SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

RIVERBED TECHNOLOGY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 20, 2011

Dear Stockholder:

I am pleased to invite you to attend Riverbed Technology, Inc.’s 2011 Annual Meeting of Stockholders, to be held on Wednesday, June 1, 2011 at The Courtyard by Marriott, 299 2nd Street, San Francisco, CA 94105. The meeting will begin promptly at 2:00 p.m. local time. If you wish to attend the meeting and need directions, please contact Renee Lyall of Riverbed Investor Relations at 415-247-6353 or renee.lyall@riverbed.com.

Details regarding the business to be conducted at the Annual Meeting are more fully described in Riverbed’s Notice of Annual Meeting of Stockholders and Proxy Statement. We encourage you to read these materials carefully.

Riverbed is pleased to take advantage of SEC rules that allow us to furnish proxy materials to our stockholders on the Internet. These rules enable us to reduce the environmental impact of our Annual Meeting while still providing you with the information that you need.

Your vote is important. Whether or not you expect to attend the Annual Meeting, please vote your shares promptly to ensure that your shares will be represented at the Annual Meeting.

On behalf of the Board of Directors, thank you for your continued support and interest.

|

Sincerely, |

|

| Jerry M. Kennelly |

| Chairman of the Board of Directors, President and Chief Executive Officer |

199 Fremont Street

San Francisco, CA 94105

T415.247.8800F415.247.8801

www.riverbed.com

YOUR VOTE IS EXTREMELY IMPORTANT

Please vote promptly to ensure that your shares are represented at the Annual Meeting.

Riverbed Technology, Inc.

199 Fremont Street

San Francisco, California 94105

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 1, 2011

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Riverbed Technology, Inc., a Delaware corporation (the “Company”). The meeting will be held on Wednesday, June 1, 2011, at 2:00 p.m. local time at The Courtyard by Marriott, 299 2nd Street, San Francisco, CA 94105 for the following purposes:

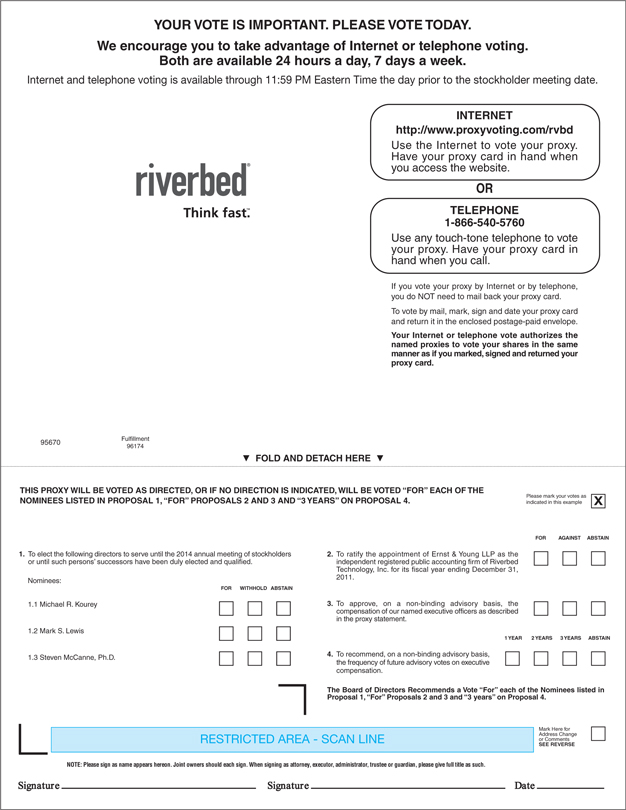

1. To elect three (3) members of the Board of Directors to serve until the 2014 annual meeting of stockholders of the Company or until such persons’ successors have been duly elected and qualified.

2. To ratify the appointment by the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2011.

3. To hold an advisory vote on executive compensation.

4. To hold an advisory vote on the frequency of the advisory vote on executive compensation.

5. To transact any other business properly brought before the meeting or any adjournment or postponement thereof.

These items of business are more fully described in the Company’s Proxy Statement.

The record date for the 2011 Annual Meeting is April 11, 2011. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

By Order of the Board of Directors |

|

|

| Brett A. Nissenberg |

| General Counsel, Senior Vice President of Corporate and Legal Affairs and Secretary |

San Francisco, California

April 20, 2011

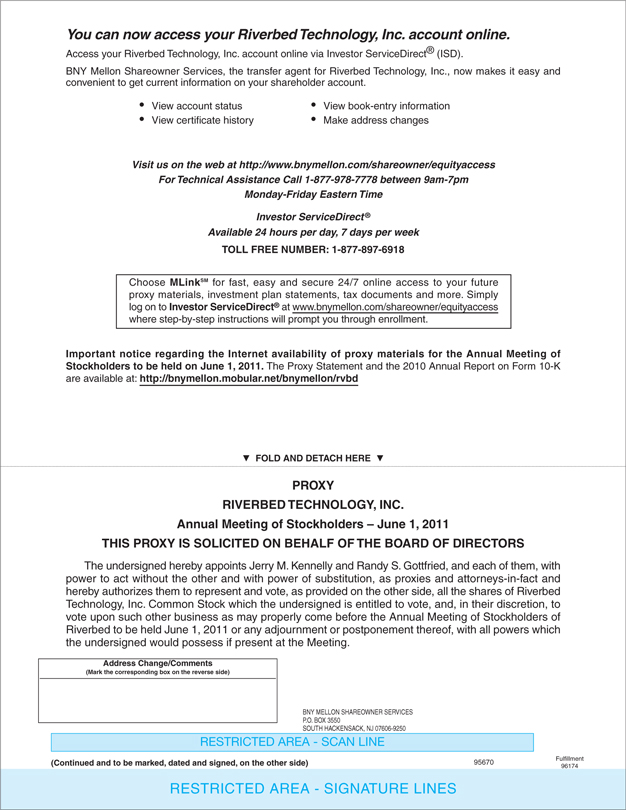

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy card, if applicable, or vote via telephone or the Internet as instructed in these materials, as promptly as possible. If you received printed versions of these materials by mail, a return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. However, if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must provide a valid proxy issued in your name from that record holder.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 1, 2011

The Proxy Statement and Annual Report on Form 10-K are available at

http://bnymellon.mobular.net/bnymellon/rvbd.

2011 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

i

ii

iii

Riverbed Technology, Inc.

199 Fremont Street

San Francisco, California 94105

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

June 1, 2011

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We have made these materials available to you on the Internet or, upon your request, have delivered printed versions of these materials to you by mail in connection with the solicitation by the Board of Directors of Riverbed Technology, Inc. (sometimes referred to as the “Company” or “Riverbed”) of your proxy to vote at the 2011 Annual Meeting of Stockholders (the “Annual Meeting”). You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), Riverbed has elected to provide access to its proxy materials via the Internet. As a result, Riverbed is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to its stockholders of record entitled to vote at the Annual Meeting. All Riverbed stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed set may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Riverbed encourages its stockholders to access proxy materials over the Internet in order to assist it in reducing the environmental impact of its annual meetings.

