Exhibit 99.1

Exhibit 99.1

Philips / Volcano Merger Presentation

December 17, 2014

1

Additional Information

The tender offer described in this communication (the “Offer”) has not yet commenced, and this communication is neither an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of Volcano Corporation (“Volcano”) or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the United States

Securities and Exchange Commission (the “SEC”) by Philips and a Solicitation/Recommendation

Statement on Schedule 14D-9 will be filed with the SEC by Volcano. The offer to purchase shares of Volcano common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION/ RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The tender offer statement will be filed with the SEC by Clearwater Merger Sub, Inc., a wholly owned subsidiary of Philips Holding USA Inc., which is a wholly owned subsidiary of Royal Philips, and the solicitation/recommendation statement will be filed with the SEC by Volcano. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the offer, which will be named in the tender offer statement.

2

Cautionary Statement Regarding Forward-Looking Statements

This release may contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, including without limitation completion of the tender offer and merger and any expected benefits of the merger. Completion of the tender offer and merger are subject to conditions, including satisfaction of a minimum tender condition and the need for regulatory approvals, and there can be no assurance that those conditions can be satisfied or that the transactions described in this release will completed. Often, but not always, forward-looking statements can be identified by the use of words such as “plans,” “expects,” “expected,” “scheduled,” “estimates,” “intends,” “anticipates,” “projects,” “potential,” “continues” or “believes,” or variations of such words and phrases or state that certain actions, events, conditions, circumstances or results “may,” “could,” “should,” “would,” “might” or “will” be taken, occur or be achieved. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, (i) the risk that not all conditions of the Offer or the merger will be satisfied or waived; (ii) uncertainties regarding the two companies’ ability to successfully market both new and existing products; (iii) uncertainties relating to the anticipated timing of filings and approvals relating to the Transactions; (iv) uncertainties as to the timing of the Offer and merger; (v) uncertainties as to how many of Volcano’s stockholders will tender their stock in the Offer; (vi) the possibility that competing offers will be made; (vii) the failure to complete the Offer or the merger in the timeframe expected by the parties or at all; (viii) the outcome of legal proceedings that may be instituted against Volcano and/or others relating to the Transactions; (ix) Volcano’s ability to maintain relationships with employees, customers, or suppliers; (x) domestic and global economic and business conditions; (xi) developments within the euro zone; (xii) the successful implementation of

Philips’ strategy and the ability to realize the benefits of this strategy; (xiii) legal claims; (xiv) changes in exchange and interest rates; (xv) changes in tax rates, raw materials and employee costs; (xvi) the ability to successfully exit certain businesses or restructure the operations; (xvii) the rate of technological changes; (xviii) political, economic and other developments in countries where Philips operates; and (xix) industry consolidation and competition. Any forward-looking statements in this release are based upon information known to Philips on the date of this announcement. Philips undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

3

What Did We Announce?

Transaction Details

Philips to acquire Volcano for a total value of approximately $USD 1.2 billion

(approx. EUR 1 billion), inclusive of Volcano’s cash and debt

Transaction to be executed through a tender offer of $18.00 per share for all outstanding shares of Volcano

Expected to close in Q1-2015

Transaction Summary

Combines two industry leaders in IGT

Volcano employees will become part of a dedicated, new IGT business group within Philips

Combines Volcano’s leading IP position and product portfolio with Philips’s global scale and resources

4

More About Philips

Leading health and well-being company headquartered in Amsterdam, with a rich history of innovation for over 100 years

Manufactures a broad range of medical devices and consumer products focused on health

Truly global company with approximately 115,000 employees in more than 100 countries, and annual revenues of more than $28 billion

Over the past few years, Philips has built a leading IGT business through strategic investments in R&D, partnerships and technology licenses

Over 2,000 of our current systems are used along with Philips systems at Volcano customers around the world

Have worked closely with Philips’s IGT for over five years

Mutually beneficial business relationship and strong admiration for Philips’s technology leadership, people, culture and values

