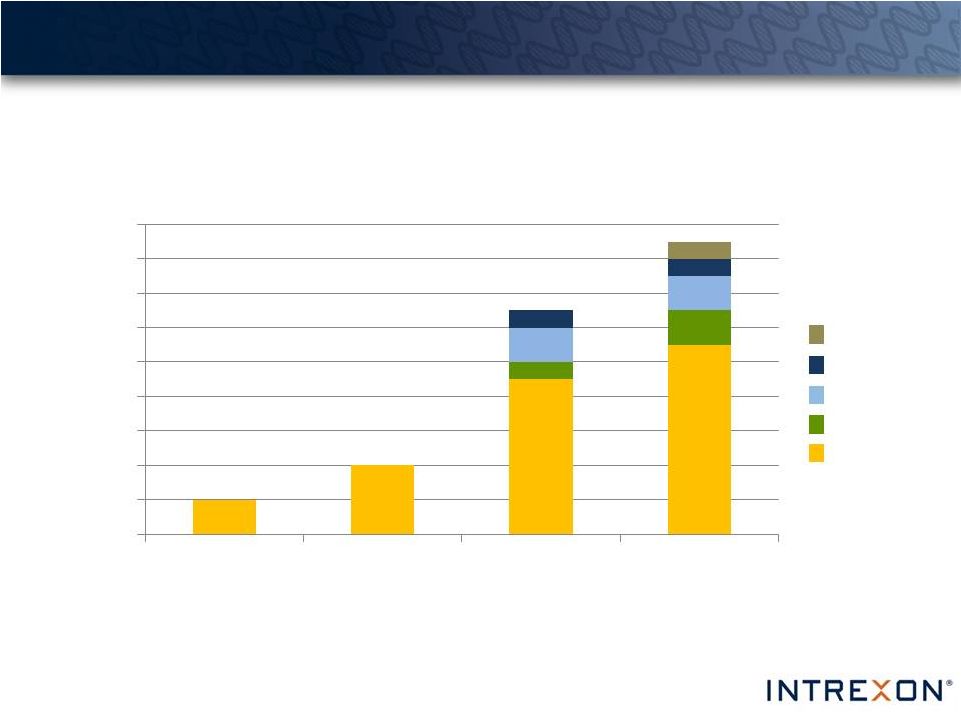

© 2015 Intrexon Corp. All rights reserved. 30 Appendix A Intrexon Corporation and Subsidiaries Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Adjusted EBITDA. reconciliation of Adjusted EBITDA to Intrexon's net income or loss attributable to Intrexon under GAAP appears below. Adjusted EBITDA is a non-GAAP financial measure that Intrexon calculates as net income or loss attributable to Intrexon adjusted for income tax expense or benefit, interest expense, depreciation and amortization, stock-based compensation, contribution of services by shareholder, unrealized appreciation or depreciation in the fair value of equity securities, gain on previously held equity investment, equity in net loss of affiliate and the change in deferred revenue related to upfront and milestone payments. Adjusted EBITDA is a key metric for Intrexon's management and Board of Directors for evaluating the Company's financial and operating performance, generating future operating plans and making strategic decisions about the allocation of capital. Management and the Board of Directors believe that adjusted EBITDA is useful to understand the long- term performance of Intrexon's core business and facilitates comparisons of the Company's operating results over multiple reporting periods. Intrexon is providing this information to investors and others to assist them in understanding and evaluating the Company's operating results in the same manner as its management and board of directors. While Intrexon believes that this non-GAAP financial measure is useful in evaluating its business, and may be of use to investors, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in accordance with GAAP. In addition, this non-GAAP financial measure may not be the same as non-GAAP financial measures presented by other companies. Adjusted EBITDA is not a measure of financial performance under GAAP, and is not intended to represent cash flows from operations under GAAP and should not be used as an alternative to net income or loss as an indicator of operating performance or to represent cash flows from operating, investing or financing activities as a measure of liquidity. Intrexon compensates for the limitations of Adjusted EBITDA by using it only to supplement the Company's GAAP results to provide a more complete understanding of the factors and trends affecting the Company's business. Adjusted EBITDA has its limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of Intrexon's results as reported under GAAP. In addition to the reasons stated above, which are generally applicable to each of the items Intrexon excludes from its non-GAAP financial measure, Intrexon believes it is appropriate to exclude certain items for the following reasons: Interest expense may be subject to changes in interest rates which are beyond Intrexon's control; Depreciation of Intrexon's property and equipment and amortization of acquired identifiable intangibles can be affected by the timing and magnitude of business combinations and capital asset purchases; Stock-based compensation expense is a noncash expense and may vary significantly based on the timing, size and nature of awards granted and also because the value is determined using formulas which incorporate variables, such as market volatility; Contribution of services by shareholder is a noncash expense which Intrexon excludes in evaluating its financial and operating performance; Unrealized appreciation or depreciation in the fair value of securities which Intrexon holds in its collaborators may be significantly impacted by market volatility and other factors which are outside of the Company's control in the short term and Intrexon intends to hold these securities over the long term; Equity in net loss of affiliate reflects Intrexon's proportionate share of the income or loss of entities over which the Company has significant influence, but not control, and accounts for using the equity method of accounting. Gain on previously held equity investment occurred as a result of a step acquisition of AquaBounty Technologies, Inc. which was completed in the first quarter of 2013 which resulted in a controlling interest by Intrexon and the