What is included in these materials?

These materials include:

| | • | | This Proxy Statement for the Annual Meeting; and |

| | • | | Riverbed’s Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the SEC on February 8, 2011 (the “Annual Report”). |

If you requested printed versions of these materials by mail, these materials also include the proxy card or vote instruction form for the Annual Meeting.

How may I obtain electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

| | • | | View on the Internet Riverbed’s proxy materials for the Annual Meeting; and |

| | • | | Instruct Riverbed to send future proxy materials to you by email. |

Choosing to receive future proxy materials by email will save Riverbed the cost of printing and mailing documents to you and will reduce the impact of Riverbed’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

1

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 11, 2011 (the “Record Date”) will be entitled to vote at the Annual Meeting. On this record date, there were 153,478,414 shares of Company common stock (“Common Stock”) outstanding. All of these outstanding shares are entitled to vote at the Annual Meeting.

What is the difference between a stockholder of record and a beneficial owner of shares?

Stockholder of Record: Shares Registered in Your Name

If on April 11, 2011 your shares were registered directly in your name with our transfer agent, BNY Mellon Shareowner Services, then you are a stockholder of record, and the Notice or proxy materials were sent directly to you by Riverbed. If you request printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 11, 2011 your shares were held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in “street name” and the Notice was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. Those instructions are contained in a “vote instruction form.” If you request printed copies of the proxy materials by mail, you will receive a vote instruction form. A number of brokers and banks enable beneficial holders to give voting instructions via telephone or the Internet. Please refer to the voting instructions provided by your bank or broker. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you provide a valid legal proxy from your broker, bank or other custodian.

What am I voting on?

There are four matters scheduled for a vote:

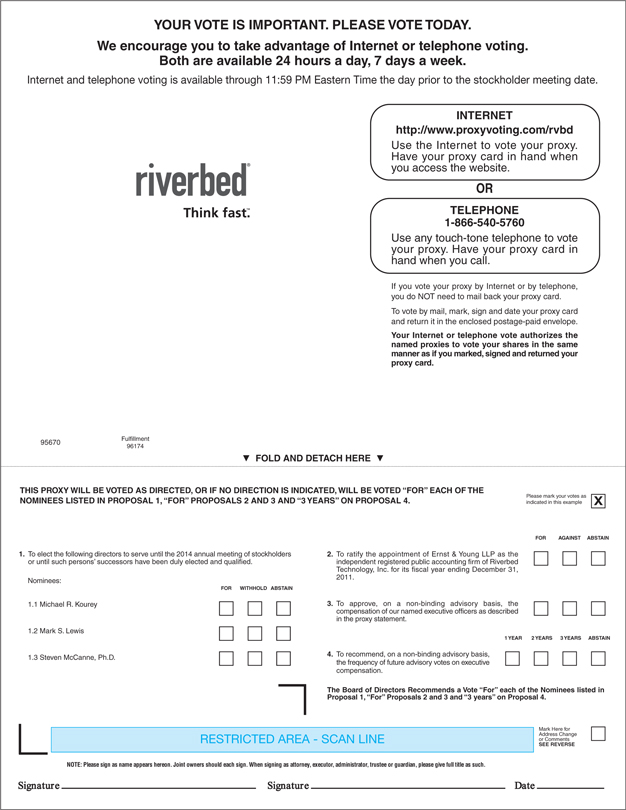

| | • | | Proposal 1: Election of three directors to serve until the 2014 annual meeting of stockholders or until such persons’ successors have been duly elected and qualified; |

| | • | | Proposal 2: Ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011; |

| | • | | Proposal 3: An advisory vote on executive compensation; and |

| | • | | Proposal 4: An advisory vote on the frequency of the advisory vote on executive compensation. |

What are the Board’s voting recommendations?

Riverbed’s Board of Directors recommends that you vote your shares:

| | • | | “For” each of the nominees to the Board (Proposal 1); |

| | • | | “For” ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011 (Proposal 2); |

| | • | | “For” the proposal regarding an advisory vote on executive compensation (Proposal 3); and |

| | • | | “3 Years” for the proposal regarding an advisory vote on the frequency of the advisory vote on executive compensation (Proposal 4). |

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Common Stock you own as of April 11, 2011.

How do I vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote:

| | • | | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy using the proxy card. To vote using the proxy card, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| | • | | Via the Internet. You may vote by proxy on the Internet by following the instructions provided in the Notice. |

| | • | | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the number provided on your proxy card. |

| | • | | In person. To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are the beneficial owner of shares held in “street name”, you may vote:

| | • | | By Mail. If you request printed copies of the proxy materials by mail, you may vote by completing the vote instruction form and returning it as directed. |

| | • | | Via the Internet. You may vote by proxy on the Internet by visiting the website provided in the Notice and entering the control number. |

| | • | | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the number provided on the vote instruction form. |

| | • | | In person. If you are a beneficial owner of shares held in “street name” and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy. |

***

We provide Internet proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers.

How are proxies voted?

All shares represented by valid proxies received prior to the Annual Meeting will be voted. Where a stockholder has specified by means of the proxy a choice with respect to any matter to be voted upon, the shares will be voted in accordance with the stockholder’s instructions.

3

What happens if I do not give specific voting instructions?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and you:

| | • | | Indicate when voting on the Internet, or by telephone, that you wish to vote as recommended by the Board; or |

| | • | | Sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares held in “street name” and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2011 fiscal year (Proposal 2) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2.

The election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 3), and the advisory vote on the frequency of the advisory vote on executive compensation (Proposal 4) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 3 and 4.

Who is paying for this proxy solicitation?

Riverbed will pay for the entire cost of soliciting proxies. In addition to soliciting proxies by mail, Riverbed’s directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. Riverbed may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice or printed set of proxy materials?

If you receive more than one Notice or printed set of proxy materials, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions with respect to each Notice and, if applicable, printed set of proxy materials to ensure that all of your shares are voted.

4

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

Under a procedure called “householding”, a single copy of the Notice and, if applicable, this Proxy Statement and Annual Report will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. This helps to reduce the Company’s printing and mailing costs. Stockholders that participate in householding will continue to be able to access and receive separate proxy cards. If you no longer wish to participate in householding and would prefer to receive a separate Notice and, if applicable, this Proxy Statement and Annual Report, please direct your written request to Riverbed Technology, Inc., 199 Fremont Street, San Francisco, California 94105, Attn: Secretary, or call (415) 247-8800.

A number of brokers with account holders who are Riverbed stockholders will be householding our proxy materials. Stockholders that hold shares in “street name” may contact their brokerage firm, bank, dealer or similar organization to request information about householding.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of the following ways:

| | • | | You may submit another properly completed proxy card or vote instruction form with a later date. |

| | • | | You may vote again on a later date via the Internet or by telephone. |

| | • | | You may send a written notice that you are revoking your proxy to the Corporate Secretary of the Company at 199 Fremont Street, San Francisco, California 94105. |

| | • | | You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

How many votes are needed to approve each proposal?

