August 9, 2017 Second Quarter 2017 Financial Results and Business Update Exhibit 99.2

Safe Harbor Statement Some of the statements made in this presentation are forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon Intrexon’s current expectations and projections about future events and generally relate to Intrexon’s plans, objectives and expectations for the development of Intrexon’s business. Although management believes that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed in this presentation. These risks and uncertainties include, but are not limited to, (i) Intrexon’s current and future ECCs and joint ventures; (ii) Intrexon’s ability to successfully enter new markets or develop additional products, whether with its collaborators or independently; (iii) actual or anticipated variations in Intrexon’s operating results; (iv) actual or anticipated fluctuations in Intrexon’s competitors’ or its collaborators’ operating results or changes in their respective growth rates; (v) Intrexon’s cash position; (vi) market conditions in Intrexon’s industry; (vii) the volatility of Intrexon’s stock price; (viii) Intrexon’s ability, and the ability of its collaborators, to protect Intrexon’s intellectual property and other proprietary rights and technologies; (ix) Intrexon’s ability, and the ability of its collaborators, to adapt to changes in laws or regulations and policies; (x) the outcomes of pending and future litigation; (xi) the rate and degree of market acceptance of any products developed by a collaborator under an ECC or through a joint venture; (xii) Intrexon’s ability to retain and recruit key personnel; (xiii) Intrexon’s expectations related to the use of proceeds from its public offerings and other financing efforts; (xiv) Intrexon’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and (xv) Intrexon’s expectations relating to its subsidiaries and other affiliates. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Intrexon’s actual results to differ from those contained in the forward-looking statements, see the section entitled ”Risk Factors“ in Intrexon’s Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in Intrexon’s subsequent filings with the Securities and Exchange Commission. All information in this presentation is as of the date of the release, and Intrexon undertakes no duty to update this information unless required by law. Non-GAAP Financial Measures This presentation presents Adjusted EBITDA, which are non-GAAP financial measures within the meaning of applicable rules and regulations of the Securities and Exchange Commission (SEC). For a reconciliation of Adjusted EBITDA to net loss attributable to Intrexon in accordance with generally accepted accounting principles and for a discussion of the reasons why the company believes that these non-GAAP financial measures provide information that is useful to investors see the tables below under “Reconciliation of GAAP to Non-GAAP Measures.” Such information is provided as additional information, not as an alternative to Intrexon’s consolidated financial statements presented in accordance with GAAP, and is intended to enhance an overall understanding of the Company’s current financial performance. © 2017 Intrexon Corp. All rights reserved. Intrexon Corporation is sharing the following materials for informational purposes only. Such materials do not constitute an offer to sell or the solicitation of an offer to buy any securities of Intrexon. Any offer and sale of Intrexon’s securities will be made, if at all, only upon the registration and qualification of such securities under all applicable federal and state securities laws or pursuant to an exemption from such requirements. The attached information has been prepared in good faith by Intrexon. However, Intrexon makes no representations or warranties as to the completeness or accuracy of any such information. Any representations or warranties as to Intrexon shall be limited exclusively to any agreements that may be entered into by Intrexon and to such representations and warranties as may arise under law upon distribution of any prospectus or similar offering document by Intrexon. Forward-Looking Statements

Collaborations, Marketable Products & Sectors Update Andrew Last, Ph.D. – Chief Operating Officer

Precigen: Biotech 2.0 Platform for Human Health Intrexon has assembled the world’s leading technology platform for programming and engineering the most pervasive code on the planet Precigen will utilize platform to build next generation therapeutic products faster and cost effectively Broad pipeline of clinical and pre-clinical programs, both partnered and un-partnered

New Collaborations: Microbial Expression Platforms June 2017 - Entered into an exclusive collaboration with Johnson Matthey (LSE: JMAT), a global leader in science that enables cleaner air, improved health and more efficient use of natural resources, focused on the development of microbial strains for fermentative production of peptide-based active pharmaceutical ingredients May 2017 - Entered into a research collaboration agreement with Huvepharma EOOD, a global pharmaceutical company with a focus on developing, manufacturing, and marketing human and animal health products, for the utilization and first commercial application of Intrexon’s proprietary fungal expression platform to produce a new animal feed enzyme developed by Huvepharma

EnviroFlight: BSF Larvae Production Facility in US EnviroFlight - a Joint Venture between Intrexon & Darling Ingredients (NYSE:DAR) Construction of largest commercial-scale black soldier fly (BSF) larvae production facility in US began in May 2017 Significantly expand production of advanced ingredients for sustainable feed and nutrition derived from BSF larvae Supports development of sustainable high-nutrition BSF ingredients for the $60B global animal feed industry Initial capacity from US plant expected in Q1’2018 Production will be targeted toward livestock, pet food and aquaculture markets

AquAdvantage® Salmon AquAdvantage® Salmon First engineered food animal approved by US FDA/Health Canada AquaBounty entered into an agreement to purchase certain assets of Bell Fish Company Land-based farming facility in Albany, Indiana Expected annual capacity of 1200 metric tons à >$10 million a year in potential sales with potential for expansion AquaBounty evaluating additional opportunities for larger production facilities in US and Canada Advantages of AquAdvantage® platform Lower production cost driven by faster growth rate and less feed requirement No vaccines or antibiotics Land-based production enables “production anywhere” Potential for lower supply fluctuations and steady prices Atlantic salmon market in U.S. estimated at >$2 billion Almost all commercially available Atlantic salmon is farmed US alone imports over 200,000 tons of farmed Atlantic salmon annually

Commercial Launch in Fall 2017 Commercial launch of fresh sliced Arctic® apples in US in Fall of 2017 Non-chemical, preservative-free approach to non-browning No change to apple taste/texture Fresh sliced apple market in US estimated at ~$500 million in sales

Arctic® Non-browning Platform Arctic® Apple First USDA approved non-browning apple without use of chemical or antioxidant treatments Planting progress and outlook: Anticipate planting over 250,000 Arctic® apple trees during 2017 and over 500,000 in 2018 Planning for 4 million Arctic® apple trees to be planted by year end 2020 Commitment to development: Completed 2017 staffing and lab facility build-out plans to support tissue culture and molecular biology activities Expanding applications of non-browning platform: Production cost advantage given no need for preservative coatings Additional fruits (cherries, pears and avocados) Vegetables (lettuce)

Broad Application of Innovative Arctic® Solution Unique Arctic Advantage™ solution creates benefits for commercial tree fruit varieties across the entire supply chain, from growers to consumers Convenience drives consumer purchase selection, especially in healthy snack market Positively impact food waste, lessening the current 40% of apples wasted

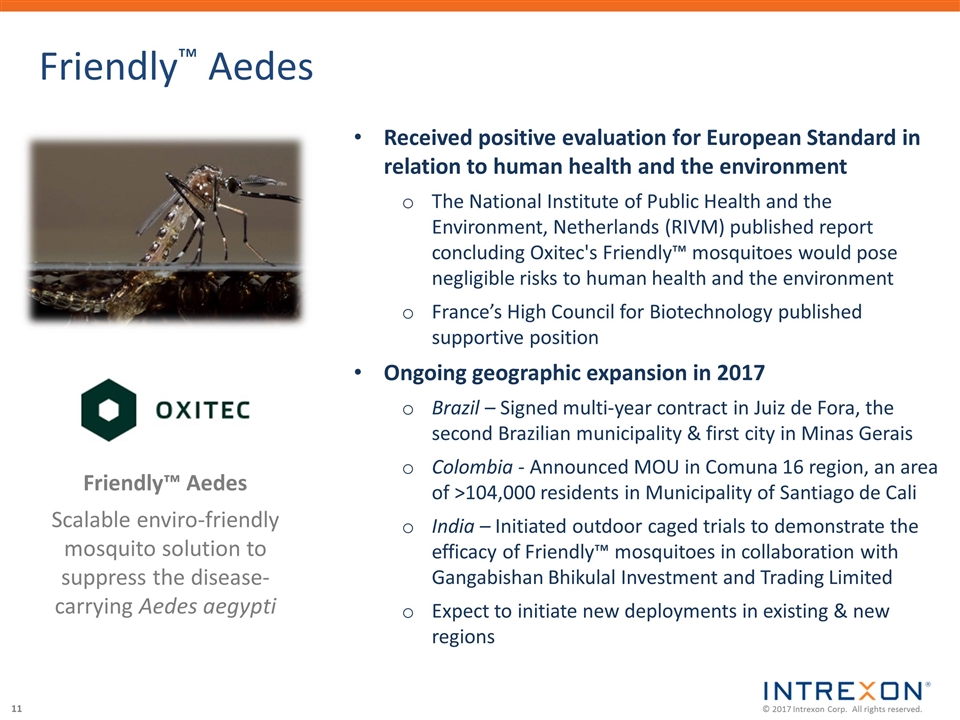

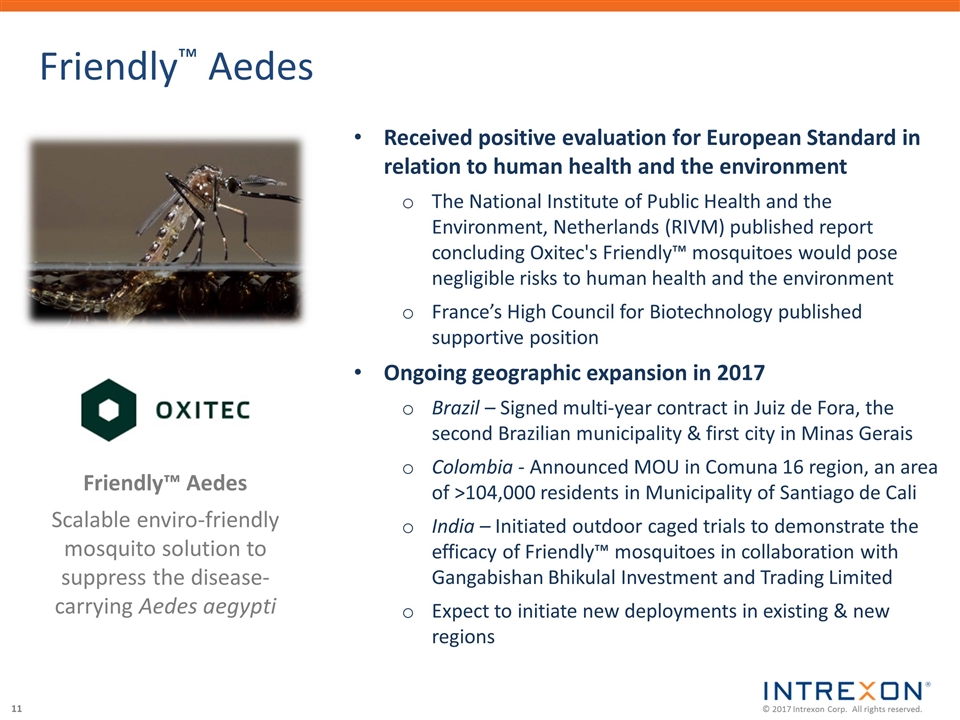

Friendly™ Aedes Friendly™ Aedes Scalable enviro-friendly mosquito solution to suppress the disease-carrying Aedes aegypti Received positive evaluation for European Standard in relation to human health and the environment The National Institute of Public Health and the Environment, Netherlands (RIVM) published report concluding Oxitec's Friendly™ mosquitoes would pose negligible risks to human health and the environment France’s High Council for Biotechnology published supportive position Ongoing geographic expansion in 2017 Brazil – Signed multi-year contract in Juiz de Fora, the second Brazilian municipality & first city in Minas Gerais Colombia - Announced MOU in Comuna 16 region, an area of >104,000 residents in Municipality of Santiago de Cali India – Initiated outdoor caged trials to demonstrate the efficacy of Friendly™ mosquitoes in collaboration with Gangabishan Bhikulal Investment and Trading Limited Expect to initiate new deployments in existing & new regions

