- ERJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Embraer (ERJ) 6-KCurrent report (foreign)

Filed: 26 Mar 19, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16

under the Securities Exchange Act of 1934

For the month of March 2019

Commission File Number:001-15102

Embraer S.A.

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7): ☐

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

2

1. Message from the Chairman of the Board of Directors

São José dos Campos, March 22, 2019

Dear Shareholder,

We are pleased to invite you to attend the Annual and Extraordinary General Shareholders’ Meetings (“AGOE” or “Meetings”) of Embraer S.A. (“Embraer” or “Company”), cumulatively called for April 22, 2019, at 10:00 a.m., to be held at the Company’s headquarters located at Avenida Brigadeiro Faria Lima, 2170, in the city of São José dos Campos, State of São Paulo.

Embraer’s shares have been listed on B3 S.A.—Brasil, Bolsa, Balcão (“B3”) since 1989 and on the New York Stock Exchange (NYSE) since July 2000 through American Depositary Receipts (ADRs).

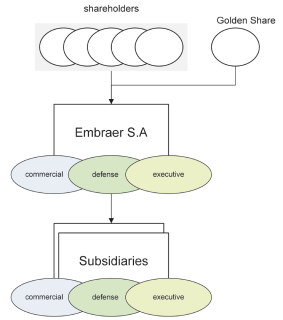

Since the corporate restructuring that took place in 2006, Embraer’s capital stock has been exclusively comprised of common shares, as well as one golden share held by the Brazilian Federal Government, without a control group or a controlling shareholder. Since then, Embraer’s shares have been included in theNovo Mercado segment of B3, the highest level of corporate governance that a company can have in Brazil.

In the AGOE, you will be invited to review and resolve on the matters included in the Call Notice, in accordance with item 3 below. Embraer’s Management presented proposals related to the matters on which to be voted, which are included in this Manual.

For the (i) Annual General Shareholders’ Meeting to take place on first call, the attendance of shareholders representing at least 25% of the capital stock is required, pursuant to Section 125 of Law No. 6,404/76; and (ii) Extraordinary General Shareholders’ Meeting to take place on first call, the attendance of shareholders representing at leasttwo-thirds of the voting capital stock is required, pursuant to Section 135 of Law No. 6,404/76.

Considering the legal and statutory requirements related to the quorum for these resolutions, I emphasize the importance of your vote on the matters presented herein.

Embraer’s relationship with its shareholders is based on the disclosure of information with transparency, clarity and respect for legal and ethical principles, which allows the consolidation and maintenance of Embraer’s image of leadership and innovation in the capital markets. We hope that the information contained herein, prepared in this spirit, will clarify the matters on the agenda and motivate you to attend the AGOE.

We encourage your attendance in the AGOE, in the best interest of Embraer. Remember, your vote is very important to us.

We appreciate your attention,

Alexandre Gonçalves Silva

Chairman of the Board of Directors

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

3

2. Information and Guidelines for Attendance at the Meetings

Each common share will be entitled to one vote on the resolutions of the Meetings, subject to the following limits set forth in the Company’s Bylaws:

| a) | No shareholder, or Shareholders’ Group (as defined below), Brazilian or foreign, may cast votes in excess of 5% of the shares of the Company’s capital stock; and |

| b) | The Foreign Shareholders (as defined below) and Foreign Shareholders’ Group (as defined below) may not cast votes in excess of 2/3 of the total votes that may be exercised by the Brazilian Shareholders (as defined below) in attendance. |

The above limitations apply to the Foreign Shareholders and Foreign Shareholders’ Group, jointly and successively.

The votes of the Brazilian Shareholders and the Foreign Shareholders on the resolutions of the Meetings will be calculated separately. To that end, the Chairman of the Meetings shall, upon becoming Chairman, determine and communicate the total number of votes that may be cast by the Brazilian Shareholders and by the Foreign Shareholders, observing the voting limits set forth in the Company’s Bylaws. If the total number of votes of the Foreign Shareholders exceeds 2/3 of the votes that may be cast by the Brazilian Shareholders, the number of votes of each Foreign Shareholder, including those received by means of distance voting ballot (boletim de voto à distância) sent directly to the Company or through a third party, shall be proportionately reduced by the percentage of such excess, so that the total number of votes of the Foreign Shareholders does not exceed the limit oftwo-thirds of the total votes that may be cast in the Meetings.

For purposes of applying the restriction on the maximum number of votes attributed to each shareholder, you must take into account the following definitions set forth in Embraer’s Bylaws:

Shareholders’ Group– A shareholders’ group are two or more shareholders: (i) that are parties to a voting agreement, either directly or through companies that are subsidiaries, parent companies or companies under common control; (ii) where one shareholder is, directly or indirectly, a controlling shareholder or a controlling parent company of the other shareholder or shareholders; (iii) that are companies directly or indirectly controlled by the same person, or group of persons, who may or may not be shareholders themselves; or (iv) that are companies, associations, foundations, cooperatives and trusts, investment funds or portfolios, universal rights or any other form of organization or undertaking (a) with the same administrators or managers, or further (b) whose administrators or managers are companies that are directly or indirectly controlled by the same person/entity, or group of persons/entities, which may or may not be shareholders.

As regards to investment funds, only funds with a common administrator, whose policies of investments and exercise of voting rights provides the administrator with full authority to decide and resolve at shareholders’ meetings, will be considered to be a member of a Shareholders’ Group.

The holders of securities issued under the Company’s Depositary Receipts program are not considered a Shareholders’ Group, unless they meet any of the criteria set forth in items (i) through (iv) above.

Any shareholders or Shareholders’ Group that are represented by the same proxy, administrator or attorney in fact, shall be deemed members of the same Shareholders’ Group in the Meeting, except in the case of holders of securities issued in connection with the Company’s Depositary Receipts program, when represented by the respective Depositary Bank.

In the event of shareholders’ agreements that govern the exercise of voting rights, all signatories thereto shall be considered members of the same Shareholders’ Group for purposes of the limitation on the number of votes described above.

Foreign Shareholders’ Group– A Shareholders’ Group will be considered foreign whenever one or more of its members is a Foreign Shareholder.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

4

Brazilian Shareholders– The following are Brazilian Shareholders: (i) individuals born or naturalized in Brazil, residing in Brazil or abroad; (ii) legal entities organized under Brazilian private law and having their management based in Brazil and which: a) have no foreign controlling shareholder or foreign parent company, unless the latter falls under item “b” of this definition; b) are controlled, directly or indirectly, by one or more individuals referred to in item (i) of this definition; and (iii) investment funds or clubs organized under the laws of Brazil and having their management based in Brazil and whose administrators and/or majority unitholders are persons referred to in items (i) and (ii) of this definition.

Foreign Shareholders– Foreign Shareholders are individuals, legal entities, investment funds or clubs and any other entities not included in the definition of Brazilian Shareholders, and those that fail to prove that they meet the requirements to be registered as Brazilian Shareholders, pursuant to paragraph 2 of Section 10 of the Company’s Bylaws.

2.2. In-person Attendance at Meetings

In order to attend the Meetings in person or by proxy, we request that you present to Embraer, at least 48 hours prior to the date of the Meetings, the following documents:

| a) | Power of attorney with special power for representation at the Meetings, in the case of a proxy; |

| b) | For shareholders who have their shares deposited in the fungible custody of shares (custódia fungível de ações), an extract provided by the custodian institution confirming their respective shareholdings; and |

| c) | Evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, (x) presenting a valid identification document or (y) submitting to the Company a certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution), as provided for in Section 20 of the Company’s Bylaws. |

For purposes of verifying the limit of votes that may be cast at the Meetings, you shall also inform the Company, at least 48 hours before the Meetings, if you belong to a Shareholders’ Group.

