Filed by Legacy Reserves LP

(Commission File No. 1-33249)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Legacy Reserves LP

(Commission File No. 1-33249)

MARCH 2018 CORPORATE TRANSITION

Certain Disclosures Forward-Looking Information This presentation relates to the proposed corporate reorganization between Legacy and New Legacy (the “Transaction”) and includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the expected benefits of the Transaction to Legacy and its unitholders, the anticipated completion of the Transaction or the timing thereof, the expected future growth, dividends, distributions of the reorganized company, and plans and objectives of management for future operations. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that Legacy expects, believes or anticipates will or may occur in the future, are forward-looking statements. Words such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “projects,” “believes,” “seeks,” “schedules,” “estimated,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties, factors and risks, many of which are outside the control of Legacy, which could cause results to differ materially from those expected by management of Legacy. Such risks and uncertainties include, but are not limited to, realized oil and natural gas prices; production volumes, lease operating expenses, general and administrative costs and finding and development costs; future operating results; and the factors set forth under the heading “Risk Factors” in Legacy’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form10-K, Quarterly Reports on Form10-Q and Current Reports on Form8-K. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Unless legally required, Legacy undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It The Transaction will be submitted to Legacy’s unitholders for their consideration and approval. In connection with the Transaction, Legacy and New Legacy will prepare and file with the SEC a registration statement on FormS-4 that will include a proxy statement of Legacy and a prospectus of New Legacy (the “proxy statement/prospectus”). In connection with the Transaction, Legacy plans to mail the definitive proxy statement/prospectus to its unitholders. INVESTORS AND UNITHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT LEGACY AND NEW LEGACY, AS WELL AS THE PROPOSED TRANSACTION AND RELATED MATTERS. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. A free copy of the proxy statement/prospectus and other filings containing information about Legacy and New Legacy may be obtained at the SEC’s Internet site at www.sec.gov. In addition, the documents filed with the SEC by Legacy and New Legacy may be obtained free of charge by directing such request to: Legacy Reserves LP, Attention: Investor Relations, at 303 W. Wall, Suite 1800, Midland, Texas 79701 or emailing IR@legacylp.com or calling855-534-5200. These documents may also be obtained for free from Legacy’s investor relations website at https://www.legacylp.com/investor-relations. Participants in Solicitation Relating to the Transaction Legacy and its general partner’s directors, executive officers, other members of management and employees may be deemed to be participants in the solicitation of proxies from Legacy’s unitholders in respect of the Transaction that will be described in the proxy statement/prospectus. Information regarding the directors and executive officers of Legacy’s general partner is contained in Legacy’s public filings with the SEC, including its definitive proxy statement on Form DEF 14A filed with the SEC on April 10, 2017 and its Current Report on Form8-K filed with the SEC on February 21, 2018. A more complete description will be available in the registration statement and the proxy statement/prospectus.Non-GAAP Financial Measures Legacy’s management uses Adjusted EBITDA as a tool to provide additional information and a metric relative to the performance of Legacy’s business. Legacy’s management believes that Adjusted EBITDA is useful to investors because this measure is used by many companies in the industry as a measure of operating and financial performance and is commonly employed by financial analysts and others to evaluate the operating and financial performance of Legacy from period to period and to compare it with the performance of our peers. Adjusted EBITDA may not be comparable to a similarly titled measure of such peers because all entities may not calculate Adjusted EBITDA in the same manner. Adjusted EBITDA should not be considered as an alternative to GAAP measures, such as net income, operating income, cash flow from operating activities or any other GAAP measure of financial performance. 2

Transaction Summary Legacy Reserves LP announces execution of definitive documentation to effectuate its Corporate Transition to Legacy Reserves Inc. (“New Legacy”), a newly-created Delaware corporation (the “Transaction”). Key elements of the Transaction include: Each unit (LGCY) will be converted to one share of New Legacy’s common stock; Series A&B preferred units (LGCYP, LGCYO) will be converted to 1.9620 shares and 1.72236 shares, respectively, of New Legacy’s common stock as specified in the Partnership Agreement; All incentive distribution units will cease to exist; New Legacy will pay $3 million to acquire Legacy’s General Partner; and General Partner Interest of Legacy will remain outstanding and will be owned by New Legacy The Board of Directors of the General Partner, acting upon the recommendation of the Conflicts Committee where appropriate, unanimously approved the terms of the Transaction and recommends unitholders approve the Transaction Transitioning to aC-Corp better aligns our structure with our business model, enhances shareholder rights and is expected to lower our cost of capital as we leave the Upstream MLP space (1) Specific entities and transaction steps can be found on Form8-K filed on March 26, 2018. 3

