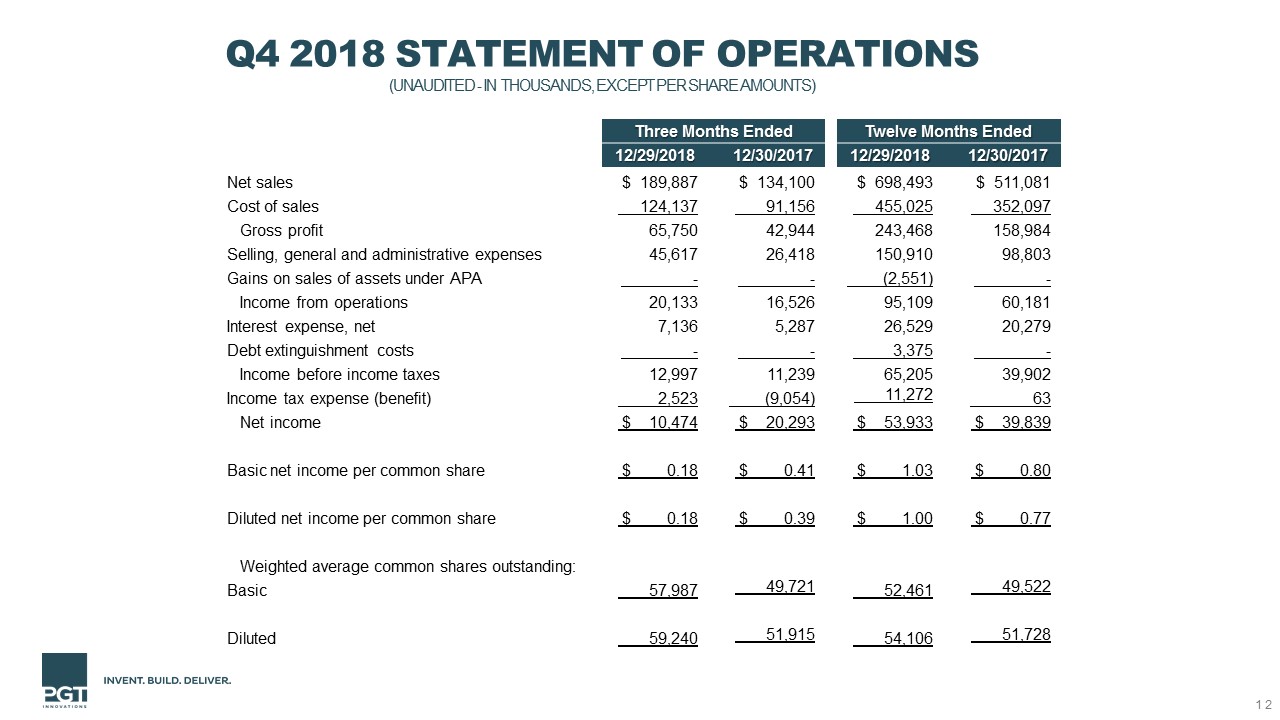

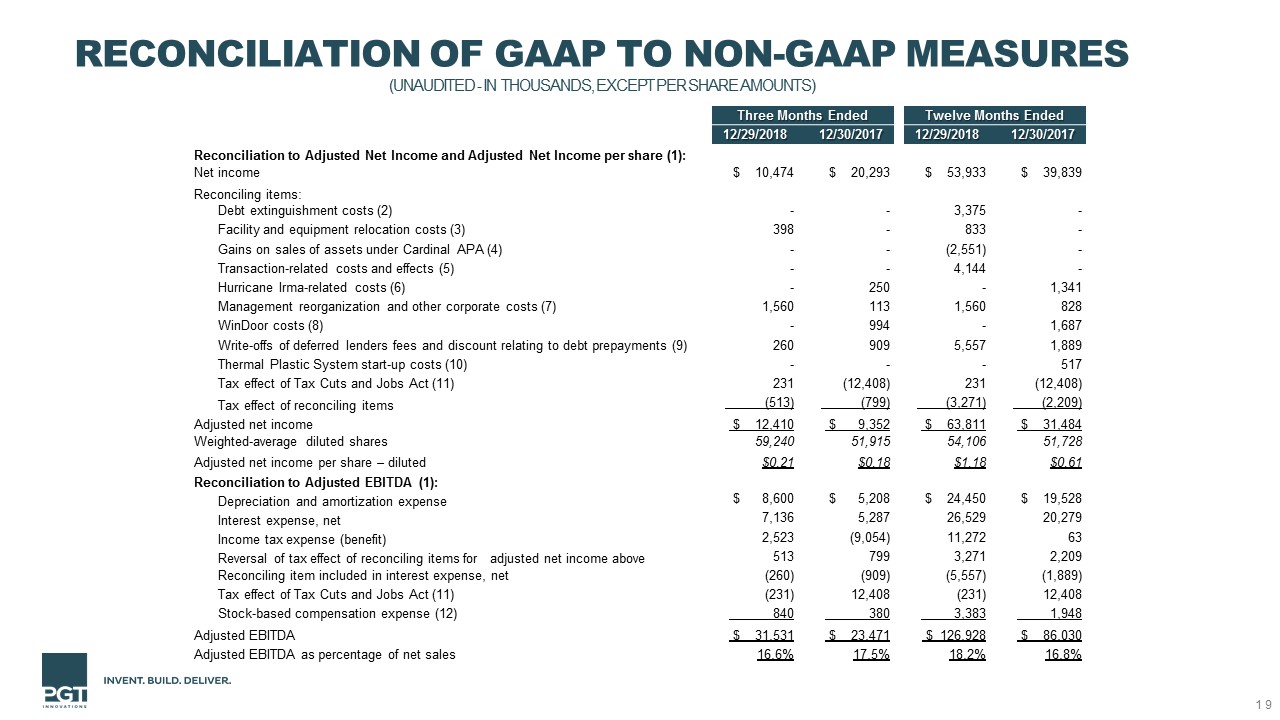

20 The Company's non-GAAP financial measures were explained in its Form 8-K filed February 27, 2019. Represents debt extinguishment costs of $3.1 million recognized in the first quarter of 2018 relating to the Company's second refinancing and second amendment of the 2016 Credit Agreement on March 16, 2018, and $296 thousand in the third quarter relating to changes in lender positions under the revolving credit portion of the 2016 Credit Agreement. We repriced and amended our 2016 Credit Agreement for the first time on February 17, 2017. However, because there were no changes in lender positions in the first action, it did not result in any lender positions being considered as modified or extinguished. Therefore, there was no charge for debt extinguishment costs in the year ended December 30, 2017. Represents costs associated with planned relocations of certain equipment and product lines, including the manufacturing operations of CGI Windows & Doors into its new facility in Hialeah, FL, costs associated with machinery and equipment relocations within our glass plant operations in North Venice, FL as the result of our planned disposal of certain glass manufacturing assets to Cardinal Glass Industries, and relocation of our EZ Breeze porch enclosures product line to our Orlando manufacturing facility. Of the $833 thousand, $814 thousand is classified within cost of sales during 2018, with the remainder classified within selling, general and administrative expenses. Of the $398 thousand, all is classified within cost of sales during the fourth quarter of 2018. Represents gains from sales of assets to Cardinal LG Company (Cardinal) under an Asset Purchase Agreement (APA) dated September 22, 2017. Pursuant to the terms of the APA, which required us to transfer assets to Cardinal in phases, during the second quarter of 2018, we made transfers of assets to Cardinal which had a net book value totaling $3.2 million and fair value totaling $5.8 million, resulting in the recognition of gains totaling $2.6 million, classified as gains on sales of assets in the year ended December 29, 2018. Represents costs and other effects relating to our acquisition of Western Window Systems, which we announced on July 24, 2018, and completed on August 13, 2018. Of the $4.1 million in the year ended December 29, 2018, $3.8 million relates to transaction-related costs classified within selling, general and administrative expenses. The remaining $392 thousand relates to an opening balance sheet inventory valuation adjustment which is classified within cost of sales in the year ended December 29, 2018. Represents community outreach costs, recovery-related expenses and other disruption costs caused by Hurricane Irma in early September 2017, some of which carried into the fourth quarter of 2017, of which $250 thousand is