A PENNSYLVANIA LIMITED LIABILITY PARTNERSHIP

MAILING ADDRESS P.O. BOX 5231 PRINCETON, NJ 08543-5231

PRINCETON PIKE CORPORATE CENTER 997 LENOX DRIVE BUILDING 3 LAWRENCEVILLE, NJ 08648-2311

609-896-3600 FAX 609-896-1469 www.foxrothschild.com

June 23, 2006

VIA EDGAR & FEDERAL EXPRESS

Owen Pinkerton, Esq.

Senior Attorney

U.S. Securities and Exchange Commission

Division of Corporate Finance, Mail Stop 4561

Washington, D.C. 20549

| Re: | KMA Global Solutions International, Inc.Amendment No. 2 to Form 10-SB File No. 0-51864; Filed May 30, 2006 |

Dear Mr. Pinkerton:

We submit this letter on behalf of our client, KMA Global Solutions International, Inc. (the “Company”) in response to your comment letter dated June 8, 2006, regarding the above filing. We trust that the information herein will fully satisfy the staff’s comments and allow you to consider your review to be completed.

We present revisions to the Company’s disclosure, as indicated below in the sequence set forth in your letter. The Company’s revised registration statement disclosure is provided, in the enclosed clean and marked copies of Amendment No. 3 to its Form 10-SB.

General

| 1. | Our previous response letter and this letter are filed as correspondence on EDGAR. |

Item 1. Description of Business, page 4

| 2. | Disclosure under the “Business Development” section has been further expanded to explain that the Company’s merger with Espo’s, Ltd. (“Espo’s”) was intended to accomplish its objective of raising capital in the United States public markets. The Company’s strategy was to merge with a U.S. company that had public shareholders, qualify for listing on the OTC - Bulletin Board or Nasdaq Small Cap market, and obtain capital through a private placement of common stock and/or a public offering. With respect to your comment that Espo’s was not a “public company,” we point out that it was not a public SEC reporting company (which is disclosed in the Form 10-SB) but it was a company with public shareholders and its stock was traded on the pink sheets. The Company has further noted in its disclosure that the Pink Sheets is a quotation service, not a formal exchange, and that it does not have quotation standards. |

Owen Pinkerton, Esq.

June 23, 2006

Page 2

Business Development, page 4

| 3. | You asked that the Company provide additional disclosure to clarify whether any consideration was received by 2095511 Ontario Limited “in exchange for the retirement of its shares into treasury.” [emphasis supplied] |

| | According to the Company, and as reflected in the revised disclosure, 2095511 Ontario Limited was a special purpose company formed for the limited purpose of coordinating, as agent under a power of attorney, the purchase of 4,225,427 shares of Espo’s common stock by seven entities (Brant Fellowship Holdings, Inc.; Candas Enterprises Corp.; Carrick Mortgage Holdings, Inc.; Culross Forwarding Limited; Greenock Export Holdings AG; Bedford Place Investments Ltd.; and Brican Holdings Limited’ collectively referred to as the “Entities”) prior to the merger between Espo’s and the Company and pursuant to a March 7, 2006 Stock Purchase Agreement (the “March 7th Agreement”). 2095511 Ontario was not the owner of the shares that were retired into treasury and did not receive consideration from the Company. The 4,225,427 shares of Espo’s common stock were acquired by the Entities in the following amounts: 4,065,427 shares of Espo’s common stock held be Jeffrey R. Esposito and 160,000 shares of Espo’s common stock held by Kenneth C. Dollman. |

| | Your comment demonstrates that the disclosure in this portion of the Form 10-SB may lead its readers to believe that 2095511 Ontario Limited was a purchaser of the shares being purchased by the Entities from the owners of Espo’s shares. As 2095511 Ontario Limited had no ownership of the shares transferred to the Entities, we believe that it would be misleading to refer to 2095511 Ontario Limited outside of the context of the March 7th Agreement, and that it is more appropriate to refer to it as the agent for the respective Entities. |

| | The consideration paid to Messrs. Esposito and Dollman for the sale of the 4,225,427 shares of Espo’s common stock was $209,830. Promptly following the closing of the sale of Messrs. Esposito and Dollman’s shares, the Entities presented the 4,225,427 shares to the Company for retirement to treasury, which left a balance of 8,823 issued and outstanding restricted shares of Espo’s common stock and 686,000 unrestricted shares of Espo’s common stock outstanding. The Company subsequently issued a 17 for 1 forward split of the remaining outstanding common stock. There was no specific consideration for the retirement of the shares to treasury. The consideration for the retirement of the 4,225,427 shares was part of the overall consideration under the March 7th Agreement and the restructuring of the stock holdings of the Company. |

