Use these links to rapidly review the document

TABLE OF CONTENTS

Annex C—Liberty Entertainment, Inc., LMC Entertainment and Liberty Media Corporation Financial Statements

Annex D—Holdings and DIRECTV Financial Information

TABLE OF CONTENTS 4

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 3)

| Filed by the Registrantý | |||

Filed by a Party other than the Registranto | |||

Check the appropriate box: | |||

ý | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

o | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material Pursuant to §240.14a-12 | ||

Liberty Media Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

N/A | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

o | No fee required. | |||

ý | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: Liberty Entertainment, Inc.'s Series A common stock, par value $.01 per share, and Series B common stock, par value $0.01 per share | |||

| (2) | Aggregate number of securities to which transaction applies: 459,650,435 shares of Series A common stock; 26,721,935 shares of Series B common stock | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): The filing fee has been calculated using the high and low prices reported for each series of Liberty Entertainment common stock on the Nasdaq Global Select Market on August 24, 2009 (which were $27.92 for Series A Liberty Entertainment common stock and $27.88 for Series B Liberty Entertainment common stock). | |||

| (4) | Proposed maximum aggregate value of transaction: $13,578,314,072.15 | |||

| (5) | Total fee paid: $622,032.20. Fees in the amount of $323,064.40 were previously paid on January 22, 2009 with Liberty Media Corporation's preliminary proxy statement on Schedule 14A and fees in the amount of $174,337.94 were previously paid on April 24, 2009 in connection with the filing of the Registration Statement on Form S-4 (Form S-4) of Liberty Entertainment, Inc. (File No. 333-158795), of which this proxy statement/prospectus forms a part. Fees in the amount of $124,629.86 were paid on August 27, 2009 in connection with the filing of Amendment No.3 to the Form S-4, of which this proxy statement/prospectus forms a part. | |||

ý | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | ||||

| (2) | ||||

| (3) | ||||

| (4) | ||||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

Information in this proxy statement/prospectus is not complete and may be changed. We may not sell the securities offered by this proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction where an offer or solicitation is not permitted.

Subject to completion, dated October 2, 2009

| LIBERTY MEDIA CORPORATION 12300 Liberty Boulevard Englewood, Colorado 80112 (720) 875-5400 |

[ ], 2009

Dear Stockholder:

You are cordially invited to a special meeting of stockholders of Liberty Media Corporation's (Liberty Media) Series A Liberty Entertainment common stock (LMDIA) and Series B Liberty Entertainment common stock (LMDIB) to be held at[ ] a.m., local time, on [ ], 2009, at[ ], telephone[( ) - ]. A notice of the special meeting, a proxy card, and a proxy statement/prospectus containing important information about the matters to be acted on at the special meeting accompany this letter.

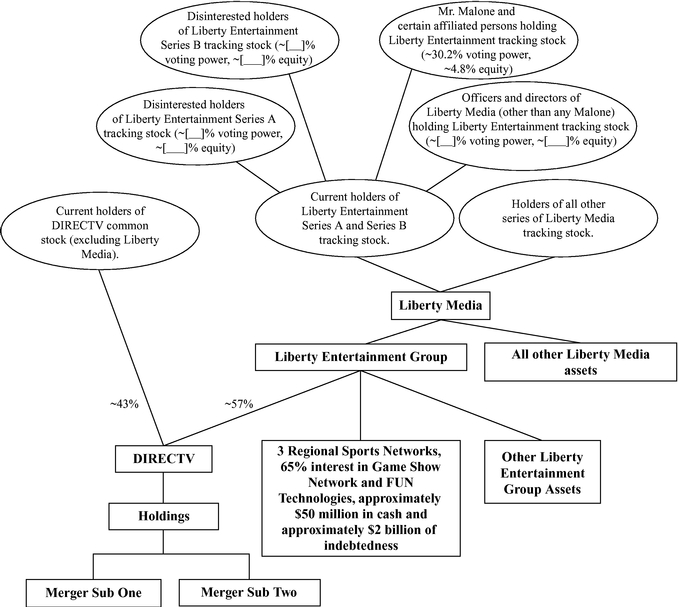

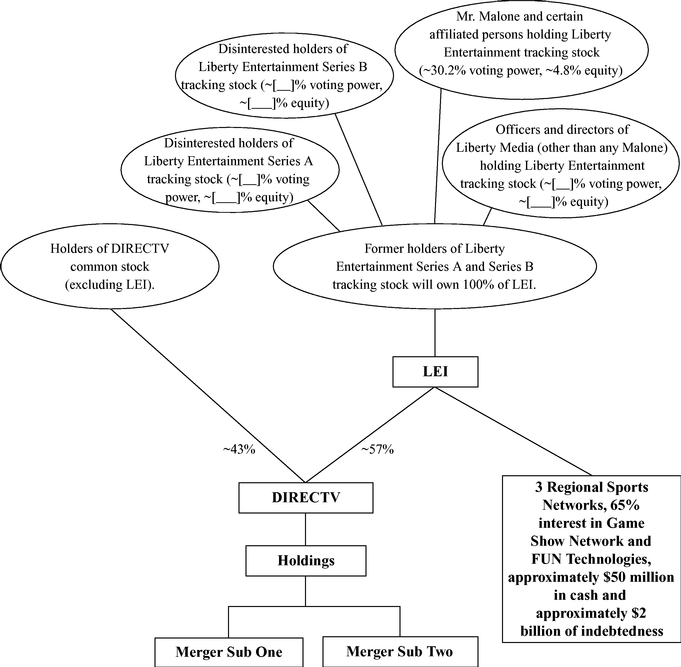

At the special meeting, you will be asked to consider and vote on a proposal (theredemption proposal) which would allow Liberty Media to redeem 0.9 of each outstanding share of Liberty Entertainment common stock for 0.9 of a share of the corresponding series of common stock of a newly formed, wholly owned subsidiary of Liberty Media, Liberty Entertainment, Inc.(LEI). LEI would hold Liberty Media's 57% interest in The DIRECTV Group, Inc. (DIRECTV), a 100% interest in Liberty Sports Holdings, LLC, a 65% interest in Game Show Network, LLC and approximately $50 million in cash and cash equivalents, together with approximately $2 billion of indebtedness. All of the businesses, assets and liabilities currently attributed to Liberty Media's Entertainment Group that are not held by LEI would remain with Liberty Media and continue to be attributed to the Entertainment Group. These assets consist primarily of a 100% interest in Starz Entertainment LLC and cash and cash equivalents, which will be tracked by the shares of Liberty Entertainment common stock that are not redeemed. Cash will be paid in lieu of any fractional shares. We refer to the redemption and the resulting separation of LEI from Liberty Media pursuant to the redemption as theSplit-Off.

