- ERJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Embraer (ERJ) 6-KEMBRAERPR2Q18_6K

Filed: 31 Jul 18, 4:50pm

____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2018

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):¨

HIGHLIGHTS

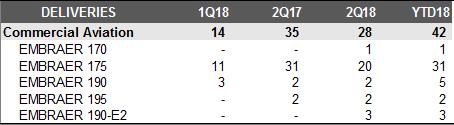

· In 2Q18, Embraer delivered 28 commercial and 20 executive (15 light and 5 large) jets, compared to the 35 commercial and 24 executive (16 light and 8 large) jets in 2Q17;

· The Company’s firm order backlog was US$ 17.4 billion at the end of 2Q18, including contracts of the Services & Support segment;

· Reported EBIT and EBITDA1in 2Q18 were US$ (17.7) million and US$ 44.1 million, respectively, yielding margins of -1.4% and 3.5%. The reported EBIT and EBITDA figures include the negative impact of a non-recurring special item of US$ 127.2 million related to additional costs (cost base revision) on the KC-390 development contract in 2Q18, resulting from the recent incident with prototype aircraft 001 in May (see page 9 for more details);

· Adjusted EBIT and adjusted EBITDA, excluding the impact of the KC-390 cost base revision, were US$ 109.5 million and US$ 171.3 million, respectively. Adjusted EBIT margin in 2Q18 was 8.7% and adjusted EBITDA margin in the same period was 13.6%. Year-to-date, adjusted EBIT margin for the Company was 6.0% and adjusted EBITDA margin was 11.6%, in line with Embraer’s published 2018 guidance ranges of 5-6% for adjusted EBIT and 10-11% for adjusted EBITDA;

· 2Q18 Net loss attributable to Embraer shareholders and Loss per ADS were US$ (126.5) million and US$ (0.69), respectively. Adjusted Net income (excluding deferred income tax and social contribution and special items) for 2Q18 was US$ 6.1 million, with Adjusted earnings per ADS of US$ 0.03;

· Embraer generated US$ 47.8 million in Free cash flow in 2Q18, and finished the quarter with total cash of US$ 3,341.1 million and total debt of US$ 4,062.3 million, yielding net debt of US$ 721.2 million;

· The Company reaffirms all aspects of its 2018 financial and aircraft deliveries guidance, which does not include the non-recurring impact of the KC-390 cost base revision recognized in 2Q18.

Main financial indicators2

1 EBIT and EBITDA are non-GAAP measures. For more detailed information please refer to page 13.

2 Adjusted Net Income (loss) is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period, in addition to adjusting for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting from unrealized gains or losses due to the impact of changes in theReal to US Dollar exchange rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution, which was US$ (69.9) million in 2Q17, US$ (48.6) million in 2Q18 and US$ 17.8 million in 1Q17. Adjusted Net Income (loss) also excludes the net after-tax special items of US$ 5.0 million in 2Q17 and US$ (84.0) million in 2Q18.

| 1 |

São Paulo, Brazil, July 31, 2018- (B3: EMBR3, NYSE: ERJ).The Company's operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended June 30, 2018 (2Q18), March 31, 2018 (1Q18) and June 30, 2017 (2Q17), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

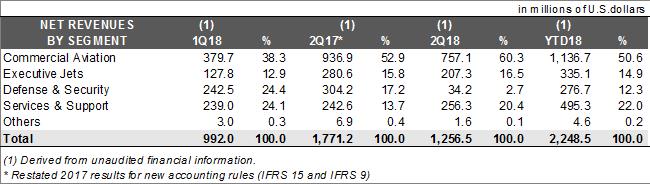

REVENUES and gross margin

Embraer delivered 28 commercial and 20 executive aircraft (15 light jets and 5 large jets) in 2Q18, for a total of 48 jets delivered during the quarter. This compares to the Company’s total aircraft deliveries of 59 jets in 2Q17, of which 35 were commercial jets and 24 were executive jets (16 light jets and 8 large jets). For the first six months of 2018, Embraer delivered 42 commercial jets and 31 executive jets (23 light jets and 8 large jets), compared to deliveries of 53 commercial jets and 39 executive jets (27 light jets and 12 large jets) over the first six months of 2017. Embraer remains confident in its 2018 guidance for 85 to 95 total commercial jet deliveries and 105 to 125 total executive jet deliveries (70-80 light jets and 35-45 large jets). The Company again expects the Executive Jets segment to deliver a significant volume of aircraft during the fourth quarter of 2018, similar to the seasonality of previous years.