The abovementioned documents must be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, Portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo.

2.3. Participation through Distance Voting Ballot (Boletim de Votoà Distância)

If the shareholder wishes to send a distance voting ballot directly to the Company, the shareholder must send the following documents:

(i) original hard copy or digital copy of the original distance voting ballot, available on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários—CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br) on the Internet, duly filled in, initialed on all pages and signed at the end;

(ii) to prove oneself as a Brazilian Shareholder or Foreign Shareholder, (x) a certified copy or digital copy of the original identity document, or (y) the certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution); and

(iii) certified copy or digital copy of the original of the following documents:

For individuals:

- identity document with photograph of the shareholder;

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

5

For legal entities:

- current bylaws or consolidated articles of association and corporate documents that evidence the legal representation of the shareholder; and

- identity document with photograph of the legal representative.

For investment funds:

- current consolidated governing document of the fund;

- bylaws or articles of association of its administrator or manager, as the case may be, according to the voting policy of the fund, and corporate documents evidencing the powers of representation; and

- identity document with photograph of the legal representative.

The above distance voting ballots and documents shall be received by no later than seven days before the date of the Meetings and those received after such date will be disregarded.

The Company waives the certification of signature, notarization and consularization for acceptance of the distance voting ballots. The Company will not require the sworn translation of documents originally drawn up in Portuguese, English or Spanish, or to be accompanied by a translation in those languages. The following identity documents will be accepted, provided they include a photograph: identity card (RG), national registry of foreigners (RNE), driver’s license (CNH), passport or officially recognized professional identification.

Under the terms of the current regulations, the Company will inform the shareholder, within three days, (i) whether the distance voting ballot (boletim de voto à distância) has been received, as well as whether the documents received are sufficient for the vote to be valid; or (ii) the need to rectify or resend the distance voting ballot (boletim de voto à distância) or any accompanying documents, describing the procedures and deadlines required for the distance voting ballot (boletim de voto à distância) to be valid.

As an alternative to sending the distance voting ballot directly to the Company, shareholders holding shares issued by the Company may send voting instructions to complete the distance voting ballot by means of: (i) their respective custodian agents, in the case of shares that are deposited in custody (depositário central); or (ii) the financial institution engaged by the Company to provide securities bookkeeping services, in the case of shares that are not deposited in custody (depositário central).

The Company requests that the above documents be sent to the attention of its Investor Relations Department, preferably to the electronic address: investor.relations@embraer.com.br. If by mail, the documents should be mailed to Av. Brigadeiro Faria Lima, 2170, post office 294, in the city of São José dos Campos, State of São Paulo, CEP12.227-901, to the attention of the Investor Relations Department and, if delivered personally, to Av. Brigadeiro Faria Lima, 2170, in the city of São José dos Campos-SP, portaria F46, to the attention of the Investor Relations Department (extension 3953). When sent by mail or delivered personally, the Company requests a copy of the distance voting ballot also be sent bye-mail to investor.relations@embraer.com.br.

If you have any questions regarding the procedure and deadlines described in this item 2, we ask that you contact the Investor Relations Department at (11) 3040-9518, or bye-mail at investor.relations@embraer.com.br.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

6

(The Call Notice will be published in the newspapersValor Econômico, in the editions dated March 22, 25 and 26, 2019,O Vale andDiário Oficial do Estado de São Paulo in the editions dated March 22, 23 and 26, 2019.)

We invite the shareholders of Embraer S.A. (“Company” or “Embraer”) to attend an Annual and Extraordinary General Shareholders’ Meetings (“Meetings”), to be held, cumulatively, onApril 22, 2019, at10:00 a.m. local time, at the Company’s headquarters, in the city of São José dos Campos, State of São Paulo, at Avenida Brigadeiro Faria Lima, 2170, to review and resolve on the following agenda:

At the Annual General Shareholders’ Meeting:

| 1. | To review the management accounts and to examine, discuss and approve the financial statements for the fiscal year ended December 31, 2018; |

| 2. | To review and to resolve on the allocation of the net income for the fiscal year ended December 31, 2018; |

| 3. | To elect the members of the Board of Directors; |

| 4. | To elect the members of the Fiscal Council; |

| 5. | To determine the aggregate annual compensation of the Company’s management; and |

| 6. | To determine the compensation of the members of the Fiscal Council. |

At the Extraordinary General Shareholders’ Meeting:

| 1. | To review and resolve on the amendment and restatement of the Company’s Bylaws to contemplate the following changes, as detailed in the Manual and Management’s Proposal: |

| a) | To change all references to BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros to B3 S.A. – Brasil, Bolsa, Balcão; |

| b) | To adapt the relevant statutory provisions to the newNovo Mercadolisting rules, amended in 2017; |

| c) | To reflect the increase in the Company’s capital stock, approved by the Company’s Board of Directors at the meeting held on March 5, 2018; |

| d) | To adapt the statutory provisions to the requirements set forth in CVM Instruction No. 358/02 and CVM Instruction No. 481/09, as well as to the guidelines contained inOfício-Circular/CVM/SEP/Nº3/2019; |

| e) | To modify the responsibilities of management and the advisory committees of the Board of Directors in order to optimize the Company’s decision-making and governance processes, reinforcing its commitment to constantly improving its governance; |

| f) | To include a rule about the possibility of the Company entering into an indemnity agreement (contrato de indenidade); |

| g) | Other formal and editorial adjustments, as well as the renumbering and cross-referencing of provisions of the Company’s Bylaws when applicable. |

Pursuant to paragraph 6 of Section 124 and to paragraph 3 of Section 135 of Law No. 6,404/76, the documents that are the subject matter of the resolutions of the Meetings hereby called, including those mentioned in Sections 9, 10, 11 and 12 of CVM Instruction No. 481/09, are available to shareholders at the Company’s headquarters and on the Internet on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br).

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

7

General Instructions:

| a) | To participate in the Meetings in person or by proxy, we request, if possible, that you present to the Company, at least 48 hours prior to the date of the Meetings, the following documents: (i) power of attorney with special powers for representation at the Meetings, in the case of a proxy; (ii) for shareholders who have their shares deposited in the fungible custody of shares, an extract provided by the custodian institution confirming their respective shareholdings; and (iii) evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meetings, you shall also inform the Company, at least 48 hours before the Meetings, whether you belong to a Shareholders’ Group (as such term is defined in the Company’s Bylaws). |

| b) | The documents mentioned in item “a” above shall be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo. |

| c) | In order to participate in the Meetings through distance voting ballot (boletim de voto à distância), shareholders must send a distance voting ballot (boletim de voto à distância) directly to the Company or through third parties, according to the instructions contained in the Manual and Management’s Proposal published on this same date and available on the websites above. |

| d) | The minimum percentage required for adoption of cumulative voting (voto múltiplo) in the election of the members of the Board of Directors is 5%, according to Section 3 of CVM Instruction No. 165/91, as amended, subject to the provisions in Section 32 of the Company’s Bylaws. |

| e) | The slates of candidates that are running for Board of Directors and Fiscal Council positions, as proposed by the Board of Directors and the Fiscal Council, respectively, are available to shareholders at the Company’s headquarters and on the internet on the websites of B3 S.A. – Brasil, Bolsa, Balcão (www.b3.com.br), the Company (ri.embraer.com.br) and the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br). Shareholders wishing to propose another slate for the Board of Directors and/or the Fiscal Council must comply with the provisions in paragraph 2 of Section 31 of the Company’s Bylaws. Any such slate proposed by the shareholders will be made available by the Company as contemplated in paragraph 2 of Section 31 of the Company’s Bylaws. |

São José dos Campos, March 22, 2019.

