- PGTI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

PGT Innovations (PGTI) 425Business combination disclosure

Filed: 3 Jan 24, 9:31am

Filed by Masonite International Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed to be filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: PGT Innovations, Inc.

Commission File No.: 001- 37971

Date: January 3, 2024

Masonite International Corporation has made available the following communication through its website, investor.masonite.com under the headings “Investor Relations” then “PGTI Acquisition,” in connection with its proposed acquisition of PGT Innovations, Inc.:

Combining complementary products and channels to accelerate growth Masonite, the largest supplier of doors in North America, is acquiring PGT Innovations, a leading manufacturer of patio doors and premium windows, to create a must-own, specialty building products company primed for growth. Expands addressable market into complementary and adjacent categories Masonite Key Products Interior Doors Exterior Doors Luxury Glass Doors Door System Components PGT Innovations Key Products Impact Resistant Windows Non-Impact Windows Garage Doors Patio Doors & Enclosures Creates a premier door and window company, with expertise across all the openings in the home Significantly increases Masonite’s growth profile Pro forma Masonite PGT Innovations incl. synergies Net sales ~$2.8B ~$1.5B ~$4B+ Adj. 1 $423M $270M ~$800M EBITDA* Adj. EBITDA 1 ~15% ~18% ~18% Margin* Free Cash $282M $125M ~$400M+ Flow* Addition of fast growing PGT Innovations business (24% Sales CAGR 2017-2024) adds ~200bps to Masonite’s expected growth profile Note: Figures reflect LTM Q3 2023 (1) Inclusive of synergies (*) See ‘Safe Harbor / Non-GAAP Financial Measures’ for definitions and other information and appendix for non-GAAP reconciliations. Transaction Summary $3B Total Cash and Stock Transaction $33.50 In cash per share plus 0.07353 shares of Masonite common stock per PGTI share (fixed exchange ratio) Unanimously approved by both Masonite and PGTI Boards of Directors Upon completion, Masonite Shareholders to own ~84% and PGTI shareholders to own ~16% of the combined company Howard Heckes to continue to serve as CEO Jeff Jackson and additional PGT Innovations director to join Masonite Board of Directors at close Anticipated closing in the middle of 2024 subject to PGT Innovations shareholder approval, required regulatory approvals and other customary closing conditions

