Q3 2016 Dunkin’ Brands Investor Presentation 1

Forward-Looking Statements • Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. • Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. We do not undertake to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved and the Company undertakes no duty to update its targets. • Regulation G This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These measure should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP amounts to the relevant GAAP amount are available on www.investor.dunkinbrands.com. 2

YEARS OF BRAND HERITAGE SIGNIFICANT U.S. & GLOBAL GROWTH OPPORTUNITY ASSET-LIGHT, NEARLY 60+ 100% FRANCHISED BUSINESS Dunkin’ Brands is unique in the QSR space 3

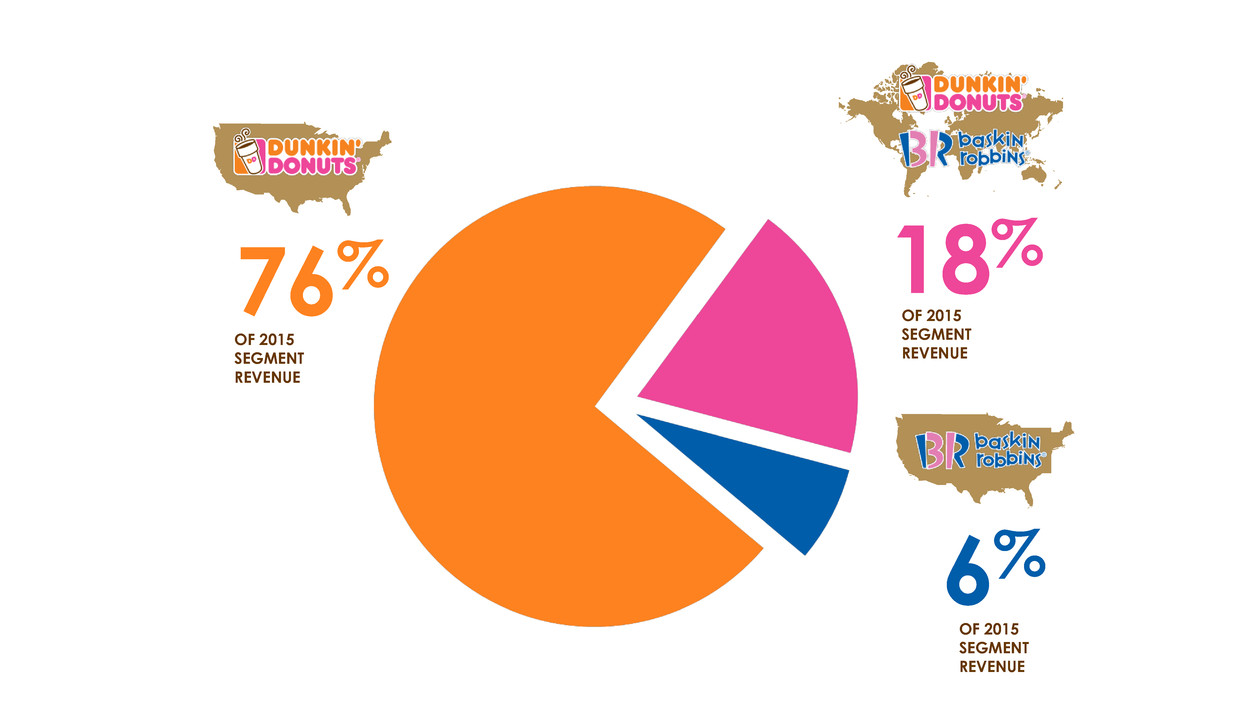

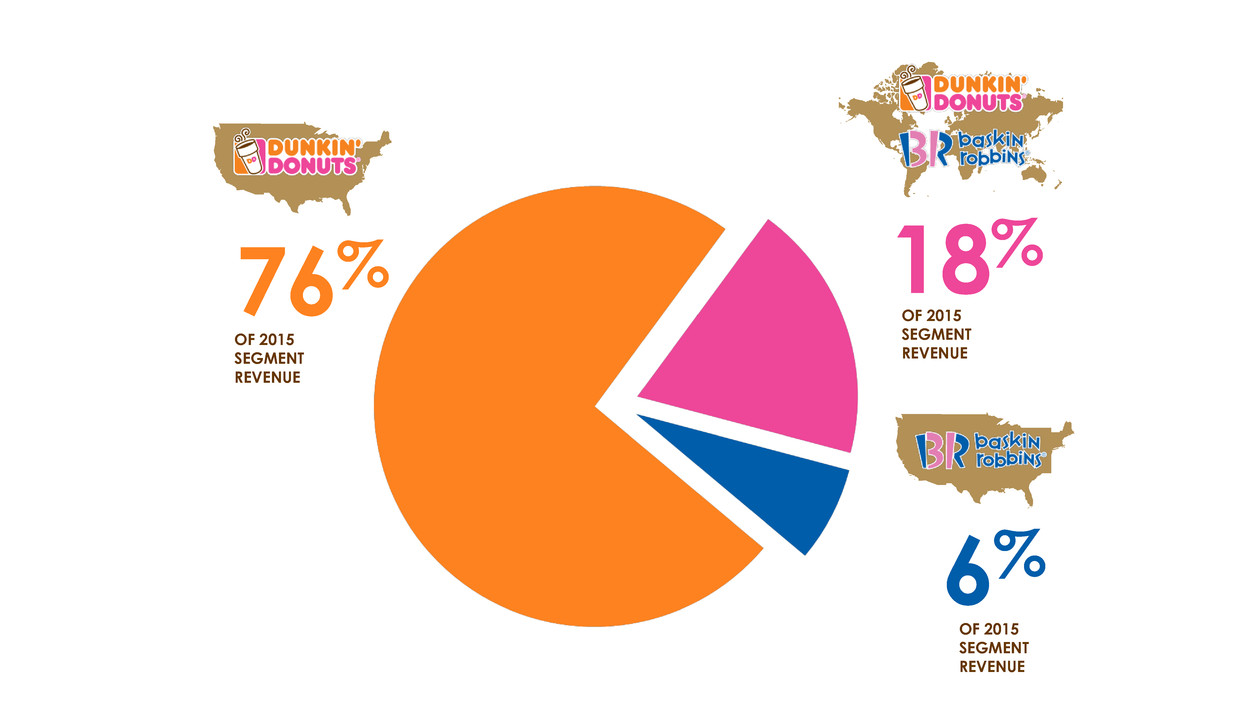

76% 18 % 6% OF 2015 SEGMENT REVENUE OF 2015 SEGMENT REVENUE OF 2015 SEGMENT REVENUE

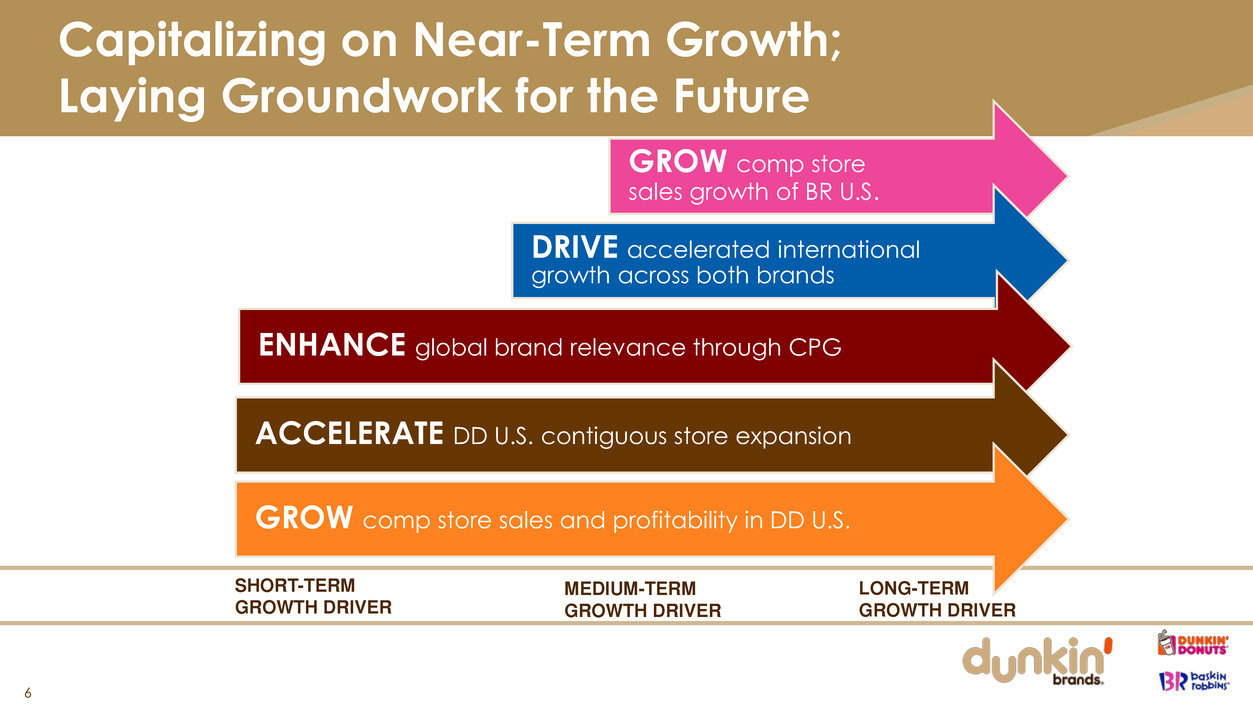

Focused Strategies to Drive Incremental Profitable Growth for Dunkin’ Brands and Franchisees INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S. INCREASE COMPARABLE STORE SALES AND DRIVE STORE GROWTHFOR BR U.S. CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS ENHANCE GLOBAL BRAND RELEVANCE THROUGH CPG 5

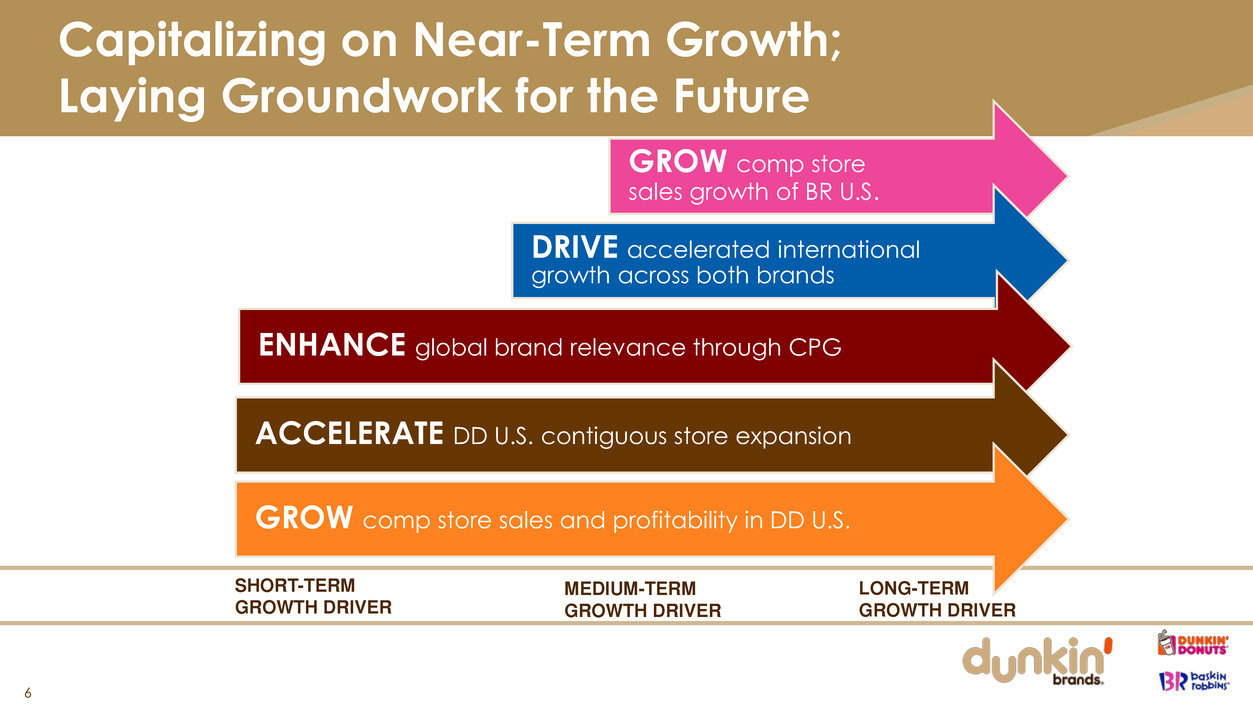

Capitalizing on Near-Term Growth; Laying Groundwork for the Future 6 GROW comp store sales growth of BR U.S. DRIVE accelerated international growth across both brands SHORT-TERM GROWTH DRIVER MEDIUM-TERM GROWTH DRIVER LONG-TERM GROWTH DRIVER ENHANCE global brand relevance through CPG ACCELERATE DD U.S. contiguous store expansion GROW comp store sales and profitability in DD U.S.

INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S. 7

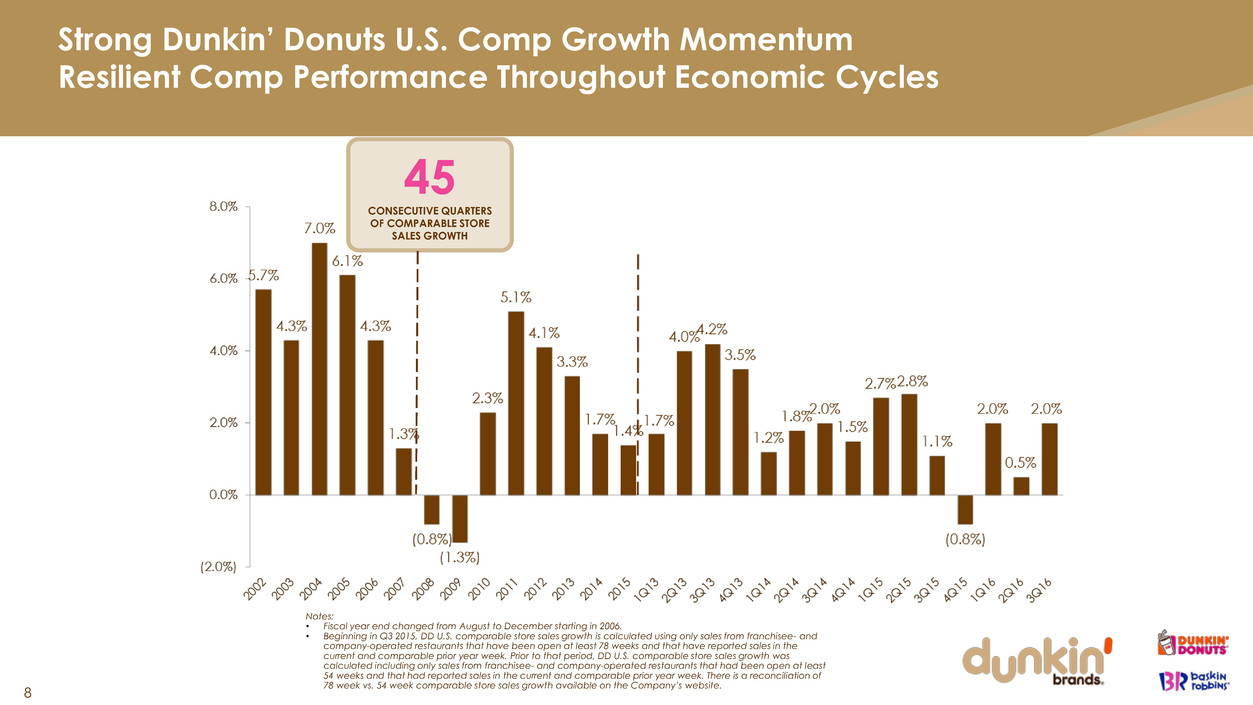

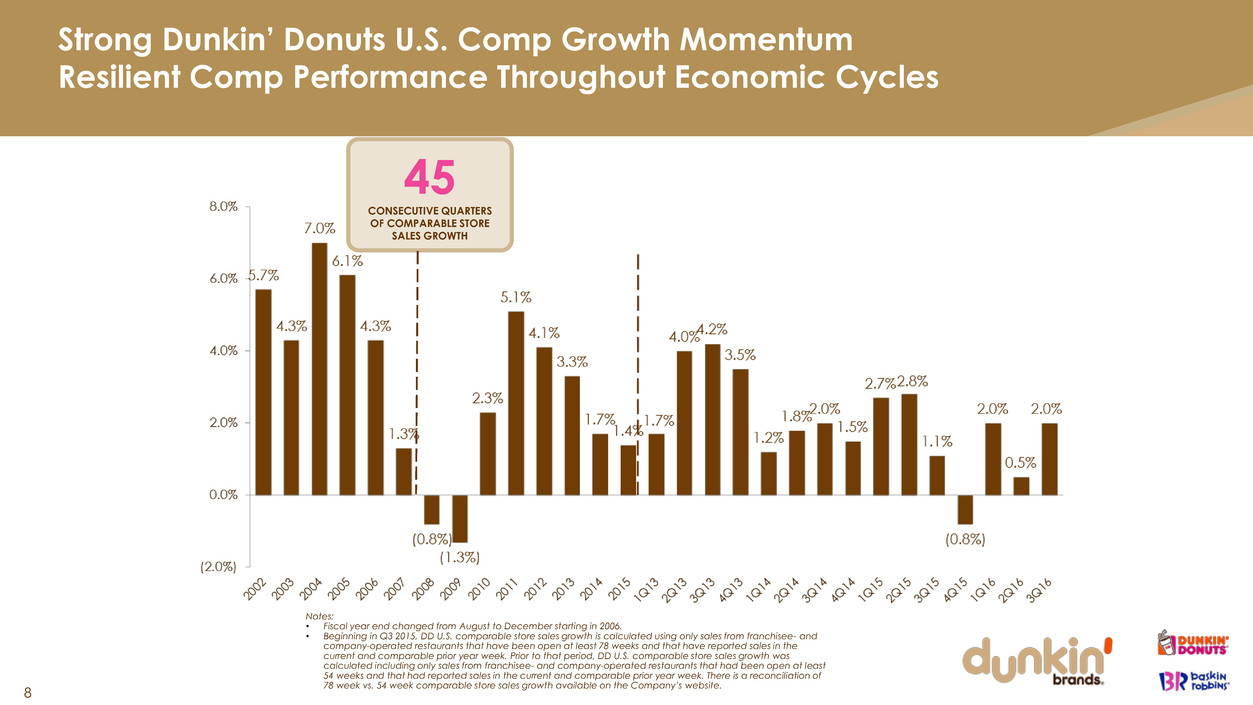

Strong Dunkin’ Donuts U.S. Comp Growth Momentum Resilient Comp Performance Throughout Economic Cycles 8 Notes: • Fiscal year end changed from August to December starting in 2006. • Beginning in Q3 2015, DD U.S. comparable store sales growth is calculated using only sales from franchisee- and company-operated restaurants that have been open at least 78 weeks and that have reported sales in the current and comparable prior year week. Prior to that period, DD U.S. comparable store sales growth was calculated including only sales from franchisee- and company-operated restaurants that had been open at least 54 weeks and that had reported sales in the current and comparable prior year week. There is a reconciliation of 78 week vs. 54 week comparable store sales growth available on the Company’s website. 45 CONSECUTIVE QUARTERS OF COMPARABLE STORE SALES GROWTH

Dunkin’ Donuts U.S. Strategies: Continuing the evolution 9 Building our Coffee Culture Faster and Improved Product Innovation Becoming a Digital Leader Improving Restaurant Experience Targeted Value and Smart Pricing

Building a strong Dunkin’ Donuts U.S. digital ecosystem to power targeted 1:1 engagement 10 21M+ Mobile App Users 7M+ Email Subscribers 5.4M DD Perks Members 15M+ Social Connections

CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION 11

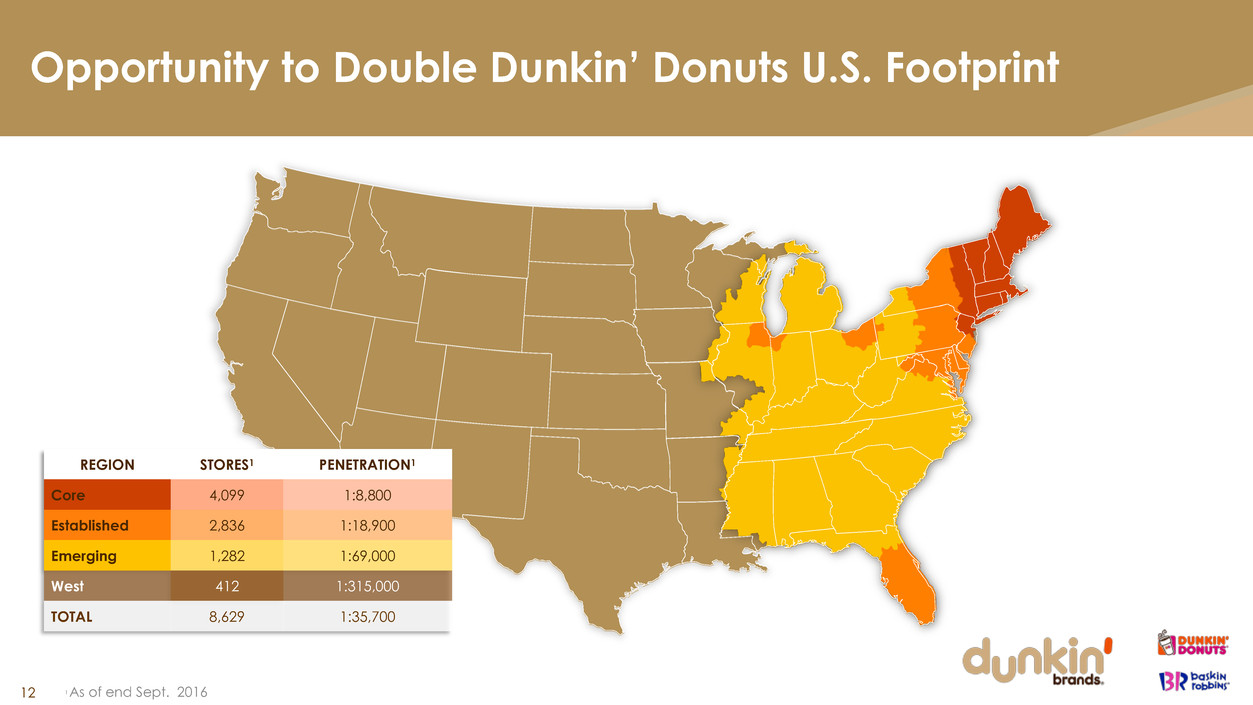

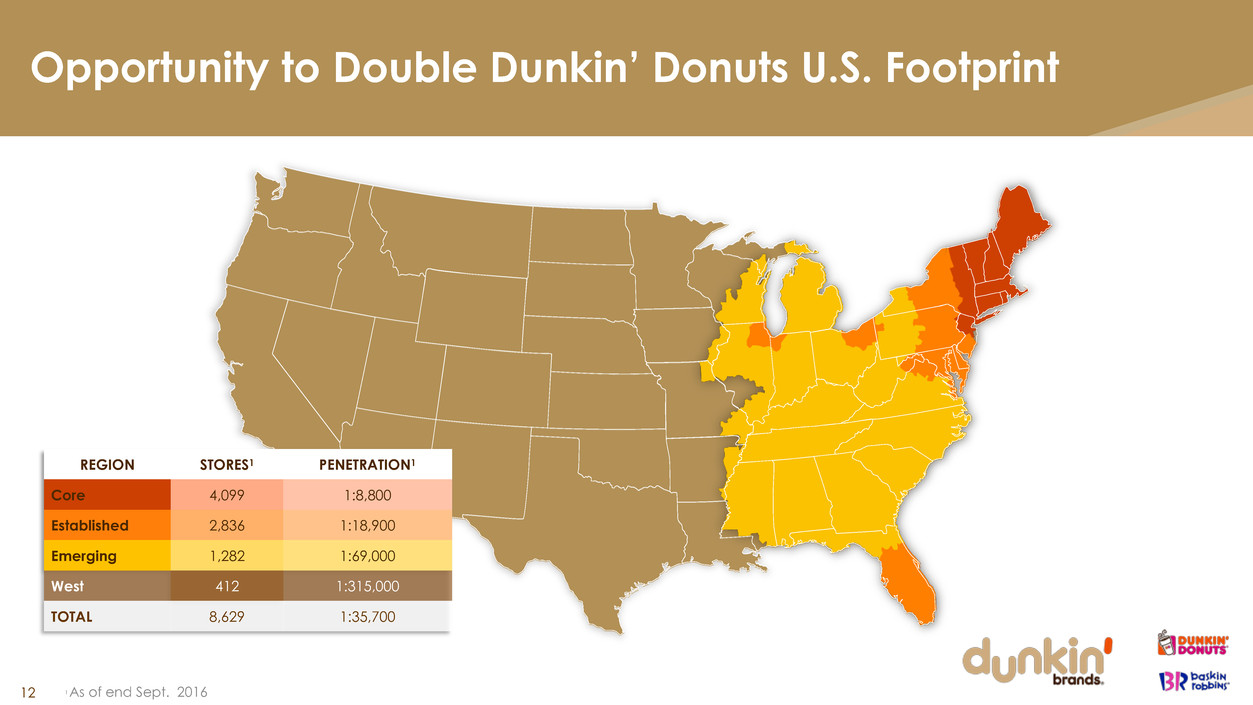

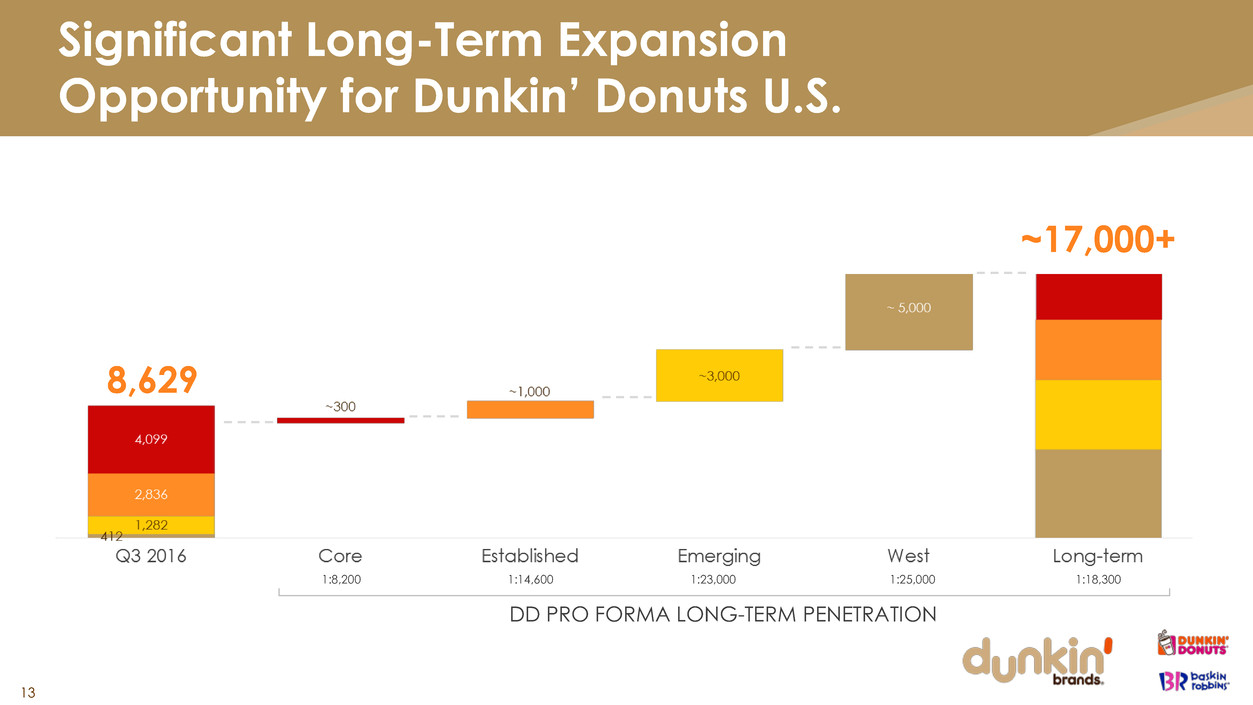

Opportunity to Double Dunkin’ Donuts U.S. Footprint 1 As of end Sept. 2016 12 REGION STORES1 PENETRATION1 Core 4,099 1:8,800 Established 2,836 1:18,900 Emerging 1,282 1:69,000 West 412 1:315,000 TOTAL 8,629 1:35,700

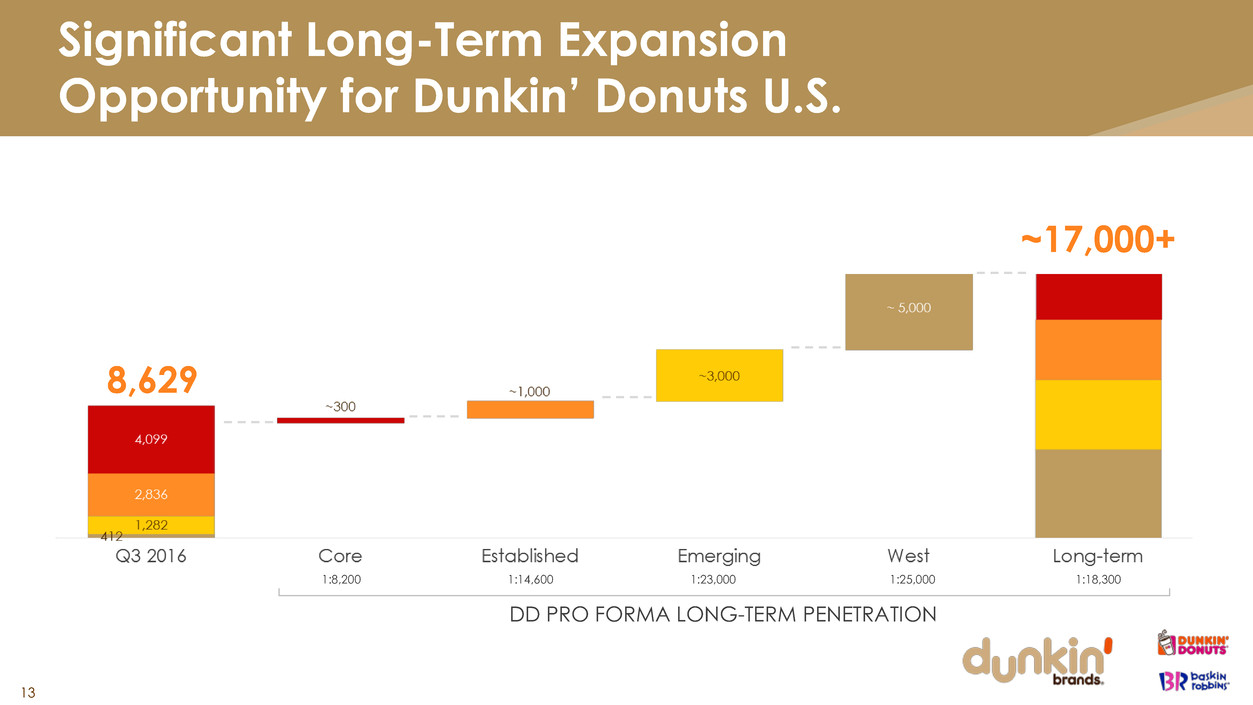

Significant Long-Term Expansion Opportunity for Dunkin’ Donuts U.S. 13 DD PRO FORMA LONG-TERM PENETRATION 8,629 ~17,000+ 1:8,200 1:14,600 1:23,000 1:25,000 1:18,300

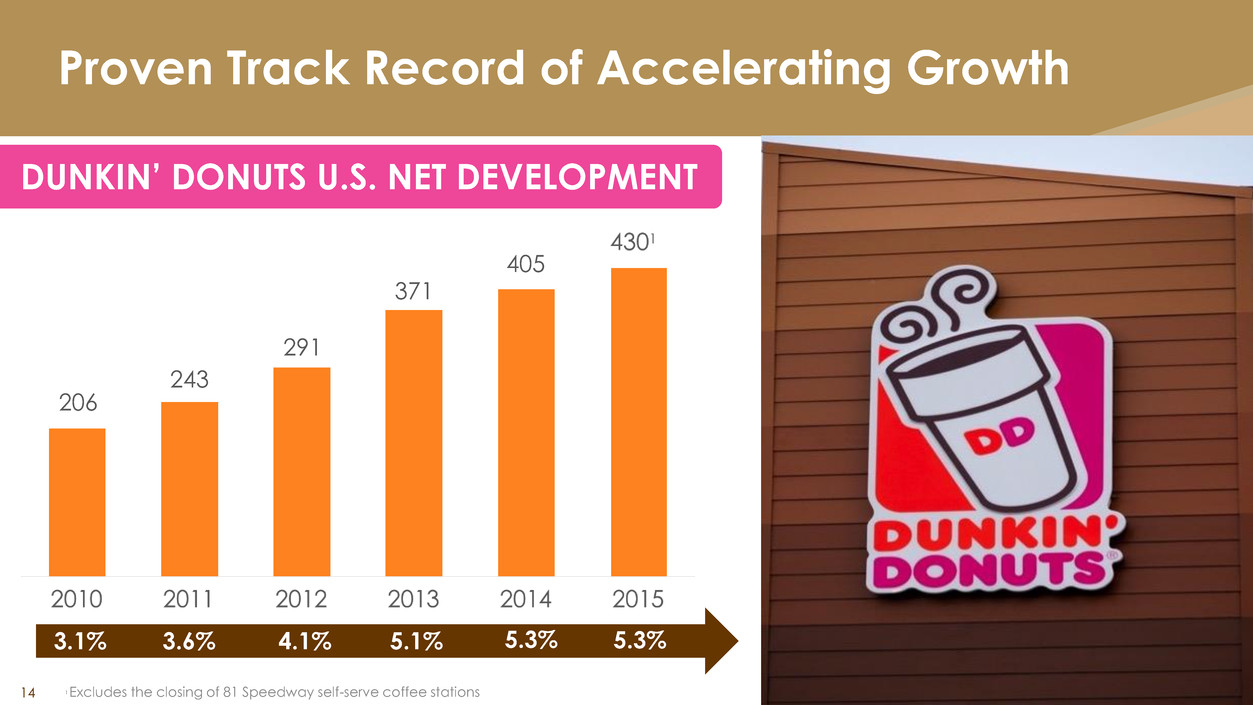

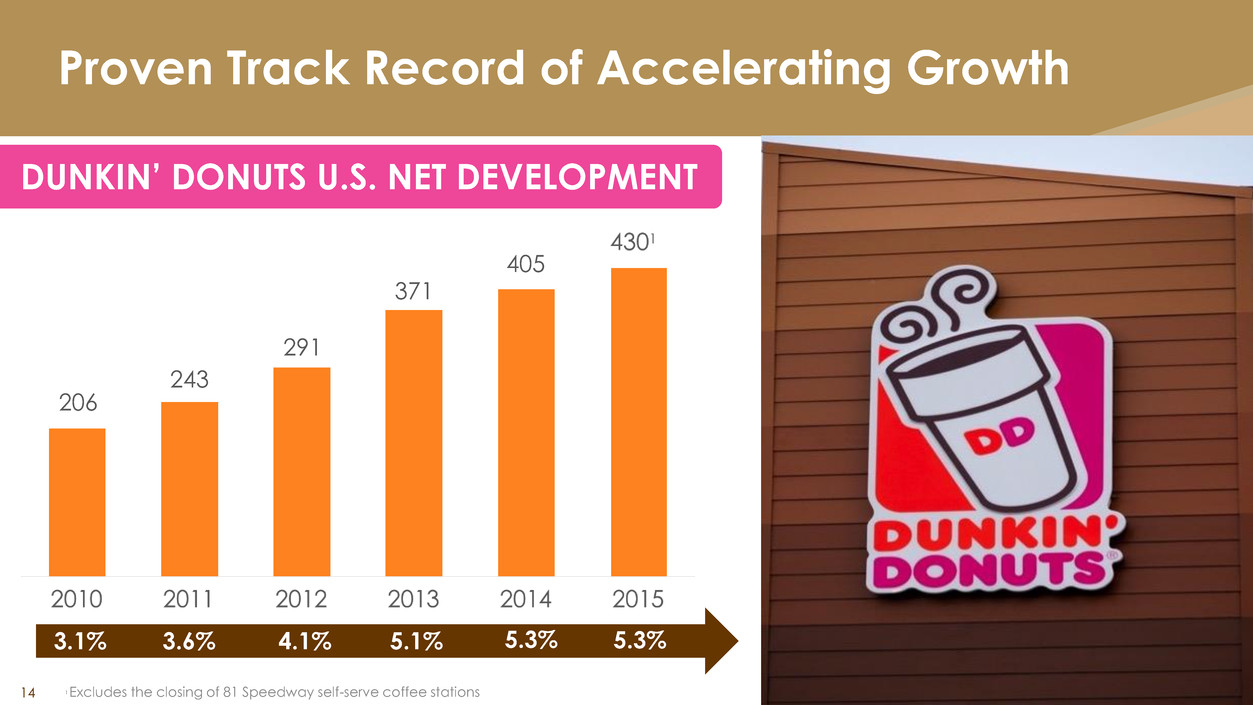

Proven Track Record of Accelerating Growth 14 206 243 291 371 DUNKIN’ DONUTS U.S. NET DEVELOPMENT 405 3.1% 3.6% 4.1% 5.1% 5.3% 1 Excludes the closing of 81 Speedway self-serve coffee stations 5.3%

Compelling Unit Economics Driving Accelerated Growth 15 AVERAGE UNIT VOLUMES $900,000 CASH-ON-CASH RETURNS 20% AVERAGE INITIAL CAPEX $485,000 2014 West & Emerging Cohort Store-Level Economics – Traditional Stores As of Sept. 2016 Standalone, Traditional Dunkin Donuts Restaurants only

DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS . 16

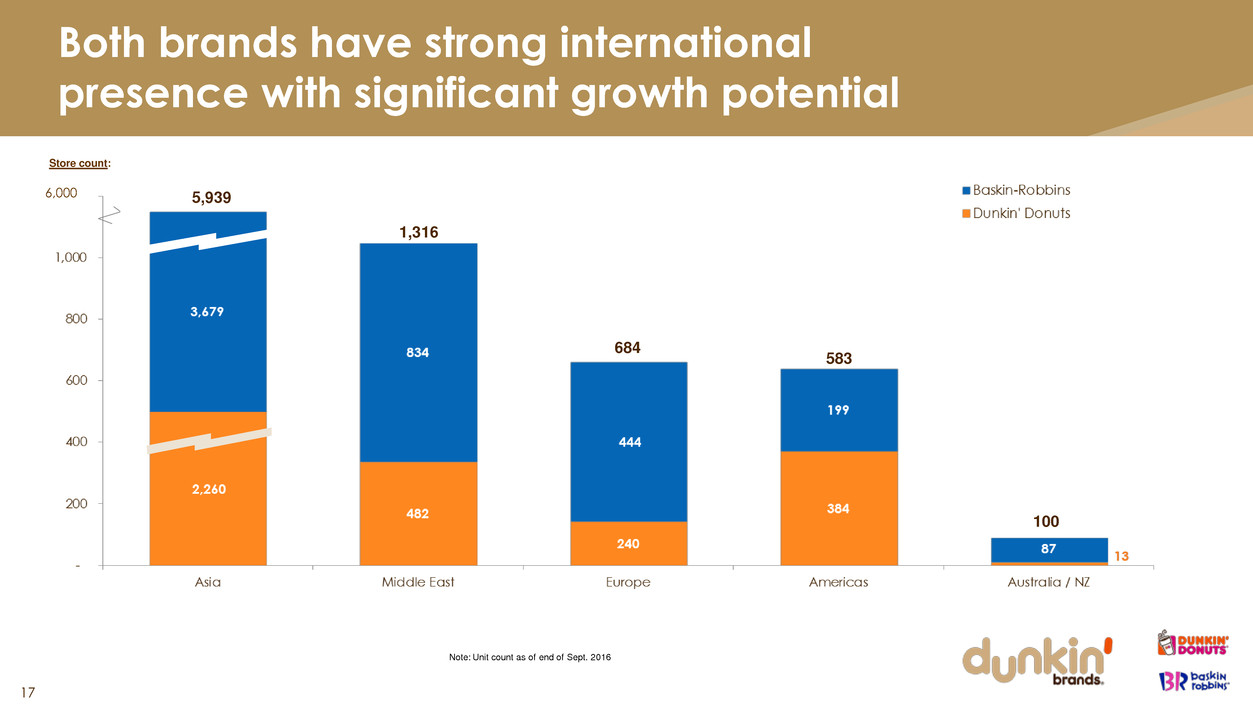

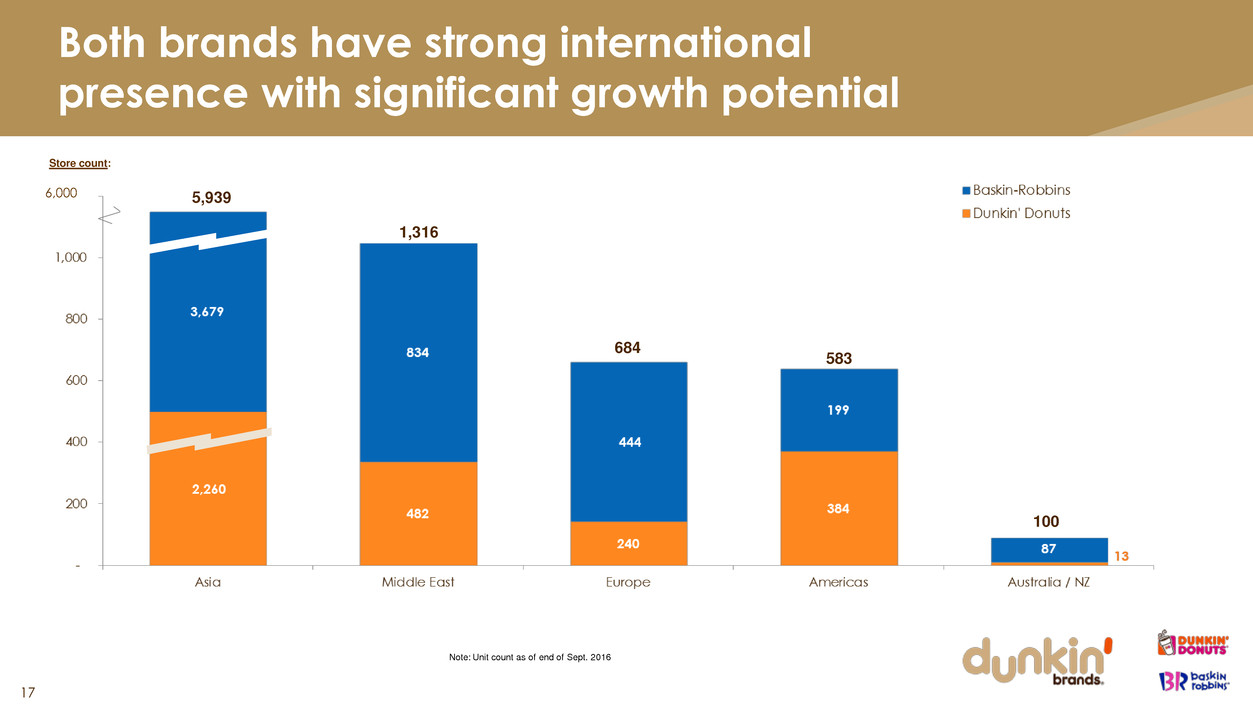

Note: Unit count as of end of Sept. 2016 Both brands have strong international presence with significant growth potential 17 Store count: 5,939 684 583 100 1,316 6,000

Growing our international business in highest-profit potential markets DD Europe off to good start; promising future DD & BR Middle East consistent strong performers Excitement for DD & BR in China after reformatting DD & BR steady growth in Southeast Asia DD Latin America has upside potential 18

INCREASE COMPARABLE STORE SALES AND DRIVE STORE GROWTH FOR BR U.S. 19

(0.9)% Q3 2016 comps Expecting slightly positive comp store sales in 2016 Driving topline sales with technology Attractive franchising offers Growing with top-performing franchisees 20 Restaurant base optimization complete Growing brand advertising fund 20 Returning Baskin-Robbins U.S. to Growth Expecting 5 to 10 net new restaurants in 2016 Improving unit economics Opened 19 net new restaurants in 2015

ENHANCE GLOBAL BRAND RELEVANCE THROUGH CPG 21

Strong Dunkin’ K-Cup Launch in Retail – 300M+ Dunkin’ K-Cups sold in 1st year totaling nearly $220M in retail sales1 22 Enhancing and growing brand awareness 1 As reported by IRI retail scanner data

CAPITAL STRUCTURE & SHAREHOLDER RETURNS 23

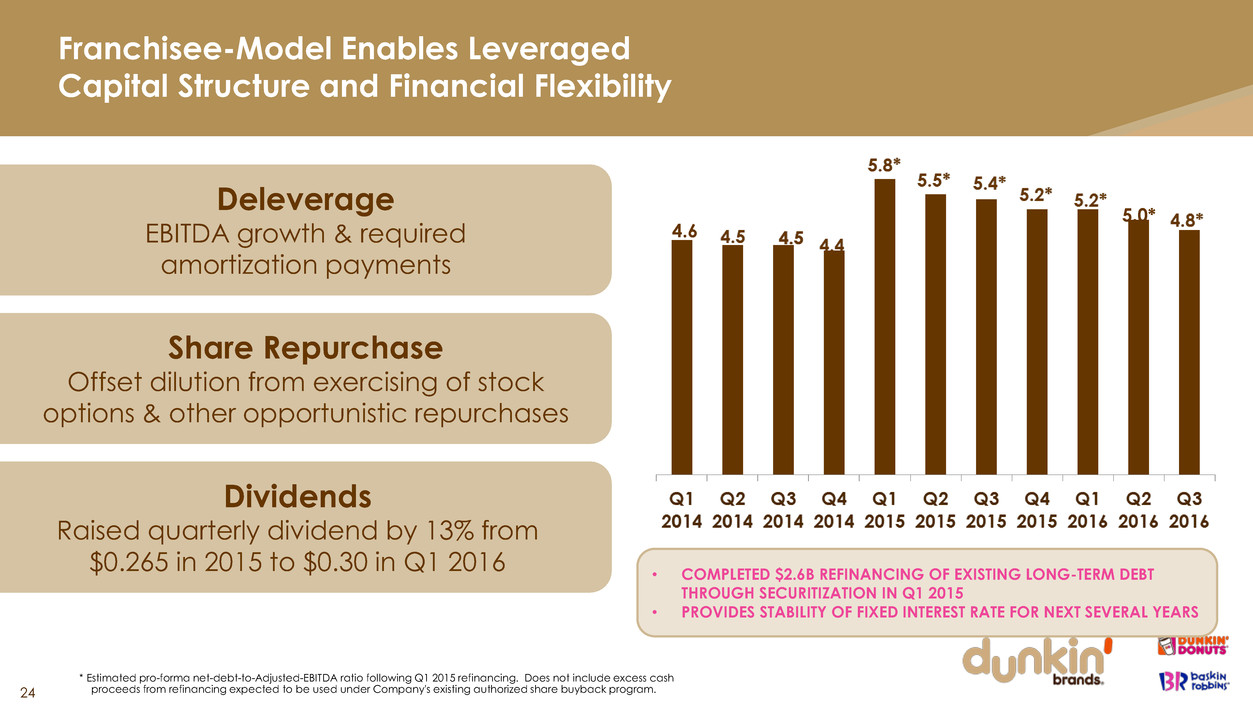

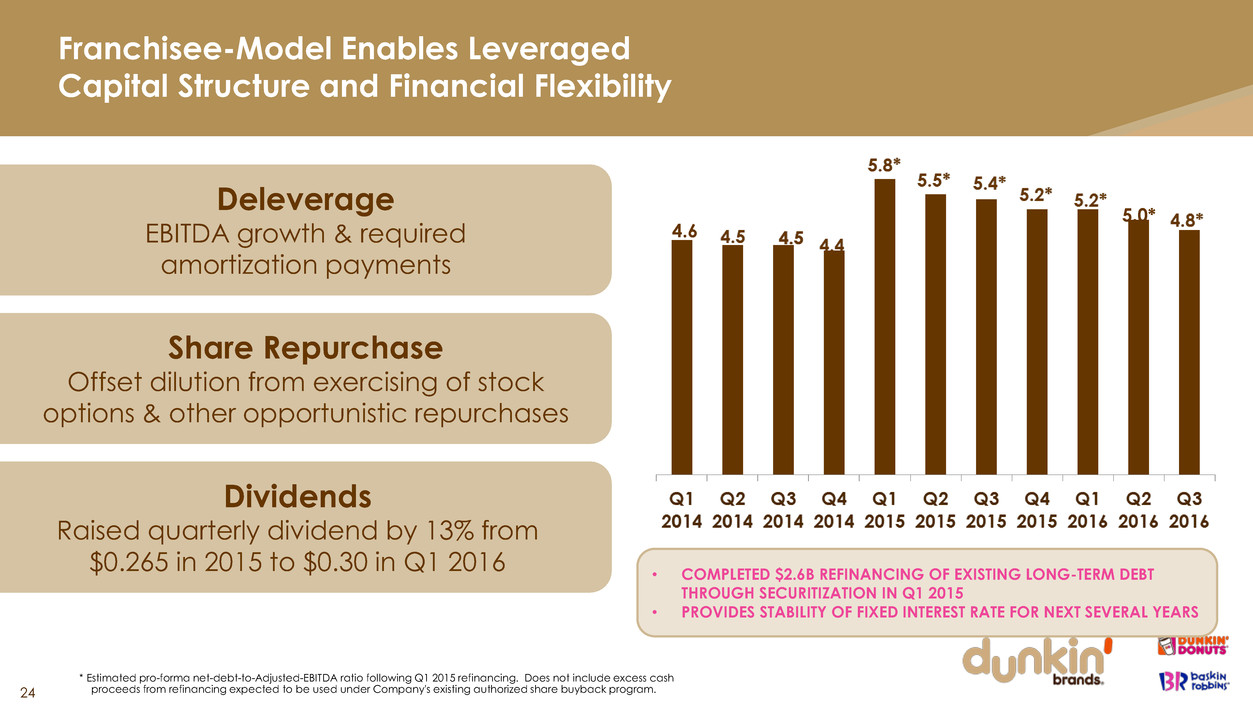

Franchisee-Model Enables Leveraged Capital Structure and Financial Flexibility 24 Deleverage EBITDA growth & required amortization payments Share Repurchase Offset dilution from exercising of stock options & other opportunistic repurchases Dividends Raised quarterly dividend by 13% from $0.265 in 2015 to $0.30 in Q1 2016 4.6 • COMPLETED $2.6B REFINANCING OF EXISTING LONG-TERM DEBT THROUGH SECURITIZATION IN Q1 2015 • PROVIDES STABILITY OF FIXED INTEREST RATE FOR NEXT SEVERAL YEARS * Estimated pro-forma net-debt-to-Adjusted-EBITDA ratio following Q1 2015 refinancing. Does not include excess cash proceeds from refinancing expected to be used under Company's existing authorized share buyback program. 5.0*

GROWTH TARGETS 25

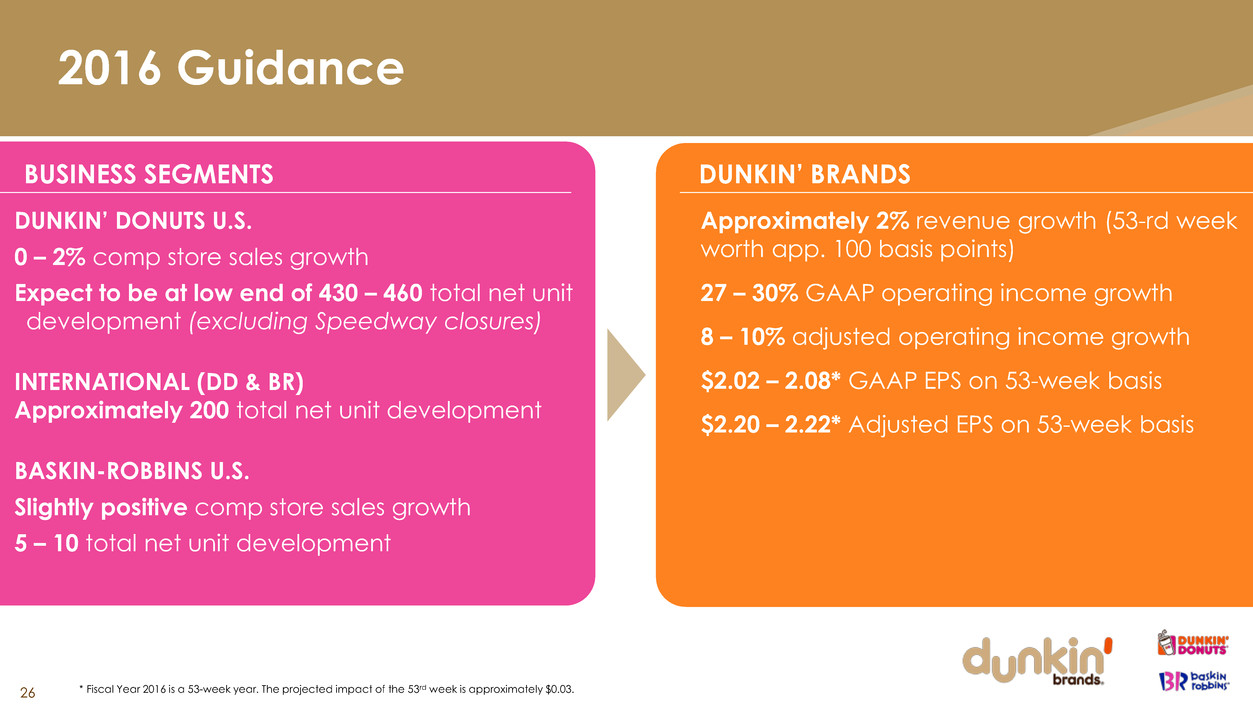

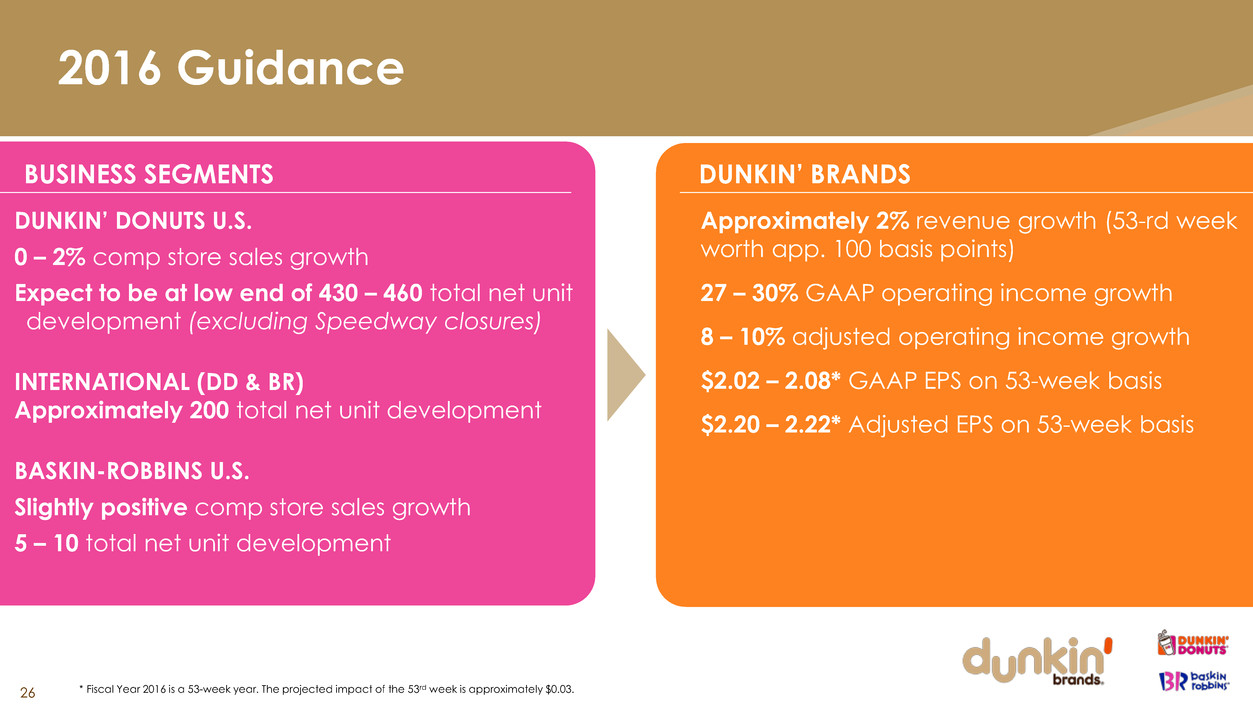

2016 Guidance 26 DUNKIN’ DONUTS U.S. 0 – 2% comp store sales growth Expect to be at low end of 430 – 460 total net unit development (excluding Speedway closures) INTERNATIONAL (DD & BR) Approximately 200 total net unit development BASKIN-ROBBINS U.S. Slightly positive comp store sales growth 5 – 10 total net unit development BUSINESS SEGMENTS DUNKIN’ BRANDS Approximately 2% revenue growth (53-rd week worth app. 100 basis points) 27 – 30% GAAP operating income growth 8 – 10% adjusted operating income growth $2.02 – 2.08* GAAP EPS on 53-week basis $2.20 – 2.22* Adjusted EPS on 53-week basis * Fiscal Year 2016 is a 53-week year. The projected impact of the 53rd week is approximately $0.03.

Q3 2016 Dunkin’ Brands Investor Presentation 27