INDEX TO FINANCIAL STATEMENTS OF WIRELESS RONIN AND

BROADCAST

| | Page |

| WIRELESS RONIN TECHNOLOGIES, INC. AND SUBSIDIARIES | |

| | |

Audited Financial Statements for fiscal year ended December 31, 2013 | |

| Report of Independent Registered Public Accounting Firm | F-2 |

| Consolidated Financial Statements | |

| Consolidated Balance Sheets | F-3 |

| Consolidated Statement of Operations | F-4 |

| Consolidated Statement of Comprehensive Loss | F-5 |

| Consolidated Statement of Shareholders’ Equity | F-6 |

| Consolidated Statement of Cash Flows | F-7 |

| Notes to Consolidated Financial Statements | F-8 |

| | |

| Unaudited Financial Statements | |

| Consolidated Balance Sheets at March 31, 2104 and December 31, 2013 | F-31 |

| Consolidated Statement of Operations for the three months ended March 31, 2014 and March 31, 2013 | F-32 |

| Consolidated Statement of Cash Flows for the three months ended March 31, 2014 and March 31, 2013 | F-33 |

| Notes to Consolidated Financial Statements | F-34 |

| | |

| BROADCAST INTERNATIONAL, INC. AND SUBSIDIARIES | |

| | |

Audited Financial Statements for fiscal year ended December 31, 2013 | |

| Report of Independent Registered Public Accounting Firm | F-46 |

| Consolidated Financial Statements | |

| Consolidated Balance Sheets | F-47 |

| Consolidated Statement of Operations | F-48 |

| Consolidated Statement of Comprehensive Loss | |

| Consolidated Statement of Shareholders’ Equity | F-49 |

| Consolidated Statement of Cash Flows | F-50 |

| Notes to Consolidated Financial Statements | F-51 |

| | |

| Unaudited Financial Statements | |

| Consolidated Balance Sheets at March 31, 2104 and December 31, 2013 | F-72 |

| Consolidated Statement of Operations for the three months ended March 31, 2014 and March 31, 2013 | F-73 |

| Consolidated Statement of Cash Flows for the three months ended March 31, 2014 and March 31, 2013 | F-74 |

| Notes to Consolidated Financial Statements | F-75 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders, Audit Committee and Board of Directors

Wireless Ronin Technologies, Inc.

Minnetonka, Minnesota

We have audited the accompanying consolidated balance sheets of Wireless Ronin Technologies, Inc. (the Company) as of December 31, 2013 and 2012, and the related consolidated statements of operations, comprehensive loss, shareholders' equity and cash flows for the years ended December 31, 2013, 2012 and 2011. These consolidated financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of its internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Wireless Ronin Technologies, Inc. as of December 31, 2013 and 2012 and the results of their operations and cash flows for the years ended December 31, 2013, 2012 and 2011, in conformity with U.S. generally accepted accounting principles.

The accompanying consolidated financial statements have been prepared assuming that the company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the company has suffered recurring losses from operations and as of December 31, 2013, does not have sufficient cash available to fund operations beyond April 30, 2014. These factors raise substantial doubt about its ability to continue as a going concern. Managements plans in regard to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Baker Tilly Virchow Krause, LLP

Minneapolis, Minnesota

March 11, 2014

WIRELESS RONIN TECHNOLOGIES, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

| | | December 31, | | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| ASSETS | |

| CURRENT ASSETS | | | | | | |

| Cash and cash equivalents | | $ | 1,484 | | | $ | 2,252 | |

| Accounts receivable, net of allowance of $35 and $49, respectively | | | 1,070 | | | | 1,358 | |

| Inventories | | | 69 | | | | 158 | |

| Prepaid expenses and other current assets | | | 135 | | | | 111 | |

| Total current assets | | | 2,758 | | | | 3,879 | |

| Property and equipment, net | | | 229 | | | | 415 | |

| Restricted cash | | | 50 | | | | 50 | |

| Other assets | | | 19 | | | | 20 | |

| TOTAL ASSETS | | $ | 3,056 | | | $ | 4,364 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| CURRENT LIABILITIES | | | | | | | | |

| Line of credit - bank | | $ | - | | | $ | 400 | |

| Accounts payable | | | 298 | | | | 584 | |

| Deferred revenue | | | 754 | | | | 596 | |

| Accrued liabilities | | | 421 | | | | 527 | |

| Total current liabilities | | | 1,473 | | | | 2,107 | |

| | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Convertible notes payable (net of discount $153) | | | 672 | | | | - | |

| Convertible notes payable - related party (net of discount $47) | | | 203 | | | | - | |

| Total Long-term liabilities | | | 875 | | | | - | |

| Total liabilities | | | 2,348 | | | | 2,107 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | - | | | | - | |

| | | | | | | | | |

| SHAREHOLDERS' EQUITY | | | | | | | | |

| Capital stock, $0.01 par value, 66,667 shares authorized | | | | | | | | |

| Preferred stock, 16,667 shares authorized, no shares issued and outstanding | | | - | | | | - | |

| Common stock, 50,000 shares authorized; 5,973 and 5,004 shares issued | | | | | | | | |

| and outstanding | | | 60 | | | | 50 | |

| Additional paid-in capital | | | 99,166 | | | | 97,128 | |

| Accumulated deficit | | | (98,019 | ) | | | (94,422 | ) |

| Accumulated other comprehensive loss | | | (499 | ) | | | (499 | ) |

| Total shareholders' equity | | | 708 | | | | 2,257 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | $ | 3,056 | | | $ | 4,364 | |

See accompanying Notes to Consolidated Financial Statements.

WIRELESS RONIN TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

| | | For the Years Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| Sales | | | | | | | | | |

| Hardware | | $ | 1,697 | | | $ | 1,540 | | | $ | 3,845 | |

| Software | | | 1,122 | | | | 339 | | | | 1,150 | |

| Services and other | | | 3,983 | | | | 4,825 | | | | 4,279 | |

| Total sales | | | 6,802 | | | | 6,704 | | | | 9,274 | |

| Cost of sales | | | | | | | | | | | | |

| Hardware | | | 1,065 | | | | 908 | | | | 2,639 | |

| Software | | | 13 | | | | 67 | | | | 141 | |

| Services and other | | | 1,689 | | | | 2,019 | | | | 2,363 | |

| Inventory lower of cost or market adjustment | | | 47 | | | | 35 | | | | 65 | |

| Total cost of sales (exclusive of depreciation and amortization shown separately below) | | | 2,814 | | | | 3,029 | | | | 5,208 | |

| Gross profit (exclusive of depreciation and amortization) | | | 3,988 | | | | 3,675 | | | | 4,066 | |

| Operating expenses: | | | | | | | | | | | | |

| Sales and marketing expenses | | | 1,482 | | | | 1,550 | | | | 2,090 | |

| Research and development expenses | | | 935 | | | | 1,795 | | | | 2,116 | |

| General and administrative expenses | | | 4,930 | | | | 5,443 | | | | 6,105 | |

| Depreciation and amortization expense | | | 213 | | | | 286 | | | | 467 | |

| Total operating expenses | | | 7,560 | | | | 9,074 | | | | 10,778 | |

| Operating loss | | | (3,572 | ) | | | (5,399 | ) | | | (6,712 | ) |

| Other income (expenses): | | | | | | | | | | | | |

| Interest expense | | | (25 | ) | | | (8 | ) | | | (30 | ) |

| Interest income | | | - | | | | 1 | | | | 4 | |

| Total other expense | | | (25 | ) | | | (7 | ) | | | (26 | ) |

| Net loss | | $ | (3,597 | ) | | $ | (5,406 | ) | | $ | (6,738 | ) |

| Basic and diluted loss per common share | | $ | (0.63 | ) | | $ | (1.14 | ) | | $ | (1.72 | ) |

| Basic and diluted weighted average shares outstanding | | | 5,744 | | | | 4,732 | | | | 3,920 | |

See accompanying Notes to Consolidated Financial Statements.

