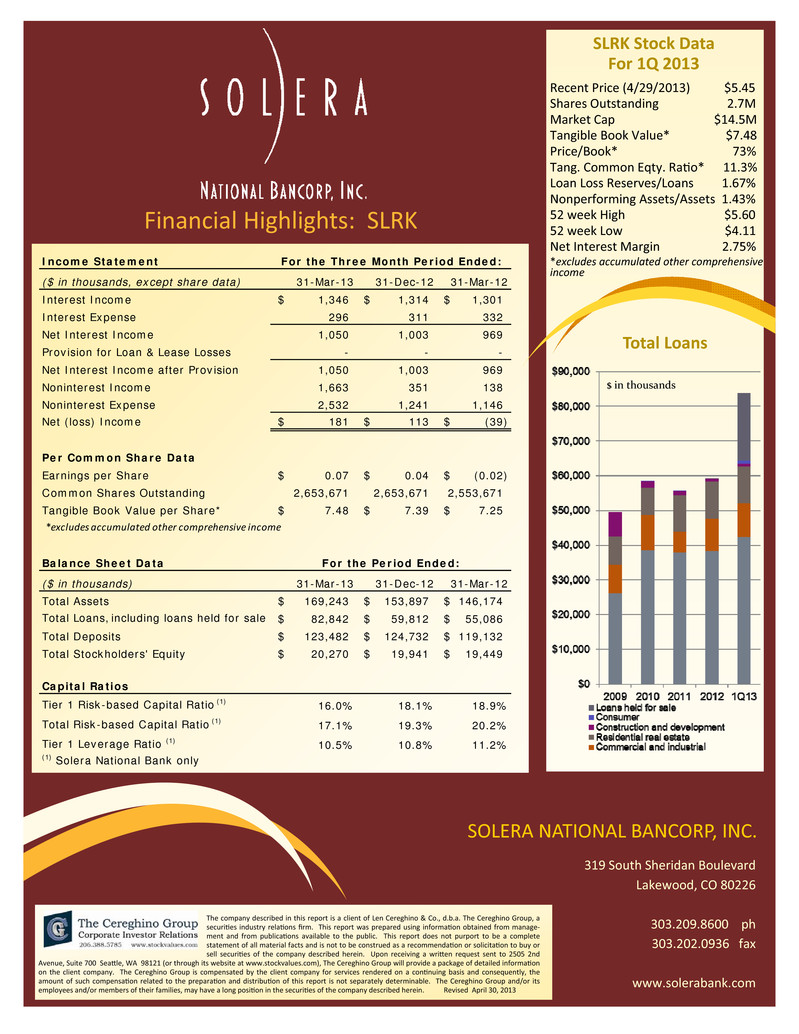

OTCQB: SLRK $5.45 April 29, 2013 FACT SHEET First Quarter 2013 Highlights (at or for the period ended March 31, 2013, except as noted) Net income increased 60% to $181,000, from the preceding quarter, mainly due to the increase in noninterest income which was bolstered by $1.5 million in gains from the sale of loans, primarily due to our residen?al mortgage division. With the fourth quarter launch of its residen?al mortgage division, Solera opened 5 loan produc?on offices and brought on more than 50 experienced mortgage professionals. Solera announced it will acquire approximately $12 million in core deposits from Liberty Savings Bank, with the transac?on to close in the second quarter of 2013. Solera Na?onal Bank received its Preferred Lender status from the U.S. Government’s Small Business Administra?on (SBA) on April 12, 2013. Total revenue increased to $2.7 million in the first quarter of 2013, up from $1.1 million in the first quarter of 2012. Loans, excluding loans held for sale, increased 17%, or $9.2 million, to $64.2 million from the like quarter a year ago, and grew 8%, or $4.6 million, from the fourth quarter 2012. Total deposits increased 4% to $123.5 million, and noninterest‐bearing demand deposits grew 8%, compared to a year ago. The Bank’s capital ra?os significantly exceed regulatory requirements for a well‐ capitalized financial ins?tu?on with total risk‐based capital at 17.1%. Tangible book value, excluding unrealized gains on securi?es, improved to $7.48 per share up from $7.25 per share a year earlier. “Solera Na?onal Bank won the 2012 Diversity Corpora?on of the Year Award,” ColoradoBiz Magazine. ABOUT SOLERA NATIONAL BANCORP Founded in 2007, Solera Na?onal Bank, a wholly‐owned subsidiary of Solera Na?onal Bancorp, Inc., was organized to serve the mul?‐ ethnic popula?on of the greater Denver market. We pride our‐ selves in delivering personalized customer service — welcoming, inclusive and respec?ul — com‐ bined with leading edge banking capabili?es. We are also ac?vely involved in our communi?es. Located in the heart of the Denver MSA, Solera’s market is strong and vibrant. Within a three mile radius of our headquarters, there are: 7,250 businesses 97,000 employees 52% Hispanic households 198,000 residents 140,000 vehicles pass by the branch intersec?on daily. Data from SNL Analy?cs

