UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

OCZ TECHNOLOGY GROUP, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

August 18, 2011

Dear Stockholder:

You are cordially invited to attend this year’s annual meeting of stockholders on Tuesday, September 27, 2011 at 9:00 a.m., local time. The meeting will be held at OCZ’s principal executive offices located at 6373 San Ignacio Avenue, San Jose, CA 95119. The meeting will commence with a discussion and voting on the matters set forth in the accompanying Notice of Annual Meeting of Stockholders followed by presentations and a report on our operations.

The Notice of Annual Meeting of Stockholders and the Proxy Statement, which more fully describe the formal business to be conducted at the meeting, follow this letter. A copy of our Annual Report to Stockholders is also enclosed for your information.

Whether or not you plan to attend the meeting, your vote is very important and we encourage you to vote promptly. After reading the proxy statement, please promptly mark, sign and date the enclosed proxy card and return it in the prepaid envelope provided. Alternatively, you may vote your shares via a toll-free telephone number or over the Internet. Instructions regarding all three methods of voting are provided on the proxy card. If you attend the meeting you will, of course, have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

We look forward to seeing you at the annual meeting.

Sincerely yours,

Ryan M. Petersen

President and Chief Executive Officer

Notice Of 2011 Annual Meeting Of Stockholders

To Be Held September 27, 2011

The 2011 annual meeting of stockholders of OCZ Technology Group, Inc., a Delaware corporation, will be held on Tuesday, September 27, 2011 at 9:00 a.m., local time, at OCZ’s principal executive offices located at 6373 San Ignacio Avenue, San Jose, CA 95119, for the following purposes:

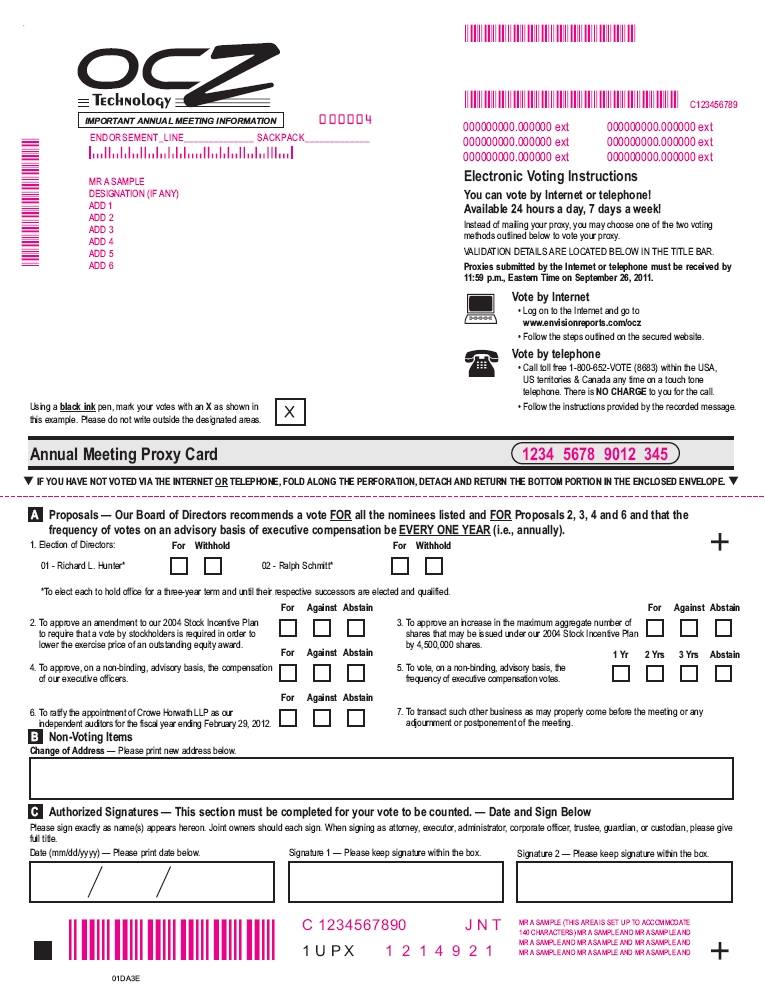

1. To elect Richard L. Hunter and Ralph Schmitt as Class II directors, each to hold office for a three-year term and until their respective successors are elected and qualified.

2. To approve an amendment to our 2004 Stock Incentive Plan to require that a vote by stockholders is required in order to lower the exercise price of an outstanding equity award.

3. To approve an increase in the maximum aggregate number of shares that may be issued under our 2004 Stock Incentive Plan by 4,500,000 shares.

4. To approve, on a non-binding, advisory basis, the compensation of our executive officers.

5. To vote, on a non-binding, advisory basis, on the frequency of future advisory votes on executive compensation.

6. To ratify the appointment of Crowe Horwath LLP as our independent auditors for the fiscal year ending February 29, 2012.

7. To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Our Board of Directors (the “Board”) recommends a vote FOR Items 1, 2, 3, 4 and 6 and that the frequency of votes on an advisory basis of executive compensation be EVERY ONE YEAR (i.e., annually). Stockholders of record at the close of business on August 9, 2011 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 6373 San Ignacio Avenue, San Jose, CA 95119.

| By order of the Board of Directors, |

| |

| Arthur F. Knapp, Jr. |

| Corporate Secretary |

August 18, 2011

IMPORTANT: Please vote your shares via telephone or the Internet, as described in the accompanying materials, to assure that your shares are represented at the meeting, or, if you received a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 27, 2011: Financial and other information concerning OCZ Technology Group, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended February 28, 2011. A complete set of proxy materials relating to our annual meeting is available on the Internet. These materials, consisting of the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report to Stockholders, may be viewed at http://www.edocumentview.com/OCZ. |

OCZ TECHNOLOGY GROUP, INC.

6373 SAN IGNACIO AVENUE

SAN JOSE, CA 95119

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

We are providing these proxy materials to you in connection with the solicitation by the Board of Directors of OCZ Technology Group, Inc., a Delaware corporation, of proxies to be used at our annual meeting of stockholders to be held on September 27, 2011 (the “2011 Annual Meeting”) or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and related materials are first being mailed to stockholders on or about August 18, 2011. References in this Proxy Statement to the “Company,” “we,” “our,” “us” and “OCZ” are to OCZ Technology Group, Inc. and to the “annual meeting” are to the 2011 Annual Meeting. When we refer to the Company’s fiscal year, we mean the annual period ending on February 28, 2011. This Proxy Statement covers our fiscal year 2011, which was from March 1, 2010 through February 28, 2011.

SOLICITATION AND VOTING

Record Date

The Board has fixed the close of business on August 9, 2011 as the record date for determination of stockholders entitled to notice of and to vote at the meeting and any adjournment thereof. As of the record date, we had 51,724,945 shares of common stock outstanding and entitled to vote, held by approximately 97 stockholders of record.

Quorum

A majority of the shares of common stock issued and outstanding as of the record date must be represented, either in person or by proxy, to constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for the limited purposes of determining the presence of a quorum.

Vote Required

Proposal 1: Elect two directors from the named director nominees.

The two director nominees receiving the highest number of “FOR” votes will be elected as directors. This number is called a plurality. Failing to vote or voting your proxy to withhold authority for all or some of the director nominees will have no effect on the election of directors. Broker non-votes will also have no effect on this proposal.

