Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258318

PROSPECTUS

7,262,460 shares of Common Stock

This prospectus covers the offer and resale by the selling stockholder identified in this prospectus of up to an aggregate of 7,262,460 shares of our common stock issuable upon the exercise of warrants to purchase 7,262,460 shares of our common stock, or the Warrants. We issued the Warrants to the selling stockholder (i) in exchange for warrants issued by Leading BioSciences, Inc. (“LBS”) pursuant to the Securities Purchase Agreement, dated December 16, 2020, by and between the selling stockholder and LBS which exchange occurred in connection with the Merger described in this prospectus, (ii) in a private placement transaction pursuant to the Securities Purchase Agreement, dated December 16, 2020, by and among us, LBS and the selling stockholder and (iii) in a private placement transaction pursuant to the Waiver and Amendment Agreement, dated July 21, 2021, by and between us and the selling stockholder. We are registering these shares issuable upon exercise of the Warrants on behalf of the selling stockholder, to be offered and sold by them from time to time.

We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale by the selling stockholder of such shares. We are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling stockholder is responsible for all selling commissions, transfer taxes and other costs related to the offer and sale of their shares.

Sales of the shares by the selling stockholder may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, at negotiated prices and/or at varying prices determined at the time of sale. The selling stockholder may sell shares directly or to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholder, the purchasers of the shares, or both. The selling stockholder may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the selling stockholder may sell their shares of common stock hereunder following the effective date of the registration statement of which this prospectus forms a part. We provide more information about how the selling stockholder may sell or otherwise dispose of their shares of common stock in the section titled “Plan of Distribution” on page 36.

Our common stock is listed on The Nasdaq Capital Market under the symbol “PALI.” On August 9, the last reported sale price of our common stock was $2.76 per share.

Investing in our common stock involves a high degree of risk. Before making an investment decision, please read the information under "Risk Factors" beginning on page 9 of this prospectus and under similar headings in any amendment or supplement to this prospectus or in any filing with the Securities and Exchange Commission that is incorporated by reference herein.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 10, 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using a "shelf" registration process. Under this registration statement, the selling stockholder may sell from time to time in one or more offerings the common stock described in this prospectus.

We have not authorized anyone to provide you with information other than the information that we have provided or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is at your own risk. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed since those dates.

Unless otherwise stated, all references in this prospectus to "we," "us," "our," "Palisade," the "Company" and similar designations refer to Palisade Bio, Inc. This prospectus contains references to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies' trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any applicable prospectus supplement or free writing prospectus, including the documents that we incorporate by reference herein and therein, contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We discuss many of these risks in greater detail under “Risk Factors” in this prospectus, in the "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections incorporated by reference from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC.

Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, any applicable prospectus supplement, together with the documents that we have filed with the SEC that are incorporated by reference and any free writing prospectus we have authorized for use in connection with this offering, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of our company, you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the factors described under the heading “Risk Factors” beginning on page 9 of this prospectus, as well as the information incorporated by reference from our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, before making an investment decision.

Company Overview

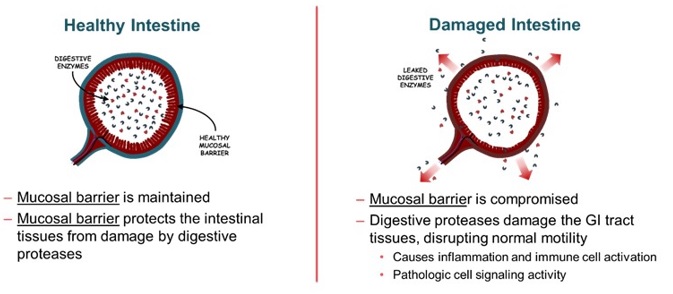

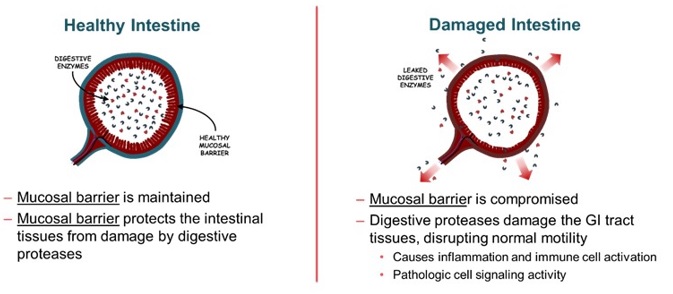

We are a clinical stage biopharmaceutical company focused on discovering, developing, and commercializing innovative oral therapies that target serious diseases associated with the breakdown of the mucosal barrier protecting the gastrointestinal (“GI”) tract. Our goal is to be an industry leader in developing therapies to treat these diseases and to improve the lives of patients suffering from such diseases.

Our approach is founded on the discovery that damage to the intestinal epithelial barrier can result in leakage of digestive enzymes from the GI tract that can damage tissue and promote inflammation, causing a broad array of acute and chronic conditions.

Using our scientific and drug development expertise, we are developing a portfolio of oral product candidates to treat conditions driven by protease (intestinal enzymes) leakage through the intestinal epithelial barrier, including surgical complications and inflammatory conditions.

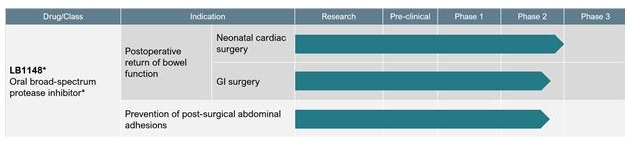

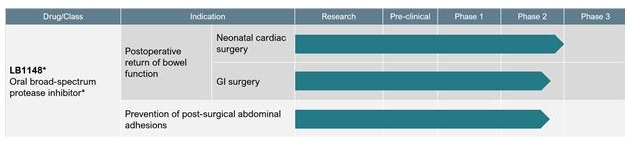

Our pipeline of product candidates is illustrated in this chart:

* Commercial right to LB1148 in Greater China (excluding Taiwan) have been out-licensed to Newsoara.

Our lead therapeutic candidate, LB1148, is a novel oral liquid formulation of the well-characterized digestive enzyme inhibitor, tranexamic acid, intended to inhibit digestive enzyme activity and preserve gut integrity during intestinal stress, such as results from reduced blood flow to the intestine, infections, and surgery. Peer reviewed publications of third-party research suggest that digestive enzyme leakage from the GI tract drives GI and organ dysfunction following these events.