With respect to your call for additional disclosure on the legal relationship between Mr. Reid and/or KMA Global Solutions, LLC (“KMA LLC”) on the one hand and KMA Acquisition Exchangeco, Inc. (“Exchangeco”) on the other, the Company has added disclosure to reflect that Mr. Reid has a contractual relationship with KMA LLC, which is a wholly-owned subsidiary of the Company, based on his right to have KMA LLC acquire some or all of the Exchangeable Shares issued by Exchangeco. Further, Mr. Reid owns 28,900,000 common shares of the Company, he is an indirect control person of KMA LLC by virtue of his control position in the Company, and he is an officer and a director of Exchangeco, which is related to the Company only in that it has a contractual arrangement with KMA LLC to exchange the shares of the Company that KMA LLC currently owns.

Owen Pinkerton, Esq.

June 23, 2006

Page 3

| 4. | In reference to the final paragraph on page 4, you comment that we have indicated that “[c]ertain other entities will receive 11,662,000 shares in connection with financing and investor relations services”. These 11,662,000 shares were the 686,000 pre-17:1 forward split shares of Espo’s that were acquired directly from Espo’s by certain entities prior to the merger. The Company’s disclosure in the Business Development section has been substantially revised to clarify the information set forth regarding the initial stock purchase transaction between the purchasing entities and the Espo’s shareholders and to disclose 2095511 Ontario Limited’s actions as agent for the purchasing entities. Each of the entities that held the 686,000 pre-split shares, as identified on KMA’s shareholder register, are disclosed in the Form 10-SB. They include: Brant Fellowship Holdings, Inc.; Candas Enterprises Corp.; Carrick Mortgage Holdings, Inc.; Culross Forwarding Limited; Greenock Export Holdings AG; Bedford Place Investments Ltd.; Brican Holdings Limited. None of these companies is the beneficial owner of more than five percent of the Company's issued and outstanding shares of Common Stock. |

| | In the interest of assisting in the Company’s business operations, these Entities have agreed to provide ongoing advice and recommendations as needed with respect to corporate finance and financial restructuring, investor relations and shareholder communications, and introduction to potential sources of capital and strategic partners. |

| 5. | The organization chart on page 5 has been revised further to reflect the ownership interest of Jeffrey Reid. Also, the number of shares of KMA Global Solutions Inc. (“KMA Canada”) owned by Exchangeco is 1,700,000. |

Principal Products, page 5

| 6. | The discussion on page 5 clarifies the Company’s provision of EAS equipment. The Company has added the following language: |

Our EAS solutions are comprised of a line of custom sensor tags and labels, which contain sensors designed to provide a comprehensive, single-source solution for protection against retail merchandise theft. Our tags and labels are specialized for a variety of applications including adhesive labels for use on product packaging or tags sewn directly onto retail apparel. The Company’s proprietary, low cost solutions, serve to reduce consumer and employee theft, prevent inventory shrink, and enable retailers to capitalize on consumer buying patterns and habits by openly displaying high-margin and high-cost items typically subjected to a high level of shoplifting and employee theft. We offer a wide variety of EAS solutions to meet the varied requirements of retail configurations for multiple market segments worldwide.

Owen Pinkerton, Esq.

June 23, 2006

Page 4

In addition, the Company is an authorized distributor of Sensormatic sensors in raw form. These sensors are the basic component of an EAS tag or label. Retail stores are responsible for outfitting their own premises with an EAS system, including sensor detection and deactivation equipment that corresponds to their EAS technology of choice, either RF of AM technology. The Company also sells equipment necessary to deactivate the EAS tags to manufacturers, suppliers, wholesalers and distributors that need to deactivate either the AM sensor or the RF sensor before shipping product tagged with Dual Tags to a particular retailer only using one of the two technologies in its stores. Sales of deactivation equipment represent a small fraction of the Company’s revenues. The Company does not sell the equipment necessary to establish an EAS system to retailers.

| 7. | In reference to your comment regarding the discussion of RFID on page 7, the Company has discussed in greater detail that it does not currently earn revenues from sales of RFID nor does the Company currently provide RFID technology to its customers. The Company anticipates incorporating RFID technology into its existing line of products in the future. Further development of RFID technology is required to reduce cost per unit of RFID tags before incorporation of RFID technology into the Company’s products will become economically viable for widespread use. |

| 8. | Copies of excerpts of the two studies referred to in paragraph 7 under the heading of Business Strategy are attached herewith in Exhibit A. |

