- ERJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Embraer (ERJ) 6-KCurrent report (foreign)

Filed: 29 Apr 19, 5:18pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16

under the Securities Exchange Act of 1934

For the month of April 2019

Commission File Number:001-15102

Embraer S.A.

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7): ☐

MANUAL AND MANAGEMENT’S PROPOSAL FOR THE EXTRAORDINARY GENERAL ON MAY 27th, SHAREHOLDERS’ MEETING OF EMBRAER S.A. TO BE HELD 2019 embraer.comMANUAL AND MANAGEMENT’S PROPOSAL FOR THE EXTRAORDINARY GENERAL ON MAY 27th, SHAREHOLDERS’ MEETING OF EMBRAER S.A. TO BE HELD 2019 embraer.com

1 TABLE OF CONTENTS 1. Message from the Chairman of the Board of Directors ....................................... 2 2. Information and Guidelines for Attendance at the Meeting ............................... 3 2.1. Voting at the Meeting......................................................................................... 3 2.2. In-Person Attendance at Meeting ...................................................................... 4 2.3. Participation through Distance Voting Ballot (Boletim de Voto à Distância) ..... 5 3. Call Notice ............................................................................................................... 7 4. Management’s Proposal on the Agenda ............................................................... 9 4.1. To review and resolve on the amendments to the Bylaws to conform them to 9 the Novo Mercado (New Market) Listing Regulation ......................................... 4.2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities 9 Commission (Comissão de Valores Mobiliários – CVM) ................................... 4.3. To review and resolve on the changes in the Bylaws to the rules relating to (i) the membership of the Board of Directors, (ii) meetings of the Company’s management bodies, and (iii) certain responsibilities of the Company’s 9 management bodies .......................................................................................... 4.4. To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors ............................................................................................................ 9 4.5. To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos 9 de indenidade) .................................................................................................. 4.6. To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 9 5, 2018 .............................................................................................................. 4.7. To review and resolve on formal adjustments to the Bylaws ............................. 10 4.8. To approve the restatement of the Bylaws resulting from the amendments approved in the items above ............................................................................. 10 ANNEXES: Annex I – Proposed Bylaws Annex II – Report of Proposed Amendments to the Bylaws This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 1 TABLE OF CONTENTS 1. Message from the Chairman of the Board of Directors ...................................... 2 2. Information and Guidelines for Attendance at the Meeting ............................... 3 2.1. Voting at the Meeting......................................................................................... 3 2.2. In-Person Attendance at Meeting ...................................................................... 4 2.3. Participation through Distance Voting Ballot (Boletim de Voto à Distância) ..... 5 3. Call Notice ............................................................................................................... 7 4. Management’s Proposal on the Agenda ............................................................... 9 4.1. To review and resolve on the amendments to the Bylaws to conform them to 9 the Novo Mercado (New Market) Listing Regulation ......................................... 4.2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities 9 Commission (Comissão de Valores Mobiliários – CVM) ................................... 4.3. To review and resolve on the changes in the Bylaws to the rules relating to (i) the membership of the Board of Directors, (ii) meetings of the Company’s management bodies, and (iii) certain responsibilities of the Company’s 9 management bodies .......................................................................................... 4.4. To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors ............................................................................................................ 9 4.5. To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos 9 de indenidade) .................................................................................................. 4.6. To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 9 5, 2018 .............................................................................................................. 4.7. To review and resolve on formal adjustments to the Bylaws ............................. 10 4.8. To approve the restatement of the Bylaws resulting from the amendments approved in the items above ............................................................................. 10 ANNEXES: Annex I – Proposed Bylaws Annex II – Report of Proposed Amendments to the Bylaws This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

2 1. Message from the Chairman of the Board of Directors São José dos Campos, April 26, 2019 Dear Shareholder, We are pleased to invite you to attend the Extraordinary General Shareholders’ Meeting (“AGE” or “Meeting”) of Embraer S.A. (“Embraer” or “Company”), called for on May 27, 2019, at 10:00 a.m., to be held at the Company’s headquarters located at Avenida Brigadeiro Faria Lima, 2170, in the city of São José dos Campos, State of São Paulo. Embraer’s shares have been listed on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) since 1989 and on the New York Stock Exchange (NYSE) since July 2000 through American Depositary Receipts (ADRs). Since the corporate restructuring that took place in 2006, Embraer’s capital stock has been exclusively comprised of common shares, as well as one golden share held by the Brazilian Federal Government, without a control group or a controlling shareholder. Since then, Embraer’s shares have been included in the Novo Mercado segment of B3, the highest level of corporate governance that a company can have in Brazil. In the AGE, you will be invited to review and resolve on the matters included in the Call Notice, in accordance with item 3 below. Embraer’s Management presented a proposal related to the matters on which to be voted, which is included in this Manual. For the Meeting to take place on first call, the attendance of shareholders representing at least two-thirds of the voting capital stock is required, pursuant to Section 135 of Law No. 6,404/76. Considering the legal and statutory requirements related to the quorum for these resolutions, I emphasize the importance of your vote on the matters presented herein. Embraer’s relationship with its shareholders is based on the disclosure of information with transparency, clarity and respect for legal and ethical principles, which allows the consolidation and maintenance of Embraer’s image of leadership and innovation in the capital markets. We hope that the information contained herein, prepared in this spirit, will clarify the matters on the agenda and motivate you to attend the AGE. We encourage your attendance in the AGE, in the best interest of Embraer. Remember, your vote is very important to us. We appreciate your attention, Alexandre Gonçalves Silva Chairman of the Board of Directors This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 2 1. Message from the Chairman of the Board of Directors São José dos Campos, April 26, 2019 Dear Shareholder, We are pleased to invite you to attend the Extraordinary General Shareholders’ Meeting (“AGE” or “Meeting”) of Embraer S.A. (“Embraer” or “Company”), called for on May 27, 2019, at 10:00 a.m., to be held at the Company’s headquarters located at Avenida Brigadeiro Faria Lima, 2170, in the city of São José dos Campos, State of São Paulo. Embraer’s shares have been listed on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) since 1989 and on the New York Stock Exchange (NYSE) since July 2000 through American Depositary Receipts (ADRs). Since the corporate restructuring that took place in 2006, Embraer’s capital stock has been exclusively comprised of common shares, as well as one golden share held by the Brazilian Federal Government, without a control group or a controlling shareholder. Since then, Embraer’s shares have been included in the Novo Mercado segment of B3, the highest level of corporate governance that a company can have in Brazil. In the AGE, you will be invited to review and resolve on the matters included in the Call Notice, in accordance with item 3 below. Embraer’s Management presented a proposal related to the matters on which to be voted, which is included in this Manual. For the Meeting to take place on first call, the attendance of shareholders representing at least two-thirds of the voting capital stock is required, pursuant to Section 135 of Law No. 6,404/76. Considering the legal and statutory requirements related to the quorum for these resolutions, I emphasize the importance of your vote on the matters presented herein. Embraer’s relationship with its shareholders is based on the disclosure of information with transparency, clarity and respect for legal and ethical principles, which allows the consolidation and maintenance of Embraer’s image of leadership and innovation in the capital markets. We hope that the information contained herein, prepared in this spirit, will clarify the matters on the agenda and motivate you to attend the AGE. We encourage your attendance in the AGE, in the best interest of Embraer. Remember, your vote is very important to us. We appreciate your attention, Alexandre Gonçalves Silva Chairman of the Board of Directors This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

