April 17, 2012

To our shareholders:

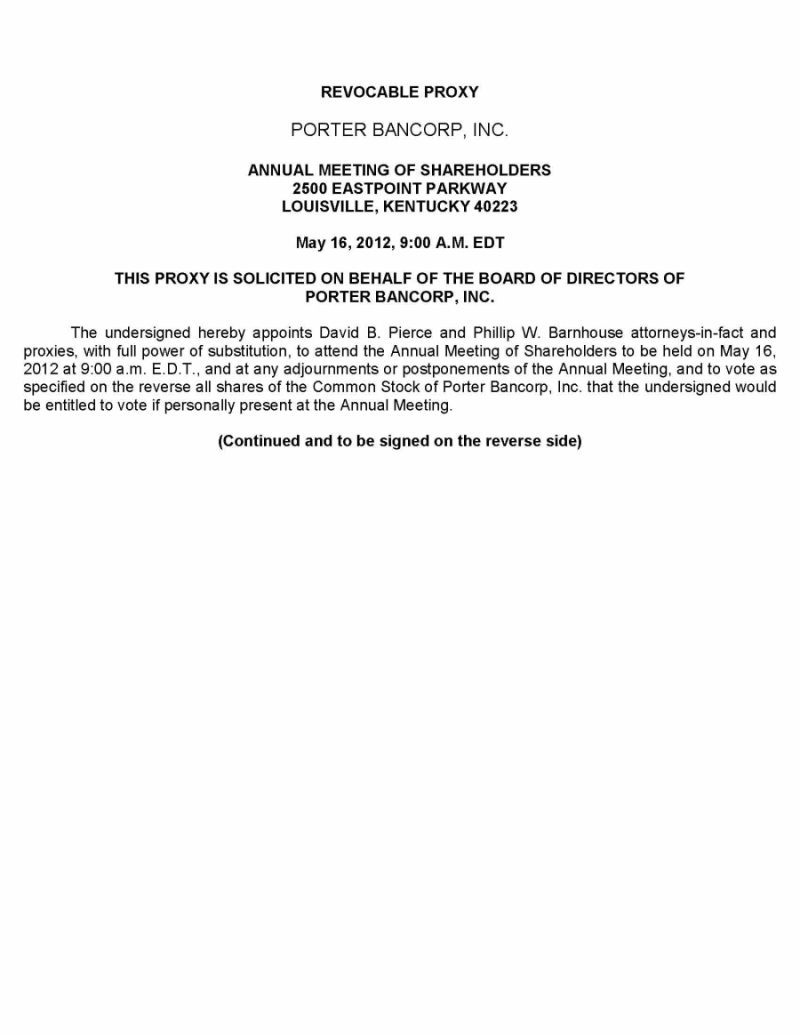

You are cordially invited to attend the 2012 annual meeting of shareholders of Porter Bancorp, Inc. The meeting will be held on Wednesday, May 16, 2012, at 9:00 a.m. EDT in the Conference Center on the second floor of our main office located at 2500 Eastpoint Parkway, Louisville, Kentucky 40223.

The enclosed Notice and Proxy Statement contain information about the matters to be voted on at the annual meeting.

We hope you can attend the annual meeting. Whether or not you plan to attend, please complete, sign and return the enclosed proxy card in the envelope provided to ensure your shares are represented and voted at the annual meeting.

We appreciate your interest and investment in Porter Bancorp and look forward to seeing you at the annual meeting.

| | By order of the Board of Directors, |

| | |

| |  |

| | |

| | Maria L. Bouvette |

| | President and CEO |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OF PORTER BANCORP, INC.

WEDNESDAY, MAY 16, 2012

To our shareholders:

Notice is hereby given that the annual meeting of shareholders of Porter Bancorp, Inc. will be held on Wednesday, May 16, 2012, at 9:00 a.m. EDT in the Conference Center on the second floor of our main office located at 2500 Eastpoint Parkway, Louisville, Kentucky 40223, to consider and act upon the following matters:

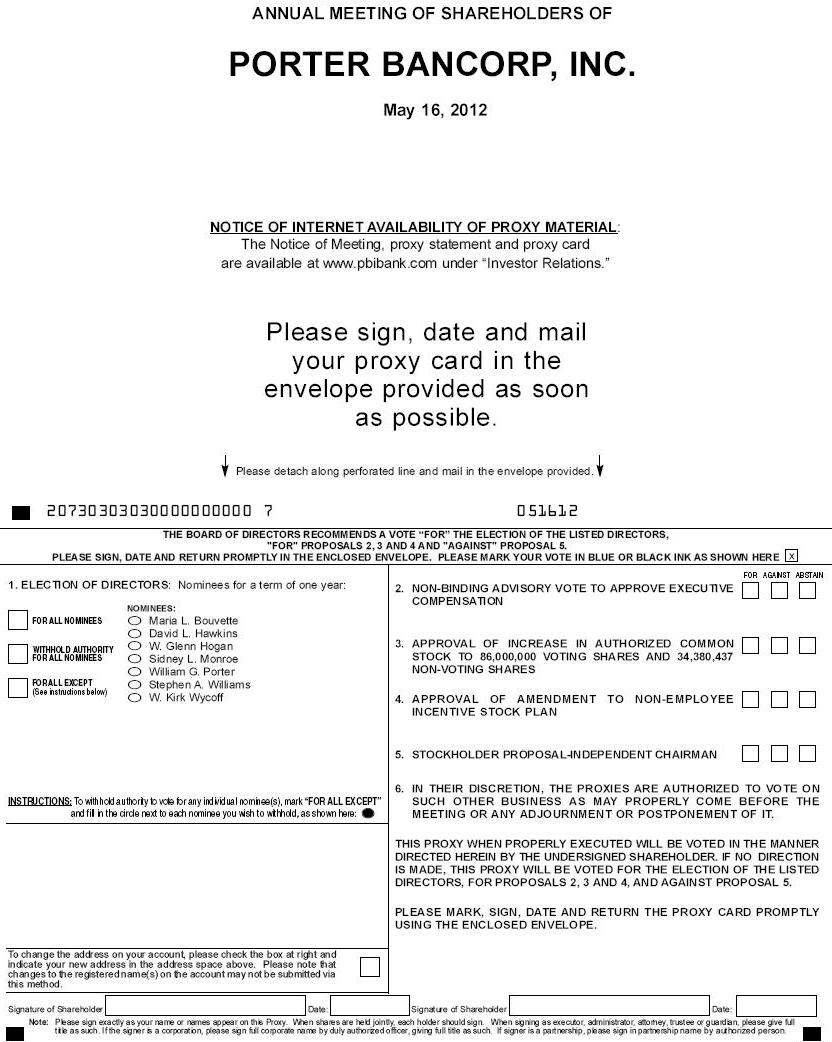

| | 1. | Election of seven nominees as directors; |

| | 2. | Proposal to approve, in a non-binding advisory vote, the compensation of the company’s executives as disclosed in the accompanying proxy statement; |

| | 3. | Proposal to increase the authorized shares of common stock to 86,000,000 shares of voting common stock and to 34,380,437 million shares of non-voting common stock; |

| | 4. | Proposal to amend the 2006 Non-employee Director Incentive Stock Plan; |

| | 5. | Stockholder proposal; and |

| | 6. | Such other business as may properly come before the meeting. |

The close of business on March 28, 2012 is the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting of Shareholders.

Whether or not you plan to attend the meeting, please sign, date and promptly return the enclosed proxy. If for any reason you desire to revoke your proxy, you may do so at any time before the voting as described in the accompanying proxy statement.

| | By order of the Board of Directors, |

| | |

| |  |

| | |

| | Maria L. Bouvette |

| | President and CEO |

April 17, 2012

Important Notice Regarding the Availability of Proxy Materials for the

Shareholders Meeting to be Held on May 16, 2012:

This proxy statement and our 2011 Annual Report to Shareholders,

including Form 10-K, are available at www.pbibank.com under “Investor Relations.”

2012 ANNUAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

QUESTIONS AND ANSWERS

IMPORTANT NOTICE REGARDING THE AVAILABLILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 16, 2012:

The proxy statement, annual report on Form 10-K, and shareholder letter are available at www.pbibank.com under “Investor Relations.”

Why am I receiving these materials?

We are sending this Proxy Statement and the accompanying proxy card to our shareholders of record beginning on or about April 16, 2012. These materials are for use at the 2012 Annual Meeting of Porter Bancorp Shareholders, which will be held on May 16, 2012, at 9:00 a.m. EDT in the Conference Center on the second floor of our main office located at 2500 Eastpoint Parkway, Louisville, Kentucky 40223. Our Board of Directors is soliciting proxies to give all shareholders of record an opportunity to vote on matters to be presented at the Annual Meeting. In the following pages of this Proxy Statement, you will find information on matters to be voted upon at the Annual Meeting of Shareholders or any adjournment of that meeting.

