August 2018 Enercom oil & gas conference Filed by Legacy Reserves LP (Commission File No. 1-33249) Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Legacy Reserves Inc. (Registration No. 333-224182)

Certain Disclosures Forward-Looking Information This presentation relates to the proposed corporate reorganization between Legacy and New Legacy (the “Transaction”) and includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the expected benefits of the Transaction to Legacy and its unitholders, final court approval of the Settlement Agreement entered into to settle the previously disclosed class action lawsuit, the anticipated completion of the Transaction or the timing thereof, the expected future growth, dividends, distributions of the reorganized company, and plans and objectives of management for future operations. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that Legacy expects, believes or anticipates will or may occur in the future, are forward-looking statements. Words such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “projects,” “believes,” “seeks,” “schedules,” “estimated,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties, factors and risks, many of which are outside the control of Legacy, which could cause results to differ materially from those expected by management of Legacy. Such risks and uncertainties include, but are not limited to, realized oil and natural gas prices; production volumes, lease operating expenses, general and administrative costs and finding and development costs; future operating results; and the factors set forth under the heading “Risk Factors” in Legacy’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Unless legally required, Legacy undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Reserve Estimates The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. Legacy discloses proved reserves but does not disclose probable or possible reserves. “Proved reserves” are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. Legacy may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as “estimated ultimate recovery” or “EUR,” “resource potential,” “development potential,” “potential bench” and similar terms to estimate oil and natural gas that may ultimately be recovered. Legacy defines EUR as estimates of the sum of reserves remaining as of a given date and cumulative production as of that date from a currently producing or hypothetical future well, as applicable. These broader classifications do not constitute reserves as defined by the SEC. Estimates of such broader classification of volumes are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. You should not assume that such terms are comparable to proved, probable and possible reserves or represent estimates of future production from properties or are indicative of expected future resource recovery. Actual locations drilled and quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of Legacy’s actual drilling program, availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, actual encountered geological conditions, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place, and other factors. These estimates may change significantly as the development of properties provides additional data. Reserve engineering is a complex and subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. Investors are also urged to consider closely the disclosure relating to “Risk Factors” in the Annual Report and subsequent filings with the SEC, which are available from Legacy’s website at www.legacylp.com or on the SEC’s website at www.sec.gov, for a discussion of the risks and uncertainties involved in the process of estimating reserves. Additional Information and Where to Find It The Transaction will be submitted to Legacy’s unitholders for their consideration and approval. In connection with the Transaction, Legacy and New Legacy has prepared and filed with the SEC a registration statement on Form S-4, which includes a preliminary proxy statement of Legacy and a preliminary prospectus of New Legacy (the “proxy statement/prospectus”). In connection with the Transaction, Legacy plans to mail the definitive proxy statement/prospectus to its unitholders to solicit approval for the merger. INVESTORS AND UNITHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT LEGACY AND NEW LEGACY, AS WELL AS THE PROPOSED TRANSACTION AND RELATED MATTERS. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. A free copy of the proxy statement/prospectus and other filings containing information about Legacy and New Legacy may be obtained at the SEC’s Internet site at www.sec.gov. In addition, the documents filed with the SEC by Legacy and New Legacy may be obtained free of charge by directing such request to: Legacy Reserves LP, Attention: Investor Relations, at 303 W. Wall, Suite 1800, Midland, Texas 79701 or emailing IR@legacylp.com or calling 855-534-5200. These documents may also be obtained for free from Legacy’s investor relations website at https://www.legacylp.com/investor-relations. Participants in Solicitation Relating to the Transaction Legacy and its general partner’s directors, executive officers, other members of management and employees may be deemed to be participants in the solicitation of proxies from Legacy’s unitholders in respect of the Transaction described in the proxy statement/prospectus. Information regarding the directors and executive officers of Legacy’s general partner is contained in Legacy’s public filings with the SEC, including its definitive proxy statement on Form DEF 14A filed with the SEC on April 6, 2018. A more complete description is available in the registration statement and the proxy statement/prospectus. Identified Drilling Locations; Adjusted Net Acreage; and Net Lateral Footage Legacy’s estimates of gross identified potential drilling locations (as used herein, “locations”, “identified locations,” “identified horizontal locations” or “identified drilling locations”) are prepared internally by Legacy’s engineers, geologists and management and are based upon a number of assumptions inherent in the estimates process. Management, with the assistance of Legacy’s engineers and other professionals, as necessary, conducts a topographical analysis of Legacy’s unproved prospective acreage to identify potential well pad locations. Legacy’s engineers and geologists then apply well spacing assumptions based on industry activity in analogous regions. A net location is calculated as a formula of a gross location multiplied by the ratio of net acreage over gross acreage. Legacy then multiplies this calculation by a pooling factor where appropriate. Legacy generally assumes minimum 5,000’ laterals. Management uses these estimates to, among other things, evaluate Legacy’s acreage holdings and formulate plans for drilling. A number of factors could cause the number of wells Legacy actually drills to vary significantly from these estimates, including the availability of capital, drilling and production costs, oil and natural gas prices, lease expirations, regulatory approvals and other factors. Adjusted net acreage is calculated as a formula of Legacy ‘s net acreage multiplied by the sum of Legacy’s ownership interest in the prospective benches as a percentage of the net acres of all prospective benches underlying the net acreage with each such percentage ownership multiplied by Legacy’s net revenue basis in such prospective bench. Adjusted net acreage is not comparable to net acreage and is a concept used by management in analyzing trades of acreage. Net lateral footage is calculated as a formula of gross lateral footage of identified locations multiplied by Legacy’s working interest. Non-GAAP Financial Measures Legacy’s management uses Adjusted EBITDA as a tool to provide additional information and a metric relative to the performance of Legacy’s business. Legacy’s management believes that Adjusted EBITDA is useful to investors because this measure is used by many companies in the industry as a measure of operating and financial performance and is commonly employed by financial analysts and others to evaluate the operating and financial performance of Legacy from period to period and to compare it with the performance of our peers. Adjusted EBITDA may not be comparable to a similarly titled measure of such peers because all entities may not calculate Adjusted EBITDA in the same manner. Adjusted EBITDA should not be considered as an alternative to GAAP measures, such as net income, operating income, cash flow from operating activities or any other GAAP measure of financial performance.

