Harland Clarke Holdings Corp.

November 15, 2007

Forward looking statements

Certain information in this presentation may be considered forward-looking information within the earnings of the Private Securities Litigation Reform Act of 1995. This information is based on the Company's current expectations and actual results could vary materially depending on risks and uncertainties that may affect the Company's operations, markets, services, prices and other factors as discussed in filings with the Securities and Exchange Commission. These risks and uncertainties include, but are not limited to, general and economic conditions, failure to complete, integrate and/or realize the cost savings from our acquisition of Harland, and declines in the market in which we participate. There is no assurance that the Company's expectations will be realized. All forward looking statements speak only as of the date of this presentation. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are qualified by the cautionary statements in this section. The Company assumes no obligation to update any forward-looking information contained in this presentation.

2

Introductions

Over 30 years of

experience in the

security printing

industry

Over 14 years with

Clarke

Former Chief Executive

Officer of Rocky

Mountain Bank Note

Spent 16 years at

Harland

Chuck Dawson

President & CEO,

Harland Clarke Holdings

30 years of experience

in technology with over

20 years in the financial

industry

Former President and

CEO positions at Fiserv,

Hogan Systems, MPCT

Capital Markets and

System Corporation

John O’Malley

President,

Harland Financial Solutions

Former Chief Financial

Officer of Honeywell’s

Aircraft Landing

Systems business

Peter Fera

EVP & CFO,

Harland Clarke Holdings

3

World class

operations

Leading market

presence

Diversified,

blue-chip

client portfolio

A leading provider of checks & office products and marketing & contact center services

A leading provider of software and services to financial institutions

A leading provider of testing and survey technologies

$1.7 billion in combined LTM revenues

Over 14,000 financial institutions clients such as:

Harland Clarke: 5 contact centers and 16 plants, supported by a national sales organization

Harland Financial Solutions: 16 fully networked facilities focused on customer support and

enhancement of software solutions

Scantron: 2 state-of-the-art facilities supported by a national sales organization

2001 Malcolm Baldrige National Quality Award winner

Strong, long-

term client

relationships

Trusted, integrated relationships with clients

Provider of mission-critical software products

Strong partnerships with long-term contracts – 80% of revenue under long-term contract