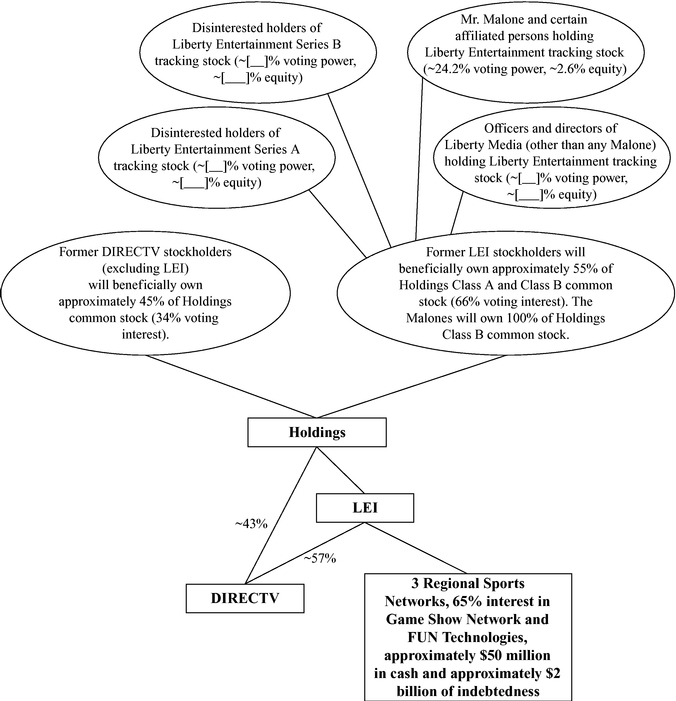

Additionally, at the special meeting, holders of Liberty Entertainment common stock, exclusive of shares beneficially owned by John C. Malone, Chairman of the Board of Liberty Media, certain affiliated persons of Mr. Malone and the other directors and officers of Liberty Media (all holders of Liberty Entertainment common stock other than such excluded persons, thedisinterested holders of Liberty Entertainment common stock), will be asked to consider and vote on a series of proposals (thetransaction proposals) pursuant to which, among other things, (i) LEI and DIRECTV will become wholly owned subsidiaries of a new parent company (Holdings), (ii) Mr. Malone and certain related persons will contribute each of their shares of LEI Series B common stock to Holdings for 1.11111 shares of Holdings Class B common stock (subject to adjustment), (iii) each other share of LEI Series A or Series B common stock will be exchanged for 1.11111 shares of Holdings Class A common stock (subject to adjustment); and (iv) each share of DIRECTV common stock will be exchanged for one share of Holdings Class A common stock. Cash will be paid in lieu of fractional shares. Each share of Holdings Class A common stock will entitle the holder to one vote per share, and each share of Holdings Class B common stock will entitle the holder to 15 votes per share and to certain limited consent rights. As a result of these transactions (theDTV Business Combination), the former LEI stockholders will own approximately 55% of the outstanding Holdings common stock, which will entitle them in the aggregate to approximately 66% of the voting power of Holdings, with the former DIRECTV stockholders owning the remaining equity and voting interests in Holdings. The Split-Off will be completed immediately prior to the completion of the DTV Business Combination, unless the Merger Agreement has been terminated, in which case, the Split-Off will be completed as soon as practical after all of the conditions to the Split-Off have been satisfied or waived (other than those related to the DTV Business Combination). We expect to complete the Split-Off and the DTV Business Combination as soon as practical after the special meeting, assuming all other conditions to

ii

such transactions have been satisfied or waived. If the Merger Agreement is terminated, we expect to complete the Split-Off as soon as practical after the date of such termination, assuming all other conditions to the Split-Off have been satisfied or waived. The Split-Off and the DTV Business Combination are referred to as theTransactions.

The approval of the transaction proposals is not required by either the terms of Liberty Media's charter or by Delaware law. Liberty Media has decided, however, that it is appropriate to seek the approval of the transaction proposals, and has contractually agreed with DIRECTV to seek the approval, in order to ensure that the disinterested holders of Liberty Entertainment common stock have the power to determine whether the various transactions contemplated by the transaction proposals are acceptable to them. In addition, Liberty Media believes the ratification of the transactions by the disinterested holders of Liberty Entertainment common stock will have certain substantive and procedural effects under Delaware law.

As of August 31, 2009, there were outstanding 496,164,688 shares of LMDIA and 23,697,987 shares of LMDIB. Based on the number of shares of Liberty Entertainment common stock outstanding on that date, LEI expects to issue up to 446,548,219 shares of its Series A common stock and 21,328,188 shares of its Series B common stock in the Split-Off; and Liberty Media expects up to 49,616,468 shares of LMDIA and 2,369,798 shares of LMDIB to remain outstanding immediately following the Split-Off. Based on the foregoing and the number of outstanding shares of DIRECTV common stock on August 31, 2009, Holdings expects to issue up to 916,628,522 shares of its Class A common stock and 21,806,138 shares of its Class B common stock in the DTV Business Combination (assuming no adjustment to the exchange ratios described above).

Following the completion of the Transactions, Holdings expects to list its Class A common stock on the Nasdaq Global Select Market under DIRECTV's current symbol "DTV." The Class B common stock of Holdings will not be listed on any stock exchange or automated dealer quotation system. Since the DTV Business Combination will be completed, if at all, immediately following the Split-Off, LEI will be acquired by Holdings and the LEI common stock will be exchanged for Holdings common stock before ever trading in the public market. If, however, the Merger Agreement is terminated before the DTV Business Combination is completed, LEI expects to list its Series A common stock and Series B common stock on the Nasdaq Global Select Market under the existing symbols "LMDIA" and "LMDIB", respectively. Following the completion of the Split-Off, and regardless of whether the Merger Agreement has been terminated, Liberty Media expects to redesignate LMDIA as Series A Liberty Starz common stock and LMDIB as Series B Liberty Starz common stock and to list these shares on the Nasdaq Global Select Market under the symbols "LSTZA" and "LSTZB", respectively.

The Liberty Media board has approved and declared advisable the redemption proposal and each of the transaction proposals (together with a related proposal that would permit Liberty Media to adjourn the special meeting to solicit further proxies), and the transactions contemplated by each of them, and recommends that the holders of LMDIA and LMDIB vote "FOR" each of these proposals.

Your vote is important, regardless of the number of shares you own. Whether or not you plan to attend the special meeting, please vote as soon as possible to make sure that your shares are represented.

Thank you for your cooperation and continued support and interest in Liberty Media.

| Very truly yours, | ||

Gregory B. Maffei President and Chief Executive Officer |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of any of the proposals or the securities being offered in the Split-Off and DTV Business Combination or has passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

Investing in the securities of LEI or Holdings involves risks. See "Risk Factors" beginning on page 51.

The accompanying proxy statement/prospectus is dated [ ], 2009 and is first being mailed on or about[ ], 2009 to the stockholders of record as of 5:00 p.m., New York City time, on October 9, 2009.

iii

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information from other documents that are not included in or delivered with this proxy statement/prospectus. This information is available to you without charge upon your written or oral request. You can obtain those documents incorporated by reference in this proxy statement/prospectus or other information about the companies that is filed with the Securities and Exchange Commission (theSEC) under the Securities and Exchange Act of 1934, as amended (theExchange Act), by requesting them in writing or by telephone from the appropriate company at the following addresses and telephone numbers:

| For information about Liberty Media or LEI: | For information about DIRECTV or Holdings: | |||||

By Mail: | Liberty Media Corporation/ Liberty Entertainment, Inc. 12300 Liberty Boulevard Englewood, Colorado 80112 Attention: Office of Investor Relations | By Mail: | The DIRECTV Group, Inc./ DIRECTV 2230 East Imperial Highway El Segundo, California 90245 Attention: Office of Investor Relations | |||

By Telephone: | (720) 875-5408 | By Telephone: | (310) 964-0808 | |||

IF YOU WOULD LIKE TO REQUEST ANY DOCUMENTS, PLEASE DO SO BY[ • ], 2009 IN ORDER TO RECEIVE THEM BEFORE THE SPECIAL MEETING.

For additional information on documents incorporated by reference in this proxy statement/prospectus, please see "Additional Information—Where You Can Find More Information."

iv

LIBERTY MEDIA CORPORATION

12300 Liberty Boulevard

Englewood, Colorado 80112

(720) 875-5400

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

to be Held on [ ], 2009

NOTICE IS HEREBY GIVEN of the special meeting of holders of Liberty Media Corporation's (Liberty Media) Series A Liberty Entertainment common stock, par value $0.01 per share (LMDIA), and Series B Liberty Entertainment common stock, par value $0.01 per share (LMDIB), to be held at[ ] a.m., local time, on[ ], 2009, at the[ ], telephone[( ) - ], to consider and vote on:

- 1.

- A proposal (theredemption proposal) to allow Liberty Media to redeem a portion of the outstanding shares of Liberty Entertainment common stock for all of the outstanding shares of Liberty Entertainment, Inc. (LEI), which would hold Liberty Media's 57% interest in The DIRECTV Group, Inc. (DIRECTV), a 100% interest in Liberty Sports Holdings, LLC, a 65% interest in Game Show Network, LLC and approximately $50 million in cash and cash equivalents, together with approximately $2 billion of indebtedness. We refer to the redemption and the resulting separation of LEI from Liberty Media pursuant to the redemption as theSplit-Off.

- 2.

- The following three, relatedtransaction proposals:

- •

- A proposal (theminority redemption proposal) to approve (i) the Split-Off and (ii) the transactions contemplated thereby (including the transactions contemplated by a reorganization agreement to be entered into between Liberty Media and LEI).

- •

- A proposal (themerger proposal) to approve (i) the Agreement and Plan of Merger, dated as of May 3, 2009, and as amended on July 29, 2009 and October 2, 2009 (theMerger Agreement), by and among Liberty Media, LEI, DIRECTV and the other parties named therein pursuant to which, among other things, LEI and DIRECTV would become wholly owned subsidiaries of a new parent company (which we refer to asHoldings) named "DIRECTV," and (ii) the transactions contemplated thereby (including the merger of a wholly owned subsidiary of Holdings with and into LEI).

