THIRD quarter 2022 Financial results OCTOBER 1, 2022 EXHIBIT 99.2

FORWARD LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “assume,” “believe,” “could,” “estimate,” “expect,” “guidance,” “intend,” “many,” “positioned,” “potential,” “project,” “think,” “should,” “target,” “will,” “would” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our acquisitions of Anlin Windows & Doors ("Anlin"), and Martin Door Holdings, Inc. ("Martin"); pricing actions benefiting margins; effects of Hurricane Ian and other economic headwinds such as increasing interest rates and rising inflation; improvement of our operations and business integration; and our net sales and Adjusted EBITDA guidance. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions regarding the future of our business, future plans �and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: the impact of the COVID-19 pandemic (the "COVID-19 pandemic" or "Pandemic") and related measures taken by governmental or regulatory authorities to combat the Pandemic, including the impact of the Pandemic and these measures on the economies and demand for our products in the states where we sell them, and on our customers, suppliers, labor force, business, operations and financial performance; unpredictable weather and macroeconomic factors that may negatively impact the repair and remodel and new construction markets and the construction industry generally, especially in the state of Florida and the western United States, where the substantial portion of our sales are currently generated, and in the U.S. generally; changes in raw material prices, especially for aluminum, glass and vinyl, including, price increases due to the implementation of tariffs and other trade-related restrictions, Pandemic-related supply chain interruptions, or interruptions from the conflict in Ukraine; our dependence on a limited number of suppliers for certain of our key materials; our dependence on our impact-resistant product lines, which increased with the acquisition of Eco Enterprises, LLC ("Eco"), and contemporary indoor/outdoor window and door systems, and on consumer preferences for those types and styles of products; the effects of increased expenses or unanticipated liabilities incurred as a result of, or due to activities related to, our recent acquisitions, including our acquisitions of Martin, Anlin and Eco; our level of indebtedness, which increased in connection with our recent acquisitions, including our acquisitions of Martin, Anlin and Eco; increases in credit losses from obligations owed to us by our customers in the event of a downturn in the home repair and remodel or new home construction channels in our core markets and our inability to collect such obligations from such customers; the risks that the anticipated cost savings, synergies, revenue enhancement strategies and other benefits expected from our acquisitions of Martin, Anlin and Eco may not be fully realized or may take longer to realize than expected or that our actual integration costs may exceed our estimates; increases in transportation costs, including increases in fuel prices; our dependence on our limited number of geographically concentrated manufacturing facilities, which increased further due to our acquisition of Eco; sales fluctuations to and changes in our relationships with key customers; federal, state and local laws and regulations, including unfavorable changes in local building codes and environmental and energy code regulations; risks associated with our information technology systems, including cybersecurity-related risks, such as unauthorized intrusions into our systems by "hackers" and theft of data and information from our systems, and the risks that our information technology systems do not function as intended or experience temporary or long-term failures to perform as intended; product liability and warranty claims brought against us; in addition to our acquisitions of Martin, Anlin and Eco, our ability to successfully integrate businesses we may acquire in the future, or that any business we acquire may not perform as we expected when acquired; and the other risks and uncertainties discussed under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K/A for the year ended January 1, 2022, and our other filings with the Securities and Exchange Commission. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