Proposal 1. A majority vote standard applies to this election of directors. Therefore, election of a nominee requires such nominee to receive more votes cast “for” his election than “against” his election. See “How is the majority voting standard applied to the election of directors” below. Stockholders may not cumulate votes in the election of directors. Abstentions will have no effect on the outcome of this election of directors. Broker non-votes will not be counted as having been voted on the proposal.

Proposal 2. Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011 requires the affirmative vote of a majority of the votes cast on this proposal. Abstentions will have the same effect as an “Against” vote. Broker non-votes will not be counted as having been voted on the proposal.

Proposal 3. The vote on executive compensation is advisory, and therefore no specific approval standard applies. However, Riverbed’s Board of Directors intends to carefully review the results of this vote.

Proposal 4. The vote on the frequency of the advisory vote on executive compensation is advisory, and therefore no specific approval standard applies. However, Riverbed’s Board of Directors intends to carefully review the results of this vote.

5

You may vote “FOR”, “WITHHOLD”, or “ABSTAIN” on each of the nominees for election as director (Proposal 1). You may not vote “For” the election of any persons other than the three named nominees. A “Withhold” vote will be treated as equivalent to an “Against” vote for purposes of applying the majority voting standard.

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to ratify the appointment of Ernst and Young LLP as Riverbed’s independent registered public accounting firm (Proposal 2) and on the advisory vote on executive compensation (Proposal 3).

You may vote “1 YEAR”, “2 YEARS”, “3 YEARS” or “ABSTAIN” on the advisory vote on the frequency of the advisory vote on executive compensation (Proposal 4).

How is the majority voting standard applied to the election of directors?

Riverbed’s Amended and Restated Bylaws (“Bylaws”) and Corporate Governance Guidelines provide for a majority voting standard in uncontested elections of directors. An uncontested election is one in which the number of nominees for director does not exceed the number of directors to be elected. The director election taking place at this Annual Meeting is uncontested, and therefore the majority voting standard will apply. Under the majority voting standard, in order for a nominee to be elected the votes cast “for” such nominee’s election must exceed the votes cast “against” such nominee’s election.

Riverbed has adopted a policy pursuant to which an incumbent director nominee that receives a greater number of votes “against” his or her election than votes “for” such election will tender his or her resignation for consideration by the Nominating/Corporate Governance Committee of Riverbed’s Board of Directors. The Nominating/Corporate Governance Committee will then recommend to the Board of Directors the action to be taken with respect to such offer of resignation.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if a majority of all outstanding shares is represented by stockholders either present at the meeting or represented by proxy. On the record date, there were 153,478,414 shares of Common Stock outstanding and entitled to vote. Thus, 76,739,208 shares would constitute a quorum. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting. In the event we are unable to obtain the final voting results within four business days, we will file the preliminary voting results in a Current Report on Form 8-K within four business days following the Annual Meeting, and will file an amended Form 8-K with the final voting results within four business days after the final voting results are known.

How can stockholders submit a proposal for inclusion in the Proxy Statement for the 2012 Annual Meeting?

To be included in our Proxy Statement for the 2012 Annual Meeting, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and be received by our Corporate Secretary at our principal executive offices no

6

later than December 22, 2011, or no later than one hundred twenty (120) calendar days before the one-year anniversary of the date on which we first mailed our Notice or proxy materials to stockholders in connection with this year’s Annual Meeting.

How can stockholders submit proposals to be raised at the 2012 Annual Meeting that will not be included in the Proxy Statement for the 2012 Annual Meeting?

To be raised at the 2012 Annual Meeting, stockholder proposals must comply with our Bylaws. Under our Bylaws, a stockholder must give advance notice to our Corporate Secretary of any business, including nominations of directors for our Board, that the stockholder wishes to raise at our Annual Meeting. To be timely, a stockholder’s notice shall be delivered to our Corporate Secretary at our principal executive offices not less than forty-five (45) or more than seventy-five (75) days before the one-year anniversary of the date on which we first mailed our Notice or proxy materials to stockholders in connection with this year’s Annual Meeting. Since our Notice or proxy materials for our 2011 Annual Meeting were first mailed to stockholders on April 20, 2011, stockholder proposals must be received by our Corporate Secretary at our principal executive offices no earlier than February 5, 2012 and no later than March 6, 2012, in order to be raised at our 2012 Annual Meeting. Stockholders may also submit a recommendation (as opposed to a formal nomination) for a candidate for membership on our Board by following the procedures discussed under “Nominating/Corporate Governance Committee.”

What if the date of the 2012 Annual Meeting changes by more than 30 days from the anniversary of this year’s Annual Meeting?

Under Rule 14a-8 of the Exchange Act, if the date of the 2012 Annual Meeting changes by more than 30 days from the anniversary of this year’s Annual Meeting, to be included in our Proxy Statement, stockholder proposals must be received by us within a reasonable time before our solicitation is made.

Under our Bylaws, if the date of the 2012 Annual Meeting is advanced by more than 30 days or delayed by more than 60 days from the anniversary of this year’s Annual Meeting, stockholder proposals to be brought before the 2012 Annual Meeting must be received not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of (x) the 90th day prior to such annual meeting or (y) the 10th day following the day on which public announcement of the date of such meeting is first made.

Does a stockholder proposal require specific information?

With respect to a stockholder’s nomination of a candidate for our Board, the stockholder notice to the Corporate Secretary must contain certain information as set forth in our Bylaws about both the nominee and the stockholder making the nomination. With respect to any other business that the stockholder proposes, the stockholder notice must contain a brief description of such business and the reasons for conducting such business at the meeting, as well as certain other information as set forth in our Bylaws. If you wish to bring a stockholder proposal or nominate a candidate for director, you are advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. Our Bylaws may be found on our website at www.riverbed.com in the Corporate Governance section of the Investor Relations page.

7

What happens if Riverbed receives a stockholder proposal that is not in compliance with the timeframes described above?

If we receive notice of a matter to come before the 2012 Annual Meeting that is not in compliance with the deadlines described above, we will use our discretion in determining whether or not to bring such matter before the Annual Meeting. If such matter is brought before the Annual Meeting, then our proxy card for such meeting will confer upon our proxy holders discretionary authority to vote on such matter.

Do the figures in this Proxy Statement take into account the two-for-one split of Riverbed’s Common Stock effected on November 8, 2010?

Yes, all figures included in this Proxy Statement reflect the stock split, and are expressed on a post-split basis.

8

PROPOSAL 1

ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation (the “Charter”) and Bylaws provide for a classified board of directors. There are three classes of directors, with each class of directors serving three-year terms that end in successive years. We currently have authorized nine directors. The class of directors standing for election at the Annual Meeting currently consists of three directors. The directors elected at the Annual Meeting will serve until our 2014 annual meeting of stockholders or until their successors are duly elected and qualified. The directors being nominated for election to the Board of Directors (each, a “Nominee”), their ages as of March 16, 2011, their positions and offices held with Riverbed and certain biographical information are set forth below. Beneath the biographical details of each Nominee or director listed below, we have also detailed the specific experience, qualifications, attributes or skills of each Nominee or director that leads the Board of Directors to conclude that each Nominee or director should serve on the Board of Directors.