Proposal 2: Approve an amendment to our 2004 Stock Incentive Plan to require a stockholder vote to lower the exercise price of outstanding equity awards.

This proposal will be approved if the votes cast “FOR” the proposal exceed the votes cast “AGAINST” the proposal at the meeting. If you submit a properly executed proxy card or use the Internet or telephone to indicate “ABSTAIN” with respect to this proposal, your vote will not be counted as cast. Similarly, a broker non-vote on this proposal will not be count as a vote cast. Accordingly, abstentions are broker non-votes will have no legal effect on whether this matter is approved.

Proposal 3: Approve an increase in the number of shares available under our 2004 Stock Incentive Plan.

This proposal will be approved if the votes cast “FOR” the proposal exceed the votes cast “AGAINST” the proposal at the meeting. If you submit a properly executed proxy card or use the Internet or telephone to indicate “ABSTAIN” with respect to this proposal, your vote will not be counted as cast. Similarly, a broker non-vote on this proposal will not be count as a vote cast. Accordingly, abstentions are broker non-votes will have no legal effect on whether this matter is approved.

Proposal 4: To approve on an advisory basis our executive compensation.

If the votes cast “FOR” the proposal exceed the votes cast “AGAINST” the proposal at the meeting, stockholders will have approved our executive compensation on a non-binding basis. If you submit a properly executed proxy card or use the Internet or telephone to indicate “ABSTAIN” with respect to this proposal, your vote will not be counted as cast. Similarly, a broker non-vote with respect to this proposal will not be count as a vote cast. Accordingly, abstentions are broker non-votes will have no legal effect on whether this matter is approved.

Proposal 5: To hold an advisory vote on the frequency of future advisory votes on executive compensation.

The frequency of future advisory votes on executive compensation of the Named Executive Officers receiving the greatest number of votes—every one, two or three years—will be the frequency that stockholders approve on a non-binding basis.

Proposal 6: Ratify the appointment of Crowe Horwath LLP as our independent auditor firm for fiscal 2012.

Stockholder approval for the appointment of our independent auditor is not required, but the Board is submitting the selection of Crowe Horwath LLP for ratification in order to obtain the views of our stockholders. This proposal will be approved if the votes cast “FOR” the proposal exceed the votes cast “AGAINST” the proposal at the meeting, including those voted by proxy card, Internet and telephone. If you submit a properly executed proxy card or use the Internet or telephone to indicate “ABSTAIN” on this proposal, your vote will not be counted as cast. Accordingly, abstentions will have no effect on whether this matter is approved. Broker non-votes will also have no effect on this proposal. If the appointment of Crowe Horwath is not ratified, the Audit Committee will reconsider its selection.

How will voting on “any other business” be conducted?

We have not received proper notice of, and are not aware of, any business to be transacted at the annual meeting other than the proposals described in this Proxy Statement. If any other business is properly presented at the 2011 Annual Meeting, the proxies received will be voted on such matter in accordance with the discretion of the proxy holders.

Voting of Proxies

Holders of shares of common stock are entitled to cast one vote per share on all matters submitted to a vote of stockholders. All shares of common stock represented by properly executed proxies received before or at the meeting will, unless the proxies are revoked, be voted in accordance with the instructions indicated on the proxies. If no instructions are indicated on a properly executed proxy card, the shares will be voted as the Board recommends on each proposal.

Stockholders whose shares are registered in their own names may vote (1) by returning a proxy card, (2) via the Internet or (3) by telephone. Specific instructions to be followed by any registered stockholder interested in voting via the Internet or by telephone are set forth in the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow the stockholders to vote his or her shares and confirm that his or her voting instructions have been properly recorded. If you do not wish to vote via the Internet or telephone, please complete, sign and return the proxy card in the self-addressed, postage paid envelope provided.

Many banks and brokerage firms have a process for their beneficial owners to provide instructions over the telephone or via the Internet. The voting form you receive from your broker or bank will contain instructions for voting.

If your shares are held in an account at a brokerage firm or bank is considered the stockholder of record for purposes of voting at the meeting. If you received a proxy card, those shares held in street name were not included in the total number of shares listed as owned by you on the proxy card. As a beneficial owner, you have the right to direct your bank or broker on how to vote the shares held in your account. You should follow the voting instructions provided by your bank or broker. Please note that if your shares are held of record by a broker, bank or nominee and you wish to vote at the meeting, you will not be permitted to vote in person unless you first obtain a proxy issued in your name from the record holder.

A “broker non-vote” generally occurs when you fail to provide your broker with voting instructions the broker does not have the discretionary authority to vote your shares on a particular proposal because the proposal is not a routine matter under the rules of the New York Stock Exchange applicable to its member brokers. Those rules apply even though our common stock is listed on NASDAQ. Broker non-votes are not counted as votes cast on a proposal, but the shares represented at the meeting by an executed proxy to which such non-votes relate are counted as present for the limited purpose of determining a quorum at the annual meeting. The proposal to ratify the appointment of Crowe Horwath LLP as our independent auditors is considered a routine matter under current applicable rules. The election of directors, the proposal to approve an amendment to our 2004 Stock Incentive Plan to require a vote by stockholders in order to lower the exercise price of outstanding equity awards, the proposal to approve an increase in the number of shares under our 2004 Stock Incentive Plan, the vote on executive compensation, and the advisory vote on the frequency of future advisory votes on executive compensation are not considered to be routine matters.

Votes submitted by telephone or via the Internet must be received by 11:59 p.m., Eastern Time, on September 26, 2011. Submitting your proxy by telephone or via the Internet will not affect your right to vote in person should you decide to attend the 2011 Annual Meeting.

A stockholder who delivers an executed proxy has the power to revoke his or her proxy at any time before it is exercised by (i) executing and delivering to the Corporate Secretary of OCZ, at 6373 San Ignacio Avenue, San Jose, CA 95119, a written instrument revoking the proxy or a duly executed proxy with a later date, or (ii) by attending the 2011 Annual Meeting and voting in person. Attendance at the meeting will not in and of itself constitute revocation of a proxy. Please note, however, that if a stockholder’s shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the annual meeting, the stockholder must bring to the 2011 Annual Meeting a letter from the broker, bank or other nominee confirming such stockholder’s beneficial ownership of the shares.

Solicitation of Proxies

We will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented by telephone, telegram and other electronic means, advertisements and personal solicitation by our officers, directors and employees. No additional compensation will be paid to officers, directors or employees for such solicitation.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified Board consisting of two Class I directors, two Class II directors and one Class III director. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates.

The terms of the respective Class II directors will expire on the date of the upcoming annual meeting. Accordingly, two individuals will be elected to serve as Class II directors of the Board at the 2011 Annual Meeting. Management’s nominees for election by the stockholders to these positions are the current Class II members of the Board, namely, Richard L. Hunter and Ralph Schmitt. If elected, each nominee will serve as a director until our annual meeting of stockholders in 2014 and until their respective successors are elected and qualified. If any of the nominees decline to serve or become unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate. The proxies cannot vote for more than two persons.

If a quorum is present, the two nominees for Class II directors receiving the highest number of votes will be elected as Class II directors. Abstentions will have no effect on the vote.

