SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | |

| Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

| | |

| Check the appropriate box: | | |

| | |

x Preliminary Proxy Statement. | | |

| |

¨ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| | |

¨ Definitive Proxy Statement. | | |

| | |

¨ Definitive Additional Materials. | | |

| |

| ¨ Soliciting Material Pursuant to Sec. 240.14a-12. |

Oppenheimer Rochester Minnesota Municipal Fund

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | Payment | | Of Filing Fee (Check the appropriate box): |

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Important Proxy Materials

PLEASE CAST YOUR VOTE NOW

OPPENHEIMER ROCHESTER® MINNESOTA MUNICIPAL FUND

Dear Shareholder:

A Special Meeting of Shareholders (the “Meeting”) of Oppenheimer Rochester Minnesota Municipal Fund (the “Fund”) will be held at 1:00 p.m. Mountain Time on July 27, 2018, as may be adjourned or postponed, at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112.

The Meeting is being held for the purpose of seeking shareholder approval on a proposalto change a fundamental investment policy of the Fund, which will permit the Fund to transition from a Minnesota municipal bond fund to a national municipal bond fund (the “Proposal”). As described further in the enclosed proxy statement, on May 16, 2018, the Fund’s Board of Trustees approved a change in the Fund’s fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax, to a fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax.

If the Proposal is approved at the Meeting it is expected that the new fundamental investment policy will become effective as soon as reasonably practicable.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL

WE URGE YOU TO VOTE PROMPTLY

YOUR VOTE IS IMPORTANT

Dated: June [22], 2018

By Order of the Board of Trustees

Cynthia Lo Bessette, Secretary

PLEASE HELP YOUR FUND AVOID THE EXPENSES OF ADDITIONAL SOLICITATIONS BY VOTING TODAY

QUESTIONS AND ANSWERS:

What proposal am I being asked to vote on?

You are being asked to approve a change to the Fund’s fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax, to a fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax. This change will enable the Fund to transition from a Minnesota municipal bond fund to a national municipal bond fund.

Has my Fund’s Board approved the Proposal?

Yes. The Board of Trustees (the “Board”) unanimously approved the Proposal on May 16, 2018, and submits it for approval by shareholders.

Why am I being asked to approve the change in the Fund’s fundamental investment policy?

The Manager requested that the Board approve changes to the Fund’s fundamental investment policy in connection with transitioning the Fund from a Minnesota municipal bond fund to a national municipal bond fund. Despite the Fund’s strong performance, due to a market preference shift to national funds away from state-specific funds and a continuing reduction in distribution demand, the Fund has had a very difficult time gaining market share. The Board noted that it had approved the closure of the Fund to new investors in 2016, due to the continuing decline in the Fund’s assets and its narrow, Minnesota-specific investment universe. The market has seen similar impacts to other state-specific municipal bond funds and other recent reorganizations of these funds into larger national funds. The Manager and the Board believe that repositioning the Fund will stimulate opportunities for growth and market adoption by establishing a fund that offers lower fees and expenses and that appeals to a larger national investor base. An increase in the Fund’s assets under management is expected to provide shareholders with an opportunity to achieve lower fund expenses through economies of scale and management fee breakpoints. Moreover, the net expense ratio is expected to decrease for each class of the Fund’s shares, if the Proposal is approved.

Will any other policies of the Fund change?

Yes. The Board has approved certain other changes that will take effect only if shareholders approve the proposed change to the Fund’s fundamental investment policy. These include renaming the Fund as the “Oppenheimer Municipal Fund”, adopting new investment strategies and policies consistent with its new name, and reducing the investment advisory fee from 55 basis points to 40 basis points (and making corresponding changes to the fee breakpoint schedule). If the Proposal is approved, it is anticipated that the Fund’s portfolio will be transitioned from its current focus on Minnesota securities to a broader, more diversified portfolio of national municipal securities gradually over a period of time, to minimize portfolio turnover and associated costs.

Will my vote make a difference?

Your vote is very important no matter how many shares you own and can make a difference in the management of the Fund. Your vote can help ensure that the proposals recommended by the Board can be implemented. Voting your shares early will eliminate the need for follow-up mail and telephone solicitation.

Who is paying for preparation, printing and mailing of the Proxy Statement?

The costs associated with the Proxy Statement, including the mailing and proxy solicitation costs, will be borne by the Fund.

When will the Meeting be held?

The Meeting will be held at 1:00 p.m. Mountain Time on July 27, 2018, unless it is adjourned.

Will the Fund’s Board attend the Meeting?

No. Members of the Fund’s Board are not required to attend the Meeting and do not plan to attend the Meeting.

How do I vote my shares?

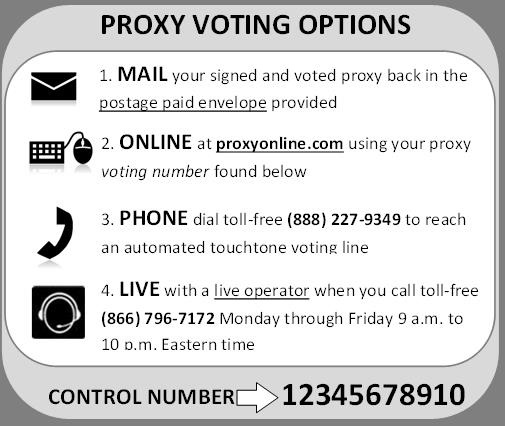

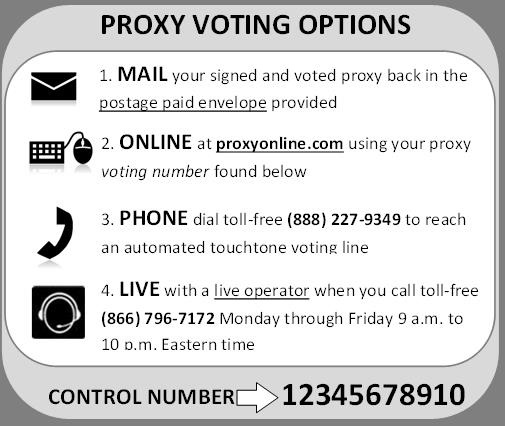

You can vote your shares by completing and signing the enclosed proxy ballot, and mailing the proxy ballot in the enclosed postage paid envelope. You also may vote your shares by telephone or via the internet by following the instructions on the attached proxy ballot and accompanying materials. If you need assistance, or have any questions regarding the proposals or how to vote your shares, please call our proxy information line toll-free at1-866-796-7172.