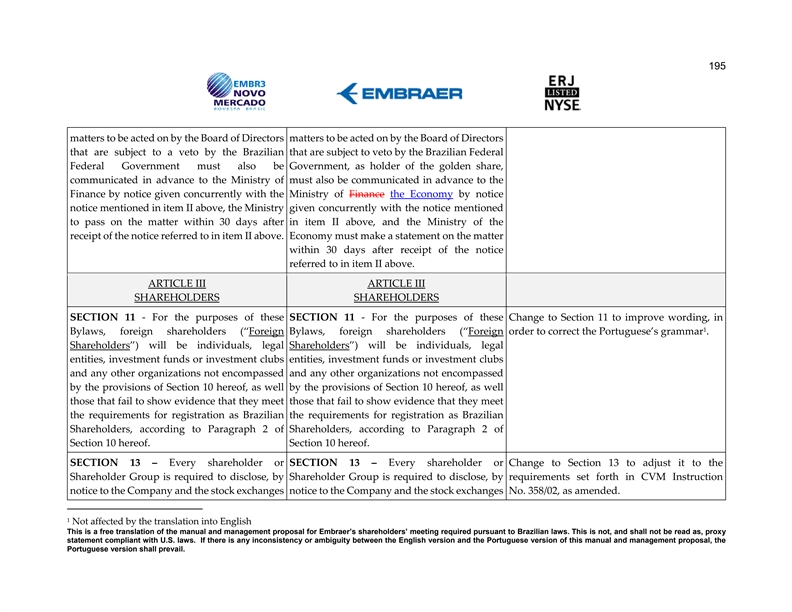

3 2. Information and Guidelines for Attendance at the Meeting 2.1. Voting at the Meeting Each common share will be entitled to one vote on the resolutions of the Meeting, subject to the following limits set forth in the Company’s Bylaws: a) No shareholder, or Shareholders’ Group (as defined below), Brazilian or foreign, may cast votes in excess of 5% of the shares of the Company’s capital stock; and b) The Foreign Shareholders (as defined below) and Foreign Shareholders’ Group (as defined below) may not cast votes in excess of 2/3 of the total votes that may be exercised by the Brazilian Shareholders (as defined below) in attendance. The above limitations apply to the Foreign Shareholders and Foreign Shareholders’ Group, jointly and successively. The votes of the Brazilian Shareholders and the Foreign Shareholders on the resolutions of the Meeting will be calculated separately. To that end, the Chairman of the Meetings shall, upon becoming Chairman, determine and communicate the total number of votes that may be cast by the Brazilian Shareholders and by the Foreign Shareholders, observing the voting limits set forth in the Company’s Bylaws. If the total number of votes of the Foreign Shareholders exceeds 2/3 of the votes that may be cast by the Brazilian Shareholders, the number of votes of each Foreign Shareholder, including those received by means of distance voting ballot (boletim de voto à distância) sent directly to the Company or through a third party, shall be proportionately reduced by the percentage of such excess, so that the total number of votes of the Foreign Shareholders does not exceed the limit of two-thirds of the total votes that may be cast in the Meeting. For purposes of applying the restriction on the maximum number of votes attributed to each shareholder, you must take into account the following definitions set forth in Embraer’s Bylaws: Shareholders’ Group – A shareholders’ group are two or more shareholders: (i) that are parties to a voting agreement, either directly or through companies that are subsidiaries, parent companies or companies under common control; (ii) where one shareholder is, directly or indirectly, a controlling shareholder or a controlling parent company of the other shareholder or shareholders; (iii) that are companies directly or indirectly controlled by the same person, or group of persons, who may or may not be shareholders themselves; or (iv) that are companies, associations, foundations, cooperatives and trusts, investment funds or portfolios, universal rights or any other form of organization or undertaking (a) with the same administrators or managers, or further (b) whose administrators or managers are companies that are directly or indirectly controlled by the same person/entity, or group of persons/entities, which may or may not be shareholders. As regards to investment funds, only funds with a common administrator, whose policies of investments and exercise of voting rights provides the administrator with full authority to decide and resolve at shareholders’ meetings, will be considered to be a member of a Shareholders’ Group. The holders of securities issued under the Company’s Depositary Receipts program are not This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 3 2. Information and Guidelines for Attendance at the Meeting 2.1. Voting at the Meeting Each common share will be entitled to one vote on the resolutions of the Meeting, subject to the following limits set forth in the Company’s Bylaws: a) No shareholder, or Shareholders’ Group (as defined below), Brazilian or foreign, may cast votes in excess of 5% of the shares of the Company’s capital stock; and b) The Foreign Shareholders (as defined below) and Foreign Shareholders’ Group (as defined below) may not cast votes in excess of 2/3 of the total votes that may be exercised by the Brazilian Shareholders (as defined below) in attendance. The above limitations apply to the Foreign Shareholders and Foreign Shareholders’ Group, jointly and successively. The votes of the Brazilian Shareholders and the Foreign Shareholders on the resolutions of the Meeting will be calculated separately. To that end, the Chairman of the Meetings shall, upon becoming Chairman, determine and communicate the total number of votes that may be cast by the Brazilian Shareholders and by the Foreign Shareholders, observing the voting limits set forth in the Company’s Bylaws. If the total number of votes of the Foreign Shareholders exceeds 2/3 of the votes that may be cast by the Brazilian Shareholders, the number of votes of each Foreign Shareholder, including those received by means of distance voting ballot (boletim de voto à distância) sent directly to the Company or through a third party, shall be proportionately reduced by the percentage of such excess, so that the total number of votes of the Foreign Shareholders does not exceed the limit of two-thirds of the total votes that may be cast in the Meeting. For purposes of applying the restriction on the maximum number of votes attributed to each shareholder, you must take into account the following definitions set forth in Embraer’s Bylaws: Shareholders’ Group – A shareholders’ group are two or more shareholders: (i) that are parties to a voting agreement, either directly or through companies that are subsidiaries, parent companies or companies under common control; (ii) where one shareholder is, directly or indirectly, a controlling shareholder or a controlling parent company of the other shareholder or shareholders; (iii) that are companies directly or indirectly controlled by the same person, or group of persons, who may or may not be shareholders themselves; or (iv) that are companies, associations, foundations, cooperatives and trusts, investment funds or portfolios, universal rights or any other form of organization or undertaking (a) with the same administrators or managers, or further (b) whose administrators or managers are companies that are directly or indirectly controlled by the same person/entity, or group of persons/entities, which may or may not be shareholders. As regards to investment funds, only funds with a common administrator, whose policies of investments and exercise of voting rights provides the administrator with full authority to decide and resolve at shareholders’ meetings, will be considered to be a member of a Shareholders’ Group. The holders of securities issued under the Company’s Depositary Receipts program are not This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