The proxy holders intend to vote all proxies received by themFOR the Nominees listed below unless otherwise instructed. In the event that any Nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the current Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware that any Nominee is unable or will decline to serve as a director. Proxies cannot be voted for more than three individuals. Abstentions will have no effect on the outcome of this election of directors. Broker non-votes will not be counted as having been voted on the proposal.

Riverbed’s Bylaws and Corporate Governance Guidelines provide for a majority voting standard in uncontested elections of directors. An uncontested election is one in which the number of nominees for director does not exceed the number of directors to be elected. The director election taking place at this Annual Meeting is uncontested, and therefore the majority voting standard will apply. Under the majority voting standard, in order for a nominee to be elected the votes cast “for” such nominee’s election must exceed the votes cast “against” such Nominee’s election. A “Withhold” vote will be treated as equivalent to an “Against” vote for purposes of applying the majority voting standard.

Riverbed has adopted a policy pursuant to which an incumbent director nominee that receives a greater number of votes “against” his or her election than votes “for” such election will tender his or her resignation for consideration by the Nominating/Corporate Governance Committee of Riverbed’s Board of Directors. The Nominating/Corporate Governance Committee will then recommend to the Board of Directors the action to be taken with respect to such offer of resignation.

Information Regarding the Nominees

| | | | | | |

Name | | Age | | | Positions and Offices Held With the Company |

Michael R. Kourey | | | 51 | | | Director |

Mark S. Lewis | | | 48 | | | Director |

Steven McCanne, Ph.D. | | | 42 | | | Director and Chief Technology Officer |

Michael R. Kourey, age 51, has been a member of the Board of Directors since March 2006 and served as our lead independent director from April 2006 to April 2011. Since January 1999, Mr. Kourey has been a member of the board of directors and served as senior vice president of Finance and Administration of Polycom, Inc., a unified collaborative communications solution company. Since January 1995, Mr. Kourey has also served as Polycom’s chief financial officer. In the past, he served as Polycom’s vice president of Finance and Administration (January 1995 to January 1999), vice president of Finance and Operations (July 1991 to January 1995), secretary (June 1993 to May 2003), and treasurer (May 2003 to May 2004). Prior to joining Polycom, Mr. Kourey was vice president of

9

Operations at Verilink Corporation. Mr. Kourey currently serves as a member of the board of directors of Aruba Networks, Inc., an enterprise mobility solution provider, and serves on the advisory board of the Graduate School of Management at the University of California, Davis. Mr. Kourey holds a B.S. in Managerial Economics from the University of California, Davis, and an M.B.A. from Santa Clara University.

We believe that Mr. Kourey’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Kourey possesses a deep understanding of accounting principles and financial reporting rules and regulations, including how internal controls are effectively managed within organizations. In addition, Mr. Kourey possesses extensive experience as a finance executive at a publicly-traded corporation, as well as significant experience as a Board member at two publicly-traded corporations.

Mark S. Lewis, age 48, has been a member of the Board of Directors since February 2010. Mr. Lewis has served as Chief Strategy Officer for the Information Infrastructure Products Business of EMC Corporation, an information infrastructure technology and solutions company, since October 2010. Mr. Lewis’ prior roles at EMC have included President of the Content Management and Archiving Division, Chief Development Officer, Chief Technology Officer and co-leader of the EMC Software Group. Mr. Lewis joined EMC in July 2002 from Hewlett-Packard/Compaq, where he was Vice President and General Manager of Compaq’s Enterprise Storage Group. From 1998 to 1999, Mr. Lewis led Compaq’s Enterprise Storage Software Business after serving for two years as Director of Engineering for Multi Vendor Online Storage. Before that, he spent 13 years in storage-related engineering and product development at Digital Equipment Corporation, a computer manufacturing company. Mr. Lewis holds a B.S. in Mechanical Engineering from University of Colorado, Boulder. He has studied Business Law, Marketing, and Accounting for an MBA at University of Colorado, Colorado Springs, and he attended the Executive Education Program at the Harvard Business School.

We believe that Mr. Lewis’ experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Lewis’ extensive operating experience positions him to provide valuable guidance on our corporate vision and technology innovations. In addition, Mr. Lewis’ industry expertise is especially important as we direct our efforts to both maintaining market and technology leadership with our core competencies as well as expanding our business into adjacent markets.

Steven McCanne, Ph.D., age 42, co-founded our company in May 2002 and has served as our Chief Technology Officer since September 2002. He has also been a member of the Board of Directors since May 2002. Prior to founding our company, Dr. McCanne served as Chief Technology Officer, Media Division and later as Chief Technology Officer for Inktomi Corporation, an infrastructure software company, from October 2000 to March 2002. Dr. McCanne joined Inktomi following its acquisition of FastForward Networks, which he co-founded in May 1998. Dr. McCanne has also served on the faculty in Electrical Engineering and Computer Science at the University of California, Berkeley. Dr. McCanne holds a Bachelor’s degree in Electrical Engineering and Computer Science and a Ph.D. in Computer Science from the University of California, Berkeley.

We believe that Dr. McCanne’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Dr. McCanne, a co-founder of our company and networking technology visionary, possesses strong technical and business insight into the WAN optimization and adjacent markets. In addition, his technology innovations and in-depth knowledge of our business and products continue to serve as significant contributors to the success of our company.

The Board of Directors Recommends a Vote “FOR” Each Named Nominee.

10

Information Regarding Other Directors Continuing in Office

Set forth below is information regarding each of the continuing directors of Riverbed, including his age as of March 16, 2011, the period during which he has served as a director, and certain information as to principal occupations and directorships held by him in corporations whose shares are publicly registered.

Continuing Directors — Term Ending in 2012

Michael Boustridge, age 47, has been a member of the Board of Directors since February 2010. Mr. Boustridge previously served as President, BT Global Services Multi-National Corporations, where he had responsibility for all aspects of BT’s operations and performance for the global Multi-National Corporations worldwide, including BT’s Global Financial Services sector. Since joining BT Global Services in April 2006 Mr. Boustridge held many positions, including President of America and Canada as well as President Asia Pacific. Prior to joining BT, Mr. Boustridge served as Chief Sales and Chief Marketing Officer at Electronic Data Systems, LLC, which he joined in 1996 from Hitachi Data Systems. Mr. Boustridge previously served on the Board of Trustees of the X PRIZE Foundation, an educational nonprofit organization.

We believe that Mr. Boustridge’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Boustridge’s deep knowledge of the information and communications service provider market is an important asset, as leveraging key service provider relationships has become increasingly important to Riverbed and our customers. In addition, his extensive global experience in the IT services sector, as well as his expertise in delivering successful operational results for global companies, will enable Mr. Boustridge to provide valuable guidance as we seek to continue growing our business.