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

_________________________

OPPENHEIMER ROCHESTER MINNESOTA MUNICIPAL FUND

_________________________

A Special Meeting of Shareholders of Oppenheimer Rochester Minnesota Municipal Fund (the “Fund”) will be held at 1:00 p.m. Mountain Time on July 27, 2018, as may be adjourned from time to time (the “Meeting”), at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112. The purpose of the Meeting is to seek shareholder approval of the proposal recently approved by the Fund’s Board of Trustees (the “Board”). At the Meeting, shareholders will be asked to vote on the following proposal (the “Proposal”):

| | (1) | To approve a change to the Fund’s fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax, to a fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax. |

Shareholders will also be asked to transact any other business as may properly come before the Meeting.

The Proposal referenced above is discussed in the Proxy Statement attached to this Notice. Only shareholders of record who owned shares of the Fund at the close of business on May 15, 2018 (the “Record Date”) are entitled to vote at the Meeting or any adjournment or postponement of the Meeting. Please be certain to sign, date and return each proxy card you receive. Please read the full text of the enclosed Proxy Statement for a complete understanding of the Proposal.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL

WE URGE YOU TO VOTE PROMPTLY

YOUR VOTE IS IMPORTANT

Dated: June [22], 2018

By Order of the Board of Trustees

Cynthia Lo Bessette, Secretary

____________________________________________________________________________________

PLEASE HELP YOUR FUND AVOID THE EXPENSES OF ADDITIONAL SOLICITATIONS BY VOTING TODAY

[TABLE OF CONTENTS]

| NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS | |

| | |

| PROXY STATEMENT | |

| | |

| Proposal: To approve a change to the fundamental investment policy for the Fund | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Information Regarding the Fund | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

_____________________________

OPPENHEIMER ROCHESTER MINNESOTA MUNICIPAL FUND

_____________________________________

Special Meeting of Shareholders to be Held on July 27, 2018

This is a Proxy Statement for Oppenheimer Rochester Minnesota Municipal Fund (the “Fund”). The Fund is soliciting proxies for a Special Meeting of Shareholders of the Fund to approve a proposal that has already been unanimously approved by the Fund’s Board of Trustees (the “Board”).

This Proxy Statement asks for your vote on a proposal affecting your Fund. The Fund will hold a Special Meeting of Shareholders on July 27, 2018 at 1:00 p.m. Mountain Time, as may be adjourned from time to time (the “Meeting”). The Meeting will be held at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112 in order to consider the proposals described in this Proxy Statement.

Shareholders of record who owned shares of the Fund at the close of business on May 15, 2018 (the “Record Date”) are entitled to vote at the Meeting or any adjournment or postponement of the Meeting. Please be certain to sign, date and return the proxy card you receive. Shareholders are entitled to cast one vote for each full share and a fractional vote for each fractional share they owned on the Record Date.

You should read the entire Proxy Statement before voting. If you have any questions, please call our proxy information line toll-free at 1-866-796-7172. The Fund expects to mail the Notice of Special Meeting, this Proxy Statement and proxy ballot to shareholders on or about June [22], 2018.

The Fund, which is organized as a Delaware statutory trust, is an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). OFI Global Asset Management, Inc. (the “Manager”), 225 Liberty Street, New York, New York 10281, serves as the Fund's investment adviser. OppenheimerFunds, Inc. (the "Sub-Adviser"), 225 Liberty Street, New York, New York 10281, serves as its sub-adviser.

The Fund is required by federal law to file reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). The SEC maintains a website that contains information about the Fund (www.sec.gov). You can inspect and copy the proxy material, reports and other information at the public reference facilities of the SEC, 100 F Street NE, Washington, D.C. 20549. You can also obtain copies of these materials from the Public Reference Branch, Office of Consumer Affairs and Information Services of the SEC at 100 F Street NE, Washington, D.C., 20549, at prescribed rates.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON July 27, 2018. The Notice of Special Meeting of Shareholders and this Proxy Statement are available at [link to be added by amendment]

The Annual Report to Shareholders of the Fund has previously been sent to shareholders.Upon request, the Fund’s most recent annual and subsequent semi-annual report (if available) is available at no cost. To request a report, please call the Fund toll-free at 1-800-CALL OPP (1-800-225-5677), or write to the Fund at OppenheimerFunds Services, P.O. Box 5270, Denver, Colorado 80217-5270.

PROPOSAL: To approve a change to the fundamental investment policy for the Fund

The only item of business that the Fund expects will come before the Special Meeting is the proposal to a change to the Fund’s fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax, to a fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax. For the reasons discussed below, the Board has approved the Proposal, and submits it for approval by the Fund’s shareholders.

PROPOSAL

TO CHANGE THE FUNDAMENTAL INVESTMENT POLICY FOR THE FUND

The purpose of this Proposal is to approve a change to the Fund’s fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax, to a fundamental policy to invest, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax. This change will enable the Fund to transition from a Minnesota municipal bond fund to a national municipal bond fund. The Manager requested that the Board approve changes to the Fund’s fundamental investment policy in connection with transitioning the Fund from a Minnesota municipal bond fund to a national municipal bond fund. Despite the Fund’s strong performance, due to a market preference shift to national funds away from state-specific funds and a continuing reduction in distribution demand, the Fund has had a very difficult time gaining market share. The Board noted that it had approved the closure of the Fund to new investors in 2016, due to the continuing decline in the Fund’s assets and its narrow, Minnesota-specific investment universe. The market has seen similar impacts to other state-specific municipal bond funds and other recent reorganizations of these funds into larger national funds. The Manager and the Board believe that repositioning the Fund will stimulate opportunities for growth and market adoption by establishing a fund that offers lower fees and expenses and that appeals to a larger national investor base. An increase in the Fund’s assets under management is expected to provide shareholders with an opportunity to achieve lower fund expenses through economies of scale and management fee breakpoints. Moreover, the net expense ratio is expected to decrease for each class of the Fund’s shares, if the Proposal is approved.