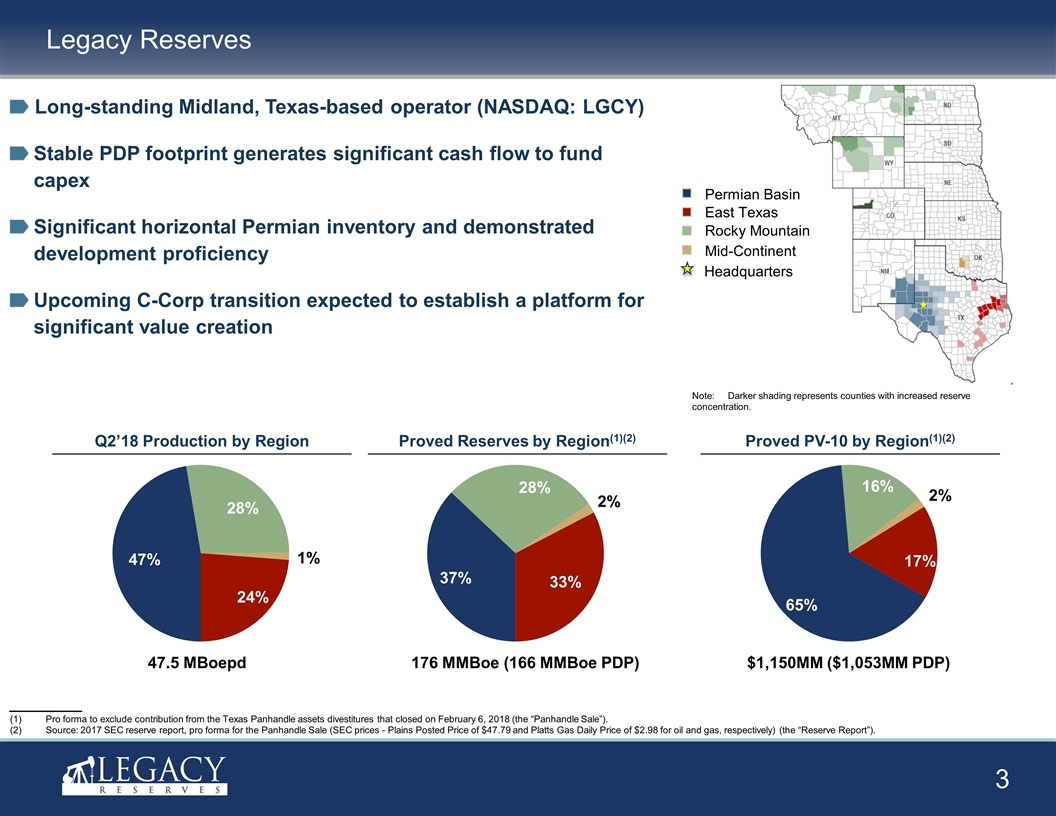

Legacy Reserves Long-standing Midland, Texas-based operator (NASDAQ: LGCY) Stable PDP footprint generates significant cash flow to fund capex Significant horizontal Permian inventory and demonstrated development proficiency Upcoming C-Corp transition expected to establish a platform for significant value creation $1,150MM ($1,053MM PDP) 176 MMBoe (166 MMBoe PDP) 47.5 MBoepd Pro forma to exclude contribution from the Texas Panhandle assets divestitures that closed on February 6, 2018 (the “Panhandle Sale”). Source: 2017 SEC reserve report, pro forma for the Panhandle Sale (SEC prices - Plains Posted Price of $47.79 and Platts Gas Daily Price of $2.98 for oil and gas, respectively) (the “Reserve Report”). Permian Basin Rocky Mountain Mid-Continent East Texas Headquarters Q2’18 Production by Region Proved Reserves by Region(1)(2) Proved PV-10 by Region(1)(2) Note: Darker shading represents counties with increased reserve concentration.

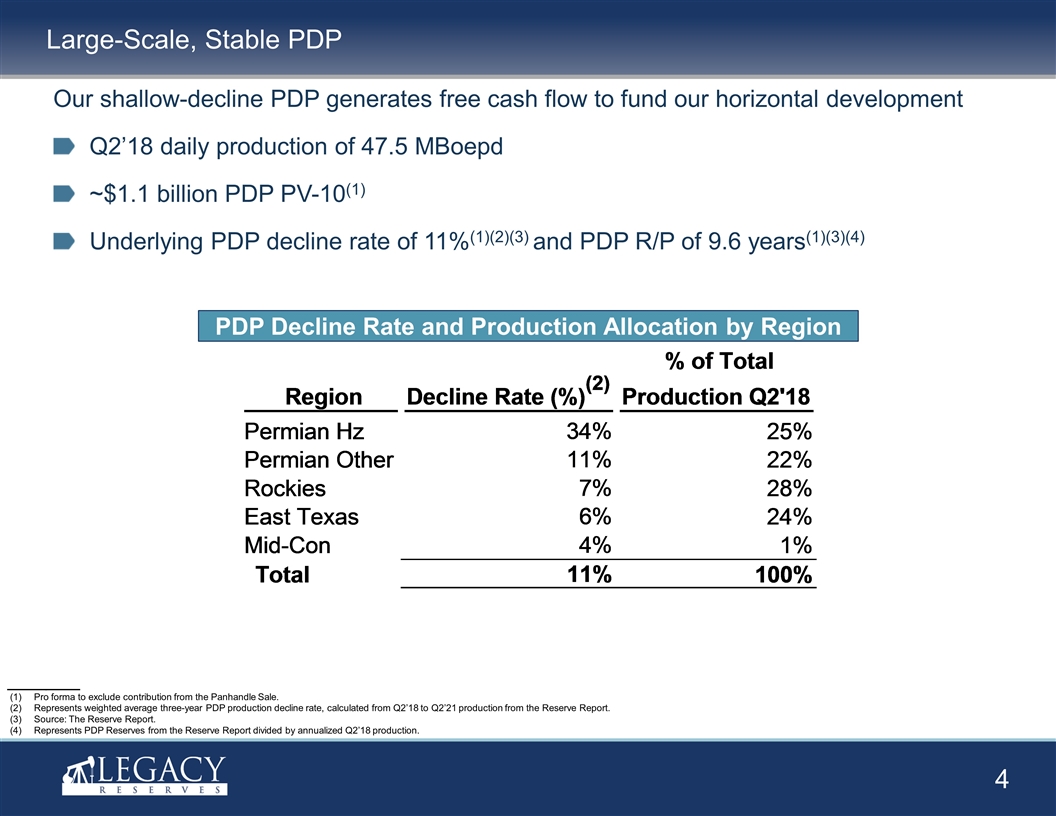

Our shallow-decline PDP generates free cash flow to fund our horizontal development Q2’18 daily production of 47.5 MBoepd ~$1.1 billion PDP PV-10(1) Underlying PDP decline rate of 11%(1)(2)(3) and PDP R/P of 9.6 years(1)(3)(4) Large-Scale, Stable PDP PDP Decline Rate and Production Allocation by Region Pro forma to exclude contribution from the Panhandle Sale. Represents weighted average three-year PDP production decline rate, calculated from Q2’18 to Q2’21 production from the Reserve Report. Source: The Reserve Report. Represents PDP Reserves from the Reserve Report divided by annualized Q2’18 production.

