Exhibit 99.2

Porter Bancorp, Inc. NASDAQ: PBIB 2nd Quarter 2009 1

Disclaimer This presentation contains forward-looking statements that involve risks and uncertainties. These forward-looking statements are based on management’s current expectations. Porter Bancorp’s actual results in future periods may differ materially from those currently expected due to various factors, including those risk factors described in documents that the Company files with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The forward-looking statements in this presentation are made as of the date of the presentation and Porter Bancorp does not assume any responsibility to update these statements. 2

Discussion Topics Market Overview and Franchise History Financial Highlights Summary of 2nd Quarter 2009 and Full Year 2008 Performance Loan Composition and Credit Quality Deposits Capital Strength Investment Considerations Going Forward 2009 Growth Strategy 2009 Key Strategic Initiatives Operating Strengths 3

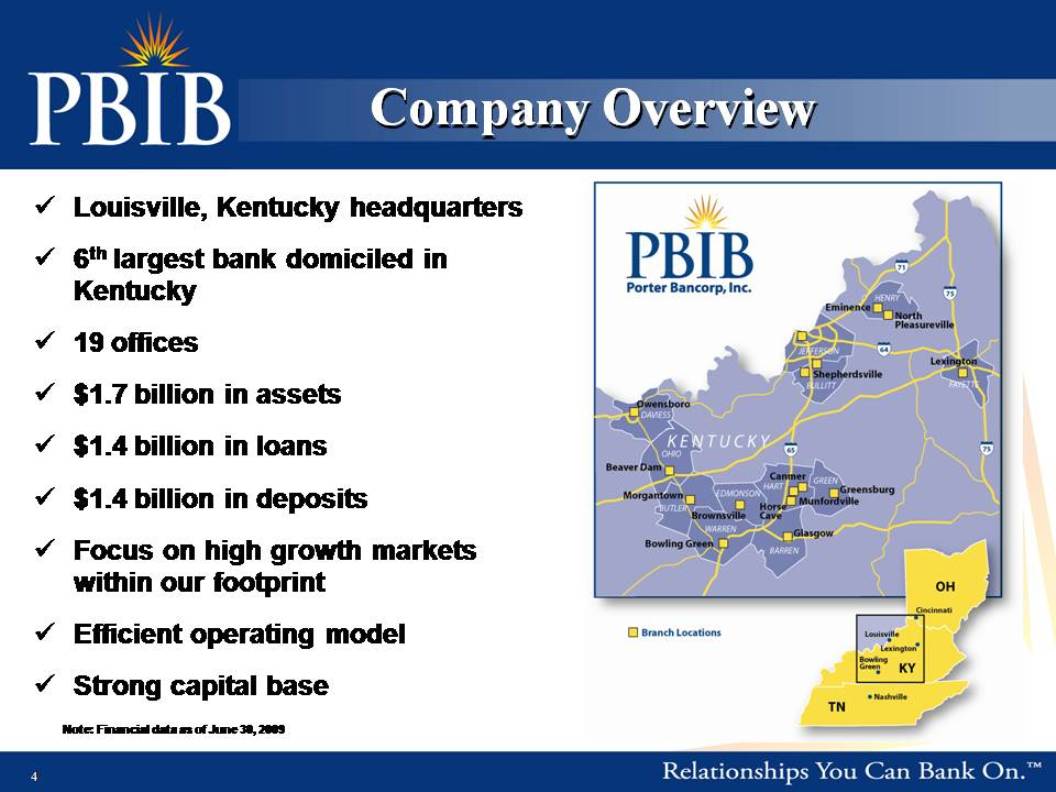

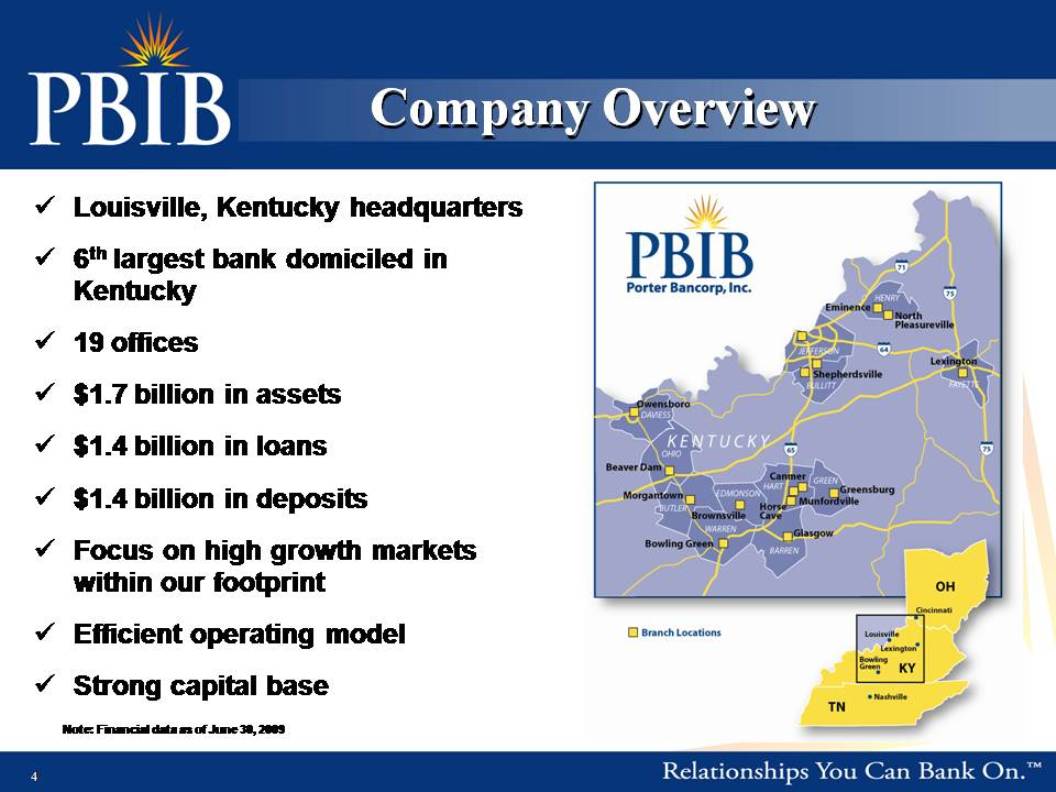

Company Overview Louisville, Kentucky headquarters 6th largest bank domiciled in Kentucky 19 offices $1.7 billion in assets $1.4 billion in loans $1.4 billion in deposits Focus on high growth markets within our footprint Efficient operating model Strong capital base Note: Financial data as of June 30, 2009 4

Market Overview Louisville and Bullitt County Largest city in Kentucky and 16th largest city in U.S. Above average growth rates for economy and jobs Large employers include UPS, GE, Humana, YUM! Brands, Ford UPS hub continues to attract distribution companies – Best Buy (“Geek Squad”), Gordon Foods, Johnson & Johnson, Zappos Home of University of Louisville Owensboro/Daviess County 3rd largest city in Kentucky Industrial, medical, retail and cultural hub for Western Kentucky Large employers include Owensboro Medical Health System, Texas Gas, and Toyotetsu Home of two four-year liberal arts colleges (Brescia University and Kentucky Wesleyan College) Lexington/Fayette County 2nd largest city in Kentucky – attractive growth market Financial, educational, retail, healthcare and cultural hub for Central and Eastern Kentucky “Horse Capital of the World” – host to the World Equestrian Games in 2010 Large employers include Toyota, Lexmark, IBM Global Services and Valvoline Home of University of Kentucky Southern/Central Kentucky Includes Bowling Green (Warren County), the 4th largest city in Kentucky, and Barren, Ohio, Hart, Edmonson, Butler & Green counties Attractive community and growth markets – stable source of deposits and loans PBIB’s main back-office operations hub Major employers include GM (Corvette), RR Donnelley and FedEx Agricultural and service based economy Home of Western Kentucky University 5

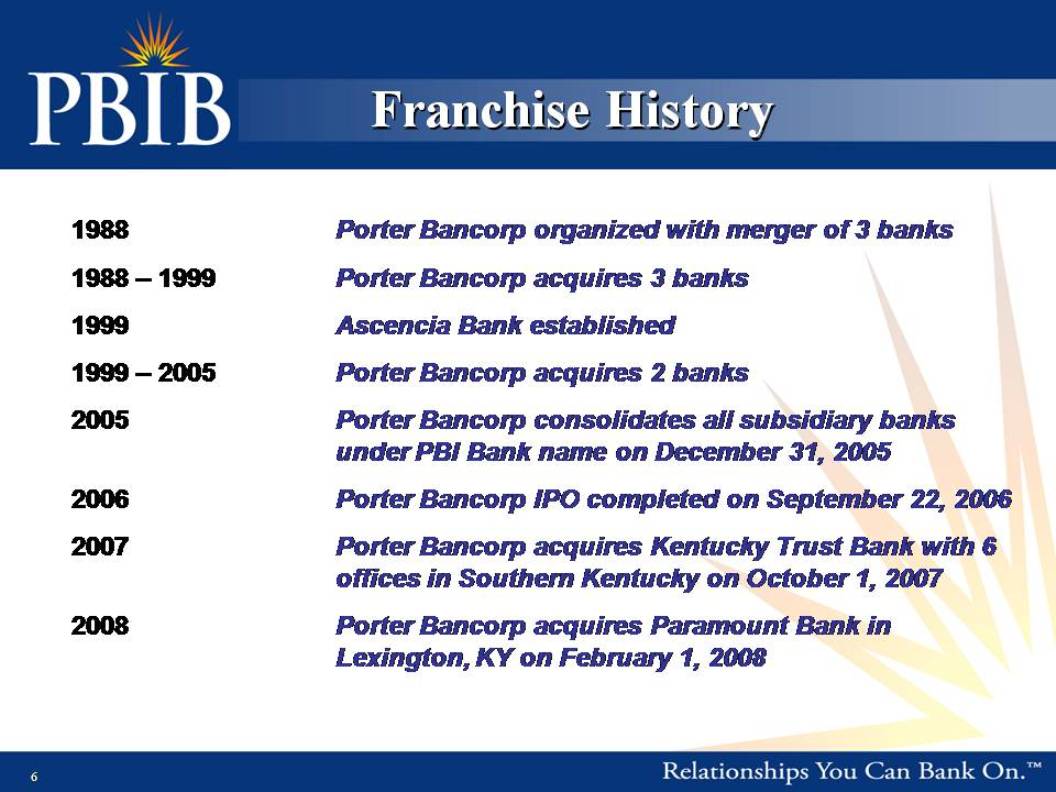

Franchise History 1988 Porter Bancorp organized with merger of 3 banks 1988 – 1999 Porter Bancorp acquires 3 banks 1999Ascencia Bank established – 2005 Porter Bancorp acquires 2 banks 2005 Porter Bancorp consolidates all subsidiary banks under PBI Bank name on December 31, 2005 2006 Porter Bancorp IPO completed on September 22, 2006 2007 Porter Bancorp acquires Kentucky Trust Bank with 6 offices in Southern Kentucky on October 1, 2007 2008 Porter Bancorp acquires Paramount Bank in Lexington, KY on February 1, 2008 6

Financial Highlights 7

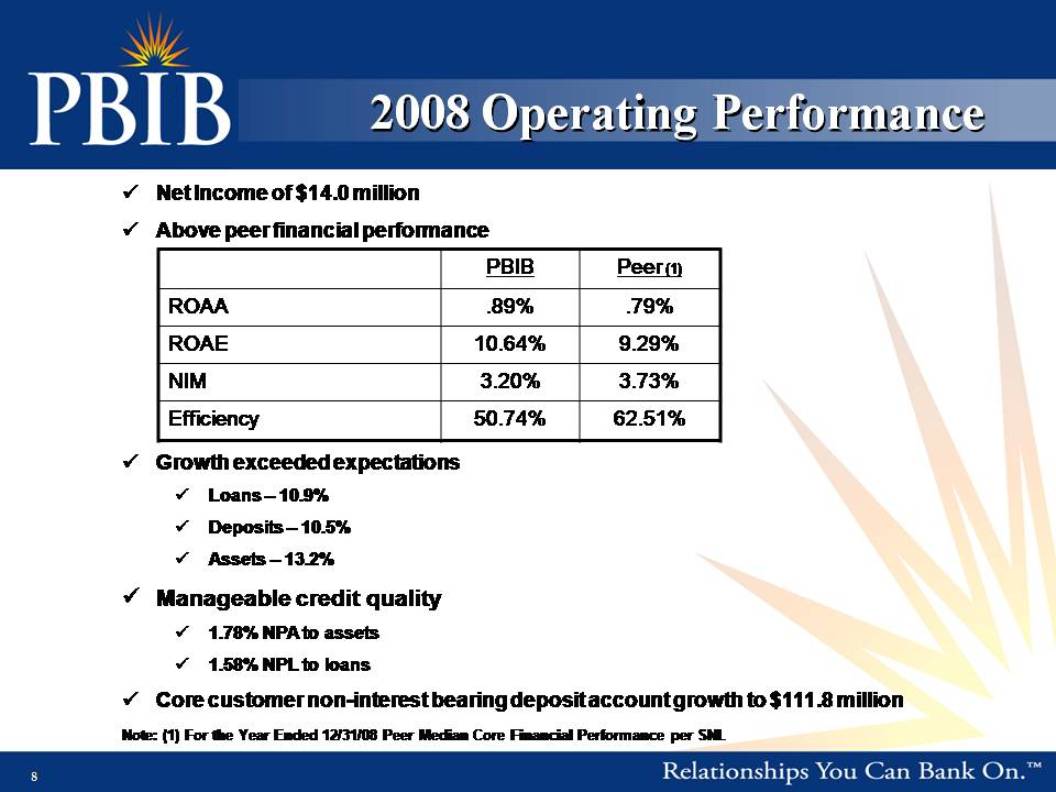

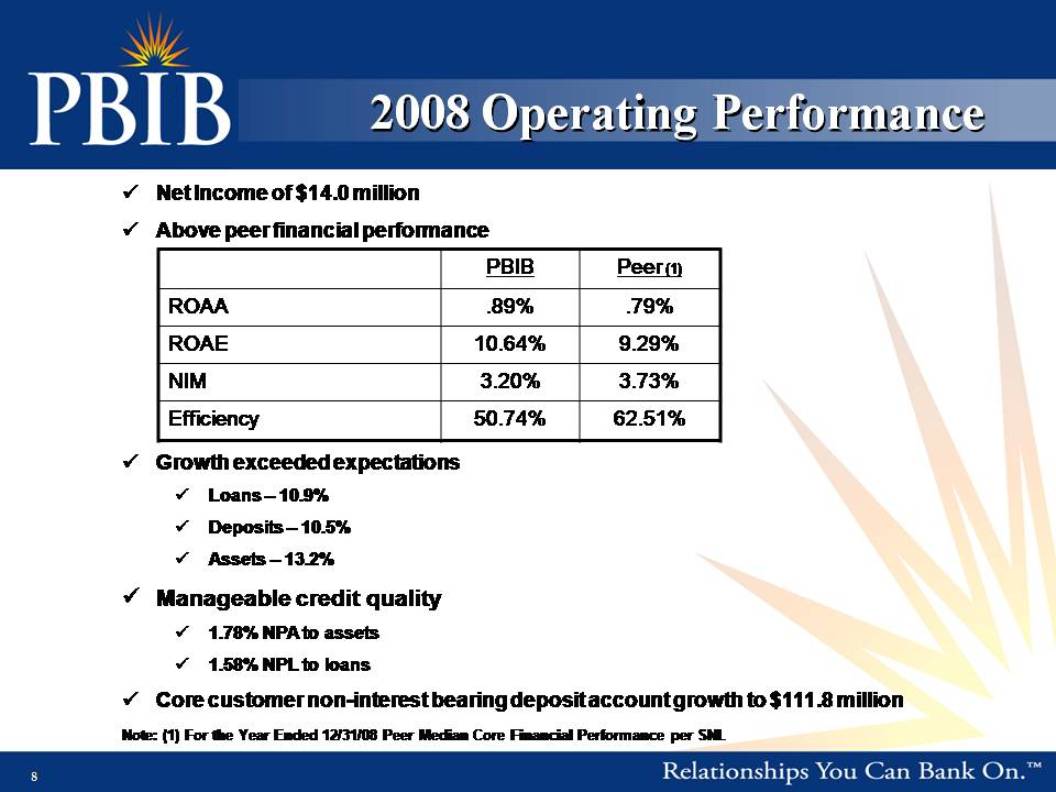

2008 Operating Performance Net Income of $14.0 million Above peer financial performance PBIB Peer (1) ROAA ROAE NIM Efficiency .89% 10.64% 3.20% 50.74% .79% 9.29% 3.73% 62.51% Growth exceeded expectations Loans – 10.9% Deposits – 10.5% Assets – 13.2% Manageable credit quality 1.78% NPA to assets 1.58% NPL to loans Core customer non-interest bearing deposit account growth to $111.8 million Note: (1) For the Year Ended 12/31/08 Peer Median Core Financial Performance per SNL 8

