|

Exhibit 99.9

|

Exhibit 99.9

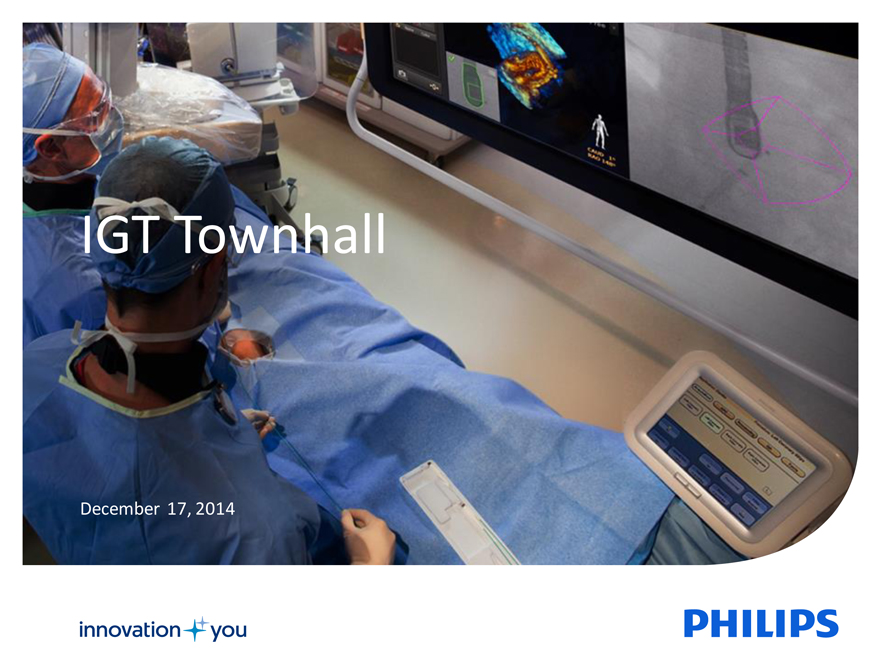

IGT Townhall

December 17, 2014

Cautionary Statement Regarding Forward-Looking Statements

This release may contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, including without limitation completion of the tender offer and merger and any expected benefits of the merger, and certain forward-looking statements regarding Volcano, including without limitation with respect to its business, the proposed tender offer and merger, the expected timetable for completing the transaction, and the strategic and other potential benefits of the transaction. Completion of the tender offer and merger are subject to conditions, including satisfaction of a minimum tender condition and the need for regulatory approvals, and there can be no assurance that those conditions can be satisfied or that the transactions described in this release (the “Transactions”) will be completed or will be completed when expected. Often, but not always, forward-looking statements can be identified by the use of words such as “plans,” “expects,” “expected,” “scheduled,” “estimates,” “intends,” “anticipates,” “projects,” “potential,” “continues” or “believes,” or variations of such words and phrases or state that certain actions, events, conditions, circumstances or results “may,” “could,” “should,” “would,” “might” or “will” be taken, occur or be achieved. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, (i) the risk that not all conditions of the Offer or the merger will be satisfied or waived; (ii) uncertainties regarding the two companies’ ability to successfully market both new and existing products; (iii) uncertainties relating to the anticipated timing of filings and approvals relating to the Transactions; (iv) uncertainties as to the timing of the tender offer and merger; (v) uncertainties as to how many of Volcano’s stockholders will tender their stock in the tender offer; (vi) the possibility that competing offers will be made; (vii) the failure to complete the tender offer or the merger in the timeframe expected by the parties or at all; (viii) the outcome of legal proceedings that may be instituted against Volcano and/or others relating to the Transactions; (ix)

Volcano’s ability to maintain relationships with employees, customers, or suppliers; (x) domestic and global economic and business conditions; (xi) developments within the euro zone; (xii) the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; (xiii) legal claims; (xiv) changes in exchange and interest rates; (xv) changes in tax rates, raw materials and employee costs; (xvi) the ability to successfully exit certain businesses or restructure the operations; (xvii) the rate of technological changes; (xviii) political, economic and other developments in countries where Philips operates; (xix) industry consolidation and competition; and (xx) other risk factors described in Volcano’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the United States Securities and Exchange Commission (“SEC”). Any forward-looking statements in this release are based upon information known to Philips on the date of this announcement. Neither Philips nor Volcano undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information

The tender offer described in this communication (the “Offer”) has not yet commenced, and this communication is neither an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of Volcano Corporation (“Volcano”) or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the United States Securities and Exchange

Commission (the “SEC”) by Philips and a Solicitation/Recommendation Statement on Schedule 14D-9 will be filed with the SEC by Volcano. The offer to purchase shares of Volcano common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION/ RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The tender offer statement will be filed with the SEC by Clearwater Merger Sub, Inc., a wholly owned subsidiary of Philips Holding USA Inc., which is a wholly owned subsidiary of Royal Philips, and the solicitation/recommendation statement will be filed with the SEC by Volcano. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the offer, which will be named in the tender offer statement.

Intro Bert van Meurs

Who is Volcano?

Patients Physicians

People Products

Volcano—highlights

Solutions for issues facing healthcare systems today

The Precision Physiology & Intravascular Imaging technology and innovation leader

Guided Therapy Physiology—rapidly growing business in large underpenetrated market

Leader

Over 7,400 installed systems

Base Business Approximately 1800 employees

Approximately 280 direct global sales reps

Strong partnerships with GE, Philips, Siemens, and Medtronic

Growth strategy Grow in peripheral vascular: Crux IVC Filters, IVUS, atherectomy

Sync-Rx co-registration hardware and software

Optical Coherence Tomography (OCT)

Financials 2013—$400M revenue

50% generated in the US, 25% in Japan and 25% in rest of world.

