s independent auditors and the Company’s internal audit firm. The Audit and Compliance Committee evaluates and selects the independent auditor subject to shareholder ratification. The Audit and Compliance Committee, in its meetings with the Company’s auditors, discusses and approves the audit and compliance scope and reviews all audit findings. The members of the Audit and Compliance Committee are Messrs. Odlum (Chair), Bogino (until March 2011), Fleming, Guarco (until October 2011), Mason (since March 2011) and Ms. Woodford. All members of the Audit and Compliance Committee are independent in accordance with Rule 5605 of the NASDAQ listing standards. The Audit and Compliance Committee operates pursuant to a written charter adopted by the Board. The Audit and Compliance Committee met seven times during 2011.

Corporate Governance Committee of the Company. The Corporate Governance Committee functions as the nominating committee for director candidates, identifies qualified individuals to become members of the Company’s Board of Directors, determines the composition of the Board of Directors and its committees, monitors and assesses the effectiveness of the Board of Directors, develops and implements the Company’s corporate governance guidelines and reviews and recommends director compensation. All members of the Corporate Governance Committee are independent as that term is defined in Rule 5605 of the NASDAQ listing standards. The members of the Corporate Governance Committee are Messrs. Bogino (Chair), Fleming, Mason (since March 2011), Reynolds and Ms. Woodford. The Corporate Governance Committee operates pursuant to a written charter adopted by the Board. The Corporate Governance Committee met six times during 2011.

The Corporate Governance Committee has a formal policy regarding the consideration of director candidates recommended by shareholders which sets forth the minimum qualifications of suitable nominees for director as well as approved processes for identifying and evaluating nominees. The Corporate Governance Committee will consider any director candidate recommended by shareholders in accordance with the standards set forth in its charter. Such suggestions, together with appropriate biographical information, should be submitted to: SBT Bancorp, Inc., Attn: Gary R. Kevorkian, Secretary, 760 Hopmeadow Street, P.O. Box 248, Simsbury, Connecticut 06070. Possible candidates who have been suggested by shareholders are evaluated by the Corporate Governance Committee in the same manner as are other possible candidates.

The general criteria used to establish the traits, abilities and experience that the Corporate Governance Committee looks for in determining candidates for election to the Board include highest ethical character, independence from management, ability to represent all shareholders of the Company, ability to exercise sound business judgment, relevant expertise and experience that would benefit the Company and the ability to offer advice and guidance to the Chief Executive Officer and the Board. Key among the criteria is a director’s existing ties to the Company’s markets and adherence to Company’s Code of Ethics and Conflicts of Interest Policy. All directors are subject to mandatory retirement from service on the Company’s Board of Directors upon reaching seventy-six years of age. The Corporate Governance Committee has not adopted a formal diversity policy with regard to the selection of director nominees. However, the Corporate Governance Committee considers diversity as a factor in identifying director nominees and believes the Board as a whole should be a diverse body, with diversity reflecting age, gender, background and professional experience.

Executive Committee of the Company. The Executive Committee is responsible for the general supervision of the Company’s affairs between meetings of the full Board, oversees the Company’s investments, asset/liability management, budget and capital planning and reviews the Company’s interest rate sensitivity and deposit and loan pricing. The Executive Committee is also responsible for overseeing the Company’s information technology planning, security and development. In addition, the Executive Committee’s responsibilities also include reviewing the financial and market performance of the subsidiary offering non-deposit products (including review and approval of the selection of and contracts with third party broker/dealers, review of all product types sold, appointment of Bank management to fill needed roles, recommendation of prudent policies and procedures, setting of commission structures and oversight of compliance with applicable regulations) and evaluating opportunities in the marketplace for enhancing the Company’s offering of non-deposit products and services. The members of the Executive Committee are Messrs. Sessions (Chair), Bogino, Geitz, Kevorkian and Odlum. The Executive Committee met 16 times during 2011.

