April 28, 2006

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attention: H. Christopher Owings

| | | Amendment No. 2 to Registration Statement on Form S-4 |

Dear Mr. Owings:

On behalf of SUPERVALU INC. (“Supervalu”), Albertson’s, Inc. (“Albertsons”), and New Albertson’s, Inc., formerly known as New Aloha Corporation (“New Albertsons”), set forth below is the response to the comments of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in the letter received by telefacsimile on April 26, 2006, concerning Supervalu’s and New Albertsons’ Amendment No. 1 (“Amendment No. 1”) to the Registration Statement (the “Registration

Page 2

Statement”) on Form S-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

For your convenience, we have set forth the text of the comments from the Comments Letter, followed in each case by our response thereto. Any capitalized terms used but not defined herein have the meanings given to such terms in Amendment No. 2 to the Registration Statement (“Amendment No. 2”). Page references are to the blacklined courtesy copy of Amendment No. 2 provided to the Staff together with this letter.

Risk Factors, page 20

| | 1. | We note your response to comment 9 of our letter dated April 11, 2006; however, we reissue our comment. |

The disclosure on page 22 of Amendment No. 2 has been revised in response to the Staff’s comment.

The Mergers, Page 38

Background of the Mergers, page 38

| | 2. | We note your response to comment 15 of our letter dated April 11, 2006; however, we reissue our comment. Please tell us why you have deleted the references to the appraisals by Cushman & Wakefield and Integra Realty Resources. We note that the opinions of Goldman Sachs and Blackstone refer to these appraisals. Please also describe in the background section any discussions relating to these appraisals among the boards, the financial advisors, and management. |

The references to the appraisals by Cushman & Wakefield and Integra Realty Resources (the “Appraisals”) were deleted because they do not materially relate to the transactions that are the subject of Amendment No. 2. The Appraisals were primarily obtained for the purpose of potentially facilitating the ability of potential buyers of all or portions of Albertsons’ businesses to more expeditiously obtain financing for their acquisition. The Appraisals were not obtained or used to any material extent by the Albertsons board or Albertsons’ financial advisors for the purpose of evaluating the Supervalu/Cerberus/CVS proposal.

Albertsons’ board of directors was never presented with copies of the Appraisals. The Albertsons’ board of directors was apprised that the Appraisals were being obtained for the purpose of potentially facilitating the ability of potential bidders to obtain financing, and a one page summary of the results of the Appraisals was included in one of the management presentations to potential bidders, a copy of which was provided to the board. The Albertsons’ board of directors did not, however, engage in any substantive discussions regarding the Appraisals at any board meetings. Similarly, although Albertsons’ management was aware that the Appraisals were being obtained and responded to requests from the appraisers for information, there were no substantive discussions regarding the quantitative results of the Appraisals between Albertsons’ management and Albertsons’ financial advisors that were material to the transactions. Although the Appraisals were mentioned, together with many other items, among the materials that were

Page 3

reviewed by Goldman Sachs and Blackstone in their respective opinions, each of Goldman Sachs and Blackstone informed Albertsons that the Appraisals were not material to the financial analyses underlying their fairness opinions or the conclusions expressed therein. In light of the foregoing, we believe that it is not necessary to include references to the Appraisals in the discussion of the financial advisors’ fairness opinions or in the background section.

| | 3. | We note your response to comment 16 of our letter dated April 11, 2006. Please describe how the final consideration was agreed upon during the negotiation process and any changes from the original bid by Supervalu/Cerberus. We note that in the second full paragraph on page 40 you state that the board instructed the financial advisors to seek to form consortia of bidders and to contact additional possible strategic buyers for the entire company and separately, its standalone business. Please describe why in September 2005, the board decided to pursue a sale of the business over other alternative transactions, and whether the board evaluated any negative factors relating to the sale of the entire or part of the business. |

The disclosure on pages 40 and 48 of Amendment No. 2 has been revised in response to the Staff’s comment. The final purchase price payable in connection with the transactions was the result of the negotiations between the parties to the transaction. The disclosure regarding these negotiations in Amendment No. 2 includes both the consideration contemplated by the original Supervalu/Cerberus bid and all subsequent changes in such consideration. Supervalu’s original bid of $20.50 in cash and 0.182 shares of Supervalu stock per share of Albertsons stock, which Supervalu submitted to Albertsons on December 8, 2005, is disclosed on page 43. The cash portion of this bid was reduced to $20.00 per share of Albertsons stock on December 16, 2005, which is disclosed on page 45. The cash portion of Supervalu’s bid was then increased to $20.25 per share of Albertsons stock on December 18, 2005, which is disclosed on page 46. The cash portion of Supervalu’s bid was then increased to $20.31 per share of Albertsons stock on December 22, 2005, which is disclosed on page 46. The cash portion of Supervalu’s bid was finally increased to $20.35 per share of Albertsons stock, which is disclosed on page 47. Although Albertsons sought a further increase in the proposed consideration when the parties reengaged in negotiations in January 2006, as disclosed on pages 47 and 48 these efforts were unsuccessful. As disclosed on page 48, after considering various relevant factors, including the proposed consideration, the Albertsons board of directors unanimously approved the merger agreement.