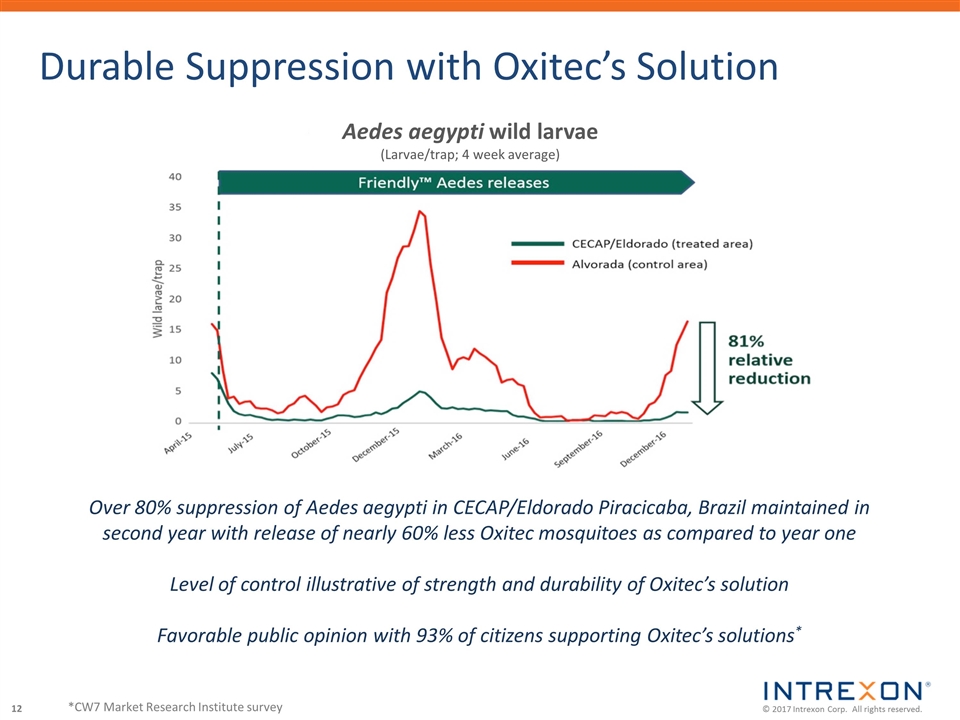

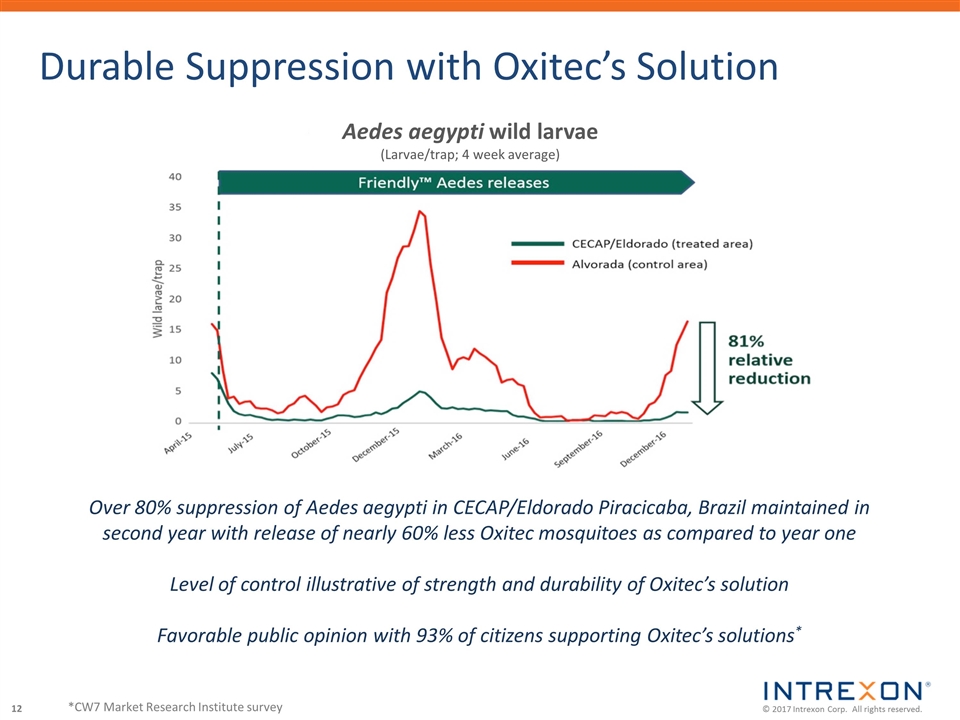

Durable Suppression with Oxitec’s Solution Over 80% suppression of Aedes aegypti in CECAP/Eldorado Piracicaba, Brazil maintained in second year with release of nearly 60% less Oxitec mosquitoes as compared to year one Level of control illustrative of strength and durability of Oxitec’s solution Favorable public opinion with 93% of citizens supporting Oxitec’s solutions* *CW7 Market Research Institute survey Aedes aegypti wild larvae (Larvae/trap; 4 week average)

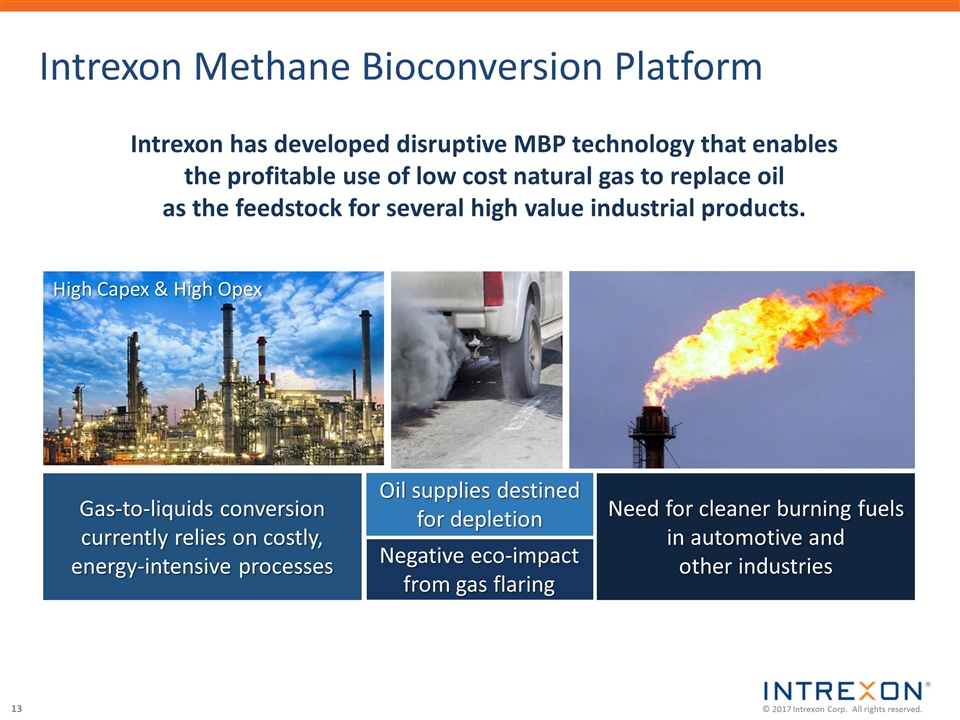

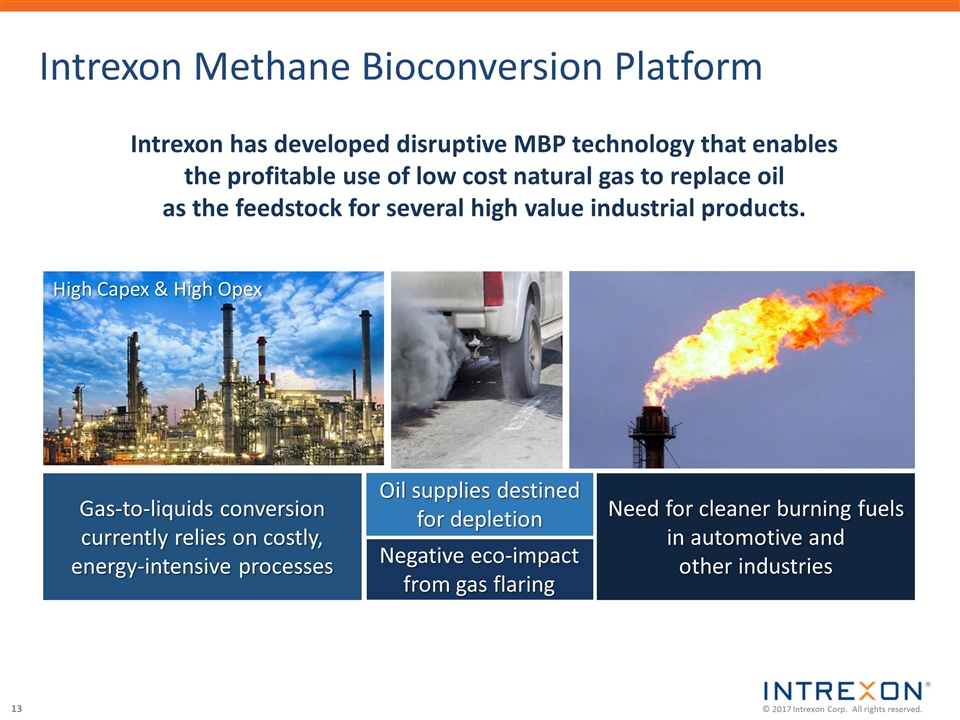

Intrexon Methane Bioconversion Platform Intrexon has developed disruptive MBP technology that enables the profitable use of low cost natural gas to replace oil as the feedstock for several high value industrial products. Need for cleaner burning fuels in automotive and other industries Gas-to-liquids conversion currently relies on costly, energy-intensive processes Oil supplies destined for depletion Negative eco-impact from gas flaring High Capex & High Opex