Harland Clarke Holdings

4

Harland Clarke

Checks and office

products and marketing

and contact center

services for financial and

commercial institutions

Scantron

Testing and surveys for

schools and businesses

Harland Financial

Solutions

Software and services

for banks, credit unions

and thrifts

What we do

5

Harland & Clarke: A compelling strategic combination

Diversified business and product lines

Diversified and expanded client relationships with long-term contracts

Significant cost savings

Strong management team

Strong free cash flow generation

6

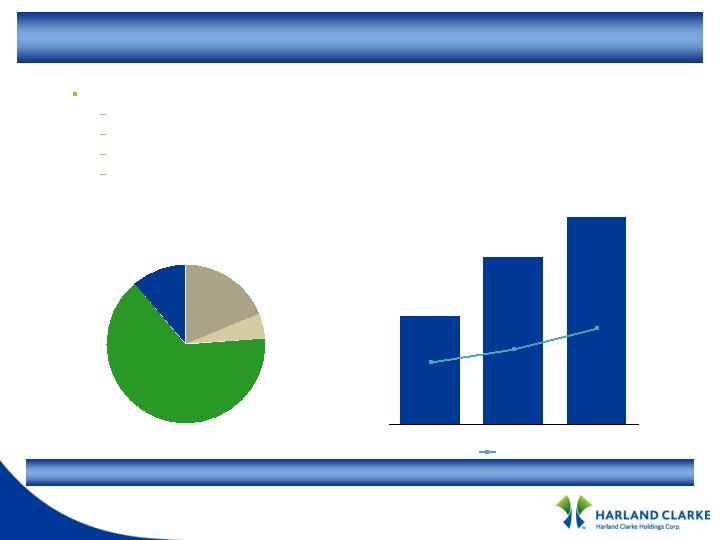

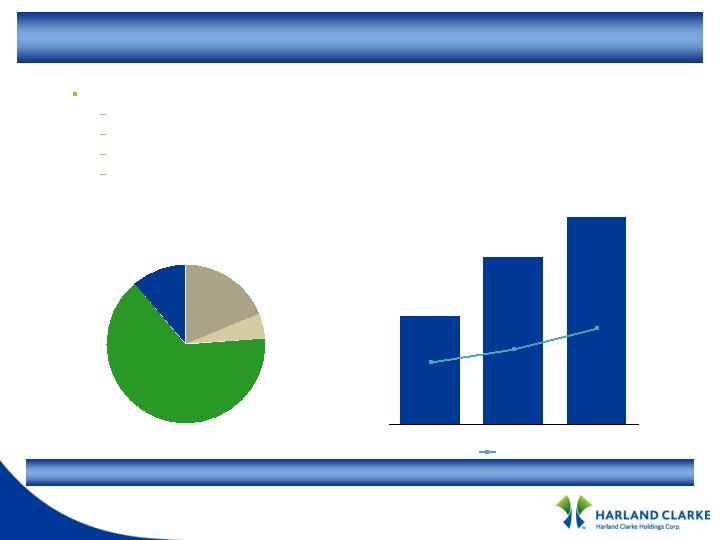

Diversified business and product lines

Combined business has four major product lines

Checks and office products

Marketing and contact center services

Software and related services

Testing and survey solutions

$1.7 billion

Checks

and Office

Products

65%

Testing and

Survey

5%

Software

19%

Marketing &

Contact Centers

and Forms

11%

2006 Revenue

$586

$378

45%

35%

29%

2002

2006

5 Year Target

% of Total Sales

Revenue for Non-Check Products

Value proposition is more than a “check provider” for financial institutions

7

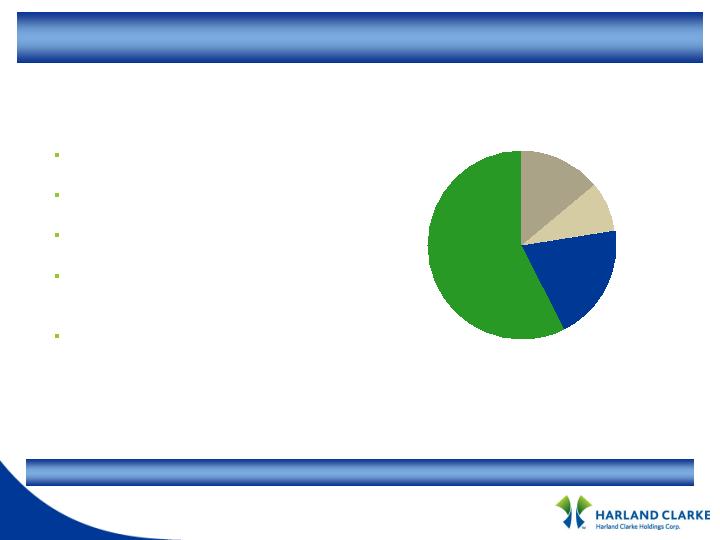

Diversified and expanded client relationships

Approximately 80% of revenue is under long-term contracts

8

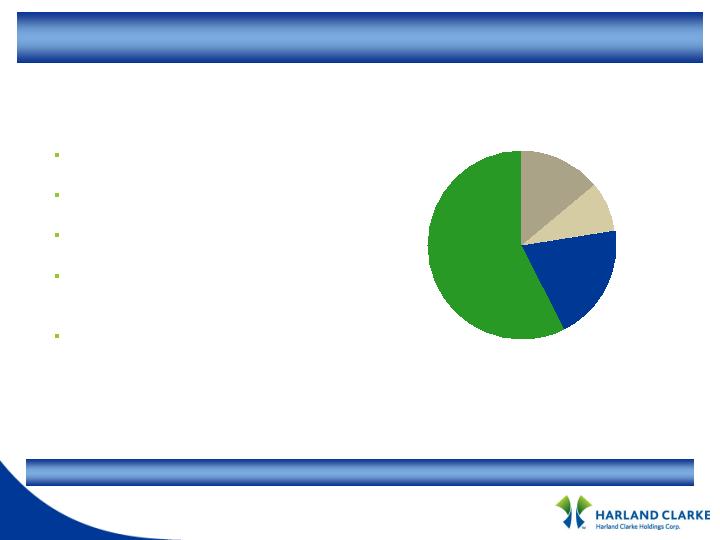

Cost savings originally planned

Facilities $15.5 million

Procurement $9.8 million

Shared services $22.7 million

Other SG&A $64.6 million

Total savings $112.6 million

Facilities

14%

Procurement

9%