Who Can Vote?

You are entitled to vote if you were a shareholder of record of Porter Bancorp stock as of the close of business on March 28, 2012. Your shares can be voted at the meeting only if you are present in person or represented by a valid proxy.

What constitutes a quorum and how many shares are outstanding?

A majority of the votes entitled to be cast by the holders of the outstanding shares of Porter Bancorp stock must be present, either in person or represented by proxy, in order to conduct the Annual Meeting of Porter Bancorp Shareholders. On March 28, 2012, there were 11,822,381shares of Porter Bancorp stock outstanding.

Who is entitled to vote?

Holders of Porter Bancorp stock are entitled to one vote on each matter submitted to a vote of shareholders for each share of Porter Bancorp stock owned on March 28, 2012. All shares entitled to vote and represented in person or by properly completed proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted in accordance with instructions indicated on those proxies.

You are voting on five items:

| | 1. | The election of seven directors; |

| | 2. | A proposal to approve, in a non-binding advisory vote, the compensation of the company’s executives as disclosed under “Executive Compensation”; |

| | 3. | A proposal to increase the authorized shares of common stock to 86,000,000 shares of voting common stock and to 34,380,437 million shares of non-voting common stock; |

| | 4. | A proposal to amend our 2006 Non-employee Director Incentive Stock Plan; and |

| | 5. | A stockholder proposal that the Chairman of the Board not be an employee. |

Our board recommends that you vote your shares “FOR” each of the seven nominees for election as directors, “FOR” items 2, 3 and 4 above, and “AGAINST” item 5 above. We are not aware of any other business to be acted upon at the annual meeting

How many votes are required for approval?

Directors are elected by a plurality of the votes cast, which means the seven nominees who receive the largest number of properly executed votes will be elected as directors. Cumulative voting is not permitted. Shares that are represented by proxies marked “withhold authority” for the election of one or more director nominees will not be counted in determining the number of votes cast for those persons. The remaining matters to be considered at the meeting will be approved if the number of votes cast in favor of the matter is greater than the number opposing it. Abstentions will be counted as present for purposes of determining whether a quorum exists, but will have no effect on the outcome of any matter.

You may vote by proxy or in person at the meeting. To vote by proxy, simply mark your proxy card, date and sign it and return it in the envelope provided. The Board has designated two individuals to vote the shares represented by proxies solicited by the Board at the Annual Meeting. If you properly submit a proxy but do not specify how you want your shares to be voted, your shares will be voted by the designated proxies:

● | “FOR” the election of all of the director nominees; |

● | “FOR” the approval of our executive compensation, the increase in our authorized voting and non-voting common stock, and the amendment to our 2006 Non-employee Director Incentive Stock Plan ; and |

● | “AGAINST” the stockholder proposal. |

The designated proxies will vote in their discretion on any other matter that may properly come before the meeting. At the date the Proxy Statement went to press, we did not anticipate that any other matters would be raised at the Annual Meeting.

If you wish to vote in person at the meeting and you hold your shares through a broker, bank or other institution, you are considered a “street name” shareholder and you must obtain a “legal proxy” from your broker or bank in order to vote in person at the meeting. Please contact the institution holding your shares for information on how to obtain a legal proxy.

How can I revoke my proxy?

If you vote by proxy, you may revoke that proxy at any time before it is voted at the meeting. You may do this by (a) signing another proxy card with a later date and returning it to us before the meeting or (b) attending the meeting in person and casting a ballot.

How may I obtain Porter Bancorp’s 10-K and other financial information?

A copy of our 2011 Annual Report on Form 10-K, is enclosed. Shareholders and prospective investors may request a free copy of our 2011 Annual Report on Form 10-K by writing to:

Phillip W. Barnhouse

Chief Financial Officer

Porter Bancorp, Inc.

2500 Eastpoint Parkway

Louisville, Kentucky 40223

502-499-4800

The Form 10-K is also available at www.pbibank.com. Click on “Investor Relations” and “SEC Filings.”

Who can help answer my questions?

If you have questions or would like to receive additional copies of this proxy statement or voting materials, please contact Phillip W. Barnhouse, Chief Financial Officer, as described above.

1. ELECTION OF DIRECTORS

Our Board of Directors is comprised of seven directors who serve for a one-year term and until their successors are elected and qualified. Our articles of incorporation and bylaws provide for a board of directors consisting of not less than two nor more than 15 members, with the actual number of directors to be set by the board of directors. The number of directors is currently fixed at seven. The Nominating and Corporate Governance Committee and the Board of Directors have nominated the following individuals for election as directors: Maria L. Bouvette, David L. Hawkins, W. Glenn Hogan, Sidney L. Monroe, Stephen A. Williams, W. Kirk Wycoff and William G. Porter. Each of the nominees other than William G. Porter is a current member of the Board of Directors; William G. Porter is a current director of PBI Bank. None of the nominees currently serves as a director of any other public or registered investment company, nor have they held any such directorship, except as indicated below.

J. Chester Porter, who has served as our Chairman of the Board since founding the Company 25 years ago, recently informed us that he would not stand for re-election to the Board and would be stepping down as an executive officer of Porter Bancorp and PBI Bank at the annual meeting. Mr. Porter will be named Chairman Emeritus after the annual meeting. We are very fortunate to have the benefit of his continued counsel regarding the banking community in Kentucky and his legal acumen.

Neither the Nominating and Corporate Governance Committee nor the Board of Directors has reason to believe that any nominee for director is unwilling or unable to serve following election. However, if that were to occur, the holders of the proxies solicited hereby will vote for such substitute nominees as the Nominating and Corporate Governance Committee or the Board of Directors may recommend.

The following table provides biographical information for each nominee and our other executive officers:

Nominee | Age | Principal Occupation and Other Information | Director Since |

| Maria L. Bouvette | 55 | Ms. Bouvette is our president and chief executive officer. She also serves as chief financial officer and a director of two affiliated banks. Ms. Bouvette is a CPA and brings us 29 years of experience in the banking industry. Ms. Bouvette has skills and extensive experience with management, public accounting and finance. Through her 25 years of service to our company, Ms. Bouvette has also developed a deep institutional knowledge and perspective regarding our strengths, challenges and opportunities. Ms. Bouvette is a member of the board of trustees of Norton Healthcare, a not-for-profit integrated healthcare delivery organization. Before joining Porter, Ms. Bouvette served as a manager of Deloitte Haskins & Sells (now Deloitte & Touche). | 1988 |

| David L. Hawkins | 56 | Mr. Hawkins is a CPA, farmer and private investor. Mr. Hawkins has extensive financial industry experience, and brings both financial services and corporate governance perspective to Porter Bancorp as the former president and chief executive officer of Pioneer Bank, Canmer, Kentucky (which merged with us in 1994). Mr. Hawkins has served as a director of PBI Bank or one of its predecessors since 1994. Mr. Hawkins also brings to us experience and skills in public accounting as a certified public accountant. Before becoming president and chief executive officer of Pioneer Bank, Mr. Hawkins was a partner in Taylor, Polson, Woosley and Hawkins, a public accounting firm in Glasgow, Kentucky. Mr. Hawkins serves as the chairman of our audit committee and is a member of our nominating and corporate governance committee. | 2006 |

| W. Glenn Hogan | 50 | Mr. Hogan is founder, president and chief executive officer of Hogan Real Estate, a full service commercial real estate development company headquartered in Louisville, Kentucky. Hogan Real Estate provides real estate services for retailers, institutional and private property owners and investors. Mr. Hogan has over twenty years of real estate development experience and has developed over five million square feet of retail space in the Midwest and Southeast. Mr. Hogan is a certified commercial investment member and is past president of the Kentucky State CCIM Chapter. Mr. Hogan brings executive decision making and risk assessment skills as a result of his experience in the commercial real estate industry. Mr. Hogan’s experience in real estate development is especially important as we manage through the current downturn. Mr. Hogan also brings to us experience and skills in the banking industry and governance perspective and experience from his previous service on the board of directors of another community bank based in Louisville. Mr. Hogan served as a director of US Wireless Online, Inc. from August 2005 until May 2006. Mr. Hogan serves as chairman of our compensation committee and as chairman of our nominating and corporate governance committee. | 2006 |

| Sidney L. Monroe | 71 | Mr. Monroe is a retired certified public accountant who brings to us skills in public accounting and extensive experience in the banking industry. From 1990 to 2001, Mr. Monroe was a partner in Kent, Gay and Monroe, an audit and consulting services firm that primarily advised small and medium-sized businesses. Before 1990, he held numerous positions during a 20 year career at Deloitte Haskins & Sells (now Deloitte & Touche), including partner in charge of several offices, including the Louisville office. While at Deloitte, Mr. Monroe was designated as a specialist in the financial institutions field. Mr. Monroe serves as a member of our audit committee. | 2006 |

| Stephen A. Williams | 61 | Mr. Williams is President and Chief Executive Officer of Norton Healthcare, a not-for-profit integrated healthcare delivery organization that is the largest healthcare provider and third largest employer in Louisville, Kentucky. Norton Healthcare owns and operates five hospitals, 14 outpatient centers and 350 employed medical providers at some 50 locations. Norton Healthcare has approximately $1.5 billion in assets and over 10,000 employees, including 2,000 physicians. Mr. Williams brings executive decision making skills and business acumen to us as the leader of a large business organization and has over 39 years of experience overseeing the preparation of financial statements and the review of accounting matters. Mr. Williams serves as a member of our audit and compensation committees and as the lead independent director. | 2006 |