WIRELESS RONIN TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

| | | For the Years Ended | |

| | | December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| Net loss | | $ | (3,597 | ) | | $ | (5,406 | ) | | $ | (6,738 | ) |

| Foreign currency translation gain (loss) | | | - | | | | - | | | | 10 | |

| Total comprehensive loss | | $ | (3,597 | ) | | $ | (5,406 | ) | | $ | (6,728 | ) |

See accompanying Notes to Consolidated Financial Statements

WIRELESS RONIN TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | | | | | Other | | | Total | |

| | | Common Stock | | | Paid-In | | | Accumulated | | | Comprehensive | | | Shareholders' | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Income (loss) | | | Equity | |

| Balances at December 31, 2010 | | | 3,847 | | | $ | 38 | | | $ | 91,292 | | | $ | (82,278 | ) | | $ | (509 | ) | | $ | 8,543 | |

| Net loss | | | - | | | | - | | | | - | | | | (6,738 | ) | | | - | | | | (6,738 | ) |

| Foreign currency translation gain | | | - | | | | - | | | | - | | | | | | | | 10 | | | | 10 | |

| Stock-based compensation | | | - | | | | - | | | | 740 | | | | - | | | | - | | | | 740 | |

| Warrants issued for debt issuance costs | | | - | | | | - | | | | 8 | | | | - | | | | - | | | | 8 | |

| Restricted and common stock issued under equity incentive plan | | | 9 | | | | - | | | | 4 | | | | - | | | | - | | | | 4 | |

| Exercise of options and warrants | | | 60 | | | | 1 | | | | 200 | | | | - | | | | - | | | | 201 | |

| Common stock issued under associate stock purchase plan | | | 14 | | | | - | | | | 68 | | | | | | | | | | | | 68 | |

| Proceeds from the sale of common stock, less offering costs | | | 664 | | | | 7 | | | | 2,919 | | | | - | | | | - | | | | 2,926 | |

| Balances at December 31, 2011 | | | 4,594 | | | $ | 46 | | | $ | 95,231 | | | $ | (89,016 | ) | | $ | (499 | ) | | $ | 5,762 | |

| Net loss | | | - | | | | - | | | | - | | | | (5,406 | ) | | | - | | | | (5,406 | ) |

| Stock-based compensation | | | - | | | | - | | | | 484 | | | | - | | | | - | | | | 484 | |

| Restricted and common stock issued under equity incentive plan | | | 29 | | | | 1 | | | | - | | | | - | | | | - | | | | 1 | |

| Warrants issued for consulting services | | | - | | | | - | | | | 75 | | | | - | | | | - | | | | 75 | |

| Issuance of unregistered shares of common stock | | | 21 | | | | - | | | | 114 | | | | - | | | | - | | | | 114 | |

| Common stock issued under associate stock purchase plan | | | 12 | | | | - | | | | 51 | | | | | | | | | | | | 51 | |

| Proceeds from the sale of common stock, less offering costs | | | 348 | | | | 3 | | | | 1,173 | | | | - | | | | - | | | | 1,176 | |

| Balances at December 31, 2012 | | | 5,004 | | | $ | 50 | | | $ | 97,128 | | | $ | (94,422 | ) | | $ | (499 | ) | | $ | 2,257 | |

| Net loss | | | - | | | | - | | | | - | | | | (3,597 | ) | | | - | | | | (3,597 | ) |

| Stock-based compensation | | | - | | | | - | | | | 434 | | | | - | | | | - | | | | 434 | |

| Restricted and common stock issued under equity incentive plan | | | 76 | | | | 1 | | | | - | | | | - | | | | - | | | | 1 | |

| Common stock issued for consulting services | | | 6 | | | | - | | | | 10 | | | | - | | | | - | | | | 10 | |

| Beneficial conversion feature of convertible notes payable | | | - | | | | - | | | | 21 | | | | - | | | | - | | | | 21 | |

| Beneficial conversion feature of convertible notes payable - related party | | | - | | | | - | | | | 6 | | | | - | | | | - | | | | 6 | |

| Warrants issued with convertible notes payable | | | - | | | | - | | | | 137 | | | | - | | | | - | | | | 137 | |

| Warrants issued with convertible notes payable - related party | | | - | | | | - | | | | 41 | | | | - | | | | - | | | | 41 | |

| Common stock issued under associate stock purchase plan | | | 19 | | | | - | | | | 21 | | | | | | | | | | | | 21 | |

| Proceeds from the sale of common stock, less offering costs | | | 868 | | | | 9 | | | | 1,368 | | | | - | | | | - | | | | 1,377 | |

| Balances at December 31, 2013 | | | 5,973 | | | $ | 60 | | | $ | 99,166 | | | $ | (98,019 | ) | | $ | (499 | ) | | $ | 708 | |

See accompanying Notes to Consolidated Financial Statements.

WIRELESS RONIN TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, except per share amounts)

| | | For the Years Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| Operating Activities: | | | | | | | | | |

| Net loss | | $ | (3,597 | ) | | $ | (5,406 | ) | | $ | (6,738 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | | | | | | | | | |

| Depreciation and amortization | | | 213 | | | | 286 | | | | 467 | |

| Loss on disposal of property and equipment | | | - | | | | - | | | | 51 | |

| Stock-based compensation expense | | | 434 | | | | 484 | | | | 740 | |

| Issuance of common stock for services | | | 10 | | | | 114 | | | | - | |

| Issuance of warrants for services | | | 3 | | | | 75 | | | | - | |

| Accretion of discount on convertible notes payable | | | 4 | | | | - | | | | - | |

| Amortization of warrants issued for debt issuance costs | | | - | | | | 3 | | | | 21 | |

| Provision for doubtful receivables | | | (14 | ) | | | - | | | | 15 | |

| Change in operating assets and liabilities: | | | | | | | | | | | | |

| Accounts receivable | | | 289 | | | | (11 | ) | | | 1,151 | |

| Inventories | | | 89 | | | | 12 | | | | 102 | |

| Prepaid expenses and other current assets | | | (24 | ) | | | 82 | | | | 68 | |

| Other assets | | | 1 | | | | 20 | | | | - | |

| Accounts payable | | | (285 | ) | | | (286 | ) | | | (693 | ) |

| Deferred revenue | | | 158 | | | | (91 | ) | | | 197 | |

| Accrued liabilities | | | (107 | ) | | | (42 | ) | | | 1 | |

| Net cash used in operating activities | | | (2,826 | ) | | | (4,760 | ) | | | (4,618 | ) |

| Investing activities | | | | | | | | | | | | |

| Purchases of property and equipment | | | (29 | ) | | | (47 | ) | | | (149 | ) |

| Net cash used in investing activities | | | (29 | ) | | | (47 | ) | | | (149 | ) |

| Financing activities | | | | | | | | | | | | |

| Payments on capital leases | | | - | | | | (41 | ) | | | (36 | ) |

| Advances on line of credit - bank | | | - | | | | 400 | | | | - | |

| Repayment on line of credit - bank | | | (400 | ) | | | - | | | | - | |

| Proceeds from the issuance of convertible notes and warrants | | | 825 | | | | - | | | | - | |

| Proceeds from the issuance of convertible notes and warrants - related party | | | 250 | | | | - | | | | - | |

| Proceeds from issuance of common stock and warrants | | | 1,377 | | | | 1,176 | | | | 2,926 | |

| Proceeds from exercise of warrants and stock options | | | - | | | | - | | | | 201 | |

| Proceeds from sale of common stock under associate stock purchase plan | | | 21 | | | | 51 | | | | 68 | |

| Net cash provided by financing activities | | | 2,073 | | | | 1,586 | | | | 3,159 | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | | | 14 | | | | (5 | ) | | | 22 | |

| Decrease in Cash and Cash Equivalents | | | (768 | ) | | | (3,226 | ) | | | (1,586 | ) |

| Cash and Cash Equivalents, beginning of year | | | 2,252 | | | | 5,478 | | | | 7,064 | |

| Cash and Cash Equivalents, end of year | | $ | 1,484 | | | $ | 2,252 | | | $ | 5,478 | |