4 considered a Shareholders’ Group, unless they meet any of the criteria set forth in items (i) through (iv) above. Any shareholders or Shareholders’ Group that are represented by the same proxy, administrator or attorney in fact, shall be deemed members of the same Shareholders’ Group in the Meeting, except in the case of holders of securities issued in connection with the Company’s Depositary Receipts program, when represented by the respective Depositary Bank. In the event of shareholders’ agreements that govern the exercise of voting rights, all signatories thereto shall be considered members of the same Shareholders’ Group for purposes of the limitation on the number of votes described above. Foreign Shareholders’ Group – A Shareholders’ Group will be considered foreign whenever one or more of its members is a Foreign Shareholder. Brazilian Shareholders – The following are Brazilian Shareholders: (i) individuals born or naturalized in Brazil, residing in Brazil or abroad; (ii) legal entities organized under Brazilian private law and having their management based in Brazil and which: a) have no foreign controlling shareholder or foreign parent company, unless the latter falls under item “b” of this definition; b) are controlled, directly or indirectly, by one or more individuals referred to in item (i) of this definition; and (iii) investment funds or clubs organized under the laws of Brazil and having their management based in Brazil and whose administrators and/or majority unitholders are persons referred to in items (i) and (ii) of this definition. Foreign Shareholders – Foreign Shareholders are individuals, legal entities, investment funds or clubs and any other entities not included in the definition of Brazilian Shareholders, and those that fail to prove that they meet the requirements to be registered as Brazilian Shareholders, pursuant to paragraph 2 of Section 10 of the Company’s Bylaws. 2.2. In-person Attendance at Meeting In order to attend the Meeting in person or by proxy, we request that you present to Embraer, at least 48 hours prior to the date of the Meeting, the following documents: a) Power of attorney with special power for representation at the Meeting, in the case of a proxy; b) For shareholders who have their shares deposited in the fungible custody of shares (custódia fungível de ações), an extract provided by the custodian institution confirming their respective shareholdings; and c) Evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, (x) presenting a valid identification document or (y) submitting to the Company a certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution), as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 4 considered a Shareholders’ Group, unless they meet any of the criteria set forth in items (i) through (iv) above. Any shareholders or Shareholders’ Group that are represented by the same proxy, administrator or attorney in fact, shall be deemed members of the same Shareholders’ Group in the Meeting, except in the case of holders of securities issued in connection with the Company’s Depositary Receipts program, when represented by the respective Depositary Bank. In the event of shareholders’ agreements that govern the exercise of voting rights, all signatories thereto shall be considered members of the same Shareholders’ Group for purposes of the limitation on the number of votes described above. Foreign Shareholders’ Group – A Shareholders’ Group will be considered foreign whenever one or more of its members is a Foreign Shareholder. Brazilian Shareholders – The following are Brazilian Shareholders: (i) individuals born or naturalized in Brazil, residing in Brazil or abroad; (ii) legal entities organized under Brazilian private law and having their management based in Brazil and which: a) have no foreign controlling shareholder or foreign parent company, unless the latter falls under item “b” of this definition; b) are controlled, directly or indirectly, by one or more individuals referred to in item (i) of this definition; and (iii) investment funds or clubs organized under the laws of Brazil and having their management based in Brazil and whose administrators and/or majority unitholders are persons referred to in items (i) and (ii) of this definition. Foreign Shareholders – Foreign Shareholders are individuals, legal entities, investment funds or clubs and any other entities not included in the definition of Brazilian Shareholders, and those that fail to prove that they meet the requirements to be registered as Brazilian Shareholders, pursuant to paragraph 2 of Section 10 of the Company’s Bylaws. 2.2. In-person Attendance at Meeting In order to attend the Meeting in person or by proxy, we request that you present to Embraer, at least 48 hours prior to the date of the Meeting, the following documents: a) Power of attorney with special power for representation at the Meeting, in the case of a proxy; b) For shareholders who have their shares deposited in the fungible custody of shares (custódia fungível de ações), an extract provided by the custodian institution confirming their respective shareholdings; and c) Evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, (x) presenting a valid identification document or (y) submitting to the Company a certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution), as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

5 inform the Company, at least 48 hours before the Meeting, if you belong to a Shareholders’ Group. The abovementioned documents must be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, Portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo. 2.3. Participation through Distance Voting Ballot (Boletim de Voto à Distância) If the shareholder wishes to send a distance voting ballot directly to the Company, the shareholder must send the following documents: (i) original hard copy or digital copy of the original distance voting ballot, available on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários - CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br) on the Internet, duly filled in, initialed on all pages and signed at the end; (ii) to prove oneself as a Brazilian Shareholder or Foreign Shareholder, (x) a certified copy or digital copy of the original identity document, or (y) the certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution); and (iii) certified copy or digital copy of the original of the following documents: For individuals: - identity document with photograph of the shareholder; For legal entities: - current bylaws or consolidated articles of association and corporate documents that evidence the legal representation of the shareholder; and - identity document with photograph of the legal representative. For investment funds: - current consolidated governing document of the fund; - bylaws or articles of association of its administrator or manager, as the case may be, according to the voting policy of the fund, and corporate documents evidencing the powers of representation; and - identity document with photograph of the legal representative. The above distance voting ballots and documents shall be received by no later than seven days before the date of the Meeting and those received after such date will be disregarded. The Company waives the certification of signature, notarization and consularization for acceptance of the distance voting ballots. The Company will not require the sworn translation of documents originally drawn up in Portuguese, English or Spanish, or to be accompanied by a translation in those languages. The following identity documents will be accepted, This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 5 inform the Company, at least 48 hours before the Meeting, if you belong to a Shareholders’ Group. The abovementioned documents must be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, Portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo. 2.3. Participation through Distance Voting Ballot (Boletim de Voto à Distância) If the shareholder wishes to send a distance voting ballot directly to the Company, the shareholder must send the following documents: (i) original hard copy or digital copy of the original distance voting ballot, available on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários - CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br) on the Internet, duly filled in, initialed on all pages and signed at the end; (ii) to prove oneself as a Brazilian Shareholder or Foreign Shareholder, (x) a certified copy or digital copy of the original identity document, or (y) the certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company will waive the presentation of the certificate by a holder of book-entry shares listed on the list of shareholders provided by the depositary financial institution); and (iii) certified copy or digital copy of the original of the following documents: For individuals: - identity document with photograph of the shareholder; For legal entities: - current bylaws or consolidated articles of association and corporate documents that evidence the legal representation of the shareholder; and - identity document with photograph of the legal representative. For investment funds: - current consolidated governing document of the fund; - bylaws or articles of association of its administrator or manager, as the case may be, according to the voting policy of the fund, and corporate documents evidencing the powers of representation; and - identity document with photograph of the legal representative. The above distance voting ballots and documents shall be received by no later than seven days before the date of the Meeting and those received after such date will be disregarded. The Company waives the certification of signature, notarization and consularization for acceptance of the distance voting ballots. The Company will not require the sworn translation of documents originally drawn up in Portuguese, English or Spanish, or to be accompanied by a translation in those languages. The following identity documents will be accepted, This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

