Exhibit 99.2

Canadian Satellite Radio Holdings Inc.

Consolidated Financial Statements

February 28, 2011

Canadian Satellite Radio Holdings Inc.

Interim Consolidated Balance Sheets

(unaudited)

February 28, 2011 $ | August 31, 2010 $ | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | 2,064,321 | 5,698,115 | ||||||

| Restricted investment - letter of credit (note 6) | 4,000,000 | 4,000,000 | ||||||

| Accounts receivable | 2,058,052 | 3,042,931 | ||||||

| Prepaid expenses and other assets | 3,028,965 | 2,493,039 | ||||||

| 11,151,338 | 15,234,085 | |||||||

| Long-term prepaid expenses | 911,187 | 923,598 | ||||||

| Property and equipment | 8,756,401 | 9,892,821 | ||||||

| Contract rights, distribution rights and computer software | 159,951,828 | 169,598,598 | ||||||

| Total assets | 180,770,754 | 195,649,102 | ||||||

| Liabilities and Shareholders’ Equity (Deficiency) | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities (note 8) | 26,859,297 | 25,306,623 | ||||||

| Interest payable | 1,236,720 | 1,094,668 | ||||||

| Deferred revenue | 31,597,116 | 28,483,663 | ||||||

| 59,693,133 | 54,884,954 | |||||||

Long-term debt (note 5) | 118,359,795 | 118,238,863 | ||||||

| Deferred revenue | 7,103,580 | 7,121,399 | ||||||

Other long-term liabilities (note 12) | 10,364,789 | 11,649,486 | ||||||

| Total liabilities | 195,521,297 | 191,894,702 | ||||||

| Shareholders’ Equity (deficiency) | ||||||||

| Share capital (note 9) | 334,565,308 | 334,152,570 | ||||||

| Contributed surplus (note 9) | 30,143,012 | 29,587,944 | ||||||

| Deficit | (379,458,863 | ) | (359,986,114 | ) | ||||

| Total shareholders’ equity (deficiency) | (14,750,543 | ) | 3,754,400 | |||||

| Total liabilities and shareholders’ equity (deficiency) | 180,770,754 | 195,649,102 | ||||||

Contracts, contingencies and commitments (note 12) Basis of presentation and material uncertainties (note 3) | ||||||||

Canadian Satellite Radio Holdings Inc.

Interim Consolidated Statements of Operations and Deficit

(unaudited)

Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||

2011 $ | 2010 $ | 2011 $ | 2010 $ | |||||||||||||

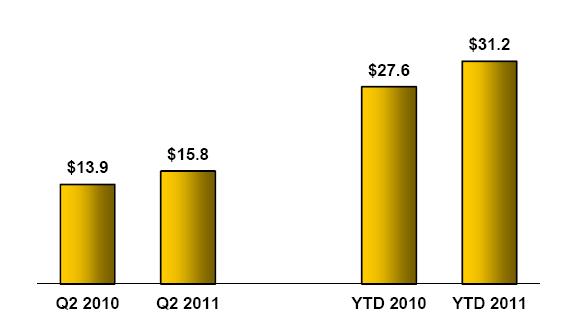

| Revenue | 15,802,769 | 13,931,755 | 31,192,196 | 27,604,173 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Cost of revenue | 9,081,496 | 8,175,686 | 17,508,439 | 16,174,640 | ||||||||||||

| Reversal of CRTC part II license fee (note 12) | - | - | - | (1,186,832 | ) | |||||||||||

| General and administrative | 3,252,573 | 4,144,826 | 6,736,515 | 8,418,006 | ||||||||||||

| Merger costs (note 4) | 1,994,600 | - | 2,806,129 | - | ||||||||||||

| Stock-based compensation (note 9) | 23,331 | 570,604 | 63,042 | 1,315,602 | ||||||||||||

| Marketing | 4,348,721 | 4,535,012 | 9,253,175 | 8,195,135 | ||||||||||||

| Amortization of intangible assets and property and equipment | 5,788,688 | 6,367,173 | 11,993,229 | 12,369,324 | ||||||||||||

| 24,489,409 | 23,793,301 | 48,360,529 | 45,285,875 | |||||||||||||

| Loss before the undernoted | (8,686,640 | ) | (9,861,546 | ) | (17,168,333 | ) | (17,681,702 | ) | ||||||||

| Interest revenue | 15,003 | 20,699 | 27,497 | 35,920 | ||||||||||||

Interest expenses (note 5) | (5,105,906 | ) | (4,567,074 | ) | (9,962,368 | ) | (8,688,140 | ) | ||||||||

Gain on debt repurchase (note 5) | - | - | - | 7,076,232 | ||||||||||||

Revaluation of derivative (note 12) | 62,971 | - | 98,863 | - | ||||||||||||

| Foreign exchange gains | 4,394,114 | 240,905 | 7,531,592 | 3,424,120 | ||||||||||||

| Net loss for the period | (9,320,458 | ) | (14,167,016 | ) | (19,472,749 | ) | (15,833,570 | ) | ||||||||

| Deficit - Beginning of period | (370,138,405 | ) | (316,917,140 | ) | (359,986,114 | ) | (315,250,586 | ) | ||||||||

| Deficit - End of period | (379,458,863 | ) | (331,084,156 | ) | (379,458,863 | ) | (331,084,156 | ) | ||||||||

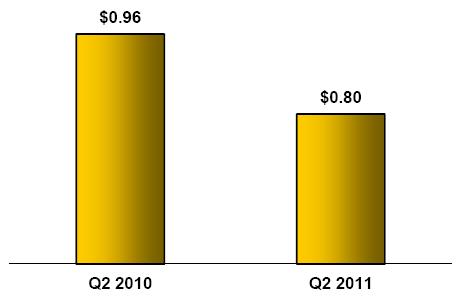

Basic and fully diluted loss per share (note 10) | (0.18 | ) | (0.28 | ) | (0.38 | ) | (0.31 | ) | ||||||||

Canadian Satellite Radio Holdings Inc.

Interim Consolidated Statements of Cash Flows

(unaudited)

Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||

2011 $ | 2010 $ | 2011 $ | 2010 $ | |||||||||||||

| Cash provided by (used in) | ||||||||||||||||

| Operating activities | ||||||||||||||||

| Net loss for the period | (9,320,458 | ) | (14,167,016 | ) | (19,472,749 | ) | (15,833,570 | ) | ||||||||

| Add (deduct): Non-cash items | ||||||||||||||||

Costs paid by parent company | - | 67,351 | - | 133,116 | ||||||||||||

Stock-based compensation expense | 23,331 | 570,604 | 63,042 | 1,315,602 | ||||||||||||

Amortization of intangible assets | 5,225,122 | 5,635,345 | 10,720,933 | 10,894,932 | ||||||||||||

Amortization of property and equipment | 563,566 | 731,828 | 1,272,298 | 1,474,393 | ||||||||||||

Accrued interest debt | 872,694 | 882,356 | 142,052 | 100,972 | ||||||||||||

Interest accretion expense | 519,803 | 535,602 | 1,013,490 | 1,043,761 | ||||||||||||

Revaluation of derivative (note 12) | (62,971 | ) | - | (98,863 | ) | - | ||||||||||

Gain on debt repurchase (note 5) | - | - | - | (7,076,232 | ) | |||||||||||

Unrealized foreign exchange gains | (3,991,187 | ) | (255,601 | ) | (6,870,128 | ) | (3,273,580 | ) | ||||||||

| Loss on disposal of property and equipment | - | 92,362 | - | 92,362 | ||||||||||||

| Net change in non-cash balances related to operations (note 11) | 4,538,045 | 6,221,164 | 10,694,886 | 6,638,879 | ||||||||||||

| Net cash provided by (used in) operating activities | (1,632,055 | ) | 313,995 | (2,535,039 | ) | (4,489,365 | ) | |||||||||

| Investing activities | ||||||||||||||||

| Purchase of property and equipment | (13,825 | ) | (65,210 | ) | (104,135 | ) | (176,747 | ) | ||||||||

| Payment for intangible assets | (401,351 | ) | (598,805 | ) | (994,251 | ) | (1,400,841 | ) | ||||||||

| Net cash used in investing activities | (415,176 | ) | (664,015 | ) | (1,098,386 | ) | (1,577,588 | ) | ||||||||

| Financing activities | ||||||||||||||||

| Repurchase of long-term debt (note 5) | - | - | - | (1,157,963 | ) | |||||||||||

| Net cash used in financing activities | - | - | - | (1,157,963 | ) | |||||||||||