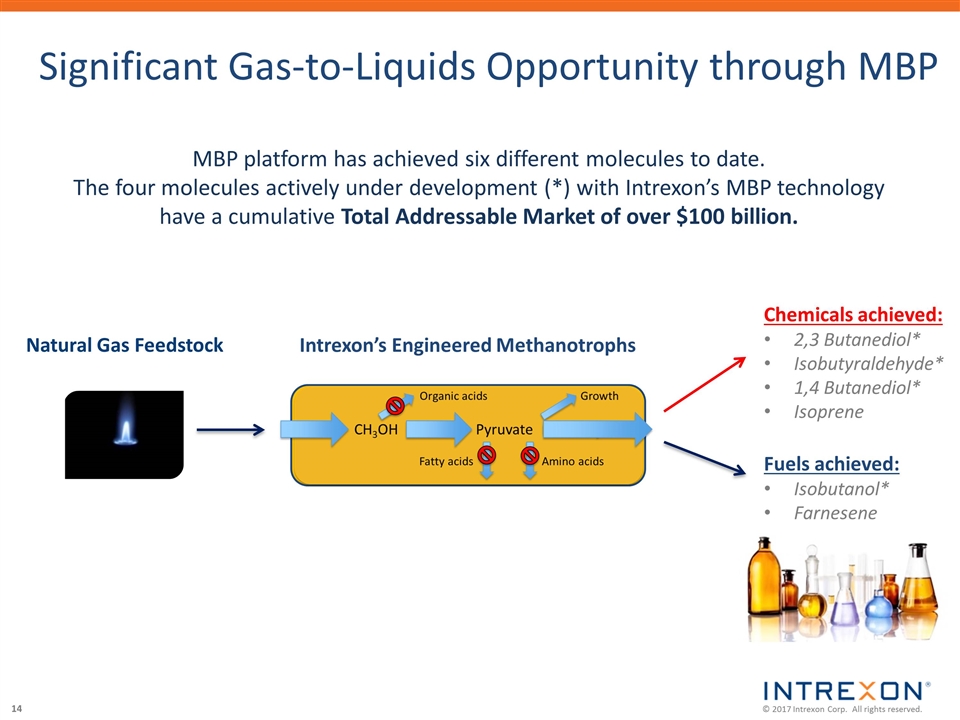

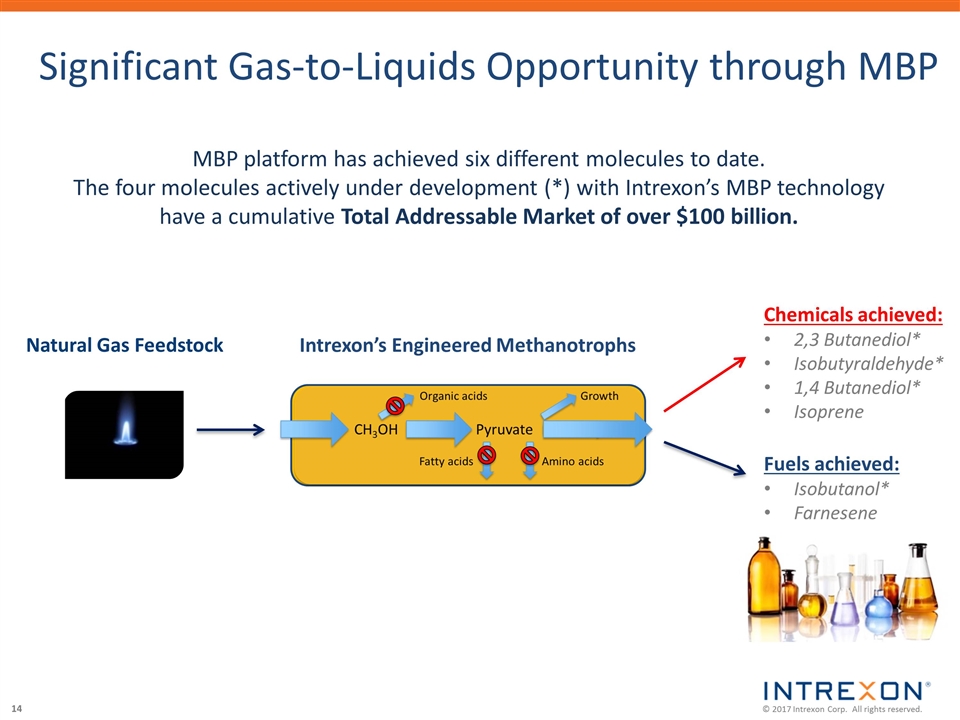

Significant Gas-to-Liquids Opportunity through MBP Intrexon’s Engineered Methanotrophs Chemicals achieved: 2,3 Butanediol* Isobutyraldehyde* 1,4 Butanediol* Isoprene Natural Gas Feedstock Fuels achieved: Isobutanol* Farnesene MBP platform has achieved six different molecules to date. The four molecules actively under development (*) with Intrexon’s MBP technology have a cumulative Total Addressable Market of over $100 billion.

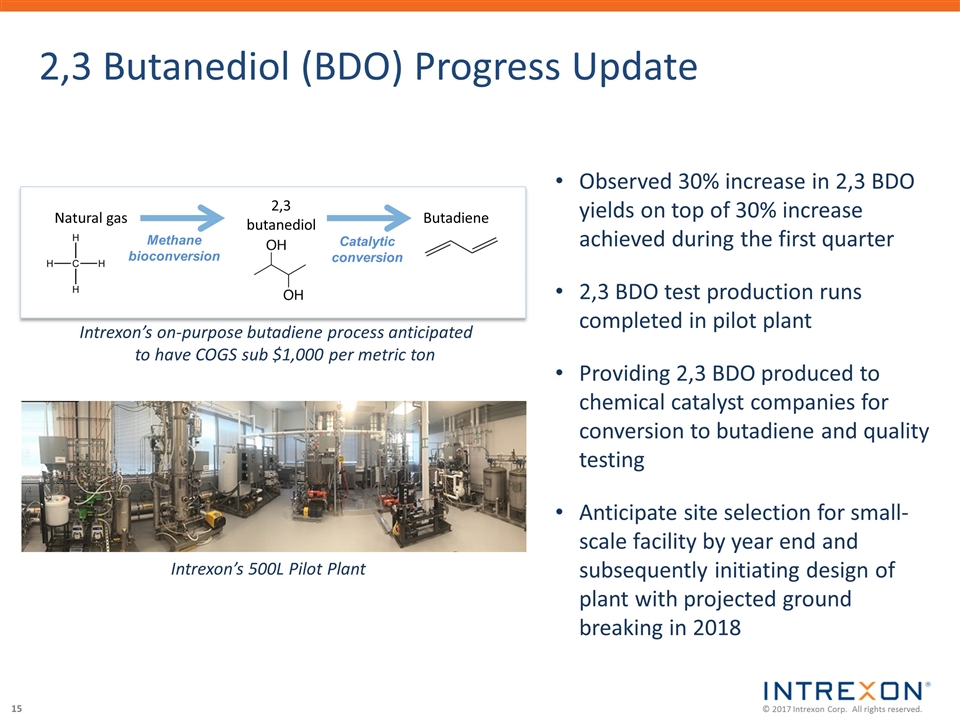

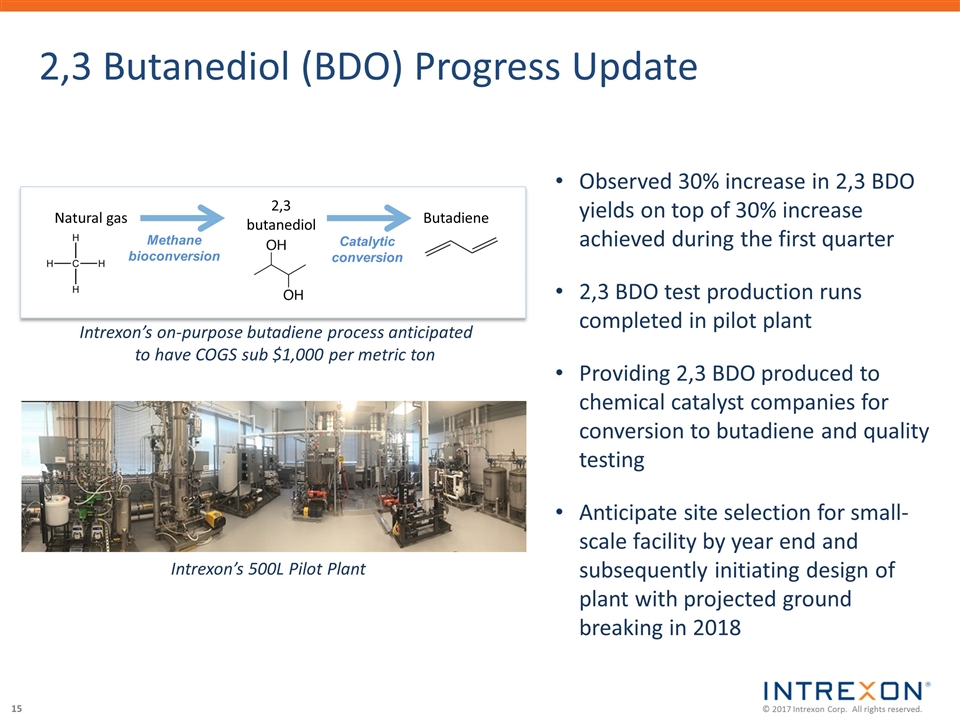

2,3 Butanediol (BDO) Progress Update 2,3 butanediol Methane bioconversion Catalytic conversion Natural gas Butadiene Observed 30% increase in 2,3 BDO yields on top of 30% increase achieved during the first quarter 2,3 BDO test production runs completed in pilot plant Providing 2,3 BDO produced to chemical catalyst companies for conversion to butadiene and quality testing Anticipate site selection for small-scale facility by year end and subsequently initiating design of plant with projected ground breaking in 2018 Intrexon’s 500L Pilot Plant Intrexon’s on-purpose butadiene process anticipated to have COGS sub $1,000 per metric ton

Harvest Intrexon Enterprise Fund → AD Skincare, Inc. Advanced topical delivery system to improve skin elasticity, firmness and reduction of fine lines and wrinkles → CRS Bio, Inc. Targeted delivery of antibodies for treatment of chronic rhinosinusitis → Exotech Bio, Inc. Innovative exosome platform for delivering therapeutic RNA using select targets → Genten Therapeutics, Inc. ActoBiotics® expression of gluten peptides to treat celiac disease → Relieve Genetics, Inc. Non-opioid gene therapy approach for neuropathic pain resultant from cancer → Thrive Agrobiotics, Inc. ActoBiotics® to express nutritive proteins to support intestinal maturation and function and enhance nutrient absorption in early weaned pigs

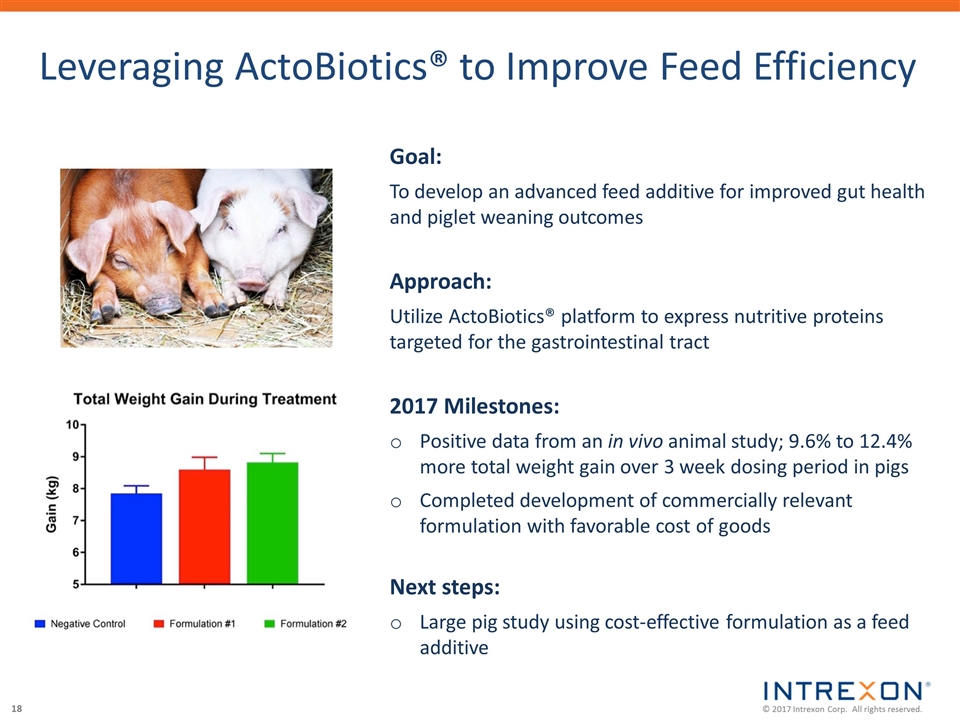

Thrive Agrobiotics: Nutrition for Weanling Pigs The Problem: By 2050 global consumption of animal protein will be two-thirds higher than current levels The Opportunity: Pork is the most widely eaten meat in the world today accounting for 36% of global meat consumption Worldwide production of indigenous pig meat in 2010 was $168 billion Healthy production will be vital to meet growing demand in a sustainable manner Our Solution: Utilize Intrexon’s ActoBiotics® platform to develop a cost-effective biologic that easily integrates into current commercial pork production systems enabling: Increased growth performance Improved feed efficacy A more sustainable food supply Sources: http://www.fao.org/news/story/en/item/116937/icode/; http://www.fao.org/ag/againfo/themes/en/meat/backgr_sources.html; http://www.fao.org/docrep/019/i3440e/i3440e.pdf