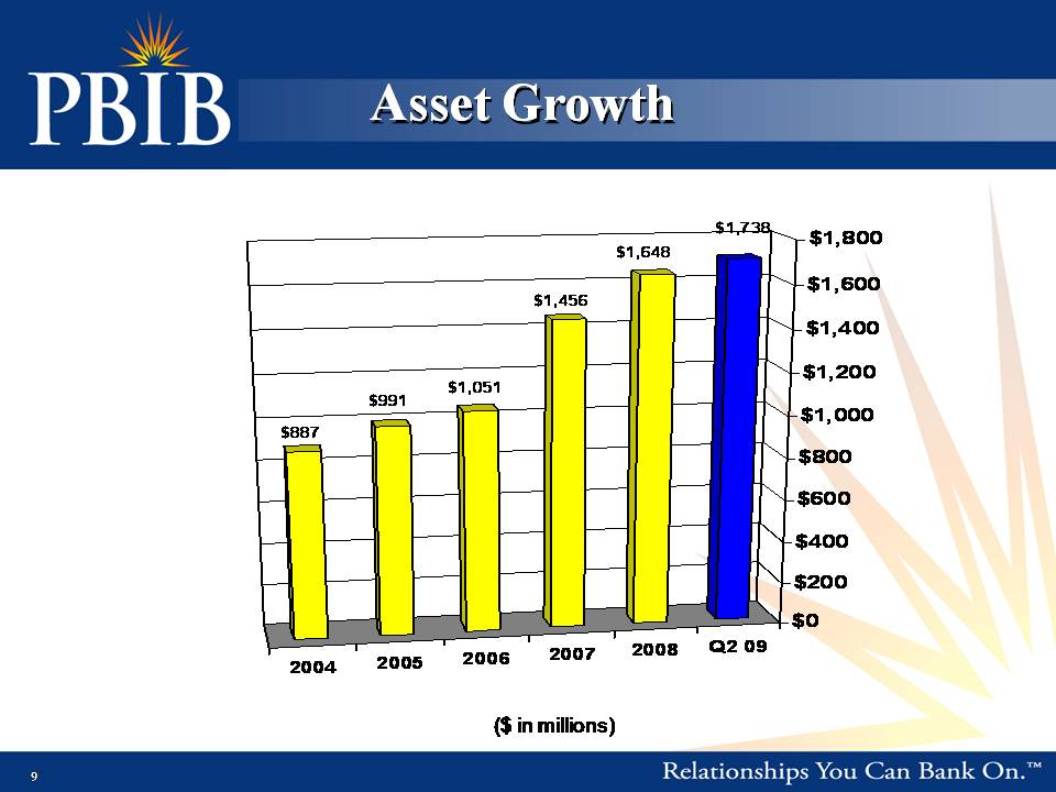

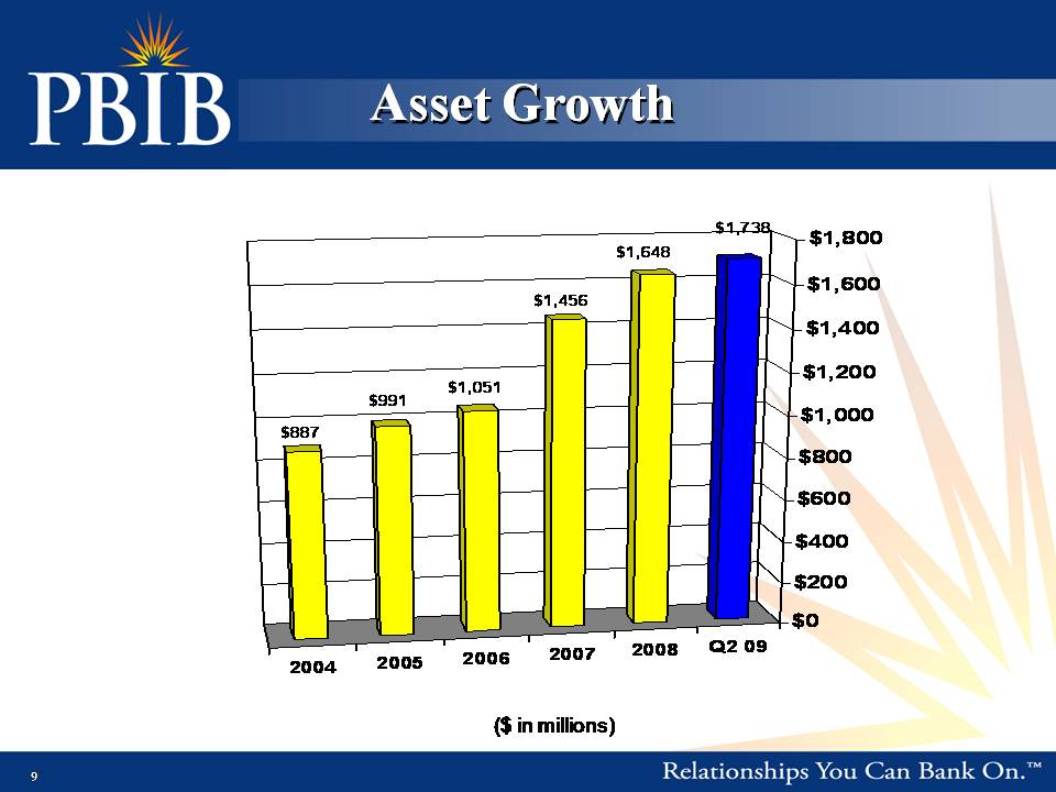

Asset Growth 2004 2005 2006 2007 2008 Q2 09 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $887 $991 $1,051 $1,456 $1,648 $1,738 ($ in millions) 9

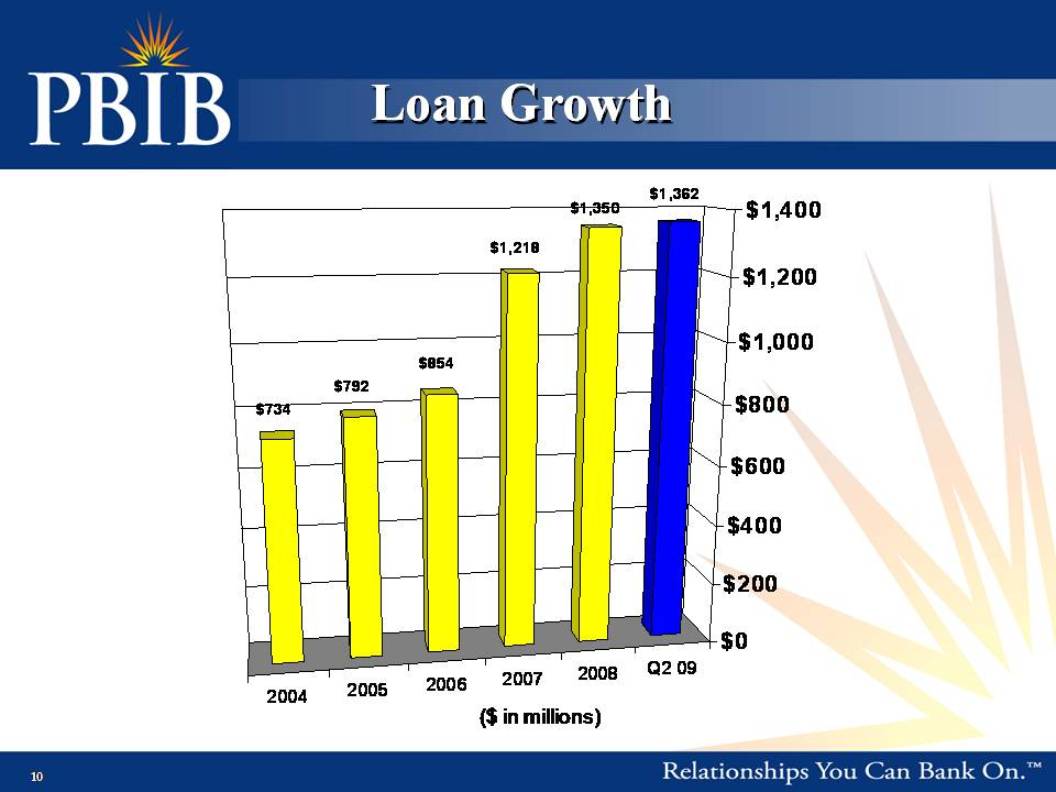

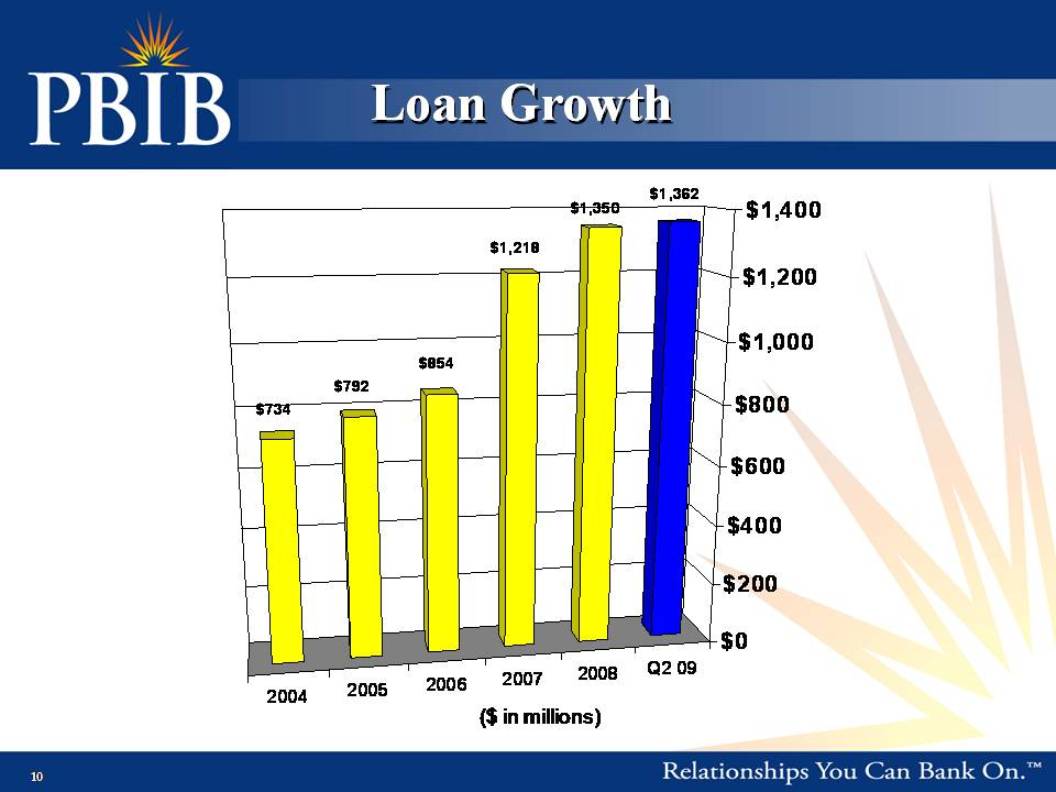

Loan Growth 2004 2005 2006 2007 2008 Q2 09 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $734 $792 $854 $1,218 $1,350 $1,362 ($ in millions) 10

