UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No._)

Filed by the Registrantþ Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| o | | Definitive Additional Materials |

| |

| o | | Soliciting Material Pursuant to §240.14a-12 |

ViewPoint Financial Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| |

| | 2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| |

| | 4) | | Proposed maximum aggregate value of transaction:

|

| |

| | | | |

| |

| | 5) | | Total fee paid: |

| |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount previously paid: |

| |

| | | | |

| |

| | 2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| |

| | 3) | | Filing Party: |

| |

| | | | |

| |

| | 4) | | Date Filed: |

| |

| | | | |

April 14, 2009

Dear Fellow Shareholder:

You are cordially invited to attend the annual meeting of shareholders of ViewPoint Financial Group. The meeting will be held on Tuesday, May 19, 2009 at 4:00 PM, in the Dallas Room on the 3rd Floor of ViewPoint Bank’s offices located at 1201 W. 15th Street, Plano, Texas.

The matters expected to be acted upon at the meeting are described in detail in the attached Notice of Annual Meeting of Shareholders and proxy statement. In addition, we will report on our progress during the past year and entertain your comments and questions.

Included with this proxy statement is a copy of our Annual Report on Form 10-K for the year ended December 31, 2008. We encourage you to read the Form 10-K. It includes information on our operations, products and services, as well as our audited financial statements.

We encourage you to attend the meeting in person.Whether or not you plan to attend, please complete, sign and date the enclosed proxy card and return it in the accompanying postpaid return envelope or vote electronically via the Internet or telephone.See “How do I vote?” in the proxy statement for more details. Your prompt response will save us additional expense in soliciting proxies and will ensure that your shares are represented at the meeting. Returning the proxy or voting electronically does NOT deprive you of your right to attend the meeting and to vote your shares in person for matters being acted upon at the meeting.

Please note that on the enclosed proxy card you have the option to enroll in our Electronic Access Program, which would give you electronic access to our future annual reports and proxy statements in lieu of mail delivery. By agreeing to get these materials via the Internet, you are helping to conserve the environment and cut postage and printing costs.

Your Board of Directors and management are committed to the success of ViewPoint Financial Group and the enhancement of your investment. As Chairman of the Board, I want to express my appreciation for your confidence and support.

| | | | | |

| | Very truly yours,

| |

| |  | |

| | James B. McCarley | |

| | Chairman of the Board | |

VIEWPOINT FINANCIAL GROUP

1309 W. 15th STREET

PLANO, TEXAS 75075

(972) 578-5000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 19, 2009

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of ViewPoint Financial Group will be held as follows:

| | | |

| TIME | | 4:00 PM local time

Tuesday, May 19, 2009 |

| | | |

| PLACE | | ViewPoint Bank

3rd Floor – Dallas Room

1201 W. 15th Street

Plano, Texas |

| | | |

| ITEMS OF BUSINESS | | The election of three directors of ViewPoint Financial Group. |

| | | |

| RECORD DATE | | Holders of record of ViewPoint Financial Group common stock at the close of business on March 23, 2009, are entitled to vote at the annual meeting or any adjournment or postponement thereof. |

| | | |

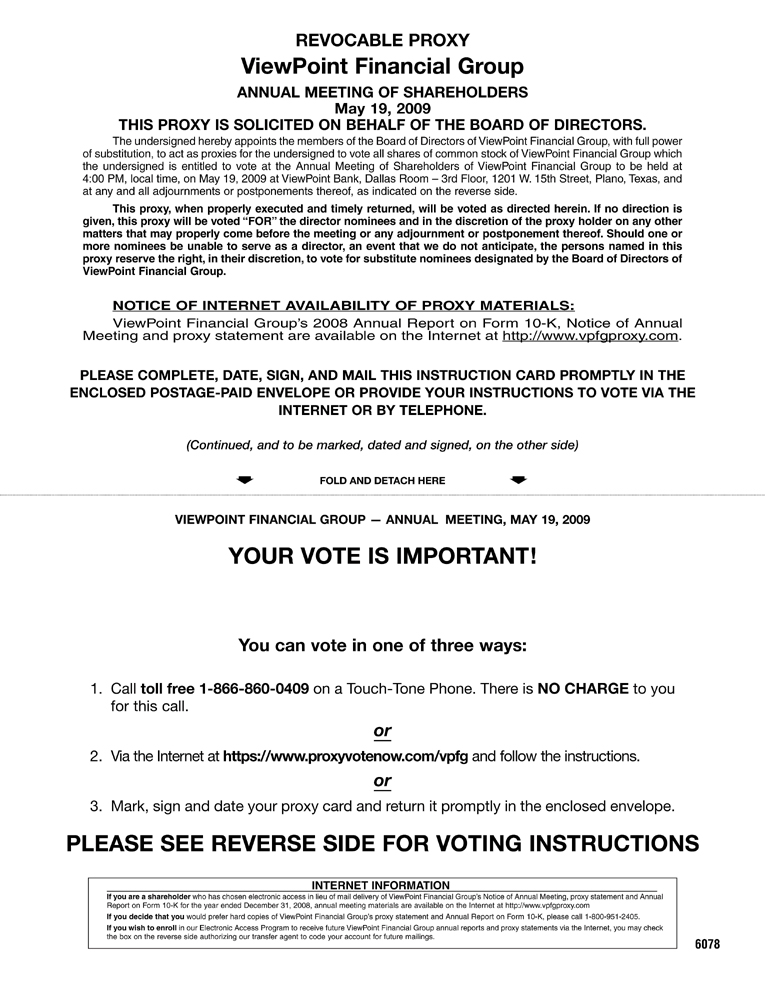

| PROXY VOTING | | It is important that your shares be represented and voted at the annual meeting. You can vote your shares by completing and returning the enclosed proxy card. Registered shareholders, that is, shareholders who hold their stock in their own name, can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on the proxy card sent to you.Regardless of the number of shares you own, your vote is very important. Please act today. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 19, 2009: This Notice of Annual Meeting, ViewPoint Financial Group’s proxy statement and ViewPoint Financial Group’s Annual Report on Form 10-K for the year ended December 31, 2008 are available on the Internet athttp://www.vpfgproxy.com.

| | | | | |

| | BY ORDER OF THE BOARD OF DIRECTORS

| |

| |  | |

| | JAMES B. McCARLEY | |

| | CHAIRMAN OF THE BOARD | |

| |

Plano, Texas

April 14, 2009

VIEWPOINT FINANCIAL GROUP

1309 W. 15th Street

Plano, Texas 75075

(972) 578-5000

PROXY STATEMENT

INTRODUCTION

The ViewPoint Financial Group Board of Directors is using this proxy statement to solicit proxies from the holders of common stock of ViewPoint Financial Group for use at ViewPoint Financial Group’s upcoming annual meeting of shareholders. The annual meeting of shareholders will be held on Thursday, May 19, 2009 at 4:00 PM, in the Dallas Room on the 3rd Floor of ViewPoint Bank’s offices located at 1201 W. 15th Street, Plano, Texas.

At the meeting, shareholders will be asked to vote on the election of directors. Shareholders also will consider any other matters that may properly come before the meeting, although the Board of Directors knows of no other business to be presented. ViewPoint Financial Group is referred to in this proxy statement from time to time as the “Company.” Certain of the information in this proxy statement relates to ViewPoint Bank, a wholly owned subsidiary of the Company.

By submitting your proxy, either by executing and returning the enclosed proxy card or by voting electronically via the Internet or by telephone, you authorize the Company’s Board of Directors to represent you and vote your shares at the meeting in accordance with your instructions. The Board of Directors also may vote your shares to adjourn the meeting from time to time and will be authorized to vote your shares at any adjournments or postponements of the meeting. This proxy statement and the accompanying materials are being mailed to shareholders on or about April 14, 2009.

Your proxy vote is important. Whether or not you plan to attend the meeting, please submit your proxy promptly either in the enclosed envelope, via the Internet or by telephone.

INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of the annual meeting?

At the annual meeting, shareholders will be asked to elect three directors of ViewPoint Financial Group. The shareholders also will transact any other business that may properly come before the meeting. Members of our management team will be present at the meeting to respond to appropriate questions from shareholders.

Who is entitled to vote?

The record date for the meeting is March 23, 2009. Only shareholders of record at the close of business on that date are entitled to receive notice of, and to vote at, the meeting. The only class of stock entitled to be voted at the meeting is ViewPoint Financial Group common stock. Each outstanding share of common stock is entitled to one vote for all matters before the meeting. At the close of business on the record date there were 24,929,157 shares of common stock outstanding.

3

What if my shares are held in “street name” by a broker?

If you are the beneficial owner of shares held in “street name” by a broker, your broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to your broker, your broker nevertheless will be entitled to vote the shares with respect to “discretionary” items, but will not be permitted to vote your shares with respect to any “non-discretionary” items. In the case of non-discretionary items, the shares will be treated as “broker non-votes.” Whether an item is discretionary is determined by the exchange rules governing your broker.