Alexandre Gonçalves Silva

Chairman of the Board of Directors

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

8

4. Management’s Proposals on the Agenda

Annual General Shareholders’ Meeting:

4.1. To review the management accounts and to examine, discuss and approve the financial statements for the fiscal year ended December 31, 2018

The management accounts are detailed in the Management Report and financial statements, and (i) were approved by the Company’s Board of Directors; and (ii) obtained a favorable opinion from the Company’s Fiscal Council and Audit and Risk Committee of the Board of Directors. The financial statements were audited and obtained a favorable opinion from the Company’s independent auditors, PricewaterhouseCoopers.

The documents to be submitted for shareholders’ approval were published in the newspapersValor Econômico,O Valeand Diário Oficial do Estado de São Paulo on March 15, 2019, and are available at the Company’s headquarters, the CVM and B3, as well as on the internet on Embraer’s website (ri.embraer.com.br).

The Company’s Board of Directors recommends that its shareholders carefully examine the documents made available by Management to review the Company’s financial statements and, if they agree, to approve these accounts and financial statements.

Pursuant to Section 9, item III, of CVM Instruction No. 481/09, the information set forth inAnnex I hereto reflects Management’s comments about the Company’s financial condition.

Moreover, the opinion and report of the Audit and Risks Committee of the Board of Directors are included inAnnex II hereto.

4.2. To review and to resolve on the allocation of net income for the fiscal year ended December 31, 2018

Pursuant to the financial statements for the fiscal year ended December 31, 2018, the Company recorded net loss of R$669,025,428.00.

The allocation of net loss consists in determining the portions of net loss that will be absorbed by the unrealized revenue, legal and statutory reserves.

The Board of Directors voted to present the following proposal for allocation of net loss for the fiscal year ended December 31, 2018 at the Annual General Shareholders’ Meeting: absorption, by the Investments and Working Capital Reserve set forth in Section 50 of the Company’s Bylaws, of the net loss already assessed for the year (R$669,025,428.00), deducted by the result of the proceeds from the sale of treasury shares by virtue of the exercise of stock options under the Company’s stock option plan in the amount of R$13,070,232.55, as well as the amount of R$449,824.00 in investment subsidies used in 2018, reclassified to the “Investment Subsidy Reserve” account, plus the result calculated from adjustments made in previous years regarding the change in accounting practices, in the amount of R$2,443,979.00, totaling R$680,101,505.55 to be absorbed by the Investments and Working Capital Reserve.

The information set forth in Annex9-1-II of CVM Instruction No. 481/09 will not be presented due to the assessment of loss in the year.

Amounts distributed in 2018, namely: (a) R$29,347,503.06, distributed to shareholders as interest on shareholders’ equity; and (b) R$14,697,587.38, distributed to shareholders as interim dividends, were reclassified to the revenue reserves (Investments and Working Capital Reserve).

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

9

4.3. To elect the members of the Board of Directors

The Board of Directors of Embraer consists of eleven members.

Separate Voting

Pursuant to Section 27, Paragraph 1, of the Company’s Bylaws, the Brazilian Federal Government, as holder of a golden share, is entitled to elect one member of the Board of Directors and his or her alternate. The Management of Embraer will inform the name of these representatives to its shareholders as soon as it obtains this information from the Brazilian Federal Government.

Pursuant to Section 27, Paragraph 2, of the Company’s Bylaws, the Company’s employees are entitled to elect, in a separate vote, two members of the Board of Directors and their respective alternates, of whom one member and his or her alternate are appointed by employees who are not the Company’s shareholders and one member and his or her alternate are appointed by Embraer’s Employee Investment Club (CIEMB –Clube de Investimentos dos Empregados da Embraer). The Company informs that it received the appointment of members from (i) the representatives of the employees who are not shareholders, namely, Mr. Edmilson Saes, as member, and Mr. Kaoru Sasaki, as alternate; and (ii) the representatives of Embraer’s Employee Investment Club (CIEMB –Clube de Investimentos dos Empregados da Embraer), namely, Mr. Alexandre Magalhães Filho, as member, and Mrs. Maria Antonieta Rosina Tedesco de Oliveira Pego, as alternate.

Election of the Other Members

Pursuant to Section 27, Paragraph 3, of the Company’s Bylaws, the other members of the Board of Directors will be elected by the other shareholders, and the Board of Directors, pursuant to Section 31, Paragraph 1, of Embraer’s Bylaws, must indicate a slate of candidates.

The Board of Directors resolved to submit to the Annual General Shareholders’ Meeting the following slate of candidates for election, which was previously discussed and recommended by the Human Resources Committee (internally referred to as the Personnel and Governance Committee):

Members of the Board of Directors:

| • | Alexandre Gonçalves Silva (Chairman) |

| • | Sergio Eraldo de Salles Pinto (Vice-Chairman) |

| • | Israel Vainboim |

| • | João Cox Neto |

| • | Márcio de Souza |

| • | Maria Letícia de Freitas Costa |

| • | Pedro Wongtschowski |

| • | Raul Calfat |

We emphasize that any shareholder, or group of shareholders, that does not comply with the legal deadline to appoint a slate of candidates on the distance voting ballot (boletim de voto à distância) and wishes to appoint an alternative slate for the Board of Directors must notify Embraer in this regard, in writing, up to ten days before the Meetings, setting forth the information related to the candidates included in items 12.5 to 12.10 of the Brazilian Annual Report (Formulário de Referência), pursuant to Section 10 of CVM Instruction No. 481/09, as well as the name, identification and professionalcurriculum of each candidate, attaching to the notice an instrument signed by each candidate confirming his or her acceptance to run for election. Embraer will publish, within eight days before the Meetings, a notice informing shareholders where they can find the list of all proposed candidates and a copy of their identification and professionalcurriculum.

Each shareholder may only vote for one slate of candidates and the candidates in the slate who receive the highest number of votes at the Meetings will be declared elected.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

10

Pursuant to Law No. 6,404/76 and Section 32 of Embraer’s Bylaws, shareholders representing at least 5% of the capital stock may request, in writing, the adoption of cumulative voting, 48 hours before the Meetings.

The Company cannot predict the result of the elections nor does it have information about the candidates that may be presented during the Meetings. If you wish to join these discussions, we recommend you attend the Meeting in person in order to be able to analyze and judge the candidates that may be considered in the Meetings.

The Company also highlights that, (i) based on the representations provided by the candidates, they meet the independence criteria set forth in the Listing RulesofNovo Mercado, segment in which the shares issued by the Company are traded, and, accordingly, 100% of the appointed members mentioned above would be Independent Members, pursuant to theNovo Mercado Listing Rules, if elected/reelected, and (ii) the candidates are in compliance with the guidelines of the Policy for Appointment and Training of Members of the Board of Directors and Committees of the Company.

The information included in items 12.5 to 12.10 of the Brazilian Annual Report related to the slate of candidates proposed by the Board of Directors, as well as the members appointed by employees who are not Embraer’s shareholders and by Embraer’s Employee Investment Club (CIEMB –Clube de Investimentos dos Empregados da Embraer), is set forth inAnnex III hereto, in compliance with Section 10 of CVM Instruction No. 481/09.

