EXHIBIT 99.2

PGT Innovations, inc.SECOND Quarter 2017FINANCIAL RESULTSJULY 1, 2017

2 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Statements in this presentation regarding our business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,” “expect,” “expectations,” “outlook,” “forecast,” “guidance,” “intend,” “believe,” “could,” “project,” “estimate,” “anticipate,” “should” and similar terminology. These risks and uncertainties include factors such as:• unfavorable changes in new home starts and home remodeling trends, especially in Florida, where the substantial portion of our sales are generated;• unfavorable changes in the economy in the United States in general and in Florida, where the substantial portion of our sales are generated;• increases in our cost of raw materials, including aluminum, glass and vinyl;• our dependence on a limited number of suppliers for certain of our key materials;• increases in our transportation costs;• our level of indebtedness;• our dependence on our impact-resistant product lines;• our ability to successfully integrate businesses we may acquire, including our acquisitions of CGI Windows and Doors, Inc. and WinDoor, Inc.• product liability and warranty claims brought against us;• federal, state and local laws and regulations, including unfavorable changes in local building codes; • our dependence on a limited number of manufacturing facilities; and,• the other risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016.Statements in this presentation that are forward-looking statements include, without limitation, our expectations regarding: (1) the results of our initiatives to further improve our operational performance; (2) the outcome of our strategies and plans to further strengthen our brands; (3) the results of the changes in management, production processes and suppliers we made at our WinDoor business; (4) the duration and frequency of temporary production challenges our WinDoor business may experience due to those changes in management, production processes and suppliers; (5) the results and benefits of our three-brand go-to-market strategy; (6) our projected financial performance, results and outlook for 2017, including our expectations regarding full-year sales and EBITDA. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. Forward-Looking Statements

3 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Management Presenters Rod Hershberger Chief Executive Officer and Chairman of the Board Business Overview Jeff Jackson President and Chief Operating Officer Market Overview Brad West Sr. V.P. and Chief Financial Officer Financial Results

4 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Business Overview Q2 2017 sales of $137M, increased 15% over Q2 2016, and marked the highest quarterly sales amount in Company history. YTD sales of $250M is an all-time record sales level for a first-half.Single-family housing starts in Florida strengthened in Q2 2017, increasing 10% compared to Q2 2016. Single-family housing starts in Florida continue to track towards 85,000 for the year, but with the highest growth in new construction occurring in homes with lower opening price-points than seen last year.The growth in the housing market in Florida continues to out-pace the rest of the country, due to:Population expansion (projected to increase 325,000 in 2017; approaching 21M)Job creation (1.4M jobs added since a low of 8.1M in December 2009; now 9.7M employed)Declining unemployment (reached a high of 11.2% in December 2009; now 4.1%)We continue to develop innovative new products, and unveiled the next generation of our cutting-edge, new products at the 2017 NAHB International Builders Show. The Company’s primary market is Florida which represents approximately 90% of sales. Our focus has been on strengthening our position in Florida. Including two key acquisitions in Florida, we now have several strong brands operating under a single, unified identity…PGT Innovations.On July 7th, we made a $12M voluntary prepayment of borrowings under our 2016 Credit Agreement using cash on hand generated from operations.

5 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Market Overview Impact product sales increased 18% quarter-over-quarter, including quarter-over-quarter increases of 27% in vinyl impact products and 15% in aluminum impact products, both driven by sales of our WinGuard products.61% of our sales were from repair and remodeling, while sales in new construction represented 39%, a slightly higher mix of sales towards repair and remodeling. We believe lower new home inventories and increasing home prices, have led some would-be trade-up home buyers to remodel versus buy.As the third largest state in the U.S., the single largest factor for economic improvement in Florida continues to be the housing market.Florida single-family housing starts in Q2 2017 finished up 10% quarter-over-quarter.Florida single-family housing starts have increased in 23 of the last 26 consecutive quarters when compared the same quarter in the prior year.Florida single-family housing starts in 2016 finished at approximately 78,000.Florida’s population can support single-family housing starts of 110,000 per year. Construction of our new, leased location in Miami is progressing as planned. On target for Q1 2018 to begin operating in this new facility.