THE BOARD RECOMMENDS A VOTE “FOR” THE NOMINEES NAMED ABOVE.

Directors

The following table sets forth as of August 1, 2011 information regarding our directors, including the nominees for Class II directors to be elected at this meeting.

| NAME | | POSITION(S) WITH OCZ | | AGE | | DIRECTOR SINCE |

| | | | | | | |

| Class I Directors Whose Terms Expire at the 2013 Annual Meeting of Stockholders: |

| |

| Ryan M. Petersen | | President, Chief Executive Officer and Director | | 36 | | 2002 |

Adam J. Epstein(1) | | Director | | 45 | | 2010 |

| |

| |

| Class II Directors Nominated for Election at the 2011 Annual Meeting of Stockholders: |

| |

Richard L. Hunter(2) | | Director | | 58 | | 2010 |

| | | | | | | |

Ralph Schmitt (3) | | Director | | 50 | | 2011 |

| | | | | | | |

| Class III Directors Whose Terms Expire at the 2012 Annual Meeting of Stockholders: |

| |

Russell J. Knittel(4) | | Director | | 61 | | 2010 |

| | (1) | Member of Audit and Compensation Committees; Chairman of Nominating and Governance Committee. |

| | (2) | Member of Audit and Nominating and Governance Committees; Chairman of Compensation Committee. |

| | (3) | Member of Audit, Nominating and Governance, and Compensation Committees. |

| | (4) | Member of Compensation and Nominating and Governance Committees; Chairman of Audit Committee. |

Ryan M. Petersen has served as Chief Executive Officer and a member of our Board since founding OCZ in 2002. Mr. Petersen is the inventor or co-inventor of much of our proprietary technology. Just as OCZ’s corporate evolution from cottage memory overclocking to enterprise class solid state drives has been atypical, Mr. Petersen’s path from an aspiring musician and youthful indiscretions to a storage technology pioneer has been similarly unique. He started as an employee at Micron Technology, Inc., and thereafter became an entrepreneur and self-taught innovator in the field of semiconductor enhancement. Mr. Petersen is an active member of JEDEC, the technical standards body. Our Board has concluded that Mr. Petersen should serve as a director based on his experience and insight as one of our founders and as our Chief Executive Officer.

Mr. Epstein is the founding principal of Third Creek Advisors, LLC (“TCA”), a special advisor to small-cap boards and investment funds with respect to corporate finance and capital markets. Prior to founding TCA in 2010, from 2003 through 2009, Mr. Epstein was co-founder and a principal at Enable Capital Management, LLC, an investment firm that provides growth financing to publicly-traded companies. Mr. Epstein previously held managerial roles with Enable Capital, LLC, Surge Components, Inc., MailEncrypt, Inc., Tickets.com, Inc., and Achilles’ Wheels, Inc. Mr. Epstein started his career as an attorney at the law firm of Brobeck, Phleger & Harrison. Mr. Epstein served as the Chief Executive Officer of Superus Holdings, Inc., a private company formed for the purpose of merging other entities therein (“Superus”). The contemplated mergers were never effectuated, and Superus filed for bankruptcy within 12 months after Mr. Epstein resigned as the Chief Executive Officer. He received a bachelor’s degree, cum laude, from Vassar College, and a J.D. from Boston University.

Richard L. Hunter has been a partner with Daylight Partners, a venture capital firm since 2008. From 1998 to 2008, Mr. Hunter was with Dell, Inc., a computer manufacturer and services company, where he most recently served as Vice President of Consumer Technical Support and Customer Service and was responsible for managing over 14,000 customer service agents. For seven years, Mr. Hunter led Dell’s Americas manufacturing operations. Mr. Hunter previously served in managerial roles with Matco Electronics, Texas Instruments, Incorporated, Ericcson/General Electric, Ryan Homes, Exide Electronics and General Electric Company. Mr. Hunter also serves on the board of four private companies and is an advisor to two additional private company boards. Mr. Hunter received a bachelor’s degree in mechanical engineering from Georgia Tech.

Russell J. Knittel has served as Interim President and Chief Executive Officer of Synaptics Incorporated since October 2010, as Executive Vice President from July 2007 to October 2010, and Chief Financial Officer, Secretary and Treasurer from November 2001 until September 2009. Mr. Knittel also served as Senior Vice President of Synaptics from November 2001 until July 2007 and as the Vice President of Administration and Finance, Chief Financial Officer, and Secretary from April 2000 through October 2001. Synaptics, based in Santa Clara, California, is a leading worldwide developer and supplier of custom designed human interface solutions that enable people to interact more easily and intuitively with a wide range of mobile computing, communications, entertainment, and other electronic devices. Mr. Knittel serves on the board of Synaptics Incorporated and MarineMax, Inc., both publicly traded companies. Mr. Knittel also serves on the board of Litepoint Corporation, a privately held company. Mr. Knittel holds a Bachelor of Arts degree in accounting from California State University and an MBA from San Jose State University.

Ralph Schmitt has served as president and CEO of PLX Technology, Inc., a global provider of semiconductor-based connectivity solutions primarily targeting the enterprise and consumer markets since 2008. He has also chaired the GSA Emerging Company Council since 2010. During 2008, he consulted with a variety of venture capitalists, and acted as CEO of Legend Silicon, a privately funded Chinese terrestrial digital TV semiconductor company. From 2005 through 2007, Mr. Schmitt was CEO of Sipex, an analog semiconductor company that merged with Exar in 2007, where he was appointed CEO. From 1999 to 2005, Mr. Schmitt was executive vice president of Sales, Marketing, and Business Development for Cypress Semiconductor where he led sales growth to more than $1 billion while also overseeing the acquisition and integration of numerous companies. Mr. Schmitt has served on the boards at Cypress subsidiaries and other privately held semiconductor and systems companies. Mr. Schmitt holds a BSEE from Rutgers University.

Executive Officers

Set forth below are the names, ages, tenure with us, and positions of those persons who are our executive officers.

| Name | | Age | | Position(s) | | Officer Since |

| Ryan M. Petersen | | 36 | | Chief Executive Officer and Director | | 2002 |

| Arthur F. Knapp, Jr. | | 62 | | Chief Financial Officer | | 2010 |

| Alex Mei | | 36 | | Executive Vice President, Chief Marketing Officer | | 2004 |

| Richard Singh | | 50 | | Chief Sales Officer | | 2010 |

Mr. Petersen’s information is set forth above.

Arthur F. Knapp, Jr. has served as Chief Financial Officer since December 2010. He also served as our Chief Financial Officer from November 2005 to March 2009, served as our Vice President of Finance from March 2009 to October 2010 and served as our Interim Chief Financial Officer from October 2010 to December 2010. Mr. Knapp previously served as Chief Financial Officer at publicly-held high-tech companies such as Duquesne Systems, Inc., LEGENT Corporation, Boole & Babbage Inc., and Calico Commerce, Inc. Mr. Knapp also spent 10 years in public accounting, and is a CPA/CMA. Mr. Knapp holds a B.S. in Accounting from Penn State University.