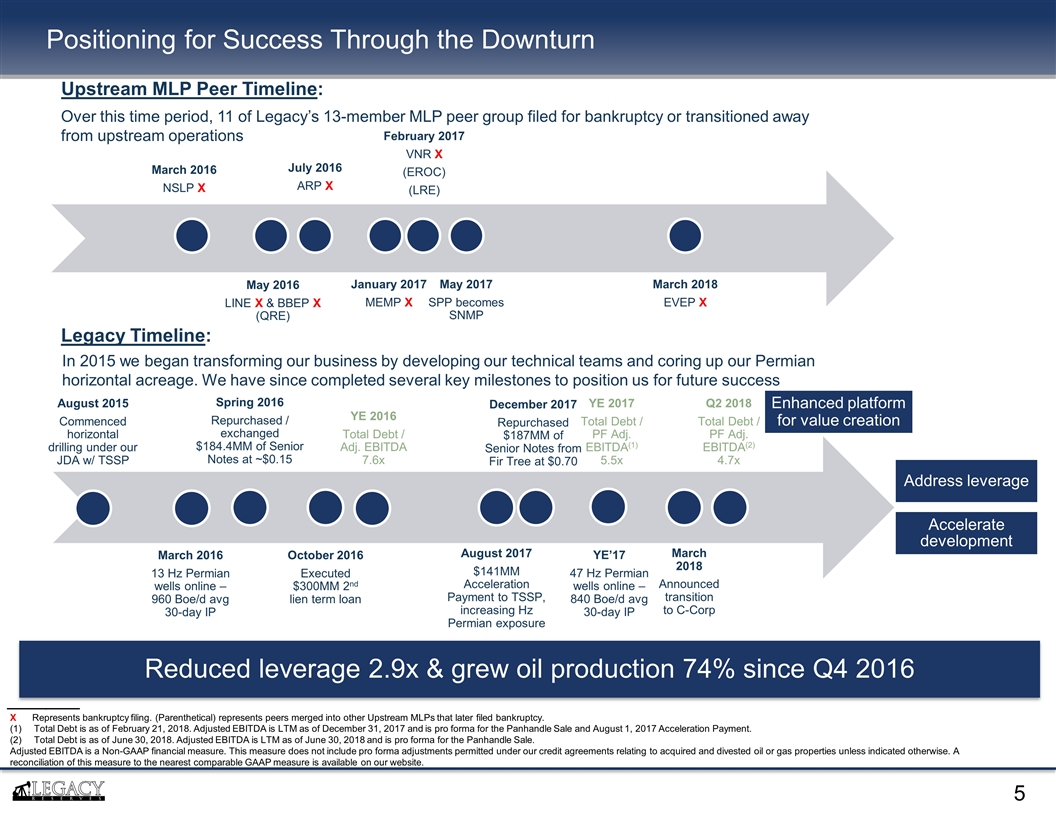

Positioning for Success Through the Downturn In 2015 we began transforming our business by developing our technical teams and coring up our Permian horizontal acreage. We have since completed several key milestones to position us for future success Legacy Timeline: March 2016 NSLP X May 2016 LINE X & BBEP X (QRE) July 2016 ARP X January 2017 MEMP X February 2017 VNR X (EROC) (LRE) March 2018 EVEP X Over this time period, 11 of Legacy’s 13-member MLP peer group filed for bankruptcy or transitioned away from upstream operations Upstream MLP Peer Timeline: August 2015 Commenced horizontal drilling under our JDA w/ TSSP March 2016 13 Hz Permian wells online – 960 Boe/d avg 30-day IP Spring 2016 Repurchased / exchanged $184.4MM of Senior Notes at ~$0.15 October 2016 Executed $300MM 2nd lien term loan August 2017 $141MM Acceleration Payment to TSSP, increasing Hz Permian exposure YE’17 47 Hz Permian wells online – 840 Boe/d avg 30-day IP December 2017 Repurchased $187MM of Senior Notes from Fir Tree at $0.70 March 2018 Announced transition to C-Corp YE 2016 Total Debt / Adj. EBITDA 7.6x YE 2017 Total Debt / PF Adj. EBITDA(1) 5.5x Enhanced platform for value creation X Represents bankruptcy filing. (Parenthetical) represents peers merged into other Upstream MLPs that later filed bankruptcy. Total Debt is as of February 21, 2018. Adjusted EBITDA is LTM as of December 31, 2017 and is pro forma for the Panhandle Sale and August 1, 2017 Acceleration Payment. Total Debt is as of June 30, 2018. Adjusted EBITDA is LTM as of June 30, 2018 and is pro forma for the Panhandle Sale. Adjusted EBITDA is a Non-GAAP financial measure. This measure does not include pro forma adjustments permitted under our credit agreements relating to acquired and divested oil or gas properties unless indicated otherwise. A reconciliation of this measure to the nearest comparable GAAP measure is available on our website. May 2017 SPP becomes SNMP Q2 2018 Total Debt / PF Adj. EBITDA(2) 4.7x Reduced leverage 2.9x & grew oil production 74% since Q4 2016 Address leverage Accelerate development