6 provided they include a photograph: identity card (RG), national registry of foreigners (RNE), driver’s license (CNH), passport or officially recognized professional identification. Under the terms of the current regulations, the Company will inform the shareholder, within three days, (i) whether the distance voting ballot (boletim de voto à distância) has been received, as well as whether the documents received are sufficient for the vote to be valid; or (ii) the need to rectify or resend the distance voting ballot (boletim de voto à distância) or any accompanying documents, describing the procedures and deadlines required for the distance voting ballot (boletim de voto à distância) to be valid. As an alternative to sending the distance voting ballot directly to the Company, shareholders holding shares issued by the Company may send voting instructions to complete the distance voting ballot by means of: (i) their respective custodian agents, in the case of shares that are deposited in custody (depositário central); or (ii) the financial institution engaged by the Company to provide securities bookkeeping services, in the case of shares that are not deposited in custody (depositário central). The Company requests that the above documents be sent to the attention of its Investor Relations Department, preferably to the electronic address: investor.relations@embraer.com.br. If by mail, the documents should be mailed to Av. Brigadeiro Faria Lima, 2170, post office 294, in the city of São José dos Campos, State of São Paulo, CEP 12.227-901, to the attention of the Investor Relations Department and, if delivered personally, to Av. Brigadeiro Faria Lima, 2170, in the city of São José dos Campos -SP, portaria F46, to the attention of the Investor Relations Department (extension 3953). When sent by mail or delivered personally, the Company requests a copy of the distance voting ballot also be sent by e-mail to investor.relations@embraer.com.br. If you have any questions regarding the procedure and deadlines described in this item 2, we ask that you contact the Investor Relations Department at (11) 3040-9518, or by e-mail at investor.relations@embraer.com.br. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 6 provided they include a photograph: identity card (RG), national registry of foreigners (RNE), driver’s license (CNH), passport or officially recognized professional identification. Under the terms of the current regulations, the Company will inform the shareholder, within three days, (i) whether the distance voting ballot (boletim de voto à distância) has been received, as well as whether the documents received are sufficient for the vote to be valid; or (ii) the need to rectify or resend the distance voting ballot (boletim de voto à distância) or any accompanying documents, describing the procedures and deadlines required for the distance voting ballot (boletim de voto à distância) to be valid. As an alternative to sending the distance voting ballot directly to the Company, shareholders holding shares issued by the Company may send voting instructions to complete the distance voting ballot by means of: (i) their respective custodian agents, in the case of shares that are deposited in custody (depositário central); or (ii) the financial institution engaged by the Company to provide securities bookkeeping services, in the case of shares that are not deposited in custody (depositário central). The Company requests that the above documents be sent to the attention of its Investor Relations Department, preferably to the electronic address: investor.relations@embraer.com.br. If by mail, the documents should be mailed to Av. Brigadeiro Faria Lima, 2170, post office 294, in the city of São José dos Campos, State of São Paulo, CEP 12.227-901, to the attention of the Investor Relations Department and, if delivered personally, to Av. Brigadeiro Faria Lima, 2170, in the city of São José dos Campos -SP, portaria F46, to the attention of the Investor Relations Department (extension 3953). When sent by mail or delivered personally, the Company requests a copy of the distance voting ballot also be sent by e-mail to investor.relations@embraer.com.br. If you have any questions regarding the procedure and deadlines described in this item 2, we ask that you contact the Investor Relations Department at (11) 3040-9518, or by e-mail at investor.relations@embraer.com.br. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

7 3. Call Notice (The Call Notice will be published in the newspapers Valor Econômico, in the editions dated April 26, 29 and 30, 2019, O Vale and Diário Oficial do Estado de São Paulo in the editions dated April 26, 27 and 30, 2019.) We invite the shareholders of Embraer S.A. (“Company” or “Embraer”) to attend an Extraordinary General Shareholders’ Meeting (“Meeting”), to be held on May 27, 2019, at 10:00 a.m. local time, at the Company’s headquarters, in the city of São José dos Campos, State of São Paulo, at Avenida Brigadeiro Faria Lima, 2170, to review and resolve on the following agenda, as detailed in the Manual and Management’s Proposal for the Extraordinary Shareholders’ Meeting: 1. To review and resolve on the amendments to the Bylaws to conform them to the Novo Mercado (New Market) Listing Regulation; 2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM); 3. To review and resolve on the changes in the Bylaws to the rules relating to (i) the membership of the Board of Directors, (ii) meetings of the Company’s management bodies, and (iii) certain responsibilities of the Company’s management bodies; 4. To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors; 5. To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos de indenidade); 6. To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 5, 2018; 7. To review and resolve on formal adjustments to the Bylaws; 8. To approve the restatement of the Bylaws resulting from the amendments approved in the items above. Pursuant to paragraph 6 of Section 124 and to paragraph 3 of Section 135 of Law No. 6,404/76, the documents that are the subject matter of the resolutions of the Meeting hereby called, including This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 7 3. Call Notice (The Call Notice will be published in the newspapers Valor Econômico, in the editions dated April 26, 29 and 30, 2019, O Vale and Diário Oficial do Estado de São Paulo in the editions dated April 26, 27 and 30, 2019.) We invite the shareholders of Embraer S.A. (“Company” or “Embraer”) to attend an Extraordinary General Shareholders’ Meeting (“Meeting”), to be held on May 27, 2019, at 10:00 a.m. local time, at the Company’s headquarters, in the city of São José dos Campos, State of São Paulo, at Avenida Brigadeiro Faria Lima, 2170, to review and resolve on the following agenda, as detailed in the Manual and Management’s Proposal for the Extraordinary Shareholders’ Meeting: 1. To review and resolve on the amendments to the Bylaws to conform them to the Novo Mercado (New Market) Listing Regulation; 2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM); 3. To review and resolve on the changes in the Bylaws to the rules relating to (i) the membership of the Board of Directors, (ii) meetings of the Company’s management bodies, and (iii) certain responsibilities of the Company’s management bodies; 4. To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors; 5. To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos de indenidade); 6. To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 5, 2018; 7. To review and resolve on formal adjustments to the Bylaws; 8. To approve the restatement of the Bylaws resulting from the amendments approved in the items above. Pursuant to paragraph 6 of Section 124 and to paragraph 3 of Section 135 of Law No. 6,404/76, the documents that are the subject matter of the resolutions of the Meeting hereby called, including This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