Transaction Summary Legacy Reserves LP announces execution of definitive documentation to effectuate its Corporate Transition to Legacy Reserves Inc. (“New Legacy”), a newly-created Delaware corporation (the “Transaction”). Key elements of the Transaction include: Each unit (LGCY) will be converted to one share of New Legacy’s common stock; Series A&B preferred units (LGCYP, LGCYO) will be converted to 1.9620 shares and 1.72236 shares, respectively, of New Legacy’s common stock as specified in the Partnership Agreement; All incentive distribution units will cease to exist; New Legacy will pay $3 million to acquire Legacy’s General Partner; and General Partner Interest of Legacy will remain outstanding and will be owned by New Legacy The Board of Directors of the General Partner, acting upon the recommendation of the Conflicts Committee where appropriate, unanimously approved the terms of the Transaction and recommends unitholders approve the Transaction Transitioning to aC-Corp better aligns our structure with our business model, enhances shareholder rights and is expected to lower our cost of capital as we leave the Upstream MLP space (1) Specific entities and transaction steps can be found on Form8-K filed on March 26, 2018. 3

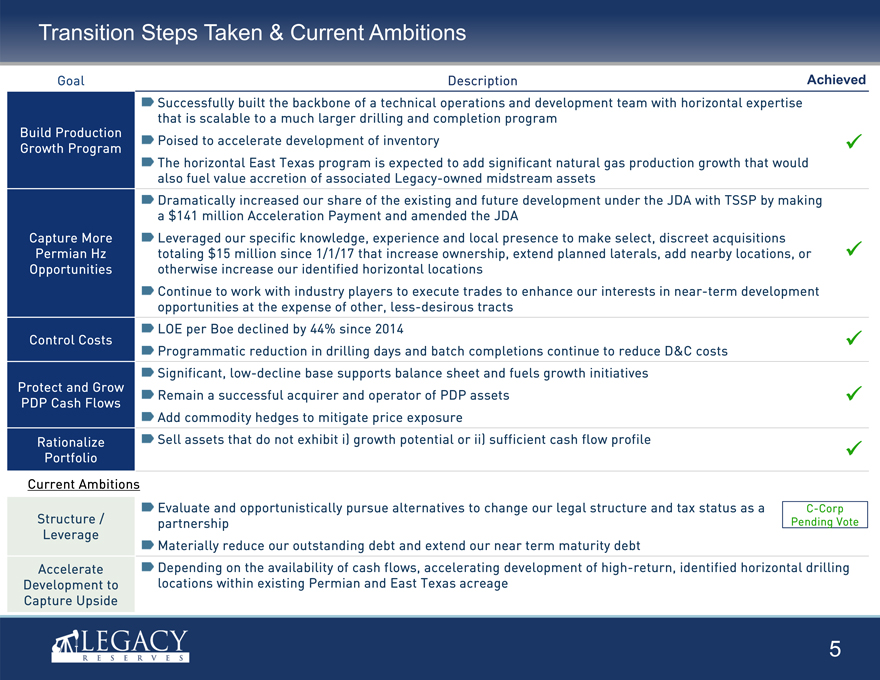

Transition Steps Taken & Current Ambitions Goal Description Achieved Successfully built the backbone of a technical operations and development team with horizontal expertise that is scalable to a much larger drilling and completion program Build Production Growth Program Poised to accelerate development of inventory  The horizontal East Texas program is expected to add significant natural gas production growth that would also fuel value accretion of associated Legacy-owned midstream assets Dramatically increased our share of the existing and future development under the JDA with TSSP by making a $141 million Acceleration Payment and amended the JDA Capture More Leveraged our specific knowledge, experience and local presence to make select, discreet acquisitions Permian Hz totaling $15 million since 1/1/17 that increase ownership, extend planned laterals, add nearby locations, or  Opportunities otherwise increase our identified horizontal locations Continue to work with industry players to execute trades to enhance our interests in near-term development opportunities at the expense of other, less-desirous tracts LOE per Boe declined by 44% since 2014 Control Costs  Programmatic reduction in drilling days and batch completions continue to reduce D&C costs Significant,low-decline base supports balance sheet and fuels growth initiatives Protect and Grow Remain a successful acquirer and operator of PDP assets  PDP Cash Flows Add commodity hedges to mitigate price exposure Rationalize Sell assets that do not exhibit i) growth potential or ii) sufficient cash flow profile  Portfolio Current Ambitions Evaluate and opportunistically pursue alternatives to change our legal structure and tax status as aC-Corp Structure / partnership Pending Vote Leverage Materially reduce our outstanding debt and extend our near term maturity debt Accelerate Depending on the availability of cash flows, accelerating development of high-return, identified horizontal drilling Development to locations within existing Permian and East Texas acreage Capture Upside 5