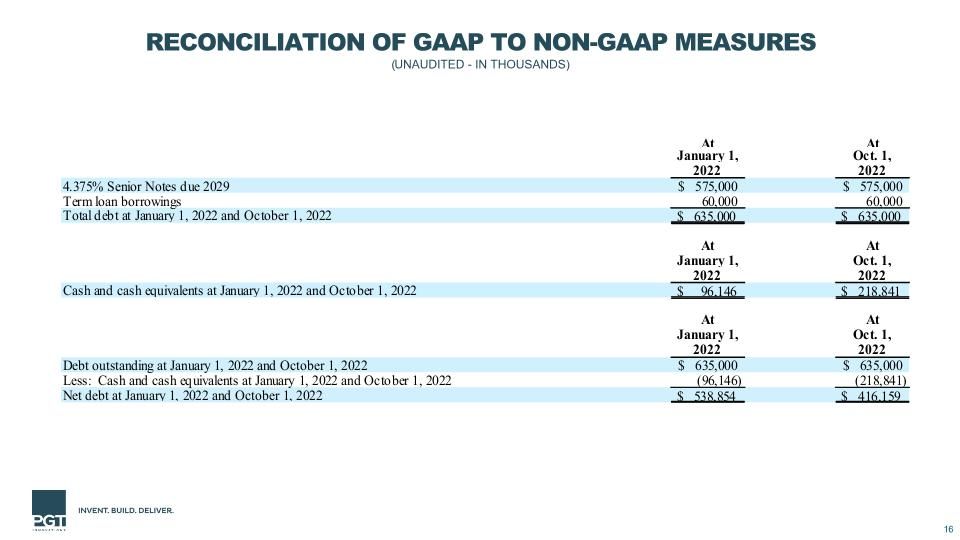

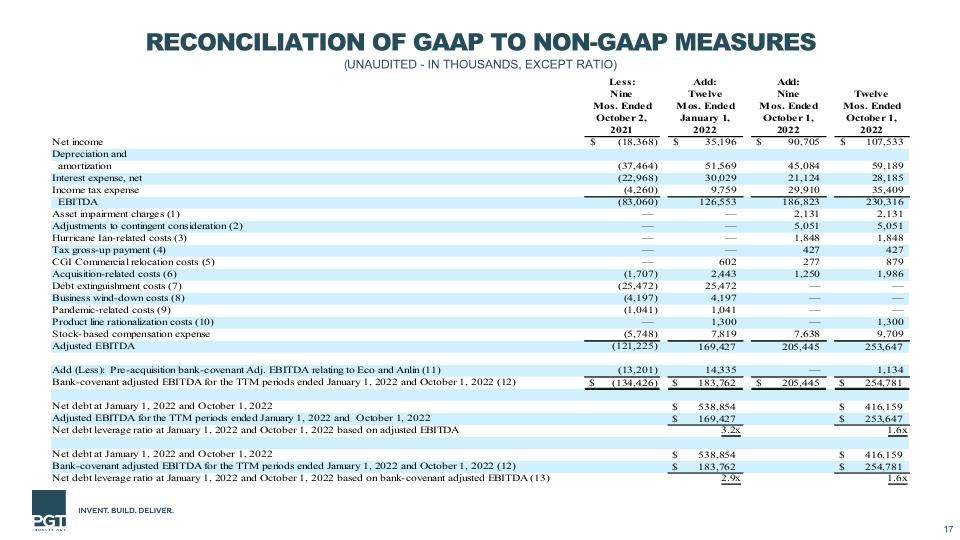

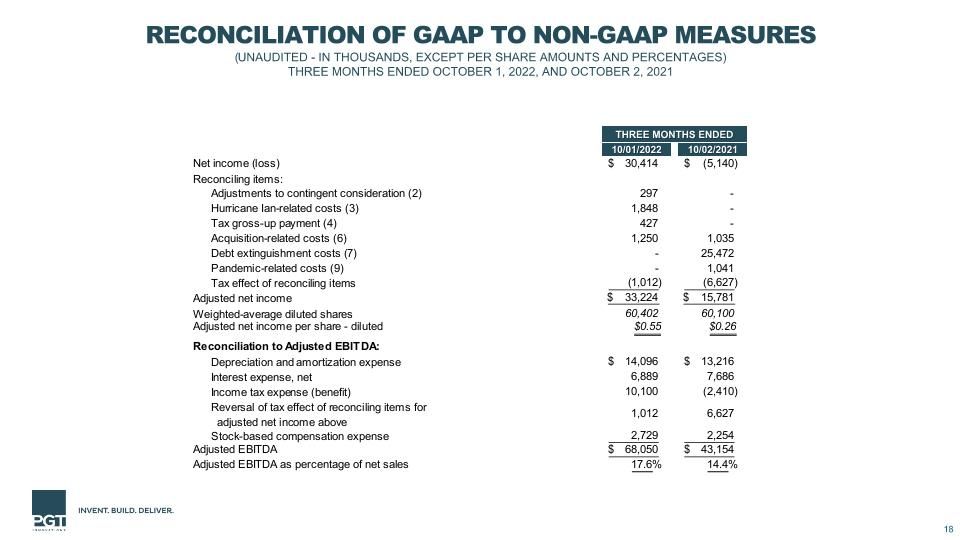

Use of Non-GAAP Financial Measures This earnings presentation and related financial schedules include financial measures and terms not calculated in accordance with U.S. generally accepted accounting principles (GAAP). Management believes that presentation of non-GAAP measures such as Adjusted net income, Adjusted net income per share, and Adjusted EBITDA provides investors and analysts with an alternative method for assessing our operating results in a manner that enables investors and analysts to more thoroughly evaluate our current performance compared to past performance. However, these measures do not provide a complete picture of our operations. Management also believes these non-GAAP measures provide investors with a better baseline for assessing our future earnings potential. The non-GAAP measures included in this earnings presentation are provided to give investors access to types of measures that we use in analyzing our results, and for internal planning and forecasting purposes. Adjusted net income consists of GAAP net income adjusted for the items included in the accompanying reconciliation. Adjusted net income per share consists of GAAP net income per share adjusted for the items included in the accompanying reconciliation. Adjusted EBITDA consists of net income, adjusted for the items included in the accompanying reconciliation. We believe that adjusted EBITDA provides useful information to investors and analysts about the Company’s performance because they eliminate the effects of period-to-period changes in taxes, costs associated with capital investments and interest expense. Adjusted EBITDA does not give effect to the cash �the Company must use to service its debt or pay its income taxes and thus does not reflect the actual funds generated from operations or available for capital investments. Bank-covenant adjusted EBITDA consists of adjusted EBITDA, as previously described, plus adjustments to reflect management’s estimates of the inclusion of the adjusted EBITDA of acquisitions. Bank-covenant adjusted EBITDA is included for the purpose of enabling investors to understand the calculation of, and compliance with, the financial maintenance covenant in our credit documents. See Note (12) on slide 19. Our calculations of adjusted net income and adjusted net income per share, adjusted EBITDA and bank-covenant adjusted EBITDA are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, such as net income, but should not be considered a substitute for or superior to GAAP measures. Schedules that reconcile adjusted net income, adjusted net income per share, adjusted EBITDA, and bank-covenant adjusted EBITDA to GAAP net income are included in the financial schedules accompanying this release. We are not able to provide a reconciliation of projected 2022 Adjusted EBITDA to the most directly comparable expected GAAP results due to the unknown effect, timing and potential significance of the effects of legal matters, tax considerations, and income and expense from changes in fair value of contingent consideration from acquisitions. Expenses associated with legal matters, tax consequences, and income and expense from changes in fair value of contingent consideration from acquisitions have in the past, and may in the future, significantly affect GAAP results in a particular period.

Key messages 1 Q3 2022 net sales increased 28% vs prior-year quarter to $386M; total organic growth of 17%; $35M from Anlin Windows & Doors acquisition 2 Adjusted EBITDA1 margin growth versus the prior-year quarter Operations impacted by Hurricane Ian 3 Diligent supply chain and raw materials management to minimize disruptions and improve performance 4 Generated strong cash flow, ending the quarter with a cash balance of $219M with net leverage at the low end of our target range 5 In October, acquired Martin Door, a leading custom manufacturing of premium overhead garage doors 1. Refer to reconciliation to GAAP on slide 18.

