Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| |

| Check the appropriate box: |

| |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

| | Legacy Reserves LP | |

| | (Name of Registrant as Specified In Its Charter) | |

| | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | 1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | | | |

| [ ] | | Fee paid previously with preliminary materials. |

| | |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | | 1) | | Amount Previously Paid: |

| | | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | 3) | | Filing Party: |

| | | | | |

| | 4) | | Date Filed: |

| | | | |

Table of Contents

303 W. Wall, Suite

1800 Midland, Texas 79701

April 6, 2018

To Our Limited Partners:

You are cordially invited to attend the 2018 Annual Meeting of Unitholders of Legacy Reserves LP to be held on May 15, 2018 commencing at 10:30 a.m. local time at the Midland Petroleum Club located at 501 W. Wall, Midland, Texas 79701. Proxy materials, which include a Notice of the Meeting, proxy statement and proxy card, are enclosed with this letter. The attached proxy statement is first being mailed to unitholders of Legacy Reserves LP on or about April 6, 2018. We have also enclosed our 2017 Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

The board of directors of our general partner has called this Annual Meeting for you to consider and act upon:

| (1) | The election of nine directors nominated to our general partner’s board of directors to serve until the next Annual Meeting of Unitholders; |

| |

| (2) | An advisory vote on executive compensation; |

| |

| (3) | The ratification of the appointment of our selection of BDO USA, LLP as independent registered public accounting firm of the Partnership for the fiscal year ending December 31, 2018; and |

| |

| (4) | Any other business as may properly come before the Annual Meeting or any adjournment thereof, including, without limitation, the adjournment of the Annual Meeting in order to solicit additional votes from unitholders in favor of adopting the foregoing proposals. |

The board of directors of our general partner recommends that you approve all three (3) of the above-listed proposals.

Your vote is important to us and our business.Even if you plan to attend the meeting, you are requested to sign, date and return the proxy card in the enclosed envelope or vote on the internet or by telephone as instructed. If you attend the meeting after having returned the enclosed proxy card (or voted by internet or telephone), you may revoke your proxy, if you wish, and vote in person. A proxy may also be revoked at any time before it is exercised by giving written notice to, or filing a duly exercised proxy bearing a later date with, our Secretary. If you would like to attend and your units are not registered in your own name, please ask the broker, trust, bank or other nominee that holds the units to provide you with evidence of your unit ownership.

We look forward to seeing you at the meeting.

| Sincerely, |

|  |

| Paul T. Horne

Chairman of the Board

Legacy Reserves GP, LLC, general partner of Legacy

Reserves LP |

Table of Contents

303 W. Wall, Suite 1800

Midland, Texas 79701

_______________

NOTICE OF THE 2018

ANNUAL MEETING OF UNITHOLDERS

_______________

The Annual Meeting of the Unitholders of Legacy Reserves LP, or the Partnership, will be held on May 15, 2018, at 10:30 a.m. local time at the Midland Petroleum Club located at 501 W. Wall, Midland, Texas 79701 for the following purposes:

| 1. | To elect nine (9) directors to the board of directors of our general partner, each to serve until the next Annual Meeting of Unitholders; |

| | |

| 2. | To hold an advisory vote on executive compensation; |

| | |

| 3. | To ratify the appointment of BDO USA, LLP as independent registered public accountants of the Partnership for the fiscal year ending December 31, 2018; and |

| | |

| 4. | To transact any other business as may properly come before the Annual Meeting or any adjournment thereof, including, without limitation, the adjournment of the Annual Meeting in order to solicit additional votes from unitholders in favor of adopting the foregoing proposals. |

Only unitholders of record at the close of business on March 20, 2018, are entitled to vote at the Annual Meeting and at any adjournment or postponement thereof. A list of such unitholders will be open to examination, during regular business hours, by any unitholder for at least ten days prior to the Annual Meeting, at our offices at 303 W. Wall, Suite 1800, Midland, Texas 79701. Unitholders holding a majority of the outstanding units representing limited partner interests are required to be present or represented by proxy at the meeting to constitute a quorum.

| YOUR VOTE IS IMPORTANT |

Your broker cannot vote your units on your behalf until it receives your voting instructions. For your convenience, internet and telephone voting are available. The instructions for voting by internet or telephone are set forth on your proxy card. If you prefer, you may vote by mail by completing your proxy card and returning it in the enclosed postage-paid envelope. If you do attend the meeting and prefer to vote in person, you may do so. |

Please note that space limitations make it necessary to limit attendance at the meeting to unitholders, though each unitholder may be accompanied by one guest. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 9:30 a.m. Each unitholder may be asked to present valid picture identification such as a driver’s license or passport. Unitholders holding units in brokerage accounts must bring a copy of a brokerage statement reflecting unit ownership as of the record date. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

| By Order of the Board of Directors, |

|  |

| Paul T. Horne

Chairman of the Board

Legacy Reserves GP, LLC, general partner of Legacy

Reserves LP |

Midland, Texas

April 6, 2018

Table of Contents

Proxy Statement for the

Annual Meeting of Unitholders of

LEGACY RESERVES LP

To Be Held on Tuesday, May 15, 2018

TABLE OF CONTENTS

i

Table of Contents

ii

Table of Contents

Legacy Reserves LP

303 W. Wall, Suite 1800

Midland, Texas 79701

_______________

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF UNITHOLDERS

TO BE HELD ON MAY 15, 2018

_______________

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

The Annual Meeting

Definitions:

Unless otherwise indicated, the terms “Partnership,” “Legacy”, “we,” “our,” and “us” are used in this proxy statement to refer to Legacy Reserves LP together with our subsidiaries. The terms “Board” and “Board of Directors” refer to our general partner’s board of directors. The term “compensation committee” refers to the compensation committee of the Board of Directors. The term “audit committee” refers to the audit committee of the Board of Directors. The term “nominating, governance and conflicts committee” refers to the nominating, governance and conflicts committee of the Board of Directors. The term “units” refers to units representing limited partner interests in the Partnership, other than our preferred units.

What is a proxy statement and why is it important?

We hold a meeting of unitholders annually. This year’s meeting will be held on May 15, 2018. Our Board of Directors is seeking your proxy to vote at the 2018 Annual Meeting of Unitholders(“Annual Meeting”). This proxy statement contains important information about the Partnership and each of the matters to be voted on at the meeting. We are mailing this proxy statement to unitholders on or about April 6, 2018. Please read these materials carefully so that you have the information you need to make informed decisions.

You do not need to attend the Annual Meeting to vote. Instead, you may simply complete, sign and return the enclosed proxy card or vote on the internet or by telephone as provided on your proxy card.

When and where is the Annual Meeting?

The 2018 Annual Meeting of Unitholders of Legacy Reserves LP will be held on Tuesday, May 15, 2018, at 10:30 a.m., local time, at the Midland Petroleum Club located at 501 W. Wall, Midland, Texas 79701.

The Petroleum Club of Midland is located on the southwest corner of Wall Street and Marienfeld in downtown Midland. From the Midland International Airport, exit the airport on the south side and cross over and merge onto Business 20 East, which turns into Wall Street. The Petroleum Club is 10 miles east of the airport and is a white, two story building. There is parking behind the building. For your convenience, the Petroleum Club phone number is (432) 682-2557.

What am I being asked to vote upon?