Distribution, page 8

| 9. | In reference to your comment regarding the specific steps taken for the planned expansion and timelines for such plans, the disclosure on page 8 has been revised to clarify that the Company may not undertake any one or more of the planned changes to its business. In addition, the revised disclosure provides that the estimated costs of those activities are not possible to estimate at this time. The Company does note the sources of funds that it will seek to undertake and complete expansion activities. |

Dependence on Customers, page 9

| 10. | The Company revised the disclosure on page 9, to clarify that its status as a “preferred provider” is “informal”, as it is not set forth in a binding agreement. |

Owen Pinkerton, Esq.

June 23, 2006

Page 5

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 11

| 11. | You commented in reference to the disclosure on page 12 that, after closing on a private or public offering of our securities, the Company expects, almost immediately, to begin manufacturing operations in China, and shortly thereafter, in India and Mexico. The Company has not yet entered into any agreements with potential purchasers or underwriters in order to conduct an offering of its securities. Accordingly, the disclosure has been revised to clearly state on page 14 that there is no assurance that the Company will be able to raise proceeds from an equity offering in order to accomplish those objectives. |

Results of Operations, page 12

| 12. | In reference to the eighth paragraph on page 13, the write-off in fiscal year 2005 by the Company of an advance commission of $43,500 was in relation to commissions that had been paid in advance to a sales representative that left the company. As there was no repayment clause in his agreement with the Company, the Company wrote off that advance. |

Selling, General and Administrative Expenses (“SG&A Expenses”), page 13

| 13. | The calculation for percentage change in professional fees between the years ended January 31, 2006 and 2005, on page 13, has been revised to reflect a 197% increase. |

Liquidity and Capital Resources, page 14

| 14. | The Company’s disclosure on page 14, referring to the difference in cash provided by operating activities between the years ended January 31, 2005 and January 31, 2006, has been revised to describe in greater detail the reasons for each the changes. |

Compliance with Section 404 of the Sarbanes-Oxley Act of 2002, page 17

| 15. | As the Company is not required, under current law, to address the effectiveness of its internal controls over financial reporting, we have removed it in its entirety from our disclosure on page 17 related to management’s assessment of such internal controls. |

Item 4. Security Ownership of Certain Beneficial Owners and Management, page 18

| 16. | The disclosure in the 2 charts on page 18 have been revised to reconcile the share number owned by KMA LLC in the first chart (28,900,000) with the number beneficially owned by Jeffrey Reid in the second chart (25,840,000). Mr. Reid controls a majority of the shares of KMA LLC, as the beneficial owner of 25,840,000 exchangeable shares of KMA Exchangeco. |

Owen Pinkerton, Esq.

June 23, 2006

Page 6

Item 5. Directors and Executive Officers and Control Persons, page 19

| 17. | The Company has expanded the description of Mr. Reid’s employment agreement, including disclosure as to how bonus payments are determined. There are no guaranteed minimum payments or maximum amounts that may be paid in bonuses. The benefits and other compensation are discussed. Further, the Company has disclosed the duration of the non-compete clause with Mr. Reid in the event that he leaves the Company and the “termination provisions” are described in more detail. Mr. Reid’s employment contract does not contemplate change in control benefits. |

| 18. | The final paragraph before the compensation table has been clarified to state that Jeffrey D. Reid has not yet been given any options, but will be entitled to earn up to 100,000 options per year once a company stock option plan has been established. |

Item 8. Description of Securities, page 22

| 19. | Our disclosure on page 22 has been revised to briefly describe each of the provisions of the Company’s bylaws that could have the effect of delaying, preventing or hindering a change in control. |

Financial Statements

General

| 20. | There was no intent on our part in answering your questions to indicate that the Auditors “took responsibility” for the Company’s financial statements. The Company’s Auditors were and remain wholly independent. |

Your comment references Regulation S-X Rule 2-01(c)(4)(i) (Non-audit services). Clause (i) states that “An accountant is not independent if, at any point during the audit and professional engagement period, the accountant provides the following non-audit services to an audit client: (i) Bookkeeping or other services related to the accounting records or financial statements of the audit client. Any service, unless it is reasonable to conclude that the results of these services will not be subject to audit procedures during an audit of the audit client’s financial statements, including: (A) Maintaining or preparing the audit client’s accounting records; (B) Preparing the audit client’s financial statements that are filed with the Commission or that form the basis of financial statements filed with the Commission; or (C) Preparing or originating source data underlying the audit client’s financial statements.”