Martin Acquisition Expands into Garage Door Market Terms Purchase price: $185 million, 8.5x pre-synergies1 TTM net sales2: approx. $60 million Expected Adjusted EBITDA margins: > 30% Closed: 10/14/2022 Expected to be accretive in first year Strategic Benefits Broadens footprint in high-growth Western region HQ in Salt Lake City; serving Western U.S. residential and commercial markets Expands into adjacent building product categories Adds premium overhead garage doors to product portfolio Large dealer base, strong backlog, and best-in-class lead times Cross-selling opportunities for Western Division brands and NewSouth Brings experienced leadership team Top leadership will remain with the company Similar cultures that value safety, innovation and quality PGT Innovations Strategic M&A Criteria Aligned with growth priorities; expected to grow shareholder value over long-term Expansion into new regions, channels or products Addition of technologies, enhanced manufacturing or supply chain capabilities 1. Price to adjusted EBITDA purchase multiple ; 2.Trailing twelve months ending September 30, 2022

Sales Trends Southeast Region Highlights Western Region Highlights Looking Ahead Q3’22 organic sales up 13% YoY Agreements for eight new communities secured Significant disruptions caused by Hurricane Ian; seeing initial signs of demand returning in certain New South markets. Q3’22 organic sales up 38% YoY Phoenix capacity expansion operational New San Diego Skye Walls showroom opened Anlin added $35 million. Demand strong; synergies with Western on track with acquisition targets Total Open Order Backlog1 at $282M down versus Q4 2021 due to shortened lead times Continued strong operational performance Increasing interest rates and slowing new home sales Increased awareness of products from Hurricane Ian 1 Open Order Backlog in all periods includes orders in which revenue has been recognized in accordance with ASC 606.

Strategic Framework for Profitable Growth 01. Drive brand recognition and loyalty through CUSTOMER-CENTRIC INNOVATION �to expand our �diversified family of premium brands 02. Invest in our employees to attract and retain talented, DEDICATED LEADERS to drive our business and SUPPORT SUSTAINABILITY TRENDS reshaping the future of our world 03. Transform our manufacturing operations to SCALE OUR BUSINESS to �capture increasing �long-term demand 04. Strategically allocate FREE CASH FLOW primarily to support profitable growth in desirable markets and geographies