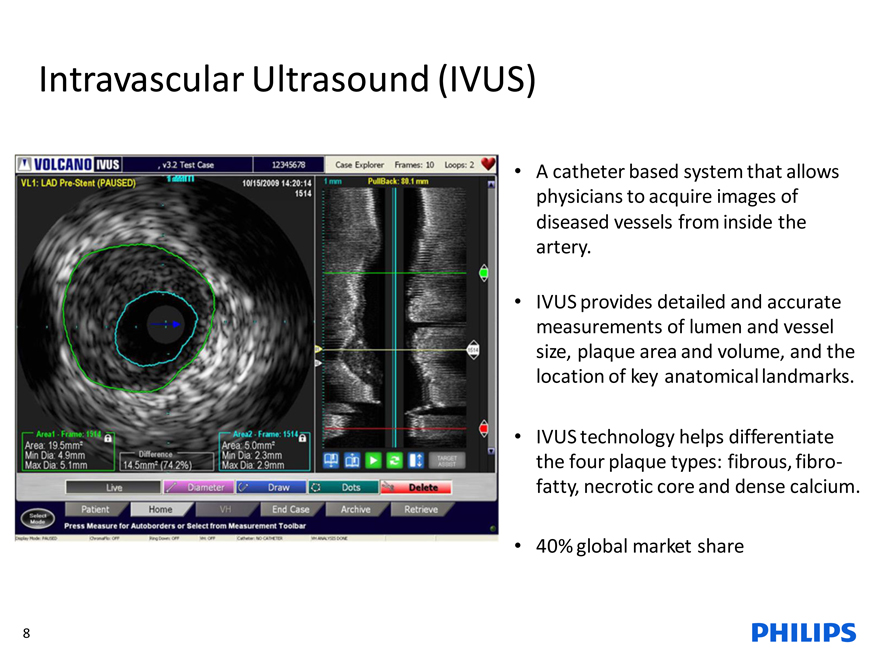

Intravascular Ultrasound (IVUS)

A catheter based system that allows physicians to acquire images of diseased vessels from inside the artery.

IVUS provides detailed and accurate measurements of lumen and vessel size, plaque area and volume, and the location of key anatomical landmarks.

IVUS technology helps differentiate the four plaque types: fibrous, fibro-fatty, necrotic core and dense calcium.

40% global market share

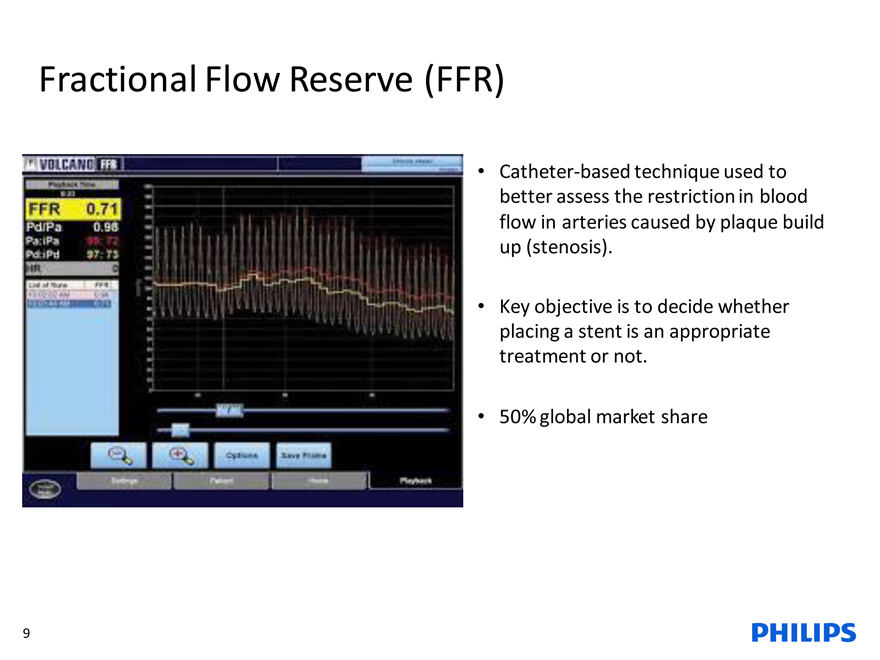

Fractional Flow Reserve (FFR)

Catheter-based technique used to better assess the restriction in blood flow in arteries caused by plaque build up (stenosis).

Key objective is to decide whether placing a stent is an appropriate treatment or not.

50% global market share

9

Strategic fit

10

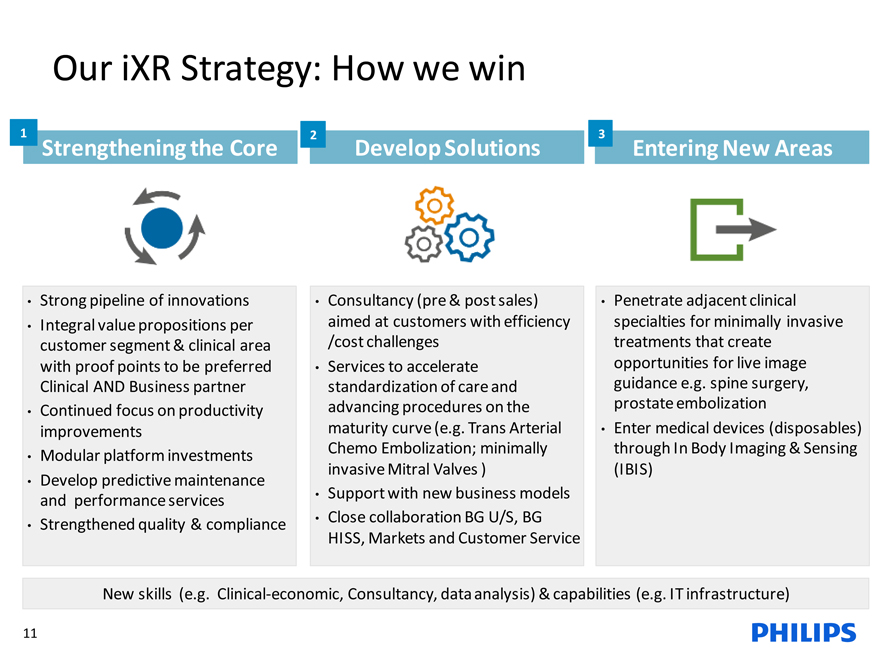

Our iXR Strategy: How we win

Strengthening the Core Develop Solutions Entering New Areas

Strong pipeline of innovations

Integral value propositions per

customer segment & clinical area

with proof points to be preferred

Clinical AND Business partner

Continued focus on productivity

improvements

Modular platform investments

Develop predictive maintenance

and performance services

Strengthened quality & compliance

Consultancy (pre & post sales)