Consolidated revenues in the quarter were US$ 1,256.5 million, representing a year-over-year decline of 29.1% compared to 2Q17, due to a combination of lower deliveries in the Commercial Aviation and Executive Jets segments in the quarter and a significant decline in Defense & Security segment revenues in 2Q18 as a result of cost base revisions related to the KC-390 development contract. In addition, 2Q17 Defense & Security revenues were the highest quarterly revenues reported in 2017 due to the launch of the SGDC satellite in May of 2017. These declines were only partially offset by 5.6% year-over-year growth in Services & Support revenues in the quarter. Year-to-date, Embraer consolidated revenues were US$ 2,248.5 million in the first six months of 2018 as compared to US$ 2,813.7 million in the first six months of 2017, with the decline driven principally by lower deliveries in the Commercial Aviation and Executive Jets segment as well as a 38.9% fall in Defense & Security revenues, driven by the aforementioned factors in the quarterly comparison above.

The Company’s consolidated gross margin in 2Q18 was 11.2% as compared to the 17.8% gross margin reported in 2Q17. The year-over-year decline in gross margin was principally a result of the cost base revision on the KC-390 contract in the Defense & Security segment. Over the first six months of the year, Embraer’s consolidated gross margin was 14.3% compared to 17.4% over the first six months of 2017.

EBIT AND ADJUSTED EBIT

In 2Q18, EBIT and EBIT margin as reported were US$ (17.7) million and -1.4%, respectively, compared to EBIT of US$ 177.5 million and EBIT margin of 10.0% reported in 2Q17. The decline in reported EBIT and EBIT margin relative to last year’s second quarter is largely due to the impact of a special non-recurring item recognized in 2Q18 related to a cost base revision on the KC-390 development contract resulting from the recent incident with prototype aircraft 001 in May, which negatively impacted reported results by US$ 127.2 million. The reported EBIT in 2Q17 also included non-recurring special items with a net positive impact of US$ 9.4 million, including: 1) a positive impact of US$ 1.2 million related to reversal of certain provisions for the Company’s voluntary redundancy program, 2) a positive impact of US$ 11.7 million related to the conversion of claims from the Republic Airways bankruptcy, and 3) a negative impact of US$ 3.5 million related to taxes on remittances executed for payments following the finalization of the FCPA investigation. Embraer’s EBIT and EBIT margin over the first six months of 2018 was US$ 8.7 million and 0.4%, respectively, compared to US$ 218.2 million in EBIT and a 7.8% reported EBIT margin over the first six months of 2017. It is important to note that the impact of the KC-390 cost base revision booked in 2Q18 does not impact the Company’s 2018 guidance for adjusted EBIT of US$ 270-355 million (adjusted EBIT margin of 5.0-6.0%) and adjusted EBITDA of US$ 540-650 million (adjusted EBITDA margin of 10.0-11.0%).

| 2 |

Excluding the KC-390 cost base revision of US$127.2 million, 2Q18 adjusted EBIT was US$ 109.5 million and adjusted EBIT margin was 8.7%, compared to 2Q17 adjusted EBIT of US$ 168.1 million and adjusted EBIT margin of 9.5%. During the first half of 2018, the Company’s adjusted EBIT was US$ 135.9 million and adjusted EBIT margin was 6.0%. Embraer reiterates its 2018 guidance for adjusted EBIT and adjusted EBITDA (and their respective adjusted margins) mentioned in the previous paragraph.

