Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-132484

333-132484-01

POWERSHARES DB G10 CURRENCY HARVEST FUND

DB G10 CURRENCY HARVEST MASTER FUND

SUPPLEMENT DATED JANUARY 30, 2008 TO

PROSPECTUS DATED MAY 15, 2007

This Supplement updates certain information contained in the Prospectus dated May 15, 2007, as supplemented from time-to-time (the “Prospectus”), of PowerShares DB G10 Currency Harvest Fund (the “Fund”) and DB G10 Currency Harvest Master Fund. All capitalized terms used in this Supplement have the same meaning as in the Prospectus.

Prospective investors in the Fund should review carefully the contents of both this Supplement and the Prospectus.

* * * * * * * * * * * * * * * * * * *

All information in the Prospectus is restated pursuant to this Supplement, except as updated hereby.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this Prospectus is

truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS

OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED UPON THE

ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

DB COMMODITY SERVICES LLC

Managing Owner

I. The section “A I M Distributors, Inc.” set forth on page 10 of the Prospectus is hereby deleted and replaced, in its entirety, with the following:

“A I M Distributors, Inc.

Through a marketing agreement between the Managing Owner and A I M Distributors, Inc., or AIM Distributors, an affiliate of PowerShares Capital Management LLC, or PowerShares, the Managing Owner, on behalf of the Fund and the Master Fund, has appointed AIM Distributors as a marketing agent. AIM Distributors assists the Managing Owner and the Administrator with certain functions and duties such as providing various educational and marketing activities regarding the Fund, primarily in the secondary trading market, which activities include, but are not limited to, communicating the Fund’s name, characteristics, uses, benefits, and risks, consistent with the prospectus. AIM Distributors will not open or maintain customer accounts or handle orders for the Fund. Investors may contact AIM Distributors toll free in the U.S. at (800) 983-0903.

AIM Distributors is a subsidiary of Invesco, Ltd. Invesco, Ltd. is a leading independent global investment manager operating under the AIM, INVESCO, AIM Trimark, Invesco Perpetual and Atlantic Trust brands.

The Managing Owner, out of the Management Fee, pays AIM Distributors for performing its duties on behalf of the Fund and the Master Fund.”

II. The section “U.S. Federal Income Tax Considerations” set forth on pages 14 and 15 of the Prospectus is hereby deleted and replaced, in its entirety, with the following:

“Subject to the discussion below in “Material U.S. Federal Income Tax Considerations,” neither the Fund nor the Master Fund will be classified as an association taxable as a corporation. Instead, each of the Fund and the Master Fund expects that it will be classified as a partnership for United States federal income tax purposes. Accordingly, neither the Master Fund nor the Fund will incur United States federal income tax liability; rather, each beneficial owner of Shares will be required to take into account its allocable share of the Fund’s items of income, gain, loss, and deduction (which includes the Fund’s allocable share of the Master Fund’s items of income, gain, loss, and deduction) for the Fund’s taxable year ending with or within the owner’s taxable year.

A regulated investment company (“RIC”) that invests in Shares will be treated as owning a proportionate share of the Fund’s assets (including a proportionate share of the Fund’s interest in the Master Fund’s assets) and will take into account its allocable share of the Fund’s items of income, gain, loss, and deduction (including a proportionate share of the Fund’s interest in the Master Fund’s items of income, gain, loss, and deduction) when testing compliance with the asset, income and other statutory requirements specifically applicable to them. Neither the Fund nor the Master Fund will meet the definition of a qualified publicly traded partnership (“qualified PTP”) within the meaning of the Internal Revenue Code of 1986, as amended, or the Code, for purposes of satisfying the qualification requirements specifically applicable to RICs. However, under current interpretation of the RIC qualification rules, a RIC’s allocable share of income from the Master Fund’s currency futures transactions and interest income from its investment in debt obligations is treated as qualifying income. Because neither the Fund nor the Master Fund is a qualified PTP, a RIC’s investment in Shares will not be counted against the 25 percent limit on a RIC’s permitted investment in securities issued by qualified PTPs, and a RIC need not limit its investment in the Shares provided it otherwise can satisfy the RIC qualification requirements. The U.S. Treasury has specific statutory authority to promulgate tax regulations to exclude from the definition of qualifying income foreign currency gains which are unrelated to a RIC’s business of investing in stocks or securities, although to date no such regulations have been issued or proposed. Nonetheless, there is a risk that at some future date, regulations could be issued which would recharacterize all or a portion of the income from the Master Fund’s foreign currency futures transactions as nonqualifying income for a RIC. The Fund and the Master Fund do not intend to seek a ruling on this issue, and no assurance can be given that any future regulations would not have retroactive effect. A prospective RIC investor is encouraged to consult a tax adviser regarding the treatment of its investment in Shares under the current tax rules.

Additionally, please refer to the “Material U.S. Federal Income Tax Considerations” section below for information on the potential United States federal income tax consequences of the purchase, ownership and disposition of Shares.”

-2-

III. Risk Factors (25), (26) and (27) set forth on pages 25 and 26 of the Prospectus are hereby deleted and replaced, in their entirety, with the following:

“(25) Shareholders of the Fund Will Be Subject to Taxation on Their Share of the Fund’s Taxable Income (Including the Fund’s Share of the Master Fund’s Taxable Income), Whether or Not They Receive Cash Distributions.

Shareholders of the Fund will be subject to U.S. federal income taxation and, in some cases, state, local, or foreign income taxation on their share of the Fund’s taxable income (including the Master Fund’s taxable income allocable to the Fund), whether or not they receive cash distributions from the Fund. Shareholders of the Fund may not receive cash distributions equal to their share of the Fund’s taxable income (including the Master Fund’s taxable income) or even the tax liability that results from such income.

(26) Items of Income, Gain, Loss, and Deduction with respect to Shares could be Reallocated if the IRS does not Accept the Assumptions or Conventions Used by the Fund or the Master Fund in Allocating Such Tax Items.

U.S. federal income tax rules applicable to partnerships are complex and often difficult to apply to publicly traded partnerships. The Fund and the Master Fund will apply certain assumptions and conventions in an attempt to comply with applicable rules and to report items of income, gain, loss, and deduction to Shareholders of the Fund in a manner that reflects the Shareholders’ beneficial interest in such tax items, but these assumptions and conventions may not be considered to be in compliance with all aspects of the applicable tax requirements. It is possible that the IRS will successfully assert that the conventions and assumptions used by the Fund or the Master Fund do not satisfy the technical requirements of the Code, the Treasury regulations (or both) and could require that items of income, gain, loss, and deduction be adjusted or reallocated in a manner that adversely affects one or more Shareholders.

(27) The Current Treatment of Long-Term Capital Gains Under Current U.S. Federal Income Tax Law May Be Adversely Affected, Changed or Repealed in the Future.

Under current law, long-term capital gains are taxed to noncorporate investors at a maximum U.S. federal income tax rate of 15%. This tax treatment may be adversely affected, changed or repealed by future changes in tax laws at any time and is currently scheduled to expire for tax years beginning after December 31, 2010.

PROSPECTIVE INVESTORS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISERS AND COUNSEL WITH RESPECT TO THE POSSIBLE TAX CONSEQUENCES TO THEM OF AN INVESTMENT IN THE SHARES; SUCH TAX CONSEQUENCES MAY DIFFER IN RESPECT OF DIFFERENT INVESTORS.”