5

Philips Introduction

Bert van Meurs

December 17, 2014

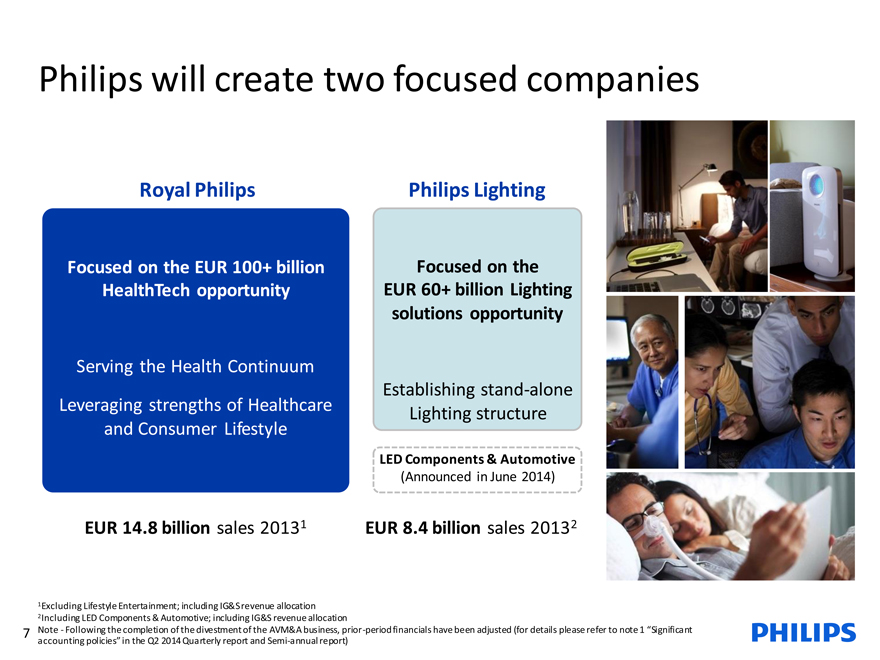

Philips will create two focused companies

Royal Philips

Focused on the EUR 100+ billion HealthTech opportunity

Serving the Health Continuum

Leveraging strengths of Healthcare and Consumer Lifestyle

Philips Lighting

Focused on the EUR 60+ billion Lighting solutions opportunity

Establishing stand-alone Lighting structure

LED Components & Automotive

(Announced in June 2014)

EUR 14.8 billion sales 20131

EUR 8.4 billion sales 20132

1Excluding Lifestyle Entertainment; including IG&S revenue allocation

2Including LED Components & Automotive; including IG&S revenue allocation

Note—Following the completion of the divestment of the AVM&A business, prior-period financials have been adjusted (for details please refer to note 1 “Significant accounting policies” in the Q2 2014 Quarterly report and Semi-annual report)