See accompanying Notes to Consolidated Financial Statements.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

NOTE 1: NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business and Operations

Overview

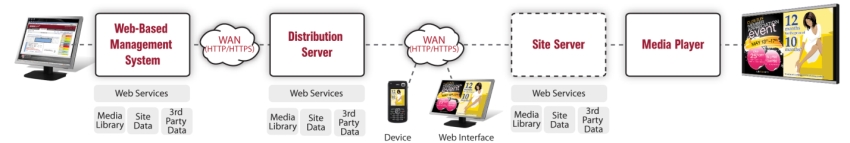

Wireless Ronin Technologies, Inc. (“the Company”) is a Minnesota corporation that provides marketing technology solutions targeting specific food service, automotive and branded retail markets. The Company provides leading expertise in content and emerging digital media solutions, including dynamic digital signage, interactive kiosk, mobile, social media and web, that enable its customers to transform how they engage with their customers. The Company is able to provide an array of marketing technology solutions through its proprietary suite of software applications marketed as RoninCast®. RoninCast software and associated applications provide an enterprise, web-based or hosted content delivery system that manages, schedules and delivers digital content over wireless or wired networks. Additionally, RoninCast® software’s flexibility allows the Company to develop custom solutions for specific customer applications.

The Company's wholly-owned subsidiary, Wireless Ronin Technologies (Canada), Inc., an Ontario, Canada provincial corporation located in Windsor, Ontario, develops "e-learning, e-performance support and e-marketing" solutions for business customers. E-learning solutions are software-based instructional systems developed specifically for customers, primarily in sales force training applications. E-performance support systems are interactive systems produced to increase product literacy of customer sales staff. E-marketing products are developed to increase customer knowledge of and interaction with customer products.

The Company and its subsidiary sell products and services primarily throughout North America.

Summary of Significant Accounting Policies

A summary of the significant accounting policies consistently applied in the preparation of the accompanying financial statements follows:

1. Principles of Consolidation

The consolidated financial statements include the accounts of Wireless Ronin Technologies, Inc. and its wholly-owned subsidiary. All inter-company balances and transactions have been eliminated in consolidation.

2. Foreign Currency

During 2012, the Company reevaluated the reporting currency and determined that the functional currency for its operations in Canada is the U.S. Dollar. As a result, the Company is no longer recording translation adjustments related to assets and liabilities or income and expense items that are transacted in the local currency as a component of accumulated other comprehensive loss in shareholders’ equity. Foreign exchange transaction gains and losses attributable to exchange rate movements related to transactions made in the local currency and on intercompany receivables and payables not deemed to be of a long-term investment nature are recorded in general and administrative. During 2013, the Company recognized a foreign currency transaction loss of $17.

For the periods presented prior to 2012, the Company’s foreign denominated monetary assets and liabilities were translated at the rate of exchange prevailing at the balance sheet date. Revenue and expenses were translated at the average exchange rates prevailing during the reporting period. Translation adjustments result from translating the subsidiary’s financial statements into the Company’s reporting currency, the U.S. dollar. These translation adjustments had not been included in determining the Company’s net loss, but were reported separately and were accumulated in a separate component of equity. The Canadian subsidiary has foreign currency transactions denominated in a currency other than the Canadian dollar. These transactions include receivables and payables that are fixed in terms of the amount of foreign currency that will be received or paid on a future date. A change in exchange rates between the functional currency and the currency in which the transaction is denominated increases or decreases the expected amount of functional currency cash flows upon settlement of the transaction. That increase or decrease in expected functional currency cash flows is a foreign currency transaction gain or loss that has been included in determining the net loss of the period. In 2012 and 2011, foreign currency transaction gains of $9 and $11 were recorded in Sales, respectively.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

3. Revenue Recognition

The Company recognizes revenue primarily from these sources:

| | · | Software and software license sales |

| | · | Professional service revenue |

| | · | Software design and development services |

| | · | Maintenance and hosting support contracts |

The Company applies the provisions of Accounting Standards Codification subtopic 605-985, Revenue Recognition: Software (or ASC 605-35) to all transactions involving the sale of software licenses. In the event of a multiple element arrangement, the Company evaluates if each element represents a separate unit of accounting, taking into account all factors following the guidelines set forth in “FASB ASC 605-985-25-5.”

The Company recognizes revenue when (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred, which is when product title transfers to the customer, or services have been rendered; (iii) customer payment is deemed fixed or determinable and free of contingencies and significant uncertainties; and (iv) collection is reasonably assured. The Company assesses collectability based on a number of factors, including the customer’s past payment history and its current creditworthiness. If it is determined that collection of a fee is not reasonably assured, the Company defers the revenue and recognizes it at the time collection becomes reasonably assured, which is generally upon receipt of cash payment. If an acceptance period is required, revenue is recognized upon the earlier of customer acceptance or the expiration of the acceptance period. Sales and use taxes are reported on a net basis, excluding them from revenue and cost of revenue.

Multiple-Element Arrangements — The Company enters into arrangements with customers that include a combination of software products, system hardware, maintenance and support, or installation and training services. The Company allocates the total arrangement fee among the various elements of the arrangement based on the relative fair value of each of the undelivered elements determined by vendor-specific objective evidence (VSOE). In software arrangements for which the Company does not have VSOE of fair value for all elements, revenue is deferred until the earlier of when VSOE is determined for the undelivered elements (residual method) or when all elements for which the Company does not have VSOE of fair value have been delivered. The Company has determined VSOE of fair value for each of its products and services.

The VSOE for maintenance and support services is based upon the renewal rate for continued service arrangements. The VSOE for installation and training services is established based upon pricing for the services. The VSOE for software and licenses is based on the normal pricing and discounting for the product when sold separately.

Each element of the Company’s multiple element arrangements qualifies for separate accounting. However, when a sale includes both software and maintenance, the Company defers revenue under the residual method of accounting. Under this method, the undelivered maintenance and support fees included in the price of software is amortized ratably over the period the services are provided. The Company defers maintenance and support fees based upon the customer’s renewal rate for these services.

Software and software license sales

The Company recognizes revenue when a fixed fee order has been received and delivery has occurred to the customer. The Company assesses whether the fee is fixed or determinable and free of contingencies based upon signed agreements received from the customer confirming terms of the transaction. Software is delivered to customers electronically or on a CD-ROM, and license files are delivered electronically.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

System hardware sales

The Company recognizes revenue on system hardware sales generally upon shipment of the product or customer acceptance depending upon contractual arrangements with the customer. Shipping charges billed to customers are included in sales and the related shipping costs are included in cost of sales.

Professional service revenue

Included in services and other revenues is revenue derived from implementation, maintenance and support contracts, content development, software development and training. The majority of consulting and implementation services and accompanying agreements qualify for separate accounting. Implementation and content development services are bid either on a fixed-fee basis or on a time-and-materials basis. For time-and-materials contracts, the Company recognizes revenue as services are performed. For fixed-fee contracts, the Company recognizes revenue upon completion of specific contractual milestones or by using the percentage-of-completion method.

Software design and development services

Revenue from contracts for technology integration consulting services where the Company designs/redesigns, builds and implements new or enhanced systems applications and related processes for clients are recognized on the percentage-of-completion method in accordance with “FASB ASC 605-985-25-88 through 107.” Percentage-of-completion accounting involves calculating the percentage of services provided during the reporting period compared to the total estimated services to be provided over the duration of the contract. Estimated revenues from applying the percentage-of-completion method include estimated incentives for which achievement of defined goals is deemed probable. This method is followed where reasonably dependable estimates of revenues and costs can be made. The Company measures its progress for completion based on either the hours worked as a percentage of the total number of hours of the project or by delivery and customer acceptance of specific milestones as outlined per the terms of the agreement with the customer.