4.4. To elect the members of the Fiscal Council

The election of members of the Fiscal Council must comply with the rules set forth in Section 41, Paragraph 1, of the Company’s Bylaws.

Pursuant to Section 31, Paragraph 1, of the Company’s Bylaws, the slate proposed for the 2019/2020 period is as follows:

| Members | Alternate Members | |

| Ivan Mendes do Carmo | Tarcísio Luiz Silva Fontenele | |

| José Mauro Laxe Vilela | Wanderley Fernandes da Silva | |

| Wilsa Figueiredo | Mônica Pires da Silva | |

| João Manoel Pinho de Mello | Pedro Jucá Maciel | |

| Maurício Rocha Alves de Carvalho | Taiki Hirashima |

Mr. Ivan Mendes do Carmo is appointed as Chairman and Mr. José Mauro Laxe Vilela is appointed as Vice-Chairman of the Fiscal Council.

We emphasize that any shareholder, or group of shareholders, that does not comply with the legal deadline to appoint a slate of candidates on the distance voting ballot (boletim de voto à distância) and wishes to appoint an alternative slate for the Fiscal Council, must notify Embraer in this regard, in writing, ten days before the Meetings, setting forth the information related to the candidates included in items 12.5 to 12.10 of the Brazilian Annual Report, pursuant to Section 10 of CVM Instruction No. 481/09, as well as the name, identification and professionalcurriculum of each candidate, attaching to the notice an instrument signed by each candidate confirming his or her acceptance to run for election. Embraer will publish, within eight days before the Meetings, a notice informing shareholders where they can find the list of all proposed candidates and a copy of their identification and professionalcurriculum.

Each shareholder may only vote for one slate of candidates and the candidates in the slate who receive the highest number of votes at the Meetings will be declared elected.

The information included in items 12.5 to 12.10 of the Brazilian Annual Report related to the slate of candidates proposed by the Fiscal Council is set forth inAnnex IV hereto, in compliance with Section 10 of CVM Instruction No. 481/09.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

11

4.5. To determine the aggregate annual compensation of the Company’s management

Pursuant to Section 18, item IV, of the Company’s Bylaws, the Annual General Shareholders’ Meeting must establish the aggregate annual compensation of members of the Company’s management.

Considering the relevance of ensuring that the amounts of the aggregate compensation include the amounts set forth in item 13 of the Brazilian Annual Report, the Company includes in the aggregate compensation the costs related to the stock-based compensation offered to the members of the management. Considering that the fair value of the grants related to the long-term incentive plan is calculated based on the market value of the Company’s shares, the appreciation of the value of these shares is reflected in the value of the stock-based compensation.

Accordingly, the annual aggregate limit proposed by the Board of Directors as compensation of members of the Company’s management is R$74 million for the period between May 2019 and April 2020.

The aggregate compensation proposed herein is equal to the amount approved by shareholders at the Annual General Shareholders’ Meetings of 2018 and 2017, even considering the provisioning of bonus and incentive for the retention of Company’s executives at closing and post-closing of the strategic partnership with Boeing and the increase in social security (INSS) charges on amounts paid to directors and officers due to the end of the payroll tax exclusion.

Please also note that the Annual General Shareholders’ Meeting held in 2018 approved an aggregate limit as compensation to members of the management of R$74 million, and the estimated amount to be effectively realized until April 2019 is approximately R$58.0 million. The difference between the approved limit and the realized amount primarily results from the failure to achieve the maximum variable compensation set forth for members of the management due to thenon-fulfillment of the Company targets.

Finally, it should be noted the amount subject to approval refers to the period between May 2019 and April 2020, while item 13.2 of the Brazilian Annual Report reflects the period between January and December 2019.

Pursuant to Section 12, item II, of CVM Instruction No. 481/09, the information set forth in item 13 of the Brazilian Annual Report is included in Annex V hereto.

4.6. To determine the compensation of the members of the Fiscal Council

Pursuant to Embraer’s Bylaws, the compensation of the members of the Fiscal Council is established by the Annual General Shareholders’ Meeting that elects them, in compliance with the legal requirements and limits, taking into account their experience, education and reputation.

Pursuant to Section 162, Paragraph 3, of Law No. 6,404/76, the compensation of each member of the Fiscal Council cannot be lower than 10% of the compensation that, on average, is attributed to each Officer, excluding benefits, representation funds and profit sharing.

Accordingly, Embraer’s Board of Directors proposes a monthly compensation for the Chairman of the Fiscal Council in the amount of R$15,000.00 and an individual compensation in the amount of R$13,250.00 for the other members of the Fiscal Council for the period between May 2019 and April 2020, maintaining the same compensation proposed and approved in the previous period.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

12

Extraordinary General Shareholders’ Meeting:

4.7. To review and resolve on the amendment and restatement of the Company’s Bylaws

As a result of the enactment of the New Regulation of theNovo Mercado by B3 (“New Regulation”), listing segment of B3 in which the Company is included, the Management of Embraer proposes that the Bylaws be amended pursuant to the new applicable rules.

In addition to the amendment of the pertinent provisions of the New Regulation, the Board of Directors of Embraer proposes to approve extensive amendments to the Bylaws, contemplating the following changes: (a) to change all references to BM&FBOVESPA S.A.– Bolsa de Valores, Mercadorias e Futuros, former name of B3 S.A. – Brasil, Bolsa, Balcão; (b) to reflect the increase in the Company’s capital stock, approved by the Company’s Board of Directors at the meeting held on March 5, 2018; (c) to adapt the statutory provisions to the requirements set forth in CVM Instruction No. 358/02 and in CVM Instruction No. 481/09, as well as the guidelines contained in theOfício-Circular/CVM/SEP/No.3/2019; (d) to modify the responsibilities of management and the advisory committees of the Board of Directors in order to optimize the Company’s decision-making and governance processes, reinforcing its commitment to constantly improving its governance; (e) to include a rule about the possibility of the Company entering into an indemnity agreement (contrato de indenidade) with the members of the management, Fiscal Council and committees of the Company and of its subsidiaries, as well as with employees and agents who duly act under powers of attorney granted by the directors and executive officers of the Company or its subsidiaries; and set forth the policy applicable to them, in line with the CVM Instruction Opinion (Parecer de Orientação) No. 38; and (f) other formal and editorial adjustments, as well as the renumbering and cross-referencing of provisions of the Company’s Bylaws when applicable.

Embraer’s Board of Directors recommends its shareholders to carefully review a copy of the proposed Bylaws and the report with the proposed amendments contained in Annexes VI and VII to this Manual, pursuant to Section 11, items I and II, of CVM Instruction No. 481/09.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

13

Annex I – Management’s Considerations

(Information set forth in Section 9, item III, of CVM Instruction No. 481/09)

| 10.1 | – Financial Position |

The assessment and opinions included herein reflect the views and perceptions of our Executive Officers about our activities, business and performance. The amounts included in this section 10.1 derive from our audited consolidated financial statements for the years ended December 31, 2018, 2017 and 2016.

The following discussion includes forward-looking statements that reflect our current expectations involving risks and uncertainties. Future results and the timing of events may differ materially from those included in these forward-looking statements due to a number of factors, including, but not limited to, other matters set forth in this Company’s Brazilian Annual Report (Formulário de Referência).

The financial information included in items 10.1 through 10.9 must be read in conjunction with our audited consolidated financial statements for the years ended December 31, 2018, 2017 and 2016, and notes thereto. The audited consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB).