Compensation and Human Resources Committee of the Company. The Compensation and Human Resources Committee determines the compensation of the employees of the Company and the Bank, including executive officers other than the President and CEO. In determining the compensation of the Company and Bank’s employees, including executive officers other than the President and CEO, the Compensation and Human Resources Committee considers the recommendations of Martin J. Geitz, President and CEO of the Company and the Bank. The Compensation and Human Resources Committee also reviews, but does not determine, the compensation of (i) the President and CEO of the Company and the Bank and (ii) the directors. Recommendations regarding the President and CEO’s compensation are made by the Compensation and Human Resources Committee to the full Board, which then approves the President and CEO’s compensation. With respect to director compensation, the Compensation and Human Resources Committee will make recommendations to the Corporate Governance Committee, which then recommends the amount of director compensation to the full Board for approval. The members of the Compensation and Human Resources Committee are Messrs. Kevorkian (Chair), Bogino, Guarco (until October 2011), Long, Reynolds and Sessions. All members of the committee are independent in accordance with Rule 5605 of the NASDAQ listing standards. The Compensation and Human Resources Committee operates pursuant to a written charter adopted by the Board on February 16, 2011. This committee met 11 times in 2011.

The Bank’s Board of Directors has a Loan Committee, all of whose members other than Mr. Nicastro are directors of both the Bank and the Company. The Loan Committee is responsible for the review and approval of consumer, mortgage and commercial loan requests above the respective individual or collective lending authorities of Bank loan officers as established in the Bank’s Loan Policy. The Loan Committee is also responsible for ensuring compliance with the Bank’s credit policies as annually approved by the Bank’s Board of Directors, including the review and monitoring of the diversification of the loan portfolio and oversight of the Bank’s compliance with the Community Reinvestment Act (CRA). The Loan Committee also reviews and monitors the growth and credit quality of the loan portfolio, including loan originations, delinquencies, risk rating changes, loan loss reserves and loan collection activities. The members of the Loan Committee are Messrs. Sessions (Chair), Bogino, Geitz, Kevorkian, Long and Nicastro. The Loan Committee met 30 times during 2011.

Availability of Committee Charters

The Audit and Compliance Committee, the Compensation and Human Resources Committee Charter and the Corporate Governance Committee each operates pursuant to a separate written charter adopted by the Board. Each committee reviews its charter at least annually. The three committee charters can be viewed at http://investors.simsburybank.com/govdocs.aspx?iid=4100578. Each charter is also available in print to any shareholder who requests it. The information contained on the website is not incorporated by reference or otherwise considered a part of this document.

Board Meetings

The Board held 19 meetings during 2011. All of the Company’s incumbent directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by the committees of the Board of Directors on which such directors served during 2011.

Board members are expected to attend the Company’s annual meeting of shareholders. Ten of the eleven directors of the Company at the time of the Company’s 2011 annual meeting of shareholders attended such meeting.

Shareholder Communications

The Board of Directors has a formal process in place for shareholder communication to the Board of Directors or any individual director. Shareholders wishing to communicate with the Board of Directors or any individual director may write to SBT Bancorp, Inc., Gary R. Kevorkian, Secretary, 760 Hopmeadow Street, P.O. Box 248, Simsbury, Connecticut 06070. All communications received of a relevant nature will be forwarded to the full Board or appropriate individual director as directed. The Board of Directors believes this approach is reasonable in light of the relatively small number of shareholders of the Company and the relatively small number of communications the Board expects to receive in the foreseeable future.

Code of Ethics and Conflicts of Interest Policy

The Company has adopted a Code of Ethics and Conflicts of Interest Policy that applies to all employees, officers and directors. The Company will supply a copy of the Code of Ethics and Conflicts of Interest Policy upon written or oral request. To obtain a copy please write to us at SBT Bancorp, Inc., 760 Hopmeadow Street, P.O. Box 248, Simsbury, Connecticut 06070-0248 or call the Company at (860) 408-5493.

COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table presents information relating to the compensation of the Company’s CEO and the next two most highly compensated executive officers (collectively, the “Named Executive Officers”) for the fiscal years ended December 31, 2011, 2010 and 2009.

Summary Compensation Table

Name and principal position | Year | Salary | Bonus | Stock awards | Option awards | Non-equity incentive plan compensation | Non-qualified deferred earnings | All other Compensation | Total |

| | | | | | | | | | |

Martin J. Geitz President & Chief Executive Officer | 2011 2010 2009 | $242,944 (1) $214,715 (1) $187,400 (1) | $48,577 (2) $0 $0 | $62,250 (3) $0 $0 | $0 $0 $0 | $0 $0 $0 | $0 $0 $0 | $90,261 (4) $41,681 (4) $23,363 (5) | $444,032 $256,396 $210,763 |

| | | | | | | | | | |

Anthony F. Bisceglio Executive Vice President & Chief Financial Officer | 2011 2010 2009 | $146,991 $141,842 $135,000 | $22,074 (6) $20,160 (7) $10,000 (8) | $22,248 (9) $0 $0 | $0 $0 $0 | $0 $0 $0 | $0 $0 $0 | $86,146 (10) $55,982 (10) $ 5,238 (11) | $277,459 $217,984 $150,238 |

| | | | | | | | | | |

Michael T. Sheahan (12) Senior Vice President &Chief Mortgage & Consumer Lending Officer | 2011 2010 | $128,462 $110,577 | $47,602 (13) $49,000 (14) | $19,500 (15) $0 | $0 $0 | $0 $0 | $0 $0 | $5,836 (16) $ 425 (17) | $201,400 $160,002 |

| (1) | Mr. Geitz also serves as a director, but does not receive any compensation for those services. |

| | |

| (2) | 2011 performance bonus to be paid in 2012. |

| | |

| (3) | On August 17, 2011, Martin J. Geitz received a grant from the Company of 3,080 shares of restricted stock with a fair market value of $62,250 on the date of grant. Such shares of restricted stock will vest over three years as follows: 1,026 shares on August 17, 2012, 1,026 shares on August 17, 2013 and 1,028 shares on August 17, 2014. |

| | |

| (4) | Includes Mr. Geitz’s personal use of a Bank-leased automobile, annual dues for country club membership, employer match of 401k Plan contributions, employer-paid premiums for group term life insurance in excess of $50,000, employer-paid premiums for life insurance under an endorsement split-dollar insurance agreement, employer-paid portion of health insurance normally paid by an employee and employer-paid amounts for a Supplemental Executive Retirement Plan (“SERP”). The imputed income related to the SERP accounted for 64.5% and 33.7%, respectively, of the amount under “All Other Compensation” in 2011 and 2010. |

| | |

| (5) | Includes Mr. Geitz’s personal use of a Bank-leased automobile, annual dues for country club membership, employer match of 401k Plan contributions, employer-paid premiums for group term life insurance in excess of $50,000 and employer-paid portion of health insurance normally paid by an employee. |

| | |

| (6) | 2011 performance bonus to be paid in 2012. |

| | |

| (7) | 2010 performance bonus paid in 2011. |

| | |

| (8) | 2009 performance bonus paid in 2010. |

| | |

| (9) | On August 17, 2011, Anthony F. Bisceglio received a grant from the Company of 1,101 shares of restricted stock with a fair market value of $22,248 on the date of grant. Such shares of restricted stock will vest over three years as follows: 367 shares on August 17, 2012, 367 shares on August 17, 2013 and 367 shares on August 17, 2014. |

| | |

| (10) | Includes Mr. Bisceglio’s employer match of 401k Plan contributions, employer-paid premiums for group term life insurance in excess of $50,000 and employer-paid amounts for a Supplemental Executive Retirement Plan (“SERP”). The imputed income related to the SERP accounted for 91.9% and 89.7%, respectively, of the amount under “All Other Compensation” in 2011 and 2010. |