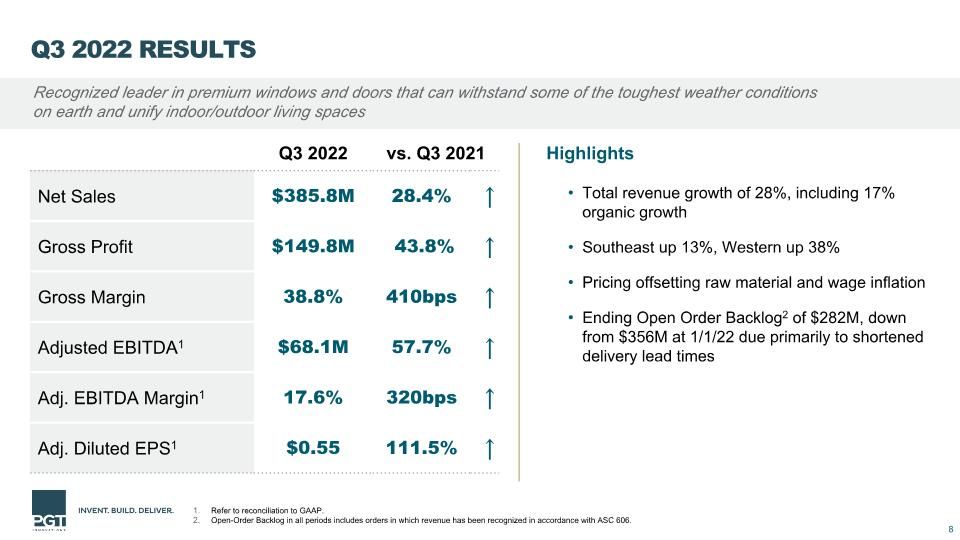

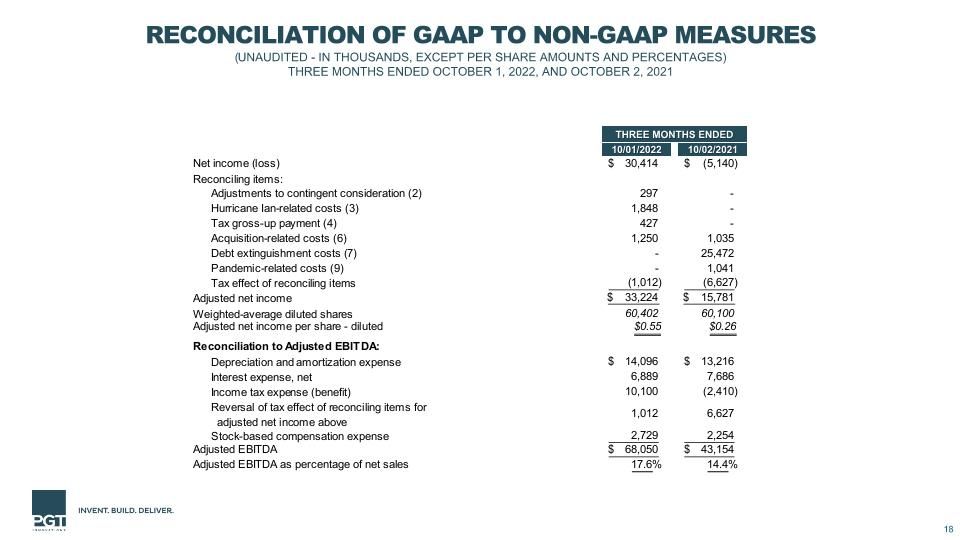

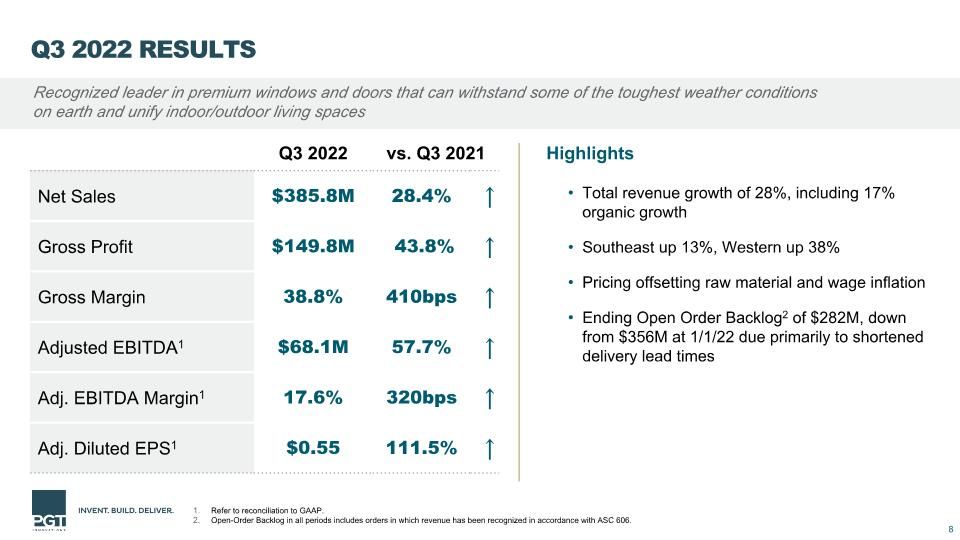

Q3 2022 results Recognized leader in premium windows and doors that can withstand some of the toughest weather conditions �on earth and unify indoor/outdoor living spaces Q3 2022 vs. Q3 2021 Net Sales $385.8M 28.4% ↑ Gross Profit $149.8M 43.8% ↑ Gross Margin 38.8% 410bps ↑ Adjusted EBITDA1 $68.1M 57.7% ↑ Adj. EBITDA Margin1 17.6% 320bps ↑ Adj. Diluted EPS1 $0.55 111.5% ↑ Highlights Total revenue growth of 28%, including 17% organic growth Southeast up 13%, Western up 38% Pricing offsetting raw material and wage inflation Ending Open Order Backlog2 of $282M, down from $356M at 1/1/22 due primarily to shortened delivery lead times Refer to reconciliation to GAAP. Open-Order Backlog in all periods includes orders in which revenue has been recognized in accordance with ASC 606.