8 those mentioned in Section 11 of CVM Instruction No. 481/09, are available to shareholders at the Company’s headquarters and on the Internet on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br). General Instructions: a) To attend the Meeting in person or by proxy, we request that you present to the Company, at least 48 hours prior to the date of the Meeting, the following documents: (i) power of attorney with special powers for representation at the Meeting, in the case of a proxy; (ii) for shareholders who have their shares deposited in the fungible custody of shares, an extract provided by the custodian institution confirming their respective shareholdings; and (iii) evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also inform the Company, at least 48 hours before the Meeting, whether you belong to a Shareholders’ Group (as such term is defined in the Company’s Bylaws). b) The documents mentioned in item “a” above shall be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo. c) In order to attend the Meeting through distance voting ballot (boletim de voto à distância), shareholders must send a distance voting ballot (boletim de voto à distância) directly to the Company or through third parties, according to the instructions contained in the Manual and Management’s Proposal published as of the date hereof and available on the websites above. São José dos Campos, April 26, 2019. Alexandre Gonçalves Silva Chairman of the Board of Directors This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 8 those mentioned in Section 11 of CVM Instruction No. 481/09, are available to shareholders at the Company’s headquarters and on the Internet on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br). General Instructions: a) To attend the Meeting in person or by proxy, we request that you present to the Company, at least 48 hours prior to the date of the Meeting, the following documents: (i) power of attorney with special powers for representation at the Meeting, in the case of a proxy; (ii) for shareholders who have their shares deposited in the fungible custody of shares, an extract provided by the custodian institution confirming their respective shareholdings; and (iii) evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also inform the Company, at least 48 hours before the Meeting, whether you belong to a Shareholders’ Group (as such term is defined in the Company’s Bylaws). b) The documents mentioned in item “a” above shall be delivered to the Company’s headquarters, to the attention of the Investor Relations Department, at Avenida Brigadeiro Faria Lima, 2170, portaria F46 (extension 3953), in the city of São José dos Campos, State of São Paulo. c) In order to attend the Meeting through distance voting ballot (boletim de voto à distância), shareholders must send a distance voting ballot (boletim de voto à distância) directly to the Company or through third parties, according to the instructions contained in the Manual and Management’s Proposal published as of the date hereof and available on the websites above. São José dos Campos, April 26, 2019. Alexandre Gonçalves Silva Chairman of the Board of Directors This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