The chart set forth below summarizes the differences between the Fund’s current fundamental investment policy and the proposed fundamental policy, as well as additional changes that will be implemented only if the Proposal is approved. No changes are proposed to the investment objective and benchmark index. Following shareholder approval of the Fund’s proposed new fundamental policy, the Fund’s name and certain of its strategies will be revised, as described below, to align the Fund with a new Oppenheimer municipal product line, which seeks a top decile yield with greater risk constraints as compared to the existing Oppenheimer Rochester product line. These changes to the Fund’s name and strategies are part of a larger rebranding effort with respect to certain Oppenheimer Rochester funds. In connection with the rebranding, the Oppenheimer Rochester portfolio managers, including the Fund’s, will be realigned. Following the realignment and shareholder approval of the Fund’s proposed new fundamental policy, the Fund will be managed by Michael L. Camarella and Charles S. Pulire, who will be primarily responsible for the day-to-day management of the Fund’s investments, and will be supported by the Oppenheimer Municipal Fund Management Team. The Fund’s proposed investment strategies do

not include Minnesota-specific limitations, including a requirement to invest the Fund’s assets so that at least 95% of the exempt-interest dividends that the Fund pays, including any exempt-interest dividends exempt from state taxation under federal law, are derived from Minnesota municipal obligations as required for state tax exemption under Minnesota law. In addition, the new strategies include certain new limitations, including: (1) a prohibition on investments in securities issued by U.S. territories and possessions; (2) the Fund will not invest more than 40% of its total assets in securities rated below the top three investment grade categories or are unrated; (3) the Fund will not invest more than 20% of its total assets in unrated securities; (4) the Fund will not invest more than 15% of its total assets in municipal securities issued by the government of a single state, with certain exceptions; and (5) the Fund will not invest more than 15% of its total assets in a single sector, as determined by the Sub-Adviser, with certain exceptions. Also, while the Fund will continue to invest without limitations regarding maturity ranges, it will focus on securities with maturities between 5 and 30 years when issued. The new strategies permit the Fund to invest up to 15% of its total assets in below-investment-grade securities, a change from the current limit of 25%. Moreover, the new strategies permit the Fund to expose up to 10% of its total assets to the effects of leverage from its investments in inverse floaters, whereas the existing strategies set this limit at 20%. The new advisory fee is 40 basis points, as compared to the current advisory fee of 55 basis points, and corresponding changes apply to the fee breakpoint schedule. The new net expense ratios are lower than those of the Fund’s current expense ratios. The principal risks are substantially similar, except that the current principal risks regarding investments in securities issued by U.S. territories and possessions are no longer applicable.

If the Proposal is approved, it is anticipated that the Fund’s portfolio will be transitioned from its current focus on Minnesota securities to a broader, more diversified portfolio of national municipal securities gradually over a period of time, to minimize portfolio turnover and associated costs.

| | Current Strategies | New Strategies |

| Name | Oppenheimer Rochester Minnesota Municipal Fund | Oppenheimer Municipal Fund |

| Investment Objective | The Fund seeks tax-free income. | The Fund seeks tax-free income. |

| Portfolio Managers | Scott S. Cottier, Troy E. Willis, Mark R. DeMitry, Michael L. Camarella, Charles S. Pulire, and Elizabeth S. Mossow | Michael L. Camarella and Charles S. Pulire |

| Principal Investment Strategies | Under normal market conditions, and as a fundamental policy, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual and, as applicable, the Fund’s state income tax. The Fund selects investments without regard to the alternative minimum tax (“AMT”). Additionally, under normal market conditions, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in Minnesota municipal securities. These securities are generally issued by the state and its political subdivisions (such as cities, towns, counties, agencies and authorities) and primarily include municipal bonds (long-term (more than one-year) obligations), municipal notes (short-term obligations) and interests in municipal leases. Municipal securities generally are classified as general or revenue obligations. General obligations are secured by the issuer’s pledge of its full faith, credit and taxing power for the payment of principal and interest. Revenue obligations are bonds whose interest is payable only from the revenues derived from a particular facility or class of facilities, or a specific excise tax or other revenue source. The securities in which the Fund invests may also include those issuers located outside of Minnesota, such as U.S. territories, commonwealths and possessions or by their agencies, instrumentalities and authorities, if the interest on such securities is not subject to Minnesota and federal income tax. These securities are “Minnesota municipal securities” for purposes of this prospectus. The Fund intends to invest its assets so that at least 95% of the exempt-interest dividends that it pays, including any exempt-interest dividends exempt from state taxation under federal law, are derived from Minnesota municipal obligations as required for state tax exemption under Minnesota law. Most of the securities the Fund buys are ��investment-grade,” although it can invest as much as 25% of its total assets in below investment-grade securities (commonly called “junk bonds”). This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund’s Sub-Adviser has changed its assessment of the security’s credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund’s holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Investment-grade securities are rated in one of the four highest rating categories of nationally recognized statistical rating organizations, such as S&P Global Ratings (“S&P”) (or, in the case of unrated securities, determined by the Fund’s Sub-Adviser, OppenheimerFunds, Inc., to be comparable to securities rated investment-grade). The Fund also invests in unrated securities, in which case the Fund’s Sub-Adviser internally assigns ratings to those securities, after assessing their credit quality and other factors, in investment-grade or below-investment-grade categories similar to those of nationally recognized statistical rating organizations. There can be no assurance, nor is it intended, that the Sub-Adviser’s credit analysis process is consistent or comparable with the credit analysis process used by a nationally recognized statistical rating organization. To the extent the Fund invests in pre-refunded municipal securities collateralized by U.S. government securities, the Fund may treat those securities as investment-grade (AAA) securities even if the issuer itself has a below-investment-grade rating. The Fund does not limit its investments to securities of a particular maturity range, and may hold both short- and long-term securities. However, the Fund currently focuses on longer-term securities to seek higher yields. This portfolio strategy is subject to change. The Fund may invest in obligations that pay interest at fixed or variable rates. The Fund can invest in inverse floating rate securities, a type of variable rate instrument, to seek increased income and return. Inverse floating rate securities are leveraged instruments and the extent of their leverage will vary depending on the security’s characteristics. The Fund limits its investments in inverse floating rate securities as further described in this prospectus under “Principal Risks.” The Fund can borrow money to purchase additional securities, another form of leverage. Although the amount of borrowing will vary from time to time, the amount of leveraging from borrowings will not exceed one-third of the Fund’s total assets. In selecting investments for the Fund, the portfolio managers look at a wide range of Minnesota municipal securities from different issuers that provide high current income, including unrated bonds, that have favorable credit characteristics and that provide opportunities for value. The portfolio managers may consider selling a security if any of these factors no longer applies to a security purchased for the Fund, but are not required to do so. | Under normal market conditions, and as a fundamental policy, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes) in securities the income from which, in the opinion of counsel to the issuer of each security, is exempt from regular federal individual income tax. The Fund selects investments without regard to the alternative minimum tax (“AMT”). The Fund invests in municipal securities issued by the governments of states, their political subdivisions (such as cities, towns, counties, agencies and authorities) and the District of Columbia, or by their agencies, instrumentalities and authorities. These primarily include municipal bonds (long-term (more than one-year) obligations), municipal notes (short-term obligations), interests in municipal leases, and tax-exempt commercial paper. Municipal securities generally are classified as general or revenue obligations. General obligations are secured by the issuer’s pledge of its full faith, credit and taxing power for the payment of principal and interest. Revenue obligations are bonds whose interest is payable only from the revenues derived from a particular facility or class of facilities, or a specific excise tax or other revenue source. The Fund will not invest in securities issued by U.S. territories and possessions or by their agencies, instrumentalities and authorities. Most of the securities the Fund buys are “investment-grade,” although it can invest as much as 15% of its total assets in below-investment-grade securities (sometimes called “junk bonds”), and may acquire securities that are in default. The Fund also will not invest more than 40% of its total assets in securities, in the aggregate, that are rated below the top three investment grade categories or that are unrated. Each of these restrictions is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund’s sub-adviser, OppenheimerFunds, Inc. (the “Sub-Adviser”), has changed its assessment of the security’s credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund’s holdings of these securities to exceed, at times significantly, these restrictions for an extended period of time. Investment-grade securities are rated in one of the four highest rating categories of nationally recognized statistical rating organizations, such as S&P Global Ratings (or, in the case of unrated securities, determined by the Fund’s Sub-Adviser to be comparable to securities rated investment-grade). The Fund also invests in unrated securities, in which case the Fund’s Sub-Adviser internally assigns ratings to those securities, after assessing their credit quality and other factors, in investment-grade or below-investment-grade categories similar to those of nationally recognized statistical rating organizations. There can be no assurance, nor is it intended, that the Sub-Adviser’s credit analysis process is consistent or comparable with the credit analysis process used by a nationally recognized statistical rating organization. The Fund will not invest more than 20% of its total assets in unrated securities. For purposes of the limitations described above regarding “unrated securities,” such securities do not include securities that are not rated but that the Fund’s Sub-Adviser determines to be comparable to securities of the same issuer that are rated by a nationally recognized statistical rating organization. The Fund can invest in inverse floaters, a variable rate obligation and form of derivative, to seek increased income and return. The Fund’s investment in inverse floaters entails a degree of leverage. The Fund can expose up to 10% of its total assets to the effects of leverage from its investments in inverse floaters. The Fund can borrow money to purchase additional securities, another form of leverage. Although the amount of borrowing will vary from time to time, the amount of leveraging from borrowings will not exceed one-third of the Fund’s total assets. The Fund will not invest more than 15% of its total assets in municipal securities issued by the government of a single state, its political subdivisions, or its agencies, instrumentalities and authorities. Notwithstanding this limitation, the Fund may invest up to 25% of its total assets in municipal securities issued by each of California, New York, and Texas, or their respective agencies, instrumentalities and authorities. In addition, the Fund will not invest more than 15% of its total assets in a single sector, as determined by the Sub-Adviser. This limitation does not apply to investments in the general obligations sector. To the extent the Fund invests in pre-refunded municipal securities collateralized by U.S. government securities, the Fund may treat those securities as investment-grade (AAA) securities even if the issuer itself has a below-investment-grade rating. The Fund does not limit its investments to securities of a particular maturity range, and may hold both short- and long-term securities. However, the Fund currently focuses on longer-term securities to seek higher yields. This portfolio strategy is subject to change. The Fund may invest in obligations that pay interest at fixed or variable rates. In selecting investments for the Fund, the portfolio managers generally look at a wide range of municipal securities nationwide that provide high current income, have favorable credit characteristics, and provide opportunities for value. The portfolio managers may consider selling a security if any of these factors no longer applies to a security purchased for the Fund, but are not required to do so. |