Shared Services

20%

Other SG&A

57%

On target to achieve $112.6 million in synergies

Significant cost savings

9

A leading provider of checks and office

products and marketing and contact

center services

15,000 financial and commercial institution

clients

85% of revenues under long-term contract

More than 20 million annual direct customer

contacts through contact centers and

websites

Diverse product and service offerings

Personal and business checks

Address labels, self-inking stamps,

checkbook covers, registers

Financial and business forms

Deposit products including deposit tickets,

security bags, cash straps, coin wraps

Marketing services including onboarding,

direct mail, contact center and agency

solutions

Strategic

partner

Partner

Supplier

Vendor

10

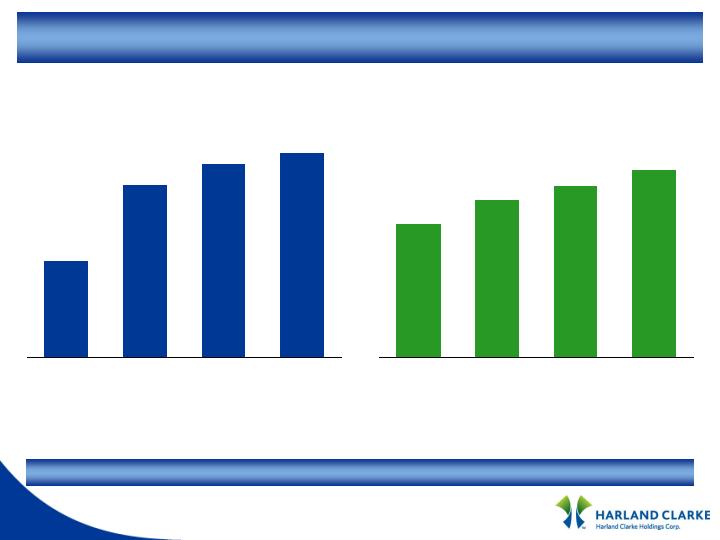

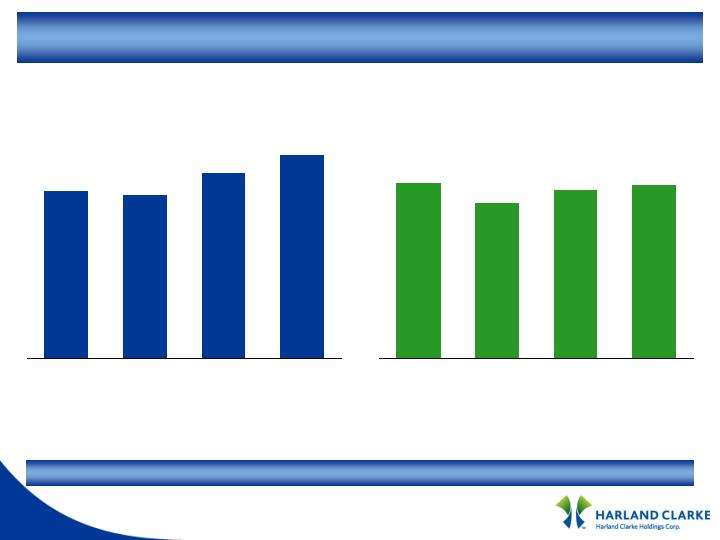

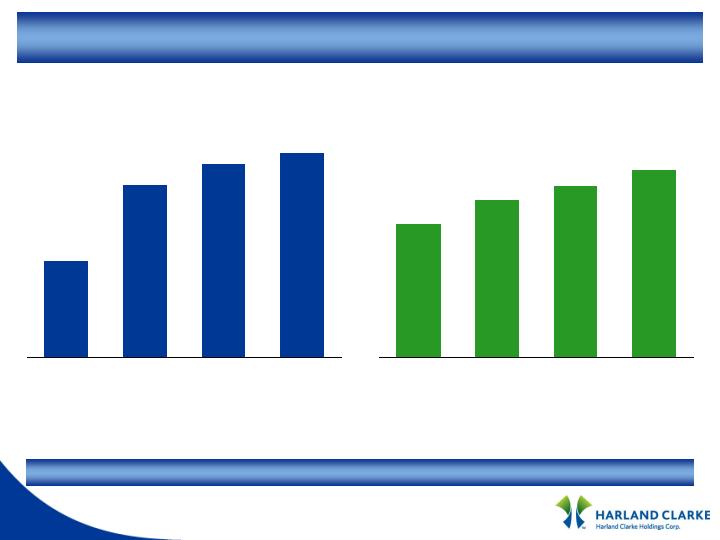

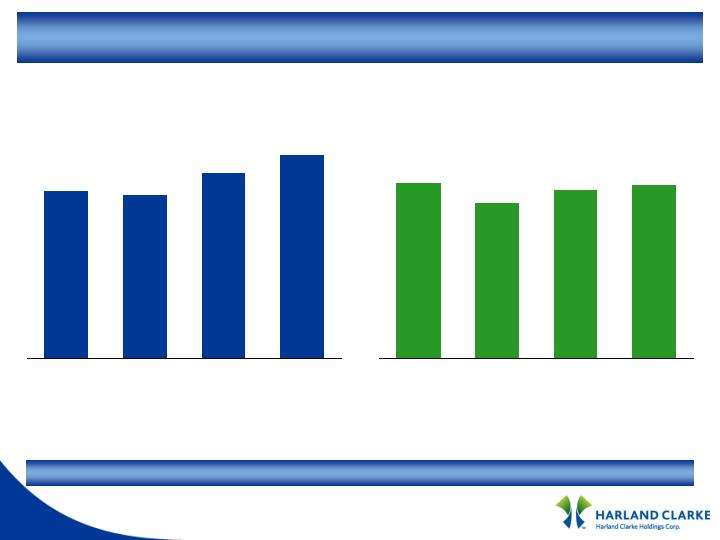

Harland Clarke financial performance

(1) Combined revenue is the sum of the revenues of the Harland Clarke segment (which consists of only Clarke American revenues prior to May 1, 2007), plus revenues of Harland’s Printed Products segment for periods prior to the completion of the Harland Acquisition on May 1, 2007, plus an adjustment to add back $0.5 million purchase accounting fair value adjustments of deferred revenue for LTM 9/30/2007, minus revenue from intersegment transactions.