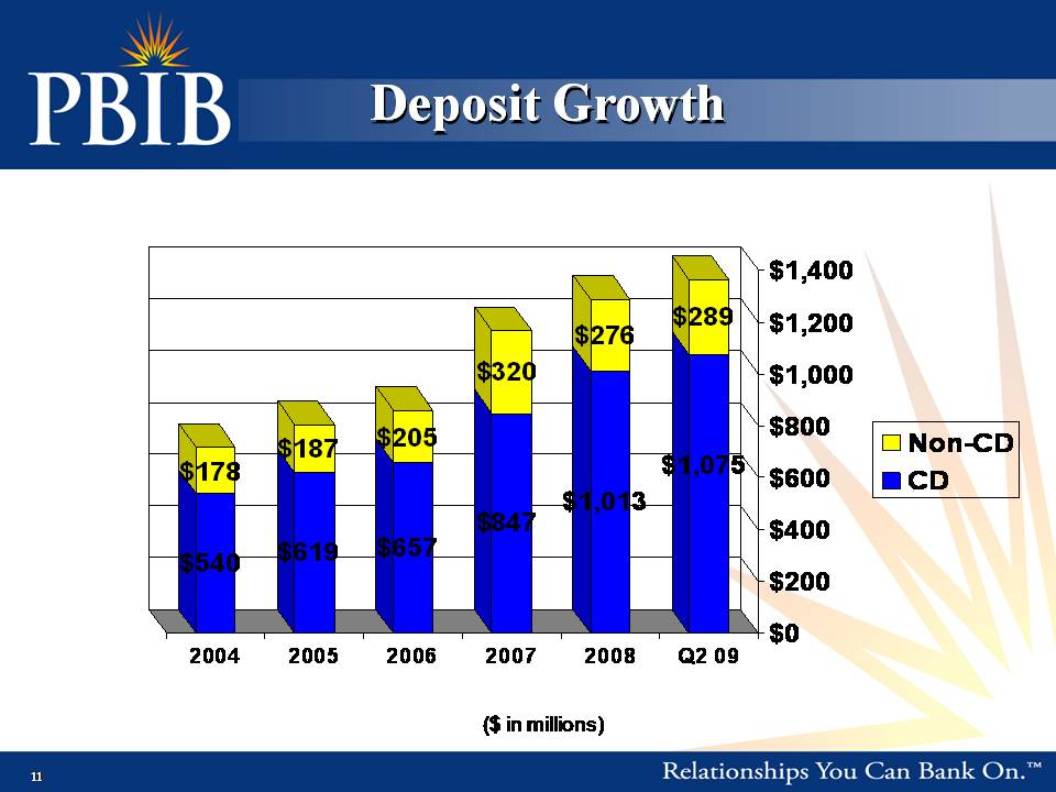

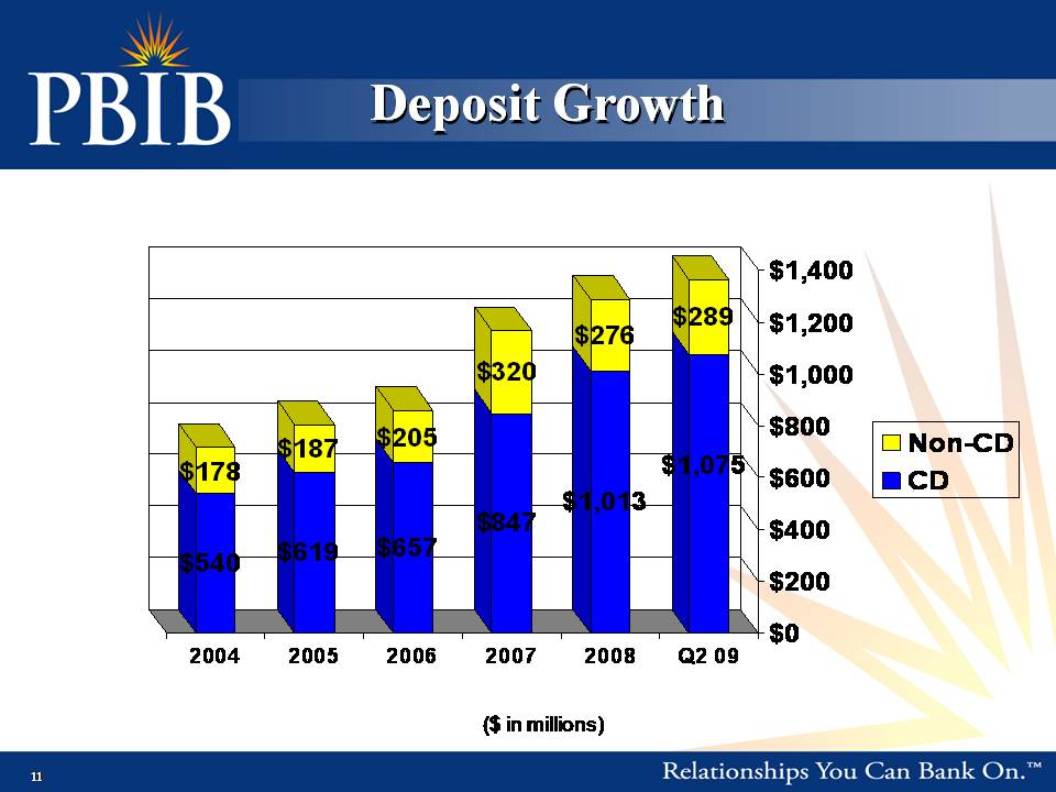

Deposit Growth 2004 2005 2006 2007 2008 Q2 09 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $540 $178 $619 $187 $657 $205 $847 $320 $1,013 $276 $1,075 $289 Non-CD CD ($ in millions) 11

Solid Growth 2006 2007 2008 Q2 09 (annualized) Assets Loans Deposits 6.0% 7.9% 6.9% 38.5% 42.5% 35.3% 13.2% 10.9% 10.5% 7.6% 1.8% 11.8% 12

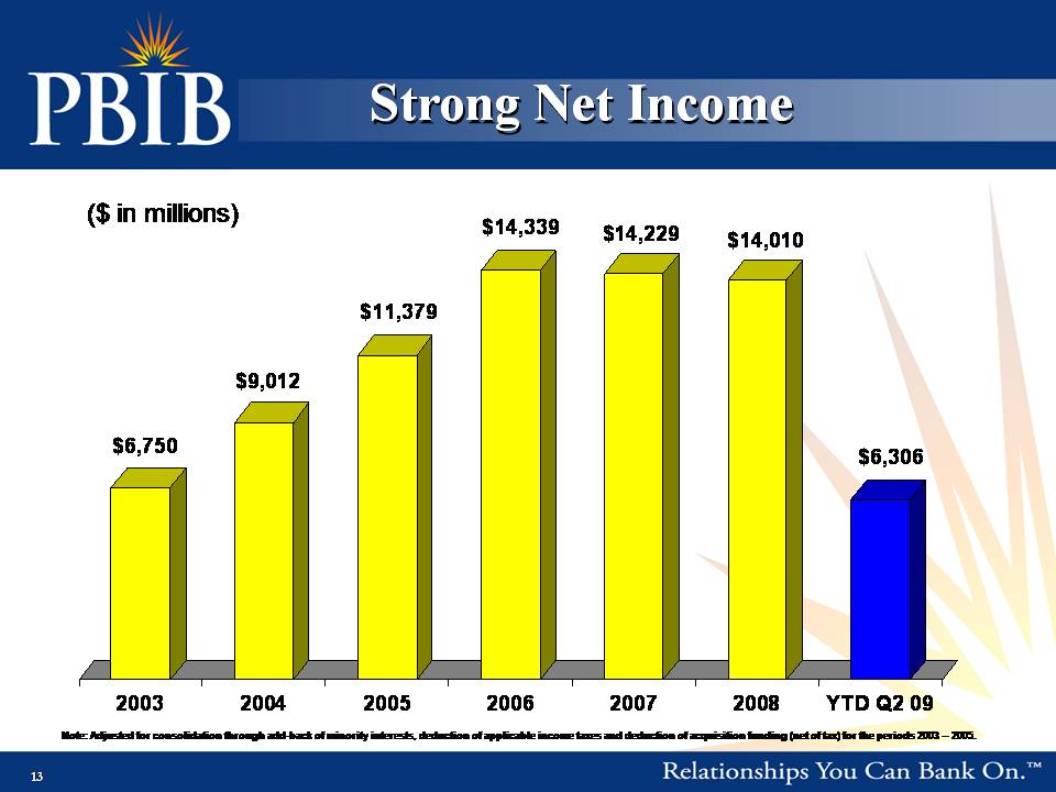

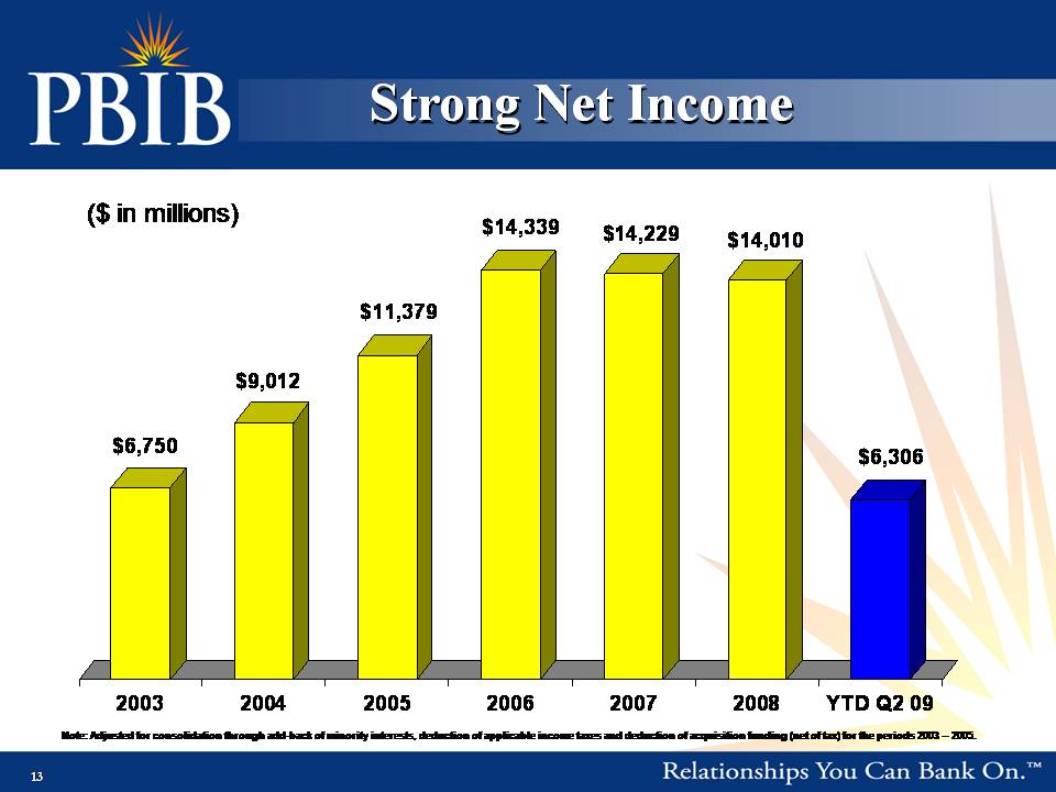

Strong Net Income ($ in millions) 2003 2004 2005 2006 2007 2008 YTD Q2 09 $6,750 $9,012 $11,379 $14,339 $14,229 $14,010 $6,306 Note: Adjusted for consolidation through add-back of minority interests, deduction of applicable income taxes and deduction of acquisition funding (net of tax) for the periods 2003 – 2005. 13

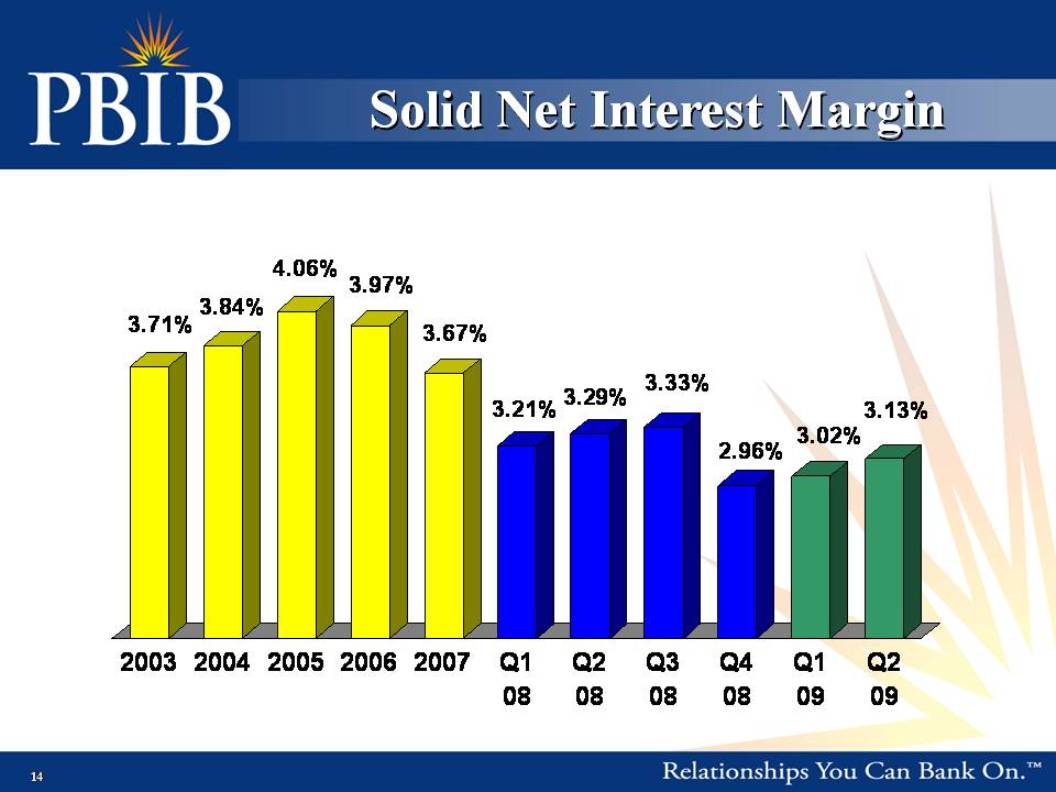

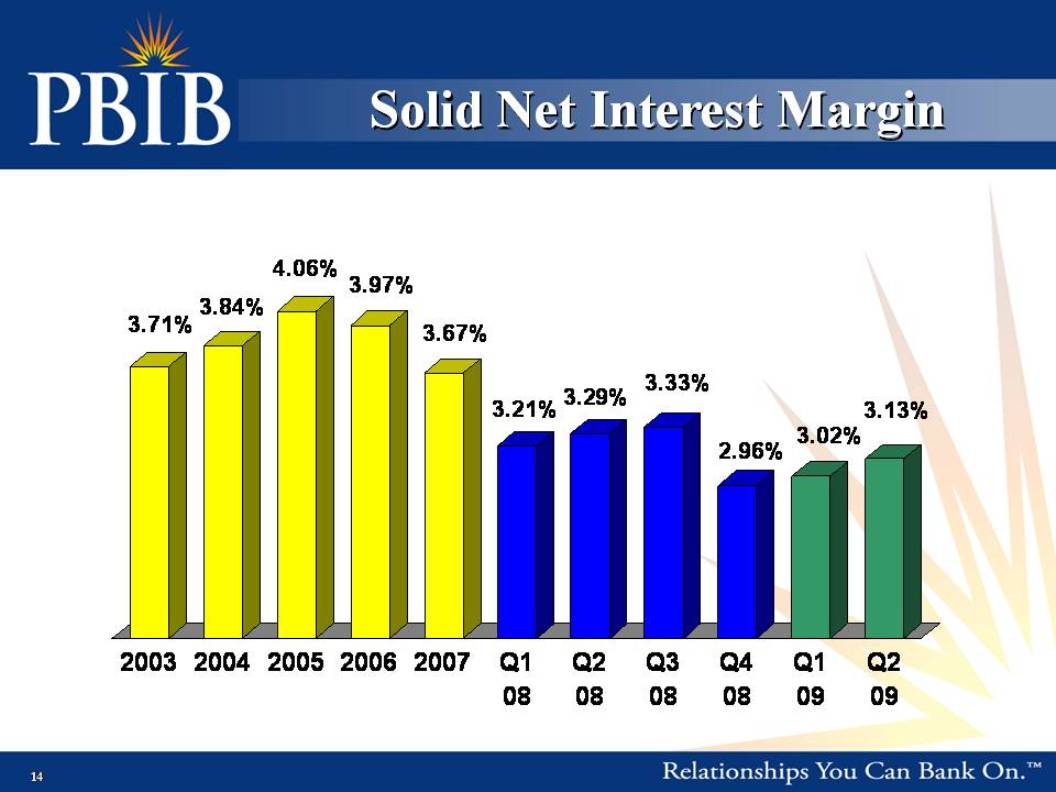

Solid Net Interest Margin 2003 2004 2005 2006 2007 Q1 08 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 3.71% 3.84% 4.06% 3.97% 3.67% 3.21% 3.29% 3.33% 2.96% 3.02% 3.13% 14

