|

Exhibit 99.1

|

Powering the Bioindustrial Revolution with Better DNA™

Corporate Presentation

May 2015

Forward-Looking Statements

Safe Harbor Statement

Some of the statements made in this presentation are forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon Intrexon’s current expectations and projections about future events and generally relate to Intrexon’s plans, objectives and expectations for the development of Intrexon’s business. Although management believes that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed in this presentation. These risks and uncertainties include, but are not limited to, (i) Intrexon’s current and future ECCs and joint ventures; (ii) Intrexon’s ability to successfully enter new markets or develop additional products, whether with its collaborators or independently; (iii) actual or anticipated variations in Intrexon’s operating results; (iv) actual or anticipated fluctuations in Intrexon’s competitors’ or its collaborators’ operating results or changes in their respective growth rates; (v) Intrexon’s cash position; (vi) market conditions in Intrexon’s industry; (vii) Intrexon’s ability, and the ability of its collaborators, to protect Intrexon’s intellectual property and other proprietary rights and technologies; (viii) Intrexon’s ability, and the ability of its collaborators, to adapt to changes in laws or regulations and policies; (ix) the rate and degree of market acceptance of any products developed by a collaborator under an ECC or through a joint venture; (x) Intrexon’s ability to retain and recruit key personnel; (xi) Intrexon’s expectations related to the use of proceeds from its public offerings and other financing efforts; (xii) Intrexon’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and (xiii) Intrexon’s expectations relating to its subsidiaries and other affiliates. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Intrexon’s actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in Intrexon’s Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in Intrexon’s subsequent filings with the Securities and Exchange Commission. All information in this presentation is as of the date of the release, and Intrexon undertakes no duty to update this information unless required by law.

Non-GAAP Financial Measures

This presentation presents Adjusted EBITDA and Adjusted EBITDA earnings per share, which are non-GAAP financial measures within the meaning of applicable rules and regulations of the Securities and Exchange Commission (SEC). For a reconciliation of Adjusted EBITDA to net loss attributable to Intrexon in accordance with generally accepted accounting principles and for a discussion of the reasons why the company believes that these non-GAAP financial measures provide information that is useful to investors see the tables below under “Reconciliation of GAAP to Non-GAAP Measures.” Such information is provided as additional information, not as an alternative to Intrexon’s consolidated financial statements presented in accordance with GAAP, and is intended to enhance an overall understanding of the Company’s current financial performance.

© 2015 Intrexon Corp. All rights reserved. Intrexon Corporation is sharing the following materials for informational purposes only. Such materials do not constitute an offer to sell or the solicitation of an offer to buy any securities of Intrexon. Any offer and sale of Intrexon’s securities will be made, if at all, only upon the registration and qualification of such securities under all applicable federal and state securities laws or pursuant to an exemption from such requirements. The attached information has been prepared in good faith by Intrexon. However, Intrexon makes no representations or warranties as to the completeness or accuracy of any such information. Any representations or warranties as to Intrexon shall be limited exclusively to any agreements that may be entered into by Intrexon and to such representations and warranties as may arise under law upon distribution of any prospectus or similar offering document by Intrexon.

2 © 2015 Intrexon Corp. All rights reserved.

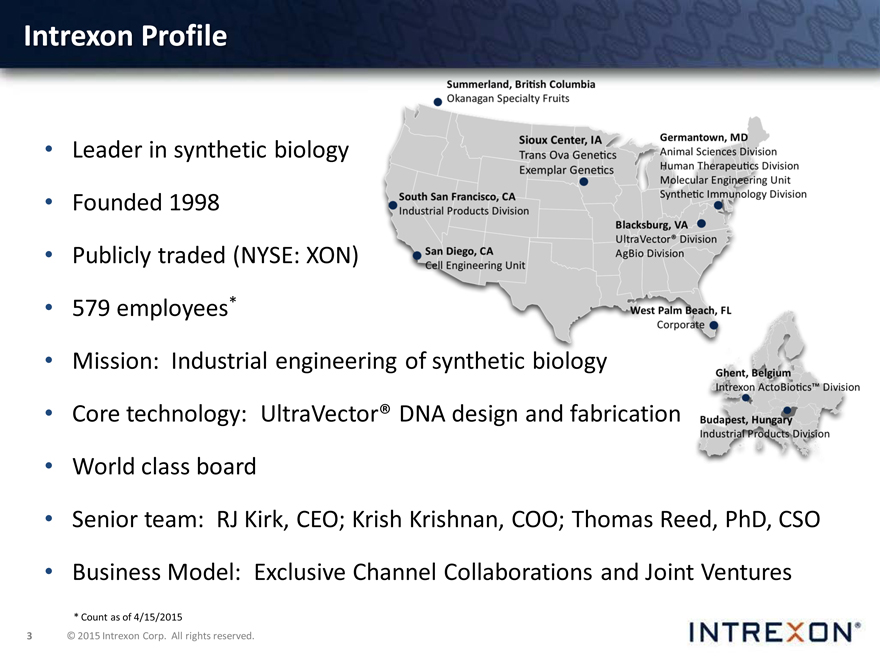

Intrexon Profile

Leader in synthetic biology

Founded 1998

Publicly traded (NYSE: XON)

579 employees*

Mission: Industrial engineer

Core technology: UltraVecto

World class board

Senior team: RJ Kirk, CEO; Krish Krishnan, COO; Thomas Reed, PhD, CSO

Business Model: Exclusive Channel Collaborations and Joint Ventures

* Count as of 4/15/2015

3 © 2015 Intrexon Corp. All rights reserved.

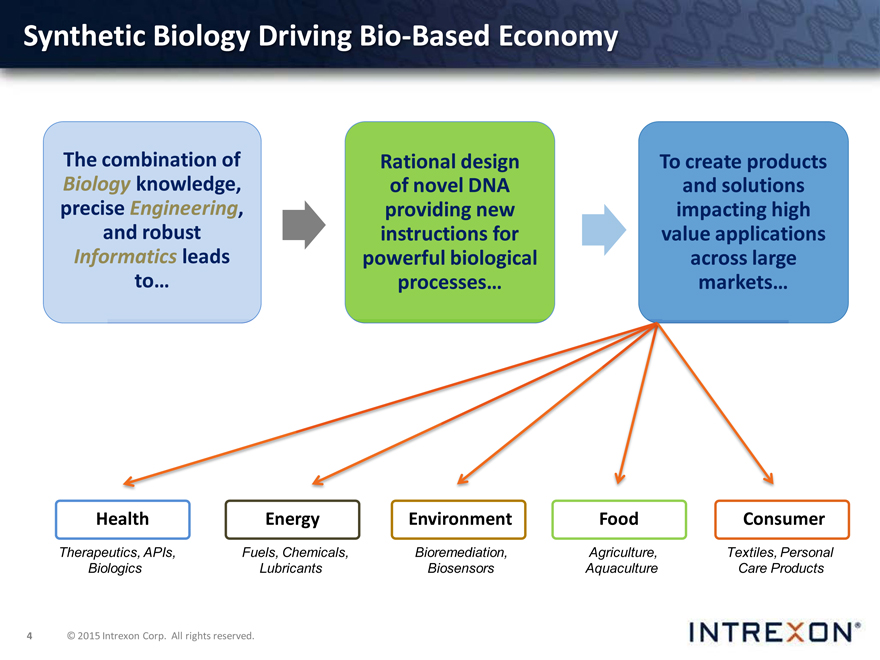

Synthetic Biology Driving Bio-Based Economy

The combination of

Biology knowledge,

precise Engineering,

and robust

Informatics leads

to…

Rational design

of novel DNA

providing new

instructions for

powerful biological

processes…

To create products and solutions impacting high value applications across large markets…

Health

Therapeutics, APIs,

Biologics

Energy

Fuels, Chemicals,

Lubricants

Environment

Bioremediation, Biosensors

Food

Agriculture, Aquaculture

Consumer

Textiles, Personal Care Products

4 © 2015 Intrexon Corp. All rights reserved.