We are initially developing LB1148 to be administered to patients prior to major surgeries that risk disrupting the intestinal mucosal barrier. As announced in March of 2020, a randomized, double-blind, parallel, placebo-controlled Phase 2 investigator-sponsored clinical trial of LB1148 in 120 patients undergoing coronary artery bypass grafting and/or heart valve replacement surgery requiring cardiopulmonary bypass was completed. Patients were randomized to receive LB1148 or placebo in conjunction with surgery. The trial’s primary endpoint was time to return of bowel function. Secondary endpoints include Intensive Care Unit (“ICU”) length of stay, hospital length of stay, organ function changes, inflammatory response and glucose control. LB1148 provided an approximately 30% improvement in the time to normal bowel function following cardiovascular (“CV”) surgery (p<0.001) compared to placebo. The treatment group also had an average 1.1-day shorter length of stay in the ICU and an average 1.1-day shorter hospital stay. Generally, treatment with LB1148 was well tolerated. Adverse events (“AEs”) were similar between the treatment groups and not considered unexpected for the subject population. None of the AEs or serious adverse events (“SAEs”) reported were considered drug-related by the sponsor-investigator. One of the primary factors in discharging patients from the hospital following surgery is the return of bowel function. LB1148 has been granted Fast Track designation from the “FDA” for the treatment of postoperative GI dysfunction (which may present as feeding intolerance, ileus, necrotizing enterocolitis (“NEC”), etc.) associated with gut hypoperfusion injury in pediatric patients who have undergone congenital heart disease repair surgery.

We are also currently conducting a randomized, double-blind, placebo-controlled, proof-of-concept Phase 2 clinical trial of LB1148 in patients undergoing elective bowel resection surgery in the Unites States. We expect to have initial data regarding the time to return of GI function from this clinical trial in the second half of 2021. The second part of this trial will evaluate whether patients treated with LB1148 also experience fewer postoperative intra-abdominal adhesions. In the second half of 2021, we are planning to initiate a Phase 2/3 clinical trial of LB1148 in neonatal patients undergoing CV surgery to correct congenital heart defects. We anticipate that this clinical trial will enroll 100 patients and that we will have data from the first 10 patients in late 2021 with final data from the full 100 patients in 2022.

Beyond our lead product candidate, we are continuing to develop additional therapeutic candidates. We believe that protease-based therapeutics hold promise in meeting a number of unmet needs resulting from chronic protease leak, beyond our initial therapeutic focus on GI-related pathology triggered by major surgeries.

Selected Risks Affecting Our Business

| · | The Company’s business depends on the successful clinical development, regulatory approval and commercialization of LB1148. |

| · | Some of the initial indications in which the Company plans to pursue development of LB1148 are indications for which there are no FDA-approved therapies. This makes it difficult to predict the timing and costs of clinical development for LB1148 in these indications, as well as the regulatory approval path. |

| · | The development and commercialization strategy for the Company’s product candidate LB1148 depends, in part, on published scientific literature and the FDA’s prior findings regarding the safety and efficacy of tranexamic acid. If the Company is not able to pursue this strategy, it may be delayed in receiving regulatory authority approval. |

| · | Clinical drug development is very expensive, time-consuming and uncertain. |

| · | The results of previous clinical trials may not be predictive of future results, and the results of the Company’s current and planned clinical trials may not satisfy the requirements of the FDA or non-U.S. regulatory authorities. |

| · | Even if the Company receives marketing approval for LB1148, or any future product candidate, it may not be able to successfully commercialize its product candidates due to unfavorable pricing regulations or third-party coverage and reimbursement policies, which could make it difficult for the Company to sell its product candidates profitably. |

| · | The Company will need to raise additional financing in the future to fund its operations, which may not be available to it on favorable terms or at all. |

| · | The Company currently has no products approved for sale, and it may never obtain regulatory approval to commercialize any of its product candidates. |

| · | The Company’s or third party’s clinical trials may fail to demonstrate the safety and efficacy of its product candidates, or serious adverse or unacceptable side effects may be identified during their development, which could prevent or delay marketing approval and commercialization, increase the Company’s costs or necessitate the abandonment or limitation of the development of the product candidate. |

| · | The Company has expressed substantial doubt about its ability to continue as a going concern. |

| · | The Company may not be able to protect its intellectual property rights throughout the world. |

| · | Our board of directors has broad discretion to issue additional securities, which might dilute the net tangible book value per share of our common stock for existing stockholders. |

Corporate Information

We were originally incorporated in 2001 in the State of Delaware under the name Neuralstem, Inc. In October 2019, we changed our name from Neuralstem, Inc. to Seneca Biopharma, Inc. In April 2021, we effected the Merger (described below). In April 2021, we changed our name from Seneca Biopharma, Inc. to Palisade Bio, Inc. Our principal executive offices are located at 5800 Armada Drive, Suite 210, Carlsbad, California 92008, our telephone number is (858) 7004-4900 and our website address is www.palisadebio.com. The information contained in or accessible through our website does not constitute part of this prospectus.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our shares of common stock held by non-affiliates does not equal or exceed $250.0 million as of the prior June 30th, or (2) our annual revenues did not equal or exceed $100.0 million during such completed fiscal year and the market value of our shares of common stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of any reduced disclosure obligations, it may make comparison of our financial statements with other public companies difficult or impossible.

Merger Transaction

On April 27, 2021, pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 16, 2020, by and among Palisade Bio, Inc., formerly known as Seneca Biopharma, Inc. (the “Company”), Leading Biosciences, Inc. (“LBS”) and Townsgate Acquisition Sub 1, Inc., a wholly owned subsidiary of the Company (“Merger Sub”), the Company completed the previously announced merger transaction with LBS, pursuant to which Merger Sub merged with and into LBS, with LBS surviving such merger as a wholly owned subsidiary of the Company (the “Merger”). In connection with the Merger, and immediately prior to the effective time of the Merger (the “Effective Time”), the Company effected a reverse stock split of the Company Common Stock at a ratio of 1-for-6 (the “Reverse Stock Split”). Unless otherwise noted, all references to share and per share amounts in this Prospectus reflect the Reverse Stock Split. Also, in connection with the closing of the Merger (the “Closing”), the Company changed its name from “Seneca Biopharma, Inc.” to “Palisade Bio, Inc.” (the “Name Change”) and the business conducted by the Company became primarily the business conducted by LBS, which is a clinical-stage biopharmaceutical company focused on advancing LBS’s clinical program and developing a therapeutic to combat the interruption of gastrointestinal function following major surgery for which there is currently a significant unmet need for safe and effective therapies.