Alex Mei has served as our Executive Vice President and Chief Marketing Officer since February 2006 responsible for our branding, product launches, channel support, and public relations. From October 2004 to February 2006, Mr. Mei served as our Senior Vice President of Marketing. Mr. Mei also served as one of our directors from April 2007 to July 2009. From 1999 to 2003, Mr. Mei served as Global Marketing Manager of First International Computer Inc. Mr. Mei holds a B.S. in Marketing Management from California Polytechnic State University, San Luis Obispo.

Richard Singh has served as our Chief Sales Officer since March 2011. He served as our Senior Vice President of Worldwide Sales from July 2010 to February 2011. Mr. Singh previously served as the Senior Vice President of Worldwide Sales at OCZ from April 2005 through December 2007. Mr. Singh’s extensive sales background includes storage related companies such as Samsung’s storage division, Toshiba Disk Products Division and Seagate Technology. Mr. Singh has also held sales management positions in other technology companies, including Corsair Memory Inc. and On-Stream Data. He attended USC’s School of Film and graduated from California State University, Chico with a B.S. in Business.

None of our directors, nominees for director or executive officers were selected pursuant to any arrangement or understanding, other than with our directors and executive officers acting within their capacity as such.

CORPORATE GOVERNANCE

Director Independence

In determining whether or not a director or director nominee is independent, the Board uses the standards for director independence pursuant to Nasdaq Capital Market listing standards. Our Board concluded that Messrs. Adam J. Epstein, Richard L. Hunter, Russell J. Knittel and Ralph Schmitt, all of whom are current non-employee directors, are independent directors under Nasdaq Capital Market rules.

The independent directors meet in executive sessions without the presence of the non-independent directors or members of our management each time the Board holds its regularly scheduled meetings.

Meetings of the Board of Directors and Committees

The Board held eight meetings during the fiscal year ended February 28, 2011. The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. During our last fiscal year, each of our then serving directors attended at least 75% of the total number of meetings of the Board and of all of the committees of the Board on which such director served during that period. Our Board may, from time to time, establish other committees. The composition and responsibilities of each of our standing committees are described below. Members serve on these committees until their resignation or until otherwise determined by our Board.

The following table sets forth the three standing committees of our Board and the current members of each such committee:

| Name of Director | | Audit | | Compensation | | Nominating and Governance |

| | | | | | | |

| Ryan M. Petersen | | — | | — | | — |

| | | | | | | |

| Adam J. Epstein | | Member | | Member | | Chairman |

| | | | | | | |

| Richard L. Hunter | | Member | | Chairman | | Member |

| | | | | | | |

| Russell J. Knittel | | Chairman | | Member | | Member |

| | | | | | | |

| Ralph Schmitt | | Member | | Member | | Member |

Audit Committee

The Audit Committee oversees our corporate accounting and financial reporting process and assists the Board in monitoring our financial systems and our legal regulatory compliance. The current members of the Audit Committee are Messrs. Adam J. Epstein, Richard L. Hunter, Russell J. Knittel and Ralph Schmitt. Each of the members of the Audit Committee is independent for purposes of the Nasdaq Capital Market listing standards as they apply to audit committee members and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended. The Board has determined that Mr. Knittel qualifies as an audit committee financial expert under the rules of the Securities and Exchange Commission (the “SEC”).

The functions of the Audit Committee include retaining and discharging our independent auditors, reviewing their independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our auditors, overseeing their audit work, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies, reviewing the results of our annual audits, our quarterly financial statements and our publicly filed reports and prepare our Audit Committee Report if required by any government agency. The Audit Committee has adopted a written charter approved by the Board, which is available on OCZ’s website at http://www.ocztechnology.com — “Investor Relations” — “Governance.”

The Audit Committee held five meetings during the last fiscal year. Additional information regarding the Audit Committee is set forth in the Report of the Audit Committee immediately following Proposal No. 6.

Compensation Committee

Our Compensation Committee reviews and recommends policy relating to compensation and benefits of our officers and directors, administers our stock option and benefit plans and reviews general policy relating to compensation and benefits. The current members of the Compensation Committee are Messrs. Adam J. Epstein, Richard L. Hunter, Russell J. Knittel and Ralph Schmitt. Each of the members of the Compensation Committee is independent for purposes of the Nasdaq Capital Market listing standards.

The Compensation Committee sets the salary and bonus earned by the Chief Executive Officer, reviews and approves corporate goals and objectives relevant to the compensation of the Chief Executive Officer and other executive officers, reviews and approves salary and bonus levels for other executive officers and approves stock option grants to executive officers, reviews and evaluates, at least annually, the performance of the Compensation Committee and its members and prepares the Compensation Committee report if required by any government agency. The Compensation Committee has adopted a written charter approved by the Board, which is available on OCZ’s website at http://www.ocztechnology.com — “Investor Relations” — “Governance.”

The Compensation Committee held two meetings during the last fiscal year. The Company does not currently engage any consultant related to executive and/or director compensation matters.

Nominating and Governance Committee

The primary responsibilities of the Nominating and Governance Committee are to identify individuals qualified to become Board members, select, or recommend to the Board, director nominees for each election of directors, develop and recommend to the Board criteria for selecting qualified director candidates, consider committee member qualifications, appointment and removal, recommend corporate governance principles, codes of conduct and compliance mechanisms applicable to us, and provide oversight in the evaluation of the Board and each committee. The current members of the Nominating and Governance Committee are Messrs. Adam J. Epstein, Richard L. Hunter, Russell J. Knittel and Ralph Schmitt. Each of the members of the Nominating and Governance Committee is independent for purposes of the Nasdaq Capital Market listing standards.

The Nominating and Governance Committee considers qualified candidates for appointment and nomination for election to the board of directors and makes recommendations concerning such candidates, determines criteria for selecting new directors, considers any nominations of director candidates validly made by our stockholders, reviews and makes recommendations to the Board concerning Board and committee compensation, develops corporate governance principles for recommendation to the Board, in consultation with the Audit Committee, considers and presents to the Board for adoption a Code of Conduct and Business Ethics applicable to all employees, officers and directors, reviews, at least annually our compliance with The Nasdaq Capital Market corporate governance listing requirements, assists the Board in developing criteria for the evaluation of Board and committee performance, evaluates the committee’s own performance on an annual basis, if requested by the Board, assists the Board in its evaluation of the performance of the Board and each committee of the Board, reviews and recommends to the Board changes to our bylaws, as needed and develops orientation materials for new directors and corporate governance related continuing education for all Board members. The Nominating and Governance Committee has adopted a written charter approved by the Board, which is available on OCZ’s website at http://www.ocztechnology.com — “Investor Relations” — “Governance.”

The Nominating and Governance Committee held two meetings during the last fiscal year.