aimed at customers with efficiency

/cost challenges

Services to accelerate

standardization of care and

advancing procedures on the

maturity curve (e.g. Trans Arterial

Chemo Embolization; minimally

invasive Mitral Valves )

Support with new business models

Close collaboration BG U/S, BG

HISS, Markets and Customer Service

Penetrate adjacent clinical specialties for minimally invasive treatments that create opportunities for live image guidance e.g. spine surgery, prostate embolization

Enter medical devices (disposables) through In Body Imaging & Sensing (IBIS)

New skills (e.g. Clinical-economic, Consultancy, data analysis) & capabilities (e.g. IT infrastructure)

11

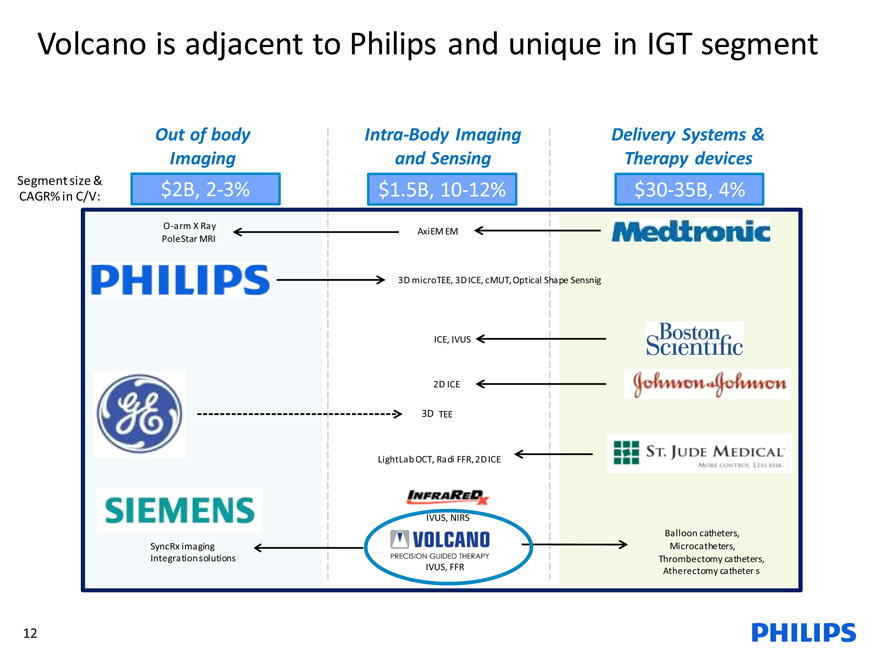

Volcano is adjacent to Philips and unique in IGT segment

Out of body Intra-Body Imaging Delivery Systems &

Imaging and Sensing Therapy devices

Segment size &

CAGR% in C/V: $2B, 2-3% $1.5B, 10-12% $30-35B, 4%

O -arm X Ray

AxiEM EM

PoleStar MRI

3D microTEE, 3D ICE, cMUT, Optical Shape Sensnig

ICE, IVUS

2D ICE

3D TEE

LightLab OCT, Radi FFR, 2D ICE

IVUS, NIRS

Balloon catheters,

SyncRx imaging Microcatheters,

Integration solutions Thrombectomy catheters,

IVUS, FFR Atherectomy catheter s

12

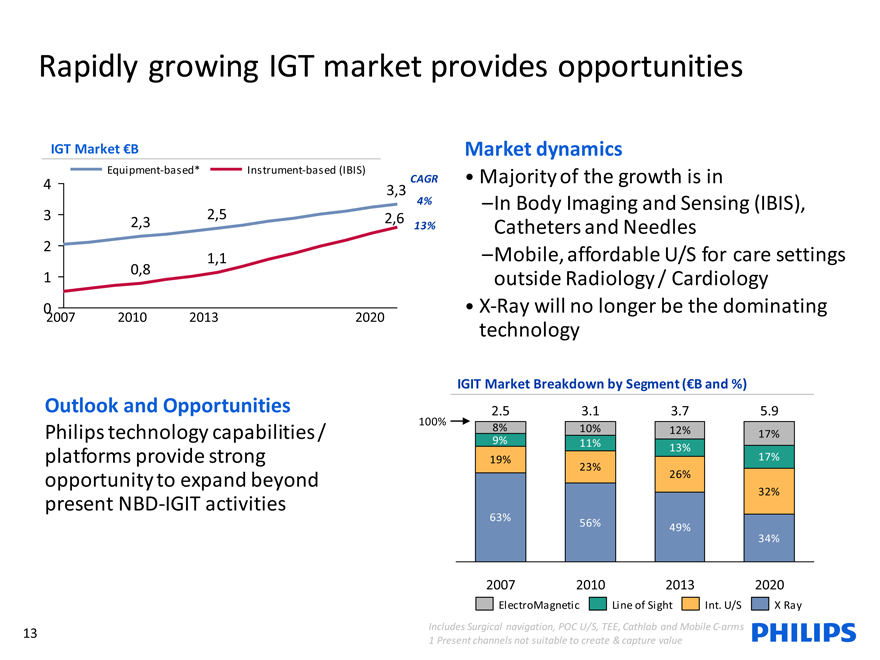

Rapidly growing IGT market provides opportunities

IGT Market €B

Equipment-based* Instrument-based (IBIS)