You are being asked to (1) approve the election of the directors nominated to our Board of Directors to serve until the next Annual Meeting of Unitholders; (2) approve, by a non-binding advisory vote, executive compensation; (3) ratify the appointment of the firm of BDO USA, LLP as independent registered public accountants of the Partnership for the fiscal year ending December 31, 2018; and (4) transact any other business as may properly come before the Annual Meeting or any adjournment thereof, including, without limitation, the adjournment of the Annual Meeting in order to solicit additional votes from unitholders in favor of adopting the foregoing proposals.

1

Table of Contents

Voting and Proxy Procedures

Who may vote at the Annual Meeting?

Only unitholders of record at the close of business on March 20, 2018, the record date for the Annual Meeting, are entitled to participate in the Annual Meeting. If you were a unitholder of record on that date, you will be entitled to vote all of the units that you held on that date at the Annual Meeting, or any postponements or adjournments of the Annual Meeting.

It is critical that you instruct your broker how you wish to vote your units on Proposals 1 and 2. Absent instructions from you, the bank or broker may not vote your units on these proposals and your units will be considered broker non-votes, which will have no effect on the outcome of Proposals 1 and 2.

What are the voting rights of the holders of units?

Each unit is entitled to one vote on all matters. Your proxy card indicates the number of units that you owned as of the record date.

Who is soliciting my proxy?

Our Board of Directors on behalf of the Partnership is soliciting proxies to be voted at the Annual Meeting.

What different methods can I use to vote?

By Written Proxy. Regardless of whether you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Annual Meeting and vote in person.

By Internet. Go to the website set forth on the proxy card and follow the on-screen instructions. You will need the control number contained on your proxy card. Voting by internet is the fastest and lowest cost medium of voting your proxy.

By Telephone. Please dial the toll-free telephone number set forth on the proxy card and follow the audio instructions. You will need the control number contained on your proxy card.

If you properly follow the instructions above in time to vote, your “proxy” (Micah C. Foster and James Daniel Westcott are the individuals named as proxies on your proxy card) will vote your units as you have directed. Unless otherwise directed by you, your proxy will vote your units:

| ● | Forthe election of the nine (9) director nominees proposed by our Board of Directors; |

| | |

| ● | Forthe approval, on an advisory basis, of executive compensation; |

| | |

| ● | Forthe ratification of the appointment of BDO USA, LLP as our independent registered accounting firm for the fiscal year ending December 31, 2018. |

If any other matter is presented, it is the intention of the persons named in the enclosed proxy card to vote proxies held by them in accordance with their best judgment. At the time this proxy statement was first mailed to unitholders, we knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this proxy statement.

In Person. All unitholders of record at the close of business on March 20, 2018 may vote in person at the Annual Meeting. If you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. However, if your units are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the beneficial owner of the units on the record date.

2

Table of Contents

How may I revoke my signed proxy card?

You may revoke your proxy card or change your vote at any time before your proxy is voted at the Annual Meeting. You can do this in one of three ways:

| ● | you can send a written notice in advance of the meeting to our Secretary at 303 W. Wall, Suite 1800, Midland, Texas 79701, stating that you would like to revoke your proxy;

|

| ● | you can complete and submit a later-dated proxy card; or

|

| ● | you can attend the Annual Meeting and vote in person. Your attendance at the Annual Meeting will not alone revoke your proxy unless you vote at the meeting as described below. |

If you have instructed a broker to vote your units, you must follow directions received from your broker to change those instructions.

You may change your internet vote as often as you wish by following the procedures for internet voting. The last known vote in the internet voting system as of 11:59 p.m., Eastern Time, on May 14, 2018 will be counted.

You may change your telephone vote as often as you wish by following the procedures for telephone voting. The last known vote in the telephone voting system as of 11:59 p.m., Eastern Time, on May 14, 2018 will be counted.

What does it mean if I get more than one proxy card?

It indicates that your units are held in more than one account, such as two brokerage accounts registered in different names. You should complete each of the proxy cards to ensure that all of your units are voted. We encourage you to register all of your brokerage accounts in the same name and address for better service. You should contact your broker, bank or nominee for more information. Additionally, our transfer agent, Computershare Trust Company, N.A., can assist you if you want to consolidate multiple accounts registered in your name by contacting our transfer agent at P.O. Box 30170, College Station, TX 77842-3170, Telephone: (781) 575-4238.

Quorum and Required Votes

How many votes are needed to hold the meeting?

A majority of the voting power of the outstanding units entitled to vote at the meeting as of the record date must be represented at the meeting in order to hold the meeting and conduct business. This is called a quorum. As of March 20, 2018, the record date, there were 76,894,049 units outstanding held by approximately 128 holders of record. Unitholders are entitled to one vote, exercisable in person or by proxy, for each unit held by such Unitholder on the record date. Our partnership agreement does not provide for cumulative voting.

Units are counted as present at the Annual Meeting if:

| ● | the unitholder is present and votes in person at the meeting;

|

| ● | the unitholder has properly submitted a proxy card; or

|

| ● | under certain circumstances, the unitholder’s broker votes the units. |

Who will count the vote?

Representatives of Computershare Trust Company, N.A., our transfer agent, will tabulate the votes cast by proxy. The Inspector of Election will tabulate any votes cast at the Annual Meeting.

3

Table of Contents

How many votes are required to approve the proposals?

The affirmative vote of holders of a plurality of the votes cast with respect to the election of a director is required to elect that director. Abstentions and broker non-votes will not be taken into account in determining the outcome of the election of directors (Proposal 1).

The affirmative vote of holders of a majority of the votes cast (not including abstentions and broker non-votes) at the meeting is required for the approval of:

| ● | the non-binding resolution on executive compensation (Proposal 2);

|

| ● | the ratification of our appointment of the independent registered public accounting firm for the fiscal year ending December 31, 2018 (Proposal 3) and any other matters that properly come before the meeting. |

How are abstentions and broker non-votes counted?

Abstentions and broker non-votes are included in determining whether a quorum is present.

Abstentions and broker non-votes will not be taken into account in determining the outcome of the election of directors (Proposal 1) or the non-binding resolution on executive compensation (Proposal 2). Brokers do not have the discretionary authority to vote on the directors standing for election or the non-binding resolution on executive compensation. With respect to the ratification of the appointment of our auditors, brokers have the discretionary authority to vote on this proposal, but abstentions will not be taken into account in determining the outcome of this vote.

How are proxies solicited?

Proxies may be solicited by mail, telephone or other means by our general partner’s officers and directors and our employees. No additional compensation will be paid to these individuals in connection with proxy solicitations. We will pay for distributing and soliciting proxies and will reimburse banks, brokers and other custodians their reasonable fees and expenses for forwarding proxy materials to unitholders.

Additional Questions and Information

If you would like additional copies of this proxy statement (which copies will be provided to you without charge) or if you have questions, including with respect to the procedures for voting your units, you should contact:

Legacy Reserves LP

303 W. Wall, Suite 1800

Midland, Texas 79701

Attention: Dan G. LeRoy

Vice President, General Counsel and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF UNITHOLDERS TO BE HELD ON MAY 15, 2018.

The Notice of the 2018 Annual Meeting of Unitholders and proxy statement are available athttp://ir.legacylp.com/proxy.cfm and our Annual Report on Form 10-K for the year ended December 31, 2017 is available athttp://ir.legacylp.com/annuals.cfm.