Estimates of total contract revenue and costs are continuously monitored during the term of the contract, and recorded revenue and costs are subject to revision as the contract progresses. Such revisions may result in increases or decreases to revenue and income and are reflected in the financial statements in the periods in which they are first identified. If estimates indicate that a contract loss will occur, a loss provision is recorded in the period in which the loss first becomes probable and reasonably estimable. Contract losses are determined to be the amount by which the estimated direct and indirect costs of the contract exceed the estimated total revenue that will be generated by the contract and are included in cost of sales and classified in accrued expenses in the balance sheet. The Company’s presentation of revenue recognized on a contract completion basis has been consistently applied for all periods presented.

The Company classifies the revenue and associated cost on the “Services and Other” line within the “Sales” and “Cost of Sales” sections of the Consolidated Statement of Operations. In all cases where the Company applies the contract method of accounting, the Company’s only deliverable is professional services, thus, the Company believes presenting the revenue on a single line is appropriate.

Costs and estimated earnings recognized in excess of billings on uncompleted contracts are recorded as unbilled services and are included in accounts receivable on the balance sheet. Billings in excess of costs and estimated earnings on uncompleted contracts are recorded as deferred revenue until revenue recognition criteria are met.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

Uncompleted contracts at December 31, 2013 and 2012 are as follows:

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Cost incurred on uncompleted contracts | | $ | 226 | | | $ | 14 | |

| Estimated earnings | | | 288 | | | | 61 | |

| Revenue recognized | | | 514 | | | | 75 | |

| Less: billings to date | | | (611 | ) | | | (32 | ) |

| | | $ | (97 | ) | | $ | 43 | |

The above information is presented in the balance sheet as follows:

| | | December 31, | |

| | | 2013 | | | 2012 | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | | $ | 6 | | | $ | 44 | |

| Billings in excess of costs and estimated earnings on uncompleted contracts | | | (103 | ) | | | (1 | ) |

| | | $ | (97 | ) | | $ | 43 | |

Implementation services

Implementation services revenue is recognized when installation is completed.

Maintenance and hosting support contracts

Maintenance and hosting support consists of software updates and support. Software updates provide customers with rights to unspecified software product upgrades and maintenance releases and patches released during the term of the support period. Support includes access to technical support personnel for software and hardware issues. The Company also offers a hosting service through its network operations center, or NOC, allowing the ability to monitor and support its customers’ networks 7 days a week, 24 hours a day.

Maintenance and hosting support revenue is recognized ratably over the term of the maintenance contract, which is typically one to three years. Maintenance and support is renewable by the customer. Rates for maintenance and support, including subsequent renewal rates, are typically established based upon a specified percentage of net license fees as set forth in the arrangement. The Company’s hosting support agreement fees are based on the level of service provided to its customers, which can range from monitoring the health of a customer’s network to supporting a sophisticated web-portal.

4. Cash and Cash Equivalents

Cash equivalents consist of commercial paper and all other liquid investments with original maturities of three months or less when purchased. As of December 31, 2013, the Company had substantially all cash invested in a commercial paper sweep account. The Company maintains the majority of its cash balances in one financial institution located in Chicago. The balance is insured by the Federal Deposit Insurance Corporation up to $250.

5. Restricted Cash

In connection with the Company’s bank’s credit card program, the Company was required to maintain a cash balance of $50, at both December 31, 2013 and 2012.

6. Accounts Receivable

Accounts receivable are usually unsecured and stated at net realizable value and bad debts are accounted for using the allowance method. The Company performs credit evaluations of its customers' financial condition on an as-needed basis and generally requires no collateral. Payment is generally due 90 days or less from the invoice date and accounts past due more than 90 days are individually analyzed for collectability. In addition, an allowance is provided for other accounts when a significant pattern of uncollectability has occurred based on historical experience and management's evaluation of accounts receivable. If all collection efforts have been exhausted, the account is written off against the related allowance. No interest is charged on past due accounts. The allowance for doubtful accounts was $35 and $49 at December 31, 2013 and 2012, respectively.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

7. Inventories

The Company records inventories using the lower of cost or market on a first-in, first-out (FIFO) method. Inventories consist principally of finished goods, product components and software licenses. Inventory reserves are established to reflect slow-moving or obsolete products. The Company had an inventory reserve of $85 and $38 at December 31, 2013 and 2012, respectively.

8. Impairment of Long-Lived Assets

The Company reviews the carrying value of all long-lived assets, including property and equipment with definite lives, for impairment in accordance with “FASB ASC 360-10-05-4,” Accounting for the Impairment or Disposal of Long-Lived Assets. Under FASB ASC 360-10-05-4, impairment losses are recorded whenever events or changes in circumstances indicate the carrying value of an asset may not be recoverable.

If the impairment tests indicate that the carrying value of the asset is greater than the expected undiscounted cash flows to be generated by such asset, an impairment loss would be recognized. The impairment loss is determined by the amount by which the carrying value of such asset exceeds its fair value. We generally measure fair value by considering sale prices for similar assets or by discounting estimated future cash flows from such assets using an appropriate discount rate. Assets to be disposed of are carried at the lower of their carrying value or fair value less costs to sell.

Considerable management judgment is necessary to estimate the fair value of assets, and accordingly, actual results could vary significantly from such estimates. There have been no impairment losses for long-lived assets recorded in 2013, 2012 or 2011.

9. Depreciation and Amortization

Depreciation is provided for in amounts sufficient to relate the cost of depreciable assets to operations over the estimated service lives, principally using straight-line methods. Leased equipment is depreciated over the term of the capital lease. Leasehold improvements are amortized over the shorter of the life of the improvement or the lease term, using the straight-line method.

The estimated useful lives used to compute depreciation and amortization are as follows:

| Equipment | 3 – 5 years |

| Demonstration equipment | 3 – 5 years |

| Furniture and fixtures | 7 years |

| Purchased software | 3 years |

| Leased equipment | 3 years |

| Leasehold improvements | Shorter of 5 years or term of lease |

Depreciation and amortization expense was $213, $286 and $467 for the years ended December 31, 2013, 2012 and 2011, respectively.

10. Advertising Costs

Advertising costs are charged to operations when incurred. Advertising costs were $47, $25 and $23 for the years ended December 31, 2013, 2012 and 2011, respectively.

11. Comprehensive Loss

Comprehensive loss includes revenues, expenses, gains and losses that are excluded from net loss. Items of comprehensive loss are foreign currency translation adjustments which are added to net income or loss to compute comprehensive income or loss. In 2013, 2012 and 2011, comprehensive losses included $0, $0 and $10, respectively, of unrealized foreign currency translation gains on the translation of the financial statements of the Company’s foreign subsidiary from its functional currency to the U.S. dollar.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

12. Research and Development and Software Development Costs

Research and development expenses consist primarily of development personnel and non-employee contractor costs related to the development of new products and services, enhancement of existing products and services, quality assurance and testing. “FASB ASC 985-20-25,” Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed, requires certain software development costs to be capitalized upon the establishment of technological feasibility.

The establishment of technological feasibility and the ongoing assessment of the recoverability of these costs require considerable judgment by management with respect to certain external factors such as anticipated future revenue, estimated economic life, and changes in software and hardware technologies. Software development costs incurred beyond the establishment of technological feasibility have not been significant. No software development costs were capitalized during the years ended December 31, 2013, 2012 and 2011. Software development costs have been recorded as research and development expense. The Company incurred research and development expenses of $935 in 2013, $1,795 in 2012 and $2,116 in 2011.