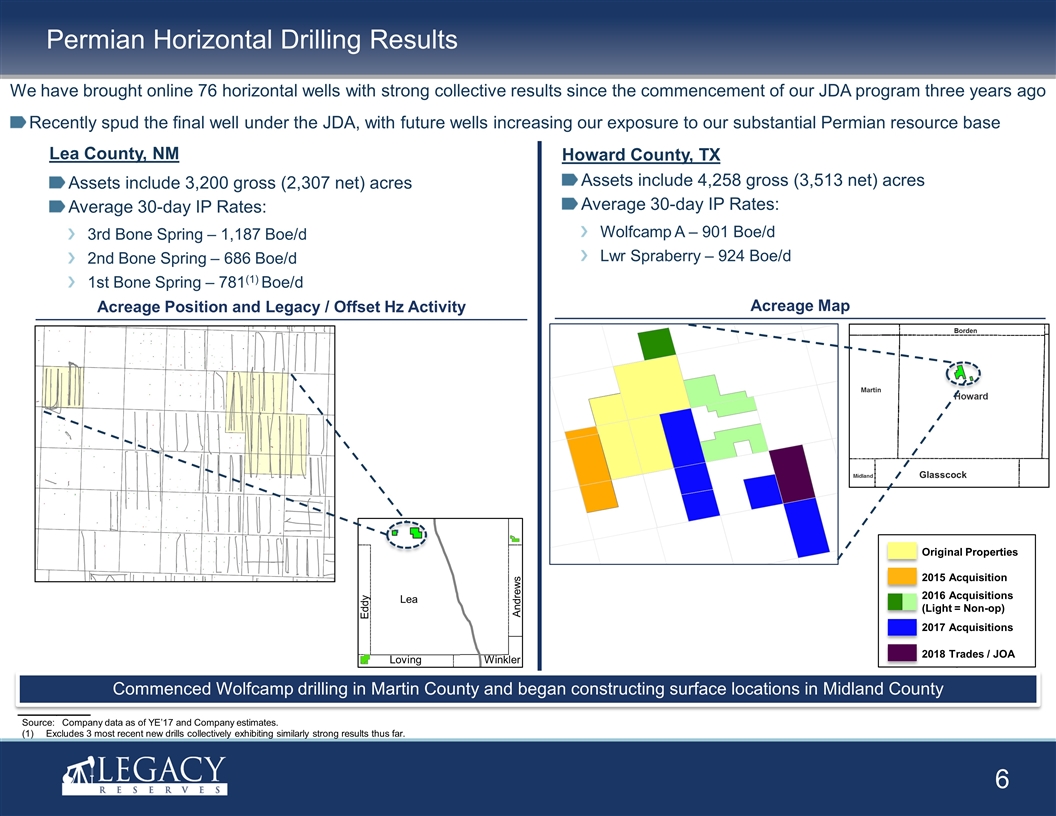

Source: Company data as of YE’17 and Company estimates. Excludes 3 most recent new drills collectively exhibiting similarly strong results thus far. Permian Horizontal Drilling Results Acreage Position and Legacy / Offset Hz Activity Lea County, NM Assets include 3,200 gross (2,307 net) acres Average 30-day IP Rates: 3rd Bone Spring – 1,187 Boe/d 2nd Bone Spring – 686 Boe/d 1st Bone Spring – 781(1) Boe/d Borden Martin Midland Glasscock Original Properties 2015 Acquisition 2017 Acquisitions 2016 Acquisitions (Light = Non-op) Acreage Map Howard County, TX Assets include 4,258 gross (3,513 net) acres Average 30-day IP Rates: Wolfcamp A – 901 Boe/d Lwr Spraberry – 924 Boe/d We have brought online 76 horizontal wells with strong collective results since the commencement of our JDA program three years ago Recently spud the final well under the JDA, with future wells increasing our exposure to our substantial Permian resource base Andrews Lea Loving Winkler Eddy 2018 Trades / JOA Commenced Wolfcamp drilling in Martin County and began constructing surface locations in Midland County

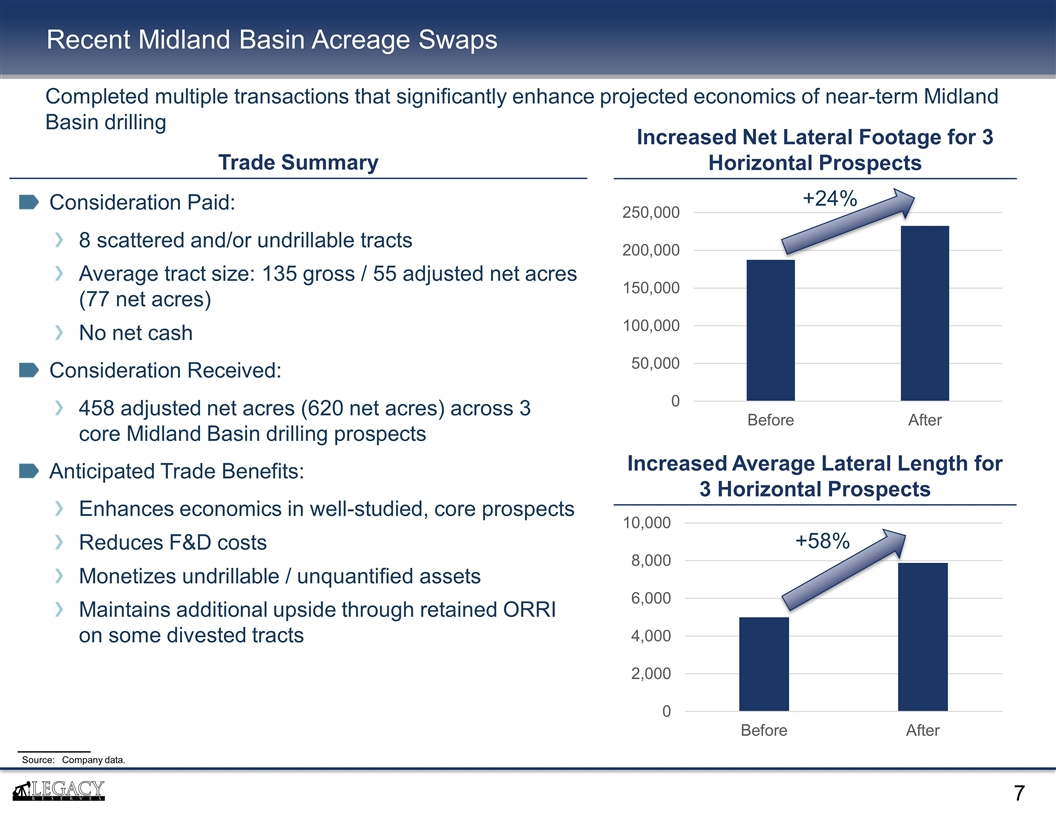

Recent Midland Basin Acreage Swaps Trade Summary Consideration Paid: 8 scattered and/or undrillable tracts Average tract size: 135 gross / 55 adjusted net acres (77 net acres) No net cash Consideration Received: 458 adjusted net acres (620 net acres) across 3 core Midland Basin drilling prospects Anticipated Trade Benefits: Enhances economics in well-studied, core prospects Reduces F&D costs Monetizes undrillable / unquantified assets Maintains additional upside through retained ORRI on some divested tracts Completed multiple transactions that significantly enhance projected economics of near-term Midland Basin drilling Increased Net Lateral Footage for 3 Horizontal Prospects Increased Average Lateral Length for 3 Horizontal Prospects +24% +58% Source: Company data.