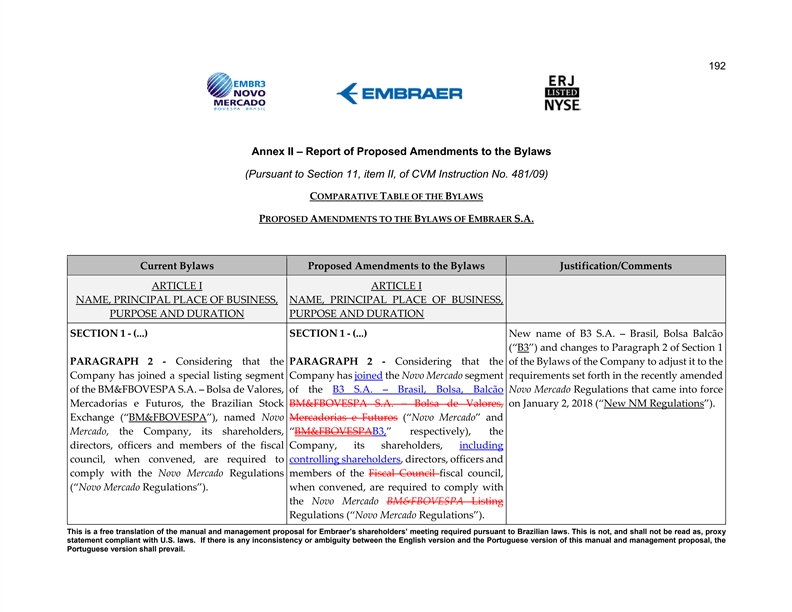

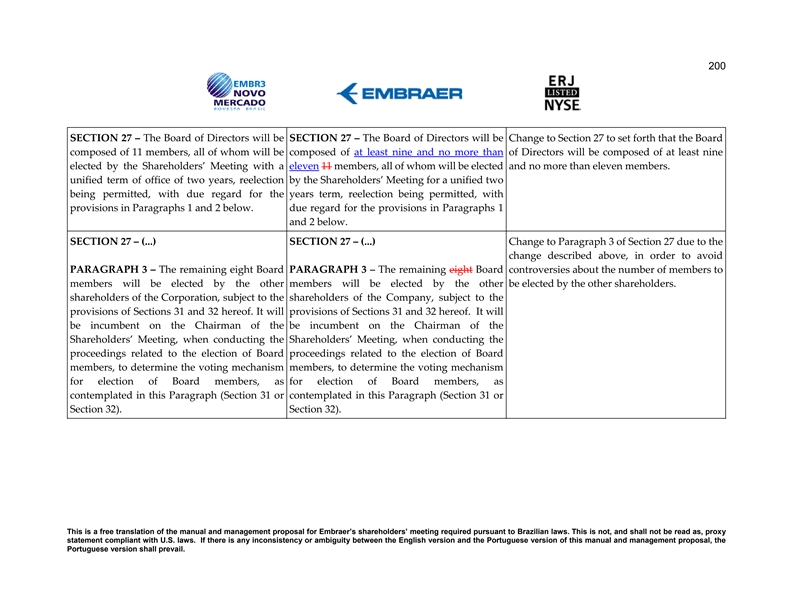

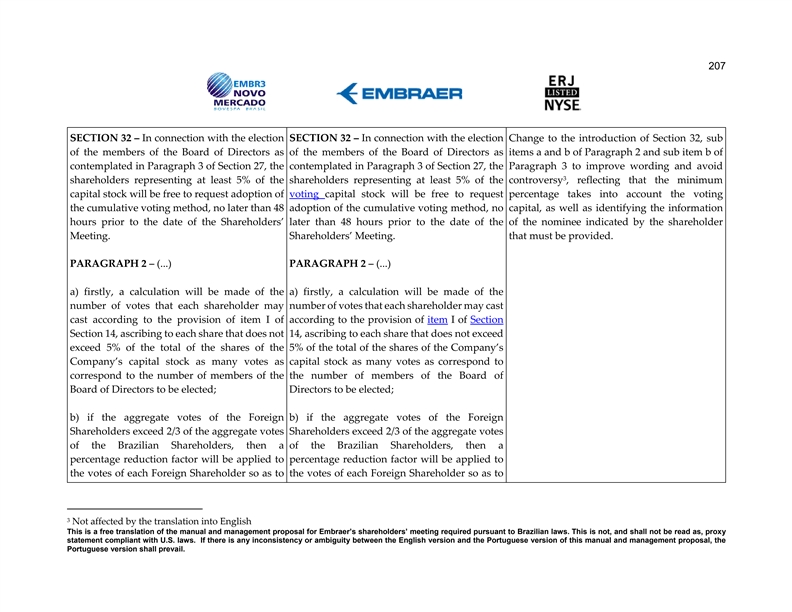

9 4. Management’s Proposal on the Agenda 4.1. To review and resolve on the amendments to the Bylaws to conform them to the Novo Mercado (New Market Listing Regulation As a result of the enactment of the New Regulation of the Novo Mercado by B3 (“New Regulation”), listing segment of B3 in which the Company is included, the Management of Embraer proposes that the Bylaws be amended pursuant to the new applicable rules. 4.2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM Embraer’s Management proposes to conform the Bylaws provisions with the requirements contained in the CVM Instruction 358/02, as well as in the Ofício-Circular/CVM/SEP/Nº3/2019. 4.3 To review and resolve on the changes in the Bylaws to the rules relating to (i the membership of the Board of Directors, (ii meetings of the Company’s management bodies, and (iii certain responsibilities of the Company’s management bodies The Board of Directors proposes that the membership of the Board of Directors be flexible, and it is the Shareholders’ Meeting responsibility to determine the number of its members, which may be comprised of at least 9 and at most 11 members. Additionally, in order to reinforce its commitment to constantly improve its governance, Management proposes changes to the rules pertaining to the meetings of the Company’s management bodies, as well as the modification of certain responsabilities of the management bodies, in order to optimize the company’s decision-making processes and governance. 4.4 To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors Embraer Management proposes to change the names of the advisory committees of the Board of Directors, so that the Human Resources Committee becomes the Personnel and Governance Committee and the Audit and Risk Committee becomes the Audit, Risk and Ethics Committee, as well as modify the membership of the advisory committees of the Board of Directors. 4.5 To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos de indenidade In line with CVM Guideline 38, Embraer Management proposes to include a rule on the possibility for the Company to enter into indemnity agreements (acordos de indenidade) with directors, members of the Fiscal Council and committees of the Company and its subsidiaries, as well as employees and representatives who legally act by delegation of the Company’s or its subsidiaries’ managers, as well as establish policy applicable to them. 4.6 To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 5, 2018 This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 9 4. Management’s Proposal on the Agenda 4.1. To review and resolve on the amendments to the Bylaws to conform them to the Novo Mercado (New Market Listing Regulation As a result of the enactment of the New Regulation of the Novo Mercado by B3 (“New Regulation”), listing segment of B3 in which the Company is included, the Management of Embraer proposes that the Bylaws be amended pursuant to the new applicable rules. 4.2. To review and resolve on the amendments to the Bylaws to conform them to the requirements set forth in the regulations of the Brazilian Securities Commission (Comissão de Valores Mobiliários – CVM Embraer’s Management proposes to conform the Bylaws provisions with the requirements contained in the CVM Instruction 358/02, as well as in the Ofício-Circular/CVM/SEP/Nº3/2019. 4.3 To review and resolve on the changes in the Bylaws to the rules relating to (i the membership of the Board of Directors, (ii meetings of the Company’s management bodies, and (iii certain responsibilities of the Company’s management bodies The Board of Directors proposes that the membership of the Board of Directors be flexible, and it is the Shareholders’ Meeting responsibility to determine the number of its members, which may be comprised of at least 9 and at most 11 members. Additionally, in order to reinforce its commitment to constantly improve its governance, Management proposes changes to the rules pertaining to the meetings of the Company’s management bodies, as well as the modification of certain responsabilities of the management bodies, in order to optimize the company’s decision-making processes and governance. 4.4 To review and resolve on the amendments to the Bylaws in order to change the names and the membership of the advisory committees of the Board of Directors Embraer Management proposes to change the names of the advisory committees of the Board of Directors, so that the Human Resources Committee becomes the Personnel and Governance Committee and the Audit and Risk Committee becomes the Audit, Risk and Ethics Committee, as well as modify the membership of the advisory committees of the Board of Directors. 4.5 To review and resolve on the amendments to the Bylaws to include a rule on the possibility for the Company entering into indemnity agreements (acordos de indenidade In line with CVM Guideline 38, Embraer Management proposes to include a rule on the possibility for the Company to enter into indemnity agreements (acordos de indenidade) with directors, members of the Fiscal Council and committees of the Company and its subsidiaries, as well as employees and representatives who legally act by delegation of the Company’s or its subsidiaries’ managers, as well as establish policy applicable to them. 4.6 To review and resolve on the change in the Company’s capital stock to reflect the increase approved by the Board of Directors at a meeting held on March 5, 2018 This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

