UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14A-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Materials Pursuant to Section 240.14a-12 | |

RIVERBED TECHNOLOGY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which the transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Riverbed Technology, Inc.

2014 Annual Meeting Proxy Matters

May 2014

|

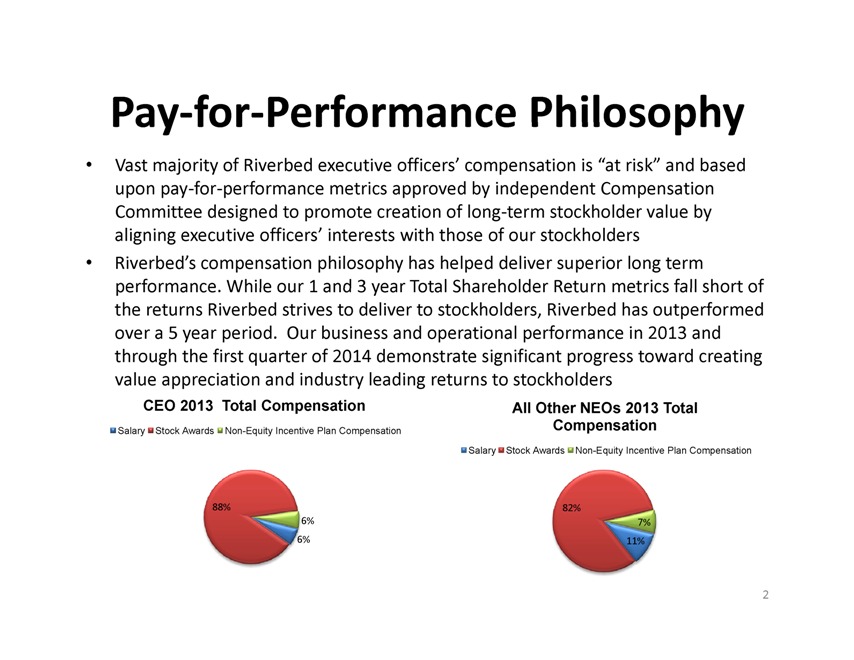

Pay-for-Performance Philosophy

Vast majority of Riverbed executive officers’ compensation is “at risk” and based

upon pay-for-performance metrics approved by independent Compensation

Committee designed to promote creation of long-term stockholder value by

aligning executive officers’ interests with those of our stockholders

Riverbed’s compensation philosophy has helped deliver superior long term

performance. While our 1 and 3 year Total Shareholder Return metrics fall short of

the returns Riverbed strives to deliver to stockholders, Riverbed has outperformed

over a 5 year period. Our business and operational performance in 2013 and

through the first quarter of 2014 demonstrate significant progress toward creating

value appreciation and industry leading returns to stockholders

CEO 2013 Total Compensation

Salary Stock Awards Non-Equity Incentive Plan Compensation

All Other NEOs 2013 Total

Compensation

Salary Stock Awards Non-Equity Incentive Plan Compensation

6%

88%

6%

11%

82%

7%

2

|

Riverbed’s Performance-Based

Approach Stands Out from Peers

Riverbed’s Compensation Committee, with the assistance of Radford, an

independent compensation consultant, developed an appropriate group of peer

companies against which to benchmark compensation levels and practices

Riverbed’s executive officers have more of their compensation opportunity tied to

performance-based at-risk awards than any of its peers

– 100% of Riverbed equity awards made to executive officers in 2012 and 2013

were performance-based at-risk awards, and 100% of equity awards in 2014

continue to be performance-based and at-risk

– At peer companies, performance-based at-risk awards on average make up

only 35% of the total annual equity granted to executive officers

The 2013 compensation package for Jerry Kennelly, Riverbed’s CEO, was structured

so that a substantial majority of its total at-target value was in the form of

performance-based at-risk awards and also included a stipulation that any earned

performance-based shares cannot be sold for two additional years

Riverbed targets 75th percentile versus its peers on total compensation and above

50th percentile in base salary, reflecting the fact that, unlike its peers, long-term

incentive opportunities for Riverbed’s executive officers are provided exclusively

through at-risk performance-based awards

– Excluding one-time OPNET performance based awards, for 2013 overall

executive officer compensation levels were between the 50th to 75th percentile

versus peers (at 100% target levels)