| Foreign exchange loss on cash held in foreign currency | (214 | ) | (695 | ) | (369 | ) | (8,839 | ) | ||||||||

| Change in cash and cash equivalents during the period | (2,047,445 | ) | (350,715 | ) | (3,633,794 | ) | (7,233,755 | ) | ||||||||

| Cash and cash equivalents - Beginning of period | 4,111,766 | 4,502,960 | 5,698,115 | 11,386,000 | ||||||||||||

| Cash and cash equivalents - End of period | 2,064,321 | 4,152,245 | 2,064,321 | 4,152,245 | ||||||||||||

| Supplemental cash flow disclosures | ||||||||||||||||

| Utilization of XM credit facility (note 5) | 3,330,938 | 2,622,481 | 6,485,568 | 5,095,091 | ||||||||||||

| Issuance of promissory notes (note 5) | - | - | - | 1,192,935 | ||||||||||||

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| 1 | Basis of accounting |

The accompanying interim consolidated financial statements of Canadian Satellite Radio Holdings Inc. (the Company or CSR) have been prepared in accordance with Canadian generally accepted accounting principles (Canadian GAAP) for interim financial information. Accordingly, they do not include all of the information and footnotes required by Canadian GAAP for annual financial statements. These interim consolidated financial statements should be read in conjunction with the most recent annual consolidated financial statements of the Company. The accompanying financial information reflects all adjustments, consisting primarily of normally recurring adjustments, which are, in the opinion of management, necessary for a fair presentation of results for interim periods. Operating results for the three-month and six-month periods ended February 28, 2011 are not necessarily indicative of the results that may be expected for the fiscal year ending August 31, 2011. These interim consolidated financial statements follow the same accounting principles and methods of application as the consolidated financial statements for the year ended August 31, 2010.

| 2 | Summary of significant accounting policies |

Changes in accounting policies

In October of 2008, the CICA issued Handbook Section 1582, Business Combinations (“CICA 1582”), concurrently with Handbook Sections 1601, Consolidated Financial Statements (“CICA 1601”), and 1602, Non-controlling Interests (“CICA 1602”). CICA 1582, which replaces Handbook Section 1581, Business Combinations, establishes standards for the measurement of a business combination and the recognition and measurement of assets acquired and liabilities assumed. CICA 1601, which replaces Handbook Section 1600, carries forward the existing Canadian guidance on aspects of the preparation of consolidated financial statements subsequent to acquisition other than non-controlling interests. CICA 1602 establishes guidance for the treatment of non-controlling interests subsequent to acquisition through a business combination. These new standards are effective for the Company’s interim and annual consolidated financial statements commencing on September 1, 2011 with earlier adoption permitted as of the beginning of a fiscal year. The Company has decided to early adopt these standards effective September 1, 2010. The adoption did not have an impact on these interim financial statements, however future business combinations will be accounted for under CICA 1582 which is different in many respects from CICA 1581.

Future accounting pronouncements

In December of 2009, the CICA Emerging Issues Committee issued Abstract 175, “Multiple Deliverable Revenue Arrangements”. The Abstract requires a vendor to allocate arrangement consideration at the inception of an arrangement to all deliverables using the relative selling price method. The new requirements are effective for fiscal years beginning on or after January 1, 2011 with early adoption permitted. The Company is currently evaluating the impact of the adoption of this standard.

In April 2009, the CICA amended Section 3855, “Financial Instruments - Recognition and Measurement” (“Section 3855”), adding and amending paragraphs regarding the application of the effective interest method to previously impaired financial assets and embedded prepayment options. The amendments are effective for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011, with early adoption permitted. The Company is currently evaluating the impact of the adoption of this standard.

(1)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| 3 | Basis of Presentation and Material Uncertainties |

These consolidated financial statements have been prepared using Canadian generally accepted accounting principles applicable to a going concern, which assumes the Company will continue in operation for the foreseeable future and will be able to realize its assets and settle its liabilities in the normal course of operations.

As discussed in note 4 the Company has entered into an agreement to merge with Sirius Canada and is in the process of refinancing its long-term debt however conditions remain to be satisfied before there can be assurance that the merger and refinancing will be completed. The Company has also incurred additional obligations for fees related to the merger and the financing which will be paid regardless of whether the merger occurs. The Company has expended and will continue to expend funds for marketing to grow the business, maintain its terrestrial repeater network, programming and distribution contracts, royalty fees and the maintenance of its broadcast and office facilities. The Company’s losses for the three months ended February 28, 2011 have been reduced compared to the losses for the three months ended February 28, 2010. The major contributing factor to the results for the three months ended February 28, 2011 compared to the results for the three months ended February 28, 2010 was an increase in the gain on foreign exchange of $4.2 million in the three months ended February 28, 2011, an increase in revenue of $1.9 million offset by $2.0 million in merger expenses. The Company’s losses for the six months ended February 28, 2011 have not been reduced compared to the losses for the six months ended February 28, 2010. The major contributing factor to the results for the six months ended February 28, 2011 compared to the results for the six months ended February 28, 2010 was a gain on debt repurchase of $7.1 million in the six months ended February 28, 2010, an increase in revenue of $3.6 million offset by $2.8 million in merger expenses and higher cost of revenue.

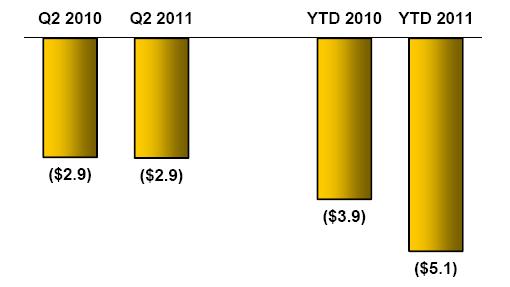

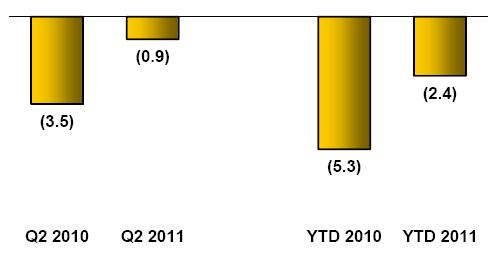

The Company has an accumulated deficit of $379.5 million as at February 28, 2011. During the three and six months ended February 28, 2011, the Company used cash for operating activities of ($1.6 million) and ($2.5 million) respectively compared to providing (using) cash of $0.3 million and ($4.5 million) for the three and six months ended February 28, 2010. The Company also used cash for investing activities of ($0.4 million) and ($1.1 million) during the three and six months ending February 28, 2011 compared to ($0.7 million) and ($1.6 million) for the three and six months ended February 28, 2010. As at February 28, 2011, the Company’s current financial liabilities expected to be settled in unrestricted cash or financial assets are $27.4 million (August 31, 2010 - $25.7 million) and the current unrestricted financial assets are $4.1 million (August 31, 2010 - $8.7 million).

The Company expects cash flows from operating activities to continue to be negative as the Company incurs expenses to maintain and grow its subscriber base. Also, the prevailing economic conditions may affect the Company’s ability to continue to generate significant revenue growth or maintain current levels of revenue as the automobile industry has in recent years experienced stagnant or declining sales. In addition, some of the Company’s customers may choose not to renew their subscriptions. While some of the Company’s costs are variable based on the revenue generated, a significant portion of the costs, including interest costs, are fixed and cannot be reduced quickly. Certain of the Company’s costs are denominated in U.S. Dollars which results in a cash flow risk as the amount of Canadian dollars required to settle such liabilities will fluctuate as foreign exchange rates change (note 7). Some of these factors are beyond the Company’s control and may impact the future cash flows from operating activities. The credit markets also continue to be constrained, raising concern about available funding for a number of companies including CSR. These material uncertainties related to conditions affecting the Company cast significant doubt upon the ability of the Company to continue as a going concern.