7

A rich 100+ year history in Healthcare

8

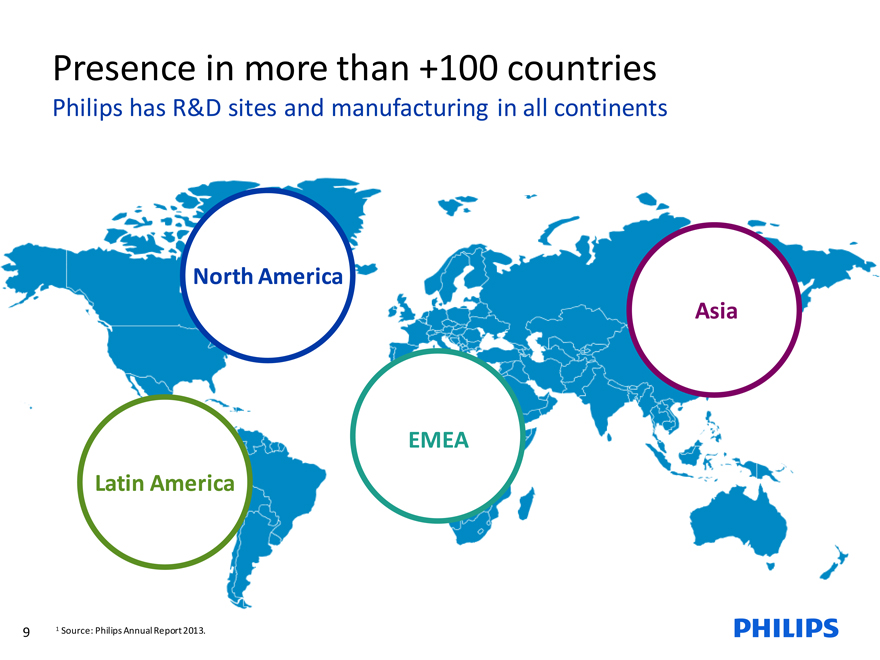

Presence in more than +100 countries

Philips has R&D sites and manufacturing in all continents

North America

Asia

EMEA

Latin America

9 1 Source: Philips Annual Report 2013.

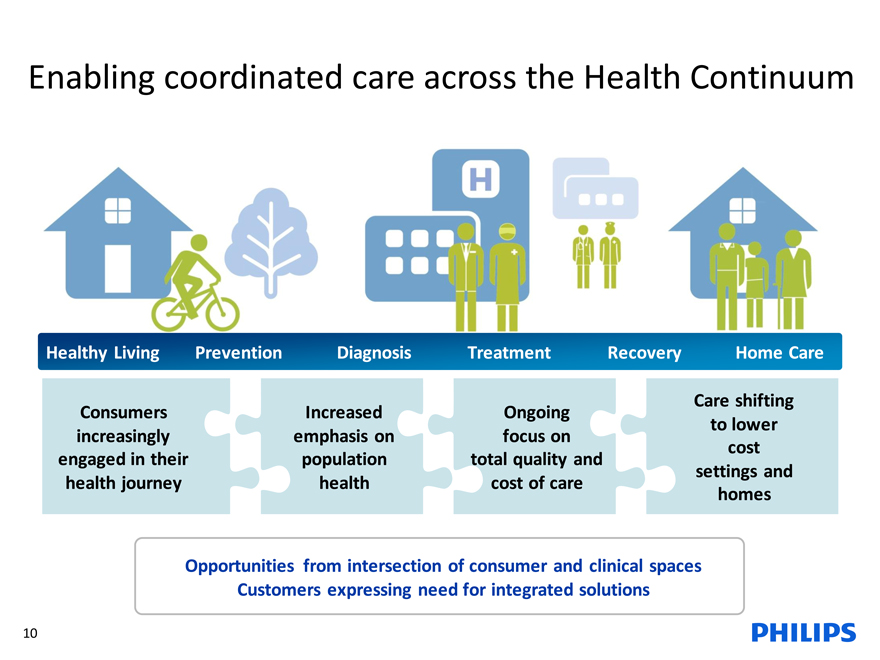

Enabling coordinated care across the Health Continuum

Healthy Healthy Living Living

Healthy Living

Prevention

Diagnosis

Treatment

Treatment

Recovery

Recovery

Home Care

Home Care

Consumers increasingly engaged in their health journey

Increased emphasis on population health

Ongoing focus on total quality and cost of care

Care shifting to lower cost settings and homes

Opportunities from intersection of consumer and clinical spaces Customers expressing need for integrated solutions