At the Effective Time:

| | (a) | Each outstanding share of LBS’s common stock, par value $0.001 per share (“LBS Common Stock”), and each outstanding non-voting share of LBS’s Series 1 preferred stock, par value $0.001 per share (“LBS Series 1 Preferred”), issued in the Pre-Merger Financing (as defined below) was converted into the right to receive 0.02719 (the “Exchange Ratio”) shares of Company Common Stock, as set forth in the Merger Agreement. The Exchange Ratio was determined based on the total number of outstanding shares of Company Common Stock and LBS Common Stock, in each case as calculated on an adjusted fully diluted treasury stock method basis, after giving effect to the Pre-Merger Financing, including 50% of the shares subject to the Equity Warrants (as defined below), and taking into account certain adjustments based on the proceeds of the Pre-Merger Financing and the net cash of the Company at the Closing in accordance with the Merger Agreement. |

| | (b) | Each option to purchase shares of LBS Common Stock (each, an “LBS Option”) that was outstanding and unexercised immediately prior to the Effective Time under LBS’s 2013 Equity Incentive Plan (the “LBS Plan”), whether or not vested, was converted into and became an option to purchase shares of Company Common Stock, and the Company assumed the LBS Plan and each such LBS Option in accordance with the terms of the LBS Plan (the “Assumed Options”). The number of shares of Company Common Stock subject to each Assumed Option was determined by multiplying (i) the number of shares of LBS Common Stock that were subject to such Assumed Option, as in effect immediately prior to the Effective Time, by (ii) the Exchange Ratio, and rounding the resulting number down to the nearest whole number of shares of Company Common Stock, and the per share exercise price for the Company Common Stock issuable upon exercise of each Assumed Option was determined by dividing (A) the per share exercise price of such Assumed Option, as in effect immediately prior to the Effective Time, by (B) the Exchange Ratio and rounding the resulting per share exercise price up to the nearest whole cent. |

| | (c) | Each warrant to purchase shares of LBS Common Stock (each, an “LBS Warrant”) outstanding immediately prior to the Effective Time was assumed by the Company and converted into a warrant to purchase shares of Company Common Stock (the “Assumed Warrants”) and thereafter (i) each Assumed Warrant may be exercised solely for shares of Company Common Stock; (ii) the number of shares of Company Common Stock subject to each Assumed Warrant was determined by multiplying (A) the number of shares of LBS Common Stock that were subject to such LBS Warrant, as in effect immediately prior to the Effective Time, by (B) the Exchange Ratio, and rounding the resulting number down to the nearest whole number of shares of Company Common Stock; (iii) the per share exercise price for the Company Common Stock issuable upon exercise of each Assumed Warrant was determined by dividing (A) the exercise price per share of the LBS Common Stock subject to such LBS Warrant, as in effect immediately prior to the Effective Time, by (B) the Exchange Ratio, and rounding the resulting exercise price up to the nearest whole cent. |

Pre-Merger Financing

Securities Purchase Agreement (Bridge Financing)

In connection with signing the Merger Agreement, LBS entered into a securities purchase agreement, dated as of December 16, 2020 (the “Bridge SPA”) with the selling stockholder (the “Investor”), pursuant to which the Investor purchased senior secured promissory notes (the “Bridge Notes”) and warrants to purchase such number of shares of LBS Common Stock equal to the aggregate principal amount of the Bridge Notes issued divided by the initial per share exercise price of $0.4816 (the “Bridge Warrants”), subject to adjustment as disclosed below. The Bridge Warrants have a term of five years from the date all of the shares underlying the Bridge Warrants are registered for resale, and the exercise price shall be subject to price-only full ratchet anti-dilution protection upon the issuance of any shares of LBS Common Stock or securities convertible into LBS Common Stock for a period of two years from the effective date of the registration statement covering such shares. The Bridge Warrants also contain certain participation rights with regard to asset distributions and fundamental transactions. As a result of the Merger, at the Effective Time, each Bridge Warrant was automatically converted into a warrant to purchase that number of shares of the Company’s common stock equal to the number of shares underlying the Bridge Warrants immediately prior to the closing of the Merger multiplied by the Exchange Ratio and the exercise price was proportionately adjusted. At the Effective Time, there were 188,192 shares of the Company’s common stock issuable upon exercise of the Bridge Warrants. The Bridge Warrants were Assumed Warrants pursuant to the Merger Agreement, as described above.

Securities Purchase Agreement (Equity Financing)

In connection with signing the Merger Agreement, on December 16, 2020, LBS, Seneca and the Investor entered into a Securities Purchase Agreement (the “Equity SPA”), pursuant to which, among other things, the Investor agreed to invest $20.0 million in cash and cancel any outstanding principal and interest on the Bridge Notes immediately prior to the closing of the Merger (the aggregate amount of such cash investment and the cancellation of the outstanding principal and interest on the Bridge Notes, the “Purchase Price” and the financing arrangement described herein, the “Pre-Merger Financing”) to fund the combined company following the Merger. In return, LBS issued an amount of shares (the “Initial Shares”) of LBS Series 1 Preferred Stock to the Investor equal to the Purchase Price divided by the per share purchase price of $0.4816 and the Company agreed to issue to the Investor, warrants to purchase shares of the Company’s Common stock (the “Equity Warrants”). The Equity Warrants were issued on the 17th trading day following the closing of the Merger, and had an initial exercise price per share equal to $4.70 and were exercisable for up to 4,995,893 shares of the Company’s common stock, and are immediately exercisable and will have a term of five years from the date of issuance.

The Bridge Warrants and Equity Warrants provide that, until the second anniversary of the date on which all shares of Company’s common stock issued to the Investor (including any shares underlying the Equity Warrants) are registered on one or more registration statements, if the Company publicly announces, issues or sells, enters into a definitive, binding agreement pursuant to which the Company is required to issue or sell or is deemed, pursuant to the provisions of the Bridge Warrants and Equity Warrants, to have issued or sold, any shares of the Company’s common stock for a price per share lower than the exercise price then in effect, subject to certain limited exceptions, then the exercise price of the Bridge Warrants and Equity Warrants shall be reduced to such lower price per share. Further, on preset reset dates, the exercise price of the Bridge Warrants and Equity Warrants was to be adjusted downward (but not increased)(the “Resets”). Further, the Equity Warrants include a provision such that, beginning six months after the closing of the Merger, if the volume weighted average price of Company Common Stock is less than the then-applicable exercise price for five consecutive trading days, the holder of the Equity Warrant shall be entitled to receive 1.0 share of Company Common Stock for each share underlying the Equity Warrants being exercised thereunder in a cashless exercise. The exercise price and the number of shares of Company Common Stock issuable upon exercise of the Bridge Warrants and Equity Warrants will also be subject to adjustment in the event of any stock splits, dividends or distributions or other similar transactions as well as fundamental transactions. Prior to the effectiveness of the Waiver and Amendment Agreement (described below), two Resets occurred and the two Bridge Warrants and the Equity Warrants were exercisable for up to 429,446, 429,446, and 5,303,568 shares, respectively, each at an exercise price of $3.88 per share, and two potential Resets remained.

Waiver and Amendment Agreement

Effective July 21, 2021 (the “Effective Date”), the Investor entered into a Waiver and Amendment Agreement with the Company (the “Waiver Agreement”). Pursuant to the Waiver Agreement, the Investor and the Company agreed to waive certain rights, waive the reset provisions with respect to the exercise price and number of shares subject to the outstanding Bridge Warrants and Equity Warrants, eliminate certain financing restrictions, and accelerate registration rights for the shares underlying the warrants. As consideration for the foregoing, pursuant to the Waiver Agreement, the Company issued to the Investor an additional warrant to purchase up to 1,100,000 shares of the Company’s common stock (the “July Warrant” and together with the Bridge Warrants and the Equity Warrants, the “Warrants”). The July Warrant is exercisable beginning on January 21, 2022 and expires on the later of (x) five years from the date that the underlying shares are registered for resale and (y) January 21, 2027. The per share exercise price for the July Warrant is $3.631, subject to certain adjustments. Pursuant to the Waiver Agreement, Investor agreed to waive the reset provisions in the outstanding Bridge Warrants and Equity Warrants such that the number of shares and exercise price in effect immediately prior to the Effective Time (as described above) shall no longer be subject to price-based resets.