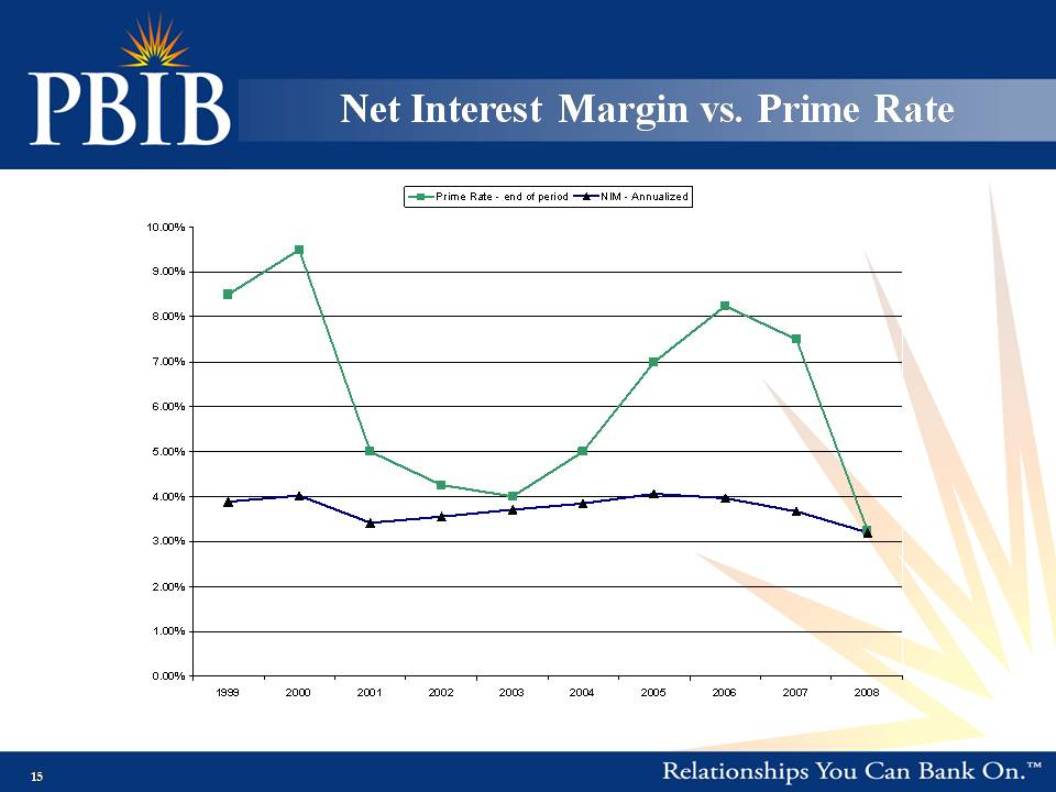

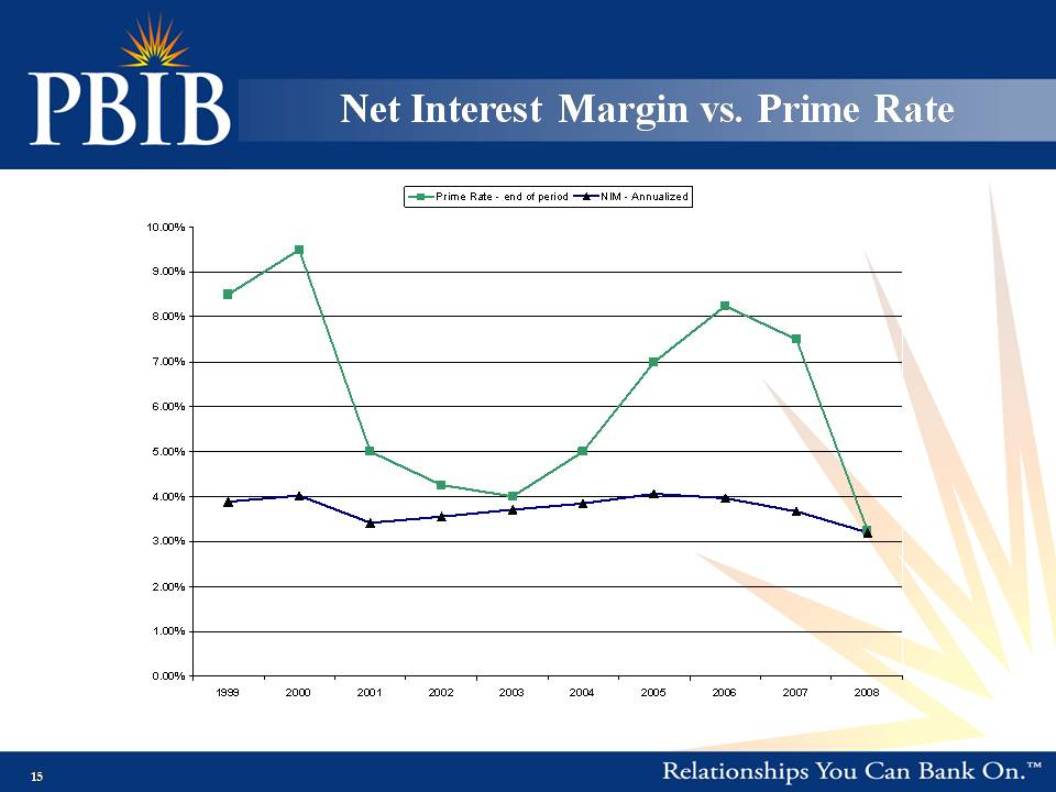

Net Interest Margin vs. Prime Rate 15

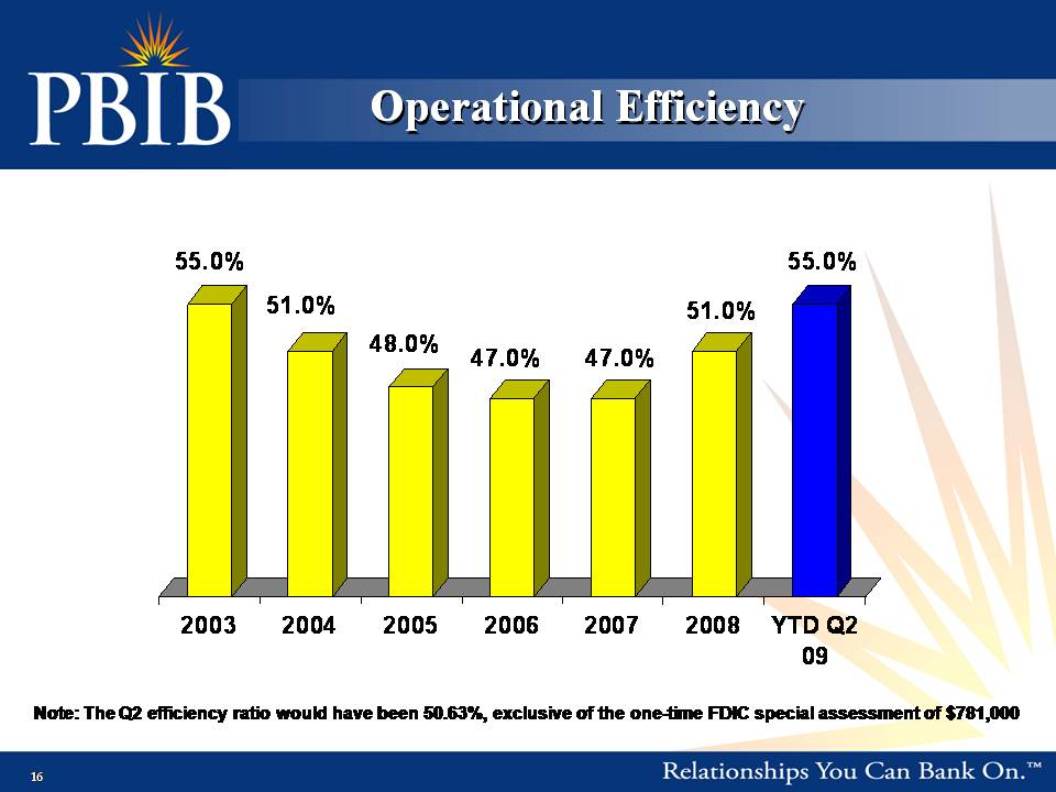

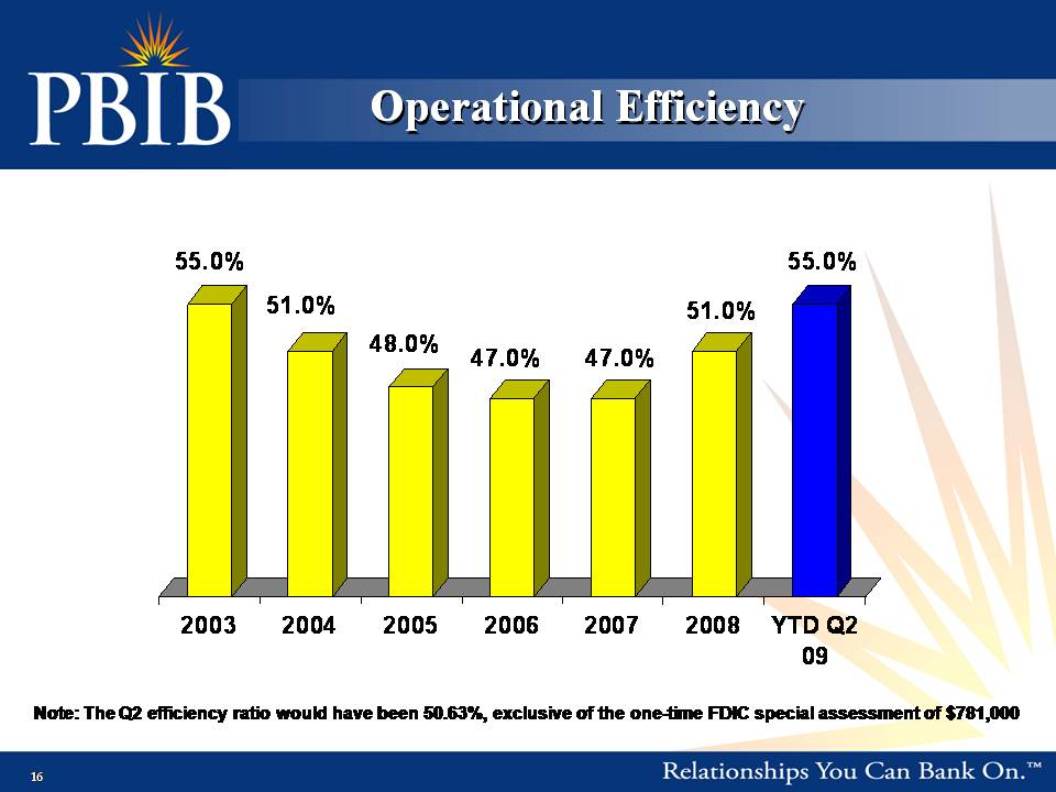

Operational Efficiency 2003 2004 2005 2006 2007 2008 YTD Q2 09 55.0% 51.0% 48.0% 47.0% 47.0% 51.0% 55.0% Note: The Q2 efficiency ratio would have been 50.63%, exclusive of the one-time FDIC special assessment of $781,000 16