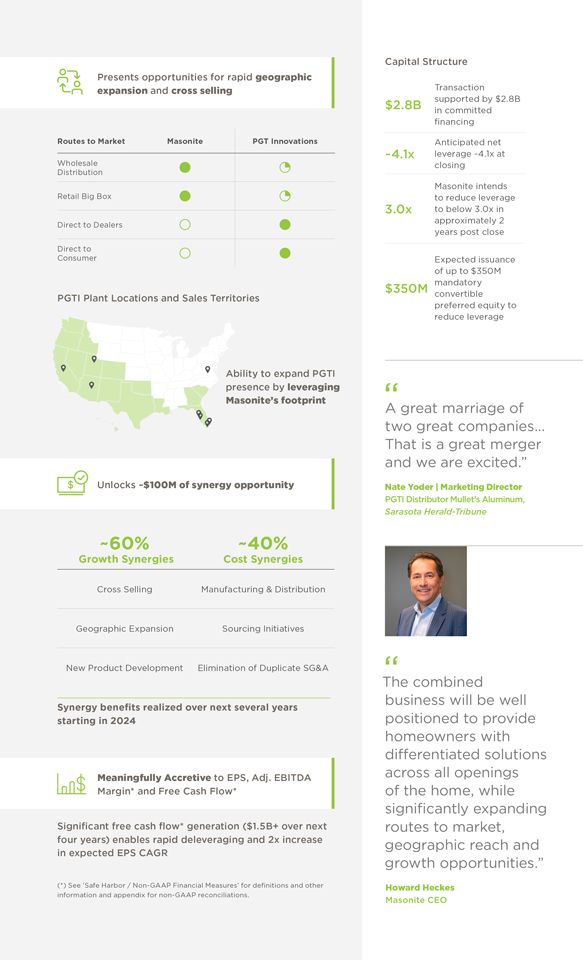

Presents opportunities for rapid geographic expansion and cross selling Routes to Market Masonite PGT Innovations Wholesale Distribution Retail Big Box Direct to Dealers Direct to Consumer PGTI Plant Locations and Sales Territories Ability to expand PGTI presence by leveraging Masonite’s footprint Unlocks ~$100M of synergy opportunity ~60% ~40% Growth Synergies Cost Synergies Cross Selling Manufacturing & Distribution Geographic Expansion Sourcing Initiatives New Product Development Elimination of Duplicate SG&A Synergy benefits realized over next several years starting in 2024 Meaningfully Accretive to EPS, Adj. EBITDA Margin* and Free Cash Flow* Significant free cash flow* generation ($1.5B+ over next four years) enables rapid deleveraging and 2x increase in expected EPS CAGR (*) See ‘Safe Harbor / Non-GAAP Financial Measures’ for definitions and other information and appendix for non-GAAP reconciliations. Capital Structure Transaction $2.8B supported by $2.8B in committed financing Anticipated net ~4.1x leverage ~4.1x at closing Masonite intends to reduce leverage 3.0x to below 3.0x in approximately 2 years post close Expected issuance of up to $350M $350M mandatory convertible preferred equity to reduce leverage “ A great marriage of two great companies... That is a great merger and we are excited.” Nate Yoder | Marketing Director PGTI Distributor Mullet’s Aluminum, Sarasota Herald-Tribune The “ combined business will be well positioned to provide homeowners with differentiated solutions across all openings of the home, while significantly expanding routes to market, geographic reach and growth opportunities.” Howard Heckes Masonite CEO

Frequently Asked Questions Q: How is this acquisition aligned to your Doors That Do MoreTM Strategy? A: This acquisition is a natural next step to advance our Doors That Do More™ strategy. With PGT Innovations, Masonite adds complementary product offerings in adjacent categories, attractive geographies, expanded routes to market and cross-selling opportunities, enhanced engineering and manufacturing capabilities, as well as a significantly stronger growth and financial profile. Q: Can you give some examples of the potential cross-selling synergies? A: Masonite has the opportunity to bring PGT Innovations products up for consideration with the large wholesalers and big box retailers with whom we now have strong relationships. In addition, doors are often included as part of a window replacement project. There will be an increased opportunity to sell Masonite doors at PGT Innovations dealers and PGT Innovations company owned showrooms. Q: How are you going to unlock the geographic expansion? A: Masonite has a complementary geography with manufacturing, distribution and selling resources throughout the U.S. and Canada, which can be leveraged for expansion of PGT Innovations business. For example, Masonite assets in the heart of Texas provide a potential platform to expand operations. Q: Can you give more detail on the cost synergies and timing for realization? A: A majority of cost savings are related to SG&A optimization including duplicative corporate / public company costs. We see additional opportunities in sourcing of glass, packaging, aluminum, MRO, and logistics as well as in the potential for manufacturing and distribution efficiencies. We anticipate completing the initiatives required to realize these synergies over the course of the first two years after the transaction has closed. Q: What gives you confidence in your ability to reduce leverage? A: The combination of synergies and approximately $400M of pro-forma free cash flow* is expected to provide the opportunity for significant debt pay-down and rapid deleveraging to below 3.0x in two years following close. (*) See ‘Safe Harbor / Non-GAAP Financial Measures’ for definitions and other information and appendix for non-GAAP reconciliations.