The Company has ensured that no services provided by the Auditors were subject to their audit procedures during the audit of the Company’s financial statements.

Report of Independent Registered Accounting Firm, page 1

Owen Pinkerton, Esq.

June 23, 2006

Page 7

| 21. | With respect to the additional scope of the work for the updated audit, the Company has informed us that a further review of its inventory was undertaken over a five day period by the Company’s Controller and another staff person, during which they assembled documentation going back two years prior to the latest fiscal year end. The auditors workd at the Company’s offices for three days to verify the inventory and and other documentation provided by management. The date on the audit opinion letter has been updated to April 13, 2006. |

Statement of Cash Flows, page 6

| 22. | The cash out flow of $17,092 is a repayment of a bank loan. SFAS 95 Par. 18 explains financing activities to include “borrowing money and repaying amounts borrowed”. SFAS 95 Par. 20b states “Repayments of amounts borrowed”. Therefore, management believes the presentation as it is is correct. |

Note 2. Summary of Significant Accounting Policies

Equipment and Amortization, page 7

| 23. | The Company has a “bargain purchase option” at the end of the 36-month lease term to purchase the equipment for a total of $250 plus applicable taxes and therefore the estimated useful life was the basis for estimating the amortization of the equipment. |

Leases, page 8

24. The disclosure has been revised to be consistent. Assets recorded under capital leases are amortized on a straight-line basis.

Note 14. Subsequent Events, page 15

| 25. | Note 14 (c) has been revised to include disclosure regarding the percentage ownership of the KMA (Canada) shareholders after the transactions. The group that held shares of KMA (Canada) prior to the merger transaction now hold, as a group, almost 75% of the outstanding shares of the Company, of which Jeffrey Reid is by far the largest beneficial shareholder. Exchangeco received 1,700,000 shares of KMA (Canada) in the transaction and three persons own all of the shares of Exchangeco, namely Siderion Capital Group Inc., Jim Molyneaux and Jeffrey D. Reid, which shares are exchangeable into shares of KMA Global Solutions International, Inc. |

| 26. | The Company has revised its response to disclose all stock transaction that took place subsequent to the Company’s fiscal year end but prior to the issuance of the financial statements as subsequent events. |

Owen Pinkerton, Esq.

June 23, 2006

Page 8

| | The weighted average shares outstanding, basic and diluted EPS, and the common shares outstanding in Note 10 have been revised in accordance with SFAS 128, PAR. 54. |

| | The Company has informed us that the stock transactions that reduced the KMA (Canada) issued and outstanding shareholdings from 1,890,400 to the 314,400 were the result of two independent reverse stock splits. Certain shareolders of 8,500,000 shares underwent a 5-to-1 reverse stock split, which reduced their holdings to 1,700,000. Another group of holders of 2,192,000 common shares underwent a 22 2/3-to-1 reverse stock split, which reduced their holdings to approximately 96,709 Common shares. |

Part II

Item 1. Market Price of Stock and Dividends on the Registrant’s Common Equity and Other Stockholder Matters, page 23

| 27. | The Company revised the chart to reflect the fact that the information provided is for the quarter ended January 31, 2006. |

Item 4. Recent Sales of Unregistered Securities, page 24

| 28. | As required by Item 701 of Regulation S-B, the Company discloses the following information for all securities that it sold within the past three years without registering the securities under the Securities Act: |

(a) The date, title and amount of securities sold.

(b) There were no principal underwriters. As the Company did not publicly offer any securities, the persons or class of persons to whom the small business issuer sold the securities are identified.

(c) For securities sold for cash, the total offering price is disclosed (there were no underwriting discounts or commissions). For securities sold other than for cash, the transaction and the type and amount of consideration received by the Company is described.

(d) The claimed exemption from registration under the Securities Act based on Section 4(2) and the facts relied upon to make the exemption available are set forth.

(e) The securities sold are not convertible or exchangeable into equity securities, nor were they warrants or options representing equity securities.

Owen Pinkerton, Esq.

June 23, 2006

Page 9

Please feel free to contact the undersigned if you have any questions with respect to this response letter.