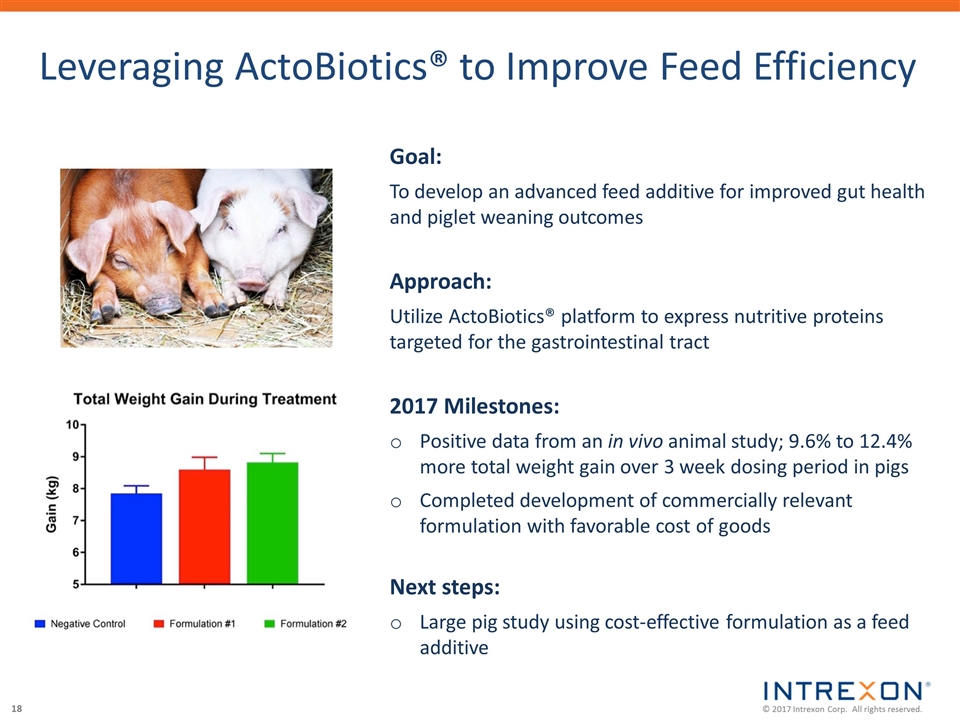

Leveraging ActoBiotics® to Improve Feed Efficiency Goal: To develop an advanced feed additive for improved gut health and piglet weaning outcomes Approach: Utilize ActoBiotics® platform to express nutritive proteins targeted for the gastrointestinal tract 2017 Milestones: Positive data from an in vivo animal study; 9.6% to 12.4% more total weight gain over 3 week dosing period in pigs Completed development of commercially relevant formulation with favorable cost of goods Next steps: Large pig study using cost-effective formulation as a feed additive

Health Sector Andrew Last, Ph.D. – Chief Operating Officer

Clinical Development Outlook for 2017 Patient population # based on United States only; * Estimated new cases per year; **ZIOPHARM plans to initiate pivotal trial in 2017 Indication Gene/Cell Therapy Patient # Phase XON Cost XON Economics Recurrent Glioblastoma Ad-RTS-IL12 >10,000* Phase 3** 0 20% Op Profits Recessive Dystrophic EB FCX-007 2,500 Phase 1/2 0 14% Net Sales Adv. Lymphoid Malignancies Non-viral SB CD19+ CAR T >80,000* Phase 1 0 20% Op Profits Relapsed/Refractory AML Viral CD33+ CAR T <8,000* Phase 1 0 20% Op Profits Pediatric Brain Tumors Ad-RTS-IL12 >3,000 Phase 1 0 20% Op Profits Recurrent Glioblastoma Ad-RTS-IL12 & Checkpoint >10,000* Phase 1 0 20% Op Profits Indication Gene/Cell Therapy Patient # IND XON Cost XON Economics AML Off-the-Shelf NK ~20,000* 2017 0 20% Op Profits Linear Scleroderma FCX-013 ~40,000 2017 0 14% Net Sales Oral Mucositis ActoBiotics AG013 ~500,000 2017 0 12% Net Sales Clostridium difficile Lantibiotics OG716 ~500,000* 2017 0 25% Op Profits Solid Tumors Sleeping Beauty TCR n/a 2017 n/a n/a Wet AMD AAV-RTS >1 million 2017 50% (JV) >50% Op Profits T1 Diabetes ActoBiotics >1.25 million 2017 50% (JV) 50% Op Profits Cardiac Disease pXoX Multi-Gene >20 million 2017 75% (Sub) 75% Op Profits Up to 8 additional INDs filed by year end 2017

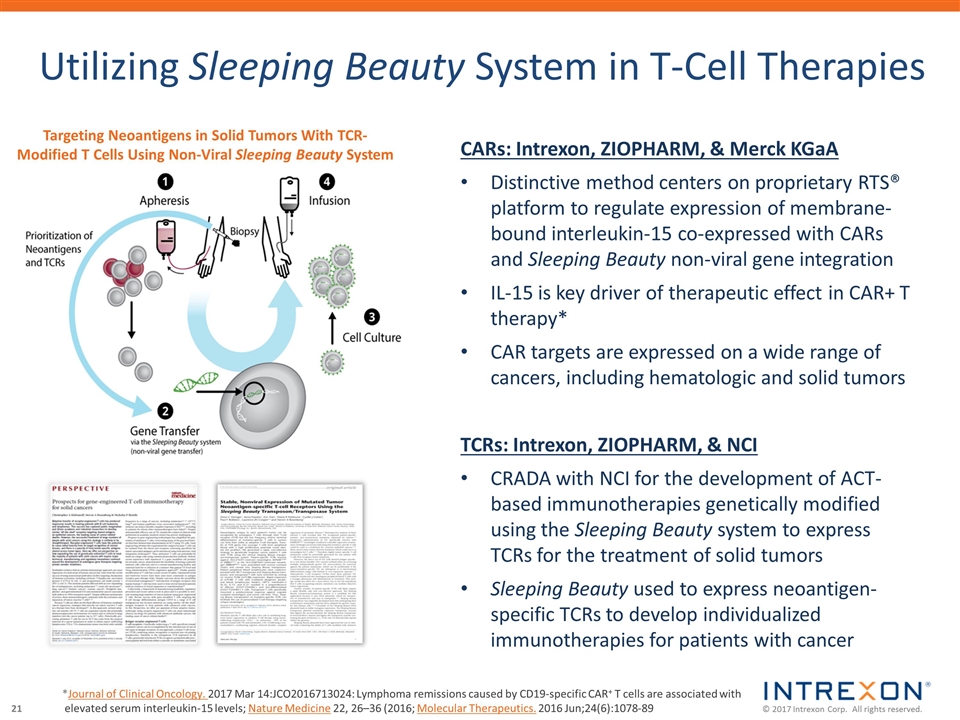

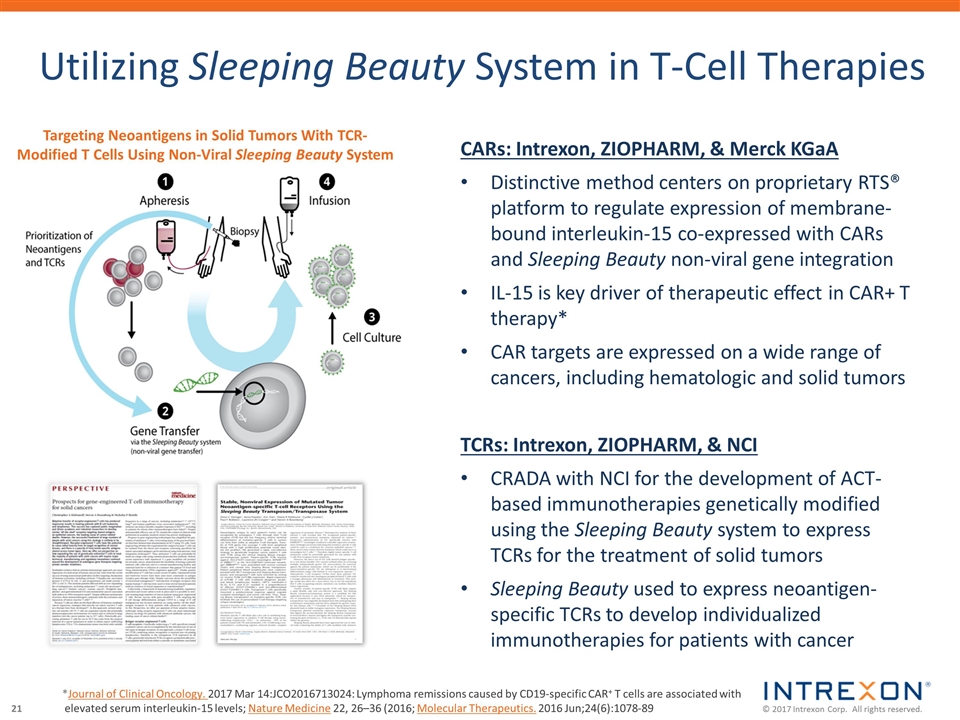

Utilizing Sleeping Beauty System in T-Cell Therapies Targeting Neoantigens in Solid Tumors With TCR-Modified T Cells Using Non-Viral Sleeping Beauty System CARs: Intrexon, ZIOPHARM, & Merck KGaA Distinctive method centers on proprietary RTS® platform to regulate expression of membrane-bound interleukin-15 co-expressed with CARs and Sleeping Beauty non-viral gene integration IL-15 is key driver of therapeutic effect in CAR+ T therapy* CAR targets are expressed on a wide range of cancers, including hematologic and solid tumors TCRs: Intrexon, ZIOPHARM, & NCI CRADA with NCI for the development of ACT-based immunotherapies genetically modified using the Sleeping Beauty system to express TCRs for the treatment of solid tumors Sleeping Beauty used to express neoantigen-specific TCRs to develop individualized immunotherapies for patients with cancer *Journal of Clinical Oncology. 2017 Mar 14:JCO2016713024: Lymphoma remissions caused by CD19-specific CAR+ T cells are associated with elevated serum interleukin-15 levels; Nature Medicine 22, 26–36 (2016; Molecular Therapeutics. 2016 Jun;24(6):1078-89