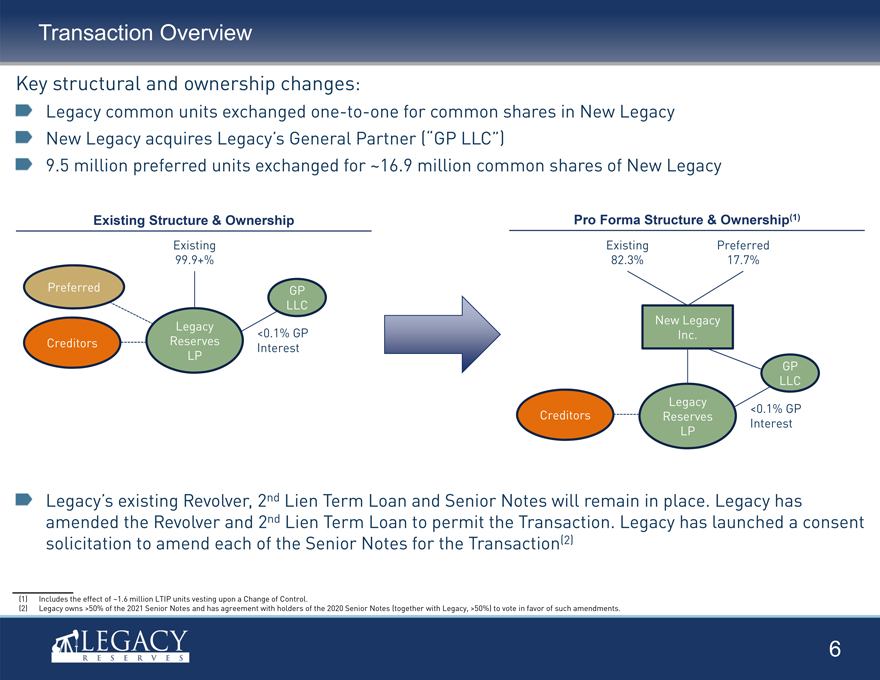

Transaction Overview Key structural and ownership changes: Legacy common units exchangedone-to-one for common shares in New Legacy New Legacy acquires Legacy’s General Partner (“GP LLC”) 9.5 million preferred units exchanged for ~16.9 million common shares of New Legacy Existing Structure & Ownership Pro Forma Structure & Ownership(1) Existing Existing Preferred 99.9+% 82.3% 17.7% Preferred GP LLC New Legacy Legacy <0.1% GP Inc. Creditors Reserves Interest LP GP LLC Legacy <0.1% GP Creditors Reserves Interest LP Legacy’s existing Revolver, 2nd Lien Term Loan and Senior Notes will remain in place. Legacy has amended the Revolver and 2nd Lien Term Loan to permit the Transaction. Legacy has launched a consent solicitation to amend each of the Senior Notes for the Transaction(2) (1) Includes the effect of ~1.6 million LTIP units vesting upon a Change of Control. (2) Legacy owns >50% of the 2021 Senior Notes and has agreement with holders of the 2020 Senior Notes (together with Legacy, >50%) to vote in favor of such amendments. 6