The set of audited consolidated financial statements for the year ended December 31, 2018 includes the first year of adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. The transition method chosen by the Company was the full retrospective method. Accordingly, the financial statements for the year ended December 31, 2017 were restated to reflect such adoption. For more information on the adoption of such accounting standards, see Section 10.4 of Company’s Brazilian Annual Report (Formulário de Referência).

A company’s functional currency is the currency used in the main economic environment in which the company operates, as this currency influences the prices of goods and services, the competitive forces and regulations of its country of origin, the costs of supplying products and services, and in raising financial resources. In this context, Embraer’s management, after analyzing its operations and business, concluded that the U.S. dollar (“US$” or “dollar”) is its functional currency.

| (a) | Financial Position |

The Executive Officers believe that the Company has been keeping a satisfactory liquidity, reflected in the adjustedworking capital as of December 31, 2018 R$4,640.0 million, December 31, 2017 R$3,402.0 million and December 31, 2016 R$3,565.3 million, which corresponds to the Company’s current assets, less the balance of cash and cash equivalents and financial investments, and current liabilities, less loans and financing. This level of working capital represents adequate conditions to fulfill short-term operating obligations.

The Executive Officers believe that the Company’s financial health is sufficient to fulfill its obligations with third parties, including the payment of debt, based on current liquidity (Current Assets/Current Liabilities) of 2.32 as of December 31, 2018, 2.53 as of December 31, 2017, and 2.13 as of December 31, 2016. The Company has access to sources of funding, supported by credit rating from Standard and Poor’s, Moody’s and Fitch Ratings. Standard & Poor’s rated the Company as BBB, with a negative outlook, and has granted the Company an investment grade rating since 2006. The Company’s credit rating by Moody’s is rated Ba1, which was downgraded from Baa3 in February 2016, following the downgrading of the Brazilian sovereign credit rating, from Baa3 to Ba2, in the same period. In April 2016, Fitch Ratings rated the Company’s credit risk asBBB-. In February 2018, Fitch Ratings downgraded the Brazilian sovereign credit rating from BB toBB-. However, Fitch Ratings did not change Embraer’s credit ratings. In January 2019, Standard and Poor’s and Fitch included the Company’s ratings in the “Credit/Rating Watching” list with negative implications, reflecting the potential weakening of our business risk profile if the strategic partnership with Boeing is approved.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

14

In terms of debt profile, the average maturity was 5.5 years in 2018, 6.0 years in 2017 and 5.3 years in 2016, in line with the business cycle and development of new Embraer products.

The Board of Executive Officers understands that the Company, in the last three fiscal years, has demonstrated sufficient financial conditions to make investments in new products and services, and to fulfill short- and medium-term obligations.

The Board of Executive Officers considers that cash resources, which totaled R$12,429.3 million as of December 31, 2018, R$12,861.9 million as of December 31, 2017 and R$10,381.0 million as of December 31, 2016, have been sufficient to finance operations and meet funding requirements for at least 12 months.

In 2018, the Company had total indebtedness of R$14,134.1 million, representing an increase of 2% compared to R$13,888.8 million in 2017, which, in turn, represented an increase of 13% compared to R$12,254.0 million in 2016. At the end of 2018, 95.1% of the Company’s total indebtedness referred to long-term credit facilities. Of the total indebtedness, R$12,947.78 million (91.6%) was denominated in U.S. dollars, R$1,110.3 million (7.9%) was denominated inReais and R$76.1 million (0.5%) was denominated in Euros. At the end of 2017, 90.7% of the Company’s indebtedness referred to long-term credit facilities. Of the total indebtedness, R$11,761.2 million (84.7%) was denominated in U.S. dollars, R$2,081.2 million (15.0%) was denominated inReais and R$46.3 million (0.3%) was denominated in Euros. At the end of 2016, 86.4% of the Company’s indebtedness referred to long-term credit facilities. Of the total indebtedness, R$9,486.1 million (77.4%) was denominated in U.S. dollars, R$53.5 million (0.4%) was denominated in Euros and the remaining R$2,714.4 million (22.2%) was denominated inReais.

In 2018, inventory totaled R$9,714.3 million, representing a 36.7% increase compared to R$7,108.0 million in 2017, which, in turn, represented a 12.6% decrease compared to R$8,136.2 million in 2016. The increase in inventory in 2018 compared to 2017 was primarily due to the decrease in inventory turnover, which was 1.6 in 2018, representing a decrease compared to 2.1 in 2017 and 2.1 in 2016, which is not enough to meet the Company’s operating needs.

Financial Indicators

The table below sets forth the main balance sheet indicators of the Company, for the last three fiscal years:

Consolidated Highlights | As of December 31, | |||||||||||

Amounts in R$ million | 2018 | 2017(1) | 2016(2) | |||||||||

Cash(3) | 12,429.3 | 12,861.9 | 10,381.0 | |||||||||

Trade accounts receivable, net | 1,232.3 | 982.4 | 2,168.9 | |||||||||

Customer financing | 45.7 | 54.4 | 122.0 | |||||||||

Inventories | 9,714.3 | 7,108.0 | 8,136.2 | |||||||||

Fixed assets(4) | 14,994.5 | 13,208.4 | 12,458.8 | |||||||||

Trade accounts payable | 3,456.8 | 2,728.0 | 3,103.0 | |||||||||

Indebtedness – Current | 694.7 | 1,286.6 | 1,663.2 | |||||||||

Indebtedness –Non-current | 13,439.4 | 12,602.2 | 10,590.8 | |||||||||

Shareholders’ Equity | 15,267.0 | 13,819.5 | 12,844.9 | |||||||||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

| (3) | Includes cash and cash equivalents and active current andnon-current financial investments. |

| (4) | Includes property, plant and equipment, intangible assets and investments. |

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

15

As of 2015, the Company started to recordnon-current financial investments as cash, in addition to cash and cash equivalents and current financial investments, as it understands that this amount, although recorded asnon-current, may be used to meet any cash requirement.

Consolidated Highlights | As of December 31, | |||||

Amounts in R$ million | 2018 | 2017(1) | 2016(2) | |||

Debt/Shareholders’ Equity | 0.9 | 1.0 | 1.0 | |||

Inventory turnover | 1.6 | 2.1 | 2.1 | |||

Assets turnover | 0.4 | 0.5 | 0.6 | |||

ROA(3) | -1.5% | 2.3% | 1.5% | |||

ROE(4) | -4.2% | 6.5% | 4.6% | |||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

| (3) | ROA – means Return on Assets, calculated as net income/total assets. |

| (4) | ROE – means Return on Equity, calculated as net income/shareholders’ equity. |

| (b) | Capital Structure |

As of December 31, 2018, the Company’s total debt exceeded cash and cash equivalents by R$1,704.8 million. As of December 31, 2017, the Company’s total debt exceeded cash and cash equivalents by R$1,026.9 million and, as of 2016, the Company’s total debt exceeded cash and cash equivalents by R$1,873.0 million. The table below sets forth the ratio between our third-party capital and shareholders’ equity, for the last three fiscal years:

Consolidated | As of December 31, | |||||

(In R$ million, except percentages) | 2018 | 2017(1) | 2016(2) | |||

Shareholders’ Equity (Own capital) | 15,267.0 | 13,819.5 | 12,844.9 | |||

Loans and Financing (Third-party Capital) | 14,134.1 | 13,888.8 | 12,254.0 | |||

Third-party Capital + Own capital | 29,401.1 | 27,708.3 | 25,098.9 | |||

Third-party Capital/Own capital | 92.6% | 100.5% | 95.4% | |||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

| (c) | Payment capacity in relation to assumed financial commitments |

The Company maintains its payment capacity in relation to all its financial commitments, presenting a strong cash position. As of December 31, 2018, the Company’s total cash amounted to R$12,429.3 million. Net cash (cash and cash equivalentsplus current andnon-current financial investments less financial indebtedness), in the same period, totaled net debt of R$1,704.8 million.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