Safe Harbor / Non-GAAP Financial Measures Cautionary Statement Regarding Forward-Looking Statements This communication contains certain statements that are “forward-looking” statements within the meaning of Section 27A of the 1933 Act and Section 21E of the Securities Exchange Act of 1934. You can identify these statements and other forward-looking statements in this document by words such as “may,” “will,” “should,” “can,” “could,” “anticipate,” “estimate,” “expect,” “predict,” “project,” “future,” “potential,” “intend,” “plan,” “assume,” “believe,” “forecast,” “look,” “build,” “focus,” “create,” “work,” “continue,” “target,” “poised,” “advance,” “drive,” “aim,” “forecast,” “approach,” “seek,” “schedule,” “position,” “pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,” “commit,” “on track,” “objective,” “goal,” “strategy,” “opportunity,” “ambitions,” “aspire” and similar expressions, and variations or negative of such terms or other variations thereof. Words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such statements regarding the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) among Masonite International Corporation (“Masonite” or “our” or “we”), PGT Innovations, Inc. (“PGTI”) and Peach Acquisition, Inc. (the “Transaction”), including the expected time period to consummate the Transaction, the anticipated benefits (including synergies) of the Transaction and integration and transition plans, opportunities, anticipated future performance, expected share buyback programs and expected dividends. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of Masonite and PGTI, that could cause actual results to differ materially from those expressed in such forward-looking statements. Key factors that could cause actual results to differ materially include, but are not limited to, the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction; the ability to successfully integrate the businesses of the companies, including the risk that problems may arise in successfully integrating the such businesses, which may result in the combined company not operating as effectively and efficiently as expected; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the possibility that PGTI’s stockholders may not approve the Transaction; the risk that the anticipated tax treatment of the Transaction is not obtained; the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the Transaction; the risk that any announcements relating to the Transaction could have adverse effects on the market price of Masonite’s or PGTI’s common shares; the risk that the Transaction and its announcement could have an adverse effect on the parties’ business relationships and business generally, including the ability of Masonite and PGTI to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, and on their operating results and businesses generally; the risk of unforeseen or unknown liabilities; customer, shareholder, regulatory and other stakeholder approvals and support; the risk of unexpected future capital expenditures; the risk of potential litigation relating to the Transaction that could be instituted against Masonite and/or PGTI or their respective directors and/or officers; the risk that the combined company may be unable to achieve cost-cutting or revenues synergies or it may take longer than expected to achieve those synergies; the risk that the combined company may not buy back shares; the risk associated with third party contracts containing material consent, anti-assignment, transfer or other provisions that may be related to the Transaction which are not waived or otherwise satisfactorily resolved; the risk of receipt of required Masonite Board of Directors’ authorizations to implement capital allocation strategies; the risk of rating agency actions and Masonite’s and PGTI’s ability to access short- and long-term debt markets on a timely and affordable basis; the risk of various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, cybersecurity attacks, security threats and governmental response to them, and technological changes; the risks of labor disputes, changes in labor costs and labor difficulties; and the risks resulting from other effects of industry, market, economic, legal or legislative, political or regulatory conditions outside of Masonite’s or PGTI’s control. All such factors are difficult to predict and are beyond our control, including those detailed in Masonite’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on Masonite’s website at https:// www.masonite.com and on the SEC website at http://www.sec.gov, and those detailed in PGTI’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on PGTI’s website at https:// pgtinnovations.com and on the SEC website at http://www.sec.gov. PGTI’s forward-looking statements are based on assumptions that PGTI’s believes to be reasonable but that may not prove to be accurate. Other unpredictable or factors not discussed in this communication could also have material adverse effects on forward-looking statements. Neither Masonite nor PGTI assumes an obligation to update any forward-looking statements, except as required by applicable law. These forward-looking statements speak only as of the date hereof. Additional Information and Where to Find It In connection with the Transaction, Masonite will file with the SEC a registration statement on Form S-4 to register the common shares of Masonite to be issued in connection with the Transaction. The registration statement will include a proxy statement of PGTI that also constitutes a prospectus of Masonite. The definitive proxy statement/prospectus will be sent to the stockholders of PGTI seeking their approval of the Transaction and other related matters. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE PROXY STATEMENT/ PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING MASONITE, PGTI, THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents, including the proxy statement/prospectus, and other documents filed with the SEC by Masonite or PGTI through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Masonite will be made available free of charge by accessing Masonite’s website at https://www.masonite.com or by contacting Masonite’s Investor Relations Department by phone at (813) 877-2726. Copies of documents filed with the SEC by PGTI will be made available free of charge by accessing PGTI’s website at https://pgtinnovations.com or by contacting PGTI by submitting a message at https://ir.pgtinnovations.com/investor-contact or by mail at 1070 Technology Drive, North Venice, FL 34275. Participants in the Solicitation Masonite, PGTI, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of PGTI in connection with the Transaction under the rules of the SEC. Information about the interests of the directors and executive officers of Masonite and PGTI and other persons who may be deemed to be participants in the solicitation of stockholders of PGTI in connection with the Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus related to the Transaction, which will be filed with the SEC. Additional information about Masonite, the directors and executive officers of Masonite and their ownership of Masonite common shares is also set forth in the definitive proxy statement for Masonite’s 2023 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 29, 2023 (and which is available at https://www.sec.gov/Archives/ edgar/data/893691/000119312523083032/d326829ddef14a.htm), and other documents subsequently filed by Masonite with the SEC. Information about the directors and executive officers of Masonite, their beneficial ownership of common shares of Masonite, and Masonite’s transactions with related parties is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” included in Masonite’s annual report on Form 10-K for the fiscal year ended January 1, 2023, which was filed with the SEC on February 28, 2023 (and which is available at https:// www.sec.gov/Archives/edgar/data/893691/000089369123000013/door-20230101.htm), in Masonite’s Current Report on Form 8-K filed with the SEC on May 12, 2023 (and which is available at https://www.sec.gov//Archives/ edgar/data/893691/000089369123000037/door-20230511.htm), and in the sections entitled “Proposal 1: Election of Directors,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Party Transactions” included in Masonite’s definitive proxy statement for Masonite’s 2023 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 29, 2023 and which is available at https://www.sec.gov/ Archives/edgar/data/893691/000119312523083032/d326829ddef14a.htm). Information about the directors and executive officers of PGTI and their ownership of PGTI common stock is also set forth in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April 28, 2023 (and which is available at https://www.sec. gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a. htm), PGTI’s Current Report on Form 8-K filed with the SEC on July 3, 2023 (and which is available at https://www.sec.gov/Archives/edgar/ data/1354327/000095010323009816/dp196528_8k.htm), and PGTI’s Current Report on Form 8-K filed with the SEC on November 6, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323016034/ dp202537_8k.htm). Information about the directors and executive officers of PGTI, their ownership of PGTI common stock, and PGTI’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain Relationships and Related Transactions, and Director Independence” included in PGTI’s annual report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 27, 2023 (and which is available at https://www. sec.gov/Archives/edgar/data/1354327/000095017023004543/pgti-20221231. htm), and in the sections entitled “Board Highlights” and “Security Ownership of Certain Beneficial Owners and Management” included in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April 28, 2023 (and which is available at https://www. sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a. htm). Additional information regarding the interests of such participants in the solicitation of proxies in respect of the Transaction will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available These documents can be obtained free of charge from the SEC’s website at www.sec.gov. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the 1933 Act. Non-GAAP Measures To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), this communication includes the following non-GAAP financial measures in this communication: Adjusted EBITDA, Adjusted EBITDA Margin and free cash flow. These non-GAAP financial measures are based on internal forecasts and represent management’s best judgment. The reconciliation of these non-GAAP measures to the most directly comparable financial measure calculated and presented in accordance with GAAP can be found under the title ‘Safe Harbor / Non-GAAP Financial Measures’ of this communication. Because these non-GAAP measures exclude certain items as described herein, they may not be indicative of the results that Masonite expects to recognize for future periods. As a result, these non-GAAP measures should be considered in addition to, and not a substitute for, the financial information prepared in accordance with GAAP. Masonite’s Adjusted EBITDA is a non-GAAP financial measure which does not have a standardized meaning under GAAP and is unlikely to be comparable to similar measures used by other companies. Adjusted EBITDA should not be considered as an alternative to either net income or operating cash flows determined in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not include certain cash requirements such as interest payments, tax payments and debt service requirements. Adjusted EBITDA is defined as net income attributable to Masonite adjusted to exclude the following items, as applicable: depreciation; amortization; share based compensation expense; loss (gain) on disposal of property, plant and equipment; registration and listing fees; restructuring costs; asset impairment; loss (gain) on disposal of subsidiaries; interest expense (income), net; loss on extinguishment of debt; other expense (income), net; income tax expense (benefit); other items; loss (income) from discontinued operations, net of tax; and net income (loss) attributable to non-controlling interest. This definition of Adjusted EBITDA differs from the definitions of EBITDA contained in the indentures governing the 2028 and 2030 Notes and the credit agreements governing the ABL Facility and Term Loan Facility. Adjusted EBITDA, as calculated under our ABL Facility or senior notes would also include, among other things, additional add-backs for amounts related to: cost savings projected by us in good faith to be realized as a result of actions taken or expected to be taken prior to or during the relevant period; fees and expenses in connection with certain plant closures and layoffs; and the amount of any restructuring charges, integration costs or other business optimization expenses or reserve deducted in the relevant period in computing consolidated net income, including any one-time costs incurred in connection with acquisitions. Adjusted EBITDA is used to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation. Intersegment sales are recorded using market prices. We believe that Adjusted EBITDA, from an operations standpoint, provides an appropriate way to measure and assess segment performance. Our management team has established the practice of reviewing the performance of each segment based on the measures of net sales and Adjusted EBITDA. We believe that Adjusted EBITDA is useful to users of the consolidated financial statements because it provides the same information that we use internally to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation.