During 2Q18, administrative expenses totaled US$ 41.4 million, representing a slight increase from the US$ 39.7 million reported in 2Q17. In the first six months of 2018, administrative expenses were US$ 85.7 million as compared to US$ 82.3 million in the first six months of 2017. Selling expenses declined from US$ 79.7 million in 2Q17 to US$ 71.0 million in 2Q18, reflecting year-over-year improvement across the majority of the Company’s business units as Embraer continues to achieve cost efficiencies. Selling expenses were also lower in the first half of 2018 as compared to the first half of 2017, at US$ 142.3 million versus US$ 152.6 million. Research expenses increased slightly in the quarter, at US$ 10.1 million in 2Q18 vs. US$ 9.3 million in 2Q17. Year-to-date, research expenses were US$ 19.9 million in 2018 as compared to US$ 17.5 million in 2017, and are tracking in line with Embraer’s 2018 guidance for US$ 50 million in research expenses.

Other operating income (expense), net in 2Q18 was an expense of US$ 35.5 million, compared to the US$ 9.2 million reported in 2Q17. Last year’s reported other operating income (expense) figure includes the previously mentioned special items totaling a net positive impact of US$ 9.4 million. Excluding the net benefits of these special items, 2Q17 other operating income (expense), net was expense of US$ 18.6 million. The principal reasons for the increase in other operating expense in 2Q18 relative to 2Q17 included higher taxes on remittances related to our used aircraft leasing operations and higher expenses on consulting services.

net income

Net income (loss) attributable to Embraer shareholders and Earnings (Loss) per ADS for 2Q18 were US$ (126.5) million and US$ (0.69) per share, respectively, compared to US$ 61.7 million in net income (loss) attributable to Embraer shareholders and US$ 0.34 per share in Earnings (Loss) per ADS in 2Q17. Over the first six months of 2018, net income (loss) attributable to Embraer shareholders was US$ (138.8) million and Earnings (Loss) per ADS was US$ (0.76) per share.

Adjusted net income (loss), excluding deferred income tax and social contribution and the total after-tax impacts of any special items booked in the period, was US$ 6.1 million in 2Q18 and Adjusted Earnings (Loss) per ADS was US$ 0.03 per share, compared to US$ 126.5 million in adjusted net income and US$ 0.69 per share in adjusted earnings per ADS in 2Q17. In the first half of 2018, adjusted net income (loss) attributable to Embraer shareholders was US$ (18.5) million and adjusted earnings (loss) per ADS was US$ (0.10) per share. This compares to adjusted net income (loss) attributable to Embraer shareholders of US$ 166.9 million in the first half of 2017 and adjusted earnings (loss) per ADS of US$ 0.91 per share over the same time period.

Net income (loss) and adjusted net income (loss) in the first half of 2018 were negatively impacted by lower operating results in addition to higher net financial expenses and net foreign exchange losses. The higher net financial expenses are largely due to our current net debt position and lower financial income from our cash and equivalents, while foreign exchange losses are associated to the recent devaluation in the Brazilianreal versus the U.S. dollar.

| 3 |

monetary balance sheet accounts and other measures

Embraer finished 2Q18 with a net debt position of US$ 721.2 million, compared to the net debt position of US$ 758.6 million at the end of 1Q18. The improvement in the Company’s net debt position is largely a result of the positive free cash flow generation during the quarter, as explained further below. Embraer’s total loans position at the end of 2Q18 was US$ 4,062.3 million, declining US$ 124.7 million from the total loans position reported at the end of 1Q18.

Adjusted net cash generated in operating activities net of adjustments for financial investments was US$ 133.8 million in 2Q18 and adjusted free cash flow for the quarter was US$ 47.8 million. This compares to adjusted net cash generated in operating activities net of financial investments of US$ 397.5 million and adjusted free cash flow of US$ 219.8 million in 2Q17. The principal factors explaining lower free cash flow generation in 2Q18 include lower benefits from working capital (particularly higher inventories) and a net loss reported in 2Q18. Over the first six months of 2018, adjusted Free cash flow was negative US$ 383.1 million, compared to adjusted Free cash flow of positive US$ 20.7 million over the first six months of 2017. Embraer continues to expect the Company’s adjusted Free cash flow for 2018 will be a use of US$ 100 million or better.