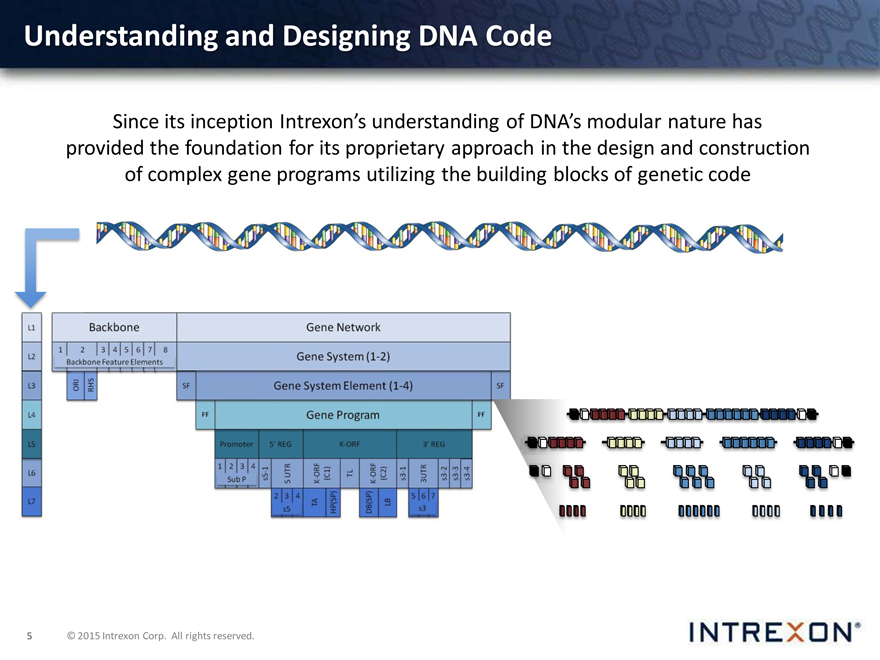

Understanding and Designing DNA Code

Since its inception Intrexon’s understanding of DNA’s modular nature has provided the foundation for its proprietary approach in the design and construction of complex gene programs utilizing the building blocks of genetic code

5 © 2015 Intrexon Corp. All rights reserved.

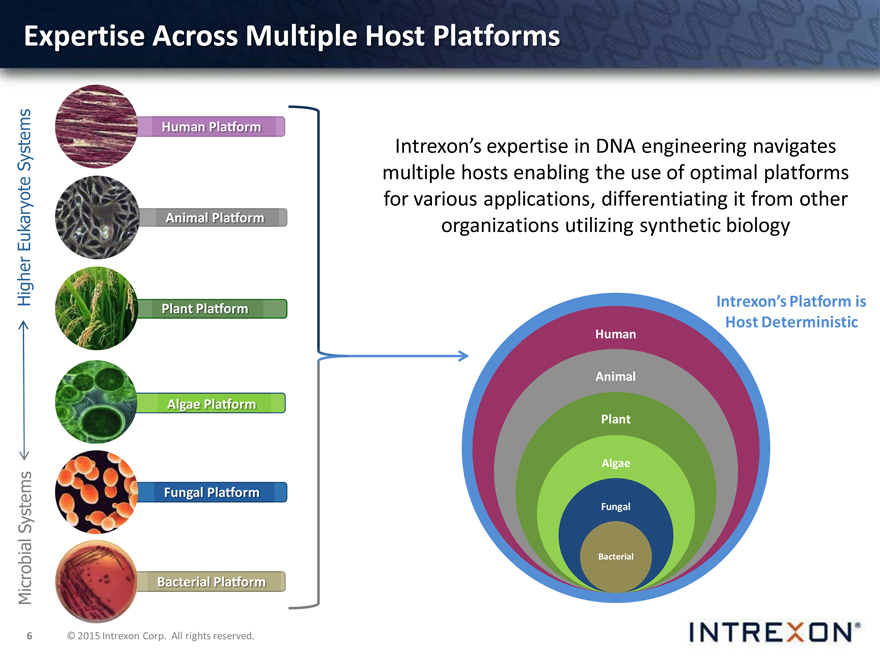

Expertise Across Multiple Host Platforms

Intrexon’s expertise in DNA engineering navigates multiple hosts enabling the use of optimal platforms for various applications, differentiating it from other organizations utilizing synthetic biology

Intrexon’s Platform is Host Deterministic

Human Animal Plant

Algae

Fungal

Bacterial

Systems Human Platform

Eukaryote Animal Platform

Higher Plant Platform

Algae Platform

Systems Fungal Platform

Microbial Bacterial Platform

6 © 2015 Intrexon Corp. All rights reserved.

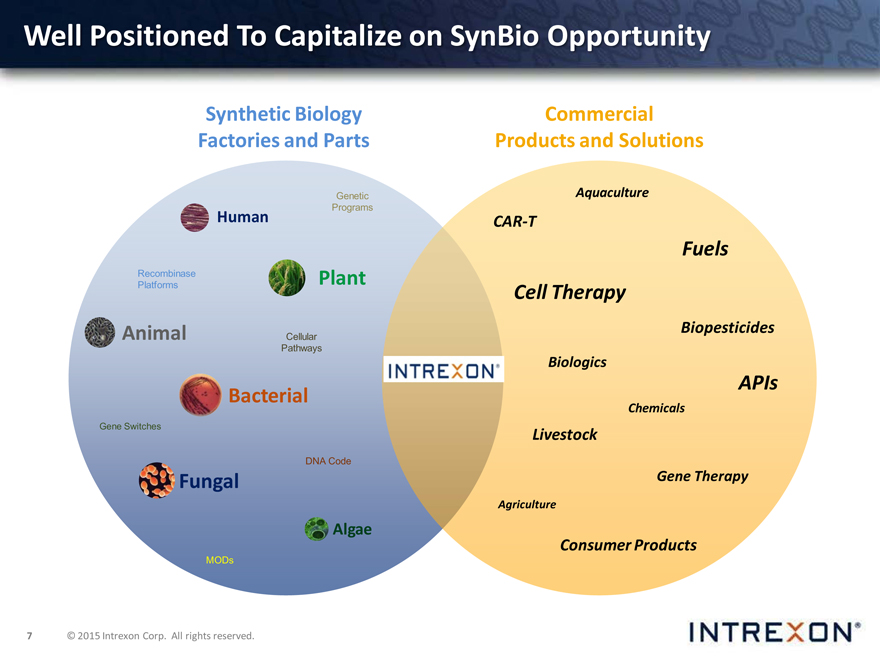

Well Positioned To Capitalize on SynBio Opportunity

Synthetic Biology Commercial Factories and Parts Products and Solutions

Genetic Human Programs

Recombinase Plant Platforms

Animal Cellular Pathways

Bacterial

Gene Switches

DNA Code

Fungal

Algae

MODs

Products and Solutions

Aquaculture

CAR-T

Fuels Cell Therapy

Biopesticides

Biologics

APIs

Chemicals

Livestock

Gene Therapy

Agriculture

Consumer Products

7 © 2015 Intrexon Corp. All rights reserved.

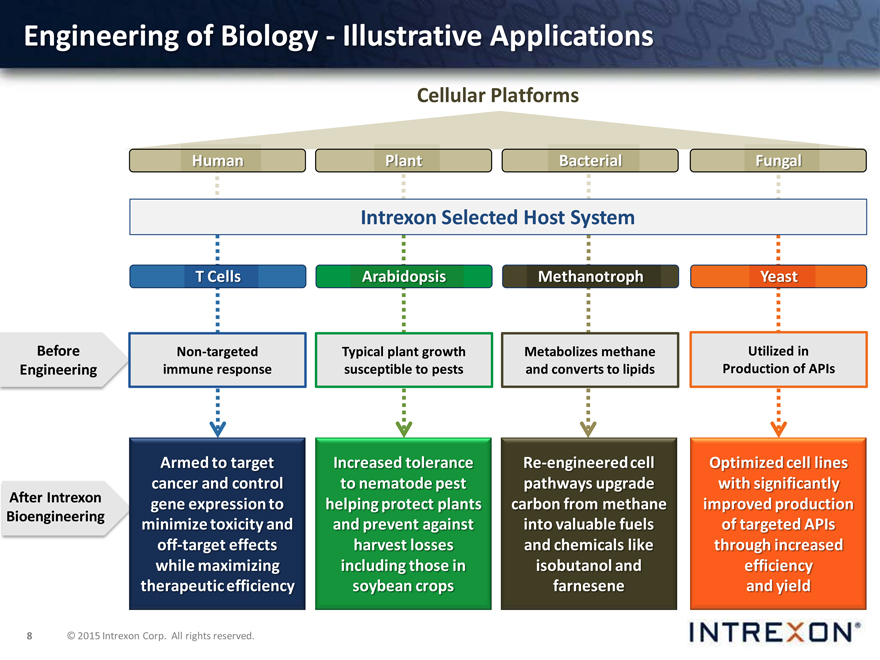

Engineering of Biology—Illustrative Applications

Cellular Platforms

Human Plant Bacterial Fungal

Intrexon Selected Host System

T Cells Arabidopsis Methanotroph Yeast

Before Non-targeted Typical plant growth Metabolizes methane Utilized in Engineering immune response susceptible to pests and converts to lipids Production of APIs

After Intrexon Bioengineering

Armed to target cancer and control gene expression to minimize toxicity and off-target effects while maximizing therapeutic efficiency

Increased tolerance to nematode pest helping protect plants and prevent against harvest losses including those in soybean crops

Re-engineered cell pathways upgrade carbon from methane into valuable fuels and chemicals like isobutanol and farnesene

Optimized cell lines with significantly improved production of targeted APIs through increased efficiency and yield

8 © 2015 Intrexon Corp. All rights reserved.