- •

- A proposal (thecontribution proposal) to approve (i) the Voting and Right of First Refusal Agreement, dated as of May 3, 2009, and as amended on July 29, 2009 and October 2, 2009 (theMalone Agreement), pursuant to which, among other things, John C. Malone, Leslie Malone and certain trusts in favor of their children (collectively, theMalones) would receive shares of Holdings Class B common stock in exchange for their shares of LEI Series B common stock, and (ii) the transactions contemplated thereby.

- 3.

- A proposal (theadjournment proposal) to authorize the adjournment of the special meeting by Liberty Media to permit further solicitation of proxies, if necessary or appropriate, if sufficient votes are not represented at the special meeting to approve the transaction proposals in accordance with the Merger Agreement.

We refer to the transactions contemplated by the Merger Agreement and the Malone Agreement as theDTV Business Combination and the Split-Off together with the DTV Business Combination as theTransactions.

Liberty Media encourages you to read the accompanying proxy statement/prospectus in its entirety before voting, including the following annexes hereto:Annex B—Form of LEI's proposed amended and restated certificate of incorporation (theLEI restated charter);Annex E—Merger Agreement;

v

Annex F—Malone Agreement; andAnnex G—Form of Holdings' proposed amended and restated certificate of incorporation (theHoldings charter).

Holders of record of LMDIA and LMDIB, in each case, outstanding as of 5:00 p.m., New York City time, on October 9, 2009, therecord date for the special meeting, will be entitled to notice of the special meeting and to vote at the special meeting or any adjournment or postponement thereof. The proposals described above require the following stockholder approvals:

- •

- The redemption proposal requires the approval by holders of record, as of the record date, of a majority of the aggregate voting power of the shares of Liberty Entertainment common stock that are present (in person or by proxy) and entitled to vote at the special meeting, voting together as a single class.

- •

- Each of the transaction proposals requires the approval by the holders of record, as of the record date, voting together as a separate class, of a majority of the aggregate voting power of the outstanding shares of Liberty Entertainment common stock, excluding all shares of Liberty Entertainment common stock beneficially owned by Mr. Malone, certain affiliated persons of Mr. Malone or any director or officer of Liberty Media.

- •

- The adjournment proposal requires the approval by holders of record, as of the record date, of a majority of the aggregate voting power of the shares of Liberty Entertainment common stock that are present (in person or by proxy) and entitled to vote at the special meeting, voting together as a single class.

Each of the minority redemption proposal, the merger proposal and the contribution proposal is dependent on the other, and the DTV Business Combination will not be implemented unless they are all approved at the special meeting. The Split-Off is conditioned on the receipt of the requisite approval of the redemption proposal but not on the receipt of the requisite approval of any of the transaction proposals, including the minority redemption proposal. The DTV Business Combination is conditioned on the receipt of the requisite approval of each of the transaction proposals and the completion of the Split-Off. The Split-Off, however, will be completed immediately prior to the completion of the DTV Business Combination, unless the Merger Agreement has been terminated, in which case, the Split-Off will be completed as soon as practical after all of the conditions to the Split-Off have been satisfied or waived (other than those related to the DTV Business Combination). We expect to complete the Split-Off and the DTV Business Combination as soon as practical after the special meeting, assuming all other conditions to such transactions have been satisfied or waived. If the Merger Agreement is terminated, we expect to complete the Split-Off as soon as practical after the date of such termination, assuming all other conditions to the Split-Off have been satisfied or waived.

The Liberty Media board of directors has approved and declared advisable each enumerated proposal, and recommends that the holders of LMDIA and LMDIB vote "FOR" each of them.

Votes may be cast in person or by proxy at the special meeting or prior to the meeting by telephone or via the Internet.

A list of stockholders entitled to vote at the special meeting will be available at Liberty Media's offices in Englewood, Colorado for review by its stockholders for any purpose germane to the special meeting, for at least 10 days prior to the special meeting.

YOUR VOTE IS IMPORTANT. Liberty Media urges you to vote as soon as possible by telephone, Internet or mail.

| By order of the board of directors, | ||

Pamela L. Coe Vice President, Deputy General Counsel and Secretary |

Englewood, Colorado

[ ], 2009

vi

QUESTIONS AND ANSWERS | 1 | |||||||

SUMMARY | 9 | |||||||

The Companies | 9 | |||||||

Recent Developments | 11 | |||||||

The Split-Off | 14 | |||||||

DTV Business Combination | 24 | |||||||

Comparative Per Share Market Price and Dividend Information | 49 | |||||||

RISK FACTORS | 51 | |||||||

Factors Relating to the Split-Off | 51 | |||||||

Factors Relating to LEI | 55 | |||||||

Factors Relating to the DTV Business Combination | 61 | |||||||

Factors Relating to DIRECTV | 64 | |||||||

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS | 75 | |||||||

THE SPECIAL MEETING | 77 | |||||||

Time, Place and Date | 77 | |||||||

Purpose | 77 | |||||||

Quorum | 77 | |||||||

Who May Vote | 78 | |||||||

Votes Required | 78 | |||||||

Votes You Have | 78 | |||||||

Shares Outstanding | 78 | |||||||

Number of Holders | 78 | |||||||

Voting Procedures for Record Holders | 79 | |||||||

Voting Procedures for Shares Held in Street Name | 79 | |||||||

Revoking a Proxy | 79 | |||||||

Solicitation of Proxies | 80 | |||||||

SPECIAL FACTORS | 81 | |||||||

Background | 81 | |||||||

Liberty Media's Reasons for the Split-Off and the DTV Business Combination; | 100 | |||||||

Opinion of Financial Advisor to the Liberty Media Board | 103 | |||||||

DIRECTV's Reasons for the DTV Business Combination | 113 | |||||||

THE SPLIT-OFF | 116 | |||||||

General | 116 | |||||||

The Redemption; Redemption Ratio | 116 | |||||||

Effect of the Redemption | 117 | |||||||

Conditions to the Split-Off | 118 | |||||||

Treatment of Fractional Shares | 119 | |||||||

Board Discretion to Terminate Split-Off | 119 | |||||||

Treatment of Outstanding Equity Awards | 119 | |||||||

Transaction Agreements | 122 | |||||||

Conduct of the Business of the Entertainment Group if the Split-Off is Not Completed | 122 | |||||||

Interests of Certain Persons | 123 | |||||||

Amount and Source of Funds and Financing; Expenses | 124 | |||||||

Accounting Treatment | 124 | |||||||

No Appraisal Rights | 124 | |||||||

Regulatory Approvals | 124 | |||||||

Stock Exchange Listings | 125 | |||||||

Stock Transfer Agent and Registrar | 125 | |||||||

vii

Federal Securities Law Consequences | 125 | |||||||

Vote and Recommendation | 125 | |||||||

DTV BUSINESS COMBINATION | 126 | |||||||

Effect of the Malone Contribution | 126 | |||||||

Effect of the LEI Merger; What LEI Stockholders Will Receive in the LEI Merger | 126 | |||||||

Effect of the DIRECTV Merger; What DIRECTV Stockholders Will Receive in the | 128 | |||||||

Effects of the DTV Business Combination | 129 | |||||||

Exchange of LEI and DIRECTV Shares | 129 | |||||||

Treatment of Outstanding Equity Awards | 130 | |||||||

Interests of Certain Persons | 131 | |||||||

Holdings Board of Directors and Management after the Mergers | 134 | |||||||

Amount and Source of Funds and Financing; Expenses | 134 | |||||||

Accounting Treatment | 135 | |||||||

No Appraisal Rights | 136 | |||||||

Regulatory Approvals | 136 | |||||||

Legal Proceedings Regarding the DTV Business Combination | 136 | |||||||

Delivery of Excess Shares in the LEI Merger | 137 | |||||||

Stock Exchange Listings; Delisting of LEI and DIRECTV | 137 | |||||||

Stock Transfer Agent and Registrar | 138 | |||||||

Federal Securities Law Consequences; Restrictions on Resale | 138 | |||||||

Purpose of the Transaction Proposals | 138 | |||||||

Vote and Recommendation | 139 | |||||||

TRANSACTION AGREEMENTS | 140 | |||||||

Agreements Relating to the Split-Off | 140 | |||||||

Reorganization Agreement | 140 | |||||||

Services Agreement | 140 | |||||||

Tax Sharing Agreement | 141 | |||||||

Agreements Relating to the DTV Business Combination | 145 | |||||||

Merger Agreement | 145 | |||||||

Malone Agreement | 166 | |||||||

Liberty Agreement | 167 | |||||||

Liberty Revolving Credit Facility | 168 | |||||||

DIRECTV Credit Facility | 169 | |||||||

Bennett Agreement | 169 | |||||||

Standstill Agreement | 170 | |||||||

DESCRIPTION OF COMMON STOCK AND COMPARISON OF STOCKHOLDER RIGHTS | 173 | |||||||

Other Provisions of LEI's Restated Charter and By-laws | 188 | |||||||

Other Provisions of the Holdings Charter and By-laws | 195 | |||||||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES | 203 | |||||||