(2) Combined Adjusted EBITDA is the sum of the operating income of the Harland Clarke segment (which consists of only Clarke American operating income prior to May 1, 2007), plus the operating income of Harland’s Printed Products segment for periods prior to the completion of the Harland Acquisition on May 1, 2007, plus combined depreciation and amortization (other than amortization of upfront contract payments), plus adjustments to add back (i) purchase accounting fair value adjustments of inventory and deferred revenue, (ii) Harland Acquisition-related expenses, (iii) intangible asset impairment (iv) a contingent earnout payment, and (v) restructuring expenses.

LTM 2007 revenue and adj. EBITDA up 1.7% and 9.9%, respectively

$ in millions

Combined Revenue(1)

$1,088

$1,234

$1,274

$1,296

2004

2005

2006

LTM 9/30/07

$ in millions

Margin 21.0% 22.0% 23.1% 24.9%

Combined Adjusted EBITDA(2)

$229

$271

$294

$323

2004

2005

2006

LTM 9/30/07

11

Harland Clarke

(1) For periods prior to May 1, 2007, consists of the operating income of Clarke American Corp.

(2) Consists of the operating income of the printed products segment of John H. Harland Company for periods prior to May 1, 2007

The table below presents a reconciliation of (x) the combined operating income of the Harland Clarke segment and John H. Harland Company's printed products segment to (y) combined adjusted EBITDA for 2004, 2005, 2006 and the twelve months ended September 30, 2007.

Harland Clarke

2004

2005

2006

LTM 9/30/07

Harland Clarke operating income (1)

$

107.0

$

78.3

$

87.0

$

141.1

Harland Printed Products segment operating income (2)

63.6

98.4

111.7

53.4

Combined operating income

170.6

176.7

198.7

194.5

D&A (other than upfront contract payments amort)