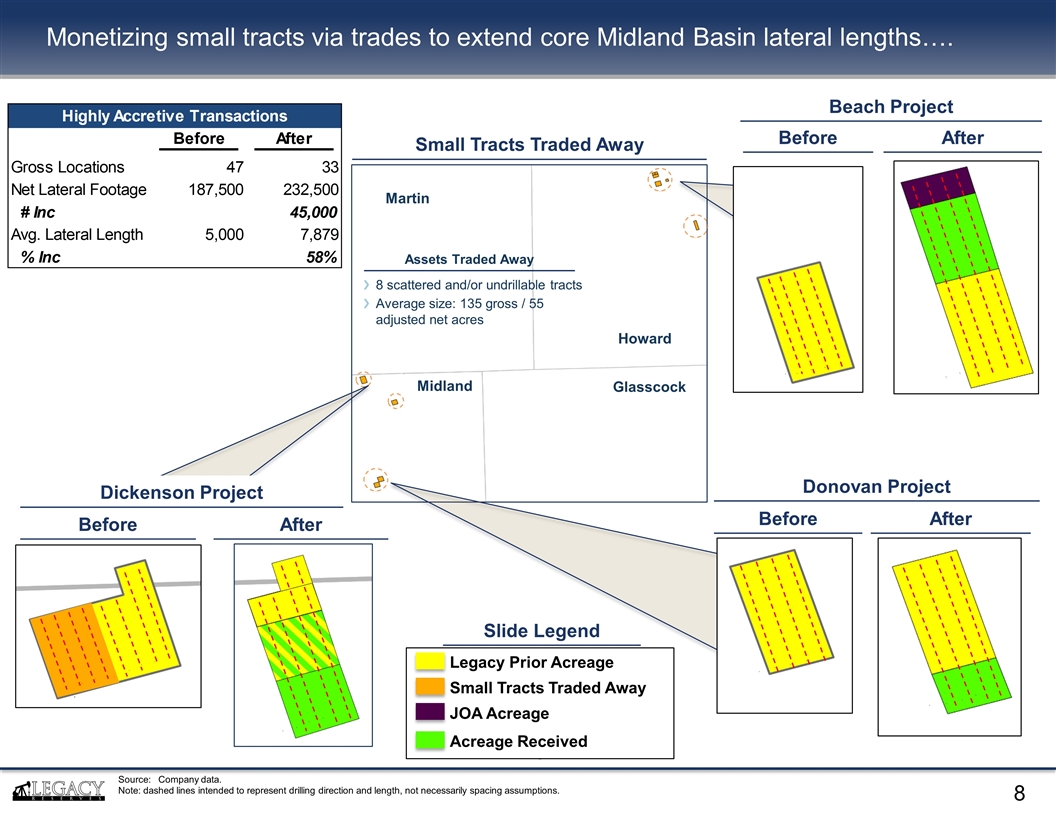

Martin Midland Howard Glasscock Monetizing small tracts via trades to extend core Midland Basin lateral lengths…. Beach Project Before After Dickenson Project Before After Donovan Project Before After Slide Legend Legacy Prior Acreage Small Tracts Traded Away JOA Acreage Acreage Received Small Tracts Traded Away 8 scattered and/or undrillable tracts Average size: 135 gross / 55 adjusted net acres Assets Traded Away Source: Company data. Note: dashed lines intended to represent drilling direction and length, not necessarily spacing assumptions.

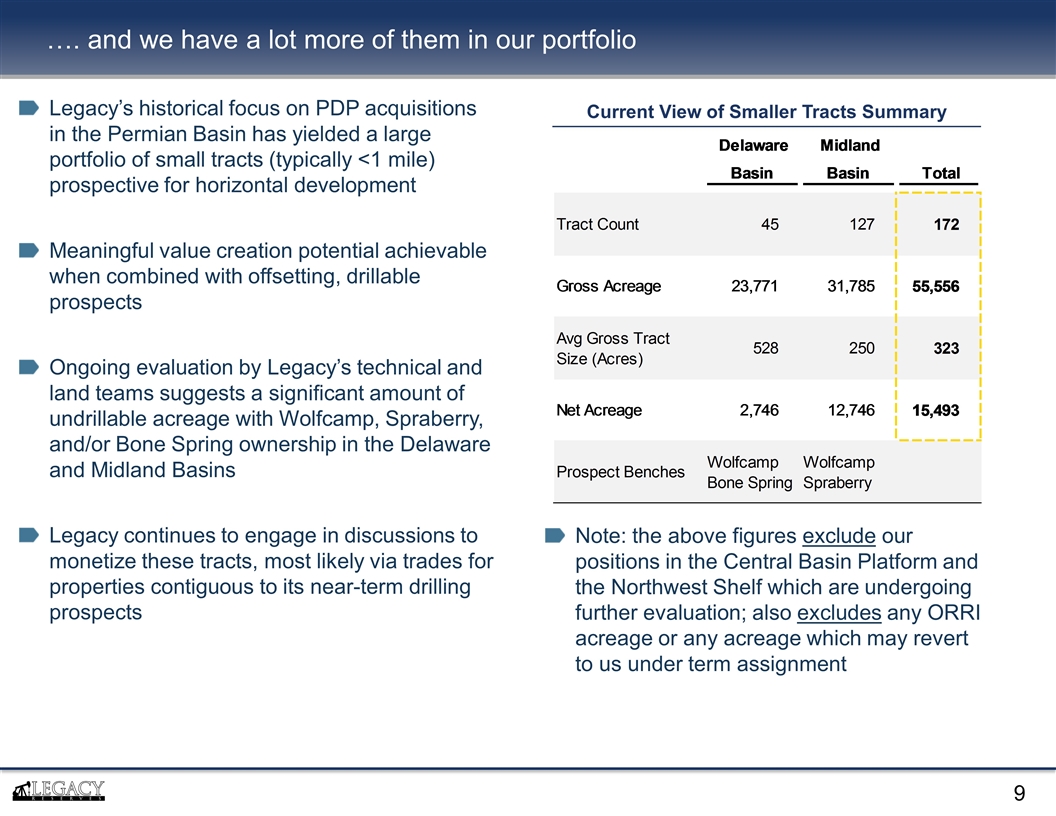

Legacy’s historical focus on PDP acquisitions in the Permian Basin has yielded a large portfolio of small tracts (typically <1 mile) prospective for horizontal development Meaningful value creation potential achievable when combined with offsetting, drillable prospects Ongoing evaluation by Legacy’s technical and land teams suggests a significant amount of undrillable acreage with Wolfcamp, Spraberry, and/or Bone Spring ownership in the Delaware and Midland Basins Legacy continues to engage in discussions to monetize these tracts, most likely via trades for properties contiguous to its near-term drilling prospects …. and we have a lot more of them in our portfolio Current View of Smaller Tracts Summary Note: the above figures exclude our positions in the Central Basin Platform and the Northwest Shelf which are undergoing further evaluation; also excludes any ORRI acreage or any acreage which may revert to us under term assignment