13. Basic and Diluted Loss per Common Share

Basic and diluted loss per common share for all periods presented is computed using the weighted average number of common shares outstanding. Basic weighted average shares outstanding include only outstanding common shares. Diluted net loss per common share is computed by dividing net loss by the weighted average common and potential dilutive common shares outstanding computed in accordance with the treasury stock method. Shares reserved for outstanding stock warrants and options totaling 2,148, 537 and 474 for 2013, 2012 and 2011, respectively, were excluded from the computation of loss per share as their effect was antidilutive due to the Company’s net loss in each of those years. The loss per share amounts presented in the Company’s Statement of Operations are not net of tax due to the full tax valuation allowance on deferred tax assets for the years ended December 31, 2013, 2012 and 2011.

14. Deferred Income Taxes

Deferred income taxes are recognized in the financial statements for the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts based on enacted tax laws and statutory tax rates. Temporary differences arise from net operating losses, reserves for uncollectible accounts receivables and inventory, differences in depreciation methods, and accrued expenses. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

15. Accounting for Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with FASB ASC 718-10 which requires the measurements and recognition of compensation expense for all stock-based payments including warrants, stock options, restricted stock grants and stock bonuses based on estimated fair value. For purposes of determining estimated fair value under FASB ASC 718-10-30, the Company computes the estimated fair values of stock options using the Black-Scholes option pricing model. The fair value of restricted stock and stock award grants are determined based on the number of shares granted and the closing price of the Company’s common stock on the date of grant. Compensation expense for all share-based payment awards is recognized using the straight-line amortization method over the vesting period. Stock-based compensation expense of $434, $484 and $740 was charged to expense during 2013, 2012 and 2011, respectively. No tax benefit has been recorded due to the full valuation allowance on deferred tax assets that the Company has recorded.

The Company accounts for equity instruments issued for services and goods to non-employees under “FASB ASC 505-50-1” Accounting for Equity Instruments that are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services and “FASB ASC 505-50-25” Accounting Recognition for Certain Transactions Involving Equity Instruments Granted to Other Than Employees. Generally, the equity instruments issued for services and goods are shares of the Company’s common stock, or warrants or options to purchase shares of the Company’s common stock. These shares, warrants or options are either fully-vested and exercisable at the date of grant or vest over a certain period during which services are provided. The Company expenses the fair market value of these securities over the period in which the related services are received.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

During the years ended December 31, 2013 and 2012, the Company recognized $13 and $189, respectively, of stock-based compensation expense related to the fair market value of stock and a warrant that were issued to outside vendors for professional services. The Company did not issue equity instruments to non-employees during the years ended December 31, 2011.

See Note 7 for further information regarding the impact of the Company’s application of FASB ASC 718-10 and the assumptions used to calculate the fair value of share-based compensation.

16. Fair Value of Financial Instruments

“FASB ASC 820-10,” Fair Value Measurements and Disclosures, requires disclosure of the estimated fair value of an entity's financial instruments. Such disclosures, which pertain to the Company's financial instruments, do not purport to represent the aggregate net fair value of the Company. The carrying value of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities approximates fair value because of the short maturity of those instruments. The fair value of the line of credit and convertible notes payable approximates carrying value based on the interest rates in the lease and line of credit compared to current market interest rates.

17. Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant estimates of the Company are the allowance for doubtful accounts, recognition of revenue under fixed price contracts, deferred tax assets, deferred revenue, depreciable lives and methods of property and equipment, and valuation of warrants and other stock-based compensation. Actual results could differ from those estimates.

18. Deferred Financing Costs

Amortization expense related to deferred financing costs was $0, $3 and $21 for the years ended December 31, 2013, 2012 and 2011 and was recorded as a component of interest expense. The balance of deferred finance costs at December 31, 2013 was $14.

The financial statements accompanying this report for the fiscal year ended December 31, 2013 have been prepared on a going concern basis, meaning that they do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. However, the Company’s auditor also expressed substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is an issue raised as a result of losses suffered from operations. The Company does not currently have sufficient capital resources to fund its operations beyond April 2014. The Company continues to experience operating losses. The Company continues to seek financing on favorable terms; however, there can be no assurance that any such financing can be obtained on favorable terms, if at all. At present, the Company has no commitments for any additional financing. Because the Company’s has received an opinion from its auditor that substantial doubt exists as to whether the Company can continue as a going concern, it may be more difficult for the Company to attract investors, secure debt financing or bank loans, or a combination of the foregoing, on favorable terms, if at all. The Company’s future depends upon its ability to obtain financing and upon future profitable operations. If the Company is unable to generate sufficient revenue find financing, or adjust its operating expenses so as to maintain positive working capital, then the Company will likely will be forced to cease operations and investors will likely lose their entire investment. The Company can give no assurance as to its ability to generate adequate revenue, raise sufficient capital, sufficiently reduce operating expenses or continue as a going concern.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

NOTE 3: OTHER FINANCIAL STATEMENT INFORMATION

The following tables provide details of selected financial statement items:

ALLOWANCE FOR DOUBTFUL RECEIVABLES

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Balance at beginning of period | | $ | 49 | | | $ | 50 | |

| Provision for doubtful receivables | | | 9 | | | | - | |

| Write-offs | | | (23 | ) | | | (1 | ) |

| Balance at end of period | | $ | 35 | | | $ | 49 | |

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Finished goods | | $ | 24 | | | $ | 103 | |

| Work-in-process | | | 45 | | | | 55 | |

| Total inventories | | $ | 69 | | | $ | 158 | |

The Company has recorded adjustments to reduce inventory values to the lower of cost or market for certain finished goods, product components and supplies. The Company recorded expense of $47, $35 and $65 during the years ended December 31, 2013, 2012 and 2011, respectively, related to these adjustments to cost of sales.

PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets as of December 31, 2013 and 2012 consisted primarily of deposits for trade shows and facilities, along with corporate insurance premiums.

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Leased equipment | | $ | 89 | | | $ | 89 | |

| Equipment | | | 1,065 | | | | 1,192 | |

| Leasehold improvements | | | 381 | | | | 381 | |

| Demonstration equipment | | | 5 | | | | 5 | �� |

| Purchased software | | | 357 | | | | 373 | |

| Furniture and fixtures | | | 566 | | | | 572 | |

| Total property and equipment | | $ | 2,463 | | | $ | 2,612 | |

| Less: accumulated depreciation and amortization | | | (2,234 | ) | | | (2,197 | ) |

| Net property and equipment | | $ | 229 | | | $ | 415 | |

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

Other assets consist of long-term deposits on operating leases.

ACCRUED LIABILITIES

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Compensation | | $ | 202 | | | $ | 254 | |

| Accrued rent | | | 178 | | | | 208 | |

| Sales tax and other | | | 41 | | | | 65 | |

| Total accrued liabilities | | $ | 421 | | | $ | 527 | |

| | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Deferred software maintenance | | $ | 172 | | | $ | 480 | |

| Customer deposits and deferred project revenue | | | 582 | | | | 116 | |

| Total deferred revenue | | $ | 754 | | | $ | 596 | |

SUPPLEMENTAL CASH FLOW INFORMATION

| | | December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| Supplemental disclosures of cash flow information | | | | | | | | | |

| Cash paid for: | | | | | | | | | |

| Interest | | $ | 24 | | | $ | 8 | | | $ | 9 | |

| | | | | | | | | | | | | |

| Supplemental disclosures of cash flow information | | | | | | | | | | | | |

| Warrants issued for debt issuance costs | | | - | | | | - | | | | 8 | |

| Warrants issued for convertible notes payable | | | 137 | | | | - | | | | - | |

| Warrants issued for convertible notes payable - related party | | | 41 | | | | - | | | | - | |

| Beneficial conversion of convertible notes payable | | | 21 | | | | - | | | | - | |

| Beneficial conversion of convertible notes payable related party | | | 6 | | | | - | | | | - | |

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

NOTE 4: FAIR VALUE MEASUREMENTS

The Company maintained all investments in cash and cash equivalents for 2011 through 2013 and accordingly recorded no gains or losses. Interest income of $0, $1 and $4 was recorded in 2013, 2012 and 2011, respectively.