consolidation of the investment. Intrexon believes excluding the impact of such losses or gains on these types of strategic investments from its operating results is important to facilitate comparisons between periods; and GAAP requires Intrexon to account for its collaborations as multiple-element arrangements. As a result, the Company defers certain collaboration revenues because certain of its performance obligations cannot be separated and must be accounted for as one unit of accounting. The collaboration revenues that Intrexon so defers arise from upfront and milestone payments received from the Company's collaborators, which Intrexon recognizes over the future performance period even though the Company's right to such consideration is neither contingent on the results of Intrexon's future performance nor refundable in the event of nonperformance. In order to evaluate Intrexon's operating performance, its management adjusts for the impact of the change in deferred revenue for these upfront and milestone payments in order to include them as a part of adjusted EBITDA when the transaction is initially recorded. The adjustment for the change in deferred revenue removes the noncash revenue recognized during the period and includes the cash and stock received from collaborators for upfront and milestone payments during the period. Intrexon believes that adjusting for the impact of the change in deferred revenue in this manner is important since it permits the Company to make quarterly and annual comparisons of the Company's ability to consummate new collaborations or to achieve significant milestones with existing collaborators. Further, Intrexon believes it is useful when evaluating its financial and operating performance, generating future operating plans and making strategic decisions about the allocation of capital. Pro forma adjusted EBITDA per share. Intrexon's calculations for pro forma adjusted EBITDA per share, basic and diluted, assumes, as of the end of the respective period, the conversion of all outstanding shares of Intrexon's redeemable convertible preferred stock plus all cumulative dividends payable thereon into shares of common stock as if such conversion had occurred as of the later of (i) the beginning of the period or (ii) the issuance date of those shares. Because all of Intrexon's shares of redeemable convertible preferred stock and all accrued and cumulative dividends thereon automatically converted into common shares upon the closing of the Company's initial public offering on August 13, 2013, Intrexon believes that the inclusion of such shares on an as-converted basis results in a useful metric for its investors, analysts and others when evaluating Intrexon's results on a comparable basis with other periods. While Intrexon's management and board of directors believe that this non-GAAP per share metric is useful in evaluating the Company's past adjusted EBITDA results, and may be of use to investors, analysts and others, this information should be considered supplemental in nature and is not meant as a substitute for the per share information prepared in accordance with GAAP. In addition, this non-GAAP per share metric may not be the same as non-GAAP per share metrics presented by other companies. Pro forma adjusted EBITDA per share is not a measure of financial performance under GAAP, and is not intended to represent cash flows per share from operations under GAAP and should not be used as an alternative to net income or loss per share as an indicator of operating performance or to represent cash flows from operating, investing or financing activities as a measure of liquidity. Intrexon compensates for the limitations of pro forma adjusted EBITDA per share by using it only to supplement the Company's GAAP results to provide a more complete understanding of the factors and trends affecting the Company's business. Pro forma adjusted EBITDA per share has its limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of Intrexon's results as reported under GAAP. Continued on next slide… To supplement Intrexon's financial information presented in accordance with U.S. generally accepted accounting principles ("GAAP"), Intrexon presents Adjusted EBITDA. A |