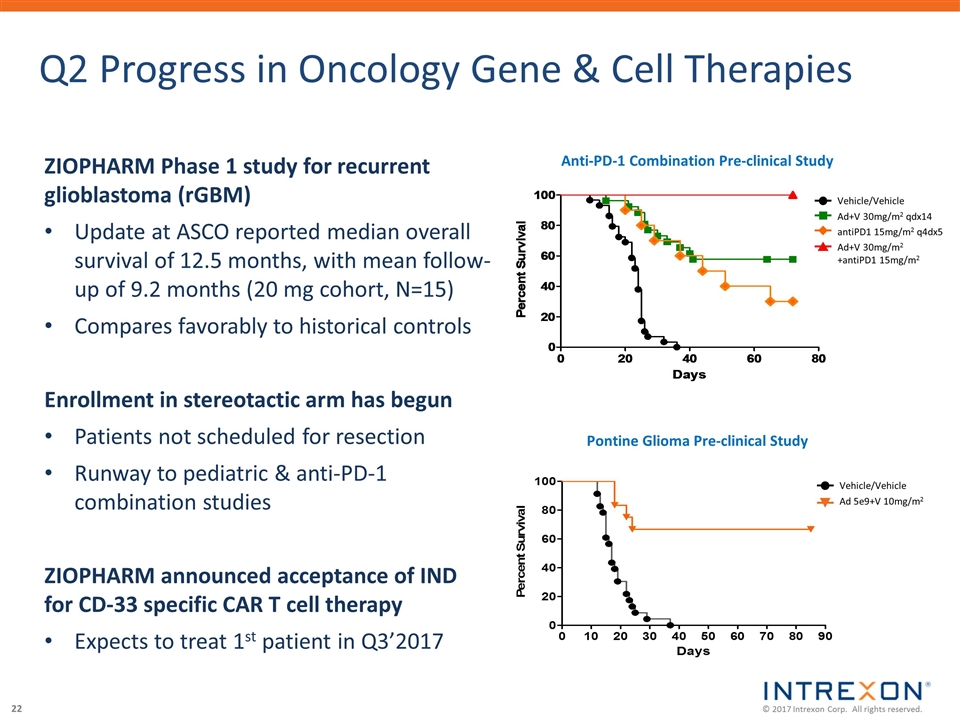

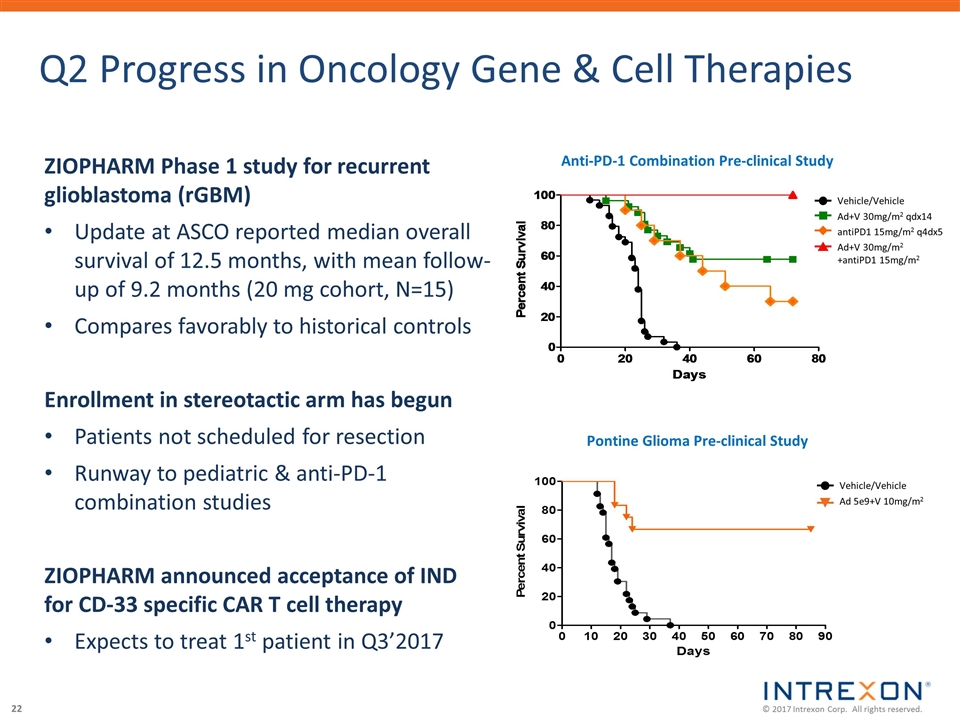

Q2 Progress in Oncology Gene & Cell Therapies Pontine Glioma Pre-clinical Study Anti-PD-1 Combination Pre-clinical Study ZIOPHARM Phase 1 study for recurrent glioblastoma (rGBM) Update at ASCO reported median overall survival of 12.5 months, with mean follow-up of 9.2 months (20 mg cohort, N=15) Compares favorably to historical controls Enrollment in stereotactic arm has begun Patients not scheduled for resection Runway to pediatric & anti-PD-1 combination studies ZIOPHARM announced acceptance of IND for CD-33 specific CAR T cell therapy Expects to treat 1st patient in Q3’2017 Vehicle/Vehicle Ad+V 30mg/m2 qdx14 antiPD1 15mg/m2 q4dx5 Ad+V 30mg/m2 +antiPD1 15mg/m2 Vehicle/Vehicle Ad 5e9+V 10mg/m2

Rare Diseases FCX-007 Rare Skin Disease Gene Therapy (Fibrocell Science): Data Safety Monitoring Board recommended continuation of Phase 1/2 clinical trial for treatment of recessive epidermolysis bullosa (RDEB) following planned review of safety data from first adult patient dosed Completed dosing of first cohort of three adult patients in Phase 1 portion of the clinical trial FCX-013 Rare Skin Disease Gene Therapy (Fibrocell Science): Granted Rare Disease Designation for FCX-013 for the treatment of moderate to severe linear scleroderma Highlighted pre-clinical data for FCX-013 at the 20th Annual Meeting of the American Society of Gene & Cell Therapy

Completion of GenVec Acquisition → Developing a next generation viral platform with significantly higher payload capacity (exceeding 30kb) compared to current viral delivery methods (4.5kb – 9kb) → Will further advance the field of gene-based medicine by enabling delivery of multiple therapeutic effectors not possible with current viral delivery systems → RTS® platform combined with GenVec’s AdV-based technology is projected to accelerate cutting-edge gene therapies that regulate in vivo expression Vectors with no or very low seroprevalence in the human population Non-integrating transgene limits probability of disturbance of vital cellular genes Efficient transduction in dividing cells and non-dividing cells Large packaging capability (up to 12 kb) with multiple expression cassettes Improved safety with multiple deletions in vector genomes Administered to over 3,000 clinical study subjects Scalable platform with efficient manufacturing process and attractive cost of goods AdenoVerse™ Strengths

Precigen Helen Sabzevari, Ph.D. - SVP, Human Therapeutics and Head of R&D for Precigen

Evolution of Precigen: New Model for Bio Pharma Unique position among Pharma and Biotech Comprehensive suite of technology platforms, through invention and acquisition, under one roof Creation of unique internal portfolio for R&D in various therapeutic areas based on combinations of platforms including biologics, genetic engineering, immunology, microbiome, vaccines, among others Leading position in single and multigene programming with limited off-target effects Well positioned to capitalize on the substantial promise of engineering biology to solve critical issues in human health and personalized care Precigen Technology Platform Precise & Controlled Therapy

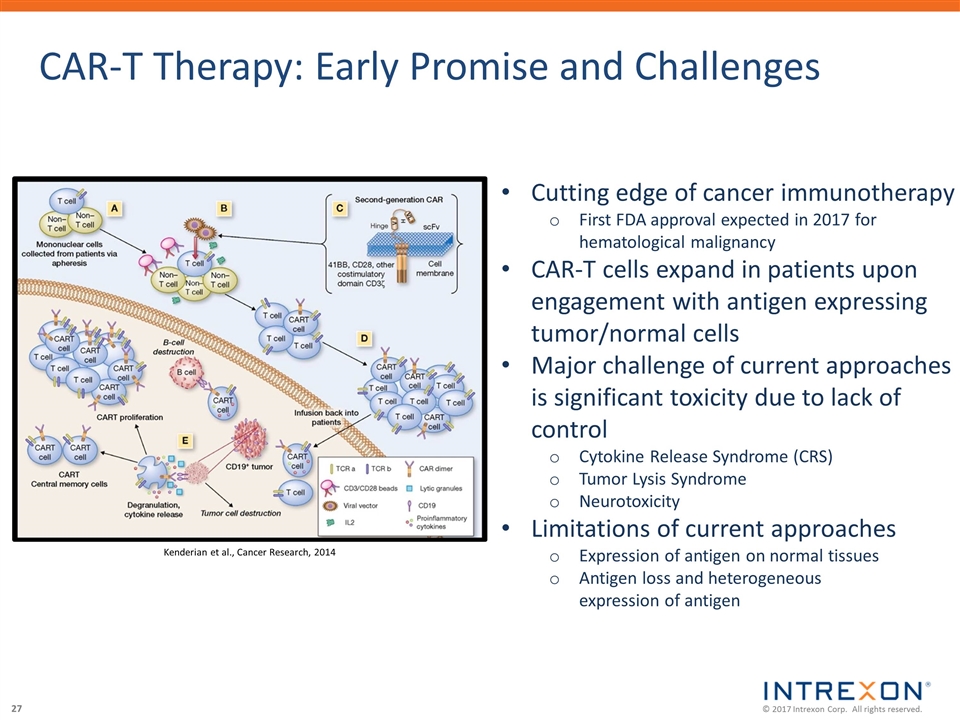

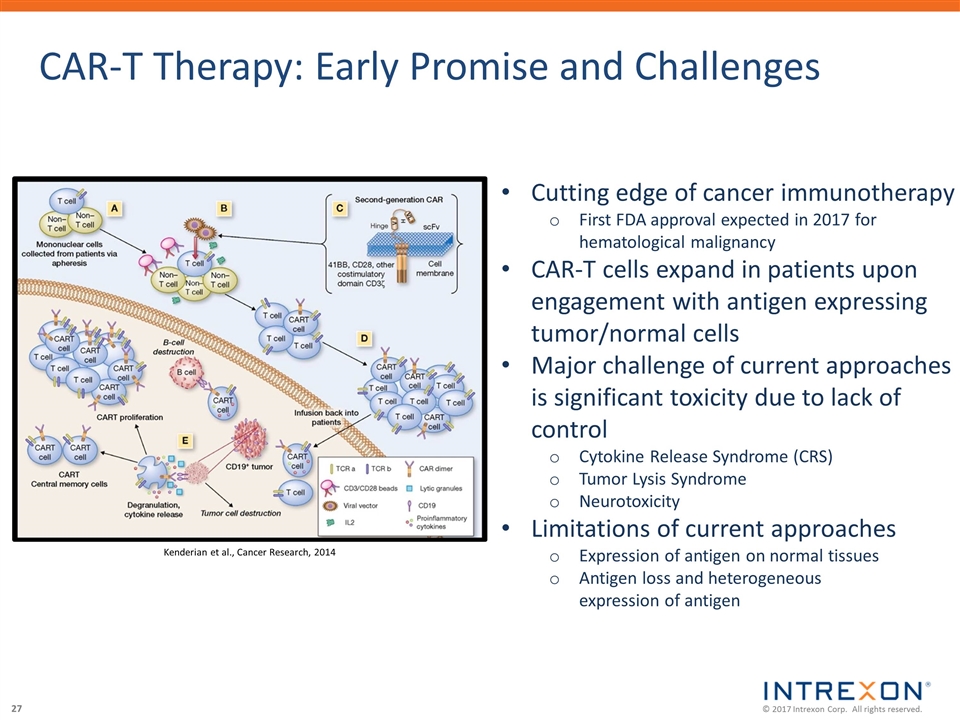

CAR-T Therapy: Early Promise and Challenges Cutting edge of cancer immunotherapy First FDA approval expected in 2017 for hematological malignancy CAR-T cells expand in patients upon engagement with antigen expressing tumor/normal cells Major challenge of current approaches is significant toxicity due to lack of control Cytokine Release Syndrome (CRS) Tumor Lysis Syndrome Neurotoxicity Limitations of current approaches Expression of antigen on normal tissues Antigen loss and heterogeneous expression of antigen Kenderian et al., Cancer Research, 2014