The registration statement of which this prospectus is a part relates to the resale of the shares of common stock that may be issued to the selling stockholder in connection with the exercise of the Warrants issued in the foregoing transactions.

Selected Financial Data of Palisade Bio, Inc. Reflecting Reverse Stock Split

On April 27, 2021, in connection with, and prior to the completion of, the Merger, the Company effected a 1-for-6 reverse stock split of its common stock (the “Reverse Stock Split”). No fractional shares have been issued in the Reverse Stock Split and the remaining fractions were paid out in cash.

Please see below selected financial data presenting selected share and per share data reflecting the effect of the 1-for-6 reverse stock split on all periods previously reported. We derived the selected financial data from our consolidated financial statements included in our Annual Report on Form 10-K filed with the SEC on March 22, 2021, as adjusted to reflect the Reverse Stock Split for all periods presented.

AS REPORTED

| | | Years Ended December 31, |

| (in thousands, except share and per share amounts) | | 2020 | | 2019 |

| Net loss | | $ | (16,267 | ) | | | (8,352 | ) |

| Net loss per share attributable to common stockholders-basic and diluted | | $ | (1.17 | ) | | | (3.80 | ) |

| Weighted-average common shares outstanding, basic and diluted | | | 13,869,272 | | | | 2,197,434 | |

| Common shares outstanding at period end | | | 17,295,703 | | | | 3,866,457 | |

AS ADJUSTED FOR ONE-FOR-SIX REVERSE STOCK SPLIT

| (in thousands, except share and per share amounts) | | Years Ended December 31, |

| | | 2020 | | 2019 |

| | | (unaudited) |

| Net loss | | $ | (16,267 | ) | | $ | (8,352 | ) |

| Net loss per share attributable to common stockholders-basic and diluted | | $ | (7.04 | ) | | $ | (22.80 | ) |

| Weighted-average common shares outstanding, basic and diluted | | | 2,311,545 | | | | 366,239 | |

| Common shares outstanding at period end | | | 2,882,617 | | | | 644,409 | |

The Offering

| Common stock offered by the selling stockholder | | 7,262,460 shares |

| | | |

| Terms of the offering | | Each selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described in “Plan of Distribution.” |

| | | |

| Use of proceeds | | We will not receive any proceeds from the sale of shares of our common stock by the selling stockholder. |

| | | |

| Risk factors | | See “Risk Factors” beginning on page 9, for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| | | |

| Nasdaq Capital Market symbol | | PALI |

The selling stockholder named in this prospectus may offer and sell up to 7,262,460 shares of our common stock.

The selling stockholder is prohibited, subject to certain exceptions, from exercising the Warrants to the extent that immediately prior to or after giving effect to such exercise, the selling stockholder, together with its affiliates and other attribution parties, would own more than 4.99% of the total number of shares of the Company’s common stock then issued and outstanding, which percentage may be changed at the selling stockholder’s election to a lower percentage at any time or to a higher percentage not to exceed 9.99% upon 61 days’ notice to the Company.

Our common stock is currently listed on The Nasdaq Capital Market under the symbol “PALI.”

Shares of common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholder of any of the common stock covered by this prospectus. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholder for offer and resale, we are referring to the shares of common stock issued to the selling stockholder in connection with the exercise of warrants issued in the transactions as described above. When we refer to the selling stockholder in this prospectus, we are referring to the selling stockholder identified in this prospectus and, as applicable, their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below and described in the sections entitled "Risk Factors" in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as filed with the SEC, which are incorporated herein by reference in their entirety, as well any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including any applicable prospectus supplement. Our business, financial condition, results of operations or prospects could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned elsewhere in this prospectus. For more information, see the section entitled "Where You Can Find Additional Information." Please also read carefully the section entitled "Special Note Regarding Forward-Looking Statements."

Risks Related to the Company’s Development, Commercialization and Regulatory Approval of the Company’s Investigational Therapies

The Company’s business depends on the successful clinical development, regulatory approval and commercialization of LB1148.

The success of the Company’s business, including its ability to finance itself and generate revenue in the future, primarily depends on the successful development, regulatory approval and commercialization of LB1148. The clinical and commercial success of LB1148 depends on a number of factors, including the following:

| | · | timely and successful completion of required clinical trials not yet initiated, which may be significantly slower or costlier than the Company currently anticipates and/or produce results that do not achieve the endpoints of the trials; |

| | · | whether the Company is required by the FDA or similar foreign regulatory agencies to conduct additional studies beyond those planned to support the approval and commercialization of LB1148; |

| | · | achieving and maintaining, and, where applicable, ensuring that the Company’s third-party contractors achieve and maintain compliance with their contractual obligations and with all regulatory requirements applicable to LB1148; |

| | · | ability of third parties with whom the Company contracts to manufacture adequate clinical trial and commercial supplies of LB1148, to remain in good standing with regulatory agencies and to develop, validate and maintain commercially viable manufacturing processes that are compliant with current good manufacturing practices (“cGMP”); |

| | · | a continued acceptable safety profile during clinical development and following approval of LB1148; |

| | | |

| | · | ability to obtain favorable labeling for LB1148 through regulators that allows for successful commercialization, given the drugs may be marketed only to the extent approved by these regulatory authorities (unlike with most other industries); |

| | · | ability to successfully commercialize LB1148 in the United States and internationally, if approved for marketing, sale and distribution in such countries and territories, whether alone or in collaboration others; |

| | · | acceptance by physicians, insurers and payors, and patients of the quality, benefits, safety and efficacy of LB1148, if either is approved, including relative to alternative and competing treatments; |

| | · | existence of a regulatory environment conducive to the success of LB1148; |

| | · | ability to price LB1148 to recover the Company’s development costs and generate a satisfactory profit margin; and |

| | · | The Company’s ability and its partners’ ability to establish and enforce intellectual property rights in and to LB1148. |

If the Company does not achieve one or more of these factors, many of which are beyond its control, in a timely manner or at all, the Company could experience significant delays or an inability to obtain regulatory approvals or commercialize LB1148. Even if regulatory approvals are obtained, the Company may never be able to successfully commercialize LB1148. Accordingly, the Company cannot assure you that it will ever be able to generate sufficient revenue through the sale of LB1148, if approved, to continue its business.

Some of the initial indications in which the Company plans to pursue development of LB1148 are indications for which there are no FDA-approved therapies. This makes it difficult to predict the timing and costs of clinical development for LB1148 in these indications, as well as the regulatory approval path.