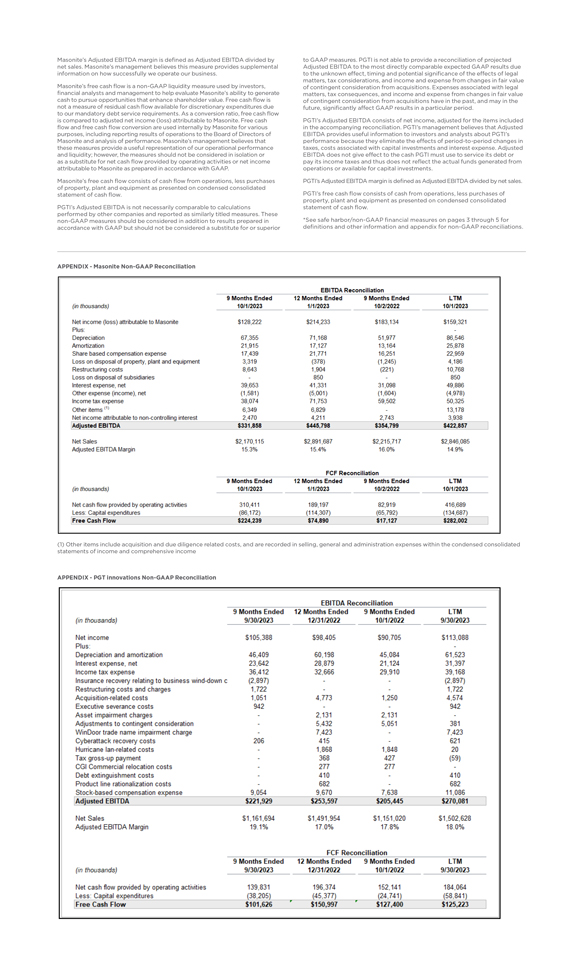

Masonite’s Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. Masonite’s management believes this measure provides supplemental information on how successfully we operate our business. Masonite’s free cash flow is a non-GAAP liquidity measure used by investors, financial analysts and management to help evaluate Masonite’s ability to generate cash to pursue opportunities that enhance shareholder value. Free cash flow is not a measure of residual cash flow available for discretionary expenditures due to our mandatory debt service requirements. As a conversion ratio, free cash flow is compared to adjusted net income (loss) attributable to Masonite. Free cash flow and free cash flow conversion are used internally by Masonite for various purposes, including reporting results of operations to the Board of Directors of Masonite and analysis of performance. Masonite’s management believes that these measures provide a useful representation of our operational performance and liquidity; however, the measures should not be considered in isolation or as a substitute for net cash flow provided by operating activities or net income attributable to Masonite as prepared in accordance with GAAP. Masonite’s free cash flow consists of cash flow from operations, less purchases of property, plant and equipment as presented on condensed consolidated statement of cash flow. PGTI’s Adjusted EBITDA is not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP measures. PGTI is not able to provide a reconciliation of projected Adjusted EBITDA to the most directly comparable expected GAAP results due to the unknown effect, timing and potential significance of the effects of legal matters, tax considerations, and income and expense from changes in fair value of contingent consideration from acquisitions. Expenses associated with legal matters, tax consequences, and income and expense from changes in fair value of contingent consideration from acquisitions have in the past, and may in the future, significantly affect GAAP results in a particular period. PGTI’s Adjusted EBITDA consists of net income, adjusted for the items included in the accompanying reconciliation. PGTI’s management believes that Adjusted EBITDA provides useful information to investors and analysts about PGTI’s performance because they eliminate the effects of period-to-period changes in taxes, costs associated with capital investments and interest expense. Adjusted EBITDA does not give effect to the cash PGTI must use to service its debt or pay its income taxes and thus does not reflect the actual funds generated from operations or available for capital investments. PGTI’s Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. PGTI’s free cash flow consists of cash from operations, less purchases of property, plant and equipment as presented on condensed consolidated statement of cash flow. *See safe harbor/non-GAAP financial measures on pages 3 through 5 for definitions and other information and appendix for non-GAAP reconciliations. APPENDIX - Masonite Non-GAAP Reconciliation (in thousands) 9 Months Ended 10/1/2023 12 Months Ended 1/1/2023 9 Months Ended 10/2/2022 LTM 10/01/2023 Net income(loss) attributable to Masonite $128,222 $214,233 $183,134 $159,321 Plus: - Depreciation 67,355 71,168 51,977 86,546 Amortization 21,915 17,127 13,164 25,878 Share based compensation expense 17,439 21,771 16,251 22,959 Loss on disposal of property, plant and equipment 3,319 (378) (1,245) 4,186 Restructuring costs 8,643 1,904 (221) 10,768 Loss on disposal of subsidiaries - 850 - 850 Interest expense, net 39,653 41,331 31,098 49,886 Other expense (income), net (1,581) (5,001) (1,604) (4,978) Income tax expense 38,074 71,753 59,502 50,325 Other items (1) 6,349 6,829 - 13,178 Net income attributable to non-controlling interest 2,470 4,211 2,743 3,938 Adjusted EBITDA $331,858 $445,798 $354,799 $422,857 Net Sales $2,170,115 $2,891,687 $2,215,717 $2,846,085 Adjusted EBITDA Margin 15.3% 15.4% 16.0% 14.9% FCR Reconciliation (in thousands) 9 Months Ended 10/1/2023 12 Months ended 1/1/2023 9 Months Ended 10/2/2022 LTM 10/1/2023 Net cash flow provided by operating activities 310,411 189,197 82,919 416,689 Less: Capital expenditures (86,172) (114,307) (65,792) (134,687) Free Cash Flow $224,239 $74,890 $17,127 $282,002 (1) Other items include acquisition and due diligence related costs, and are recorded in selling, general and administration expenses within the condensed consolidated statements of income and comprehensive income APPENDIX - PGT innovations Non-GAAP Reconciliation (in thousands) 9 Months Ended 9/30/2023 12 Months Ended 12/31/2022 9 Months Ended 10/1/2022 LTM 9/30/2023 Net income $105,388 Net income$90,705 $113,088 Plus: Depreciation and amortization 46,409 60,198 45,084 61,523 Interest expense, net 23,642 28,879 21,124 31,397 Income tax expense 36,412 32,666 29,910 39,168 Insurance recovery relating to business wind-down c (2,897) - - (2,897) Restructuring costs and charges 1,722 - - 1,722 Acquisition-related costs 1,051 4,773 1,2450 4,574 Executive severance costs 942 - - 942 Asset impairment charges – 2,131 2,131 – Adjustments to contingent consideration – 5,432 5,051 381 WinDoor trade name impairment charge – 7,423 – 7,423 Cyberattack recovery costs 206 415 – 621 Hurricane lan-related costs – 1,868 1,848 20 Tax gross-up payment – 368 427 (59) CGI Commercial relocation costs – 277 277 – Debt extinguishment costs – 410 – 410 Product line rationalization costs – 682 – 682 Stock-based compensation expense 9,054 9,670 7,638 11,086 Adjusted EBITDA $221,929 $253,597 $205,445 $270,081 Net Sales $1,161,694 $1,491,954 $1,151,020 $1,502,628 Adjusted EBITDA Margin 19.1% 17.0% 17.8% 18.0% FCF Reconciliation (in thousands) 9 Months Ended 9/30/2023 12 Months Ended 12/31/2022 9 Months Ended 10/1/2022 LTM 9/30/2023 Net cash flow provided by operating activities 139,831 196,374 152,141 184,064 Less: Capital expenditures (38,205) (45,377) (24,741) (58,841) Free Cash Flow $101,626 $150,997 $127,400 $125,223