Net additions to total PP&E were US$ 31.1 million in 2Q18, versus US$ 60.5 million in net additions reported in 2Q17. Of the total 2Q18 additions to PP&E, CAPEX amounted to US$ 16.1 million, additions of aircraft available for or under lease was US$ 1.9 million, and additions of pool program spare parts was US$ 13.4 million. The Company’s CAPEX amounted to US$ 38.9 million over the first half of 2018, compared to US$ 80.9 million in the first half of 2017. Although CAPEX spending should ramp in the second half of the year, the Company recognizes that CAPEX could finish 2018 slightly lower than its outlook of US$ 200 million.

In 2Q18, Embraer invested a total of US$ 54.9 million in product development, principally related to the development of the E-Jets E2 commercial jet program, which continues to progress according to schedule. Development expenditures net of contributions from suppliers in 2Q18 were US$ (3.6) million, and over the first six months of the year amounted to US$ 9.6 million. Although the Company also expects development

| 4 |

spending to increase in the second half of the year, 2018 development spending net of supplier contributions could finish the year lower than its outlook for US$ 300 million.

| The Company’s total debt decreased US$ 124.7 million to US$ 4,062.3 million at the end of 2Q18 compared to US$ 4,187.0 million at the end of 1Q18. Short-term debt at the end of 2Q18 was US$ 361.0 million and long-term debt was US$ 3,701.3 million. The average loan maturity of the Company’s debt at the end of 2Q18 was 5.6 years. The cost of Dollar denominated loans at the end of 2Q18 rose slightly to 5.26% p.a. compared to 5.22% p.a. at the end of 1Q18. The cost ofrealdenominated loans also rose, to 3.47% p.a. at the end of 2Q18 vs. 3.40% at the end of 1Q18. |

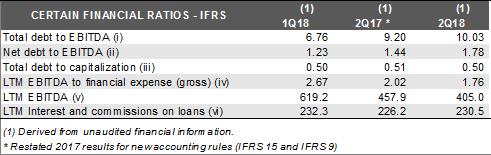

Embraer’s EBITDA over the last 12 months (unadjusted EBITDA LTM) to financial expenses (gross) for 2Q18 declined to 1.76 vs. 2.67 at the end of 1Q18. At the end of 2Q18, 12% of total debt was denominated in Reais. Embraer’s cash allocation management strategy continues to be one of its most important tools to mitigate exchange rate risks. By balancing cash allocation in Real and Dollar assets, the Company attempts to neutralize its balance sheet exchange rate exposure. Of total cash at the end of 2Q18, 81% was denominated in US Dollars |

|

Complementing its strategy to mitigate exchange rate risks, the Company entered into certain financial hedges in order to reduce its cash flow exposure.

The Company’s cash flow exposure is due to the fact that approximately 10% of its net revenues are denominated in Reais while approximately 20% of total costs are denominated in Reais. Having more Real denominated costs than revenues generates this cash flow exposure. For 2018, around 45% of the Company’s Real cash flow exposure is hedged if the US Dollar depreciates below an average rate floor of R$ 3.32. For exchange rates above this level, the Company will benefit up to an average exchange rate cap of R$ 3.75.��

.

| 5 |

operational balance sheet accounts

During 2Q18, trade accounts receivable increased US$ 20.5 million to end the quarter at US$ 918.9 million, largely due to increased accounts receivable in the Commercial Aviation segment due to some deliveries at the end of the quarter in which payment was received in July. Inventories were also higher at the end of 2Q18, at US$ 2,535.0 million, an increase of US$ 54.6 million from that reported at the end of 1Q18. Offsetting these consumptions of working capital during the quarter, Embraer had a US$ 47.7 million increase in trade accounts payable to US$ 941.2 million at the end of 2Q18 and a US$ 138.4 million increase in advances from customers to end the quarter at US$ 1,083.2 million.

Intangibles decreased slightly, from US$ 1,877.9 million at the end of 1Q18 to US$ 1,853.6 million, and property, plant, and equipment ended 2Q18 at US$ 2,004.1 million, compared to US$ 2,075.2 million at the end of 1Q18.