52.0

85.2

89.3

100.8

Purchase accounting related fair value adjustments

-

4.9

1.3

2.0

Harland Acquisition expenses

-

-

-

15.4

Intangible asset impairment costs

-

-

-

3.1

Contingent earnout payment

-

1.9

1.1

0.4

Restructuring expenses

6.5

2.4

3.3

6.4

Combined adjusted EBITDA

$

229.1

$

271.0

$

293.7

$

322.6

12

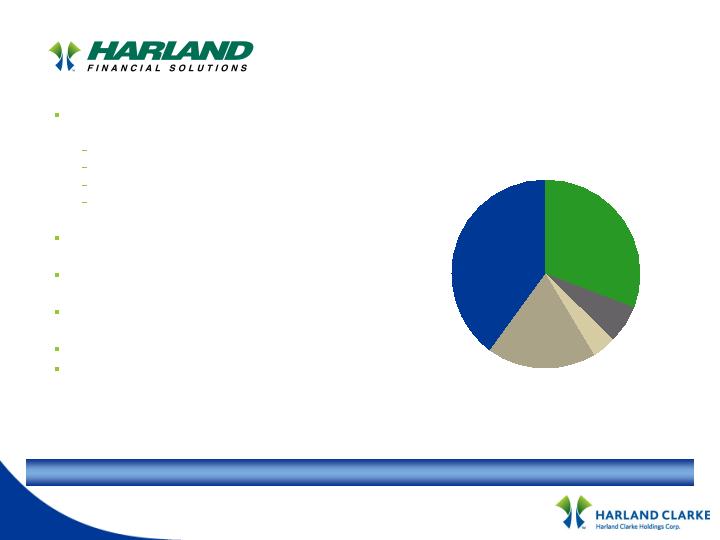

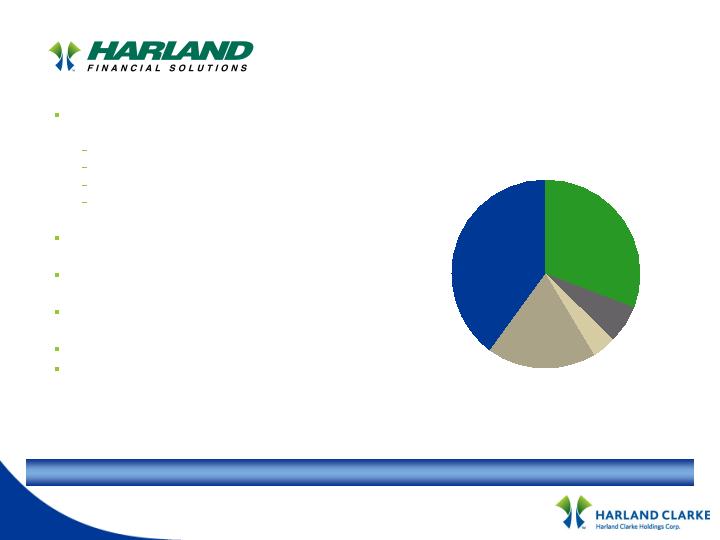

A leading supplier of software and services

to financial institutions

Core processing

Retail solutions (branch, teller, call center)

Lending compliance

Mortgage origination

High switching costs associated with

switching integrated software providers

Contracts: license (33%); subscriptions

(37%); service (30%)

Sell to 39% of all financial institutions in the

US

Top 20 customers < 6% of revenue

Recurring revenue for 75% of sales

Customer Mix

7%

4%

19%

31%

39%

Banks

3,108

Other

1,449

Credit Unions

2,388

Thrifts

509

Mortgage Co.

310

Total 7,764

Revenue growth is primarily driven by the growth of financial institutions’ assets