| | |

| (11) | Includes Mr. Bisceglio’s employer match of 401k Plan contributions and employer-paid premiums for group term life insurance in excess of $50,000. |

| (12) | Mr. Sheahan was not a Named Executive Officer for 2009. |

| | |

| (13) | 2011 performance bonus to be paid in 2012. |

| | |

| (14) | Includes $5,000 of performance bonus paid in 2010 for 2010 performance and $44,000 paid in 2011 for 2010 performance. |

| | |

| (15) | On August 17, 2011, Michael T. Sheahan received a grant from the Company of 965 shares of restricted stock with a fair market value of $19,500 on the date of grant. Such shares of restricted stock will vest over three years as follows: 321 shares on August 17, 2012, 321shares on August 17, 2013 and 323 shares on August 17, 2014. |

| | |

| (16) | Includes Mr. Sheahan’s employer match of 401k Plan contributions and employer-paid premiums for group term life insurance in excess of $50,000. |

| | |

| (17) | Includes Mr. Sheahan’s employer-paid premium for group term insurance in excess of $50,000. |

The Compensation and Human Resources Committee is responsible for reviewing the performance and establishing the compensation of the Bank’s officers and key employees, including the Company’s executive officers other than the President and CEO. The Committee also reviews, but does not determine, the compensation of the President and CEO and makes a recommendation of his compensation to the full Board, which then approves the President and CEO’s compensation. The Committee relies upon industry information, including surveys of similarly sized and located institutions and targets the Bank’s compensation to be generally at the level of its peer group institutions.

The Compensation and Human Resources Committee retained the services of Arthur Warren Associates during 2010 and the first quarter of 2011 to advise such committee on executive compensation matters and non-executive employee compensation matters. Arthur Warren Associates was engaged to perform a strategic review of the total compensation program of the Company’s executive officers (including the three named executive officers) and develop a long term equity compensation plan. In addition, the Compensation and Human Resources Committee retained Arthur Warren Associates to review the Bank’s model compensation philosophy statement, the charter for the Compensation and Human Resources Committee and the Bank’s executive management succession plan, develop short-term bonus plans for both non-executive employees and executive employees, and provide recommendations to enhance the Bank’s existing defined contribution retirement plan. The work performed by Arthur Warren Associates was completed in the first quarter of 2011.

The Compensation and Human Resources Committee instructed Arthur Warren Associates to benchmark the Bank’s compensation programs against its peers to ensure that such programs are consistent with prevailing practices in its industry. The peer group consisted of three market surveys (Connecticut Bankers Association, Economic Research Institute and Pearl Meyer & Partners) as well as 10 publicly traded banks within the region having assets ranging between $134 million and $559 million. The banks included in the public bank peer analysis were Salisbury Bancorp, Inc., PSB Holdings, Inc., Greene County Bancorp, Newport Bancorp, Bancorp of New Jersey, Inc., Cornerstone Financial Corp, BNC Financial Group, Inc., Mayflower Bancorp, Connecticut River Community Bank and Southern Connecticut Bancorp, Inc. Based on the analysis prepared by Arthur Warren Associates, the Compensation and Human Resources Committee determined that the Bank’s compensation programs and levels were generally lower than the compensation programs and levels maintained by the Bank’s peers. Accordingly, the Compensation and Human Resources Committee took actions in early 2011 to increase the compensation of its executive officers to levels that were consistent with the Bank’s peers. The members of the Compensation and Human Resources Committee are Messrs. Kevorkian (chair), Bogino, Guarco (until October 2011), Long, Reynolds and Sessions.

Employment and Change in Control Agreements

The Bank maintains employment or change in control agreements with the following named executive officers: Messrs. Geitz, Bisceglio and Sheahan. The continued success of the Company and the Bank depends to a significant degree on the skills and competence of these officers. These agreements are with the Bank, not the Company.