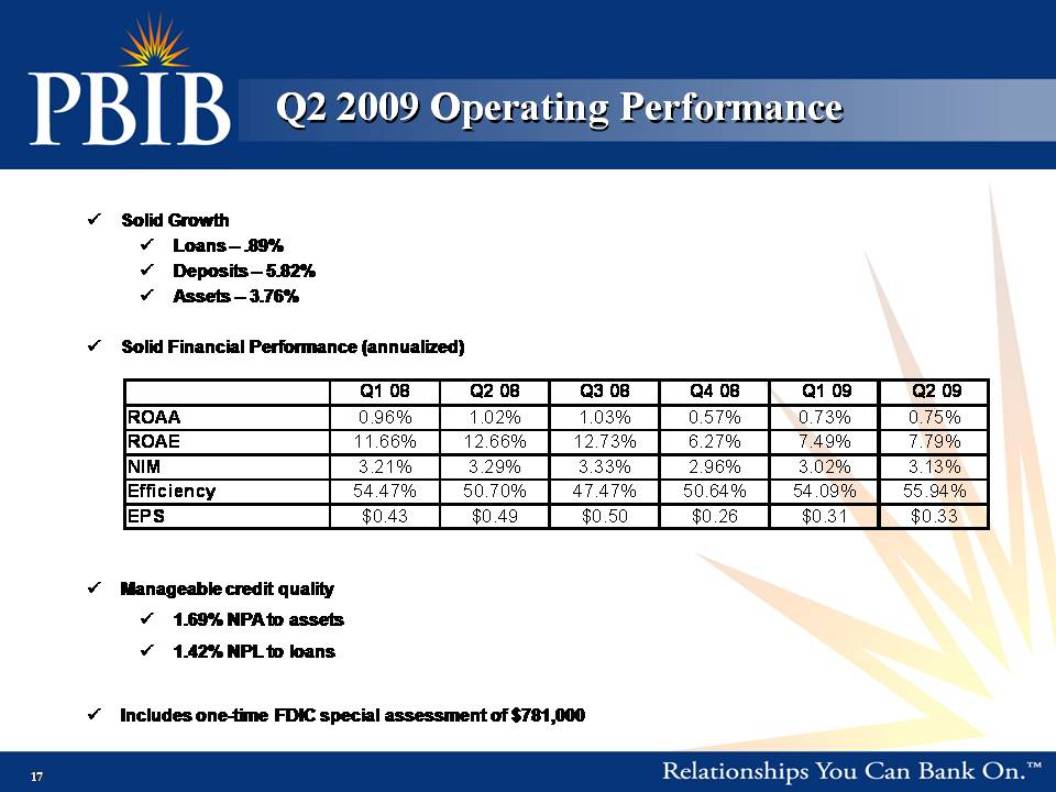

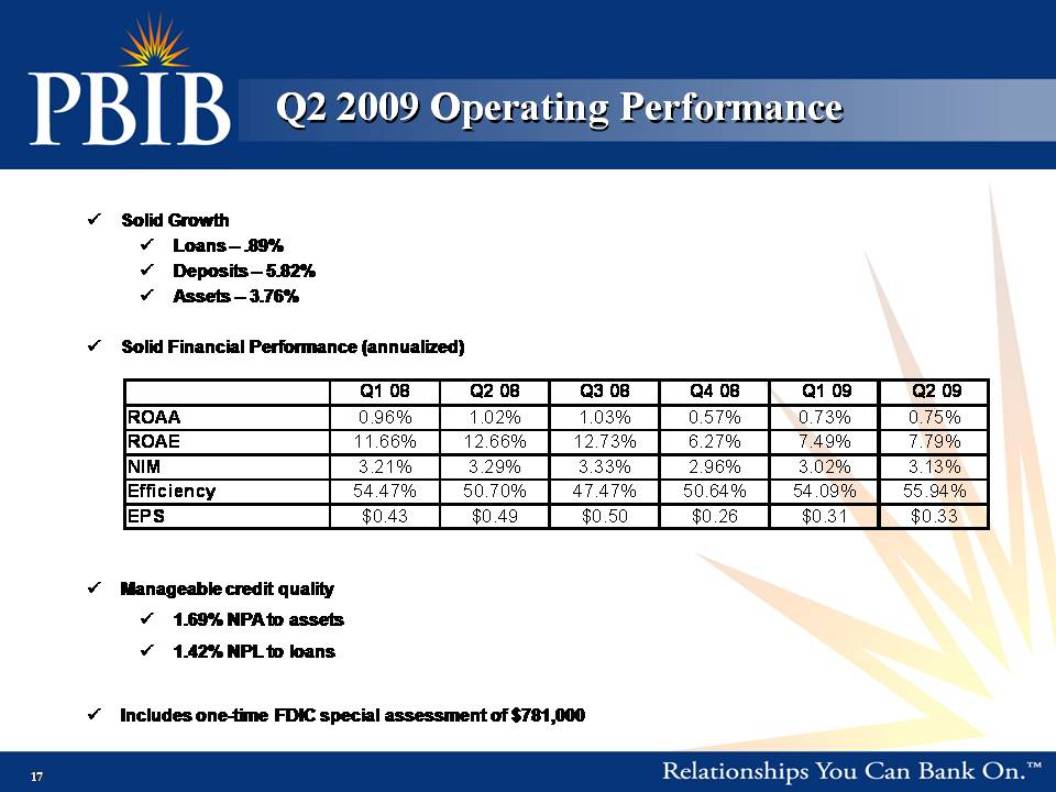

Q2 2009 Operating Performance Solid Growth Loans – .89% Deposits – 5.82% Assets – 3.76% Solid Financial Performance (annualized) ROAA ROAE NIM Efficiency EPS Q1 08 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 0.96% 11.66% 3.21% 54.47% $0.43 1.02% 12.66% 3.29% 50.70% $0.49 1.03% 12.73% 3.33% 47.47% $0.50 0.57% 6.27% 2.96% 50.64% $0.26 0.73% 7.49% 3.02% 54.09% $0.31 0.75% 7.79% 3.13% 55.94% $0.33 Manageable credit quality 1.69% NPA to assets 1.42% NPL to loans Includes one-time FDIC special assessment of $781,000 17

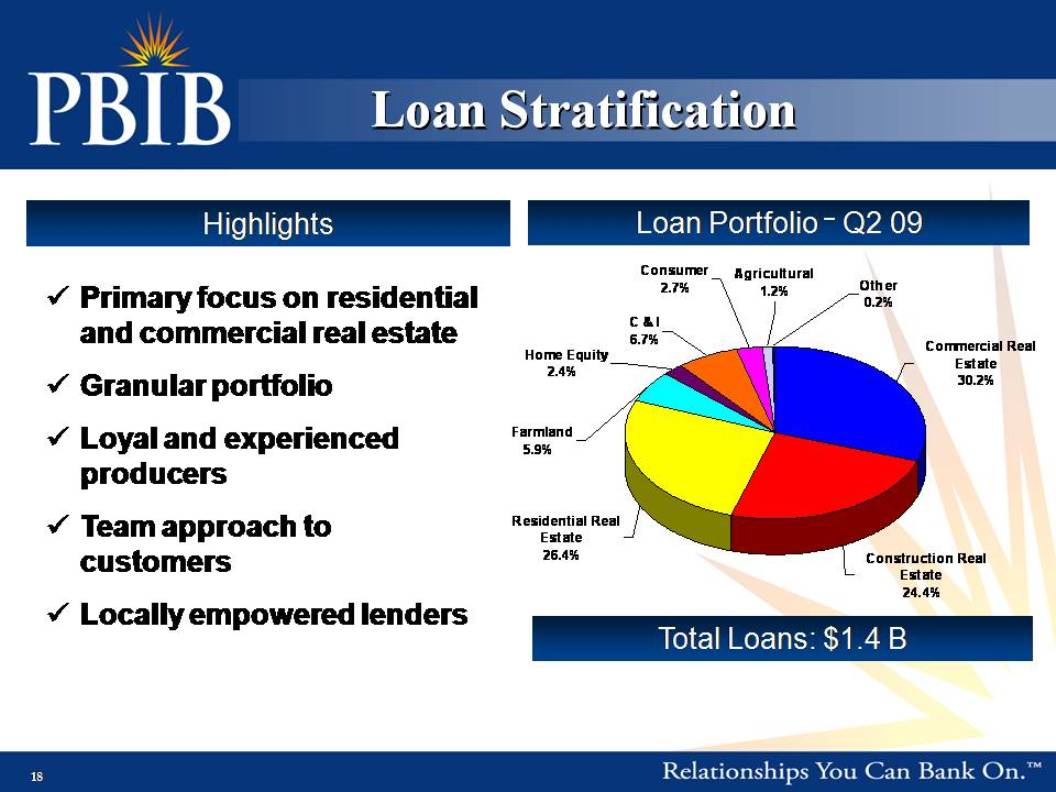

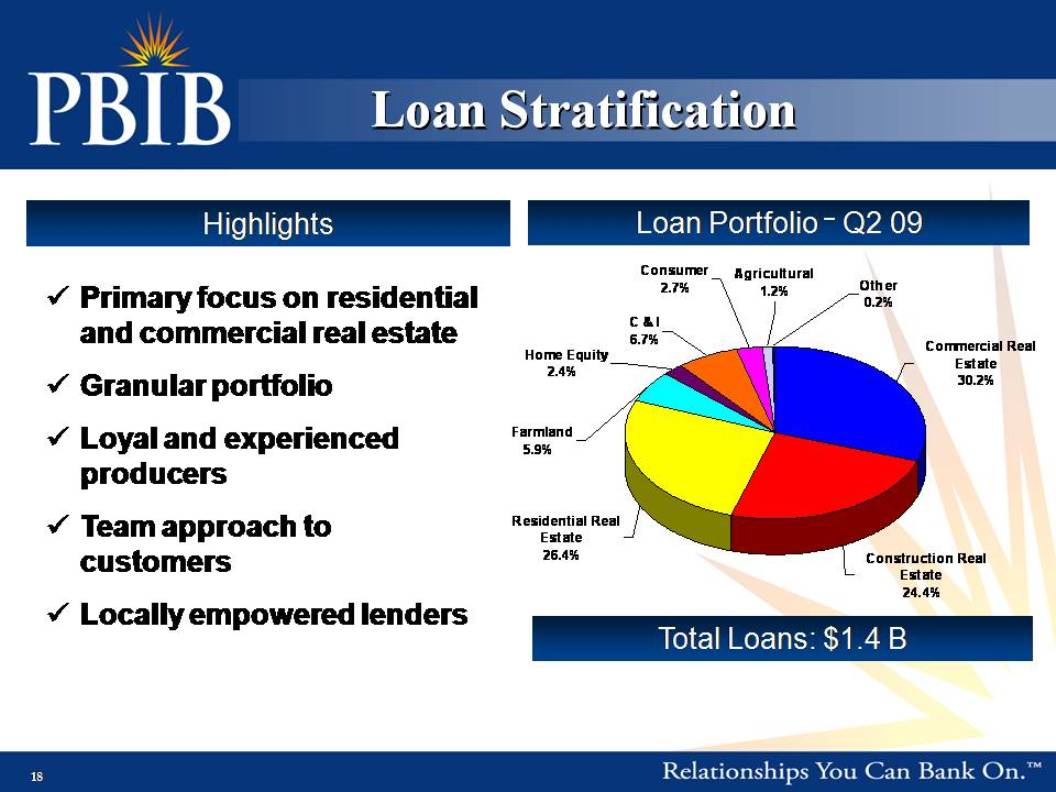

Loan Stratification Highlights Primary focus on residential and commercial real estate Granular portfolio Loyal and experienced producers Team approach to customers Locally empowered lenders Commercial Real Estate 30.2% Construction Real Estate 24.4% Residential Real Estate 26.4% Farmland 5.9% Home Equity 2.4% C & I 6.7% Consumer 2.7% Agricultural 1.2% Other 0.2% Loan Portfolio – Q2 09 Total Loans: $1.4 B 18

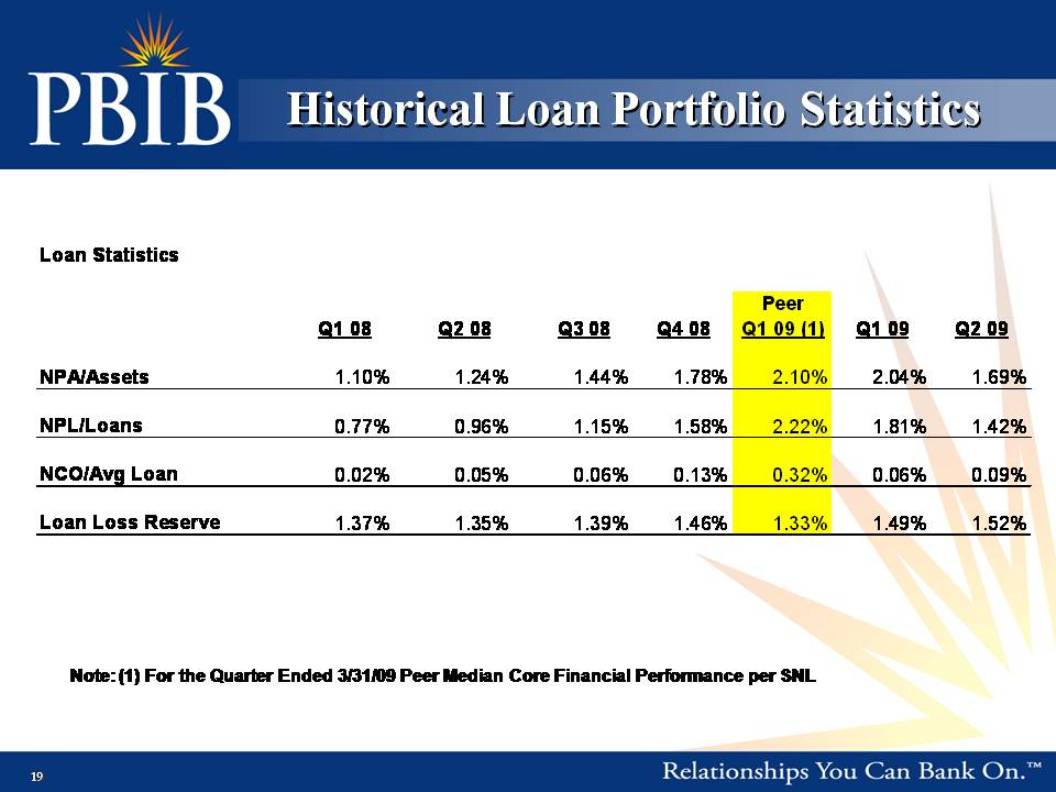

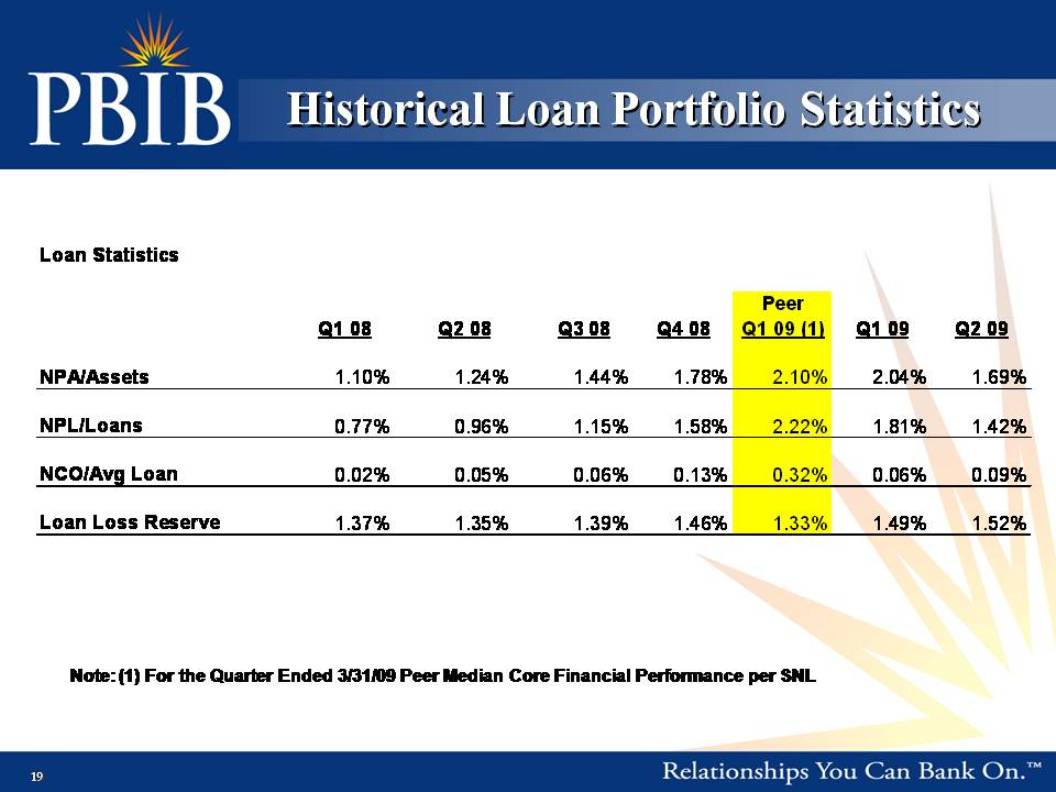

Historical Loan Portfolio Statistics Loan Statistics Q1 08 Q2 08 Q3 08 Q4 08 Peer Q1 09 (1) Q1 09 Q2 09 NPA/Assets NPL/Loans NCO/Avg Loan Loan Loss Reserve 1.10% 0.77% 0.02% 1.37% 1.24% 0.96% 0.05% 1.35% 1.44% 1.15% 0.06% 1.39% 1.78% 1.58% 0.13% 1.46% 2.10% 2.22% 0.32% 1.33% 2.04% 1.81% 0.06% 1.49% 1.69% 1.42% 0.09% 1.52% Note: (1) For the Quarter Ended 3/31/09 Peer Median Core Financial Performance per SNL 19