Thank you.

| | | |

| | Sincerely, |

| | |

| | |

| | /s/ Lawrence Cohen |

| | |

| | Lawrence Cohen |

Enclosures

cc (w/enclosures): Amanda McManus - SEC Division of Corporation Finance

Steven Jacobs - SEC Accounting Branch Chief

Amanda Sledge - SEC Accounting Branch

Jeffrey D. Reid

Exhibit A

RFID Tag Market to Approach $3 billion in 2009

SCOTTSDALE, Ariz., January 12, 2005 - RFID tags are poised to become the most far-reaching wireless technology since the cell phone, according to high-tech market research firm, In-Stat (http://www.in-stat.com). Worldwide revenues from RFID tags will jump from $300 million in 2004 to $2.8 billion in 2009. During this period, the technology will appear in many industries with significant impact on the efficiency of business processes.

“By far the biggest RFID segment in coming years will be cartons/supply chain,” says In-Stat analyst Allen Nogee. “This segment alone is forecasted to account for the largest number of tags/labels from 2005 through 2009.” Wal-Mart, which has mandated that top suppliers use the technology, will drive this market segment.

In-Stat has also found that:

The widespread adoption of the technology will take a couple of years to really ramp up, as tags are still relatively expensive, ranging from a low of around $0.15 to a high of over $100.

Privacy issues remain a concern for many applications of RFID, and currently courts and governments around the world are in the process of determining related legal issues.

The second-largest market for RFID, at least in the latter years of the forecast, is consumer products, even though this market is one of the most privacy-sensitive areas.

Recent In-Stat research, RFID Tags And Chips: Changing The World For Less Than The Price Of A Cup Of Coffee (#IN0402440WT), investigates the many uses of RFID, looks at the costs of making the tags, and examines many issues, including privacy, that can potentially slow its momentum. The report contains estimates and a five-year forecast for the number of tags, revenue from tags, and semiconductor revenue from tags, broken-down into the following segments: livestock, domestic pets, humans, cartons/supply chain uses, pharmaceuticals, large freight containers, package tracking, consumer products, security/banking/purchasing/access control, and other. In addition, there are estimates and forecasts for tag/label ASP for each of these segments.

To purchase this research, or for more information, please contact Tina Sheltra at 480-609-4531; tina.sheltra@reedbusiness.com. The price is $2,995 U.S. Dollars.

For more information, contact:

Allen Nogee, Principal Analyst

Phone: 480-609-4538

Email: anogee@reedbusiness.com

Kirsten Fischer, Senior Marketing Manager

Phone: 480-609-4534

Email: kirsten.fischer@reedbusiness.com

Updated in May 2006

RFID Forecasts, Players & Opportunities 2006 - 2016

Your complete guide to the RFID markets and opportunities

By Raghu Das and Dr Peter Harrop

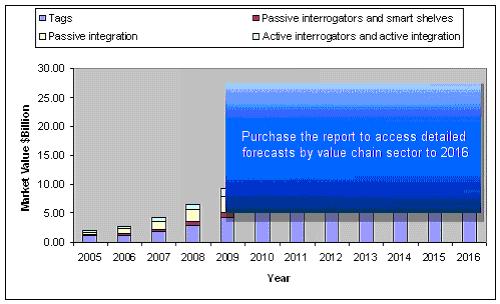

This essential report analyses the rapidly growing and diversifying market for Radio Frequency Identification (RFID) with detailed ten year forecasts. Cumulative sales of RFID tags for sixty years until the beginning of 2006 total 2.4 billion, with 600 million tags being sold in 2005 alone. In 2006, IDTechEx expect 1.3 billion tags to be sold, with 500 million RFID smart labels for pallet and case level tagging but the majority into a range of diverse markets from baggage and passports to contactless payment cards and drugs.

In the short term large "closed loop" markets requiring high value RFID will remain very profitable and companies will seek to position themselves as the leader in hardware and integration in different vertical market segments. Challenges with tag yield versus cost, frequency acceptance, specification creep and required performance levels are some of the key issues that are being resolved to grow the RFID market exponentially over coming years to be almost ten times the size in 2016 that it will be in 2006. At 2016, IDTechEx see the value of the total market including systems and services to rocket to $26.23Bn from $2.71Bn in 2006. This includes many new markets that are being created, such as the market for Real Time Location Systems using active RFID, which will itself be more than $6Bn in 2016.