Jerry M. Kennelly, age 60, co-founded our company in May 2002 and serves as Chairman of the Board of Directors and as our President and Chief Executive Officer. Immediately prior to founding our company, Mr. Kennelly spent six years at Inktomi Corporation, an infrastructure software company, where he served as Executive Vice President, Chief Financial Officer and Secretary. From June 1990 until joining Inktomi in October 1996, Mr. Kennelly worked for Sybase, Inc., an infrastructure software company, in a number of senior financial and operational positions, most recently as Vice President of Corporate Finance. From November 1988 until June 1990, Mr. Kennelly worked at Oracle Corporation as finance director for US Operations. From June 1980 until November 1988, Mr. Kennelly worked at Hewlett-Packard Company as Worldwide Sales and Marketing Controller for the Tandem Computers Division. Mr. Kennelly holds a Bachelor’s degree from Williams College and a Masters degree from the New York University Graduate School of Business Administration.

We believe that Mr. Kennelly’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Kennelly, a co-founder of our company, possesses in-depth knowledge of our business and markets, extensive operating experience, and strong leadership skills, having served as our Chief Executive Officer since shortly after the Company’s inception as well as an executive at technology companies for two decades prior. In addition, his expertise in guiding our long-term strategic and corporate planning continues to contribute significantly to the success of our company.

Stanley J. Meresman, age 64, has been a member of the Board of Directors since March 2005. Mr. Meresman was a Venture Partner with Technology Crossover Ventures, a private equity firm, from January through December 2004 and was General Partner and Chief Operating Officer of Technology Crossover Ventures from November 2001 to December 2003. During the four years prior to joining Technology Crossover Ventures, Mr. Meresman was a private investor and board member and advisor to several technology companies. From May 1989 to May 1997, Mr. Meresman was the Senior Vice President and Chief Financial Officer of Silicon Graphics, Inc. Prior to Silicon Graphics, he was Vice

11

President of Finance and Administration and Chief Financial Officer of Cypress Semiconductor. Mr. Meresman holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and an M.B.A. from the Stanford Graduate School of Business. Mr. Meresman is also a director of Meru Networks, a wireless networking solution provider.

We believe that Mr. Meresman’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Meresman possesses a deep understanding of accounting principles and financial reporting rules and regulations, including how internal controls are effectively managed within organizations. In addition, Mr. Meresman’s financial and accounting expertise is strengthened by his extensive experience as a chief financial officer at two publicly-traded corporations.

Continuing Directors — Term Ending in 2013

Mark A. Floyd, age 55, has been a member of the Board of Directors since August 2007. Mr. Floyd has served as the Chief Executive Officer of SafeNet, Inc., an information security company, since July 2009. Mr. Floyd served as President and Chief Executive Officer of Entrisphere, Inc., a telecommunications equipment company, from August 2001 until its acquisition by Ericsson in February 2007. Prior to that, Mr. Floyd served as President and Chief Executive Officer of Siemens ICN, Inc., a telecommunications equipment company, from April 2000 until January 2001, and President and Chief Executive Officer of Efficient Networks, Inc., another telecommunications equipment company, from July 1993 to April 2000. Mr. Floyd holds a B.B.A. degree in Finance from the University of Texas. Mr. Floyd has served as a director of Tekelec, Inc., a network applications company, since October 2004, most recently as chairman. Mr. Floyd has announced that he will not be standing for reelection to the board of directors of Tekelec at their 2011 annual meeting to be held on May 13, 2011. Mr. Floyd previously served as a director of Carrier Access Corporation, a telecommunications equipment manufacturer, from June 2001 to March 2008.

We believe that Mr. Floyd’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Floyd has extensive experience as an executive in the technology industry, having served as Chief Executive Officer on four separate occasions. In addition, his service provider industry expertise has been an important asset to Riverbed as we have increasingly viewed service provider engagement as a key growth lever.

Christopher J. Schaepe, age 47, has been a member of the Board of Directors since December 2002. Mr. Schaepe is a founding managing director of Lightspeed Venture Partners, a venture capital firm. Prior to joining Lightspeed in September 2000, he was a general partner at Weiss, Peck & Greer Venture Partners, a venture capital firm, which he joined in 1991. Mr. Schaepe holds B.S. and M.S. degrees in Computer Science and Electrical Engineering from MIT and an M.B.A. from the Stanford Graduate School of Business. Mr. Schaepe served as a director of eHealth, Inc., an online health insurance provider, from April 1999 to September 2008.

We believe that Mr. Schaepe’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Schaepe possesses a broad perspective of the technology industry, having guided numerous companies in his role as a venture capital investor and Board member over the past two decades, as well as substantive professional experience serving in corporate finance and capital markets roles. In addition, he possesses in-depth knowledge of our business, having advised Riverbed since December 2002.

James R. Swartz, age 68, has been a member of the Board of Directors since November 2002 and has served as our lead independent director since April 2011. Mr. Swartz is a founding partner of Accel Partners, a venture capital firm, and has been with Accel Partners since 1983. He holds a B.S. degree from Harvard University with a concentration in Engineering Sciences and Applied Physics and an M.S. in Industrial Administration from Carnegie Mellon University.

12

We believe that Mr. Swartz’s experience and skills make him a qualified and valuable member of our Board of Directors. In particular, Mr. Swartz possesses deep expertise in guiding the long-term strategic planning of technology companies, having served as a Board member of more than fifty successful companies over four decades of venture capital investing. In addition, Mr. Swartz possesses in-depth knowledge of our business, having advised Riverbed since November 2002.

13

CORPORATE GOVERNANCE

Independence of the Board of Directors

The Board of Directors is currently comprised of nine members. Seven of our nine members, Messrs. Boustridge, Floyd, Kourey, Lewis, Meresman, Schaepe and Swartz, qualify as independent directors in accordance with the published listing requirements of the Nasdaq Stock Market, or Nasdaq. The Nasdaq independence definition includes a series of objective tests. In addition, as further required by the Nasdaq rules, the Board of Directors has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to us and our management. The information reviewed included information relating to any sales of our products and services to, and purchases by us of products and services from, entities (or affiliates of such entities) where any of our directors are employed. See “Review, Approval or Ratification of Transactions with Related Persons.”

Chairman of the Board

Mr. Kennelly, our President and Chief Executive Officer, also serves as the Chairman of our Board of Directors. It is the opinion of the Board of Directors that Mr. Kennelly’s service as Chairman best meets the needs of Riverbed and its stockholders.

In his capacity as Chairman, Mr. Kennelly, with the advice and input of other Board members, is responsible for ensuring that the quality, quantity and timeliness of the information provided by management is sufficient to enable the Board to effectively and responsibly perform its duties. The Board believes that this responsibility in particular is currently best discharged by the individual serving as the Company’s chief executive.