What if my shares are held in ViewPoint Financial Group’s employee stock ownership plan?

We maintain an employee stock ownership plan which owns 3.7% of ViewPoint Financial Group’s common stock. Employees of ViewPoint Financial Group and ViewPoint Bank participate in the employee stock ownership plan. Each participant instructs the trustee of the plan how to vote the shares of common stock allocated to his or her account under the employee stock ownership plan. If a participant properly executes the voting instruction card distributed by the trustee, the trustee will vote the participant’s shares in accordance with the instructions. Where properly executed voting instruction cards are returned to the trustee with no specific instruction as to how to vote at the annual meeting, the trustee will vote the shares “FOR” each of management’s director nominees. In the event the participant fails to give timely voting instructions to the trustee with respect to the voting of the common stock that is allocated to his or her employee stock ownership plan account, the trustee will vote such shares “FOR” each of management’s director nominees. The trustee will vote the shares of ViewPoint Financial Group common stock held in the employee stock ownership plan but not allocated to any participant’s account in the same proportion as directed by the participants who directed the trustee as to the manner of voting their allocated shares in the employee stock ownership plan with respect to the election of directors.

How many shares must be present to hold the meeting?

A quorum must be present at the meeting for any business to be conducted. The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

What if a quorum is not present at the meeting?

If a quorum is not present at the scheduled time of the meeting, the shareholders who are represented may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the meeting.

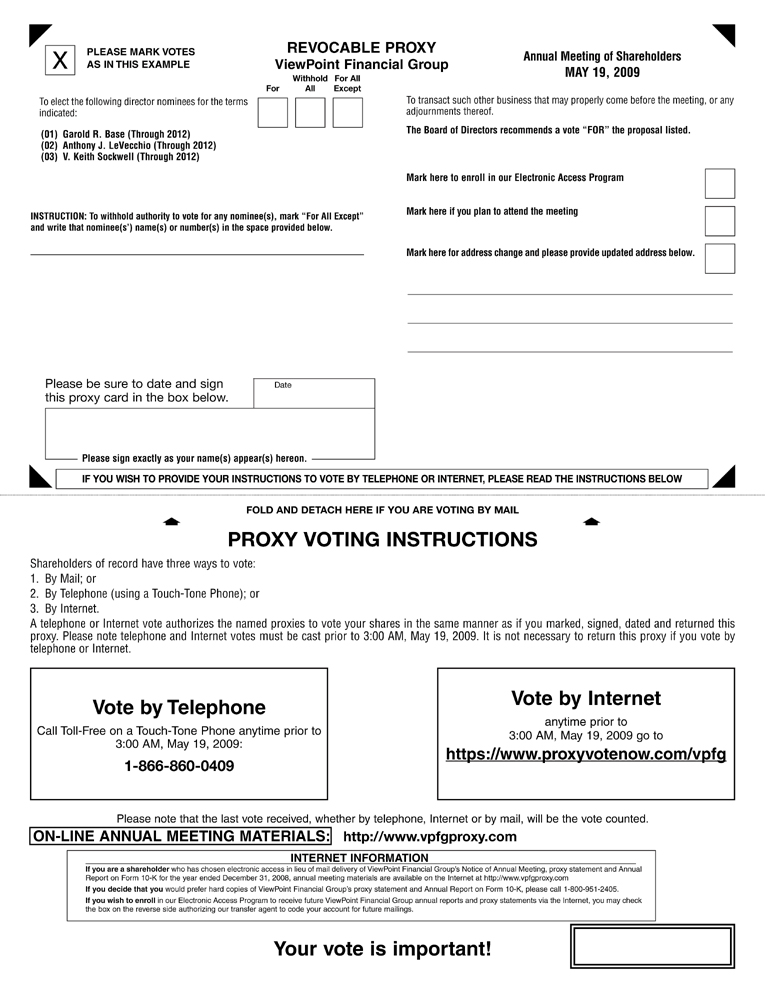

How do I vote?

1. You may vote by mail. If you properly complete and sign the accompanying proxy card and return it in the enclosed envelope, it will be voted in accordance with your instructions.

2. You may vote by telephone.If you are a registered shareholder, that is, if you hold your stock in your own name, you may vote by telephone by following the instructions included with the proxy card. If you vote by telephone, you do not have to mail in your proxy card.

3. You may vote on the internet. If you are a registered shareholder, that is, if you hold your stock in your own name, you may vote on the Internet by following the instructions included with the proxy card. If you vote on the Internet, you do not have to mail in your proxy card.

4

4. You may vote in person at the meeting.If you plan to attend the annual meeting and wish to vote in person, we will give you a ballot at the annual meeting. However, if your shares are held in the name of your broker, bank or other nominee, you will need to obtain a proxy form from the institution that holds your shares indicating that you were the beneficial owner of ViewPoint Financial Group common stock on March 23, 2009, the record date for voting at the annual meeting.

Can I vote by telephone or on the Internet if I am not a registered shareholder?

If your shares are held in “street name” by a broker or other nominee, you should check the voting form used by that firm to determine whether you will be able to vote by telephone or on the Internet.

Can I change my vote after I submit my proxy?

If you are a registered shareholder, you may revoke your proxy and change your vote at any time before the polls close at the meeting by:

| | • | | signing another proxy with a later date; |

| |

| | • | | voting by telephone or on the Internet — your latest telephone or Internet vote will be counted; |

| |

| | • | | giving written notice of the revocation of your proxy to the Secretary of ViewPoint Financial Group prior to the annual meeting; or |

| |

| | • | | voting in person at the annual meeting. |

If you have instructed a broker, bank or other nominee to vote your shares, you must follow directions received from your nominee to change those instructions.

What if I do not specify how my shares are to be voted?

If you submit an executed proxy but do not indicate any voting instructions, your shares will be voted FOR the election of the director nominees to ViewPoint Financial Group’s Board of Directors.

Will any other business be conducted at the annual meeting?

The Board of Directors knows of no other business that will be conducted at the meeting. If any other proposal properly comes before the shareholders for a vote at the meeting, however, the proxy holders will vote your shares in accordance with their best judgment.

Vote Required to Approve Proposal: Election of Directors.

Directors are elected by a plurality of the votes cast, in person or by proxy, at the annual meeting by the holders of ViewPoint Financial Group common stock. Votes may be cast for or withheld from a nominee. Votes that are withheld and broker non-votes have no effect on the election of the director nominees. ViewPoint MHC, which owns 57% of ViewPoint Financial Group’s outstanding common stock, intends to vote its shares in favor of the director nominees, ensuring the election of the Board’s nominees.Our Board of Directors unanimously recommends that you vote “FOR” the election of management’s director nominees.

5

STOCK OWNERSHIP

The following table presents information regarding the beneficial ownership of ViewPoint Financial Group common stock, as of the March 23, 2009 voting record date, by:

| | • | | ViewPoint MHC and any other shareholders known by management to beneficially own more than five percent of the outstanding common stock of ViewPoint Financial Group; |

| |

| | • | | each of our directors and our director nominees for election; |

| |

| | • | | each of our executive officers named in the “Summary Compensation Table” appearing below; and |

| |

| | • | | all of the executive officers, directors and director nominees as a group. |

The persons named in the following table have sole voting and investment powers for all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and except as indicated in the footnotes to this table. The address of each of the beneficial owners, except where otherwise indicated, is the same address as that of ViewPoint Financial Group. An asterisk (*) in the table indicates that an individual beneficially owns less than one percent of the outstanding common stock of ViewPoint Financial Group. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”). As of March 23, 2009, there were 24,929,157 shares of ViewPoint Financial Group common stock outstanding.

| | | | | | | | | |

| | | | | | | Percent of |

| | | Beneficial | | Common Stock |

| Name of Beneficial Owner | | Ownership | | Outstanding |

5% and Greater Shareholders | | | | | | | | |

| | | | | | | | | |

| ViewPoint MHC | | | 14,183,812 | (1) | | | 56.9 | % |

1309 W. 15th Street

Plano, TX 75075 | | | | | | | | |

| | | | | | | | | |

| Columbia Wanger Asset Management, LP | | | 1,301,378 | (2) | | | 5.2 | % |

227 West Monroe Street, Suite 3000

Chicago, IL 60606 | | | | | | | | |

| | | | | | | | | |

| Wellington Management Company, LLP | | | 1,278,239 | (3) | | | 5.1 | % |

75 State Street

Boston, MA 02109 | | | | | | | | |

| | | | | | | | | |

Directors, Director Nominees and Named Executive Officers | | | | | | | | |

| | | | | | | | | |

James B. McCarley,Chairman of the Board | | | 47,450 | (4) | | | * | |

Gary D. Basham,Vice Chairman of the Board | | | 43,394 | (4) (5) | | | * | |

Garold R. Base,Director, President and CEO/Director Nominee | | | 173,324 | (4) (6) | | | * | |