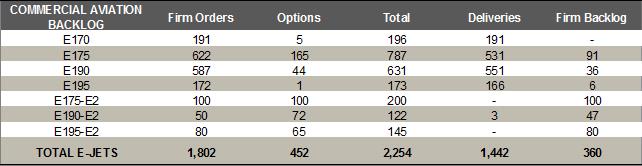

Total Backlog

Considering all deliveries as well as firm orders obtained during the period, the Company’s firm order backlog ended 2Q18 at US$ 17.4 billion.

| 6 |

segment Results

The Commercial Aviation segment represented 60.3% of consolidated revenues in 2Q18 versus 52.9% of revenues in 2Q17, as the segment’s revenues declined at a lower rate than consolidated Company revenues in the quarter. The portion of Executive Jets revenues also increased, from 15.8% in 2Q17 to 16.5% in 2Q18, despite a year-over-year decline in deliveries. The Defense & Security segment reported an 88.8% decline in revenues in 2Q18 as compared to 2Q17, and its portion of total Company revenues fell from 17.2% in 2Q17 to 2.7% in 2Q18. The Defense & Security segment’s year-over-year decline in revenues resulted from a combination of the aforementioned cost base revisions on the KC-390 development contract (leading to a negative adjustment during 2Q18 of revenues recognized in previous periods, as defense contracts are generally accounted for under percentage of completion) and a higher comparison with 2Q17 reported revenues positively impacted by the launch of the SGDC in May. Revenues for Services & Support grew 5.6% year-over-year to US$ 256.3 million, representing 20.4% of the Company’s consolidated revenues in 2Q18, compared to 13.7% in 2Q17. Other segment revenues were 0.1% of consolidated revenues in 2Q18.

Commercial Aviation

In 2Q18, Embraer delivered a total of 28 commercial jets, as shown below:

During the second quarter, Embraer celebrated a major milestone when Norway’s Widerøe took delivery of the first three E190-E2 aircraft. Scandinavia’s largest regional airline started its scheduled passenger service with the aircraft in late April. As expected, the aircraft is presenting outstanding operational results, flying 8 cycles for 11 hours per day, accumulating 300 flight hours with 100% schedule reliability.

During 2Q18, Embraer announced that American Airlines Inc. signed a firm order for 15 E175 jets with a 76-seat configuration. The contract has a value of US$ 705 million, based on current list prices, and was included in the Company’s 2Q18 backlog. Deliveries under this contract will take place between March and November of 2019. American Airlines selected Envoy, a wholly owned subsidiary of American Airlines Group, to operate the 15 aircraft, which will be configured with 12 First Class seats and 64 Main Cabin seats, including Main Cabin Extra seats. Combined with the airline’s three previous orders for the E175, the new contract resulted in a total of 89 E175s for American Airlines.

| 7 |

Embraer and Mauritania Airlines signed a firm order for two E175 jets with a 76-seat configuration, as part of its fleet modernization program. The E175s will replace some of its older narrow body jets and complement its younger fleet. The contract, valued at US$ 93.8 million based on current list prices, was signed in June and therefore included in the 2Q18 backlog. Deliveries will take place in 2019.

Air Costa’s order for 50 E-Jets E2 is no longer considered in Embraer’s backlog as of the end of 2Q18. This backlog adjustment has no impact on the E2’s production or delivery schedule for 2018 or for 2019.

At the end of 2Q18, the backlog and cumulative deliveries for Commercial Aviation were as follows:

Executive JETS

The Executive Jets segment delivered 15 light and 5 large jets, totaling 20 aircraft in 2Q18.

In 2Q18, Embraer’s Legacy 450 business jet set a new transatlantic speed record on a flight between Portland, Maine in the United States and Farnborough in the United Kingdom, according to the U.S. National Aeronautic Association (NAA) and the Fédération Aéronautique Internationale. The record-setting flight occurred on March 7, 2018, with two pilots and two passengers on a ferry flight of Embraer’s new Legacy 450 demonstrator aircraft. The flight lasted six hours and five minutes, covering a distance of 2,756 nautical miles (5,105 km) at an average speed of 521.89 mph (840 kph).