Such growth will be driven by the tagging of high volume items - notably consumer goods, drugs and postal packages - at the request of retailers, military forces and postal authorities and for legal reasons. In these cases, the primary benefits sought will be broader and include cost, increased sales, improved safety, reduced crime and improved customer service.

This comprehensive report from IDTechEx gives the complete picture with detailed forecasts at a price unmatched by others.

Owen Pinkerton, Esq.

June 23, 2006

Page 12

Source: IDTechEx

Market Analysis by a huge number of parameters

Using new, unique information researched globally by IDTechEx technical experts, we analyze the RFID market in many different ways, with over 120 tables and figures. They include detailed ten year projections for EPC vs non-EPC, high value niche markets, active vs passive, readers, markets by frequency, markets by geographical region, label vs non label, chip vs chipless, markets by application, tag format and tag location. Cumulative sales of RFID is analyzed as are the major players and unmet opportunities. It covers the emergence of new products, legal and demand pressures and impediments for the years to come.

Here are just a few examples.

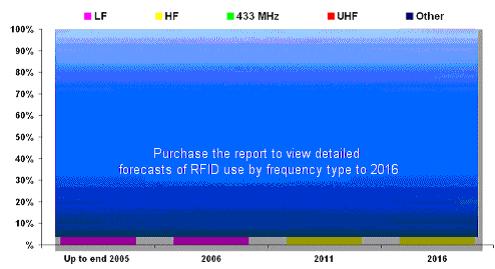

Percentage of RFID systems by frequency type, cumulative to 2006, 2006, 2011 and 2016

source: IDTechEx

Owen Pinkerton, Esq.

June 23, 2006

Page 13

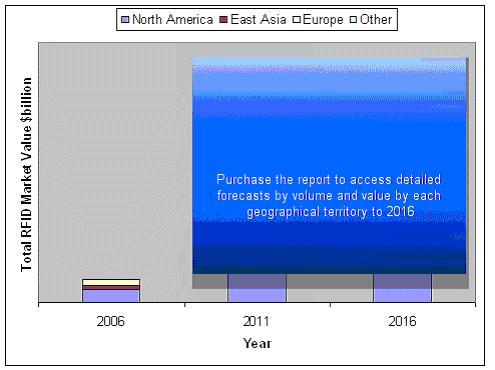

Total Spend on RFID Systems, Services and Tags 2006, 2011 and 2016 by Territory $ Billion

source: IDTechEx

For example, we give detailed ten year forecasts of the volumes of tags required, their value and the total market value for the following market segments:

| · | Smart cards/payment key fobs |

| · | Smart tickets/ banknotes/ secure docs |

| · | Conveyances/Other, Freight |

| · | Intermodal containers and ULDs |

Owen Pinkerton, Esq.

June 23, 2006

Page 14

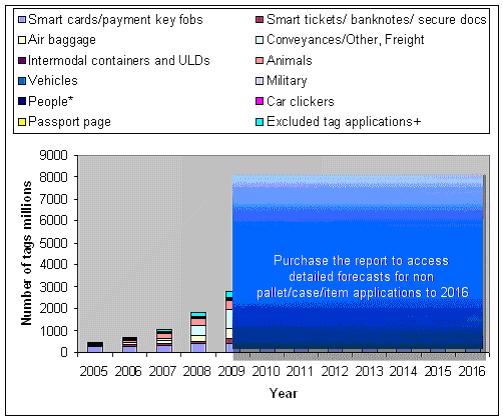

We cover markets for item, case and pallet level tagging in great detail and also the vast opportunities beyond that, as shown below.

Numbers of RFID tags required by non Pallet/Case/Item applications 2006-2016

Source: IDTechEx

Highly profitable 'niche' markets analyzed

Major players now and in future in the various parts of the value chain are identified and the big orders and milestones now and in future are analyzed, such as the rollout of the $6 billion national ID card system in China. Of course, not everyone will want to serve the severely price constrained, highest volume markets. For them, we examine many niches of at least one billion dollars potential that are emerging and many smaller opportunities where there is even less competition. They include:

| · | Passports in the face of new terrorism resulting in new laws |

| · | Livestock and food traceability in the face of new laws, bioterrorism, avian flu, BSE, fraud with subsidies etc. |

| · | Intermodal containers (Smart and Secure Tradelanes and other initiatives) |

| · | Those in prison and on parole |

Owen Pinkerton, Esq.

June 23, 2006

Page 15

| · | Ubiquitous Sensor Networks USN, for warning of natural disasters, military and other purposes |