As of December 31, 2013 and 2012, cash equivalents consisted of the following:

| | | December 31, 2013 | |

| | | Gross | | | Gross | | | Gross | | | Estimated | |

| | | Amortized | | | Unrealized | | | Unrealized | | | Fair | |

| | | Cost | | | Gains | | | (Losses) | | | Value | |

| Commercial paper | | $ | 1,377 | | | $ | - | | | $ | - | | | $ | 1,377 | |

| Total included in cash and cash equivalents | | $ | 1,377 | | | $ | - | | | $ | - | | | $ | 1,377 | |

| | | December 31, 2012 | |

| | | Gross | | | Gross | | | Gross | | | Estimated | |

| | | Amortized | | | Unrealized | | | Unrealized | | | Fair | |

| | | Cost | | | Gains | | | (Losses) | | | Value | |

| Commercial paper | | $ | 2,009 | | | $ | - | | | $ | - | | | $ | 2,009 | |

| Total included in cash and cash equivalents | | $ | 2,009 | | | $ | - | | | $ | - | | | $ | 2,009 | |

The Company measures certain financial assets, including cash equivalents and available-for-sale marketable securities at fair value on a recurring basis. In accordance with FASB ASC 820-10-30, fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, FASB ASC 820-10-35 establishes a three-level hierarchy which prioritizes the inputs used in measuring fair value. The three hierarchy levels are defined as follows:

Level 1 – Valuations based on unadjusted quoted prices in active markets for identical assets. The fair value of available-for-sale securities included in the Level 1 category is based on quoted prices that are readily and regularly available in an active market. The Level 1 category at December 31, 2013 and December 31, 2012 includes funds held in a commercial paper sweep account totaling $1,377 and $2,009, which are included in cash and cash equivalents in the consolidated balance sheet.

Level 2 – Valuations based on observable inputs (other than Level 1 prices), such as quoted prices for similar assets at the measurement date; quoted prices in markets that are not active; or other inputs that are observable, either directly or indirectly. At December 31, 2013 and 2012, the Company had no Level 2 financial assets on its consolidated balance sheet.

Level 3 – Valuations based on inputs that are unobservable and involve management judgment and the reporting entity’s own assumptions about market participants and pricing. At December 31, 2013 and 2012, the Company had no Level 3 financial assets on its consolidated balance sheet.

The hierarchy level assigned to each security in the Company’s cash equivalents is based on its assessment of the transparency and reliability of the inputs used in the valuation of such instruments at the measurement date. The Company did not have any financial liabilities that were covered by FASB ASC 820-10-30 as of December 31, 2013 and 2012.

NOTE 5: COMMITMENTS AND CONTINGENCIES AND DEBT

Operating Leases

The Company leases approximately 19 square feet of office and warehouse space located at 5929 Baker Road, Minnetonka, Minnesota. In July 2010, the Company entered into an amendment that extended the term of the lease through January 31, 2018. In consideration for this extension, the landlord provided the Company with a leasehold improvement allowance totaling $191 and a reduction in base rent per square foot. The leasehold allowance was recorded as an addition to deferred rent. See Note 3 (Other Financial Statement Information). The Company will recognize the leasehold improvement allowance on a straight-line basis as a benefit to rent expense over the life of the lease, along with the existing deferred rent credit balance of $60 as of the date of the amendment. In addition, the amendment contains a rent escalation provision, which also will be recognized on a straight-line basis over the term of the lease. The Company had drawn upon the entire amount of leasehold improvement allowances as of December 31, 2010. The lease requires the Company to maintain a letter of credit which can, in the discretion of the landlord, be reduced or released. The amount of the letter of credit as of December 31, 2013 was $180. In addition, the Company leases office space of approximately 10 square feet to support its Canadian operations at a facility located at 4510 Rhodes Drive, Suite 800, Windsor, Ontario under a lease that, as amended, extends through June 30, 2014.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

Rent expense under the operating leases was $342, $369 and $378 for the years ended December 31, 2013, 2012 and 2011, respectively.

Future minimum lease payments for operating leases are as follows:

| Years Ending December 31, | | Lease Obligations |

| 2014 | | $ | 233 | |

| 2015 | | | 209 | |

| 2016 | | | 205 | |

| 2017 | | | 206 | |

| 2018 | | | 24 | |

| Total future minimum obligations | | $ | 877 | |

Litigation

The Company was not party to any material legal proceedings as of March 1, 2014.

Revolving Line-of-Credit

In March 2010, the Company entered into a Loan and Security Agreement with Silicon Valley Bank (the “Loan and Security Agreement”), which was most recently amended effective March 13, 2013. The Loan and Security Agreement provides the Company with a revolving line-of-credit at an annual interest rate of prime plus 1.5%, the availability of which is the lesser of (a) $1,500, or (b) the amount available under the Company’s borrowing base (75% of the Company’s eligible accounts receivable plus 50% of the Company’s eligible inventory) minus (1) the dollar equivalent amount of all outstanding letters of credit, (2) 10% of each outstanding foreign exchange contract, (3) any amounts used for cash management services, and (4) the outstanding principal balance of any advances. In connection with the July 2010 lease amendment for the Company’s corporate offices, Silicon Valley Bank issued a letter of credit which as of December 31, 2013 was in the amount of $180, along with a letter of credit issued to a vendor for $50.

As of December 31, 2013, the Company was not in compliance with the tangible net worth requirement and therefore not eligible to draw down on the line of credit. As of December 31, 2013, the Company’s tangible net worth totaled $1,583 or $635 below the minimum required amount per the terms of the Loan and Security Agreement. The Company had no outstanding balance under this loan agreement (other than our letter of credits) as of December 31, 2013.

Under the Loan and Security Agreement, the Company is generally required to obtain the prior written consent of Silicon Valley Bank to, among other things, (a) dispose of assets, (b) change its business, (c) liquidate or dissolve, (d) change CEO or COO (replacements must be satisfactory to the lender), (e) enter into any transaction in which the Company’s shareholders who were not shareholders immediately prior to such transaction own more than 40% of the Company’s voting stock (subject to limited exceptions) after the transaction, (f) merge or consolidate with any other person, (g) acquire all or substantially all of the capital stock or property of another person, or (h) become liable for any indebtedness (other than permitted indebtedness). The line of credit is secured by all the Company’s assets and matures on July 15, 2014. Starting with the month ending March 31, 2014 and on the last day of each following month, the Company’s new tangible net worth requirement has been reduced to $150,000, commencing with the quarter ending March 31, 2014, the minimum tangible net worth requirement increases, commencing with the quarter ending March 31, 2014 and each quarter thereafter, by the sum of (a) fifty-percent (50%) of the Company’s quarterly net income (without reduction for any losses) for such quarter, plus (b) fifty-percent (50%) of all proceeds received from the issuance of equity during such quarter and/or the principal amount of all subordinated debt incurred during such quarter. The Company must comply with this tangible net worth minimum in order to draw down on such line of credit and also while there are outstanding credit extensions (other than the Company’s existing lease letter of credit).

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

During the years end 2013 and 2012, the weighted average interest rate on the line of credit was 5.5%. The Company did not have an outstanding balance on the line of credit as of December 31, 2013, compared to $400 at the end of 2012.