Also in the second quarter, Embraer participated in the 18th European Business Aviation Convention and Exhibition (EBACE) in Geneva, Switzerland, from May 29 to May 31. The company placed the entire Embraer Executive Jets portfolio on static display and presented the following highlights:

· Embraer announced a purchase agreement with Air Hamburg for four Legacy 650E business jets. With this additional order, the Germany-based business charter operator, which serves European, Russian and Middle Eastern destinations, will expand its Embraer flagship fleet to 17 aircraft (15 Legacy 600/650 and two Phenom 300). Air Hamburg is the world’s largest operator of the Legacy 600/650 aircraft.The delivery of these aircraft started in 2Q18 and should continue through 1Q19;

· The Phenom 100EV made its EBACE debut. The entry-level jet, an evolution of the Phenom 100E, delivers improved performance with modified engines and a new avionics suite.The evolution of Embraer’s very first clean-sheet-design business jet, which entered into service in 2008, is the result of continuous customer feedback and the Company’s commitment to continue delivering revolutionary aircraft with superior value to the Market;

| 8 |

· The debut of the Phenom 300E. The new aircraft is designated “E” for “Enhanced” in reference to its entirely redesigned cabin and the addition of the industry-leading nice® HD CMS/IFE (Cabin Management System/InFlight Entertainment) by Lufthansa Technik.The Phenom 300, the new model’s successful predecessor that entered the market in late 2009, has been the best-selling and most delivered light business jet for the last six years;

· Enhancements to the Legacy 450 and Legacy 500 aircraft also debuted, including best-in-class cabin altitude (5,800 ft.), new seat designs with a broader selection of options, new AVANCE L5 internet connectivity and readiness for the Future Air Navigation System (FANS). Also, Embraer announced Ka-Band ultra-high speed connectivity for the Legacy 450 and 500, with EIS expected for 2019.

Also in 2Q18, Embraer delivered its first Phenom 300E in Asia Pacific to Northern Escape Collection. The Phenom 300E offers Northern Escape Collection an elegant solution to provide their guests access to its collection of private lodges in Queensland including Orpheus Island Lodge, Daintree Ecolodge and Mt Mulligan Lodge.

Defense & security

The development of the KC-390 program continues to progress and the basic certification (green aircraft) from the Brazilian National Civil Aviation Agency (ANAC) is expected for the second half of 2018, as initially planned. The flight test campaign achieved more than 1,700 flight hours by the end of 2Q18, despite an incident involving prototype 001 in May, when it experienced a runway excursion while performing ground tests at Embraer's Gavião Peixoto (SP) facility, with extensive damage to the fuselage and landing gears.

The first serial production KC-390 (aircraft 003) was completed in the first half of 2018 and is currently undergoing certification trials. This first serial production aircraft would be delivered to the Brazilian Air Force (FAB) by the end of 2018, as previously announced.However, as a result of the incident involving prototype 001, as described above, and an effort to minimize the potential impact on the test campaign for final military certification (FOC – Final Operational Capability), the FAB has agreed to leave aircraft 003 available for Embraer to be used in the completion of the flight test campaign alongside prototype aircraft 002.

As a result, the entry into service of the KC-390 with the FAB, previously expected by the end of 2018, will now occur with the delivery of the second serial production aircraft (004), in 2019.Deliveries of the serial production aircraft to follow will continue to occur on their contracted dates, with no changes. The change to the flight test campaign plan under this new scenario, with the use of prototype 002 and serial aircraft 003, is in final revision and the economic impact of these changes of approximately US$ 127 million was already considered in the 2Q18 results. Meanwhile, the serial production of the KC-390 program progresses normally, with the assembly of aircraft numbers 004 to 008.

During 2Q18, two A-29 Super Tucano aircraft were delivered to the US Air Force “USAF” under the Light Air Support “LAS” Program.