CAGR

4%

1,1

02007 2010 2013 2020

Market dynamics

Majority of the growth is in

–In Body Imaging and Sensing (IBIS),

Catheters and Needles

–Mobile, affordable U/S for care settings outside Radiology / Cardiology

X-Ray will no longer be the dominating technology

Outlook and Opportunities

Philips technology capabilities / platforms provide strong opportunity to expand beyond present NBD-IGIT activities

IGIT Market Breakdown by Segment (€B and %)

2.5 3.1 3.7 5.9

100%

8% 10% 12% 17%

9% 11% 13%

19% 17%

23%

26%

32%

63%

56% 49%

34%

2007 2010 2013 2020

ElectroMagnetic Line of Sight Int. U/S X Ray

Includes Surgical navigation, POC U/S, TEE, Cathlab and Mobile C-arms

1 | | Present channels not suitable to create & capture value |

13

Creating a unique positioning

together

14

Video Gerard Winkels

15

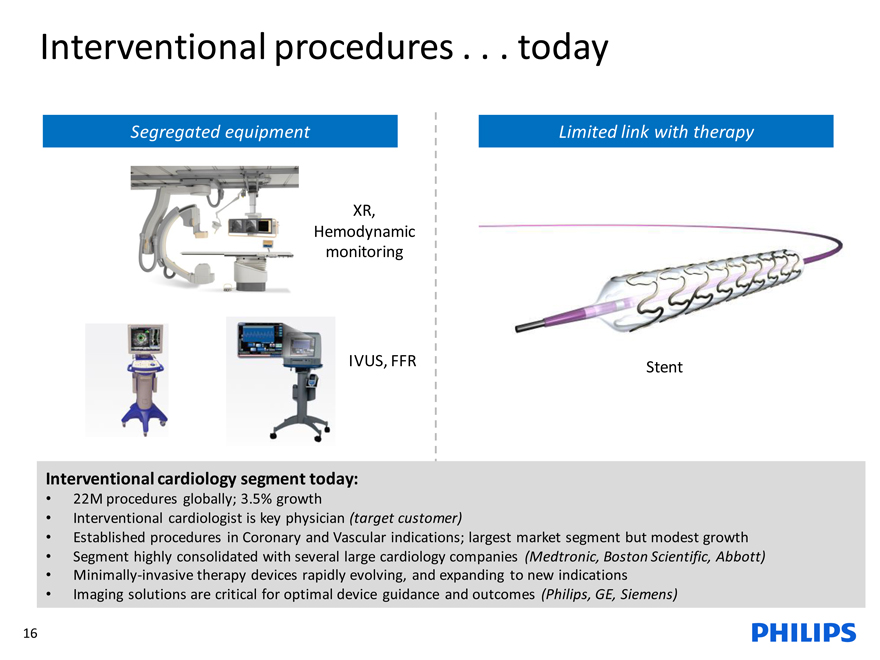

Interventional procedures . . . today

Segregated equipment

XR,

Hemodynamic

monitoring

IVUS, FFR

Limited link with therapy

Stent

Interventional cardiology segment today:

22M procedures globally; 3.5% growth

Interventional cardiologist is key physician (target customer)

Established procedures in Coronary and Vascular indications; largest market segment but modest growth

Segment highly consolidated with several large cardiology companies (Medtronic, Boston Scientific, Abbott)

Minimally-invasive therapy devices rapidly evolving, and expanding to new indications

Imaging solutions are critical for optimal device guidance and outcomes (Philips, GE, Siemens)

16

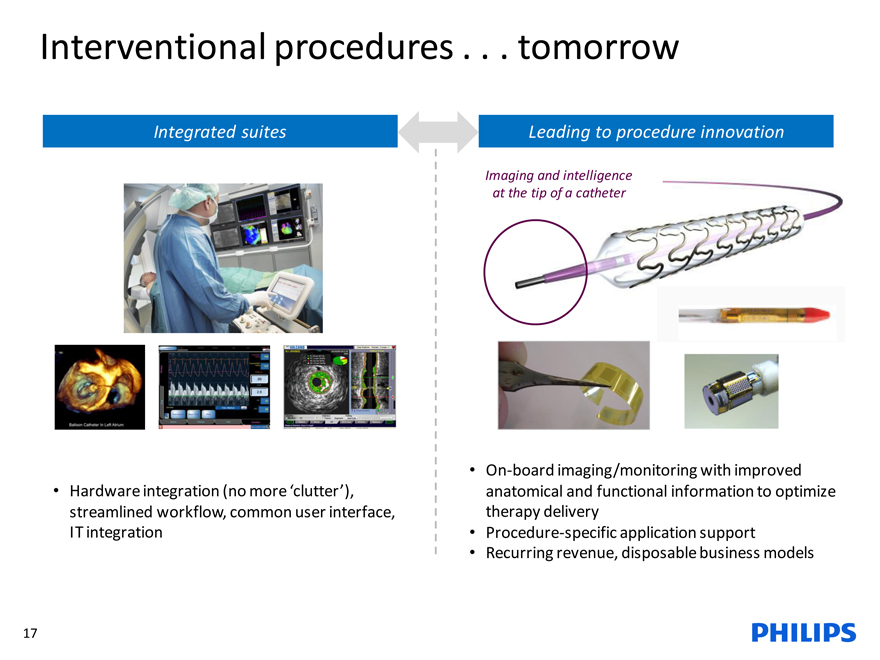

Interventional procedures . . . tomorrow

Integrated suites

Hardware integration (no more ‘clutter’),

streamlined workflow, common user interface,

IT integration

Leading to procedure innovation

Imaging and intelligence at the tip of a catheter

On-board imaging/monitoring with improved anatomical and functional information to optimize therapy delivery Procedure-specific application support Recurring revenue, disposable business models