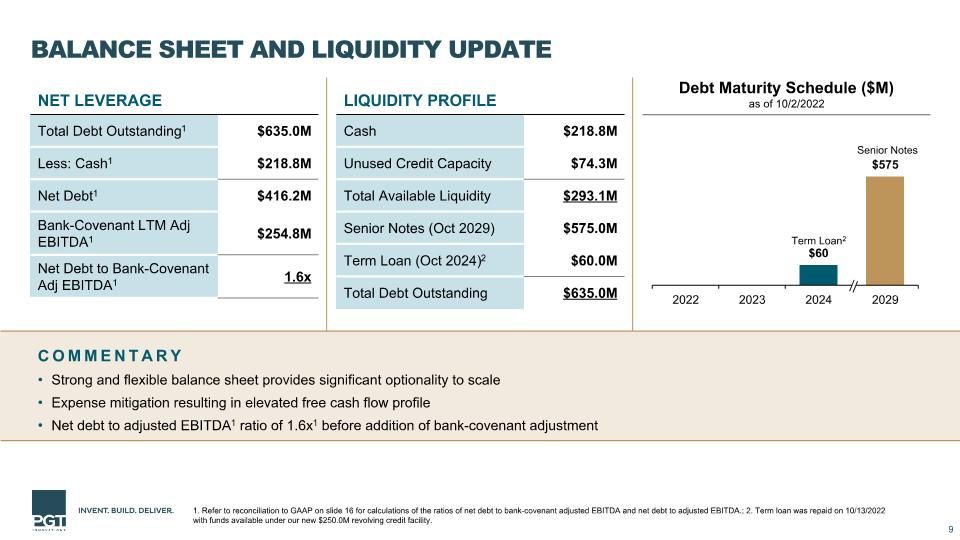

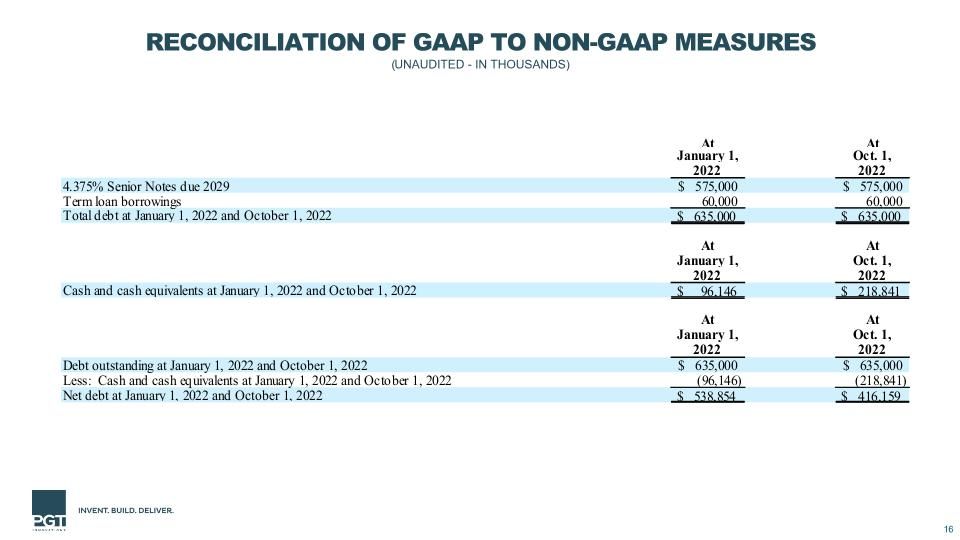

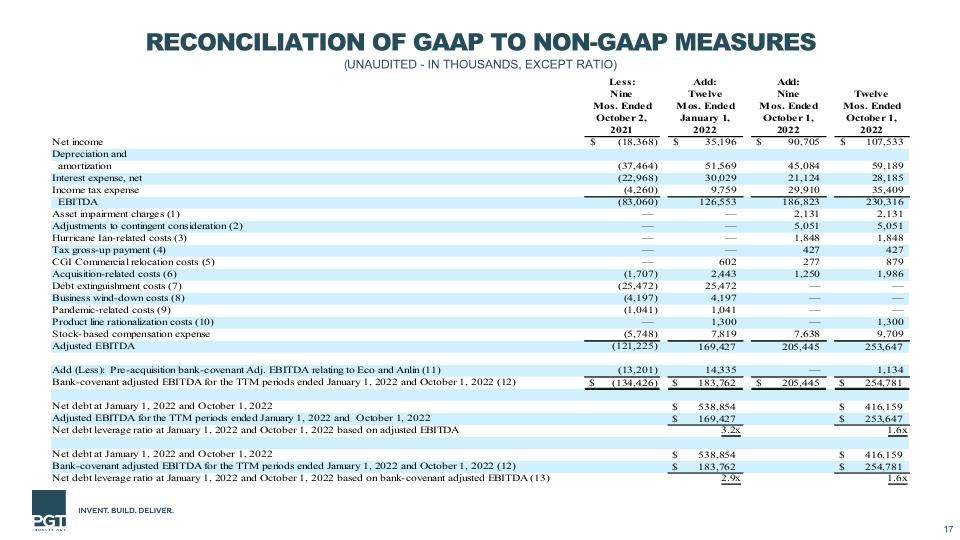

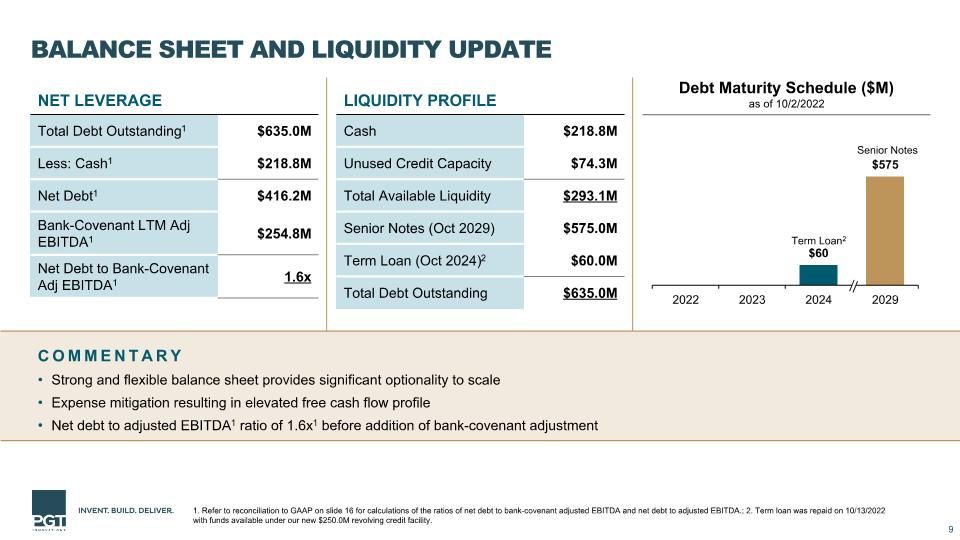

Balance sheet and Liquidity Update NET LEVERAGE Total Debt Outstanding1 $635.0M Less: Cash1 $218.8M Net Debt1 $416.2M Bank-Covenant LTM Adj EBITDA1 $254.8M Net Debt to Bank-Covenant Adj EBITDA1 1.6x LIQUIDITY PROFILE Cash $218.8M Unused Credit Capacity $74.3M Total Available Liquidity $293.1M Senior Notes (Oct 2029) $575.0M Term Loan (Oct 2024)2 $60.0M Total Debt Outstanding $635.0M Debt Maturity Schedule ($M) as of 10/2/2022 Term Loan2 Senior Notes COMMENTARY Strong and flexible balance sheet provides significant optionality to scale Expense mitigation resulting in elevated free cash flow profile Net debt to adjusted EBITDA1 ratio of 1.6x1 before addition of bank-covenant adjustment 1. Refer to reconciliation to GAAP on slide 16 for calculations of the ratios of net debt to bank-covenant adjusted EBITDA and net debt to adjusted EBITDA.; 2. Term loan was repaid on 10/13/2022 with funds available under our new $250.0M revolving credit facility.