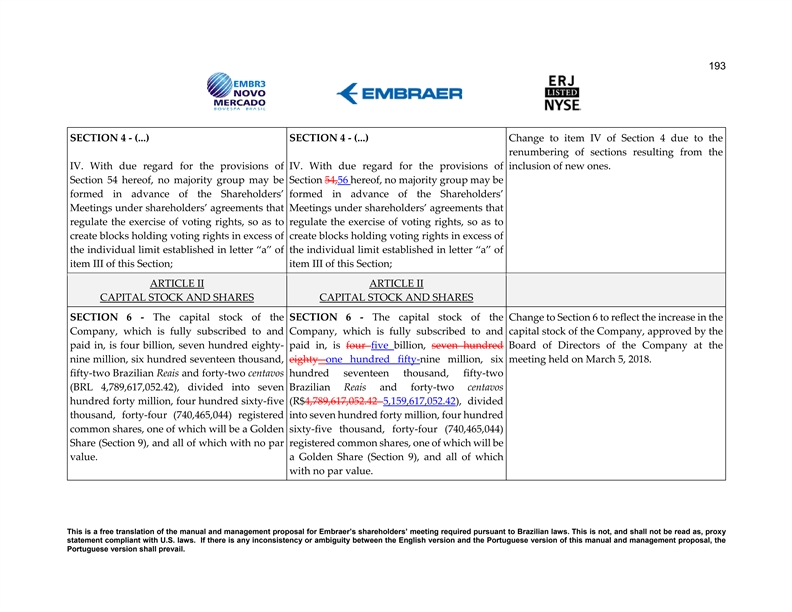

10 We also propose that the caption of Section 6 of the Company’s Bylaws be amended to reflect the capital increase approved by the Board of Directors, within the limit of authorized capital, at the meeting held on March 5, 2018. 4.7 To review and resolve on formal adjustments to the Bylaws The Board of Directors of Embraer proposes to approve extensive amendments to the Bylaws, contemplating the following changes: (a) to change all references to BM&FBOVESPA S.A.– Bolsa de Valores, Mercadorias e Futuros, former name of B3 S.A. – Brasil, Bolsa, Balcão; and (b) other formal and editorial adjustments, as well as the renumbering and cross- referencing of provisions of the Company’s Bylaws when applicable. 4.8 To approve the restatement of the Bylaws resulting from the amendments approved in the items above The Board of Directors of Embraer proposes to restate the Company's Bylaws as a result of the amendments approved in the above items. Embraer’s Board of Directors recommends its shareholders to carefully review a copy of the proposed Bylaws and the report with the proposed amendments contained in Annexes I and II to this Manual, pursuant to Section 11, items I and II, of CVM Instruction No. 481/09. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 10 We also propose that the caption of Section 6 of the Company’s Bylaws be amended to reflect the capital increase approved by the Board of Directors, within the limit of authorized capital, at the meeting held on March 5, 2018. 4.7 To review and resolve on formal adjustments to the Bylaws The Board of Directors of Embraer proposes to approve extensive amendments to the Bylaws, contemplating the following changes: (a) to change all references to BM&FBOVESPA S.A.– Bolsa de Valores, Mercadorias e Futuros, former name of B3 S.A. – Brasil, Bolsa, Balcão; and (b) other formal and editorial adjustments, as well as the renumbering and cross- referencing of provisions of the Company’s Bylaws when applicable. 4.8 To approve the restatement of the Bylaws resulting from the amendments approved in the items above The Board of Directors of Embraer proposes to restate the Company's Bylaws as a result of the amendments approved in the above items. Embraer’s Board of Directors recommends its shareholders to carefully review a copy of the proposed Bylaws and the report with the proposed amendments contained in Annexes I and II to this Manual, pursuant to Section 11, items I and II, of CVM Instruction No. 481/09. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

11 Annex I – PROPOSED BYLAWS (Pursuant to Section 11, item II, of CVM Instruction 481/09) This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 11 Annex I – PROPOSED BYLAWS (Pursuant to Section 11, item II, of CVM Instruction 481/09) This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail.

Annex I – Proposed Bylaws (Pursuant to Section 11, item I, of CVM Instruction No. 481/09) Bylaws of EMBRAER S.A. Article I Name, Principal Place of Business, Purpose and Duration Section 1 – Embraer S.A. (the “Company”) is a corporation governed by these Bylaws and the applicable law. Paragraph 1 – The Company was incorporated as a federal mixed-capital company (sociedade de economia mista) pursuant to an authorization under Decree-Law No. 770, of August 19, 1969, and was privatized in accordance with Law No. 8,031, of April 12, 1990, and Public Notice No. PND-A-05/94-EMBRAER issued by the Executive Committee of the Brazilian Privatization Program, published in the Official Gazette, Part 3, on April 4, 1994, pages 5,774 to 5,783. Paragraph 2 – Considering that the Company has joined the Novo Mercado segment of the B3 S.A. – Brasil, Bolsa de Valores, Mercadorias e Futuros (“BM&FBOVESPA, Balcão (“Novo Mercado” and “B3,” respectively), the Company, its shareholders, including controlling shareholders, directors, officers and members of the Fiscal Council fiscal council, when convened, are required to comply with the Novo Mercado BM&FBOVESPA Listing Regulations (“Novo Mercado Regulations”). Principal Place of Business Section 2 – The Company will have its principal place of business and headquarters in the City of São José dos Campos, State of São Paulo, and may incorporate companies and open branches and other offices as well as appoint agents or representatives anywhere in Brazil or abroad. Corporate Purpose Section 3 – The corporate purpose of the Company is as follows: I. to design, build and market aircraft and aerospace materials and related accessories, components and equipment, according to the highest standards of technology and quality; II. to perform and carry out technical activities related to the manufacturing and servicing of aerospace materials; III. to contribute to the training of technical personnel as necessary for the aerospace industry; IV. to engage in other technological, manufacturing and business activities in connection with the aerospace industry, and to provide services therefor; V. to design, build and trade in equipment, materials, systems, software, accessories and components for the defense, security and power industries, as well as perform and carry out technical activities related to the manufacturing and servicing thereof, in accordance with the highest technological and quality standards; and VI. to conduct other technological, manufacturing, trading and services activities related to the defense, security and power industries. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 41803.00100Annex I – Proposed Bylaws (Pursuant to Section 11, item I, of CVM Instruction No. 481/09) Bylaws of EMBRAER S.A. Article I Name, Principal Place of Business, Purpose and Duration Section 1 – Embraer S.A. (the “Company”) is a corporation governed by these Bylaws and the applicable law. Paragraph 1 – The Company was incorporated as a federal mixed-capital company (sociedade de economia mista) pursuant to an authorization under Decree-Law No. 770, of August 19, 1969, and was privatized in accordance with Law No. 8,031, of April 12, 1990, and Public Notice No. PND-A-05/94-EMBRAER issued by the Executive Committee of the Brazilian Privatization Program, published in the Official Gazette, Part 3, on April 4, 1994, pages 5,774 to 5,783. Paragraph 2 – Considering that the Company has joined the Novo Mercado segment of the B3 S.A. – Brasil, Bolsa de Valores, Mercadorias e Futuros (“BM&FBOVESPA, Balcão (“Novo Mercado” and “B3,” respectively), the Company, its shareholders, including controlling shareholders, directors, officers and members of the Fiscal Council fiscal council, when convened, are required to comply with the Novo Mercado BM&FBOVESPA Listing Regulations (“Novo Mercado Regulations”). Principal Place of Business Section 2 – The Company will have its principal place of business and headquarters in the City of São José dos Campos, State of São Paulo, and may incorporate companies and open branches and other offices as well as appoint agents or representatives anywhere in Brazil or abroad. Corporate Purpose Section 3 – The corporate purpose of the Company is as follows: I. to design, build and market aircraft and aerospace materials and related accessories, components and equipment, according to the highest standards of technology and quality; II. to perform and carry out technical activities related to the manufacturing and servicing of aerospace materials; III. to contribute to the training of technical personnel as necessary for the aerospace industry; IV. to engage in other technological, manufacturing and business activities in connection with the aerospace industry, and to provide services therefor; V. to design, build and trade in equipment, materials, systems, software, accessories and components for the defense, security and power industries, as well as perform and carry out technical activities related to the manufacturing and servicing thereof, in accordance with the highest technological and quality standards; and VI. to conduct other technological, manufacturing, trading and services activities related to the defense, security and power industries. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 41803.00100