3

|

Selection of Relevant Peer Group is

Critical to Assessing Pay Practices

Peer group developed by Riverbed’s Compensation Committee includes technology

companies that (1) have similar financial profiles to Riverbed (based primarily on market

capitalization and industry, as well as revenue scale, projected growth and profitability),

(2) have similar business models, and/or (3) compete with Riverbed for talent

ISS’ list of 24 peers disregards 5 of Riverbed’s selected peers and includes 14 additional

companies that have profiles fundamentally different from Riverbed and the peer group

developed by the Riverbed Compensation Committee :

–6 of the 14 companies have declining year over year revenue

–13 of 14 have a lower market capitalization than Riverbed with an average market cap

of less than half of Riverbed’s

–13 of 14 are companies that Riverbed does not compete with for either business or

talent

The peer group chosen has a substantial effect on benchmarking comparisons:

–Riverbed CEO pay multiple relative to ISS designated peer group median is 3.26x

–Riverbed CEO pay multiple relative to Riverbed’s peer group median is 1.59x and if the

one-time OPNET performance award is excluded is 1.10x

4

|

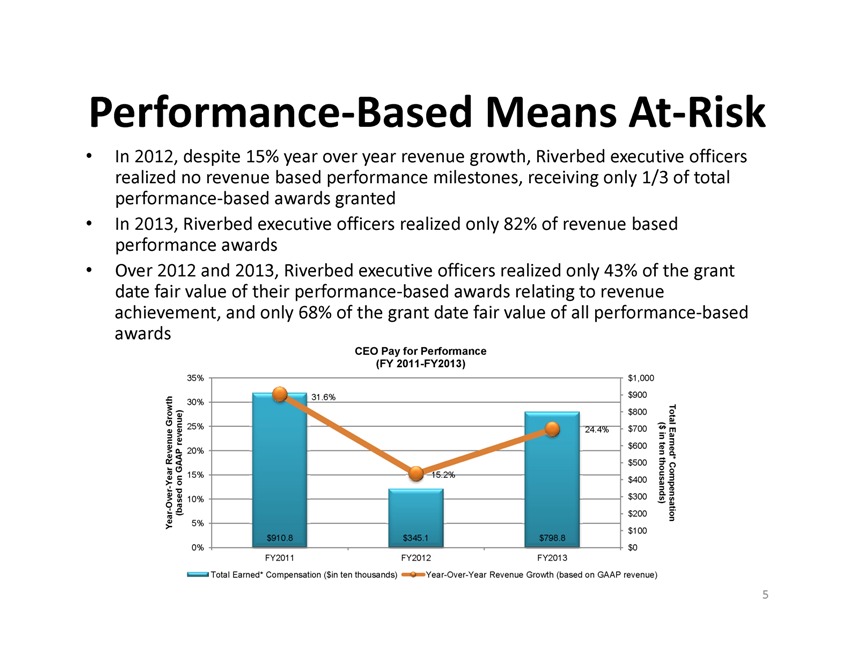

Performance-Based Means At-Risk

In 2012, despite 15% year over year revenue growth, Riverbed executive officers

realized no revenue based performance milestones, receiving only 1/3 of total

performance-based awards granted

In 2013, Riverbed executive officers realized only 82% of revenue based

performance awards

Over 2012 and 2013, Riverbed executive officers realized only 43% of the grant

date fair value of their performance-based awards relating to revenue

achievement, and only 68% of the grant date fair value of all performance-based

awards

CEO Pay for Performance

(FY 2011-FY2013)

31.6%

24.4%

$600

$700

$800

$900

$1,000

20%

25%

30%

35%

Total Earned

($ in ten

evenue Growth

AP revenue)

15.2%

$100

$200

$300

$400

$500

5%

10%

15%

* Compensation

thousands)

Year-Over-Year R

(based on GAA

910.8 345.1 798.8

0% $0

FY2011 FY2012 FY2013

Total Earned* Compensation ($in ten thousands) Year-Over-Year Revenue Growth (based on GAAP revenue)

5 |

|

|

OPNET Performance Awards were One-Time

Grants in Context of a Transformational

Transaction

Riverbed Compensation Committee designed one-time equity awards to

executive officers to achieve performance on OPNET integration in 2013

Performance metric of non-GAAP EPS for 2013 was 13% higher than non-

GAAP EPS performance target for 2013 LTIP designed to drive synergies of

expense savings through successful OPNET integration

Riverbed executive officers realized only 88% of the OPNET performance-based

equity awards as these were at-risk awards

Continued employment through 2014 also required in order to receive the

one-time OPNET performance awards

Compensation Committee understands the impact of the OPNET

performance awards--which were structured to address the largest

acquisition and resulting integration in Riverbed’s history—on overall

executive compensation levels, and does not expect such an award to

recur.