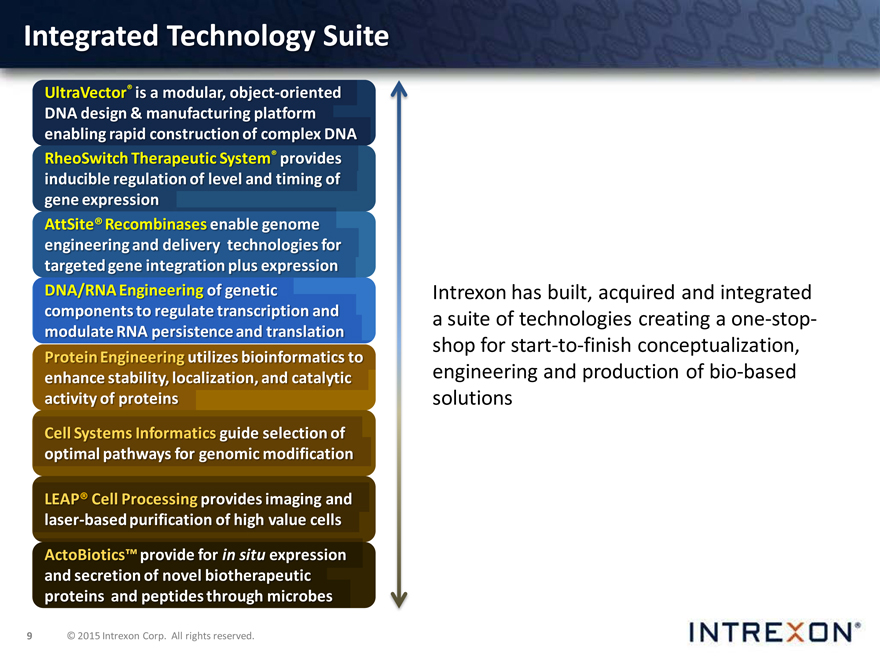

Integrated Technology Suite

UltraVector® is a modular, object-oriented DNA design & manufacturing platform enabling rapid construction of complex DNA RheoSwitch Therapeutic System® provides inducible regulation of level and timing of gene expression AttSite® Recombinases enable genome engineering and delivery technologies for targeted gene integration plus expression DNA/RNA Engineering of genetic components to regulate transcription and modulate RNA persistence and translation Protein Engineering utilizes bioinformatics to enhance stability, localization, and catalytic activity of proteins Cell Systems Informatics guide selection of optimal pathways for genomic modification

LEAP® Cell Processing provides imaging and laser-based purification of high value cells ActoBiotics™ provide for in situ expression and secretion of novel biotherapeutic proteins and peptides through microbes

Intrexon has built, acquired and integrated a suite of technologies creating a one-stop-shop for start-to-finish conceptualization, engineering and production of bio-based solutions

9 © 2015 Intrexon Corp. All rights reserved.

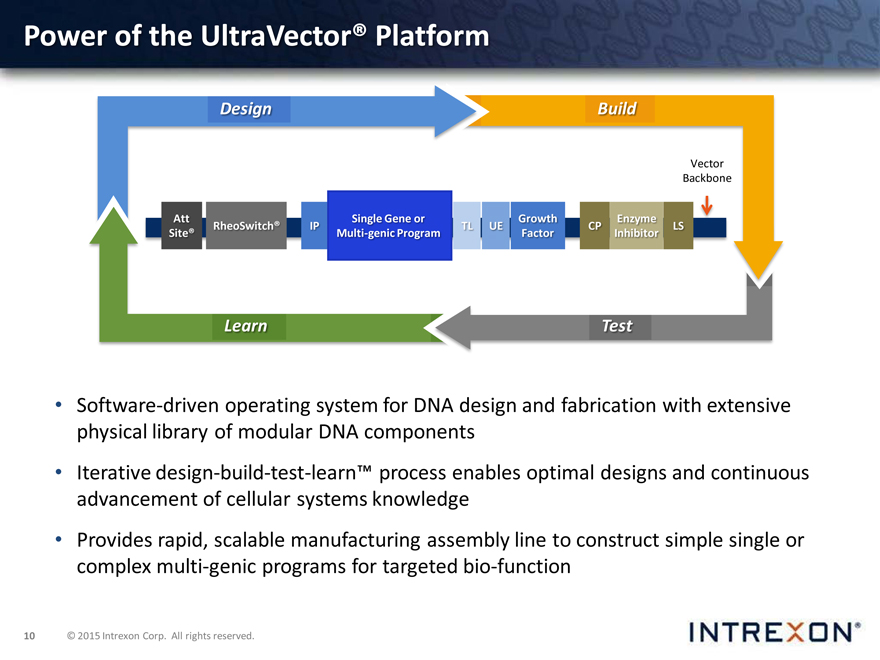

Power of the UltraVector® Platform

Design Build

Learn Test

Software-driven operating system for DNA design and fabrication with extensive physical library of modular DNA components

Iterative design-build-test-learn™ process enables optimal designs and continuous advancement of cellular systems knowledge

Provides rapid, scalable manufacturing assembly line to construct simple single or complex multi-genic programs for targeted bio-function

10 © 2015 Intrexon Corp. All rights reserved.

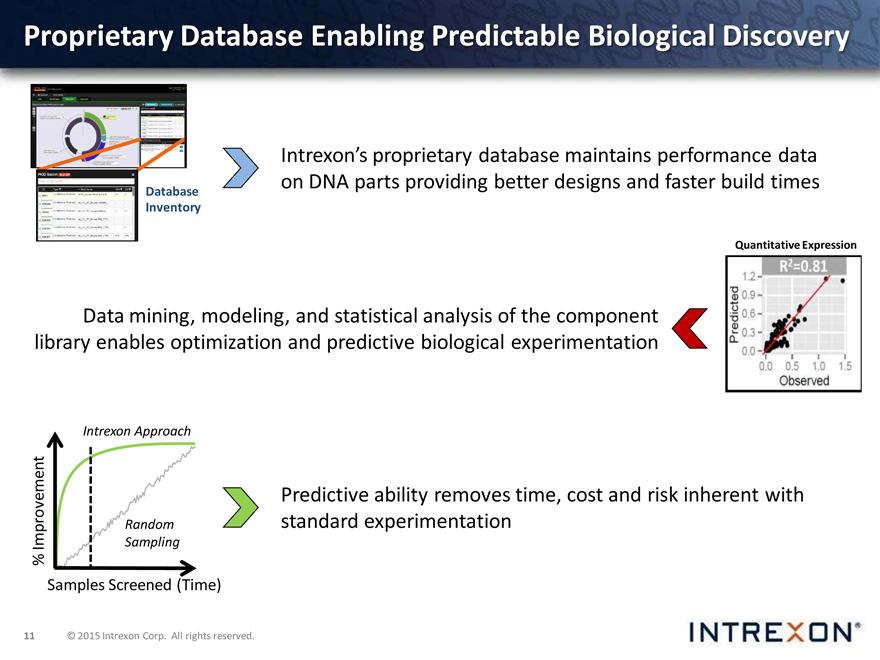

Proprietary Database Enabling Predictable Biological Discovery

Intrexon’s proprietary database maintains performance data on DNA parts providing better designs and faster build times

Database Inventory

Quantitative Expression

Data mining, modeling, and statistical analysis of the component library enables optimization and predictive biological experimentation

Intrexon Approach

Predictive ability removes time, cost and risk inherent with Random standard experimentation

Improvement Sampling % Samples Screened (Time)

11 © 2015 Intrexon Corp. All rights reserved.

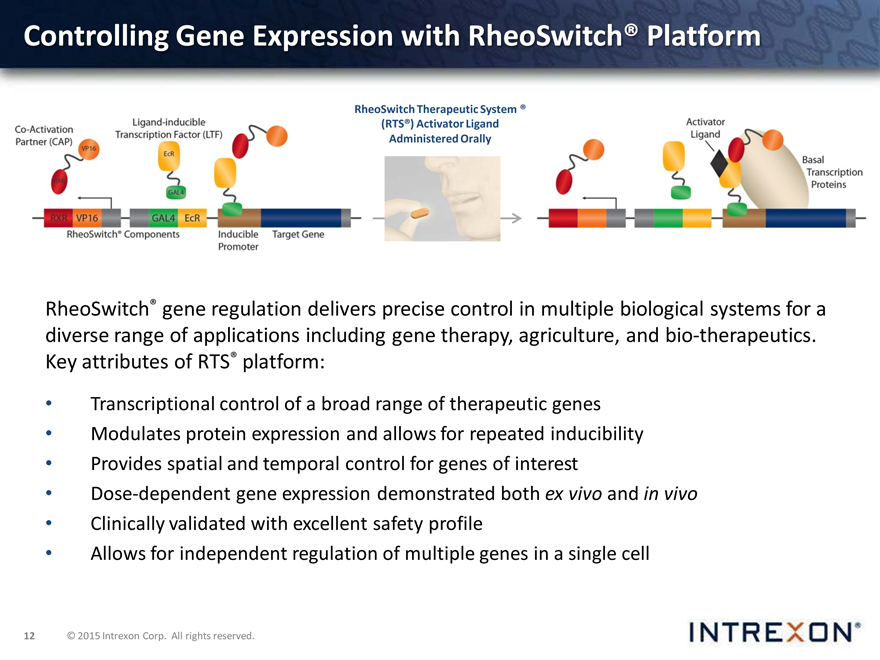

Controlling Gene Expression with RheoSwitch® Platform

RheoSwitch Therapeutic System ® (RTS®) Activator Ligand Administered Orally

RheoSwitch® gene regulation delivers precise control in multiple biological systems for a diverse range of applications including gene therapy, agriculture, and bio-therapeutics. attributes of RTS® platform: Key

Transcriptional control of a broad range of therapeutic genes

Modulates protein expression and allows for repeated inducibility

Provides spatial and temporal control for genes of interest

Dose-dependent gene expression demonstrated both ex vivo and in vivo

Clinically validated with excellent safety profile

Allows for independent regulation of multiple genes in a single cell

12 © 2015 Intrexon Corp. All rights reserved.