PROPOSAL 1

ELECTION OF DIRECTORS

Board of Directors

The Amended and Restated Limited Liability Company Agreement, as amended, of our general partner provides that our Board of Directors will consist of a number of directors as determined from time to time by resolution adopted by a majority of directors then in office, but shall not be less than seven or more than nine. Currently, our Board of Directors has nine directors. Each of the nominees for election to the Board of Directors is currently a director. If elected at the Annual Meeting, each of the nominees will be elected to hold office for a one-year term and thereafter until his successor has been elected and qualified, or until his earlier death, resignation or removal.

4

Table of Contents

Voting

Directors are elected by a plurality of the votes cast at the Annual Meeting. Units represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such units will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board of Directors chooses to reduce the number of directors serving on the Board of Directors. Each person nominated for election has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve.

Recommendation and Proxies

The Board of Directors recommends a vote FOR each of the nominees named below.

The persons named as proxies in the enclosed proxy card will vote all units over which they have discretionary authority FOR the election of the nominees named below. Although our Board of Directors does not anticipate that any of the nominees will be unable to serve, if such a situation should arise prior to the meeting, the appointed persons will use their discretionary authority pursuant to the proxy and vote in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board of Directors chooses to reduce the number of directors serving on the Board of Directors.

Set forth below is biographical information regarding each director nominee and information regarding the specific experience, qualifications, attributes and skills that qualify the nominees to serve on the Board of Directors. Each of the director nominees is an existing director standing for re-election for a one-year term expiring at the 2019 Annual Meeting.

Nominees for Election

| Name | | Principal Occupation | | Age | | Director Since |

Paul T. Horne | | Mr. Horne was appointed to the Board of Directors in December 2014 and was appointed as the Chairman of the Board of Directors on May 12, 2016. Mr. Horne has also served as Chief Executive Officer of our general partner since March 1, 2015. Mr. Horne previously served as President of our general partner from March 1, 2015 to March 1, 2018, as Executive Vice President and Chief Operating Officer of our general partner from March 16, 2012 to March 1, 2015 and as Executive Vice President of Operations of our general partner from our founding in October 2005 to March 2012. From January 2000 to October 2005, Mr. Horne served as Operations Manager of Moriah Resources, Inc. From January 1985 to January 2000, Mr. Horne worked for Mobil E&P U.S. Inc. in a variety of petroleum engineering and operations management roles primarily in the Permian Basin. Mr. Horne has a Bachelor of Science degree in Petroleum Engineering from Texas A&M University. The Board of Directors determined that Mr. Horne should be nominated to our Board of Directors due to his serving as Chief Executive Officer and pertinent experience, qualifications, attributes and skills, which include: the knowledge and experience attained through 34 years of service in the oil and gas industry and 32 years of experience in the Permian Basin. | | 56 | | December 2014 |

5

Table of Contents

| Name | | Principal Occupation | | Age | | Director Since |

Kyle D. Vann | | Mr. Vann was appointed to the Board of Directors upon completion of our private equity offering on March 15, 2006 and was named Lead Independent Director of the Board of Directors on May 12, 2016. From 1970 through 1979, Mr. Vann was employed in the refining division of Exxon Company USA, and from 1979 through January 2001, Mr. Vann was employed by Koch Industries. From February 2001 through December 2004, Mr. Vann served as Chief Executive Officer of Entergy — Koch, LP, an energy trading and transportation company. Mr. Vann continues to serve Entergy as a consultant and serves on the advisory board and consults with Texon, LP, a private energy marketing company. On May 8, 2006, Mr. Vann was appointed to the board of directors of Crosstex Energy, L.P. (now EnLink Midstream Partners, LP), a publicly traded midstream master limited partnership. From January 2009 through June 2010, Mr. Vann served as an advisory board member for Enexus, LLC, which is a subsidiary of Entergy Corporation. From October 2012 to October 2017, Mr. Vann served as an Executive Advisor for CCMP Capital Advisors, LLC, a private equity firm. In October 2017, Mr. Vann joined the board of PQ Chemical, which is a portfolio company of CCMP Capital. Mr. Vann has a Bachelor of Science degree in Chemical Engineering, with honors, from the University of Kansas. Mr. Vann serves on the Board of Advisors for the School of Engineering at the University of Kansas, which selected him to receive its Distinguished Engineering Service Award in 2012. The Board of Directors determined that Mr. Vann should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: the knowledge and experience attained through 46 years of service in the commodity trading business and his background and expertise in risk assessment and leadership in the energy sector. | | 70 | | March 2006 |

| | | | | | | |

Cary D. Brown | | Mr. C. Brown is a member of the Board of Directors and previously served as Chief Executive Officer of our general partner from our founding in October 2005 to March 1, 2015 and as Chairman of the Board of Directors of our general partner from our founding in October 2005 to May 12, 2016. Mr. C. Brown also served as President of our general partner from March 16, 2012 until March 1, 2015. Since 2005, Mr. C. Brown has been a principal of Moriah Group, which invests in real estate, oil and gas and other direct investments. Prior to October 2005, Mr. C. Brown co-founded two businesses, Moriah Resources, Inc. and Petroleum Strategies, Inc. Moriah Resources, Inc. was formed in 1992 to acquire oil and natural gas reserves. Petroleum Strategies, Inc. was formed in 1991 to serve as a qualified intermediary in connection with the execution of Section 1031 transactions for major oil companies, public independents and private oil and natural gas companies. Mr. C. Brown has served as Executive Vice President of Petroleum Strategies, Inc. since its inception in 1991. Mr. C. Brown served as an auditor for Grant Thornton in Midland, Texas from January 1991 to June 1991 and for Touche Ross in Houston, Texas from June 1989 to December 1990. Mr. C. Brown has a Bachelor of Business Administration degree, with honors, from Abilene Christian University. Mr. C. Brown is the son of Dale A. Brown, a current member of our Board of Directors. The Board of Directors determined that Mr. C. Brown should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: the knowledge and experience attained through 27 years of experience in the oil and natural gas industry and 25 years of experience in the Permian Basin. | | 51 | | October 2005 |

6

Table of Contents

| Name | | Principal Occupation | | Age | | Director Since |

Dale A. Brown | | Mr. D. Brown is a member of our Board of Directors and has served in such capacity since our founding in October 2005. Mr. D. Brown has been President of Moriah Resources, Inc. since its inception in 1992 and President of Petroleum Strategies, Inc. since he co-founded it in 1991 with Cary D. Brown. Since 2005, Mr. D. Brown has been a principal in the Moriah Group, including Managing General Partner of Moriah Investment Partners. The Moriah Group invests in real estate and other business ventures. Mr. D. Brown is a retired certified public accountant. Mr. D. Brown has a Bachelor of Science degree in Accounting from Pepperdine University. Mr. D. Brown is the father of Cary D. Brown, a current member of our Board of Directors. The Board of Directors determined that Mr. D. Brown should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: financial literacy and experience as a Certified Public Accountant (retired at age 65) since 1967; the knowledge and experience attained through his service in the petroleum industry since 1972 and managerial experience attained through his service with Moriah Resources, Inc. prior to the contribution of its assets as part of the formation transactions of Legacy. | | 75 | | October 2005 |