10

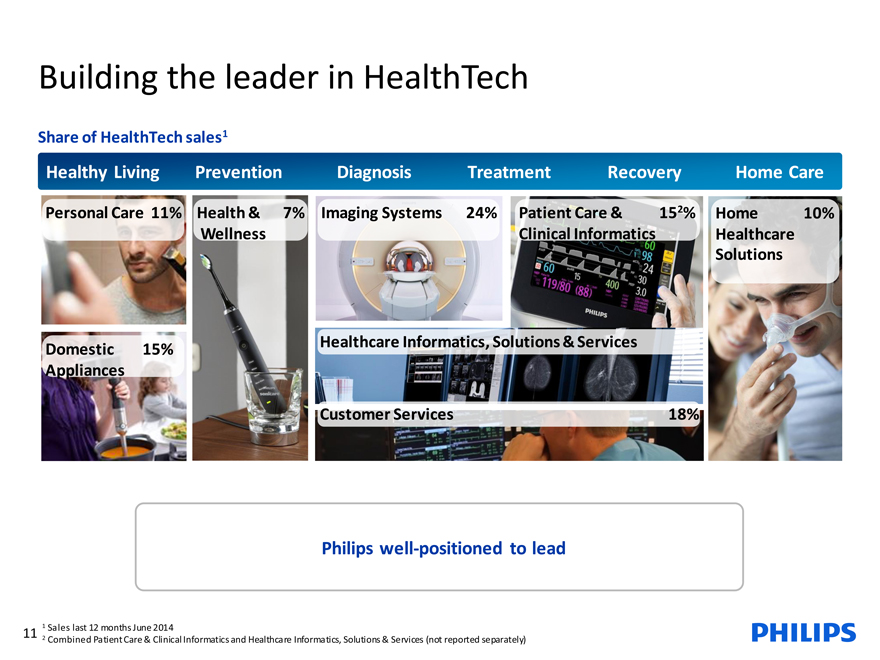

Building the leader in HealthTech

Share of HealthTech sales1

Healthy Living Prevention Diagnosis Treatment Recovery Home Care

Healthy Living Prevention Diagnosis Treatment Recovery Home Care

Personal Care 11%

Domestic 15% Appliances

Health & 7% Wellness

Imaging Systems 24%

Patient Care & 152% Clinical Informatics

Home 10%

Healthcare Solutions

Healthcare Informatics, Solutions & Services

Customer Services 18%

Philips well-positioned to lead

1 Sales last 12 months June 2014

11 2

Combined Patient Care & Clinical Informatics and Healthcare Informatics, Solutions & Services (not reported separately)

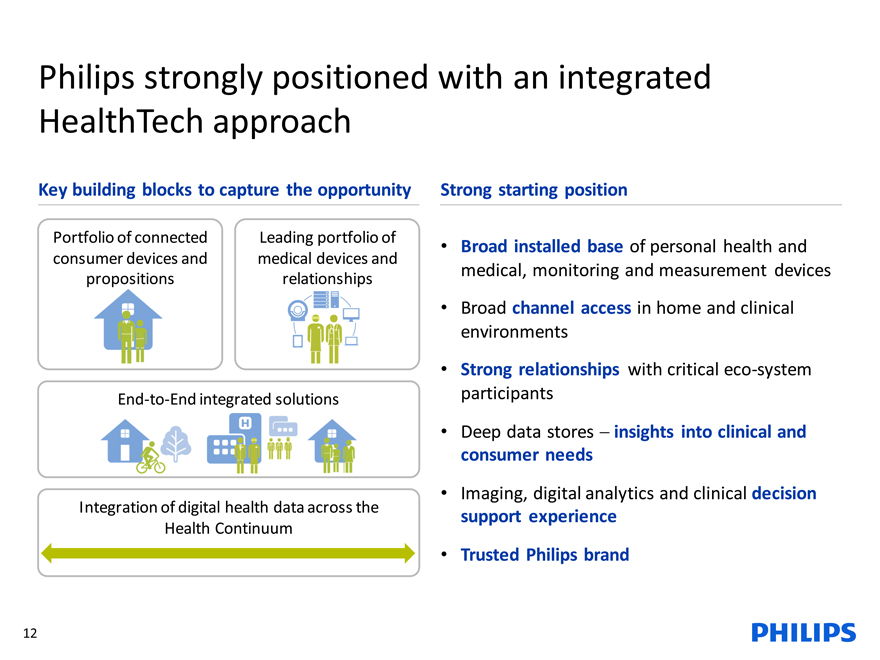

Philips strongly positioned with an integrated HealthTech approach

Key building blocks to capture the opportunity

Portfolio of connected consumer devices and propositions

Leading portfolio of medical devices and relationships

End-to-End integrated solutions

Integration of digital health data across the Health Continuum

Strong starting position

Broad installed base of personal health and medical, monitoring and measurement devices