(2)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

The Company’s projections for the next 12 months reflect continuing use of cash and reflect the following arrangements and key assumptions as at February 28, 2011:

| • | Revenue and deferred revenue. The Company has experienced a net increase in the number of paying subscribers during the quarter and has projected a net increase in subscribers for the projection period. During the quarter the Company has actively marketed longer term arrangements with its subscribers and this, along with the increase in paying subscribers, has contributed to the increase in deferred revenue of $2.1 million (2010 - $3.4 million) and $3.1 million (2010 - $3.4 million) for the three and six months ended February 28, 2011 respectively. The Company expects to continue to actively promote and obtain prepaid subscription arrangements with its customers which provide the customers with a discounted fee. While these arrangements increase the cash inflow from customers when they are entered into, the Company will not realize further future cash flows from such customers until a renewal period that may be one to five years in the future. These arrangements are cancellable by the customer which may require the Company to refund a significant portion of the prepaid fees. In addition, management’s projection includes an estimated increase in the monthly fee charged to customers and assumptions related to cash outflows related to royalties and commissions on these fees. |

| • | Reduction of operating costs. The Company continues to seek opportunities to reduce its operating costs, however these opportunities may be limited. A significant portion of costs are fixed; however, the Company incurs significant marketing costs which are discretionary. |

| • | Deferral of payment of operating expenses. During the quarter ended February 28, 2011, the Company and the General Motors of Canada Limited (GMCL) signed an agreement to defer a portion of the monthly revenue share and loyalty bounty due to GMCL. The amount of the deferral is up to $3.7 million and the payments will be deferred for 12 months. This deferral is included in accounts payable and accrued liabilities and the details are included in note 12.The Company had previously entered into deferred payment terms for payments related to the NHL programming and the services provided by Accenture. The table in note 6 reflects the contractual cash flows related to these arrangements. The deferrals resulted in the recognition of additional financial liabilities which at February 28, 2011 are approximately $5.0 million (2010 - $4.4 million). During the year ended August 31, 2010, the Company and the NHL signed an agreement to defer a portion of the annual licence fees due to the NHL for the 2009/2010 season. The amount of the deferral is US$1.5 million and the payments will be deferred for 12 months. This deferral is included in accounts payable and accrued liabilities and the details are included in note 12. |

(3)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

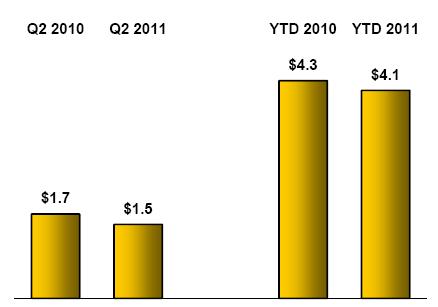

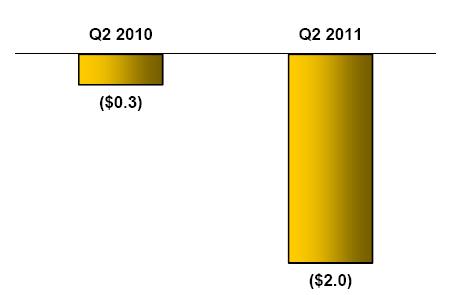

| • | Utilizing the XM credit facility. The Company has access to a $45 million credit facility from XM (note 5) that can be used only to finance the purchase of terrestrial repeater equipment from XM, to pay licence fees to XM and to pay interest due on the drawn facility. At February 28, 2011, the Company had utilized a total of $33.3 million of the facility and $11.7 million was available for future use. The Company has used these draws on the facility to pay all of the licence fees due to XM in the amount of $2.2 million (2010 - $2.0 million) and $4.3 million (2010 - $3.9 million) for the three and six months ended February 28, 2011 respectively and to pay the interest due on the facility in the amount of $1.2 million (2010 -$0.6 million) and $2.2 million (2010 -$1.2 million) for the three and six months ended February 28, 2011 respectively. The Company expects to fully use the facility to pay all future licence fees and interest payments due to XM as long as it is available until the facility is fully utilized. Should the refinancing (note 4) successfully close, the XM facility will be repaid. Management projects to fully utilize the facility by the second quarter of fiscal 2012 if the refinancing does not occur. The facility requires an annual financial covenant to be met prior to further drawings under the facility. The annual financial covenant was met at August 31, 2010 which provides for draws throughout fiscal 2011. |

| • | Settlement of interest payments through the issuance of shares. Holders of the convertible notes (note 5) are permitted to elect settlement of their interest payments in shares of the Company. One of the significant holders has previously elected to settle their interest payment in shares of the Company. The amount of interest settled in common shares during the quarter ended February 28, 2011 was $0.4 million (2010 - $0.3 million). The Company anticipates that the holder will continue to exercise this election; however, there is no assurance that this will occur. |

In the prior year, the Company had opportunities to reduce the amount of its Senior notes (note 5) and related interest payments by repurchasing a portion of its Senior notes in exchange for cash and new notes at lower interest rates. During the quarter ended November 30, 2009, the Company used $1.1 million of cash to repurchase such debt (note 5) and in the third quarter of fiscal 2009, an additional $2.2 million had been used to repurchase more of these Senior notes (note 5). As noted above and further described in note 4, a condition of the proposed merger transaction with Sirius Canada, a refinancing of the Company’s existing Senior notes for new unsecured Senior notes must take place.

At this time, the Company is unable to predict how current financial market conditions may affect its financial results and cash flows from operations. The prevailing financial market conditions may affect the Company’s ability to continue to generate significant revenue growth in its OEM business should Canadian demand for automobiles equipped with the XM receiver decline in a significant manner or if customer churn rates increase due to economic conditions on the Company’s customers.

The Company’s operations depend on XM’s programming content, satellite network and underlying technology, as well as XM’s operational and marketing efficiency. As a result of this dependency, should XM’s business suffer as a result of increased competition, increased costs of programming, satellite malfunctions, regulatory changes, adverse effects of litigation or other factors, the Company’s business may suffer as well.

(4)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

Management continues to implement plans to increase cash flows from subscriptions, manage costs and defer payments of certain financial liabilities as noted above. While these activities may be significant, there is no assurance that some or all of these initiatives would be successful. It is possible that the Company will not achieve the cash flows projected by management or the proposed merger (note 4) may not close, and management will have to consider other alternatives such as issuing equity. However there is no assurance of this occurrence.

These financial statements do not reflect any adjustments to the carrying values of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary if the Company is not able to continue its operations for the foreseeable future and realize its assets and settle its liabilities in the normal course of operations. Such adjustments could be material.

| 4 | Merger and Financing |

On November 24, 2010, the Company entered into a Purchase Agreement with Sirius Canada (“Sirius”) and each of the shareholders of Sirius, being, Sirius XM Radio Inc., Canadian Broadcasting Corporation (CBC) and Slaight Communications Inc. (“the Vendors”). The Purchase Agreement sets out the terms and conditions relating to the acquisition of all of the issued and outstanding shares of Sirius by CSR (”the transaction” or “the merger”). Subject to the satisfaction of certain conditions set out in the Purchase Agreement by November 24, 2011, upon closing of the transaction, CSR will issue a combination of Class A and Class B Shares that is equivalent to 71,284,578 Class A Shares to the Vendors. In the event that CSR has a cash balance (which includes cash and cash equivalents and restricted investments) that is less than $9 million at the closing of the transaction, the Vendors shall receive non-interest bearing promissory notes in the aggregate, for the difference between the actual cash balance and $9 million.

The closing of the transaction is conditional upon approval by 66.7% of CSR’s shareholders, excluding XM, the Competition Bureau, the Toronto Stock Exchange (“TSX”) and the Canadian Radio-television and Telecommunications Commission (“CRTC”), the CBC receiving approval from the Governor in Council and a refinancing of CSR’s existing senior notes (note 5) for new unsecured senior notes. During the quarter ending February 28, 2011, CSR obtained shareholder approval of the transaction and the Competition Bureau issued a No-Action letter and announced that it did not intend to make an application to challenge the proposed merger. On April 11, 2011, the CRTC approved the merger transaction and has imposed certain requirements on CSR and Sirius Canada relating to commitments made at the hearing of the application. The CRTC also extended the broadcasting licences of Sirius and CSR for one year ending August 31, 2012.

Merger costs incurred during the six months ended February 28, 2011 relate to legal costs, fees to review the proposed agreement and fees paid to members of the board of directors related to the committee of independent directors established to review the transaction. The Company’s financial advisors will also receive a fee of approximately $1.6 million that is contingent on the completion of the merger.

The Chief Executive Officer of the Company is contractually entitled to a payment in the event of termination of his employment upon a change of control. The Executive Chairman is entitled to a payment if the Vendors decide to change the nature of his role in the future. The total of these payments is approximately $2.8 million. The Company has not accrued for these costs at February 28, 2011 as the conditions required to be satisfied prior to the merger being completed have not been resolved or the events obligating the Company have not occurred.