13

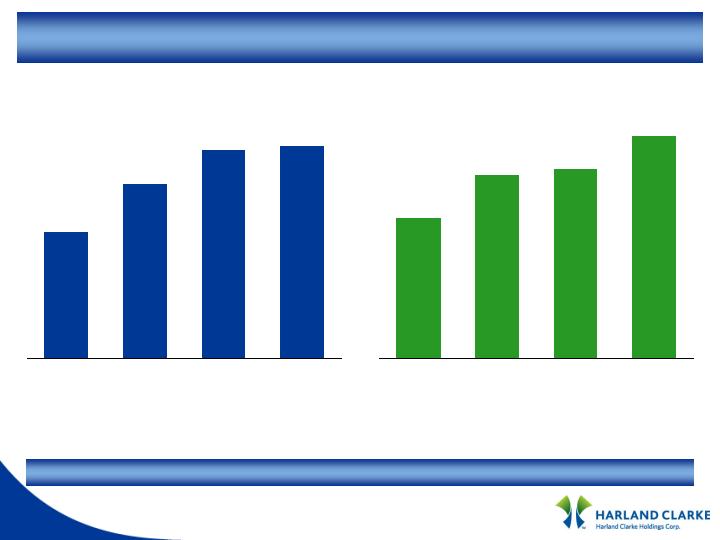

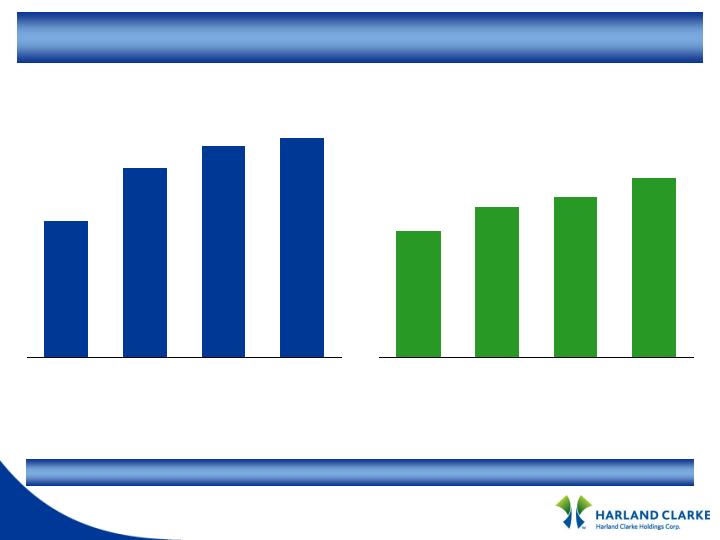

HFS financial performance

$ in millions

$235

$287

$322

$328

2004

2005

2006

LTM 9/30/07

Revenue(1)

$ in millions

$45

$59

$61

$71

2004

2005

2006

LTM 9/30/07

Margin 19.1% 20.6% 18.9% 21.6%

Adjusted EBITDA(2)

LTM 2007 revenue and adj. EBITDA up 1.9% and 16.4%, respectively

(1) Revenue is adjusted to add back $6.4 million purchase accounting fair value adjustments of deferred revenue for LTM 9/30/07, minus revenue from intersegment transactions.

(2) Adjusted EBITDA consists of operating income, plus combined depreciation and amortization, plus adjustments to add back (i) the effect of purchase accounting fair value adjustments of inventory and deferred revenue and (ii) Harland Acquisition-related expenses.

14

HFS

The table below presents a reconciliation of the operating income of the Harland Financial Solutions segment to adjusted EBITDA for 2004, 2005, 2006 and the twelve months ended September 30, 2007.

Consists of the operating income of the Harland Financial Solutions segment (for periods following the completion of the Harland Acquisition on May 1, 2007) and the operating income of Harland’s software and services segment (for periods prior to May 1, 2007)

Harland Financial Solutions

2004

2005

2006

LTM 9/30/07

Operating income (1)

$

32.6

$

42.4

$

42.9

$

18.6

D&A

12.4

16.4

17.9

22.0

Purchase accounting related fair value adjustments

-

-

-

6.4

Harland Acquisition expenses

-

-

-

24.3

Adjusted EBITDA

$

45.0

$

58.8

$

60.8

$

71.3

(1)

15

Strong brand recognition

A leading testing provider for over 34 years

Razor blade model

Provide patent protected scanner to school

Sales of forms create annuity-like revenue

stream

Large installed base

80%+ of all public schools

38,000 scanning machines

Customer diversification

100,000 accounts

Largest account approximately 2% of

revenue

Focus on being a leading provider of

enterprise-wide testing and surveying

technology

School Forms and Testing

Surveys, Forms, and Processing

16

Scantron financial performance

LTM 2007 revenue and adj. EBITDA up 2.6% and 4.0%, respectively

$ in millions

$75

$74

$78

$80

2004

2005

2006

LTM 9/30/07

Revenue(1)

$ in millions

$26

$23

$25

$26

2004

2005

2006

LTM 9/30/07

Margin 34.7% 31.1% 32.1% 32.5%

Adjusted EBITDA(2)

(1) Revenue is adjusted to add back $1.4 million purchase accounting fair value adjustments of deferred revenue for LTM 9/30/07, minus revenue from intersegment transactions.