| | | | | | | |

William R. Granberry | | Mr. Granberry was appointed to our Board of Directors on January 23, 2008. Mr. Granberry was a member of the board of directors of The Williams Companies, Inc. (an integrated gas company with exploration and production, midstream, and gas pipeline operations) from November 2005 to December 2011. In January 2012, Mr. Granberry began serving an initial three-year term as a member of the board of directors of WPX Energy, Inc., an exploration and production company that was spun off from The Williams Companies Inc. From May 21, 2015 through May 2017, he was elected to one year terms as a member of the board of directors of WPX Energy, Inc. Mr. Granberry was a member of Compass Operating Company, LLC, a small, private oil and gas exploration, development and producing company with properties in West Texas and Southeast New Mexico from October 2004 through December 2013. In January 2014, he retired and sold his interest in Compass Operating Company, LLC, to his partners. From 1999 through September 2004, Mr. Granberry managed investments and consulted with oil and gas companies. In 1999, Mr. Granberry invested in and became a board member ofJust4Biz.com, a start-up internet company engaged in online office supply, and served as Interim CEO for brief periods in 2000 and2001. Just4Biz.com filed for bankruptcy in May 2001. From January 1996 to May 1999, Mr. Granberry was President and Chief Operating Officer of Tom Brown, Inc., a public oil and gas company with exploration, development, acquisition and production activities throughout the central United States. Mr. Granberry earned Bachelor of Science and Master of Science degrees in Petroleum Engineering from the University of Texas and upon graduation, worked for Amoco Production Company for 16 years. The Board of Directors determined that Mr. Granberry should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: expertise in the oil and gas industry that was attained through his 52 years of service in engineering and service in executive positions with companies ranging from a large global energy company to small independents. | | 75 | | January 2008 |

7

Table of Contents

| Name | | Principal Occupation | | Age | | Director Since |

G. Larry Lawrence | | Mr. Lawrence has been a member of our Board of Directors since May 1, 2006. Mr. Lawrence is Chief Financial Officer and Vice President - Finance of Natural Gas Services Group (NGSG), a public company that provides small to medium horsepower compression equipment to the natural gas industry, and has served in this position since July 2011. Previously, Mr. Lawrence served as Controller of NGSG from September 2010 to January 2011 before being promoted to Treasurer, Manager of Accounting and Principal Accounting Officer of NGSG in January 2011. From June 2006 to September 2010, Mr. Lawrence was self-employed as a management consultant doing business as Crescent Consulting. From September 2006 to August 2009, Mr. Lawrence served as Chief Financial Officer on a contract basis for Lynx Operating Company, a private company engaged in oil and gas operations with a primary business focus on gas processing. From May 2004 through April 2006, Mr. Lawrence served as Controller of Pure Resources, an exploration and production company and a wholly owned subsidiary of Unocal Corporation which was acquired by Chevron Corporation. From June 2000 through May 2004, Mr. Lawrence was a practice manager of the Parson Group, LLC, a financial management consulting firm whose services included Sarbanes Oxley engagements with oil and natural gas industry clients. From 1973 through May 2000, Mr. Lawrence was employed by Atlantic Richfield Company, a public oil and gas company (ARCO) where he most recently (from 1993 through 2000) served as Controller of ARCO Permian. Mr. Lawrence has a Bachelor of Arts degree in Accounting, with honors, from Dillard University. The Board of Directors determined that Mr. Lawrence should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: financial expertise and experience as a chief financial officer and controller, Sarbanes Oxley consulting expertise, and financial reporting expertise and the knowledge and experience attained through his years of service in the preparation of publicly audited financial statements. | | 66 | | May 2006 |

| | | | | | | |

Kyle A. McGraw | | Mr. McGraw is a member of the Board of Directors and also serves as the Executive Vice President and Chief Development Officer of our general partner. Mr. McGraw was appointed as Executive Vice President and Chief Development Officer effective March 16, 2012, and has served as a director since our founding in October 2005. Previously, Mr. McGraw served as Executive Vice President of Business Development and Land of our general partner from our founding in October 2005 to March 2012. Mr. McGraw joined Brothers Production Company in 1983, and has served as its General Manager since 1991 and became President in 2003. During his 23-year tenure at Brothers Production Company, Mr. McGraw served in numerous capacities including reservoir and production engineering, acquisition evaluation and land management. Mr. McGraw has a Bachelor of Science degree in Petroleum Engineering from Texas Tech University. Mr. McGraw has 35 years of experience in the oil and natural gas industry in the Permian Basin. The Board of Directors determined that Mr. McGraw should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: the knowledge and experience attained through 35 years of experience in the oil and natural gas industry in the Permian Basin, experience as a petroleum engineer and managerial and executive experience attained through his service with Brothers Production Company where he has served in numerous capacities, including reservoir and production engineering, acquisition evaluation and land management. | | 58 | | October 2005 |

8

Table of Contents

| Name | | Principal Occupation | | Age | | Director Since |

| D. Dwight Scott | | Mr. Scott was appointed to the Board of Directors on November 15, 2016 pursuant to a Director Nomination Agreement (the“Director Nomination Agreement”), dated October 25, 2016, between our general partner and GSO Capital Partners LP (“GSO”). Mr. Scott is a Senior Managing Director of Blackstone and President of GSO. Mr.Scottoversees the management of GSO and sits on the investment committees for GSO’s energy funds, mezzanine funds and rescue lending funds. Prior to his current role, Mr.Scottmanaged the energy investing activity at GSO, where he remains active. Before joining GSO Capital in 2005, Mr.Scottwas an Executive Vice President and Chief Financial Officer of El Paso Corporation. Prior to joining El Paso, Mr.Scottserved as a Managing Director in the energy investment banking practice of Donaldson, Lufkin & Jenrette. Mr.Scottis currently a Director of TapStone Energy, LLC, FourPoint Energy, LLC and GEP Haynesville, LLC. He is a member of the Board of Trustees of KIPP, Inc. and the Wall Street for McCombs Board. Mr.Scottgraduated from the University of North Carolina and the University of Texas’ McCombs School of Business. The Board of Directors determined that Mr. Scott should be nominated to our Board of Directors due to his pertinent experience, qualifications, attributes and skills, which include: the knowledge and experience attained through an extensive career including service in the energy investment banking business, energy private investing business and service in an executive position with a large global energy company and his background and expertise in financing companies in the oil and natural gas industry. | | 54 | | November 2016 |

| | | | | | |

| William D. (Bill) Sullivan | | Mr. Sullivan was appointed to our Board of Directors upon completion of our private equity offering on March 15, 2006. Since May 2004, Mr. Sullivan has served as a director and since May 2009 as a non-executive Chairman of the board of directors of SM Energy Company, a publicly traded exploration and production company (formerly known as St. Mary Land & Exploration Company). Mr. Sullivan has served as a director of TETRA Technologies, Inc. since August 2007 and a non-executive Chairman of the board of TETRA since May 2015. TETRA is principally in the oilfield services business. Mr. Sullivan has served as a director of CSI Compressco GP, LLC (f/k/a Compressco Partners GP, LLC), the general partner of CSI Compressco, L.P., since Compressco Partners completed its initial public offering in June 2011. CSI Compressco is a provider of wellhead compression-based production enhancement services and is a partially owned, controlled subsidiary of TETRA. Mr. Sullivan served as director of Targa Resources GP, LLC (the general partner of Targa Resource Partners LP) from February 14, 2007 until May 2015. Targa is principally in the gas and gas liquids gathering, processing and logistics services business. From 1981 through August 2003, Mr. Sullivan was employed in various capacities by Anadarko Petroleum Corporation, most recently as Executive Vice President, Exploration and Production. Mr. Sullivan has been retired for the past fourteen years. Mr. Sullivan has a Bachelor of Science degree in Mechanical Engineering, with high honors, from Texas A&M University. The Board of Directors determined that Mr. Sullivan should be nominated to our Board of Directors due to his significant management experience in midstream oil and natural gas operations and in the exploration and production of oil and natural gas. Mr. Sullivan also has substantial experience in executive compensation matters and in serving on the boards of publicly held corporations and publicly traded limited partnerships operating in the oil and natural gas industry. | | 61 | | March 2006 |

9

Table of Contents

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE FOREGOING DIRECTOR NOMINEES.