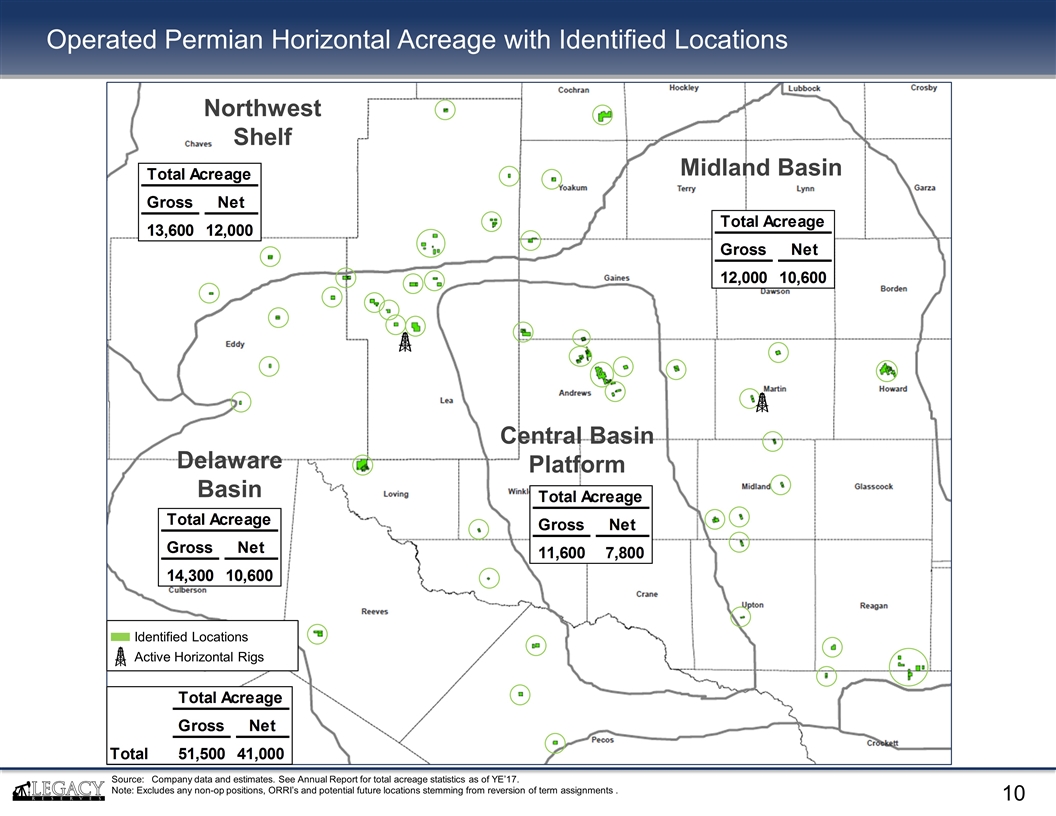

Operated Permian Horizontal Acreage with Identified Locations Midland Basin Central Basin Platform Delaware Basin Northwest Shelf Source: Company data and estimates. See Annual Report for total acreage statistics as of YE’17. Note: Excludes any non-op positions, ORRI’s and potential future locations stemming from reversion of term assignments . Identified Locations Active Horizontal Rigs

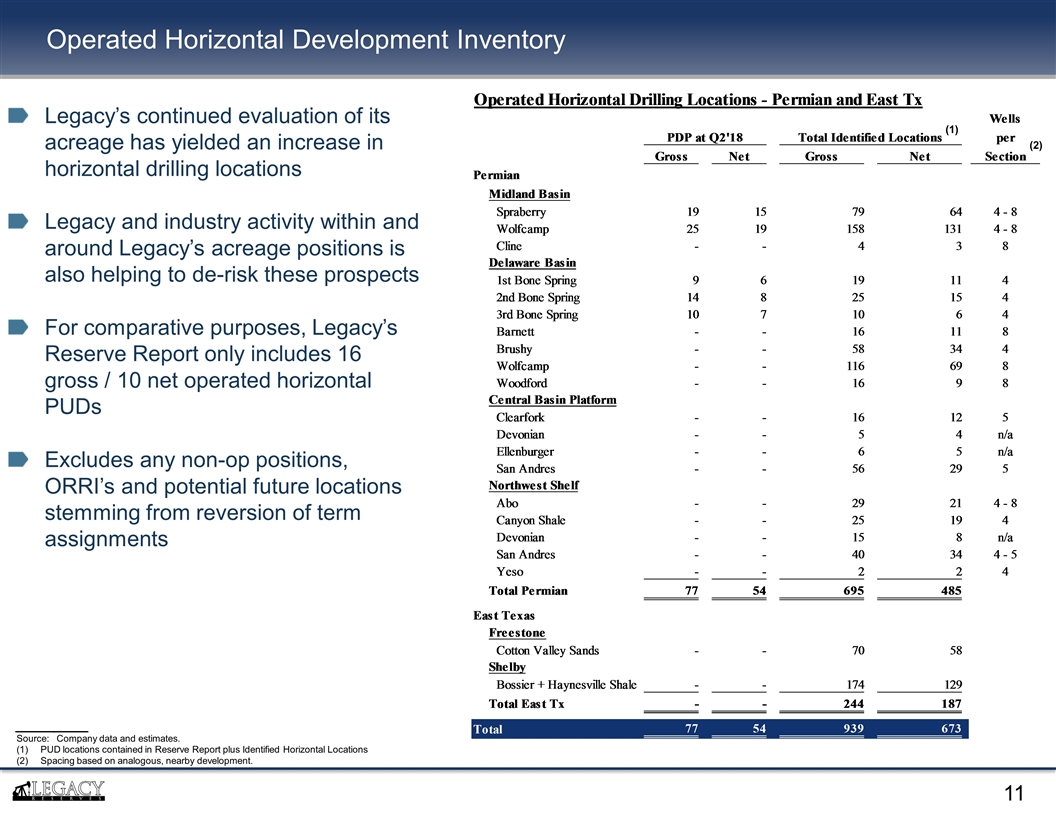

Operated Horizontal Development Inventory Legacy’s continued evaluation of its acreage has yielded an increase in horizontal drilling locations Legacy and industry activity within and around Legacy’s acreage positions is also helping to de-risk these prospects For comparative purposes, Legacy’s Reserve Report only includes 16 gross / 10 net operated horizontal PUDs Excludes any non-op positions, ORRI’s and potential future locations stemming from reversion of term assignments Source: Company data and estimates. PUD locations contained in Reserve Report plus Identified Horizontal Locations Spacing based on analogous, nearby development. (1) (2)