W. Kirk Wycoff | 53 | Mr. Wycoff has been a managing member of Patriot Financial Partners, L.P., a private equity fund headquartered in Philadelphia focused on investing in community banks and thrifts throughout the U.S. since 2007. Mr. Wycoff also currently serves as Chairman of Continental Bank of Plymouth Meeting, Pennsylvania, a $500 million community bank. From 2005 to 2007, Mr. Wycoff served as President and CEO of Continental Bank. From 1991 to 2004, Mr. Wycoff served as Chairman and CEO of Progress Financial Corp. During his tenure with Progress, the bank grew from $280 million in assets and seven offices, to more than $1.2 billion in assets and 21 offices. Early in his career, Mr. Wycoff served as Chairman and CEO of Crusader Savings Bank, a Philadelphia community bank, which he transformed into a profitable mortgage lender. He also held senior level positions with Girard Bank and the Philadelphia Savings Fund Society. Mr. Wycoff also serves as a director of three other bank holding companies, Heritage Commerce Corp, Guaranty Bancorp, and Square 1 Financial, Inc. Mr. Wycoff brings extensive leadership and community banking experience to our Board, including executive management experience, as well as public company expertise and risk assessment skills. In addition, he provides the perspective of a significant, non-employee investor. Mr. Wycoff has been designated by Patriot Financial Partners to serve on our board of directors, as provided by the terms of our June 2010 stock purchase agreement. Mr. Wycoff serves as a member of our compensation and nominating and corporate governance committees. | 2010 |

| William G. Porter | 74 | William G. Porter is a retired certified public accountant who has had a 43-year career as a senior executive in the manufacturing industry. He has been nominated to succeed his brother, J. Chester Porter. William Porter is currently the Executive Vice President of The Peoples Bank, Taylorsville, Kentucky, in which he and his brother each own a 50% interest. William Porter is a substantial shareholder of Porter Bancorp in his own right, and has served as a director of PBI Bank since September 2006. In addition to his experience in community banking, William Porter also served for more than 20 years as the president of hardware manufacturing companies, adding the perspective of a chief executive officer in a non-financial industry to the Board. | Director of PBI Bank since 2006 |

| Other Executive Officers | Age | Principal Occupation and Other Information | |

| David B. Pierce | 52 | As Chief Risk Officer, David B. Pierce has assumed responsibility for risk management for both Porter Bancorp and PBI Bank. He had served as Chief Financial Officer of Porter Bancorp since 2006 and in a number of executive positions with Porter Bancorp’s subsidiary banks from 1990 through 2005. From 1984 to 1989, Mr. Pierce was a manager at Coopers & Lybrand (now PricewaterhouseCoopers) where he was responsible for audits of public and private entities including financial institutions. Before 1984, Mr. Pierce was a senior accountant at Deloitte Haskins & Sells (now Deloitte & Touche). He is a certified public accountant and has over 20 years of banking and management experience. Mr. Pierce also serves as a director of PBI Bank. | |

| Phillip W. Barnhouse | 41 | Phil W. Barnhouse became our Chief Financial Officer in 2012 and has served as Chief Financial Officer of PBI Bank since 2006. He served as Chief Financial Officer of Ascencia Bank from 1998 until it was merged into PBI Bank at the end of 2005. From 1992 to 1998, Mr. Barnhouse worked with Arthur Andersen LLP, where he managed the audits of public and private companies. He is a member of the American Institute of Certified Public Accountants and the Kentucky Society of CPAs. Mr. Barnhouse earned a Bachelor's degree in Accounting at Western Kentucky University and a diploma from The Graduate School of Banking at Louisiana State University. | |

The Board recommends that you vote “FOR” the election of the seven nominees.

CORPORATE GOVERNANCE

Corporate Governance Principles

Our board of directors has adopted corporate governance principles that address the role and composition of our board of directors and the functions of our board and the board’s committees. We regularly review and may revise our corporate governance principles from time to time in response to changing regulatory requirements, evolving best practices and concerns expressed by our shareholders and other constituents. Our corporate governance principles are available on our website at www.pbibank.com under “Investor Relations” and “Corporate Governance.”

Controlled Company Status and Director Independence

We are a “controlled company” within the meaning of the NASDAQ corporate governance rules by virtue of the voting control of J. Chester Porter and Maria L. Bouvette, who together own more than 50% of our sole class of voting stock. A “controlled company” may elect not to comply with the following NASDAQ corporate governance rules:

| | • | | A majority of its board of directors must consist of “independent directors,” as defined by the NASDAQ rules; |

| | • | | Decisions regarding the compensation paid to executive officers must be made either by a compensation committee composed entirely of independent directors or by a majority of the independent directors; and |

| | • | | Nominations for election to the board of directors must be made either by a nominating and corporate governance committee composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities or by a majority of the independent directors. |

Despite our “controlled company” status, we have elected to comply with all of these NASDAQ corporate governance rules.

The “controlled company” exception does not modify requirements under the Securities Exchange Act of 1934, SEC rules and the NASDAQ corporate governance rules that we have an audit committee comprised of at least three directors, all of whom must be independent as defined by the Exchange Act and the SEC and NASDAQ rules. We anticipate that at least one member of our audit committee will always qualify as an audit committee financial expert.

Our principles provide that it is our policy that a majority of the members of the Board be independent from management. For this purpose, the Board has adopted Director Independence Standards that meet the listing standards of the NASDAQ corporate governance rules. In accordance with our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee undertakes an annual review of director independence during the first quarter of each year. During this review, the Board considers any and all commercial and charitable relationships of directors, including transactions and relationships between each Director or any member of his or her immediate family and the Company and its subsidiaries.

Following the review in 2012, the Board affirmatively determined that David L. Hawkins, W. Glenn Hogan, Sidney L. Monroe, Stephen A Williams and W. Kirk Wycoff are each independent of the Company and its management in that none have any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, in accordance with the NASDAQ corporate governance rules.

Following our Chairman J. Chester Porter’s decision not to stand for reelection to our Board of Directors in March, we nominated his brother William G. Porter for election as our seventh director. William Porter has already been serving as a director of PBI Bank since 2006 and is a substantial shareholder in his own right. He had a 43-year career as a senior executive of a number of manufacturing companies, and has been an owner, director and executive officer of community banks. The transactions between PBI Bank and The Peoples Bank, Taylorsville, Kentucky, in which J. Chester Porter and William G. Porter each own a 50% interest, are described in greater detail below under “Certain Relationships and Related Transactions --Management Service Agreements and Loan Participations with Banks Under Common Control.”

Director Nominations and Qualifications

In making its nominations for persons to be elected to the board of directors and included in our proxy statement, the Nominating and Corporate Governance Committee evaluates incumbent directors, board nominees and persons nominated by shareholders, if any. The committee reviews each candidate in light of the selection criteria set forth in our corporate governance principles. Candidates are selected based on their integrity, independence, diversity of experience, leadership and their ability to exercise sound judgment. While we do not have a separate diversity policy, the committee does consider the diversity of experience of its nominees in knowledge, skills, expertise and other demographics that may contribute to the board. When considering potential board members, the committee will look at all of the foregoing criteria and the current and anticipated needs of the Company. The various qualifications and criteria are normally considered at a committee meeting during the month of January of each calendar year so that the respective names can be placed on the ballot for the annual meeting which is customarily held in May. All of the nominees for election as directors for the 2012 annual meeting were nominated by the committee. The committee did not receive any stockholder nominations for directors.