-3-

IV. Page 31 of the Prospectus is hereby deleted and replaced, in its entirety, with the following:

“PERFORMANCE OF POWERSHARES DB G10 CURRENCY HARVEST FUND (TICKER: DBV)

Name of Pool:PowerShares DB G10 Currency Harvest Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:September 2006

Aggregate Gross Capital Subscriptions as of November 30, 2007: $610,557,630

Net Asset Value as of November 30, 2007:$517,599,959

Net Asset Value per Share as of November 30, 2007:$28.13

Worst Monthly Drawdown:(3.94)% August 2007

Worst Peak-to-Valley Drawdown:(4.86)% June – August 2007

Monthly Rate of Return | 2007(%) | 2006(%) | ||

January | 1.01 | — | ||

February | 0.65 | — | ||

March | 2.47 | — | ||

April | 2.27 | — | ||

May | 2.14 | — | ||

June | 3.09 | — | ||

July | (0.97) | — | ||

August | (3.94) | — | ||

September | 2.79 | (0.24) | ||

October | 3.10 | 1.92 | ||

November | (3.76) | (1.30) | ||

December | 2.996 | |||

Compound Rate of Return | 8.86% (11 months) | 3.36% (3 1/2 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Footnotes to Performance Information

1. “Aggregate Gross Capital Subscriptions” is the aggregate of all amounts ever contributed to the pool, including redeemed investments.

2. “Net Asset Value” is the net asset value of the pool as of November 30, 2007.

3. “Net Asset Value per Share” is the Net Asset Value of the pool divided by the total number of Shares outstanding as of November 30, 2007.

4. “Worst Monthly Drawdown” is the largest single month loss sustained since inception of trading. “Drawdown” as used in this section of the Prospectus means losses experienced by the relevant pool over the specified period and is calculated on a rate of return basis, i.e., dividing net performance by beginning equity. “Drawdown” is measured on the basis of monthly returns only, and does not reflect intra-month figures. “Month” is the month of the Worst Monthly Drawdown.

5. “Worst Peak-to-Valley Drawdown” is the largest percentage decline in the Net Asset Value per Share over the history of the pool. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive returns. “Worst Peak-to-Valley Drawdown” represents the greatest percentage decline from any month-end Net Asset Value per Share that occurs without such month-end Net Asset Value per Share being equaled or exceeded as of a subsequent month-end. For example, if the Net Asset Value per Share of a particular pool declined by $1 in each of January and February, increased by $1 in March and declined again by $2 in April, a “peak-to-valley drawdown” analysis conducted as of the end of April would consider that “drawdown” to be still continuing and to be $3 in amount, whereas if the Net Asset Value per Share had increased by $2 in March, the January-February drawdown would have ended as of the end of February at the $2 level.

6. The December 2006 return of 2.99% includes the $0.06 per Share distribution made to Shareholders of record as of December 20, 2006. Prior to the December 20, 2006 distribution, the pool’s return for December 2006 was 3.23%.

7. “Compound Rate of Return” is calculated by multiplying on a compound basis each of the monthly rates of return set forth in the chart above and not by adding or averaging such monthly rates of return. For periods of less than one year, the results are year-to-date.”

-4-

V. Pages 36, beginning with the section entitled “Historical Closing Levels”, through page 52 of the Prospectus are hereby deleted and replaced, in their entirety, with the following:

“Historical Closing Levels

Set out below are the closing levels based on historical data from March 12, 1993 to November 30, 2007.

The following Closing Levels table starts from March 12, 1993 and reflects both the high and low closing values, the annual Index changes and Index changes since inception of the Index. Since March 13, 2003, CME currency futures close prices were used in the Index calculation. The Index Sponsor has not independently verified the CME currency futures close prices obtained from Bloomberg. Since February 1, 2006, the Index Sponsor has obtained the CME currency futures close prices from Reuters. Prior to March 13, 2003, implied futures prices were calculated using the relevant currencies spot rates, money market rates and USD money market rates obtained from Reuters, Bloomberg and WM Company. Implied futures prices are an accurate proxy for the futures close prices due to the high liquidity in foreign exchange forward markets.

It is not necessary to have a USD futures contract because the forward rate of the USD vis-à-vis the USD will be equal. Whenever USD was used to calculate the value of the Index, the futures price of USD was assumed to be 100.

The Index Sponsor used 3 month money market rates as a proxy for 3 month Libor fixings with respect to the USD on and prior to June 10, 1998.

The Index Sponsor used 3 month money market rates as a proxy for 3 month Libor fixings with respect to the EUR, JPY, GBP, CHF, CAD and AUD on and prior to March 11, 1998.

The Index Sponsor used 3 month money market rates as a proxy for 3 month Libor fixings with respect to the NZD on and prior to September 10, 2003.

The Index Sponsor used 3 month money market rates as a proxy for 3 month Stibor fixings with respect to the SEK on and prior to December 9, 1998.

The Index Sponsor used 3 month money market rates as a proxy for 3 month Nibor fixings with respect to the NOK on and prior to December 9, 1998.

The Libor, Stibor and Nibor rates for the Eligible Index Currencies, as applicable, mean the London, Stockholm and Norway interbank offered rates for

overnight deposits, respectively, each of which is published by Reuters on pages libor01 and libor02 with respect to Libor and pages SIDE and NIBR with respect to Stibor and Nibor.

The Index Sponsor considers the use of 3 month money market rates as a proxy for Libor, Stibor and Nibor to be appropriate because the difference between Libor, Stibor and Nibor rates and money market rates should not be material in light of the liquidity of the 3 month deposit markets.

The CME-traded futures contract of each applicable Index Currency that is closest to expiration is used in the Index calculation. The futures contracts on the Index Currencies are rolled during the Index Re-Weighting Period. The new futures contract on an Index Currency that has the next closest expiration date is selected. The calculation of the Index on an excess return basis is the weighted return on the change in price of the futures contracts on the Index Currencies.

The Index is calculated on both an excess return basis and a total return basis. The excess return index reflects the return of the applicable underlying currencies. The total return is the sum of the return of the applicable underlying currencies plus the return of 3-month U.S. Treasury bills. The following tables reflect both the excess return calculation and the total return calculation of the Index.

Cautionary Statement–Statistical Information

Various statistical information is presented on the following pages, relating to the Closing Levels of the Index, on an annual and cumulative basis, including certain comparisons of the Index to other currencies indices. In reviewing such information, prospective investors should consider that:

| • | Changes in Closing Levels of the Index during any particular period or market cycle may be volatile. For example, the “worst peak-to-valley drawdown” of the Index, representing the greatest percentage decline from any month-end Closing Level, without such Closing Level being equaled or exceeded as of a subsequent month-end, is 11.63% and occurred during the period December 30, 1994 through March 31, 1995. The worst monthly |

-5-

drawdown of the Index during such period was 6.95%, and occurred in March 1995. See “The Risks You Face—(16) Price Volatility May Possibly Cause the Total Loss of Your Investment.” |

| • | Neither the fees charged by the Fund nor the execution costs associated with establishing futures positions in the Index Currencies are incorporated into the Closing Levels of the Index. Accordingly, such Index Levels have not been reduced by the costs associated with an actual investment, such as the Fund, with an investment objective of tracking the Index. |

| • | The Index was established in December 2005, and is independently calculated by Deutsche Bank AG London, the Index Sponsor. The Index calculation methodology and commodity futures contracts selection is the same before and after December 2005, as described above. Accordingly, the Closing Levels of the Index, terms of the Index methodology and Index Currencies, reflect an element of hindsight at the time the Index was established. See “The Risks You Face—(11) You May Not Rely on Past Performance or Index Results in Deciding Whether to Buy Shares” and “—(12) Fewer Representative Index Currencies May Result In Greater Index Volatility.” |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN DECEMBER 2005, CERTAIN INFORMATION RELATING TO THE INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED

BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD MARCH 1993 THROUGH NOVEMBER 2005, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX METHODOLOGY, AND SELECTION OF INDEX CURRENCIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE CURRENCIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK THE INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER HAS HAD LIMITED EXPERIENCE IN TRADING ACTUAL ACCOUNTS FOR ITSELF OR FOR CLIENTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

[Remainder of page left blank intentionally.]