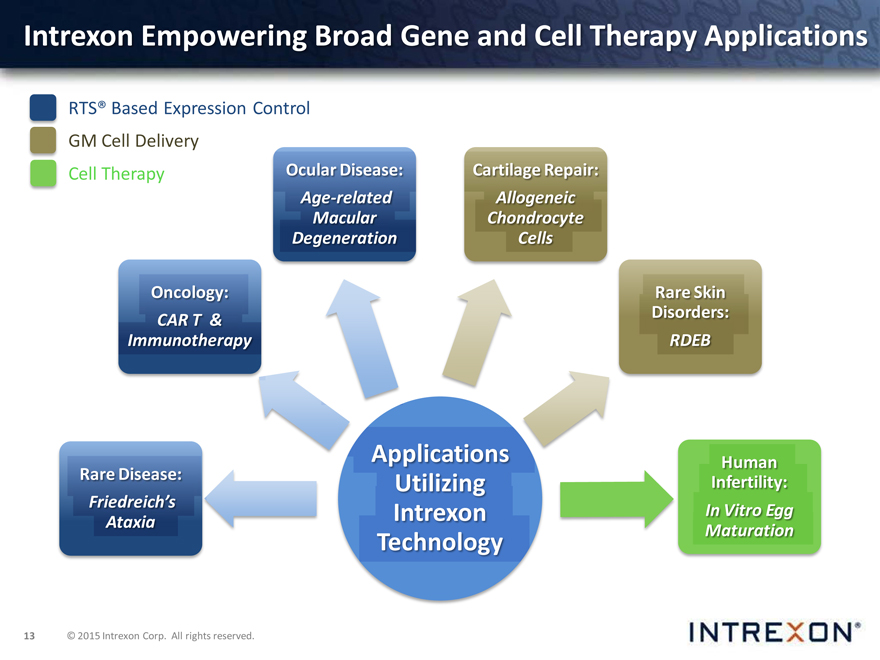

Intrexon Empowering Broad Gene and Cell Therapy Applications

RTS® Based Expression Control GM Cell Delivery

Cell Therapy Ocular Disease: Cartilage Repair: Age-related Allogeneic Macular Chondrocyte Degeneration Cells

Oncology: Rare Skin CAR T & Disorders:

Immunotherapy RDEB

Rare Disease: Applications Human Utilizing Infertility: Friedreich’s Intrexon In Vitro Egg Ataxia Maturation

Technology

13 © 2015 Intrexon Corp. All rights reserved.

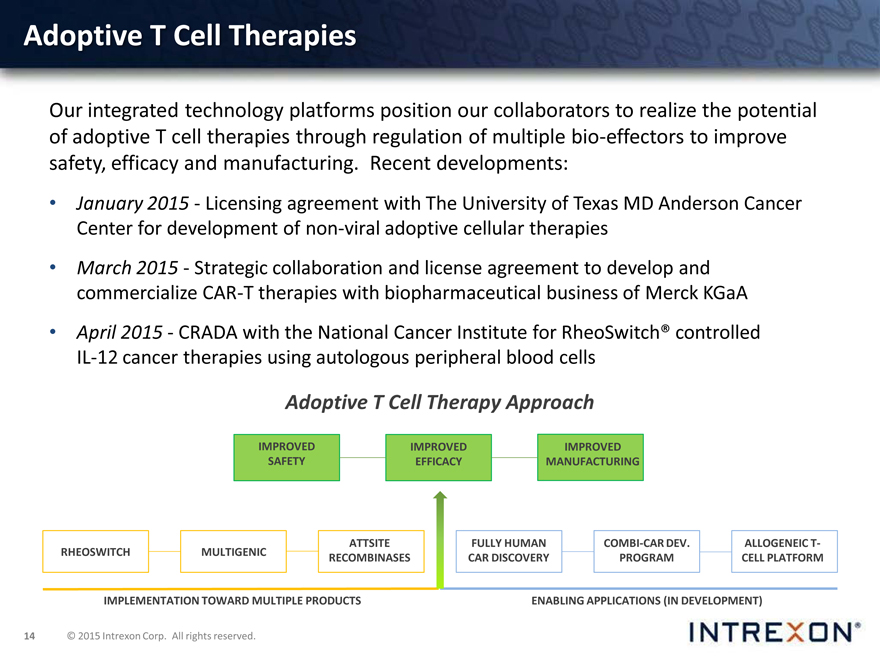

Adoptive T Cell Therapies

Our integrated technology platforms position our collaborators to realize the potential of adoptive T cell therapies through regulation of multiple bio-effectors to improve safety, efficacy and manufacturing. Recent developments:

January 2015—licensing agreement with The University of Texas MD Anderson Cancer Center for development of non-viral adoptive cellular therapies

March 2015—strategic collaboration and license agreement to develop and commercialize CAR-T therapies with biopharmaceutical business of Merck KGaA

April 2015— CRADA with the National Cancer Institute for RheoSwitch® controlled IL-12 cancer therapies using autologous peripheral blood cells

Adoptive T Cell Therapy Approach

IMPROVED IMPROVED IMPROVED SAFETY EFFICACY MANUFACTURING

ATTSITE FULLY HUMAN COMBI-CAR DEV. ALLOGENEIC T-RHEOSWITCH MULTIGENIC RECOMBINASES CAR DISCOVERY PROGRAM CELL PLATFORM

IMPLEMENTATION TOWARD MULTIPLE PRODUCTS ENABLING APPLICATIONS (IN DEVELOPMENT)

14 © 2015 Intrexon Corp. All rights reserved.

Cell-based Treatments for Rare Skin Diseases

Collaboration with Fibrocell Science to develop genetically-modified human dermal fibroblasts expressing collagen VII for treatment of Recessive Dystrophic Epidermolysis Bullosa (RDEB)

RDEB is a debilitating disease with no approved treatment and is often lethal before the age of 30

Plan to file an IND application with the U.S. FDA in 1H of 2015 for drug candidate, GM-HDF-COL7

Also pursuing Linear scleroderma, a skin-hardening disease affecting movement and development

15 © 2015 Intrexon Corp. All rights reserved.

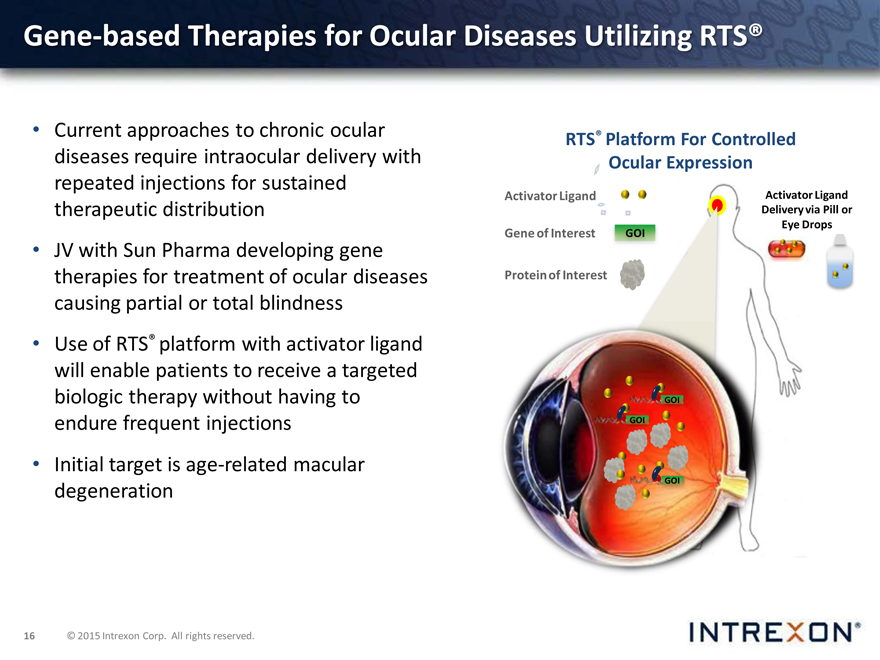

Gene-based Therapies for Ocular Diseases Utilizing RTS®

Current approaches to chronic ocular RTS® Platform For Controlled diseases require intraocular delivery with Ocular Expression repeated injections for sustained

Activator Ligand

therapeutic distribution

Gene of Interest GOI

JV with Sun Pharma developing gene therapies for treatment of ocular diseases Protein of Interest causing partial or total blindness

Use of RTS® platform with activator ligand will enable patients to receive a targeted biologic therapy without having to GOI endure frequent injections GOI

Initial target is age-related macular degeneration GOI

16 © 2015 Intrexon Corp. All rights reserved.