Martin J. Geitz, President and Chief Executive Officer – The Bank and Martin J. Geitz are parties to an Employment Agreement, effective as of October 4, 2004, which was subsequently amended effective as of December 31, 2008. The term of that agreement is the earlier to occur of Mr. Geitz attaining the age of sixty-five or the termination of Mr. Geitz’s contract voluntarily or upon some other basis. Mr. Geitz is to be paid a salary of $170,000, subject to adjustment by the Board. In addition, Mr. Geitz is entitled to an annual bonus in an amount and form set by the Board. Option grants and restricted stock awards are discussed in the footnotes of the Summary Compensation Table and the Outstanding Equity Awards Table. Mr. Geitz is entitled to: (1) participate in the Bank’s comprehensive health insurance and major medical coverage; (2) participate in any long-term disability insurance plan (monthly cap of $25,000 compared to $8,000 for employees who are not executive officers) and pension plan maintained by the Bank; (3) paid vacation of four weeks per year; (4) the use of an automobile for business purposes; (5) membership in a private “country” or similar golf club; and (6) attendance at two banking trade association conventions per year, including the cost of attendance and travel for Mr. Geitz and his spouse. The Bank may terminate Mr. Geitz’s employment at any time without notice. The Bank may give up to sixty days’ prior notice of the termination. If such notice is given to Mr. Geitz, the Bank may require him to remain in the employ of the Bank for the period of notice given. If the Bank terminates Mr. Geitz’s employment other than for Cause or due to a Change in Control or potential Change in Control (as such terms are defined in the Employment Agreement), Mr. Geitz shall be entitled to receive a lump sum payment equal to the aggregate of: (1) twelve months of Mr. Geitz’s then current salary base salary; (2) an amount equal to bonus to which he would have been entitled under the agreement had a Change of Control occurred; (3) payment for any accrued but unused vacation time; and (4) payment of Mr. Geitz’s medical insurance for twelve months following his termination. This lump sum amount shall be reduced by any compensation Mr. Geitz receives for other employment after the termination of his employment with the Bank. Mr. Geitz may voluntarily terminate his employment on ninety days’ prior notice to the Bank, however, notice need not be given where the termination has been approved by the Board of Directors or there has been a material breach of the Bank’s obligations under the agreement. If Mr. Geitz fails to meet the terms of the agreement concerning his voluntary termination, the Bank will be entitled to enjoin Mr. Geitz’s employment with any significant competitor of the Bank for a period of twelve months.

In the event of a Change in Control or Potential Change in Control of the Bank or the Company, Mr. Geitz would be entitled to receive (1) credit for his years of service to the Bank plus five additional years for purposes of vesting and calculation of benefits under any benefit plan of the Bank or a successor thereto; (2) twelve months notice of termination during which time he shall receive payment at his then current salary and the highest bonus received by Mr. Geitz during the preceding thirty-six months, provided that if the Change in Control occurs prior to December 31, 2005 the amount of the bonus will equal $25,000; (3) a lump sum cash payment in an amount equal to the sum of Mr. Geitz’s then current salary plus the highest bonus he had received during the preceding 36 months; and (4) outplacement services in an amount not to exceed $10,000. Mr. Geitz is not entitled to receive compensation or other benefits for any period after termination for Cause. Notwithstanding anything to the contrary set forth in Mr. Geitz’s Employment Agreement, any payments due to Mr. Geitz as a result of his termination of employment may be delayed for up to six months after his termination of employment if the Bank determines that the delay is necessary to comply with Section 409A of the Internal Revenue Code. In the event that payments are delayed, the Bank will pay 5% simple interest on such delayed payments to Mr. Geitz.