With respect to ongoing modernization programs, Embraer delivered the third aircraft of the AF1/1A Program to the Brazilian Navy, DAerM during the quarter. The program is focused on the modernization of the avionics systems of AF1/1A aircraft.

The first stage of the technical and operational evaluation of the SISFRON Pilot Phase was concluded by the Brazilian Army in the second quarter, comprising most of the project subsystems. The second evaluation stage, which will involve Communications Intelligence, is planned to occur in the third quarter.

During the same period, Visiona concluded the assisted operation of the SGDC’s system. In addition, the migration to the final Control Center facilities was initiated.

| 9 |

services & support

In April, Embraer Services & Support completed the first upgrade of a Phenom 300 light business jet with a two-person divan, increasing the aircraft's capacity to 11 occupants, the highest in its class.

Also in April, CommutAir, a United Express carrier, selected Embraer Aircraft Maintenance Services (EAMS) in Nashville, Tennessee as the exclusive heavy maintenance provider for the company’s fleet of up to 61 ERJ-145 aircraft. Per the three-year agreement, EAMS will provide airframe maintenance, modification, and repair services.

In the same month, Embraer Services & Support and Belavia, Belarusian Airlines, the leading carrier of Belarus, signed an agreement for the support of Belavia’s fleet of Embraer E-Jets. The deal will streamline Belavia’s fleet support and improve aircraft availability. In a multi-year deal, Embraer’s popular component support solution is being tailored to Belavia’s specific needs, offering customized exchange plus repair coverage for a wider scope of components, as well as access to a range of special tooling and ground support equipment needed for heavy maintenance checks, allowing Belavia to move those checks ‘in-house’.

partnership WITH BOEING

On July 5, 2018, Embraer announced that it entered into a preliminary and non-binding memorandum of understanding (MOU) with The Boeing Co. (Boeing), through which the parties have established the basic premises for a potential business combination of certain businesses, which will include the creation of a joint venture (JV) between the Company and Boeing. This JV will consist of the transfer of the Commercial Aviation business of Embraer and its related operations, services, and engineering capabilities, and Boeing, upon closing of the transaction, will acquire 80% of the JV for US$ 3.8 billion, while Embraer will retain a 20% stake in the JV. The Company will retain the Executive Jets and Defense & Security business units, as well as their related operations, services, and engineering capabilities.

In addition, in order to enable mutual growth and stability of the business, the parties involved in the transaction will enter into long-term operating contracts involving engineering services, reciprocal intellectual property licenses, research and development agreements, agreement to share the use of certain facilities and preferential treatment in the supply of certain products, components and raw materials. Also, Boeing and Embraer will assess the feasibility of joint investments for the promotion and development of new markets and applications for defense products and services, notably the KC-390, on jointly identified opportunities.

Embraer and Boeing have begun negotiations on the final documents of the transaction, which will guide in a binding manner, the structure and financial terms of the transaction on mutually satisfactory bases. Following the completion of due diligence and the carve-out audit, and in the event that Boeing and Embraer reach a consensus on such definitive documents of the transaction, the parties will submit necessary approvals for completion of the transaction, including among others, 1) approval by the Brazilian government, 2) approvals by the competent corporate bodies of both parties involved in the transaction, and 3) approval of anti-trust authorities. The Company expects this transaction to close by the end of 2019, and the transaction is expected to provide Embraer with significant cash proceeds to reinforce the balance sheet and return meaningful proceeds to its shareholders upon closing.

class action UPDATE

In August, 2016, a putative securities class action was filed in a U.S. court against the Company and certain of its former executives, asserting claims in connection with allegedly false and misleading statements and omissions concerning the FCPA investigation and related matters. On March 30, 2018, the Court granted the motion to dismiss filed by the Company and such decision was not appealed.

| 10 |

restated 2017 results for new accounting rules

Please see below selected information from the restated quarterly results for the adoption of IFRS 15 (Revenue from Contracts with Customers) and IFRS 9 (Financial Instruments) on January 1, 2018.