PROPOSAL 2

ADVISORY (NON-BINDING) RESOLUTION ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended(“ExchangeAct”), and the related rules of the U.S. Securities and Exchange Commission (the “SEC”), we are not required to include in these proxy materials a non-binding advisory resolution seeking unitholder approval of the compensation of our named executive officers. However, while not required with respect to our proxy materials this year, the Board of Directors has elected to include such non-binding advisory resolution in these proxy materials in consideration of the fact that a majority of the votes cast by unitholders on the non-binding vote on the frequency of advisory votes on the compensation of our named executive officers at the 2017 Annual Meeting were affirmative votes for an annual vote seeking non-binding advisory unitholder approval of the compensation of our named executive officers.

Our executive officer compensation strategy is designed to align the compensation of the executive officers with unitholder return. We provide financial incentives to our executive officers for performance, achievement of goals and enhancement of unitholder value. Our compensation philosophy is to drive and support the long-term goal of growing asset value and total unitholder return by paying for performance and not rewarding underperformance. In meeting these goals, we intend to invest in our long-term opportunities while meeting our short-term commitments. Our compensation policy allows us to attract and retain highly qualified executive officers.

As all our executive officers hold units in the Partnership, we focus on the growth of our business. Through this approach, our executives receive salaries and incentive pay opportunities consistent with the market value of their services, and their performance is further rewarded through the return on their holdings of our units, which creates alignment of interests with our unitholders.

The text of the advisory (non-binding) resolution with respect to this Proposal 2 is as follows:

“RESOLVED, that the unitholders of Legacy Reserves LP approve, on a non-binding advisory basis, the compensation of the individuals identified in the Summary Compensation Table, as disclosed in the Legacy Reserves LP proxy statement with respect to Legacy Reserves LP’s 2018 Annual Meeting pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in this proxy statement.”

In considering their vote, unitholders may wish to review with care the information on the Partnership’s compensation policies and decisions regarding executive compensation as presented in the “Compensation Discussion and Analysis” on pages 16-31 in this proxy statement and the compensation tables and related narrative disclosure on pages 32-40 in this proxy statement.

Although the unitholder vote on this advisory resolution is non-binding, the compensation committee values unitholder opinions and will consider the outcome of the vote when making future decisions regarding our executive compensation program.

10

Table of Contents

THE BOARD RECOMMENDS THAT YOU VOTE “FOR”

THE APPROVAL OF THE ADVISORY (NON-BINDING) RESOLUTION ON

EXECUTIVE COMPENSATION.

CORPORATE GOVERNANCE

Management of Legacy Reserves LP

The directors and officers of Legacy Reserves GP, LLC, as our general partner, manage our operations and activities. Our general partner is not elected by our unitholders and will not be subject to re-election on a regular basis in the future. Other than through their ability to elect directors of our general partner as described below, unitholders will not be entitled to directly or indirectly participate in our management or operation.

Our general partner owes certain fiduciary duties to the Partnership. Our general partner will be liable, as general partner, for all of our debts (to the extent not paid from our assets), except for indebtedness or other obligations that are made specifically nonrecourse to it. Our general partner therefore may cause us to incur indebtedness or other obligations that are nonrecourse to it.

The amended and restated limited liability company agreement, as amended, of our general partner provides for a board of directors of not less than seven and not more than nine members.

Our unitholders, including affiliates of our general partner, are entitled to elect all of the directors of our general partner annually. Directors of our general partner hold office for a one-year term and thereafter until the earlier of their death, resignation, removal or disqualification or until their successors have been elected and qualified.

Board of Directors

During the fiscal year ended December 31, 2017, our Board of Directors held 9 meetings. It is the policy of our Board of Directors to encourage directors to attend each meeting of unitholders. All of our directors serving on the Board of Directors at the time of the Annual Meeting held in 2017 attended the Annual Meeting held in 2017.

During 2017, the audit committee met 5 times, the compensation committee met 4 times, and the nominating, governance and conflicts committee met 3 times.

Director Independence

The Board of Directors includes four individuals who the Board of Directors has determined meet the independence and experience standards established by the NASDAQ Global Select Market, or NASDAQ, and the Exchange Act: Messrs. Granberry, Lawrence, Sullivan and Vann. The NASDAQ rules do not require the boards of publicly-traded partnerships to be made up of a majority of independent directors.

The Board annually reviews all relevant business relationships any director may have with Legacy and the independence standards established by the NASDAQ.

Leadership Structure of the Board

As prescribed by the Amended and Restated Limited Liability Company Agreement of our general partner, the Chairman of the Board of Directors has the power to preside at all meetings of the Board. On May 12, 2016, the Board appointed Mr. Horne as Chairman of the Board. Mr. Horne also currently serves as our Chief Executive Officer. The nominating, governance and conflicts committee believes that Mr. Horne’s history as one of the Partnership’s founders, his industry experience and excellent performance in his previous roles at Legacy make him the appropriate leader of the Board. Also on May 12, 2016, the Board named Mr. Vann as the Lead Independent Director of the Board. The Lead Independent Director has clearly defined leadership authority and responsibilities, which include presiding at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent directors, and serving as liaison between the Chairman of the Board and the independent directors. Our Lead Independent Director is afforded direct and complete access to the Chairman of the Board at any time as such director deems necessary or appropriate. The nominating, governance and conflicts committee will reevaluate its view on the Board’s leadership structure periodically.

11

Table of Contents

Risk Oversight

While it is the job of management to assess and manage our risk, the Board and its audit committee (each where applicable) discuss the guidelines and policies that govern the process by which risk assessment and management is undertaken and evaluate reports from various functions with the management team on risk assessment and management. The Board interfaces regularly with management and receives periodic reports that include updates on operational, financial, legal and risk management matters. The audit committee assists the Board in oversight of the integrity of our financial statements and our compliance with legal and regulatory requirements, including those related to the health, safety and environmental performance of Legacy. The audit committee also reviews and assesses the performance of our internal audit function and our independent auditors. The Board receives regular reports from the audit committee. We do not believe that the Board’s role in risk oversight has an effect on the Board’s leadership structure.