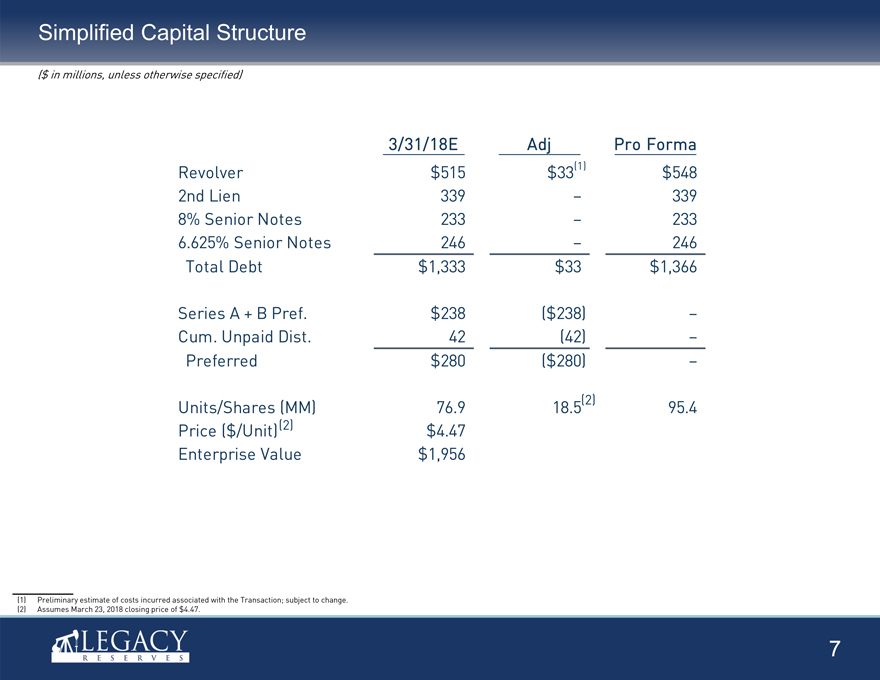

Simplified Capital Structure ($ in millions, unless otherwise specified) 3/31/18E Adj Pro Forma Revolver $515 $33(1) $548 2nd Lien 339 – 339 8% Senior Notes 233 – 233 6.625% Senior Notes 246 – 246 Total Debt $1,333 $33 $1,366 Series A + B Pref. $238 ($238) – Cum. Unpaid Dist. 42 (42) – Preferred $280 ($280) – Units/Shares (MM) 76.9 18.5(2) 95.4 Price ($/Unit) (2) $4.47 Enterprise Value $1,956 (1) Preliminary estimate of costs incurred associated with the Transaction; subject to change. (2) Assumes March 23, 2018 closing price of $4.47. 7