(2) Adjusted EBITDA consists of operating income, plus combined depreciation and amortization, plus adjustments to add back (i) the effect of purchase accounting fair value adjustments of inventory and deferred revenue and (ii) Harland Acquisition-related expenses.

17

Scantron

The table below presents a reconciliation of the operating income of the Scantron segment to adjusted EBITDA for 2004, 2005, 2006 and the twelve months ended September 30, 2007.

(1) Consists of the operating income of the Scantron segment

Scantron

2004

2005

2006

LTM 9/30/07

Operating income (1)

$

22.7

$

20.3

$

21.9

$

8.3

D&A

3.5

2.9

3.3

8.0

Purchase accounting related fair value adjustments

-

-

-

4.4

Harland Acquisition expenses

-

-

-

5.1

Adjusted EBITDA

$

26.2

$

23.2

$

25.2

$

25.8

18

Harland Clarke Holdings financial highlights

Strong historical financial performance

High EBITDA margins

Low working capital requirements

Efficient deployment of capital

Significant cash flow generation

19

(1) As reported; reflects five months of the Harland acquisition.

(2) Adjustments to EBITDA are net of upfront contract payment amortization and adds back purchase accounting related fair value adjustments to inventory and deferred revenue, restructuring expenses,

transaction-related expense, intangible asset impairment, and a contingent earn-out payment related to a prior transaction. Adjusted EBITDA for these periods is reconciled in Harland Clarke Holdings 8-k

dated November 9, 2007.

Harland Clarke Holdings 3-mos. and 9-mos. 2007

Revenue

$

155.3

$

432.8

$

474.4

$

937.0

Adjusted EBITDA

(2)

$

37.2

$

113.5

$

113.0

$

236.9

Margin

24.0

%

26.2

%

23.8

%

25.3

%

3 mos. ended

9/30/06

3 mos. ended

(1)

9/30/07

9 mos. ended

9/30/06

9 mos. ended

(1)

9/30/07

20

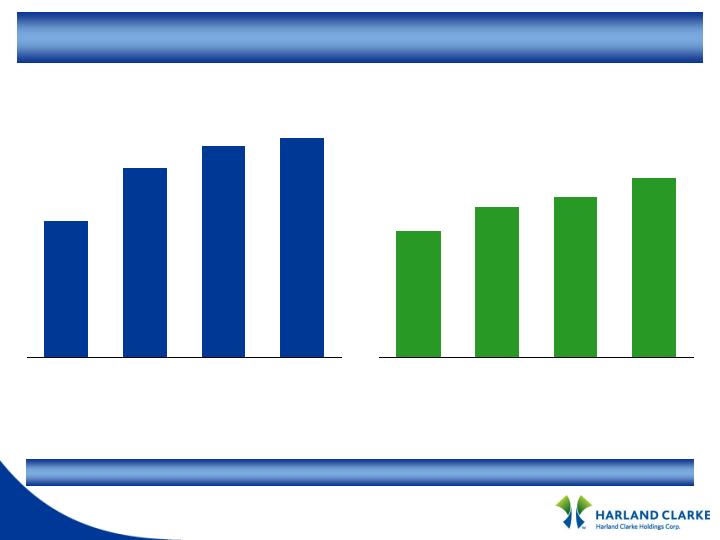

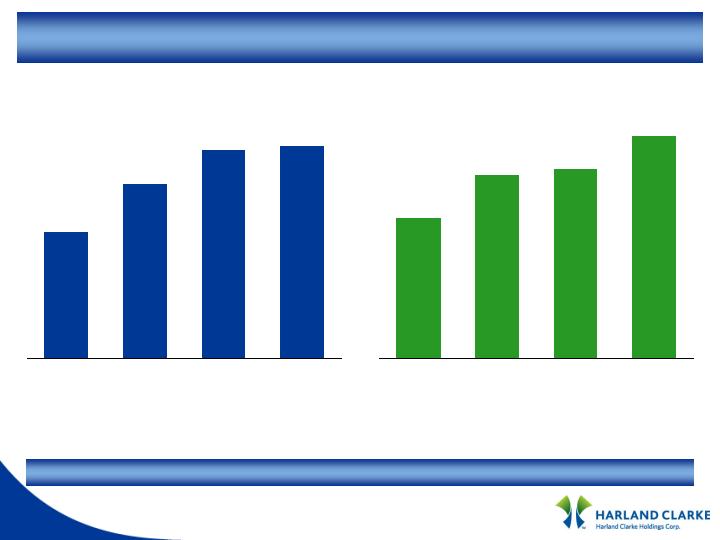

Harland Clarke Holdings financial performance

LTM 2007 revenue and adj. EBITDA up 1.8% and 11.3%, respectively

Combined Revenue(1)