Stockholder-Recommended Nominees

The Nominating and Governance Committee considers recommendations for director nominees that are properly submitted by stockholders. The Nominating and Governance Committee evaluates each director nominee and reviews the qualifications and attributes of each such director nominee. In order to be properly submitted, recommendations of director nominees must be timely sent to the Company’s principal executive offices located at 6373 San Ignacio Avenue, San Jose, CA 95119. The recommendation must include the following written materials: (i) the name and address, as they appear on the Company’s books, of the stockholder who intends to make the nomination and the names and addresses of the beneficial owners, if any, on whose behalf the nomination is being made and of the person or persons to be nominated, (ii) a representation that the stockholder is a holder of record of stock of the Company entitled to vote for the election of directors on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (iii) the following information regarding the ownership interests of the stockholder or such other beneficial owner, which shall be supplemented in writing by the stockholder not later than 10 days after the record date for the meeting to disclose such interests as of the record date: (A) the class and number of shares of the Company that are owned beneficially and of record by the stockholder and such other beneficial owner; (B) any derivative instrument directly or indirectly owned beneficially by such stockholder and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company; (C) any proxy, contract, arrangement, understanding, or relationship pursuant to which such stockholder has a right to vote any shares of any security of the Company; (D) any short interest in any security of the Company; (E) any rights to dividends on the shares of the Company owned beneficially by such stockholder that are separated or separable from the underlying shares of the Company; (F) any proportionate interest in shares of the Company or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such stockholder is a general partner or, directly or indirectly, beneficially owns an interest in a general partner; and (G) any performance-related fees (other than an asset-based fee) to which such stockholder is entitled based on any increase or decrease in the value of shares of the Company or derivative instruments, if any, as of the date of such notice, including, without limitation, any such interests held by members of such stockholder’s immediate family sharing the same household, (iv) a description of all arrangements or understandings between the stockholder or such beneficial owner and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder, (v) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such stockholder and such other beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant, (vi) such other information regarding each nominee proposed by such stockholder as would be required to be included in a Proxy Statement filed pursuant to the proxy rules of the SEC, had the nominee been nominated, or intended to be nominated, by the Board, and (vii) the consent of each nominee to serve as a director of the Company if so elected.

If the director nominee is intended to be considered by the Nominating and Governance Committee for recommendation to the Board for the slate of directors to be voted on at the Company’s annual meeting of stockholders, the written materials must be submitted within the time permitted for submission of a stockholder proposal for inclusion in the Company’s Proxy Statement for the subject annual meeting and such submission must also comply with the provisions for stockholder proposals set forth in the Company’s Bylaws.

Other Factors for Potential Consideration

In connection with its evaluation of prospective director nominees, the Nominating and Governance Committee also considers whether the prospective director nominee (i) promotes a diversity of business experience, skill and background; (ii) possesses the requisite education, training and experience to qualify as “financially literate” or as an “audit committee financial expert” under applicable SEC and stock exchange rules; and (iii) complements or adds to the Board’s existing strengths.

Code of Ethics and Corporate Governance Materials

The Board has adopted a charter for each of the committees described above which are available on our website at http://ir.stockpr.com/ocztechnology/governance-documents. The Board has also adopted a Code of Conduct and Business Ethics that applies to all of our employees, officers and directors. The Code of Conduct and Business Ethics can be found on our website at http://ir.stockpr.com/ocztechnology/governance-documents.

Board Leadership Structure and Board’s Role in Risk Oversight

Currently, Mr. Ryan M. Petersen serves both as our Chief Executive Officer and Chairman of the Board. The Board does not have a lead independent director. The Board believes that Mr. Petersen’s service as both Chairman of the Board and Chief Executive Officer is in the best interests of the Company and its stockholders because Mr. Petersen possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its business and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most important matters. The combined positions help to provide a unified leadership and direction for OCZ, enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s stockholders, employees, customers and suppliers. We believe that our current leadership structure enhances Mr. Petersen’s ability to provide insight and direction on important strategic initiatives simultaneously to both management and the independent directors.

We face a number of risks, including strategic, financial, business and legal. Management is responsible for the day-to-day management of risks we face, while our Board, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management process designed and implemented by management is appropriate and functioning as designed.

Our Board believes that full and open communication between management and the Board is essential for effective risk management and oversight. Our Board meets with our Chief Executive Officer and other senior management at our regularly scheduled Board meetings to discuss strategy and risks facing our Company. Periodically, senior management delivers presentations to our Board or a Board committee regarding strategic matters and matters involving material risk.

While our Board is ultimately responsible for risk oversight, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists our Board in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. The Audit Committee discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposure. The Compensation Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating and Governance Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, and corporate governance. While our Board committees are responsible for assisting the Board in evaluating certain risks and overseeing the management of such risks, our entire Board is regularly informed through management and committee reports about such risks and steps taken to manage and mitigate them.

Stockholder Communication with the Board

Stockholders may communicate with OCZ’s Board through OCZ’s Corporate Secretary by writing to the following address:

Board of Directors

c/o Corporate Secretary

OCZ Technology Group, Inc.

6373 San Ignacio Avenue

San Jose, CA 95119

OCZ’s Corporate Secretary will forward all correspondence to the Board, except for spam, junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. OCZ’s Corporate Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within OCZ for review and possible response.

Director Attendance at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by directors taking into account the directors’ schedules. All directors are encouraged to attend our annual meetings. None of our directors attended our 2010 annual meeting.

Compensation Committee Interlocks and Insider Participation

Currently, no member of our Compensation Committee is or has been a current or former officer or employee of ours or had any related person transaction involving us. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers serviced as a director or member of our Compensation Committee during the fiscal year ended February 28, 2011.

PROPOSALS NO. 2 AND NO. 3

APPROVAL OF AMENDMENTS TO THE

OCZ’S 2004 STOCK INCENTIVE PLAN

At the 2011 Annual Meeting, stockholders will be asked to approve amendments to OCZ’s 2004 Stock Incentive Plan (the “Stock Incentive Plan”) to:

| | · | To require a vote of stockholders in order to lower the price of an outstanding equity award; and |

| | · | Authorize an increase in shares available under the Stock Incentive Plan of 4,500,000 shares. |

A copy of the Stock Incentive Plan, as amended, is attached as EXHIBIT A.

Why you should vote “For” the Amendments to the Stock Incentive Plan

The Board believes that if there were ever an instance where it sought to reprice outstanding equity awards at a lower price, that stockholders should have the right to approve the repricing in advance. Therefore, the Board has adopted an amendment to the Stock Incentive Plan, subject to stockholder approval, to reflect the requirement for stockholders to approve any repricing at a lower price.

As discussed in the section entitled Compensation Discussion and Analysis, equity incentive awards are central to our compensation program and the Stock Incentive Plan is a critical component of our equity compensation. Our Compensation Committee and Board believe that our ability to grant stock options to new and existing employees has helped us attract, retain, and motivate key talent. Since the potential value of stock options and other equity awards is realized only if our share price increases, this form of compensation provides a strong incentive for employees to work to grow the business and build stockholder value. Equity awards are most attractive to employees who share the entrepreneurial spirit that has made OCZ a success. The Board believes that the number of shares remaining available for future issuance under the Stock Incentive Plan to be inadequate to achieve the purpose of the Stock Incentive Plan in the future.

As of August 1, 2011 only 744,978 shares remained available for the future grant of stock options under the Stock Incentive Plan, a number that the Board believes to be insufficient to meet OCZ’s anticipated needs. Therefore, the Board has unanimously adopted, subject to stockholder approval, an amendment to Section 5.1 of the Plan to increase the maximum number of shares of common stock issuable under the Stock Incentive Plan by 4,500,000 shares to a total of 12,232,873 shares to ensure that OCZ will continue to have available a reasonable number of shares for its stock option program. This would increase the number of shares for which we could grant additional options, restricted stock or other equity-based awards following stockholder approval to 5,244,978.