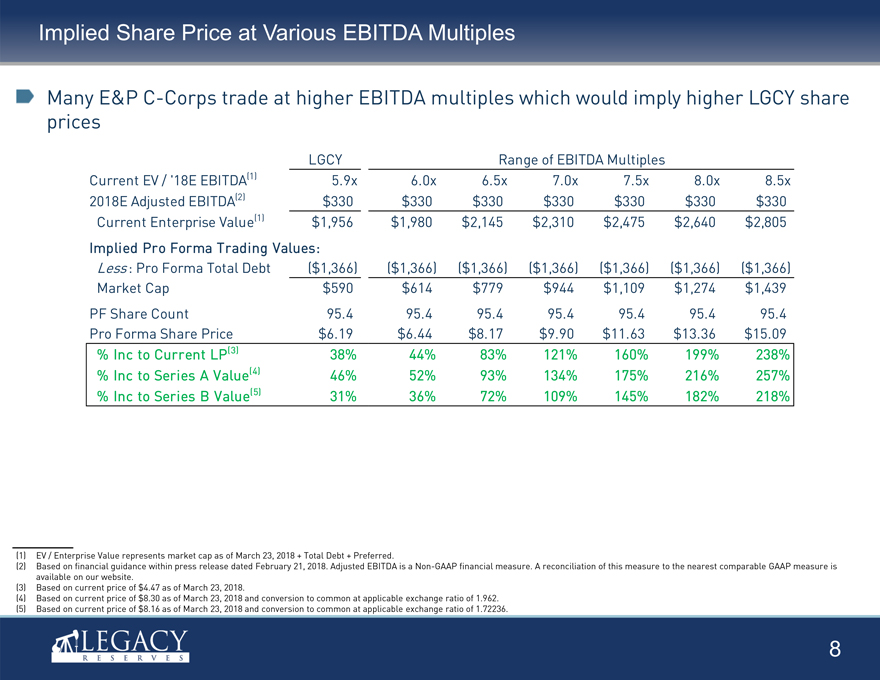

Implied Share Price at Various EBITDA Multiples Many E&PC-Corps trade at higher EBITDA multiples which would imply higher LGCY share prices LGCY Range of EBITDA Multiples Current EV / ‘18E EBITDA(1) 5.9x 6.0x 6.5x 7.0x 7.5x 8.0x 8.5x 2018E Adjusted EBITDA(2) $330 $330 $330 $330 $330 $330 $330 Current Enterprise Value(1) $1,956 $1,980 $2,145 $2,310 $2,475 $2,640 $2,805 Implied Pro Forma Trading Values: Less : Pro Forma Total Debt ($1,366) ($1,366) ($1,366) ($1,366) ($1,366) ($1,366) ($1,366) Market Cap $590 $614 $779 $944 $1,109 $1,274 $1,439 PF Share Count 95.4 95.4 95.4 95.4 95.4 95.4 95.4 Pro Forma Share Price $6.19 $6.44 $8.17 $9.90 $11.63 $13.36 $15.09 % Inc to Current LP(3) 38% 44% 83% 121% 160% 199% 238% % Inc to Series A Value(4) 46% 52% 93% 134% 175% 216% 257% % Inc to Series B Value(5) 31% 36% 72% 109% 145% 182% 218% (1) EV / Enterprise Value represents market cap as of March 23, 2018 + Total Debt + Preferred. (2) Based on financial guidance within press release dated February 21, 2018. Adjusted EBITDA is aNon-GAAP financial measure. A reconciliation of this measure to the nearest comparable GAAP measure is available on our website. (3) Based on current price of $ 4.47 as of March 23, 2018. (4) Based on current price of $ 8.30 as of March 23, 2018 and conversion to common at applicable exchange ratio of 1.962. (5) Based on current price of $ 8.16 as of March 23, 2018 and conversion to common at applicable exchange ratio of 1.72236. 8

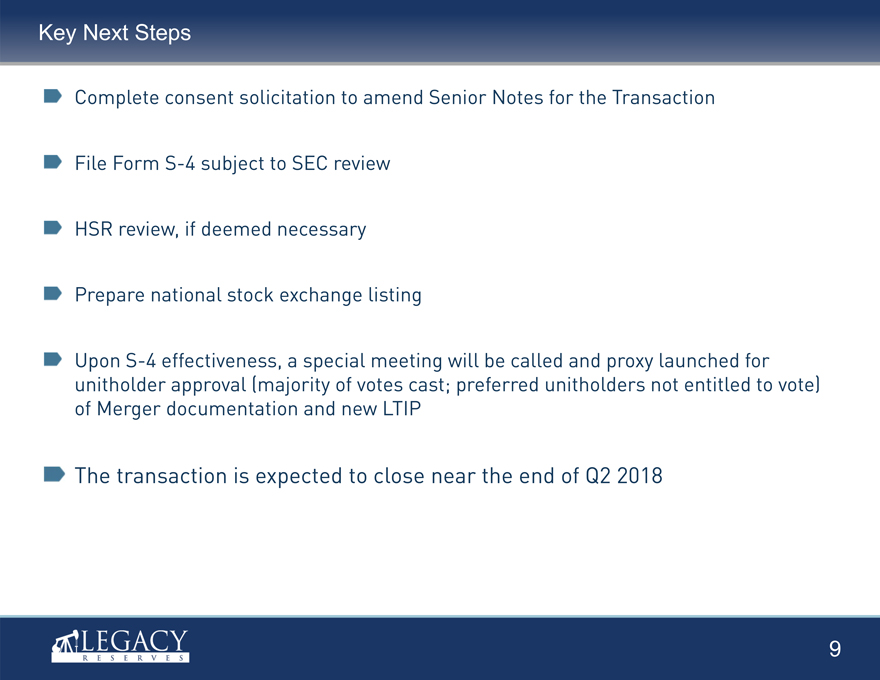

Key Next Steps Complete consent solicitation to amend Senior Notes for the Transaction File FormS-4 subject to SEC review HSR review, if deemed necessary Prepare national stock exchange listing UponS-4 effectiveness, a special meeting will be called and proxy launched for unitholder approval (majority of votes cast; preferred unitholders not entitled to vote) of Merger documentation and new LTIP The transaction is expected to close near the end of Q2 2018 9