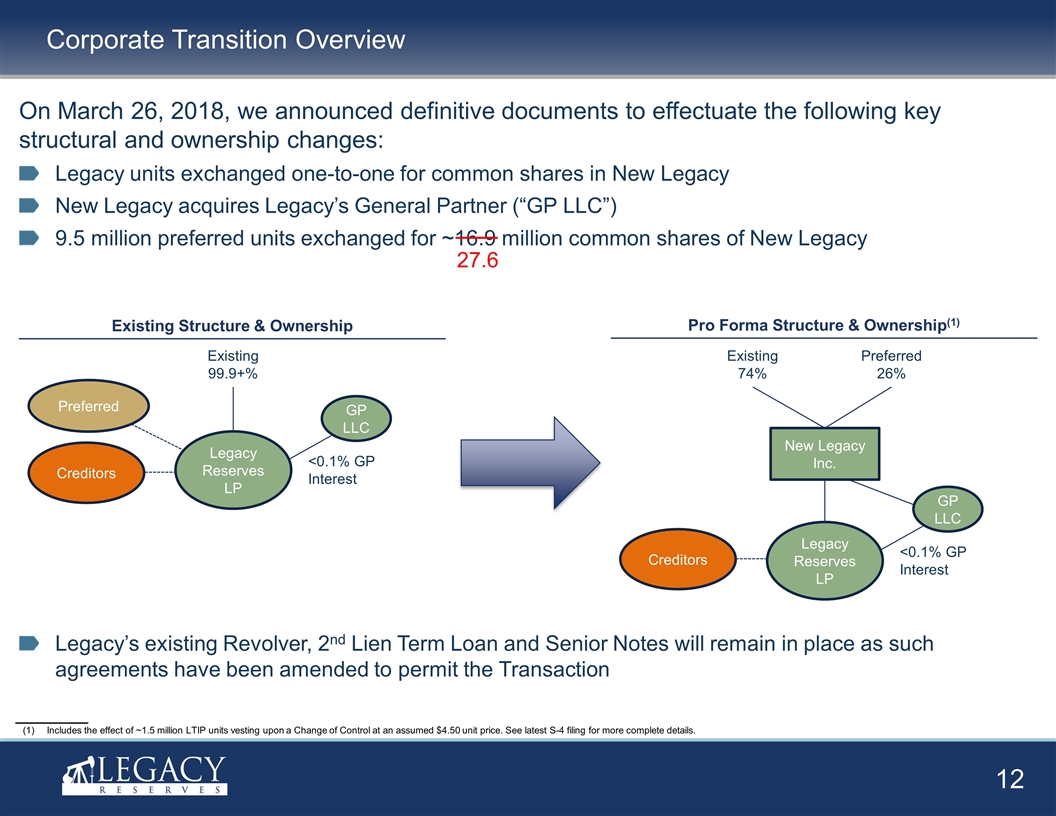

On March 26, 2018, we announced definitive documents to effectuate the following key structural and ownership changes: Legacy units exchanged one-to-one for common shares in New Legacy New Legacy acquires Legacy’s General Partner (“GP LLC”) 9.5 million preferred units exchanged for ~16.9 million common shares of New Legacy Corporate Transition Overview Existing Structure & Ownership Pro Forma Structure & Ownership(1) Includes the effect of ~1.5 million LTIP units vesting upon a Change of Control at an assumed $4.50 unit price. See latest S-4 filing for more complete details. Legacy Reserves LP GP LLC Creditors New Legacy Inc. <0.1% GP Interest Existing 74% Preferred 26% Legacy’s existing Revolver, 2nd Lien Term Loan and Senior Notes will remain in place as such agreements have been amended to permit the Transaction Preferred Legacy Reserves LP GP LLC <0.1% GP Interest Existing 99.9+% Creditors 27.6