6

|

2014 Equity Incentive Plan

Consolidates existing stockholder – approved equity plans into a single

plan for more efficient use of equity awards but does not increase number

of shares available for equity awards

– The 12.4 million shares proposed to be made available under the 2014

Plan are already available under existing stock plans

2014 Plan relinquishes evergreen provisions that remained in the 2012

Stock Plan and Directors Plan, including an additional 9 million shares that

would have automatically been made available over the remaining terms

of those plans

Riverbed continues to promote creation of stockholder value by issuing

equity awards to our employees to align their interests with those of our

stockholders

Availability of shares under 2014 Plan is critical to employee recruitment

and retention

7

|

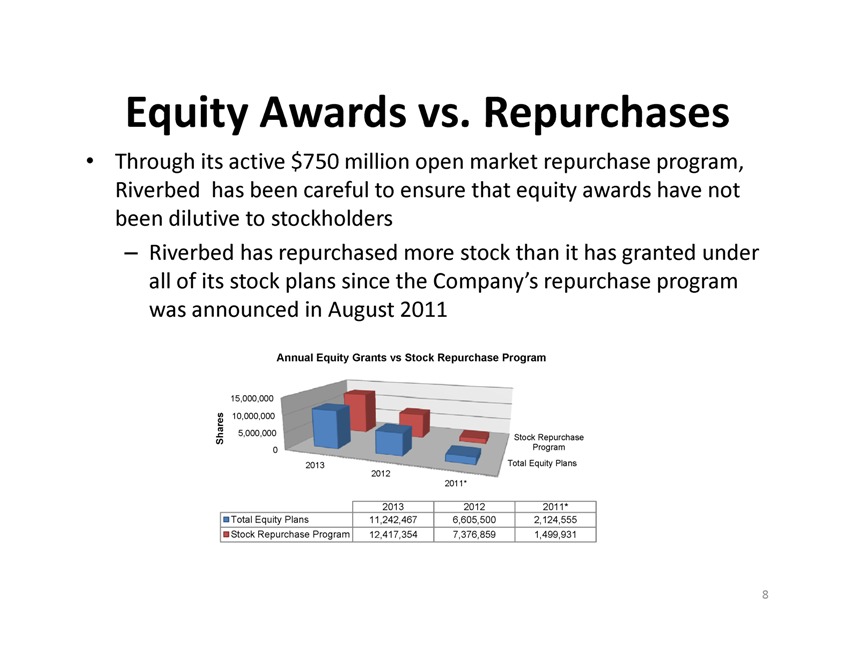

Equity Awards vs. Repurchases

Through its active $750 million open market repurchase program,

Riverbed has been careful to ensure that equity awards have not

been dilutive to stockholders

– Riverbed has repurchased more stock than it has granted under

all of its stock plans since the Company’s repurchase program

was announced in August 2011

Annual Equity Grants vs Stock Repurchase Program

Stock Repurchase

0 Program

5,000,000

10,000,000

15,000,000

Shares

2013 Total Equity Plans

2012

2011*

2013 2012 2011*

Total Equity Plans 11,242,467 6,605,500 2,124,555

Stock Repurchase Program 12,417,354 7,376,859 1,499,931

8

|

Stockholder Rights Plan

November 2013 adoption of Stockholder Rights Plan was designed to promote the

fair and equal treatment of all stockholders and ensure that the Board remains in

the best position to discharge its fiduciary duties

Stockholder Rights Plan affords a level playing field to give the Board time to

evaluate alternatives and additional leverage to negotiate on behalf of all

stockholders to maximize stockholder value, protecting stockholders from coercive

or unfair takeover tactics

Riverbed’s Board believes adoption of the Stockholder Rights Plan was an

appropriate response under the circumstances, including inadequate offers from

Elliott Management potentially designed to put Riverbed “in play” and where

Elliott Management represents both a potential buyer and seller in a change of

control

Stockholder Rights Plan has a one year term, and the Board will continue to

evaluate its utility

Board and management remain committed to executing on Riverbed’s strategic

plan and will carefully review any credible acquisition offer

9