Please note that the Albertsons board did not decide in September 2005 to pursue a sale of any or all of its businesses to the exclusion of the other strategic alternatives available to Albertsons. The actions taken on behalf of Albertsons with respect to the formation of bidder consortia were intended to facilitate the exploration of a possible sale by Albertsons as one potential alternative. As disclosed on page 40, the press release issued by Albertsons indicated that a possible sale of Albertsons was one of the strategic alternatives that was being explored. As disclosed on pages 44-47, Albertsons board considered at several different subsequent board meetings in December and January the various strategic alternatives that were available to Albertsons. We note also that during this time period the Albertsons board continued to discuss the ongoing operations of the company as part of the agenda at their regularly scheduled board meetings,

Page 4

which included a consideration of the strategic initiatives being pursued by the company in the ordinary course of its operations.

| | 4. | In this regard, please describe the reasons why the board decided on December 10th that the Supervalu/Cerberus bid offered an opportunity to obtain a more favorable current value for the outstanding stock. Please also clarify the “risk-adjusted basis” for the conclusion that the Supervalu/Cerberus bid was more favorable than the alternatives. Further, please state whether the Supervalu/Cerberus bid offered the highest consideration to Albertsons’ stockholders. |

The disclosure on pages 44-45 of Amendment No. 2 has been revised in response to the Staff’s comment.

Legal Proceedings, page 97

| | 5. | We note your response to comment 23 of our letter dated April 11, 2006; however, we reissue our comment. Because the legal proceeding is in connection with the transactions that stockholders are being asked to vote upon, it appears that this constitutes a material risk that should be discussed in the risk factors section. |

The disclosure on page 22 of Amendment No. 2 has been revised in response to the Staff’s comment.

The Transaction Agreements, page 100

Additional Agreements, page 125

| | 6. | We note your response to comment 6 of our letter dated April 11, 2006. Please describe the services for which Cerberus and Albertsons are expected to pay up to $360 million. Further, please disclose the $3 million fee under the standalone drug sale agreement. |

The disclosure on pages 125 and 130 of Amendment No. 2 has been revised in response to the Staff’s comment. The disclosure on page 130 now discloses the services expected to be provided under the transition services agreements relating to the standalone drug sale, in addition to the fees provided for under those agreements.

Annex F. Opinion of Lazard Freres

| | 7. | We note your response to comment 30 of our letter dated April 11, 2006; however, we reissue our comment regarding Exhibit F. We note that use of the term “solely” in the second-to-last paragraph on page F-3. |

The language on page F-3 of Amendment No. 2 has been revised in response to the Staff’s comment.

Page 5

Exhibit 5.01. Legality Opinion

| | 8. | We refer you to the legality opinion relating to the Supervalu shares filed as Exhibit 5.01. We note that as to Delaware law, the opinion appears to be limited to the General Corporation Law of the State of Delaware. Please have counsel confirm that it concurs with our understanding that the reference and limitation to Delaware “General Corporation Law” includes the statutory provisions and also all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting these laws. Alternatively, you may provide a revised opinion that removes the limitation or clarifies that the reference includes reported judicial decisions and applicable provisions of the Delaware Constitution. |

Exhibit 5.01 to Amendment No. 2 has been clarified in response to the Staff’s comment.

| | 9. | We note that the last paragraph of the opinion states that it is “[s]olely for your benefit and is not to be used, circulated . . . .” Please revise to remove this limitation as the shareholders/investors should be able to rely on the opinion as well. Please also file the fully executed legality opinions. |

The limitation in Exhibit 5.01 to Amendment No. 2 has been removed in response to the Staff’s comments and the fully executed legality opinions have been filed with Amendment No. 2.

*****

The undersigned, on behalf of Supervalu and New Albertsons, hereby acknowledges that (i) Supervalu and New Albertsons are responsible for the adequacy and accuracy of the disclosure in the filing; (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) Supervalu and New Albertsons may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

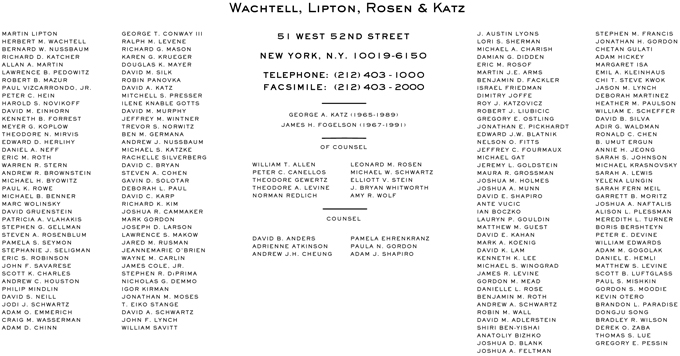

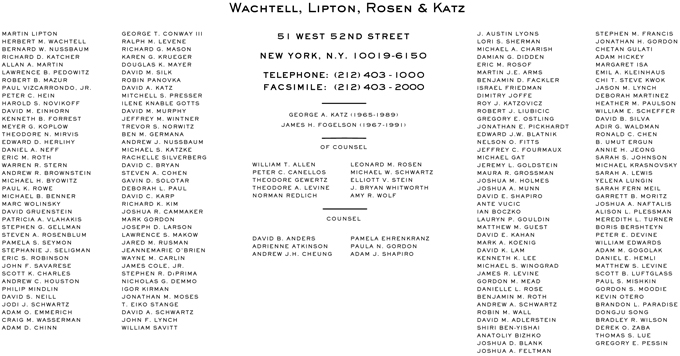

Please direct any questions concerning this letter to me at (212) 403-1393 or Matt Levine at (212) 403-1122.

Very truly yours,

/s/ Igor Kirman

Igor Kirman

Page 6