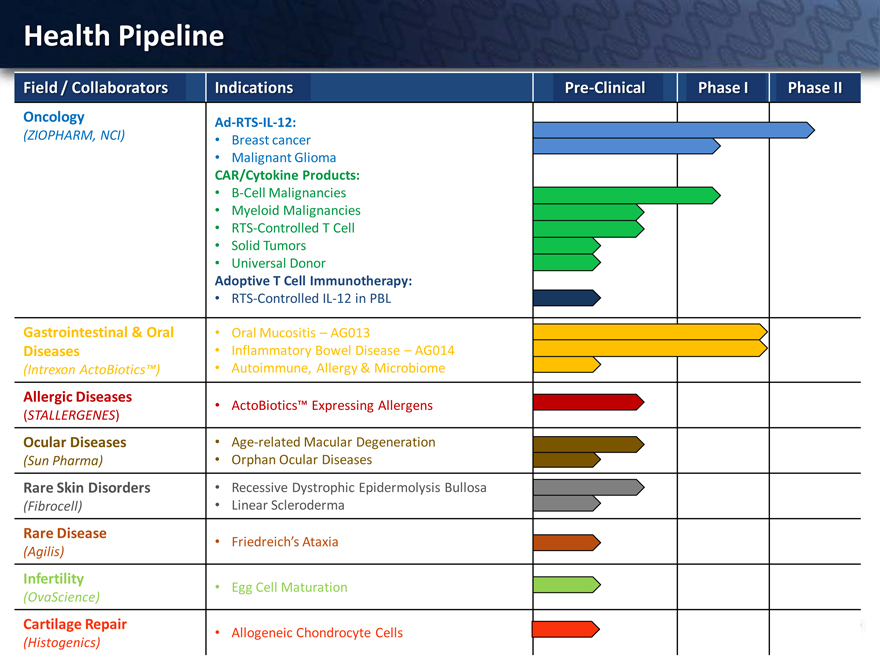

Health Pipeline

Field / Collaborators Indications Pre-Clinical Phase I Phase II

Oncology Ad-RTS-IL-12:

(ZIOPHARM, NCI) • Breast cancer

• Malignant Glioma

CAR/Cytokine Products:

• B-Cell Malignancies

• Myeloid Malignancies

• RTS-Controlled T Cell

• Solid Tumors

• Universal Donor

Adoptive T Cell Immunotherapy:

• RTS-Controlled IL-12 in PBL

Gastrointestinal & Oral • Oral Mucositis – AG013

Diseases • Inflammatory Bowel Disease – AG014

(Intrexon ActoBiotics™) • Autoimmune, Allergy & Microbiome

Allergic Diseases • ActoBiotics™ Expressing Allergens

(STALLERGENES)

Ocular Diseases • Age-related Macular Degeneration

(Sun Pharma) • Orphan Ocular Diseases

Rare Skin Disorders • Recessive Dystrophic Epidermolysis Bullosa

(Fibrocell) • Linear Scleroderma

Rare Disease • Friedreich’s Ataxia

(Agilis)

Infertility • Egg Cell Maturation

(OvaScience)

Cartilage Repair • Allogeneic Chondrocyte Cells

(Histogenics)

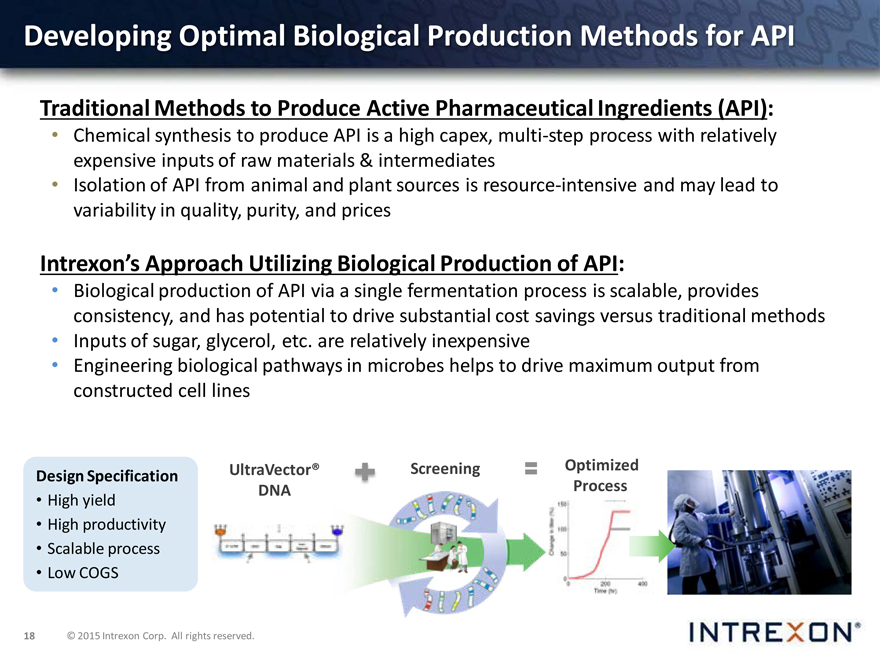

Developing Optimal Biological Production Methods for API

Traditional Methods to Produce Active Pharmaceutical Ingredients (API):

Chemical synthesis to produce API is a high capex, multi-step process with relatively expensive inputs of raw materials & intermediates

Isolation of API from animal and plant sources is resource-intensive and may lead to variability in quality, purity, and prices

Intrexon’s Approach Utilizing Biological Production of API:

Biological production of API via a single fermentation process is scalable, provides consistency, and has potential to drive substantial cost savings versus traditional methods

Inputs of sugar, glycerol, etc. are relatively inexpensive

Engineering biological pathways in microbes helps to drive maximum output from constructed cell lines

Design Specification

High yield

High productivity

Scalable process

Low COGS

UltraVector® DNA

Screening

Optimized Process

18 © 2015 Intrexon Corp. All rights reserved.

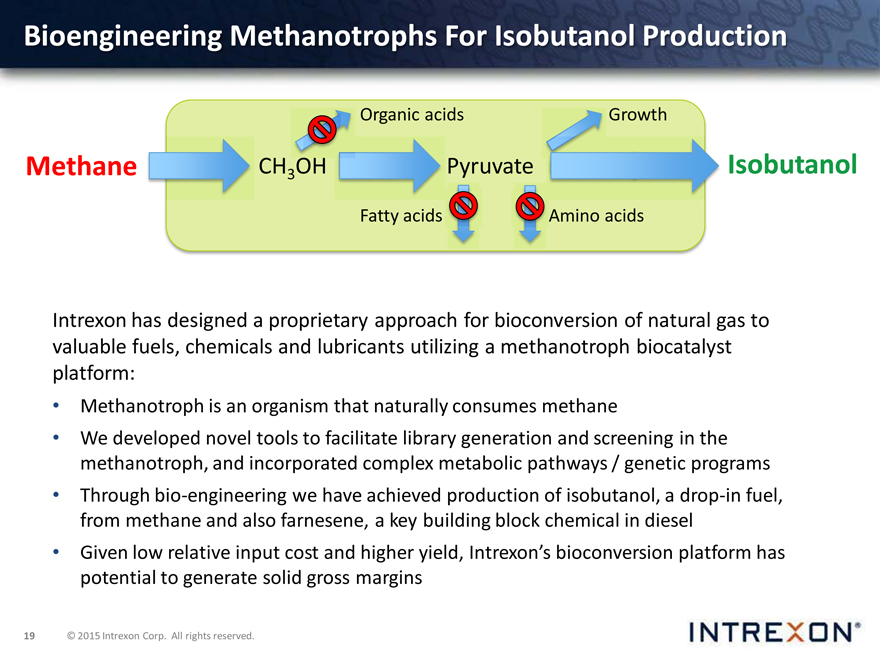

Bioengineering Methanotrophs For Isobutanol Production

Organic acids Growth

Methane CH3OH Pyruvate Isobutanol

Fatty acids Amino acids

Intrexon has designed a proprietary approach for bioconversion of natural gas to valuable fuels, chemicals and lubricants utilizing a methanotroph biocatalyst platform:

Methanotroph is an organism that naturally consumes methane

We developed novel tools to facilitate library generation and screening in the methanotroph, and incorporated complex metabolic pathways / genetic programs

Through bio-engineering we have achieved production of isobutanol, a drop-in fuel, from methane and also farnesene, a key building block chemical in diesel

Given low relative input cost and higher yield, Intrexon’s bioconversion platform has potential to generate solid gross margins

19 © 2015 Intrexon Corp. All rights reserved.

Trans Ova Genetics—Leading Bovine Reproductive Technologies

Trans Ova is a wholly owned subsidiary of Intrexon and the largest producer and supplier of bovine embryos in the U.S.