16

In 2018, the generation of cash from operating activities measured by EBITDA totaled R$1,016.8 million and the total financial debt/EBITDA ratio was 13.9:1.

| As of December 31, | ||||||||||||

Amounts in R$ million | 2018 | 2017(1) | 2016(2) | |||||||||

Net Cash (Indebtedness) | (1,704.8 | ) | (1,026.9 | ) | (1,873.0 | ) | ||||||

EBITDA(3) | 1,016.8 | 2,107.1 | 1,861.5 | |||||||||

Financial Indebtedness | 14,134.1 | 13,888.8 | 12,254.0 | |||||||||

Shareholders’ Equity | 15,267.0 | 13,819.5 | 12,844.9 | |||||||||

Financial expenses(4) | 997.4 | 728.4 | 877 | |||||||||

Financial Indebtedness/EBITDA | 13.9 | 6.6 | 6.6 | |||||||||

EBITDA/Financial expenses | 1.0 | 2.9 | 2.12 | |||||||||

Financial Debt/Shareholders’ Equity | 0.9 | 1.0 | 1.0 | |||||||||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

| (3) | In 2016, we changed metrics for the calculation of EBITDA, taking into account the amortization of contributions from partners. |

| (4) | Excludes IOF on financial transactions. |

The table below sets forth a summary of the Company’s balance sheet, for the last three fiscal years:

| As of December 31, | ||||||||||||

Amounts in R$ million | 2018 | 2017(1) | 2016(2) | |||||||||

Current assets | 27,398.4 | 23,419.1 | 22,102.1 | |||||||||

Non-current assets | 1,365.8 | 2,984.2 | 3,455.7 | |||||||||

Investments | 24.3 | 18.5 | 12.7 | |||||||||

Property, plant and equipment | 7,612.7 | 6,962.9 | 7,020.8 | |||||||||

Intangible assets | 7,357.5 | 6,227.1 | 5,425.3 | |||||||||

Total Assets | 43,758.8 | 39,611.8 | 38,016.7 | |||||||||

Current liabilities | 11,734.8 | 9,272.9 | 10,367.3 | |||||||||

Non-current liabilities | 16,757.0 | 16,519.4 | 14,804.5 | |||||||||

Shareholders’ equity | 15,267.0 | 13,819.5 | 12,844.9 | |||||||||

Non-controlling interest | 365.7 | 375.3 | 301.3 | |||||||||

Total Liabilities | 43,758.8 | 39,611.8 | 38,016.7 | |||||||||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

| (d) | Sources of funds for working capital and investments innon-current assets used by the Company |

Investments innon-current assets consist primarily of expenses with research and development associated with the development of aircraft for the commercial and executive aviation markets and investments in industrial capacity in Brazil and abroad. Generally, these investments are supported by funds provided by operations, borrowings under credit arrangements primarily obtained from government financing agencies, such as the Brazilian Social and Economic Development Bank (BNDES –Banco Nacional de Desenvolvimento Econômico e Social) and the Brazilian Funding Authority for Studies and Projects (FINEP –Financiadora de Estudos e Projetos), contributions in cash from risk-sharing partners, and advance payments from customers.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

17

In 2018, the Company did not make any significant use of any of the sources of funds mentioned above.

In 2017, Embraer Netherlands Finance B. V., a subsidiary of the Company, issued US$750.0 million guaranteed notes due February 1, 2027, to meet general corporate purposes.

In 2016, Embraer Portugal S.A., a subsidiary of the Company, entered into a credit facility with Santander Totta in the amount of US$200.0 million to fund the acquisition of fixed assets and working capital.

| (e) | Sources of funds for working capital and investments innon-current assets that the Company intends to use to cover liquidity deficiencies |

The Company has a Financial Management Policy, approved by the Board of Directors, whose purpose is to establish the guidelines applicable to all business areas, focusing on the management of corporate finances, including the management of cash flow and capital structure, in order to set out the risks associated with financial transactions and any liquidity deficiencies.

The Company believes that its traditional sources of funds are sufficient to meet its foreseeable working capital and investment requirements, including (i) continuing to improve the following jets family: Phenom 100EV, the Phenom 300E, the Lineage 1000, the Legacy 650E, the Legacy 450, the Legacy 500 and the Legacy 600, (ii) the development of the E2 jet family, and (iii) other planned capital expenditures.

In case of liquidity deficiency, the Company believes it will be able to access additional source of financing, such as: issuance of corporate bonds, issuance of debentures, import and export financing, credit facilities provided by development agencies in Brazil and credit facilities provided by Brazilian and international banks, whose funds will be subject to market conditions, including cost and credit, in effect at the time of the contracting.

| (f) | Levels of indebtedness and characteristics of these debts |

At the end of 2018, the Company’s total debt amounted to R$14,134.1 million (R$13,888.8 million in 2017), of which 95.1% referred tonon-current debt (90.7% in 2017). The weighted average cost of debt denominated in U.S. dollars increased from 5.18% p.a. in 2017 to 5.27% p.a. in 2018, while the cost of debt denominated inReais decreased from 3.72% p.a. in 2017 to 2.47% in 2018. At the end of 2017, the Company’s total debt amount to R$13,888.8 million (R$12,254.0 million in 2016), of which 90.7% wasnon-current debt (86.4% in 2016). The weighted average cost of debt denominated in U.S. dollars increased from 5.12% p.a. in 2016 to 5.18% p.a. in 2017, while the cost of debt denominated inReais decreased from 5.00% p.a. in 2016 to 3.72% p.a. in 2017.

Indebtedness maturity profile | ||||||||

Year | Amount in R$ | % | ||||||

2019 | 694.7 | 4.9 | % | |||||

2020 | 918.3 | 6.5 | % | |||||

2021 | 1,114.2 | 7.9 | % | |||||

2022 | 2,013.1 | 14.2 | % | |||||

2023 | 2,017.9 | 14.3 | % | |||||

After 2023 | 7,375.9 | 52.2 | % | |||||

Total | 14,134.1 | 100.0 | % | |||||

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

18

| i. | Material loan and financing agreements |

We describe below the material financing agreements of the Company and its subsidiaries, in effect as of December 31, 2018:

In October 2009, Embraer Overseas issued 6.375% US$500.0 million guaranteed notes due in January 2020 and, as of December 31, 2018, R$635.9 million was outstanding, including principal and accrued interest. The notes have been registered with the U.S. Securities and Exchange Commission (SEC) and listed in the New York Stock Exchange. The notes are fully and unconditionally guaranteed by the Company and interest is paid semiannually.

On June 15, 2012, the Company issued 5.150% US$500.0 million guaranteed notes due on June 15, 2022 and, as of December 31, 2018, R$1,936.5 million was outstanding. The notes have been registered with the SEC and listed on the New York Stock Exchange. Interest is paid semiannually.