There are no FDA-approved therapies for decreasing the time to normal feedings and bowel movement (or preventing necrotizing enterocolitis) in infants after heart surgery. While Entereg is approved to accelerate the time to upper and lower gastrointestinal recovery following surgeries that include partial bowel resection with primary anastomosis, there is no guarantee that regulatory precedence regarding Entereg will apply to the approval of other therapies that may accelerate the time to gastrointestinal recovery following surgery. While there are multiple medical devices approved for the reduction or elimination of postoperative intra-abdominal adhesions, there are no drugs approved to reduce postoperative intra-abdominal adhesions. The regulatory approval process for novel product candidates such as LB1148 can be more expensive and take longer than for other, better known or extensively studied therapeutic approaches.

The development and commercialization strategy for the Company’s product candidate LB1148 depends, in part, on published scientific literature and the FDA’s prior findings regarding the safety and efficacy of tranexamic acid. If the Company is not able to pursue this strategy, it may be delayed in receiving regulatory authority approval.

The Hatch-Waxman Act added Section 505(b)(2) to the U.S. Federal Food, Drug, and Cosmetic Act (“FDCA”). Section 505(b)(2) permits the submission of an NDA or BLA where at least some of the information required for approval comes from investigations that were not conducted by or for the applicant and for which the applicant has not obtained a right of reference or use from the person by or for whom the investigations were conducted. The FDA interprets Section 505(b)(2) of the FDCA, for purposes of approving an NDA/BLA, to permit the applicant to rely, in part, upon published literature and/or the FDA’s previous findings of safety and efficacy for an approved product. The FDA also requires companies to perform additional clinical trials or measurements to support any deviation from the previously approved product and to justify that it is scientifically appropriate to rely on the applicable published literature or referenced product, referred to as bridging. The FDA may then approve the new product candidate for all or some of the indications for which the referenced product has been approved, as well as for any new indication sought by the Section 505(b)(2) applicant, if such approval is supported by study data. The labeling, however, may be required to include all or some of the limitations, contraindications, warnings or precautions or restrictions on use included in the reference product’s labeling, including a boxed warning, or may require additional limitations, contraindications, warnings or precautions or restrictions on use.

The Company currently plans to pursue marketing approval for LB1148, in the United States through a 505(b)(2) NDA and will be completing bridging analyses prior to NDA submissions. If the FDA disagrees with the Company’s conclusions regarding the appropriateness of its reliance on the FDA’s prior findings of safety and efficacy for tranexamic acid (“TXA”) or on published literature, or if the Company is not otherwise able to bridge to the listed drug or published literature to demonstrate that its reliance is scientifically appropriate, the Company could be required to conduct additional clinical trials or other studies to support its NDA, which could lead to unanticipated costs and delays or to the termination of the development program for LB1148. If the Company is unable to obtain approval for LB1148 through the 505(b)(2) NDA process, it may be required to pursue the more expensive and time consuming 505(b)(1) approval process, which consists of full reports of investigations of safety and effectiveness conducted by or for the Company.

Notwithstanding the approval of a number of products by the FDA under Section 505(b)(2), pharmaceutical companies and others have objected to the FDA’s interpretation of Section 505(b)(2). If the FDA’s interpretation of Section 505(b)(2) is successfully challenged, the FDA may be required to change its policies and practices with respect to Section 505(b)(2) regulatory approvals, which could delay or even prevent the FDA from approving any NDA that the Company submits pursuant to the 505(b)(2) process. Even if the Company is allowed to pursue the 505(b)(2) regulatory pathway to FDA approval, it cannot assure you that its product candidates will receive the requisite approvals for commercialization.

The Company may find it difficult to enroll patients in its clinical trials, which could delay or prevent it from proceeding with clinical trials of its product candidates.

Identifying and qualifying subjects to participate in clinical trials of the Company’s product candidates is critical to its success. The timing of clinical trials depends on the Company’s ability to recruit subjects to participate, as well as the completion of required follow-up periods. Patients may be unwilling to participate in clinical trials because of negative publicity from adverse events related to the biotechnology or pharmaceutical fields, competitive clinical trials for similar patient populations, the existence of current treatments or for other reasons. The timeline for recruiting patients, conducting studies and obtaining regulatory approval of the Company’s product candidates may be delayed, which could result in increased costs, delays in advancing its product candidates, delays in testing the effectiveness of its product candidates or termination of the clinical trials altogether.

Patient enrollment and trial completion are affected by numerous additional factors, including the:

| | · | process for identifying patients; |

| | · | design of the trial protocol; |

| | · | eligibility and exclusion criteria; |

| | · | perceived risks and benefits of the product candidate under study; |

| | · | availability of competing therapies and clinical trials; |

| | · | severity of the disease under investigation; |

| | · | proximity and availability of clinical trial sites for prospective patients; |

| | · | ability to obtain and maintain patient consent; |

| | · | risk that enrolled patients will drop out before completion of the trial; |

| | · | patient referral practices of physicians; and |

| | · | ability to monitor patients adequately during and after treatment. |

If the Company has difficulty enrolling a sufficient number of patients to conduct its clinical trials as planned, it may need to delay, limit or terminate ongoing or planned clinical trials, any of which would have an adverse effect on its business, financial condition, results of operations and prospects.

Clinical drug development is very expensive, time-consuming and uncertain.

Clinical development for the Company’s product candidates is very expensive, time-consuming, difficult to design and implement, and the outcomes are inherently uncertain. Most product candidates that commence clinical trials are never approved by regulatory authorities for commercialization and of those that are approved many do not cover their costs of development. In addition, the Company, any partner with which it may in the future collaborate, the FDA, an institutional review board (“IRB”), or other regulatory authorities, including state and local agencies and counterpart agencies in foreign countries, may suspend, delay, require modifications to or terminate the Company’s clinical trials at any time.

The results of previous clinical trials may not be predictive of future results, and the results of the Company’s current and planned clinical trials may not satisfy the requirements of the FDA or non-U.S. regulatory authorities.

The results from the prior preclinical studies and clinical trials for LB1148 discussed elsewhere in this prospectus may not necessarily be predictive of the results of future preclinical studies or clinical trials. Even if the Company is able to complete its planned clinical trials of its product candidates according to its current development timelines, the results from its prior clinical trials of its product candidates may not be replicated in these future trials. Many companies in the pharmaceutical and biotechnology industries (including those with greater resources and experience than the Company) have suffered significant setbacks in late-stage clinical trials after achieving positive results in early stage development, and the Company cannot be certain that it will not face similar setbacks. These setbacks have been caused by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including previously unreported adverse events. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials nonetheless have failed to obtain FDA approval. If the Company fails to produce positive results in its clinical trials of any of its product candidates, the development timelines and regulatory approvals and commercialization prospects for its product candidates and its business and financial prospects, would be adversely affected. If the Company fails to produce positive results in its clinical trials of any of its product candidates, the development timelines, regulatory approvals, and commercialization prospects for its product candidates, as well as the Company’s business and financial prospects, would be adversely affected. Further, the Company’s product candidates may not be approved even if they achieve their respective primary endpoints in Phase 3 registration trials. The FDA or non-U.S. regulatory authorities may disagree with the Company’s trial designs or its interpretation of data from preclinical studies and clinical trials. the Company has taken the position that LB1148 has a single active ingredient, TXA. LB1148 also contains polyethylene glycol 3350 (“PEG”). Across different countries and different circumstances, PEG may be regulated as an inactive ingredient, a medical device, or an active ingredient. There is uncertainty on how the FDA and other regulatory agencies will classify the PEG in LB1148. If the FDA determines that LB1148 is a combination product (of TXA and PEG) regulatory approval of this product candidate will require additional clinical trials for which there is not currently a feasible clinical trial design. In addition, any of these regulatory authorities may change requirements for the approval of a product candidate even after reviewing and providing comments or advice on a protocol for a pivotal clinical trial that has the potential to result in approval by the FDA or another regulatory authority. Furthermore, any of these regulatory authorities may also approve the Company’s product candidate for fewer or more limited indications than it requests or may grant approval contingent on the performance of costly post-marketing clinical trials.