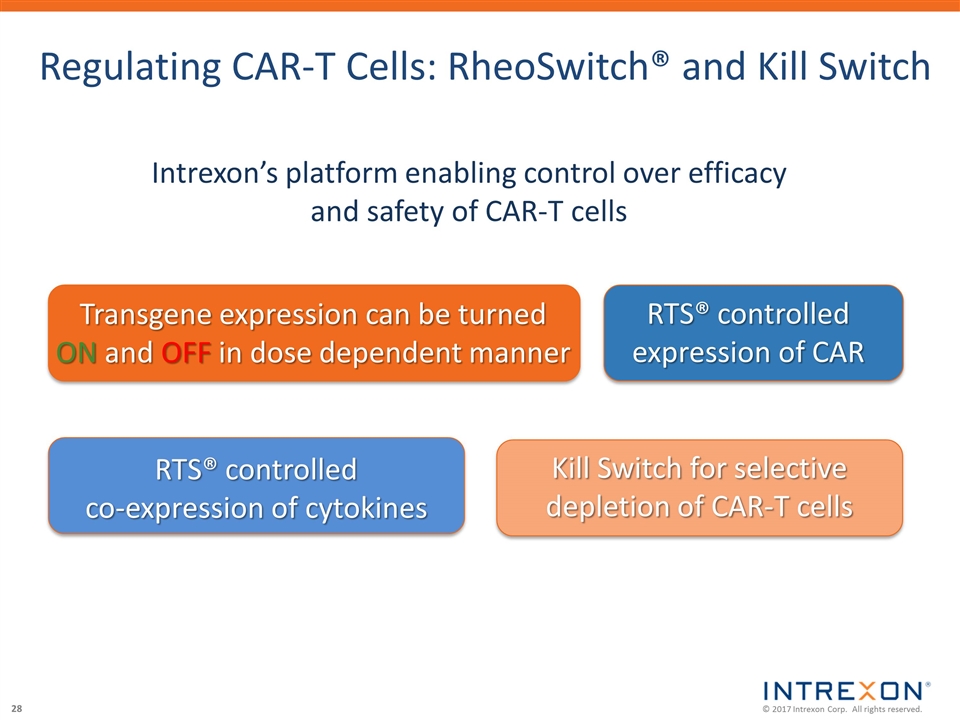

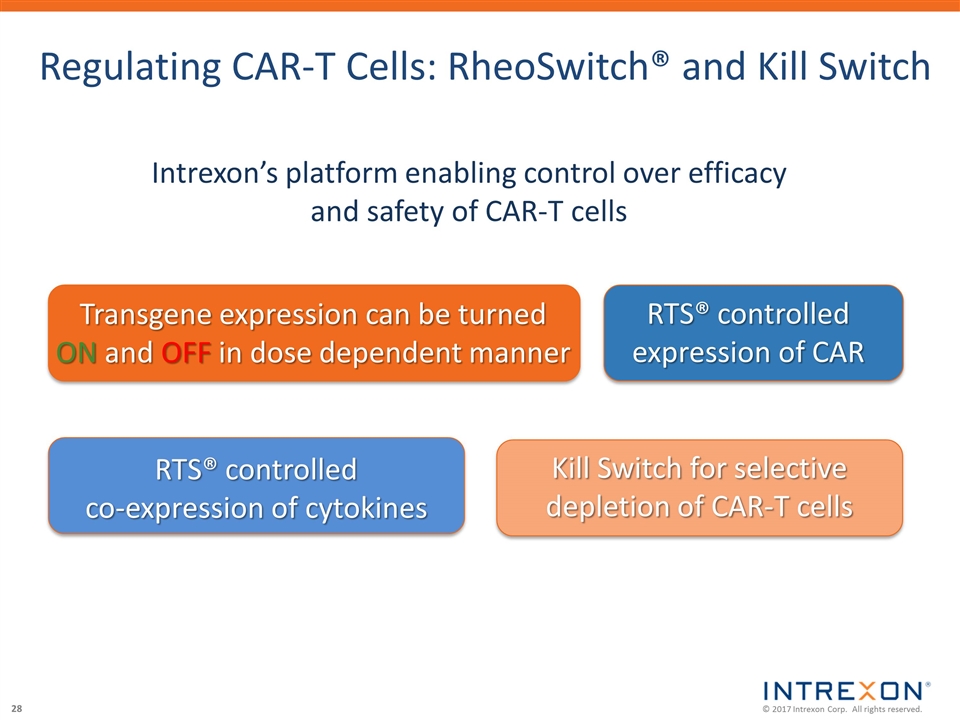

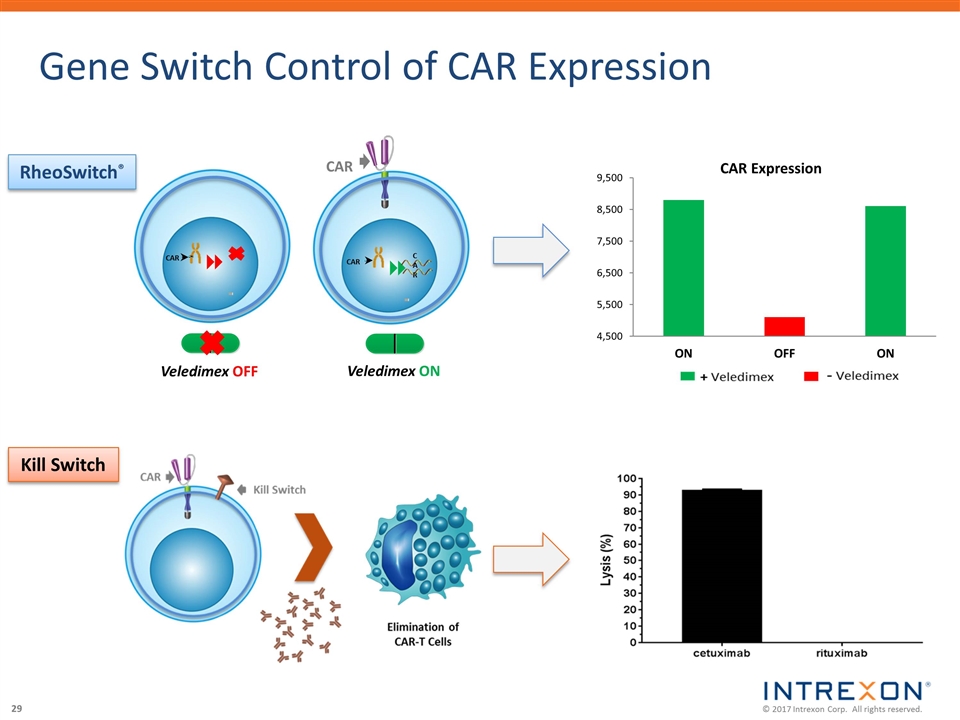

Regulating CAR-T Cells: RheoSwitch® and Kill Switch Transgene expression can be turned ON and OFF in dose dependent manner Intrexon’s platform enabling control over efficacy and safety of CAR-T cells RTS® controlled co-expression of cytokines RTS® controlled expression of CAR Kill Switch for selective depletion of CAR-T cells

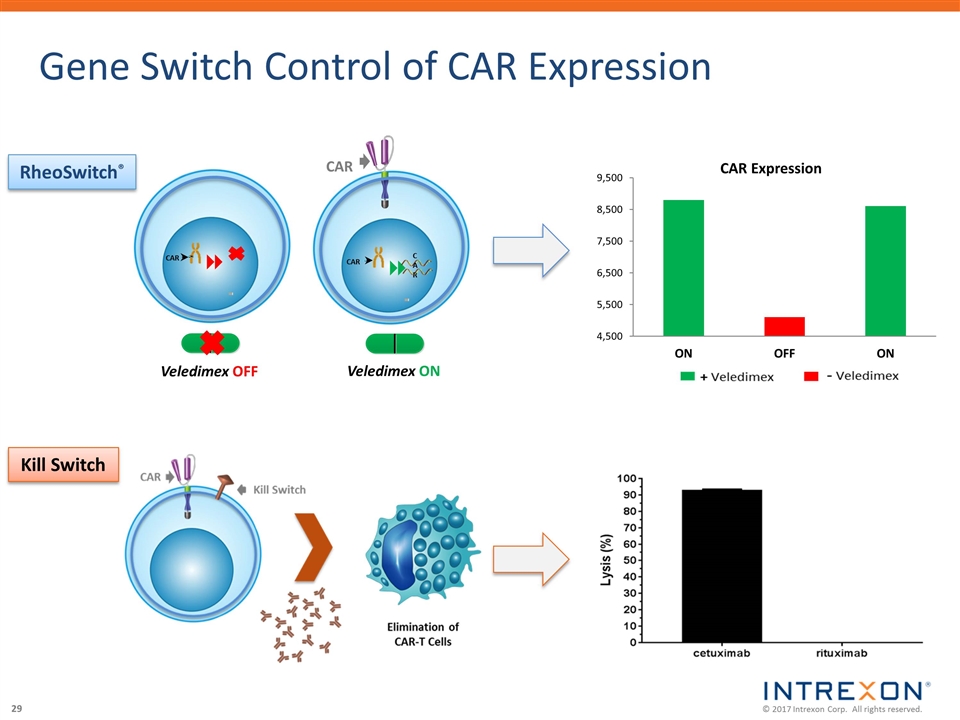

Kill Switch Gene Switch Control of CAR Expression RheoSwitch® Veledimex ON Veledimex OFF CAR 8 CAR 8 CAR CAR