Principal

Risks | Principal Risks. The price of the Fund’s shares can go up and down substantially. The value of the Fund’s investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth less than what you paid for them.These risks mean that you can lose money by investing in the Fund. Risks of Investing in Municipal Securities. Municipal securities may be subject to interest rate risk, duration risk, credit risk, credit spread risk, extension risk, reinvestment risk and prepayment risk. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may be worth less than the amount the Fund paid for them. When interest rates change, the values of longer-term debt securities usually change more than the values of shorter-term debt securities. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Duration risk is the risk that longer-duration debt securities will be more volatile and more likely to decline in price in a rising interest rate environment than shorter-duration debt securities. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or repay principal, the Fund’s income or share value might be reduced. Adverse news about an issuer or a downgrade in an issuer’s credit rating, for any reason, can also reduce the market value of the issuer’s securities. “Credit spread” is the difference in yield between securities that is due to differences in their credit quality. There is a risk that credit spreads may increase when the market expects lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund’s lower-rated and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price. Extension risk is the risk that an increase in interest rates could cause principal payments on a debt security to be repaid at a slower rate than expected. Extension risk is particularly prevalent for a callable security where an increase in interest rates could result in the issuer of that security choosing not to redeem the security as anticipated on the security’s call date. Such a decision by the issuer could have the effect of lengthening the debt security’s expected maturity, making it more vulnerable to interest rate risk and reducing its market value. Reinvestment risk is the risk that when interest rates fall the Fund may be required to reinvest the proceeds from a security’s sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds. Prepayment risk is the risk that the issuer may redeem the security prior to the expected maturity or that borrowers may repay the loans that underlie these securities more quickly than expected, thereby causing the issuer of the security to repay the principal prior to the expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Fixed-Income Market Risks. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity may decline unpredictably in response to overall economic conditions or credit tightening. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund’s books and could experience a loss. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds’ prices, particularly for lower-rated and unrated securities. An unexpected increase in redemptions by Fund shareholders, which may be triggered by general market turmoil or an increase in interest rates, could cause the Fund to sell its holdings at a loss or at undesirable prices. Economic and other market developments can adversely affect fixed-income securities markets in the United States, Europe and elsewhere. At times, participants in debt securities markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt securities to facilitate an orderly market. Those concerns may impact the market price or value of those debt securities and may cause increased volatility in those debt securities or debt securities markets. Under some circumstances, as was the case during the latter half of 2008 and early 2009, those concerns could cause reduced liquidity in certain debt securities markets, reducing the willingness of some lenders to extend credit, and making it more difficult for borrowers to obtain financing on attractive terms (or at all). A lack of liquidity or other adverse credit market conditions may hamper the Fund’s ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments. Risks of Below-Investment-Grade Securities. As compared to investment-grade debt securities, below-investment-grade debt securities (also referred to as “junk” bonds), whether rated or unrated, may be subject to greater price fluctuations and increased credit risk, as the issuer might not be able to pay interest and principal when due, especially during times of weakening economic conditions or rising interest rates. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. The market for below-investment-grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline. Because the Fund can invest up to 25% of its total assets in below-investment-grade securities, the Fund’s credit risks are greater than those of funds that buy only investment-grade securities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund’s Sub-Adviser has changed its assessment of the security’s credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund’s holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. If the Fund has more than 25% of its total assets invested in below-investment-grade securities, the Sub-Adviser will not purchase additional below-investment-grade securities until the level of holdings in those securities no longer exceeds the restriction. Risks of Minnesota Municipal Securities. Because the Fund invests primarily in Minnesota municipal securities, the value of its portfolio investments will be highly sensitive to events affecting the financial stability of the State of Minnesota and its municipalities, agencies, authorities and other instrumentalities that issue those securities. Budgetary stress on the state or its municipalities, changes in federal, state, and local legislation or policy, erosion of the tax base, the effects of natural disasters or environmental issues, or other economic, legislative or political, or social issues may have a significant negative impact on the value of state or local securities. Risks of Investing in U.S. Territories, Commonwealths and Possessions. The Fund also invests in obligations of the governments of the U.S. territories, commonwealths and possessions such as Puerto Rico, the U.S. Virgin Islands, Guam, or the Northern Mariana Islands to the extent such obligations are exempt from regular federal individual and state income taxes. These investments also are considered to be “Minnesota municipal securities” for purposes of this prospectus. Accordingly, the Fund may be adversely affected by local political, economic and social conditions and developments within these U.S. territories, commonwealths and possessions affecting the issuers of such obligations. Certain of the municipalities in which the Fund invests, including Puerto Rico, currently experience significant financial difficulties. As a result, securities issued by certain of these municipalities are currently considered below-investment-grade securities. A credit rating downgrade relating to, default by, or insolvency or bankruptcy of, one or several municipal security issuers of a state, territory, commonwealth or possession in which the Fund invests could affect the market values and marketability of many or all municipal obligations of such state, territory, commonwealth or possession. Municipal Sector Focus Risk. The Fund will not concentrate its investments in issuers in any one industry. The Securities and Exchange Commission has taken the position that investment of more than 25% of a fund’s total assets in issuers in the same industry constitutes concentration. Many types of municipal securities (such as general obligation, government appropriation, municipal leases, special assessment and special tax bonds) are not considered a part of any “industry” for purposes of this policy. Therefore, the Fund may invest more than 25% of its total assets in those types of municipal securities. Those municipal securities may finance or pay interest from the revenues of projects that are subject to similar economic, business or political developments that could increase their credit risk. Legislation that affects the financing of a particular municipal project, or economic factors that have a negative impact on a project, would be likely to affect many other similar projects. At times, the Fund may change the relative emphasis of its investments in securities issued by certain municipalities. If the Fund has a greater emphasis on investments in one or more particular municipalities, it may be subject to greater risks from adverse events affecting such municipalities than a fund that invests in different municipalities or that is more diversified. Risks of Tobacco Related Bonds. In 1998, the largest U.S. tobacco manufacturers reached an out of court agreement, known as the Master Settlement Agreement (the “MSA”), to settle claims against them by 46 states and six other U.S. jurisdictions. The tobacco manufacturers agreed to make annual payments