If the clinical development of LB1148 is successful, the Company plans to eventually seek regulatory approvals of LB1148 initially in the United States, and may seek approvals in other geographies. Before obtaining regulatory approvals for the commercial sale of any product candidate for any target indication, the Company must demonstrate with substantial evidence gathered in preclinical studies and adequate and well-controlled clinical studies, and, with respect to approval in the United States, to the satisfaction of the FDA, that the product candidate is safe and effective for use for that target indication. The Company cannot assure you that the FDA or non-U.S. regulatory authorities would consider its planned clinical trials to be sufficient to serve as the basis for approval of its product candidates for any indication. The FDA and non-U.S. regulatory authorities retain broad discretion in evaluating the results of the Company’s clinical trials and in determining whether the results demonstrate that its product candidates are safe and effective. If the Company is required to conduct clinical trials of its product candidates in addition to those it has planned prior to approval, the Company will need substantial additional funds, and cannot assure you that the results of any such outcomes trial or other clinical trials will be sufficient for approval.

The Company’s product candidates may cause undesirable side effects or have other unexpected properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in post-approval regulatory action.

Unforeseen side effects from LB1148 could arise either during clinical development or, if approved, after it has been marketed. Undesirable side effects could cause the Company, any partners with which the Company may collaborate, or regulatory authorities to interrupt, extend, modify, delay or halt clinical trials and could result in a more restrictive or narrower label or the delay or denial of regulatory approval by the FDA or comparable foreign authorities.

Results of clinical trials could reveal a high and unacceptable severity and prevalence of side effects. In such an event, trials could be suspended or terminated, and the FDA or comparable foreign regulatory authorities could order us to cease further development of or deny approval of a product candidate for any or all targeted indications. The drug-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial or result in product liability claims. Any of these occurrences may harm the Company’s business, financial condition, operating results and prospects.

Additionally, if the Company or others identify undesirable side effects, or other previously unknown problems, caused by a product after obtaining U.S. or foreign regulatory approval, a number of potentially negative consequences could result, which could prevent the Company or its potential partners from achieving or maintaining market acceptance of the product and could substantially increase the costs of commercializing such product.

The Company may in the future conduct clinical trials for its product candidates outside the United States, and the FDA and applicable foreign regulatory authorities may not accept data from such trials.

The Company, as well as investigator sponsors, have conducted clinical trials, is conducting clinical trials, and may in the future choose to conduct one or more clinical trials outside of the United States. Although the FDA or applicable foreign regulatory authority may accept data from clinical trials conducted outside the United States or the applicable jurisdiction, acceptance of such study data by the FDA or applicable foreign regulatory authority may be subject to certain conditions or exclusion. Where data from foreign clinical trials are intended to serve as the basis for marketing approval in the United States, the FDA will not approve the application on the basis of foreign data alone unless such data are applicable to the U.S. population and U.S. medical practice; the studies were performed by clinical investigators of recognized competence; and the data are considered valid without the need for an on-site inspection by the FDA or, if the FDA considers such an inspection to be necessary, the FDA is able to validate the data through an on-site inspection or other appropriate means. Many foreign regulatory bodies have similar requirements. In addition, such foreign studies would be subject to the applicable local laws of the foreign jurisdictions where the studies are conducted. There can be no assurance the FDA or applicable foreign regulatory authority will accept data from trials conducted outside of the United States or the applicable home country. If the FDA or applicable foreign regulatory authority does not accept such data, it would likely result in the need for additional trials, which would be costly and time-consuming and delay aspects of the Company’s business plan.

The Company expects to rely on third-party CROs and other third parties to conduct and oversee its clinical trials. If these third parties do not meet the Company’s requirements or otherwise conduct the trials as required, the Company may not be able to satisfy its contractual obligations or obtain regulatory approval for, or commercialize, its product candidates.

The Company expects to rely on third-party contract research organizations (“CROs”) to conduct and oversee its LB1148 clinical trials and other aspects of product development. The Company also expects to rely on various medical institutions, clinical investigators and contract laboratories to conduct its trials in accordance with the Company’s clinical protocols and all applicable regulatory requirements, including the FDA’s regulations and good clinical practice (“GCP”) requirements, which are an international standard meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators and monitors, and state regulations governing the handling, storage, security and recordkeeping for drug and biologic products. These CROs and other third parties will play a significant role in the conduct of these trials and the subsequent collection and analysis of data from the clinical trials. the Company will rely heavily on these parties for the execution of its clinical trials and preclinical studies and will control only certain aspects of their activities. The Company and its CROs and other third-party contractors will be required to comply with GCP and good laboratory practice (“GLP”) requirements, which are regulations and guidelines enforced by the FDA and comparable foreign regulatory authorities. Regulatory authorities enforce these GCP and GLP requirements through periodic inspections of trial sponsors, principal investigators and trial sites. If the Company or any of these third parties fail to comply with applicable GCP and GLP requirements, or reveal noncompliance from an audit or inspection, the clinical data generated in the Company’s clinical trials may be deemed unreliable and the FDA or other regulatory authorities may require the Company to perform additional clinical trials before approving the Company’s or the Company’s partners’ marketing applications. the Company cannot assure that upon inspection by a given regulatory authority, such regulatory authority will determine that any of the Company’s clinical or preclinical trials comply with applicable GCP and GLP requirements. In addition, the Company’s clinical trials generally must be conducted with product produced under cGMP regulations. The Company’s failure to comply with these regulations and policies may require it to repeat clinical trials, which would delay the regulatory approval process.

If any of the Company’s CROs or clinical trial sites terminate their involvement in one of its clinical trials for any reason, it may not be able to enter into arrangements with alternative CROs or clinical trial sites or do so on commercially reasonable terms. In addition, if the Company’s relationship with clinical trial sites is terminated, it may experience the loss of follow-up information on patients enrolled in its ongoing clinical trials unless the Company is able to transfer the care of those patients to another qualified clinical trial site. In addition, principal investigators for the Company’s clinical trials may serve as scientific advisors or consultants to it from time to time and could receive cash or equity compensation in connection with such services. If these relationships and any related compensation result in perceived or actual conflicts of interest, the integrity of the data generated at the applicable clinical trial site may be questioned by the FDA.