Jack D. Ersman,Director | | | 41,243 | (4) (7) | | | * | |

Anthony J. LeVecchio,Director/Director Nominee | | | 21,243 | (4) | | | * | |

Karen H. O’Shea,Director | | | 34,178 | (4) (8) | | | * | |

V. Keith Sockwell,Director/Director Nominee | | | 32,243 | (4) (9) | | | * | |

Mark E. Hord,EVP, General Counsel and Corporate Secretary | | | 50,264 | (4) (6) | | | * | |

Pathie E. McKee,EVP, CFO and Treasurer | | | 51,199 | (4) (6) | | | * | |

James C. Parks,EVP, COO and Chief Information Officer of the Bank | | | 49,098 | (4) (6) (10) | | | * | |

Rick M. Robertson,EVP, Chief Banking Officer of the Bank | | | 54,592 | (4) (6) | | | * | |

| Directors, director nominees and executive officers of ViewPoint | | | 598,228 | (11) | | | 2.4 | % |

| Financial Group as a group (11 persons) | | | | | | | | |

6

| | |

| (1) | | As reported by ViewPoint MHC in a Schedule 13D filed with the SEC on October 13, 2006, which reported sole voting and dispositive power with respect to all shares beneficially owned. |

| |

| (2) | | As reported by Columbia Wanger Asset Management, LP in a Schedule 13G filed with the SEC on February 5, 2009, which reported sole voting and dispositive power with respect to all share beneficially owned. |

| |

| (3) | | As reported by Wellington Management Company, LLP in a Schedule 13G filed with the SEC on February 17, 2009, which reported shared voting power with respect to 1,153,039 shares beneficially owned and shared dispositive power over 1,278,239 shares beneficially owned. |

| |

| (4) | | Includes restricted stock awarded to the individual under the 2007 Equity Incentive Plan, over which they have sole voting but no dispositive power, as follows: Mr. McCarley — 15,160 shares; Mr. Basham — 12,994 shares; Mr. Base — 111,407 shares; Mr. Ersman — 12,994 shares; Mr. LeVecchio — 12,994 shares; Ms. O’Shea — 12,994 shares; Mr. Sockwell — 12,994 shares; Mr. Hord — 36,156 shares; Ms. McKee — 36,156 shares; Mr. Parks — 36,156 shares; Mr. Robertson — 36,156 shares. |

| |

| (5) | | Includes 400 shares owned by Mr. Basham’s spouse. |

| |

| (6) | | Includes shares allocated to the individual under the Employee Stock Ownership Plan, over which they have sole voting but no dispositive power, as follows: Mr. Base — 3,380 shares; Mr. Hord — 3,232 shares; Ms. McKee — 3,167 shares; Mr. Parks -2,242 shares; Mr. Robertson — 2,560 shares. |

| |

| (7) | | 25,000 shares are held in a trust for which Mr. Ersman is the trustee and beneficiary. |

| |

| (8) | | Includes 7,435 shares owned by Ms. O’Shea’s spouse. |

| |

| (9) | | Includes 12,900 shares owned by Mr. Sockwell’s spouse. |

| |

| (10) | | Includes 1,700 shares owned by Mr. Parks’s spouse. |

| |

| (11) | | Includes shares held directly, as well as shares held by and jointly with certain family members, shares held in retirement accounts, shares held by trusts of which the individual or group member is a trustee or substantial beneficiary, or shares held in another fiduciary capacity with respect to which shares the individual or group member may be deemed to have sole or shared voting and/or investment powers. |

ELECTION OF DIRECTORS

ViewPoint Financial Group’s Board of Directors is currently composed of seven members, each of whom is also a director of ViewPoint Bank. Approximately one-third of the directors are elected annually. Directors of ViewPoint Financial Group are elected to serve for a three-year term or until their respective successors are elected and qualified.

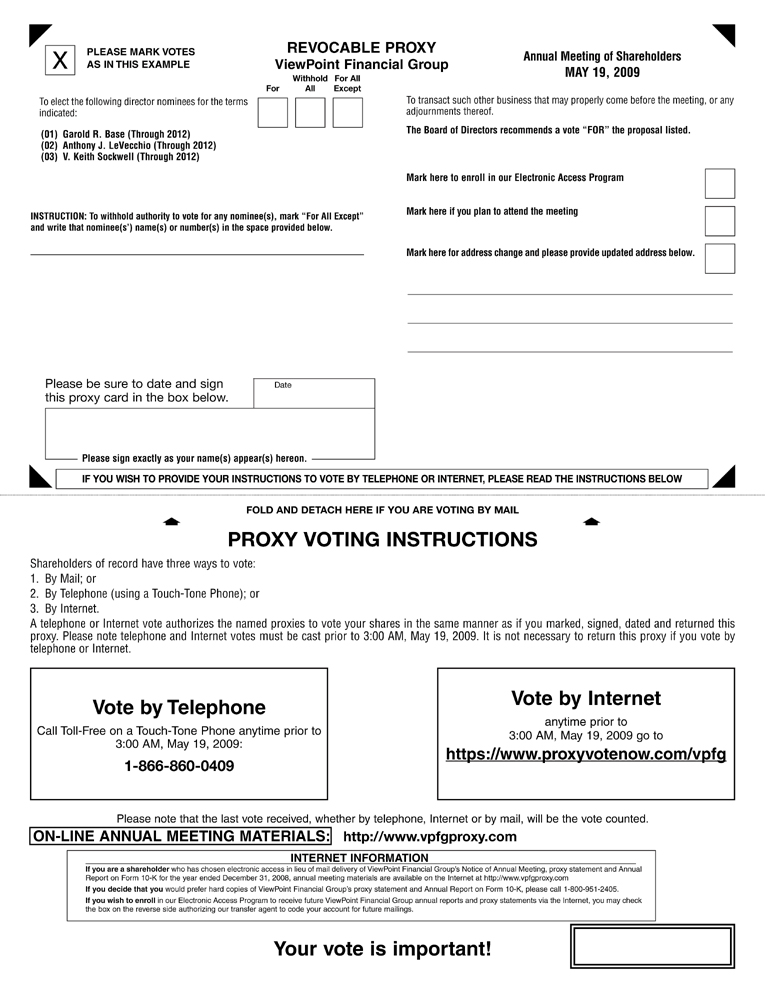

The following table sets forth certain information regarding the composition of ViewPoint Financial Group’s Board of Directors, including each director’s term of office. The Board of Directors, acting on the recommendation of the Nominating Committee, has recommended and approved the nomination of Garold R. Base, Anthony J. LeVecchio and V. Keith Sockwell to serve as directors for a term of three years to expire at the annual meeting of shareholders to be held in 2012.

It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the authority to vote for a nominee is withheld) will be voted at the annual meeting “FOR” the election of Garold R. Base, Anthony J. LeVecchio and V. Keith Sockwell as directors. If Mr. Base, Mr. LeVecchio, or Mr. Sockwell is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute nominee as the Board of Directors, acting on the recommendations of the Nominating Committee, may recommend. At this time, the Board of Directors knows of no reason why Mr. Base, Mr. LeVecchio, or Mr. Sockwell might be unable to serve if elected. Except as disclosed in this proxy statement, there are no arrangements or understandings between the nominees and any other person pursuant to which the nominees were selected.

7

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Term of | |

| | | | | | | Position(s) Held in | | | Director | | | Office | |

| Name | | Age(1) | | | ViewPoint Financial Group | | | Since(2) | | | Expires | |

| | | | | | | | | | | | | | | | | |

| NOMINEES |

| Garold R. Base | | | 61 | | | Director, President and CEO | | | 2006 | | | | 2012 | |

| Anthony J. LeVecchio | | | 62 | | | Director | | | 2006 | | | | 2012 | |

| V. Keith Sockwell | | | 66 | | | Director | | | 1987 | | | | 2012 | |

| | | | | | | | | | | | | | | | | |

| DIRECTORS REMAINING IN OFFICE |

| Gary D. Basham | | | 65 | | | Vice Chairman of the Board | | | 1988 | | | | 2010 | |

| Jack D. Ersman | | | 66 | | | Director | | | 1989 | | | | 2010 | |

| James B. McCarley | | | 65 | | | Chairman of the Board | | | 1992 | | | | 2011 | |

| Karen H. O’Shea | | | 58 | | | Director | | | 1998 | | | | 2011 | |

| | |

| (1) | | As of December 31, 2008. |

| |

| (2) | | Includes service as a director of ViewPoint Bank and its predecessor entity. |

The business experience of each director and director nominee for at least the past five years is set forth below.