(5)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

On February 25, 2011, the Company issued an offer to exchange the Company’s outstanding 12.75% Senior notes due 2014 for newly issued 9.75% Senior notes (new notes) due 2018. The new notes will bear interest of 9.75%, payable semi-annually and have a maturity date of seven years after the closing date. The existing Senior notes may be tendered prior to the expiration date of the third business day prior to the closing of the merger. In exchange for each US$1,000 principal amount of the existing Senior notes, holders will receive at their election one of the following:

| A) | The Canadian dollar equivalent of US$1,015 of new notes; |

| B) | The Canadian dollar equivalent of US$1,000 of new notes plus two cash payments of US$7.50 each; or |

| C) | A cash payment of the Canadian dollar equivalent of US$960. |

As of the March 31, 2011, 98.7% of the Senior notes have been tendered under option A.

The Company is also soliciting the consent from holders of the existing Senior notes to proposed amendments which would eliminate the Company’s obligation to comply with substantially all of the financial covenants contained in the Senior notes indenture. By tendering their notes, the holders of the Senior notes will be deemed to have consented to the amendments.

In the event that the exchange offering is terminated or the merger does not occur prior to June 30, 2011, the holders of the Senior notes who have tendered their notes under the options A and B shall receive a cash payment of the Canadian equivalent of US$15 for each US$1,000 principal amount of the Senior notes tendered and their original notes will be returned.

Subsequent to the end of the quarter, as a condition of the proposed merger, the Company has also conducted an offering of new notes in the amount of $62 million. These notes are identical to the new notes above and the closing date will be the same as both the exchange offering and the merger. The issuance of the new notes under the exchange offering and the offering of the new notes is contingent on the closing of the merger. The note holders are entitled to a commitment fee of 0.5% of the principal of the notes for each month prior to the merger closing to a maximum of 1.5% of the principal of the notes. The agents will be entitled to fee equal to 3% of the proceeds that will be deducted from the proceeds of the offering. Should the merger be completed and the financing successfully close, the XM credit facility and the Subordinated promissory notes will be repaid.

(6)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| 5 | Long-term debt |

February 28, 2011 | August 31, 2010 | |||||||

| Senior notes | $ | 67,975,209 | $ | 74,687,743 | ||||

| Convertible notes | 17,298,283 | 16,890,231 | ||||||

| XM credit facility | 30,745,997 | 24,265,156 | ||||||

| Subordinated promissory notes | 1,088,948 | 1,083,282 | ||||||

| Subordinated promissory notes II | 1,251,358 | 1,312,451 | ||||||

| 118,359,795 | 118,238,863 | |||||||

Senior Notes

As at February 28, 2011, the principal amount outstanding of the 12.75% senior notes due in 2014 is $67.8 million (US$69.8 million) (August 31, 2010 - $74.4 million). Interest payments on the notes are due semi-annually, on February 15 and August 15. The notes are redeemable at the option of the Company on or after February 15, 2010 which has been determined to be an embedded derivative. The value of the derivative has been netted against the senior notes on the balance sheet. The interest expense for the three and six months ended February 28, 2011 was $2,240,169 and $4,514,947 respectively (2010 - $2,354,819 and $4,779,910). The effective interest rate for the Senior notes is 15.0%

The indenture governing the senior notes required the Company to establish an interest reserve account to cover the first six interest payments due under the notes. There is no longer an interest reserve account as all six interest payments were completed at February 15, 2009. The indenture also contains certain provisions that restrict or limit the Company’s ability to, among other things, incur more debt, pay dividends, redeem shares or make other distributions, enter into transactions with affiliates, transfer or sell assets.

During the quarter ended November 30, 2009, the Company completed the repurchase of US$9.0 million of the face value of the senior notes, which had a carrying value of US$8.8 million. In exchange for these senior notes, the Company paid US$1.1 million in cash and issued unsecured subordinated promissory notes II with a face value of US$2.1 million and a fair value of US$1.1 million.

As part of the issuance of the above-mentioned senior notes, the Company incurred costs amounting to $5,520,032, which were applied against the notes. During the three and six months ended February 28, 2011, $0 and $0 (2010 - $150,872 and $311,754) respectively of interest accretion expense was included in the consolidated statements of operations.

(7)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

Convertible notes

On September 12, 2007, the Company issued $20 million aggregate principal amount of 8.0% unsecured subordinated convertible notes, due September 12, 2014 (the convertible notes) in a private placement. Interest payments on the convertible notes are due semi-annually, on June 30 and December 31, commencing on December 31, 2007. $4.0 million of the convertible notes were issued to XM Satellite Radio Holdings Inc (XM) and $6.0 million were issued to shareholders of CSRI, including John I. Bitove, the Executive Chairman of the Company. CSRI is the controlling shareholder of the Company. The debenture holders may elect to receive interest payments in the form of Class A Subordinate Voting Shares of the Company based on the market price of the Class A Subordinate Voting Shares at the time of the payment.

The convertible notes are convertible at the option of the debenture holders at any time at a conversion price of $5.92 per share. The notes are redeemable at the option of the Company on or after September 12, 2010. The Company may elect to pay the amount due on the maturity of the debentures in Class A Subordinate Voting Shares, provided that the market price of the Class A Subordinate Voting Shares exceeds $3.00. If the market price of the Class A Subordinate Voting Shares does not exceed $3.00, there is no option to pay the amount in Class A Subordinate Voting Shares. The number of shares to be issued would be determined based on dividing the principal amounts of the debentures due by 95% of the market price of the Class A Subordinate Voting Shares on the maturity date.

This financial instrument contains both a liability and an equity element. The Company determined the fair value of the liability, the most easily measurable component, to be $14,806,520 on issuance and assigned the residual amount of $5,193,480 to the equity component as required under the CICA Handbook Section 3863, “Financial Instruments - Presentation” (CICA 3863). As part of the issuance of the convertible notes, costs were incurred amounting to $603,555. These costs are netted against both the liability and equity elements. The liability element is carried at amortized cost using the effective interest rate method. Increased interest accretion for the three months ended November 30, 2010 reflected a revision in the estimated timing of expected cash outflows using the original effective interest rate related to the convertible notes. During the three and six months ended February 28, 2011, $193,467 and $408,052 (2010 - $192,571 and $390,202) respectively of interest accretion expense was included in the consolidated statements of operations. The accrued interest payable balance at February 28, 2011 included $266,666 (August 31, 2010 - $266,661) for the convertible notes. The effective interest rate based on the liability element is 15%. The interest expense for the three and six months ended February 28, 2011 was $400,000 and $800,000 (2010 - $400,000 and $800,000) respectively.

XM Credit Facility

In fiscal 2006, XM provided to the Company a $45 million credit facility to be utilized to finance the purchase of terrestrial repeater equipment and to pay license fees. During the three months ended February 28, 2011, the Company utilized $3,330,938 (2010 - $2,622,481) under the facility to pay fees due to XM of $2,175,422 and interest accrued on the outstanding balance of the facility of $1,155,516. As at February 28, 2011, the principal amount outstanding is $26.3 million (August 31, 2010 - $22.0 million) and the interest outstanding is $7.0 million (August 31, 2010 - $4.8 million). The facility matures on December 31, 2012 and bears an interest rate of 17.75% per year on drawings under the facility made after September 1, 2008 and 9% on drawings under the facility made prior to September 1, 2008.The interest can be satisfied through additional borrowings under the facility. XM has the right to convert the unpaid principal amounts into Class A Subordinate Voting Shares of the Company at the Offering price of $16.00 per share at any time and any unpaid principal amounts are automatically converted upon the occurrence of certain conditions. The amount available under the credit agreement is permanently reduced by the aggregate principal borrowed under the facility prior to its maturity. Availability of remaining amounts of the credit facility is dependent on the Company meeting certain annual covenants. During the year ended August 31, 2008, an amendment to the credit facility was signed which revised the condition to be met prior to drawing on the credit facility and amended the interest rate. As at February 28, 2011, the Company had $11.7 million available under the facility.

(8)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

This financial instrument contains both a liability and an equity element. For the quarter ended February 28, 2011, the Company determined the fair value of the liability, the most easily measureable component to be $3,090,799 and assigned the residual amount of $240,139 to the equity component as provided in CICA 3863. Over the term of the facility, the liability will be accreted to its estimated future payment amount with the increase in liability value recorded as interest expense over the period the liability is outstanding. During the three and six months ended February 28, 2011, $263,244 and $ 494,694 (2010 - $146,793 and $278,823) respectively of interest accretion expense was included in the consolidated statements of operations and deficit. The interest expense for the three and six months ended February 28, 2011 was $1,155,516 and $2,190,562 (2010 - $668,060 and $ 1,238,011) respectively. The effective interest rate related to the credit facility is 24.0%.