Even if the Company receives marketing approval for LB1148, or any future product candidate, it may not be able to successfully commercialize its product candidates due to unfavorable pricing regulations or third-party coverage and reimbursement policies, which could make it difficult for the Company to sell its product candidates profitably.

Obtaining coverage and reimbursement approval for a product from a government or other third-party payor is a time consuming and costly process that could require the Company to provide supporting scientific, clinical and cost effectiveness data to the payor. There may be significant delays in obtaining such coverage and reimbursement for newly approved products, and coverage may be more limited than the purposes for which the product is approved by the FDA or comparable foreign regulatory authorities. Moreover, eligibility for coverage and reimbursement does not imply that a product will be paid for in all cases or at a rate that covers costs, including research, development, intellectual property, manufacture, sale and distribution expenses. Interim reimbursement levels for new products, if applicable, may also not be sufficient to cover costs and may not be made permanent. Reimbursement rates may vary according to the use of the product and the clinical setting in which it is used, may be based on reimbursement levels already set for lower cost products and may be incorporated into existing payments for other services. Net prices for products may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors, by any future laws limiting drug prices and by any future relaxation of laws that presently restrict imports of product from countries where they may be sold at lower prices than in the United States.

There is significant uncertainty related to the insurance coverage and reimbursement of newly approved products. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting reimbursement policies, but also have their own methods and approval process apart from Medicare coverage and reimbursement determinations.

Coverage and reimbursement by a third-party payor may depend upon a number of factors, including the third-party payor’s determination that use of a product is:

| | · | a covered benefit under its health plan; |

| | · | safe, effective and medically necessary; |

| | · | appropriate for the specific patient; |

| | · | cost-effective; and |

| | | |

| | · | neither experimental nor investigational. |

The Company cannot be sure that coverage and reimbursement will be available for any product that it commercializes and, if coverage and reimbursement are available, what the level of reimbursement will be. The Company’s inability to promptly obtain coverage and adequate reimbursement rates from both government-funded and private payors for any approved products that the Company develops could have a material adverse effect on its operating results, its ability to raise capital needed to commercialize products and its overall financial condition.

Reimbursement may impact the demand for, and the price of, any product for which the Company obtains marketing approval. Assuming the Company obtains coverage for a given product by a third-party payor, the resulting reimbursement payment rates may not be adequate or may require co-payments that patients find unacceptably high. Patients who are prescribed medications for the treatment of their conditions, and their prescribing physicians, generally rely on third-party payors to reimburse all or part of the costs associated with those medications. Patients are unlikely to use the Company’s products unless coverage is provided and reimbursement is adequate to cover all or a significant portion of the cost of the Company’s products. Therefore, coverage and adequate reimbursement is critical to new product acceptance. Coverage decisions may depend upon clinical and economic standards that disfavor new products when more established or lower cost therapeutic alternatives are already available or subsequently become available.

The Company’s expects to experience pricing pressures in connection with the sale of any of its product candidates due to the trend toward managed healthcare, the increasing influence of health maintenance organizations, and additional legislative changes. The downward pressure on healthcare costs in general, particularly prescription medicines, medical devices and surgical procedures and other treatments, has become very intense. As a result, increasingly high barriers are being erected to the successful commercialization of new products. Further, the adoption and implementation of any future governmental cost containment or other health reform initiative may result in additional downward pressure on the price that the Company may receive for any approved product.

Outside of the United States, many countries require approval of the sale price of a product before it can be marketed and the pricing review period only begins after marketing or product licensing approval is granted. To obtain reimbursement or pricing approval in some of these countries, the Company may be required to conduct a clinical trial that compares the cost-effectiveness of its product candidate to other available therapies. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, the Company might obtain marketing approval for a product candidate in a particular country, but then be subject to price regulations that delay its commercial launch of the product, possibly for lengthy time periods, and negatively impact the revenues, if any, the Company is able to generate from the sale of the product in that country. Adverse pricing limitations may hinder the Company’s ability to recoup its investment in one or more product candidates, even if such product candidates obtain marketing approval.

Even if a product candidate obtains regulatory approval, it may fail to achieve the broad degree of physician and patient adoption and use necessary for commercial success.

The commercial success of both LB1148, if approved, will depend significantly on the broad adoption and use of them by physicians and patients for approved indications, and it may not be commercially successful even though it is shown to be safe and effective. The degree and rate of physician and patient adoption of a product, if approved, will depend on a number of factors, including but not limited to:

| | · | patient demand for approved products that treat the indication for which a product is approved; |

| | · | the effectiveness of the product compared to other available therapies or treatment regimens; |

| | · | the availability of coverage and adequate reimbursement from managed care plans and other healthcare payors; |

| | · | the cost of treatment in relation to alternative treatments and willingness to pay on the part of patients; |

| | | |

| | · | insurers’ willingness to see the applicable indication as a disease worth treating’ |

| | | |

| | · | proper administration; |

| | · | patient satisfaction with the results, administration and overall treatment experience; |

| | · | limitations or contraindications, warnings, precautions or approved indications for use different than those sought by the Company that are contained in the final FDA-approved labeling for the applicable product; |

| | · | any FDA requirement to undertake a risk evaluation and mitigation strategy; |

| | · | the effectiveness of the Company’s sales, marketing, pricing, reimbursement and access, government affairs, and distribution efforts; |

| | · | adverse publicity about a product or favorable publicity about competitive products; |

| | · | new government regulations and programs, including price controls and/or limits or prohibitions on ways to commercialize drugs, such as increased scrutiny on direct-to-consumer advertising of pharmaceuticals; and |

| | · | potential product liability claims or other product-related litigation. |

If LB1148 is approved for use but fails to achieve the broad degree of physician and patient adoption necessary for commercial success, the Company’s operating results and financial condition will be adversely affected, which may delay, prevent or limit its ability to generate revenue and continue its business.

The Company’s product candidates, if approved, will face significant competition and their failure to compete effectively may prevent them from achieving significant market penetration.

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition, less effective patent terms, and a strong emphasis on developing newer, fast-to-market proprietary therapeutics. Numerous companies are engaged in the development, patenting, manufacturing and marketing of healthcare products competitive with those that the Company is developing, including LB1148. The Company will face competition from a number of sources, such as pharmaceutical companies, generic drug companies, biotechnology companies, medical device companies and academic and research institutions, many of which have greater financial resources, marketing capabilities, sales forces, manufacturing capabilities, research and development capabilities, regulatory expertise, clinical trial expertise, intellectual property portfolios, more international reach, experience in obtaining patents and regulatory approvals for product candidates and other resources than the Company. Some of the companies that offer competing products also have a broad range of other product offerings, large direct sales forces and long-term customer relationships with the Company’s target physicians, which could inhibit the Company’s market penetration efforts.