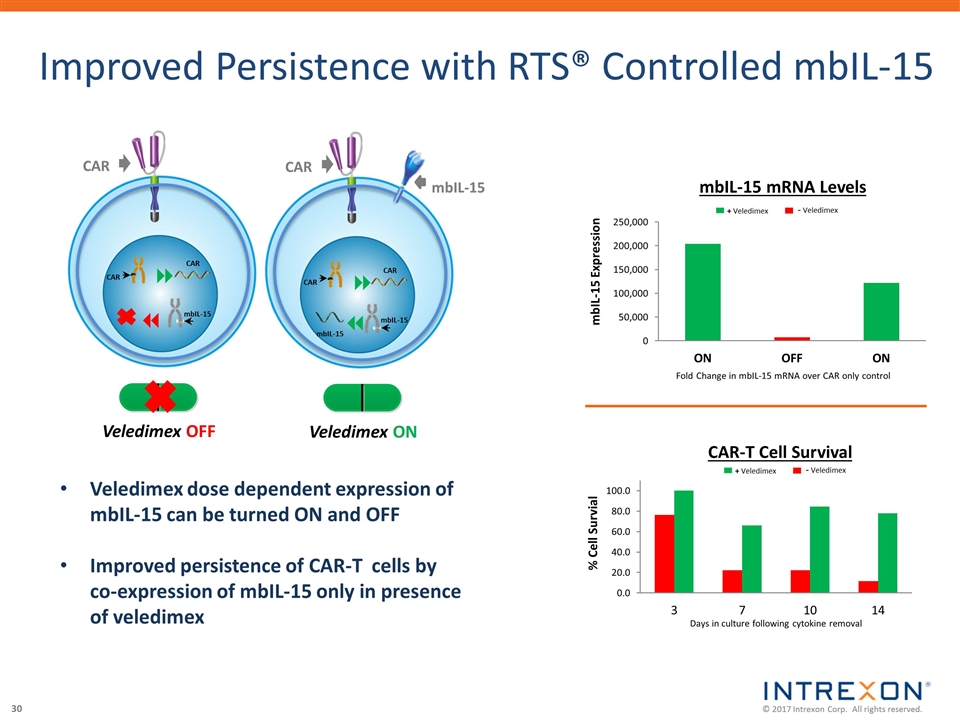

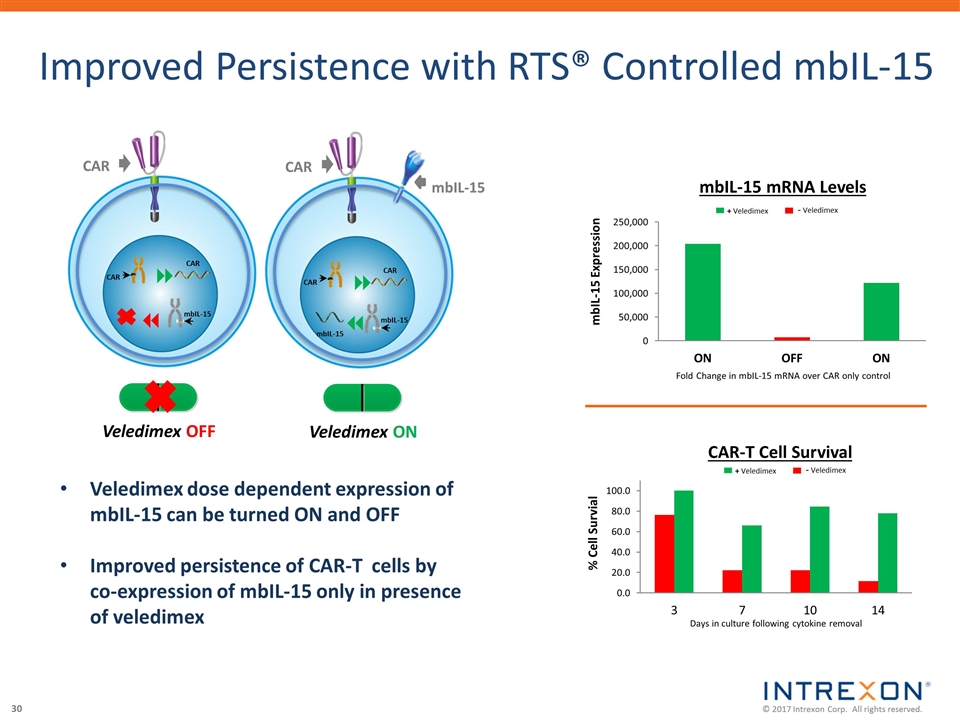

Improved Persistence with RTS® Controlled mbIL-15 Veledimex OFF Fold Change in mbIL-15 mRNA over CAR only control CAR 8 7 CAR mbIL-15 CAR Veledimex ON Veledimex dose dependent expression of mbIL-15 can be turned ON and OFF Improved persistence of CAR-T cells by co-expression of mbIL-15 only in presence of veledimex CAR mbIL-15 8 CAR mbIL-15 CAR 7 mbIL-15

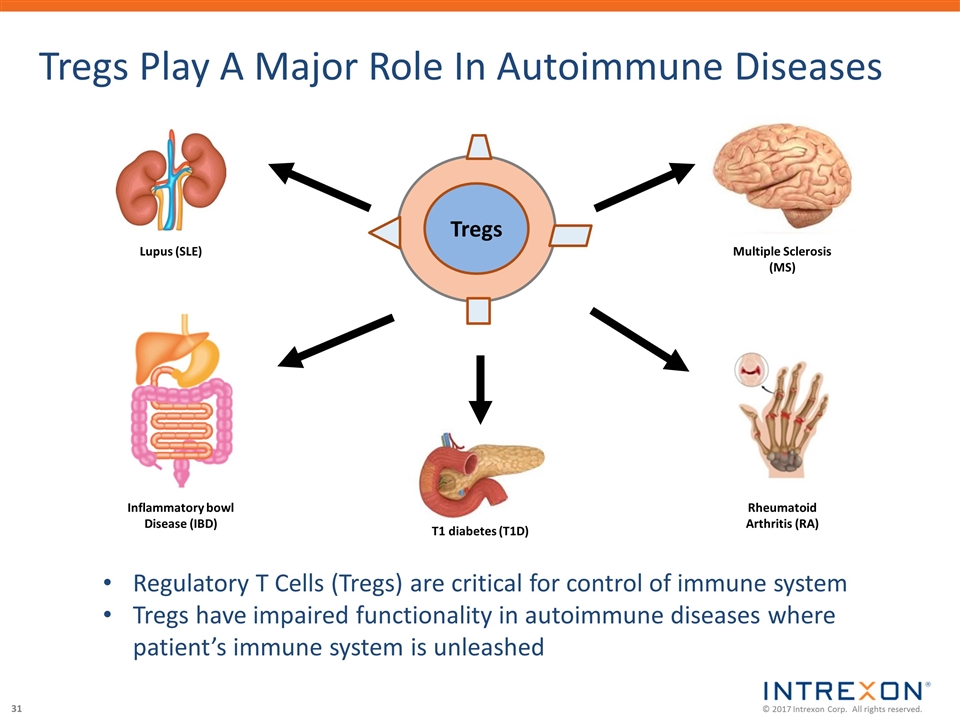

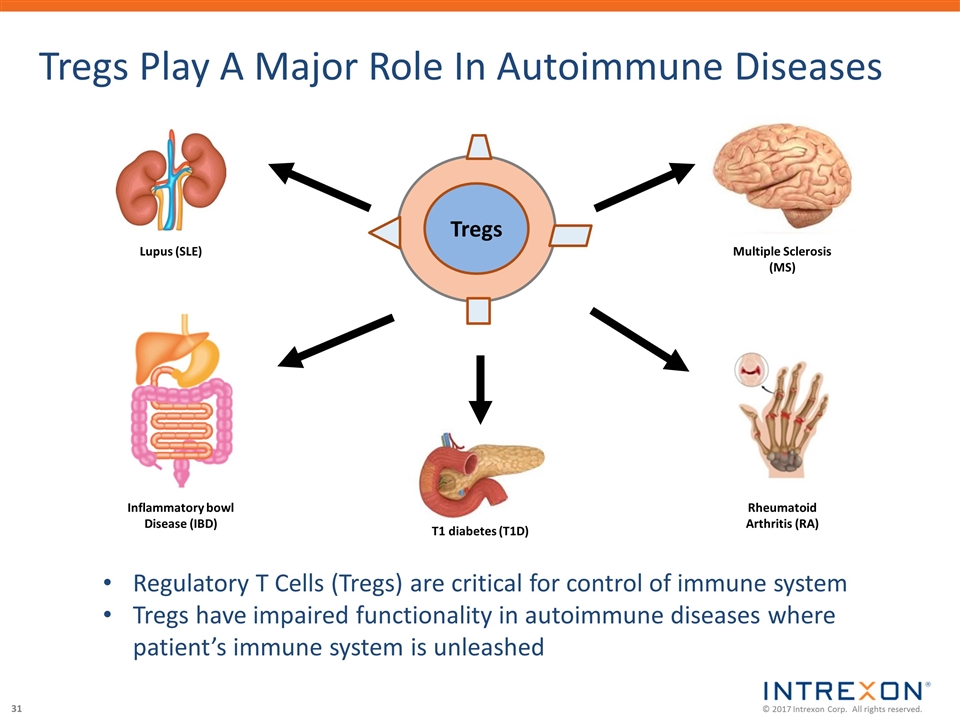

Tregs Play A Major Role In Autoimmune Diseases Inflammatory bowl Disease (IBD) T1 diabetes (T1D) Multiple Sclerosis (MS) Lupus (SLE) Rheumatoid Arthritis (RA) Regulatory T Cells (Tregs) are critical for control of immune system Tregs have impaired functionality in autoimmune diseases where patient’s immune system is unleashed Tregs

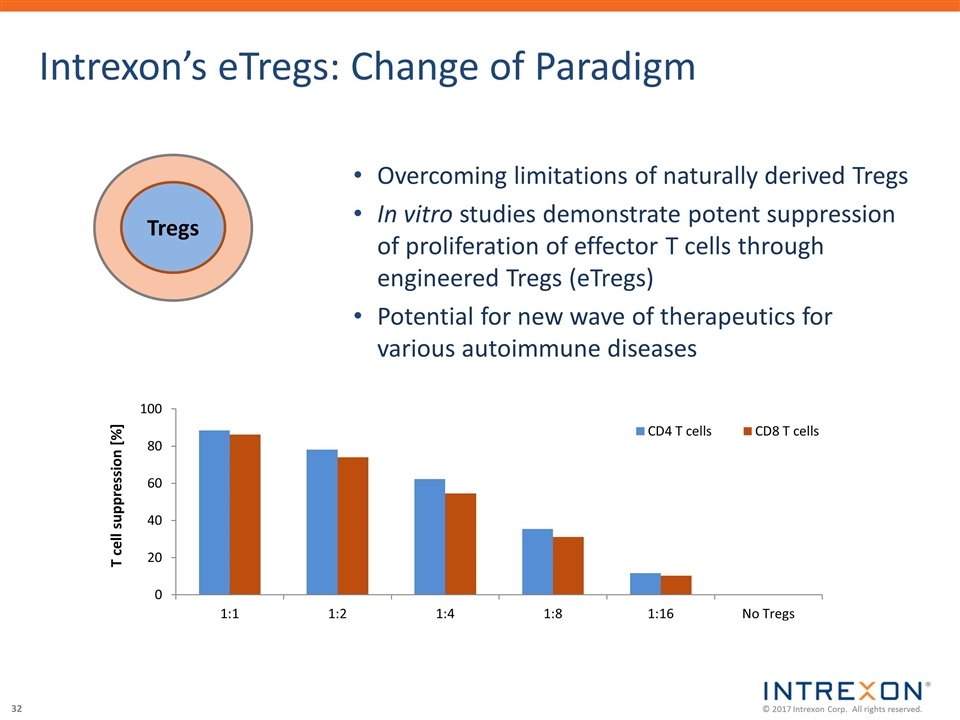

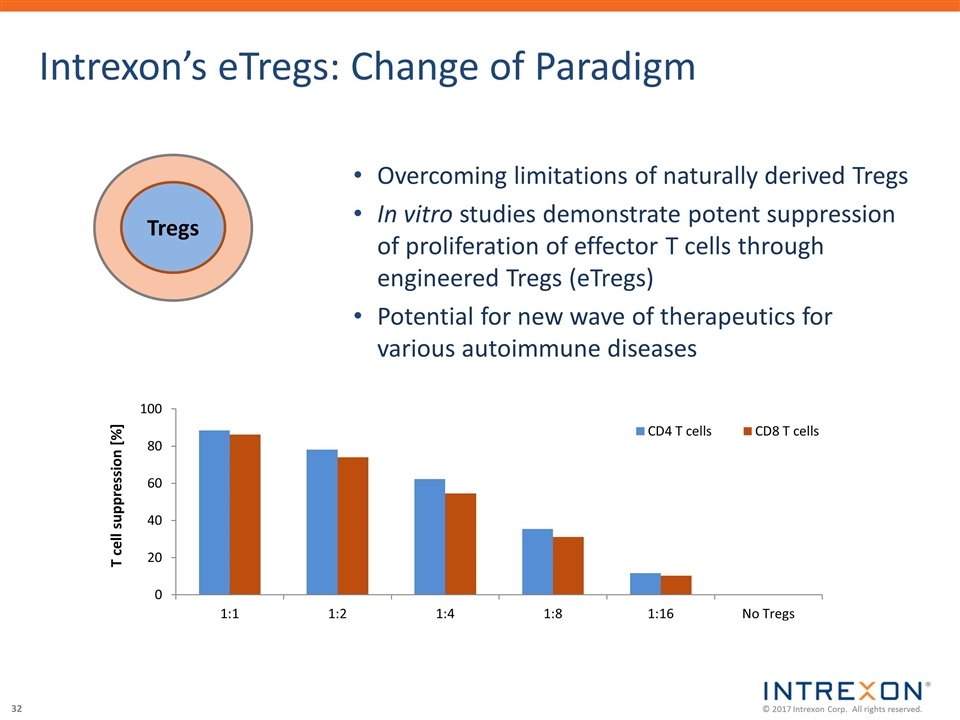

Intrexon’s eTregs: Change of Paradigm T cell suppression [%] Overcoming limitations of naturally derived Tregs In vitro studies demonstrate potent suppression of proliferation of effector T cells through engineered Tregs (eTregs) Potential for new wave of therapeutics for various autoimmune diseases Tregs