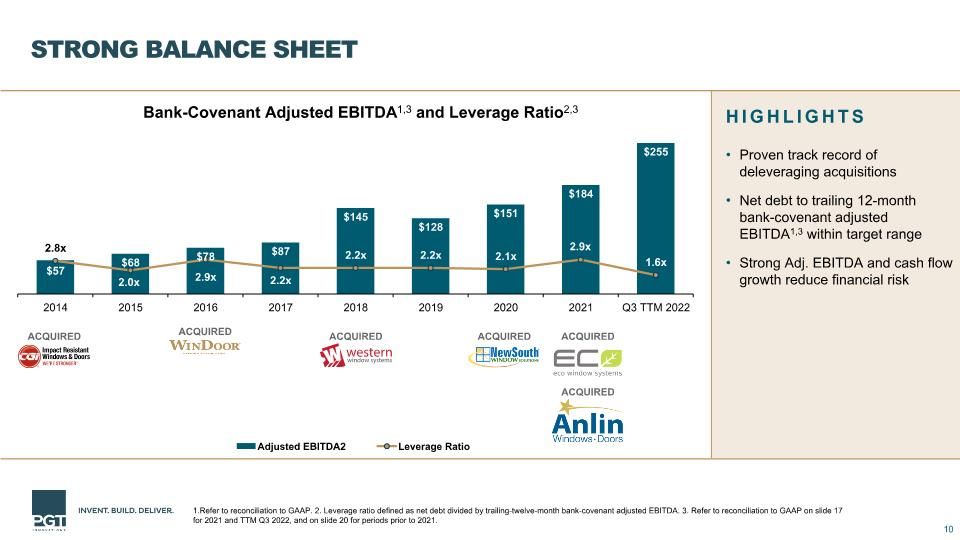

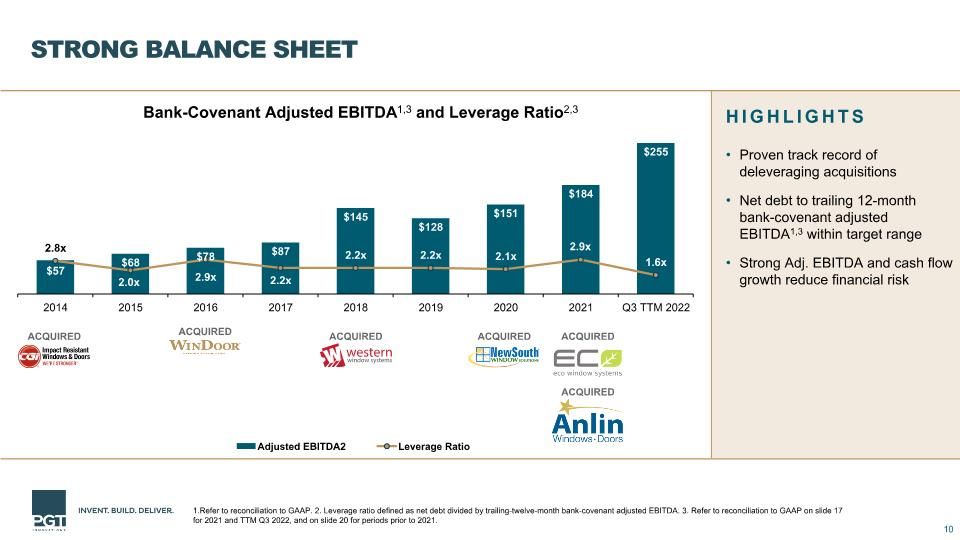

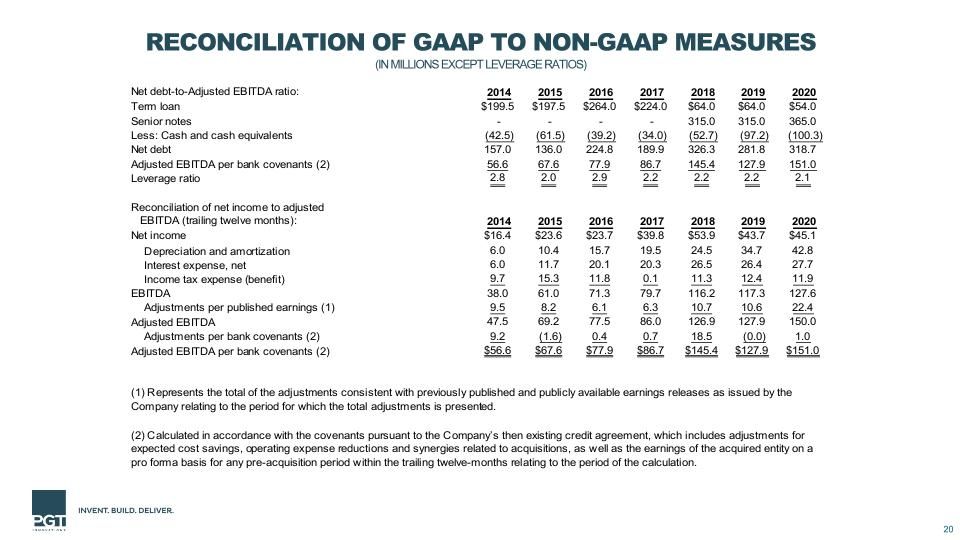

HIGHLIGHTS Proven track record of deleveraging acquisitions Net debt to trailing 12-month bank-covenant adjusted EBITDA1,3 within target range Strong Adj. EBITDA and cash flow growth reduce financial risk Strong balance sheet Bank-Covenant Adjusted EBITDA1,3 and Leverage Ratio2,3 ACQUIRED ACQUIRED ACQUIRED ACQUIRED 1.Refer to reconciliation to GAAP. 2. Leverage ratio defined as net debt divided by trailing-twelve-month bank-covenant adjusted EBITDA. 3. Refer to reconciliation to GAAP on slide 17 for 2021 and TTM Q3 2022, and on slide 20 for periods prior to 2021. ACQUIRED ACQUIRED

INTERNAL INVESTMENT DEBT REDUCTION STRATEGIC ACQUISITIONS Long-Term Capital Allocation priorities Investment in continuous improvement expected to drive margin growth Strategic selling initiatives and marketing enhancements driving sales Capex target: 3-4% of sales Expect to maintain a strong balance sheet and conservative capital structure Long-term target Leverage Ratio of 2x – 3x Aligned with growth priorities and expected to grow shareholder value over the long-term Expansion into new regions, channels or products Addition of technologies, enhanced manufacturing or supply chain capabilities