The Bank and Martin J. Geitz are parties to a Supplemental Executive Retirement Agreement dated October 20, 2010. The agreement was approved by the Board in November 2008 but implementation was deferred pending a determination that implementation of the agreement was permissible under the terms of the United States Department of the Treasury’s Troubled Assets Relief Program (“TARP”) Capital Purchase Program in which the Bank was participating. The agreement is an unfunded, non-qualified supplemental retirement program for Mr. Geitz and provides for supplemental retirement benefits payable in installments over 15 years upon his attainment of normal retirement age of 65. The supplemental retirement benefits are to be earned over the remaining working career of Mr. Geitz subject to certain conditions. Under the agreement, the projected retirement benefit for Mr. Geitz, assuming he remains employed by the Bank until normal retirement age of 65, is $82,800 per year for 15 years, with such payments beginning in the year 2021. The benefits are capped at $82,800 per year for 15 years and are subject to being substantially less should Mr. Geitz not remain employed until the normal retirement age of 65. The agreement also contains restrictive covenants that may result in Mr. Geitz forfeiting all accrued benefits should he be terminated for cause, removed by regulatory order, or accept employment with a competing financial institution within 12 months after his termination of employment with the Bank.

The Bank and Martin J. Geitz are parties to an Endorsement Split Dollar Insurance Agreement dated October 20, 2010. This agreement provides for the division of death proceeds under certain life insurance policies owned by the Bank on the life of Mr. Geitz with the Mr. Geitz’s designated beneficiary. The Bank has the right to exercise all incidents of ownership of the life insurance policies and may terminate such policies without the consent of Mr. Geitz. Under the agreement, if Mr. Geitz dies prior to termination of his employment for reasons other than death or disability, Mr. Geitz’s designated beneficiary will be entitled to a benefit of $750,000, which will increase four percent (4%) on each anniversary of the effective date of the agreement. In no event will the benefit exceed the total death proceeds of the life insurance policies minus the greater of (i) such policies’ cash surrender value or (ii) the aggregate premiums paid by the Bank for such policies. If Mr. Geitz dies after termination of his employment with the Bank for reasons other than death or disability, Mr. Geitz’s designated beneficiary will not be entitled to any benefits. Mr. Geitz’s rights under this agreement will terminate if he is subject to a final removal or prohibition order issued by an appropriate federal banking agency. Under the agreement, no benefits will be paid to Mr. Geitz’s designated beneficiary if he commits suicide prior to September 15, 2012 or if the insurance company denies coverage for any reason, provided, however, that the Bank will evaluate the reasons for denial and, upon advice of legal counsel and in its sole discretion, consider judicially challenging such denial.

Anthony F. Bisceglio, Executive Vice President, Treasurer and Chief Financial Officer – Anthony F. Bisceglio is an at-will employee of the Company and the Bank. He is entitled to receive paid time off of 28 days per year and to participate in the Bank’s benefit plans, including its medical plan, dental plan, group term life insurance plan ($300,000 in coverage compared to $200,000 for employees who are not executive officers), long-term disability insurance plan (monthly cap of $25,000 compared to $8,000 for employees who are not executive officers) and 401k retirement plan. In addition, effective in late March 2012, he became entitled to an additional $100,000 in life insurance benefits in the event he dies while an active employee of the Bank.

The Bank has entered into a Change in Control Agreement with Mr. Bisceglio dated December 29, 2010. Pursuant to the Change in Control Agreement, in the event Mr. Bisceglio is terminated by the Bank without Cause (as defined in the Change in Control Agreement) or he resigns for Good Reason (as defined in the Change in Control Agreement) upon a Change in Control (as defined in the Change in Control Agreement) or during the remainder of the month in which a Change in Control occurs and 12 months thereafter, Mr. Bisceglio will be entitled to, among other benefits, the following: (i) a lump sum payment equal to two times the sum of (a) the greater of his annual base salary in effect immediately prior to the Change in Control or his annual base salary in effect at the time a notice of termination is given and (b) the greater of his annual target bonus for the year in which the Change in Control occurs or his annual bonus for the year immediately preceding the year in which the Change in Control occurs; (ii) accelerated vesting of his stock options, restricted stock and any other performance related incentive compensation awards; and (iii) 24 months of health insurance benefits on the same terms as were provided prior to termination of employment. The Change in Control Agreement shall continue in effect through December 31, 2011 and commencing on January 1, 2012 and for each January 1 thereafter, the Change in Control Agreement shall be automatically extended for one additional year unless the Bank or the Executive gives notice to the other party no later than September 30th of the preceding year that the Change in Control Agreement will not be extended. Notwithstanding anything to the contrary set forth in Mr. Bisceglio’s Change in Control Agreement, any payments due to Mr. Bisceglio as a result of his termination of employment may be delayed for up to six months after his termination of employment if the Bank determines that the delay is necessary to comply with Section 409A of the Internal Revenue Code. In the event that payments are delayed, the Bank will pay 5% simple interest on such delayed payments to Mr. Bisceglio.