Board Leadership Structure

As a result of J. Chester Porter’s decision to step down as Chairman of the Board and as an executive officer, our Company’s leadership structure will change following the annual meeting. We anticipate that Maria L. Bouvette, currently President and Chief Executive Officer of the Company and PBI Bank, will also become Chairman of the Company and PBI Bank. As a co-founder of Porter Bancorp and the holder of more than 24% of our outstanding common stock, we believe that Ms. Bouvette is the appropriate person to succeed Mr. Porter as Board Chairman. Her substantial ownership interest gives her a personal financial interest in the Company’s performance that is well aligned with the interests of shareholders. Ms. Bouvette will continue to serve as the President and Chief Executive Officer of Porter Bancorp, where her experience and knowledge of the opportunities and challenges facing our Company will enable her to provide strategic leadership to the entire organization.

As part of its succession planning process, the Board intends to name a new President and Chief Executive Officer of PBI Bank with responsibility for day-to-day management of our banking operations. Appointing a separate chief executive of PBI Bank will allow Ms. Bouvette to focus more on strategic organization-wide matters. We believe by reallocating operational authority through this appointment and the other recent changes to our senior management team, we will have strengthened our leadership and operational oversight function. The Board’s five independent directors are serving as a search committee to identify and hire the new PBI Bank Chief Executive Officer.

With the addition of William G. Porter to our Board of Directors, six of its seven members will be non-employee directors. We believe it is important to continue to have a member of the Porter family serve on our Board. William Porter has been a director of PBI Bank since 2006, and has had a 43-year career as an executive of a number of manufacturing companies in addition to his banking experience. William Porter is a significant shareholder, but does not have voting power with respect to the shares held by his brother, the holder of approximately 27% of our outstanding common stock.

We believe that having a substantial majority of independent directors creates an effective counterbalance to having a Chairman and Chief Executive Officer. Consistent with NASDAQ’s listing requirements, the independent directors meet regularly in executive session without management or any non-independent directors in attendance. Stephen A. Williams serves as the “lead” independent director. The lead independent director assists the board in communicating issues to management and serves as chairman of the independent director executive sessions. The Board as a whole actively considers strategic decisions proposed by management, including matters affecting the business strategy and competitive and financial positions of the Company, and also monitors the Company’s risk profile. Board meetings are focused on strategic matters affecting major areas of the Company’s business, including operational, execution and risk management initiatives. In 2011, the independent directors met four times in executive session.

Board Structure and Committee Composition

Our board of directors has established standing committees in connection with the discharge of its responsibilities. These committees include an audit committee, a compensation committee and a nominating and corporate governance committee. Our committee charters are available on our website at www.pbibank.com under “Investor Relations” and “Corporate Governance.”

Audit Committee

Our audit committee is comprised of Mr. Hawkins, Mr. Monroe and Mr. Williams. Our board of directors has determined that Messrs. Hawkins, Monroe and Williams currently meet the independence requirements of the NASDAQ corporate governance rules and relevant federal securities laws and regulations. The audit committee is responsible for and assists our board in monitoring the integrity of the financial statements, the qualifications and independence of our independent registered public accounting firm, the performance of our internal audit function and our independent registered public accounting firm and our compliance with legal and regulatory requirements. Mr. Hawkins and Mr. Monroe each qualify as an audit committee financial expert.

Compensation Committee

Our compensation committee is comprised of Mr. Hogan, Mr. Williams, Mr. Monroe and Mr. Wycoff. The compensation committee has overall responsibility for evaluating and approving our executive officer incentive compensation, benefit, severance, equity-based or other compensation plans, policies and programs. The compensation committee is also responsible for producing an annual report on executive compensation for inclusion in this proxy statement.

The compensation committee is responsible for establishing a compensation policy that fairly rewards our executive officers for performance benefiting the shareholders and effectively attracts and retains executive talent necessary to successfully lead and manage the Company. In practice, our Chief Executive Officer is expected to present a total compensation policy for the management team, which the compensation committee will evaluate and retains the right to modify or reject. The compensation committee is directly responsible for evaluating the performance of the Chief Executive Officer and determining the details of her total pay. The Committee also evaluates the Chief Executive Officer’s recommendations for the salaries and incentive compensation of other executives, which it will modify and authorize as it deems appropriate.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is comprised of Mr. Hogan, Mr. Hawkins, Mr. Monroe and Mr. Wycoff. The nominating and corporate governance committee assists our board of directors in promoting our best interests and the best interests of our shareholders through the implementation of sound corporate governance principles and practices. In furtherance of this purpose, the nominating and corporate governance committee identifies individuals qualified to become board members and recommend to our board of directors the director nominees for the next annual meeting of shareholders. It also reviews the qualifications and independence of the members of our board of directors and its various committees on a regular basis and makes any recommendations the committee members may deem appropriate from time to time concerning any recommended changes in the composition of our board.

Meeting Attendance

During 2011, our board of directors met 9 times. No director attended fewer than 75 percent of the total number of meetings of the board of directors and the committees on which he or she served. All directors and director nominees are expected to attend each annual meeting of shareholders, unless an emergency prevents them from doing so. All directors attended last year’s annual meeting.

Board’s Role in Risk Oversight

As a bank holding company, we face a number of risks, including general economic risk, credit risk, regulatory risk, liquidity risk, interest rate risk, audit risk, reputational risk and others. Management is responsible for the day-to-day management of risks to the company, and the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

While the full board of directors is charged with ultimate oversight responsibility for risk management, various standing committees of the board also have responsibilities with respect to our risk oversight. In particular, the audit committee plays a large role in monitoring and assessing our risk related to financial reporting and accounting matters as well as any other particular areas of concern of the board. The chair of our audit committee is also a director of our subsidiary, PBI Bank, as is William Porter who has been nominated for election to our board. In addition, each of our five independent directors will also be joining the PBI Bank board. The board’s compensation committee monitors and assesses the various risks associated with compensation policies, and oversees incentives that encourage performance subject to a level of risk-taking consistent with our overall strategy.

After PBI Bank entered into a consent order with the Federal Deposit Insurance Corporation and the Kentucky Department of Financial Institutions on June 24, 2011, the Board of Directors established a Risk Policy and Oversight Committee to lead the Board’s oversight of senior management's assessment and management of the risks of Porter Bancorp and PBI Bank, including credit risk, market risk, interest rate risk, investment risk, liquidity risk and reputational risk. Mr. Hawkins, Mr. Hogan, Mr. Monroe and Mr. Wycoff were appointed to the Oversight Committee. The Oversight Committee was authorized to review and consult with the PBI Bank board with respect to actions to be taken in response to the consent order. It was also authorized to investigate and evaluate the concerns raised in a 13D filing by Clinton Group LLC and its affiliates on July 11, 2011. The Oversight Committee reported on its actions with respect to both of these matters in our Quarterly Report on Form 10-Q filed on November 10, 2011. The Oversight Committee is expected to meet on an as-needed basis in the future.

Code of Business Conduct and Ethics

Our Board has adopted the Code of Business Conduct and Ethics that sets forth important company policies and procedures in conducting our business in a legal, ethical and responsible manner. These standards are applicable to all of our directors and employees. In addition, the Board has adopted the Code of Ethics for CEO and Senior Financial Officers that supplements the Code of Business Conduct and Ethics by providing more specific requirements and guidance on certain topics. The Code of Ethics for CEO and Senior Financial Officers applies to the Company’s Chairman, Chief Executive Officer and Chief Financial Officer. The Code of Ethics for CEO and Senior Financial Officers is available on our website at www.pbibank.com under “Investor Relations” and “Corporate Governance.” We will post any amendments to, or waivers from, our Code of Ethics for CEO and Senior Financial Officers on our website.

Employees must report any conduct they believe in good faith to be an actual or apparent violation of our Code of Conduct. In addition, as required under the Sarbanes-Oxley Act of 2002, the audit committee has established confidential procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by company employees of concerns regarding questionable accounting or auditing matters.

Stock Ownership Guidelines

Our Corporate Governance Guidelines require all non-employee directors to hold at least 1,000 of our shares while serving as a director of the Company. Shares that may be acquired through the exercise of stock options are included in calculating the number of shares of ownership to determine whether this minimum ownership requirement has been met. All directors are expected to be in compliance with the stock ownership guidelines within five years of becoming a director.