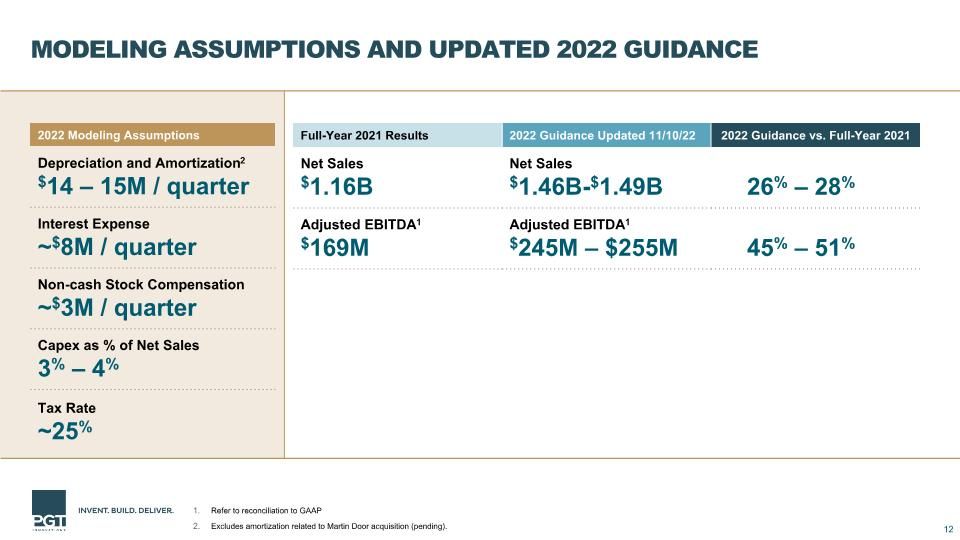

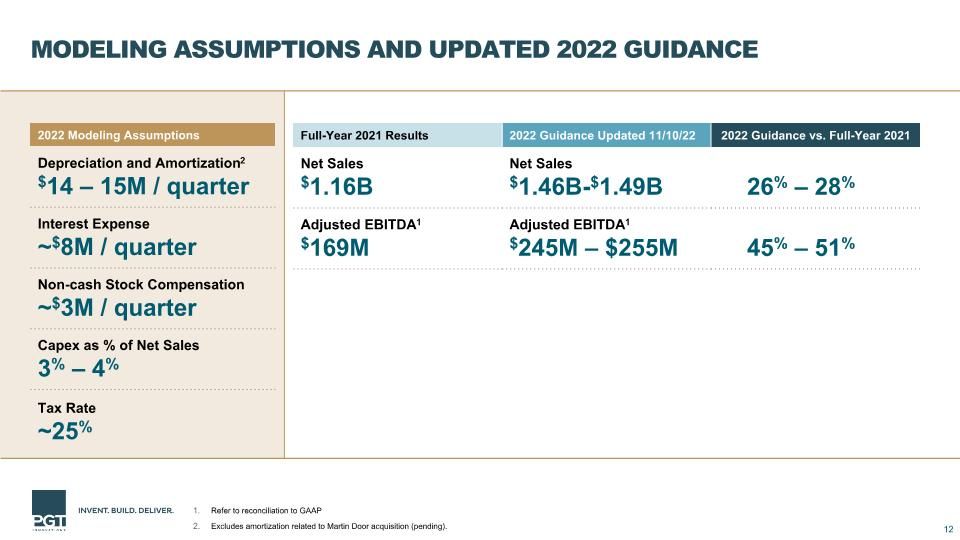

Modeling Assumptions and UPDATED 2022 Guidance 2022 Modeling Assumptions Depreciation and Amortization2 $14 – 15M / quarter Interest Expense ~$8M / quarter Non-cash Stock Compensation ~$3M / quarter Capex as % of Net Sales 3% – 4% Tax Rate ~25% Full-Year 2021 Results 2022 Guidance Updated 11/10/22 2022 Guidance vs. Full-Year 2021 Net Sales $1.16B Net Sales $1.46B-$1.49B 26% – 28% Adjusted EBITDA1 $169M Adjusted EBITDA1 $245M – $255M 45% – 51% Refer to reconciliation to GAAP Excludes amortization related to Martin Door acquisition (pending).

Why Invest in PGT Innovations 01. National leader in growing premium impact-resistant and indoor / outdoor window and door category 02. Well positioned with diversified product portfolio to capture profitable �growth in new construction and R&R channels 03. Continued focus on operational efficiencies expected to drive additional margin expansion 04. Expect to continue investing in R&D and talent to remain an industry �leader in innovation and product development 05. Sustainability has long been part of our company culture

Q&A

Appendix Reconciliation to Pro Forma Net Debt Leverage Ratio, Adjusted Net Income, Adjusted Net Income per Share-diluted, and Adjusted EBITDA, and Bank-Covenant Adjusted EBITDA

Reconciliation of GAAP to NON-gaap MEASURES�(unaudited - in thousands)

Reconciliation of GAAP to NON-gaap MEASURES�(unaudited - in thousands, except RATIO)

Reconciliation of GAAP to NON-gaap MEASURES�(unaudited - in thousands, except per share amounts and PERCENTAGES) THREE MONTHS ENDED OCTOBER 1, 2022, AND OCTOBER 2, 2021 THREE MONTHS ENDED 10/01/2022 10/02/2021