-6-

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–EXCESS RETURN™

CLOSING LEVELS TABLE

| CLOSING LEVEL | ||||||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception | |||||||

19934 | 105.60 | 94.03 | -0.19 | % | -0.19 | % | ||||

1994 | 108.79 | 99.81 | 7.42 | % | 7.22 | % | ||||

1995 | 110.52 | 94.16 | 2.66 | % | 10.07 | % | ||||

1996 | 140.05 | 110.42 | 27.23 | % | 40.05 | % | ||||

1997 | 146.72 | 137.83 | 2.58 | % | 43.67 | % | ||||

1998 | 151.79 | 132.52 | -6.35 | % | 34.55 | % | ||||

1999 | 151.12 | 134.71 | 9.81 | % | 47.76 | % | ||||

2000 | 158.57 | 146.79 | 4.73 | % | 54.74 | % | ||||

2001 | 171.15 | 154.68 | 10.61 | % | 71.15 | % | ||||

2002 | 199.51 | 172.25 | 15.76 | % | 98.13 | % | ||||

2003 | 234.45 | 199.00 | 18.33 | % | 134.45 | % | ||||

2004 | 252.36 | 230.02 | 6.69 | % | 150.14 | % | ||||

2005 | 286.06 | 248.34 | 10.66 | % | 176.81 | % | ||||

2006 | 280.48 | 254.18 | 1.00 | % | 179.58 | % | ||||

20075 | 315.27 | 276.77 | 5.10 | % | 193.84 | % | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND

CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF

THE FUND’S FUTURE PERFORMANCE.

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–TOTAL RETURN™

CLOSING LEVELS TABLE

| CLOSING LEVEL | ||||||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception | |||||||

19934 | 106.15 | 95.13 | 2.30 | % | 2.30 | % | ||||

1994 | 116.32 | 102.32 | 12.15 | % | 14.73 | % | ||||

1995 | 124.55 | 102.55 | 8.56 | % | 24.55 | % | ||||

1996 | 166.84 | 125.01 | 33.95 | % | 66.84 | % | ||||

1997 | 180.54 | 164.92 | 8.01 | % | 80.19 | % | ||||

1998 | 195.70 | 172.90 | -1.68 | % | 77.17 | % | ||||

1999 | 203.96 | 177.49 | 15.12 | % | 103.96 | % | ||||

2000 | 227.93 | 202.75 | 11.11 | % | 126.61 | % | ||||

2001 | 259.57 | 226.67 | 14.55 | % | 159.57 | % | ||||

2002 | 307.46 | 261.27 | 17.68 | % | 205.47 | % | ||||

2003 | 365.18 | 306.83 | 19.55 | % | 265.18 | % | ||||

2004 | 398.22 | 359.55 | 8.18 | % | 295.05 | % | ||||

2005 | 465.10 | 392.65 | 14.23 | % | 351.27 | % | ||||

2006 | 479.65 | 421.90 | 5.96 | % | 378.18 | % | ||||

20075 | 554.63 | 477.16 | 9.63 | % | 424.21 | % | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND

CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF

THE FUND’S FUTURE PERFORMANCE.

Please refer to notes and legends that follow on page 44.

-7-

INDEX CURRENCY WEIGHTS TABLE

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–EXCESS RETURN™

| USD | EUR | JPY | CAD | CHF | GBP | AUD | NZD | NOK | SEK | |||||||||||||||||||||||||||||||||||||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | |||||||||||||||||||||||||||||||||||||||||

19934 | -31.6% | -36.8% | 33.8% | 34.0% | -33.7% | -37.2% | 0.0% | -36.8% | 0.0% | 0.0% | 0.0% | 0.0% | -31.1% | 0.0% | 0.0% | 0.0% | 33.9% | 34.1% | 33.9% | 32.3% | ||||||||||||||||||||||||||||||||||||||||

1994 | 0.0% | -33.3% | -33.0% | 32.5% | -33.1% | -32.5% | 0.0% | -33.4% | -33.1% | 0.0% | 0.0% | 0.0% | 33.2% | 0.0% | 33.3% | 33.6% | 0.0% | 0.0% | 33.4% | 33.2% | ||||||||||||||||||||||||||||||||||||||||

1995 | 0.0% | 0.0% | -33.7% | -35.7% | -33.1% | -39.1% | 0.0% | 35.9% | -33.7% | -36.8% | 0.0% | 0.0% | 32.4% | 0.0% | 33.0% | 36.3% | 0.0% | 0.0% | 36.2% | 34.6% | ||||||||||||||||||||||||||||||||||||||||

1996 | 0.0% | 0.0% | 0.0% | -33.5% | -31.7% | -32.5% | -32.1% | 0.0% | -31.5% | -33.3% | 33.3% | 0.0% | 32.4% | 33.3% | 32.6% | 33.3% | 0.0% | 0.0% | 0.0% | 33.2% | ||||||||||||||||||||||||||||||||||||||||

1997 | 0.0% | 0.0% | 0.0% | 0.0% | -31.5% | -30.6% | -31.7% | -33.1% | -32.2% | -30.4% | 33.2% | 31.7% | 31.9% | 31.5% | 32.6% | 32.3% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

1998 | 0.0% | 0.0% | -32.3% | -36.7% | -32.9% | -40.1% | 0.0% | 0.0% | -31.8% | -37.5% | 32.3% | 36.0% | 34.2% | 0.0% | 34.2% | 36.5% | 0.0% | 35.7% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

1999 | 32.6% | 33.0% | -31.6% | -32.2% | -31.3% | -34.4% | 0.0% | 0.0% | -31.4% | -32.0% | 31.6% | 32.5% | 0.0% | 0.0% | 0.0% | 0.0% | 32.1% | 34.1% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2000 | 31.9% | 33.3% | -29.4% | -33.7% | -30.8% | -32.9% | 0.0% | 0.0% | -30.5% | -33.5% | 31.6% | 33.5% | 0.0% | 0.0% | 31.6% | 0.0% | 0.0% | 33.5% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2001 | -33.1% | 33.1% | 0.0% | 0.0% | -32.1% | -32.4% | 0.0% | 0.0% | -32.5% | -34.5% | 0.0% | 0.0% | 32.7% | 0.0% | 33.0% | 34.1% | 32.8% | 34.1% | 0.0% | -33.7% | ||||||||||||||||||||||||||||||||||||||||

2002 | -33.2% | -32.9% | 0.0% | 0.0% | -33.1% | -31.6% | 0.0% | 0.0% | -33.5% | -32.7% | 0.0% | 0.0% | 33.3% | 32.6% | 33.5% | 33.1% | 33.5% | 33.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2003 | -33.0% | -33.2% | 0.0% | 0.0% | -33.0% | -33.4% | 0.0% | 0.0% | -33.5% | -34.2% | 33.7% | 0.0% | 33.4% | 33.2% | 33.4% | 33.9% | 0.0% | 34.1% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2004 | 0.0% | -34.6% | 0.0% | 0.0% | -33.2% | -33.5% | 0.0% | 0.0% | -33.0% | -34.7% | 33.4% | 34.1% | 33.6% | 32.6% | 33.4% | 32.3% | -33.1% | 0.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2005 | 0.0% | 0.0% | 0.0% | 0.0% | -29.1% | -34.4% | 0.0% | 0.0% | -30.7% | -32.8% | 30.7% | 32.7% | 31.2% | 33.9% | 32.7% | 33.2% | 0.0% | -33.2% | -30.2% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2006 | 32.9% | 36.0% | 0.0% | 0.0% | -32.6% | -38.1% | 0.0% | 0.0% | -32.9% | -39.1% | 0.0% | 0.0% | 33.2% | 37.1% | 33.7% | 35.1% | 0.0% | 0.0% | -33.1% | -38.8% | ||||||||||||||||||||||||||||||||||||||||