We believe the increase in the number of shares is reasonable in light of the recent growth of the Company. Since fiscal year end February 28, 2011, we acquired Indilinx, as a result of which we granted an aggregate of 565,000 shares to former Indilinx employees. The Indilinx share grant was not anticipated during our last Stockholder Meeting. In addition, in the past year we have hired approximately 207 new employees, which was more than anticipated due to business growth in excess of our projections. Although we believe this growth has had a positive impact on our efforts to create stockholder value, it has resulted in the share reserves under the Stock Incentive Plan depleting more quickly than we had originally anticipated. We operate in a very competitive high-technology market and we anticipate that we will need to continue to offer competitive equity incentive compensation to attract highly qualified employees to support the growth of our business.

We believe that equity incentive compensation is a critical component to our compensation practices and allows us to incent our employees and more closely align their efforts with the creation of long-term stockholder value. Equity compensation fosters an ownership culture in which employees think and act like stockholders. In order to continue with our equity compensation practices, we feel it is important for stockholders to approve the proposed increase in shares available for grant under our Stock Incentive Plan.

Summary of the Stock Incentive Plan

Purpose. The purpose of the Stock Incentive Plan is to offer selected employees, directors and consultants the opportunity to acquire equity in OCZ through awards of options to purchase common stock (which may constitute incentive stock options (an “ISO”) or non-statutory stock options (an “NSO”)) and the award or sale of common stock. ISOs have a more favorable tax treatment under U.S. law for the optionee. The award of options and the award or sale of common stock under the Stock Incentive Plan is intended to be exempt from the securities qualification requirements of the California Corporations Code.

Authorized Shares. Currently, a maximum of 7,732,873 of the authorized but unissued or reacquired shares of common stock of OCZ may be issued under the Stock Incentive Plan. Of this amount, as of August 1, 2011, a total of 2,047,709 shares had been issued upon the exercise of previously granted options and options to purchase 4,940,186 shares were outstanding. As a result, we currently may grant options to purchase only another 744,978 shares of our common stock, without giving effect to any options that may expire or be cancelled, as described later in this paragraph. The Board has amended the Stock Incentive Plan, subject to stockholder approval, to increase the maximum number of shares that may be issued under the Stock Incentive Plan to 12,232,873, which includes the 2,047,709 shares of common stock that we have already issued upon exercise of options. In the event that any outstanding option or other right expires or is cancelled for any reason, the shares of common stock allocable to the unexercised portion of such option or other rights shall remain available for issuance pursuant to the Stock Incentive Plan. If we reacquire a share of common stock previously issued under the Stock Incentive Plan pursuant to a forfeiture provision, a right of repurchase or a right of first refusal, then such share shall again become available for issuance under the Stock Incentive Plan. However, if stockholders approve the proposed increase in the number of shares that can be issued under the Stock Incentive Plan, no more than 12,232,873 shares, including the 2,047,709 shares that have been issued previously, may be issued under the Stock Incentive Plan.

The closing price of our common stock as reported on the Nasdaq Capital Market on August 9, 2011 was $6.34 per share.

Administration. The Stock Incentive Plan is administered by the Board. However, the Board may delegate any or all administrative functions under the Stock Incentive Plan otherwise exercisable by the Board to one or more committees. Subject to the provisions of the Stock Incentive Plan, the Board shall have full authority and discretion to take any actions it deems necessary or advisable for the administration of the Stock Incentive Plan.

Eligibility. All of our employees are eligible for the grant of ISOs. Our employees, consultants and non-executive directors are eligible for the grant of NSOs or the award or sale of common stock. As of August 1, 2011, OCZ had approximately 547 employees, including 4 executive officers, 4 outside directors and 17 consultants who were eligible under the Stock Incentive Plan. While any eligible person may be granted non-statutory stock options, only employees may be granted incentive stock options.

Restricted shares. Each award or sale of shares of common stock under the Stock Incentive Plan (other than upon exercise of any option) shall be evidenced by a restricted share agreement between the recipient and OCZ. Any right to acquire shares of common stock (other than an option) shall automatically expire if not exercised by the purchaser within 30 days after OCZ communicates a grant of such right to the purchaser. Such right shall be nontransferable and shall be exercisable only by the purchaser to whom the right was granted. The purchase price for common stock offered under the Stock Incentive Plan shall not be less than 85% of the fair market value of such common stock; provided, however, if the purchaser is a 10% stockholder, the purchase price shall not be less than 100% of the fair market value of such common stock. Subject to this, the Board shall determine the amount of the purchase price in its sole discretion.

Common stock awarded or sold shall be subject to such forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Board may determine.

To date, no restricted shares have been awarded under the Stock Incentive Plan.

Stock Options. Each option grant under the Stock Incentive Plan shall be evidenced by a stock option agreement between us and the option holder. The stock option agreement shall specify the number of shares of common stock that are subject to the option, provide for the adjustment of such number and whether the option is intended to be an ISO or an NSO.

The exercise price per share of an ISO shall not be less than 100% of the fair market value on the date of grant. The exercise price per share of an NSO shall not be less than 85% of the fair market value of a share on the date of grant. If the option holder is a 10% stockholder, the exercise price per share of any ISO or NSO must be at least 110% of the fair market value on the date of grant. Subject to this, the exercise price under any option shall be determined by the Board in its sole discretion.

The term of an option shall in no event exceed 10 years from the date of grant. The term of an ISO granted to a 10% stockholder shall not exceed 5 years from the date of grant. Subject to this, the Board, in its sole discretion, shall determine when an option shall expire.

The date when all or any installment of the option is to become exercisable shall be specified in the stock option agreement; provided, however, that no option shall be exercisable unless the option holder has delivered to us an executed copy of the stock option agreement. An option granted to an option holder who is not a consultant, officer or director shall be exercisable at the minimum rate of 20% per year for each of the first 5 years starting from the date of grant, subject to reasonable conditions such as continued service. An option granted to an option holder who is a consultant or an officer or director shall be exercisable at any time during any period established by the Board, subject to reasonable conditions such as continued service. Subject to the preceding conditions, the Board shall determine when all or any installment of an option is to become exercisable. A stock option agreement may permit the option holder to exercise their option early, provided any unvested shares remain subject to our right of repurchase.

Common stock purchased upon exercise of options shall be subject to such forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Board may determine.

During an option holder’s lifetime, his or her options shall be exercisable only by the option holder or by the option holder’s guardian or legal representative, and shall not be transferable other than by beneficiary designation, will, or the laws of descent and distribution. If a stock option agreement so provides, an NSO may be transferred by the option holder to one or more family members or a trust established for the benefit of the option holder and/or one or more family members.

The option shall set forth the extent to which the option holder shall have the right to exercise the option following termination of the option holder’s service. To the extent the option was vested and exercisable upon the option holder’s termination of service, the option holder will have the right to exercise the option for at least 30 days after termination of service that is due to any reason other than cause, death or disability, and for at least 6 months after termination of service that is due to death or disability (but in no event later than the expiration of the option term). If the option holder’s service is terminated for cause, the stock option agreement may provide that the option holder’s right to exercise the option terminates immediately on the effective date of the option holder’s termination of service. To the extent the option was not exercisable for vested common stock upon termination of service, the option shall terminate when the option holder’s service terminates.