to the government entities in exchange for the release of all litigation claims. A number of the states have sold bonds that are backed by those future payments. The Fund may invest in two types of those bonds: (i) bonds that make payments only from a state’s interest in the MSA and (ii) bonds that make payments from both the MSA revenue and from an “appropriation pledge” by the state. An “appropriation pledge” requires the state to pass a specific periodic appropriation to make the payments and is generally not an unconditional guarantee of payment by a state. The settlement payments are based on factors, including, but not limited to, annual domestic cigarette shipments, cigarette consumption, inflation and the financial capability of participating tobacco companies. Payments could be reduced if consumption decreases, if market share is lost to non-MSA manufacturers, or if there is a negative outcome in litigation regarding the MSA, including challenges by participating tobacco manufacturers regarding the amount of annual payments owed under the MSA. The Fund can invest up to 25% of its total assets in tobacco-related bonds without an appropriation pledge that make payments only from a state’s interest in the MSA. Risks of Land-Secured or “Dirt” Bonds. These special assessment or special tax bonds are issued to promote residential, commercial and industrial growth and redevelopment. They are exposed to real estate development-related risks. The bonds could default if the developments failed to progress as anticipated or if taxpayers failed to pay the assessments, fees and taxes specified in the financing plans for a project. Taxability Risk. The Fund’s investments in municipal securities rely on the opinion of the issuer’s bond counsel that the interest paid on those securities will not be subject to federal and state income tax. Income from tax-exempt municipal securities could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service, state tax authorities, or a court, or the non-compliant conduct of a bond issuer. Risks of Borrowing and Leverage. The Fund can borrow up to one-third of the value of its total assets (including the amount borrowed) from banks, as permitted by the Investment Company Act of 1940. It can use those borrowings for a number of purposes, including for purchasing securities, which can create “leverage.” In that case, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not borrow. Borrowing results in interest payments to the lenders and related expenses. Borrowing for investment purposes might reduce the Fund’s return if the yield on the securities purchased is less than those borrowing costs. The Fund may also borrow to meet redemption obligations, for temporary and emergency purposes, or to unwind or contribute to trusts in connection with the Fund’s investment in inverse floaters (instruments also involving the use of leverage, as discussed below). The Fund currently participates in a line of credit with other Oppenheimer funds for its borrowing. The Fund can participate in a committed reverse repurchase agreement program. Reverse repurchase agreements that the Fund may engage in also create leverage. A reverse repurchase agreement is the sale by the Fund of a debt obligation to a party for a specified price, with the simultaneous agreement by the Fund to repurchase that debt obligation from that party on a future date at a higher price. Similar to a borrowing, reverse repurchase agreements provide the Fund with cash for investment and operational purposes. When the Fund engages in reverse repurchase agreements, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not engage in these transactions due to the effect of leverage. Reverse repurchase agreements create fund expenses and require that the Fund have sufficient cash available to repurchase the debt obligation when required. Reverse repurchase agreements also involve the risk that the market value of the debt obligation that is the subject of the reverse repurchase agreement could decline significantly below the price at which the Fund is obligated to repurchase the security. Risks of Derivative Investments. Derivatives may involve significant risks. Derivatives may be more volatile than other types of investments, may require the payment of premiums, may increase portfolio turnover, may be illiquid, and may not perform as expected. Derivatives are subject to counterparty risk and the Fund may lose money on a derivative investment if the issuer or counterparty fails to pay the amount due. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund’s initial investment. As a result of these risks, the Fund could realize little or no income or lose money from its investment, or a hedge might be unsuccessful. In addition, under new rules enacted and currently being implemented under financial reform legislation, certain over-the-counter derivatives are (or soon will be) required to be executed on a regulated market and/or cleared through a clearinghouse. It is unclear how these regulatory changes will affect counterparty risk, and entering into a derivative transaction with a clearinghouse may entail further risks and costs. Inverse Floaters. The Fund invests in inverse floating rate securities (“inverse floaters”) because, under ordinary circumstances, they offer higher yields and thus provide higher income than fixed-rate municipal bonds of comparable maturity and credit quality. Because inverse floaters are leveraged instruments, the value of an inverse floater will change more significantly in response to changes in interest rates and other market fluctuations than the market value of a conventional fixed-rate municipal security of comparable maturity and credit quality, including the municipal bond underlying an inverse floater. During periods of rising interest rates, the market values of inverse floaters will tend to decline more quickly than those of fixed-rate securities. An inverse floater is created when a fixed-rate municipal bond is contributed to a trust. The trust issues two separate classes of securities: short-term floating rate securities with a fixed principal amount that represent a senior interest in the underlying municipal bond, and the inverse floater that represents a residual, subordinate interest in the underlying municipal bond. The trust issues and sells the short-term floating rate securities to third parties and the inverse floater to the Fund. The short-term floating rate securities generally bear short-term rates of interest. When interest is paid on the underlying municipal bond to the trust, such proceeds are first used to pay interest owing to holders of the short-term floating rate securities, with any remaining amounts being paid to the Fund, as the holder of the inverse floater. Accordingly, the amount of such interest paid to the Fund is inversely related to the rate of interest on the short-term floating rate securities. Inverse floaters produce less income when short-term interest rates rise (and, in extreme cases, may pay no income) and more income when short-term interest rates fall. Thus, if short-term interest rates rise after the issuance of the inverse floater, any yield advantage to the Fund is reduced and may be eliminated. Additionally, because the principal amount of the short-term floating rate security is fixed and is not adjusted in response to changes in the market value of the underlying municipal bond, any change in the market value of the underlying municipal bond is reflected entirely in a change to the value of the inverse floater. Upon the occurrence of certain adverse events, a trust may be collapsed and the underlying municipal bond liquidated, and the Fund could lose the entire amount of its investment in the inverse floater and may, in some cases, be contractually required to pay the negative difference, if any, between the liquidation value of the underlying municipal bond and the principal amount of the short-term floating rate securities. The Fund may invest in inverse floaters with any degree of leverage (measured by comparing the outstanding principal amount of related short-term floating rate securities to the par value of the underlying municipal bond). However, the Fund may only expose up to 20% of its total assets to the effects of leverage from its investments in inverse floaters. This limitation is measured by comparing the aggregate principal amount of the short-term floating rate securities that are related to the inverse floaters held by the Fund to the total assets of the Fund. Nevertheless, the value of, and income earned on, an inverse floater that has a higher degree of leverage (represented by an outstanding principal amount of related short-term floating rate securities that constitutes a larger percentage of the par value of the underlying municipal bond) will fluctuate more significantly in response to changes in interest rates and to changes in the market value of the related underlying municipal bond, and are more likely to be eliminated entirely under adverse market conditions. | Principal Risks. The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may fall due to adverse changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth less than what you paid for them.These risks mean that you can lose money by investing in the Fund. Risks of Investing in Municipal Securities. Municipal securities may be subject to interest rate risk, duration risk, credit risk, credit spread risk, extension risk, reinvestment risk and prepayment risk. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally fall, and therefore, those debt securities may be worth less than the amount the Fund paid for them or valued them. When interest rates change, the values of longer-term debt securities usually change more than the values of shorter-term debt securities. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are near historic lows. Duration is a measure of the price sensitivity of a debt security or portfolio to interest rate changes. Duration risk is the risk that longer-duration debt securities will be more volatile and thus more likely to decline in price, and to a greater extent, in a rising interest rate environment than shorter-duration debt securities. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or repay principal, the Fund's income or share value might be reduced. Adverse news about an issuer or a downgrade in an issuer's credit rating, for any reason, can also reduce the market value of the issuer's securities. "Credit spread" is the difference in yield between securities that is due to differences in their credit quality. There is a risk that credit spreads may increase when the market expects lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund's lower-rated and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price. Extension risk is the risk that an increase in interest rates could cause prepayments on a debt security to be repaid at a slower rate than expected. Extension risk is particularly prevalent for a callable security where an increase in interest rates could result in the issuer of that security choosing not to redeem the security as anticipated on the security's call date. Such a decision by the issuer could have the effect of lengthening the debt security's expected maturity, making it more vulnerable to interest rate risk and reducing its market value. Reinvestment risk is the risk that when interest rates fall the Fund may be required to reinvest the proceeds from a security's sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds. Prepayment risk is the risk that the issuer may redeem the security prior to the expected maturity or that borrowers may repay the loans that underlie these securities more quickly than expected, thereby causing the issuer of the security to repay the principal prior to the expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Fixed-Income Market Risks. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity may decline unpredictably in response to overall economic conditions or credit tightening. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund's books and could experience a loss. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds' prices, particularly for lower-rated and unrated securities. An unexpected increase in redemptions by Fund shareholders (including requests from shareholders who may own a significant percentage of the Fund’s shares), which may be triggered by general market turmoil or an increase in interest rates, as well as other adverse market and economic developments, could cause the Fund to sell its holdings at a loss or at undesirable prices and adversely affect the Fund’s share price and increase the Fund’s liquidity risk, Fund expenses and/or taxable distributions. As of the date of this prospectus, interest rates in the U.S. are near historically low levels, increasing the exposure of bond investors to the risks associated with rising interest rates. Economic and other market developments can adversely affect fixed-income securities markets in the United States, Europe and elsewhere. At times, participants in debt securities markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt securities to facilitate an orderly market. Those concerns may impact the market price or value of those debt securities and may cause increased volatility in those debt securities or debt securities markets. Under some circumstances, as was the case during the latter half of 2008 and early 2009, those concerns could cause reduced liquidity in certain debt securities markets, reducing the willingness of some lenders to extend credit, and making it more difficult for borrowers to obtain financing on attractive terms (or at all). A lack of liquidity or other adverse credit market conditions may hamper the Fund's ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments. Risks of Below-Investment-Grade Securities. As compared to investment-grade debt securities, below-investment-grade debt securities (also referred to as “junk” bonds), whether rated or unrated, may be subject to greater price fluctuations and increased credit risk, as the issuer might not be able to pay interest and principal when due, especially during times of weakening economic conditions or rising interest rates. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. The market for below-investment-grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline. Because the Fund can invest up to 15% of its total assets in below-investment-grade securities, the Fund’s credit risks are greater than those of funds that buy only investment-grade securities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund’s Sub-Adviser has changed its assessment of the security’s credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund’s holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. If the Fund has more than 15% of its total assets invested in below-investment-grade securities, the Sub-Adviser will not purchase additional below-investment-grade securities until the level of holdings in those securities no longer exceeds the restriction. Risks of Minnesota Municipal Securities. Because the Fund has recently begun transitioning from a fund focused on Minnesota municipal securities to a national municipal fund, and a significant portion of the Fund’s assets are invested in Minnesota municipal securities as of the date of this prospectus, the value of its portfolio investments will be highly sensitive to events affecting the financial stability of the State of Minnesota and its municipalities, agencies, authorities and other instrumentalities that issue those securities. Budgetary stress on the state or its municipalities, changes in federal, state, and local legislation or policy, erosion of the tax base, the effects of natural disasters or environmental issues, or other economic, legislative or political, or social issues may have a significant negative impact on the value of state or local securities. The Fund’s exposure to Minnesota municipal securities is expected to decrease substantially following the completion of its transition to a national municipal fund. Municipal Securities Focus Risk. The Fund will not concentrate its investments in issuers in any one industry. The Securities and Exchange Commission has taken the position that investment of more than 25% of a fund’s total assets in issuers in the same industry constitutes concentration. Many types of municipal securities (such as general obligation, government appropriation, municipal leases, special assessment and special tax bonds) are not considered a part of any “industry” for purposes of this policy. Therefore, the Fund may invest more than 25% of its total assets in those types of municipal securities, subject to any applicable limits described in this prospectus. Those municipal securities may finance or pay interest from the revenues of projects that are subject to similar economic, business or political developments that could increase their credit risk. Legislation that affects the financing of a particular municipal project, or economic factors that have a negative impact on a project, would be likely to affect many other similar projects. At times, the Fund may change the relative emphasis of its investments in securities issued by certain municipalities. If the Fund has a greater emphasis on investments in one or more particular municipalities, it may be subject to greater risks from adverse events affecting such municipalities than a fund that invests in different municipalities or that is more diversified. Risks of Tobacco Related Bonds. In 1998, the largest U.S. tobacco manufacturers reached an out of court agreement, known as the Master Settlement Agreement (the “MSA”), to settle claims against them by 46 states and six other U.S. jurisdictions. The tobacco manufacturers agreed to make annual payments to the government entities in exchange for the release of all litigation claims. A number of the states have sold bonds that are backed by those future payments. The Fund may invest in two types of those bonds: (i) bonds that make payments only from a state’s interest in the MSA and (ii) bonds that make payments from both the MSA revenue and from an “appropriation pledge” by the state. An “appropriation pledge” requires the state to pass a specific periodic appropriation to make the payments and is generally not an unconditional guarantee of payment by a state. The settlement payments are based on factors, including, but not limited to, annual domestic cigarette shipments, cigarette consumption, inflation and the financial capability of participating tobacco companies. Payments could be reduced if consumption decreases, if market share is lost to non-MSA manufacturers, or if there is a negative outcome in litigation regarding the MSA, including challenges by participating tobacco manufacturers regarding the amount of annual payments owed under the MSA. Risks of Land-Secured or “Dirt” Bonds. These special assessment or special tax bonds are issued to promote residential, commercial and industrial growth and redevelopment. They are exposed to real estate development-related risks. The bonds could default if the developments failed to progress as anticipated or if taxpayers failed to pay the assessments, fees and taxes specified in the financing plans for a project. Taxability Risk. The Fund’s investments in municipal securities rely on the opinion of the issuer’s bond counsel that the interest paid on those securities will not be subject to federal income tax. Tax opinions are generally provided at the time the municipal security is initially issued. However, tax opinions are not binding on the Internal Revenue Service or any court, and after the Fund buys a security, the Internal Revenue Service or a court may determine that a bond issued as tax-exempt should in fact be taxable and the Fund’s dividends with respect to that bond might be subject to federal income tax. In addition, income from tax-exempt municipal securities could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service, a court, or the non-compliant conduct of a bond issuer. Risks of Borrowing and Leverage. The Fund can borrow up to one-third of the value of its total assets (including the amount borrowed) from banks, as permitted by the Investment Company Act of 1940. It can use those borrowings for a number of purposes, including for purchasing securities, which can create “leverage.” In that case, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not borrow. Borrowing results in interest payments to the lenders and related expenses. Borrowing for investment purposes might reduce the Fund’s return if the yield on the securities purchased is less than those borrowing costs. The Fund may also borrow to meet redemption obligations, for temporary and emergency purposes, or to unwind or contribute to trusts in connection with the Fund’s investment in inverse floaters (instruments also involving the use of leverage, as discussed below). The Fund currently participates in a line of credit with other Oppenheimer funds for its borrowing. The Fund can participate in a committed reverse repurchase agreement program. Reverse repurchase agreements that the Fund may engage in also create leverage. A reverse repurchase agreement is the sale by the Fund of a debt obligation to a party for a specified price, with the simultaneous agreement by the Fund to repurchase that debt obligation from that party on a future date at a higher price. Similar to a borrowing, reverse repurchase agreements provide the Fund with cash for investment and operational purposes. When the Fund engages in reverse repurchase agreements, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not engage in these transactions due to the effect of leverage. Reverse repurchase agreements create fund expenses and require that the Fund have sufficient cash available to repurchase the debt obligation when required. Reverse repurchase agreements also involve the risk that the market value of the debt obligation that is the subject of the reverse repurchase agreement could decline significantly below the price at which the Fund is obligated to repurchase the security. Risks of Derivative Investments.Derivatives may involve significant risks. Derivatives may be more volatile than other types of investments, may require the payment of premiums, may increase portfolio turnover, may be illiquid, and may not perform as expected. Derivatives are subject to counterparty risk and the Fund may lose money on a derivative investment if the issuer or counterparty fails to pay the amount due. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund’s initial investment. As a result of these risks, the Fund could realize little or no income or lose money from its investment, or a hedge might be unsuccessful. In addition, under new rules enacted and currently being implemented under financial reform legislation, certain over-the-counter derivatives are (or soon will be) required to be executed on a regulated market and/or cleared through a clearinghouse. It is unclear how these regulatory changes will affect counterparty risk, and entering into a derivative transaction with a clearinghouse may entail further risks and costs. Inverse Floaters. The Fund invests in inverse floating rate securities (“inverse floaters”) because, under ordinary circumstances, they offer higher yields and thus provide higher income than fixed-rate municipal bonds of comparable maturity and credit quality. Because inverse floaters are leveraged instruments, the value of an inverse floater will change more significantly in response to changes in interest rates and other market fluctuations than the market value of a conventional fixed-rate municipal security of comparable maturity and credit quality, including the municipal bond underlying an inverse floater. During periods of rising interest rates, the market values of inverse floaters will tend to decline more quickly than those of fixed-rate securities. An inverse floater is created when a fixed-rate municipal bond is contributed to a trust. The trust issues two separate classes of securities: short-term floating rate securities with a fixed principal amount that represent a senior interest in the underlying municipal bond, and the inverse floater that represents a residual, subordinate interest in the underlying municipal bond. The trust issues and sells the short-term floating rate securities to third parties and the inverse floater to the Fund. The short-term floating rate securities generally bear short-term rates of interest. When interest is paid on the underlying municipal bond to the trust, such proceeds are first used to pay interest owing to holders of the short-term floating rate securities, with any remaining amounts being paid to the Fund, as the holder of the inverse floater. Accordingly, the amount of such interest paid to the Fund is inversely related to the rate of interest on the short-term floating rate securities. Inverse floaters produce less income when short-term interest rates rise (and, in extreme cases, may pay no income) and more income when short-term interest rates fall. Thus, if short-term interest rates rise after the issuance of the inverse floater, any yield advantage to the Fund is reduced and may be eliminated. Additionally, because the principal amount of the short-term floating rate security is fixed and is not adjusted in response to changes in the market value of the underlying municipal bond, any change in the market value of the underlying municipal bond is reflected entirely in a change to the value of the inverse floater. Upon the occurrence of certain adverse events, a trust may be collapsed and the underlying municipal bond liquidated, and the Fund could lose the entire amount of its investment in the inverse floater and may, in some cases, be contractually required to pay the negative difference, if any, between the liquidation value of the underlying municipal bond and the principal amount of the short-term floating rate securities. The Fund may invest in inverse floaters with any degree of leverage (measured by comparing the outstanding principal amount of related short-term floating rate securities to the par value of the underlying municipal bond). However, the Fund may only expose up to 10% of its total assets to the effects of leverage from its investments in inverse floaters. This limitation is measured by comparing the aggregate principal amount of the short-term floating rate securities that are related to the inverse floaters held by the Fund to the total assets of the Fund. Nevertheless, the value of, and income earned on, an inverse floater that has a higher degree of leverage (represented by a larger outstanding principal amount of related short-term floating rate securities relative to the par value of the underlying municipal bond) will fluctuate more significantly in response to changes in interest rates and to changes in the market value of the related underlying municipal bond, and are more likely to be eliminated entirely under adverse market conditions. |