20075 | 0.0% | 33.3% | 0.0% | 0.0% | -33.2% | -33.7% | 0.0% | 0.0% | -33.2% | -33.1% | 33.8% | 0.0% | 34.2% | 32.9% | 34.8% | 32.8% | 0.0% | 0.0% | -34.1% | -32.3% | ||||||||||||||||||||||||||||||||||||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–TOTAL RETURN™

| USD | EUR | JPY | CAD | CHF | GBP | AUD | NZD | NOK | SEK | |||||||||||||||||||||||||||||||||||||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | |||||||||||||||||||||||||||||||||||||||||

19934 | -31.6% | -36.8% | 33.6% | 34.0% | -34.8% | -37.2% | 0.0% | -36.8% | 0.0% | 0.0% | 0.0% | 0.0% | -30.3% | 0.0% | 0.0% | 0.0% | 33.6% | 34.1% | 34.7% | 32.3% | ||||||||||||||||||||||||||||||||||||||||

1994 | 0.0% | -33.3% | -33.1% | 32.5% | -33.1% | -32.5% | 0.0% | -33.4% | -33.1% | 0.0% | 0.0% | 0.0% | 33.2% | 0.0% | 33.3% | 33.6% | 0.0% | 0.0% | 33.4% | 33.2% | ||||||||||||||||||||||||||||||||||||||||

1995 | 0.0% | 0.0% | -33.5% | -35.7% | -32.9% | -39.1% | 0.0% | 35.9% | -33.6% | -36.8% | 0.0% | 0.0% | 33.4% | 0.0% | 33.4% | 36.3% | 0.0% | 0.0% | 33.2% | 34.6% | ||||||||||||||||||||||||||||||||||||||||

1996 | 0.0% | 0.0% | 0.0% | -33.5% | -31.7% | -32.5% | -32.1% | 0.0% | -31.5% | -33.3% | 33.3% | 0.0% | 32.4% | 33.3% | 32.6% | 33.3% | 0.0% | 0.0% | 0.0% | 33.2% | ||||||||||||||||||||||||||||||||||||||||

1997 | 32.4% | 0.0% | -32.1% | 0.0% | -30.0% | -30.6% | 0.0% | -33.1% | -32.8% | -30.4% | 34.0% | 31.7% | 0.0% | 31.5% | 31.3% | 32.3% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

1998 | 0.0% | 0.0% | -32.3% | -36.7% | -32.9% | -40.1% | 0.0% | 0.0% | -31.8% | -37.5% | 32.3% | 36.0% | 34.2% | 0.0% | 34.2% | 36.5% | 0.0% | 35.7% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

1999 | 33.1% | 33.0% | -32.5% | -32.2% | -32.9% | -34.4% | 0.0% | 0.0% | -32.4% | -32.0% | 32.8% | 32.5% | 0.0% | 0.0% | 0.0% | 0.0% | 32.8% | 34.1% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2000 | 32.9% | 33.3% | 0.0% | -33.7% | -32.3% | -32.9% | 0.0% | 0.0% | -33.7% | -33.5% | 0.0% | 33.5% | 0.0% | 0.0% | 34.0% | 0.0% | 33.4% | 33.5% | -33.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2001 | -33.1% | 33.1% | 0.0% | 0.0% | -32.1% | -32.4% | 0.0% | 0.0% | -32.5% | -34.5% | 0.0% | 0.0% | 32.7% | 0.0% | 33.0% | 34.1% | 32.8% | 34.1% | 0.0% | -33.7% | ||||||||||||||||||||||||||||||||||||||||

2002 | -33.2% | -32.9% | 0.0% | 0.0% | -33.1% | -31.6% | 0.0% | 0.0% | -33.5% | -32.7% | 0.0% | 0.0% | 33.3% | 32.6% | 33.5% | 33.1% | 33.5% | 33.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2003 | -33.0% | -33.2% | 0.0% | 0.0% | -33.0% | -33.4% | 0.0% | 0.0% | -33.5% | -34.2% | 33.7% | 0.0% | 33.4% | 33.2% | 33.4% | 33.9% | 0.0% | 34.1% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2004 | 0.0% | -34.6% | 0.0% | 0.0% | -33.2% | -33.5% | 0.0% | 0.0% | -33.0% | -34.7% | 33.4% | 34.1% | 33.6% | 32.6% | 33.4% | 32.3% | -33.1% | 0.0% | 0.0% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2005 | 0.0% | 0.0% | 0.0% | 0.0% | -29.1% | -34.5% | 0.0% | 0.0% | -30.7% | -32.8% | 30.7% | 32.8% | 31.2% | 34.0% | 32.7% | 33.2% | 0.0% | -33.2% | -30.2% | 0.0% | ||||||||||||||||||||||||||||||||||||||||

2006 | 32.9% | 36.0% | 0.0% | 0.0% | -32.6% | -38.1% | 0.0% | 0.0% | -32.9% | -39.1% | 0.0% | 0.0% | 33.2% | 37.1% | 33.7% | 35.1% | 0.0% | 0.0% | -33.1% | -38.8% | ||||||||||||||||||||||||||||||||||||||||

20075 | 0.0% | 33.1% | 0.0% | 0.0% | -33.2% | -32.9% | 0.0% | 0.0% | -33.2% | -32.7% | 33.8% | 0.0% | 34.2% | 33.0% | 34.8% | 33.1% | 0.0% | 0.0% | -34.1% | -32.9% | ||||||||||||||||||||||||||||||||||||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK G10 CURRENCY FUTURE HARVEST INDEX–TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Please refer to notes and legends that follow on page 44.

-8-

| VARIOUS STATISTICAL MEASURES* | INDEX-TR6,7 | INDEX-ER7,8 | DXY9 | EFFAS US Treasuries10 | S&P 500 TR11 | DBLCI12 | ||||||

Annualized Changes to Index Level13 | 11.8% | 7.5% | -1.3% | 6.4% | 10.5% | 14.4% | ||||||

Average rolling 3 month daily volatility14 | 7.3% | 7.2% | 7.6% | 4.4% | 14.9% | 19.0% | ||||||

Sharpe Ratio15 | 1.10 | 0.51 | -0.67 | 0.58 | 0.45 | 0.56 | ||||||

% of months with positive change | 72% | 68% | 47% | 67% | 65% | 56% | ||||||

Average monthly positive return change | 2.0% | 1.8% | 1.7% | 1.2% | 3.2% | 5.1% | ||||||

Average monthly negative return change | -1.8% | -1.9% | -1.6% | -0.9% | -3.4% | -3.6% | ||||||

CORRELATION OF MONTHLY INDEX LEVELS*,16 | INDEX-TR | INDEX-ER | DXY | EFFAS US Treasuries | S&P 500 TR | DBLCI | ||||||

Index TR | 100% | 100% | 18% | -6% | 19% | 10% | ||||||

Index-ER | 100% | 17% | -7% | 19% | 10% | |||||||

DXY | 100% | -15% | 4% | -18% | ||||||||

EFFAS US Treasuries | 100% | -11% | 2% | |||||||||

S&P 500 TR | 100% | 2% | ||||||||||

DBLCI | 100% |

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN DECEMBER 2005, CERTAIN INFORMATION RELATING TO THE INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD MARCH 1993 THROUGH NOVEMBER 2005, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX METHODOLOGY, AND SELECTION OF INDEX CURRENCIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE CURRENCIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK THE INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER HAS HAD LIMITED EXPERIENCE IN TRADING ACTUAL ACCOUNTS FOR ITSELF OR FOR CLIENTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 44.