In the future, selecting an independent director to serve as Chairman may or may not be in the best interests of Riverbed and its stockholders. We believe that the Board of Directors will be in the best position to make that determination. The Board values its flexibility to select the Chairman that it considers best able to meet the needs of the Company and its stockholders, based on the qualifications of the directors then serving on the Board.

Lead Independent Director

Mr. Kourey served as our Lead Independent Director in 2010. Mr. Swartz has served as our Lead Independent Director since April 2011. The Lead Independent Director is responsible for calling special meetings of the independent directors, as and if he deems that such meetings are necessary. The Lead Independent Director is also responsible for chairing all meetings of independent directors. The independent members of the Board meet regularly in executive session at which only independent directors are present, typically after regularly scheduled Board of Directors meetings.

Board Leadership Structure

The Board of Directors believes that our Board structure, with its strong emphasis on Board independence, is successful in achieving effective independent oversight of management and the Company. Board members have complete access to management and outside advisors, and the Chairman is not the sole source of information for the Board of Directors. The Chairman does not serve on any of the Board’s three committees, and the Nominating/Corporate Governance Committee is

14

chaired by our Lead Independent Director. Seven of our nine Board members are independent under Nasdaq rules. In addition, every member of each of the Board’s three committees is independent. The Board of Directors delegates substantial responsibility to the Board committees, which regularly report their activities and actions to the full Board of Directors. We believe that our independent Board committees are an important aspect of our Board leadership structure.

Information Regarding the Board of Directors and its Committees

The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating/Corporate Governance Committee. The Board has determined that the Chairs and members of each committee are independent under the applicable Nasdaq and Securities and Exchange Commission (“SEC”) rules. The following table provides membership and meeting information for each of the Board committees during 2010:

| | | | | | | | | | | | |

Name | | Audit | | | Compensation | | | Nominating/Corporate

Governance | |

Michael Boustridge (1) | | | | | | | X | | | | | |

Mark A. Floyd | | | X | | | | X | | | | | |

Jerry M. Kennelly | | | | | | | | | | | | |

Michael R. Kourey | | | X | | | | | | | | X | (2) |

Mark S. Lewis (3) | | | | | | | | | | | X | |

Steven McCanne, Ph.D. | | | | | | | | | | | | |

Stanley J. Meresman | | | X | (2) | | | | | | | X | |

Christopher J. Schaepe | | | | | | | X | | | | X | |

James R. Swartz | | | | | | | X | (2) | | | | |

Total meetings in fiscal year 2010 | | | 8 | | | | 23 | | | | 5 | |

| (1) | Joined the Compensation Committee in February 2010 |

| (3) | Joined the Nominating/Corporate Governance Committee in February 2010 |

In April 2011, the following changes occurred in Riverbed’s Board Committee membership and chairperson composition:

| | • | | Mr. Kourey assumed the chairpersonship of the Audit Committee. |

| | • | | Mr. Meresman joined the Compensation Committee and no longer serves on the Nominating/Corporate Governance Committee. |

| | • | | Mr. Schaepe assumed the chairpersonship of the Compensation Committee. |

| | • | | Mr. Swartz joined the Nominating/Corporate Governance Committee as chairperson and no longer serves on the Compensation Committee. |

Below is a description of each committee of the Board of Directors. Each committee of the Board of Directors has a written charter approved by the Board of Directors. Copies of each of the committee charters are posted on our website at www.riverbed.com in the Corporate Governance section of the Investor Relations page.

Audit Committee

The Audit Committee of the Board of Directors oversees our accounting practices, system of internal controls, audit processes and financial reporting processes. Among other things, the Audit Committee is responsible for reviewing our disclosure controls and processes and the adequacy and effectiveness of our internal controls and internal audit functions. It also discusses the scope and results of the audit and interim reviews with our independent auditors, reviews with our management

15

our interim and year-end operating results and, as appropriate, initiates inquiries into aspects of our financial affairs. The Audit Committee is responsible for establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. In addition, the Audit Committee has sole and direct responsibility for the appointment, retention, compensation and oversight of the work of our independent auditors, including approving services and fee arrangements. Our Audit Committee has the principal responsibility for reviewing related person transactions pursuant to written policies and procedures adopted by the Board of Directors, subject to specified exceptions and other than those that involve compensation. A more detailed description of the Audit Committee’s functions can be found in the Audit Committee charter.

The members of the Audit Committee in 2010 and currently are Messrs. Floyd, Kourey and Meresman. Mr. Meresman chaired the Audit Committee in 2010. Mr. Kourey has chaired the Audit Committee since April 2011.

The Board of Directors has determined that Messrs. Floyd, Kourey and Meresman are each an “Audit Committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K. The designation does not impose on Messrs. Floyd, Kourey and Meresman any duties, obligations or liability that are greater than are generally imposed on them as members of the Audit Committee and the Board of Directors.

Compensation Committee

The Compensation Committee of the Board of Directors reviews and approves our overall compensation strategy and policies. Specifically, the Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management, reviews and approves the compensation and other terms of employment of our Chief Executive Officer and other executive officers, approves the bonus programs in effect for the Chief Executive Officer, other executive officers and key employees for each fiscal year, recommends to the Board of Directors the compensation of our directors, recommends to the Board of Directors the adoption or amendment of equity and cash incentive plans, approves amendments to such plans, grants stock options and other stock-related awards, and administers our stock option plans, stock purchase plan and similar programs. The Compensation Committee may, to the extent permitted under applicable law and the rules of Nasdaq and the SEC, delegate its authority to subcommittees when appropriate. A more detailed description of the Compensation Committee’s functions can be found in the Compensation Committee charter.

Our Chief Executive Officer does not participate in the determination of his own compensation or the compensation of directors. However, he makes recommendations to the Compensation Committee regarding the amount and form of the compensation of the other executive officers and key employees, and he may participate in the Compensation Committee’s deliberations about their compensation. No other executive officers participate in the determination of the amount or form of the compensation of executive officers or directors.

For certain 2010 compensation matters the Compensation Committee retained Radford, An AonHewitt Company (“Radford”) as its independent compensation consultant. See “Compensation Discussion and Analysis”.

The members of the Compensation Committee in 2010 were Messrs. Boustridge, Floyd, Schaepe and Swartz, with Mr. Boustridge joining in February 2010. Mr. Swartz chaired the Compensation Committee in 2010.

16

The current members of the Compensation Committee are Messrs. Boustridge, Floyd, Meresman and Schaepe. Mr. Schaepe has chaired the Compensation Committee since April 2011.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors currently consists of Messrs. Boustridge, Floyd, Meresman and Schaepe. In addition, Mr. Swartz served on the Compensation Committee in 2010. None of these individuals was at any time during fiscal year 2010, or at any other time, an officer or employee of the Company. None of our executive officers has ever served as a member of the Board of Directors or Compensation Committee of any other entity that has or has had one or more executive officers serving as a member of our Board of Directors or the Compensation Committee.