With respect to the Company’s lead product candidate, LB1148, for the indication of postoperative improvement of bowel function, the Company expects to face competition in the pharmacological therapy space from alvimopan, marketed as a branded product, ENTEREG, by Merck, as well as in generic form. There are no pharmacotherapies for decreasing the time to normal feedings and bowel movement (or preventing necrotizing enterocolitis) in infants after heart surgery or for the reduction or elimination of postoperative intra-abdominal adhesions. However, the Company will face general competition from other medical interventions, namely surgical procedures and adhesion barrier products. Adhesion barrier products approved for abdominal or pelvic surgery in the United States consist of SEPRAFILM, INTERCEED and ADEPT. In addition, several products are used off-label for adhesion prevention in the United States, including EVICEL, SURGIWRAP, COSEAL and PRECLUDE. Adhesion barrier products available outside the United States include HYALOBARRIER, SPRAYSHIELD, PREVADH, and INTERCOAT. Such products are used as adjunctive interventions, have variable efficacy, and are not easily used with laparoscopic procedures, which are becoming increasingly common.

Any adverse developments that occur during any clinical trials conducted by Newsoara may affect the Company’s ability to obtain regulatory approval or commercialize LB1148.

Newsoara Biopharma Co., Ltd. (“Newsoara”) has the rights to develop and commercialize LB1148 in China for return of bowel function, reduction of adhesions, and sepsis. If serious adverse events occur during any clinical trials Newsoara decides to conduct with respect to LB1148, the FDA and other regulatory authorities may delay, limit or deny approval of LB1148 or require the Company to conduct additional clinical trials as a condition to marketing approval, which would increase our costs. If the Company receives FDA approval for LB1148 and a new and serious safety issue is identified in connection with clinical trials conducted by Newsoara, the FDA and other regulatory authorities may withdraw their approval of the product or otherwise restrict the Company’s ability to market and sell the Company’s product. In addition, treating physicians may be less willing to administer the Company’s product due to concerns over such adverse events, which would limit the Company’s ability to commercialize LB1148.

Risks Related to the Company’s Business

The Company has a very limited operating history and has never generated any revenues from product sales.

The Company is an early-stage biotechnology company with a very limited operating history that may make it difficult to evaluate the success of its business to date and to assess its future viability. The Company was initially formed in 2005 and its operations, to date, have been limited to business planning, raising capital, developing the Company’s pipeline assets and other research and development. The Company has not yet demonstrated an ability to successfully complete any clinical trials and has never completed the development of any product candidate, nor has it ever generated any revenue from product sales or otherwise. Consequently, the Company has no meaningful operations upon which to evaluate its business, and predictions about its future success or viability may not be as accurate as they could be if it had a longer operating history or a history of successfully developing and commercializing biopharmaceutical products.

The Company currently has no products approved for sale, and it may never obtain regulatory approval to commercialize any of its product candidates.

The research, testing, manufacturing, safety surveillance, efficacy, quality control, recordkeeping, labeling, packaging, storage, approval, sale, marketing, distribution, import, export and reporting of safety and other post-market information related to its biopharmaceutical products are subject to extensive regulation by the FDA and other regulatory authorities in the United States and in foreign countries, and such regulations differ from country to country and frequently are revised.

Even after the Company achieves U.S. regulatory approval for a product candidate, if any, the Company will be subject to continued regulatory review and compliance obligations. For example, with respect to the Company’s product candidates, the FDA may impose significant restrictions on the approved indicated uses for which the product may be marketed or on the conditions of approval. A product candidate’s approval may contain requirements for potentially costly post-approval studies and surveillance, including Phase 4 clinical trials, to monitor the safety and efficacy of the product. The Company also will be subject to ongoing FDA obligations and continued regulatory review with respect to, among other things, the manufacturing, processing, labeling, packaging, distribution, pharmacovigilance and adverse event reporting, storage, advertising, promotion and recordkeeping for the Company’s product candidates. These requirements include submissions of safety and other post-marketing information and reports, registration, continued compliance with cGMP requirements and with the FDA’s GCP requirements and GLP requirements, which are regulations and guidelines enforced by the FDA for all of the Company’s product candidates in clinical and preclinical development, and for any clinical trials that it conducts post-approval, as well as continued compliance with the FDA’s laws governing commercialization of the approved product, including but not limited to the FDA’s Office of Prescription Drug Promotion (“OPDP”) regulation of promotional activities, fraud and abuse, product sampling, scientific speaker engagements and activities, formulary interactions as well as interactions with healthcare practitioners. To the extent that a product candidate is approved for sale in other countries, the Company may be subject to similar or more onerous (i.e., prohibition on direct-to-consumer advertising that does not exist in the United States) restrictions and requirements imposed by laws and government regulators in those countries.

In addition, manufacturers of drug and biologic products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with cGMP regulations. If the Company or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the manufacturing, processing, distribution or storage facility where, or processes by which, the product is made, a regulatory agency may impose restrictions on that product or the Company, including requesting that the Company initiate a product recall, or requiring notice to physicians or the public, withdrawal of the product from the market, or suspension of manufacturing.

If the Company, its product candidates or the manufacturing facilities for its product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

| | · | impose restrictions on the sale, marketing or manufacturing of the product, amend, suspend or withdraw product approvals or revoke necessary licenses; |

| | · | mandate modifications to promotional and other product-specific materials or require the Company to provide corrective information to healthcare practitioners or in its advertising; |

| | · | require the Company or its partners to enter into a consent decree, which can include imposition of various fines, reimbursements for inspection costs, required due dates for specific actions, penalties for noncompliance and, in extreme cases, require an independent compliance monitor to oversee the Company’s activities; |

| | · | issue warning letters, bring enforcement actions, initiate surprise inspections, issue show cause notices or untitled letters describing alleged violations, which may be publicly available; |

| | · | commence criminal investigations and prosecutions; |

| | · | impose injunctions, suspensions or revocations of necessary approvals or other licenses; |

| | · | impose other civil or criminal penalties; |

| | · | suspend any ongoing clinical trials; |

| | · | place restrictions on the kind of promotional activities that can be done; |

| | · | delay or refuse to approve pending applications or supplements to approved applications filed by the Company or its potential partners; |

| | · | refuse to permit drugs or precursor chemicals to be imported or exported to or from the United States; |

| | · | suspend or impose restrictions on operations, including costly new manufacturing requirements; or |

| | · | seize or detain products or require the Company or its partners to initiate a product recall. |

The regulations, policies or guidance of the FDA and other applicable government agencies may change, and new or additional statutes or government regulations may be enacted, including at the state and local levels, which can differ by geography and could prevent or delay regulatory approval of the Company’s product candidates or further restrict or regulate post-approval activities. The Company cannot predict the likelihood, nature or extent of adverse government regulations that may arise from future legislation or administrative action, either in the United States or abroad. If the Company is not able to achieve and maintain regulatory compliance, it may not be permitted to commercialize its product candidates, which would adversely affect its ability to generate revenue and achieve or maintain profitability.

The Company currently has no marketing capabilities and no sales organization. If the Company is unable to establish sales and marketing capabilities on its own or through third parties, the Company will be unable to successfully commercialize its product candidates, if approved, or generate product revenue.