classified within selling, general and administrative expenses in the three months ended December 30, 2017, and $345 thousand is classified within cost of sales, and $996 thousand is classified within selling, general and administrative expenses in the year ended December 30, 2017. In 2018, represents certain costs incurred relating to a fourth quarter legal settlement and regulatory actions, as well as costs relating to a unique warranty issue. In 2017, represents costs associated with planned changes in our management structure, directed towards maximizing the effectiveness and efficiency of the Company's leadership team, classified within selling, general and administrative expenses in the three months and year ended December 30, 2017. Represents costs relating to operating inefficiencies caused by changes in WinDoor's leadership and its supply chain for glass, of which $600 thousand in the three months ended and $1.2 million in the year ended December 30, 2017, is classified within cost of sales, and the remainders in both periods classified within selling, general and administrative expenses. In 2018, represents non-cash charges from write-offs of deferred lenders fees and discount relating to prepayments of borrowings outstanding under the term loan portion of the 2016 Credit Agreement totaling $160.0 million, of which $152.0 million was in the 2018 third quarter using proceeds from the issuance of 7 million shares of Company common stock in the 2018 Equity Issuance, and $8.0 million was in the 2018 fourth quarter using cash on hand, included in interest expense, net, in the three months and year ended December 29, 2018. In 2017, represents non-cash charges relating to write-offs of deferred lenders fees and discount relating to prepayments of borrowings outstanding under the term loan portion of the 2016 Credit Agreement totaling $40.0 million using cash on hand, of which $20.0 million was in the 2017 third quarter, and $20.0 million was in the 2017 fourth quarter, included in interest expense, net, in the three months and year ended December 30, 2017. Represents costs incurred associated with the start-up of our Thermal Plastic Spacer system insulated glass lines, all of which is classified within cost of sales. Represents a discrete non-cash tax benefit recorded in the three months ended December 30, 2017, relating to accounting for the decrease in our net deferred tax liability due to the reduction in the Federal corporate income tax rate under the Tax Cuts and Jobs Act legislation enacted on December 22, 2017, subsequently adjusted in 2018 for certain changed items. Beginning in 2018, we updated our reporting of adjusted EBITDA to exclude non-cash stock-based compensation expense. Prior periods have been revised to reflect this change for consistency of comparisons. Reconciliation of GAAP to NON-gaap MEASURES(unaudited - in thousands, except per share amounts)