| Advisory Fee | 0.55% | 0.40% |

| Advisory Fee Breakpoint Schedule | 0.55% of the first $500 million of average annual net assets; 0.50% of the next $500 million; 0.45% of the next $500 million; and 0.40% of average annual net assets over $1.5 billion, calculated on the daily net assets of the Fund. | 0.40% of the first $500 million of average annual net assets; 0.35% of the next $500 million; 0.30% of the next $500 million; and 0.28% of average annual net assets over $1.5 billion, calculated on the daily net assets of the Fund. |

| Benchmark Index | Bloomberg Barclays Municipal Bond Index | Bloomberg Barclays Municipal Bond Index |

Expense Ratios

It is expected that all Class B shares will have converted to Class A shares in June 2018, prior to the Meeting.

| Current Class A | Proposed Class A3 |

| Shareholder Fees(fees paid directly from your investment) |

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | 4.75% | 4.75% |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | None1 | None1 |

| Annual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment) |

| Management Fees | 0.55% | 0.40% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.25% |

| Other Expenses |

| Interest and Fees from Borrowing | 0.14% | 0.14% |

| Interest and Related Expenses from Inverse Floaters | 0.06% | 0.06% |

| Other Expenses | 0.16% | 0.16% |

| Total Other Expenses | 0.36% | 0.36% |

| Total Annual Fund Operating Expenses | 1.16% | 1.01% |

| Fee Waiver and Expense Reimbursement | (0.16)%4 | (0.11)%5 |

| Total Annual Fund Operating Expenses after Fee Waiver and Expense Reimbursement | 1.00% | 0.90% |

| Current Class C | Proposed Class C3 |

| Shareholder Fees(fees paid directly from your investment) |

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | 1%2 | 1%2 |

| Annual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment) |

| Management Fees | 0.55% | 0.40% |

| Distribution and/or Service (12b-1) Fees | 1.00% | 1.00% |

| Other Expenses |

| Interest and Fees from Borrowing | 0.14% | 0.14% |

| Interest and Related Expenses from Inverse Floaters | 0.06% | 0.06% |

| Other Expenses | 0.18% | 0.18% |

| Total Other Expenses | 0.38% | 0.38% |

| Total Annual Fund Operating Expenses | 1.93% | 1.78% |

| Fee Waiver and Expense Reimbursement | (0.18)%4 | (0.33)%5 |

| Total Annual Fund Operating Expenses after Fee Waiver and Expense Reimbursement | 1.75% | 1.45% |

| Current Class Y | Proposed Class Y3 |

| Shareholder Fees(fees paid directly from your investment) |

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | None | None |

| Annual Fund Operating Expenses(expenses that you pay each year as a percentage of the value of your investment) |

| Management Fees | 0.55% | 0.40% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses |

| Interest and Fees from Borrowing | 0.14% | 0.14% |

| Interest and Related Expenses from Inverse Floaters | 0.06% | 0.06% |

| Other Expenses | 0.18% | 0.18% |

| Total Other Expenses | 0.38% | 0.38% |

| Total Annual Fund Operating Expenses | 0.93% | 0.78% |

| Fee Waiver and Expense Reimbursement | None | (0.13)%5 |

| Total Annual Fund Operating Expenses after Fee Waiver and Expense Reimbursement | 0.93% | 0.65% |

| 1. | A Class A contingent deferred sales charge may apply to redemptions of investments of $1 million or more in Oppenheimer funds if they are redeemed within an 18-month "holding period" or to certain retirement plan redemptions. |

| 2. | Applies to shares redeemed within 12 months of purchase. |

| 3. | “Other Expenses” are based on estimated amounts for the current fiscal year. |

| 4. | After discussions with the Fund’s Board, the Manager has contractually agreed to waive fees and/or reimburse the Fund for certain expenses in order to limit “Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement” (excluding any applicable interest and fees from borrowings and interest and related expenses from inverse floaters, dividend expenses, taxes, any subsidiary expenses, Acquired Fund Fees and Expenses, brokerage commissions, unusual and infrequent expenses and certain other Fund expenses) to annual rates of 0.80% for Class A shares, 1.55% for Class B and Class C shares and 0.80% for Class Y shares, as calculated on the daily net assets of the Fund. This fee waiver and/or expense reimbursement may not be amended or withdrawn for one year from the date of this prospectus, unless approved by the Board. |