Nominating/Corporate Governance Committee

The Nominating/Corporate Governance Committee of the Board of Directors oversees the nomination of directors, including, among other things, identifying, evaluating and making recommendations of nominees to the Board of Directors, and evaluates the performance of the Board of Directors and individual directors. The Nominating/Corporate Governance Committee is also responsible for reviewing developments in corporate governance practices, evaluating the adequacy of our corporate governance practices and making recommendations to the Board of Directors concerning corporate governance matters. A more detailed description of the Nominating/Corporate Governance Committee’s functions can be found in the Nominating/Corporate Governance Committee charter.

The Nominating/Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including having the highest professional and personal ethics and values, broad experience at the policy-making level in business, government, education, technology or public interest, a commitment to enhancing stockholder value, and sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. The Nominating/Corporate Governance Committee also considers such other factors as various and relevant career experience, relevant skills, such as an understanding of WAN Optimization, financial expertise, diversity and local and community ties.

Candidates for director nominees are reviewed in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating/Corporate Governance Committee considers diversity, age, skills, and such other factors as it deems appropriate, given the then-current needs of the Board of Directors and the Company, to maintain a balance of knowledge, experience and capability. We do not maintain a formal diversity policy with respect to our Board of Directors. As noted above, however, we do consider diversity to be a relevant consideration, among others, in the process of evaluating and identifying director candidates, and view diversity expansively to include those attributes that we believe will contribute to a Board of Directors that, through a variety of backgrounds, viewpoints, professional experiences, skills, educational experiences and other such attributes, is best able to guide the Company and its strategic direction.

In the case of incumbent directors whose terms of office are set to expire, the Nominating/Corporate Governance Committee reviews such directors’ overall performance during their term, including the number of meetings attended, level of participation, quality of performance, and any relationships or transactions that might impair such directors’ independence.

In connection with a review of potential candidates for the Board of Directors, the Nominating/Corporate Governance Committee compiles a list of potential candidates using relevant sources, which may include other current members of the Board of Directors, professional search firms, and stockholders. The Nominating/Corporate Governance Committee then conducts any appropriate and

17

necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Nominating/Corporate Governance Committee then meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board of Directors.

The Nominating/Corporate Governance Committee will consider director candidates recommended by stockholders and evaluate them using the same criteria as candidates identified by the Board of Directors or the Nominating/Corporate Governance Committee for consideration. If a stockholder of the Company wishes to recommend a director candidate for consideration by the Nominating/Corporate Governance Committee, pursuant to the Company’s Corporate Governance Guidelines, the stockholder recommendation should be delivered to the General Counsel of the Company at the principal executive offices of the Company, and must include:

| | • | | To the extent reasonably available, information relating to such director candidate that would be required to be disclosed in a proxy statement pursuant to Regulation 14A under the Exchange Act, in which such individual is a nominee for election to the Board of Directors; |

| | • | | Certain information regarding the stockholder making such nomination and any Stockholder Associated Person (as defined in our Bylaws) and a statement whether such stockholder or Stockholder Associated Person will deliver a proxy statement and form of proxy to holders of a number of the Company’s voting securities reasonably believed by such stockholder or Stockholder Associated Person to be necessary to elect such nominee; |

| | • | | Such other information as required by the Company’s Bylaws; |

| | • | | The director candidate’s written consent to (A) if selected, be named in the Company’s proxy statement and proxy and (B) if elected, serve on the Board of Directors; |

| | • | | Such other information as may reasonably be required by the Company to determine the eligibility of the proposed nominee to serve as an independent director of the Company or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such nominee; and |

| | • | | Any other information that such stockholder believes is relevant in considering the director candidate. |

The members of the Nominating/Corporate Governance Committee in 2010 were Messrs. Kourey, Lewis, Meresman and Schaepe, with Mr. Lewis joining in February 2010. Mr. Kourey chaired the Nominating/Corporate Governance Committee in 2010.

The current members of the Nominating/Corporate Governance Committee are Messrs. Kourey, Lewis, Schaepe and Swartz. Mr. Swartz has chaired the Nominating/Corporate Governance Committee since April 2011.

Risk Management Oversight

The Board of Directors actively manages Riverbed’s risk oversight process and receives regular reports from management on areas of material risk to Riverbed, including operational, financial, legal and regulatory risks.

Our Board committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk:

| | • | | The Audit Committee assists the Board of Directors with its oversight of Riverbed’s major financial risk exposures. The Audit Committee regularly reviews with management Riverbed’s risk assessment and risk management policies. Risk assessment reports are regularly provided by management to the Audit Committee. |

18

| | • | | The Compensation Committee assists the Board of Directors with its oversight of risks arising from our compensation policies and programs, as well as with its oversight of risks associated with succession planning. |

| | • | | The Nominating/Corporate Governance Committee assists the Board of Directors with its oversight of risks associated with Board organization, Board independence and corporate governance. |

While each Board committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks.

Risk Management Regarding Compensation Policies and Programs. Our Compensation Committee is responsible for assessing our compensation policies and practices relative to all our employees, including non-executive officers, to determine if the risks arising from these policies and practices are reasonably likely to have a material adverse effect on our company. In performing its duties, the Compensation Committee meets at least annually with our management and the Compensation Committee’s independent compensation consultant to review and discuss potential risks relating to our employee compensation plans and programs.

In April 2010 and March 2011, the Compensation Committee reviewed and discussed with our management and the Compensation Committee’s independent compensation consultant a report analyzing the risk in our compensation programs and practices. This report included an analysis of the mechanisms in our compensation plans and programs intended to reduce the risk of conduct reasonably likely to have a material adverse effect on our company, and an overall risk assessment of such programs based on this analysis. Among other things, the Compensation Committee considered the risk profile of our base salary programs, our broad-based benefit plans, our sales compensation plans, our management bonus plan, new hire equity awards, annual equity awards for continuing employees, our long-term incentive plan and the employee stock purchase plan. The Compensation Committee also considered in connection with this review our internal financial reporting and regulatory compliance procedures.

Board of Directors Meeting Attendance

The Board of Directors met five times during the fiscal year ended December 31, 2010. During 2010, each director then in office attended 75% or more of the meetings held of the Board of Directors and committees on which he served.

Code of Business Conduct

The Board of Directors has adopted a code of business conduct and a code of ethics. The code of business conduct applies to all of our employees, officers and directors. The code of ethics is in addition to our code of business conduct and applies to our chief executive officer and senior financial officers, including our principal financial officer and principal accounting officer. The full texts of our codes of business conduct and ethics are posted on our website at www.riverbed.com in the Corporate Governance section of the Investor Relations page. We intend to disclose future amendments to our codes of business conduct and ethics, or certain waivers of such provisions, at the same location on our website identified above and also in public filings, to the extent required by Nasdaq.

Compensation of Directors

This section provides information regarding the compensation policies for non-employee directors in effect, and amounts paid and securities awarded to these directors, in fiscal 2010.