-9-

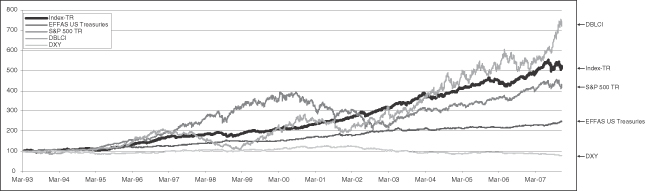

COMPARISON OF THE INDICES WITH CERTAIN GENERAL MARKET INDICES REPRESENTING CURRENCIES, BONDS, STOCKS AND COMMODITIES

(MARCH, 1993 – NOVEMBER 30, 2007)*

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of the Index-TR, EFFAS US Treasuries, S&P 500 TR, DBLCI and DXY are indices and do not reflect actual trading.

Each of the indices, except DXY, are calculated on a total return basis and does not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN DECEMBER 2005, CERTAIN INFORMATION RELATING TO THE INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD MARCH 1993 THROUGH NOVEMBER 2005, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX METHODOLOGY, AND SELECTION OF INDEX CURRENCIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE CURRENCIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK THE INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER HAS HAD LIMITED EXPERIENCE IN TRADING ACTUAL ACCOUNTS FOR ITSELF OR FOR CLIENTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 44.

-10-

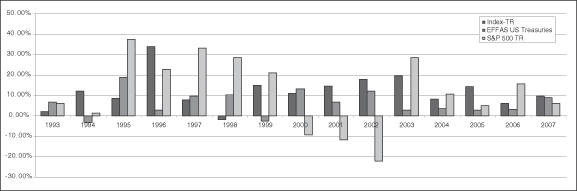

COMPARISON OF ANNUAL PERCENTAGE CHANGE IN THE INDICES WITH CERTAIN GENERAL MARKET INDICES REPRESENTING BONDS AND STOCKS

(MARCH, 1993 – NOVEMBER 30, 2007)*

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of the Index-TR, EFFAS US Treasuries and S&P 500 TR are indices and do not reflect actual trading.

Each of these indices are calculated on a total return basis and does not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN DECEMBER 2005, CERTAIN INFORMATION RELATING TO THE INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD MARCH 1993 THROUGH NOVEMBER 2005, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX METHODOLOGY, AND SELECTION OF INDEX CURRENCIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE CURRENCIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK THE INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER HAS HAD LIMITED EXPERIENCE IN TRADING ACTUAL ACCOUNTS FOR ITSELF OR FOR CLIENTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 44.

-11-

NOTES AND LEGENDS:

1. “High” reflects the highest closing level of the Index during the applicable year.

2. “Low” reflects the lowest closing level of the Index during the applicable year.

3. “Annual Index Change” reflects the change to the Index level on an annual basis as of December 31 of each applicable year.

4. Closing levels as of inception on March 12, 1993.

5. Closing levels as of November 30, 2007.

6. “INDEX-TR” is Deutsche Bank G10 Currency Future Harvest Index — Total Return™. The Deutsche Bank G10 Currency Future Harvest Index™ is calculated on both an excess return basis and total return. The Index-TR calculation is funded and reflects the change in market value of both the underlying index currencies and the interest income from a hypothetical basket of fixed income securities. The sponsor of the Index, or the Index Sponsor, is Deutsche Bank AG London. A Trade Mark application for Deutsche Bank G10 Currency Future Harvest Index™ is pending.

7. In the current interest rate environment, the total return on an investment in the Fund is expected to outperform the INDEX-ER (as such term is defined in the following footnote) and underperform the INDEX-TR. The only difference between the INDEX-ER and the INDEX-TR is that the INDEX-ER does not include interest income from a hypothetical basket of fixed income securities while the INDEX-TR does include such a component. The difference between the INDEX-ER and the INDEX-TR is attributable entirely to the hypothetical interest income from this hypothetical basket of fixed income securities. The Fund’s interest income from its holdings of fixed-income securities is expected to exceed the Fund’s fees and expenses, and the amount of such excess is expected to be distributed periodically. The market price of the Shares is expected closely to track the INDEX-ER. The total return on an investment in the Fund over any period is the sum of the capital appreciation or depreciation of the Shares over the period, plus the amount of any distributions during the period. Consequently, in the current interest rate environment, the Fund’s total return is expected to outperform the INDEX-ER by the amount of the excess of its interest income over its fees and expenses but, as a result of the Fund’s fees and expenses, the total return on the Fund is expected to underperform the INDEX-TR. If the Fund’s fees and expenses were to exceed the Fund’s interest income from its holdings of fixed income securities, the Fund would underperform the INDEX-ER.

8. “INDEX-ER” is the Deutsche Bank G10 Currency Future Harvest Index — Excess Return™. The excess return calculation is unfunded and reflects the change in market value of the underlying index currencies.

9. “DXY” is U.S. Dollar Index®. The U.S. Dollar Index® provides a general indication of the international value of the USD by averaging the exchange rates between the USD and the following six major world currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc. U.S. Dollar Index® is a registered service mark of the Board of Trade of the City of New York, Inc.

10. “EFFAS US Treasuries” is Bloomberg/EFFAS Index of U.S. Treasuries. The Bloomberg/EFFAS indices are designed as transparent benchmarks for government bond markets. Indices are grouped by country and maturity sectors. Bloomberg computes daily values and index characteristics for each sector. The Bloomberg/EFFAS Index of U.S. Treasuries includes treasuries with more than one year prior to maturity and is representative of the bond market.

11. “S&P 500 TR” is the Standard & Poor’s index calculated on a total return basis. Widely regarded as the benchmark gauge of the U.S. equities market, this index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with over 80% coverage of U.S. equities, it also serves as a proxy for the total market. The total return calculation provides investors with a price plus gross cash dividend return. Gross cash dividends are applied on the ex date of the dividend.

12. “DBLCI” is the Deutsche Bank Liquid Commodity Index — Total Return™. This Index is intended to reflect the change in market value of the following commodities: Light, Sweet Crude Oil, Heating Oil, Aluminum, Gold, Corn and Wheat. The notional amounts of each index commodity included in this index are broadly in proportion to historical levels of the world’s production and stocks of the index commodities. The sponsor of the Index, or the Index Sponsor, is

-12-

Deutsche Bank AG London. Deutsche Bank Liquid Commodity Index – Total Return™ is a trade mark of Deutsche Bank AG and is the subject of Community Trade Mark Number 3054996. Trade Mark applications in the United States are pending.

13. “Annualized Changes to Index Level” reflects the change to the level of the applicable index on an annual basis as of December 31 of each applicable year.

14. “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis.

15. “Sharpe Ratio” compares the annualized rate of return minus the annualized risk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 3.80%.