James B. McCarley.Mr. McCarley has served on the Board of Directors of ViewPoint Bank (including its predecessor entity) since 1992, and has served as Chairman of the Board since 1999. Mr. McCarley serves as Chairman of the Executive Committee and is also a member of the Compensation, Legislative and Nominating Committees. Since January 1996, Mr. McCarley has served as President of James McCarley Consultants, a governmental affairs consulting company. He served as Executive Director of the Dallas Regional Mobility Coalition (DRMC) on a contract basis from 1996 until his retirement in 2007. DRMC is a voluntary coalition of five counties and 27 cities in the Texas Department of Transportation Dallas District that promotes mobility issues, projects and programs for transportation improvements. From February 1987 through January 1996, Mr. McCarley served as the Assistant City Manager-Director of Public Safety for the City of Plano, Texas. Prior to 1987, Mr. McCarley spent 23 years in law enforcement, including serving nearly 11 years as the Chief of Police for the City of Plano, Texas.

Karen H. O’Shea.Ms. O’Shea has served on the Board of Directors of ViewPoint Bank (including its predecessor entity) since 1998. Ms. O’Shea chairs the Nominating Committee and is also a member of the Audit, Compensation and Executive Committees. Recently retired, she was Vice President of Communications and Public Relations for Lennox International Inc., a major manufacturer of heating and air conditioning equipment. Prior to her career at Lennox, she was a teacher, an owner and manager of a retail business, and an editor for a major Texas metropolitan newspaper.

Jack D. Ersman.Mr. Ersman has served on the Board of Directors of ViewPoint Bank (including its predecessor entity) since 1989. Mr. Ersman serves as Chairman of the Lending Committee and is also a member of the Audit, Compensation, Executive and Nominating Committees and the Board of Directors of ViewPoint Bankers Mortgage, Inc. He has been an automobile dealer doing business as Village Motors, located in Sachse, Texas, since 1983. Mr. Ersman also served as a Senior Vice President and Loan Manager of ViewPoint Bank’s predecessor entity from 1970 to 1989.

V. Keith Sockwell.Mr. Sockwell has served on the Board of Directors of ViewPoint Bank (including its predecessor entity) since 1987. Mr. Sockwell serves as Chairman of the Compensation Committee and is also a member of the Legislative and Nominating Committees and the Board of Directors of ViewPoint Bankers Mortgage, Inc. He is the Chief Executive Officer/Chairman of Cambridge Strategic Services. Mr. Sockwell retired after 40 years in public education where he served as Deputy Superintendent of the Plano Independent School District and Superintendent of the Northwest

8

Independent School District. He is a member of the Texas Association of School Administrators. He served on the Executive Committees for the Texas School Coalition and the Fast Growth Coalition of Texas Public Schools.

Garold (Gary) R. Base.Since 1987, Mr. Base has served as the President and Chief Executive Officer of ViewPoint Financial Group and ViewPoint Bank (including its predecessor entity.) He serves on the Board of Directors of both institutions. Additionally, he currently serves as a Director of the North Texas Tollway Authority and has served as a Trustee of the Plano School District, Member of the Thrift Advisory Board of the Federal Reserve, Chairman of the Plano Chamber of Commerce, Board Member of the North Dallas Chamber of Commerce, Chairman of a Texas State Commission, Director of the Texas Bankers Association and in a number of other positions locally and nationally.

Anthony J. LeVecchio.Mr. LeVecchio joined the Board of Directors of ViewPoint Financial Group and ViewPoint Bank in September 2006. Mr. LeVecchio serves as Chairman of the Audit Committee and is also a member of the Compensation, Legislative and Lending Committees. Mr. LeVecchio is President and Principal of The James Group, Inc., a Plano, Texas-based consulting group that focuses on providing executive support to businesses throughout the United States. Prior to founding The James Group, Mr. LeVecchio served as Senior Vice President and Chief Financial Officer of VHA Southwest, Inc., a regional health care system comprised of not-for-profit hospitals in Texas. Before VHA Southwest, Mr. LeVecchio served in various senior financial management capacities with Phillips Information Systems, Exxon Office Systems and Xerox Corporation. Mr. LeVecchio currently serves on the boards of directors of several public and private companies, including Microtune, Inc. and DG Fast Channel, each of which is a public company.

Gary D. Basham.Mr. Basham has served on the Board of Directors of ViewPoint Bank (including its predecessor entity) since 1988 and was named Vice Chairman of the Board in 2005. Mr. Basham serves as Chairman of the Legislative Committee and is also a member of the Audit, Compensation, Executive and Lending Committees. Prior to his retirement in April 2005, Mr. Basham served as the Director of Sales for the Western United States and Mexico for OSRAM Opto Semiconductor, a division of OSRAM Sylvania and a wholly-owned subsidiary of Siemens AG, one of the world’s three largest lamp manufacturers. From November 1990 until November 2002, Mr. Basham served as the Director of Sales for the Southeastern/South Central regions of the United States for Infineon Technologies AG (formerly Siemens Semiconductors).

9

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

We provide what we believe is a competitive total compensation package to our executive management team through a combination of base salary, annual incentives, long-term incentives and broad-based benefits programs.

This Compensation Discussion and Analysis explains our compensation philosophy, policies and practices with respect to our chief executive officer, chief financial officer and the other three most highly-compensated executive officers, who are collectively referred to as the named executive officers.

The Objectives of our Executive Compensation Program

Our Compensation Committee is responsible for establishing and administering our policies governing the compensation for our named executive officers. The Compensation Committee is composed entirely of independent directors.

Our executive compensation programs are designed to achieve the following objectives:

| | • | | Attract and retain talented and experienced executives in the highly competitive banking industry; |

| |

| | • | | Motivate and reward executives whose knowledge, skills and performance are critical to our success; |

| |

| | • | | Provide a competitive compensation package which is weighted towards pay for performance, and in which total compensation is determined by company/team and individual results and the creation of shareholder value; |

| |

| | • | | Ensure fairness among the executive management team by recognizing the contributions each executive makes to our success; |

| |

| | • | | Foster a shared commitment among executives by coordinating their company/team and individual goals; and |

| |

| | • | | Compensate our executives to manage our business to meet our long-range objectives. |

Our Executive Compensation Programs

Overall, our executive compensation programs are designed to be consistent with the objectives and principles set forth above. The basic elements of our executive compensation programs are summarized in the table below, followed by a more detailed discussion of each compensation program.

| | | | | |

| Element | | Characteristics | | Purpose |

| | | | | |

| Base salary | | Fixed annual cash compensation; all executives are eligible for periodic increases in base salary based on performance; targeted at market pay levels. | | Keep our annual compensation competitive with the market for skills and experience necessary to meet the requirements of the executive’s role with us. |

| | | | | |

Executive Officer

Incentive Plan | | An annual cash incentive for executives based on ViewPoint Bank and individual performance. | | Encourage achievement of goals related to profitability and growth and reward exceptional performance, both organizationally and individually. |

10

| | | | | |

| Element | | Characteristics | | Purpose |

| | | | | |

| Equity Incentive Plan | | This plan is a long term incentive plan that consists of equity based awards, such as options and restricted stock. Awards are generally subject to forfeiture and limits on transfer until they vest. | | This plan was designed to retain key employees, encourage directors and key employees to focus on long-range objectives and to further link the interests of directors and officers directly to the interests of the shareholders. |

| | | | | |

| Retirement Benefits | | Tax-deferred 401(k) plan in which all eligible employees can choose to defer compensation for retirement. We provide a matching contribution for eligible employees and employees vest in these contributions with each year of service with full vesting after 6 years of service. We do not allow employees to invest these savings in company stock. | | Provide employees the opportunity to save for their retirement. Account balances are affected by contributions. The 401(k) Plan is described in more detail on page 24 of this proxy statement. |

| | | | | |

| | | In the 4th quarter of 2006, an ESOP feature was added to the 401(k) plan to create a KSOP. Shares of ViewPoint Financial Group stock are allocated to all eligible employees. | | To reward employees for the success of ViewPoint Bank and to create ownership among the employee population, aiding in recruitment and retention of employees. The ESOP is described in more detail on pages 24 and 25 of this proxy statement. |

| | | | | |

| | | The Deferred Compensation Plan is a nonqualified voluntary deferral program that allows executive officers to defer a portion of their annual cash compensation. | | Provides a tax-deferred retirement savings alternative. The Deferred Compensation Plan is described in more detail on page 24 of this proxy statement. |

| | | | | |

| | | The Supplemental Executive Retirement Plan (SERP) is a nonqualified, contributory program. The SERP applies only to the CEO, and allows him to defer all or part of his cash compensation. ViewPoint Bank also makes a contribution equal to 7% of the CEO’s annual base salary and incentive award. | | The SERP supplements the CEO’s retirement benefits. The SERP is described in more detail on page 23 of this proxy statement. |

| | | | | |

| | | Retired employees are eligible to receive a contribution toward the cost of medical benefits. Upon retirement, ViewPoint Bank will provide $175 per month toward the eligible participant’s group coverage. Eligibility is determined by age and length of service, and ends when the participant becomes eligible for Medicare. | | Provide a benefit to the retired employee to meet the health and welfare needs of the employee. |

| | | | | |

Health & Welfare

Benefits | | Fixed component. The same/comparable health and welfare benefits (medical, dental, vision, disability insurance and life insurance) are available for all full-time employees. | | Provides benefits to meet the health and welfare needs of employees and their families. |

| | | | | |

| | | Continuation of health and welfare benefits may occur as part of severance upon termination of employment under certain circumstances. | | |