Board Compensation

Compensation of Directors

Each director receives a fee of $15,000 per year, which is paid in quarterly increments, and each non-employee director receives $500 for each committee meeting attended. Our executives who serve on the boards of directors of Porter Bancorp and PBI Bank are paid the same cash director fees as those paid to non-employee directors. Although paying cash director fees to “inside” executives who serve on boards of directors is not the prevalent market practice, it has been the historical practice at Porter Bancorp for many years and constitutes a small portion of affected executive’s total compensation amount. During 2011, directors J. Chester Porter, Maria L. Bouvette and David L. Hawkins also served as directors of PBI Bank. Each bank director receives $500 for each board meeting attended. The directors fees paid to Mr. Porter and Ms. Bouvette are included in the “All Other Compensation” column of the Summary Compensation Table.

In addition to the board and committee fees, non-employee directors have been automatically granted 500 restricted shares, and non-employee directors of PBI Bank are automatically granted 100 restricted shares on the first day of the month after our annual meeting of shareholders, which will ordinarily be June 1. We propose to amend the Directors Plan to the annual grant of restricted stock to an amount having a market value of $25,000. See Proposal to amend the 2006 Non-employee Director Incentive Stock Plan.

Restricted shares are shares of our common stock that may not be transferred, and are subject to forfeiture, during a specified period. Directors that are granted restricted shares will have all of the same rights as a shareholder, including the right to vote the restricted shares and the right to receive dividends. One-sixth of the restricted shares of common stock will vest on each six month anniversary of the date of grant as long as the director is continuing to serve on the board of directors. If a director ceases to serve on the board of directors for any reason, the director will automatically forfeit the unvested portion of the restricted shares. In the event of a change in control, the restriction on the sale of any unvested restricted shares will end. Under the Directors Plan, a change in control means (i) the disposal of our business or the business of PBI Bank pursuant to a liquidation, sale of assets or otherwise, (ii) any person, group or entity acquiring or gaining ownership or control of more than 50% of our outstanding shares or the outstanding shares of PBI Bank, other than any trustee or other fiduciary holding shares under any employee benefit plan, or (iii) during any period of two consecutive years, individuals who were our directors at the beginning of that period cease to constitute a majority of the board of directors, unless the election of each new director was approved by at least two-thirds of the directors then still in office who were directors at the beginning of the period.

The following table provides information on the compensation paid to non-employee directors 2011.

| Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Option Awards | All Other Compensation | Total |

| David L. Hawkins | $ 64,999 (3) | $3,216 | - | - | $71,015 | |

| W. Glenn Hogan | 18,000 (4) | 2,680 | - | - | 20,680 | |

| Sidney L. Monroe | 19,500 (5) | 2,680 | - | - | 22,180 | |

| Stephen A. Williams | 18,000 (6) | 2,680 | - | - | 20,680 | |

| W. Kirk Wycoff | 17,500 (7) | 2,680 | - | - | 20,180 | |

| (1) | Each director received four quarterly retainers of $3,750 and $500 for each committee meeting attended. |

| (2) | On June 1, 2011, each non-employee director received a restricted stock award of 500 shares with a grant date fair value of $5.36 per share. Mr. Hawkins received an additional restricted stock award of 100 shares as a member of PBI Bank’s board of directors. The restricted shares vest in one-sixth increments every six-month anniversary of the grant date over three years. The amounts in Stock Awards column reflects the grant date fair value for the restricted stock awards for the fiscal year ended December 31, 2011. The assumptions used in the calculation of these amounts for awards granted in 2011 are included in Note 20 “Stock Plans and Stock-based Compensation” in the “Notes to Consolidated Financial Statements” included within our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. |

| (3) | Mr. Hawkins received $2,500 for attendance at audit committee meetings, $500 for nominating and corporate governance committee meetings, and $37,999 for his service on the Board’s Risk Policy and Oversight Committee during 2011. He also received $6,000 in PBI Bank director fees and $3,000 for attendance at meetings of the trust committee. |

| (4) | Mr. Hogan received $500 for attendance at compensation committee meetings, $500 for nominating and corporate governance committee meetings, and $2,000 for risk policy and oversight committee meetings during 2011. |

| (5) | Mr. Monroe received $2,500 for attendance at audit committee meetings, and $2,000 for risk policy and oversight committee meetings during 2011. |

| (6) | Mr. Williams received $2,500 for attendance at audit committee meetings and $500 for compensation committee meetings during 2011. |

| (7) | Mr. Wycoff’s fees are paid to Patriot Financial Manager LP. Mr. Wycoff received $2,000 for attendance at risk policy and oversight committee meetings and $500 for compensation committee meetings. |

STOCK OWNERSHIP OF DIRECTORS, OFFICERS,

AND PRINCIPAL SHAREHOLDERS

As of March 28, 2012, Porter Bancorp had 11,822,381 shares of common stock issued and outstanding. The information provided below is based on our records, information filed with the SEC, and information provided to us, except where otherwise noted.

Under SEC rules, a person is deemed to beneficially own any shares as to which the entity or individual has the right to acquire within 60 days of March 28, 2012 through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole voting and investment power (or shares these powers with his or her spouse) with respect to the shares set forth in the following table.

Security Ownership of Directors and Management

The following table shows, as of March 28, 2012, the number and percentage of shares of common stock held by (1) Porter Bancorp’s directors and nominees, (2) each of the named executive officers set forth in the Summary Compensation Table and (3) current directors and named executive officers as a group.

Name and Address of Beneficial Owner(1) | | Amount and Nature of Beneficial Ownership of Common Stock | | Percent of Class |

Directors and Nominee | | | | |

J. Chester Porter(2) | | 3,198,405 | | 27.1% |

| Maria L. Bouvette | | 2,863,201 | | 24.2 |

David L. Hawkins(3) | | 11,879 | | * |

W. Glenn Hogan(4) | | 20,378 | | * |

Sidney L. Monroe(4) | | 13,647 | | * |

Stephen A. Williams(4) | | 10,262 | | * |

W. Kirk Wycoff(5)(6) | | 1,173,629 | | 9.9 |

| William G. Porter | | 409,008 | | 3.5 |

| | | | | |

Other Named Executive Officers | | | | |

David B. Pierce(8) | | 22,261 | | * |

| Phillip W. Barnhouse | | 7,590 | | * |

| | | | | |

Named Executive Officers and Directors as a Group (10 persons) | | 7,730,760 | | 65.3% |

| * | Represents beneficial ownership of less than 1%. |

| (1) | The business address for these individuals is c/o Porter Bancorp, Inc., 2500 Eastpoint Parkway, Louisville, Kentucky 40223. |

| (2) | Includes 4,542 shares of common stock held by a company of which Mr. Porter is the sole owner. |

| (3) | Includes 1,159 shares held jointly and 6,946 shares subject to exercisable options. |

| (4) | Includes 5,789 shares subject to exercisable options. |

| (5) | Includes 1,000,752 shares of common stock held by Patriot Financial Partners, L.P. and 172,877 shares of common stock held by Patriot Financial Partners Parallel, L.P. Patriot Financial Partners, GP, L.P. ("Patriot GP") is a general partner of each of Patriot Financial Partners, L.P. and Patriot Financial Partners Parallel, L.P. (together, the "Funds") and Patriot Financial Partners, GP, LLC ("Patriot LLC") is a general partner of Patriot GP. In addition, Mr. Wycoff is one of the general partners of the Funds and Patriot GP and a member of Patriot LLC. Accordingly, securities owned by the Funds may be regarded as being beneficially owned by Mr. Wycoff. |

| (6) | Does not include 1,086,156 shares of common stock underlying 317,042 shares of Series C Preferred Stock and warrants to purchase 717,393 shares of non-voting common stock held by the Patriot Funds. Both the non-voting preferred stock and the non-voting common stock convert into common stock automatically only if, and to the extent that, the holder beneficially owns, together with affiliates, less than 9.9% of the outstanding shares of common stock. |

| (8) | Includes 1,159 shares that are held by Mr. Pierce as trustee for a living trust. |

Security Ownership of Certain Beneficial Owners

The following table sets forth the beneficial ownership of the common stock by any shareholder known to us, based on public filings made with the SEC, to own 5% or more of the outstanding shares of our common stock.