16. “Correlation of Monthly Index Levels.” Every investment asset, by definition, has a correlation coefficient of 1.0 with itself; 1.0 indicates 100% positive correlation. Two investments that always move in the opposite direction from each other have a correlation coefficient of 1.0; 1.0 indicates 100% negative correlation. Two investments that perform entirely independently of each other have a correlation coefficient of 0; 0 indicates 100% non correlation.

| * | For the period from March 12, 1993 to November 30, 2007. |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN DECEMBER 2005, CERTAIN INFORMATION RELATING TO THE INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD MARCH 1993 THROUGH NOVEMBER 2005, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX METHODOLOGY, AND SELECTION OF INDEX CURRENCIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE CURRENCIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK THE INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

-13-

THE MANAGING OWNER HAS HAD LIMITED EXPERIENCE IN TRADING ACTUAL ACCOUNTS FOR ITSELF OR FOR CLIENTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

ALTHOUGH THE INDEX SPONSOR WILL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCE(S) WHICH THE INDEX SPONSOR CONSIDERS RELIABLE, THE INDEX SPONSOR WILL NOT INDEPENDENTLY VERIFY SUCH INFORMATION AND DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. THE INDEX SPONSOR WILL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR IN THE INDEX AND THE INDEX SPONSOR IS UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN.

UNLESS OTHERWISE SPECIFIED, NO TRANSACTION RELATING TO THE INDEX IS SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE INDEX SPONSOR AND THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES AS TO (A) THE ADVISABILITY OF PURCHASING OR ASSUMING ANY RISK IN CONNECTION WITH ANY SUCH TRANSACTION, (B) THE LEVELS AT WHICH THE INDEX STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE, (C) THE RESULTS TO BE OBTAINED BY THE ISSUER OF ANY SECURITY OR ANY COUNTERPARTY OR ANY SUCH ISSUER’S SECURITY HOLDERS OR CUSTOMERS OR ANY SUCH COUNTERPARTY’S CUSTOMERS OR COUNTERPARTIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH ANY LICENSED RIGHTS OR FOR ANY OTHER USE, OR (D) ANY OTHER MATTER. THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE INDEX SPONSOR HAVE ANY LIABILITY (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

-14-

PERFORMANCE OF COMMODITY POOLS OPERATED

BY THE MANAGING OWNER AND ITS AFFILIATES

General

The performance information included herein is presented in accordance with CFTC regulations. The Fund differs materially in certain respects from the performance of the following pools which are included herein. The following sets forth summary performance information for all pools operated by the Managing Owner (other than the Fund) as of November 30, 2007.

The below pools, the performance of which are summarized herein, are materially different in certain respects from the Fund and the past performance summary of such pools are generally not representative of how the Fund might perform in the future. These pools also have material differences from the Fund, such as different investment objectives and strategies, leverage, employment of short in addition to long positions and fee structures, among other variations. The performance record of these pools may give some general indication of the Managing Owner’s capabilities by indicating the past performance of other pools sponsored by the Managing Owner.

All summary performance information is current as of November 30, 2007. Performance information is set forth, in accordance with CFTC Regulations since (i) January 31, 2006 (inception with respect to PowerShares DB Commodity Index Tracking Fund (DBC)), (ii) January 5, 2007 (inception with respect to each of PowerShares DB Energy Fund (DBE), PowerShares DB Oil Fund (DBO), PowerShares DB Precious Metals Fund (DBP), PowerShares DB Gold Fund (DGL), PowerShares DB Silver Fund (DBS), PowerShares DB Base Metals Fund (DBB) and PowerShares DB Agriculture Fund (DBA)) and (iii) February 20, 2007 (inception with respect to each of PowerShares DB Us Dollar Index Bullish Fund (UUP) and PowerShares DB US Dollar Index Bearish Fund (UDN)). CFTC Regulations require inclusion of only performance information within the five most recent calendar years and year-to-date, or, if inception of the pool has been less than five years and year-to-date, then since inception.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS, AND MATERIAL DIFFERENCES EXIST AMONG THE FUND AND THE POOLS WHOSE PERFORMANCE ARE SUMMARIZED HEREIN.

INVESTORS SHOULD NOTE THAT INTEREST INCOME MAY CONSTITUTE A SIGNIFICANT PORTION OF A COMMODITY POOL’S INCOME AND, IN CERTAIN INSTANCES, MAY GENERATE PROFITS WHERE THERE HAVE BEEN REALIZED AND UNREALIZED LOSSES FROM COMMODITY TRADING.

PERFORMANCE OF POWERSHARES DB COMMODITY INDEX TRACKING FUND(TICKER: DBC)

Name of Pool:PowerShares DB Commodity Index Tracking Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:February 2006

Aggregate Gross Capital Subscriptions as of November 30, 2007:$1,279,520,878

Net Asset Value as of November 30, 2007:$1,425,014,546

Net Asset Value per Share as of November 30, 2007:$30.32

Worst Monthly Drawdown:(4.70)% December 2006

Worst Peak-to-Valley Drawdown:(7.13)% July 2006 – September 2006

Monthly Rate of Return | 2007(%) | 2006(%) | ||

January | (2.36) | — | ||

February | 5.31 | (4.66) | ||

March | 0.68 | 3.63 | ||

April | 0.55 | 6.51 | ||

May | (0.51) | (0.42) | ||

June | 1.22 | (0.29) | ||

July | 1.94 | 1.65 | ||

August | (2.21) | (2.71) | ||

September | 8.58 | (4.54) | ||

October | 8.58 | 1.21 | ||

November | 0.26 | 6.40 | ||

December | (4.70)* | |||

Compound Rate of Return | 23.50% (11 months) | 1.23%** (11 months) |

* The December 2006 return of (4.70) includes the $0.61 per Share distribution made to Shareholders of record as of December 20, 2006. Prior to the December 20, 2006 distribution, the pool’s return for December 2006 was (2.33)%.

** “Compound Rate of Return” is based on an initial net asset value per share of $24.25 and is calculated by multiplying on a compound basis each of the monthly rates of return set forth in the chart above and not by adding or averaging such monthly rates of return. For periods of less than one year, the results are year-to-date.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 52.

-15-

PERFORMANCE OF POWERSHARES DB ENERGY FUND (TICKER: DBE), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool: PowerShares DB Energy Fund

Type of Pool: Public, Exchange-Listed Commodity Pool

Inception of Trading: January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $70,981,614

Net Asset Value as of November 30, 2007: $53,612,056

Net Asset Value per Share as of November 30, 2007: $33.51

Worst Monthly Drawdown: (4.07)% August 2007

Worst Peak-to-Valley Drawdown: (4.07)% July – August 2007

Monthly Rate of Return | 2007(%) | |

January | 0.08 | |

February | 5.80 | |

March | 5.33 | |

April | 0.86 | |

May | (0.92) | |

June | 3.41 | |

July | 2.26 | |

August | (4.07) | |

September | 7.78 | |

October | 12.90 | |

November | (2.56) | |

December | ||

Compound Rate of Return | 34.04% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB OIL FUND (TICKER: DBO), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Oil Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $68,488,102

Net Asset Value as of November 30, 2007: $26,414,390

Net Asset Value per Share as of November 30, 2007: $33.02

Worst Monthly Drawdown:(4.20%) August 2007

Worst Peak-to-Valley Drawdown:(4.63%) March – May 2007

Monthly Rate of Return | 2007(%) | |

January | (2.08) | |

February | 6.13 | |

March | 4.77 | |

April | (2.20) | |

May | (2.48) | |

June | 4.58 | |

July | 2.65 | |

August | (4.20) | |

September | 9.59 | |

October | 15.62 | |

November | (2.39) | |

December | ||

Compound Rate of Return | 32.08% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 52.