An option holder or a transferee of an option holder shall have no rights as a stockholder with respect to any common stock covered by the option until such person becomes entitled to receive such common stock by filing a notice of exercise and paying the exercise price.

Within the limitations of the Stock Incentive Plan, the Board may modify, extend or renew outstanding options or may accept the cancellation of outstanding options in return for the grant of new options for the same or a different number of shares of common stock, and at the same or different exercise price.

Change in Control. The Stock Incentive Plan defines a “Change in Control” of OCZ as

a) the consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if persons who were not stockholders of the Company immediately prior to such merger, consolidation or other reorganization own immediately after such merger, consolidation or other reorganization fifty percent (50%) or more of the voting power of the outstanding securities of each of

a. the continuing or surviving entity and

b. any direct or indirect parent corporation of such continuing or surviving entity;

b) The consummation of the sale, transfer or other disposition of all or substantially all of the Company’s assets or the stockholders of the Company approve a plan of complete liquidation of the Company; or

c) Any person who, by the acquisition or aggregation of securities, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of the Company representing fifty percent (50%) or more of the combined voting power of the Company’s then outstanding securities ordinarily (and apart from rights accruing under special circumstances) having the right to vote at elections of directors (the “Base Capital Stock”); except that any change in the relative beneficial ownership of the Company’s securities by any person resulting solely from a reduction in the aggregate number of outstanding shares of Base Capital Stock, and any decrease thereafter in such person’s ownership of securities, shall be disregarded until such person increases in any manner, directly or indirectly, such person’s beneficial ownership of any securities of the Company.

The Stock Incentive Plan authorizes the Board to provide in any option agreement for acceleration of the vesting and exercisability of the option upon such circumstances in connection with a Change in Control as the Board determines in its discretion. Options that are not assumed, replaced or exercised prior to the Change in Control will terminate.

Amendment and Terminations. The Stock Incentive Plan automatically terminates 10 years after adoption by the Board, and the Board may amend, suspend or terminate the Stock Incentive Plan at any time or for any reason. To amend the Stock Incentive Plan or an outstanding option or common stock purchased under the Stock Incentive Plan in a manner that is adverse to the holder of such option or common stock requires the consent of the holder of such option or common stock. No shares of common stock shall be issued or sold under the Stock Incentive Plan after the termination thereof, except upon exercise of an option granted prior to such termination. Stockholder approval is required for an amendment if it increases the number of Shares available for issuance under the Stock Incentive Plan (except with respect to share adjustments described in Section 9 of the Stock Incentive Plan) or of if it materially changes the class of persons who are eligible for the grant of Options or the award or sale of Shares. In addition, at least two-thirds (2/3) of the OCZ’s shares entitled to vote must affirmatively approve an increase in the number of shares available for issuance under the Stock Incentive Plan if the total number of shares that may be issued upon the exercise of all outstanding options and the total number of shares provided under any stock bonus or similar plan of OCZ exceed thirty percent (30%) of all outstanding OCZ shares.

Voting and Dividend Rights. The holders of shares acquired under the Stock Incentive Plan shall have the same voting, dividend and other rights as the OCZ’s other stockholders. A restricted share agreement, however, may require that the holders of Shares invest any cash dividends received in additional shares. Such additional shares shall be subject to the same conditions and restrictions as the award with respect to which the dividends were paid.

Options Granted to Certain Persons

The aggregate numbers of shares of common stock subject to options granted to certain persons under the Stock Incentive Plan since its inception are as follows: (i) Ryan M. Petersen, President and Chief Executive Officer, 0 shares; (ii) Kerry T. Smith1, former Chief Financial Officer, 200,000 shares; (iii) Arthur F. Knapp, Jr., Chief Financial Officer, 754,872 shares; (iv) Alex Mei, Chief Marketing Officer, 465,000 shares; (v) Justin Shong, former Senior Vice President of Global Sales, 120,000 shares; (vi) Richard Singh, Chief Sales Officer, 508,000 shares, (vii) all current executive officers as a group, an aggregate of 1,727,872 shares; (viii) all current directors who are not executive officers as a group, an aggregate of 602,842 shares that includes the nominees for election as a director Richard L. Hunter, 172,614 shares, and Ralph Schmitt, 75,000 shares; and (ix) all employees, including current officers who are not executive officers, as a group, an aggregate of 6,469,600 shares. Since its inception, no options have been granted under the Stock Incentive Plan to any other nominee for election as a director, or any associate of any such director, nominee or executive officer, and no other person has been granted five percent or more of the total amount of options granted under the Stock Incentive Plan. The specific individuals who will be granted awards under the Stock Incentive Plan and the type and amount of such awards will be determined by the Board or committee administering the plan from time to time.

Summary of U.S. Federal Income Tax Consequences

The following summary is intended only as a general guide as to the U.S. federal income tax consequences of participation in the Stock Incentive Plan and does not attempt to describe all possible federal or other tax consequences of such participation or tax consequences based on particular circumstances.

Non-Qualified Options. The grant of a non-qualified option will not result in taxable income to the participant. Except as described below, the participant will realize ordinary income at the time of exercise in an amount equal to the excess of the fair market value of the shares of stock acquired over the exercise price for those shares, and the Company will be entitled to a corresponding deduction. Gains or losses realized by the participant upon disposition of such shares will be treated as capital gains and losses, with the basis in such shares equal to the fair market value of the shares at the time of exercise.

If the participant exercises the option prior to vesting, the participant will receive non-vested shares that remain subject to restrictions constituting a “substantial risk of forfeiture” for U.S. income tax purposes until such vesting date. In such event, the participant will realize ordinary income at the time of vesting in an amount equal to the excess of the fair market value of the shares of stock acquired over the exercise price for those shares, and the Company will be entitled to a corresponding deduction. However, the participant may elect, pursuant to Section 83(b) of the IRC, to realize ordinary income at the time of exercise in an amount equal to the excess of the fair market value of the shares of stock acquired over the exercise price for those shares, notwithstanding the fact that such shares remain subject to a substantial risk of forfeiture, by filing an election with the Internal Revenue Service no later than 30 days after the date the option is exercised.

The exercise of a non-qualified option through the delivery of previously acquired shares will generally be treated as a non-taxable, like-kind exchange as to the number of shares surrendered and the identical number of shares received under the option. That number of shares, will take the same basis and, for capital gains purposes, the same holding period as the shares that are given up. The value of the shares received upon such an exchange that are in excess of the number given up will be includible as ordinary income to the participant at the time of the exercise. The excess shares will have a new holding period for capital gain purposes and a basis equal to the value of such shares of common stock determined at the time of exercise.

Incentive Stock Options. The grant of an incentive stock option will not result in taxable income to the participant. The exercise of an incentive stock option will not result in taxable income to the participant provided that the participant was, without a break in service, an employee of the Company or a subsidiary during the period beginning on the date of the grant of the option and ending on the date three months prior to the date of exercise or ending one year prior to the date of exercise if the participant is disabled, as that term is defined in the IRC.