*****

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain statements that are “forward-looking” statements within the meaning of Section 27A of the 1933 Act and Section 21E of the Securities Exchange Act of 1934. You can identify these statements and other forward-looking statements in this document by words such as “may,” “will,” “should,” “can,” “could,” “anticipate,” “estimate,” “expect,” “predict,” “project,” “future,” “potential,” “intend,” “plan,” “assume,” “believe,” “forecast,” “look,” “build,” “focus,” “create,” “work,” “continue,” “target,” “poised,” “advance,” “drive,” “aim,” “forecast,” “approach,” “seek,” “schedule,” “position,” “pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,” “commit,” “on track,” “objective,” “goal,” “strategy,” “opportunity,” “ambitions,” “aspire” and similar expressions, and variations or negative of such terms or other variations thereof. Words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such statements regarding the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) among Masonite International Corporation (“Masonite” or “our” or “we”), PGT Innovations, Inc. (“PGTI”) and Peach Acquisition, Inc. (the “Transaction”), including the expected time period to consummate the Transaction, the anticipated benefits (including synergies) of the Transaction and integration and transition plans, opportunities, anticipated future performance, expected share buyback programs and expected dividends. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of Masonite and PGTI, that could cause actual results to differ materially from those expressed in such forward-looking statements. Key factors that could cause actual results to differ materially include, but are not limited to, the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction; the ability to successfully integrate the businesses of the companies, including