In the April 2014 Top Young Genomic Bull List, 87% of the top 100 bulls were produced by Trans Ova and its clients

With Intrexon’s technologies, Trans Ova is positioned to enable unparalleled productivity advancements for efficient, high-quality food production

20 © 2015 Intrexon Corp. All rights reserved.

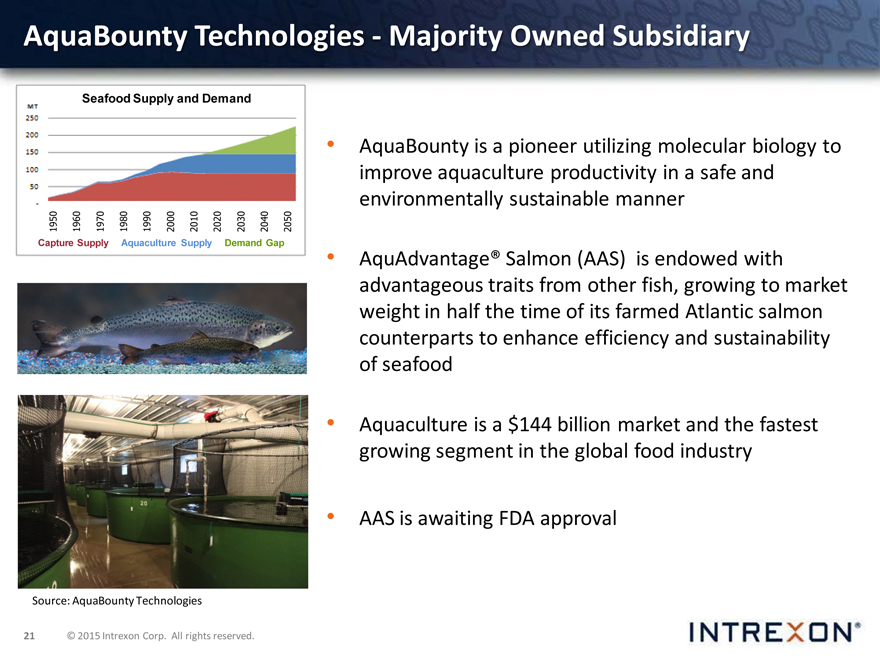

AquaBounty Technologies—Majority Owned Subsidiary

AquaBounty is a pioneer utilizing molecular biology to improve aquaculture productivity in a safe and environmentally sustainable manner

AquAdvantage® Salmon (AAS) is endowed with advantageous traits from other fish, growing to market weight in half the time of its farmed Atlantic salmon counterparts to enhance efficiency and sustainability of seafood

Aquaculture is a $144 billion market and the fastest growing segment in the global food industry

AAS is awaiting FDA approval

Capture 1950

1960

Supply 1970

1980 Seafood

1990

Aquaculture 2000 Supply

2010 and

Supply

2020

2030 Demand

Demand Gap 2040

2050

Source: AquaBounty Technologies

21 © 2015 Intrexon Corp. All rights reserved.

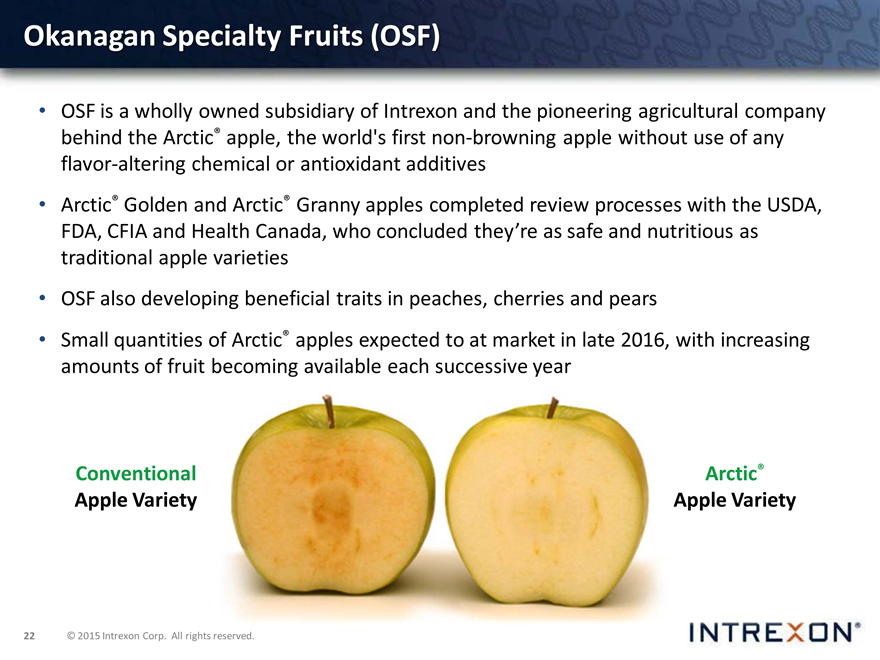

Okanagan Specialty Fruits (OSF)

OSF is a wholly owned subsidiary of Intrexon and the pioneering agricultural company behind the Arctic® apple, the world’s first non-browning apple without use of any flavor-altering chemical or antioxidant additives

Arctic® Golden and Arctic® Granny apples completed review processes with the USDA, FDA, CFIA and Health Canada, who concluded they’re as safe and nutritious as traditional apple varieties

OSF also developing beneficial traits in peaches, cherries and pears

Small quantities of Arctic® apples expected to at market in late 2016, with increasing amounts of fruit becoming available each successive year

Conventional Arctic® Apple Variety Apple Variety

22 © 2015 Intrexon Corp. All rights reserved.

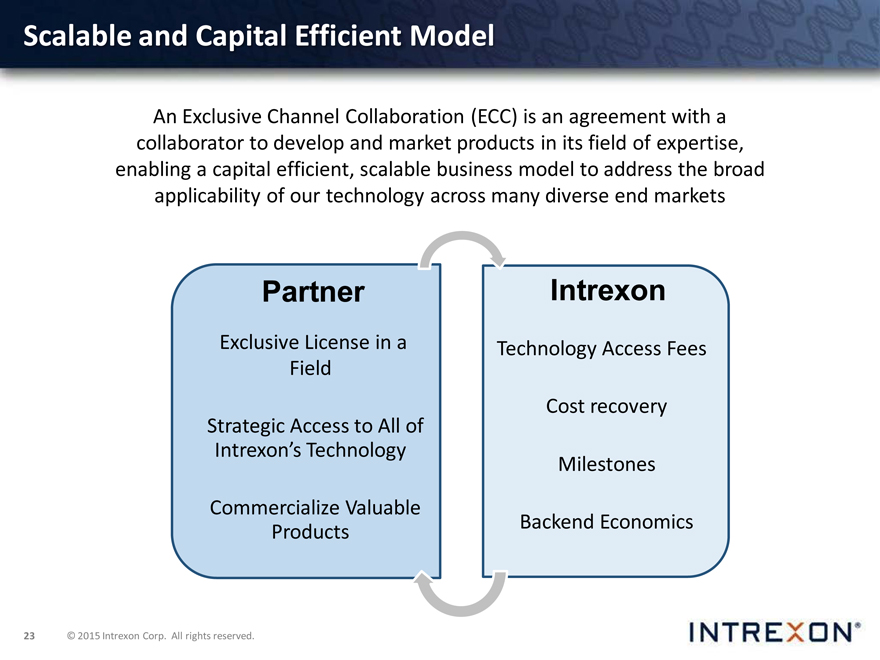

Scalable and Capital Efficient Model

An Exclusive Channel Collaboration (ECC) is an agreement with a collaborator to develop and market products in its field of expertise, enabling a capital efficient, scalable business model to address the broad applicability of our technology across many diverse end markets

Partner

Exclusive License in a Field

Strategic Access to All of Intrexon’s Technology

Commercialize Valuable Products

Intrexon

Technology Access Fees Cost recovery Milestones Backend Economics

23 © 2015 Intrexon Corp. All rights reserved.