Evaluation of Compensation Risk

Our compensation committee has reviewed our employee compensation programs and overall compensation structure and internal controls. There are several design features of our compensation policy that reduce the likelihood of excessive risk-taking:

| ● | annual cash incentive opportunities are contingent upon several carefully designed objective operational and financial measures (50% at target levels), as well as the compensation committee’s discretion as to whether and in what amount to award additional cash incentive compensation (also 50% at target levels); |

| |

| ● | our compensation policy is designed to provide a balanced mix of cash, equity-linked and equity and short- and long-term incentives; |

| |

| ● | the potential payouts pursuant to our annual cash incentives are subject to reasonable maximum limits; and |

| |

| ● | internal controls are in place to assure that payments and awards are consistent with actions approved by the compensation committee. Taking into consideration the factors above, the compensation committee does not believe that there is a reasonable likelihood that Legacy’s compensation policy could have a material adverse effect on Legacy. |

Audit Committee

Membership

The audit committee has been established in accordance with Rule 10A-3 promulgated under the Exchange Act. The Board of Directors has appointed Messrs. Lawrence, Sullivan, and Granberry as members of the audit committee. Mr. Lawrence serves as the chairman of the committee. Each of the members of the audit committee has been determined by the Board of Directors to be independent under NASDAQ’s standards for audit committee members to serve on its audit committee. In addition, the Board of Directors has determined that at least one member of the audit committee (Mr. Lawrence) has such accounting or related financial management expertise sufficient to qualify such person as the audit committee financial expert in accordance with Item 407 of Regulation S-K and NASDAQ requirements.

Responsibilities

The audit committee assists the Board of Directors in overseeing:

| ● | our accounting and financial reporting processes; |

12

Table of Contents

| ● | the integrity of our financial statements; |

| |

| ● | our compliance with legal and regulatory requirements; |

| |

| ● | the qualifications and independence of our independent auditors; and |

| |

| ● | the performance of our internal audit function and our independent auditors. |

The audit committee is also charged with making regular reports to the Board of Directors and preparing any reports that may be required under NASDAQ-listing standards or SEC rules.

Charter

The Board of Directors has adopted a charter for the audit committee, a copy of which is available on our website atwww.legacylp.com. Please note that the preceding Internet address is for information purposes only and is not intended to be a hyperlink. Accordingly, no information found or provided at that Internet address or at our website in general is intended or deemed to be incorporated by reference herein.

Compensation Committee

Membership

The compensation committee consists of three members of the Board of Directors, Messrs. Vann, Granberry and Sullivan, all of whom have been determined by the Board of Directors to be independent under NASDAQ-listing standards. In addition, each member of the compensation committee qualifies as a “non-employee” director within the meaning of Rule 16b-3 promulgated under the Exchange Act, and as an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code. Mr. Vann is the chairman of the compensation committee.

Responsibilities

The committee’s responsibilities under its charter are to:

| ● | evaluate and/or develop the compensation policies applicable to the executive officers of our general partner, which are required to include guidance regarding the specific relationship of performance to executive compensation; |

| |

| ● | review and approve, on an annual basis, the corporate goals and objectives with respect to compensation for the executive officers of the general partner; |

| |

| ● | evaluate at least once a year the performance of the executive officers of the general partner in light of established goals and objectives; |

| |

| ● | determine and approve, either as a committee or together with the other independent directors (as directed by the Board of Directors), the compensation for each of the executive officers of the general partner, including salary, bonus, incentive and equity compensation based on this evaluation; |

| |

| ● | periodically review the compensation paid to non-employee directors (including Board of Directors and committee chairpersons) in the form of annual retainers and meeting fees, if any, and make recommendations to the Board of Directors regarding any adjustments; |

| |

| ● | review and make recommendations to the Board of Directors with respect to our incentive compensation and other unit-based plans; |

| |

| ● | assist the full Board of Directors with respect to the administration of our incentive compensation and other unit-based plans; |

| |

| ● | maintain regular contact with our management team; |

13

Table of Contents

| ● | prepare and publish an annual executive compensation report in our proxy statement or annual report on Form 10-K; and |

| |

| ● | evaluate its own performance, and review the adequacy of the charter, at least annually, delivering a report setting forth the results of such evaluation and review, and any recommended changes, to the Board of Directors for its approval. |

Charter

The Board of Directors has adopted a charter for the compensation committee, a copy of which is available on our website atwww.legacylp.com. Please note that the preceding Internet address is for information purposes only and is not intended to be a hyperlink. Accordingly, no information found or provided at that Internet address or at our website in general is intended or deemed to be incorporated by reference herein.

Nominating, Governance and Conflicts Committee

Membership

The nominating, governance and conflicts committee consists of Messrs. Granberry, Lawrence, Sullivan and Vann. Mr. Granberry serves as the chairman of the committee. The Board of Directors has determined that all members of the nominating and governance committee are independent under NASDAQ-listing standards.

Responsibilities

The duties of the nominating, governance and conflicts committee are to:

| ● | identify, recruit and evaluate candidates for membership on the Board of Directors and its committees; |

| | |

| ● | develop a process to be used by the committee in identifying and evaluating candidates for membership on the Board of Directors and its committees; |

| |

| ● | annually present to the Board a list of nominees recommended for election to the Board at the annual meeting of unitholders; |

| |

| ● | evaluate any director candidates recommended by unitholders of the Partnership pursuant to the procedures set forth in the fifth amended and restated agreement of limited partnership of the Partnership to be followed by unitholders in making such recommendations; |

| |

| ● | adopt a process for unitholders of the Partnership to send communications to the Board of Directors; |

| | |

| ● | oversee the evaluation of the Board of Directors and the other committees of the Board of Directors; |

| | |

| ● | evaluate its own performance, and review the adequacy of the charter, at least annually, delivering a report setting forth the results of such evaluation and review, and any recommended changes, to the Board for its approval; |

| |

| ● | recommend general matters for consideration by the Board of Directors, which may include: (i) the structure of Board meetings, including recommendations for the improvement of such meetings, and the timeliness and adequacy of the information provided to the Board of Directors prior to such meetings; (ii) director retirement policies; (iii) director and officer insurance policy requirements; (iv) policies regarding the number of boards on which a director may serve; (v) director orientation and training; and (vi) the roles of the general partner’s executive officers and the outside directorships of such executive officers; |

| |

| ● | consult with the Chief Executive Officer, as appropriate, and the other Board members to ensure that its decisions are consistent with the sound relationship between and among the Board of Directors, Board committees, individual directors, and the general partner’s executive officers; |

14

Table of Contents

| ● | oversee the general partner’s policies and procedures regarding compliance with applicable laws and regulations relating to the honest and ethical conduct of the general partner’s directors, officers and employees;

|

| ● | have the sole responsibility for granting any waivers under the general partner’s Code of Ethics and Code of Ethics for Chief Executive Officer and Senior Financial Officers (or any successor codes, guidelines or policies) to the general partner’s directors, officers and employees;

|

| ● | review and approve certain related party transactions as described in the committee’s charter; and

|

| ● | perform any other activities consistent with the charter, the limited liability company agreement and certificate of formation of the general partner (as each may be amended and/or restated and in effect from time to time), the limited partnership agreement and certificate of limited partnership of the Partnership (as each may be amended and/or restated and in effect from time to time) and applicable law as the committee or the Board of Directors deems necessary or appropriate. |

Further, the nominating, governance and conflicts committee, at the request of the Board of Directors, will review specific matters that the Board of Directors believes may involve a conflict of interest. The committee will determine if the resolution of the conflict of interest is fair and reasonable to the unitholders. Any matters approved by the committee will be conclusively deemed to be fair and reasonable to us, approved by all of our partners and not a breach by our general partner of any duties it may owe us or our unitholders.

Director Nominations

Under our fifth amended and restated agreement of limited partnership, unitholders desiring to suggest a Board nominee must give prior written notice to our Secretary regarding the persons to be nominated. The notice must be received at our principal executive offices at the address shown on the cover page within the specified period and must be accompanied by the information and documents specified in the fifth amended and restated agreement of limited partnership. A copy of the fifth amended and restated agreement of limited partnership may be obtained by writing to our Secretary at the address shown on the cover page of this proxy statement.