Name and Address of Beneficial Owner(1) | | Amount and Nature of Beneficial Ownership of Common Stock | | Percent of Class | |

| | | | | | |

Patriot Financial Group(1) Cira Centre 2929 Arch Street, 27th Floor Philadelphia, PA 19104-2868 | | 1,173,629 | | 9.9 | % |

| | | | | | | |

Clinton Group, Inc. (3) West 57th Street, 26th Floor New York, NY 10019 | | 1,134,491 | | 9.4 | | |

| | | | | | | |

Mendon Capital Advisors Corp. (2) 150 Allens Creek Road Rochester, NY 14618 | | 978,907 | | 8.1 | | |

| | | | | | | |

Stieven Capital Advisors, L.P. (4) 12412 Powerscourt Drive, Suite 250 St. Louis, MO 63131 | | 714,598 | | 6.0 | | |

| (1) | The information is included in reliance on a Schedule 13D filed with the SEC on June 10, 2010, jointly on behalf of Patriot Financial Partners, L.P., Patriot Financial Partners Parallel, L.P., Patriot Financial Partners GP, L.P., Patriot Financial Partners GP, LLC, W. Kirk Wycoff, Ira M. Lubert and James J. Lynch (collectively, the “Patriot Financial Group”) and updated information provided to the Company. The shares listed in the table include 1,000,752 shares of common stock held by Patriot Financial Partners, L.P. and 172,877 shares of common stock held by Patriot Financial Partners Parallel, L.P. In addition to the listed shares, the Patriot Financial Group reported beneficial ownership of 317,042 shares of non-voting preferred stock and warrants to purchase 717,393 shares of non-voting common stock held by the Patriot Funds. Each share of both the non-voting preferred stock and the non-voting common stock converts into 1.05 shares of voting common stock automatically only if, and to the extent that, the holder beneficially owns, together with affiliates, less than 9.9% of the outstanding shares of common stock. |

| (2) | The information is included in reliance on a Schedule 13D and amendments filed with the SEC jointly on behalf of Clinton Group, Inc., SBAV LP, SBAV GP LLC, Clinton Magnolia Master Fund, Ltd. and George Hall. The listed shares include warrants to purchase 228,261 shares of common stock. |

| (3) | The information is included in reliance on a Schedule 13G/A filed with the SEC jointly on behalf of Mendon Capital Advisors Corp. and Anton V. Schutz . The listed shares include warrants to purchase 228,261 shares of common stock. |

| (4) | The information is included in reliance on a Schedule 13G/A filed with the SEC jointly on behalf of Stieven Financial Investors, L.P., Stieven Financial Offshore Investors, Ltd., Stieven Capital GP, LLC, Stieven Capital Advisors, L.P., Stieven Capital Advisors GP, LLC, Joseph A. Stieven, Stephen L. Covington and Daniel M. Ellefson. The listed shares include warrants to purchase 228,261 shares of common stock. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Related Parties

Our Audit Committee has the responsibility to review and approve or ratify all transactions, other than loans and extensions of credit, between the Company and related parties, including without limitation, fees and commissions for services, purchases or sales of assets, rental arrangements and any other financial arrangement.

As a bank, we are not subject to Section 402 of the Sarbanes-Oxley Act of 2002, which prohibits any issuer to extend, renew or arrange for the extension of credit in the form of a personal loan to or for any director or executive officer of that issuer. However, loans must be made:

| | • | in the ordinary course of our consumer credit business; |

| | • | of a type we generally make available to the public; and |

| | • | on market terms, or terms that are no more favorable than those offered by the issuer to the general public. |

We have long-standing policies and procedures governing our extension of credit to related parties in compliance with the insider lending restrictions of Section 22(h) of the Federal Reserve Act or the Federal Reserve’s Regulation O. All loans to directors and executive officers or their affiliates are approved by the Board of Directors of PBI Bank. As of December 31, 2011, the aggregate amount of all loans outstanding to our executive officers and directors, the executive officers and directors of PBI Bank and the firms and corporations in which they have at least a ten percent beneficial interest was approximately $1.4 million.

Our officers, directors and principal shareholders and their affiliates and certain of the officers and directors of PBI Bank and their affiliates have conducted banking transactions with PBI Bank from time to time, including investments in certificates of deposit. All such investments have been made, and will continue to be made, only in the ordinary course of business of PBI Bank on substantially the same terms as those prevailing at the time for comparable transactions with unaffiliated persons and did not involve more than the normal risk of collectability or present other unfavorable features.

Management Service Agreements and Loan Participations with Banks Under Common Control

Our chairman, J. Chester Porter and his brother, William G. Porter, each own a 50% interest in Lake Valley Bancorp, Inc., the parent holding company of The Peoples Bank, Taylorsville, Kentucky, located approximately 25 miles southeast of Louisville in Spencer County. J. Chester Porter, William G. Porter and our president and chief executive officer, Maria L. Bouvette, serve as directors of this bank.

Our chairman, J. Chester Porter owns an interest of approximately 36.0% and his brother, William G. Porter, owns an interest of 3.0% in Crossroads Bancorp, Inc., the parent holding company of The Peoples Bank, Mount Washington, Kentucky, located approximately 20 miles south of Louisville in Bullitt County. PBI Bank also has banking offices in Bullitt County. J. Chester Porter and our president and chief executive officer, Maria L. Bouvette, serve as directors of this bank.

We have entered into management services agreements with each of these banks. Each agreement provides that our executives and employees provide management and accounting services to the subject bank, including overall responsibility for establishing and implementing policy and strategic planning. Maria Bouvette also serves as chief financial officer of each of the banks. We receive a $4,000 monthly fee from The Peoples Bank, Taylorsville and a $2,000 monthly fee from The Peoples Bank, Mount Washington for these services, which together totaled $72,000 in 2011.

From time to time, these banks may also participate with PBI Bank in making loans to certain borrowers when our executive officers believe it is mutually beneficial to do so. As of December 31, 2011, we had $4.1 million of participations in real estate loans purchased from, and $13.2 million of participations in real estate loans sold, to these affiliate banks. We believe the terms of our arrangements with these two banks in which J. Chester Porter and William G. Porter have substantial ownership interests are fair and reasonable to us and to the other banks. We have had the terms of our management services agreements with these banks reviewed by an independent accounting firm from time to time. The terms of these arrangements are also subject to ongoing review by the independent directors on our audit committee.

Other Transactions in Which Related Parties Have an Interest

Our chairman, J. Chester Porter is the owner of Porter & Associates, a law firm that we retained during our last fiscal year and will retain in the future. We paid $149,000 to Porter & Associates for legal services provided during 2011. In addition, Porter & Associates received fees from borrowers for its representation of PBI Bank in connection with loan closings.

Keith Griffee, the son-in-law of J. Chester Porter, is PBI Bank’s President of the Bullitt County Market. Albert J. Bouvette, brother of our president and chief executive officer, Maria L. Bouvette, is an employee of PBI Bank’s information technology department. Neither of them received compensation of more than $120,000 for his services during 2011. Jack C. Porter, son of J. Chester Porter, serves as an advisory director of our Bullitt County banking office and from time to time provides real estate-related services to PBI Bank for which he was paid $127,000 in fees during 2011.

In 1994, J. Chester Porter and Maria L. Bouvette issued a promissory note to David L. Hawkins, a director and chairman of our audit committee, in the principal amount of $500,000 as part of the consideration paid to Mr. Hawkins in connection with the acquisition of Pioneer Bank by a predecessor of our company. The promissory note bears interest at the prime rate plus 1% per annum (currently 4.25%) and payments of interest only are due quarterly. The loan is secured by a mortgage on real estate. The original term of the note has been extended to January 1, 2015.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers, and persons who own more than 10 percent of our common stock, to file reports of ownership and changes in ownership with the SEC. Directors, executive officers, and greater than 10 percent beneficial owners, referred to as “reporting persons,” are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to us, we believe that during 2011 all reporting persons complied with the filing requirements of Section 16(a).

COMPENSATION DISCUSSION AND ANALYSIS

The compensation committee of our Board of Directors is responsible for developing specific policies regarding compensation of our executive officers, as well as evaluating and approving our executive officer incentive compensation, benefit, severance, equity-based or other compensation plans, policies and programs implementing and administering all aspects of our benefit and compensation plans and programs. Our compensation committee is comprised of Mr. Hogan, Mr. Williams, Mr. Monroe and Mr. Wycoff. Our board of directors has determined that all of the committee members currently meet the independence requirements of the NASDAQ corporate governance rules and relevant federal securities laws and regulations. As previously discussed, we are a “controlled company” within the meaning of the NASDAQ corporate governance rules. A controlled company may elect not to comply with certain NASDAQ corporate governance rules, including the requirement that decisions regarding the compensation paid to executive officers must be made either by a compensation committee composed entirely of independent directors or by a majority of the independent directors. Nonetheless, since 2009, all the members of our compensation committee have been independent. As a practical matter, our controlled company status also gives Mr. Porter and Ms. Bouvette the ability to assert significant influence over executive compensation decisions. We did not engage any compensation consultants to assist the compensation committee in determining the compensation paid to our executives in 2011.