-16-

PERFORMANCE OF POWERSHARES DB PRECIOUS METALS FUND (TICKER: DBP), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Precious Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $48,318,812

Net Asset Value as of November 30, 2007: $41,624,439

Net Asset Value per Share as of November 30, 2007: $29.73

Worst Monthly Drawdown:(5.36)% October 2007

Worst Peak-to-Valley Drawdown:(5.49)% April – June 2007

Monthly Rate of Return | 2007(%) | |

January | 4.04 | |

February | 2.77 | |

March | (1.87) | |

April | 2.10 | |

May | (2.43) | |

June | (3.14) | |

July | 2.96 | |

August | (0.77) | |

September | 16.86 | |

October | (5.36) | |

November | 3.95 | |

December | ||

Compound Rate of Return | 18.92% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB GOLD FUND (TICKER: DGL), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Gold Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $47,139,110

Net Asset Value as of November 30, 2007: $36,558,610

Net Asset Value per Share as of November 30, 2007: $30.47

Worst Monthly Drawdown:(2.93)% May 2007

Worst Peak-to-Valley Drawdown:(4.86)% April – June 2007

Monthly Rate of Return | 2007(%) | |

January | 3.44 | |

February | 2.44 | |

March | (1.02) | |

April | 2.86 | |

May | (2.93) | |

June | (1.99) | |

July | 2.61 | |

August | 0.68 | |

September | 9.81 | |

October | 6.01 | |

November | (1.26) | |

December | ||

Compound Rate of Return | 21.88% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 52.

-17-

PERFORMANCE OF POWERSHARES DB SILVER FUND (TICKER: DBS), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Silver Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $36,099,486

Net Asset Value as of November 30, 2007: $27,278,674

Net Asset Value per Share as of November 30, 2007: $27.28

Worst Monthly Drawdown:(7.80)% June 2007

Worst Peak-to-Valley Drawdown:(14.25)% February – August 2007

Monthly Rate of Return | 2007(%) | |

January | 6.48 | |

February | 4.13 | |

March | (4.91) | |

April | 0.49 | |

May | (0.26) | |

June | (7.80) | |

July | 4.60 | |

August | (6.71) | |

September | 13.76 | |

October | 3.92 | |

November | (2.92) | |

December | ||

Compound Rate of Return | 9.12% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB BASE METALS FUND (TICKER: DBB), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Base Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $109,768,264

Net Asset Value as of November 30, 2007: $48,337,513

Net Asset Value per Share as of November 30, 2007: $24.17

Worst Monthly Drawdown:(7.61)% August 2007

Worst Peak-to-Valley Drawdown:(13.21)% July – November 2007

Monthly Rate of Return | 2007(%) | |

January | (5.84) | |

February | 3.70 | |

March | 1.88 | |

April | 10.74 | |

May | (2.40) | |

June | (1.19) | |

July | 4.86 | |

August | (7.61) | |

September | 2.37 | |

October | (2.43) | |

November | (5.95) | |

December | ||

Compound Rate of Return | (3.32)% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 52.

-18-

PERFORMANCE OF POWERSHARES DB AGRICULTURE FUND (TICKER: DBA), A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Agriculture Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007: $760,746,748

Net Asset Value as of November 30, 2007: $837,468,013

Net Asset Value per Share as of November 30, 2007: $30.79

Worst Monthly Drawdown:(5.81)% March 2007

Worst Peak-to-Valley Drawdown:(7.63)% February – April 2007

Monthly Rate of Return | 2007(%) | |

January | 3.44 | |

February | 3.91 | |

March | (5.81) | |

April | (1.94) | |

May | 5.84 | |

June | (0.04) | |

July | (0.50) | |

August | 2.07 | |

September | 10.20 | |

October | (0.17) | |

November | 4.94 | |

December | ||

Compound Rate of Return | 23.16% (11 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB US DOLLAR INDEX BULLISH FUND(TICKER: UUP),A SERIES OF POWERSHARES DB US DOLLAR INDEX TRUST

Name of Pool:PowerShares DB US Dollar Index Bullish Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:February 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007:$58,452,308

Net Asset Value as of November 30, 2007:$42,687,148

Net Asset Value per Share as of November 30, 2007:$23.72

Worst Monthly Drawdown:(3.31)% September 2007

Worst Peak-to-Valley Drawdown:(5.16)% February – October 2007

Monthly Rate of Return | 2007(%) | |

January | — | |

February | (0.32) | |

March | (0.32) | |

April | (1.29) | |

May | 1.55 | |

June | 0.00 | |

July | (0.92) | |

August | 0.57 | |

September | (3.31) | |

October | (1.17) | |

November | 0.04 | |

December | ||

Compound Rate of Return | (5.12)% (9 1/4 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 52.

-19-

PERFORMANCE OF POWERSHARES DB US DOLLAR INDEX BEARISH FUND(TICKER: UDN), A SERIES OF POWERSHARES DB US DOLLAR INDEX TRUST

Name of Pool:PowerShares DB US Dollar Index Bearish Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Date of Inception of Trading:February 2007

Aggregate Gross Capital Subscriptions as of November 30, 2007:$80,209,226

Net Asset Value as of November 30, 2007:$84,228,051

Net Asset Value per Share as of November 30, 2007:$28.08

Worst Monthly Drawdown:(0.73)% May 2007

Worst Peak-to-Valley Drawdown:(0.73)% April – May 2007

Monthly Rate of Return | 2007(%) | |

January | — | |

February | 0.64 | |

March | 0.99 | |

April | 2.01 | |

May | (0.73) | |

June | 0.74 | |

July | 1.54 | |

August | 0.38 | |

September | 3.82 | |

October | 1.68 | |

November | 0.68 | |

December | ||

Compound Rate of Return | 12.32% (9 1/4 months) |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information.

Footnotes to Performance Information

1. “Aggregate Gross Capital Subscriptions” is the aggregate of all amounts ever contributed to the relevant pool, including investors who subsequently redeemed their investments.

2. “Net Asset Value” is the net asset value of each pool as of November 30, 2007.

3. “Net Asset Value per Share” is the Net Asset Value of the relevant pool divided by the total number of Shares outstanding with respect to such pool as of November 30, 2007.

4. “Worst Monthly Drawdown” is the largest single month loss sustained since inception of trading. “Drawdown” as used in this section of the Prospectus means losses experienced by the relevant pool over the specified period and is calculated on a rate of return basis, i.e., dividing net performance by beginning equity. “Drawdown” is measured on the basis of monthly returns only, and does not reflect intra-month figures. “Month” is the month of the Worst Monthly Drawdown.

5. “Worst Peak-to-Valley Drawdown” is the largest percentage decline in the Net Asset Value per Share over the history of the relevant pool. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive returns. “Worst Peak-to-Valley Drawdown” represents the greatest percentage decline from any month-end Net Asset Value per Share that occurs without such month-end Net Asset Value per Share being equaled or exceeded as of a subsequent month-end. For example, if the Net Asset Value per Share of a particular pool declined by $1 in each of January and February, increased by $1 in March and declined again by $2 in April, a “peak-to-valley drawdown” analysis conducted as of the end of April would consider that “drawdown” to be still continuing and to be $3 in amount, whereas if the Net Asset Value per Share had increased by $2 in March, the January-February drawdown would have ended as of the end of February at the $2 level.

6. “Compound Rate of Return” is calculated by multiplying on a compound basis each of the monthly rates of return set forth in the respective charts above and not by adding or averaging such monthly rates of return. For periods of less than one year, the results are year-to-date.”

-20-

VI. The section “A I M DISTRIBUTORS, INC.” set forth on page 78 of the Prospectus is hereby deleted and replaced, in its entirety, with the following:

“A I M DISTRIBUTORS, INC.