17

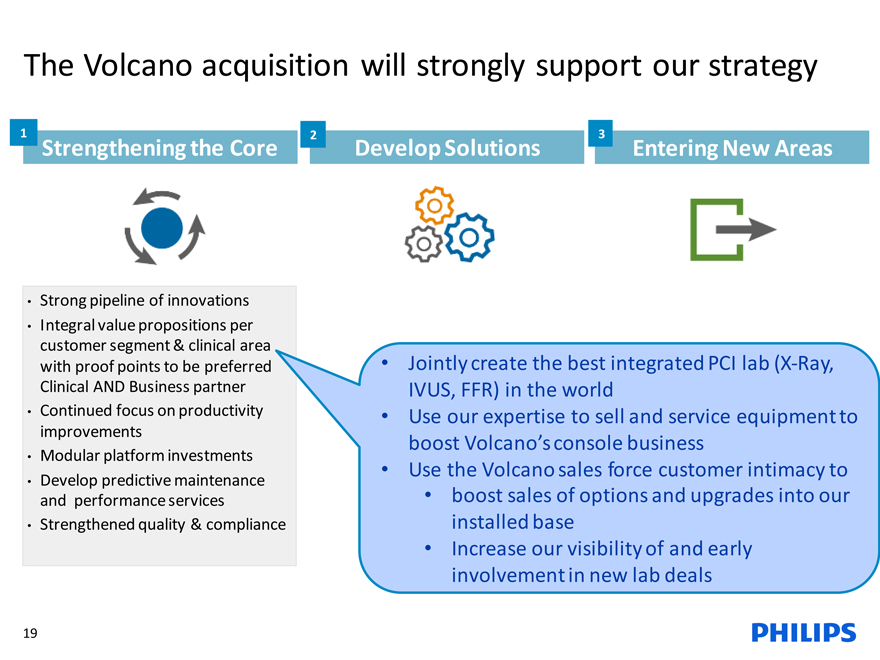

The Volcano acquisition will strongly support our strategy

Strengthening the Core Develop Solutions Entering New Areas

Strong pipeline of innovations

Integral value propositions per customer segment & clinical area with proof points to be preferred Clinical AND Business partner

Continued focus on productivity improvements

Modular platform investments

Develop predictive maintenance and performance services

Strengthened quality & compliance

Consultancy (pre & post sales) aimed at customers with efficiency /cost challenges

Services to accelerate standardization of care and advancing procedures on the maturity curve (e.g. Trans Arterial Chemo Embolization; minimally invasive Mitral Valves )

Support with new business models

Close collaboration BG U/S, BG HISS, Markets and Customer Service

Penetrate adjacent clinical specialties for minimally invasive treatments that create opportunities for live image guidance e.g. spine surgery, prostate embolization

Enter medical devices (disposables) through In Body Imaging & Sensing (IBIS)

New skills (e.g. Clinical-economic, Consultancy, data analysis) & capabilities (e.g. IT infrastructure)

18

The Volcano acquisition will strongly support our strategy

Strengthening the Core Develop Solutions Entering New Areas

Strong pipeline of innovations

Integral value propositions per customer segment & clinical area with proof points to be preferred Clinical AND Business partner

Continued focus on productivity improvements

Modular platform investments

Develop predictive maintenance and performance services

Strengthened quality & compliance

Jointly create the best integrated PCI lab (X-Ray,

IVUS, FFR) in the world

Use our expertise to sell and service equipment to boost Volcano’s console business

Use the Volcano sales force customer intimacy to

boost sales of options and upgrades into our installed base

Increase our visibility of and early involvement in new lab deals

19

The Volcano acquisition will strongly support our strategy

Strengthening the Core Develop Solutions Entering New Areas

Consultancy (pre & post sales) aimed at customers with efficiency /cost challenges

Services to accelerate standardization of care and advancing procedures on the maturity curve (e.g. Trans Arterial Chemo Embolization; minimally invasive Mitral Valves )

Support with new business models

Close collaboration BG U/S, BG HISS, Markets and Customer Service

Most flexible business model in the industry

(equipment, services, consumables)

Use our joint deep clinical insights to improve clinical practice, better outcomes and lower cost

20

The Volcano acquisition will strongly support our strategy

Strengthening the Core Develop Solutions Entering New Areas

Combine Philips technology with Volcano channel, consumables know-how, and experience with clinical trials to accelerate the growth of the IBIS business

Penetrate adjacent clinical specialties for minimally invasive treatments that create opportunities for live image guidance e.g. spine surgery, prostate embolization

Enter medical devices (disposables) through In Body Imaging & Sensing (IBIS)

21

More about Volcano

22

Patients Physicians

People Products

23

Volcano Worldwide

Manufacturing &

Systems/Hardware Volcano Europe

R&D Brussels, Belgium

Rancho Cordova, CA

Volcano East Volcano Israel

Billerica, MA

FL.ICE & Crux Tel Aviv, Israel

Bay Area, CA Global Sales & Volcano Japan

Micro Catheters

Corporate Tokyo, Japan

Atlanta, GA

Headquarters

San Diego, CA

Disposables

Manufacturing

San Jose, Costa Rica

24

Philips and Volcano: a merger of strengths

We share a vision and passion for health care

Mission:

Improving people’s lives through meaningful innovation

Vision:

At Philips, we strive to make the world healthier and more sustainable through innovation. Our goal is to improve the lives of 3 billion people a year by 2025. We will be the best place to work for people who share our passion. Together, we will deliver superior value for our customers and shareholders.

Mission:

To improve the lives of patients

Vision:

Through innovation and dedication to our values, we seek to provide the means for superior therapeutic solutions that enable patients to live long fulfilling lives.