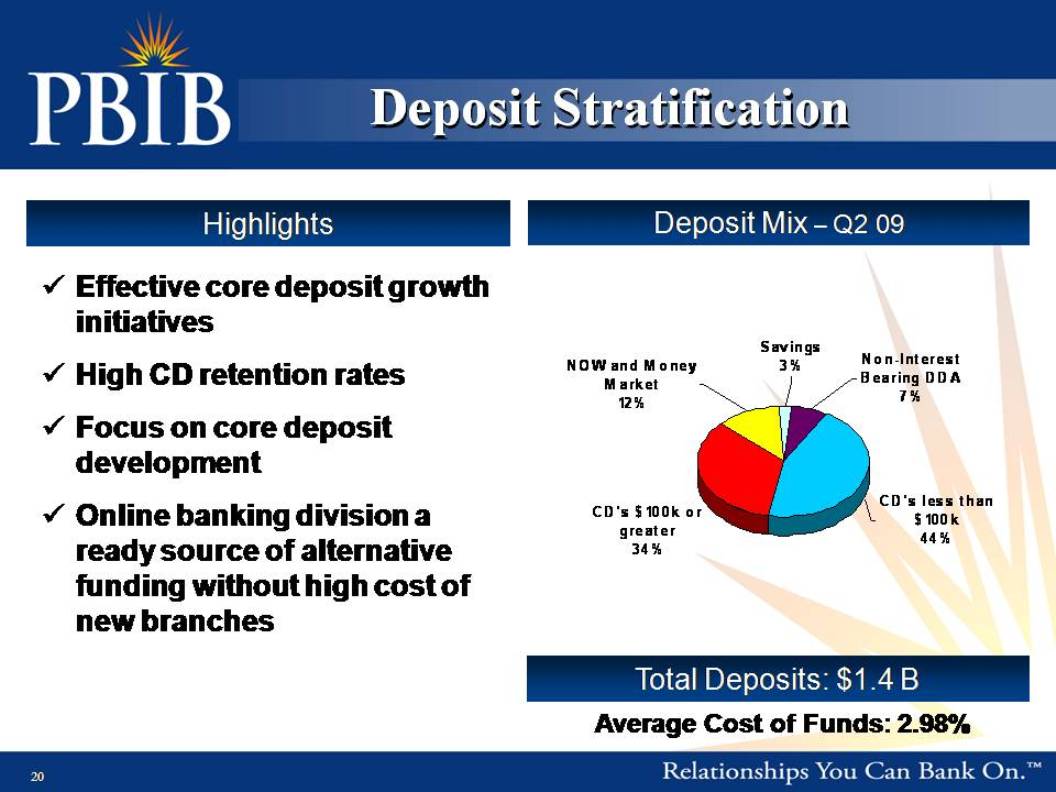

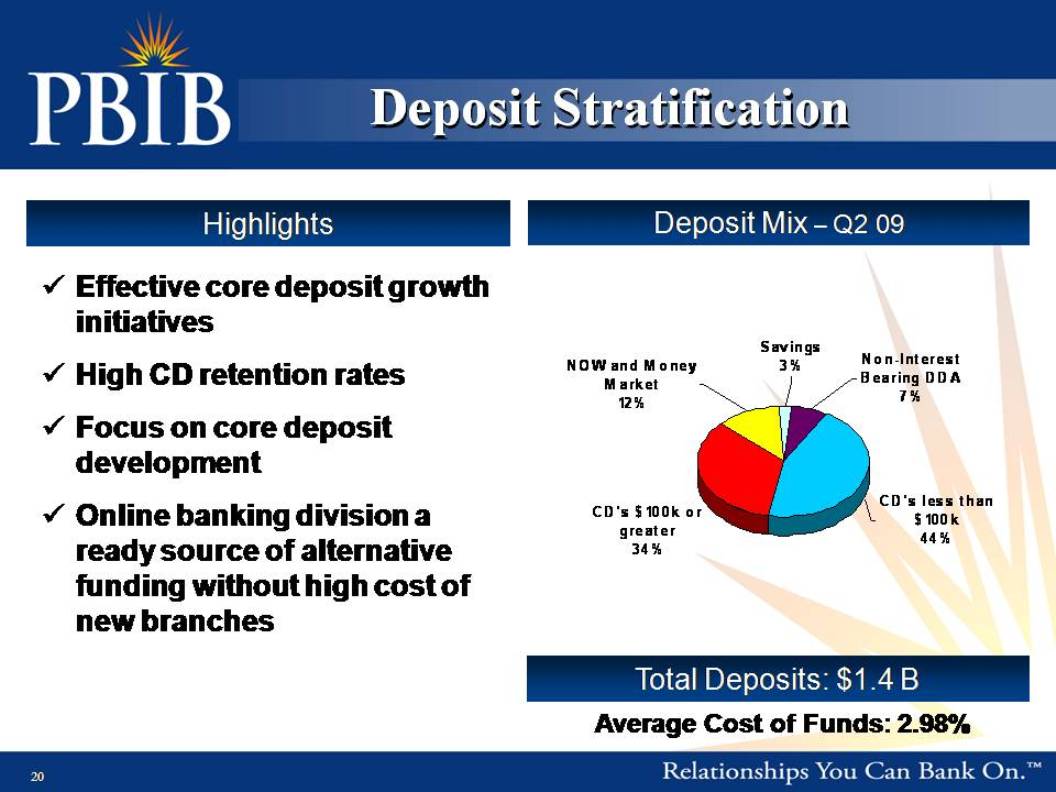

Deposit Stratification Highlights Effective core deposit growth initiatives High CD retention rates Focus on core deposit development Online banking division a ready source of alternative funding without high cost of new branches CD’s less than $100k 44% CD’s $100k or greater 34% NOW and Money Market 12% Savings 3% Non-Interest Bearing DDA 7% Deposit Mix – Q2 09 Total Deposits: $1.4 B Average Cost of Funds: 2.98% 20

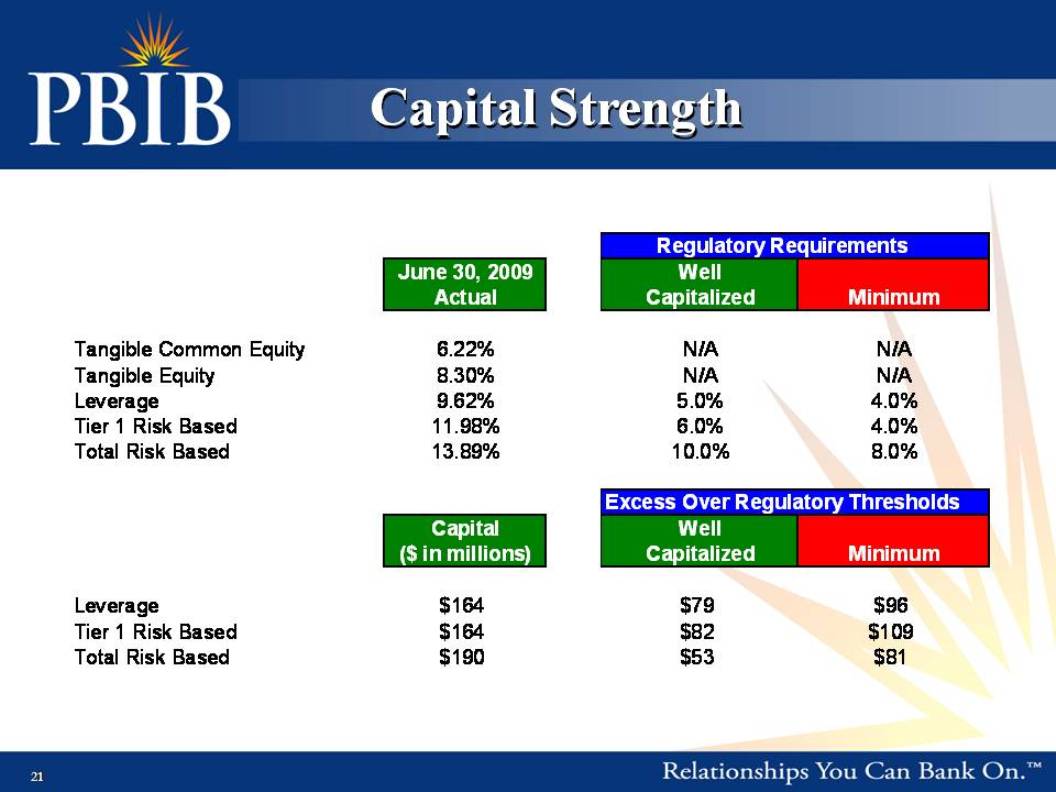

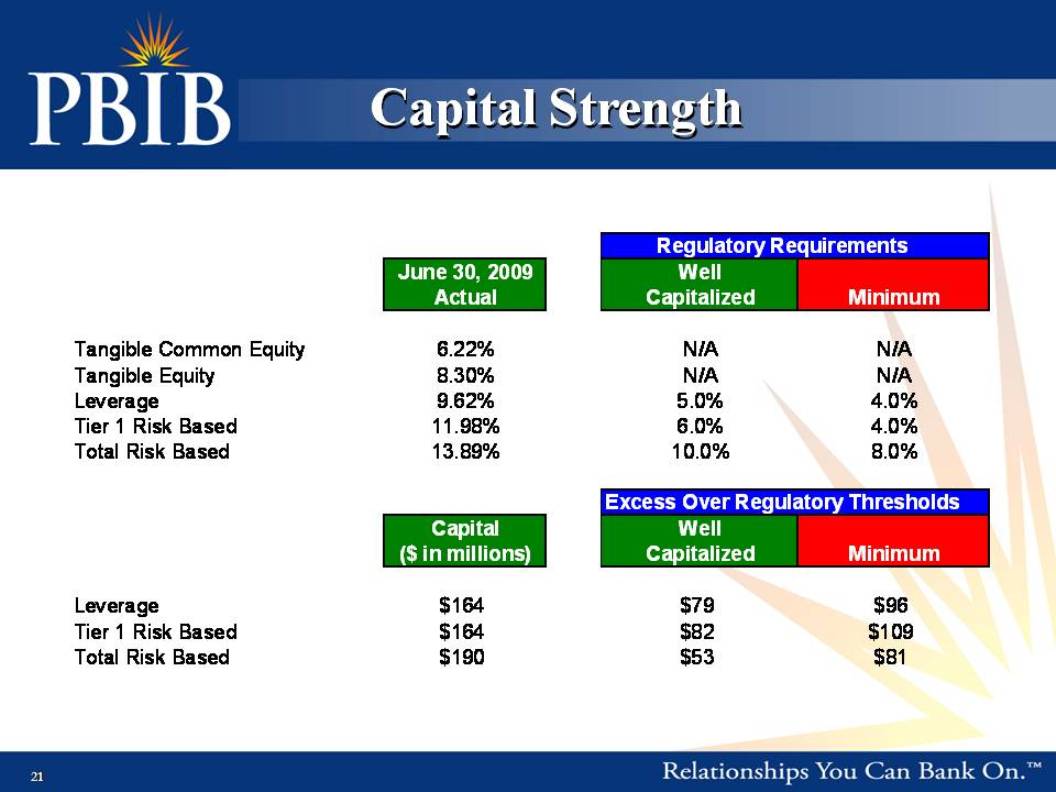

Capital Strength June 30, 2009 Actual Regulatory Requirements Well Capitalized Minimum Tangible Common Equity Tangible Equity Leverage Tier 1 Risk Based Total Risk Based 6.22% 8.30% 9.62% 11.98% 13.89% N/A N/A 5.0% 6.0% 10.0% N/A N/A 4.0% 4.0% 8.0% Capital ($ in millions) Excess Over Regulatory Thresholds Well Capitalized Minimum Leverage Tier 1 Risk Based Total Risk Based $164 $164 $190 $79 $82 $53 $96 $109 $81 21

Investment Highlights 22

Operating Strengths Experienced management team Extensive market knowledge and community relationships Acquisition and integration experience Highly efficient organizational structure Diversified funding sources Highly focused on profits Strong capital base 23

2009 Growth Strategy Increase market share of existing franchise – managed growth Expand core deposit development initiatives and non-interest income improvement strategies Continue long-term strategy of considering M&A opportunities that arise Remain disciplined and focused Accretive to earnings in first full year Markets with high growth potential Strong management team compatible with our culture 24

2009 Key Strategic Initiatives Client-driven service that consistently provides better value Rational risk taking and exceptional risk management Maintain strict focus on credit quality in this challenging environment Earnings growth Consistent, superior operational efficiency Targeted and disciplined investments for the future 25

Investment Considerations Attractive, diversified growth markets Successful history of executing growth strategy Scalable operating platform Efficient operating model Solid operating performance Undervalued investment opportunity 26

Undervalued Opportunity Current Market Price (7/16/2009) $16.35 Trading Multiples: Value Multiple EPS (1) Tangible BV Per Share (2) Annual Dividend (3) $1.38 $12.52 $.84 11.85x 130.59% 5.14% Note: Mean 2009 EPS estimates per analysts as reported by NASDAQ Market Report As of June 30, 2009 Annualized based on financial data for quarter ended June 30, 2009 27