11

| | | | | |

| Element | | Characteristics | | Purpose |

| | | | | |

Additional Benefits &

Perquisites | | CEO only. | | Provides for benefit allowance, automobile, home security and spouse travel. |

| | | | | |

| Employment and Change in Control Agreements; Termination Benefits | | We have an employment agreement with the CEO and change in control agreements with certain officers, including our named executive officers. The employment agreement provides for a liquidated damages payment over a two to three year period in the event of a termination other than for cause, death or disability. The change in control agreements provide severance benefits if an officer’s employment is terminated in connection with a change in control. | | Change in control arrangements are designed to retain executives and provide continuity of management in the event of an actual or threatened change in control. The employment agreement and change in control agreements are described in more detail on pages 22 and 23 of this proxy statement. |

We consider market pay practices and practices of peer companies in determining the amounts to be paid. Compensation opportunities for our executive officers, including our named executive officers, are designed to be competitive with peer companies.

Determination of Appropriate Pay Levels

Pay Philosophy and Competitive Standing

To attract and retain executives with the ability and the experience necessary to lead us and deliver strong performance to ViewPoint Bank, we strive to provide a total compensation package that is competitive with total compensation provided by industry peer groups.

Our compensation package consists of three main components: base salary, annual incentive pay and long-term incentives. We target base salaries to be at or above the 50th percentile of our peer group for each position, adjusted for marketplace demands, needs of our organization, an individual’s experience and overall relationship to competitive market data surveys. The annual incentive pay is a cash award, based on our performance compared to company/team and individual goals. The long-term incentives, which were instituted in 2007, are equity based and designed to retain key employees, to encourage directors and key employees to focus on long-range objectives and to further link the interests of directors and officers directly to the interests of shareholders.

To determine the 2008 total compensation package, the Compensation Committee in 2007 engaged an independent compensation consultant, Longnecker and Associates. With the assistance of this consultant, the Compensation Committee reviewed total compensation for the top five executive officers and compared this compensation to published survey data and selected peer data. The peer companies, which were determined by the Compensation Committee and the independent consultant, include companies from the banking and financial services industry in which we compete, and were chosen based upon relevant financial factors such as asset size, revenue and market cap. These peer companies were intended to serve as a foundation for compensation comparison purposes for the named executive officers; however, the Compensation Committee also relied on published survey sources. This information was used to determine our competitive position among similar companies in the marketplace,

12

and assisted us in setting our targeted pay at the desired range relative to our peers. The peer company information used for the 2008 compensation package is shown below, as of June 30, 2007.

| | | | | | | | | | | | | |

| | | Assets | | Market | | Revenue |

| Company | | ($M) | | Cap ($M) | | ($M) |

| BankFinancial Corporation | | | 1,613.12 | | | | 352.73 | | | | 67.25 | |

| Clifton Savings Bancorp, Inc. | | | 805.04 | | | | 301.30 | | | | 16.20 | |

| Columbia Banking System, Inc. | | | 2,553.13 | | | | 461.55 | | | | 120.37 | |

| Dime Community Bancshares, Inc. | | | 3,173.38 | | | | 461.69 | | | | 86.39 | |

| First Financial Holdings, Inc. | | | 2,658.13 | | | | 376.48 | | | | 132.41 | |

| First Indiana Corporation | | | 2,162.11 | | | | 518.01 | | | | 100.45 | |

| Heartland Financial USA, Inc. | | | 3,058.24 | | | | 362.49 | | | | 133.32 | |

| Wauwatosa Holdings, Inc. | | | 1,648.47 | | | | 503.28 | | | | 40.53 | |

| TierOne Corporation | | | 3,431.17 | | | | 521.05 | | | | 151.42 | |

| Average | | | 2,344.80 | | | | 428.70 | | | | 94.30 | |

ViewPoint Financial Group | | | 1,604.73 | | | | 443.32 | | | | 52.90 | |

The 2009 compensation package was determined by the Compensation Committee using published survey data, including consulting from Cardwell Consulting, Inc., an executive compensation firm for financial institutions. The published data used was the Watson Wyatt Data Services 2008/2009 Financial Services — Survey Report on Executive and General Industry Personnel Compensation. The data in this survey is based on the responses of 111 organizations encompassing 292 locations and 12,430 incumbents. The compensation data is organized by industry, asset size and positions. The committee chose the asset size group of companies with assets from $2.0 billion to $9.9 billion. The committee targeted annual base salaries to the median of the salary range with adjustments for performance, experience and the needs of our organization.

Our annual incentive plan awards will take into account the achievement of goals set forth in our annual strategic plan. Individual performance goals are set at the Committee’s discretion and, for those other than the CEO, the recommendation of the CEO. We believe our executive compensation packages are reasonable when considering our business strategy, our compensation philosophy and the competitive market pay data.

Base Salary

Our base salary levels reflect a combination of factors, including competitive pay levels relative to peer groups discussed above, the published survey data, the executive’s experience and tenure, our overall annual budget, the executive’s individual performance, and level of responsibility. We review salary levels annually to recognize these factors.

As noted above, our compensation philosophy targets base salaries that are consistent with the market for comparable positions. The base salaries of our named executive officers compared to competitive benchmarking at the median of the peer data reflect our philosophy. Base salary increases are consistent with marketplace data and practice. Base pay increases granted to Mr. Base, Ms. McKee, Mr. Robertson, Mr. Hord, and Mr. Parks in 2008 were 4% and were established after considering job performance, internal pay alignment, and marketplace competitiveness. Salary increases in 2009 range from 2.5% to 4%. Base salaries for 2009 are as follows: Mr. Base — $490,360; Ms. McKee — $216,320; Mr. Robertson — $223,860; Mr. Hord — $217,625; and Mr. Parks — $227,136.

13

Annual Cash Incentive Plan

In addition to base salaries, we provide the opportunity for our named executive officers and other executives to earn an annual cash incentive award. Our Incentive Plan consists of annual awards that recognizes exceptional performance, both organizationally and individually, and encourages achievement of goals related to profitability and growth. The 2008 payouts could have ranged from a payout of 25% to 100% of salary for Mr. Base and 15% to 60% for the other officers.

As in setting base salaries, we consider a combination of factors in establishing the annual award opportunities for our named executive officers. In general, ViewPoint Financial Group performance targets for the plan are based upon the coming year’s forecast of business activity, interest rates, pricing assumptions, operating assumptions and forecasted net income. Specifically, these annual awards have clearly defined performance measurements that allow the executives to focus on set company wide goals and align executive’s compensation with key objectives of ViewPoint Financial Group and its shareholders. In addition, the Compensation Committee has the discretion to adjust awards to participants due to special circumstances. The 2008 annual incentive was comprised of two parts, a corporate portion which is 75% of the total payout, and an individual portion which is 25% of the total payout. The corporate award was based on performance measurements with a set range and minimum and maximum payout possibilities. For 2008 the following metrics determined 60% of the portion of each participant’s award that was based on corporate goals:

| | • | | Return on average equity |

| |

| | • | | Efficiency ratio |

| |

| | • | | Loan growth |

| |

| | • | | Deposit growth |

In calculating these metrics, specifically the return on average equity and efficiency ratio, the Compensation Committee concluded that it was proper to exclude the other-than-temporary impairment charge recognized during the fourth quarter of 2008 (in the aggregate amount of $13.8 million), in order to provide a more reasonable view of ViewPoint Financial Group’s core operating performance. This charge resulted primarily from disruptions in the market for our collateralized debt obligations and a lack of activity and market indicative prices for these securities. As of December 31, 2008, no actual loss of principal or interest had occurred.

Additional metrics that determined the remaining 40% of each participant’s corporate goal-based award were tailored to the participants’ particular areas of responsibility.

Individual goals varied according to each executive. These goals were specific, measurable, and supported achievement of the defined goals in the annual business plan and accounted for 25% of the total payout.

The 2008 annual cash incentives were paid in January 2009. Mr. Base received 51% of his maximum available bonus payout and Ms. McKee, Mr. Robertson, Mr. Hord, and Mr. Parks received payouts that ranged from 56% to 68% of their maximum available bonus. For the amounts paid under the annual cash incentive plan, please refer to the Summary Compensation Table. The Grants of Plan-Based Awards Table includes the possible payouts under the threshold level, the target level, or the maximum level.