The Bank entered into a Supplemental Executive Retirement Agreement with Mr. Bisceglio dated April 23, 2001. This Agreement provides that upon Mr. Bisceglio’s retirement on or after attaining age 65, the Bank shall pay him a supplemental annual pension of $10,000, payable in equal monthly installments, for a period of twenty years. Upon Mr. Bisceglio’s death, while still actively employed with the Bank, his designated beneficiary shall receive an annual survivor’s benefit equal to $10,000, payable in equal monthly installments, for a period of twenty years. Upon Mr. Bisceglio’s death, while receiving the supplemental annual pension, his designated beneficiary shall receive the remaining equal monthly payments which would have been due to Mr. Bisceglio. Furthermore, upon a change in control of the Company or the Bank, Mr. Bisceglio would be credited with five years of service with respect to the Supplemental Executive Retirement Agreement.

The Bank entered into an additional Supplemental Executive Retirement Agreement with Mr. Bisceglio dated May 7, 2010. This agreement is an unfunded, non-qualified supplemental retirement program for Mr. Bisceglio and provides for supplemental retirement benefits payable in installments over 15 years upon his attainment of normal retirement age of 65. The supplemental retirement benefits are to be earned over the remaining working career of Mr. Bisceglio subject to certain conditions. Under the agreement, the projected retirement benefit for Mr. Bisceglio, assuming he remains employed by the Bank until normal retirement age of 65, is $21,500 per year, with such payments beginning in the year 2012. The benefits are capped at the above amounts and are subject to being substantially less should Mr. Bisceglio not remain employed until the normal retirement age of 65. The Agreement also contains restrictive covenants that may result in Mr. Bisceglio forfeiting all accrued benefits should he be terminated for cause, removed by regulatory order, or accept employment with a competing financial institution after his termination of employment with the Company for a period as defined in the agreement.

Michael T. Sheahan, Senior Vice President and Chief Mortgage and Consumer Lending Officer – Michael T. Sheahan is an at-will employee of the Bank. He is entitled to receive paid time off of 28 days per year and to participate in the Bank’s benefit plans, including its medical plan, dental plan, group term life insurance plan ($300,000 in coverage compared to $200,000 for employees who are not executive officers), long-term disability insurance plan (monthly cap of $25,000 compared to $8,000 for employees who are not executive officers) and 401k retirement plan. In addition, effective in late March 2012, he became entitled to an additional $100,000 in life insurance benefits in the event he dies while an active employee of the Bank.

