2018 Investor & Analyst Day February 8, 2018

Forward Looking Statements • Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. • Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. We do not undertake to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved and the Company undertakes no duty to update its targets. • Regulation G This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These measure should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP amounts to the relevant GAAP amount are available on www.investor.dunkinbrands.com.

Proud of Our Heritage

Evolving to Stay Modern and Relevant with Consumers

6

7

Asset Light, 100% Franchised Model Strong Free Cash Flow Shareholder Friendly Returned $2B to Shareholders Since IPO Two Brands with Deep Heritage & Intense Consumer Loyalty Significant White Space Opportunities for U.S. Growth Strong Restaurant-level Economics Stable & Predictable Model Fan-centric Digital Following

Proud of Historical Global Development Growth; White Space Opportunities Ahead 0 3,000 6,000 9,000 12,000 15,000 18,000 21,000 2011 2012 2013 2014 2015 2016 2017 DD U.S. BR U.S. DD Int'l BR Int'l 4,150 net new stores opened globally since the IPO

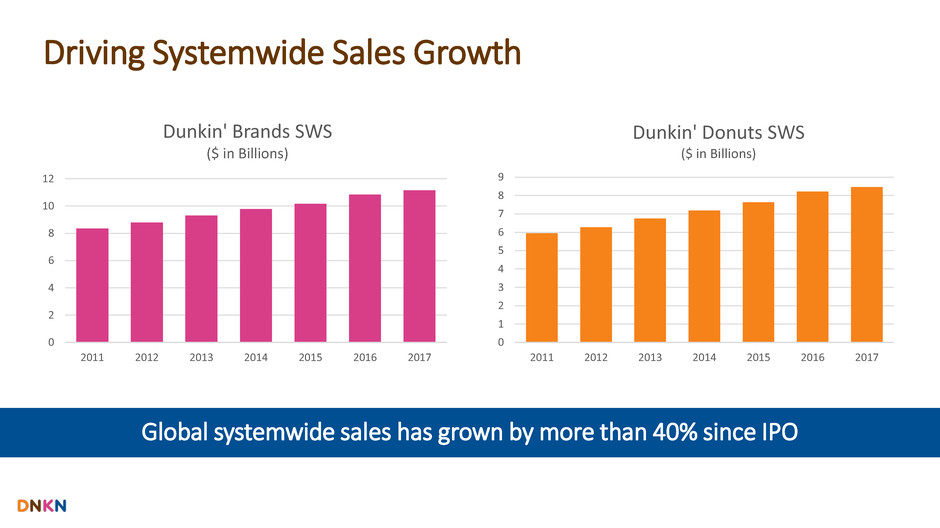

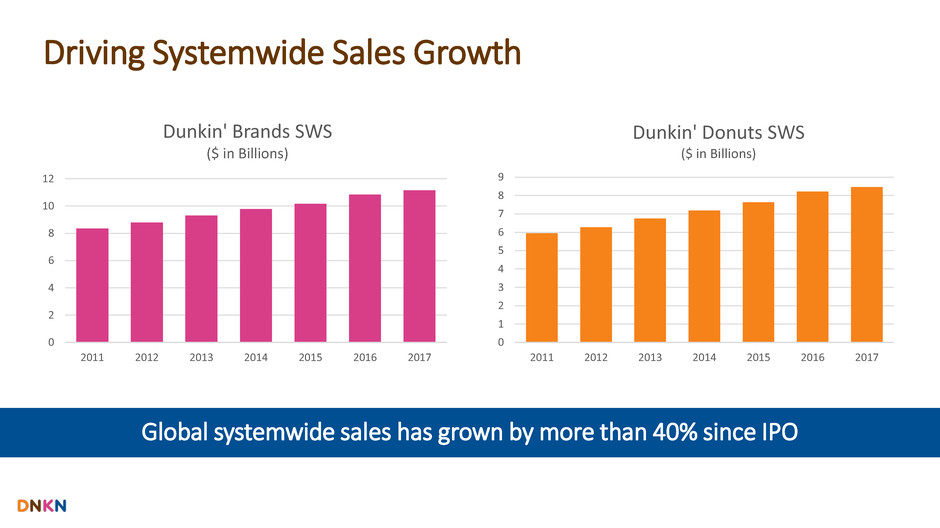

Driving Systemwide Sales Growth 0 2 4 6 8 10 12 2011 2012 2013 2014 2015 2016 2017 Dunkin' Brands SWS ($ in Billions) 0 1 2 3 4 5 6 7 8 9 2011 2012 2013 2014 2015 2016 2017 Dunkin' Donuts SWS ($ in Billions) Global systemwide sales has grown by more than 40% since IPO

Baskin-Robbins U.S.

13 Baskin-Robbins U.S.

International

15 Dunkin’ Donuts China Opportunities Abound in China

Baskin-Robbins International

17 Baskin-Robbins UK

Baskin-Robbins Korea

Reaching Consumers Outside the Traditional Four Walls

Dunkin’ Donuts International

21

22 Dunkin’ Donuts Chile

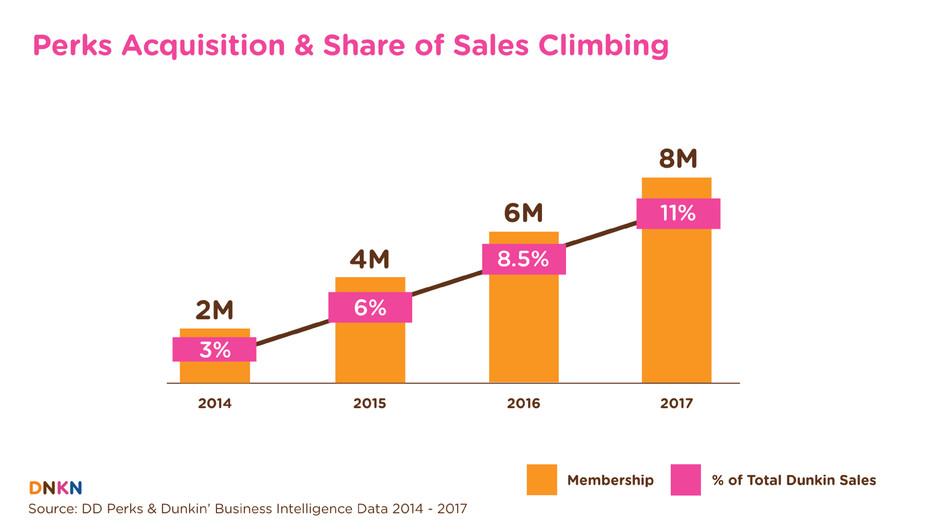

Continue to Invest in Digital Future

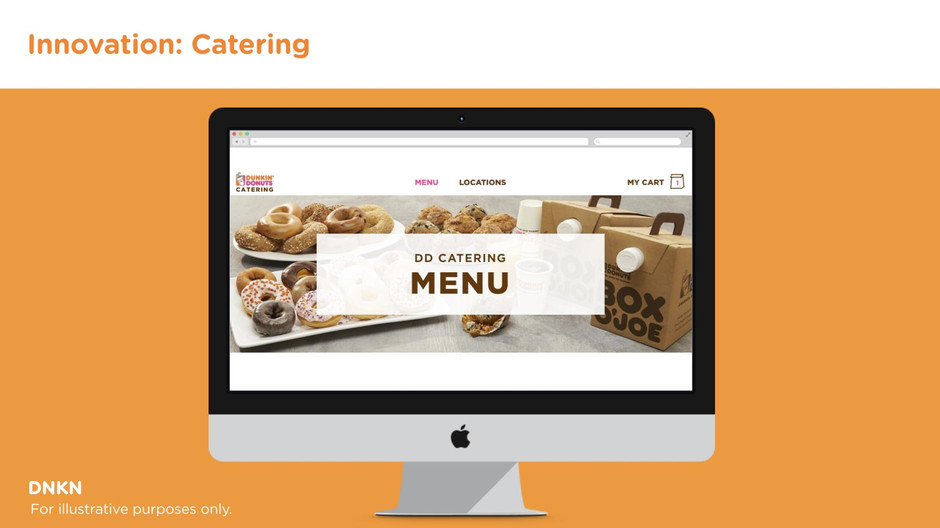

Looking Ahead Net Unit Development Blueprint for Growth CPG Digital

DD U.S. BLUEPRINT FOR GROWTH Dave Hoffmann, President of Dunkin’ Donuts U.S.

YEAR 1: TIME TO MAKE THE DONUTS Compelling business model • Strong unit economics • Record of delivering top shareholder value

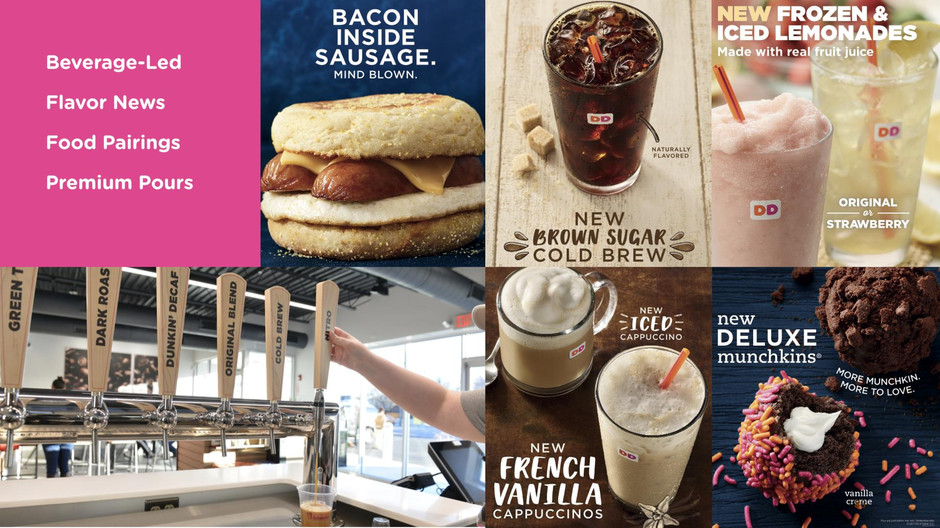

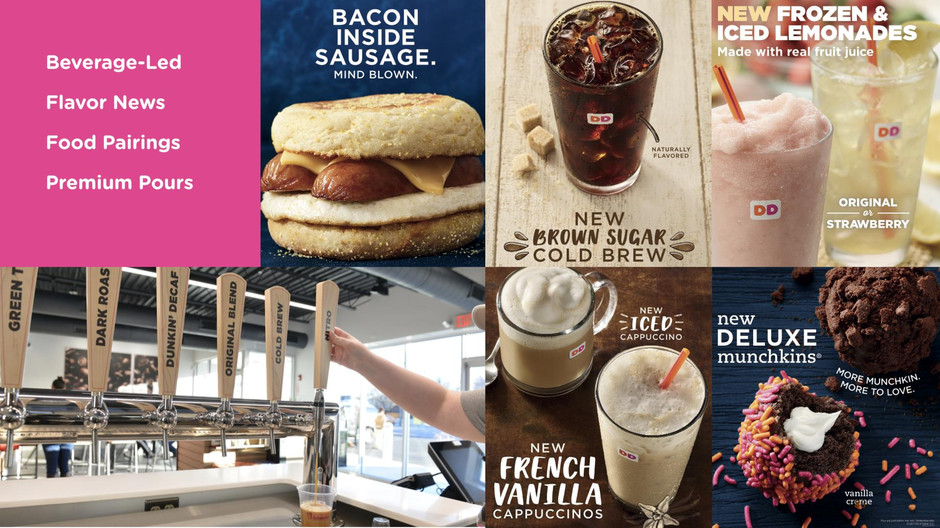

OUR FOCUS: BEVERAGE-LED, ON-THE-GO

OPERATIONALIZING OUR PLAN: BLUEPRINT FOR GROWTH

29 Brand Evolution Menu Innovation Unparalleled Convenience Broad Accessibility AMER ICA ’ S M O S T L O V E D B E V E R A G E - L E D , O N - T H E - G O B R A N D Menu Innovation Restaurant Excellence Broad Accessibility Br nd luti Unparalleled Convenience

30 DUNKIN’ 2020

31 DD U.S. SAME STORE SALES Low single digit growth accelerating to upwards of 3% by 2020

Stabilize the Core Beverage-Led Innovation National Value Platform Bolt-on Revenue Streams NextGen Store + Equipment

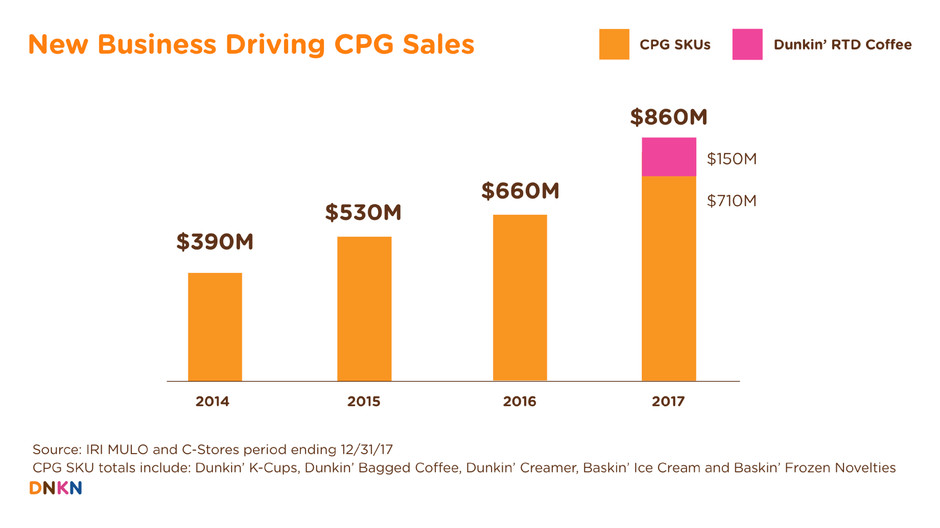

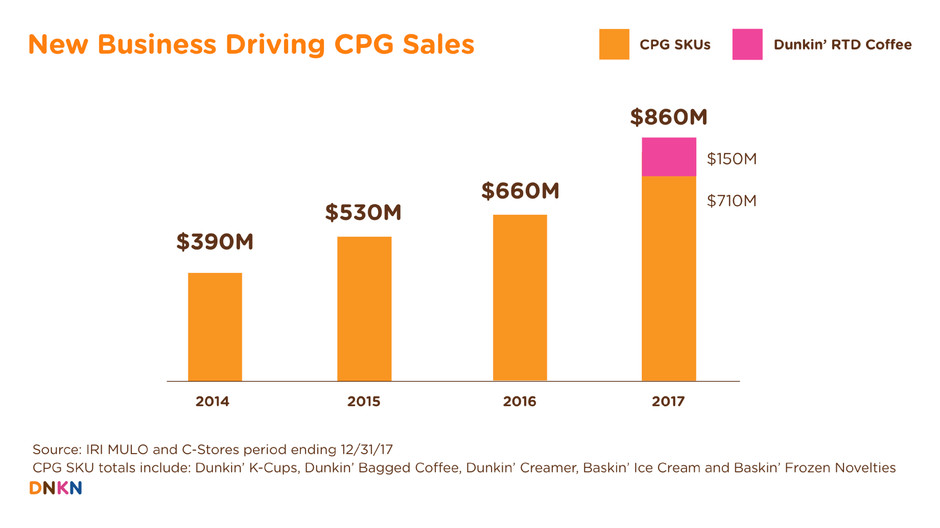

33 CONSUMER PACKAGED GOODS High single digit growth

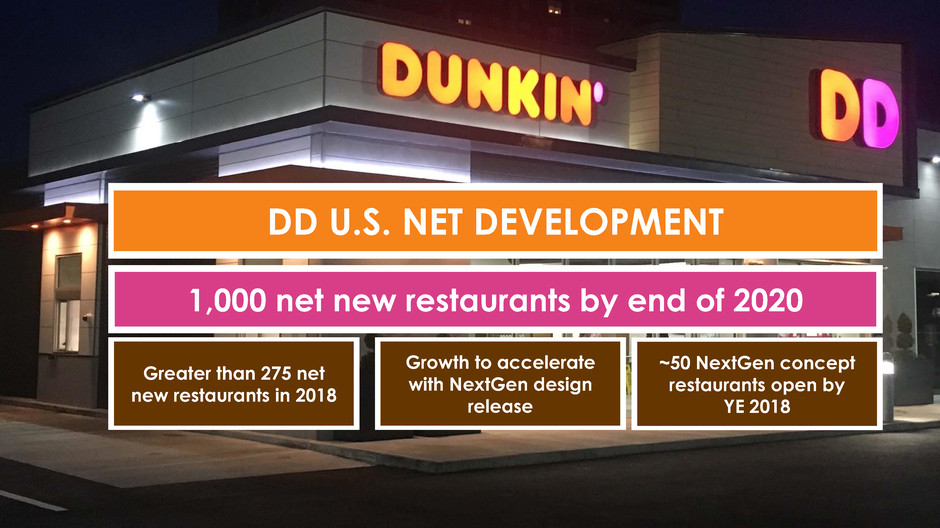

34 DD U.S. NET DEVELOPMENT 1,000 net new restaurants by end of 2020 Greater than 275 net new restaurants in 2018 Growth to accelerate with NextGen design release ~50 NextGen concept restaurants open by YE 2018

DD U.S. RESTAURANT EXPANSION

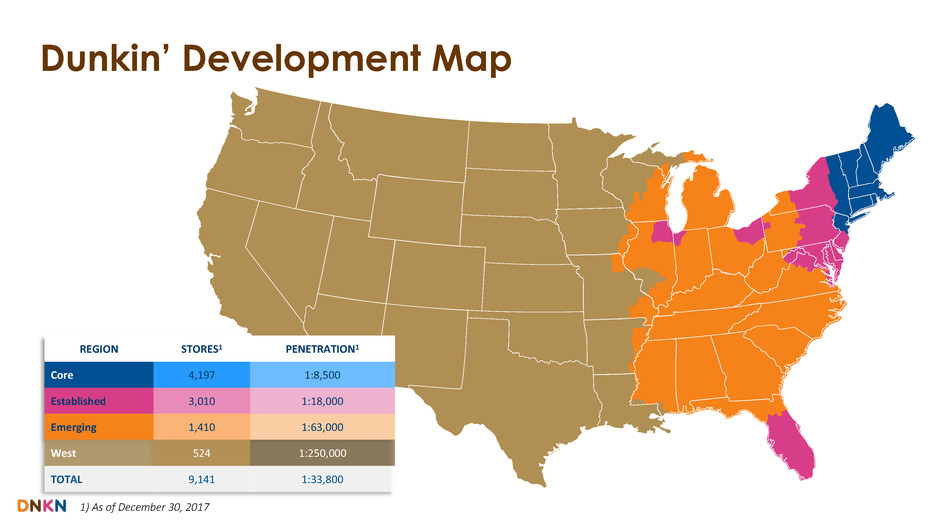

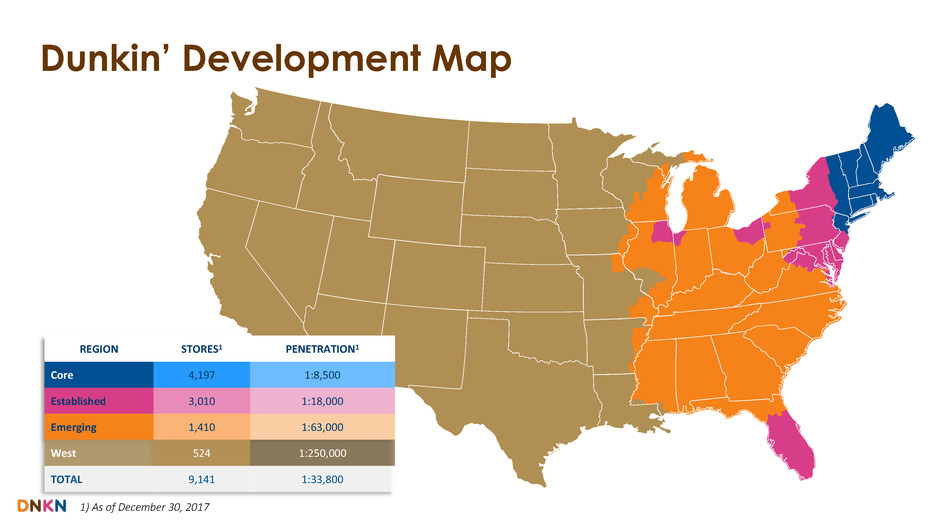

REGION STORES1 PENETRATION1 Core 4,197 1:8,500 Established 3,010 1:18,000 Emerging 1,410 1:63,000 West 524 1:250,000 TOTAL 9,141 1:33,800 Dunkin’ Development Map 1) As of December 30, 2017

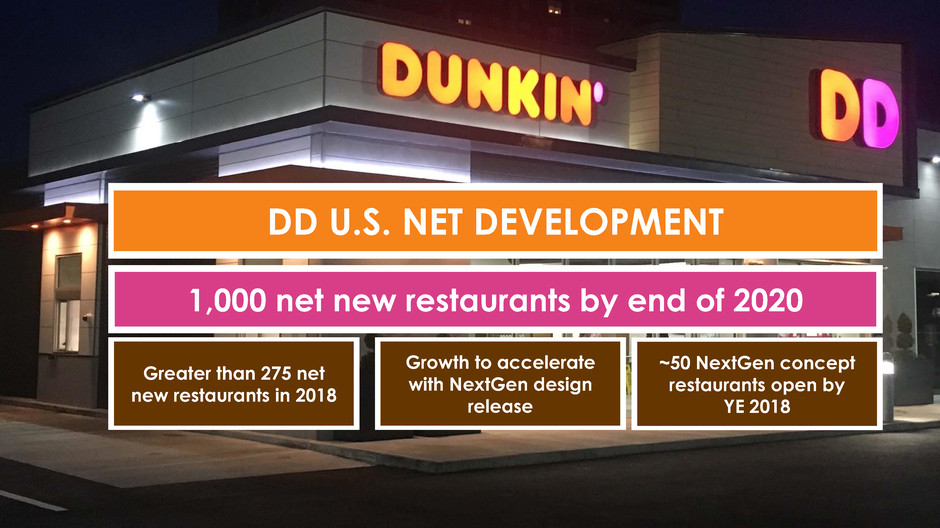

DIFFERENT DEVELOPMENT STRATEGIES FOR DIFFERENT MARKETS

Different Development Strategies for Different Markets Northeast Primarily: • Remodels • Relocations • Consolidation

Different Development Strategies for Different Markets East of the Mississippi River Planted Seeds Few Years Ago: Coming to Fruition Now

Different Development Strategies for Different Markets West of the Mississippi River Growth Today, Tomorrow & Beyond Not Yet Selling SDAs

Different Development Strategies for Different Markets West of the Mississippi River CA: 57% Growth Rate in 2017 Not Yet Selling SDAs Growth Today, Tomorrow & Beyond 2016 WEST & EMERGING COHORT’S EXPECTED CASH-ON- CASH RETURNS 18% - 20%

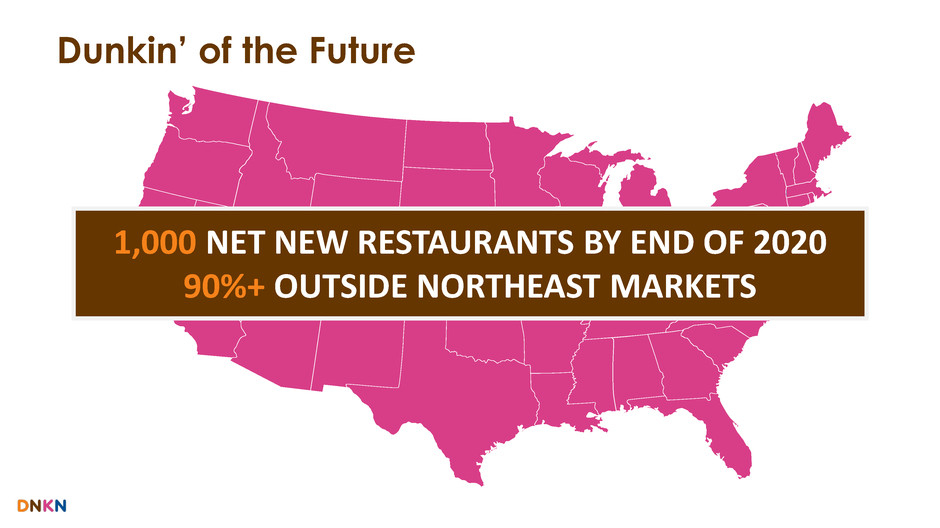

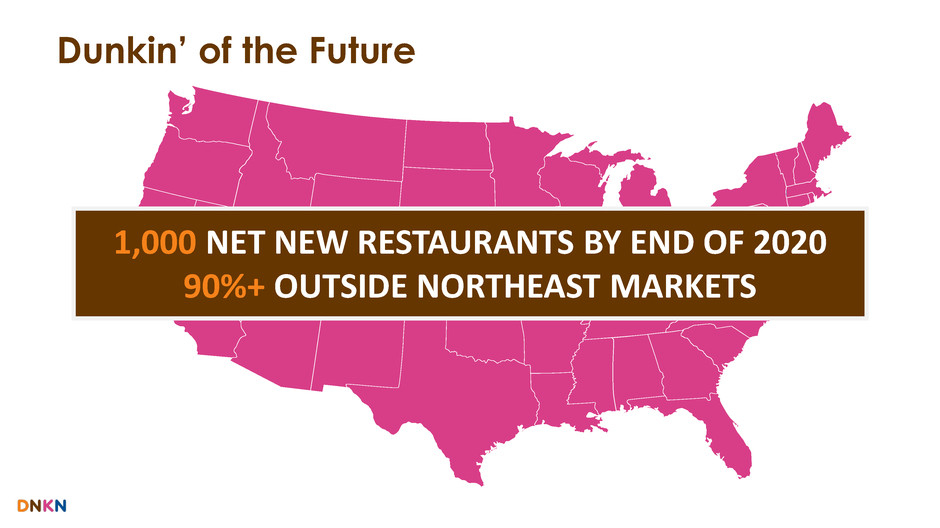

Dunkin’ of the Future 1,000 NET NEW RESTAURANTS BY END OF 2020 90%+ OUTSIDE NORTHEAST MARKETS

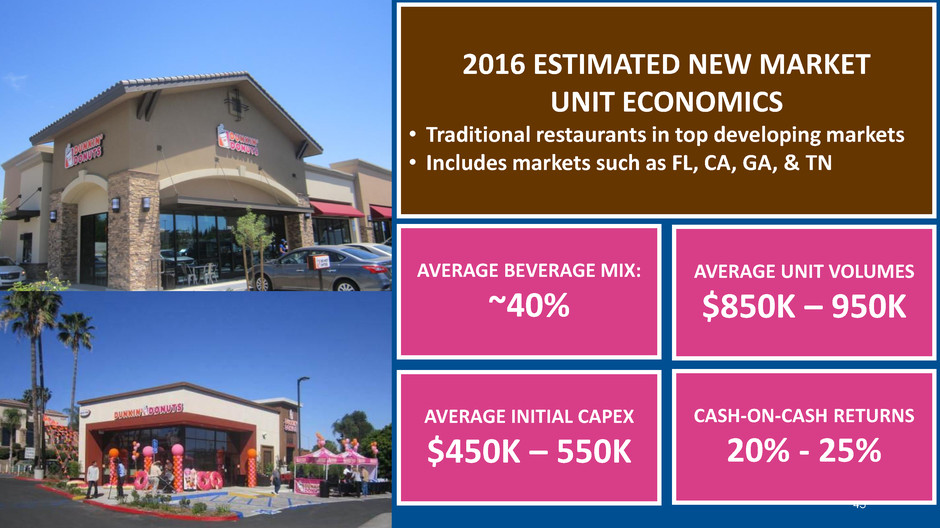

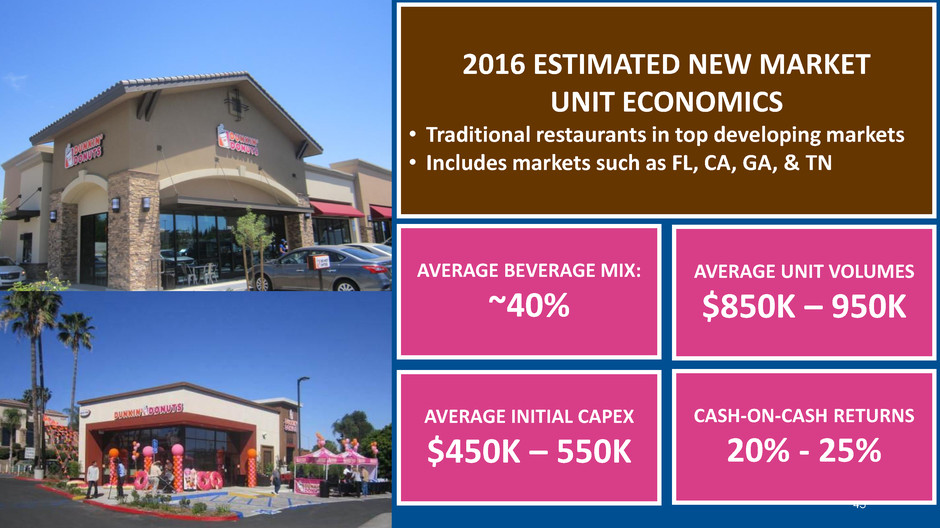

43 2016 ESTIMATED NEW MARKET UNIT ECONOMICS • Traditional restaurants in top developing markets • Includes markets such as FL, CA, GA, & TN AVERAGE BEVERAGE MIX: ~40% AVERAGE INITIAL CAPEX $450K – 550K AVERAGE UNIT VOLUMES $850K – 950K CASH-ON-CASH RETURNS 20% - 25%

Dunkin’ of the Future 1,000 NET NEW RESTAURANTS BY END OF 2020 90%+ OUTSIDE NORTHEAST MARKETS

45 Brand Evolution Menu Innovation Unparalleled Convenience Broad Accessibility AMER ICA ’ S M O S T L O V E D B E V E R A G E - L E D , O N - T H E - G O B R A N D Menu Innovation Restaurant Excellence Broad Accessibility Br nd luti Unparalleled Convenience

DD U.S. Operations: Restaurant Excellence Scott Murphy, COO

9,000+ 1,000+ Restaurants Franchisees States 428 80% Average number of restaurants per network Franchisees in system >10 years

Robust Supply Chain • Franchisee-owned cooperative • One stop shopping for franchisees • $2 billion in annual purchases • $400 million in savings since 2012 Food safety, continuity of supply and franchisee profitability

49 Franchisee Concerns Labor Sales Competition Regulatory Source: December 2017 survey of all US Franchisees

Menu Simplification Store Equipment Store Technology 1 2 3

1

•Confusing menu •Too much choice •Unfocused •Inconsistent 80% from <20% Consumer Feedback

53 • Launched 42 LTOs • Can be complex • Hard to train • Need to simplify

• Data driven approach • Based upon our strategy • Test & learn philosophy

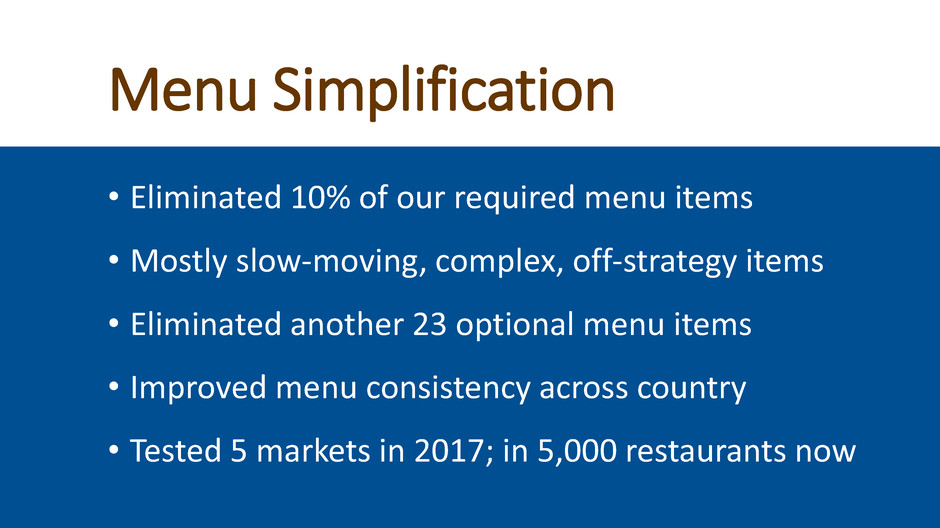

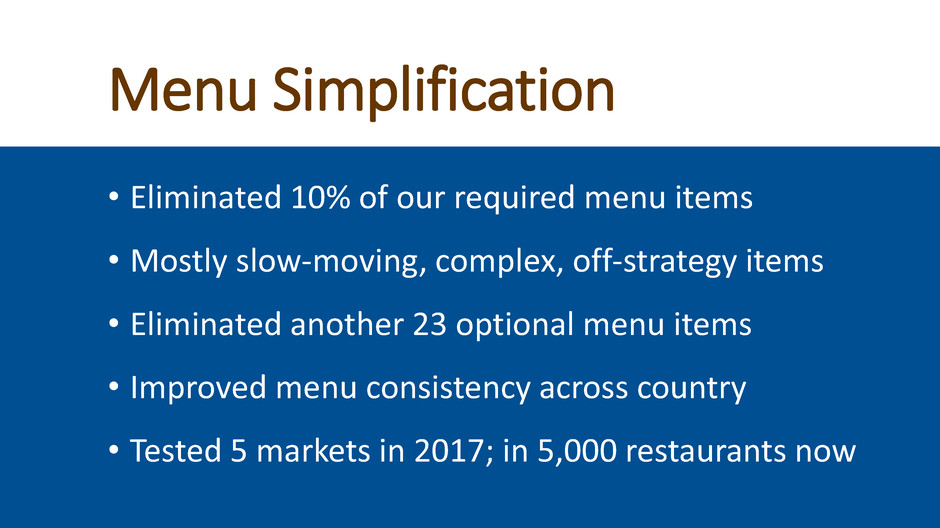

Menu Simplification • Eliminated 10% of our required menu items • Mostly slow-moving, complex, off-strategy items • Eliminated another 23 optional menu items • Improved menu consistency across country • Tested 5 markets in 2017; in 5,000 restaurants now

We trained crews to suggest replacements

Based upon the tests, we believe the impact will be… ~1% Short Term Sales Decline ~1% COGS Improvement ~1% Labor Improvement 2 points Accuracy Improvement Source: 2017 Menu Simplification Test Analysis

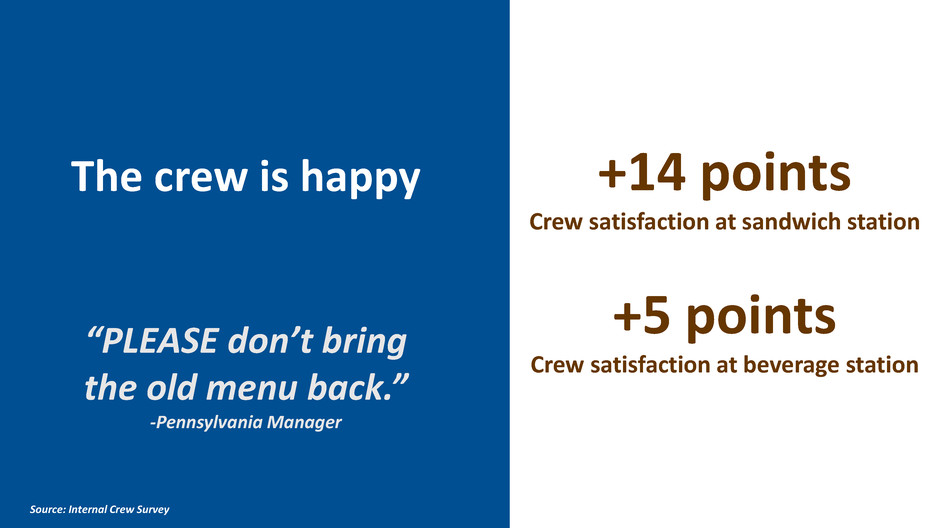

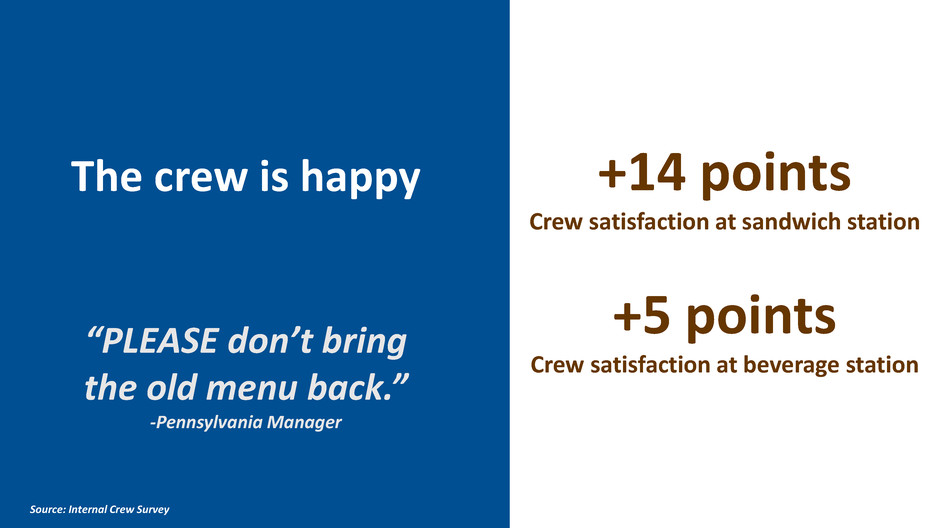

The crew is happy “PLEASE don’t bring the old menu back.” -Pennsylvania Manager +14 points Crew satisfaction at sandwich station +5 points Crew satisfaction at beverage station Source: Internal Crew Survey

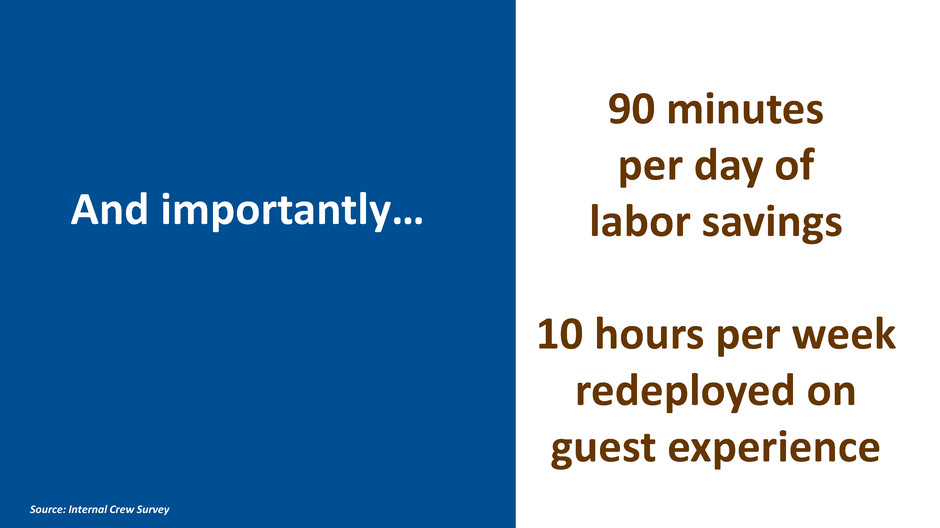

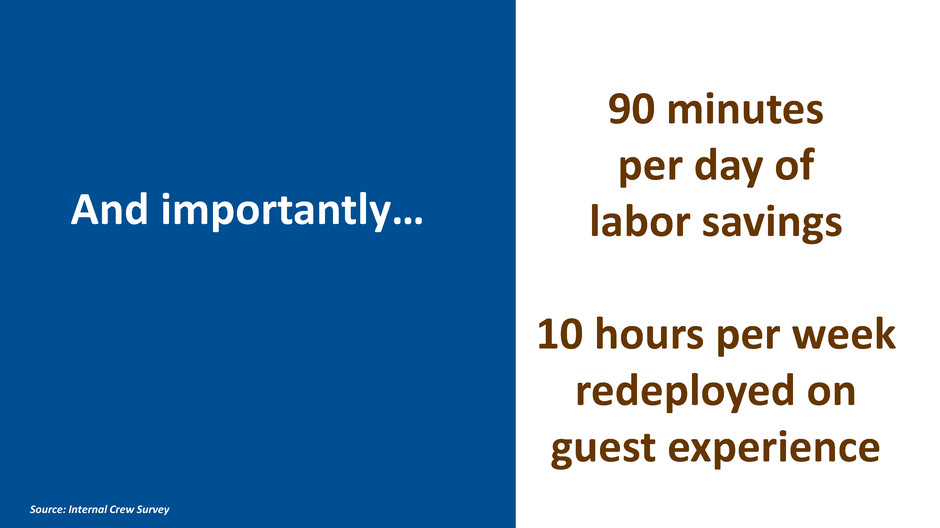

90 minutes per day of labor savings 10 hours per week redeployed on guest experience And importantly… Source: Internal Crew Survey

• Speed, accuracy • Profitability • Crew satisfaction • Labor efficiency • National by 3/31 Menu Simplification Making room for future innovation 1

Store Equipment2

Labor is the #1 issue our franchisees are facing in the U.S.

We need to become the employer of choice

67

CERTIFICATION PEOPLE PEOPLE FIRST CULTURE MENTORING HIRING ON-BOARDING UNIFORMS HIGHER WAGES SIMPLIFICATION SCHEDULING MANAGER CONNECTS TRAINING

Store Technology 3

We are world class at speed We need to be accurate as well

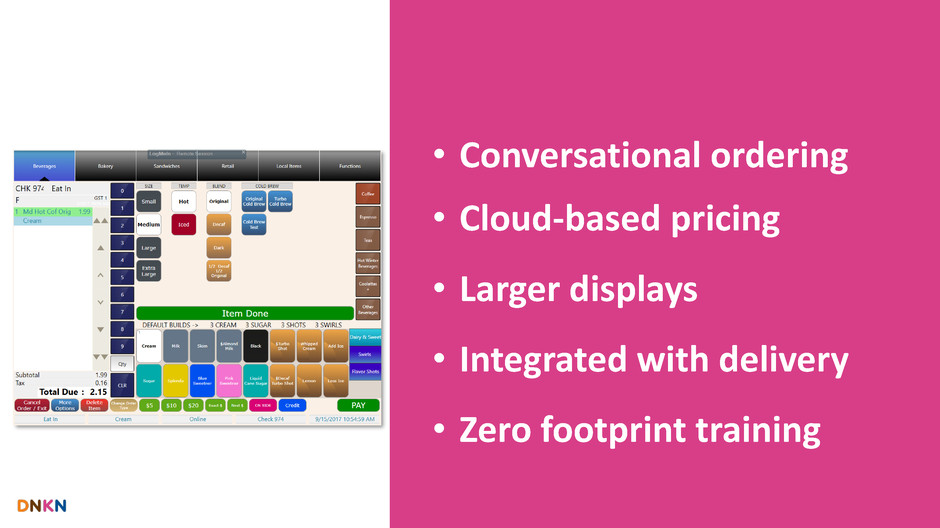

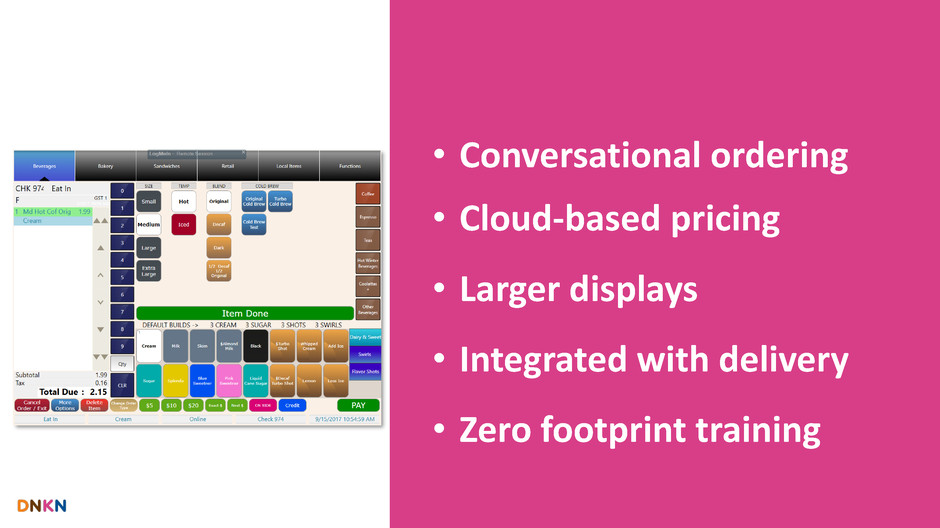

We are implementing a new store technology solution

• Conversational ordering • Cloud-based pricing • Larger displays • Integrated with delivery • Zero footprint training

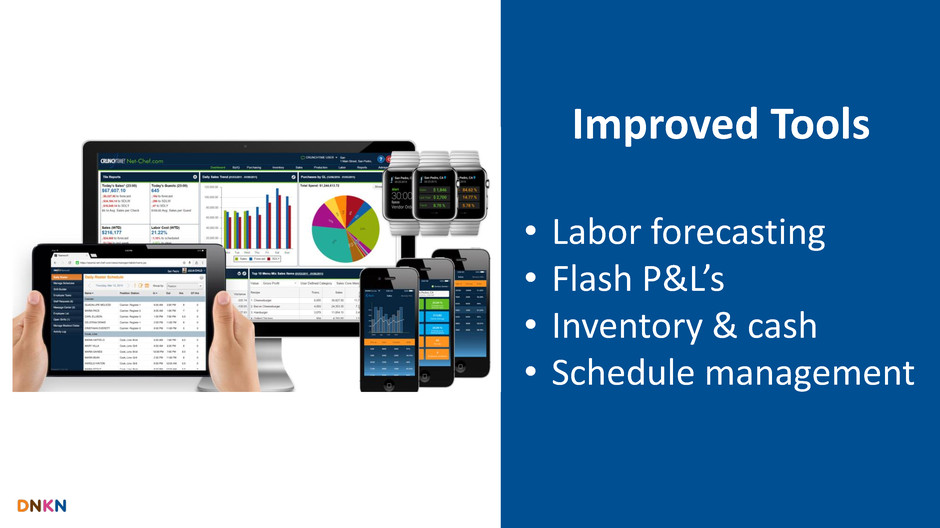

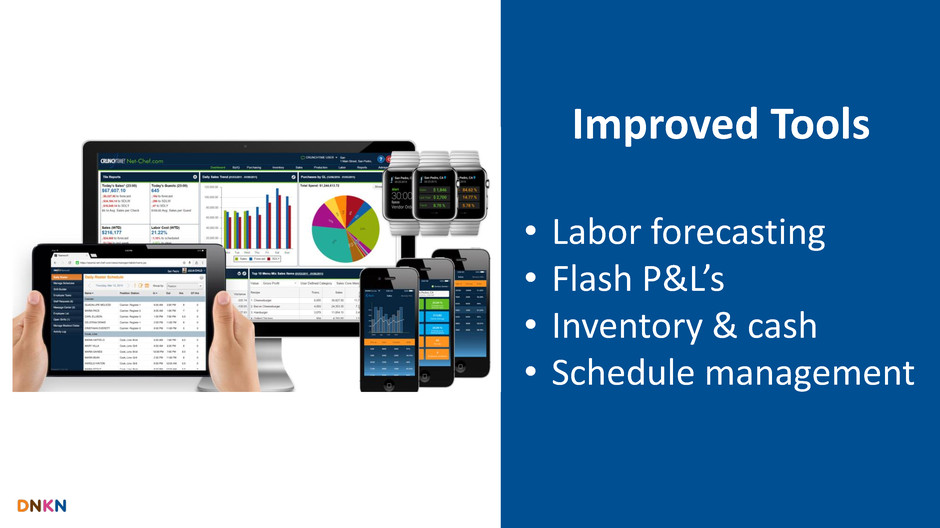

Improved Tools • Labor forecasting • Flash P&L’s • Inventory & cash • Schedule management

Franchise Profitability Guest Experience

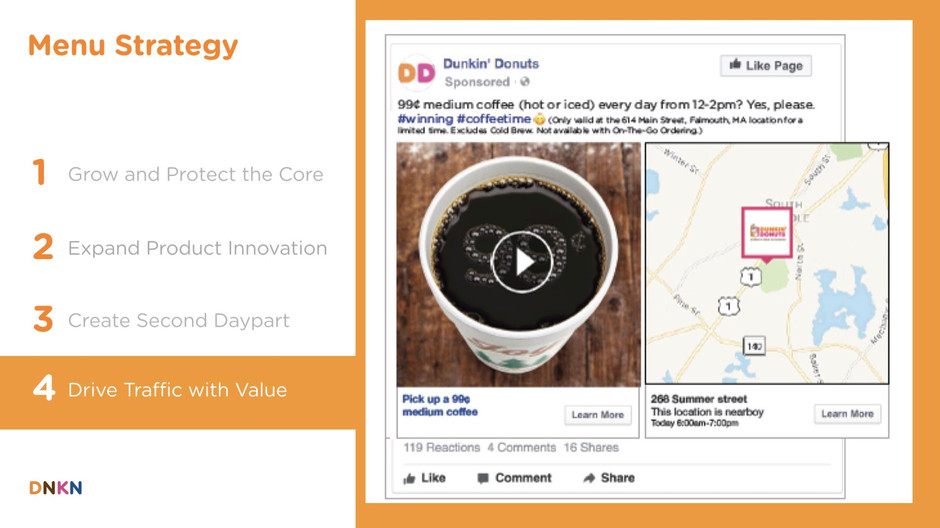

Marketing Vision for Growth Tony Weisman, CMO 76

83

85

86

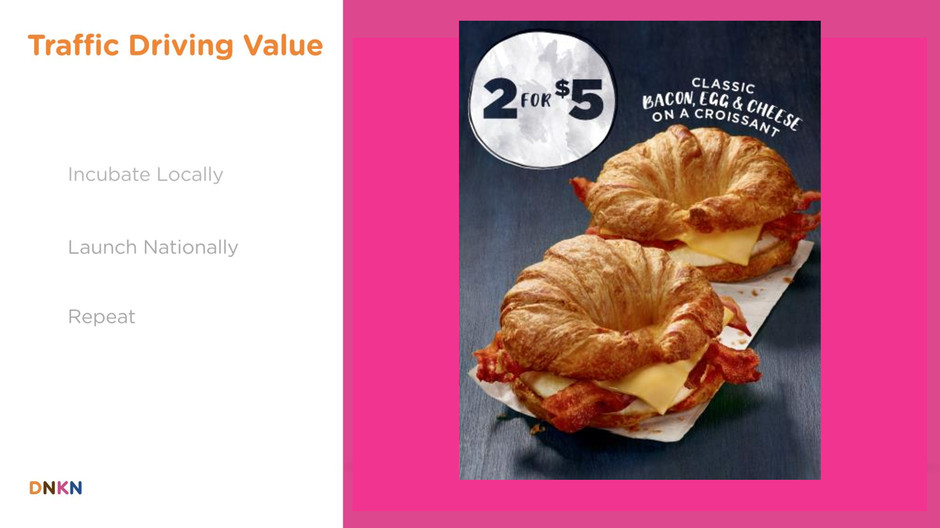

93 Jan ’15, Providence: 2 for $3 Egg & Cheese Jan ’16, Multiple DMAs: 2 for $3 Egg & Cheese Feb ’16, Chicago & DC: PM Break Afternoon Beverage Offers April ’16, Hartford: 2 for $2 Egg & Cheese Wake Up Wrap Mar ’17, NY: 2 for $5 Bacon, Egg & Cheese Oct’17, NATIONAL: 2 for $5 Bacon, Egg & Cheese Driving National value through local trial

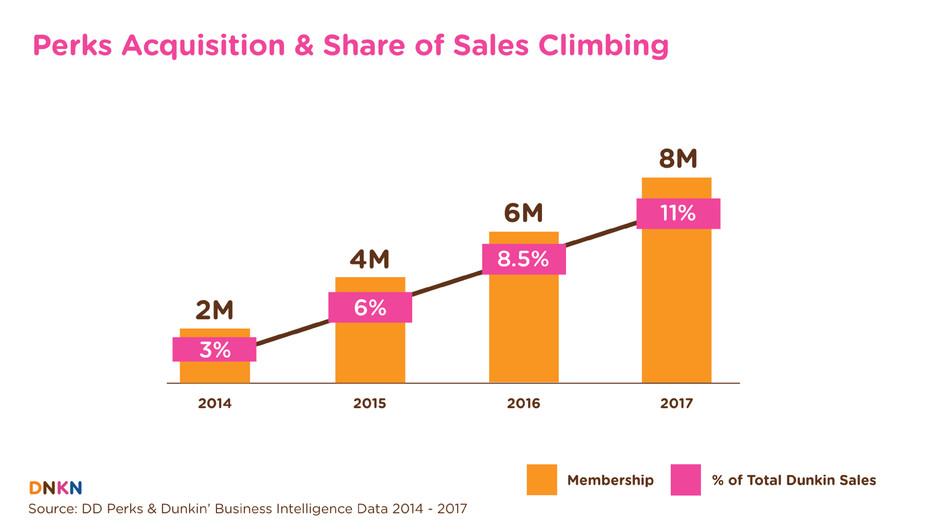

96

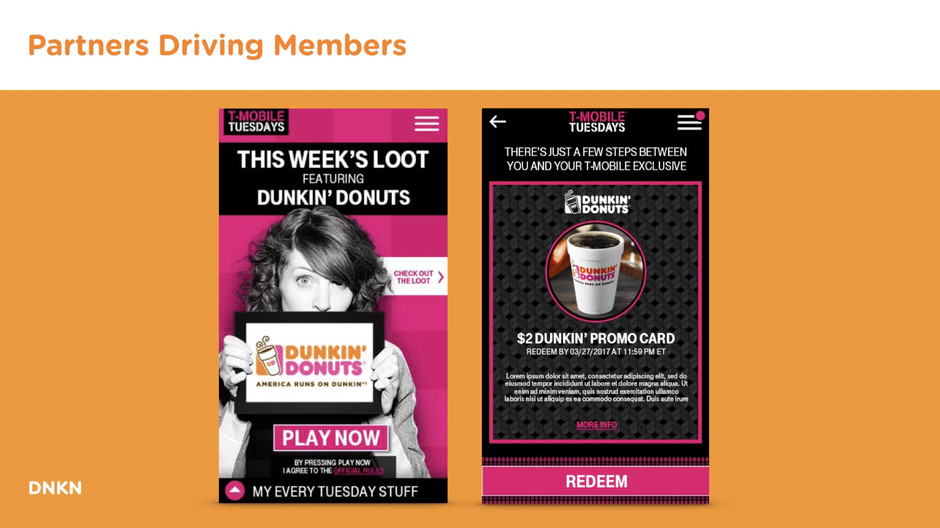

112

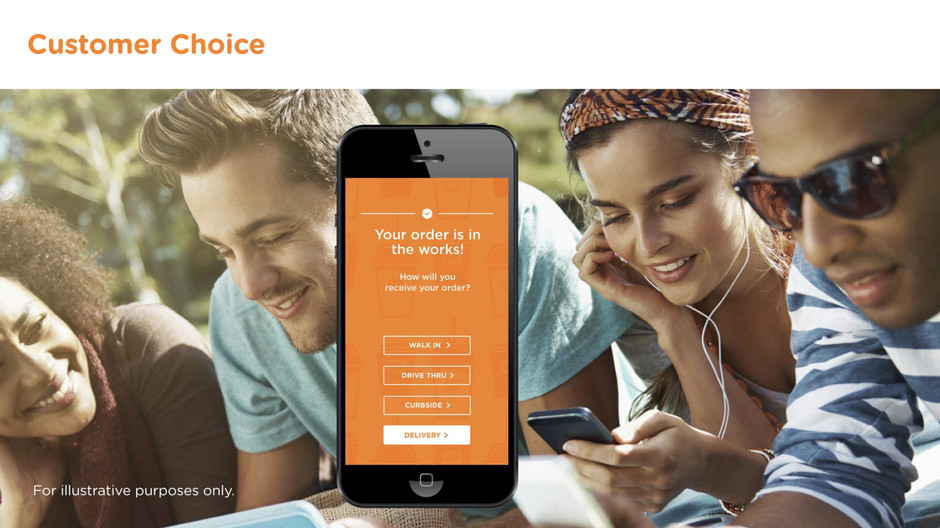

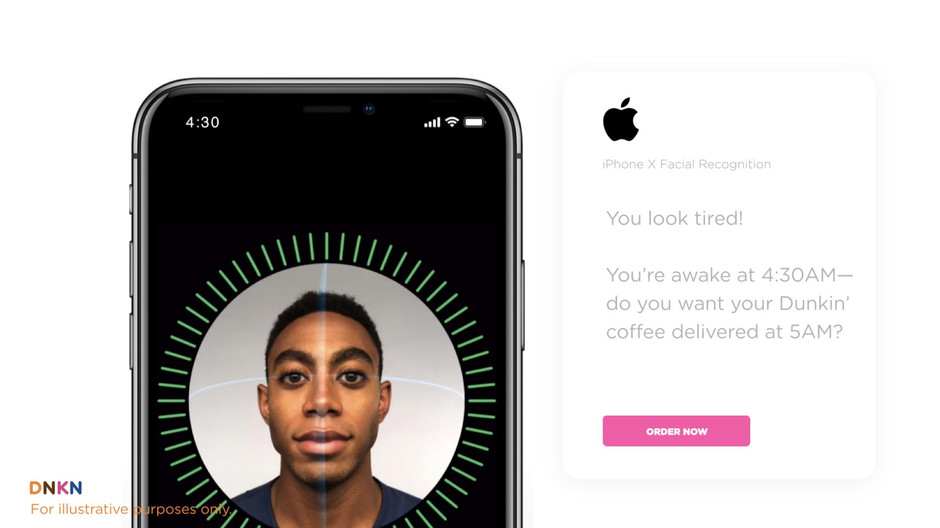

*For Illustrative purposes

*For Illustrative purposes

*For Illustrative purposes

Next Generation Store Design Chris Fuqua, SVP Operations & Supply Chain

The future is now!

1 Modern Design for Mobile Lives 2 Dunkin’ on Demand 3 Friction-Free Drive Thru 4 Premium Pours 5 Enhanced Efficiency 6 Signs of Success

1 Modern Design for Mobile Lives

Consumer–led design Branding and design agency collaboration Franchisee input every step of the way

Quincy is now open!

130

134

135

Life is Good Partnership

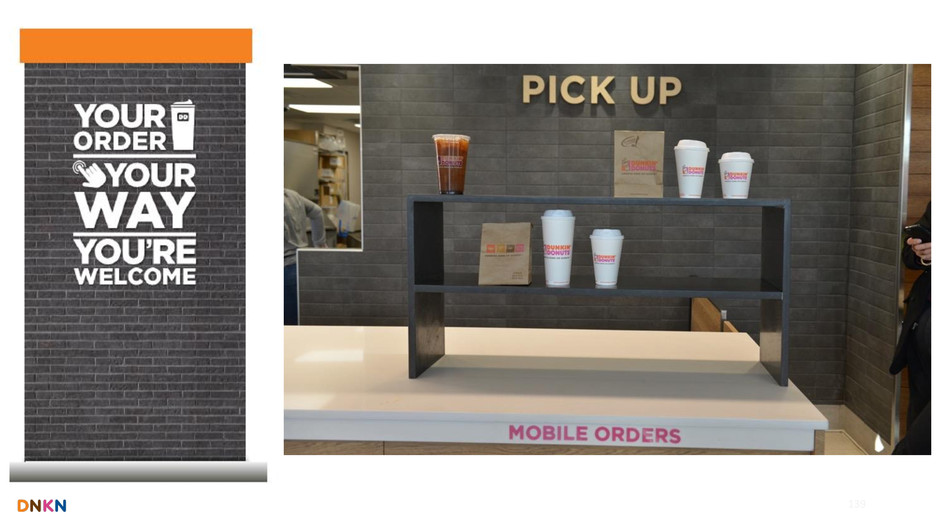

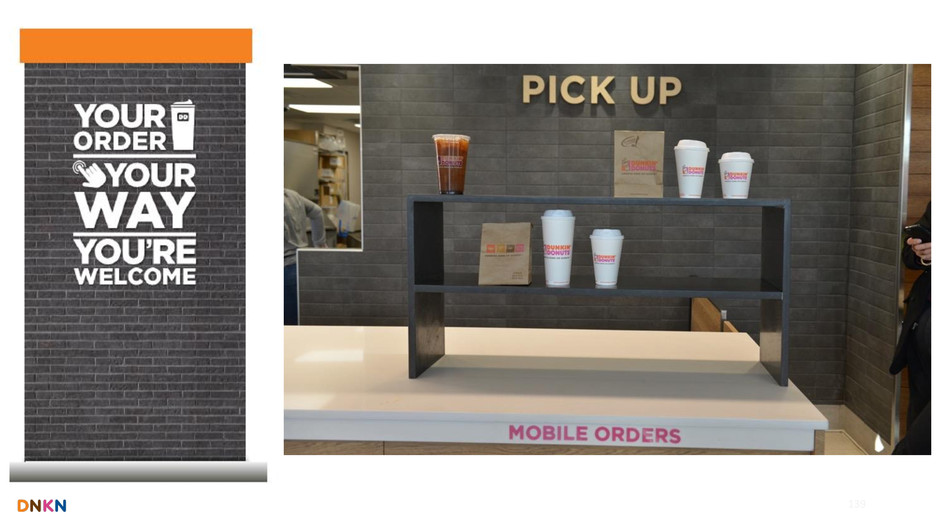

2 Dunkin’ on Demand

139

140

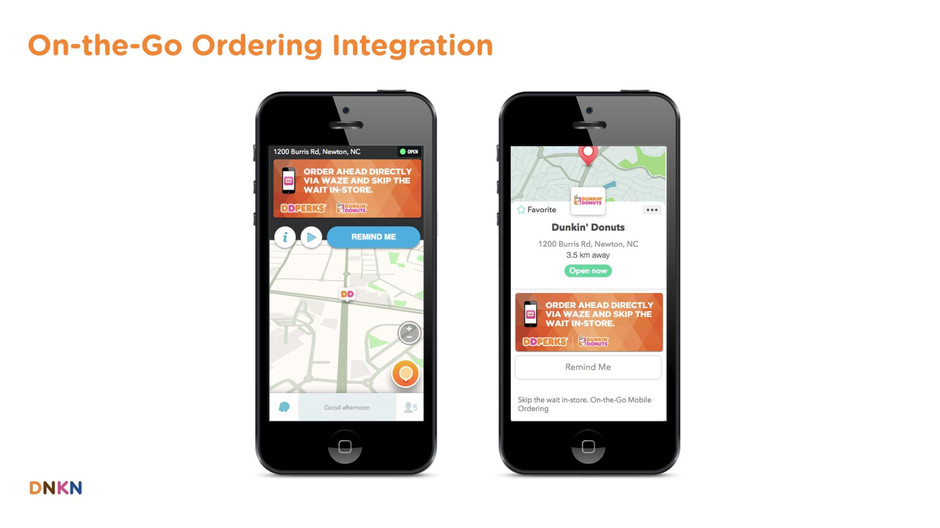

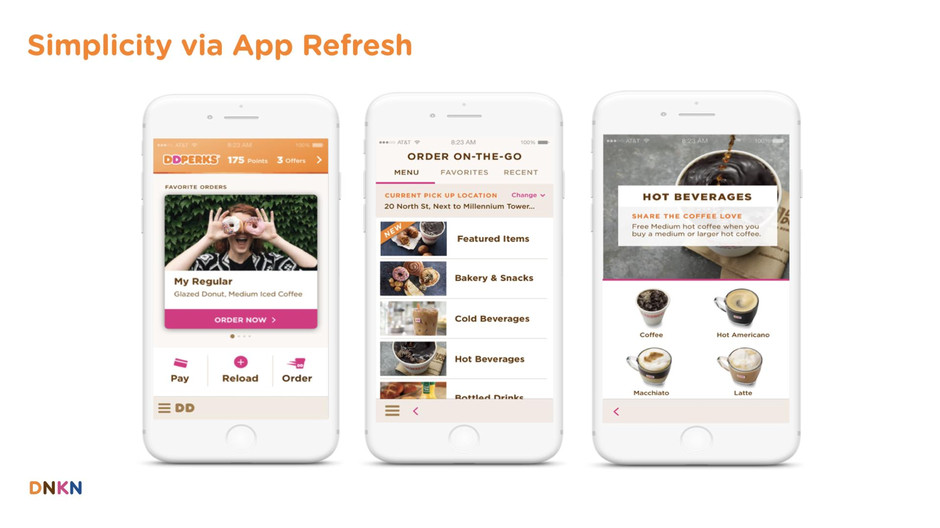

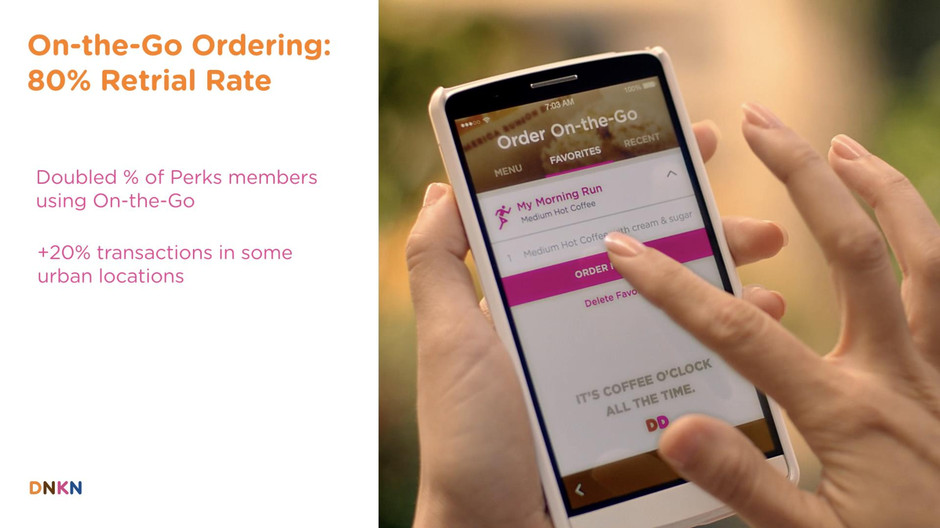

Putting coffee in the hands of mobile, on-the-go consumers

3 Friction-Free Drive-Thru

The first QSR to create a dedicated mobile order drive-thru lane

4 Premium Pours

No baristas here

Revolutionizing the way cold beverages are served

Opening up the innovation funnel

Protecting our core by investing in modern, efficient equipment

5 Enhanced Efficiency

Digital ordering Single beverage line New POS solutions Order confirmation

186th DD Green Restaurant 25% more energy efficient >500 DD Green stores by 2020

6 Signs of Success

1. Brand affinity 2. Transaction growth 3. Sales increase 4. EBITDA improvement 5. Labor reduction Goals of New Design

What’s Next? Now Pilot Testing H1 2018 Feedback and Iterate Targeting H2 2018 NextGen Release >1,000 new & remodels per year once released Rollout

Q&A Dave Hoffmann, President of Dunkin’ Donuts U.S. Scott Murphy, COO Tony Weisman, CMO Chris Fuqua, SVP Operations & Supply Chain

Bringing it All Together: Financials & Long-Term Guidance Kate Jaspon, CFO

Big changes in the financial world that will impact 2018 results…

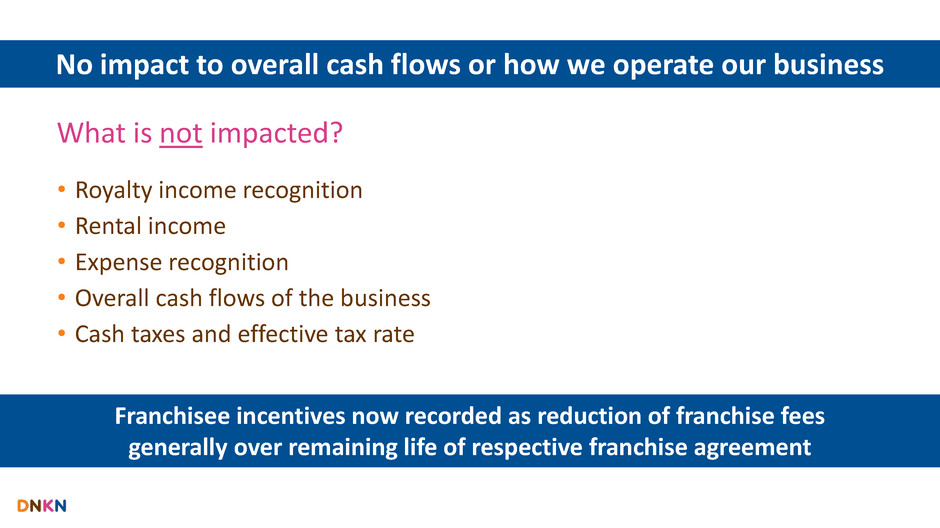

Revenue Recognition Refresher Presented on a new standard basis beginning Q1 2018

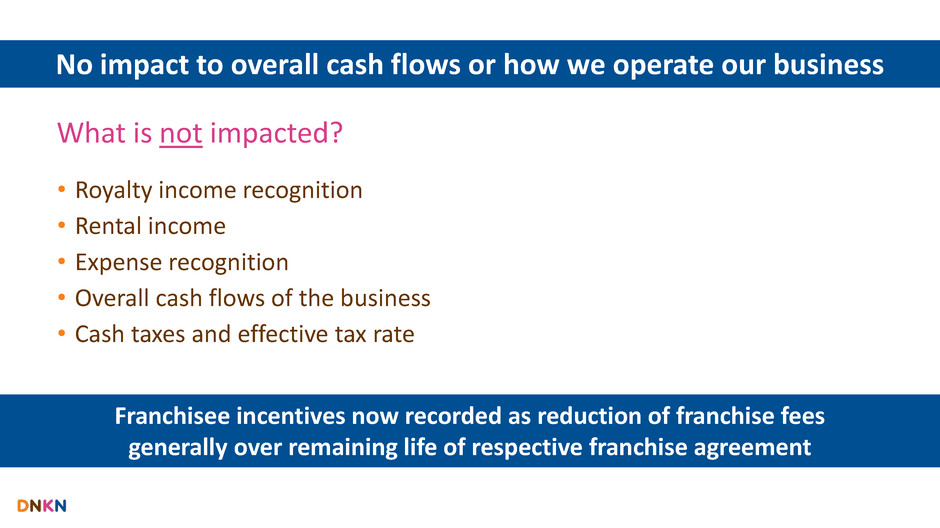

What is not impacted? • Royalty income recognition • Rental income • Expense recognition • Overall cash flows of the business • Cash taxes and effective tax rate Franchisee incentives now recorded as reduction of franchise fees generally over remaining life of respective franchise agreement No impact to overall cash flows or how we operate our business

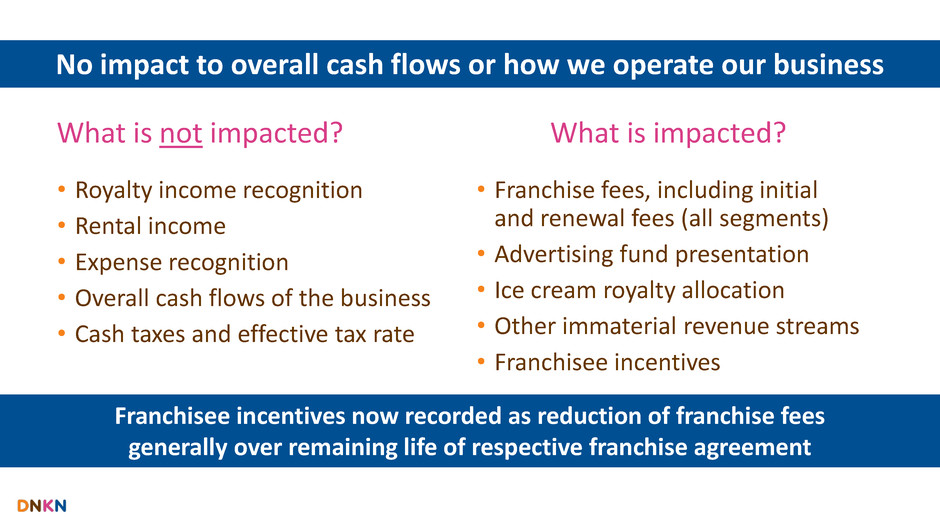

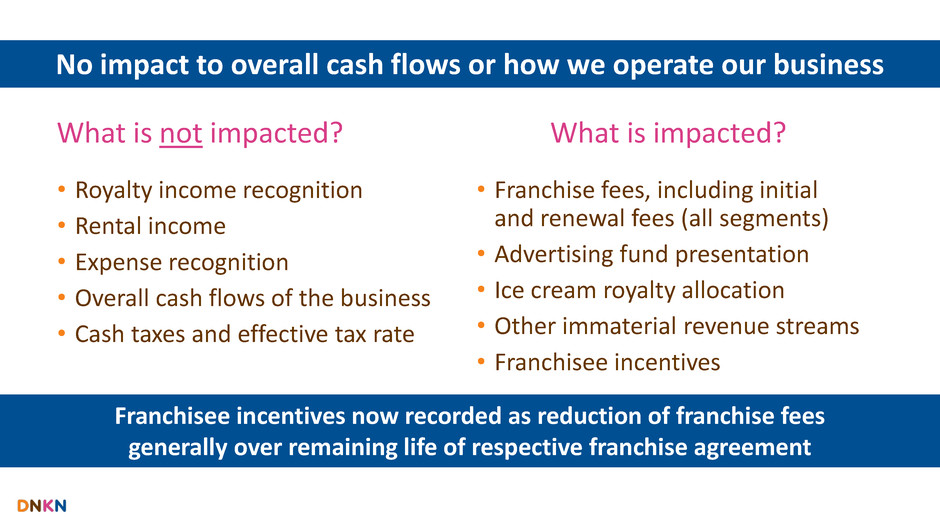

What is not impacted? What is impacted? • Royalty income recognition • Rental income • Expense recognition • Overall cash flows of the business • Cash taxes and effective tax rate • Franchise fees, including initial and renewal fees (all segments) • Advertising fund presentation • Ice cream royalty allocation • Other immaterial revenue streams • Franchisee incentives Franchisee incentives now recorded as reduction of franchise fees generally over remaining life of respective franchise agreement No impact to overall cash flows or how we operate our business

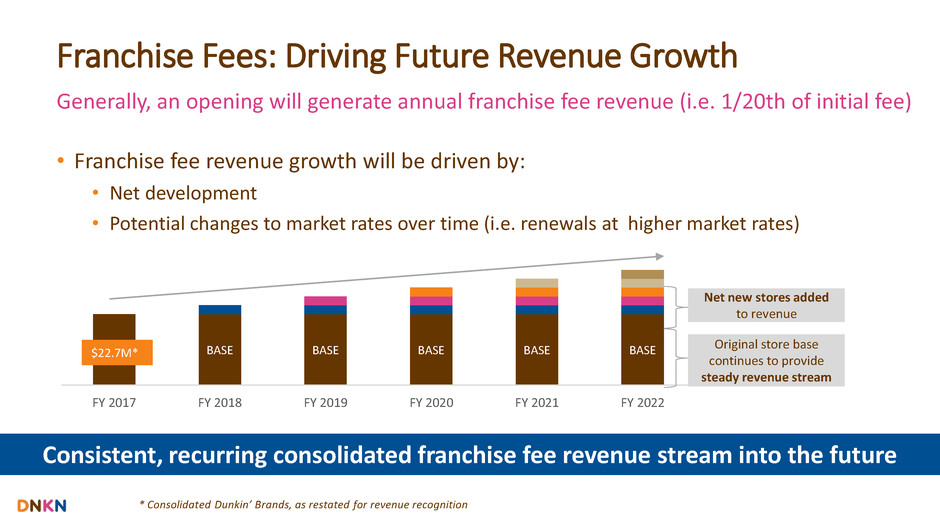

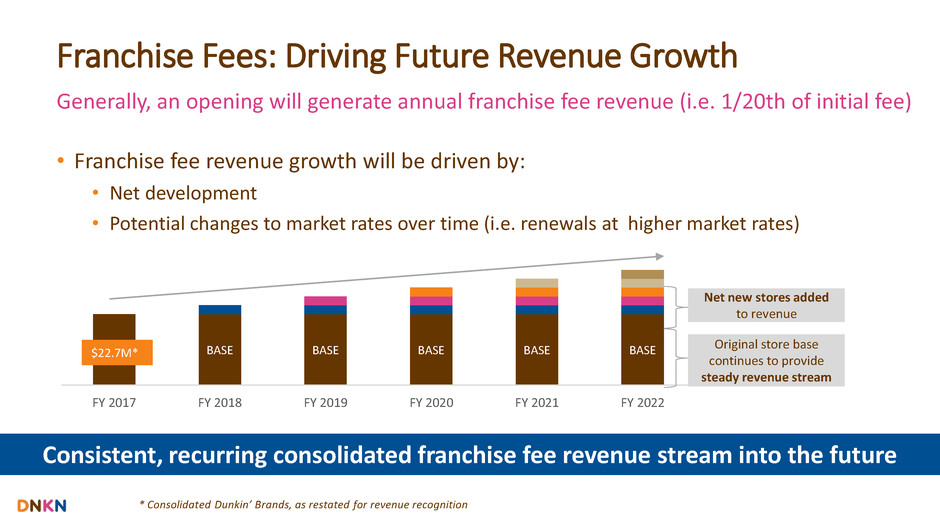

Franchise Fees: Driving Future Revenue Growth • Franchise fee revenue growth will be driven by: • Net development • Potential changes to market rates over time (i.e. renewals at higher market rates) Generally, an opening will generate annual franchise fee revenue (i.e. 1/20th of initial fee) BASE BASE BASE BASE BASE BASE FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 * Consolidated Dunkin’ Brands, as restated for revenue recognition Net new stores added to revenue Original store base continues to provide steady revenue stream Consistent, recurring consolidated franchise fee revenue stream into the future $22.7M*

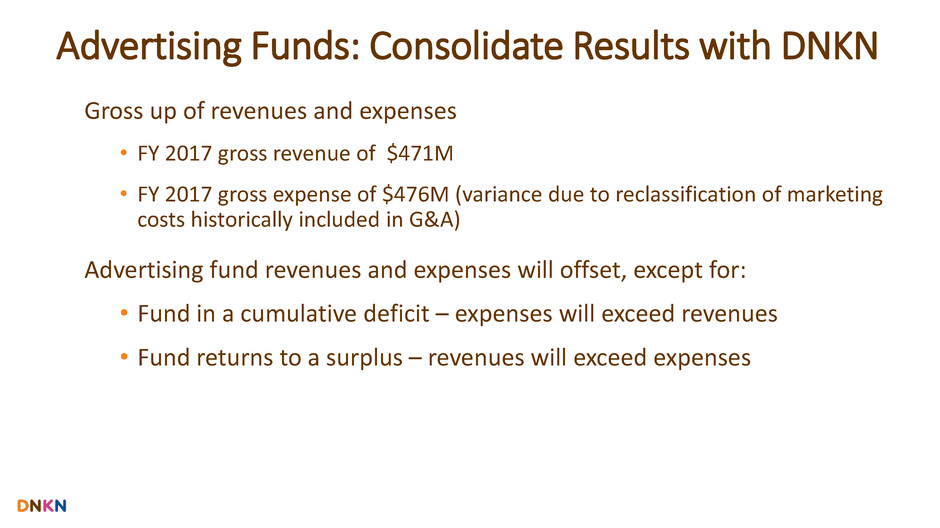

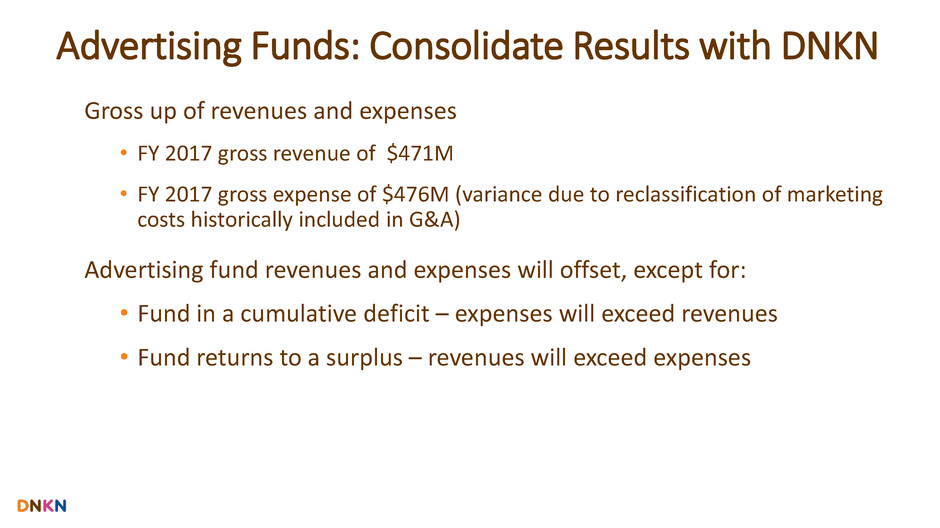

Advertising Funds: Consolidate Results with DNKN Gross up of revenues and expenses • FY 2017 gross revenue of $471M • FY 2017 gross expense of $476M (variance due to reclassification of marketing costs historically included in G&A) Advertising fund revenues and expenses will offset, except for: • Fund in a cumulative deficit – expenses will exceed revenues • Fund returns to a surplus – revenues will exceed expenses

Tax Reform: Expected Corporate & Franchisee Benefits • Federal corporate tax rate decreased from 35% to 21% • Potential limitation on interest deduction • Sweeping changes to international tax provisions • Working through international changes • Reduction of benefit received from state and local taxes • Expect cash tax savings of app. $35M • Primarily pass-through entities • Potential beneficial tax reform provisions: • Generally can exclude 20% of profit as pass- through entity • Favorability of expensing qualified equipment • Lowered individual rates Relevant corporate tax reform provisions: Franchisee benefits: Expected DNKN 2018 effective tax rate: ~28%

The world has changed dramatically since our last Investor & Analyst Day…

Who would have predicted this? U.K. Votes to Leave the European Union June 2016

Donald Trump Elected 45th President November 2016 Who would have predicted this?

The digital currency draws increasing attention and surges to all-time highs December 2017 Who would have predicted this?

…with all this change, we need to change too.

So we are redefining “long-term” guidance as a three-year time horizon.

Our Financial Targets1 Fiscal 2018 Long Term (2 more years: 2019-2020) DD U.S. Comps ~1% growth Low single digit % growth accelerating to 3% as Blueprint rolls out DD U.S. Development, Net > 275 net new restaurants ~3% growth 1,000 net new restaurants in 3 years BR U.S. Comp Low single digit % growth Low single digit % growth BR U.S. Development, Net 0 - 10 net new stores 0 - 10 net new stores International Development, Net No longer providing guidance Other Revenue High single digit % growth High single digit % growth Revenue Low to mid single digit % growth Low to mid single digit % growth Profit from Sale of Ice Cream & Other Products2 Flat compared to 2017 from a profit $ standpoint No guidance G&A Expense ~5% reduction from 2017 G&A expense 2% - 3% growth annually Joint Venture Net Income Down approximately 20% from 2017 No guidance (1) Excludes impact of additional investment into the Blueprint (2) Profit includes sales less costs of ice cream and other products, as well as amount allocated to royalty income from sales of ice cream under the new revenue recognition standard

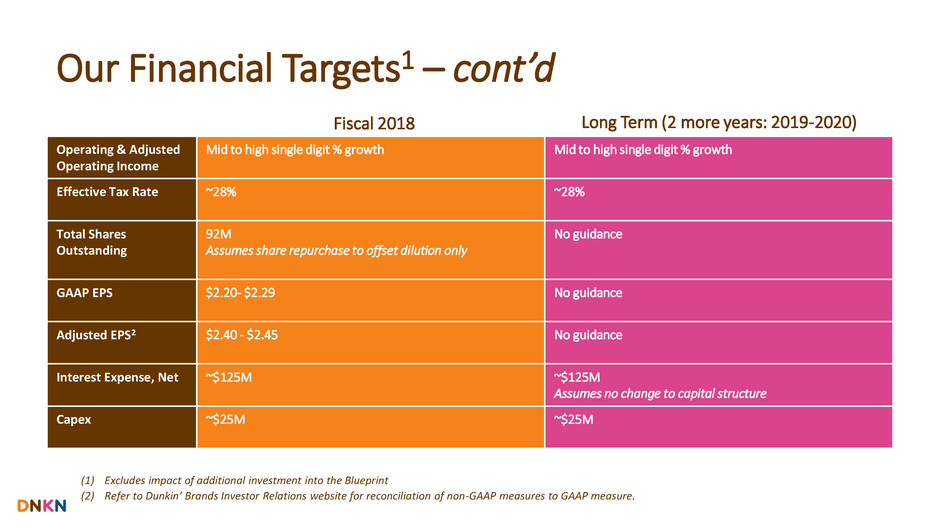

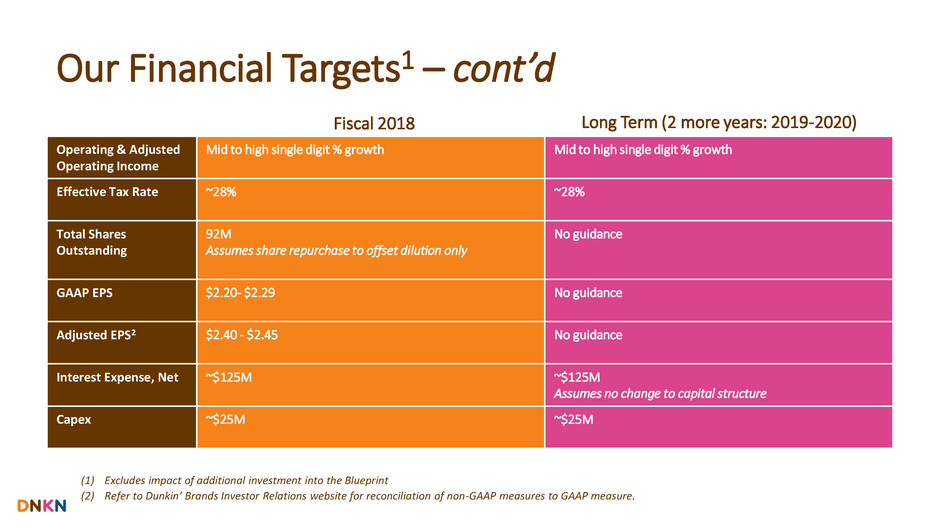

Our Financial Targets1 – cont’d Fiscal 2018 Long Term (2 more years: 2019-2020) Operating & Adjusted Operating Income Mid to high single digit % growth Mid to high single digit % growth Effective Tax Rate ~28% ~28% Total Shares Outstanding 92M Assumes share repurchase to offset dilution only No guidance GAAP EPS $2.20- $2.29 No guidance Adjusted EPS2 $2.40 - $2.45 No guidance Interest Expense, Net ~$125M ~$125M Assumes no change to capital structure Capex ~$25M ~$25M (1) Excludes impact of additional investment into the Blueprint (2) Refer to Dunkin’ Brands Investor Relations website for reconciliation of non-GAAP measures to GAAP measure.

Investment into Blueprint for DD U.S. Growth

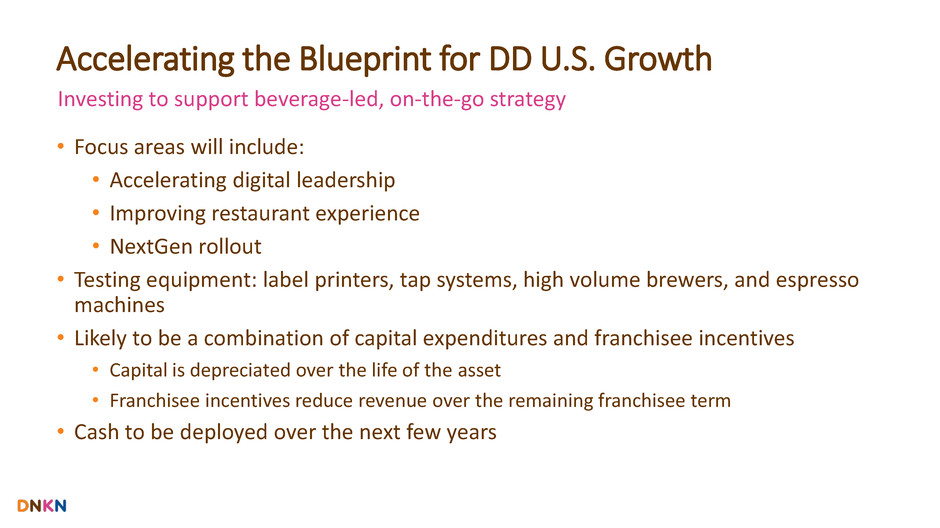

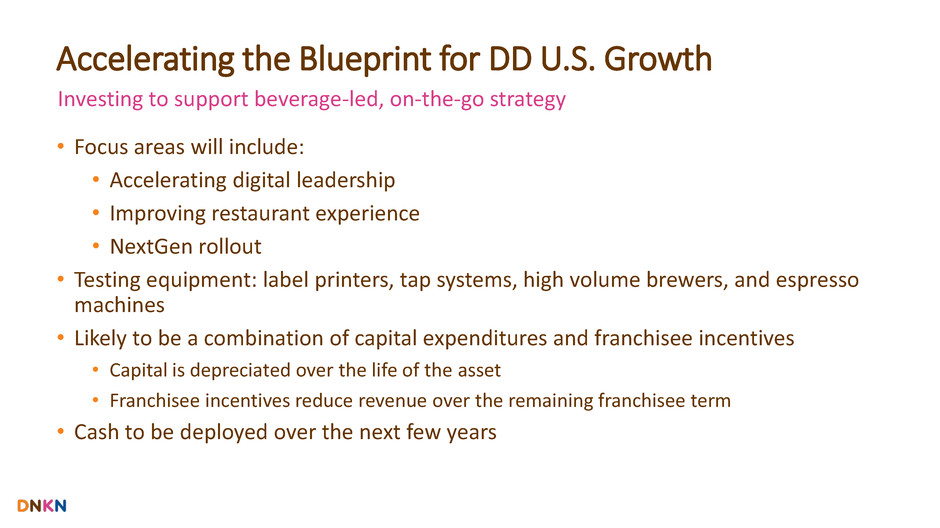

Accelerating the Blueprint for DD U.S. Growth • Focus areas will include: • Accelerating digital leadership • Improving restaurant experience • NextGen rollout • Testing equipment: label printers, tap systems, high volume brewers, and espresso machines • Likely to be a combination of capital expenditures and franchisee incentives • Capital is depreciated over the life of the asset • Franchisee incentives reduce revenue over the remaining franchisee term • Cash to be deployed over the next few years Investing to support beverage-led, on-the-go strategy

Asset-Light Model Strength Facilitates shareholder-friendly capital structure

Dec ’17 Dec’18 Feb’19 Nov’20 Nov’21 Feb’22 Nov’23 Nov’24 Nov’25 Nov’26 Nov’27 Callable at Par Callable at Par Callable at Par As of December 30, 2017 $3.1B outstanding Class A2 Notes: Blended Rate 3.925% 2015 A-2-II Notes: $1.7B @ 3.98% 2017 A-2-I Notes: $0.6B @ 3.629% 2017 A-2-II Notes: $0.8B @ 4.03% Anticipated Repayment Date Deleverage • EBITDA growth & required amortization payments • Anticipate being back in market app. every 2 years Dividends • Raised quarterly dividend by 7.75% from $0.3225 in 2017 to $0.3475 in Q1 2018 • Estimated Payout Ratio remains above 50% “Asset-Light” Model Allows for Leveraged Capital Structure In conjunction with high-level of on-going financial flexibility Share Repurchase • Offset dilution from exercising of stock options • Share Repurchase remains a strategic tool to return capital to our investors 4.4X 5.2X 4.6X 4.4X 5.2X 4.6X 5.5X Q4 2011 Q4 2012 Q4 2013 Q4 2014 Q4 2015 Q4 2016 Q4 2017 Leverage Ratio Trend Lever-up Lever-up Lever-up 4.2X 4.2X Q417 leverage ratio • Includes $641M of net proceeds from Q417 re-finance transaction •Net of proceeds, 2017 pro forma leverage ratio equals 5.5X

$2 billion returned to shareholders since July 2011 IPO…

The “Perks” of Investing in Dunkin’ Brands Reliable and diversified financial results Asset-light, 100% franchised model Strong free cash flow conversion

Q&A Nigel Travis, Chairman & CEO Dave Hoffmann, President of Dunkin’ Donuts U.S. Kate Jaspon, CFO

Top 10 Takeaways Nigel Travis, Chairman & CEO

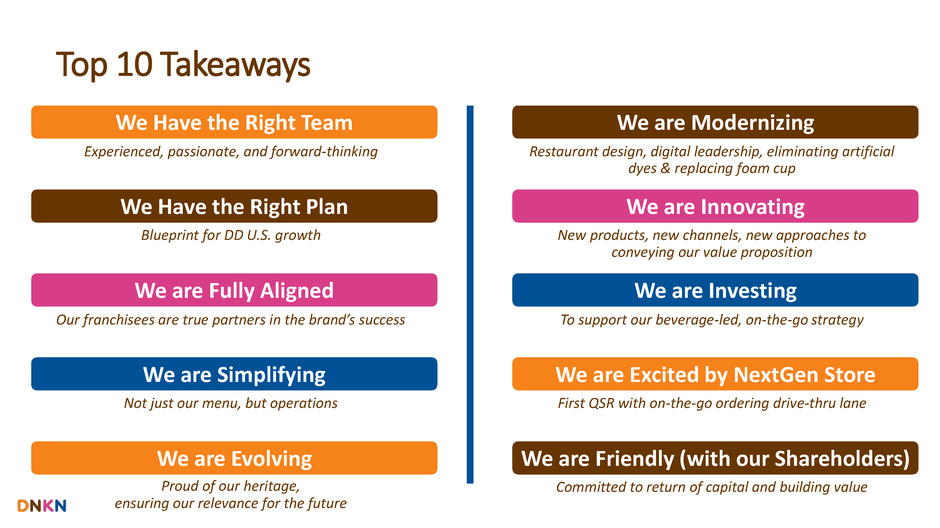

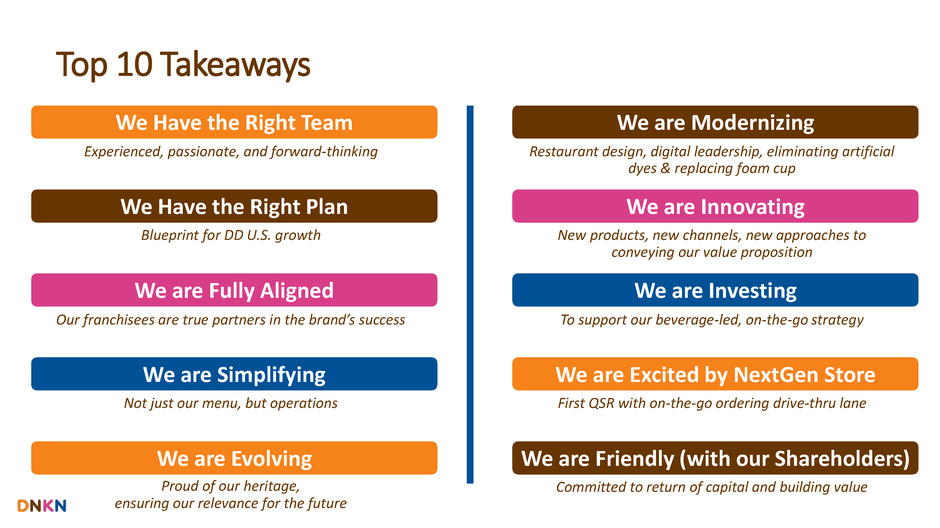

Top 10 Takeaways We Have the Right Team We Have the Right Plan We are Fully Aligned We are Simplifying We are Evolving We are Modernizing We are Innovating We are Investing We are Excited by NextGen Store We are Friendly (with our Shareholders) Experienced, passionate, and forward-thinking Blueprint for DD U.S. growth Our franchisees are true partners in the brand’s success Not just our menu, but operations Proud of our heritage, ensuring our relevance for the future Restaurant design, digital leadership, eliminating artificial dyes & replacing foam cup New products, new channels, new approaches to conveying our value proposition To support our beverage-led, on-the-go strategy First QSR with on-the-go ordering drive-thru lane Committed to return of capital and building value

2018 Investor & Analyst Day February 8, 2018