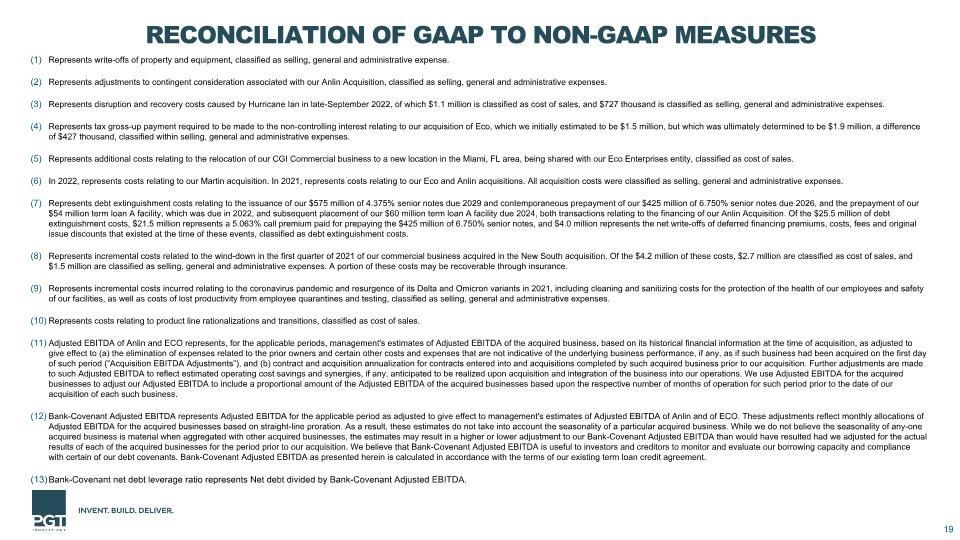

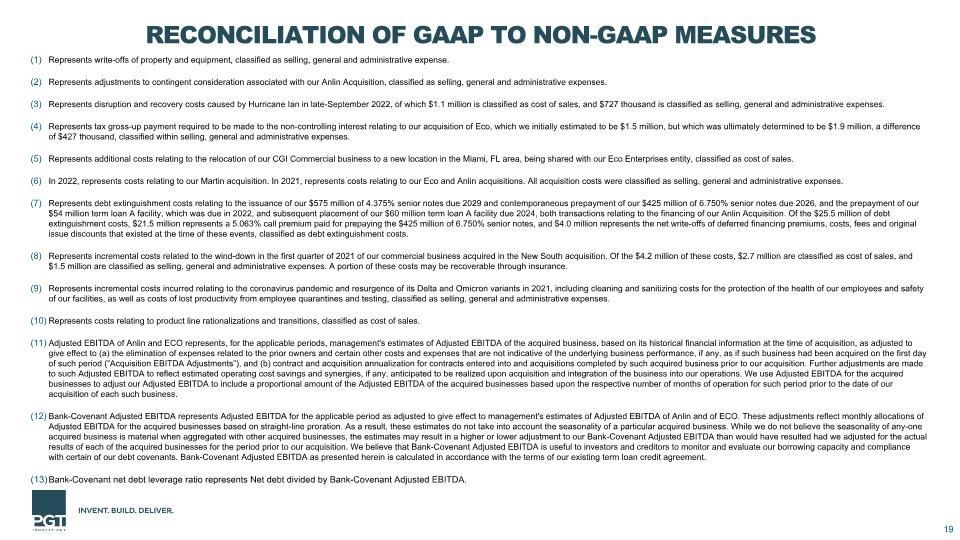

Reconciliation of GAAP to NON-gaap MEASURES Represents write-offs of property and equipment, classified as selling, general and administrative expense. Represents adjustments to contingent consideration associated with our Anlin Acquisition, classified as selling, general and administrative expenses. Represents disruption and recovery costs caused by Hurricane Ian in late-September 2022, of which $1.1 million is classified as cost of sales, and $727 thousand is classified as selling, general and administrative expenses. Represents tax gross-up payment required to be made to the non-controlling interest relating to our acquisition of Eco, which we initially estimated to be $1.5 million, but which was ultimately determined to be $1.9 million, a difference of $427 thousand, classified within selling, general and administrative expenses. Represents additional costs relating to the relocation of our CGI Commercial business to a new location in the Miami, FL area, being shared with our Eco Enterprises entity, classified as cost of sales. In 2022, represents costs relating to our Martin acquisition. In 2021, represents costs relating to our Eco and Anlin acquisitions. All acquisition costs were classified as selling, general and administrative expenses. Represents debt extinguishment costs relating to the issuance of our $575 million of 4.375% senior notes due 2029 and contemporaneous prepayment of our $425 million of 6.750% senior notes due 2026, and the prepayment of our $54 million term loan A facility, which was due in 2022, and subsequent placement of our $60 million term loan A facility due 2024, both transactions relating to the financing of our Anlin Acquisition. Of the $25.5 million of debt extinguishment costs, $21.5 million represents a 5.063% call premium paid for prepaying the $425 million of 6.750% senior notes, and $4.0 million represents the net write-offs of deferred financing premiums, costs, fees and original issue discounts that existed at the time of these events, classified as debt extinguishment costs. Represents incremental costs related to the wind-down in the first quarter of 2021 of our commercial business acquired in the New South acquisition. Of the $4.2 million of these costs, $2.7 million are classified as cost of sales, and $1.5 million are classified as selling, general and administrative expenses. A portion of these costs may be recoverable through insurance. Represents incremental costs incurred relating to the coronavirus pandemic and resurgence of its Delta and Omicron variants in 2021, including cleaning and sanitizing costs for the protection of the health of our employees and safety of our facilities, as well as costs of lost productivity from employee quarantines and testing, classified as selling, general and administrative expenses. Represents costs relating to product line rationalizations and transitions, classified as cost of sales. Adjusted EBITDA of Anlin and ECO represents, for the applicable periods, management's estimates of Adjusted EBITDA of the acquired business, based on its historical financial information at the time of acquisition, as adjusted to give effect to (a) the elimination of expenses related to the prior owners and certain other costs and expenses that are not indicative of the underlying business performance, if any, as if such business had been acquired on the first day of such period (“Acquisition EBITDA Adjustments”), and (b) contract and acquisition annualization for contracts entered into and acquisitions completed by such acquired business prior to our acquisition. Further adjustments are made to such Adjusted EBITDA to reflect estimated operating cost savings and synergies, if any, anticipated to be realized upon acquisition and integration of the business into our operations. We use Adjusted EBITDA for the acquired businesses to adjust our Adjusted EBITDA to include a proportional amount of the Adjusted EBITDA of the acquired businesses based upon the respective number of months of operation for such period prior to the date of our acquisition of each such business. Bank-Covenant Adjusted EBITDA represents Adjusted EBITDA for the applicable period as adjusted to give effect to management's estimates of Adjusted EBITDA of Anlin and of ECO. These adjustments reflect monthly allocations of Adjusted EBITDA for the acquired businesses based on straight-line proration. As a result, these estimates do not take into account the seasonality of a particular acquired business. While we do not believe the seasonality of any-one acquired business is material when aggregated with other acquired businesses, the estimates may result in a higher or lower adjustment to our Bank-Covenant Adjusted EBITDA than would have resulted had we adjusted for the actual results of each of the acquired businesses for the period prior to our acquisition. We believe that Bank-Covenant Adjusted EBITDA is useful to investors and creditors to monitor and evaluate our borrowing capacity and compliance with certain of our debt covenants. Bank-Covenant Adjusted EBITDA as presented herein is calculated in accordance with the terms of our existing term loan credit agreement. Bank-Covenant net debt leverage ratio represents Net debt divided by Bank-Covenant Adjusted EBITDA.

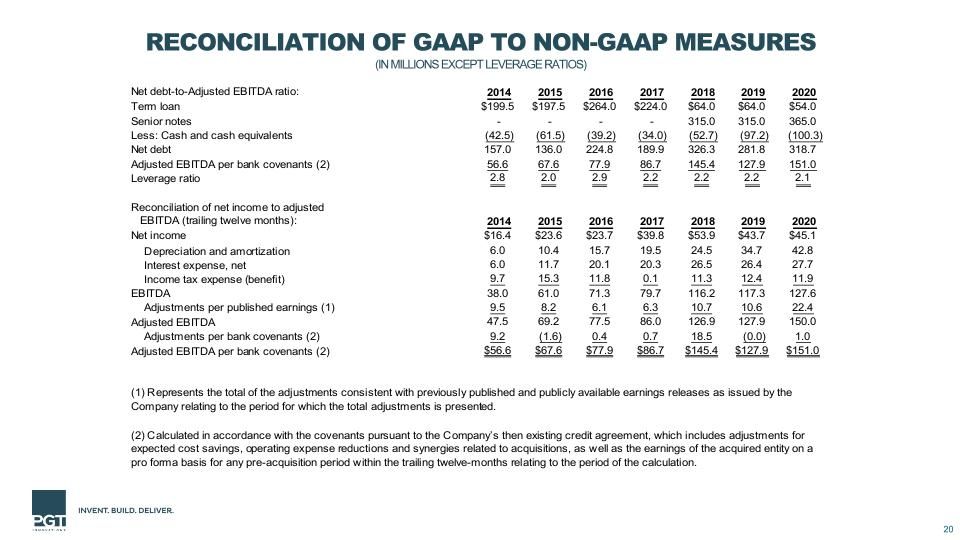

Reconciliation of GAAP to NON-gaap MEASURES�(IN MILLIONS EXCEPT LEVERAGE RATIOS)