25

The Volcano Vision

A platform company guiding and optimizing minimally invasive therapies utilizing visualization, physiology, or future technologies

Future

Today

26

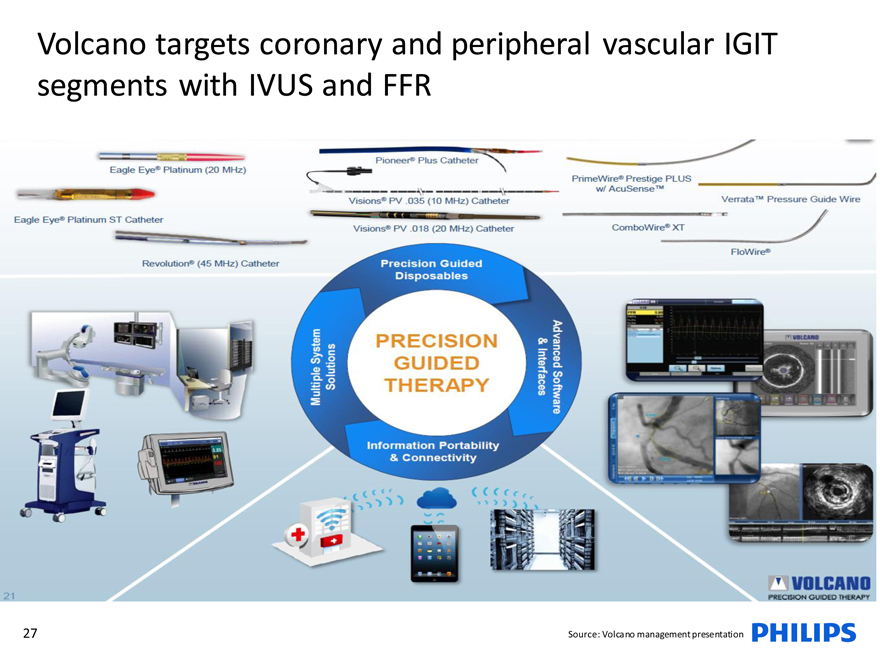

Volcano targets coronary and peripheral vascular IGIT segments with IVUS and FFR

Source: Volcano management presentation

27

Multiple Solutions from Volcano

FFR Co-Reg +

IVUS

iFR® Angio+

CRUX™ VCF

CFR + IVUS

CRUX™

pFFR VCF

Combo Digital Rotational Peripheral Pioneer™

ChromaFlo® VH® IVUS FACT

(Pressure + IVUS IVUS IVUS Plus

Flow)

Pre-Procedure Peri-Procedure Post-Procedure

“FACT” is an acronym for Volcano Corporation’s focused acoustic computed tomography (FACT). Technologies with gray outlines are currently under development and are not commercially available for sale.

28

What happens next?

29

Next steps

Closing the deal

Q1 2015

Integration of Volcano

After closing the deal

30

Questions?