U.S. Federal Income Tax Consequences of the Split-Off | 204 | |||||||

Backup Withholding | 206 | |||||||

Stockholder Information Reporting | 206 | |||||||

U.S. Federal Income Tax Consequences of the LEI Transactions | 206 | |||||||

Backup Withholding | 207 | |||||||

Stockholder Information Reporting | 208 | |||||||

CAPITALIZATION OF LEI | 209 | |||||||

SELECTED FINANCIAL DATA FOR LEI AND LIBERTY MEDIA | 210 | |||||||

Selected Historical Financial Data of LEI | 210 | |||||||

Selected Unaudited Condensed Pro Forma Combined Financial Data of LEI | 211 | |||||||

Selected Historical Financial Data of Liberty Media | 212 | |||||||

viii

Selected Unaudited Condensed Pro Forma Combined Financial Data of Liberty Media | 213 | ||||||

Selected Unaudited Historical Attributed Financial Data of the Entertainment Group | 214 | ||||||

Selected Unaudited Pro Forma Attributed Financial Data of the Entertainment Group | 215 | ||||||

SELECTED FINANCIAL DATA FOR DIRECTV AND HOLDINGS | 216 | ||||||

How the Financial Data was Prepared | 216 | ||||||

Selected Historical Financial Data of DIRECTV | 217 | ||||||

Selected Unaudited Pro Forma Condensed Combined Financial Data of Holdings | 218 | ||||||

UNAUDITED COMPARATIVE PER SHARE INFORMATION | 220 | ||||||

MANAGEMENT OF LEI | 222 | ||||||

Executive Officers and Directors | 222 | ||||||

Director Independence | 224 | ||||||

Board Committees | 225 | ||||||

Compensation Committee Interlocks and Insider Participation | 225 | ||||||

Executive Compensation | 225 | ||||||

Equity Incentive Plans | 226 | ||||||

Equity Compensation Plan Information | 227 | ||||||

Pro Forma Security Ownership of Certain Beneficial Owners | 228 | ||||||

Pro Forma Security Ownership of Management | 229 | ||||||

MANAGEMENT OF HOLDINGS | 232 | ||||||

Executive Officers and Directors | 232 | ||||||

Director Independence | 238 | ||||||

Involvement in Certain Proceedings | 238 | ||||||

Board Committees | 238 | ||||||

Executive Compensation | 238 | ||||||

Director Compensation | 238 | ||||||

Pro Forma Security Ownership of Certain Beneficial Owners | 239 | ||||||

Pro Forma Security Ownership of Management | 239 | ||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF | 242 | ||||||

Security Ownership of Certain Beneficial Owners | 242 | ||||||

Security Ownership of Management | 244 | ||||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 250 | ||||||

Relationships Between LEI and Liberty Media Following the Split-Off | 250 | ||||||

Relationships between DIRECTV and Liberty Media | 250 | ||||||

ADDITIONAL INFORMATION | 253 | ||||||

Legal Matters | 253 | ||||||

Experts | 253 | ||||||

Stockholder Proposals | 254 | ||||||

Where You Can Find More Information | 255 | ||||||

ANNEX A: | Description of Business | A-1 | |||||

ANNEX B: | Form of Amended and Restated Certificate of Incorporation of LEI | B-1 | |||||

ANNEX C: | LEI, LMC Entertainment and Liberty Media Financial Statements | ||||||

Liberty Entertainment, Inc. | C-3 | ||||||

Management's Discussion and Analysis of Financial Condition and Results of | C-3 | ||||||

Condensed Pro Forma Combined Financial Statements (unaudited) | C-16 | ||||||

LMC Entertainment | |||||||

Audited Financial Statements | C-35 | ||||||

ix

Liberty Media Corporation | ||||||

Condensed Pro Forma Combined Financial Statements (unaudited) | C-65 | |||||

Pro Forma Attributed Financial Information for Tracking Stock Groups | C-76 | |||||

ANNEX D: | Holdings and DIRECTV Financial Information | |||||

Holdings | ||||||

Proforma Condensed Combined Financial Statements | D-2 | |||||

DIRECTV | ||||||

Management's Discussion and Analysis of Financial Condition and Results of | D-11 | |||||

Historical Consolidated Financial Statements—Six months ended June 30, 2009 and 2008 | D-12 | |||||

Management's Discussion and Analysis of Financial Condition and Results of Operations—Years ended December 31, 2008, 2007 and 2006 | D-55 | |||||

Historical Consolidated Financial Statements—Years ended December 31, 2008, 2007 and 2006 | D-80 | |||||

ANNEX E: | Agreement and Plan of Merger, dated as of May 3, 2009, by and among Liberty | E-1 | ||||

ANNEX F: | Voting and Right of First Refusal Agreement, dated as of May 3, 2009, by and | F-1 | ||||

ANNEX G: | Form of Amended and Restated Certificate of Incorporation of Holdings | G-1 | ||||

ANNEX H: | Fairness Opinion of Goldman, Sachs & Co. dated as of May 3, 2009 | H-1 |

x

The questions and answers below highlight only selected information about the special meeting and how to vote your shares. You should read carefully the entire proxy statement/prospectus, including the Annexes and the additional documents incorporated by reference herein, to fully understand the proposals being considered at the special meeting.

- Q:

- When and where is the special meeting?

- A:

- The special meeting will be held at[ ] a.m., local time, on[ ], 2009 at the [ ], telephone[( ) - ].

- Q:

- What is the record date for the special meeting?

- A:

- The record date for the special meeting is 5:00 p.m., New York City time, on October 9, 2009.

- Q:

- What is the purpose of the special meeting?

- A:

- To consider and vote on each of the redemption proposal and the adjournment proposal and each of the transaction proposals.

- Q:

- What is the proposed Split-Off for which holders of Liberty Entertainment common stock are being asked to vote?

- A:

- In accordance with the terms of Liberty Media's charter, the Liberty Media board has determined, subject to receipt of stockholder approval at the special meeting and the satisfaction of certain other conditions, to redeem 90% of the outstanding shares of Liberty Entertainment common stock for all of the outstanding shares of common stock of LEI, a wholly owned subsidiary of Liberty Media which has been formed in contemplation of the Split-Off. At the time of the Split-Off, LEI would hold Liberty Media's 57% interest in DIRECTV, a 100% interest in Liberty Sports Holdings, LLC, a 65% interest in Game Show Network, LLC and approximately $50 million in cash and cash equivalents, together with approximately $2 billion of indebtedness. (The foregoing cash amount increased from the previously disclosed $30 million to $50 million as a result of recent exercises of LMDIA options, a portion of the aggregate exercise prices of which will be retained for the benefit of LEI pursuant to the Merger Agreement.) All of the businesses, assets and liabilities currently attributed to Liberty Media's Entertainment Group that are not held by LEI at the time of the Split-Off would remain with Liberty Media and continue to be attributed to the Entertainment Group. These assets consist primarily of a 100% interest in Starz Entertainment LLC and cash and cash equivalents. For more information, see "Summary—The Split-Off", "Special Factors" and "The Split-Off" below.

- Q:

- What is the proposed DTV Business Combination for which holders of Liberty Entertainment common stock are being asked to vote?

- A:

- LEI and Liberty Media have entered into the Merger Agreement with DIRECTV, Holdings and two transitory wholly owned merger subsidiaries of Holdings, pursuant to which, among other things, immediately following the Split-Off and subject to the satisfaction of certain conditions, LEI and DIRECTV would each merge with one of the transitory merger subsidiaries of Holdings and become wholly owned subsidiaries of Holdings. Upon completion of the merger to which LEI is a party (theLEI Merger) and the merger to which DIRECTV is a party (theDIRECTV Merger, and together with the LEI Merger, theMergers) in accordance with the Merger Agreement, Holdings will become an independent, publicly-traded company. In connection with the Merger Agreement, the Malones have entered into the Malone Agreement, pursuant to which, among other things, the Malones will receive shares of Holdings Class B common stock in exchange for their shares of LEI

1

Series B common stock (theMalone Contribution). All other holders of LEI Series A common stock and LEI Series B common stock will receive shares of Holdings Class A common stock in the Mergers. For more information, see "Summary—DTV Business Combination", "Special Factors" and "DTV Business Combination" below. The sole stockholder of LEI prior to the Split-Off voted in favor of the adoption of the Merger Agreement and the transactions contemplated thereby at a meeting of the sole stockholder of LEI.

You are also being asked to vote to authorize the adjournment of the special meeting by Liberty Media, to permit further solicitation of proxies, if necessary or appropriate, if sufficient votes are not represented at the special meeting to approve the transaction proposals in accordance with the Merger Agreement.

- Q:

- What will the holders of Liberty Entertainment common stock receive as a result of the Split-Off?

- A:

- If the Split-Off is effected on the redemption date, (i) 0.9 of each outstanding share of LMDIA will be redeemed for 0.9 of a share of LEI Series A common stock, and 0.1 of each share of LMDIA will remain outstanding as Liberty Entertainment common stock; and (ii) 0.9 of each outstanding share of LMDIB will be redeemed for 0.9 of a share of LEI Series B common stock, and 0.1 of each share of LMDIB will remain outstanding as Liberty Entertainment common stock, subject, in each case, to the payment of cash in lieu of any fractional shares. By way of example, a holder of 100 shares of LMDIA would receive 90 shares of LEI Series A common stock in redemption for 90 shares of LMDIA and would retain the remaining 10 shares of LMDIA, while a holder of 100 shares of LMDIB would receive 90 shares of LEI Series B common stock in redemption for 90 shares of LMDIB and would retain the remaining 10 shares of LMDIB.

There are a number of differences between the terms of the LEI common stock and the terms of the Liberty Entertainment common stock to be redeemed in exchange therefor, including those relating to the tracking stock nature of the Liberty Entertainment common stock, certain limited consent rights applicable to the LEI Series B common stock, certain enhanced supermajority voting rights of the stockholders, and the possibility that shares of LEI common stock may be treated as excess shares that are transferred to a trust for the benefit of a charity in order to prevent transfers which could cause potential adverse tax effects relating to the Split-Off. See "Description of Common Stock and Comparison of Stockholder Rights" for more information on these differences.

- Q:

- What will the holders of LEI common stock receive as a result of the DTV Business Combination?

If the DTV Business Combination is completed, (i) in accordance with the Malone Agreement, each outstanding share of LEI Series B common stock held by the Malones will be exchanged for 1.11111 shares of Class B common stock of Holdings; (ii) each outstanding share of LEI Series A common stock (other than those owned by LEI or Holdings) will be exchanged for 1.11111 shares of Class A common stock of Holdings; and (iii) each outstanding share of LEI Series B common stock (other than those owned by LEI or Holdings) will be exchanged for 1.11111 shares of Class A common stock of Holdings, in each case, subject to adjustment (theLEI Exchange Ratio) and the payment of cash in lieu of fractional shares. The LEI Exchange Ratio will be adjusted to reflect (i) changes in the number of outstanding shares of Liberty Entertainment common stock from March 1, 2009 through the completion of the Split-Off and the LEI Merger and (ii) certain grants of incentive awards during that period. See "DTV Business Combination—Effect of the LEI Merger; What LEI Stockholders Will Receive in the LEI Merger—LEI Exchange Ratio" below for more information, including an example calculation of the LEI Exchange Ratio.

2

Any shares of Holdings common stock received in exchange for LEI Excess Shares in the LEI Merger will be deemed Holdings excess shares and subject to the excess share provisions of the Holdings charter.

There are a number of differences between the terms of the LEI common stock and the terms of the Holdings common stock to be exchanged therefor in the LEI Merger, including the number of votes attributable to Holdings high-vote stock, certain limited consent rights applicable to the Holdings Class B common stock, certain class voting rights in favor of holders of Holdings Class A common stock, Holdings' redemption right with respect to certain shares of Holdings Class B common stock, the requirement that the holders of the Holdings Class B common stock receive per share consideration in any business combination that is not less than the per share consideration received by the holders of the Holdings Class A common stock, and the automatic conversion feature of the Holdings Class B common stock. See "Description of Common Stock and Comparison of Stockholder Rights" for more information on these differences.

Also, if the DTV Business Combination is completed, each outstanding share of DIRECTV common stock (other than those owned by DIRECTV or LEI) will be exchanged for one share of Class A common stock of Holdings.

- Q:

- Why are the Malones receiving shares of high-vote Holdings common stock?

- A:

- In order to induce the Malones to execute the Malone Agreement in which they agreed to vote their shares of LMDIA and LMDIB in favor of the Split-Off and against any transaction that competes with the DTV Business Combination and agreed to certain significant restrictions on their shares of Holdings common stock, DIRECTV agreed to create a dual class capital structure at Holdings, similar to the dual class capital structure at LEI. As a result, immediately prior to the Mergers, the Malones will exchange all of their shares of LEI Series B common stock, representing 92% of the outstanding shares of LEI Series B common stock, for shares of Holdings Class B common stock at the LEI Exchange Ratio. After the Malone Contribution, all of the remaining outstanding shares of LEI Series A and Series B common stock (other than those owned by LEI or Holdings) and DIRECTV common stock (other than those owned by DIRECTV or LEI) will be exchanged for shares of Holdings Class A common stock in the Mergers.

The Holdings Class B common stock carries 15 votes per share and provides for class consent rights with respect to (i) certain share distributions (including distributions of convertible securities of Holdings) of voting securities on Holdings Class C common stock and certain share distributions (including distributions of convertible securities of Holdings) pursuant to which the holders of Holdings Class B common stock would receive voting securities with lesser relative voting rights than those of the Holdings Class B common stock, (ii) certain charter amendments and certain recapitalizations and reclassifications pursuant to which the holders of Holdings Class C common stock would receive voting securities or the holders of Holdings Class B common stock would receive voting securities with lesser voting rights than those of the Holdings Class B common stock, and (iii) certain charter amendments, including amendments relating to the consent rights of the holders of the Holdings Class B common stock, the voting rights of the Holdings common stock, the terms for the automatic conversion of Holdings Class B common stock into Holdings Class A common stock, the terms of distributions or dividends (including share distributions), the requirement that the corporation reclassify the Holdings common stock on an equal per share basis, the exemption of the Malones and certain transferees from the terms of the provisions relating to excess shares, the terms requiring that the consideration received in certain corporate transactions by holders of Holdings Class B common stock to not be less than the consideration received by the holders of Holdings Class A common stock, Holdings' right to redeem the Holdings Class B common stock upon the death of Mr. Malone, and the terms for any liquidation,

3

dissolution or winding-up of Holdings, except that no consent of the Holdings Class B common stock will be required for Holdings to enter into certain transactions with non-affiliates of Holdings, regardless of whether such transactions would result in any amendment or change described in clauses (ii) or (iii) above. As the Malones will be the only holders of Holdings Class B common stock, these consent rights coupled with the approximately 24.2% aggregate voting power of Holdings common stock held by the Malones will provide them with significant influence over the business and affairs of Holdings.

- Q:

- Why are the Malones the only holders of LEI Series B common stock to receive shares of high-vote Holdings common stock in the DTV Business Combination?

- A:

- Mr. Malone, in his capacity as a stockholder and on behalf of the other Malones, was willing to enter into the Malone Agreement described above if he and the other Malones received high-vote stock in the DTV Business Combination. Although DIRECTV was willing to issue high-vote stock in the DTV Business Combination, it required that all recipients of Holdings high-vote stock in the LEI Merger be subject to significant restrictions on their shares similar to those to which the Malones agreed to be subject (other than the voting obligations), in order to assist in the preservation of the tax-free treatment of the transactions and to enable Holdings over time to reduce the number of outstanding Holdings Class B shares. These restrictions include a lock-up, which includes a prohibition against having substantial negotiations with a person regarding a sale or purchase of shares, for one year following the Split-Off and a right of first refusal in favor of Holdings thereafter. Liberty Media believed it would be inappropriate to subject the public holders of the LEI Series B shares to these restrictions, and the parties believed that, in any event, it would be impracticable to negotiate such restrictions with or enforce such restrictions on the public stockholders. Accordingly, it was decided that the Malones will be the only holders of LEI Series B shares to receive Holdings Class B shares in the DTV Business Combination.

- Q:

- Where will LEI common stock and Holdings common stock trade?