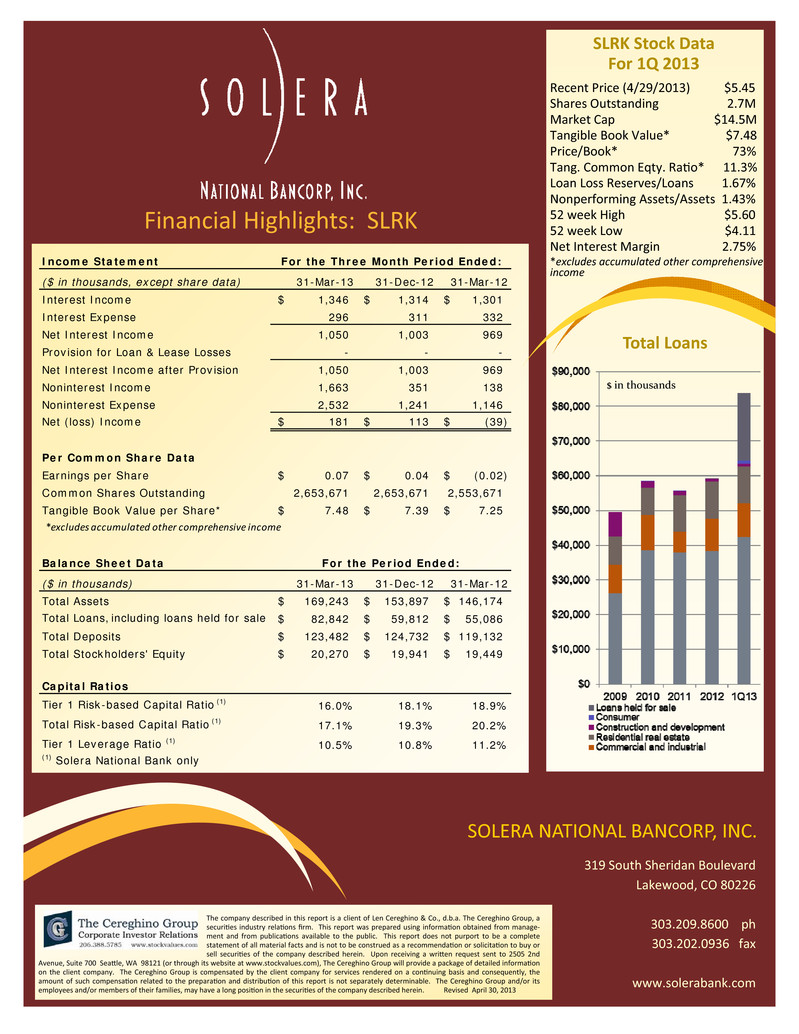

SOLERA NATIONAL BANCORP, INC. 319 South Sheridan Boulevard Lakewood, CO 80226 303.209.8600 ph 303.202.0936 fax www.solerabank.com Income Statement ($ in thousands, except share data) 31-Mar-13 31-Dec-12 31-Mar-12 Interest Income 1,346$ 1,314$ 1,301$ Interest Expense 296 311 332 Net Interest Income 1,050 1,003 969 Provision for Loan & Lease Losses - - - Net Interest Income after Provision 1,050 1,003 969 Noninterest Income 1,663 351 138 Noninterest Expense 2,532 1,241 1,146 Net (loss) Income 181$ 113$ (39)$ Per Common Share Data Earnings per Share 0.07$ 0.04$ (0.02)$ Common Shares Outstanding 2,653,671 2,653,671 2,553,671 Tangible Book Value per Share* 7.48$ 7.39$ 7.25$ *excludes accumulated other comprehensive income Balance Sheet Data ($ in thousands) 31-Mar-13 31-Dec-12 31-Mar-12 Total Assets 169,243$ 153,897$ 146,174$ Total Loans, including loans held for sale 82,842$ 59,812$ 55,086$ Total Deposits 123,482$ 124,732$ 119,132$ Total Stockholders' Equity 20,270$ 19,941$ 19,449$ Capital Ratios Tier 1 Risk-based Capital Ratio (1) 16.0% 18.1% 18.9% Total Risk-based Capital Ratio (1) 17.1% 19.3% 20.2% Tier 1 Leverage Ratio (1) 10.5% 10.8% 11.2% (1) Solera National Bank only For the Three Month Period Ended: For the Period Ended: The company described in this report is a client of Len Cereghino & Co., d.b.a. The Cereghino Group, a securi?es industry rela?ons firm. This report was prepared using informa?on obtained from manage‐ ment and from publica?ons available to the public. This report does not purport to be a complete statement of all material facts and is not to be construed as a recommenda?on or solicita?on to buy or sell securi?es of the company described herein. Upon receiving a wri?en request sent to 2505 2nd Avenue, Suite 700 Sea?le, WA 98121 (or through its website at www.stockvalues.com), The Cereghino Group will provide a package of detailed informa?on on the client company. The Cereghino Group is compensated by the client company for services rendered on a con?nuing basis and consequently, the amount of such compensa?on related to the prepara?on and distribu?on of this report is not separately determinable. The Cereghino Group and/or its employees and/or members of their families, may have a long posi?on in the securi?es of the company described herein. Revised April 30, 2013 Financial Highlights: SLRK Recent Price (4/29/2013) $5.45 Shares Outstanding 2.7M Market Cap $14.5M Tangible Book Value* $7.48 Price/Book* 73% Tang. Common Eqty. Ra?o* 11.3% Loan Loss Reserves/Loans 1.67% Nonperforming Assets/Assets 1.43% 52 week High $5.60 52 week Low $4.11 Net Interest Margin 2.75% *excludes accumulated other comprehensive income SLRK Stock Data For 1Q 2013 Total Loans $ in thousands