31

Some iXR announcements

32

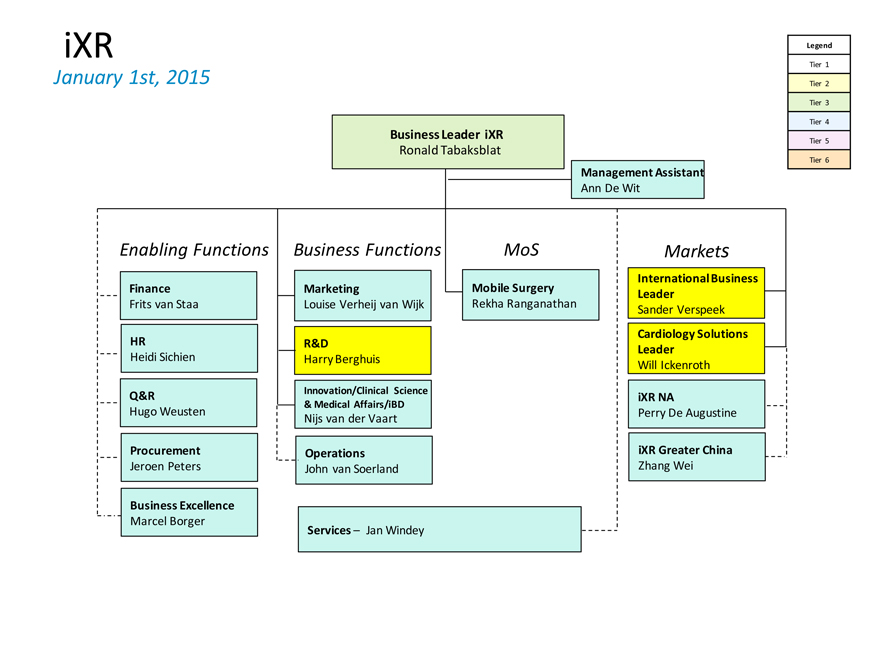

iXR

January 1st, 2015

Business Leader iXR

Ronald Tabaksblat

Management Assistant

Ann De Wit

Enabling Functions Business Functions MoS Markets

International Business

Finance Marketing Mobile Surgery Leader

Frits van Staa Louise Verheij van Wijk Rekha Ranganathan Sander Verspeek

Cardiology Solutions

HR R&D Leader

Heidi Sichien Harry Berghuis Will Ickenroth

Innovation/Clinical Science

Q&R iXR NA

& Medical Affairs/iBD

Hugo Weusten Perry De Augustine

Nijs van der Vaart

Procurement Operations iXR Greater China

Jeroen Peters John van Soerland Zhang Wei

Business Excellence

Marcel Borger

Services – Jan Windey

Legend

Tier 1

Tier 2

Tier 3

Tier 4

Tier 5

Tier 6

33

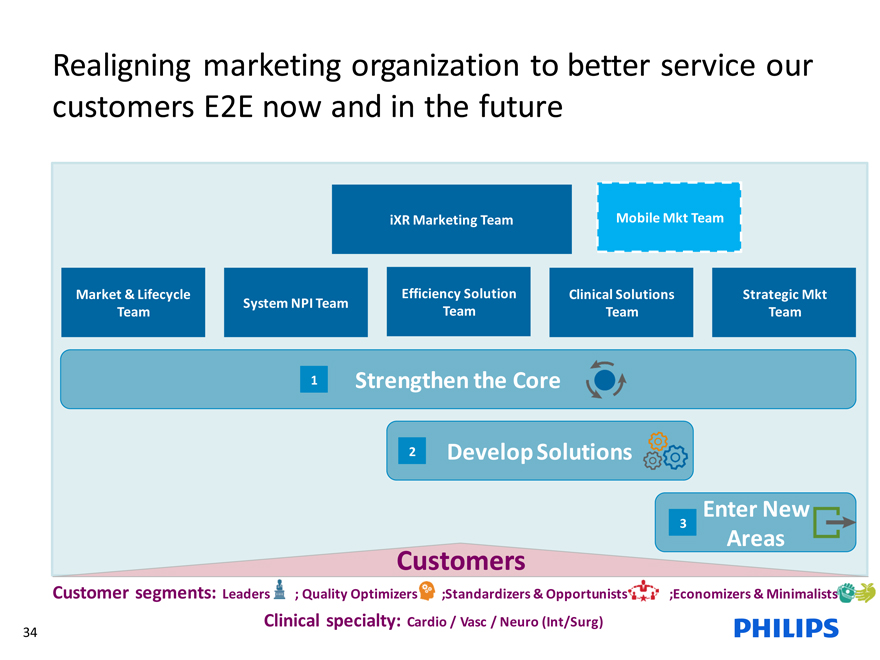

Realigning marketing organization to better service our customers E2E now and in the future

iXR Marketing Team Mobile Mkt Team

Market & Lifecycle Efficiency Solution Clinical Solutions Strategic Mkt

System NPI Team

Team Team Team Team

Enter New

Areas

Customers

Customer segments: Leaders ; Quality Optimizers ;Standardizers & Opportunists ;Economizers & Minimalists

Clinical specialty: Cardio / Vasc / Neuro (Int/Surg)