19

We have a policy of reimbursing directors for travel, lodging and other reasonable expenses incurred in connection with their attendance at board or committee meetings. In addition, during 2010, cash compensation earned by non-employee directors for their services as members of the Board of Directors or any committee of the Board of Directors was as follows:

| | • | | Annual retainer fee of $30,000 for each non-employee director; |

| | • | | Additional annual retainer fee of $5,000 for Mr. Kourey for serving as Lead Independent Director; |

| | • | | Additional annual retainer fee of $5,000 each for Messrs. Kourey, Meresman and Swartz for serving as chair of the Nominating/Corporate Governance Committee, Audit Committee and Compensation Committee, respectively; |

| | • | | Additional annual retainer fee of $5,000 for Mr. Boustridge for serving as a member of the Compensation Committee; |

| | • | | Additional annual retainer fee of $10,000 for Mr. Floyd for serving as a member of the Audit Committee and Compensation Committee; |

| | • | | Additional annual retainer fee of $10,000 for Mr. Kourey for serving as a member of the Audit Committee and Nominating/Corporate Governance Committee; |

| | • | | Additional annual retainer fee of $5,000 for Mr. Lewis for serving as a member of the Nominating/Corporate Governance Committee; |

| | • | | Additional annual retainer fee of $10,000 for Mr. Meresman for serving as a member of the Audit Committee and Nominating/Corporate Governance Committee; |

| | • | | Additional annual retainer fee of $10,000 for Mr. Schaepe for serving as a member of the Compensation Committee and Nominating/Corporate Governance Committee; and |

| | • | | Additional annual retainer fee of $5,000 for Mr. Swartz for serving as a member of the Compensation Committee. |

The above cash compensation earned by Messrs. Boustridge and Lewis was pro-rated to reflect that their service as members of the Board of Directors and as Board committee members did not begin until February 2010.

Our 2006 Director Option Plan provides for automatic grants of options to non-employee directors. All options are granted at the fair market value on the date of the award. A non-employee director is entitled to an initial stock option award to purchase 60,000 shares of our common stock upon such director’s election to the Board of Directors, plus an additional option to purchase 10,000 shares of our common stock if serving on the Audit Committee and an additional option to purchase 10,000 shares of our common stock if serving as chairman of the Audit Committee. Each initial option will become exercisable for the shares in 48 equal monthly installments and will fully vest if we are acquired while the director is in our service. Each of Messrs. Boustridge and Lewis received an option to purchase 60,000 shares of our common stock on February 2, 2010, the date of their election to the Board of Directors.

Each year thereafter, pursuant to the 2006 Director Option Plan, each non-employee director will receive an annual stock option award to purchase 20,000 shares of our common stock on the date of our annual stockholders meeting, plus an additional option to purchase 8,000 shares of our common stock if serving on the Audit Committee and an additional option to purchase 4,000 shares of our common stock if serving as chairman of the Audit Committee, each of which will vest in 48 equal monthly installments and will fully vest if we are acquired while the director is in our service. Annual grants are not made in the same year as the initial grants. Each member of our Board of Directors that served in 2010, other than Messrs. Boustridge and Lewis, received an annual stock option award in 2010.

20

Directors Compensation

The following table sets forth all of the compensation awarded to, earned by, or paid to our non-employee directors in fiscal year 2010.

| | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | | Option Awards

($) (1) | | | Total

($) | |

Michael Boustridge (2) | | | 23,139 | | | | 636,906 | (3) | | | 660,045 | |

Mark A. Floyd | | | 40,000 | | | | 345,439 | (4) | | | 385,439 | |

Michael R. Kourey | | | 50,000 | | | | 345,439 | (5) | | | 395,439 | |

Mark S. Lewis (6) | | | 23,139 | | | | 636,906 | (7) | | | 660,045 | |

Stanley J. Meresman | | | 45,000 | | | | 394,787 | (8) | | | 439,787 | |

Christopher J. Schaepe | | | 40,000 | | | | 246,742 | (9) | | | 286,742 | |

James R. Swartz | | | 40,000 | | | | 246,742 | (10) | | | 286,742 | |

| (1) | The amounts in this column represent the aggregate grant date fair value in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, Stock Compensation (formerly, FASB Statement No. 123R). See Note 12 of the notes to our consolidated financial statements contained in our Annual Report on Form 10-K filed on February 8, 2011 for a discussion of all assumptions made by the Company in determining the grant date fair value of its equity awards. |

| (2) | Mr. Boustridge was appointed to the Board of Directors effective February 2, 2010. |

| (3) | On February 2, 2010, Mr. Boustridge was granted an option to purchase 120,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Boustridge held outstanding options to purchase an aggregate of 120,000 shares of our common stock. |

| (4) | On May 25, 2010, Mr. Floyd was granted an option to purchase 56,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Floyd held outstanding options to purchase an aggregate of 260,168 shares of our common stock. |

| (5) | On May 25, 2010, Mr. Kourey was granted an option to purchase 56,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Kourey held outstanding options to purchase an aggregate of 242,000 shares of our common stock. |

| (6) | Mr. Lewis was appointed to the Board of Directors effective February 2, 2010. |

| (7) | On February 2, 2010, Mr. Lewis was granted an option to purchase 120,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Lewis held outstanding options to purchase an aggregate of 120,000 shares of our common stock. |

| (8) | On May 25, 2010, Mr. Meresman was granted an option to purchase 64,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Meresman held outstanding options to purchase an aggregate of 236,022 shares of our common stock. |

| (9) | On May 25, 2010, Mr. Schaepe was granted an option to purchase 40,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Schaepe held outstanding options to purchase an aggregate of 160,000 shares of our common stock. |

| (10) | On May 25, 2010, Mr. Swartz was granted an option to purchase 40,000 shares of our common stock (as adjusted to reflect the Company’s two-for-one stock split effected on November 8, 2010). As of December 31, 2010, Mr. Swartz held outstanding options to purchase an aggregate of 160,000 shares of our common stock. |

21

Attendance at Annual Stockholders Meetings by the Board of Directors

The Company does not have a formal policy regarding attendance by members of the Board of Directors at the Company’s annual meeting of stockholders. The Company encourages, but does not require, directors to attend. All of our directors that served in 2010 attended the Company’s 2010 Annual Meeting of Stockholders telephonically or in person.

Contacting the Board of Directors

Stockholders may communicate with our Board of Directors at the following address:

The Board of Directors

c/o General Counsel

Riverbed Technology, Inc.

199 Fremont Street

San Francisco, CA 94105

Communications are received by the General Counsel of the Company, who then distributes any such communication to the Board of Directors or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded with the provision that any communication that is filtered out will be made available to any director upon request.

22

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2011 and has further directed that management submit the appointment of independent auditors for ratification by our stockholders at the Annual Meeting. Ernst & Young LLP has audited our financial statements since our 2004 fiscal year. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws nor other governing documents or law require stockholder ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm. However, the Board of Directors is submitting the appointment of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the appointment, the Board of Directors will reconsider whether or not to retain that firm. Even if the appointment is ratified, the Board of Directors in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.