Broad channel access in home and clinical environments

Strong relationships with critical eco-system participants

Deep data stores insights into clinical and consumer needs

Imaging, digital analytics and clinical decision support experience

Trusted Philips brand

12

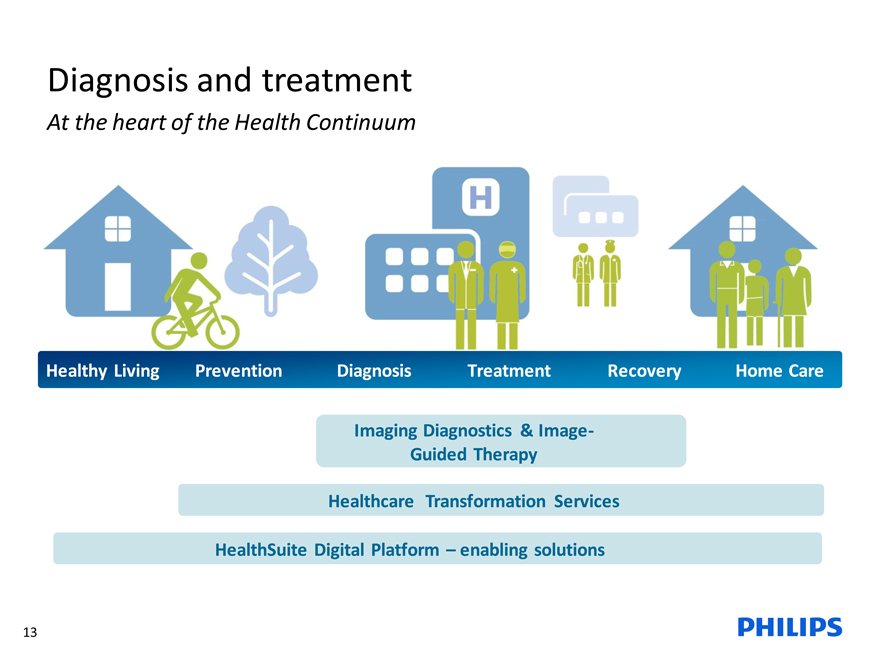

Diagnosis and treatment

At the heart of the Health Continuum

Healthy Healthy Living Living Prevention Diagnosis Treatment Recovery Home Care

Healthy Living Prevention Diagnosis Treatment Recovery Home Care

Imaging Diagnostics & Image-

Guided Therapy

Healthcare Transformation Services

HealthSuite Digital Platform – enabling solutions

13

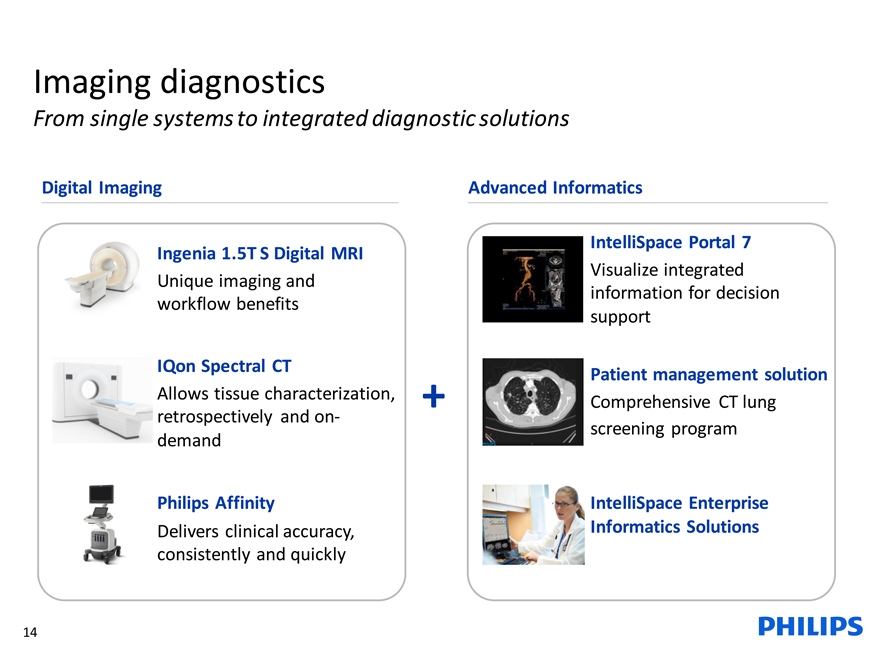

Imaging diagnostics

From single systems to integrated diagnostic solutions

Digital Imaging

Ingenia 1.5T S Digital MRI

Unique imaging and workflow benefits

IQon Spectral CT

Allows tissue characterization, retrospectively and on-demand

Philips Affinity

Delivers clinical accuracy, consistently and quickly

14

Advanced Informatics

IntelliSpace Portal 7

Visualize integrated information for decision support

Patient management solution

Comprehensive CT lung screening program

IntelliSpace Enterprise Informatics Solutions

Advancing treatment with image-guided therapy

Integrated solutions