Through a marketing agreement between the Managing Owner, A I M Distributors, Inc., or AIM Distributors, an affiliate of PowerShares Capital Management LLC, or PowerShares, the Managing Owner, on behalf of the Fund and the Master Fund, has appointed AIM Distributors as a marketing agent. AIM Distributors assists the Managing Owner and the Administrator with certain functions and duties such as providing various educational and marketing activities regarding the Fund, primarily in the secondary trading market, which activities will include, but are not limited to, communicating the Fund’s name, characteristics, uses, benefits, and risks, consistent with the prospectus. AIM Distributors will not open or maintain customer accounts or handle orders for the Fund. AIM Distributors engage in public seminars, road shows, conferences, media interviews, field incoming telephone “800” number calls and distribute sales literature and other communications (including electronic media) regarding the Fund. Investors may contact AIM Distributors toll-free in the U.S. at (800) 983-0903.

AIM Distributors is a subsidiary of Invesco, Ltd. Invesco, Ltd. is a leading independent global investment manager operating under the AIM, INVESCO, AIM Trimark, Invesco Perpetual and Atlantic Trust brands.

The Managing Owner, out of the Management Fee, pays AIM Distributors for performing its duties on behalf of the Fund or the Master Fund.”

VII. The section “MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS” set forth on pages 85 through 97 of the Prospectus is hereby deleted and replaced, in its entirety, with the following:

“MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion describes the material U.S. federal (and certain state and local) income tax considerations associated with the purchase, ownership and disposition of Shares as of the date hereof by U.S. Shareholders (as defined below) and non-U.S. Shareholders (as defined below). Except where noted, this discussion deals only with Shares held as capital assets by Shareholders who acquired Shares by purchase and does not address special situations, such as those of:

• dealers in securities or currencies;

• financial institutions;

• regulated investment companies, other than the status of the Fund and the Master Fund as qualified PTPs within the meaning of the Code;

• real estate investment trusts;

• tax-exempt organizations;

• insurance companies;

• persons holding Shares as a part of a hedging, integrated or conversion transaction or a straddle;

• traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; or

• persons liable for alternative minimum tax.

Furthermore, the discussion below is based upon the provisions of the Internal Revenue Code of 1986, as amended, or the Code, the Treasury regulations promulgated thereunder, or the Regulations, and administrative and judicial interpretations thereof, all as of the date hereof, and such authorities may be repealed, revoked, modified or subject to differing interpretations, possibly on a retroactive basis, so as to result in U.S. federal income tax consequences different from those described below.

A “U.S. Shareholder” of Shares means a beneficial owner of Shares that is for U.S. federal income tax purposes:

• an individual citizen or resident of the United States;

• a corporation (or other entity taxable as a corporation) created or organized in or under the laws of the United States or any state thereof or the District of Columbia;

• an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

-21-

• a trust if it (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all substantial decisions of such trust or (2) has a valid election in effect under applicable Regulations to be treated as a U.S. person.

A “non-U.S. Shareholder” of Shares means a beneficial owner of Shares that is not a U.S. Shareholder.

If a partnership or other entity or arrangement treated as a partnership for U.S. federal income tax purposes holds Shares, the tax treatment of a partner will generally depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership holding Shares, we urge you to consult your own tax adviser.

No statutory, administrative or judicial authority directly addresses the treatment of Shares or instruments similar to Shares for U.S. federal income tax purposes. As a result, we cannot assure you that the United States Internal Revenue Service, or IRS, or the courts will agree with the tax consequences described herein. A different treatment from that described below could adversely affect the amount, timing and character of items of income, gain, loss, or deduction in respect of an investment in the Shares.If you are considering the purchase of Shares, we urge you to consult your own tax adviser concerning the particular U.S. federal income tax consequences to you of the purchase, ownership and disposition of Shares, as well as any consequences to you arising under the laws of any other taxing jurisdiction.

Status of the Fund and the Master Fund

Under current law and assuming full compliance with the terms of the Trust Declaration (and other relevant documents), in the opinion of Sidley AustinLLP, (1) the Fund will not be treated as an association taxable as a corporation for U.S. federal income tax purposes, and (2) the Master Fund will be classified as a partnership for U.S. federal income tax purposes. Accordingly, each of the Fund and the Master Fund will not be taxable entities for U.S. federal income tax purposes and will not incur U.S. federal income tax liability.

The Master Fund will file a partnership tax return, including for the taxable year ending December 31, 2007. Prospective Shareholders should be aware that there is no authority directly addressing the proper classification of a separate unincorporated entity, such as the Fund, whose sole asset is an interest in a limited

liability entity classified as a partnership for U.S. federal income tax purposes, where that interest represents substantially all of the equity interests in such partnership. In 2007, the IRS announced that it will take the position that certain trusts of this type should be treated as partnerships rather than grantor trusts. As a result of this development, the Managing Owner has determined that the Fund should also file a partnership tax return rather than a trust return, including for the taxable year ending December 31, 2007. The Fund will provide the annual tax information to its Shareholders on IRS Form 1065, Schedule K-1 (“Schedule K-1”) rather than in a grantor trust letter. See “Tax Reporting by the Fund to its Shareholders” below. Accordingly, investors in Shares will be taxed as partners in a partnership, which means that investors generally will be required to take into account their allocable shares of the Fund’s and the Master Fund’s items of income, gain, loss, and deduction in computing the investors’ U.S. federal income tax liability.

If the Managing Owner determines, based on a challenge to the Fund’s tax status or otherwise, that the existence of the Fund results or is reasonably likely to result in a material tax detriment to Shareholders, then the Managing Owner may, among other things, agree to dissolve the Fund and transfer the Master Fund Units to Shareholders of such Fund in exchange for their Shares.

Special Rules for Publicly Traded Partnerships

A partnership is not a taxable entity and incurs no U.S. federal income tax liability. Section 7704 of the Code provides that publicly traded partnerships will, as a general rule, be taxed as corporations. However, an exception exists with respect to publicly traded partnerships of which 90% or more of the gross income during each taxable year consists of “qualifying income” within the meaning of Section 7704(d) of the Code (“qualifying income exception”). Qualifying income includes dividends, interest, capital gains from the sale or other disposition of stocks and debt instruments and, in the case of a partnership (such as the Master Fund) a principal activity of which is the buying and selling of commodities or futures contracts with respect to commodities, income and gains derived from commodities or futures contracts with respect to commodities. The types of currency futures contracts held by the Master Fund are regulated as commodities and are traded on a commodities exchange, and, although there is no specific authority directly addressing the issue, such contracts should be treated as futures contracts with respect to commodities under Section 7704(d) of the Code. Each of the Fund and the Master Fund anticipates that at least 90% of its gross income for each taxable year will constitute qualifying

-22-

income within the meaning of Section 7704(d) of the Code.

There can be no assurance that the IRS will not assert that the Fund or the Master Fund should be treated as a publicly traded partnership taxable as a corporation. No ruling has been or will be sought from the IRS, and the IRS has made no determination as to the status of the Fund or the Master Fund for U.S. federal income tax purposes or whether the Fund’s or Master Fund’s operations generate “qualifying income” under Section 7704(d) of the Code. Whether the Fund or the Master Fund will continue to meet the qualifying income exception is a matter that will be determined by the Fund’s or Master Fund’s operations and the facts existing at the time of future determinations. However, the Fund’s and the Master Fund’s Managing Owner will use its best efforts to cause the operation of the Fund and the Master Fund in such manner as is necessary for the Fund and the Master Fund to continue to meet the qualifying income exception.