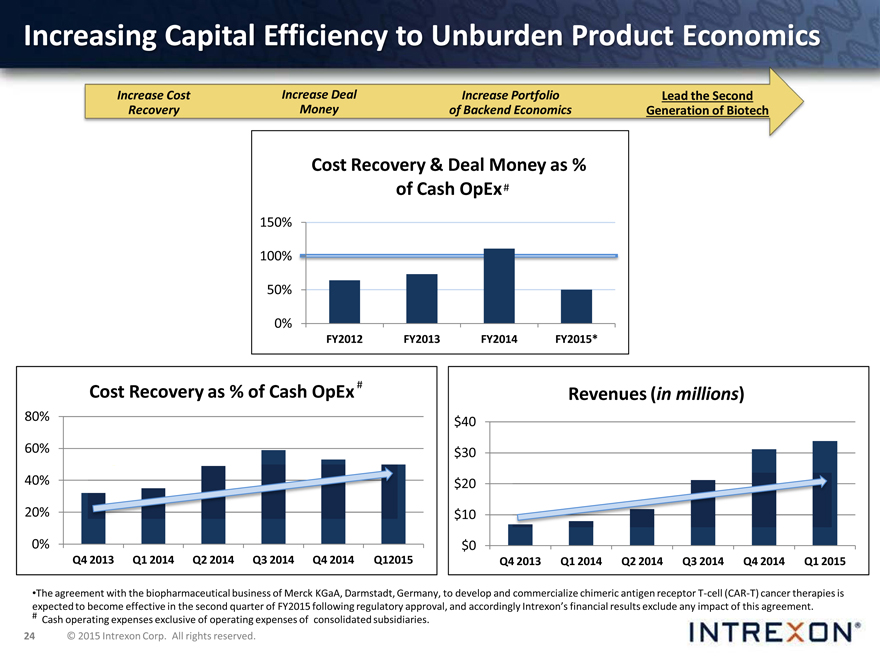

Increasing Capital Efficiency to Unburden Product Economics

Increase Cost Increase Deal Increase Portfolio Lead the Second Recovery Money of Backend Economics Generation of Biotech

Cost Recovery & Deal Money as % of Cash OpEx

FY2012, FY2013, FY2014

150% 100% 50%

0%

FY2012 FY2013 FY2014 FY2015*

Cost Recovery as % of Cash OpEx

80%

60% 40%

20%

0%

Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q12015

Revenues (in millions)

$40 $30 $20 $10 $0

Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015

* The agreement with the biopharmaceutical business of Merck KGaA, Darmstadt, Germany, to develop and commercialize chimeric antigen receptor T-cell (CAR-T) cancer therapies expected to become effective in the second quarter of FY2015 following regulatory approval, and accordingly Intrexon’s financial results exclude any impact of this agreement.

# Cash operating expenses exclusive of operating expenses of consolidated subsidiaries.

24 © 2015 Intrexon Corp. All rights reserved.

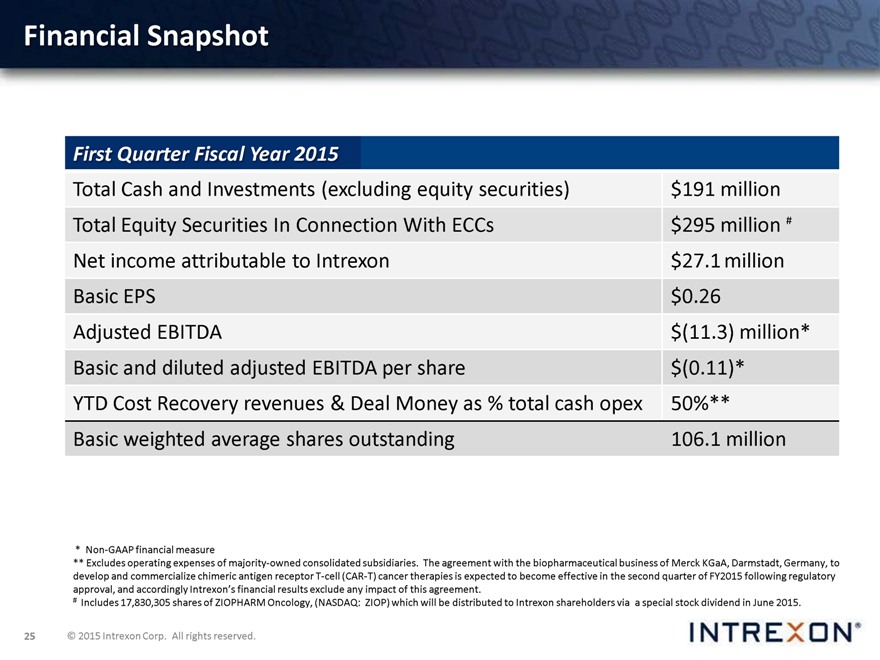

Financial Snapshot

First Quarter Fiscal Year 2015

Total Cash and Investments (excluding equity securities) $191 million Total Equity Securities In Connection With ECCs $295 million Net income attributable to Intrexon $27.1 million Basic EPS $0.26 Adjusted EBITDA $(11.3) million* Basic and diluted pro forma adjusted EBITDA per share $(0.11)* YTD Cost Recovery revenues & Deal Money as % total cash opex 50%** Basic weighted average shares outstanding 106.1 million

* Non-GAAP financial measure

** Excludes operating expenses of majority-owned consolidated subsidiaries. The agreement with the biopharmaceutical business of Merck KGaA, Darmstadt, Germany, to develop and commercialize chimeric antigen receptor T-cell (CAR-T) cancer therapies is expected to become effective in the second quarter of FY2015 following regulatory approval, and accordingly Intrexon’s financial results exclude any impact of this agreement.

# Includes 17,830,305 shares of ZIOPHARM Oncology, (NASDAQ: ZIOP) which will be distributed to Interxon shareholders via a special stock dividend in June 2015.

25 © 2015 Intrexon Corp. All rights reserved.

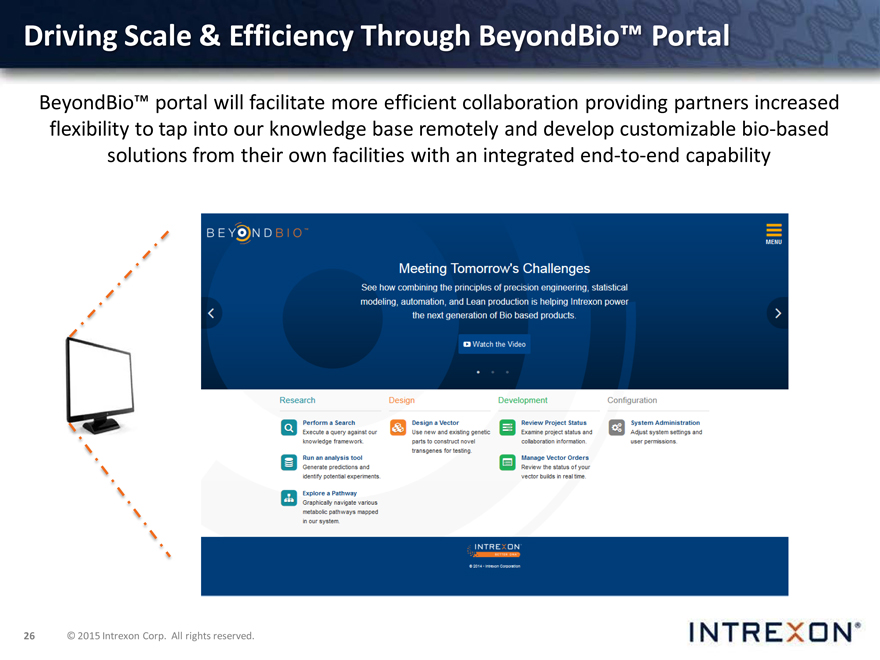

Driving Scale & Efficiency Through BeyondBio™ Portal

BeyondBio™ portal will facilitate more efficient collaboration providing partners increased flexibility to tap into our knowledge base remotely and develop customizable bio-based solutions from their own facilities with an integrated end-to-end capability

26 © 2015 Intrexon Corp. All rights reserved.

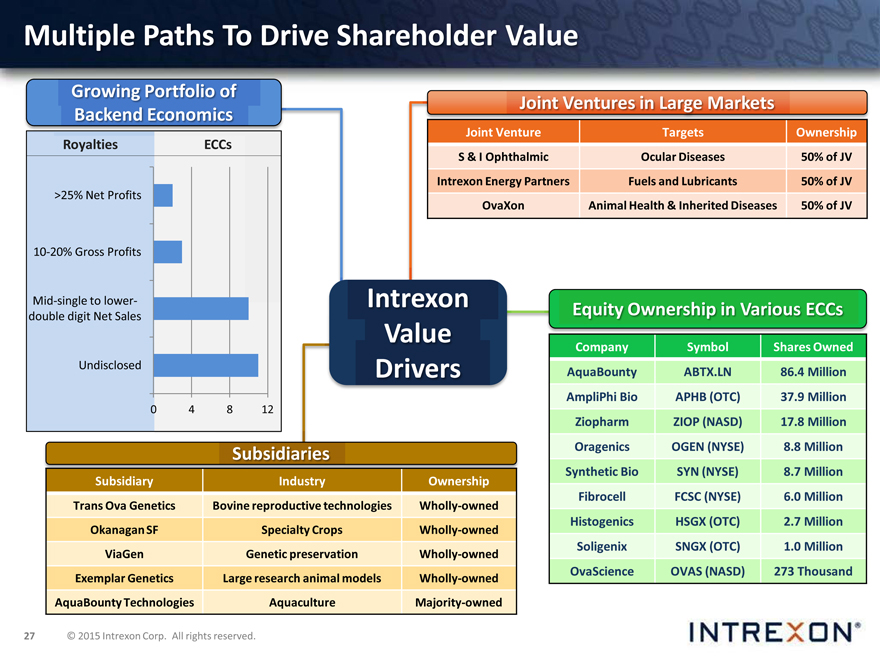

Multiple Paths To Drive Shareholder Value

Growing Portfolio of Backend Economics

Royalties ECCs

>25% Net Profits

10-20% Gross Profits

Mid-single to lower-double digit Net Sales

Undisclosed

0 4 8 12

Intrexon Value Drivers

Joint Ventures in Large Markets

Joint Venture Targets Ownership

S & I Ophthalmic Ocular Diseases 50% of JV Intrexon Energy Partners Fuels and Lubricants 50% of JV