| 11 |

Reconciliation OF IFRS and “non gaap” information

| We define Free cash flow as operating cash flow less Additions to property, plant and equipment, Additions to intangible assets, Financial investments and Other assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure for evaluating certain aspects of our business. The Company also believes that some investors find it to be a useful tool for measuring Embraer's cash position. Free cash flow should not be considered as a measure of the Company's liquidity or as a measure of its cash flow as reported under IFRS. In addition, Free cash flow should not be interpreted as a measure of residual cash flow available to the Company for discretionary expenditures, since the Company may have mandatory debt service requirements or other nondiscretionary expenditures that are not deducted from this measure. Other companies in the industry may calculate Free cash flow differently from Embraer for purposes of their earnings releases, thus limiting its usefulness for comparing Embraer to other companies in the industry. |

EBITDA LTM represents earnings before interest, taxation, depreciation and amortization accumulated over a period of the last 12 months. It is not a financial measure of the Company’s financial performance under IFRS. EBIT as mentioned in this press release refers to earnings before interest and taxes, and for purposes of reporting is the same as that reported on the Income Statement as Operating Profit before Financial Income.

EBIT and EBITDA are presented because they are used internally as measures to evaluate certain aspects of the business. The Company also believes that some investors find them to be useful tools for measuring a Company’s financial performance. EBIT and EBITDA should not be considered as alternatives to, in isolation from, or as substitutes for, analysis of the Company’s financial condition or results of operations, as reported under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purposes of their earnings releases, limiting EBIT and EBITDA’s usefulness as comparative measures.

| 12 |

Adjusted EBIT and Adjusted EBITDA are non-GAAP measures, and both exclude the impact of several non-recurring items, as described in the tables above.

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and social contribution for the period, as well as removing the impact of non-recurring items. Furthermore, under IFRS for purposes of calculating Embraer’s Income Tax benefits (expenses), the Company is required to record taxes resulting from gains or losses due to the impact of the changes in the Real to the US Dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E). It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

| 13 |

Some Financial Ratios based on “non GAAP” information

(i) Total debt represents short and long-term loans and financing.

(ii) Net cash represents cash and cash equivalents, plus financial investments, minus short and long-term loans and financing.

(iii) Total capitalization represents short and long-term loans and financing, plus shareholders equity.

(iv) Financial expense (gross) includes only interest and commissions on loans.

(v) The table at the end of this release sets forth the reconciliation of Net income to adjusted EBITDA, calculated on the basis of financial information prepared with IFRS data, for the indicated periods.

(vi) Interest expense (gross) includes only interest and commissions on loans, which are included in Interest income (expense), net presented in the Company’s consolidated Income Statement.

| 14 |

Investor Relations

Eduardo Couto, Chris Thornsberry, Caio Pinez, Nádia Santos, Paulo Ferreira and Viviane Pinheiro.

(+55 12) 3927 1000

investor.relations@embraer.com.br

ri.embraer.com.br

CONFERENCE CALL INFORMATION

Embraer will host a conference call to present its 2Q18 Results onTuesday, July 31, 2018 at 11:00 AM (SP) / 10:00 AM (NY). The conference call will also be broadcast live over the web atri.embraer.com.br

Conference ID: EMBRAER

Telephones USA / International: (Toll-free) +1 (866) 262-4553 / (Dial-in) +1 (412) 317-6029

Telephones Brazil: +55 (11) 3193-1001 / +55 (11) 2820-4001

ABOUT EMBRAER

Embraer is a global company headquartered in Brazil with businesses in commercial and executive aviation, defense & security. The company designs, develops, manufactures and markets aircraft and systems, providing customer support and services.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. About every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 150 seats. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

For more information, please visit www.embraer.com.br

This document may contain projections, statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks, uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”, “is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect” and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates, events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as Embraer expectations.

| 19 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 31, 2018

|

|

|

|

|

Embraer S.A. | ||||

|

| |||

By: |

|

/s/Nelson Krahenbuhl Salgado | ||

|

|

Name: |

| Nelson Krahenbuhl Salgado |

|

| Title: |

| Chief Financial and Investor Relations Officer |