Convertible Notes Payable

In December 2013, the Company received $1,075 in proceeds from the issuance of unsecured convertible promissory notes, along with three year warrants to purchase 1,075 share of common stock at $0.75 per share. The notes mature two years after issuance, require the payment of interest at the rate of 4% per year (payable on maturity), and are convertible, at the holder’s option, into unregistered shares of the Company’s common stock at a conversion price of $0.50 per share. The notes are subordinated to the Silicon Valley Bank line of credit. The warrants are immediately exercisable, expire three years after issuance, have a cashless exercise feature, and may be exercised to purchase unregistered shares of the Company’s common stock at an exercise price of $0.75 per share. The fair value of the warrants granted was calculated at $178 using the Black-Scholes model. The Company determined the warrants are permanent equity. See Note 7 for the inputs used in valuing the warrants using the Black-Scholes model. The Company reduced the carrying value of the notes and is amortizing the relative fair value of the warrants granted in connection with the notes payable over the original term of the notes as additional interest expense. The unamortized balance of the fair value allocated to the warrants totaled $175 as of December 31, 2013. In addition, the Company determined that there was a beneficial conversion feature of $27 at the date of issuance which was recorded as debt discount at the date of issuance and is also amortized into interest expense over the original term of the notes. The unamortized balance of the beneficial conversion feature was $27 as of December 31, 2013. For the year ended December 31, 2013, the Company recorded interest expense of $4 related to the amortization of the warrants and beneficial conversion feature. The effective interest rate of the convertible notes payable was computed at 13.25% subsequent to the allocation of proceeds to the warrants and beneficial conversion feature.

In January 2014, the Company received exercise notices from various holders of the convertible notes payable electing to convert the notes payable into common stock. The total principal amount was $250, including $1 of accrued interest, which converted into 501 shares of the Company’s common stock.

Convertible Notes Payable – Related Party

In December 2013, the Company received $250 of the $1,075 proceeds from the issuance of unsecured convertible promissory notes, along with three year warrants to purchase 250 shares of common stock at $0.75 per share from Perkins Capital Management, who was an affiliate of ours due to its beneficial ownership of 31.7% of our outstanding common stock as of March 1, 2014. Of the $178 and $27 allocated to the fair value of the warrants and the beneficial conversion feature, $41 and $6 related to the proceeds the Company received from to Perkins Capital Management. For the portion considered related party, the Company recorded interest expense of $1 for year ended December 31, 2013 associated with the amortization of the warrants and beneficial conversion feature.

In January 2014, the Company received exercise notices from Perkins Capital Management, who has investment power over the convertible notes payable electing to convert the notes payable into common stock. The total principal amount was $250, including $1 of accrued interest, which converted into 501 shares of the Company’s common stock.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

NOTE 6: SHAREHOLDERS' EQUITY

Authorized Common Stock

In June 2013, the Company’s shareholders approved the amended of the Company’s Articles of Incorporation to increase the number of shares of authorized common stock from 10,000 to 50,000.

Reverse Stock Split

In November 2012, the Company’s board of directors approved a one-for-five reverse stock split of all outstanding common shares, which became effective December 14, 2012. A proportionate adjustment also was made to the Company’s outstanding derivative securities. All share and per share information in these financial statements are restated to reflect such reverse stock split.

Registered Direct Offerings

In March 2013, the Company sold a total of 868 units at a price of $1.80 per unit, each unit consisting of one share of common stock and one five-year warrant to purchase 0.50 of a share of common stock, with exercisability commencing six months and one day after issuance, at an exercise price of $2.73 per share, pursuant to a registration statement on Form S-3 which was declared effective by the Securities and Exchange Commission in January 2013. The Company determined the warrants are permanent equity. The Company obtained approximately $1,377 in net proceeds as a result of this registered direct offering.

In September 2012, the Company sold a total of 348 shares of its common stock at $4.05 per share pursuant to a registration statement on Form S-3 which was declared effective by the Securities and Exchange Commission in September 2009. The Company obtained approximately $1,176 in net proceeds as a result of this registered direct offering.

In December 2011, the Company sold a total of 664 shares of the Company’s common stock at $5.00 per share pursuant to a registration statement on Form S-3 which was declared effective by the Securities and Exchange Commission in September 2009. The Company obtained approximately $2,926 in net proceeds as a result of this registered direct offering.

Warrants

The Company has issued common stock purchase warrants to certain debt holders, contractors, and investors in connection with various transactions. The Company values the warrants using the Black-Scholes pricing model and they are recorded based on the reason for their issuance.

Warrants held by non-employees during the years ended December 31, 2013, 2012 and 2011 were as follows:

| | | 2013 | | | 2012 | | | 2011 | |

| | | | | Weighted | | | | | Weighted | | | | | Weighted | |

| | | Common | | Average | | | Common | | Average | | | Common | | Average | |

| | | Stock | | Exercise | | | Stock | | Exercise | | | Stock | | Exercise | |

| | | Warrants | | Price | | | Warrants | | Price | | | Warrants | | Price | |

| Outstanding at beginning of year | | | 102 | | | $ | 7.74 | | | | 64 | | | $ | 7.15 | | | | 289 | | | $ | 17.50 | |

| Granted | | | 1,521 | | | | 1.38 | | | | 38 | | | | 8.75 | | | | - | | | | - | |

| Exercised | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Expired | | | (57 | ) | | | 7.19 | | | | - | | | | - | | | | (225 | ) | | | 20.25 | |

| Outstanding at end of year | | | 1,566 | | | $ | 1.59 | | | | 102 | | | $ | 7.74 | | | | 64 | | | $ | 7.15 | |

| Non-exercisable | | | - | | | | - | | | | - | | | | | | | | - | | | | | |

| Outstanding and exercisable at end of year | | | 1,566 | | | $ | 1.59 | | | | 102 | | | $ | 7.74 | | | | 64 | | | $ | 7.15 | |

In December 2013, the Company issued three-year warrants for the purchase of 1,075 shares of common stock at an exercise price of $0.75 per share to the unsecured convertible promissory note holders. The fair value of the warrants was $0.17 per share or $178 based on the Black-Scholes model using an expected term of two years, a risk-free interest rate of 0.40% and a volatility rate of 99.3%. The Company reduced the carry value of the convertible notes by the relative fair value of the warrants and is amortizing the fair value of the warrants granted in connection with the convertible note payable over the original term of the convertible note as additional interest expense.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

In March 2013, the Company issued five-year warrants to purchase 434 shares of common stock, with exercisability commencing six months and one day after issuance, at an exercise price of $2.73. The Company determined the warrants are permanent equity.

During 2013 and 2012, the Company issued three-year warrants for the purchase of 12 and 38 shares of common stock, respectively, at an exercise price of $8.75 per share to a vendor in exchange for public relations services. The weighted average fair value of the warrants was $0.26 and $1.97 per share based on the Black-Scholes model using an expected term of three years, a risk-free interest rate of 1.40% to 0.36% and a volatility rate of 99.7% to 88.3%. The total fair value of $3 and $75 was recognized as compensation expense during the years ended December 31, 2013 and 2012 as the warrant was 100% exercisable upon issuance.

In March 2010, the Company issued Silicon Valley Bank a 10-year fully vested warrant to purchase up to 8 shares of the Company’s common stock at an exercise price of $14.50 per share, as additional consideration for the Loan and Security Agreement. Fair value at the date of grant was $7.95 per warrant. The fair value of $66 was amortized on a straight-line basis over the one-year term of the agreement as interest expense in the Company’s Statement of Operations. In January 2011, the Company reduced the exercise price to $6.89 per share, resulting in an incremental increase to the fair value of $1.00 per share. As of December 31, 2013, $0 remained to be expensed.

In connection with the January 2011 amendment to the Loan and Security Agreement, the Company reduced the exercise price of the warrants to $6.89 per share. The reduction in the exercise price resulted in an incremental increase of the fair value of $1.00 per warrant.

No common stock warrants were exercised in 2013, 2012 or 2011.

As of December 31, 2013, 2012 and 2011, the weighted average contractual life of the outstanding warrants was 3.29 years, 1.92 years and 2.69 years, respectively.

NOTE 7: STOCK-BASED COMPENSATION AND BENEFIT PLANS

Warrants

The Company has also issued common stock warrants to employees as stock-based compensation. The Company values the warrants using the Black-Scholes pricing model. The warrants vest immediately and have exercise periods of five years.

All 21 exercisable warrants held by employees expired unexercised during 2011, leaving no warrants held by employees outstanding as of December 31, 2013, 2012 or 2011.