The Bank has entered into a Change in Control Severance Agreement with Mr. Sheahan dated November 2, 2010. Pursuant to the Change in Control Agreement, in the event Mr. Sheahan is terminated by the Bank without Cause (as defined in the Change in Control Agreement) or he resigns for Good Reason (as defined in the Change in Control Agreement) upon a Change in Control (as defined in the Change in Control Agreement) or during the remainder of the month in which a Change in Control occurs and 12 months thereafter, Mr. Sheahan will be entitled to, among other benefits, the following: (i) a lump sum payment equal to two times the sum of (a) the greater of his annual base salary in effect immediately prior to the Change in Control or his annual base salary in effect at the time a notice of termination is given and (b) the greater of his annual target bonus for the year in which the Change in Control occurs or his annual bonus for the year immediately preceding the year in which the Change in Control occurs; (ii) accelerated vesting of his stock options, restricted stock and any other performance related incentive compensation awards; and (iii) 24 months of health insurance benefits on the same terms as were provided prior to termination of employment. The Change in Control Agreement was in effect through December 31, 2010 and as of January 1, 2011, it was automatically extended for one additional year. Commencing each January 1 thereafter, the Change in Control Agreement shall be automatically extended for one additional year unless the Bank or the Executive gives notice to the other party no later than September 30th of the preceding year that the Change in Control Agreement will not be extended. Notwithstanding anything to the contrary set forth in Mr. Sheahan’s Change in Control Agreement, any payments due to Mr. Sheahan as a result of his termination of employment may be delayed for up to six months after his termination of employment if the Bank determines that the delay is necessary to comply with Section 409A of the Internal Revenue Code. In the event that payments are delayed, the Bank will pay 5% simple interest on such delayed payments to Mr. Sheahan.

Equity Awards

On August 17, 2011, Martin J. Geitz received a grant from the Company of 3,080 shares of restricted stock with a fair market value of $62,250 on the date of grant. Such shares of restricted stock will vest over three years as follows: 1,026 shares on August 17, 2012, 1,026 shares on August 17, 2013 and 1,028 shares on August 17, 2014.

On August 17, 2011, Anthony F. Bisceglio received a grant from the Company of 1,101 shares of restricted stock with a fair market value of $22,248 on the date of grant. Such shares of restricted stock will vest over three years as follows: 367 shares on August 17, 2012, 367 shares on August 17, 2013 and 367 shares on August 17, 2014.

On August 17, 2011, Michael T. Sheahan received a grant from the Company of 965 shares of restricted stock with a fair market value of $19,500 on the date of grant. Such shares of restricted stock will vest over three years as follows: 321 shares on August 17, 2012, 321 shares on August 17, 2013 and 323 shares on August 17, 2014.

The outstanding equity awards held by the Named Executive Officers as of December 31, 2011 were as follows:

Outstanding Equity Awards at Fiscal Year-End

| | | Option Awards(1) | | | Stock Awards(2) | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) | |

Martin J. Geitz, President & Chief Executive Officer | | | 21,000 | (1) | | | 0 | | | | $31.50 | | | 12/20/2015 | | | | 3,080 | (2) | | | $62,250 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Anthony F. Bisceglio, Executive Vice President, Treasurer & Chief Financial Officer | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 1,101 | (2) | | | $22,248 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Michael T. Sheahan Senior Vice President & Chief Mortgage & Consumer Lending Officer | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 965 | (2) | | | $19,500 | |

| | (1) | Options vested at the rate of 33 1/3% per year, with vesting dates of 12/21/2006, 12/21/2007 and 12/21/2008. Vesting was conditioned on the named individual remaining an employee until the end of each vesting period. |

| | (2) | Restricted stock awards vest at the rate of 33 1/3% per year, with vesting dates of 8/17/2012, 8/17/2013 and 8/18/2014. Vesting is conditioned on the named individual remaining an employee until the end of each vesting period. |

Director Compensation

The Company has adopted a Director Compensation Plan for non-employee directors. From January 1, 2011 to February 28, 2011, directors were compensated for service by means of: (1) an annual retainer of $4,000 per director; (2) $450 for each Board meeting attended in person; and (3) $150 for each standing committee meeting attended in person. That compensation rate structure was changed effective March 1, 2011 to: (1) an annual retainer of $6,000 for directors; (2) an annual retainer of $8,000 for the chairman of the board; (3) $450 for each Board meeting attended in person; and (4) $200 for each standing committee meeting attended in person. No individual arrangements were granted during 2011. The following table sets forth the amount of compensation paid to non-employee directors in 2011.

| Director Compensation | |

| | | | | | | | | | | | | | | | | | | | | | |