Financial Overview Joel Liffmann – Senior Vice President, Finance

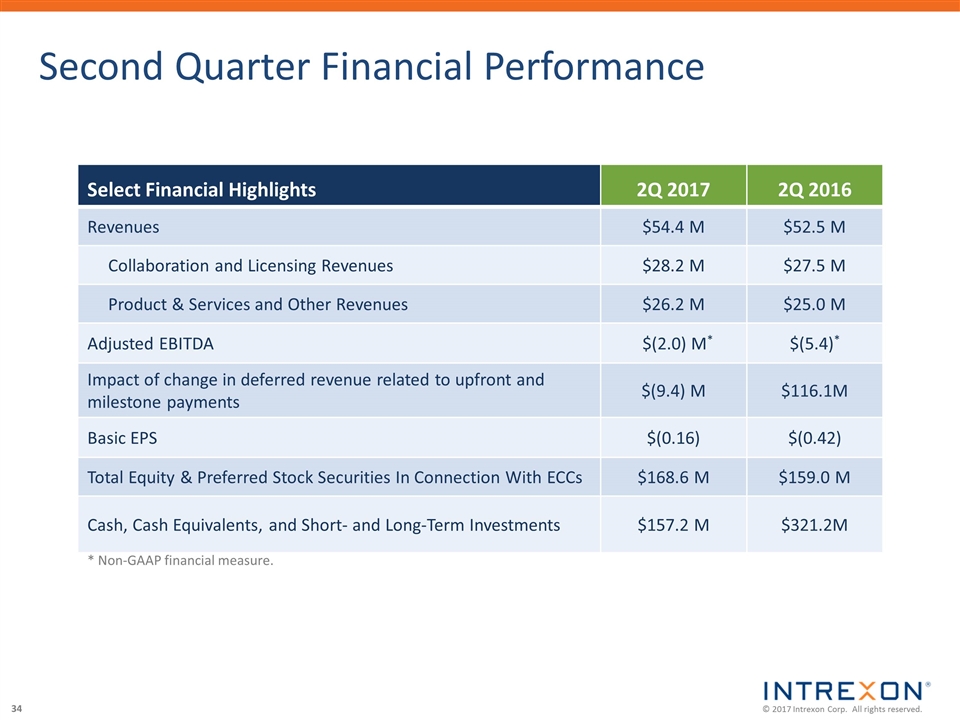

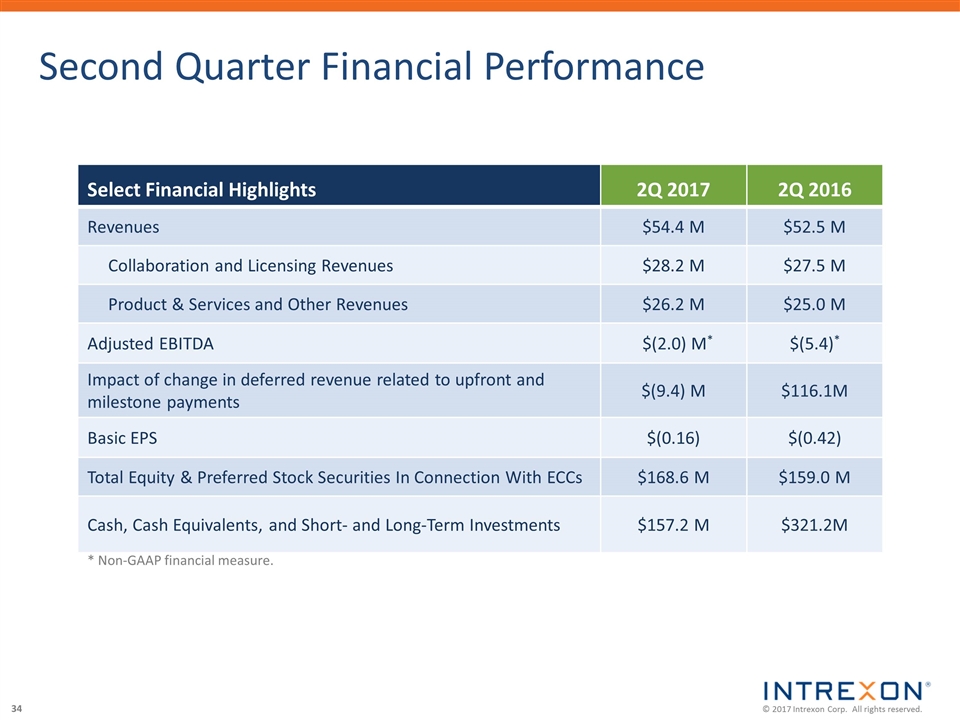

Second Quarter Financial Performance * Non-GAAP financial measure. Select Financial Highlights 2Q 2017 2Q 2016 Revenues $54.4 M $52.5 M Collaboration and Licensing Revenues $28.2 M $27.5 M Product & Services and Other Revenues $26.2 M $25.0 M Adjusted EBITDA $(2.0) M* $(5.4)* Impact of change in deferred revenue related to upfront and milestone payments $(9.4) M $116.1M Basic EPS $(0.16) $(0.42) Total Equity & Preferred Stock Securities In Connection With ECCs $168.6 M $159.0 M Cash, Cash Equivalents, and Short- and Long-Term Investments $157.2 M $321.2M

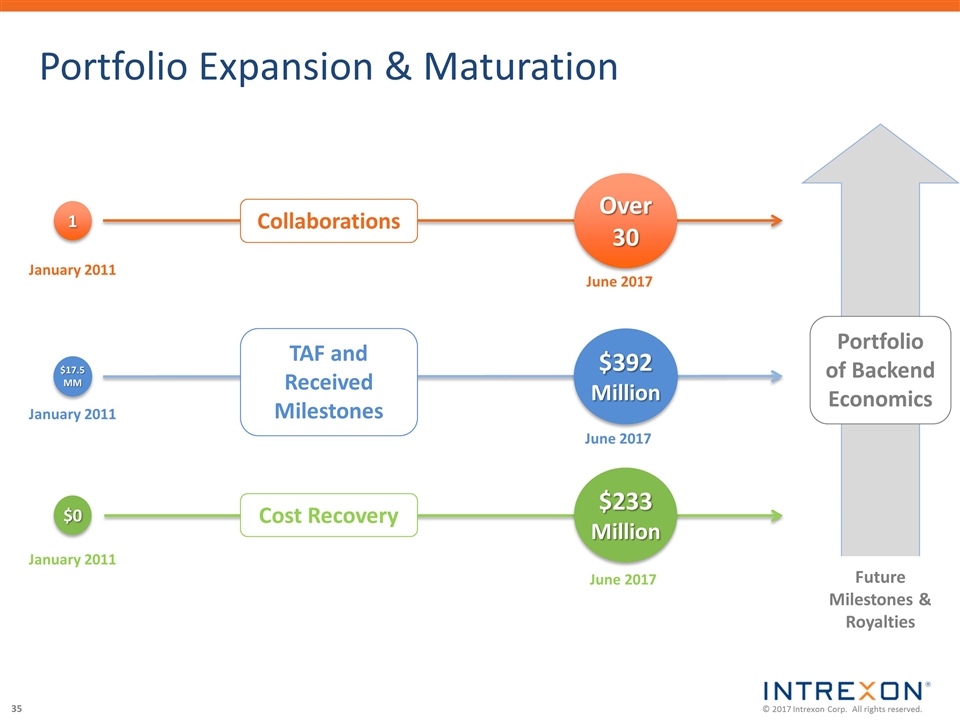

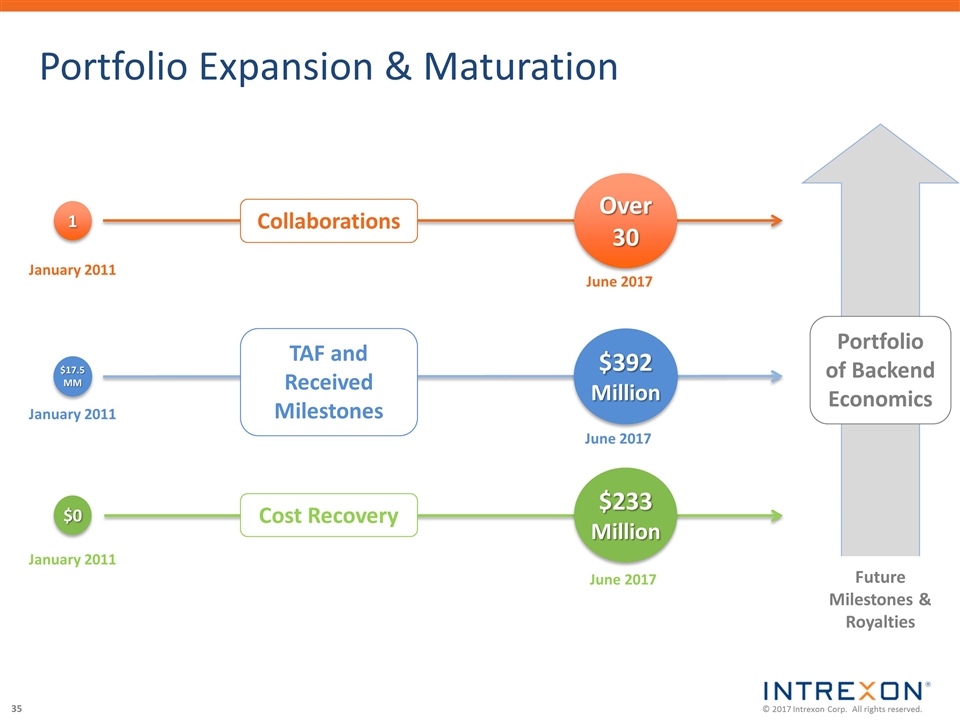

Portfolio Expansion & Maturation June 2017 1 Over 30 January 2011 Collaborations June 2017 $17.5MM $392 Million January 2011 TAF and Received Milestones June 2017 $0 $233 Million January 2011 Cost Recovery Portfolio of Backend Economics Future Milestones & Royalties

Summary Over 30 collaborations in place capitalizing on our leadership position in the engineering of biology Strong cash position with $157 million in cash, cash equivalents, and short-term investments, and equity securities and preferred stock valued at $168 million Developing high value bio-solutions with our collaborators in large established markets with built-in demand Positioned to deliver meaningful returns to our shareholders through our scalable, capital efficient model and successful execution of current & future opportunities

Q&A Session