Executive Compensation Philosophy and Objectives

Our philosophy for executive compensation is to attract, retain and reward excellent executives and align their interests with the interests of our shareholders. To promote this philosophy, we have established the following objectives:

| | ● | provide fair and competitive compensation to executives, based on their performance and contributions to our company, that will attract, motivate and retain individuals that will enable our company to successfully compete with other financial institutions in our markets; |

| | ● | provide incentives that reward executives for attaining predetermined objectives that promote and reward individual performance, company financial performance, achievement of strategic goals and company stock performance; |

| | ● | instill in our executives a long-term commitment and a sense of ownership through the use of equity-based compensation; and |

| | ● | ensure that the interests of our executives are aligned with our shareholders’ interests. |

TARP Compensation Standards

On November 21, 2008, Porter Bancorp became a participant in the U.S. Treasury’s Capital Purchase Program (“CPP”). As a result, we are required to comply with a number of executive compensation standards during the period of time in which the U.S. Treasury holds an equity position in Porter Bancorp. On February 17, 2009, the America Reinvestment and Recovery Act of 2009 (“ARRA”) required the U.S. Treasury to enact additional compensation standards. The Compensation Committee has taken a number of actions in order to comply with the provisions of CPP and ARRA:

| | ● | Meets with senior risk officers two times annually to review senior executive officer compensation plans and employee incentive compensation plans and the risks associated with these plans. The risk assessment is described in more detail beginning under Incentive Compensation Plan Risk Assessment; |

| | ● | Reviews and revises bonus and other incentive plans to ensure that the plans are in compliance with ARRA; |

| | ● | Required all senior executive officers and next twenty most highly compensated employees to enter into clawback agreements, which require them to return any bonus payment or award made during the CPP period based upon materially inaccurate financial statements or performance metrics. Each of our current executive officers has agreed that their separation entitlements and bonuses, retention awards and other incentive compensation will comply with these standards; |

| | ● | Restructured our Compensation Committee to include only independent directors; and |

| | ● | Adopted a policy regarding luxury or excessive expenditures. |

As required by CPP (and now by the SEC), we provide an annual “say on pay” advisory vote regarding executive compensation. In last year’s “say on pay” vote, we received majority approval of our executive compensation programs, with more than 98% of the votes being cast in favor of our pay programs. Because we continue to participate in CPP, we continue to be required to include a non-binding shareholder vote to approve compensation as disclosed in this proxy statement, which we have included as Proposal 2. We will not be subject to the so-called “say on pay” frequency vote required by the Dodd-Frank Wall Street Reform and Consumer Protection Act until after our repayment of TARP preferred stock.

Executive Compensation Components

Our compensation program is comprised of three components:

| | ● | Base salary that is competitive with levels paid by comparable financial institutions; |

| | ● | Annual incentive cash payments based on the attainment of targeted performance goals; and |

| | ● | Equity-based compensation, consisting of stock options and restricted stock, based on the attainment of targeted performance goals. |

The executive compensation plan provides a compensation package that is driven by our overall financial performance and is competitive with the public and non-public financial institutions in our market to enable us to attract and retain executives who we believe are critical to our future success. The plan establishes a range of percentages of total compensation for each of the three components set forth above. For each of our executives, base salary constitutes between 50% and 70% of total compensation, cash incentives constitute between 10% and 20%, and equity based compensation constitutes between 20% and 30%. The Committee will establish the target percentage of compensation for each of the three components at the beginning of each year. We have agreed with the Federal Reserve to obtain its written consent prior to increasing any salaries or bonuses of our insiders.

Base Salary. When establishing base salaries for our executives, we consider the scope of executive responsibilities and publicly available information concerning the compensation paid to executives with similar levels of responsibility by other comparable public and non-public financial institutions in our market. Although we do not attempt to set the salaries of our executives to fall within a certain percentage range compared to the salaries paid by other comparable institutions, we do consider compensation data from comparable institutions to satisfy ourselves that the compensation we pay is competitive and sufficient to recruit and retain the talented employees our business requires to be successful. Our practice has been to increase base salaries by between 3% and 5% annually to account for a cost of living adjustment, considering an individual executive’s performance when determining the percentage within that range.

For 2011, management and the Compensation Committee determined that it was in the Company’s best interest to continue its salary freeze for all named executive officers given the sustained weakness in business and economic conditions generally in our markets. Upon management’s recommendation, the Compensation Committee agreed to hold salaries for all named executive officers at the same level for 2011. The Committee reviewed 2009 publicly available national peer group data as compiled by SNL Financial in the 2010 Executive Compensation Review, the most recent data available, to ensure that our base salaries, from which total compensation is derived from, were competitive with comparable financial institutions. The publicly available data showed base salary and total compensation, which included base salary, annual bonus, other annual compensation, restricted stock awards, performance units and other compensation paid due to long-term incentive plans. The peer groups were: (i) the 62 financial institutions in the Midwest with assets of $1 billion to $5 billion, (ii) the 127 financial institutions nationwide with assets of $1 billion to $5 billion and a ROAE of less than 5%. As of December 31, 2010, we had total assets of approximately $1.7 billion and our return on average equity for 2010 was approximately (2.33%). The Committee evaluated data on the chief executive officer compensation of the two peer groups for Mr. Porter and Ms. Bouvette and on the chief operating officer and chief financial officer compensation of the two peer groups for Mr. Pierce.

The following table shows the median base salary for 2009 paid to chief executive officers, chief financial officers, chief operating officers and chief credit officers of the two peer groups described above:

Position | Median Base Salary of Midwest Financial Institutions with Assets of $1 billion to $5 billion | Median Base Salary of Financial Institutions with Assets of $1 billion to $5 billion and ROAE of less than 5.00% |

| CEO | $350,000 | $368,407 |

| CFO | 195,599 | 200,000 |

| COO | 207,771 | 235,001 |

| CCO | 194,977 | 192,477 |

The following table shows the median total compensation for 2009 paid to chief executive officers, chief financial officers, chief operating officers and chief credit officers of the two peer groups described above:

Position | Median Total Compensation of Midwest Financial Institutions with Assets of $1 billion to $5 billion | Median Total Compensation of Financial Institutions with Assets of $1 billion to $5 billion and ROAE of less than 5.00% |

| CEO | $399,203 | $442,606 |

| CFO | 227,292 | 234,685 |

| COO | 298,844 | 322,935 |

| CCO | 215,365 | 213,843 |

For 2012, the Committee used the same process for evaluating base salaries for all of our named executives as has been used in previous years. The Committee reviewed 2010 publicly available national peer group data as compiled by SNL Financial in its 2011 Executive Compensation Review, the most recent data available, to ensure that our base salaries, and our incentive compensation that is determined as a percentage of base salary, were competitive with comparable financial institutions. The publicly available data showed base salary and total compensation, which included base salary, annual bonus, other annual compensation, restricted stock awards, performance units and other compensation paid due to long-term incentive plans. The peer groups were: (i) the 62 financial institutions in the Midwest with assets of $1 billion to $5 billion, (ii) the 127 financial institutions nationwide with assets of $1 billion to $5 billion and a ROAE of less than 5.00%. As of December 31, 2011, we had total assets of approximately $1.5 billion and our return on average equity for 2011 was approximately (67.30%).

The following table shows the median base salary for 2010 paid to chief executive officers, chief financial officers, chief operating officers and chief credit officers of the two peer groups described above:

Position | Median Base Salary of Midwest Financial Institutions with Assets of $1 billion to $5 billion | Median Base Salary of Financial Institutions with Assets of $1 billion to $5 billion and ROAE of less than 5.00% |

| CEO | $366,987 | $371,404 |

| CFO | 208,750 | 209,999 |

| COO | 212,838 | 247,774 |

| CCO | 212,308 | 200,000 |

The following table shows the median total compensation for 2010 paid to chief executive officers, chief financial officers, chief operating officers and chief credit officers of the two peer groups described above:

Position | Median Total Compensation of Midwest Financial Institutions with Assets of $1 billion to $5 billion | Median Total Compensation of Financial Institutions with Assets of $1 billion to $5 billion and ROAE of less than 5.00% |

| CEO | $465,246 | $473,348 |

| CFO | 269,397 | 265,953 |

| COO | 298,534 | 333,616 |

| CCO | 286,845 | 239,421 |

Cash Incentives. For 2011, the Compensation Committee adopted a cash incentive plan that was based solely on the Company’s performance. Under the revised plan, named executive officers could earn up to a maximum of 30% of their base salary based upon our attainment of pre-established performance objectives. The following table shows the pre-established 2011 targets and the corresponding percentage of salary earned for attaining the target:

| Objective | Level 1 Target Goal | Cash award as percentage of Salary | Level 2 Target Goal | Cash award as percentage of Salary |

| Earnings per share | 100% of target | 3% | 110% of target | 6% |

| Return on average assets | 100% of peer median | 3% | 110% of peer median | 6% |

| Return on average equity | 100% of peer median | 3% | 110% of peer median | 6% |

| Net interest margin | 100% of peer median | 3% | 110% of peer median | 6% |

| Efficiency ratio | 100% of peer median | 3% | 110% of peer median | 6% |

| Total | | 15% | | 30% |

The cash incentive plan required that we achieve threshold performance goals of 0.50% for return on average assets and 9.0% for return on average equity before any incentive can be earned for those results, regardless of performance compared to peer median.