Addendum 28

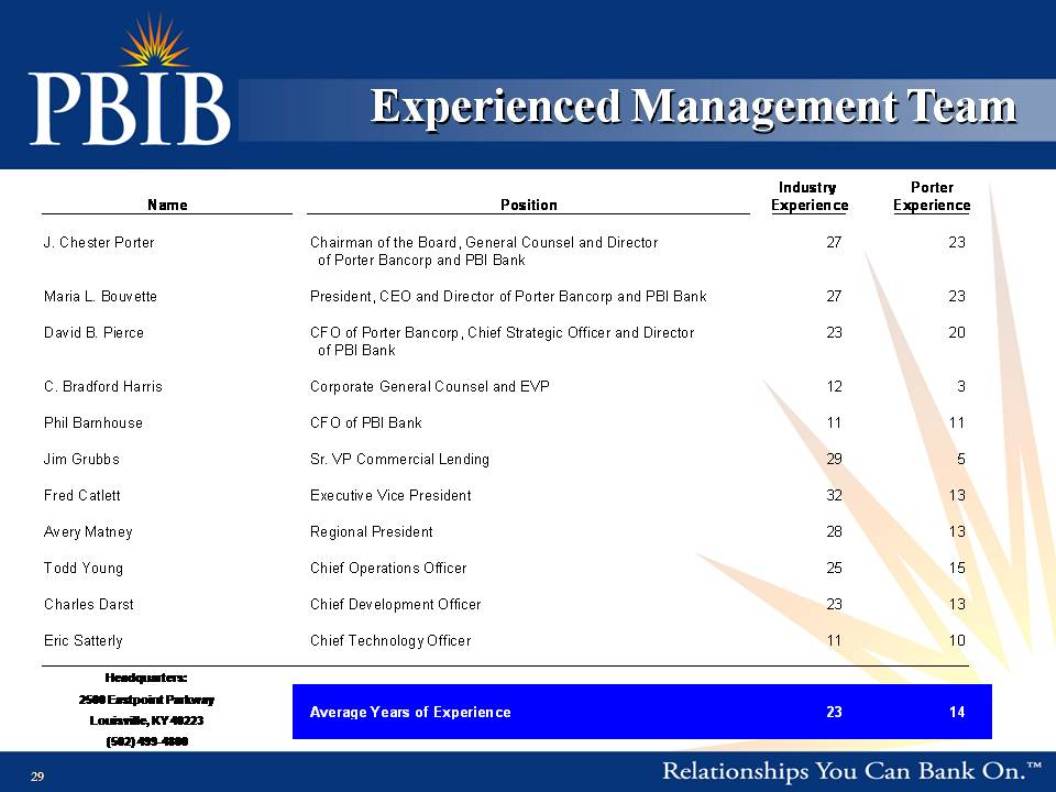

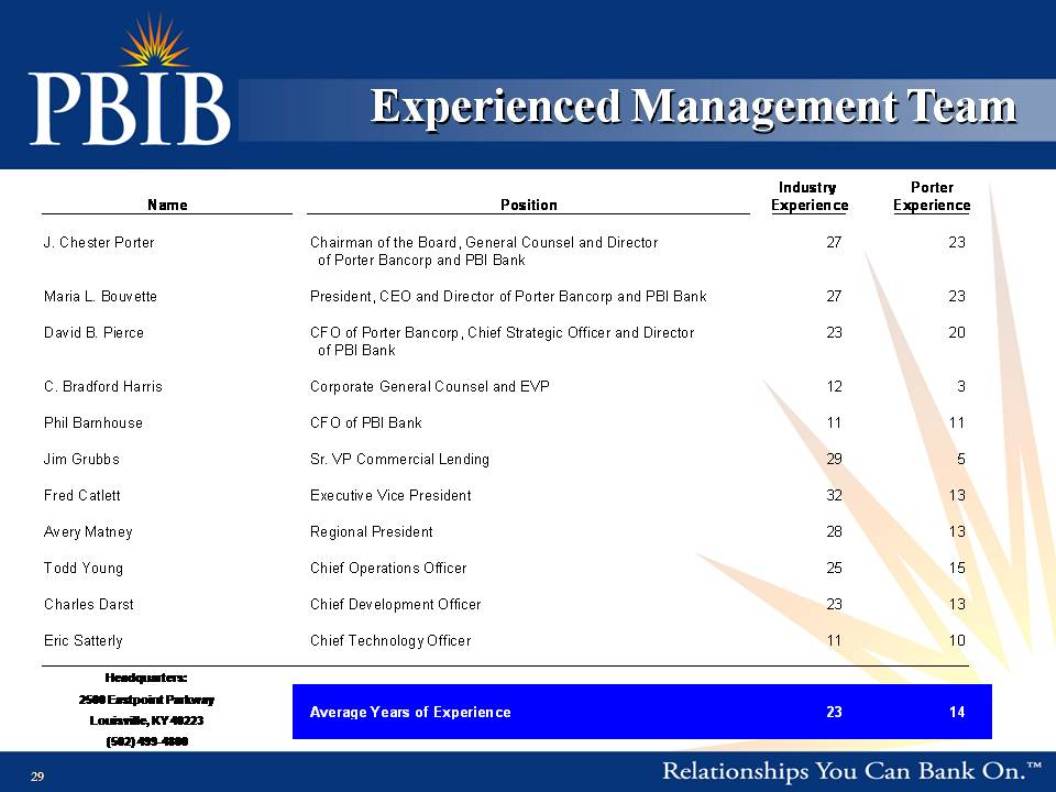

Experienced Management Team Name Position Industry Experience Porter Experience J. Chester Porter Chairman of the Board, General Counsel and Director of Porter Bancorp and PBI Bank 27 23 Maria L. Bouvette President, CEO and Director of Porter Bancorp and PBI Bank 27 23 David B. Pierce CFO of Porter Bancorp, Chief Strategic Officer and Director of PBI Bank 23 20 C. Bradford Harris Corporate General Counsel and EVP 12 3 Phil Barnhouse CFO of PBI Bank 11 11 Jim Grubbs Sr. VP Commercial Lending 29 5 Fred Catlett Executive Vice President 32 13 Avery Matney Regional President 28 13 Todd Young Chief Operations Officer 25 15 Charles Darst Chief Development Officer 23 13 Eric Satterly Chief Technology Officer 11 10 Average Years of Experience 23 14 Headquarters: 2500 Eastpoint Parkway Lousiville, KY 40223 (502) 499-4800 29

Peer Metrics Porter Bancorp, Inc. Comparable Data Financial Information for the Quarter Ended 3/31/09 ($ in thousands) Total Core Core Net Interest Efficiency NPLs/ Reserves/ Reserves/ NCOs/ NPAs/ Company Name Ticker City State Assets ROAA ROAE Margin Ratio Loans NPLs Loans Avg Loans Assets Republic Bancorp, Inc RBCAA Louisville KY 3,337,645 2.68% 37.88% 8.12% 38.13% 1.06% 73.02% 0.77% 3.46% 0.92% Integra Bank Corp IBNK Evansville IN $3,555,533 -2.76% -41.40% 2.39% 102.04% 7.80% 41.50% 3.24% 2.82% 5.88% Community Trust Bancorp, Inc CTBI Pikeville KY 3,022,199 0.92% 8.96% 3.61% 64.60% 2.23% 58.66% 1.31% 0.37% 2.23% Farmers Capital Bank Corp FFKT Frankfort KY 2,241,133 0.52% 5.76% 3.03% 74.77% 2.20% 61.37% 1.35% 0.22% 1.96% S Y Bancorp, Inc SYBT Louisville KY 1,630,724 1.16% 12.96% 3.80% 59.29% 0.43% 277.01% 1.18% 0.23% 0.46% Bank of Kentucky Financial Corp BKYF Crestview Hills KY 1,315,329 0.84% 8.88% 3.58% 62.86% 1.18% 88.50% 1.05% 0.27% 1.02% First Financial Service Corp FFKY Elizabethtown KY 1,053,194 0.32% 3.76% 3.73% 70.45% 2.30% 69.59% 1.60% 0.23% 2.57% Community Bank Shares of Indiana, Inc CBIN New Albany IN 865,682 0.04% 0.76% 3.08% 86.64% 3.93% 36.49% 1.43% 1.10% 2.90% High $3,555,533 2.68% 37.88% 8.12% 102.04% 7.80% 277.01% 3.24% 3.46% 5.88% Low 865,682 -2.76% -41.40% 2.39% 38.13% 0.43% 36.49% 0.77% 0.22% 0.46% Average 2,127,680 0.47% 4.70% 3.92% 69.85% 2.64% 88.27% 1.49% 1.09% 2.24% Median 1,935,929 0.68% 7.32% 3.60% 67.53% 2.22% 65.48% 1.33% 0.32% 2.10% Porter Bancorp, Inc PBIB Louisville KY $1,738,393 0.72% 7.40% 3.02% 54.09% 1.81% 82.13% 1.49% 0.26% 2.04% Note: Data per SNL 30

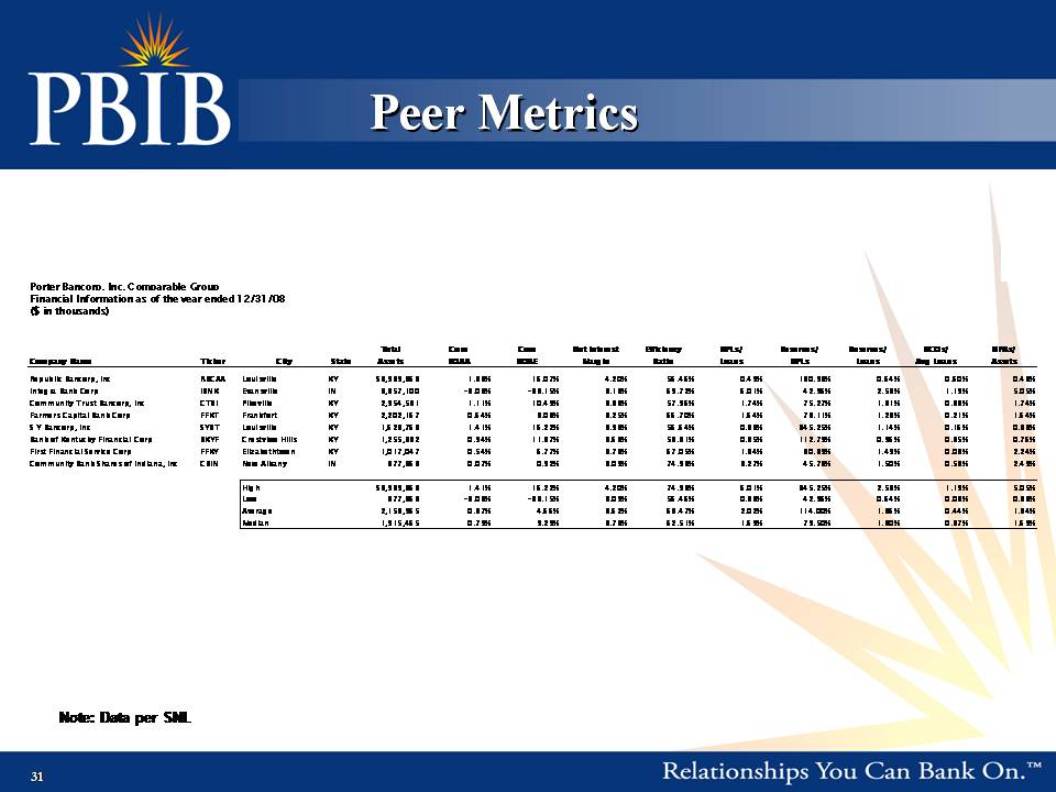

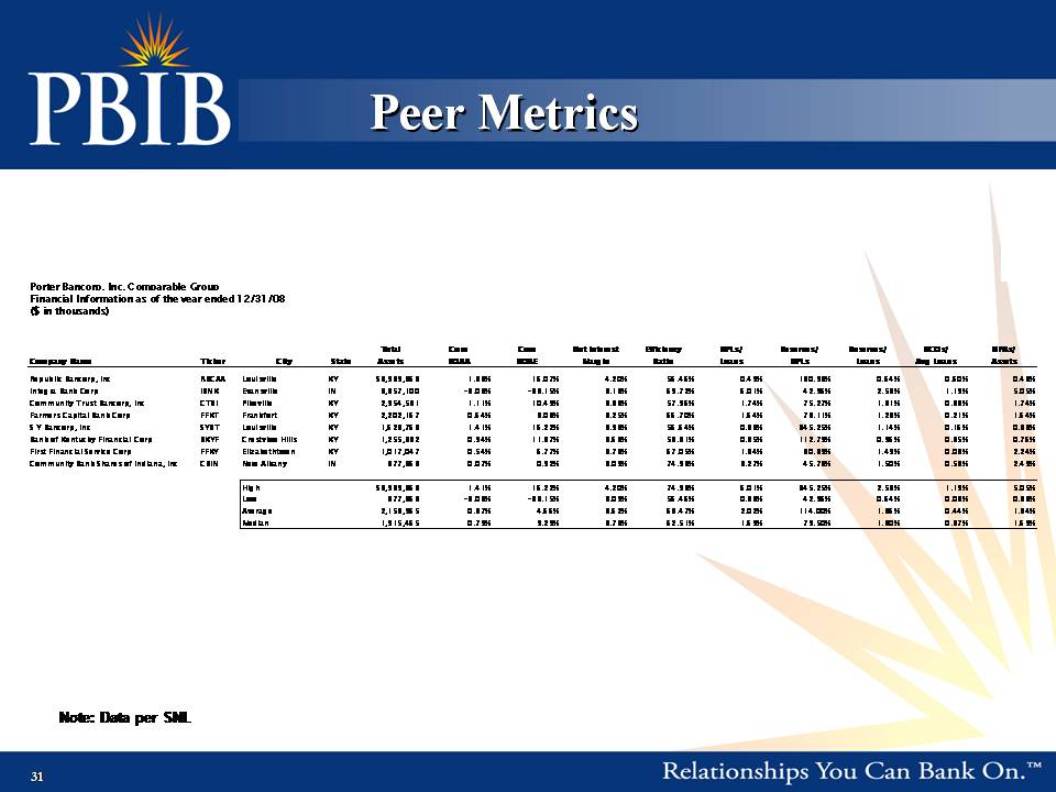

Peer Metrics Porter Bancorp, Inc. Comparable Group Financial Information as of the year ended 12/31/08 ($ in thousands) Total Core Core Net Interest Efficiency NPLs/ Reserves/ Reserves/ NCOs/ NPAs/ Company Name Ticker City State Assets ROAA ROAE Margin Ratio Loans NPLs Loans Avg Loans Assets Republic Bancorp, Inc RBCAA Louisville KY $3,939,368 1.33% 16.07% 4.20% 56.46% 0.49% 130.98% 0.64% 0.60% 0.43% Integra Bank Corp IBNK Evansville IN 3,357,100 -3.08% -33.15% 3.18% 69.72% 6.01% 42.96% 2.58% 1.19% 5.05% Community Trust Bancorp, Inc CTBI Pikeville KY 2,954,531 1.11% 10.49% 3.88% 57.96% 1.74% 75.27% 1.31% 0.38% 1.74% Farmers Capital Bank Corp FFKT Frankfort KY 2,202,167 0.64% 8.08% 3.25% 66.70% 1.64% 78.11% 1.28% 0.21% 1.64% S Y Bancorp, Inc SYBT Louisville KY 1,628,763 1.41% 16.22% 3.93% 56.64% 0.33% 345.25% 1.14% 0.16% 0.38% Bank of Kentucky Financial Corp BKYF Crestview Hills KY 1,255,382 0.94% 11.87% 3.68% 58.31% 0.85% 112.79% 0.96% 0.35% 0.76% First Financial Service Corp FFKY Elizabethtown KY 1,017,047 0.54% 6.77% 3.78% 67.05% 1.84% 80.89% 1.49% 0.08% 2.24% Community Bank Shares of Indiana, Inc CBIN New Albany IN 877,363 0.07% 0.92% 3.09% 74.93% 3.27% 45.78% 1.50% 0.58% 2.49% High $3,939,368 1.41% 16.22% 4.20% 74.93% 6.01% 345.25% 2.58% 1.19% 5.05% Low 877,363 -3.08% -33.15% 3.09% 56.46% 0.33% 42.96% 0.64% 0.08% 0.38% Average 2,153,965 0.37% 4.66% 3.62% 63.47% 2.02% 114.00% 1.36% 0.44% 1.84% Median 1,915,465 0.79% 9.29% 3.73% 62.51% 1.69% 79.50% 1.30% 0.37% 1.69% Note: Data per SNL 31