Between August and September 2013, the Company, through its subsidiary Embraer Overseas Limited, completed an exchange offer of our notes with maturity in 2017 and 2020 for newly issued notes maturing in 2023. In the offer, US$146.4 million in principal amount of our notes with maturity in 2017 and US$337.2 million in principal amount of our notes with maturity in 2020, which corresponded to approximately 54.9% of the exchanged notes, were exchanged for approximately 5.70% US$540.5 million in principal amount of notes issued by Embraer Overseas due on September 16, 2023, considering the exchange price and the issuance of the new notes. Interest is paid semiannually. As of December 31, 20187, a total of US$2,001.7 million under our notes due 2023 was outstanding.

In December 2013, the Company entered into a financing agreement with the BNDES to support project development in the total aggregate amount of approximately R$1.4 billion, equivalent to US$364.3 million with final maturity on January 15, 2022. The facility bears interest of 3.5% per annum and as of December 31, 2018, we had US$741.9 million outstanding under this credit facility, including principal and accrued interest.

In June 2015, Embraer Netherlands Finance B.V. issued 5.05% US$1.0 billion guaranteed notes due on June 15, 2025 and, as of December 31, 2018, R$3,862.9 million was outstanding. Interest is paid semiannually and the notes are fully and unconditionally guaranteed by the Company. The notes have been registered with the SEC and listed on the New York Stock Exchange.

In December 2015, the Company entered into loan transactions through export credit notes (Nota de Crédito de Exportação) with a number of Brazilian financial institutions to make investments in export activities and manufacturing of export goods, in the amount of R$685 million, at a weighted average interest rate of 10.96% per annum. As of December 31, 2018, the outstanding balance totaled R$149.2 million.

In August 2016, Embraer Portugal S.A., a subsidiary of the Company, entered into a credit facility with Santander Totta in the amount of US$200.0 million, bearing interest at 3.07%, with maturity in August 2021, to fund acquisition of fixed assets and working capital. As of December 31, 2018, R$781.4 million was outstanding under this facility.

In February 2017, Embraer Netherlands Finance B. V., a subsidiary of the Company, issued 5.40% US$750.0 million guaranteed notes due on February 1, 2027 and as of December 31, 2018, R$2,961.7 million was outstanding. Interest is paid semiannually. The notes are unconditionally guaranteed by us. The notes have been registered with the SEC and listed on the New York Stock Exchange.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

19

| ii. | Other long-term relationships with financial institutions |

There are no other long-term relationships with financial institutions.

| iii. | Debt subordination |

As of December 31, 2018, our total debt amounted to R$14,134.1 million, of which 6.8% or R$961.1 million (R$328.6 million referring to current debt and R$632.5 million tonon-current debt) corresponded to financings obtained from FINEP and BNDES. Collaterals include a combination of real estate mortgages, liens of machinery and equipment and bank guarantees in the total amount of R$1,315.0 million.

All other credit facilities and financings of the Company correspond to unsecured debt and arepari passu with all the other debts of the Company.

| iv. | Any restrictions imposed on the company, especially, in relation to indebtedness limits and incurrence of additional debt, distribution of dividends, sale of assets, issuance of additional securities and sale of ownership control |

Below are the restrictions imposed on the Company and its subsidiaries under material long-term financing agreements of the Company and its subsidiaries, as of December 31, 2018.

The issuances of notes by the Company and its subsidiaries in 2009, 2012, 2013, 2015 and 2017, in the amounts of US$500 million, US$500 million, US$540.5 million, US$1.0 billion and US$750 million, respectively, are subject to the following restrictions:

| (A) | Negative pledge |

The assets of the Company cannot be pledged as collateral, except if:

| (i) | related to the purchase of new assets; |

| (ii) | in the ordinary course of business regarding the financing of aircraft by the guarantorto other entity or in import/export transactions; |

| (iii) | related to debts of the guarantor with BNDES and other international agencies; |

| (iv) | held by acquired companies; |

| (v) | they already exist, or result from legal imposition or judicial decision; |

| (vi) | due to developments related to governmental authorities; |

| (vii) | already existing in assets to be acquired; |

| (viii) | related to funds for payment of principal, interest and additional amounts; |

| (ix) | arising from Capitalized Lease Obligations; or |

| (x) | in an amount below 10% of the Company’s share capital. |

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

20

| (B) | Corporate transactions |

The Company and the guarantor may only enter into consolidation/merger and transfer of assets transactions, without the consent of noteholders, if:

| (i) | the successor expressly assumes the repayment of principal, interest and other obligations; |

| (ii) | no Default occurs; |

| (iii) | opinions are delivered confirming the transaction meets all conditions precedent; |

| (iv) | the successor agrees to assume any resulting costs, ensuring that payments to noteholders will not be affected. |

The agreements entered into with BNDES contain customary covenants and restrictions, including those that require us to maintain: (i) a maximum leverage ratio, calculated as net debt to EBITDA, of 3.5:1 and (ii) a minimum net debt service coverage ratio, calculated as EBITDA to financial expenses, of 2.25:1.

In addition to the financial covenants mentioned above, the Company is also required to maintain certain measures and to take actions in order to avoid or correct issues regarding environmental damages, occupational safety and occupational medicine. The Company is also required to maintain its obligations in good standing with environmental agencies and, during the term of the agreement, comply with the laws applicable to persons with disabilities.

The agreements entered into with FINEP are subject to the following restrictive clauses:

| (a) | no change in direct or indirect effective control may occur, which, in the opinion of FINEP, may compromise the regular development of the project and/or prevent the due performance of the agreement; |

| (b) | no corporate agreements or bylaws can include provisions requiring special quorum for resolutions or approval of matters that limit or hinder control in any company of the group by the respective controlling shareholders, or provisions imposing: |

| (i) | restrictions on the Company’s ability to grow or develop its technologies; |

| (ii) | restrictions on access to new markets; or |

| (iii) | restrictions on the payment capacity or affecting the payment of financial obligations derived from the relevant transaction entered into with financial institutions. |

| (c) | During the term of the agreement, the Company must adopt measures and actions to avoid or correct matters regarding environmental damages, occupational safety and occupational medicine that may be caused by the project financed through such agreement. |

| (d) | The Company must comply with applicable law regarding the Brazilian Environmental Policy (Politica Nacional de Meio Ambiente), maintaining its obligations in good standing with environmental agencies during the term of such agreement. |

| (e) | There can be no final judgment sentencing Embraer for its acts or the acts of its management in connection with racial or gender discrimination, child labor, slave labor, workplace or sexual harassment, or environmental crime. |

As of December 31, 2018, the Company and its subsidiaries were fully in compliance with all the restrictive covenants contained in our financing agreements. All financial andnon-financial covenants set forth in agreements that provide for obligations, in effect in 2016, 2017 and 2018, were met in the respective years.

| (g) | Maximum amounts contracted and percentages already disbursed |

As of December 31, 2018, no credit facilities had been entered into whose disbursements had not been made.