The excess of the fair market value of the shares of common stock at the time of the exercise of an incentive stock option over the exercise price is an adjustment that is included in the calculation of the participant’s alternative minimum taxable income for the tax year in which the incentive stock option is exercised. For purposes of determining the participant’s alternative minimum tax liability for the year of disposition of the shares of common stock acquired pursuant to the incentive stock option exercise, the participant will have a basis in those shares equal to the fair market value of the shares at the time of exercise.

If the participant does not sell or otherwise dispose of the common stock within two years from the date of the grant of the incentive stock option or within one year after receiving the transfer of such shares of common stock, then, upon disposition of such shares of stock, any amount realized in excess of the exercise price will be taxed to the participant as capital gain, and the Company will not be entitled to any deduction. A capital loss will be recognized to the extent that the amount realized is less than the exercise price.

1 Mr. Smith resigned as our Chief Financial Officer, Corporate Secretary and Director on October 6, 2010 and we appointed Arthur F. Knapp, Jr. to serve as interim Chief Financial Officer. Mr. Knapp was elected as our Chief Financial Officer in December 2010.

If the foregoing holding period requirements are not met, the participant will generally realize ordinary income, and a corresponding deduction will be allowed to the Company, at the time of the disposition of the shares, in an amount equal to the lesser of (i) the excess of the fair market value of the shares of common stock on the date of exercise over the exercise price, or (ii) the excess, if any, of the amount realized upon disposition of the shares over the exercise price. If the amount realized exceeds the value of the shares on the date of exercise, any additional amount will be capital gain. If the amount realized is less than the exercise price, the participant will recognize no income, and a capital loss will be recognized equal to the excess of the exercise price over the amount realized upon the disposition of the shares.

The exercise of an incentive stock option through the exchange of previously acquired shares of common stock will generally be treated in the same manner as such an exchange would be treated in connection with the exercise of a non-qualified option; that is, as a non-taxable, like-kind exchange as to the number of shares given up and the identical number of shares received under the option. That number of shares, will take the same basis and, for capital gain purposes, the same holding period as the shares that are given up. However, such holding period will not be credited for purposes of the one-year holding period required for the new shares to receive incentive stock option treatment. Shares received in excess of the number of shares given up will have a new holding period and will have a basis of zero or, if any cash was paid as part of the exercise price, the excess shares received will have a basis equal to the amount of the cash. If a disqualifying disposition, which is a disposition before the end of the applicable holding period, occurs with respect to any of the shares received from the exchange, it will be treated as a disqualifying disposition of the shares with the lowest basis.

If the exercise price of an incentive stock option is paid with shares of common stock of the Company acquired through a prior exercise of an incentive stock option, gain will be realized on the shares given up and will be taxed as ordinary income if those shares have not been held for the minimum incentive stock option holding period, which holding period is two years from the date of grant and one year from the date of transfer, but the exchange will not affect the tax treatment, as described in the immediately preceding paragraph, of the shares received.

Restricted Shares. A participant who has been granted restricted shares will not realize taxable income at the time of grant, and the Company will not be entitled to a deduction at that time, if the grant is subject to a risk of forfeiture or other restrictions that will lapse upon the achievement of other objectives, assuming that the restrictions constitute a “substantial risk of forfeiture” for U.S. income tax purposes. Upon the vesting of shares subject to an award, the holder will realize ordinary income in an amount equal to the then fair market value of those shares minus any amount paid for such shares, and the Company will be entitled to a corresponding deduction. Gains or losses realized by the participant upon disposition of such shares will be treated as capital gains and losses, with the basis in such shares equal to the fair market value of the shares at the time of vesting. Dividends paid to the holder during the restriction period will also be compensation income to the participant and deductible as such by the Company.

Withholding of Taxes. Pursuant to the Stock Incentive Plan, the Company may deduct, from any payment or distribution of shares under the Stock Incentive Plan, the amount of any tax required by law to be withheld with respect to such payment, or may require the participant to pay such amount to the Company prior to, and as a condition of, making such payment or distribution. Subject to rules and limitations established by the Compensation Committee, a participant may elect to satisfy the withholding required, in whole or in part, either by having the Company withhold shares of common stock from any payment under the Stock Incentive Plan or by the participant delivering shares of the Company to the Company. However, the number of such shares used to satisfy the withholding obligation with respect to the exercise of a stock option may not be more than the number required to satisfy the Company’s minimum statutory withholding obligation based on minimum statutory withholding rates for U.S. federal and state tax purposes, including payroll taxes, that are applicable to such supplemental taxable income. The portion of the withholding that is satisfied with shares will be determined using the fair market value shares of shares of common stock of the Company on the date when the taxes otherwise would be withhold in cash.

The use of shares of common stock of the Company to satisfy any withholding requirement will be treated, for U.S. income tax purposes, as a sale of such shares for an amount equal to the fair market value of the shares on the date when the amount of taxes to be withheld is determined. If previously-owned shares of common stock of the Company are delivered by a participant to satisfy a withholding requirement, the disposition of such shares would result in the recognition of gain or loss by the participant for tax purposes, depending on whether the basis in the delivered shares is less than or greater than the fair market value of the shares at the time of disposition.

Change in Control. Any acceleration of the vesting or payment of awards under the Stock Incentive Plan in the event of a change in control in the Company may cause part or all of the consideration involved to be treated as an “excess parachute payment” under the IRC, which may subject the participant to a 20% excise tax and preclude deduction by a subsidiary.

Deferred Compensation. Awards granted pursuant to the Stock Incentive Plan are generally not intended to constitute “deferred compensation” subject to section 409A of the IRC. A violation of section 409A of the IRC may subject a participant to immediate taxation of an award plus a 20 percent excise tax and interest. In addition, to the extent that the Stock Incentive Plan is treated as a plan of a “nonqualified entity” (which generally includes an entity in a jurisdiction that is not subject to U.S. income tax or a comprehensive foreign income tax), income will be recognized by the recipient at the time of vesting, rather than the time of distribution.

Tax Advice. The preceding discussion is based on U.S. tax laws and regulations presently in effect, which are subject to change, and the discussion does not purport to be a complete description of the Federal income tax aspects of the Stock Incentive Plan. A participant may also be subject to state and local taxes, or taxes in other jurisdictions, in connection with the grant of awards under the Stock Incentive Plan. The Company suggests that participants consult with their individual tax advisors to determine the applicability of the tax rules to the awards granted to them in their personal circumstances.

Vote Required and Board Recommendation

Approval of these proposals require the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote on this proposal. Abstentions will have the same effect as votes against the proposal. Broker non-votes will have no effect on the outcome of this vote.

THE BOARD BELIEVES THAT THE PROPOSED AMENDMENTS TO THE STOCK INCENTIVE PLAN ARE IN THE BEST INTERESTS OF OCZ AND ITS STOCKHOLDERS FOR THE REASONS STATED ABOVE. THEREFORE:

| | · | THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 2 TO AMENDTHE STOCK INCENTIVE PLAN TO REQUIRE THAT A VOTE BY STOCKHOLDERS IS REQUIRED IN ORDER TO LOWER THE EXERCISE PRICE OF AN OUTSTANDING EQUITY AWARD; AND |

| | · | THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 3 TO AMEND THE STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AVAILABLE UNDER THE STOCK INCENTIVE PLAN BY 4,500,000 SHARES. |

PROPOSAL NO. 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION