Q4 & FY 2019 INVESTOR PRESENTATION

Forward Looking Statements • Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. • Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. We do not undertake to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved and the Company undertakes no duty to update its targets. • Regulation G This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These measure should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP amounts to the relevant GAAP amount are available on www.investor.dunkinbrands.com.

Asset-Light 70+ 100% Years Of Brand Significant U.S. & Global Franchised Business Global Channel Heritage Growth Opportunity Opportunities Defensive, Predictable Business Model

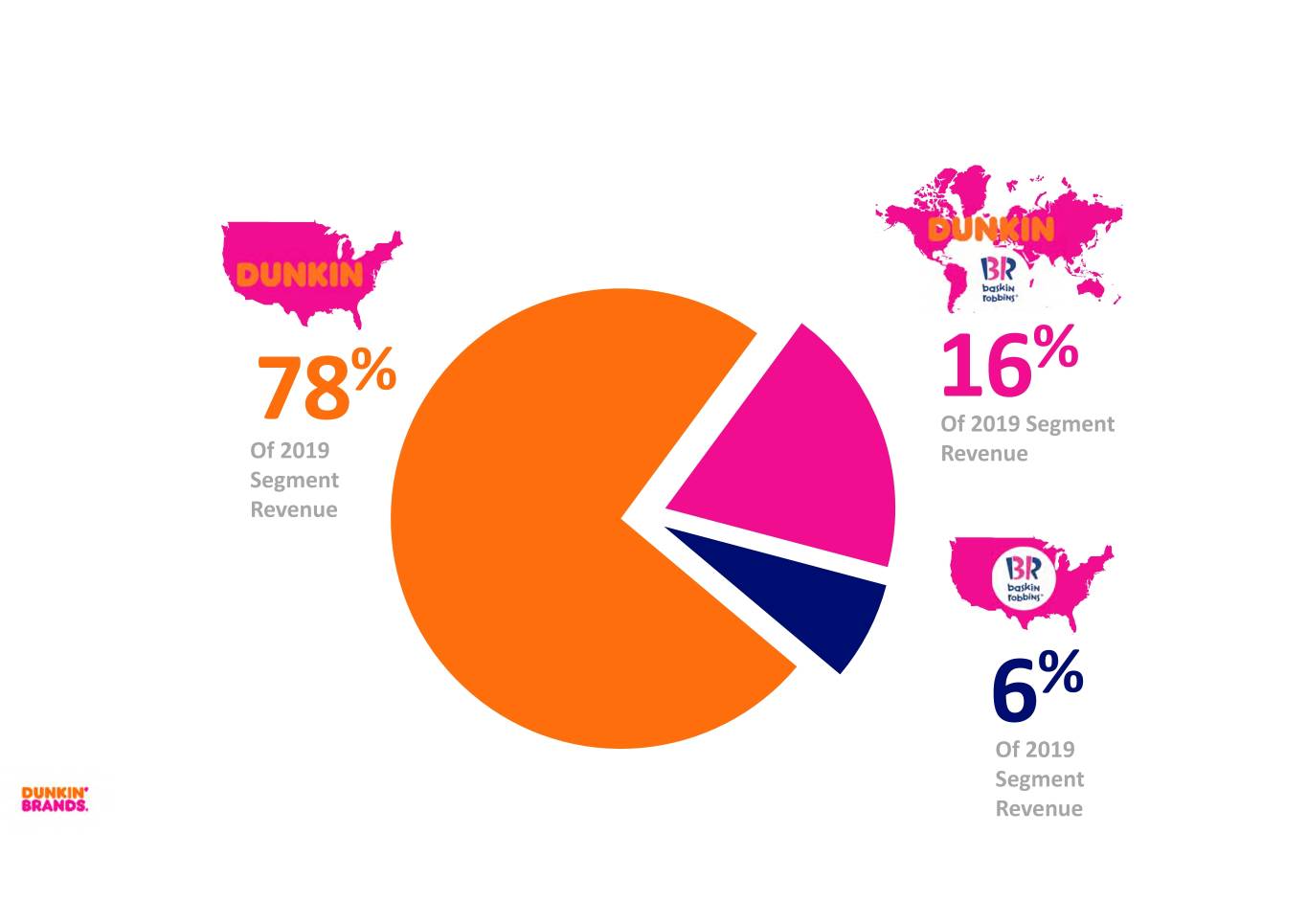

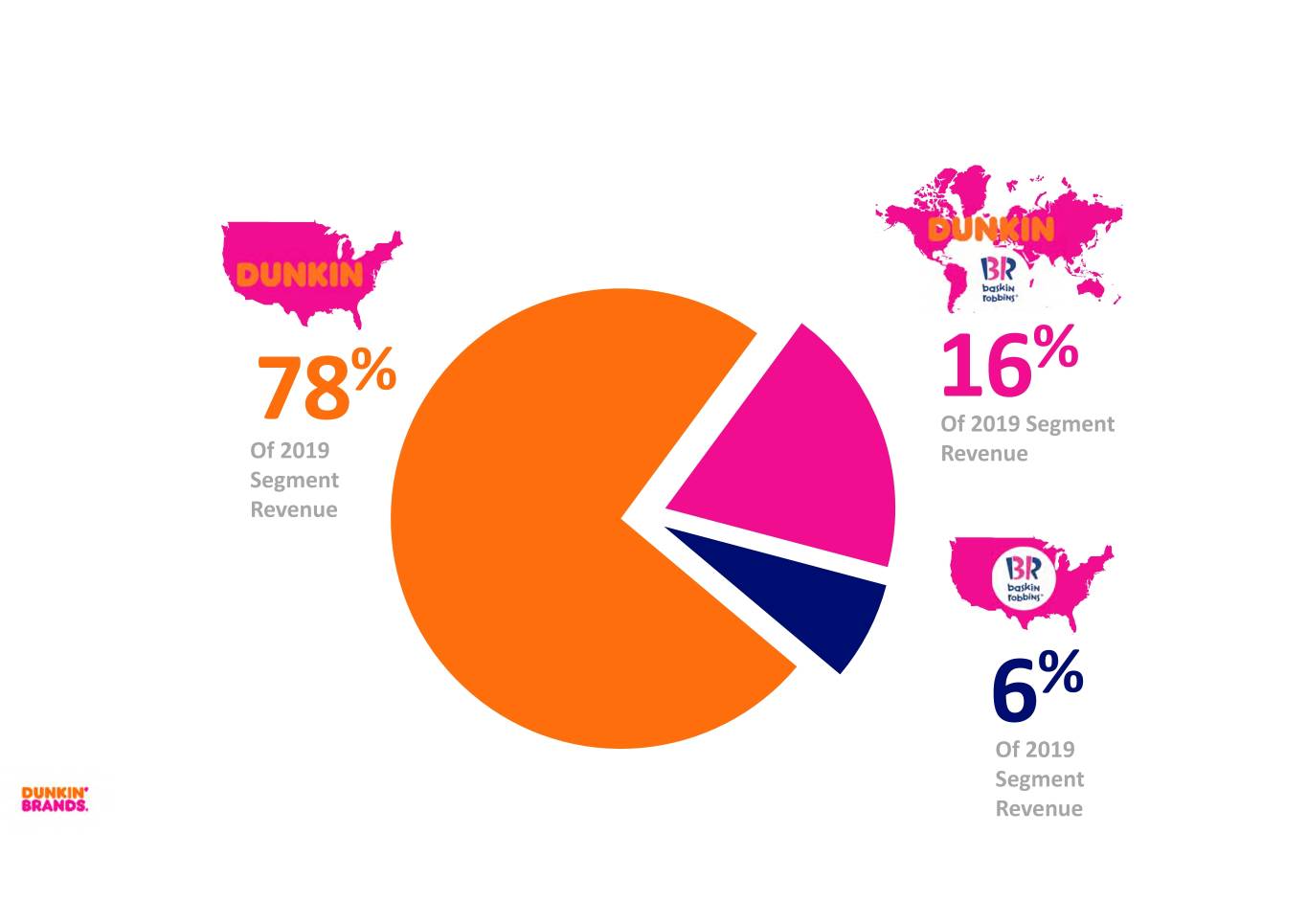

% 16% 78 Of 2019 Segment Of 2019 Revenue Segment Revenue 6% Of 2019 Segment Revenue

FY 2019 Performance Highlights +2.1% +211 +385 Dunkin’ U.S. Dunkin’ U.S. Net Global Net Unit Comps Development Development FY 2019 Financial Highlights ~$12B +3.7% Systemwide Sales Revenue Growth +8.2% +9.3% Adjusted Operating Diluted Adjusted EPS Income Growth Growth 5

DUNKIN’ U.S.

Dunkin’ is a Leading Brand Across QSR 14 consecutive years of 5 billion+ cups of Dunkin’ being named #1 Coffee 9,600+ coffee consumed in 2019 (2) (1) chain by consumers U.S. Stores #1 seller of total drip coffee #2 seller of total espresso $9.2B #1 seller of iced brewed coffee #2 seller of cold brew coffee U.S. Systemwide #1 seller of donuts #2 seller of breakfast sandwiches (3) Sales in 2019 #1 seller of bagels (3) Broad DD product accessibility: Ready-to- drink bottled iced coffee, Cold Brew, 7-years of growth in breakfast espresso, K-cups, and bagged coffee in sandwich servings grocery and retail (1) Totalcupsofcoffeein U.S.restaurantsandCPGchannels (2) Source: BrandKeys, Dunkin’ named#1 brandfor CustomerLoyalty in the Out-Of-Home Coffee category,and #1 brand in the PackagedCoffee category (3) Source: The NPD Group/CREST for the year ending December2019 in QSR (includes total QSR and retail foodservice); Breakfastsandwichservings include wraps/burritos

OUR FOCUS: BEVERAGE-LED, ON-THE-GO

Broad Accessibility UnparalleledUnparalleled RestaurantRestaurant ConvenienceConvenience ExcellenceExcellence MenuMenu BrandBrand InnovationInnovation RelevanceEvolution BLUEPRINT FOR GROWTH: MOST LOVED BEVERAGE-LED ON-THE-GO BRAND

MENU INNOVATION

Beverage-Led Innovation Fueling Growth GROW AND PROTECT THE CORE EXPAND PRODUCT INNOVATION OFFER CONSISTENT, COMPELLING VALUE CREATE SECOND DAYPART

UNPARALLELED CONVENIENCE

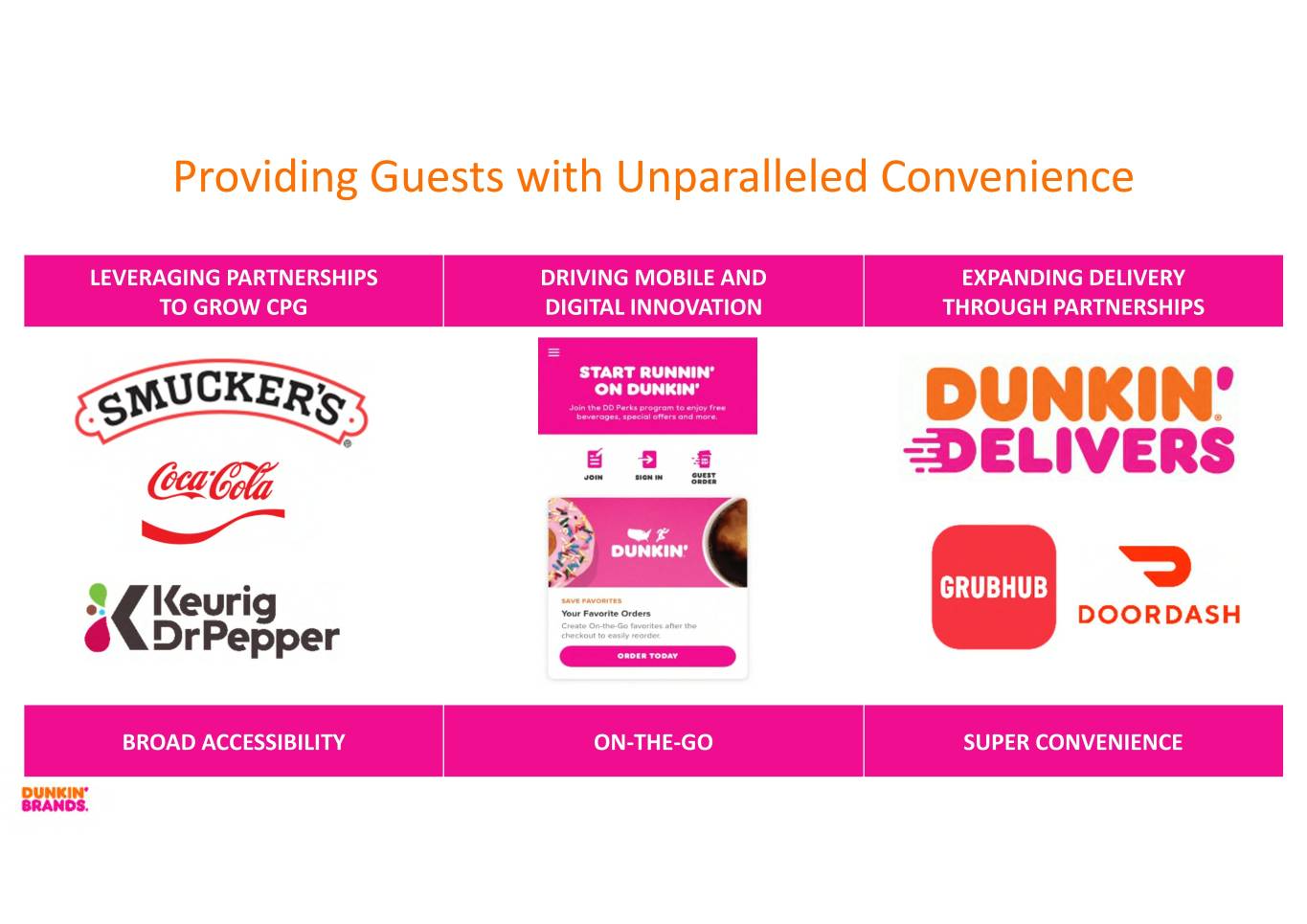

Providing Guests with Unparalleled Convenience LEVERAGING PARTNERSHIPS DRIVING MOBILE AND EXPANDING DELIVERY TO GROW CPG DIGITAL INNOVATION THROUGH PARTNERSHIPS BROAD ACCESSIBILITY ON-THE-GO SUPER CONVENIENCE

Building Brand Beyond Traditional Four Walls BREW-AT-HOME BREWED GRAB AND GO NEW PARTNERSHIPS CONVENIENCE ON-THE-GO AND OCCASIONS $940M in CPG Retail Sales in FY 2019 Source: IRI, 52 weeks ending 12/29/2019; $940M represents total retail sales in CPG across Dunkin’ and Baskin-Robbins brands.

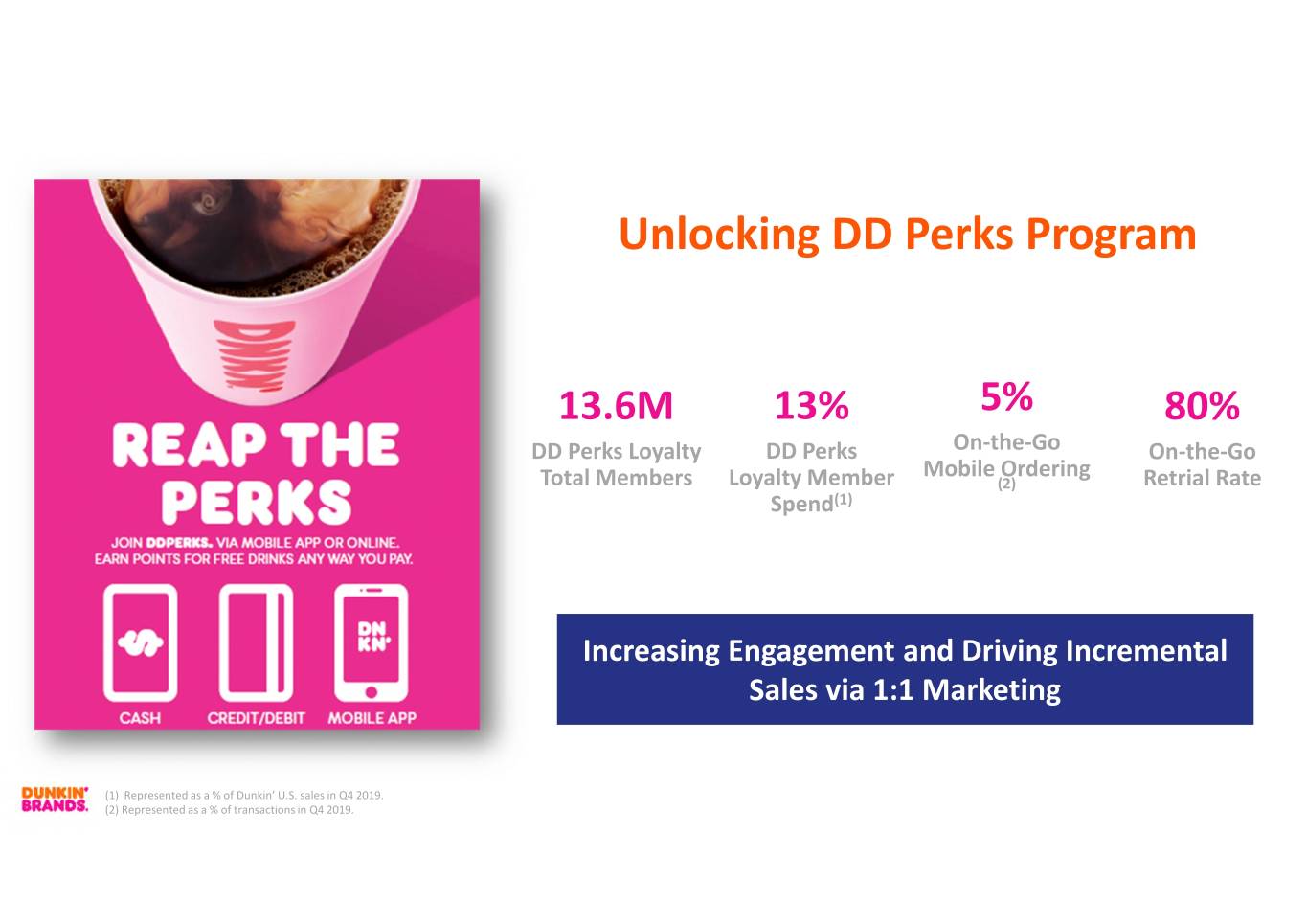

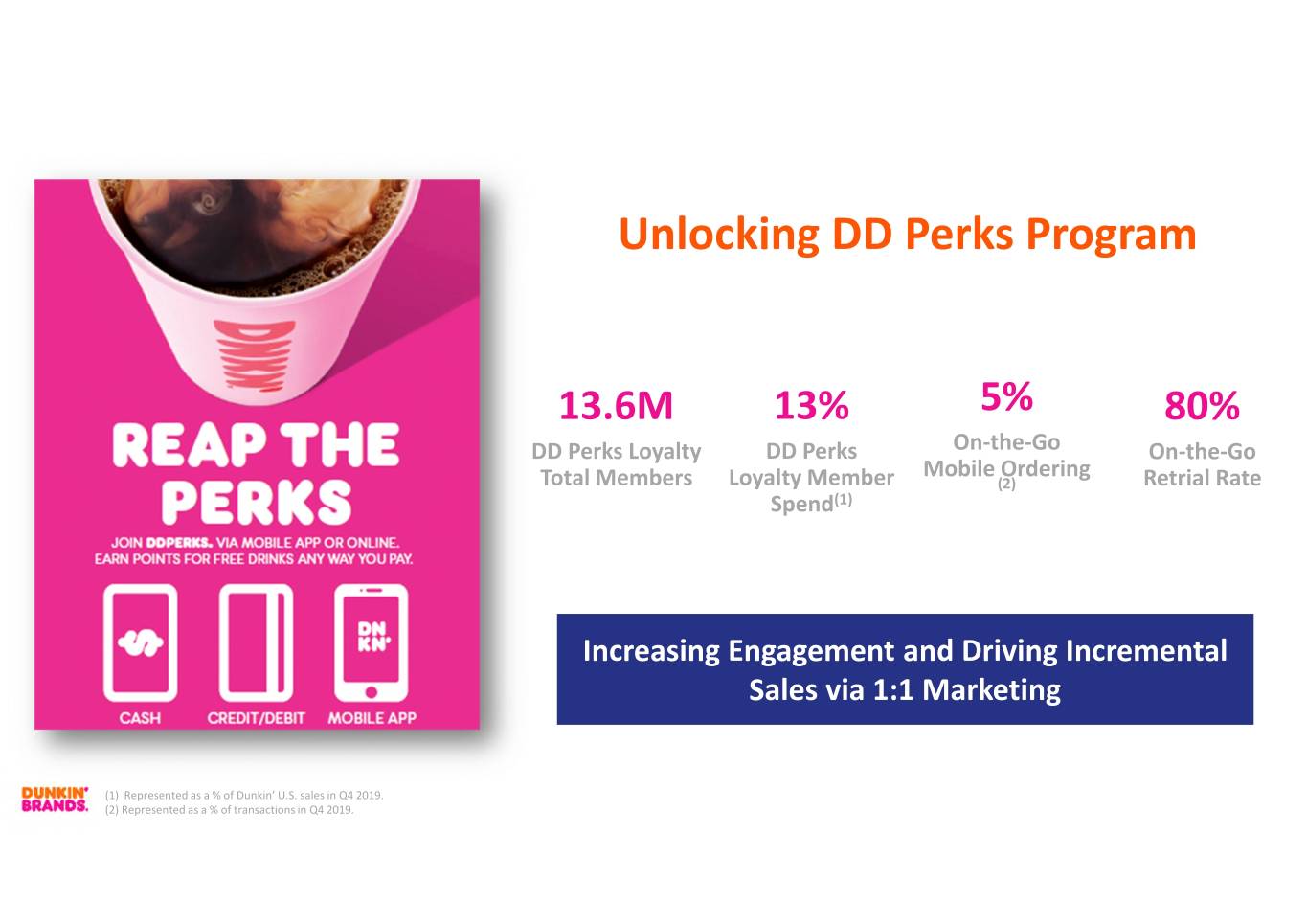

Unlocking DD Perks Program 13.6M 13% 5% 80% DD Perks Loyalty DD Perks On-the-Go On-the-Go Mobile Ordering Total Members Loyalty Member (2) Retrial Rate Spend(1) Increasing Engagement and Driving Incremental Sales via 1:1 Marketing (1) Representedas a % of Dunkin’ U.S. salesin Q4 2019. (2) Representedas a % of transactionsin Q4 2019.

Enabling Speed and Convenience Through Digital Channels DELIVERY MULTI-TENDER GUEST CHECKOUT APP UPGRADES Frictionless Experience For Our Guests

UNPARALLELED CONVENIENCE: RESTAURANT EXPANSION

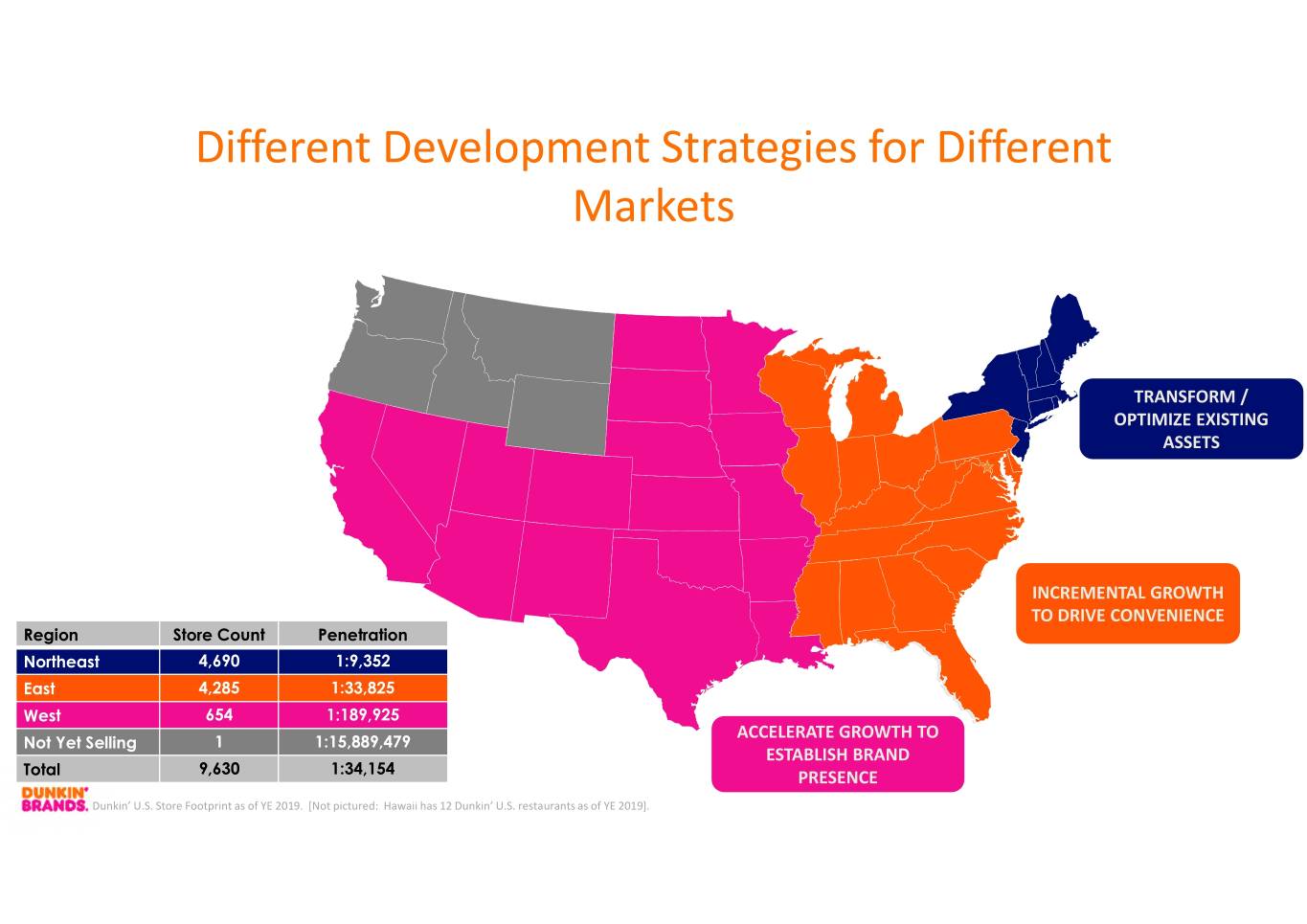

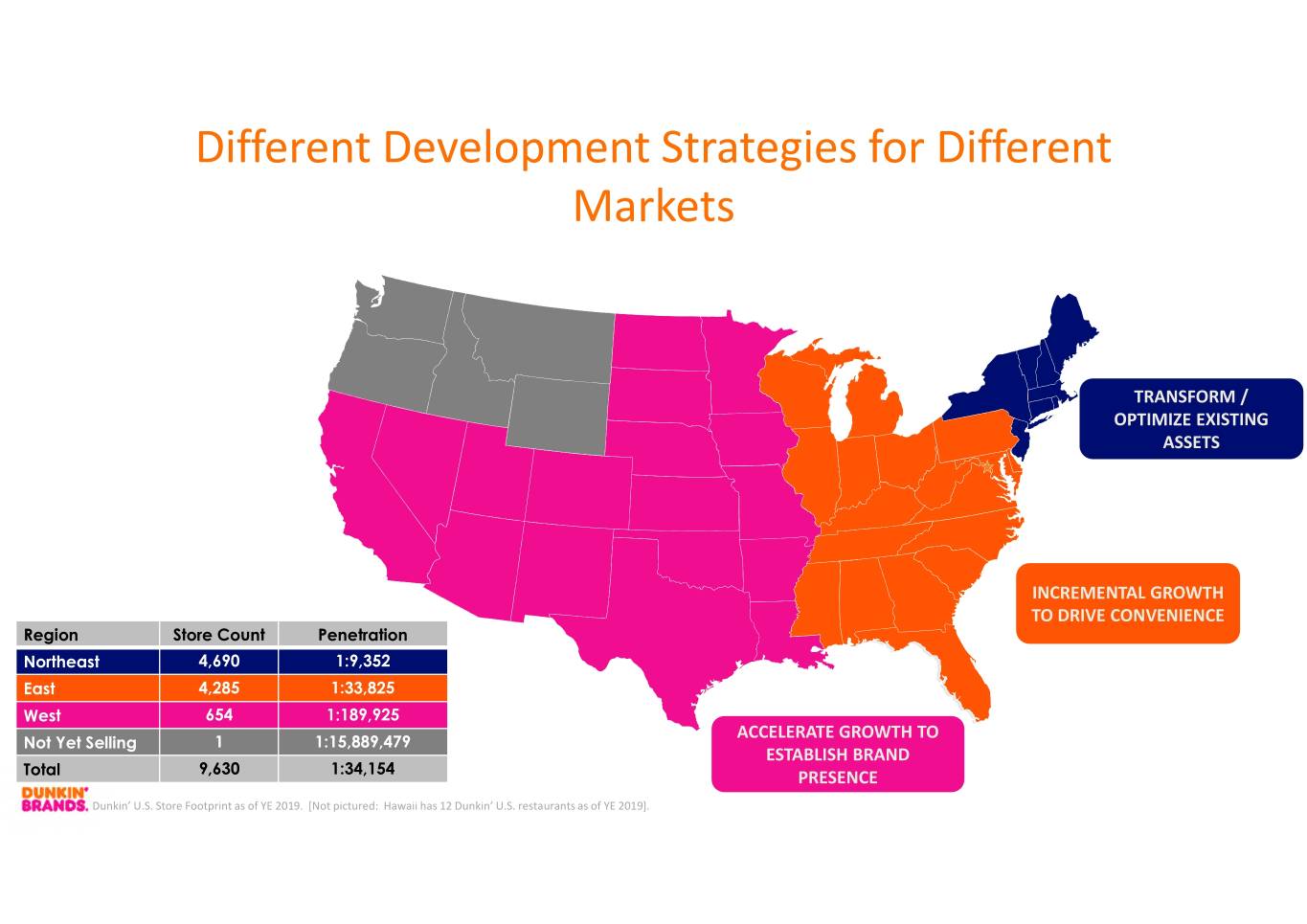

Different Development Strategies for Different Markets TRANSFORM / OPTIMIZE EXISTING ASSETS INCREMENTAL GROWTH TO DRIVE CONVENIENCE Region Store Count Penetration Northeast 4,690 1:9,352 East 4,285 1:33,825 West 654 1:189,925 ACCELERATE GROWTH TO Not Yet Selling 1 1:15,889,479 ESTABLISH BRAND Total 9,630 1:34,154 PRESENCE Dunkin’ U.S. Store Footprint as of YE 2019. [Not pictured: Hawaii has 12 Dunkin’ U.S. restaurants as of YE 2019].

DD U.S. NET DEVELOPMENT One of the fastest-growing QSR brands by unit count in the U.S. FY 2019 Highlights: • Released NextGen image for new builds and remodels • 100% of 2019 net development outside of core markets • New restaurants contributed ~$140M to systemwide sales

Compelling Unit Economics Driving Accelerated Growth Outside of Core Markets 2017 Top 10 Developing Markets • 90% of future growth outside of core markets • Top 10 developing markets represent 60% of future growth AVERAGE INITIAL AVERAGE UNIT AVERAGE BEVERAGE CASH-ON-CASH CAPEX (1) VOLUMES (2) MIX: RETURNS (3) ~$550K ~$950K ~40% 20% - 25% Note: As of April 2019. Based on standalone, traditional Dunkin' Restaurants. Not disclosing specific markets for competitive reasons; these are the expected returns. (1) Number is rounded; represents the approximate initial capex for cohort (2) Number is rounded; represents the approximate unit volume for cohort (3) Number is rounded; represents the approximate cash-on-cash return for cohort

RESTAURANT EXCELLENCE

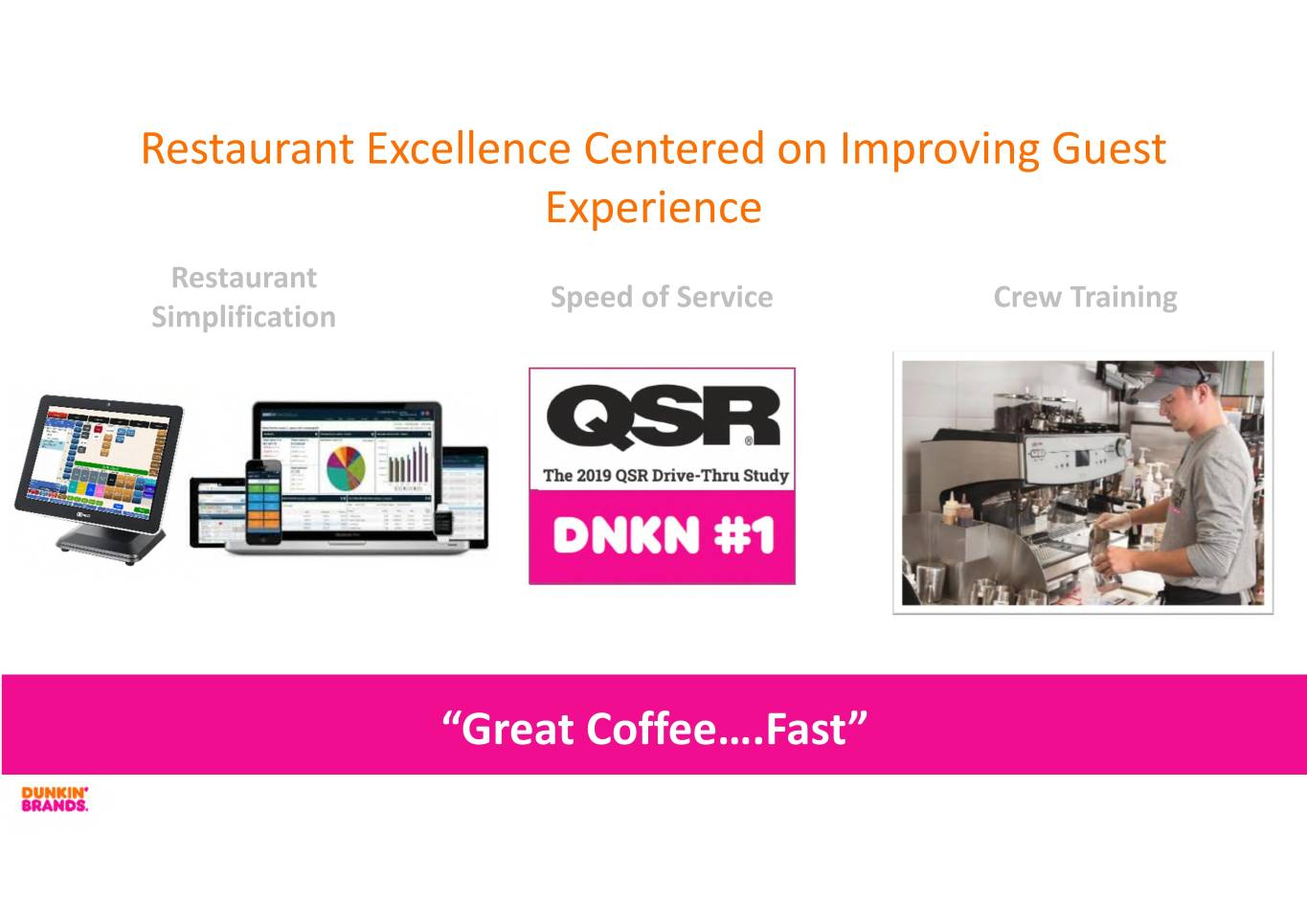

Restaurant Excellence Centered on Improving Guest Experience Restaurant Speed of Service Crew Training Simplification “Great Coffee….Fast”

BRAND RELEVANCE

Increasing Brand Relevance Transitioning From Foam to Released Dunkin’ U.S. NextGen Unveiled New Relaunched Espresso Double Walled Paper Cup Store Image Brand Identity Platform

NextGen Improving Guest and Crew Experience Dedicated Mobile Order Front-Facing Tap System to Serve Iced Pick-up Area Bakery Cases Beverages 525 NextGen Restaurants Open Across U.S. System Dunkin’ U.S. NextGenRestaurant Count as of YE 2019.

BASKIN-ROBBINS U.S.

Premium Products, Premium Experience “Raising the Bar” Initiatives: • Deliver premium guest experience to match premium products • Expand national value program • Enhance convenience: • Grow eCommerce • Home delivery with DoorDash • Expand test of Moments store design; 19 Moments stores open in the U.S. • Optimize restaurant base through strategic closures and transfers #1 Seller of Hard Serve Ice Cream (1) (1) Source: The NPD Group/CREST for the year ending December 2019 in QSR (includes 27 total QSR and retail foodservice)

INTERNATIONAL

International Focus on Strategic Markets and Long- Term Growth Opportunities ENHANCING IN-STORE EXPERIENCE ESTABLISHING STRONG GROWING NON-TRADITIONAL DELIVERY INFRASTRUCTURE AND CHANNEL TO INCREASE TRANSACTIONS TO INCREASE BRAND ACCESSIBILITY TO ENHANCE BRAND RELEVENCE & AND BUILD SALES AND CONVENIENCE OPTIMIZE BRAND PENETRATION

FINANCIAL TARGETS

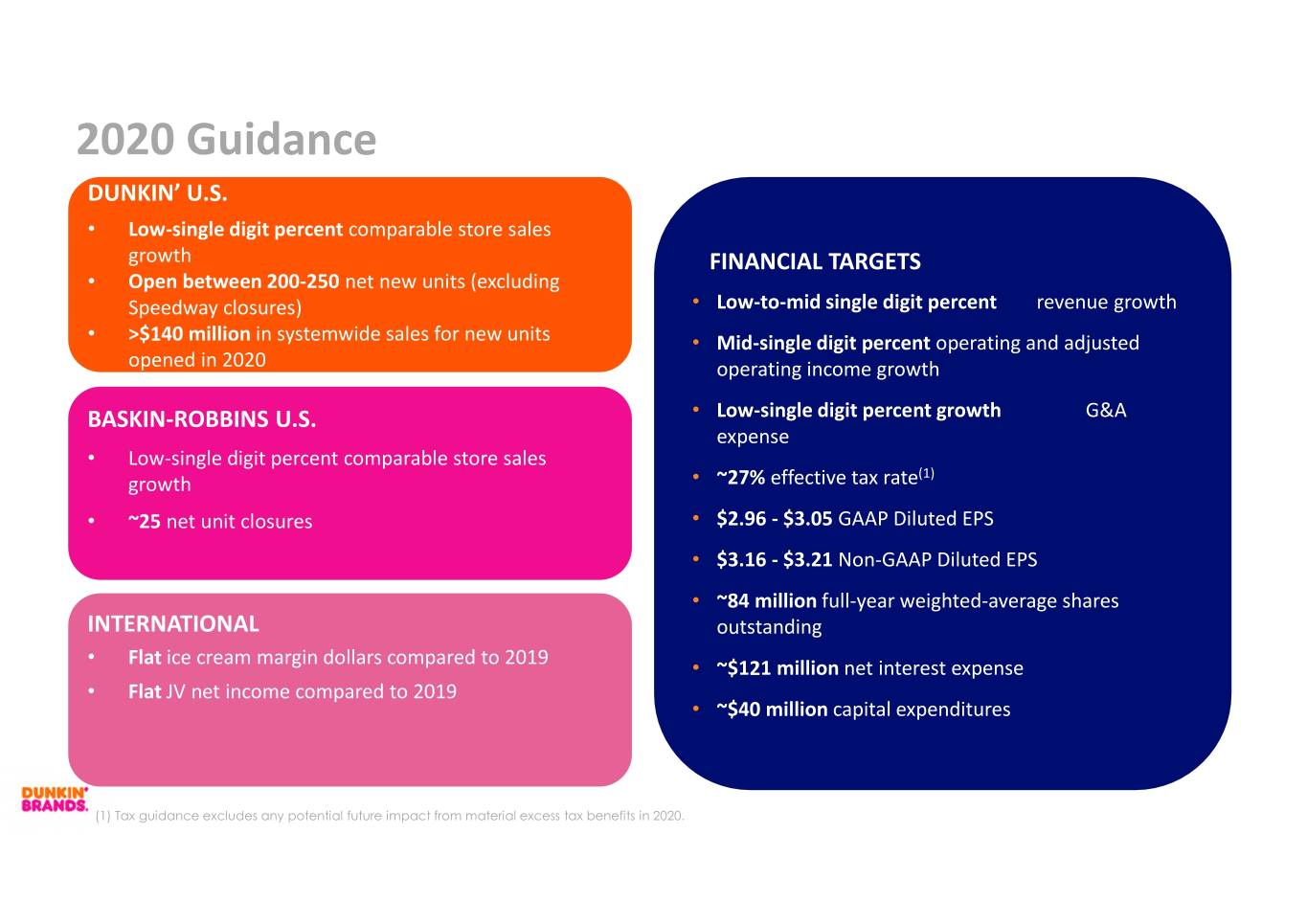

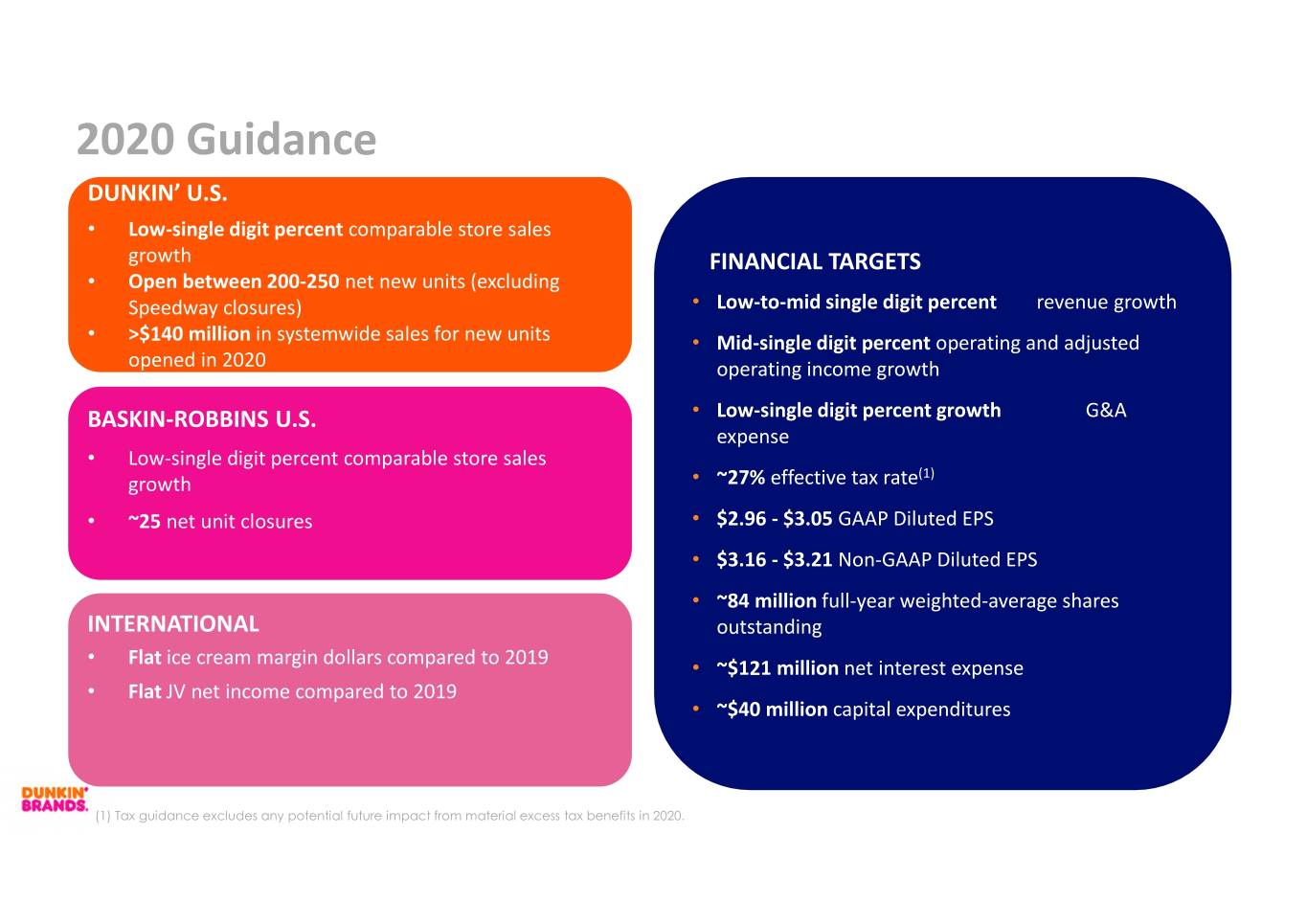

2020 Guidance DUNKIN’ U.S. • Low-single digit percent comparable store sales growth FINANCIAL TARGETS • Open between 200-250 net new units (excluding Speedway closures) • Low-to-mid single digit percent revenue growth • >$140 million in systemwide sales for new units • Mid-single digit percent operating and adjusted opened in 2020 operating income growth BASKIN-ROBBINS U.S. • Low-single digit percent growth G&A expense • Low-single digit percent comparable store sales (1) growth • ~27% effective tax rate • ~25 net unit closures • $2.96 - $3.05 GAAP Diluted EPS • $3.16 - $3.21 Non-GAAP Diluted EPS • ~84 million full-year weighted-average shares INTERNATIONAL outstanding • Flat ice cream margin dollars compared to 2019 • ~$121 million net interest expense • Flat JV net income compared to 2019 • ~$40 million capital expenditures (1) Tax guidance excludes any potential future impact from material excess tax benefits in 2020.

Long-Term Targets (Through 2021) Financial Targets • Low-single digit percent comparable sales growth for Dunkin' U.S. • 200 - 250 net new units for Dunkin’ U.S. • Low-to-mid single digit percent revenue growth • Low-single digit percent G&A expense growth • Mid-to-high single digit percent operating and adjusted operating income growth Dunkin' Brands announced its long-term targets on February 7, 2019.

The “Perks” of Investing in Dunkin’ Brands • Reliable and diversified financial results • Asset-light, 100% franchised model • Strong free cash flow conversion