34

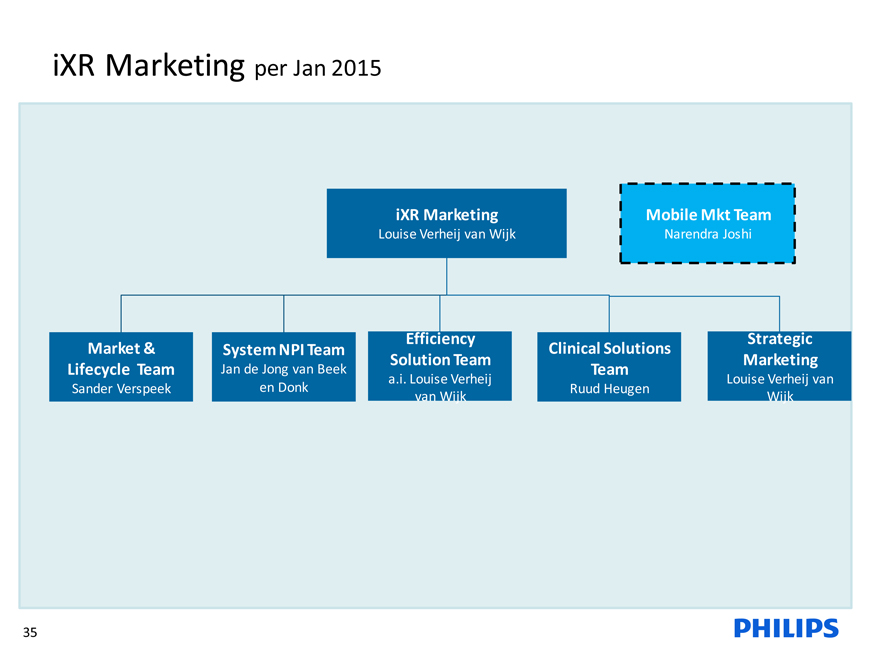

iXR Marketing per Jan 2015

iXR Marketing Mobile Mkt Team

Louise Verheij van Wijk Narendra Joshi

Efficiency Strategic

Market & System NPI Team Clinical Solutions

Solution Team Marketing

Lifecycle Team Jan de Jong van Beek Team

a.i. Louise Verheij Louise Verheij van

Sander Verspeek en Donk Ruud Heugen

van Wijk Wijk

35

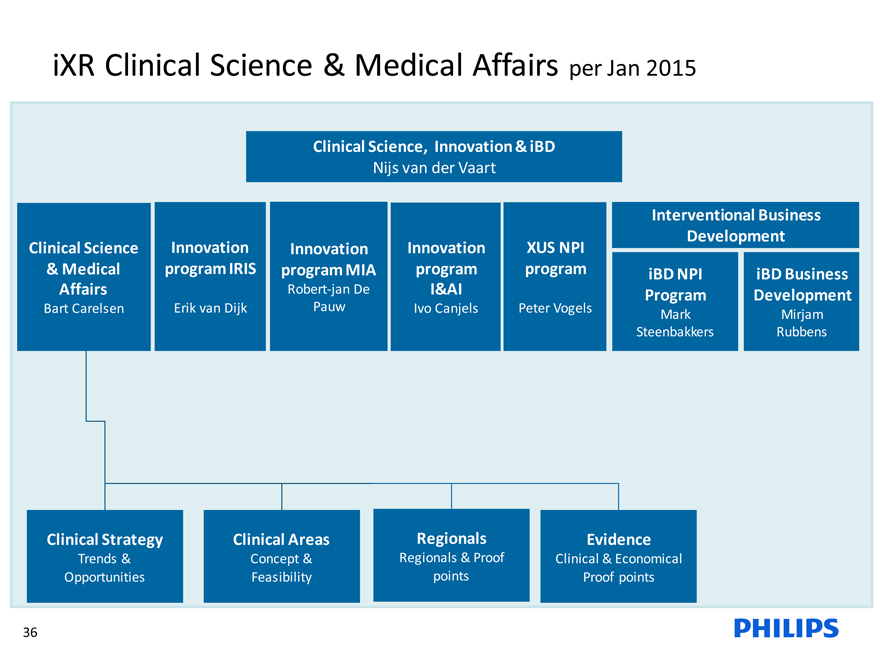

iXR Clinical Science & Medical Affairs per Jan 2015

Clinical Science, Innovation & iBD

Nijs van der Vaart

Interventional Business

Development

Clinical Science Innovation Innovation Innovation XUS NPI

& Medical program IRIS program MIA program program iBD NPI iBD Business

Affairs Robert-jan De I&AI Program Development

Bart Carelsen Erik van Dijk Pauw Ivo Canjels Peter Vogels Mark Mirjam

Steenbakkers Rubbens

Clinical Strategy Clinical Areas Regionals Evidence

Trends & Concept & Regionals & Proof Clinical & Economical

Opportunities Feasibility points Proof points

36

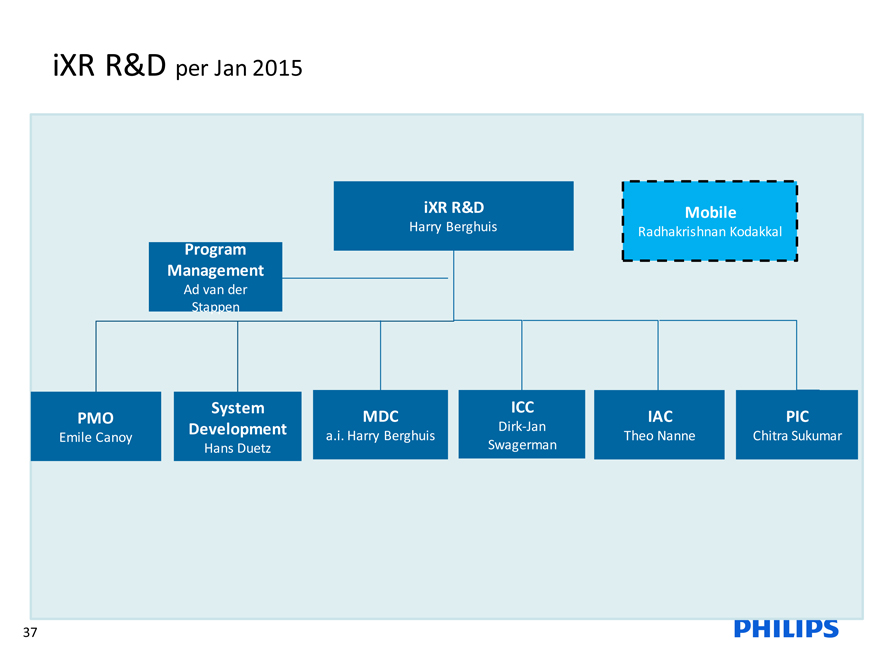

iXR R&D per Jan 2015

iXR R&D Mobile

Harry Berghuis Radhakrishnan Kodakkal

Program

Management

Ad van der

Stappen

System ICC

PMO MDC IAC PIC

Development Dirk-Jan

Emile Canoy a.i. Harry Berghuis Theo Nanne Chitra Sukumar

Hans Duetz Swagerman

37

Questions?

38

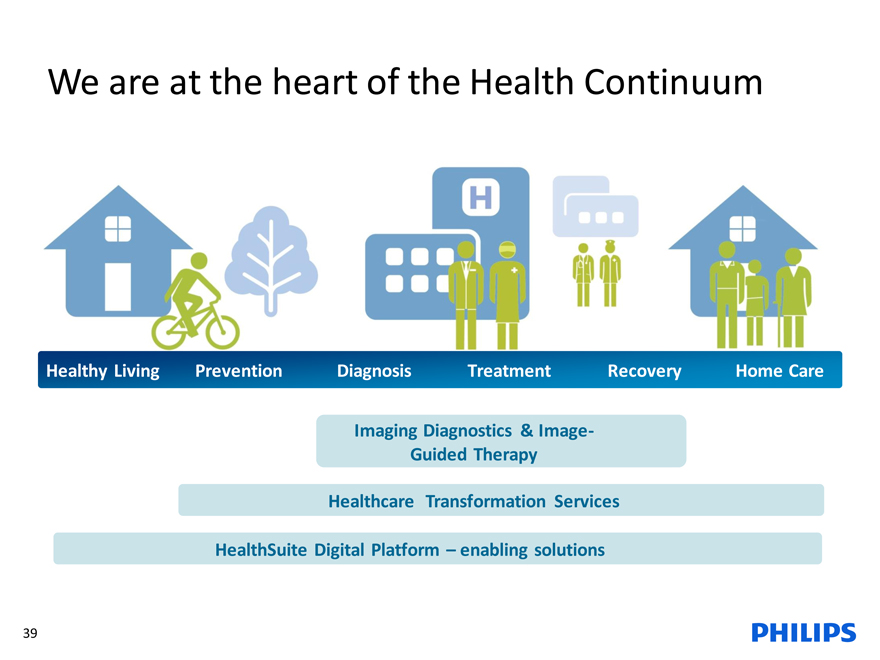

We are at the heart of the Health Continuum

HealthyLiving Prevention Diagnosis Treatment Recovery Home Care

Imaging Diagnostics & Image-

Guided Therapy

Healthcare Transformation Services

HealthSuite Digital Platform – enabling solutions

39