The performance components, except earnings per share, were still measured against our peers’ performance. Historically, our earnings per share goal has been measured against our prior year’s performance. Since we had a loss in 2010, we established an earnings per share target of $0.80 for 2011. The Compensation Committee determined to keep the same peer group, which includes:

| | ● | Bank of Kentucky Financial Corporation |

| | ● | Community Bank Shares of Indiana, Inc. |

| | ● | Community Trust Bancorp, Inc. |

| | ● | Farmers Capital Bank Corporation |

| | ● | First Financial Service Corporation |

| | ● | MainSource Financial Group, Inc. |

As long as the U.S. Treasury holds an equity position in Porter Bancorp, then under the CPP compensation regulations, no bonuses, retention awards or incentive compensation can be paid to or accrued for our five most highly compensated employees of Porter Bancorp, which include Mr. Porter, Ms. Bouvette and Mr. Pierce. We are permitted, however, to grant employees long-term restricted common stock in an amount that does not exceed 1/3 the employee’s total annual compensation. As a result of these restrictions, effective for the year 2011, the Compensation Committee determined to grant the five most highly compensated employees additional shares of restricted stock if the pre-established performance measures described above were satisfied. The fair market value of the shares granted to each of these employees would equal the amount of the incentive cash compensation they would have earned for attaining the criteria described above. The shares granted to these employees would be subject to the restrictions on vesting and transfer set forth in the Treasury regulations.

In 2011, none of our named executives earned any cash or stock incentive compensation for 2011. The following table shows Porter Bancorp’s data and the individual bonus targets for our executives in 2011:

Objective | Porter Bancorp | Actual Level 1 Target | Actual Level 2 Target | Cash award as percentage of Salary |

| Earnings per share | $(8.98) | $0.80 | $0.88 | 0% |

| Return on average assets | (6.46)% | 1.06 | 1.17 | 0% |

| Return on average equity | (67.30)% | 10.63 | 11.69 | 0% |

| Net interest margin | 3.40 % | 4.07 | 4.48 | 0% |

| Efficiency ratio | 138.09 % | 60.11 | 54.85 | 0% |

| Total | | | | 0% |

For 2012, the Compensation Committee modified the cash incentive plan to be based on a weighted scoring of Company performance metrics across a range of pre-determined targets. Five of the metrics are ratios customarily used to evaluate the performance of banks. The maximum bonus attributable to this plan is 20% of base salary. The following table shows the pre-established 2012 target ranges:

| Goal | Weighting | | 1 | 2 | 3 | 4** | 5 |

| Return on Assets | 20% | | -6.39% | 0.25% | 0.34% | Peer Median | 110% Peer Median |

| Net interest margin | 20% | | 3.40% | 3.55% | 3.65% | Peer Median | 110% Peer Median |

| Capital - Tier 1 leverage ratio | 10% | | 6.62% | 8.00% | 9.00% | Peer Median | 110% Peer Median |

| Nonperforming assets/total assets | 15% | | 9.26% | 6.00% | 4.00% | Peer Median | 110% Peer Median |

| Nonperforming loans/total loans | 15% | | 8.22% | 4.00% | 3.00% | Peer Median | 110% Peer Median |

| Regulatory composite ratings | 20% | | N/A | * | 3 | 2 | 1 |

| | 100% | | | | | | |

| Award as % of Salary | | | 0% | 5.00% | 10.00% | 15.00% | 20.00% |

| | * - Improvement to net rating components from previous examination | |

| | ** - Only if Peer Median ratio is greater than Column 3 ratio | | |

Additionally, each named executive will be eligible for a maximum bonus equal to 10% of base pay based upon that executives predetermined individual performance objectives for 2012.

As discussed above, CPP compensation regulations do not permit us to pay cash incentive compensation to our five most highly compensated employees as long as the U.S. Treasury holds an equity position in Porter Bancorp. Any incentive compensation earned by our named executive officers will be paid in the form of shares of restricted stock having a fair market value equal to the amount earned. Any shares granted to these employees will be subject to the restrictions on vesting and transfer set forth in the Treasury regulations.

Equity-Based Compensation. In February 2006, we established the Porter Bancorp, Inc. 2006 Stock Incentive Plan in anticipation of becoming a public company. The 2006 Plan authorizes the issuance of up to 400,000 shares in the form of stock options and restricted stock awards.

The Compensation Committee has the authority to award options and restricted stock awards under the 2006 Plan and to determine the amounts and awards. Although the 2006 Plan authorizes both stock options and restricted stock grants, the Committee has used restricted stock because it believes that restricted stock better serves our purposes of promoting employee retention and linking executives’ interests more closely with those of our shareholders and our long-term performance. Restricted stock carries the rights to vote and to receive dividends, thus encouraging stock ownership by executives. The shares of restricted stock granted to our executives may not be transferred, and, subject to a few exceptions, will be forfeited if the recipient’s employment with us ends, for a period of up to five years after the grant date. Because of the risk of forfeiture if the recipient’s employment ends before the restrictions have terminated, restricted stock grants also serve as a valuable retention tool. Grants of restricted stock also have a more favorable financial impact than stock options.

In October 2007, the Compensation Committee established an arrangement for determining the amount of restricted stock grant awards to be made each year. The Committee sets the maximum dollar value of equity incentive compensation as a percentage of base salary. For 2010, the maximum dollar value of equity incentive compensation as a percentage of base salary was 45% for Mr. Porter, Ms. Bouvette and Mr. Pierce and 30% for all other senior executives, which we refer to as the “equity goal.”

This maximum dollar value assumes we achieve our maximum performance level, which is currently set at 125% of the peer average in each of the four equity incentive components, which are return on average assets, return on average equity, net interest margin and efficiency ratio. We use these performance criteria metrics because we believe that these are the metrics that (i) drive shareholder value and (ii) are used by our investors to evaluate us. As with our cash incentive plan, we use corporate performance measures instead of individual performance measures because our philosophy emphasizes teamwork. The restricted shares that are granted are shares of our common stock that may not be transferred, and are subject to forfeiture, over a specified period. The restricted stock vests at the rate of 20% on each one-year anniversary of the grant date. The named executive officers that are granted restricted shares have all of the same rights as a shareholder, including the right to vote the restricted shares and the right to receive dividends. The following table provides the reward factors for the two levels of achievement for each of the components for 2011:

Objective | Peer Median | 125% of Peer Median |

| Return on average assets | 15% | 25% |

| Return on average equity | 15% | 25% |

| Net interest margin | 15% | 25% |

| Efficiency ratio | 15% | 25% |

| Total | 60% | 100% |

The peer group for the calculation of equity incentive awards is comprised of the same publicly traded bank holding companies used for the cash incentive plan. The following table shows the 2011 Porter Bancorp and peer computations using data published by SNL and the corresponding reward factor awarded:

Objective | Peer Median | 125% of Peer Median | Porter Bancorp | Reward Factor |

| Return on average assets | 1.06 | 1.33 | (6.46) | 0% |

| Return on average equity | 10.63 | 13.29 | (67.30) | 0% |

| Net interest margin | 4.07 | 5.09 | 3.40 | 0% |

| Efficiency ratio | 60.11 | 48.09 | 138.09 | 0% |

| Total | | | | 0% |

Based on the Company’s performance in 2011, none of our named executive officers were awarded shares of restricted stock .

For the year 2012, the Compensation Committee has approved the same formula for calculation of restricted stock awards that was used in 2011. For 2012, the Compensation Committee set the equity goal as 30% for senior executives and 45% for Ms. Bouvette, Mr. Pierce and Mr. Barnhouse. Equity incentive awards are generally granted in March or April each year when we have received all of the peer data necessary to make the peer average calculations.

Other Benefits