OvaXon Animal Health & Inherited Diseases 50% of JV

Equity Ownership in Various ECCs

Company Symbol Shares Owned AquaBounty ABTX.LN 86.4 Million AmpliPhi Bio APHB (OTC) 37.9 Million Ziopharm ZIOP (NASD) 17.8 Million Oragenics OGEN (NYSE) 8.8 Million Synthetic Bio SYN (NYSE) 8.7 Million Fibrocell FCSC (NYSE) 6.0 Million Histogenics HSGX (OTC) 2.7 Million Soligenix SNGX (OTC) 1.0 Million OvaScience OVAS (NASD) 273 Thousand

Subsidiaries

Subsidiary Industry Ownership

Trans Ova Genetics Bovine reproductive technologies Wholly-owned Okanagan SF Specialty Crops Wholly-owned ViaGen Genetic preservation Wholly-owned Exemplar Genetics Large research animal models Wholly-owned AquaBounty Technologies Aquaculture Majority-owned

27 © 2015 Intrexon Corp. All rights reserved.

Intrexon Summary

We apply engineering principles to artisanal biological systems in large and established markets with built-in demand using a scalable capital efficient business model to develop imperative high value applications

for present and future generations while delivering

meaningful returns to our shareholders.

28 © 2015 Intrexon Corp. All rights reserved.

Appendix A

Intrexon Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

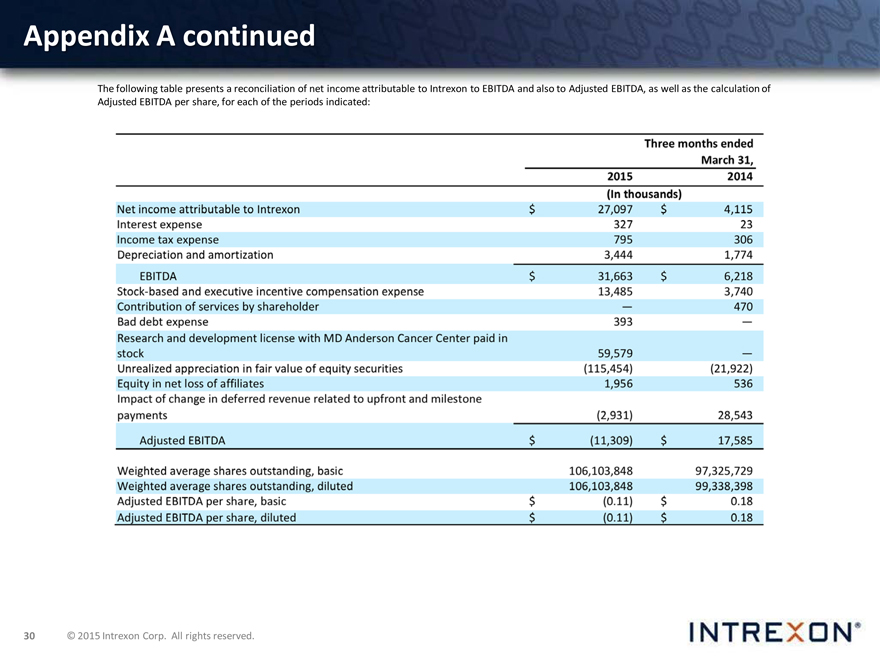

Adjusted EBITDA and Adjusted EBITDA per share. To supplement Intrexon’s financial information presented in accordance with U.S. generally accepted accounting principles (“GAAP”), Intrexon presents Adjusted EBITDA and Adjusted EBITDA per share. A reconciliation of Adjusted EBITDA to Intrexon’s net income or loss attributable to Intrexon under GAAP appears below. Adjusted EBITDA is a non-GAAP financial measure that Intrexon calculates as net income or loss attributable to Intrexon adjusted for income tax expense or benefit, interest expense, depreciation and amortization, stock-based and executive incentive compensation, contribution of services by shareholder, noncash research and development expenses related to the acquisition of our license agreement with the University of Texas MD Anderson Cancer Center, unrealized appreciation or depreciation in the fair value of equity securities, equity in net loss of affiliate and the change in deferred revenue related to upfront and milestone payments. Adjusted EBITDA and Adjusted EBITDA per share are key metrics for Intrexon’s management and Board of Directors for evaluating the Company’s financial and operating performance, generating future operating plans and making strategic decisions about the allocation of capital. Management and the Board of Directors believe that Adjusted EBITDA and Adjusted EBITDA per share are useful to understand the long-term performance of Intrexon’s core business and facilitates comparisons of the Company’s operating results over multiple reporting periods. Intrexon is providing this information to investors and others to assist them in understanding and evaluating the Company’s operating results in the same manner as its management and board of directors. While Intrexon believes that these non-GAAP financial measures are useful in evaluating its business, and may be of use to investors, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be the same as non-GAAP financial measures presented by other companies. Adjusted EBITDA and Adjusted EBITDA per share are not measures of financial performance under GAAP, and are not intended to represent cash flows from operations nor earnings per share under GAAP and should not be used as an alternative to net income or loss as an indicator of operating performance or to represent cash flows from operating, investing or financing activities as a measure of liquidity. Intrexon compensates for the limitations of Adjusted EBITDA and Adjusted EBITDA per share by using them only to supplement the Company’s GAAP results to provide a more complete understanding of the factors and trends affecting the Company’s business. Adjusted EBITDA and Adjusted EBITDA per share have limitations as an analytical tool and you should not consider them in isolation or as a substitute for analysis of Intrexon’s results as reported under GAAP.

In addition to the reasons stated above, which are generally applicable to each of the items Intrexon excludes from its non-GAAP financial measure, Intrexon believes it is appropriate to exclude certain items from the definition of Adjusted EBITDA for the following reasons: Interest expense may be subject to changes in interest rates which are beyond Intrexon’s control; Depreciation of Intrexon’s property and equipment and amortization of acquired identifiable intangibles can be affected by the timing and magnitude of business combinations and capital asset purchases; Stock-based compensation expense is a noncash expense and may vary significantly based on the timing, size and nature of awards granted and also because the value is determined using formulas which incorporate variables, such as market volatility. Executive incentive compensation expenses are determined by the compensation committee of the Board of Directors at the end of the year and may be based on, among other items, the results of Adjusted EBITDA, exclusive of such expenses. Contribution of services by shareholder is a noncash expense which Intrexon excludes in evaluating its financial and operating performance; Unrealized appreciation or depreciation in the fair value of securities which Intrexon holds in its collaborators may be significantly impacted by market volatility and other factors which are outside of the Company’s control in the short term and Intrexon intends to hold these securities over the long term except as provided above; Equity in net loss of affiliate reflects Intrexon’s proportionate share of the income or loss of entities over which the Company has significant influence, but not control, and accounts for using the equity method of accounting. Our acquisition of the license agreement with the University of Texas MD Anderson Cancer Center was a noncash expense we incurred to obtain access to specific technologies which are strategic to us. Intrexon believes excluding the impact of such losses or gains on these types of strategic investments from its operating results is important to facilitate comparisons between periods; and GAAP requires Intrexon to account for its collaborations as multiple-element arrangements. As a result, the Company defers certain collaboration revenues because certain of its performance obligations cannot be separated and must be accounted for as one unit of accounting. The collaboration revenues that Intrexon so defers arise from upfront and milestone payments received from the Company’s collaborators, which Intrexon recognizes over the future performance period even though the Company’s right to such consideration is neither contingent on the results of Intrexon’s future performance nor refundable in the event of nonperformance. In order to evaluate Intrexon’s operating performance, its management adjusts for the impact of the change in deferred revenue for these upfront and milestone payments in order to include them as a part of adjusted EBITDA when the transaction is initially recorded. The adjustment for the change in deferred revenue removes the noncash revenue recognized during the period and includes the cash and stock received from collaborators for upfront and milestone payments during the period. Intrexon believes that adjusting for the impact of the change in deferred revenue in this manner is important since it permits the Company to make quarterly and annual comparisons of the Company’s ability to consummate new collaborations or to achieve significant milestones with existing collaborators. Further, Intrexon believes it is useful when evaluating its financial and operating performance, generating future operating plans and making strategic decisions about the allocation of capital. Continued on next slide…

29 © 2015 Intrexon Corp. All rights reserved.

Appendix A continued

The following table presents a reconciliation of net income attributable to Intrexon to EBITDA and also to Adjusted EBITDA, as well as the calculation of Adjusted EBITDA per share, for each of the periods indicated:

30 © 2015 Intrexon Corp. All rights reserved.