6 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Financial Overview

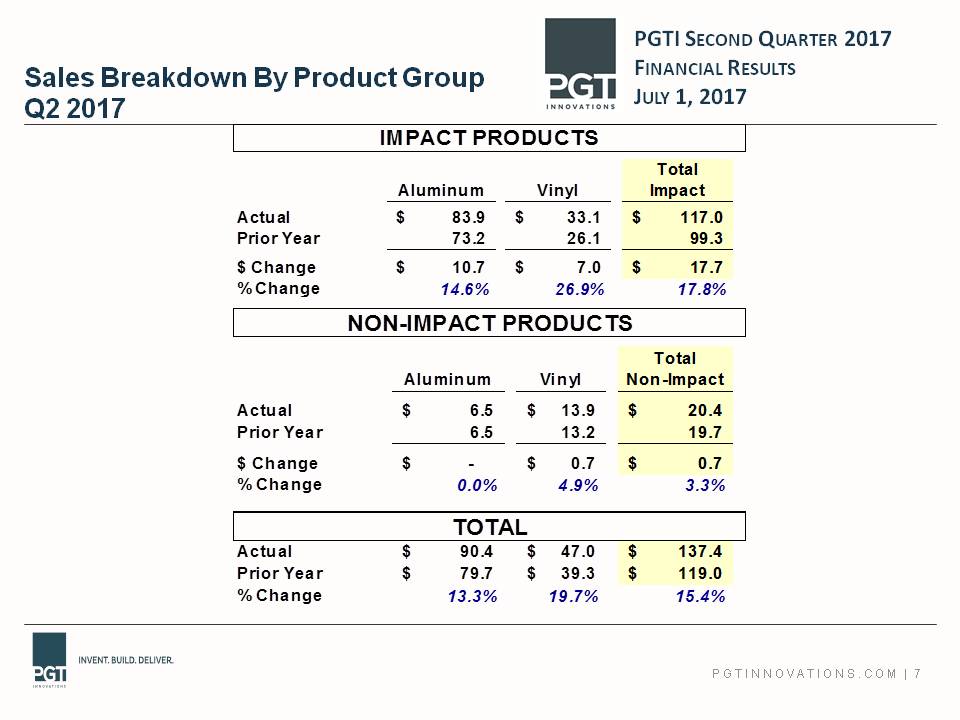

7 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Sales Breakdown By Product GroupQ2 2017