Subordinated Promissory Notes

During the year ended August 31, 2009, the Company issued US$2.8 million in unsecured subordinated promissory notes (promissory notes) with a fair value of US$0.8 million as part of the Company’s repurchase of US$21.2 million of senior notes. The promissory notes have a maturity date of February 15, 2016 and shall bear interest for semi-annual payments on February 15th and August 15th of each year. The interest rate for all interest paid on or prior to August 15th, 2011 is 1.5% and thereafter, the interest rate is 12.0%. The promissory notes are not redeemable until February 15th, 2015, at which time the Company may redeem the promissory notes at its option. The effective interest rate on the promissory notes is 31.0%. The cash interest expense for the three and six months ended February 28, 2011 was $43,769 and $84,949 (2010 - $35,268 and $68,415) respectively and the interest accretion expense for the three and six months ended February 28, 2011 was $54,694 and $106,153 (2010 - $44,070 and $85,491) respectively. The accrued interest payable balance at February 28, 2011 included $180,071 (2010 - $74,928) for the subordinated promissory notes.

Subordinated Promissory Notes II

On September 14, 2009, the Company issued US$2.1 million in unsecured subordinated promissory notes (promissory notes II) with a fair value of US$1.1 million as part of the Company’s repurchase of US$9.0 million of senior notes. The promissory notes have a maturity date of September 14, 2014 and bear interest at a rate of 18% compounded annually and is payable on the maturity date. The promissory notes are not redeemable until September 14, 2010, at which time the Company may redeem the promissory notes II at its option. The effective interest rate on the promissory notes is 29.0%. The cash interest expense for the three and six months ended February 28, 2011 was $90,628 and $176,306 (2010 - $99,505 and $167,796) respectively and the interest accretion expense for the three and six months ended February 28, 2011 was $30,044 and $58,446 (2010 - $24,425 and $41,427) respectively. The accrued interest payable balance at February 28, 2011 included $431,845 (2010 - $138,583) for the subordinated promissory notes II.

(9)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| 6 | Liquidity Risk |

Liquidity risk is the risk that the Company will encounter difficulty in meeting its financial obligations associated with financial liabilities that are settled by delivering cash or another financial asset. The Company is exposed to significant liquidity risk as it continues to have net cash outflows to support its operations and interest payments on its long-term debt. The Company’s objective is to manage cash and short-term investments, collections of accounts receivable and the availability of funding for certain payments through a committed credit facility while maintaining operations and settling liabilities. The Company monitors its liquidity risk by forecasting its future cash flows over a 15 month horizon, updated on a quarterly basis. The Company has been managing this risk by taking a number of actions as described in note 3.

The Company’s projections of future cash flows are prepared using assumptions that reflect management’s planned courses of action and reflect management’s best estimate of future economic conditions. The key assumptions used in management’s models include the number of estimated new subscribers which reflects estimated growth in automobile sales and extent of penetration in the market; the number of customers expected to cancel existing subscriptions; the volume of multi-year advance subscriptions estimated to be entered into; estimated price increases; amounts of royalties and commissions; and reduction of discretionary costs. Since these projections are based on assumptions about future events, actual cash flows will vary from the Company’s projections and such variations may be material.

At February 28, 2011, the Company has a cash balance of $2,064,321 (August 31, 2010 - $5,698,115), accounts receivable of $2,058,052 (August 31, 2010 - $3,042,931) and restricted investment - letter of credit of $4,000,000 (August 31, 2010 - $4,000,000). The restricted investment supports a letter of credit provided to the Company’s credit card processor and is not available to the Company while it continues to use the credit card processor. The Company used cash of $1,632,055 and $2,535,039 from its operating activities for the three and six months ended February 28, 2011 respectively (2010 - provided cash of $313,995 and used cash of $4,489,365). The Company continued to use cash of $415,176 and $1,098,386 in its investing activities for the three and six months ended February 28, 2011 (2010 - used cash of $664,015 and $1,577,588).

The table below summarizes the Company’s financial and accrued liabilities into relevant maturity groups based on the remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows (in $000’s):

(10)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| Total | 0 - 3 Months | 3 - 6 Months | 6 - 12 Months | 1 - 3 Years | 4 - 5 Years | More than 5 Years | ||||||||||||||||||||||

| Accounts payable and accrued liabilities | 25,770 | 18,395 | 3,887 | 3,488 | - | - | - | |||||||||||||||||||||

| XM accounts payable and accrued liabilities* | 1,090 | 1,090 | - | - | - | - | - | |||||||||||||||||||||

| Principal on 12.75% Senior Notes* | 67,757 | - | - | - | 67,757 | - | - | |||||||||||||||||||||

| Interest on 12.75% Senior Notes* | 25,920 | - | 4,320 | 4,320 | 17,280 | - | - | |||||||||||||||||||||

| Principal on 8.0% Convertible Notes | 20,000 | - | - | - | - | 20,000 | - | |||||||||||||||||||||

| Interest on 8.0% Convertible Notes | 5,933 | - | 800 | 800 | 3,200 | 1,133 | - | |||||||||||||||||||||

| XM Credit Facility | 26,324 | - | - | - | 26,324 | - | - | |||||||||||||||||||||

| Interest on XM Credit Facility | 6,960 | - | - | - | 6,960 | - | - | |||||||||||||||||||||

| Principal on Subordinated Promissory Notes* | 2,766 | - | - | - | - | 2,766 | - | |||||||||||||||||||||

| Interest on Subordinated Promissory Notes* | 1,515 | - | 21 | 166 | 664 | 664 | - | |||||||||||||||||||||

| Principal on Subordinated Promissory Notes II* | 2,054 | - | - | - | - | 2,054 | - | |||||||||||||||||||||

| Interest on Subordinated Promissory Notes II * | 2,616 | - | - | - | - | 2,616 | - | |||||||||||||||||||||

| Accenture agreement | 226 | - | - | - | 226 | - | - | |||||||||||||||||||||

| GM Commission | 550 | - | - | - | 550 | - | - | |||||||||||||||||||||

| NHL Agreement- long term obligations* | 8,802 | - | - | - | 6,719 | 2,083 | - | |||||||||||||||||||||

| Total | 198,283 | 19,485 | 9,028 | 8,774 | 129,680 | 31,316 | - | |||||||||||||||||||||

* Balance denominated in USD, subject to fluctuations in exchange rate

Amounts disclosed in the table above are summarized by contractual maturity date. The expected cash repayment dates may differ as a result of the proposed merger (note 4).

| 7 | Financial instruments |

The Company, through its financial assets and liabilities, is exposed to various risks. The analysis in notes 6 and 7 provides a measurement of these risks:

Market Risk

To perform sensitivity analysis, the Company assesses the impact of hypothetical changes in interest rates and foreign currency exchange rates on foreign currency denominated and interest-bearing financial instruments. Information provided by the analysis does not represent the Company’s view of future market changes, nor does it necessarily represent the actual changes in fair value that would occur under normal market conditions because, of necessity, all variables other than the specific market risk factor are held constant. In reality, changes in one factor may result in change to another, which may magnify or counteract the sensitivities.

(11)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

Foreign currency risk

The Company is exposed to fluctuations of the Canadian dollar in relation to the US dollar, resulting from the issuance of debt denominated in US dollars, the purchase of US dollar investments, and US dollar-denominated liabilities. The Company does not currently use foreign currency derivatives.

Most of the Company’s revenues and expenses are received or paid in Canadian dollars. Specifically under the XM License Agreement, the Company is not exposed to material foreign currency exchange rate risk as the monthly fees due under this agreement are payable in Canadian dollars. The Company’s only exposure to material foreign currency exchange rate risk is with respect to payments due to XM, under the broadcasting agreement with the NHL and with respect to the payments on the Company’s US dollar-denominated senior and promissory notes. For the six months ending February 28, 2011, these payments amounted to US$9.3 million (2010 - US$8.8 million). The total amount of US dollar denominated liabilities is disclosed in note 6.

The Company’s exposure relates to material foreign currency exchange rate risk resulting from the issuance of debt denominated in US dollars and the purchase of US dollar investments. The Company is also exposed to certain operating costs denominated in US dollars. Management has chosen to not hedge its foreign currency exchange risk.

Fair Value

The carrying value of restricted investments, accounts receivable, accounts payable and accrued liabilities approximates their fair value given their short-term nature.

The carrying value of the senior notes is $68.0 million. The face value of the senior notes is $67.8 million (US$69.8 million) while their fair value is approximately $65.0 million. The fair value is determined using the market prices of the publicly traded senior notes.

The carrying value of the convertible notes is $17.3 million. The face value of the convertible notes is $20.0 million while their fair value is approximately $12.8 million.