Recommendations by unitholders for directors to be nominated at the 2019 annual meeting of unitholders must be in writing and include sufficient biographical and other relevant information such that an informed judgment as to the proposed nominee’s qualifications can be made and the name, address and the class and number of units owned by such unitholder. Recommendations must be accompanied by a notarized statement executed by the proposed nominee consenting to be named in the proxy statement, if nominated, and to serve as a director, if elected. Notice and the accompanying information must be received by our Secretary at our principal executive office at the address shown on the cover page of this proxy statement no later than January 15, 2019 and no earlier than December 31, 2018.

The fifth amended and restated agreement of limited partnership does not affect any unitholder’s right to request inclusion of proposals in our proxy statement pursuant to Rule 14a-8 promulgated under the Exchange Act. For more information with respect to Rule 14a-8, please see “Other Matters–Unitholder Proposals.”

Nomination Criteria

The nominating, governance and conflicts committee is responsible for assessing the skills and characteristics that candidates for election to our Board of Directors should possess, as well as the composition of our Board of Directors as a whole. The assessments include qualifications under applicable independence standards and other standards applicable to our Board of Directors and its committees as well as consideration of skills and experience in the context of the needs of our Board of Directors. Each candidate must meet certain minimum qualifications including:

| ● | the ability to dedicate sufficient time, energy and attention to the performance of her or his duties, taking into consideration the nominee’s service on other public company boards; and

|

| ● | skills and expertise complementary to the skills and expertise of the existing members of our Board of Directors (in this regard, the Board of Directors will consider its need for individuals with skills and expertise in operational, managerial, financial or governmental affairs or other relevant expertise). |

15

Table of Contents

The nominating, governance and conflicts committee may also consider the ability of a prospective candidate to work with the then-existing interpersonal dynamics of our Board of Directors and the candidate’s ability to contribute to the collaborative culture among the members of the Board of Directors.

The nominating, governance and conflicts committee will also evaluate each nominee based upon a consideration of diversity, age, skills and experience in the context of the needs of the Board of Directors. The committee does not have a policy with regard to the consideration of diversity in identifying director nominees. Diversity, including diversity of experience, professional expertise, gender, race and age, is one factor considered in evaluating a nominee.

Based on this initial evaluation, the nominating, governance and conflicts committee will determine whether to interview the candidate and, if warranted, will recommend that one or more of its members, other members of our Board of Directors or senior management, as appropriate, interview the candidate in person or by telephone. After completing this evaluation and interview process, the committee ultimately determines its list of nominees and submits it to the full Board of Directors for consideration and approval.

Charter

Our Board of Directors has adopted a charter for the nominating, governance and conflicts committee, a copy of which is available on our website atwww.legacylp.com. Please note that the preceding Internet address is for information purposes only and is not intended to be a hyperlink. Accordingly, no information found or provided at that Internet address or at our website in general is intended or deemed to be incorporated by reference herein.

Code of Ethics

The Board of Directors has adopted a Code of Ethics and Business Conduct applicable to officers and directors of our general partner and our employees, including the principal executive officer, principal financial officer, principal accounting officer and controller, or those persons performing similar functions, of our general partner. The Code of Ethics and Business Conduct is available on our website atwww.legacylp.com and in print to any unitholder who requests it. Amendments to or waivers from the Code of Ethics and Business Conduct will also be available on our website and reported as may be required under SEC rules; however, any technical, administrative or other non-substantive amendments to the Code of Ethics and Business Conduct may not be posted. Please note that the preceding Internet address is for information purposes only and is not intended to be a hyperlink. Accordingly, no information found or provided at that Internet address or at our website in general is intended or deemed to be incorporated by reference herein.

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis of compensation arrangements of the named executive officers of our general partner, Legacy Reserves GP, LLC, should be read together with the compensation tables and related disclosures set forth below.

Introduction

Our general partner manages our operations and activities through its Board of Directors. Under our fifth amended and restated agreement of limited partnership, we reimburse our general partner for direct and indirect general and administrative expenses incurred on our behalf, including the compensation of our general partner’s executive officers. Our general partner has not incurred any reimbursable expenses related to the compensation of our general partner’s executive officers for their management of us. Currently, our general partner’s executive officers are employed by our wholly owned subsidiary, Legacy Reserves Services, Inc., and are directly compensated by Legacy Reserves Services, Inc. for their management of us pursuant to their employment agreements. The compensation amounts disclosed in this section and under “Executive Compensation” reflect the total compensation paid to the executive officers of our general partner. Please read “Executive Compensation - Employment Agreements.”

16

Table of Contents

Executive Summary

We are a master limited partnership headquartered in Midland, Texas, focused on the development of oil and natural gas properties primarily located in the Permian Basin, East Texas, Rocky Mountain and Mid-Continent regions of the United States. Our compensation policy, as adopted by the compensation committee and approved by the Board of Directors of the General Partner in March 2013 and subsequently amended (the “Compensation Policy”), is designed to make our executive officers’ total compensation comparable to that of similarly-sized exploration and production companies. The goals of our Compensation Policy are to:

| ● | align the compensation of the executive officers with unitholder return;

|

| ● | provide financial incentives to our executive officers for performance, achievement of goals and enhancement of unitholder value;

|

| ● | drive and support the long-term goal of growing asset value and total unitholder return by paying for performance; and

|

| ● | enable us to attract and retain highly qualified executive officers. |

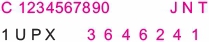

To achieve these goals, our total compensation to our executive officers is comprised of base salary, annual cash incentive compensation (annual cash bonuses), quarterly cash retention bonuses and equity-based incentive compensation. The charts below illustrate the allocation of compensation opportunities among salary, target annual cash bonuses, quarterly cash retention bonuses and target annual grants of equity to our Chief Executive Officer and other named executive officers (“NEOs”) with respect to fiscal year 2017. Base salaries in the charts below are represented based on annualized base salaries that became effective on March 1, 2017. Target incentive compensation is based on the targets in place with respect to 2017 performance. Quarterly cash retention bonuses included in the charts below are based upon actual amounts paid to the Chief Executive Officer and the other NEOs with respect to 2017.

| Chief Executive Officer: | | All Other NEOs |

| | | |

| |  |

Cash Incentive Compensation. We believe meaningful annual cash incentive compensation to be a strong motivating factor that will result in significant increases in value and in growth. Payouts of annual cash incentive compensation to our executive officers during fiscal year 2018 were made in accordance with the Compensation Policy based on performance during fiscal year 2017. For more information regarding cash incentive compensation earned in fiscal year 2017 please see “—Components of Compensation—Cash Incentive Compensation (Cash Bonus) under the Compensation Policy.”

17

Table of Contents

Subjective Component of Cash Incentive Compensation. In determining cash incentive awards earned in fiscal year 2017, our compensation committee conducted a subjective evaluation of individual officer and Partnership performance attributable to fiscal year 2017 for 50% of target annual cash incentive compensation. Under the Compensation Policy, the compensation committee has the discretion to award up to 200% of the subjective component of target annual cash incentive compensation based on the performance of the individual officer and the Partnership.