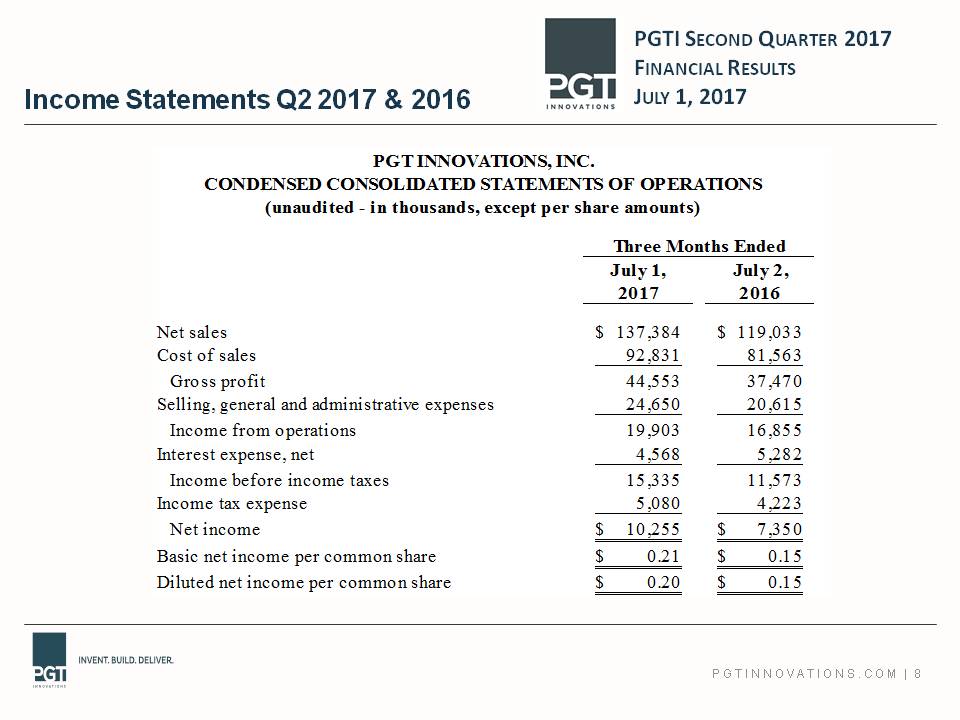

8 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Income Statements Q2 2017 & 2016

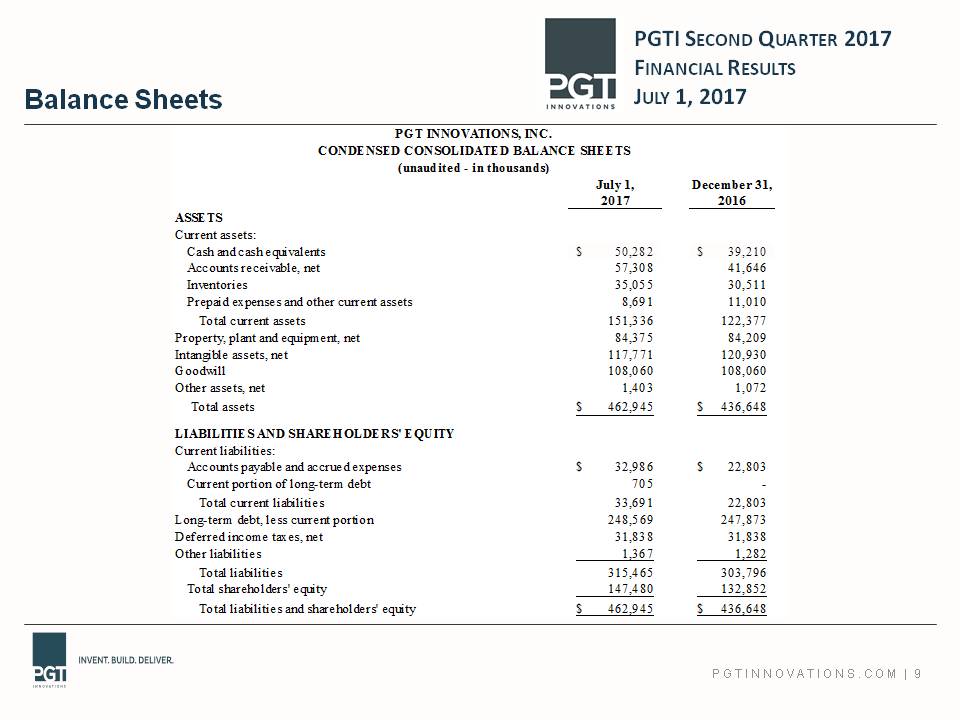

9 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 Balance Sheets

10 PGTI Second Quarter 2017 Financial ResultsJuly 1, 2017 2017 Outlook We expect the voluntary prepayment of $12M we made on July 7th, will save approximately $3M in debt service costs over the remaining life of the 2016 Credit Agreement, including approximately $360,000 in the second half of 2017.Slight increases in LIBOR have resulted in our all-in borrowing rate under our term loan to increase to approximately 6%, from 5.75%. Total interest expense estimated to be approximately $19.1M in 2017.Depreciation and amortization will continue to increase due to significant capital investments made over the last three years, including manufacturing modernization, and expansion of capabilities and capacity, and acquisitions. We estimate that depreciation and amortization expense will be nearly $19M in 2017, an increase of more than $3M from 2016.Combined with a solid first half of 2017, we anticipate ending the year towards the high end of the ranges for consolidated sales and EBITDA we previously provided, which are sales of $490 to $500 million, and EBITDA of between $83 and $87 million.