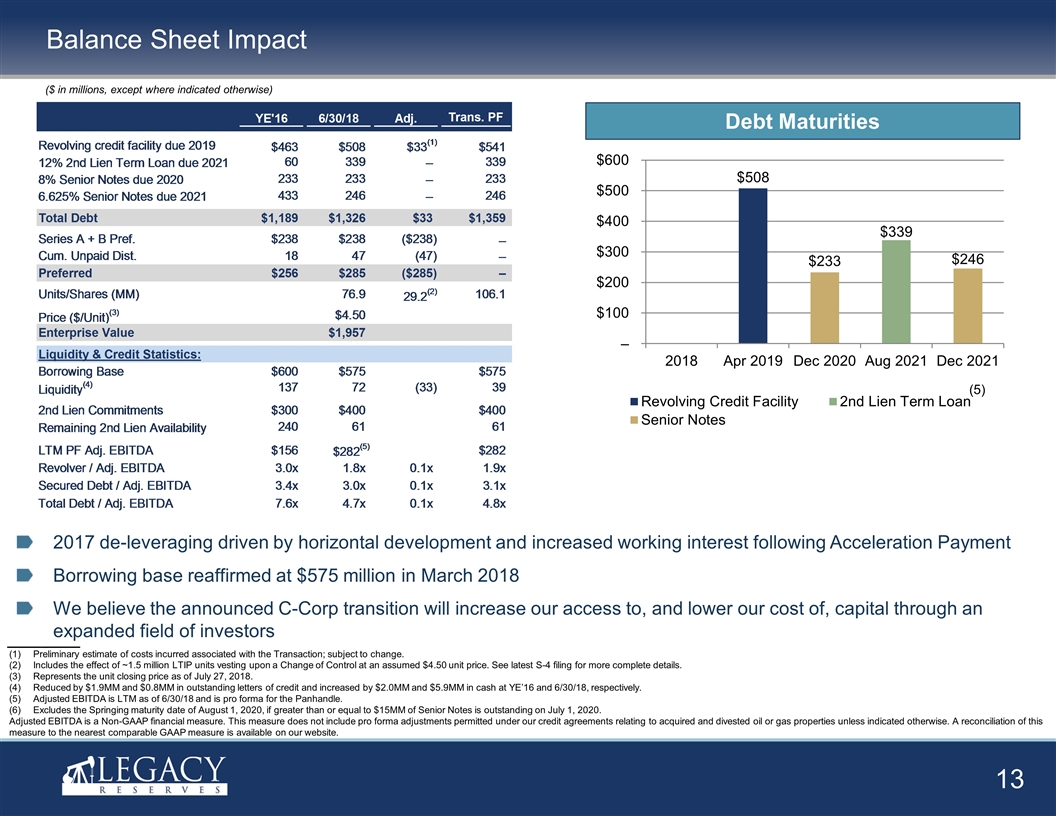

Balance Sheet Impact Preliminary estimate of costs incurred associated with the Transaction; subject to change. Includes the effect of ~1.5 million LTIP units vesting upon a Change of Control at an assumed $4.50 unit price. See latest S-4 filing for more complete details. Represents the unit closing price as of July 27, 2018. Reduced by $1.9MM and $0.8MM in outstanding letters of credit and increased by $2.0MM and $5.9MM in cash at YE’16 and 6/30/18, respectively. Adjusted EBITDA is LTM as of 6/30/18 and is pro forma for the Panhandle. Excludes the Springing maturity date of August 1, 2020, if greater than or equal to $15MM of Senior Notes is outstanding on July 1, 2020. Adjusted EBITDA is a Non-GAAP financial measure. This measure does not include pro forma adjustments permitted under our credit agreements relating to acquired and divested oil or gas properties unless indicated otherwise. A reconciliation of this measure to the nearest comparable GAAP measure is available on our website. Debt Maturities (5) 2017 de-leveraging driven by horizontal development and increased working interest following Acceleration Payment Borrowing base reaffirmed at $575 million in March 2018 We believe the announced C-Corp transition will increase our access to, and lower our cost of, capital through an expanded field of investors ($ in millions, except where indicated otherwise)

The Transaction provides clear benefits to Legacy as it: Allows entrance into more supportive C-Corp sector Following widespread bankruptcy filings and the destruction of nearly all of the collective equity value of our upstream MLP peers, investor confidence in our current space has eroded Our assets and growth development plan are no longer best suited for yield-based MLP universe Simplifies governance structure and enhances fiduciary duties benefitting shareholders Members of Legacy’s General Partner relinquish negative control right resulting in customary corporate governance model Directors and officers subject to corporate fiduciary duties Better aligns our corporate structure with our business model Through our horizontal Permian development efforts, we have been transitioning our business model to reinvest our cash flow to grow our asset base Transition away from yield-based structure will give us more options and better aligns us with Permian-focused C-Corps Allows for access to lower cost of capital to fund future growth and improved credit profile The transition to a C-Corp should increase our access to, and lower the cost of, our capital through an expanded field of investors Such improvements should enhance our ability to fund greater growth efforts and address our credit profile Transaction Benefits

Fairness hearing scheduled for September 12, 2018 for court to approve settlement with Preferred Unitholders Hold special meeting of unitholders on September 19, 2018 Upon closing of the Corporate Reorganization, NASDAQ ticker LGCY will reflect the trading of the shares of Legacy Reserves Inc. Transaction: Next Steps

LGCY: Key Takeaways Stable, low-decline PDP with meaningful free cash flow Significant operated horizontal inventory Experienced team with capacity to accelerate development Proposed structure expected to enhance access to, and cost of, capital

Appendix

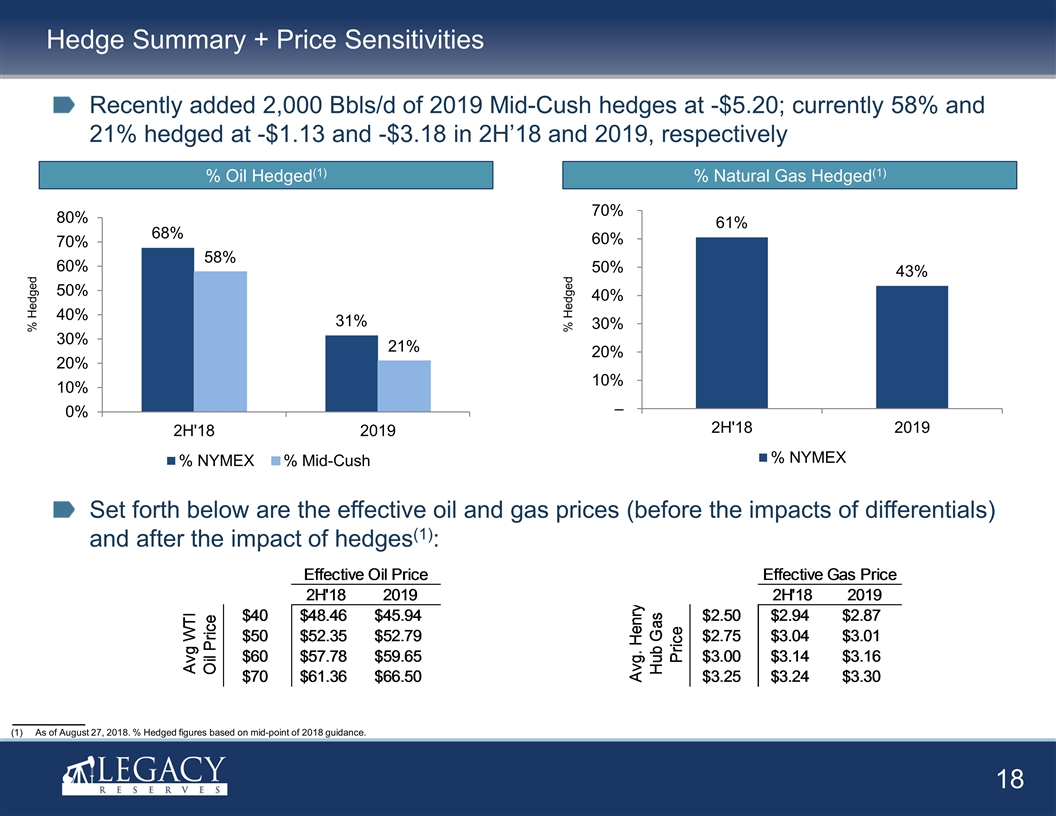

Recently added 2,000 Bbls/d of 2019 Mid-Cush hedges at -$5.20; currently 58% and 21% hedged at -$1.13 and -$3.18 in 2H’18 and 2019, respectively Set forth below are the effective oil and gas prices (before the impacts of differentials) and after the impact of hedges(1): Hedge Summary + Price Sensitivities As of August 27, 2018. % Hedged figures based on mid-point of 2018 guidance. % Natural Gas Hedged(1) % Oil Hedged(1) % Hedged % Hedged