the risk that problems may arise in successfully integrating the such businesses, which may result in the combined company not operating as effectively and efficiently as expected; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the possibility that PGTI’s stockholders may not approve the Transaction; the risk that the anticipated tax treatment of the Transaction is not obtained; the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the Transaction; the risk that any announcements relating to the Transaction could have adverse effects on the market price of Masonite’s or PGTI’s common shares; the risk that the Transaction and its announcement could have an adverse effect on the parties’ business relationships and business generally, including the ability of Masonite and PGTI to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, and on their operating results and businesses generally; the risk of unforeseen or unknown liabilities; customer, shareholder, regulatory and other stakeholder approvals and support; the risk of unexpected future capital expenditures; the risk of potential litigation relating to the Transaction that could be instituted against Masonite and/or PGTI or their respective directors and/or officers; the risk that the combined company may be unable to achieve cost-cutting or revenues synergies or it may take longer than expected to achieve those synergies; the risk that the combined company may not buy back shares; the risk associated with third party contracts containing material consent, anti-assignment, transfer or other provisions that may be related to the Transaction which are not waived or otherwise satisfactorily resolved; the risk of receipt of required Masonite Board of Directors’ authorizations to implement capital allocation strategies; the risk of rating agency actions and Masonite’s and PGTI’s ability to access short-and long-term debt markets on a timely and affordable basis; the risk of various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, cybersecurity attacks, security threats and governmental response to them, and technological changes; the risks of labor disputes, changes in labor costs and labor difficulties; and the risks resulting from other effects of industry, market, economic, legal or legislative, political or regulatory conditions outside of Masonite’s or PGTI’s control. All such factors are difficult to predict and are beyond our control, including those detailed in Masonite’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on Masonite’s website at https://www.masonite.com and on the SEC website at http://www.sec.gov, and those detailed in PGTI’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available on PGTI’s website at https://pgtinnovations.com and on the SEC website at http://www.sec.gov. PGTI’s forward-looking statements are based on assumptions that PGTI’s believes to be reasonable but that may not prove to be accurate. Other unpredictable or factors not discussed in this communication could also have material adverse effects on forward-looking statements. Neither Masonite nor PGTI assumes an obligation to update any forward-looking statements, except as required by applicable law. These forward-looking statements speak only as of the date hereof.

Additional Information and Where to Find It

In connection with the Transaction, Masonite will file with the SEC a registration statement on Form S-4 to register the common shares of Masonite to be issued in connection with the Transaction. The registration statement will include a proxy statement of PGTI that also constitutes a prospectus of Masonite. The definitive proxy statement/prospectus will be sent to the stockholders of PGTI seeking their approval of the Transaction and other related matters.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING MASONITE, PGTI, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free copies of these documents, including the proxy statement/prospectus, and other documents filed with the SEC by Masonite or PGTI through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Masonite will be made available free of charge by accessing Masonite’s website at https://www.masonite.com or by contacting Masonite’s Investor Relations Department by phone at (813) 877-2726. Copies of documents filed with the SEC by PGTI will be made available free of charge by accessing PGTI’s website at https://pgtinnovations.com or by contacting PGTI by submitting a message at https://ir.pgtinnovations.com/investor-contact or by mail at 1070 Technology Drive, North Venice, FL 34275.

Participants in the Solicitation

Masonite, PGTI, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of PGTI in connection with the Transaction under the rules of the SEC. Information about the interests of the directors and executive officers of Masonite and PGTI and other persons who may be deemed to be participants in the solicitation of stockholders of PGTI in connection with the Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus related to the Transaction, which will be filed with the SEC. Additional information about Masonite, the directors and executive officers of Masonite and their ownership of Masonite common shares is also set forth in the definitive proxy statement for Masonite’s 2023 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 29, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/893691/000119312523083032/d326829ddef14a.htm), and other documents subsequently filed by Masonite with the SEC. Information about the directors and executive officers of Masonite, their beneficial ownership of common shares of Masonite, and Masonite’s transactions with related parties is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” included in Masonite’s annual report on Form 10-K for the fiscal year ended January 1, 2023, which was filed with the SEC on February 28, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/893691/000089369123000013/door-20230101.htm), in Masonite’s Current Report on Form 8-K filed with the SEC on May 12, 2023 (and which is available at https://www.sec.gov//Archives/edgar/data/893691/000089369123000037/door-20230511.htm), and in the sections entitled “Proposal 1: Election of Directors,” “Security Ownership of Certain Beneficial Owners and Management,” and “Certain Relationships and Related Party Transactions” included in Masonite’s definitive proxy statement for Masonite’s 2023 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 29, 2023 and which is available at https://www.sec.gov/Archives/edgar/data/893691/000119312523083032/d326829ddef14a.htm).

Information about the directors and executive officers of PGTI and their ownership of PGTI common stock is also set forth in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April 28, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm), PGTI’s Current Report on Form 8-K filed with the SEC on July 3, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323009816/dp196528_8k.htm), and PGTI’s Current Report on Form 8-K filed with the SEC on November 6, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323016034/dp202537_8k.htm). Information about the directors and executive officers of PGTI, their ownership of PGTI common stock, and PGTI’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain Relationships and Related Transactions, and Director Independence” included in PGTI’s annual report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 27, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095017023004543/pgti-20221231.htm), and in the sections entitled “Board Highlights” and “Security Ownership of Certain Beneficial Owners and Management” included in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April 28, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm). Additional information regarding the interests of such participants in the solicitation of proxies in respect of the Transaction will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available These documents can be obtained free of charge from the SEC’s website at www.sec.gov.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the 1933 Act.