$ in millions

$1,398

$1,595

$1,674

$1,704

2004

2005

2006

LTM 9/30/07

$ in millions

Combined Adjusted EBITDA(2)

(1) Combined revenue is the sum of the revenues of Harland Clarke Holdings (which consists of only Clarke American revenues prior to May 1, 2007), plus revenues of John H. Harland Company for periods prior to the completion of the Harland Acquisition on May 1, 2007, plus an adjustment to add back $8.2 million purchase accounting fair value adjustments of deferred revenue for LTM 9/30/07.

(2) Combined Adjusted EBITDA is the sum of the consolidated net income of Harland Clarke Holdings (which consisted only of Clarke American’s net income prior to May 1, 2007) plus the consolidated net income of John H. Harland Company for periods prior to the completion of the Harland Acquisition on May 1, 2007, before combined net interest expense, combined income taxes and combined depreciation and amortization (other than amortization related to upfront contract payments), plus adjustments to add back (i) purchase accounting fair value adjustments of inventory and deferred revenue, (ii) Harland Acquisition-related expenses, (iii) intangible asset impairment (iv) a contingent earnout payment, and (v) restructuring expenses.

$273

$323

$346

$385

2004

2005

2006

LTM 9/30/07

Margin 19.5% 20.3% 20.7% 22.6%

21

Harland Clarke Holdings Corp.

The table below presents a reconciliation of (x) the combined consolidated net income of Harland Clarke Holdings and John H. Harland Company to (y) combined adjusted EBITDA for 2004, 2005, 2006 and the twelve months ended September 30, 2007.

(1) For periods prior to May 1, 2007, consists of the consolidated net income of Clarke American Corp.

(2) Consists of the consolidated net income of John H. Harland Company for periods prior to May 1, 2007.

Harland Clarke Holdings Corp.

2004

2005

2006

LTM 9/30/07

Harland Clarke Holdings consolidated net income (1)

$

64.4

$

40.7

$

19.5

$

(23.0)

John H. Harland consolidated net income (2)

55.1

75.5

68.1

(37.3)

Combined consolidated net income

119.5

116.2

87.6

(60.3)

Combined net interest expense

23.2

20.8

76.1

132.8

Combined Income tax expense

56.2

73

49.2

(29.4)

Other expenses

(0.9)

(0.4)

3.8

57.7

Combined D&A (other than upfront contract payments amort)

68.2

104.5

110.7

131.1

Purchase accounting related fair value adjustments

-

4.9

1.3

12.8

Harland Acquisition expenses

-

-

12.6

130.9

Intangible asset impairment costs

-

-

-

3.1

Contingent earnout payment

-

1.9

1.1

0.4

Restructuring expenses

6.5

2.4

3.3

6.4

Combined adjusted EBITDA

$

272.7

$

323.3

$

345.7

$

385.5

22

Harland Clarke Holdings credit strength

YTD cash flow from operations(1) $130.0 million

Cash on hand & nbsp; $187.3 million

Net debt(2) &nbs p; $2,227.5 million

LTM Full Synergies Combined Adjusted EBITDA(3) $481.5 million

Net debt / LTM full synergies adj. EBITDA 4.6x

LTM full synergies adj. EBITDA / PF interest(4) 2.3x

9/30/2007

(1) As reported; reflects five months of the Harland acquisition.

(2) Net debt equals total debt of $2,414.8 million less cash on hand.

(3) Combined Adjusted EBITDA for Harland Clarke Holdings Corp. (as reconciled on slide 24) plus an adjustment to reflect the full $112.6 million of annual run-rate synergies described previously. No

pro forma adjustments were made.

(4) PF interest of $210.5 million reflects one year of interest on total debt as of 9/30/2007 at an assumed blended rate of 8.7% per annum.

23