Objective Component of Cash Incentive Compensation. The remaining 50% of target annual cash incentive compensation earned in fiscal year 2017 was objectively determined in accordance with the objective criteria set forth in our Compensation Policy, which are based on our results and the achievement of operational and financial goals and objectives during fiscal year 2017 and are designed to align the incentive compensation of each executive officer with unitholder return by rewarding performance that exceeds the specified target levels for EBITDA (which is defined in these proxy materials to mean Adjusted EBITDA, a non-GAAP financial measure, as described in the Partnership’s annual report on Form 10-K) and results in the actual ratio of Total Debt (as defined in our Third Amended and Restated Credit Agreement, as amended) to EBITDA being less than the specified target ratio. The respective criteria target levels, for purposes of the determination of annual objective cash incentive compensation only, are set by the compensation committee at the beginning of each year after considering management’s recommendation and the Partnership’s internal operating plan.

Set forth below are the target levels for EBITDA and the target ratios of Total Debt to EBITDA used to determine the objective component of each executive officer’s annual cash bonus that may be earned with respect to fiscal year 2017. Achievement of less than 75% of Target EBITDA or failure to achieve a Total Debt to EBITDA ratio that is less than 125% of the target Total Debt to EBITDA ratio, respectively, will result in no annual cash bonus awarded with respect to that particular performance measure.

| Performance Measure | | Weight | | Performance Level/Percent Earned |

| EBITDA | | 50% | | 75% of Target 0% | | 100% of Target 100% | | 125% of Target 200% |

| Ratio of Total Debt to EBITDA | | 50% | | 125% of Target 0% | | Target 100% | | 75% of Target 200% |

Set forth in the table below is a summary of the target cash incentive award amounts attributable to performance during 2017 of each NEO pursuant to the Compensation Policy, expressed as a percentage of each of such executive officer’s applicable base salary.

| | Target Cash Bonus as a Percentage of |

| | 2017 Annual Salary(1) |

| Named Executive Officer | | Subjective | | Objective | | Total |

| Paul T. Horne | | 55% | | 55% | | 110% |

| Chairman of the Board, President and Chief Executive Officer(2) | | | | | | |

| James Daniel Westcott | | 45% | | 45% | | 90% |

| Executive Vice President and Chief Financial Officer(2) | | | | | | |

| Kyle M. Hammond | | 40% | | 40% | | 80% |

| Executive Vice President and Chief Operating Officer | | | | | | |

| Kyle A. McGraw | | 40% | | 40% | | 80% |

| Director, Executive Vice President and Chief Development Officer | | | | | | |

| Dan G. LeRoy | | 37.5% | | 37.5% | | 75% |

| Vice President, General Counsel and Secretary | | | | | | |

____________________

| (1) | Salaries effective March 1, 2017. |

| | |

| (2) | Effective March 1, 2018, Mr. Horne resigned as President of our general partner and Mr. Westcott was promoted to President of our general partner. Messrs. Horne and Westcott retained their positions as Chairman of the Board and Chief Executive Officer and Chief Financial Officer, respectively. |

Quarterly Cash Retention Bonuses.Additionally, on February 21, 2017, and in certain ways consistent with 2016, the compensation committee approved the payment of quarterly cash retention bonuses to the General Partner’s executives payable each fiscal quarter in which the executive was continuously employed by Legacy for the fiscal year ended December 31, 2017 in the amounts per quarter as follows: $125,000 to Mr. Horne, $100,000 to Mr. Westcott, $100,000 to Mr. Hammond, $50,000 to Mr. McGraw and $25,000 to Mr. LeRoy. The compensation committee has not approved any cash retention bonuses payable in fiscal 2018.

18

Table of Contents

Equity-Based Incentive Compensation. We believe meaningful equity participation by each NEO to be a strong motivating factor that will result in significant increases in value and in growth. Grants of equity-based compensation to our executive officers during fiscal year 2017 and 2018 were made in accordance with the Compensation Policy based on performance during fiscal year 2016 and 2017, respectively.

The subjective or service-based component of equity-based incentive compensation awarded as phantom units and associated distribution equivalent rights (“DERs”) is determined by a subjective evaluation of prior fiscal year performance by the compensation committee. The objective or performance-based component of equity-based incentive compensation, awarded as phantom units and associated DERs, is designed to reward our executive officers for their long-term performance and to align their interests with those of our unitholders. For more information regarding grants made during the fiscal years 2018 and 2017, please see “—Components of Compensation—Equity-Based Incentive Compensation under the Compensation Policy.”

Subjective Component of Equity–Based Incentive Compensation under the Compensation Policy (60% of target). Under the Compensation Policy, equity-based incentive compensation awarded under this component and associated DERs cliff vest after a three-year vesting period and are not subject to any performance criteria. The DERs entitle the recipient of the award to a payment equivalent to the amount of the per unit distribution payable to unitholders over the vesting period. The compensation committee has the discretion to award up to 200% of the subjective component of target equity-based incentive compensation.

Objective Component of Equity–Based Incentive Compensation under the Compensation Policy (40% of target). Under the Compensation Policy, the objective component is granted at 200% of the target amount each year but is subject to cliff vesting after a three-year performance period in accordance with an objective performance-related formula (as set forth under “Calculation of Vesting of Objective Component of Equity–Based Compensation under the Compensation Policy”below) based on our objective average annual total unitholder return and the following: 1) our total unitholder return compared to the total unitholder returns of a group of our exploration and production MLP peers, and 2) our total unitholder return compared to the total unitholder returns of a broader group of MLPs. All total unitholder returns are measured during the cumulative three-year vesting measurement period prior to the vesting date. If none or only a portion of phantom units vest as a result of target levels not being met, the unvested portion of phantom units and associated DERs will be forfeited.

Set forth in the table below is a summary of the target equity-based incentive award amounts attributable to performance during 2017 (and granted during fiscal year 2018) of each NEO pursuant to the Compensation Policy, expressed as a percentage of each of such executive officer’s applicable base salary. On February 21, 2017, the compensation committee adjusted target levels for certain NEOs based upon input from our compensation consultant and a review of market data, as described below under “Selection of Compensation Comparative Data.”

| | Target Value of Phantom Units as a |

| | Percentage of 2017 Annual Salary(1) |

| Named Executive Officer | | Subjective | | Objective | | Total |

| Paul T. Horne | | 240% | | 160% | | 400% |

| Chairman of the Board, President and Chief Executive Officer(2) | | | | | | |

| James Daniel Westcott | | 180% | | 120% | | 300% |

| Executive Vice President and Chief Financial Officer(2) | | | | | | |

| Kyle M. Hammond | | 180% | | 120% | | 300% |

| Executive Vice President and Chief Operating Officer | | | | | | |

| Kyle A. McGraw | | 105% | | 70% | | 175% |

| Director, Executive Vice President and Chief Development Officer | | | | | | |

| Dan G. LeRoy | | 60% | | 40% | | 100% |

| Vice President, General Counsel and Secretary(3) | | | | | | |

____________________

| | |

| (1) | Salaries effective March 1, 2017. |

| | |

| (2) | Effective March 1, 2018, Mr. Horne resigned as President of our general partner and Mr. Westcott was promoted to President of our general partner. Messrs. Horne and Westcott retained their positions as Chairman of the Board and Chief Executive Officer and Chief Financial Officer, respectively. |

| | |

| (3) | For the 2018 performance year, Mr. LeRoy’s target value of phantom units, as a percentage of 2018 annual salary, was increased to 150%,weighted 100% subjective and 50% objective, to further align his compensation with that of his peers at comparable exploration and production companies. |

19

Table of Contents

2017 Say on Pay Vote