The carrying value of the credit facility is $30.7 million. The face value of the credit facility is approximately $33.3 million while its fair value is approximately $29.0 million.

The carrying value of the promissory notes is $1.1 million. The face value of the promissory notes is $2.8 million while their fair value is $1.8 million.

The carrying value of the promissory notes II is $1.3 million. The face value of the promissory notes II is $2.1 million while its fair value is $1.0 million.

(12)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

The fair values of the convertible notes, credit facility, and promissory notes are estimated using a discounted future cash flow valuation model. This model includes observable inputs, such as contractual payment terms, maturity dates and relevant market interest rates, as well as unobservable inputs, such as a credit spread attributable to the Company’s own credit risk.

| 8 | Related party accounts and transactions |

During the three and six months ended February 28, 2011, the Company had the following transactions with related parties, which were in the normal course of operations.

The Company entered into a license agreement and a technical services agreement with XM Satellite Radio Holdings Inc. (XM) in fiscal 2006. During the three and six months ended February 28, 2011, the Company incurred $2,656,815 and $5,408,519 (2010 - $2,517,126 and $4,902,980) in expenses related to the License Agreement. The Company incurred expenses of $93,528 and $189,720 (2010 - $124,375 and $252,664) for the three and six months ended February 28, 2011 respectively related to technical services.

During the three and six months ended February 28, 2011, the Company also incurred $2,000 and $5,000 (2010 - $42,743 and $104,213) related to the reimbursement of call centre and other charges paid on CSR’s behalf by XM.

The following amount included in accounts payable, is due to XM in respect of fees under the License Agreement related to subscriber revenues and activation charges, fees under the Technical Services Agreement, and the reimbursement of call centre and other charges paid on CSR’s behalf.

February 28, 2011 | August 31, 2010 | |||||||

| Accounts payable to XM | $ | 1,089,729 | $ | 1,283,982 | ||||

| Amounts able to settle through XM credit facility | $ | 660,657 | $ | 714,797 | ||||

During the three and six months ended February 28, 2011, the Company incurred $25,959 and $26,981 (2010 - $15,521 and $24,700) of expenses related to the reimbursement of operating and travel expenses from a company controlled by the Executive Chairman of the Company.

During the three and six months ended February 28, 2011, the Company received field marketing services from Vision Group of Companies (Vision) valued at approximately $11,000 and $25,000 (2010 - $1,665 and $146,948). The principal of Vision is related to the Executive Chairman of the Company. As at February 28, 2011, $nil (August 31, 2010 - $nil) was included in accounts payable and accrued liabilities.

(13)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

During the three and six months ended February 28, 2011, the Company made use of a broadcast centre within the Wayne Gretzky’s Restaurant under an agreement with Long Playing LP (LPLP) valued at $1,921 and $3,842 (2010 - $nil and $nil). The principal of LPLP is related to the Executive Chairman of the Company. As at February 28, 2011, $nil (2010 - $nil) was included in accounts payable and accrued liabilities.

During the three and six months ended February 28, 2011, the Company incurred costs on behalf of Mobilicity in the amount of $36,882 and $81,062 (2010 - $67,875 and $110,766) for which the Company was reimbursed. There is $7,307 of accounts receivable owed from Mobilicity as of February 28, 2011 (August 31, 2010 - $5,855). The Company’s Executive Chairman is the Chairman and controlling shareholder of Mobilicity.

During the three and six months ended February 28, 2011, the Company paid a guarantee fee, under an agreement between the Company and the National Hockey League, to the Executive Chairman in the amount of $12,206 and $24,414 (2010 - $nil and $nil). As at February 28, 2011, $8,064 (August 31, 2010 - $4,139) was included in accounts payable and accrued liabilities.

The Company has executed engagement letters with Canaccord Genuity to provide financial advisory services to the Board of Directors in respect of the proposed merger and refinancing transaction. Under the engagement letters, the Company expects to pay approximately $2.0 million to Canaccord Genuity upon successful completion of both transactions. The Company also expects to pay approximately $0.5 million for a fairness opinion. Philip Evershed, one of the Company’s directors, is the principal of Canaccord Genuity.

The related party transactions described above have been recorded at the exchange amount, which is the consideration paid or received as established and agreed to by the related parties.

| 9 | Share capital and other activity |

The authorized share capital of the Company as at February 28, 2011 consisted of the following shares:

| Class A Subordinate Voting Shares | unlimited | |||

| Class B Voting Shares | unlimited | |||

| Class C Non-Voting Shares | unlimited | |||

The Class B Voting Shares are convertible at any time at the holder’s option into fully paid and non-assessable Class A Subordinate Voting Shares upon the basis of one Class A Subordinate Voting Share for three Class B Voting Shares. Each Class B Voting Share participates in the equity of the Company on a per share basis equal to one third of the rate of participation of the Class A Subordinate Voting Shares and the Class C Non-voting Shares.

As at February 28, 2011, the Company had issued 24,384,717 Class A Subordinate Voting Shares (August 31, 2010 - 24,277,544) and 81,428,133 Class B Voting Shares (August 31, 2010 - 81,428,133).

Share capital and other activity are summarized as follows:

(14)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| Number of shares | Value of shares | |||||||||||||||||||||||

Class A Subordinate Voting Shares | Class B Voting Shares | Class A Subordinate Voting Shares $ | Class B Voting Shares $ | Contributed surplus $ | Total $ | |||||||||||||||||||

| Balance as at August 31, 2009 | 23,606,162 | 81,428,133 | 318,132,067 | 14,965,560 | 26,251,307 | 359,348,934 | ||||||||||||||||||

| Costs incurred by CSRI | - | - | - | - | 65,764 | 65,764 | ||||||||||||||||||

| Stock-based compensation expense | - | - | - | - | 744,998 | 744,998 | ||||||||||||||||||

| Equity portion of XM credit facility | - | - | - | - | 195,466 | 195,466 | ||||||||||||||||||

| Balance as at November 30, 2009 | 23,606,162 | 81,428,133 | 318,132,067 | 14,965,560 | 27,257,535 | 360,355,162 | ||||||||||||||||||

| Costs incurred by CSRI | - | - | - | - | 67,351 | 67,351 | ||||||||||||||||||

| Stock-based compensation expense | - | - | - | - | 570,604 | 570,604 | ||||||||||||||||||

| Issuance of subordinate class A voting shares to satisfy interest payments on Convertible Notes | 324,157 | - | 425,995 | - | - | 425,995 | ||||||||||||||||||

| Restricted stock units converted to shares | 117,122 | - | 180,369 | - | - | 180,369 | ||||||||||||||||||

| Equity portion of XM credit facility | - | - | - | - | 286,330 | 286,330 | ||||||||||||||||||

| Balance as at February 28, 2010 | 24,047,441 | 81,428,133 | 318,738,431 | 14,965,560 | 28,181,820 | 361,885,811 | ||||||||||||||||||

| Costs incurred by CSRI | - | - | - | - | 139,609 | 139,609 | ||||||||||||||||||

| Stock-based compensation expense | - | - | - | - | 772,726 | 772,726 | ||||||||||||||||||

| Issuance of subordinate class A voting shares to satisfy interest payments on Convertible Notes | 132,938 | - | 399,994 | - | - | 399,994 | ||||||||||||||||||

| Restricted stock units converted to shares | 97,165 | - | 48,585 | - | (48,585 | ) | - | |||||||||||||||||

| Equity portion of XM credit facility | - | - | - | - | 542,374 | 542,374 | ||||||||||||||||||

| Balance as at August 31, 2010 | 24,277,544 | 81,428,133 | 319,187,010 | 14,965,560 | 29,587,944 | 363,740,514 | ||||||||||||||||||

| Stock-based compensation expense | - | - | - | - | 39,711 | 39,711 | ||||||||||||||||||

| Equity portion of XM credit facility | - | - | - | - | 259,283 | 259,283 | ||||||||||||||||||

| Balance as at November 30, 2010 | 24,277,544 | 81,428,133 | 319,187,010 | 14,965,560 | 29,886,938 | 364,039,508 | ||||||||||||||||||

| Stock-based compensation expense | - | - | - | - | 23,331 | 23,331 | ||||||||||||||||||

| Issuance of subordinate class A voting shares to satisfy interest payments on Convertible Notes | 103,323 | - | 399,993 | - | - | 399,993 | ||||||||||||||||||

| Stock options exercised | 3,850 | 12,745 | (7,396 | ) | 5,349 | |||||||||||||||||||

| Equity portion of XM credit facility | - | - | - | - | 240,139 | 240,139 | ||||||||||||||||||

| Balance as at February 28, 2011 | 24,384,717 | 81,428,133 | 319,599,748 | 14,965,560 | 30,143,012 | 364,708,320 | ||||||||||||||||||