Stock options

Amended and Restated 2006 Equity Incentive Plan

In March 2006, the Company's Board of Directors adopted the 2006 Equity Incentive Plan (now known as the Amended and Restated 2006 Equity Incentive Plan (the "EIP")) which was approved by the Company's shareholders in February 2007. Participants in the EIP may include the Company's employees, officers, directors, consultants, or independent contractors. The EIP authorizes the grant of options to purchase common stock intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), the grant of options that do not qualify as incentive stock options, restricted stock, restricted stock units, stock bonuses, cash bonuses, stock appreciation rights, performance awards, dividend equivalents, warrants and other equity based awards. The number of shares of common stock originally reserved for issuance under the EIP was originally 200 shares. In November 2007, the Company's shareholders approved an amendment to increase the number of shares reserved for issuance to 350. In June 2009, the Company’s shareholders approved an amendment to increase the number of shares reserved for issuance to 425 and also increased the maximum number of shares for which awards may be granted to any individual participant in any calendar year from 60 to 100.

In June 2010, the Company’s shareholders approved an amendment to increase the number of shares reserved for issuance to 480. In June 2011, the Company’s shareholders approved an amendment to increase the number of shares reserved for issuance to 720. In June 2013, the Company’s shareholder approved an amendment to increase the number of shares reserved for issuance to 1,720. The EIP expires in March 2016. As of December 31, 2013, there were 1,106 shares available for future awards under the EIP.

Incentive options may be granted only to the Company's officers, employees or corporate affiliates. Non-statutory options may be granted to employees, consultants, directors or independent contractors who the committee determines shall receive awards under the EIP. The Company will not grant non-statutory options under the EIP with an exercise price of less than 100% of the fair market value of the Company's common stock on the date of grant. The Company issues new shares of common stock when stock options are exercised.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

Amended and Restated 2006 Non-Employee Director Stock Option Plan

In April 2006, the Company's Board of Directors adopted the 2006 Non-Employee Director Stock Option Plan (the "DSOP") which was approved by the Company's shareholders in February 2007. The DSOP provides for the grant of options to members of the Company's Board of Directors who are not employees of the Company or its subsidiaries. Under the DSOP, non-employee directors as of February 27, 2006 and each non-employee director thereafter elected to the Board of Directors was automatically entitled to a grant of an option for the purchase of 8 shares of common stock, 2 of which vest and become exercisable on the date of grant, and additional increments of 2 shares become exercisable and vest upon each director's reelection to the Board of Directors. In June 2011, the Company’s shareholders approved an amendment to the DSOP replace the automatic grants of 8 shares with discretionary grants. The number of shares originally reserved for awards under the DSOP was 102 shares. In June 2012, the Company’s shareholders approved an amendment to increase the number of shares reserved for issuance to 200. In June 2013, the Company’s shareholders approved an amendment to increase the number of share reserved for issuance to 700. Options are required to be granted at fair market value. As of December 31, 2013, there were 572 shares available for future awards under the DSOP.

The Company values the options using the Black-Scholes pricing model. The options vest over a four-year period and have a five-year term. In April 2011, as part of a former director’s resignation from the Board of Directors, a stock option for the purchase of 5 shares was modified to immediately vest, resulting in $7 of non-cash stock-based compensation expense.

A summary of the changes in outstanding stock options under all equity incentive plans is as follows:

| | | | | | Weighted | |

| | | | | | Average | |

| | | Options | | | Exercise | |

| | | Outstanding | | | Price | |

| Balance, December 31, 2010 | | | 457 | | | $ | 11.30 | |

| Granted | | | 132 | | | | 6.00 | |

| Exercised | | | (60 | ) | | | 3.35 | |

| Forfeited or expired | | | (119 | ) | | | 16.05 | |

| Balance, December 31, 2011 | | | 410 | | | $ | 9.38 | |

| Granted | | | 100 | | | | 5.35 | |

| Exercised | | | - | | | | - | |

| Forfeited or expired | | | (75 | ) | | | 14.97 | |

| Balance, December 31, 2012 | | | 435 | | | $ | 7.49 | |

| Granted | | | 273 | | | | 1.24 | |

| Exercised | | | - | | | | - | |

| Forfeited or expired | | | (126 | ) | | | 5.17 | |

| Balance, December 31, 2013 | | | 582 | | | $ | 5.34 | |

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

The Company received total proceeds of $0, $0 and $201 for stock options exercised during 2013, 2012 and 2011, respectively. The Com pany issues new shares for stock options that are exercised. The intrinsic value related to these options was $0, $0 and $185 in 2013, 2012 and 2011, respectively.

Information with respect to employee common stock options outstanding and exercisable at December 31, 2013 is as follows:

| | | | Stock Options Outstanding | | Options Exercisable |

| | | | | | Weighted | | | | | | | | | | | | | | |

| | | | | | Average | | Weighted | | Aggregate | | | | Weighted | | Aggregate |

| Range of Exercise | Number | | Remaining | | Average | | Intrinsic | | Options | | Average | | Intrinsic |

| Prices Between | Outstanding | | Contractual Life | | Exercise Price | | Value | | Exercisable | | Exercise Price | | Value |

| $ 1.80 | - | $ 1.95 | 190 | | 9.12 | Years | | $ | 1.80 | | $ | - | | 25 | | $ | 1.80 | | $ | - |

| $ 1.96 | - | $ 5.48 | 107 | | 8.36 | Years | | | 4.48 | | | - | | 32 | | | 5.35 | | | - |

| $ 5.49 | - | $ 6.23 | 103 | | 6.70 | Years | | | 5.86 | | | - | | 79 | | | 5.85 | | | - |

| $ 6.24 | - | $ 9.00 | 94 | | 6.87 | Years | | | 6.76 | | | - | | 82 | | | 6.82 | | | - |

| $ 9.01 | - | $ 15.15 | 88 | | 5.87 | Years | | | 11.81 | | | - | | 77 | | | 11.73 | | | - |

| | | | 582 | | 7.69 | Years | | $ | 5.34 | | $ | - | | 295 | | $ | 7.25 | | $ | - |

Restricted Stock and Share Awards

The Company issued 6 shares of restricted stock to a key employee in February 2012. The shares require both continued employment and achievement of certain performance targets. As of December 31, 2012, the performance targets had been achieved and the shares were issued to the employee. The weighted average fair value of the shares was based on the closing market price on the date of grant of $5.35. The fair market value of the grant totaled $32 and was recognized as stock compensation expense for the year ended December 31, 2012.

In February 2013 and 2012, the Company issued 6 and 21 unregistered shares of its common stock to a vendor in exchange for executive search services. The fair value of the shares was based on the closing price on the date issued, which totaled $10 and $114 and was recognized as compensation expense in 2013 and 2012, respectively.

During 2013 and 2012, the Company issued an aggregate of 51 and 15 shares of common stock to its six non-employee board members. In addition, the Company also issued an aggregate of 25 and 9 shares of common stock to key sales employees in 2013 and 2012, respectively. The shares were issued to the six non-employee board members as part of their compensation for board service for the years ended December 31, 2013 and 2012. The shares were issued to the key sales employees as a result of their achievement of certain performance goals outlined within the annual sales compensation plan. The weighted average fair value of the shares of $0.84 and $3.45 for the years ended December 31, 2013 and 2012 was based on the closing market prices on the dates of grant. The fair value of the stock awards was recognized as compensation expense and totaled $64 and $82 for the years ended December 31, 2013 and 2012.

WIRELESS RONIN TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

A summary of the changes in outstanding restricted stock and share awards is as follows:

| | | Restricted | | | Weighted | |

| | | Stock Awards | | | Average | |

| | | Outstanding | | | Price | |

| Balance, December 31, 2010 | | | 30 | | | $ | 9.90 | |

| Granted | | | - | | | | - | |

| Vested | | | (21 | ) | | | 8.65 | |