For 2009 the Annual Incentive Plan was adjusted to include an additional corporate measurement, earnings per share, in addition to the four corporate goal metrics used in 2008. For each participant, 75% of his or her 2009 award, if any, will be weighted to the achievement of these five designated corporate goals of ViewPoint Bank, with the balance weighted to an individual performance assessment.

14

Additional metrics that determine the remaining 25% of each participant’s corporate goal-based award are tailored to the participants’ particular areas of responsibility. Criteria for the individual performance assessment will vary according to the level of the officer and the officer’s areas of responsibility.

Awards for 2009 will be awarded by the Compensation Committee, subject to approval by the full Board of Directors in early 2010, with the amounts determined by multiplying the participant’s base salary by his or her payout percentage. The payout percentages for 2009 for the named executive officers at the threshold, target and maximum levels of performance are as follows: Mr. Base: 25%, 50%, and 100%, respectively; and all the other officers: 15%, 30%, and 60%, respectively. The threshold performance levels for the 2009 financial goals generally are based on the Company’s previously established 2009 financial and operating budgets.

Equity Incentive Plan

In May 2007, shareholders approved the ViewPoint Financial Group 2007 Equity Incentive Plan. The purpose of this plan is to promote the long-term success of ViewPoint Financial Group and increase shareholder value by attracting and retaining key employees and directors, encouraging directors and key employees and linking the interests of directors, officers and employees to the interests of the shareholders. The plan allows ViewPoint Financial Group to grant or award stock options, stock appreciation rights, restricted stock and restricted stock units to directors, advisory directors, officers and other employees of ViewPoint Financial Group or ViewPoint Bank.

During 2007, directors and the named executive officers were awarded restricted shares of ViewPoint Financial Group common stock. The number of shares awarded was based on the recommendation of our compensation consultant, Longnecker and Associates, and a review of industry practices. The awards were consistent with Office of Thrift Supervision and plan restrictions. The restricted shares were granted to the directors and named executive officers, without payment, and are subject to forfeiture and limits on transfer until the shares vest. The restricted shares vest at a rate of 20% per year. The first installment vested on May 22, 2008. Unvested restricted shares are forfeited upon termination of service by the director or named executive officer, except in the event of death, disability, or a change of control of ViewPoint Financial Group. In the event of death or disability, the vesting of the restricted shares is accelerated to the date of the director’s or officer’s termination of service with ViewPoint Financial Group. In the event of a change of control of ViewPoint Financial Group, all unvested restricted shares vest upon the earliest date of the change of control.

The restricted shares are transferable only by will or the laws of descent and distribution. The directors and named executive officers have the right to receive any dividends declared and paid on the restricted shares and are entitled to vote the shares during the restricted period.

Impact of Accounting and Tax Treatments of Compensation

The accounting and tax treatment of compensation generally has not been a factor in determining the amounts of compensation for our executive officers. However, the Compensation Committee and management have considered the accounting and tax impact of various program designs to balance the potential cost to the Company with the benefit to the executive.

15

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for annual non performance based compensation over $1.0 million paid to their named executive officers. To maintain flexibility in compensating our executive officers in a manner designed to promote varying corporate goals, it is not a policy of the committee that all executive compensation must be tax-deductible. The committee also believes that any non-deductible amounts paid to named executive officers for 2008 are not significant to ViewPoint Financial Group. The 2007 Equity Incentive Plan approved by shareholders permits the award of stock options, SARs and other equity awards that are fully deductible under Code Section 162(m).

With the adoption of FAS 123R, we do not expect accounting treatment of differing forms of equity awards to vary significantly and, therefore, accounting treatment is not expected to have a material effect on the selection of forms of equity compensation in the future.

Role of Executive Officers in Determining Compensation

The Compensation Committee meets outside the presence of all our executive officers, including the named executive officers and chief executive officer (CEO), to consider appropriate compensation for our CEO. Mr. Base, the CEO, annually reviews each other named executive officer’s performance with the committee and makes recommendations to the Compensation Committee with respect to the appropriate base salary and payments to be made under our annual incentive cash plan. Based in part on these recommendations from our CEO and other considerations discussed below, the Compensation Committee approves the annual compensation package of our named executive officers other than our CEO. The Compensation Committee also annually analyzes our CEO’s performance and determines his base salary and bonus award payout based on its assessment of his performance. The annual performance reviews of our named executive officers are considered by the Compensation Committee when making decisions on setting base salaries and award plan targets and payments. When making decisions on setting base salary and award plan targets and payments for new named executive officers, the Compensation Committee considers the importance of the position to us, the past salary history of the executive officer and the contributions to be made by the executive officer. The Compensation Committee modifies (as appropriate) and approves recommendations of the executive compensation consultants, who are selected by the committee.

16

Summary Compensation

The following table sets forth information concerning the annual compensation for services provided to us by our Chief Executive Officer, Chief Financial Officer and our three other most highly compensated executive officers during the fiscal years ended December 31, 2008, 2007 and 2006. We refer to the officers listed in the table below as the “named executive officers.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Change in | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | Pension Value & | | | | |

| | | | | | | | | | | | | | | | | | | | | | | Non-Equity | | Nonqualified | | | | |

| | | | | | | | | | | | | | | | | | | | | | | Incentive | | Deferred | | | | |

| Name and | | | | | | | | | | | | | | Stock | | Option | | Plan | | Compensation | | All Other | | |

| Principal | | | | | | Salary | | Bonus | | Awards | | Awards | | Compensation | | Earnings | | Compensation | | Total |

| Position | | Year | | ($) | | ($) | | ($)(1) | | ($) | | ($)(2) | | ($) | | ($) | | ($) |

| Garold R. Base | | | 2008 | | | | 478,400 | | | | — | | | | 514,722 | | | | — | | | | 245,180 | | | | — | | | | 148,408 | (3) | | | 1,386,710 | |

President and CEO | | | 2007 | | | | 460,000 | | | | — | | | | 313,972 | | | | — | | | | 116,653 | | | | — | | | | 124,465 | | | | 1,015,090 | |

| | | | 2006 | | | | 460,000 | | | | 256,722 | | | | — | | | | — | | | | — | | | | — | | | | 202,606 | | | | 919,328 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pathie E. McKee | | | 2008 | | | | 208,000 | | | | — | | | | 167,043 | | | | — | | | | 69,732 | | | | — | | | | 47,224 | (3) | | | 491,999 | |

EVP and CFO | | | 2007 | | | | 200,000 | | | | — | | | | 101,899 | | | | — | | | | 24,268 | | | | — | | | | 38,823 | | | | 364,990 | |

| | | | 2006 | | | | 180,000 | | | | 75,000 | | | | — | | | | — | | | | — | | | | — | | | | 40,002 | | | | 295,002 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mark E. Hord | | | 2008 | | | | 212,318 | | | | — | | | | 167,043 | | | | — | | | | 85,989 | | | | — | | | | 48,186 | (3) | | | 513,536 | |

EVP and General | | | 2007 | | | | 204,152 | | | | — | | | | 101,899 | | | | — | | | | 22,560 | | | | — | | | | 38,843 | | | | 367,454 | |

Counsel | | | 2006 | | | | 196,300 | | | | 75,000 | | | | — | | | | — | | | | — | | | | — | | | | 50,080 | | | | 321,380 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| James C. Parks | | | 2008 | | | | 218,400 | | | | — | | | | 167,043 | | | | — | | | | 79,607 | | | | — | | | | 47,713 | (3) | | | 512,763 | |

EVP, COO and Chief | | | 2007 | | | | 210,000 | | | | — | | | | 101,899 | | | | — | | | | 25,482 | | | | — | | | | 20,943 | | | | 358,324 | |

Information Officer | | | 2006 | (4) | | | 125,470 | | | | 25,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 150,470 | |

of ViewPoint Bank | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rick M. Robertson | | | 2008 | | | | 218,400 | | | | — | | | | 167,043 | | | | — | | | | 73,710 | | | | — | | | | 49,140 | (3) | | | 508,293 | |

EVP and Chief | | | 2007 | | | | 210,000 | | | | — | | | | 101,899 | | | | — | | | | 22,638 | | | | — | | | | 28,577 | | | | 363,114 | |

Banking Officer of | | | 2006 | (4) | | | 172,692 | | | | 56,509 | (5) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 229,201 | |

ViewPoint Bank | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal years ended December 31, 2008 and 2007, in accordance with FAS 123R, of restricted stock granted to the executive. The assumptions used in the calculation of this amount are included in Note 17 of the Notes to the Consolidated Financial Statements contained in the annual report on Form 10-K, accompanying this proxy statement. |

| |

| (2) | | Represents incentive award amounts awarded for performance under the Annual Incentive Plan. The awards were approved by the Compensation Committee and were paid following the end of the fiscal year. |

| |

| (3) | | The amounts reported for 2008 consist of the following (perquisites and other personal benefits totaling less than $10,000 in the aggregate for a named executive officer are excluded): |