Principles Section 4 – The organization and operation of the Company will be guided by the following principles: I. the securities of the Company will be traded on domestic and/or international capital markets in compliance with all applicable regulatory requirements and the requirements of the supervisory institutions of such markets, in order to raise the necessary capital for the growth of the Company as well as preservation of its competitiveness and continuing existence; II. all shares of the capital stock of the Company will be common shares; III. with respect to the resolutions passed by the Shareholders’ Meetings: a) no shareholder or group of shareholders, whether Brazilian or foreign, may exercise voting rights in excess of 5% of the shares of the capital stock; and b) foreign shareholders and groups of foreign shareholders, in the aggregate, may not exercise voting rights in excess of two-thirds (2/3) of all voting rights held by the Brazilian shareholders in attendance; IV. with due regard for the provisions of Section 54,56 hereof, no majority group may be formed in advance of the Shareholders’ Meetings under shareholders’ agreements that regulate the exercise of voting rights, so as to create blocks holding voting rights in excess of the individual limit established in letter “a” of item III of this Section; V. the resolutions and acts by the bodies of the Company listed in Section 9 hereof will be subject to a veto right of the Brazilian Federal Government; and VI. the Company shall not issue participation certificates (partes beneficiárias). Section 5 – The duration of the Company will be for an indefinite period of time. Article II Capital Stock and Shares Capital Stock Section 6 – The capital stock of the Company, which is fully subscribed to and paid in, is four five billion, seven hundred eighty one hundred fifty-nine million, six hundred seventeen thousand, fifty-two Brazilian Reais and forty-two centavos (R$4,789,617,052.42 5,159,617,052.42), divided into seven hundred forty million, four hundred sixty-five thousand, forty-four (740,465,044) registered common shares, one of which will be a Golden Share (Section 9), and all of which with no par value. Paragraph 1 – At all times the capital stock of the Company will be divided into common shares only, no preferred shares being permitted. Paragraph 2 – The single Golden Share of the Brazilian Federal Government will be entitled to all prerogatives attached thereto for as long as such Golden Share is owned by the Brazilian Federal Government (pursuant to Section 8 of Law No. 9,491/97). Section 7 – According to Section 168 of Law No. 6,404, of December 15, 1976, as amended (“Law No. 6,404/76”) the capital stock of the Company may be increased up to one billion (1,000,000,000) common shares, by a resolution of the Board of Directors, irrespective of any amendment to these Bylaws. Paragraph 1 – It is incumbent on the Board of Directors to establish the number of shares to be issued and the price thereof, as well as the time and terms of payment; provided, however, that a subscription to be paid in kind will be contingent on approval of the relevant appraisal report by the Shareholders’ Meeting, as required by law. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 41803.00100Principles Section 4 – The organization and operation of the Company will be guided by the following principles: I. the securities of the Company will be traded on domestic and/or international capital markets in compliance with all applicable regulatory requirements and the requirements of the supervisory institutions of such markets, in order to raise the necessary capital for the growth of the Company as well as preservation of its competitiveness and continuing existence; II. all shares of the capital stock of the Company will be common shares; III. with respect to the resolutions passed by the Shareholders’ Meetings: a) no shareholder or group of shareholders, whether Brazilian or foreign, may exercise voting rights in excess of 5% of the shares of the capital stock; and b) foreign shareholders and groups of foreign shareholders, in the aggregate, may not exercise voting rights in excess of two-thirds (2/3) of all voting rights held by the Brazilian shareholders in attendance; IV. with due regard for the provisions of Section 54,56 hereof, no majority group may be formed in advance of the Shareholders’ Meetings under shareholders’ agreements that regulate the exercise of voting rights, so as to create blocks holding voting rights in excess of the individual limit established in letter “a” of item III of this Section; V. the resolutions and acts by the bodies of the Company listed in Section 9 hereof will be subject to a veto right of the Brazilian Federal Government; and VI. the Company shall not issue participation certificates (partes beneficiárias). Section 5 – The duration of the Company will be for an indefinite period of time. Article II Capital Stock and Shares Capital Stock Section 6 – The capital stock of the Company, which is fully subscribed to and paid in, is four five billion, seven hundred eighty one hundred fifty-nine million, six hundred seventeen thousand, fifty-two Brazilian Reais and forty-two centavos (R$4,789,617,052.42 5,159,617,052.42), divided into seven hundred forty million, four hundred sixty-five thousand, forty-four (740,465,044) registered common shares, one of which will be a Golden Share (Section 9), and all of which with no par value. Paragraph 1 – At all times the capital stock of the Company will be divided into common shares only, no preferred shares being permitted. Paragraph 2 – The single Golden Share of the Brazilian Federal Government will be entitled to all prerogatives attached thereto for as long as such Golden Share is owned by the Brazilian Federal Government (pursuant to Section 8 of Law No. 9,491/97). Section 7 – According to Section 168 of Law No. 6,404, of December 15, 1976, as amended (“Law No. 6,404/76”) the capital stock of the Company may be increased up to one billion (1,000,000,000) common shares, by a resolution of the Board of Directors, irrespective of any amendment to these Bylaws. Paragraph 1 – It is incumbent on the Board of Directors to establish the number of shares to be issued and the price thereof, as well as the time and terms of payment; provided, however, that a subscription to be paid in kind will be contingent on approval of the relevant appraisal report by the Shareholders’ Meeting, as required by law. This is a free translation of the manual and management proposal for Embraer’s shareholders’ meeting required pursuant to Brazilian laws. This is not, and shall not be read as, proxy statement compliant with U.S. laws. If there is any inconsistency or ambiguity between the English version and the Portuguese version of this manual and management proposal, the Portuguese version shall prevail. 41803.00100