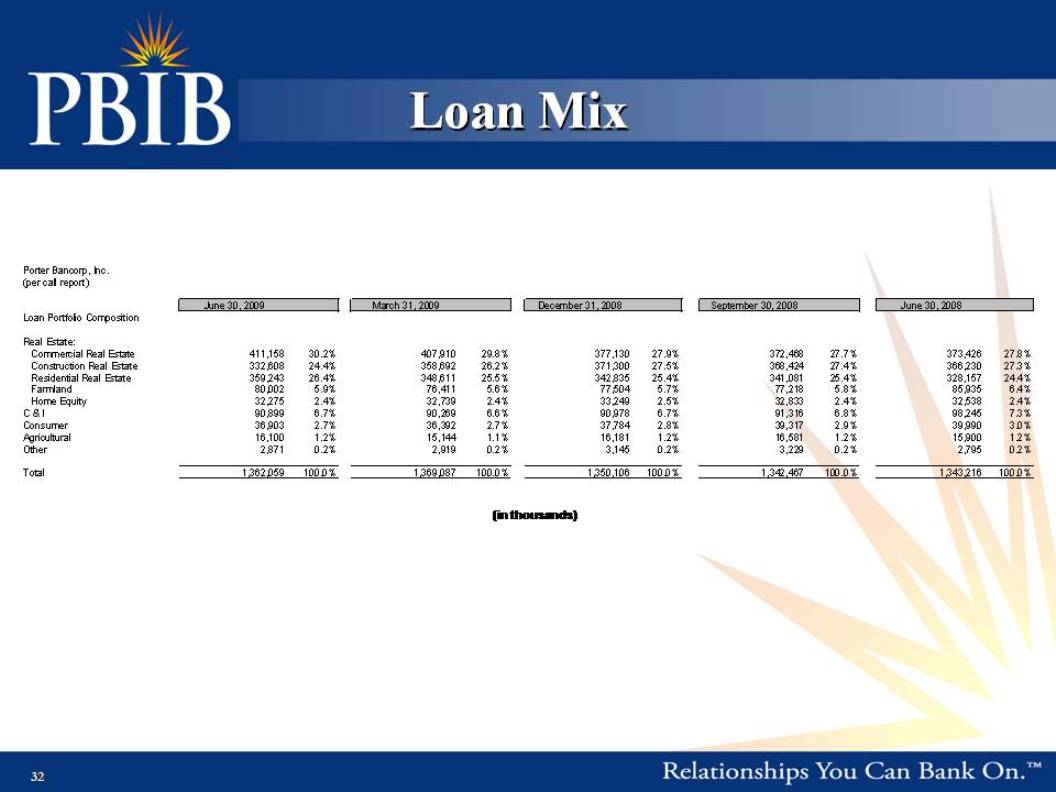

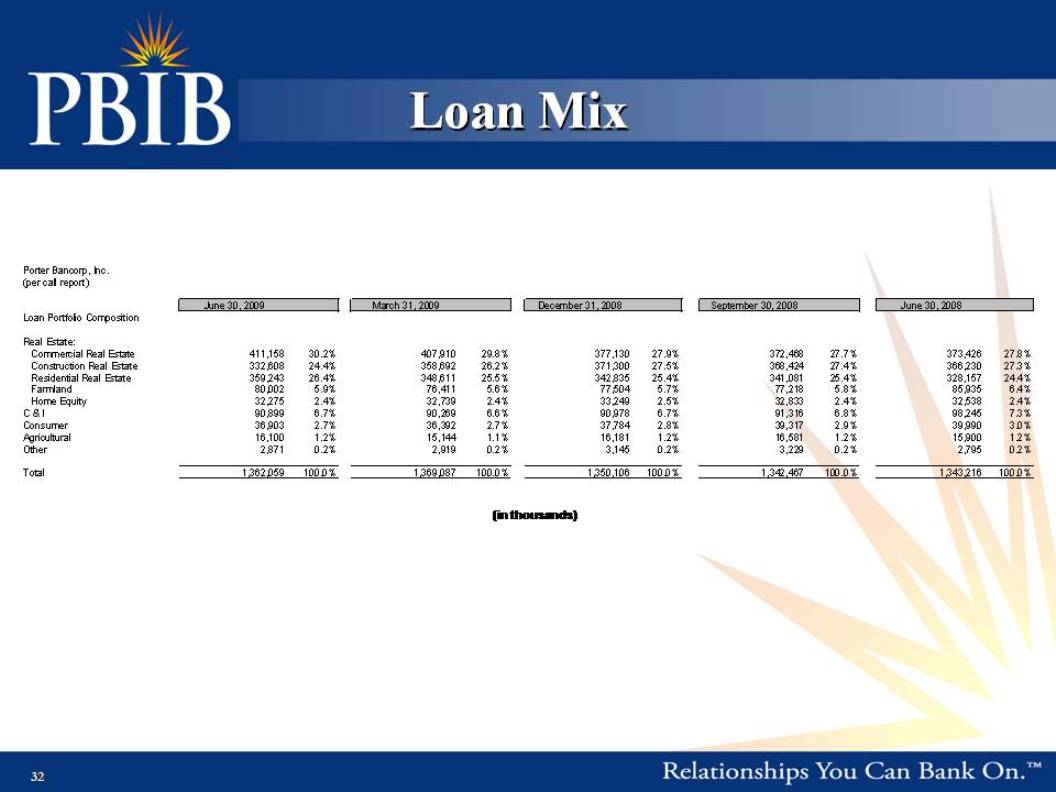

Loan Mix Porter Bancorp, Inc.(per call report) June 30, 2009 March 31, 2009 December 31, 2008 September 30, 2008 June 30, 2008 Loan Portfolio Composition Real Estate: Commercial Real Estate 411,158 30.2% 407,910 29.8% 377,130 27.9% 372,468 27.7% 373,426 27.8% Construction Real Estate 332,608 24.4% 358,692 26.2% 371,300 27.5% 368,424 27.4% 366,230 27.3% Residential Real Estate 359,243 26.4% 348,611 25.5% 342,835 25.4% 341,081 25.4% 328,157 24.4% Farmland 80,0025.9% 76,411 5.6% 77,5045.7% 77,218 5.8% 85,935 6.4% Home Equity 32,275 2.4% 32,739 2.4% 33,249 2.5% 32,833 2.4% 32,538 2.4% C & I 90,899 6.7% 90,269 6.6% 90,978 6.7% 91,316 6.8% 98,245 7.3% Consumer 36,903 2.7% 36,392 2.7% 37,784 2.8% 39,317 2.9% 39,990 3.0% Agricultural 16,100 1.2% 15,144 1.1% 16,181 1.2% 16,581 1.2% 15,900 1.2% Other 2,871 0.2% 2,919 0.2% 3,145 0.2% 3,229 0.2% 2,795 0.2% Total 1,362,059 100.0% 1,369,087100.0% 1,350,106 100.0% 1,342,467 100.0% 1,343,216100.0% (in thousands) 32

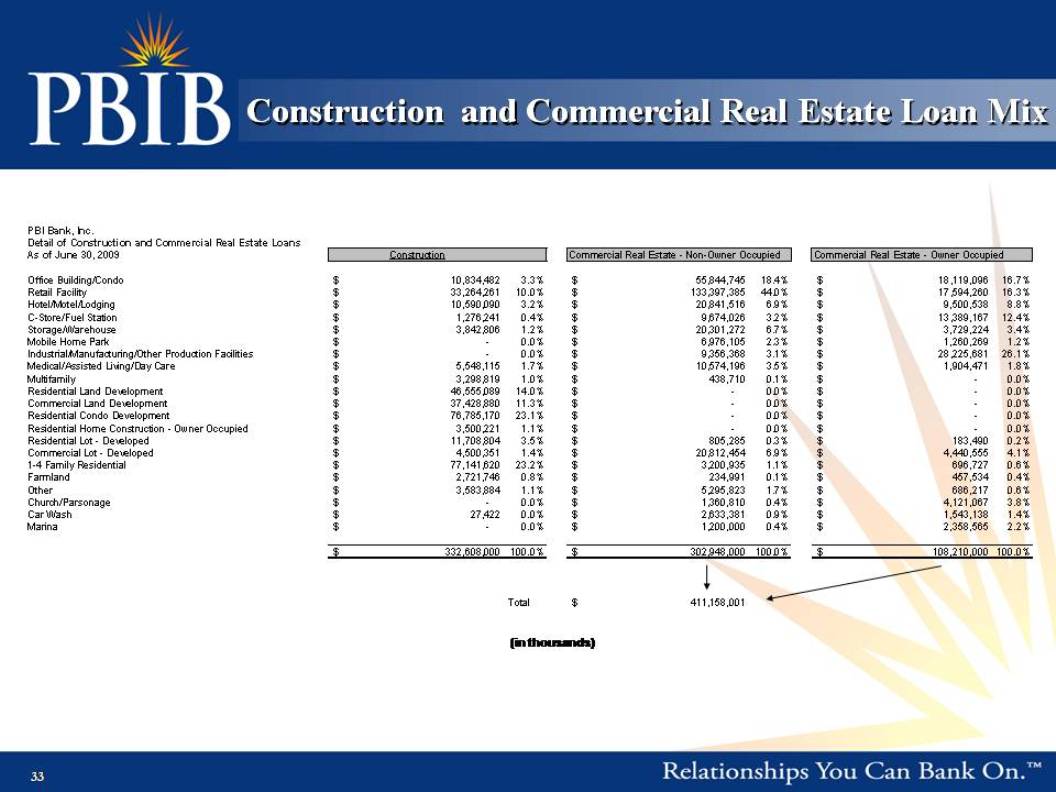

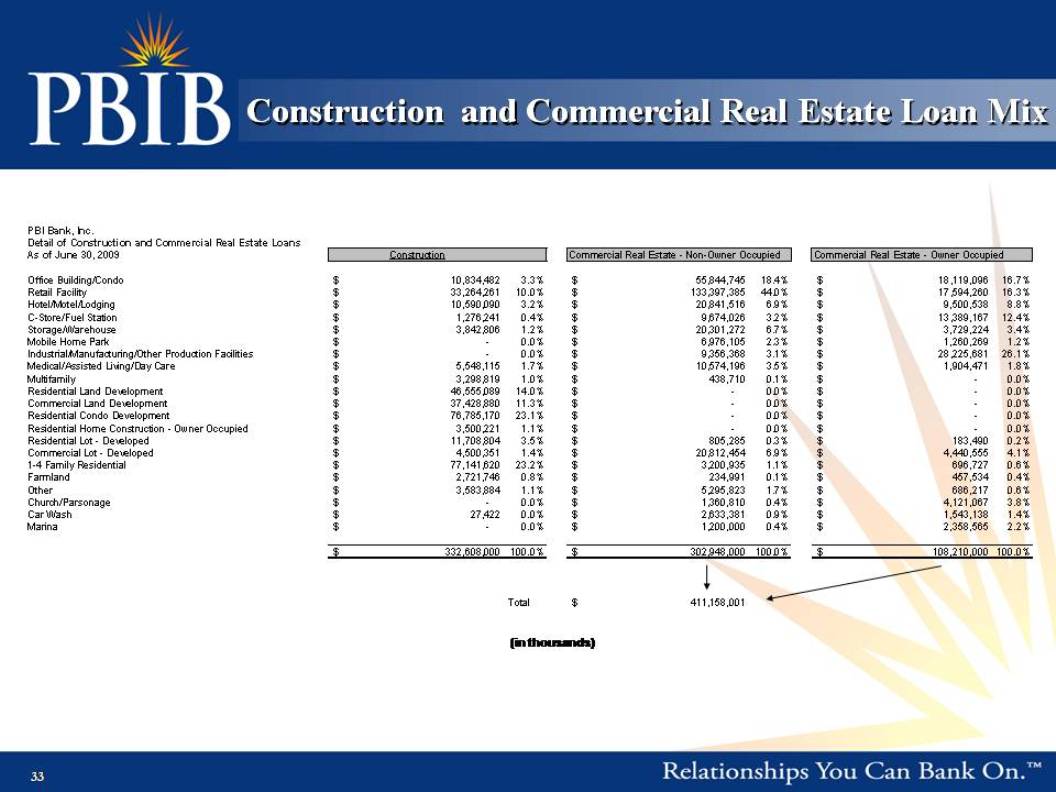

Construction and Commercial Real Estate Loan Mix PBI Bank, Inc. Detail of Construction and Commercial Real Estate Loans As of June 30, 2009 Construction Commercial Real Estate - Non-Owner Occupied Commercial Real Estate - Owner Occupied Office Building/Condo $10,834,482 3.3% $55,844,745 18.4% $18,119,096 16.7% Retail Facility $33,264,261 10.0% $133,397,385 44.0% $17,594,260 16.3% Hotel/Motel/Lodging $10,590,090 3.2% $20,841,516 6.9% $9,500,538 8.8% C-Store/Fuel Station $1,276,241 0.4% $9,674,026 3.2% $13,389,167 12.4% Storage/Warehouse $3,842,806 1.2% $20,301,272 6.7% $3,729,224 3.4% Mobile Home Park $- 0.0% $6,976,105 2.3% $1,260,269 1.2% Industrial/Manufacturing/Other Production Facilities $- 0.0% $9,356,368 3.1% $28,225,681 26.1% Medical/Assisted Living/Day Care $5,548,115 1.7% $10,574,196 3.5% $1,904,471 1.8% Multifamily $3,298,819 1.0% $438,710 0.1% $- 0.0% Residential Land Development $46,555,089 14.0% $- 0.0% $- 0.0% Commercial Land Development $37,428,880 11.3% $- 0.0% $- 0.0% Residential Condo Development $76,785,170 23.1% $- 0.0% $- 0.0% Residential Home Construction - Owner Occupied $3,500,221 1.1% $- 0.0% $- 0.0% Residential Lot - Developed $11,708,804 3.5% $805,285 0.3% $183,490 0.2% Commercial Lot - Developed $4,500,351 1.4% $20,812,454 6.9% $4,440,555 4.1% 1-4 Family Residential $77,141,620 23.2% $3,200,935 1.1% $696,727 0.6% Farmland $2,721,746 0.8% $234,991 0.1% $457,534 0.4% Other $3,583,884 1.1% $5,295,823 1.7% $686,217 0.6% Church/Parsonage $- 0.0% $1,360,810 0.4% $4,121,067 3.8% Car Wash $27,422 0.0% $2,633,381 0.9% $1,543,138 1.4% Marina $- 0.0% $1,200,000 0.4% $2,358,565 2.2% $332,608,000 100.0% $302,948,000 100.0% $108,210,000 100.0% Total $411,158,001 (in thousands) 33