17

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Pathie E. | | | | | | | | | | | Rick M. | |

| Benefit Type | | Garold R. Base | | | McKee | | | Mark E. Hord | | | James C. Parks | | | Robertson | |

| 401(k) Matching and Profit Sharing Contribution | | $ | 11,500 | | | $ | 11,148 | | | $ | 11,423 | | | $ | 10,212 | | | $ | 11,500 | |

| SERP Contribution | | | 41,655 | | | | — | | | | — | | | | — | | | | — | |

| ESOP Allocation | | | 26,387 | | | | 24,241 | | | | 24,873 | | | | 25,383 | | | | 25,522 | |

| Excess Life Insurance Premiums | | | 2,168 | | | | — | | | | — | | | | — | | | | — | |

| Dividends paid on restricted stock | | | 35,929 | | | | 11,660 | | | | 11,660 | | | | 11,660 | | | | 11,660 | |

Bank Owned Life Insurance(a) | | | 1,320 | | | | 175 | | | | 229 | | | | 458 | | | | 458 | |

| Perquisites and Other Personal Benefits: | | | | | | | | | | | | | | | | | | | | |

Benefit Allowance(b) | | | 20,000 | | | | — | | | | — | | | | — | | | | — | |

Other(c) | | | 9,449 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| Total | | | 148,408 | | | | 47,224 | | | | 48,186 | | | | 47,713 | | | | 49,140 | |

| | | | | | | | | | | | | | | |

| | |

| (a) | | In September 2007, we purchased Bank Owned Life Insurance (BOLI). Amounts represent insurance premiums paid on the death benefit portion of the BOLI. Under the terms of the BOLI, each insured employee was provided the opportunity to designate a beneficiary to receive a death benefit equal to 2 times the insured employee’s base salary on the date of purchase if the insured dies while employed at the Bank. |

| |

| (b) | | Under the terms of Mr. Base’s employment agreement, he receives an annual allowance to be used for automobile expenses, professional fees and dues, and as he may otherwise determine. |

| |

| (c) | | This amount includes monthly home security services, accrued vacation payable and spouse travel. |

| | |

| |

| (4) | | Mr. Park and Mr. Robertson commenced employment with ViewPoint Bank during 2006. |

| |

| (5) | | Includes a one-time relocation bonus of $31,509. |

Grants of Plan-Based Awards

The following table provides information concerning grants of awards made to named executive officers in 2008.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Estimated Possible Payouts Under Non-Equity |

| | | | | | | | | | | Incentive Plan Awards(1) |

| Name | | Plan Name | | Grant Date | | Threshold ($) | | Target ($) | | Maximum ($) |

| Garold R. Base | | Annual Cash Incentive Plan | | | N/A | | | | 119,600 | | | | 239,200 | | | | 478,400 | |

| Pathie E. McKee | | Annual Cash Incentive Plan | | | N/A | | | | 31,200 | | | | 62,400 | | | | 124,800 | |

| Mark E. Hord | | Annual Cash Incentive Plan | | | N/A | | | | 31,848 | | | | 63,695 | | | | 127,391 | |

| James C. Parks | | Annual Cash Incentive Plan | | | N/A | | | | 32,760 | | | | 65,520 | | | | 131,040 | |

| Rick M. Robertson | | Annual Cash Incentive Plan | | | N/A | | | | 32,760 | | | | 65,520 | | | | 131,040 | |

| | |

| (1) | | For each named executive officer, represents the threshold (i.e. lowest), target and maximum amounts that were potentially payable for the year ended December 31, 2008 under the Company’s Annual Incentive Plan. The actual amounts earned under these awards for fiscal 2008 are reflected in the Summary Compensation Table under the “Non-Equity Incentive Plan compensation” column. For additional information regarding the Annual Incentive Plan, see “Compensation Discussion and Analysis – Annual Cash Incentive Plan.” |

The material terms of the Annual Cash Incentive Plan are discussed above under “Compensation Discussion and Analysis.” The material terms of Mr. Base’s employment agreement, the change in control agreements with the other named executive officers, and our other material compensation plans and arrangements are discussed in detail under “Description of Our Material Compensation Plans and Arrangements” below.

18

Outstanding Equity Awards at Fiscal Year-End

The following table provides information concerning outstanding restricted stock awards held by named executive officers as of December 31, 2008. No other equity awards were held by the named executive officers at December 31, 2008.

| | | | | | | | | |

| Stock Awards |

| | | Number of Shares or | | |

| | | Units of Stock That | | Market Value of Shares or Units of |

| Name | | Have Not Vested (#) | | Stock That Have Not Vested ($)(1) |

| Garold R. Base | | | 111,407 | | | | 1,788,082 | |

| Pathie E. McKee | | | 36,156 | | | | 580,304 | |

| Mark E. Hord | | | 36,156 | | | | 580,304 | |

| James C. Parks | | | 36,156 | | | | 580,304 | |

| Rick M. Robertson | | | 36,156 | | | | 580,304 | |

| | |

| (1) | | The market value of the shares of restricted stock is based on the closing price of $16.05 per share of ViewPoint Financial Group common stock on December 31, 2008. |

Option Exercises and Stock Vested

The following table provides information concerning the restricted stock awards that vested during 2008 with respect to the named executive officers. There were no options outstanding to named executive officers during 2008.

| | | | | | | | | |

| Stock Awards |

| Name | | Number of Shares Acquired on Vesting (#) | | Value Realized on Vesting ($)(1) |

| Garold R. Base | | | 27,852 | | | | 453,988 | |

| Pathie E. McKee | | | 9,040 | | | | 147,352 | |

| Mark E. Hord | | | 9,040 | | | | 147,352 | |

| James C. Parks | | | 9,040 | | | | 147,352 | |

| Rick M. Robertson | | | 9,040 | | | | 147,352 | |

| (1) | | The value of the restricted stock vested shares is based on the closing price of $16.30 per share of ViewPoint Financial Group common stock on May 22, 2008, the date the shares vested. |

19

Non-qualified Deferred Compensation

The following table sets forth information about the non-qualified deferred compensation activity for the named executive officer during 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Executive | | Registrant | | Aggregate | | Aggregate | | Aggregate |

| | | | | | | Contributions | | Contributions | | Earnings | | Withdrawals/ | | Balance |

| | | | | | | in Last FY | | in Last FY | | in Last FY | | Distributions | | at Last FYE |

| Name | | Plan | | ($) | | ($)(1) | | ($)(2) | | ($) | | ($)(3) |

| Garold R. Base | | Supplemental Executive

Retirement Plan | | | — | | | | 41,655 | | | | (202,404 | ) | | | — | | | | 1,015,093 | |

| | | Deferred Compensation Plan | | | | 25,000 | | | | — | | | | (109,842 | ) | | | — | | | | 380,101 | |

| Pathie E. McKee | | Deferred Compensation Plan | | | — | | | | — | | | | (5,917 | ) | | | — | | | | 8,875 | |

| | |

| (1) | | These amounts are included in the Summary Compensation Table in the “All Other Compensation” column. |

| |

| (2) | | Earnings in this column are not included in the Summary Compensation Table because they were not preferential or above market. |

| |

| (3) | | The aggregate amount previously reported as compensation to Mr. Base in the Summary Compensation Table for previous years is $91,193. |

See the discussion under “Description of Our Material Compensation Plans and Arrangements - Supplemental Executive Retirement Plan” and “Deferred Compensation Plan” for additional information regarding our non-qualified deferred compensation arrangements.

Potential Post-Termination Payments and Benefits

The following table summarizes the value of the termination payments and benefits that Mr. Base would have received if his employment had been terminated by the Board of Directors on December 31, 2008 under the circumstances shown. The Board of Directors can terminate Mr. Base’s employment at any time. Under Mr. Base’s employment contracts, his employment shall be deemed to have been terminated if he resigns following (i) relocation of his principal workplace outside a radius of 50 miles from the Bank’s main office; (ii) a reduction in his responsibilities and authorities; (iii) a demotion from the position of President and Chief Executive Officer; or (iv) a material reduction in his compensation and benefits except as part of an overall program applied to all members of ViewPoint Bank’s senior management.

The table excludes (i) amounts accrued through December 31, 2008 that would be paid in the normal course of continued employment, such as accrued but unpaid salary and non-equity incentive plan award amounts, (ii) contracts, agreements, plans and arrangements that do not discriminate in scope, terms or operation, in favor of our executive officers, and that are available generally to all salaried employees, such as vested account balances under our 401(k) and employee stock ownership plan, and certain health and welfare benefits, and (iii) vested account balances under our nonqualified deferred compensation plans, as explained under “Description of our Material Compensation Plans and Arrangements — Deferred Compensation Plan.”