Non-GAAP Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), this communication includes the following non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA Margin and free cash flow. These non-GAAP financial measures are based on internal forecasts and represent management’s best judgment. The reconciliation of these non-GAAP measures to the most directly comparable financial measure calculated and presented in accordance with GAAP can be found in this

communication. Because these non-GAAP measures exclude certain items as described herein, they may not be indicative of the results that Masonite expects to recognize for future periods. As a result, these non-GAAP measures should be considered in addition to, and not a substitute for, the financial information prepared in accordance with GAAP.

Masonite’s Adjusted EBITDA is a non-GAAP financial measure which does not have a standardized meaning under GAAP and is unlikely to be comparable to similar measures used by other companies. Adjusted EBITDA should not be considered as an alternative to either net income or operating cash flows determined in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not include certain cash requirements such as interest payments, tax payments and debt service requirements. Adjusted EBITDA is defined as net income attributable to Masonite adjusted to exclude the following items, as applicable: depreciation; amortization; share based compensation expense; loss (gain) on disposal of property, plant and equipment; registration and listing fees; restructuring costs; asset impairment; loss (gain) on disposal of subsidiaries; interest expense (income), net; loss on extinguishment of debt; other expense (income), net; income tax expense (benefit); other items; loss (income) from discontinued operations, net of tax; and net income (loss) attributable to non-controlling interest. This definition of Adjusted EBITDA differs from the definitions of EBITDA contained in the indentures governing the 2028 and 2030 Notes and the credit agreements governing the ABL Facility and Term Loan Facility. Adjusted EBITDA, as calculated under our ABL Facility or senior notes would also include, among other things, additional add-backs for amounts related to: cost savings projected by us in good faith to be realized as a result of actions taken or expected to be taken prior to or during the relevant period; fees and expenses in connection with certain plant closures and layoffs; and the amount of any restructuring charges, integration costs or other business optimization expenses or reserve deducted in the relevant period in computing consolidated net income, including any one-time costs incurred in connection with acquisitions. Adjusted EBITDA is used to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation. Intersegment sales are recorded using market prices. We believe that Adjusted EBITDA, from an operations standpoint, provides an appropriate way to measure and assess segment performance. Our management team has established the practice of reviewing the performance of each segment based on the measures of net sales and Adjusted EBITDA. We believe that Adjusted EBITDA is useful to users of the consolidated financial statements because it provides the same information that we use internally to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation.

Masonite’s Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. Masonite’s management believes this measure provides supplemental information on how successfully we operate our business.

Masonite’s free cash flow is a non-GAAP liquidity measure used by investors, financial analysts and management to help evaluate Masonite’s ability to generate cash to pursue opportunities that enhance shareholder value. Free cash flow is not a measure of residual cash flow available for discretionary expenditures due to our mandatory debt service requirements. As a conversion ratio, free cash flow is compared to adjusted net income (loss) attributable to Masonite. Free cash flow and free cash flow conversion are used internally by Masonite for various purposes, including

reporting results of operations to the Board of Directors of Masonite and analysis of performance. Masonite’s management believes that these measures provide a useful representation of our operational performance and liquidity; however, the measures should not be considered in isolation or as a substitute for net cash flow provided by operating activities or net income attributable to Masonite as prepared in accordance with GAAP.

Masonite’s free cash flow consists of cash flow from operations, less purchases of property, plant and equipment as presented on condensed consolidated statement of cash flow.

PGTI’s Adjusted EBITDA is not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP measures. PGTI is not able to provide a reconciliation of projected Adjusted EBITDA to the most directly comparable expected GAAP results due to the unknown effect, timing and potential significance of the effects of legal matters, tax considerations, and income and expense from changes in fair value of contingent consideration from acquisitions. Expenses associated with legal matters, tax consequences, and income and expense from changes in fair value of contingent consideration from acquisitions have in the past, and may in the future, significantly affect GAAP results in a particular period.

PGTI’s Adjusted EBITDA consists of net income, adjusted for the items included in the accompanying reconciliation. PGTI’s management believes that Adjusted EBITDA provides useful information to investors and analysts about PGTI’s performance because they eliminate the effects of period-to-period changes in taxes, costs associated with capital investments and interest expense. Adjusted EBITDA does not give effect to the cash PGTI must use to service its debt or pay its income taxes and thus does not reflect the actual funds generated from operations or available for capital investments.

PGTI’s Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales.

PGTI’s free cash flow consists of cash from operations, less purchases of property, plant and equipment as presented on condensed consolidated statement of cash flow.