(15)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

Stock options

Stock option activity was as follows:

Number of options | Weighted average exercise price $ | |||||||

| Balance as at August 31, 2009 | 2,498,000 | 8.85 | ||||||

| Granted | 270,000 | 1.54 | ||||||

| Balance as at November 30, 2009 | 2,768,000 | 8.14 | ||||||

Granted | 372,000 | 1.54 | ||||||

| Forfeited | (2,000 | ) | 6.53 | |||||

| Balance as at February 28, 2010 | 3,138,000 | 7.36 | ||||||

| Cancelled | (900,000 | ) | 16.00 | |||||

| Forfeited | (116,000 | ) | 7.40 | |||||

| Balance as at August 31, 2010 | 2,122,000 | 3.69 | ||||||

| Expired | (354,708 | ) | 4.84 | |||||

| Forfeited | (26,000 | ) | 3.67 | |||||

| Balance as at November 30, 2010 | 1,741,292 | 3.46 | ||||||

| Exercised | (3,850 | ) | 1.39 | |||||

| Forfeited | (47,317 | ) | 2.19 | |||||

| Balance as at February 28, 2011 | 1,690,125 | 3.49 | ||||||

In November 2009, the Company granted stock options to certain members of the Board of Directors for 270,000 Class A Subordinate Voting Shares with an exercise price of $1.54. The options vest immediately. The fair value of the stock options granted was $0.1 million and an amount of $0.1 million was recorded in the consolidated statement of operations and contributed surplus during the quarter ended November 30, 2009.

In December 2009, the Company granted stock options to members of the Company’s management team for 372,000 Class A Subordinate Voting Shares with an exercise price of $1.54. The options vest in 1 to 3 years. The fair value of the stock options granted was $0.1 million and an amount of less than $0.1 million was recorded in the consolidated statement of operations and contributed surplus during the quarter ended February 28, 2011.

There were no new options granted in the three and six months ended February 28, 2011.

(16)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

Restricted stock units

On February 19, 2010, 117,122 previously granted Restricted Share Units (Units) were settled through the issuance of 117,122 Class A Subordinate Voting Shares of the Company. The 117,122 Units were granted on November 12, 2009 by the Company’s Board of Directors to satisfy $180,369 related to the Fiscal 2009 bonus.

| 10 | Loss per share |

The weighted average number of shares outstanding used to compute basic loss per share for the three months ended February 28, 2011 was 51,489,371 (2010 - 51,070,254).

The weighted average number of shares outstanding used to compute basic loss per share for the six months ended February 28, 2011 was 51,442,581 (2010 - 50,915,890).

For purposes of the weighted average number of shares outstanding, the Class B Voting Shares were converted into the equivalent number of Class A Subordinate Voting Shares on the basis of one Class A Subordinate Voting Share for three Class B Voting Shares. Class B Voting Shares participate in the dividends and distributions at a rate of one third of each Class A Subordinate Voting Share. The stock options (note 9) and convertible debt (note 5) were not included in the computation of diluted loss per share, as they would have been anti-dilutive for the periods presented.

| 11 | Supplemental cash flow disclosures |

Changes in non-cash working capital related to operations for the three and six months ended February 28 are as follows:

| Three months ended February 28, | Six months ended February 28, | |||||||||||||||

2011 $ | 2010 $ | 2011 $ | 2010 $ | |||||||||||||

| (Increase)/Decrease in current assets and long term prepaids | ||||||||||||||||

| Accounts receivable | 161,378 | (135 | ) | 984,878 | 1,604,729 | |||||||||||

| Prepaid expenses and other assets | 107,248 | (14,621 | ) | (523,516 | ) | (848,594 | ) | |||||||||

| Increase/(Decrease) in current and long term liabilities | ||||||||||||||||

| Accounts payable and accrued liabilities | 2,854,707 | 2,630,793 | 8,430,795 | 2,230,643 | ||||||||||||

| Deferred revenue | 2,090,603 | 3,406,437 | 3,095,633 | 3,418,821 | ||||||||||||

| Long term liabilities | (675,891 | ) | 198,690 | (1,292,904 | ) | 233,280 | ||||||||||

| Net change in non-cash balances related to operations | 4,538,045 | 6,221,164 | 10,694,886 | 6,638,879 | ||||||||||||

(17)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

| 12 | Contracts, contingencies and commitments |

| CRTC Part II Licence Fees |

| Historically, the CRTC has levied two different types of fees from broadcast licenses. These are known as Part I and Part II fees. The Canadian Association of Broadcasters (“CAB”), on behalf of their members, has challenged in Court the validity of the Part II licence fees. In December 2006, the Federal Court ruled that the Part II licence fees were an illegal tax. The Federal Government appealed the Federal Court judgment and on April 28, 2008, the Federal Court of Appeal reversed the decision and found that the fees were a valid regulatory charge. On June 27, 2008, CAB filed an application for leave to appeal the Appeal Court decision to the Supreme Court of Canada. On December 18, 2008, the Supreme Court of Canada granted the CAB leave to appeal the Part II licence fee case and on January 19, 2009 the CAB’s notice of appeal was filed. The Supreme Court of Canada was scheduled to hear the matter on October 19, 2009. |

| On October 7, 2009, the CAB announced that its Board of Directors, along with other fee-paying stakeholders, approved the terms of a settlement agreement with the Federal Government pertaining to the Part II licence fee issue. The agreement waived fees due to the Federal Government, but not collected by the CRTC for fiscal 2007, 2008 and 2009. CSR is required to pay a fee as part of the new Part II fee regime implemented that is capped on an industry wide basis and this fee was paid during the quarter ended February 28, 2011. |

| As at August 31, 2009, CSR had accrued approximately $1.2 million in current liabilities representing unpaid Part II licence fees. This amount was credited to the statement of operations during the quarter ended November 30, 2009. |

| National Hockey League |

On September 9, 2005, XM and the National Hockey League (NHL) signed a term sheet to secure satellite radio National Hockey League broadcast and marketing rights. The agreement between XM and the National Hockey League is a ten-year agreement, with satellite radio exclusivity over the last eight years, for which XM’s total cost is approximately $97.1 million (US$100 million). The Company’s commitment to reimburse XM for a portion of its obligations under this term sheet totalled $67.1 million (US$69.1 million).

During the year ended August 31, 2008, the Company, XM and the NHL agreed to an amendment to the NHL agreement which will defer a portion of the licence fee payable during the 2007-2008 and 2008-2009 seasons to years seven to nine of the original agreement. The Company also issued to the NHL 102,150 Class A Subordinate Voting Shares with a market value at the date of issuance in December 2007 equal to US$500,000. In addition, XM and the Company agreed to increase the total of the Company’s portion of the commitment to US$71.8 million over the term of the agreement. The Company accounts for the difference between the periodic cost of the services (determined on a straight line basis) and the amount paid in each period as an other financial liability. The periodic service cost reflects the fees over the term of the arrangement less the interest component determined using the effective interest rate method. Programming costs reflect the fees over the term of the arrangement and amortization of the brands. As at February 28, 2011, a liability of $8,801,577 is recorded in other long-term liabilities, of which $3,977,853 is related to programming and $4,823,724 is related to the marketing rights.

(18)

Canadian Satellite Radio Holdings Inc.

Notes to Interim Consolidated Financial Statements

(unaudited)

February 28, 2011

During the year ended August 31, 2010, the Company and the NHL signed an agreement to defer a portion of the quarterly instalments of the annual licence fees due to the NHL for the 2009/2010 season. The total amount of the deferral is US$1.5 million and the payments may be deferred for 12 months. In consideration of the deferral, the Company will pay interest of 12% annually and will compensate the NHL for any loss on value below $2.50 of the 102,150 Class A Subordinate Voting Shares issued to the NHL for the amended agreement signed during the year ended August 31, 2008. The compensation for any loss on value of the Class A Subordinate Voting Shares has been determined to be an embedded derivative that is required to be bifurcated from the underlying host contract and accounted for as a derivative at fair value with changes in fair value recorded in earnings. As at February 28, 2011, a value of $0.1 million was assigned to this embedded derivative.

The Executive Chairman of the Company has provided a guarantee to the NHL for the amount deferred in the agreement. In return, the Company will pay a monthly guarantee fee to the Executive Chairman of 0.25% of the deferred amount.

General Motors of Canada Limited (GMCL)

During the quarter ended February 28, 2011, GMCL and the Company signed an agreement to defer the payment of certain amounts due to GMCL, up to $3.7 million. The agreement defers the amount of monthly revenue share payments beginning in December 2009 and continuing through calendar 2010 for up to one year from the due date of each monthly payment to a maximum of $3 million. In addition, the agreement defers the payment of $0.7 million in loyalty bounty due to GMCL. In consideration of this deferral, the Company will pay interest of 19% annually, compounded monthly. As of February 28, 2011, the amount deferred including interest payable is $3.4 million.

The agreement includes a provision for immediate repayment of outstanding amounts in the event of the Company refinancing or completing the proposed merger. If the refinancing or proposed merger are not completed by May 31, 2011, the outstanding bounty amount is immediately due and the consideration of the deferral of the monthly revenue share payments is changed to an interest rate of 15% per annum, compounded monthly and the issuance of share purchase warrants (warrants) to GMCL. Each warrant will entitle the holder to purchase one Class A Subordinate Voting Share. Each warrant would have an exercise price equal to the market price of one CSR share at the time of issuance of the warrant. One warrant will be issued for every three dollars of the deferred revenue share amount, excluding accrued interest, adjusted for any change in the market price of the Company’s common shares between the date of the agreement and the issuance date of the warrants.

(19)

of Financial Condition and Results of Operations

Management’s discussion and analysis (“MD&A”) discusses the significant factors affecting the results of operations and financial position of Canadian Satellite Radio Holdings Inc. (the “Company”) for the three and six months (the “second quarter” and “year-to-date”) ended February 28, 2011. This MD&A should be read in conjunction with the audited consolidated financial statements and related notes thereto included in the Company’s annual report for the year ended August 31, 2010. The financial statements of the Company are prepared in accordance with Canadian generally accepted accounting principles (“GAAP”) and are expressed in Canadian dollars, unless otherwise noted.

This MD&A has been prepared as of April 12, 2011 at which time 24,384,717 Class A Subordinate Voting shares and 81,428,133 Class B Voting shares are outstanding.

This MD&A contains the following sections:

| Forward-Looking Disclaimer | 1 | |||

| Overview | 2 | |||

| Operating Definitions | 4 | |||

| Results of Operations | 10 | |||

| Liquidity and Capital Resources | 24 | |||

| Off-Balance Sheet Arrangements | 30 | |||

| Arrangements, Relationships and Transactions with Related Parties | 30 | |||

| Critical Accounting Policies and Estimates | 32 | |||

| Recent Accounting Pronouncements and Changes | 34 | |||

| Future Accounting Pronouncements | 35 | |||

| International Financial Reporting Standards | 35 | |||

| Certain Risk Factors | 37 | |||

| Outstanding Share Data and Other Information | 39 |

Forward-Looking Disclaimer

This discussion contains certain information that may constitute forward-looking statements within the meaning of securities laws. These statements relate to future events or future performance and reflect management’s expectations and assumptions regarding the growth, results of operations, performance and business prospects and opportunities of the Company on a consolidated basis. In some cases, forward-looking statements can be identified by terminology such as “may”, “would”, “could”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, “seek” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the Company’s objectives, plans and goals, including future operating results, economic performance and subscriber recruitment efforts involve forward-looking statements. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements.

Although the forward-looking statements contained in this discussion are based on what management of the Company considers are reasonable assumptions based on information currently available to it, there can be no assurance that actual events, performance or results will be consistent with these forward-looking statements, and management’s assumptions may prove to be incorrect. Our financial projections are based on estimates regarding expected future costs and expected revenue, which are fully described in this MD&A. Other than as required by applicable Canadian securities law the Company does not update or revise any forward-looking statements to reflect new information, future events or otherwise. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from expectations. These include but are not limited to the risk factors included in this MD&A (including those listed under the heading “Certain Risk Factors”) in addition to the risks itemized in our Annual Report in Form 20-F (“Form 20-F”) for the fiscal year ended August 31, 2010. Readers are advised to review these risk factors for a detailed discussion of the risks and uncertainties affecting the Company’s business. Readers should not place undue reliance on forward-looking statements.

Overview

Our Business

Our vision is to be the leading premium digital audio entertainment and information service provider in Canada. Our strategy is founded on the principles of acquiring subscribers in the near and long-term in the most cost effective manner.

Satellite Radio offers 120 - 130 channels, including commercial-free music as well as news, talk, sports and children’s programming, and over 12 Canadian channels designed and developed from studios in Toronto, Ontario and Québec City, Québec. We continue to leverage our unique programming assets, such as our exclusive broadcasting agreement with the National Hockey League (“NHL”) and our NHL Home Ice channel.

Our target market in Canada includes more than 25 million registered vehicles on the road, an estimated 1.56 million new vehicles forecasted to be sold in calendar year 2011 and more than 12 million households. We are the leader in digital audio entertainment distribution and information delivered via satellite to new vehicles sold in Canada. The Satellite radio service is available as standard equipment or as a factory-installed option in more than 50% of new vehicles to be sold in model year 2011. XM radios are available under Pioneer, Audiovox and other brand names at national consumer electronics retailers such as Best Buy, Future Shop, Canadian Tire, WalMart Canada and other national and regional retailers.

The Company is focused on achieving positive operating income as quickly as possible by maximizing our revenues through subscriptions, advertising and other ancillary opportunities as well as maintaining effective cost controls, managing subscriber acquisition costs and by creating a long-term customer base through quality service. We believe that a premium service will attract a premium customer.

Highlights for the Second Quarter of 2011

Corporate and Business Highlights

On November 24, 2010, the Company publicly announced it has entered into a definitive agreement to combine operations with Sirius Canada Inc. (“Sirius Canada”), (the “transaction” or the “merger”). Under the terms of the agreement, Sirius Canada shareholders are expected to be issued treasury shares of CSR representing a 58.0 per cent equity interest in CSR immediately following the closing of the transaction. The approximate ownership interest in CSR following the closing of the transaction would then be as follows: CSRI Inc., an entity controlled by John Bitove, the chairman of CSR, 30.0 per cent voting interest (22.7 per cent equity interest); CBC/Radio-Canada 20.2 per cent voting interest (15.0 per cent equity interest); Slaight Communications 20.2 per cent voting interest (15.0 per cent equity interest); Sirius XM Radio Inc. (Sirius XM) (NASDAQ:SIRI) 25.0 per cent voting interest (37.1 per cent equity interest); with the remainder being widely held. In the event that CSR has a cash balance (which includes cash and cash equivalents and restricted investments) of less than $9 million at the closing of the transaction, each of the Vendors shall receive non-interest bearing promissory notes in the aggregate for the difference between the actual cash balance and $9 million.

2

For the year ended August 31, 2010, the combined company expects to have pro forma revenues of approximately $200 million, pro forma adjusted EBITDA excluding stock compensation expense of approximately $3.7 million, and expects to have long-term debt of at least $150 million. As of November 30th, 2010 the combined company expects to have pro forma revenues of approximately $55 million and pro forma EBITDA excluding stock compensation expense of approximately $5.5 million. The combined company will have a total subscriber base of over 1.8 million. The combination is expected to yield synergies of approximately $20 million on an annualized basis within 18 months by allowing the combined company to better manage costs through improved efficiencies and greater economies of scale.

In addition, as part of the announcement on November 24, 2010, CSR also announced its intention to exchange its outstanding unsecured senior notes with a face value of US$69.8 million for new unsecured senior notes of CSR with different terms. At March 25, 2011 holders representing $US68.8 million have agreed to tender their notes in the exchange offer for the new unsecured senior notes of CSR and consent to the proposed amendments to the indenture governing the outstanding unsecured senior notes. Concurrent with the closing of the exchange offer, CSR anticipates issuing additional new unsecured senior notes on a private placement basis to accredited investors - for a total of approximately $130 million of long-term debt in the combined entity as a result of the exchange and new issuance. The note holders are entitled to a commitment fee of 0.5% of the principal of the notes for each month prior to the merger closing to a maximum of 1.5% of the principal of the notes. It is expected that the exchange offer and issuance of new unsecured senior notes will be completed contemporaneously with the closing of the combination transaction.

On February 17th, 2011 the Company obtained shareholder approval of the proposed transaction at its annual and special shareholder meeting.

On February 23rd, 2011 the Competition Bureau issued a No-Action Letter and announced that it does not intend to make an application to the Competition Tribunal to challenge the proposed acquisition of Sirius Canada Inc. by Canadian Satellite Radio Holdings Inc. under the merger provisions of the Competition Act.