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

21

| (h) | Significant changes in each item of the Consolidated Balance Sheets |

(in R$ million, except %) | Dec. 31, 2018 | VA | Dec. 31, 2017(1) | VA | Dec. 31, 2016(2) | VA | HA 2018 x 2017 | HA 2017 x 2016 | ||||||||||||||||||||||||

Assets |

| |||||||||||||||||||||||||||||||

Current |

| |||||||||||||||||||||||||||||||

Cash and cash equivalents | 4,963.0 | 11 | % | 4,203.7 | 11 | % | 4,046.2 | 11 | % | 18 | % | 4 | % | |||||||||||||||||||

Financial investments | 6,755.3 | 15 | % | 7,827.1 | 20 | % | 5,786.6 | 15 | % | -14 | % | 35 | % | |||||||||||||||||||

Trade accounts receivable, net | 1,232.3 | 3 | % | 982.4 | 2 | % | 2,168.7 | 6 | % | 25 | % | -55 | % | |||||||||||||||||||

Derivative financial instruments | 21.1 | 0 | % | 97.7 | 0 | % | 68.6 | 0 | % | -78 | % | 42 | % | |||||||||||||||||||

Customer financing | 4.8 | 0 | % | 7.0 | 0 | % | 27.8 | 0 | % | -31 | % | -75 | % | |||||||||||||||||||

Collateralized accounts receivable | 846.5 | 2 | % | 614.1 | 2 | % | 465.4 | 1 | % | 38 | % | 32 | % | |||||||||||||||||||

Contract assets | 1,387.1 | 3 | % | 1,480.3 | 4 | % | — | 0 | % | -6 | % | 100 | % | |||||||||||||||||||

Inventories | 9,714.3 | 22 | % | 7,108.0 | 18 | % | 8,136.2 | 21 | % | 37 | % | -13 | % | |||||||||||||||||||

Guarantee deposits | 1,316.9 | 3 | % | 0.3 | 0 | % | — | 0 | % | 438867 | % | 100 | % | |||||||||||||||||||

Income tax and social contribution | 369.2 | 1 | % | 254.5 | 1 | % | 263.1 | 1 | % | 45 | % | -3 | % | |||||||||||||||||||

Other assets | 787.9 | 2 | % | 844.0 | 2 | % | 1,139.7 | 3 | % | -7 | % | -26 | % | |||||||||||||||||||

Total current assets | 27,398.4 | 63 | % | 23,419.1 | 59 | % | 22,102.1 | 58 | % | 17 | % | 6 | % | |||||||||||||||||||

Non-current |

| |||||||||||||||||||||||||||||||

Financial investments | 710.9 | 2 | % | 831.1 | 2 | % | 548.2 | 1 | % | -14 | % | 52 | % | |||||||||||||||||||

Trade accounts receivable, net | — | 0 | % | 0.1 | 0 | % | 0.1 | 0 | % | -100 | % | -33 | % | |||||||||||||||||||

Derivative financial instruments | 16.0 | 0 | % | 16.0 | 0 | % | 36.2 | 0 | % | 0 | % | -56 | % | |||||||||||||||||||

Customer financing | 40.9 | 0 | % | 47.3 | 0 | % | 94.3 | 0 | % | -14 | % | -50 | % | |||||||||||||||||||

Collateralized accounts receivable | 67.2 | 0 | % | 341.1 | 1 | % | 588.3 | 2 | % | -80 | % | -42 | % | |||||||||||||||||||

Guarantee deposits | 37.9 | 0 | % | 1.302.7 | 3 | % | 1,666.8 | 4 | % | -97 | % | -22 | % | |||||||||||||||||||

Deferred income tax and social contribution | 83.6 | 0 | % | 44.3 | 0 | % | 11.0 | 0 | % | 89 | % | 302 | % | |||||||||||||||||||

Other assets | 409.4 | 1 | % | 401.6 | 1 | % | 510.8 | 1 | % | 2 | % | -21 | % | |||||||||||||||||||

Investments | 24.3 | 0 | % | 18.5 | 0 | % | 12.7 | 0 | % | 31 | % | 45 | % | |||||||||||||||||||

Property, plant and equipment | 7,612.7 | 17 | % | 6,962.9 | 18 | % | 7,020.8 | 18 | % | 9 | % | -1 | % | |||||||||||||||||||

Intangible assets | 7,357.5 | 17 | % | 6,227.1 | 16 | % | 5,425.3 | 14 | % | 18 | % | 15 | % | |||||||||||||||||||

Totalnon-current assets | 16,360.3 | 37 | % | 16,192.7 | 41 | % | 15,914.5 | 42 | % | 1 | % | 2 | % | |||||||||||||||||||

Total assets | 43,758.8 | 100 | % | 39,611.8 | 100 | % | 38,016.7 | 100 | % | 10 | % | 4 | % | |||||||||||||||||||

| (1) | Restated to reflect the effects of the retrospective adoption of IFRS 9/CPC 48 – Financial Instruments and IFRS 15/CPC 47—Revenue from Contracts with Customers. See note 2.2.1 of the audited consolidated financial statements. |

| (2) | Amounts derived from the audited consolidated financial statements for the year ended December 31, 2016 were not restated to reflect the effects of the adoption of IFRS 9/CPC 48 and IFRS 15/CPC 47. |

This is a free translation of the manual and management proposal for the Embraer’s shareholders’ meetings required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

22

(in R$ million, except %) | Dec. 31, 2018 | VA | Dec. 31, 2017(1) | VA | Dec. 31, 2016(2) | VA | HA 2018 x 2017 | HA 2017 x 2016 | ||||||||||||||||||||||||

Liabilities |

| |||||||||||||||||||||||||||||||

Current |

| |||||||||||||||||||||||||||||||

Trade accounts payable | 3,456.8 | 8 | % | 2,728.0 | 7 | % | 3,103.0 | 8 | % | 27 | % | -12 | % | |||||||||||||||||||

Loans and financing | 694.7 | 2 | % | 1,286.6 | 3 | % | 1,663.2 | 4 | % | -46 | % | -23 | % | |||||||||||||||||||

Non-recourse and recourse debt | 1,255.5 | 3 | % | 58.1 | 0 | % | 74.6 | 0 | % | 2061 | % | -22 | % | |||||||||||||||||||

Trade accounts payable | 1,117.4 | 3 | % | 966.6 | 2 | % | 1,236.9 | 3 | % | 16 | % | -22 | % | |||||||||||||||||||

Contract liabilities | 4,050.6 | 9 | % | 3,311.7 | 8 | % | — | 0 | % | 24 | % | 100 | % | |||||||||||||||||||

Advances from customers | — | — | — | — | 2,334.8 | 6 | % | — | -100 | % | ||||||||||||||||||||||

Derivative financial instruments | 31.2 | 0 | % | 29.2 | 0 | % | 27.5 | 0 | % | 7 | % | 6 | % | |||||||||||||||||||

Taxes and payroll charges payable | 265.0 | 1 | % | 233.9 | 1 | % | 142.1 | 0 | % | 13 | % | 65 | % | |||||||||||||||||||

Income tax and social contribution | 186.0 | 0 | % | 53.2 | 0 | % | 84.5 | 0 | % | 250 | % | -37 | % | |||||||||||||||||||

Financial guarantee and residual value guarantee | 197.5 | 0 | % | 73.6 | 0 | % | 162.0 | 0 | % | 168 | % | -55 | % | |||||||||||||||||||

Unearned income | 7.8 | 0 | % | — | 0 | % | 1,015.2 | 3 | % | 100 | % | -100 | % | |||||||||||||||||||

Dividends | 19.3 | 0 | % | 121.7 | 0 | % | 80.9 | 0 | % | -84 | % | 50 | % | |||||||||||||||||||

Provisions | 453.0 | 1 | % | 410.3 | 1 | % | 442.5 | 1 | % | 10 | % | -7 | % | |||||||||||||||||||

Total current liabilities | 11,734.8 | 27 | % | 9,272.9 | 23 | % | 10,367.2 | 27 | % | 27 | % | -11 | % | |||||||||||||||||||

Non-current |

| |||||||||||||||||||||||||||||||

Loans and financing | 13,439.4 | 31 | % | 12,602.2 | 32 | % | 10,590.8 | 28 | % | 7 | % | 19 | % | |||||||||||||||||||