- A:

- Following the completion of the Transactions, Holdings expects to list its Class A common stock on the Nasdaq Global Select Market under DIRECTV's current symbol "DTV." The Class B common stock of Holdings will not be listed on any stock exchange or automated dealer quotation system. Since the DTV Business Combination will be completed, if at all, immediately following the Split-Off, LEI will be acquired by Holdings and the LEI common stock will be exchanged for Holdings common stock before ever trading in the public market. If, however, the Merger Agreement is terminated before the DTV Business Combination is completed, LEI expects to list its Series A common stock and Series B common stock on the Nasdaq Global Select Market under the existing symbols "LMDIA" and "LMDIB", respectively. Following the completion of the Split-Off and regardless of whether the Merger Agreement has been terminated, Liberty Media expects to redesignate LMDIA as Series A Liberty Starz common stock and LMDIB as Series B Liberty Starz common stock and to list these shares on the Nasdaq Global Select Market under the symbols "LSTZA" and "LSTZB", respectively.

- Q:

- What stockholder vote is required to approve each of the proposals?

- A:

- Each of the redemption proposal and the adjournment proposal requires the approval by holders of record, as of the record date, of a majority of the aggregate voting power of the shares of Liberty Entertainment common stock that are present (in person or by proxy) and entitled to vote at the special meeting, voting together as a single class. The approval of the redemption proposal is required by the terms of Liberty Media's charter. Each of the transaction proposals requires the approval by the holders of record, as of the record date, voting together as a separate class, of a majority of the aggregate voting power of the outstanding shares of Liberty Entertainment

4

common stock, excluding all shares of Liberty Entertainment common stock beneficially owned by Mr. Malone, certain affiliated persons of Mr. Malone or any director or officer of Liberty Media (all holders of Liberty Entertainment common stock other than such excluded persons, thedisinterested holders of Liberty Entertainment common stock). The approval of the transaction proposals is not required by either the terms of Liberty Media's charter or by Delaware law, but is a contractual obligation under the terms of the Merger Agreement and is intended by Liberty Media to have certain effects under Delaware law as described in the following two questions-and-answers and elsewhere in this proxy statement/prospectus. If any of the three transaction proposals is not approved, then the DTV Business Combination will not be completed. The receipt of the requisite approvals of each of the redemption proposal and each of the transaction proposals, as described above, are collectively referred to as theLiberty Stockholder Approval.

As of 5:00 p.m., New York City time, on October 9, 2009, therecord date for the special meeting, Liberty Media's directors and executive officers beneficially owned approximately [ ]% of the total voting power of the outstanding shares of Liberty Entertainment common stock. Liberty Media has been informed that all of its executive officers and directors (including Mr. Malone) beneficially owning shares of Liberty Entertainment common stock representing in the aggregate approximately 36.3% of the aggregate voting power of the outstanding shares of Liberty Entertainment common stock, as of August 31, 2009, will vote "FOR" each of the redemption proposal and the adjournment proposal. These persons are not entitled to vote on any of the transaction proposals.

- Q:

- Why is Liberty Media asking for only certain holders of Liberty Entertainment common stock to vote on the transaction proposals?

- A:

- The approval of the transaction proposals is not required by either the terms of Liberty Media's charter or by Delaware law. Liberty Media has decided, however, that it is appropriate to seek the approval of the transaction proposals, and has contractually agreed to seek the approval in the Merger Agreement, in order to ensure that the disinterested holders of Liberty Entertainment common stock have the power to determine whether the various transactions contemplated by the transaction proposals are acceptable to them. In addition, Liberty Media believes the ratification of the Transactions by the disinterested holders of Liberty Entertainment common stock will have certain substantive and procedural effects under Delaware law, as described below.

- Q:

- What is the effect of the approval of the transaction proposals by the disinterested holders of Liberty Entertainment common stock?

- A:

- Liberty Media believes that the approval of each of the transaction proposals by a majority of the voting power of the disinterested holders of Liberty Entertainment common stock should constitute ratification of the transactions contemplated by the transaction proposals. Ratification is an expression of approval by the stockholders of one or more matters for which their approval is not necessarily required as a matter of law. In general, ratification by stockholders may be effective to approve actions taken by a corporation and its board of directors, even if the actions are challenged by some of the stockholders, provided that such actions are not against public policy (such as actions involving waste, fraud, or similar egregious conduct). The Delaware case law relating to the legal effect of stockholder ratification and whether the doctrine of stockholder ratification will be applicable to the transaction proposals is not entirely clear. Recent Delaware case law suggests that the ability of stockholder ratification to extinguish claims may be available only in limited circumstances. That recent case law also suggests that the doctrine of stockholder ratification is not applicable if the stockholder vote approving the particular transaction is a vote required under Delaware law or a corporation's charter to authorize the transaction.

5

Because the approval of the transaction proposals by a majority of the voting power of the disinterested holders of Liberty Entertainment common stock is not so required, Liberty Media believes that the approval of the transaction proposals will have certain beneficial effects under Delaware law. If any holder of Liberty Media common stock commences litigation against Liberty Media or its directors challenging the fairness of these transactions to the holders of the Liberty Entertainment common stock or alleging any deficiency or breach of fiduciary duty in the process of developing the terms of these transactions or in the consideration or approval of these transactions by the Liberty Media board of directors, Liberty Media believes that approval of each of the transaction proposals (including the transactions contemplated thereby) by a majority of the voting power of the disinterested holders of Liberty Entertainment common stock would be evidence in any such litigation of the fairness of the transactions contemplated by the transaction proposals. In addition, Liberty Media believes that approval of each of the transaction proposals (including the transactions contemplated thereby) by a majority of the voting power of the disinterested holders of Liberty Entertainment common stock would also have additional substantive and procedural effects that could benefit Liberty Media and its directors in connection with the defense of any such stockholder litigation. Liberty Media believes that such approvals would be a factor under Delaware law in invoking a standard of judicial review or burden of proof that is more favorable to Liberty Media and its directors than the standard of judicial review or burden of proof that might otherwise apply in the absence of such approval. Even though the Delaware case law addressing the circumstances in which stockholder ratification may result in the extinguishment of breach of fiduciary duty claims is not entirely clear, Liberty Media also believes that a Delaware court could conclude that approval of the transaction proposals by a majority of the voting power of the disinterested holders of Liberty Entertainment common stock operates to extinguish some or all of the claims in any such litigation.

- Q:

- Why is Liberty Media seeking approval of the adjournment proposal?

- A:

- Unlike the redemption proposal, the vote on which is based on the aggregate voting power of the shares of Liberty Entertainment common stock present (in person or by proxy) and entitled to vote at the special meeting, the vote on the transaction proposals is based on the aggregate voting power of all outstanding shares of Liberty Entertainment common stock on the record date, exclusive of the shares beneficially owned by Mr. Malone, certain affiliated persons of Mr. Malone, and the other directors and officers of Liberty Media. To ensure that a sufficient number of shares are voted to be able to determine whether the transaction proposals are acceptable or unacceptable to the majority of the disinterested holders of Liberty Entertainment common stock, Liberty Media may need to adjourn the special meeting to solicit additional proxies. If the adjournment proposal is not approved by a majority of the aggregate voting power of the shares of Liberty Entertainment common stock present (in person or by proxy) and entitled to vote at the special meeting, Liberty Media may need to call a new stockholders meeting at which it may again seek stockholder approval of the DTV Business Combination, which could significantly delay Liberty Media's ability to complete the Split-Off and the DTV Business Combination.

- Q:

- How many votes do stockholders have?

- A:

- At the special meeting:

- •

- holders of LMDIA have one vote per share; and

- •

- holders of LMDIB have ten votes per share.

Only shares owned as of the record date are eligible to vote at the special meeting.

6

- Q:

- What if the redemption proposal is not approved?

- A:

- The Split-Off will not be completed, which means no shares of Liberty Entertainment common stock would be redeemed for shares of common stock of LEI and the DTV Business Combination would not be completed.

- Q:

- What if the transaction proposals are not approved?

- A:

- The DTV Business Combination will not be completed, which means the shares of LEI common stock will not be converted into shares of Holdings common stock. Liberty Media's board of directors determined not to complete the DTV Business Combination unless the transaction proposals receive the requisite stockholder approval in order to ensure that these transactions are acceptable to the disinterested, public holders of Liberty Entertainment common stock and because their ratification of the transactions would provide certain procedural and substantive protections in the event of litigation. See "What is the effect of the approval of the transaction proposals by the disinterested holders of Liberty Entertainment common stock?" above for a description of these protections. However, this will have no effect on the ability of the Liberty Media board to complete the Split-Off following the termination of the Merger Agreement.

- Q:

- What do stockholders need to do to vote on the proposals?

- A:

- After carefully reading and considering the information contained in this proxy statement/prospectus, you should complete, sign, date and return the enclosed proxy card by mail, or vote by telephone or through the Internet, in each case as soon as possible so that your shares are represented and voted at the special meeting. Instructions for voting by using the telephone or the Internet are printed on the proxy voting instructions attached to the proxy card. In order to vote via the Internet, have your proxy card available so you can input the required information from the card, and log on to the Internet website address shown on the proxy card. When you log on to the Internet website address, you will receive instructions on how to vote your shares. The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number, which will be provided to each voting stockholder separately.

Stockholders who have shares registered in the name of a broker, bank or other nominee should follow the voting instruction card provided by their broker, bank or other nominee in instructing them how to vote their shares. We recommend that you vote by proxy even if you plan to attend the special meeting. You may change your vote at the special meeting.

If a proxy is properly executed and submitted by a record holder without indicating any voting instructions, the shares of Liberty Entertainment common stock represented by the proxy will be voted "FOR" the approval of each of the proposals.

- Q:

- If shares are held in "street name" by a broker, bank or other nominee, will the broker, bank or other nominee vote those shares for the beneficial owner on the proposals?

- A:

- If you hold your shares in street name and do not provide voting instructions to your broker, bank or other nominee, your shares willnot be voted on any of the proposals. Accordingly, your broker, bank or other nominee will vote your shares held in "street name" on the proposals only if you provide instructions on how to vote. If a broker, who is a record holder of shares, indicates on a form of proxy that the broker does not have discretionary authority to vote those shares on any proposal, or if those shares are voted in circumstances in which proxy authority is defective or has been withheld with respect to any proposal, these shares are considered "broker non-votes" with respect to such proposal.

7

Broker non-votes are counted as present and entitled to vote for purposes of determining a quorum but will have no effect (if a quorum is present) on the redemption proposal or the adjournment proposal. They will, however, count as a vote "AGAINST" each of the transaction proposals. You should follow the directions your broker, bank or other nominee provides to you regarding how to vote your shares of common stock and how to revoke prior voting instructions.

- Q:

- What if I do not vote on the proposals?

- A:

- If you fail to respond with a vote, your shares will not be counted as present and entitled to vote for purposes of determining a quorum, but your failure to vote will have no effect on determining whether the redemption proposal or the adjournment proposal is approved (if a quorum is present). If you fail to respond with a vote, your shares will count as a vote "AGAINST" each of the transaction proposals. If you respond but do not indicate how you want to vote, your proxy will be counted as a vote "FOR" each of the proposals.

- Q:

- What if I respond and indicate that I am abstaining from voting?

- A:

- If you respond and indicate that you are abstaining from voting, your proxy will have the same effect as a vote "AGAINST" each of the redemption proposal and the adjournment proposal and each of the transaction proposals.

- Q:

- May stockholders change their vote after returning a proxy card or voting by telephone or over the Internet?

- A:

- Yes. Before the start of the special meeting, stockholders who want to change their vote on any proposal may do so by telephone or over the Internet (if they originally voted by telephone or over the Internet), by voting in person at the special meeting or by delivering a signed proxy revocation or a new signed proxy with a later date to Liberty Media Corporation, c/o Computershare Trust Company, N.A., P.O. Box 43102, Providence, Rhode Island 02940.

Any signed proxy revocation or new signed proxy must be received before the start of the special meeting. Your attendance at the special meeting will not, by itself, revoke your proxy. If your shares are held in an account by a broker, bank or other nominee who you previously contacted with voting instructions, you should contact your broker, bank or other nominee to change your vote.

- Q:

- What do I do if I have additional questions?

- A:

- If you have any questions prior to the special meeting or if you would like copies of any document referred to or incorporated by reference in this document, please call Investor Relations at (720) 875-5408.

8

The following summary includes information contained elsewhere in this proxy statement/prospectus. This summary does not contain all of the important information that you should consider before voting on the proposals. You should read the entire proxy statement/prospectus, including the Annexes and the documents incorporated by reference herein, carefully.

Liberty Media owns interests in a broad range of electronic retailing, media communications and entertainment businesses. Those interests are attributed to three tracking stock groups: (1) the Liberty Interactive Group, which includes Liberty Media's interests in QVC, Inc., Provide Commerce, Inc., Backcountry.com, Inc., BuySeasons, Inc., Bodybuilding.com, LLC, IAC/InterActiveCorp (IAC), Expedia, Inc., HSN, Inc., Interval Leisure Group, Inc., Ticketmaster and Tree.com, Inc., (2) the Liberty Entertainment Group, which includes Liberty Media's interests in DIRECTV, Starz Entertainment, LLC, Game Show Network, LLC (GSN) (and its subsidiary FUN Technologies ULC (FUN)), WildBlue Communications, Inc. (WildBlue), Liberty Sports Holdings LLC (Liberty Sports), FUN's sports related businesses (FUN Sports) and PicksPal, Inc., and (3) the Liberty Capital Group, which includes all businesses, assets and liabilities not attributed to the Liberty Interactive Group or the Liberty Entertainment Group including subsidiaries Starz Media, LLC, Atlanta National League Baseball Club, Inc. and TruePosition, Inc., and minority equity investments in Time Warner Inc. and Sprint Nextel Corporation.

Liberty Media has three tracking stocks: the Liberty Entertainment common stock, the Liberty Capital common stock and the Liberty Interactive common stock, which track the Entertainment Group, the Capital Group and the Interactive Group, respectively. A tracking stock is a type of common stock that is designed to reflect or "track" the economic performance of a particular business or "group," rather than the economic performance of the company as a whole. Each group has a separate collection of businesses, assets and liabilities attributed to it, but no group is a separate legal entity and, therefore, no group can own assets, issue securities or enter into legally binding agreements. The tracking stocks of Liberty Media trade on the Nasdaq Global Select Market as follows: Series A Liberty Interactive common stock under the ticker symbol "LINTA", Series B Liberty Interactive common stock under the ticker symbol "LINTB", Series A Liberty Entertainment common stock under the ticker symbol "LMDIA", Series B Liberty Entertainment common stock under the ticker symbol "LMDIB", Series A Liberty Capital common stock under the ticker symbol "LCAPA" and Series B Liberty Capital common stock under the ticker symbol "LCAPB".

Liberty Media's principal executive offices are located at 12300 Liberty Boulevard, Englewood, Colorado 80112, its main telephone number is (720) 875-5400 and its website is located atwww.libertymedia.com.

LEI is a wholly owned subsidiary of Liberty Media formed for the purpose of effecting the Split-Off. LEI has not conducted any activities other than those incident to its formation, the preparation of applicable filings under the federal securities and communications laws and its participation in the DTV Business Combination. For information regarding the business and assets of LEI following the Split-Off, please seeAnnex A of this proxy statement/prospectus.

Following the completion of the Transactions, LEI will be a wholly-owned subsidiary of Holdings, and the LEI common stock will have been exchanged for Holdings common stock before ever trading in the public market. If the Merger Agreement is terminated so that the DTV Business Combination is not completed, LEI will become an independent, publicly-traded company upon completion of the

9

Split-Off and will share its principal executive offices with Liberty Media at 12300 Liberty Boulevard, Englewood, Colorado 80112, and its main telephone number will be (720) 875-5400.

DIRECTV is a leading provider of digital television entertainment in the United States and Latin America. Its two business segments, DIRECTV U.S. and DIRECTV Latin America, which are differentiated by their geographic location, are engaged in acquiring, promoting, selling and/or distributing digital entertainment programming via satellite to residential and commercial subscribers.

- •

- DIRECTV U.S. DIRECTV Holdings LLC and its subsidiaries (DIRECTV U.S.), is the largest provider of direct-to-home (DTH), digital television services and the second largest provider in the multi-channel video programming distribution (MVPD) industry in the United States. As of June 30, 2009, DIRECTV U.S. had over 18.3 million subscribers.

- •

- DIRECTV Latin America. DIRECTV Latin America (DTVLA) is a leading provider of DTH digital television services throughout Latin America. DTVLA is comprised of: PanAmericana, which provides services in Venezuela, Argentina, Chile, Colombia, and certain other countries in the region through DIRECTV's wholly owned subsidiary, DIRECTV Latin America, LLC; DIRECTV's 74% owned subsidiary, Sky Brasil Servicos Ltda. (Sky Brazil); and DIRECTV's 41% equity method investment in Innova, S. de R.L. de C.V. (Sky Mexico). The stock of the former DTVLA subsidiary providing such services to Puerto Rico has been placed in a trust to comply with certain conditions of the Federal Communications Commission (FCC) as described below. As of June 30, 2009, PanAmericana had approximately 2.4 million subscribers, Sky Brazil had approximately 1.7 million subscribers and Sky Mexico had approximately 1.8 million subscribers.

DIRECTV's principal executive offices are located at 2230 East Imperial Highway, El Segundo, California 90245, its main telephone number is (310) 964-5000 and its website is located atwww.directv.com.

Holdings is a newly-formed Delaware corporation that is currently a wholly owned subsidiary of DIRECTV, but, upon completion of the Mergers, will become a publicly-traded holding company named "DIRECTV" that will own all the outstanding equity interests in DIRECTV and LEI. Holdings was formed solely in contemplation of the Mergers, has not commenced any operations, has only nominal assets and has no liabilities or contingent liabilities, nor any outstanding commitments other than pursuant to the Merger Agreement and related agreements. The Class A common stock of Holdings is expected to be listed on the Nasdaq Global Select Market under DIRECTV's current ticker symbol, "DTV." The Class B common stock of Holdings will not be listed on any stock exchange. For information regarding the business of Holdings following the Mergers, please seeAnnex A of this proxy statement/prospectus.

Upon completion of the Mergers, Holdings will become an independent, publicly-traded company and will have its principal executive offices at 2230 East Imperial Highway, El Segundo, California 90245, its main telephone number will be (310) 964-5000 and its website will be located atwww.directv.com.

DTVG One, Inc. which we refer to asMerger Sub One, is a wholly owned subsidiary of Holdings formed solely to effect the DIRECTV Merger, and has not conducted and will not conduct any business during any period of its existence. Pursuant to the Merger Agreement, Merger Sub One will

10

merge with and into DIRECTV, with DIRECTV continuing as the surviving corporation and a wholly owned subsidiary of Holdings.

DTVG Two, Inc. which we refer to asMerger Sub Two, is a wholly owned subsidiary of Holdings formed solely to effect the LEI Merger, and has not conducted and will not conduct any business during any period of its existence. Pursuant to the Merger Agreement, Merger Sub Two will merge with and into LEI, with LEI continuing as the surviving corporation and a wholly owned subsidiary of Holdings.

Chase Carey, the former President and Chief Executive Officer of DIRECTV, resigned effective July 1, 2009, and became Deputy Chairman and Chief Operating Officer of News Corporation. The DIRECTV board has accepted his resignation and has formed a committee of directors tasked with searching for a new President and Chief Executive Officer. In the interim, Larry Hunter is serving as Chief Executive Officer in addition to his current responsibilities as Executive Vice President of Legal, Human Resources, and Administration. The DIRECTV board has amended the DIRECTV bylaws to ensure that the immediate successor to Mr. Carey will require the approval of at least 80% of the directors then serving on the DIRECTV board, with any fractional number being rounded up to the next whole number. A similar requirement will apply to the Holdings board if Mr. Carey's successor is appointed after the Mergers.

On July 29, 2009, the parties executed Amendment No. 1 to the Merger Agreement, which eliminated the July 31st deadline to receive the tax ruling from the IRS (which, if not received by July 31, 2009, would have provided Liberty Media with a termination right absent a waiver of the closing condition or the taking of certain other actions by DIRECTV) and instead provides that LEI has the right to terminate the Merger Agreement after the second business day following Liberty Media's notice to DIRECTV of receipt of the tax ruling relating to the qualifications of the Split-Off as a tax-free transaction under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code unless DIRECTV either notifies LEI that certain tax matters in the ruling are reasonably acceptable to it or, alternatively, waives the related tax closing condition or delivers a certificate acknowledging receipt of a tax opinion in lieu of the requested rulings as well as a modification of the related closing condition. Amendment No. 1 to the Merger Agreement also provides for the granting to Liberty Media of, among other things, certain governance rights, including a supermajority voting requirement at the board level to both approve the new Chief Executive Officer and to expand the board beyond 12 members.

The parties also executed Amendment No. 1 to the Malone Agreement on July 29, 2009, which corrects typographical errors and contains conforming changes based on the final provisions of the Holdings charter.

October 2009 Amendments to Transaction Documents; Proposed Settlement of Legal Proceedings Regarding the DTV Business Combination

On October 2, 2009, the parties executed Amendment No. 2 to the Merger Agreement, which, among other things, amended the Merger Agreement (i) to provide that the Split-Off may not be completed prior to (x) the satisfaction of the conditions to the Mergers (other than those which can only be satisfied at closing) or (y) the termination of the Merger Agreement, (ii) to change the date upon which either party may terminate the Merger Agreement to December 29, 2009 (subject to

11

certain exceptions), and (iii) to memorialize certain of the terms of the agreement in principle reached with the plaintiffs in the DIRECTV stockholder litigation described below.

DIRECTV and Liberty Media have reached an agreement in principle relating to a potential settlement with the plaintiffs in the multiple purported class action complaints pending against DIRECTV, Liberty Media and the DIRECTV board of directors in the Delaware Court of Chancery that were brought on behalf of the public stockholders of DIRECTV alleging, among other things, that the members of the DIRECTV board of directors breached their fiduciary duties in approving the Merger Agreement. However, the settlement is subject to the execution of a stipulation of settlement and the approval of the Delaware Chancery Court.

The terms of the agreement in principle include certain changes to the terms of the Mergers and the transaction agreements as follows:

- •

- the Merger Agreement will be amended to add a provision to the Holdings charter to the effect that any future merger, consolidation or sale of all or substantially all of the assets which requires stockholder approval but provides for payment of per share consideration to be made to the holders of Holdings Class B common stock that is different in form or amount from the per share consideration to be paid to holders of Holdings Class A common stock will require a separate vote of holders of Holdings Class A common stock, voting as a separate class;

- •

- the Merger Agreement will be amended to eliminate certain provisions in the Holdings charter that were intended to exculpate the directors and officers of Holdings who also serve as directors or officers of other entities for any potential breach of fiduciary duty arising out of the allocation of business opportunities not presented to such persons in their capacity as directors or officers of Holdings;

- •

- the Malones' ability to seek control of Holdings through future purchases of Holdings common stock will be restricted by their agreement to a 3-year standstill (theMalone Standstill) commencing upon the completion of the Mergers. The agreement in principle provides that the Malones may, however, acquire shares of Holdings Class A common stock: (i) pursuant to the Merger Agreement, (ii) from another Malone, (iii) pursuant to the grant, exercise or vesting of any equity incentive awards, (iv) as a result of any stock dividend, stock split or other distribution so long as such dividend or distribution is made on a pro rata basis to all holders of Holdings common stock, (v) pursuant to the exercise of any rights, warrants or other securities issued or distributed to all holders of Holdings common stock on a pro rata basis, (vi) received in exchange for shares of Holdings Class B common stock so long as the aggregate voting power of the Malones (as a group) does not increase as a result of such exchange, (vii) upon the redemption of Holdings Class B common stock following the death of Mr. Malone in accordance with the provisions of the Holdings charter and (viii) commencing on the first anniversary of the effective time of the Split-Off, in an amount not to exceed 1% of the fully diluted shares outstanding immediately following the effective time of the Mergers; provided that the Malones will not acquire more than 50% of the number of shares permitted to be acquired pursuant to this clause (viii) prior to the second anniversary of the effective time of the Split-Off and provided further that shares acquired by any Malone pursuant to clauses (i) through (vii) above will not be counted against acquisitions permitted pursuant to this clause (viii). The Malone Standstill cannot be modified without either (i) the approval of the board of directors of Holdings (including the unanimous approval of the Qualifying Directors (as defined in the sixth bullet below) then serving on the board of directors of Holdings) or (ii) the approval of the holders of a majority of the outstanding Holdings Class A common stock (other than shares held by the Malones);

- •

- that the Merger Agreement and the disclosure thereof in the registration statement on Form S-4 of Holdings, of which the DIRECTV proxy statement forms a part, will be amended to reflect

12

- •

- that the Merger Agreement will be amended to reflect that the Holdings charter will provide holders of 10% or more of the outstanding shares of Holdings Class A common stock with the right to call a special meeting;

- •