Strong technology platforms and clinical Integration

Leadership positions in iXR1 and Ultrasound

Real time image processing

Device miniaturization

Deep clinical expertise

Expanding range of clinical applications for minimally invasive interventions

Wide range of clinical software solutions

Procedure planning, navigation and monitoring software

Disease specific applications

Integration of multimodality imaging techniques

Value-added services

Maintenance and utilization services

Education

Consultancy and integration services

X-ray radiation dose management services

15 1 iXR – Interventional X-Ray

2 US News & World Report

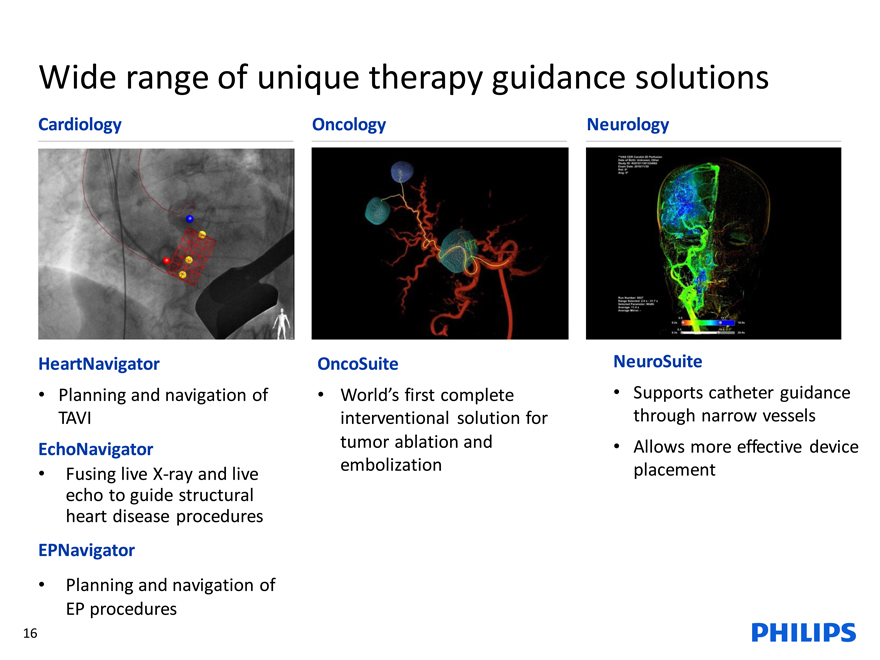

Wide range of unique therapy guidance solutions

Cardiology

Oncology

Neurology

HeartNavigator

Planning and navigation of TAVI

EchoNavigator

Fusing live X-ray and live echo to guide structural heart disease procedures

EPNavigator

Planning and navigation of EP procedures

16

OncoSuite

World’s first complete interventional solution for tumor ablation and embolization

NeuroSuite

Supports catheter guidance through narrow vessels

Allows more effective device placement

Innovating with industry-leading partners

100% of the top 50 U.S. Heart

Surgery and Cardiology

hospitals2 in 2014 have

chosen Philips

Plus:

– University Hospital Eppendorf

– University Hospital Beaujon

– University Hospital Zurich

– Antonius Hospital Nieuwegein

Top 50 cancer hospitals in the United States named by US News in 2014

17

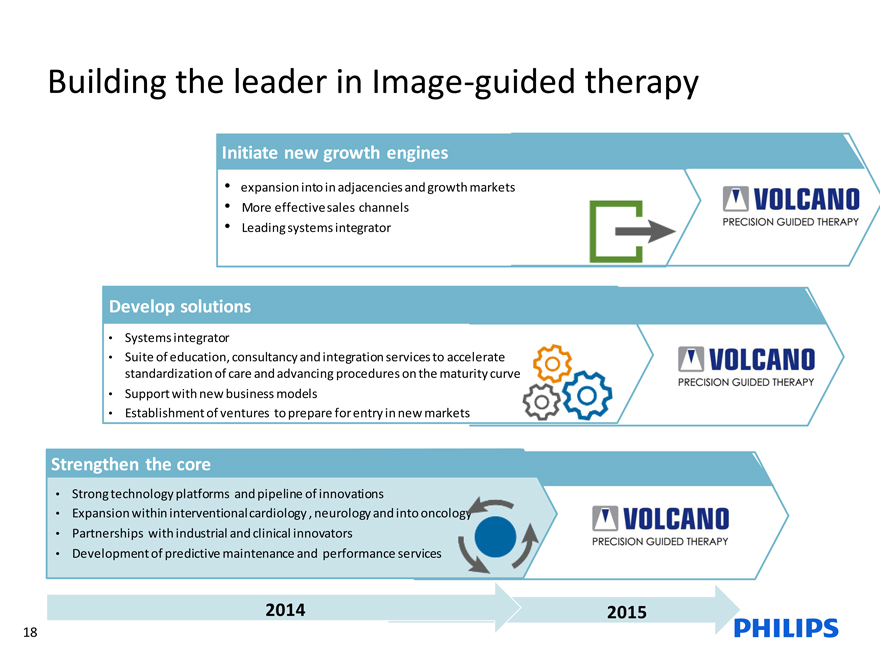

Building the leader in Image-guided therapy

Initiate new growth engines

expansion into in adjacencies and growth markets

More effective sales channels

Leading systems integrator

Develop solutions

Systems integrator

Suite of education, consultancy and integration services to accelerate standardization of care and advancing procedures on the maturity curve

Support with new business models

Establishment of ventures to prepare for entry in new markets

Strengthen the core

Strong technology platforms and pipeline of innovations

Expansion within interventional cardiology , neurology and into oncolo

Partnerships with industrial and clinical innovators

Development of predictive maintenance and performance services

2014

2015

18

Philips and Volcano, a merger of strengths We share a Vision and Passion for Healthcare

Mission:

Improving people’s lives through meaningful innovation

Vision:

At Philips, we strive to make the world healthier and more sustainable through innovation. Our goal is to improve the lives of 3 billion people a year by 2025. We will be the best place to work for people who share our passion. Together, we will deliver superior value for our customers and shareholders.

Mission:

To improve the lives of patients

Vision:

Through innovation and dedication to our values, we seek to provide the means for superior therapeutic solutions that enable patients to live long fulfilling lives.

19

PHILIPS

What Does This Mean for Volcano Employees?

GROWTH: Today’s announcement is about growth and positioning Volcano at the forefront of the global IGT industry

CAREER DEVELOPMENT: Expanded growth and career development opportunities for many Volcano employees as part of the larger Philips organization

SCALE: Joining with Philips will provide increased scale to capitalize on the large and growing global IGT market, accelerate our goals of improving patient outcomes on a global basis, lowering cost and delivering innovative diagnostics and therapies

GLOBALIZE: Shared expertise in the IGT market will allow us to further globalize IVUS and FFR products and continue to innovate in new product areas

Philips: an Ideal Fit for Volcano

Employees gain the enhanced resources to support our customers and the added benefits of being a part of a larger organization

21

What Are the Next Steps?

Business as Usual: Until closing, will continue to operate as an independent company

Focused on Customers: Merger announcement has no impact on day-to-day operations or customer contacts

Speak with One Voice: Please immediately forward any outside inquiries regarding the transaction to Jacquie Keller

Keeping You Informed: We are scheduling a number of conference calls in the next 24 hours, in person Town Hall meetings, and site visits as well as developing Q&A and other resources where you can learn more information about this exciting announcement on the PULSE website

Commitment to Our Customers Must Remain Our Top Priority

22