20

Garold R. Base

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Involuntary or Good | | |

| | | | | | | | | | | | | | | Reason termination | | Involuntary or Good |

| | | | | | | | | | | | | | | (not in connection | | Reason termination |

| | | | | | | | | | | | | | | with change in | | (in connection with |

| | | Retirement | | Death | | Disability | | control) | | change in control) |

| Benefit | | ($) | | ($) | | ($) | | ($) | | ($) |

Employment Contract(1) | | | | | | | | | | | | | | | | | | | | |

| Base Salary | | | — | | | | — | | | | — | | | | 1,435,200 | | | | 1,435,200 | |

Benefit Allowance(2) | | | — | | | | — | | | | — | | | | 60,000 | | | | 60,000 | |

Continued Employer Contributions under Defined Contribution Plans(3) | | | — | | | | — | | | | — | | | | 146,964 | | | | 146,964 | |

| Additional Life Insurance | | | — | | | | — | (4) | | | — | (5) | | | — | | | | 6,503 | (4) |

Accrued Vacation Pay(6) | | | 165,600 | | | | 165,600 | | | | 165,600 | | | | 165,600 | | | | 165,600 | |

Restricted stock award(7) | | | — | | | | 1,788,082 | | | | 1,788,082 | | | | — | | | | 1,788,082 | |

| | |

| (1) | | Reflects the amounts payable to or on behalf of Mr. Base over the liquidated damages period (except for the accrued vacation pay) contained in his employment agreement, which would have been three years at December 31, 2008. These amounts are subject to offset for income earned from providing services to another company during the period. All benefits would terminate upon Mr. Base’s death. All payments are subject to Mr. Base’s execution of a general release of claims against the Bank and compliance with a non-compete agreement for a period of 18 months from the termination of his employment agreement. |

| |

| (2) | | Reflects Mr. Base’s allowance to cover expenses related to his automobile, professional fees and dues, and such other expenses as he may determine. |

| |

| (3) | | Reflects the matching contribution under the Bank’s 401(k) plan ($15,500 annually) and Mr. Base’s Supplemental Executive Retirement Agreement ($33,488 annually, 7% of salary). Contributions shall be paid to Mr. Base as if he had continued in service during the liquidated damages period at his existing annual base salary and he made the maximum amount of employee contributions, if any, required or permitted under such plans. |

| |

| (4) | | The Bank provides and pays the premiums for a term life insurance policy in the amount of $750,000 for Mr. Base. In the event of Mr. Base’s death, his designated beneficiaries would be entitled to the insurance. |

| |

| (5) | | If Mr. Base becomes permanently disabled as defined in the Bank’s disability plan (which is available to all employees of the Bank on a non-discriminatory basis), he shall be entitled to receive the benefits available under that plan. |

| |

| (6) | | Mr. Base has accrued 90 days of unused vacation that will be paid to him upon his termination of employment with the Bank for any reason. The amount is calculated using Mr. Base’s base salary at the date of his termination. The amount Mr. Base is eligible to receive is capped at 90 days. |

| |

| (7) | | Represents the value of the executive’s restricted shares of ViewPoint Financial Group common stock based on a closing price of $16.05 per share on December 31, 2008. |

21

The following table summarizes the value of the termination payments and benefits that the named executive officers, other than Mr. Base, would have received if their employment had been terminated on December 31, 2008, under the circumstances shown.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Involuntary or | | Involuntary or |

| | | | | | | | | | | | | | | Good Reason | | Good Reason |

| | | | | | | | | | | | | | | termination (not in | | termination (in |

| | | | | | | | | | | | | | | connection with | | connection with |

| | | Retirement | | Death | | Disability | | change in control) | | change in control) |

| Benefit | | ($) | | ($) | | ($) | | ($) | | ($) |

Pathie E. McKee | | | | | | | | | | | | | | | | | | | | |

Salary Continuance(1) | | | — | | | | — | | | | — | | | | — | | | | 312,000 | |

Restricted stock award(2) | | | — | | | | 580,304 | | | | 580,304 | | | | — | | | | 580,304 | |

Mark E. Hord | | | | | | | | | | | | | | | | | | | | |

Salary Continuance(1) | | | — | | | | — | | | | — | | | | — | | | | 318,477 | |

Restricted stock award(2) | | | — | | | | 580,304 | | | | 580,304 | | | | — | | | | 580,304 | |

James C. Parks | | | | | | | | | | | | | | | | | | | | |

Salary Continuance(1) | | | — | | | | — | | | | — | | | | — | | | | 327,600 | |

Restricted stock award(2) | | | — | | | | 580,304 | | | | 580,304 | | | | — | | | | 580,304 | |

Rick M. Robertson | | | | | | | | | | | | | | | | | | | | |

Salary Continuance(1) | | | — | | | | — | | | | — | | | | — | | | | 327,600 | |

Restricted stock award(2) | | | — | | | | 580,304 | | | | 580,304 | | | | — | | | | 580,304 | |

| | |

| (1) | | The salary continuance payments represent 18 months of the employee’s current salary if the employee suffers an involuntary termination of employment in connection with or within 12 months after a change in control. These agreements are discussed in more detail under the caption “Description of Our Material Compensation Plans and Arrangements -Change in Control Agreements with Named Executive Officers” below. |

| |

| (2) | | Represents the value of the executive’s restricted shares of ViewPoint Financial Group common stock based on a closing price of $16.05 per share on December 31, 2008. |

Description of Our Material Compensation Plans and Arrangements

General.We currently provide health and welfare benefits to our employees, including hospitalization, comprehensive medical insurance, and life and long-term disability insurance, subject to certain deductibles and co-payments by employees. We also provide certain retirement benefits. See Notes 13 and 14 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K that accompanies this proxy statement.

Employment Agreements with Garold R. Base.ViewPoint Bank and ViewPoint Financial Group each have an employment agreement with Mr. Base. These agreements had an original three-year term, with annual one-year extensions subject to approval by the Board of Directors. The current term of the agreement extends to December 31, 2011. There is no duplication of salary or benefits by ViewPoint Bank and ViewPoint Financial Group. The amount of annual base salary is to be reviewed by the Board of Directors each year. Mr. Base is also entitled under the employment agreements to: an annual incentive award determined under the Annual Incentive Plan; participation in any stock-based compensation plans; a term life insurance policy in an amount of $750,000; an executive benefits allowance of $20,000 per year and related fees and expenses approved by the Board of Directors; a security system for his home and monthly service for the system; an annual medical examination; a supplemental executive retirement plan approved by the Board of Directors; and participation in any other retirement plans, group insurance and other benefits provided to full-time ViewPoint Bank employees generally and in which executive officers participate. Mr. Base also is entitled to expense reimbursement, professional and educational dues, expenses for programs related to ViewPoint Bank operations, including travel costs for himself and for his spouse if she accompanies him, and, at the time

22

his employment terminates for any reason, payment at the current rate of base salary for 90 days accrued vacation.

Under the employment agreements, if Mr. Base’s employment is terminated for any reason other than cause, death, retirement, or disability, or if he resigns following certain events such as relocation or demotion, he will be entitled to liquidated damages during the term of the agreement then remaining. The liquidated damages consist of continued payments of base salary, continued insurance coverage, continued eligibility under benefit programs for former officers and employees, and payments equal to amounts that the employer would have contributed under qualified and non-qualified retirement plans if he had been employed during the remainder of the term of the agreement. The liquidated damages would be subject to mitigation.

The employment agreements include an agreement not to compete with ViewPoint Bank and ViewPoint Financial Group with regard to the delivery of financial services for a period of 18 months following termination of employment. The value of compensation and benefits payable under the agreements is capped so as to prevent imposition of the golden parachute sanctions under Sections 280G and 4999 of the Internal Revenue Code.

Change in Control Agreements with Named Executive Officers.Ms. McKee, Mr. Hord, Mr. Parks and Mr. Robertson have each entered into a change in control agreement with ViewPoint Bank. The change in control agreements for these officers provide that ViewPoint Bank will pay to the officer an amount equal to 18 months of the employee’s current salary if the employee suffers involuntary termination of employment in connection with or within 12 months after a change in control. For purposes of the change in control agreement, “involuntary termination” means termination of employment without cause, a reduction in the amount of the employee’s base salary, a material adverse change to the employee’s benefits other than as part of a program applicable to all ViewPoint Bank senior executive officers, relocation of the employee’s principal place of employment to a location more than 50 miles from Plano, Texas, or a material demotion of the employee; and the term “change in control” means any of the following events: (i) any third person becomes the owner of shares of ViewPoint Bank or ViewPoint Financial Group with respect to which 25% or more of the total number of votes for election of the Board of Directors may be cast; (ii) persons who were a majority of the directors of ViewPoint Financial Group or ViewPoint Bank cease to constitute a majority as the result of or in connection with a tender offer, merger or sale, or similar event; and (iii) the shareholders of ViewPoint Financial Group approve an agreement providing for a transaction in which ViewPoint Financial Group will cease to be an independent public company or for the sale of all or substantially all of ViewPoint Financial Group assets. These agreements extend until December 31, 2009.